1. Introduction

The sharing economy is changing the way many businesses are operating. It is boosting the global economy and providing an alternative to traditional markets, employing individuals who would otherwise be unlikely to be involved in or profit from this exchange of goods or services [

1]. Due to these new competitive conditions, many companies operating in a traditional way are taking part in merger and acquisition (M&A) processes involving platforms in order to keep abreast of the changing environment. Yet, traditional companies are not only using this growing method, but sharing platforms as well.

The novelty of the sharing economy (also called access economy, collaborative economy, or peer-to-peer economy, among others [

2,

3,

4,

5,

6]) means there is still a lack of research about it, although it is a go-to solution for companies all around the world. This new collaborative system is considered unfair by many companies [

7], albeit in great demand amongst a large part of society seeking a more efficient and sustainable approach to consumption [

8]. This, together with vibrant, fast-moving, and innovative competition, is prompting a change in traditional business models [

7].

This increase in popularity is forcing traditional companies to decide how to cope with these unexpected competitors. While some companies are still reluctant to admit that the sharing alternative could pose a problem, and are continuing their business as usual, suggesting that platforms compete with other platforms providing comparable services but do not extend to the sharing economy [

7], other companies are creating their own sharing alternatives to compensate for the loss of market share. Moreover, there is another group of companies that prefer to buy an existing sharing platform to enter the market directly. These movements are not necessarily limited to traditional companies interacting with sharing platforms, as there are also operations between sharing platforms.

The review of these M&A operations is justified by the growth of the sharing or collaborative movement that emerged in the 2000s as a different economic model focused on changing production and consumption cultures, as well as the interactions between producers and consumers [

9]. According to Vaughan and Daveiro [

10], the revenues generated by platforms in Europe during 2015 amounted to around EUR 4bn, and they involved EUR 28bn in transactions. In this same analysis, the authors have reported sharp growth since 2013, which accelerated in 2015 as large platforms expanded their operations. In Europe alone, transactions grew by 56% from 2013 to 2014, and by 77% between 2014 and 2015, and the increase in platform revenue was 80% higher in 2014 than in 2013, and 97% higher in 2015 than in 2014 [

10]. A survey conducted in 2015 revealed that 44% of the US population were active on collaborative platforms [

11], and the number of users in the sharing economy in the US is expected to reach 86 million by 2021 [

12]. Estimations say that between 2013 and 2025, the sharing economy will increase by 2133% while, in contrast, companies using the traditional operating model will increase their revenue by just 39.6% [

13]. These figures are having an impact on the growth strategies of companies and platforms alike, with most of them opting for M&A, as an external growth method that has acquired greater importance over recent decades [

14].

This article aims to fill this gap in the research by providing an overview and synthesis of M&A operations, and the main reasons behind them. This general objective is broken down into the following specific objectives: (1) Analyze the number of M&A operations according to different criteria, and (2) Discover the rationale behind each type of movement.

By analyzing the M&A wave in the sharing economy, this paper explores the practices and rationale behind the M&A process, which as a field of study has attracted considerable attention from both business leaders and scholars in different disciplines [

15], although it is still a topic to be developed within the sharing economy.

The research questions are formulated as follows:

RQ1: Which is the most common operation and which countries are involved?

RQ2: Which are the most affected industries and how do they relate to each other?

RQ3: How do sharing platforms and traditional companies interact within these operations?

RQ4: What are the main reasons behind local and international operations, and how common are they?

To answer them, a database was created including information on each M&A operation involving at least one sharing platform. This database was created by taking data published on different specialized websites and information published by companies. Due to the novelty of the research field, the literature available is scarce, as are the data available. We began by collecting all the available information regarding these operations, including the type of operation (merger or acquisition), the country of origin of both parties, the main reason behind the operation, and the consequences it had for the parties involved, among other variables. Secondly, different filters were applied to the data to answer the research questions and gain as much information as possible from them.

The nature of these questions prompts a qualitative, exploratory inductive study for gathering new data and facts to establish whether there are interesting or novel patterns [

16]. The choice of a qualitative design is generally considered appropriate when little previous research has been conducted on a topic [

16].

There are several reasons for this research: First, to the best of our knowledge following an extensive bibliometric analysis, this is the first paper analyzing M&A processes within the sharing economy. This economy is a developing field that has been expanding its frontiers into different disciplines, whereby current research is not extensive or broad enough to cover all the topics. In this particular case, and due to the growth both in numbers and in importance of M&A operations involving sharing economy platforms, a first approximation was needed to locate all the players within the field and analyze their completed operations. Second, this provides a better understanding of the current state-of-the-art, not only by detailing the operations carried out but also by analyzing the industries, sectors, and geographic locations of the parties involved and the main motivation behind each one of them. Although these reasons are consistent with those reported by the literature, the particularities of the sharing economy add a sense of novelty and a new set of drivers to these operations, such as the acquisition of a sharing platform by a traditional company to include the former in the business portfolio and, therefore, cover both segments of clients. Finally, this analysis opens up a new research stream that will need to be further developed once the results of these operations have been reported and the strategies behind them revealed.

The results here are relevant to various stakeholders. Traditional companies have seen their business model threatened by the introduction of this new value proposition and its advantages, in terms not only of monetary savings or convenience but also of sustainability and ecofriendly behavior. This paper provides the managers of traditional companies with a clearer idea of the current state-of-the-art and each player’s position, as they will be able to analyze tendencies and operations within their field of interest both locally and globally. This research is also useful for the managers of sharing platforms, as the novelty of the operations means there is still a major lack of familiarity with patterns and tendencies, as well as outcomes and results. These managers will therefore have the opportunity to acknowledge the number and type of competitors they face, the operations they have been involved in, and the global, or local, strategies they are pursuing. This study will also provide them with information on the most common destination countries, which, at least theoretically, are more willing to accept this consumption model, and could be a potential target for future development. Both types of managers may benefit from the opportunity to rethink their products, services, and operating markets, using the information presented here to support their future decisions. Finally, this research may benefit both direct and indirect stakeholders, such as users and governments, providing them with a greater level of understanding of this system, such as the actual size of industries and their importance within their countries. Knowing this can help to advance not only local research but also regulatory and legal systems.

This paper is organized as follows:

Section 2 presents an introduction to the sharing economy concept and its main characteristics, explaining the challenges that traditional companies need to face when competing against their sharing counterparts. A brief introduction to the concepts of M&As, their main characteristics, and the reasons behind these processes will be presented at this point. These concepts will be useful for explaining the importance of the research topic. The following section describes the data-gathering methodology and the variables. The results are then presented and explained. Finally, we summarize the key findings in the discussion and conclusions. This point includes the article’s limitations, future research streams, and the main managerial and academic implications.

2. Theoretical Underpinnings

The digital-based “sharing economy” is causing a major shift in business trends [

17]. Although the sharing economy concept is not new [

18], as it was intrinsic to the private sector (family) [

3,

19], the development of ICT and online platforms has broken down the historical boundaries between geographic and social distance and economic exchange [

20], thereby providing new paths for sharing.

Although sharing refers to predominantly private and often non-commercial transactions [

18], there is still a major debate over the exact definition of “sharing economy” [

21,

22,

23]. A large proportion of the issues involved stem from the fact that there is no single term to name this phenomenon, based mainly on the better distribution of the idle capacity of resources. “Collaborative consumption”, “Peer-to-Peer economy”, or “On-demand economy” are alternative terms that are frequently used.

There is, however, closer agreement on the characteristics attributed to the platforms. The community created around these platforms and their benefits are some of the phenomenon’s main characteristics [

24,

25,

26,

27,

28,

29,

30]. Another key factor is the prioritization of access over ownership [

25,

31,

32,

33,

34,

35], which means that access is granted to the resource over a limited amount of time and there is no change in product ownership [

36,

37].

The main facilitator behind these transactions is the idle capacity of the resources, which means they are not used to their full extent [

35,

38,

39,

40,

41,

42]. As regards the previous point, the tangible nature of the resources shared is the cause for some debate in the literature, and for some authors, it is the only possibility [

25,

28,

41]. Other authors, in turn, have stated that intangible resources (e.g., time or knowledge) can also be shared [

23,

43,

44,

45], and there are those who consider that these transactions should be conducted between peers [

24,

42,

44,

46,

47], while others accept a business as one of the agents involved [

36,

48,

49,

50].

As controversial as some points may be, most research agrees on the key role played by digital platforms as facilitators of the transactions [

35,

51,

52,

53], acknowledging how difficult, or even impossible, it would have been for the sharing economy to achieve its current potential without their support. Finally, and complementary to the digital platforms, scholars have emphasized the importance of online reputation and its relevance within transactions [

31,

41,

54,

55].

To sum up, we could define the sharing economy as a community of users in which it is more important to access an asset than own it and choose to use the idle capacity of a tangible asset owned by another member of the community instead of buying it. This access is usually facilitated by a digital platform in which each member’s reputation is used as collateral.

While the phenomenon is still in its infancy in many product or service categories, its combination of economic rationality, technological infrastructure, and cultural appeal will probably see it grow significantly [

56,

57]. The sharing economy’s main achievement has probably been to change the 20th century’s hyper-consumerist trend to a more collaborative and participative approach in the 21st century [

58]. This change has been facilitated by a specific set of circumstances within a common temporal framework involving internet-based technology, the economic crisis, and the increasing interest in sustainability [

59]. This combination of technological and socioeconomic changes has ushered in a new type of connected consumption [

8]. The sharing economy provides companies with a chance to reduce their costs and perform more flexibly, rendered possible by eliminating intermediary inefficiencies, reconfiguring markets, and adapting quickly to demand at no additional cost [

60].

The effects of the sharing economy continue to trigger an intense debate [

61], as it is having a disruptive impact on an increasing number of industries [

62], opening up traditional markets to newcomers, which compete with the incumbents through a different strategy and by putting market pressure on traditional players [

61]. The sharing economy clearly signals a major transformation in production that plays a constitutive role in sustainable sociotechnical transitions [

18], changing traditional ways of doing business and causing a permanent shift in the global organization of economic activity [

1].

The sharing model has been developing rapidly in many service sectors, especially in transportation and hospitality [

63], but companies all around the world are facing a digitally driven perfect storm. Connectivity, rising consumer influence, a shortage of time, mobile payments, and the internet of things are changing where, when, and how people consume [

64]. The capacity to deal with these challenges is one of the main reasons behind the changes in large corporations’ scale and scope, in conjunction with the search for cost synergies, new markets, and technological gains [

65].

Faced with these new environmental conditions, some companies are investing large sums in the development and management of digital platforms, websites, e-commerce solutions, and social media. Other traditional brick-and-mortar enterprises are choosing to merge with firms in the sharing economy [

7], as an external growth method that, together with acquisitions, is the most common approach used to grow in size and remain competitive [

64].

The liberalization, deregulation, and globalization of the economy now mean that businesses have to face both domestic and global competition [

15]. Among the different growth options, M&As are crucial strategic means for achieving a long-term competitive advantage in today’s business environment [

66,

67]. An acquisition is the purchase of another company’s shares or assets in order to gain control over it [

68,

69,

70], without physically absorbing its business. A merger refers to the complete transfer of assets and liabilities from one company to another or the unification of two companies into one economic unit [

71,

72]. These operations, together with restructuring, initial organization, and liquidation, are the most important transactions an incorporated business can undertake [

70,

73].

These processes allow companies to expand their business portfolios, gain access to new markets, increase managerial power, specialize more, and expand their geographic distribution [

66,

74]. The main reasons for M&As are the achievement of synergies by integrating two business units in a combination that will increase competitive advantage [

75], drive expansion into new markets, enrich products or services, and facilitate new research and development [

76]. Through these processes, companies hope to gain advantages by downsizing, introducing economies of scale, rolling out new technology, or increasing their market share [

77]. Furthermore, they can foster the transfer of valuable intangible assets, such as know-how, between targets and acquirers [

78].

The process is far from simple and involves high levels of complexity [

79], including factors such as the integration of cultures, where differences may generate anxiety, distrust, and feelings of hostility [

80]. The strategic and financial fit, as well as the proper management of the change, also influence an operation’s success [

81]. These factors have an impact on a firm’s engagement in M&A processes while others, such as the nature and quality of a country’s political, economic, and legal policies and institutions, may help to explain its choice of one country over another [

15].

In 2013, Botsman [

23] reported that the sharing economy market had reached a value of USD 26 billion, and according to PwC research [

82], it has an estimated potential revenue worth USD 335 billion. Although these numbers may appear promising, this potential can only be reached by integrating the increasing trend in sharing and the proper management of the platforms. In the study carried out by Chasin et al. [

83], 122 of the 521 sharing businesses they were monitoring were wound up during the 35 months their study lasted. When they analyzed the main reasons for these failures, they found that many of them involved an insufficient analysis of the sharing market, hidden resource requirements, or unsaleable technical designs [

83]. Although the literature identifies and discusses the general factors that lead to business failure [

84,

85], these types of businesses have unique characteristics and face unique challenges, as well as an ever-changing environment [

83]. Yet, most of these problems can indeed be grounded in the fact that managers of sharing platforms tend to be less prepared for the job’s demands than managers of traditional business.

These facts, together with the need for change, are encouraging traditional companies to merge with or acquire sharing platforms, achieving an innovative image, the enhancement of their digital capabilities, and all the traditional benefits associated with these types of operations [

65]. Besides the positive aspects of these processes, managers and regulators are concerned about the legality and fairness of the competitive forces generated by sharing economy platforms, considering that the success of their business models may result in market power and anti-trust behavior [

7], as well as having a long-term effect on communities and incumbents [

86].

There seems to be no doubt about the importance the sharing economy has achieved in recent years, and its potential when impacting well-established industries, although only a limited number of studies have investigated the growth methods and strategies followed by platforms. This means that M&A processes and their reasons and outcomes remain unclear.

3. Data Collection and Methodology

As noted before, the novelty of the research field implies that only a limited amount of information on the corresponding operations is available. The sharing economy research field is growing and becoming more specific, but there is still a long way to go. Based on a previous bibliometric analysis conducted by the authors, the first academic publication published in a journal included in the Web of Science database dates from 2014. From then on, the number of publications has grown steadily and exponentially year-by-year, although to the best of our knowledge, there is still no research that combines the sharing economy with M&As. This novelty also implies that the data available are very limited and the information garnered comes from secondary sources that have collected and organized the data and from company reports.

Most of the information used to analyze M&A operations within the sharing economy was obtained from the webpage Index.co, where data from 2012 to 2019 were retrieved. Information was also extracted from the financial statements of startups, compiled by Owyang [

87], and last updated in 2016.

To make this analysis as complete as possible, the sharing economy market was analyzed, together with the markets of the on-demand economy, and peer-to-peer and collaborative consumption, although they will all be included under the terms “sharing economy” or “sharing platforms”. As noted earlier, the terminology used for this phenomenon is still an unresolved problem within the research field, so all the operations under the aforementioned terms were included in this analysis.

All the operations were listed together with the variables considered for each operation, namely the companies, the countries of origin, the date of the operation, the type of operation, the industry and sector to which each company belongs, the main reasons for the operation, as well as their consequences, and the type of company (traditional company or sharing platform).

The final number of operations included in the sample was 108. All the information was reviewed by the authors to verify that all the operations included at least one sharing economy platform.

4. Results

4.1. Number of Mergers vs. Number of Acquisitions within the Sharing Economy (2012–2019)

To remain competitive, many companies around the world have merged to expand into new markets, incorporate new technologies, and enhance revenues [

88]. Since 2000, more than 79,000 transactions have been recorded worldwide, although the number of deals decreased by 8% in 2008 [

89].

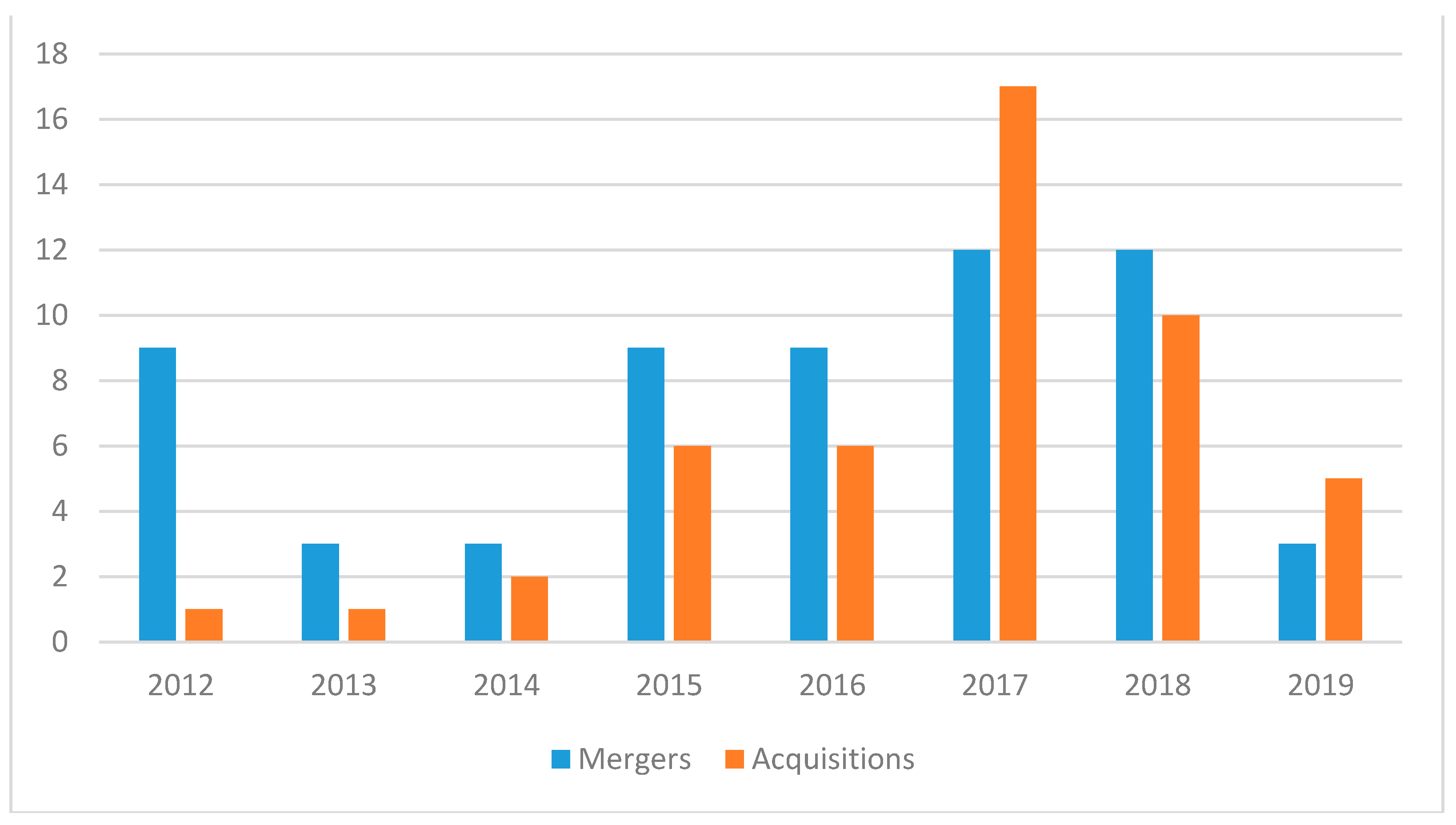

There were 60 mergers and 42 acquisitions out of the total number of 108 operations in the sample. The two remaining operations were initially considered acquisitions and were carried out as such, but after some months of operating, it was decided in both cases to finally merge the platforms.

Although they have similar numbers, there have been more mergers than acquisitions. This could be explained by the fact that the purpose of these operations is to grow internationally under the same brand, so most of these mergers imply two similar companies in different countries, which will then operate under a common tradename.

It is important to note here that some of the acquisition processes were used to recruit part (or all) of one company’s workforce. These processes are commonly known as “acqui-hire”, in which the buyer is motivated primarily by the talent of the seller’s employees rather than by its operational business or technology [

90]. As an example, Airbnb proceeded to “acquire-hire” two companies in 2012 and 2016 (ChangeTip and Fondu) simply to incorporate their management teams into its own team and exploit their knowledge in bitcoin processes and review platforms, respectively.

A closer look at the mergers reveals that most of them were arranged for operating or competitive reasons, and almost all of them could be classified as a merger by takeover, a process in which one of the firms involved (the one taken over) disappears, with its equity being transferred to the acquiring company [

91].

As shown in

Figure 1, there are records of operations from 2012 to 2019, with 2017 registering the most operations of both types. These figures correspond to the seventh wave of M&As identified by previous research [

92]. From 2010 to the present, companies have turned to M&As to capture a greater market share and change their business models to compete with companies such as Netflix, Amazon, and other tech giants seeking to enter new industries [

92]. Although the number of mergers is higher than the number of acquisitions, the latter have been become increasingly popular over the years.

These results answer the initial part of RQ1, concluding that a merger is the most common operation.

4.2. The Location of International Operations

According to previous research [

93], the shorter the distance between two countries, the greater the likelihood of M&A operations. Mergers are likely to occur between firms in countries that trade more commonly with one another, as they will probably share synergies and cultural backgrounds. Several traditional internationalization theories argue that business environments in culturally closer countries are easier to understand and make business operations smoother to implement [

94].

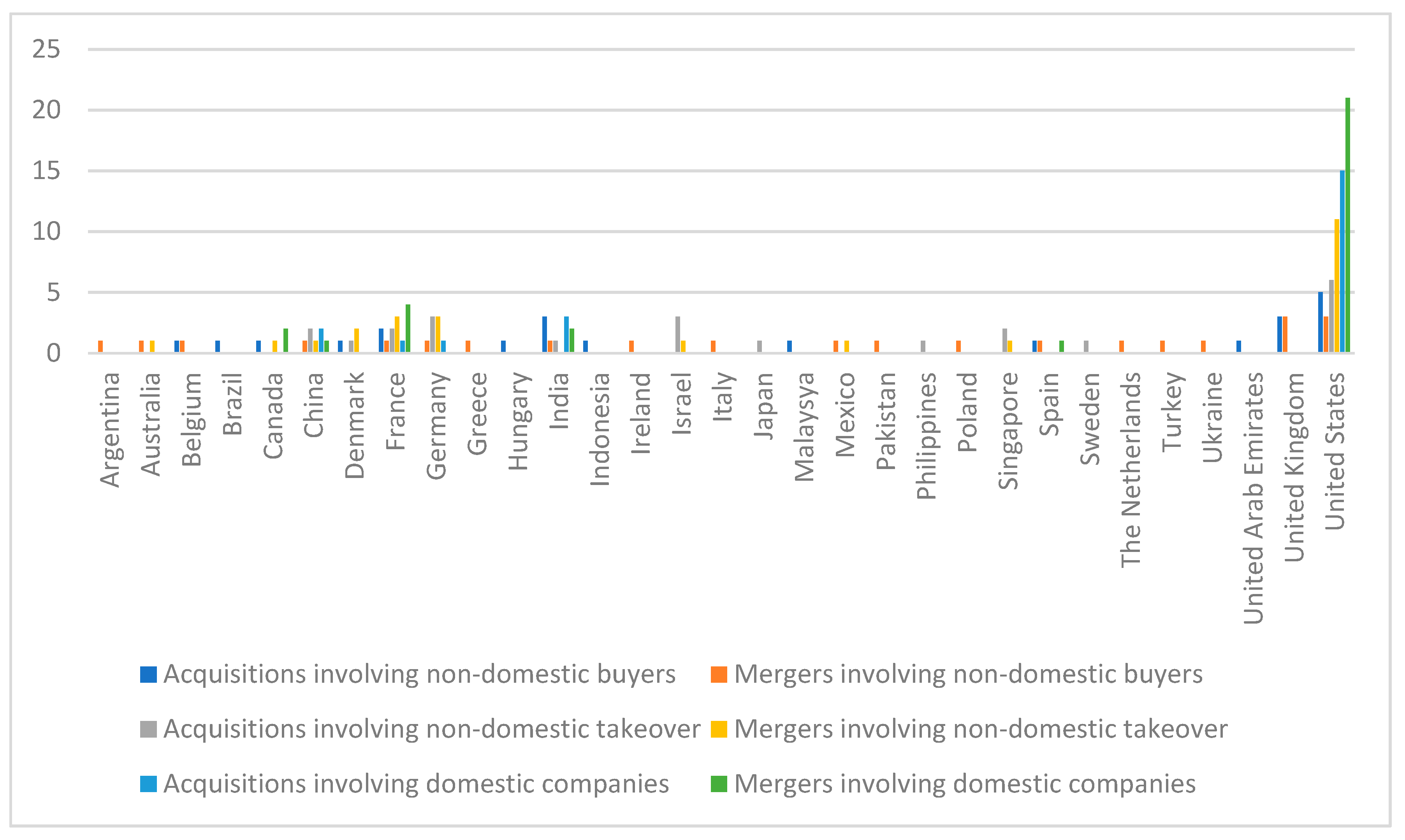

Figure 2 displays three types of countries. First, there are 15 countries (Argentina, Belgium, Brazil, Greece, Hungary, Indonesia, Ireland, Italy, Malaysia, Pakistan, Poland, the Netherlands, Turkey, Ukraine, and the UK), in which domestic companies have not invested in other countries’ companies but have attracted attention from foreign companies, especially the UK, whose companies have been bought by international companies on six occasions.

There is a second group of countries composed of Israel, Japan, and the Philippines. These countries have not attracted enough attention from foreign companies to have had any of their platforms purchased, but domestic companies have been actively involved in international operations, especially Israel, which has recorded five operations between domestic and non-domestic companies.

Finally, there are 13 countries (Australia, Canada, China, Denmark, France, Germany, India, Mexico, Singapore, Spain, Sweden, UAE, and the US) in which both types of operations have been recorded. The figures reveal a balanced share of operations. The most active ones in both cases are France (with 10 companies involved in operations by international companies, and 17 domestic companies acquiring non-domestic ones) and the US (with 45 operations from the US to other countries, and 52 the other way around). This country is by far the one with the highest number of operations, confirming that the sharing economy began and initially developed there. This implies that most of the US-born companies are available for foreign companies to merge with or acquire, and more platforms are susceptible to growth by acquiring other domestic or non-domestic companies.

These results answer the second part of RQ1, showing the countries whose companies have been involved in operations.

4.3. Number of Operations by Industry and Sector

M&As have become very important in mature industries, where it is difficult to erode competitors’ market share, or when the time factor is crucial [

95]. Many industries have been affected by the sharing economy besides the most obvious ones, such as transportation or hospitality [

63]. In some industries, the impact of platforms is either yet to be defined or potentially negligible, while in others, the sharing economy concept can be complementary to traditional business within the industry [

96].

Figure 3 shows the number of operations carried out by platforms or traditional companies belonging to an industry. This categorization has been made using the “Collaborative Economy Honeycomb” version 3.0 [

97] as classification criteria for platforms, and the traditional classification for traditional companies. Out of the 27 industries involved, and as expected, the one most affected by far is “mobility services”, followed by “space”, “vehicle sharing”, and “goods”.

In 2010, and in collaboration with Sharable Magazine [

98], Latitude used a series of surveys and studies to identify those areas with the greatest opportunities for sharing business. They found opportunities in the transportation field, where there was considerable unfulfilled demand for carsharing; in infrequently used items, such as power tools, party supplies, or sporting goods; and in the physical spaces industry, both travel accommodation and storage. Co-working spaces were also included as an opportunity. These results are consistent with our own, in which the most affected industries were the most promising ones ten years ago. A closer look at the sectors in which these industries can be divided (

Figure 4) shows that within the space industry, for example, the most affected sector is the one related to personal space, which includes platforms such as Airbnb or Couchsurfing. This industry also includes the workspace sector, which is becoming more popular, and consists of co-working spaces, such as ShareDesk or WeWork. Within the mobility services industry, the sector that has attracted more attention is the “ride as a service”, which encompasses platforms such as BlaBlaCar or Lyft. An emerging sector is the one related to support services, focused mainly on shared parking places—an important and attractive sector especially in big cities with serious mobility problems. Some of these platforms are even being promoted by local governments, which are looking for a more sustainable and respectful mobility model.

As regards the traditional companies involved in these types of operations, there are several industries affected, such as marketing or information technology, with the one most affected being the automotive industry. These operations involve mainly processes related to automotive companies acquiring collaborative alternatives. These companies have been especially impacted by carsharing platforms, seeing their sales reduced because customers have finally decided to use these initiatives instead of acquiring a private car. By acquiring a sharing platform, these companies can offset these losses by operating in both markets. A clear example of this strategy is the operation whereby Seat has acquired Respiro Car Sharing in the Spanish market.

These results answer RQ2, specifying the industries involved and how they interact with each other.

4.4. M&A Operations between Traditional Companies and Sharing Platforms

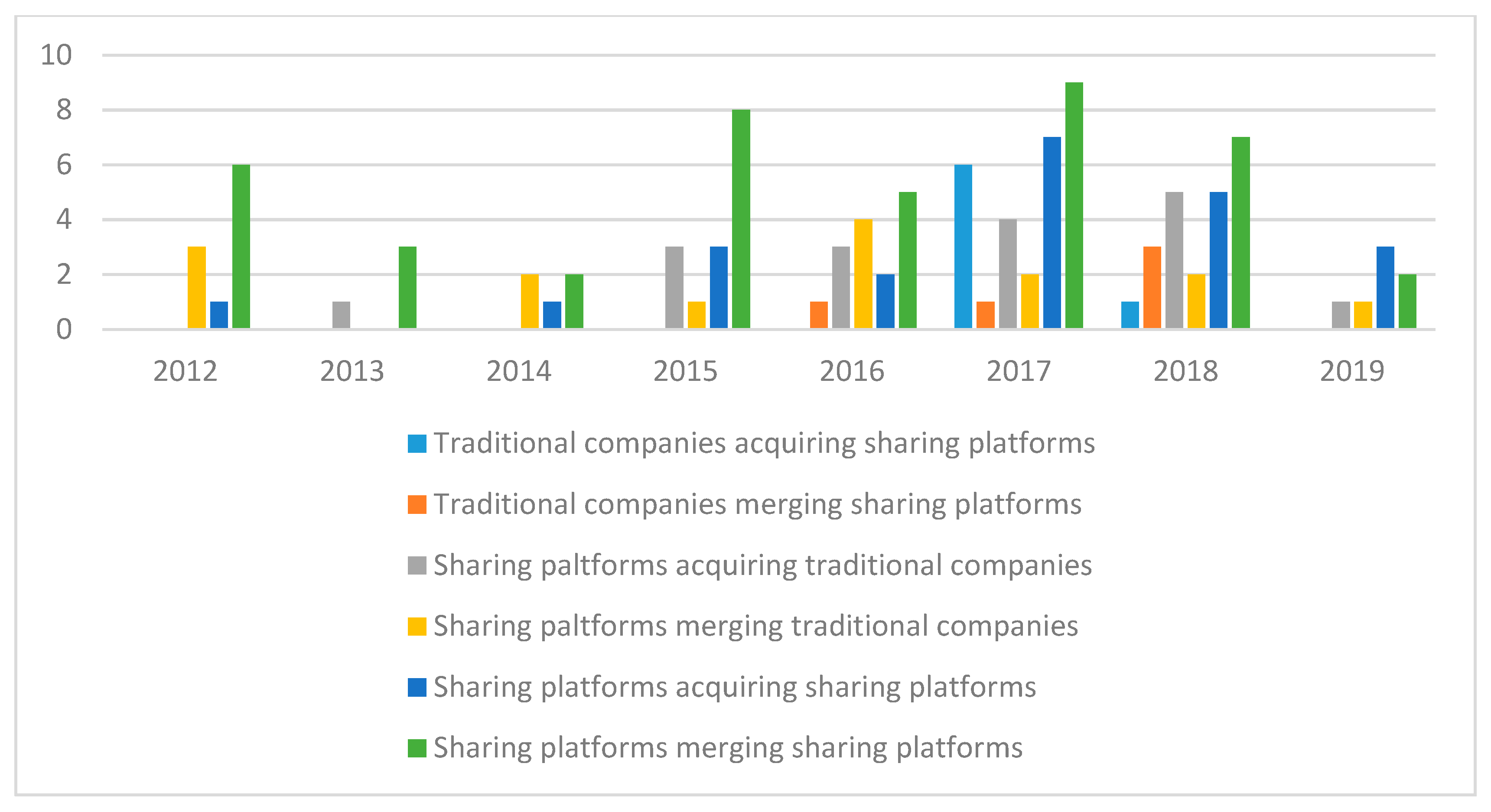

The two types of agents involved record three different types of operations: sharing platforms merging with or acquiring other platforms, sharing platforms merging with or acquiring traditional companies, and traditional companies merging with or acquiring sharing platforms.

Figure 5 reflects the direction of the operations arranged each year. The most common operation is the one in which both parties involved are sharing platforms. Operations involving two traditional companies are not uncommon, although they are not as frequent as the former ones; it is more common to find sharing platforms acquiring traditional companies than the other way around.

The interest shown by platforms in merging with or acquiring traditional companies may be motivated by the objective of acquiring some specific kind of knowledge or capability they lack. An example could be the problems faced in the development of their online platforms, therefore inducing them to acquire specialized firms. A clear example of this is Airbnb, merging with companies focused on artificial intelligence (Pencil Labs), hardware (Lapka), software (Deco Software), or micropayments (NabeWise Media). Other reasons behind these operations include entering a similar market to provide a wider range of related services. This would be the main driver behind the operation in which BlaBlaCar acquired Ouibus or Busfor, providing a new service consisting of the online sale of bus tickets and their own bus fleet. With these acquisitions, BlaBlaCar is providing new means of transport: private cars and public transport.

In the case of traditional companies acquiring or merging with sharing platforms, the most plausible justification involves entering the sharing markets without the need to build their own platforms from scratch. This is the case of Ford Motor Company merging with Chariot, Triple merging with Local Guddy, and Future Pet Animal Health merging with Go Fetch. This not only enables the larger companies to enter a new market directly, but also in the case of Ford Motor Company, for example, to offset the decrease in car sales in favor of carsharing.

These results answer RQ3, explaining how traditional companies and sharing platforms interact when analyzing the operations included in the sample.

Considering each agent’s industry (

Figure 6), the most common operation is the one in which both platforms belong to the same industry, which is explained by the fact that the merger with or acquisition of a similar platform in a different country has thus far been the most common growth method. These processes have made the biggest platforms even bigger, increased their international presence, and eliminated competitors, all in one operation. The main advantage of this type of growth, apart from its speed, is that by acquiring a local company, they also gain the necessary local knowledge to start operating in the new location [

91]. This knowledge allows companies to adapt their processes if necessary and modify other variables more susceptible to change from location to location, such as the platform’s language or the marketing approach used [

99].

4.5. Number of Domestic and Cross-Border Operations

In general, M&As occur when the managers of an acquiring firm perceive that the value of the combined firms is greater than the sum of their separate values [

93]. Domestic operations are associated with factors such as the country’s own cultural identity and physical distance, which are likely to favor operation between local firms. Meanwhile, cross-border operations are highly motivated by the differences in market development and valuation, which can increase a firm’s profitability. The volume of cross-border operations has been growing worldwide, from 23% of total merger volume in 1998 to 45% in 2007 [

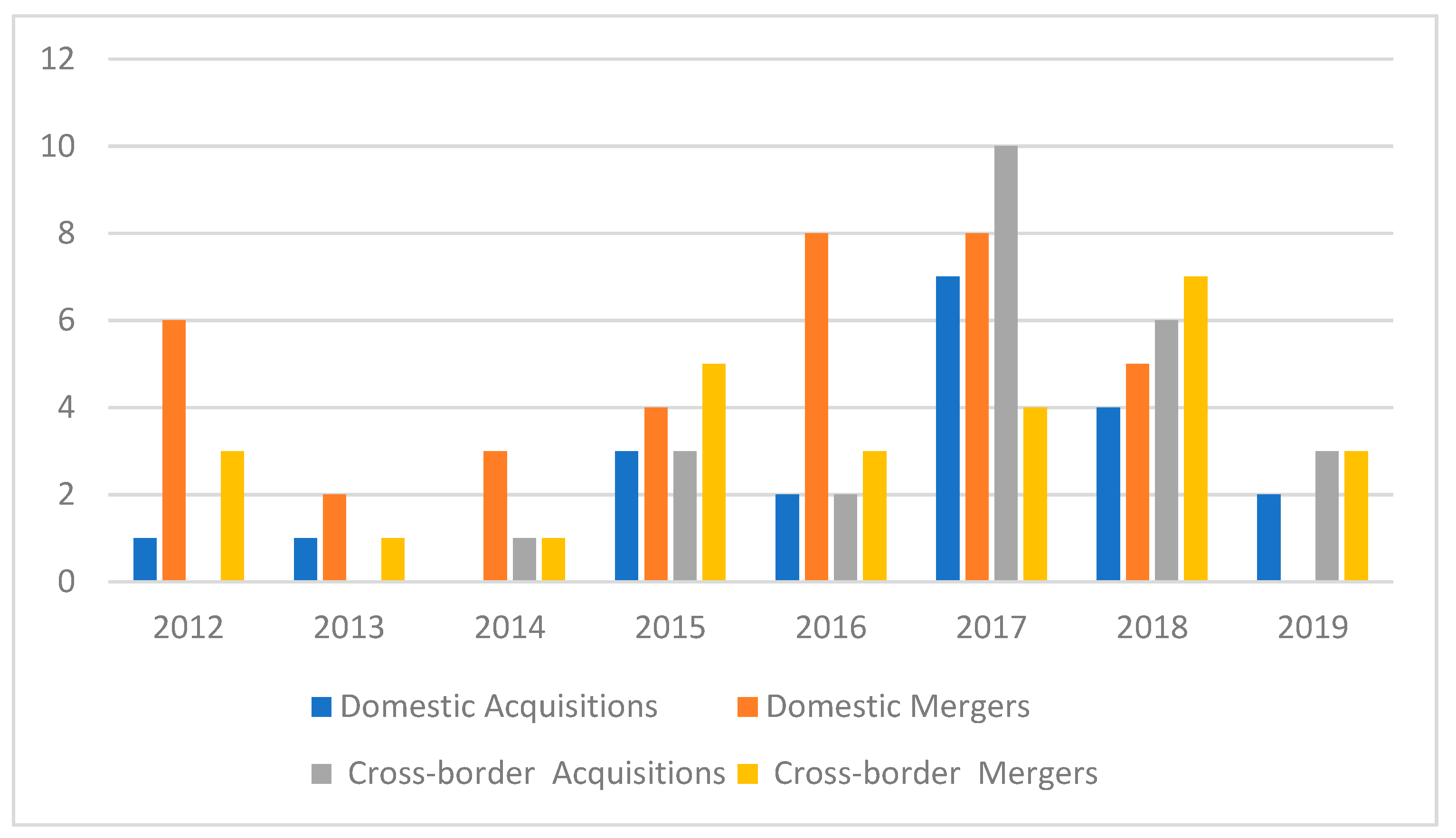

93].

Figure 7 shows the number of M&As divided according to the criteria of domestic or cross-border operations. The available data reveal an equal number of domestic (54) and cross-border operations (54). These figures show that growth is being achieved both locally and internationally, so at the same time as some companies are establishing their operations in their home country, others are expanding outside. This can be explained by the rapid global expansion of platforms and the increasing number of domestic and international competitors. Companies wishing to grow and keep up with their competitors need to keep investing.

These results answer part of RQ4, showing how both types of operations have become more common and will continue gaining in importance as markets keep developing.

4.6. The Rationale of Cross-Border and Domestic Operations

There are several different reasons for organizations to merge with or acquire other organizations: to penetrate and expand into a market in a particular area, to strengthen current sales by joining complementary product portfolios, and to vertically or horizontally integrate into new potential growth or low-cost technologies and market segments [

100].

We conclude the analysis of the data and answer the rest of RQ4 by focusing on the main reasons behind the different operations. A differentiation is made between domestic and cross-border operations because even when each operation has a different rationale, it is easier for “birds of a feather to flock together”.

The following explanations answer part of RQ4, detailing the main reasons behind each type of operation.

Table 1 presents a summary of all the operations carried out across countries.

4.6.1. Domestic Operations

Firms enter into M&As to increase competitiveness, market power, speed-to-market, and block a competitor’s moves [

101]. Firms use these operations to maximize their ability to provide attractive products or services, increase efficiency, reduce costs, and share the risks in activities that are beyond the capabilities of a single organization [

102].

In our sample, operations between local firms were found in the following countries:

France: six operations between domestic companies (one in 2013, one in 2015, two in 2017, and two in 2018). More than half of them (four) have taken place within the mobility services industry. The main motivators behind these operations are company growth in operations, either in their same sector (e.g., the merger of Buzzcar and Cityzencar or TravelCar and Tripndrive) or in a similar sector (e.g., BlaBlaCar merging with Less and Ouibus). The operation involving Drivy and Buzzcar was a failure, and after some months of trying to make it work, the company was finally wound up.

Canada: there were operations between Canadian companies. Two of them were initiated by the same platform, LeaveTown.com Vacations, merging with Guiides, and ShareShed, respectively. By doing so, their main business has been reinforced, complementing their private house renting services with an online platform to discover activities with local guides and a marketplace for outdoor sports equipment. In the other operation, a traditional company (Future Pet Animal Health) merged with an online platform to complete their retail range with collaborative services such as dog walkers and dog sitters.

China: there have been two acquisitions and one merger between Chinese companies in three different industries. Both acquisitions followed the same reasoning, namely the acquisition of a similar competitor to increase the company’s size and local presence, and eliminate competition. In the other case, Meituan-Dianping merged with Mobike to expand its business, including home delivery by bikes.

India: four out of the five operations have been initiated by Ola. The overriding goal in one case was to become big enough to compete with Uber (the merger with TaxiForSure.com). The other three operations involved Ola and three different traditional companies in the fields of information technologies (Ridl and Spieler Technologies) and location-based services (Geotagg Technologies). Ola thus obtained its own development team and became a serious competitor. The fourth operation saw mShipper acquiring Spieler Technologies to improve its technical capabilities.

The US: this is the country in which by far the most operations have taken place between companies, with 36 different operations being recorded between domestic companies. Of these, ten were initiated by Airbnb, six by Etsy, six by Lyft, and four by Uber, among others. A traditional company was involved in 22 of the operations. This suggests that the main purpose of most of the operations has been to fulfil a need (mainly related to technical and development issues) instead of merging with or acquiring competitors, as in other countries. Some operations (e.g., the acquisition of Vamo by Airbnb or JUMP bikes by Uber) were arranged to add complementary products and services to the main one, and thus set it apart from its competitors.

Finally, both Germany and Spain have a single operation involving two local companies. In both cases, a traditional automotive company has acquired a mobility services and vehicle sharing platform, respectively, whereby they ensure they outstrip their competitors when adapting their business model to the new sharing tendencies.

4.6.2. Cross-Border Operations

Cross-border M&As are defined as any transactions involving the assets of two firms belonging to two different economies [

103]. Conceptually, cross-border operations occur for the same reasons as domestic ones: two firms will merge when their combination increases value in the view of the acquiring firm’s management; however, cross-border arrangements add an extra element to the cost of domestic mergers, as they are associated with cultural or geographic differences, among other factors [

93]. This type of operation has increased sharply over the past twenty years [

104], peaking in 2015 [

105]. The rapid increase in global cross-border M&As has been attributed to several factors, including the liberalization of trade and investment, the deregulation of services, the privatization of state-owned enterprises, and the relaxation of controls [

103]. This external method of growth allows the acquiring company to obtain the other firm’s resources, such as its knowledge base, technology, workforce, and access to markets and key constituencies at the local level [

106].

In our sample, half of the 108 operations (54) have taken place between companies and platforms in different countries. The figures show that of the 15 countries involved, all of them except for Spain have recorded operations between domestic and non-domestic companies. The US is the country with the most international operations, with 17 operations involving 13 countries. The main reason behind these operations, in general, is the merger with a local company to acquire the necessary knowledge to start competing in that new market. Many of these operations imply merging the local company with the international one, whereby the customer portfolio and all the useful assets are transferred to the purchasing company, which normally uses the main brand to start trading there. While some platforms choose to invest directly in the new market and launch the new business from scratch, those that decide to acquire or merge with a local one find it easier to be profitable, as the local knowledge acquired facilitates the process and customer acceptance. These reasons are consistent with previous research, whereby cross-border operations provide access to new and lucrative markets, the expansion of the firm’s current market, and the possibility of exploiting new opportunities, as well as the chance to avoid possible threats. Cross-border acquisitions are a good opportunity for the acquiring firm to garner new knowledge and capabilities [

106].

5. Discussion

The purpose of this article is to address and analyze M&As involving sharing economy platforms. A database was therefore created to collect the information available on these operations, with a total of 108 being included in the sample.

Analytic techniques have been applied, including variables such as the number of M&A operations, the country of origin of each of the parties, and the industry to which each one belongs. The first operation was recorded in 2012, with these operations peaking in 2017. These figures correspond to the seventh wave of M&As identified by previous research [

92]. From 2010 to the present, companies turned to M&As to capture a greater market share and change their business models to compete with companies such as Netflix, Amazon, and other tech companies seeking to enter new industries [

92]. Silicon Valley’s growing ambitions helped to drive a record run of M&A activity with more than USD 2.5 trillion in mergers announced during the first half of 2018 [

107].

Concerning the countries involved, a total of 31 have had domestic companies arranging one or other type of operation, with the US leading the way.

The analysis found that 27 industries have been affected by these operations, especially those related to mobility services, space, vehicle sharing, and goods. We have also analyzed impact within the sharing economy, where the highest number of operations involved the sectors of personal space, ride as a service, and loan vehicles. These findings support previous research [

108,

109].

The most common movement involved a sharing economy platform merging with (or acquiring) another one. It is, nonetheless, quite common to find operations between traditional companies and sharing platforms. The main reason behind the operation in which a traditional company acquires a sharing platform is to enter the sharing market and recover part of the customer share lost to the collaborative alternative [

59]. The main reason a traditional company buys a sharing platform is to acquire those resources or capabilities needed to improve its processes that are not yet available in their sector [

110,

111].

An equal number of domestic and cross-border operations were found, meaning that the latter have increased their importance over the past twenty years, motivated mainly by globalization [

93]. The main reason behind domestic operations was the merger with and acquisition of domestic competitors to reduce competition and keep expanding, and of complementary domestic ones whose products were easily incorporated into the main one. By growing this way, companies have been reinforcing their business models within their country of origin and growing in complementary sectors and industries.

When analyzing cross-border operations, companies follow a clear strategy. They are acquiring or merging with similar companies in different countries to expand their operations internationally and keep apace of the major competitors present in several countries. When undertaking these operations, the acquired company is usually incorporated under the main brand and starts operating under the same name.

Although there is still a lack of information for a more thorough analysis of the operations, actions across countries are clearly becoming more popular, and the expansion of platforms is gaining in importance. This is reinforced by the environmental factors influencing the popularization of the sharing economy [

112].

The new users of sharing alternatives come from traditional markets, deciding that they can achieve greater value from their goods and resources by becoming part of these communities. This is forcing traditional companies to make decisions regarding the way they manage their business, and although there are still some companies that ignore the sharing economy’s potential, most of them are aware of the challenges it entails. This last group of companies is undertaking two alternative strategies to deal with these challenges.

There is a first group of companies that have decided to create their sharing alternative, thereby seeking to recapture lost customers, while maintaining their traditional business. Their main goal is to cover both alternatives, compensating their income loss in the traditional business by recapturing users with the sharing alternative. This is the case for, for example, Mercedes-Benz, whose carsharing alternative, Car2Go, is becoming more important each year in shared urban mobility.

Instead of creating their own platforms, the second group of companies have opted for merging with or acquiring an already existing one, as shown in the previous analysis. By so doing, they have been able to start operating as soon as the process was completed and garner the necessary knowledge to know where to start. This has been the case for, for example, IKEA acquiring TaskRabbit.

6. Conclusions and Future Research Opportunities

This research has shown how M&A operations involving sharing platforms are becoming more important and commonplace, whereby not only the expected industries are being affected by these operations, but also a wider range of industries and sectors.

This research has advanced the field by opening up a new path for analyzing M&A processes involving sharing platforms. The previous literature has confirmed that these are some of the most common development paths companies follow. We have corroborated previous findings and results by reporting similar results, verifying the predictions made in the Latitude report [

98] on the most promising industries within the sharing economy. Consequently, those industries classified as the most promising ones were found to be involved in the highest number of operations in the sample used for our analysis, concluding that the authors were on the right path when making their estimations. Theoretical assumptions made by the classical literature regarding M&As have also been corroborated in this analysis, although some limitations regarding the application of these conventional theories have been found in the interactions between traditional companies and sharing platforms, due mainly to the particular characteristics platforms have. An adaptation of traditional assumptions or the development of new ones will be needed to provide better explanations for the processes undertaken by platforms, not only in regard to M&A operations but also to topics such as expansion, general management, and internationalization. Finally, we have taken the first step toward a new research stream regarding the conjunction of M&A operations and sharing economy platforms, stating their relevance and future potential.

Regarding this paper’s managerial contributions, the main one involves the mapping of the different industries and the positioning of the players within them. By doing so, we provide managers with a useful and simple tool for identifying their main competitors or potential partners. We have also identified the most active countries and those attracting more attention, and these results can be extrapolated, as those are the countries in which the interest in and acceptance of the sharing economy are higher, and the growth potential is therefore bigger. A more detailed analysis of the country characteristics favoring the implementation of these arrangements would be needed to address the question of why there have been more operations within some geographic areas than in others, but that analysis goes beyond the scope of this paper. All the stakeholders involved in this process will benefit from this research, being invited to recognize how big and important the redistribution model the sharing economy poses is becoming and its short- and long-term implications. Managers will need to reconsider their current business models and strategies, the way they create value, and their processes and products. The global situation regarding such aspects as the implementation of more rational and sustainable processes is challenging traditional business models, forcing them to evolve toward new systems.

By addressing the different stakeholders involved, the managers of traditional companies are provided with a tool to help them understand their industry’s evolution and the level of competitiveness sharing platforms provide. They will also find information on which platforms are competing in their field, how they are undertaking external growth strategies, and what their peers are doing to cope with the changes. Apart from studying operations involving only sharing platforms, they will also find operations between traditional companies and sharing platforms, which can help them track the steps taken by their traditional competitors, predict what their future movements could be, and pre-empt them. By analyzing these data, they should be able to achieve a better understanding of their environment and better negotiate its threats and opportunities.

For the managers of sharing platforms, this research provides a graphic picture that can help them track their main competitors’ strategies and movements, as well as tendencies for both platforms and traditional companies. This information may help them in the decision-making process in topics such as external growth. By analyzing the decisions made by other players and evaluating their results, they could identify the type of strategy that works better under the given circumstances and which decisions could be extrapolated across industries or/and countries. They should thus be able to keep an eye on traditional companies entering the sharing business, as they may pose a significant challenge. We may conclude that the sharing economy is here to stay, and not just a passing fad that will vanish at some point. The managers of platforms should always bear this in mind and try to fully exploit the possibilities provided by the current framework, in which more and more people are questioning traditional consumer patterns and looking for more satisfactory alternatives.

Finally, it is not only the direct stakeholders involved in these processes that may benefit from this research, as governments may do so also. Due to the novelty of the topic, governments still have doubts about how to manage and regulate sharing initiatives [

1,

2] and are delaying taking action regarding it on the grounds that this phenomenon may only be a trend. By looking at the numbers presented, they should realize the importance this sector is acquiring and may want to work toward legislation that allows generation of the utmost value, but under a fair and legal system. Some countries have been more active than others. This research may be useful for both those countries that may want to speed up their decisions regarding the regulations and take steps to further promote these initiatives, and those countries that have not been very active until now and may want to analyze the reasons for this and work on being more appealing for this new consumer model, which, according to different scholars, may not only be more rational but also more sustainable and greener.

As stated several times in this paper, the amount of information available for this research is not enough to generalize the results, and apart from being one of our main limitations, it is an indicator of the extensive research opportunities that the sharing economy presents, some of which have been addressed in this section. As time goes by and the results of these operations become clear, it will be necessary to analyze the outcomes and establish which patterns of action are more successful. It would be interesting to analyze the future operations of those traditional companies that have invested in becoming more “sharable”, and how their business has subsequently developed, as well as the outcomes of operations between sharing platforms and, finally, how the different industries are shaped after this.