The Use of Mobile Payment Systems in Post-COVID-19 Economic Recovery: Primary Research on an Emerging Market for Experience Goods

Abstract

:1. Introduction

2. Theory

2.1. The Use of Mobile Payment Services in the Tourism Sector

2.2. Social Cognitive and Trust Theory

2.3. Antecedents of Usage Continuance Intention

2.3.1. Self-Efficacy/Personal Innovativeness

2.3.2. Outcome Expectancy

2.3.3. Social Influence

2.3.4. Perceived Trust (Including Online Trust)

2.3.5. Intention to Recommend

3. Conceptual Model and Research Hypotheses

3.1. Relation of Outcome Expectancy to Usage Continuance Intention and Intention to Recommend

3.2. Relation of Social Influence to Usage Continuance Intention and Intention to Recommend

3.3. Relation of Personal Innovativeness to Usage Continuance Intention and Intention to Recommend

3.4. Relation of Perceived Trust to Usage Continuance Intention and Intention to Recommend

3.5. Relation of Usage Continuance Intention to Intention to Recommend

4. Field Research Method

4.1. Empirical Survey, Sampling, and Data Collection

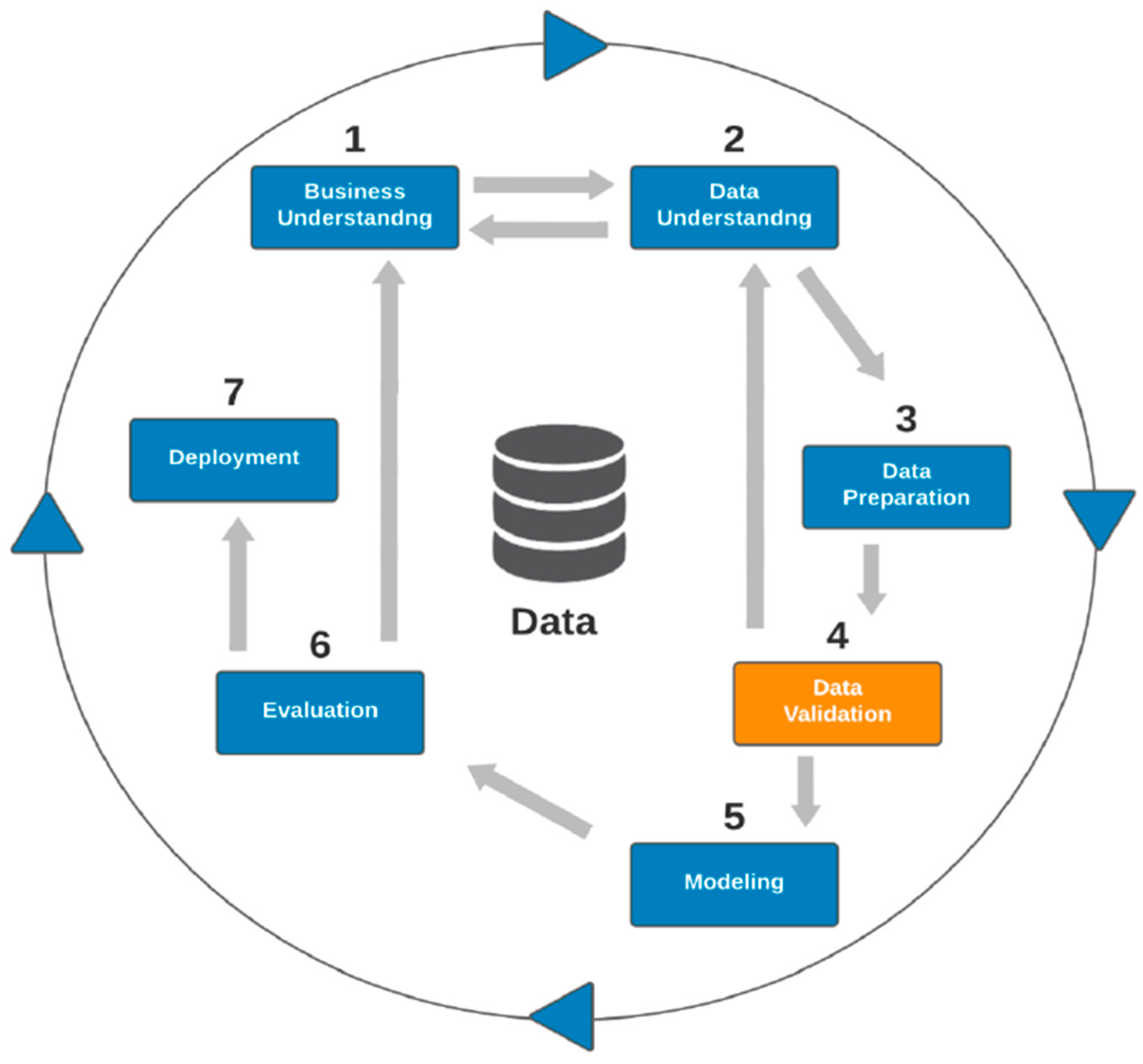

4.2. Data Pre-Processing

4.3. Computing Correlations (Composite Independent Variables)

4.4. Generating a Correlation Matrix for the Itemised Values of Intention to Recommend and Usage Continuance Intention

4.5. Conducting Regression Analysis

4.6. Splitting the Dataset

- (a)

- Applying three different machine learning models to predict usage continuance intention

| Independent Variables | Random Forest | Bayesian Network | Neural Network |

|---|---|---|---|

| Correctly classified instances | 101 | 100 | 97 |

| Percentage of correctly classified instances | 84.16 | 83.33 | 80.83 |

| Incorrectly classified instances | 19 | 20 | 23 |

| Percentage of incorrectly classified instances | 15.84 | 16.67 | 19.17 |

| Total no. of instances | 120 | 120 | 120 |

- (b)

- Applying three different machine learning models to predict intention to recommend

| Independent Variables | Random Forest | Bayesian Network | Neural Network |

|---|---|---|---|

| Correctly classified instances | 101 | 104 | 101 |

| Percentage of correctly classified instances | 84.16 | 86.67 | 84.16 |

| Incorrectly classified instances | 19 | 16 | 19 |

| Percentage of incorrectly classified instances | 15.84 | 13.33 | 15.84 |

| Total no. of instances | 120 | 120 | 120 |

5. Findings

6. Discussion and Conclusions

6.1. Theoretical Implications

6.2. Managerial Implications

6.3. Limitations and Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Construct | Indicators |

|---|---|

| Outcome expectancy | I think that using a mobile payment app will enable me to accomplish certain tasks more quickly during a tour. |

| I think that using a mobile payment app during a tour will increase my productivity. | |

| If I use a mobile payment app during a tour, it will increase my output for the same amount of effort. | |

| Social influence | The people who are important to me think that I should use a mobile payment app during domestic tours. |

| The people who influence my behaviour think that I should use a mobile payment app during domestic tours. | |

| My family/relatives have influenced my decision to use a mobile payment app especially during domestic tours. | |

| People who are important to me recommend that I use a mobile payment app during domestic tours. | |

| People who are important to me view the use of mobile payment apps as beneficial. | |

| People who are important to me think that it is a good idea for me to use a mobile payment app during tours. | |

| Self-efficacy or personal innovativeness | If I hear about a new mobile payment app, I will look for ways to experiment with it. |

| Among my peers, I am usually the first to explore a new mobile payment app on my smartphone and/or tablet. | |

| I like to experiment with using new mobile payment apps for financial services. | |

| In general, I am hesitant to try out new mobile payment apps for financial services. | |

| Mobile payment application use continuance intention | I intend to continue using mobile payment apps in the future. |

| I will always try to use mobile payment apps in my daily life. | |

| I plan to continue using mobile payment apps frequently. | |

| Perceived trust | Mobile payment apps can competently and efficiently handle my financial transactions. |

| I believe that my use of a mobile payment app will be in my best interest. | |

| I believe that mobile payment apps can be trusted at all times. | |

| Intention to recommend | I would like to recommend to others that they subscribe to mobile payment services. |

| If I have a good experience with a mobile payment app, I will recommend to my family and friends that they subscribe to the service. | |

| I will recommend to my family and friends that they subscribe to an available mobile payment service. |

References

- Gallego, I.; Font, X. Changes in air passenger demand as a result of the COVID-19 crisis: Using Big data to inform tourism policy. J. Sustain. Tour. 2020, 29, 1470–1489. [Google Scholar] [CrossRef]

- Nunkoo, R. Tourism development and trust in local government. Tour. Manag. 2015, 46, 623–634. [Google Scholar] [CrossRef]

- Khanra, S.; Dhir, A.; Kaur, P.; Joseph, R.P. Factors influencing the adoption postponement of mobile payment services in the hospitality sector during a pandemic. J. Hosp. Tour. Manag. 2021, 46, 26–39. [Google Scholar] [CrossRef]

- Karjaluoto, H.; Shaikh, A.A.; Leppäniemi, M.; Luomala, R. Examining consumers’ usage intention of contactless payment systems. Int. J. Bank Mark. 2020, 38, 332–351. [Google Scholar] [CrossRef]

- Liébana-Cabanillas, F.; García-Maroto, I.; Muñoz-Leiva, F.; Ramos-de-Luna, I. Mobile payment adoption in the age of digital transformation: The case of Apple Pay. Sustainability 2020, 12, 5443. [Google Scholar] [CrossRef]

- Liébana-Cabanillas, F.; Lara-Rubio, J. Predictive and explanatory modelling regarding adoption of mobile payment systems. Technol. Forecast. Soc. Chan. 2017, 120, 32–40. [Google Scholar] [CrossRef]

- Karjaluoto, H.; Glavee-Geo, R.; Ramdhony, D.; Shaikh, A.A.; Hurpaul, A. Consumption values and mobile banking services: Understanding the urban–rural dichotomy in a developing economy. Int. J. Bank Mark. 2021, 39, 272–293. [Google Scholar] [CrossRef]

- Au, Y.A.; Kauffman, R.J. The economics of mobile payments: Understanding stakeholder issues for an emerging financial technology application. Electron. Commer. Res. Applicat. 2008, 7, 141–164. [Google Scholar] [CrossRef]

- Coffie, C.P.K.; Zhao, H.; Adjei Mensah, I. Panel econometric analysis on mobile payment transactions and traditional banks effort toward financial accessibility in Sub-Sahara Africa. Sustainability 2020, 12, 895. [Google Scholar] [CrossRef] [Green Version]

- Lutfi, A.; Al-Okaily, M.; Alshirah, M.H.; Alshira’h, A.F.; Abutaber, T.A.; Almarashdah, M.A. Digital Financial Inclusion Sustainability in Jordanian Context. Sustainability 2021, 13, 6312. [Google Scholar] [CrossRef]

- Shaikh, A.A.; Karjaluoto, H. Marketing and Mobile Financial Services: A Global Perspective on Digital Banking Consumer Behaviour; Routledge: London, UK, 2018. [Google Scholar] [CrossRef]

- Frączek, B.; Urbanek, A. Financial inclusion as an important factor influencing digital payments in passenger transport: A case study of EU countries. Res. Transp. Bus. Manag. 2021, 100691. [Google Scholar] [CrossRef]

- Tan, G.W.H.; Ooi, K.B. Gender and age: Do they really moderate mobile tourism shopping behavior? Telemat. Informat. 2018, 35, 1617–1642. [Google Scholar] [CrossRef]

- Bandura, A. Self-efficacy: Toward a unifying theory of behavioral change. Psychol. Rev. 1977, 84, 191–215. [Google Scholar] [CrossRef]

- Mansour, E.M. Factors affecting the adoption of computer assisted audit techniques in audit process: Findings from Jordan. Bus. Econ. Res. 2016, 6, 248–271. [Google Scholar] [CrossRef]

- Charfeddine, L.; Nasri, W. The behavior intention of Tunisian banks’ customers on using internet banking. Int. J. Innov. Digit. Econ. 2013, 4, 16–30. [Google Scholar] [CrossRef]

- Hofstede, G. Culture’s Consequences: International Differences in Work-Relatedvalues; Sage Publications: Beverly Hills, CA, USA, 1980. [Google Scholar]

- Arbulú, I.; Razumova, M.; Rey-Maquieira, J.; Sastre, F. Can domestic tourism relieve the COVID-19 tourist industry crisis? The case of Spain. J. Destin. Mark. Manag. 2021, 20, 100568. [Google Scholar] [CrossRef]

- Law, R.; Sun, S.; Schuckert, M.; Buhalis, D. An exploratory study of the dependence on mobile payment among Chinese travelers. In Information and Communication Technologies in Tour; Springer: Cham, Switzerland, 2018; pp. 336–348. [Google Scholar]

- Subramaniam, V.; Nirman, N. Exploring Issues of M-Commerce on Tourism in Malaysia. Asia-Pacific. J. Innov. Hosp. Tour. 2016, 5, 111–119. [Google Scholar]

- Lei, S.; Law, R. Functionality evaluation of mobile hotel websites in the m-commerce era. J. Travel Tour. Mark. 2019, 36, 665–678. [Google Scholar] [CrossRef]

- World Travel and Tourism Council (WTTC). WTTC Outlines What “the New Normal” Will Look Like as We Start to Travel, 30/04. Available online: https://wttc.org/News-Article/WTTC-outlines-what-the-new-normal-will-look-like-as-we-start-to-travel (accessed on 10 May 2020).

- EHL Insight. Top Hospitality Industry Trends. Available online: https://hospitalityinsights.ehl.edu/hospitality-industry-trends (accessed on 15 May 2021).

- Alqatan, S.; Noor, N.M.M.; Man, M.; Mohemad, R. An empirical study on factors affecting the acceptance of M-commerce application among small and medium-sized tourism enterprises by integrating TTF with TAM. Int. J. Bus. Inf. Syst. 2019, 31, 106–135. [Google Scholar]

- Mcknight, D.H.; Choudhury, V.; Kacmar, C. Developing and validating trust measures for E-commerce: An integrative typology. Inf. Syst. Res. 2002, 13, 334–359. [Google Scholar] [CrossRef] [Green Version]

- Ratten, V. Social cognitive theory in mobile banking innovations. Int. J. E-Bus. Res. 2013, 7, 39–51. [Google Scholar] [CrossRef] [Green Version]

- Bandura, A. Self-efficacy mechanism in human agency. Am. Psychol. 1982, 37, 122–147. [Google Scholar] [CrossRef]

- Gong, Y.; Wang, H.; Xia, Q.; Zheng, L.; Shi, Y. Factors that determine a Patient’s willingness to physician selection in online healthcare communities: A trust theory perspective. Technol. Soc. 2021, 64, 101510. [Google Scholar] [CrossRef]

- Latikka, R.; Turja, T.; Oksanen, A. Self-efficacy and acceptance of robots. Comput. Hum. Behav. 2019, 93, 157–163. [Google Scholar] [CrossRef]

- Sharmin, F.; Sultan, M.T.; Wang, D.; Badulescu, A.; Li, B. Cultural Dimensions and Social Media Empowerment in Digital Era: Travel-Related Continuance Usage Intention. Sustainability 2021, 13, 10820. [Google Scholar] [CrossRef]

- Ruggieri, S.; Bonfanti, R.C.; Passanisi, A.; Pace, U.; Schimmenti, A. Electronic surveillance in the couple: The role of self-efficacy and commitment. Comput. Hum. Behav. 2021, 114, 106577. [Google Scholar] [CrossRef]

- Collado, S.; Evans, G.W. Outcome expectancy: A key factor to understanding childhood exposure to nature and children’s pro-environmental behavior. J. Environ. Psychol. 2019, 61, 30–36. [Google Scholar] [CrossRef] [Green Version]

- Savage, M.W.; Tokunaga, R.S. Moving toward a theory: Testing an integrated model of cyberbullying perpetration, aggression, social skills, and Internet self-efficacy. Comput. Hum. Behav. 2017, 71, 353–361. [Google Scholar] [CrossRef]

- Shiau, W.-L.; Yuan, Y.; Pu, X.; Ray, S.; Chen, C.C. Understanding fintech continuance: Perspectives from self-efficacy and ECT-IS theories. Ind. Manag. Data Syst. 2020, 120, 1659–1689. [Google Scholar] [CrossRef]

- Compeau, D.R.; Higgins, C.A. Computer self-efficacy: Development of a measure and initial test. MIS Quarter. 1995, 19, 189–211. [Google Scholar] [CrossRef] [Green Version]

- Chen, K.; Chen, J.V.; Yen, D.C. Dimensions of self-efficacy in the study of smart phone acceptance. Comput. Stand. Interfac. 2011, 33, 422–431. [Google Scholar] [CrossRef]

- Williams, D.M.; Anderson, E.S.; Winett, R.A. A review of the outcome expectancy construct in physical activity research. Ann. Behav. Medic. 2005, 29, 70–79. [Google Scholar] [CrossRef] [PubMed]

- Riggs, M.L.; Warka, J.; Babasa, B.; Betancourt, R.; Hooker, S. Development and validation of self-efficacy and outcome expectancy scales for job-related applications. Educ. Psychol. Measurem. 1994, 54, 793–802. [Google Scholar] [CrossRef]

- Siwatu, K.O. Preservice teachers’ culturally responsive teaching self-efficacy and outcome expectancy beliefs. Teach. Teach. Educat. 2007, 23, 1086–1101. [Google Scholar] [CrossRef]

- Stone, R.W.; Henry, J.W. The roles of computer self-efficacy and outcome expectancy in influencing the computer end-user’s organizational commitment. J. Organ. End User Comp. 2003, 15, 38–53. [Google Scholar] [CrossRef]

- Bandura, A. Social Foundations of Thought and Action: A Social Coanitive Theory; Prentice Hall: Englewood Cliffs, NJ, USA, 1986. [Google Scholar]

- Lu, H.P.; Lee, M.R. Experience differences and continuance intention of blog sharing. Behav. Inf. Technol. 2012, 31, 1081–1095. [Google Scholar] [CrossRef]

- Chang, I.C.; Liu, C.C.; Chen, K. The effects of hedonic/utilitarian expectations and social influence on continuance intention to play online games. Internet Resear. 2014, 24, 21–45. [Google Scholar] [CrossRef]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User acceptance of information technology: Toward a unified view. MIS Quart. 2003, 27, 425–478. [Google Scholar] [CrossRef] [Green Version]

- Slade, E.L.; Dwivedi, Y.K.; Piercy, N.C.; Williams, M.D. Modeling consumers’ adoption intentions of remote mobile payments in the United Kingdom: Extending UTAUT with innovativeness, risk, and trust. Psychol. Mark. 2015, 32, 860–873. [Google Scholar] [CrossRef]

- Venkatesh, V.; Thong, J.; Xu, X. Consumer acceptance and use of information technology: Extending the Unified Theory of Acceptance and Use of Technology. MIS Quarter. 2012, 36, 157–178. [Google Scholar] [CrossRef] [Green Version]

- Koenig-Lewis, N.; Marquet, M.; Palmer, A.; Zhao, A.L. Enjoyment and social influence: Predicting mobile payment adoption. Serv. Ind. J. 2015, 35, 537–554. [Google Scholar] [CrossRef]

- Mayer, R.C.; Davis, J.H.; Schoorman, F.D. An Integrative Model of Organizational Trust. Acad. Manag. Rev. 1995, 20, 709–734. [Google Scholar] [CrossRef]

- Neupane, C.; Wibowo, S.; Grandhi, S.; Deng, H. A Trust-Based Model for the Adoption of Smart City Technologies in Australian Regional Cities. Sustainability 2021, 13, 9316. [Google Scholar] [CrossRef]

- Shankar, V.; Urban, G.L.; Sultan, F. Online trust: A stakeholder perspective, concepts, implications, and future directions. J. Strateg. Inf. Syst. 2002, 11, 325–344. [Google Scholar] [CrossRef]

- Taddeo, M. Defining trust and e-trust: From old theories to new problems. Int. J. Technol. Hum. Interact. 2009, 5, 23–35. [Google Scholar] [CrossRef] [Green Version]

- Hosany, S.; Witham, M. Dimensions of cruisers’ experiences, satisfaction, and intention to recommend. J. Travel Res. 2010, 49, 351–364. [Google Scholar] [CrossRef]

- Hosany, S.; Prayag, G. Patterns of tourists’ emotional responses, satisfaction, and intention to recommend. J. Bus. Res. 2013, 66, 730–737. [Google Scholar] [CrossRef]

- Oliveira, T.; Thomas, M.; Baptista, G.; Campos, F. Mobile payment: Understanding the determinants of customer adoption and intention to recommend the technology. Comput. Hum. Behav. 2016, 61, 404–414. [Google Scholar] [CrossRef]

- Hsu, M.H.; Chiu, C.M.; Ju, T.L. Determinants of continued use of the WWW: An integration of two theoretical models. Ind. Manag. Data Syst. 2004, 104, 766–775. [Google Scholar] [CrossRef]

- Rahi, S.; Ghani, M.; Ngah, A. A structural equation model for evaluating user’s intention to adopt internet banking and intention to recommend technology. Accounting 2018, 4, 139–152. [Google Scholar] [CrossRef]

- Talukder, M.S.; Chiong, R.; Bao, Y.; Malik, B.H. Acceptance and use predictors of fitness wearable technology and intention to recommend: An empirical study. Ind. Manag. Data Syst. 2019, 119, 170–188. [Google Scholar] [CrossRef]

- Ramadhani, S.A.; Kurniawati, M.; Nata, J.H. Effect of Destination Image and Subjective Norm toward Intention to Visit the World Best Halal Tourism Destination of Lombok Island in Indonesia. KnE Soc. Sci. 2020, 83–95. Available online: https://knepublishing.com/index.php/KnE-Social/article/view/7318 (accessed on 14 September 2021). [CrossRef]

- Joo, Y.; Seok, H.; Nam, Y. The moderating effect of social media use on sustainable rural tourism: A theory of planned behavior model. Sustainability 2020, 12, 4095. [Google Scholar] [CrossRef]

- Sun, Y.; Liu, L.; Peng, X.; Dong, Y.; Barnes, S.J. Understanding Chinese users’ continuance intention toward online social networks: An integrative theoretical model. Electron. Mark. 2014, 24, 57–66. [Google Scholar] [CrossRef]

- Chen, S.C.; Yen, D.C.; Hwang, M.I. Factors influencing the continuance intention to the usage of Web 2.0: An empirical study. Comput. Hum. Behav. 2012, 28, 933–941. [Google Scholar] [CrossRef]

- Liébana-Cabanillas, F.; Singh, N.; Kalinic, Z.; Carvajal-Trujillo, E. Examining the determinants of continuance intention to use and the moderating effect of the gender and age of users of NFC mobile payments: A multi-analytical approach. Inf. Technol. Manag. 2021, 22, 131–161. [Google Scholar] [CrossRef]

- Melnikov, S.; Aboav, A.; Shalom, E.; Phriedman, S.; Khalaila, K. The effect of attitudes, subjective norms and stigma on health-care providers’ intention to recommend medicinal cannabis to patients. Int. J. Nurs. Pract. 2021, 27, e12836. [Google Scholar] [CrossRef] [PubMed]

- Lu, J. Are personal innovativeness and social influence critical to continue with mobile commerce? Internet Resear. 2014, 24, 134–159. [Google Scholar] [CrossRef]

- Lin, Z.; Filieri, R. Airline passengers’ continuance intention towards online check- in services: The role of personal innovativeness and subjective knowledge. Transportation Res. Part E Logist. Transp. Rev. 2015, 81, 158–168. [Google Scholar] [CrossRef] [Green Version]

- Bataineh, A.Q.; Al-Abdallah, G.M.; Alkharabsheh, A.M. Determinants of continuance intention to use social networking sites SNS’s: Studying the case of Facebook. Int. J. Mark. Stud. 2015, 7, 121–135. [Google Scholar] [CrossRef]

- Vatanasombut, B.; Igbaria, M.; Stylianou, A.C.; Rodgers, W. Information systems continuance intention of web-based applications customers: The case of online banking. Inf. Manag. 2008, 45, 419–428. [Google Scholar] [CrossRef]

- Shao, Z.; Zhang, L.; Li, X.; Guo, Y. Antecedents of trust and continuance intention in mobile payment platforms: The moderating effect of gender. Electron. Commer. Res. Applicat. 2019, 33, 100823. [Google Scholar] [CrossRef]

- Kim, T.T.; Kim, W.G.; Kim, H.B. The effects of perceived justice on recovery satisfaction, trust, word-of-mouth, and revisit intention in upscale hotels. Tour. Manag. 2009, 30, 51–62. [Google Scholar] [CrossRef]

- Gupta, A.; Dhiman, N.; Yousaf, A.; Arora, N. Social comparison and continuance intention of smart fitness wearables: An extended expectation confirmation theory perspective. Behav. Inf. Technol. 2020, 15, 1341–1354. [Google Scholar] [CrossRef]

- Shaikh, A.A.; Sharma, R.; Karjaluoto, H. Digital innovation & enterprise in the sharing economy: An action research agenda. Digit. Busin. 2020, 1, 100002. [Google Scholar]

- Zhang, J.; Zhang, H.; Gong, X. Mobile payment and rural household consumption: Evidence from China. Telecommun. Policy 2021, 102276. [Google Scholar] [CrossRef]

| Demographic Categories | Frequency | Percentage (%) |

|---|---|---|

| Gender | 400 | 100 |

| Male | 136 | 34 |

| Female | 264 | 66 |

| Age group | 400 | 100 |

| ≤18 years | 79 | 19.75 |

| 19–24 years | 182 | 45.5 |

| 25–34 years | 36 | 9 |

| 35–44 years | 52 | 13 |

| 45–54 years | 31 | 7.75 |

| ≥55 years | 20 | 5 |

| Experience | 400 | 100 |

| 01–03 months | 96 | 24 |

| 04–06 months | 116 | 29 |

| 07–12 months | 89 | 22 |

| 13–24 months | 99 | 25 |

| ≥25 months | 00 | 00 |

| Frequency | 400 | 100 |

| 01–03 times | 63 | 16 |

| 04–06 times | 31 | 8 |

| 07–12 times | 121 | 30 |

| 13–24 times | 96 | 24 |

| ≥25 times | 89 | 22 |

| Profession | 400 | 100 |

| Student | 232 | 58 |

| Employee/professional | 50 | 12.5 |

| Entrepreneur (self-employed) | 65 | 16.25 |

| Retired | 31 | 7.75 |

| Unemployed | 19 | 4.75 |

| Out-of-bound values | 3 | 0.75 |

| Education | 400 | 100 |

| High school | 39 | 9.75 |

| Bachelor | 255 | 63.75 |

| Master | 74 | 18.5 |

| Ph.D. | 32 | 8 |

| Annual income (tenge) | 400 | 100 |

| Less than 200,000 | 247 | 61.75 |

| 200,001–400,000 | 84 | 21 |

| 400,001–600,000 | 42 | 10.5 |

| 600,001–800,000 | 25 | 6.25 |

| More than 800,001 | 2 | 0.5 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| (1) Outcome expectancy | 1 | 0.71 | 0.70 | 0.73 |

| (2) Social influence | 1 | 0.74 | 0.68 | |

| (3) Personal innovativeness | 1 | 0.73 | ||

| (4) Perceived trust | 1 | |||

| * R2: −0.1379 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| (1) CI future | 1 | 0.73 | 0.68 | 0.64 | 0.58 |

| (2) CI daily | 1 | 0.67 | 0.53 | 0.55 | |

| (3) CI frequency | 1 | 0.69 | 0.66 | ||

| (4) IR recommendation | 1 | 0.86 | |||

| (5) IR subscribe | 1 |

| Independent Variables | β | ρ |

|---|---|---|

| Outcome expectancy | 0.1626 | 0.081 |

| Social influence | 0.0724 | 0.937 |

| Personal innovativeness | 0.4460 *** | 0.000 |

| Perceived trust | 0.4396 *** | 0.000 |

| Occupation | 0.0808 | 0.488 |

| Age group | −0.0337 | 0.557 |

| Duration of use | 0.0507 | 0.517 |

| R2 | 0.760 | |

| Adjusted R2 | 0.755 | |

| F-value | 176.9 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Suyunchaliyeva, M.M.; Nautiyal, R.; Shaikh, A.A.; Sharma, R. The Use of Mobile Payment Systems in Post-COVID-19 Economic Recovery: Primary Research on an Emerging Market for Experience Goods. Sustainability 2021, 13, 13511. https://doi.org/10.3390/su132413511

Suyunchaliyeva MM, Nautiyal R, Shaikh AA, Sharma R. The Use of Mobile Payment Systems in Post-COVID-19 Economic Recovery: Primary Research on an Emerging Market for Experience Goods. Sustainability. 2021; 13(24):13511. https://doi.org/10.3390/su132413511

Chicago/Turabian StyleSuyunchaliyeva, Maiya M., Raghav Nautiyal, Aijaz A. Shaikh, and Ravishankar Sharma. 2021. "The Use of Mobile Payment Systems in Post-COVID-19 Economic Recovery: Primary Research on an Emerging Market for Experience Goods" Sustainability 13, no. 24: 13511. https://doi.org/10.3390/su132413511

APA StyleSuyunchaliyeva, M. M., Nautiyal, R., Shaikh, A. A., & Sharma, R. (2021). The Use of Mobile Payment Systems in Post-COVID-19 Economic Recovery: Primary Research on an Emerging Market for Experience Goods. Sustainability, 13(24), 13511. https://doi.org/10.3390/su132413511