Effect of Farmers’ Perceptions of Sustainable Development Value on Their Willingness for Agricultural Land Secured Financing

Abstract

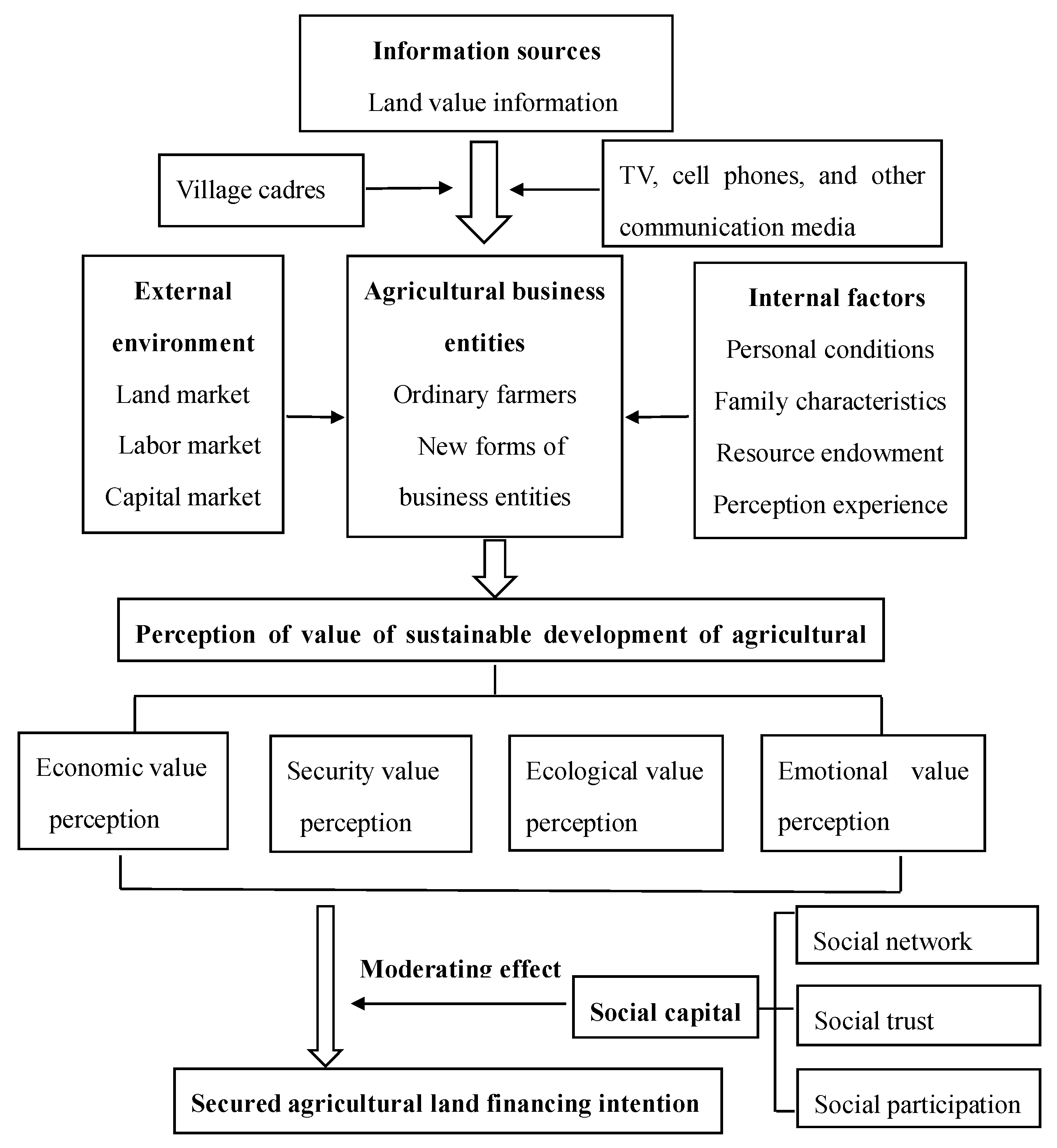

:1. Introduction

- (i)

- Whether farmers’ perceptions of the economic value, security value, emotional value, and ecological value of agricultural land influenced their intention to seek out land financing from the demand side;

- (ii)

- Whether farmers’ social capital had a moderating effect on the relationship between the farmers’ perceptions of the sustainability value of agricultural land and their intention to pursue agricultural land financing.

2. Theoretical Analysis

2.1. Effect of Value Perception on Willingness for Agricultural Land Secured Financing

2.1.1. Perceptions of Economic Value and Willingness for Agricultural Land Secured Financing

2.1.2. Perceptions of Social Security Value and Willingness for Agricultural Land Secured Financing

2.1.3. Perceptions of Ecological Value and Willingness for Agricultural Land Secured Financing

2.1.4. Perceptions of Emotional Value and Willingness for Agricultural Land Secured Financing

2.2. Effect of Social Capital on Willingness for Agricultural Land Secured Financing

3. Method

3.1. Data Source

3.2. Model Selection

3.3. Variable Selection and Measurement

3.3.1. Dependent Variable: Intention to Obtain Agricultural Land Secured Financing

3.3.2. Core Independent Variable: Perception of the Sustainable Development Value of Agricultural Land

3.3.3. Moderating Variable: Social Capital

3.3.4. Group Variable: Business Entity Types

3.3.5. Control Variable

4. Results

4.1. Effect of Farmers’ Value Perceptions on Intention to Obtain Secured Financing

4.2. Effect of Social Capital on Intention to Finance Agricultural Land

4.3. Endogeneity Test

5. Discussion

6. Conclusions and Recommendations

- (i).

- Due to China’s vast territory, there are significant differences in regional economic levels and sustainable development of agricultural land. Farmers’ cognition level of agricultural land value also has specific heterogeneity. This study only took Shaanxi Province as the study sample, which has certain limitations in the research scope;

- (ii).

- As a financial product, the key to the sustainable development of agricultural land secured financing lies in the dual role of supply and demand. The supply willingness of financial institutions is also the main factor affecting the agricultural land secured financing. This study only explored the development of agricultural land secured financing from the demand side, and the impact mechanism was not fully considered.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Stern, D.I.; Common, M.S.; Barbier, E.B. Economic growth and environmental degradation: The environmental Kuznets curve and sustainable development. World Dev. 1996, 24, 1151–1160. [Google Scholar] [CrossRef]

- Delcourt, H.R.; Delcourt, P.A. Quaternary landscape ecology: Relevant scales in space and time. Landsc. Ecol. 1988, 2, 23–44. [Google Scholar] [CrossRef]

- Dysonhudson, R. Desertification and development-Dryland ecology in social-perspective-Spooner, B, Mann, HS. Science 1983, 221, 1365–1366. [Google Scholar]

- Yansui, L.; Yuheng, L. Revitalize the world’s countryside. Nature 2018, 548, 275–277. [Google Scholar]

- Feder, G.; Onchan, T.; Raparla, T. Collateral, guaranties and rural credit in developing countries: Evidence from Asia. Agric. Econ. 1988, 2, 231–245. [Google Scholar] [CrossRef] [Green Version]

- Cliffea, L. Agricultural land redistribution: Toward greater consensus. Rev. Afr. Political Econ. 2011, 38, 179–180. [Google Scholar] [CrossRef]

- Soto, H.D. The Mystery of Capital: Why Capitalism Triumphs in the West and Fails Everywhere Else; Basic Books: New York, NY, USA, 2000. [Google Scholar]

- Chen, L.; Chen, H.; Zou, C.; Liu, Y. The Impact of Farmland Transfer on Rural Households’ Income Structure in the Context of Household Differentiation: A Case Study of Heilongjiang Province, China. Land 2021, 10, 362. [Google Scholar] [CrossRef]

- Wu, L.J.; Liu, R.M. Awakening dormant capital: The income leveraging effect of agricultural land mortgages. Financ. Res. 2021, 47, 108–122. (In Chinese) [Google Scholar]

- Tian, Z.; Gong, L.Y. Research on the Influencing Factors of Family Farm Financing Demand—A Case Study of Family Farm in Songjiang District of Shanghai. In Proceedings of the 2019 4th EBMEI International Conference on Economics, Business, Management and Social Science, Toronto, ON, Canada, 8 August 2019. [Google Scholar]

- Ma, J.; Luo, J.Z. Research on the influence of farmers’ perceptions on their participation in agricultural land management rights mortgage behavior. J. Human. 2018, 11, 72–77. (In Chinese) [Google Scholar]

- Liu, Z.Y.; Zhang, T.; Kong, R. Policy trust, transaction cost perceptions and intention to finance agricultural land mortgages—A differential analysis based on farmers’ participation experiences during the pilot period of this financial policy. Financ. Theory Pract. 2020, 18–25. (In Chinese) [Google Scholar]

- Cao, L.; Luo, J.C. Credit availability for agricultural land contracted right mortgage loan and its impact factors. J. China Agric. Univ. 2020, 25, 212–222. (In Chinese) [Google Scholar]

- Chen, Y.; Wu, J. Study on Influencing Factors of Mortgage Financing Mode of Farmland Management Rights in Anhui. J. Heilongjiang Bayi Agric. Univ. 2019, 31, 114–120. (In Chinese) [Google Scholar]

- Gladwin, C.H.; Long, B.F.; Babb, E.M.; Mulkey, D.; Zimet, D.J.; Moseley, A.; Beaulieu, L.J. Rural Entrepreneurship: One Key to Rural Revitalization. Am. J. Agric. Econ. 1989, 71, 1305–1314. [Google Scholar] [CrossRef]

- Stern, P.C.; Dietz, T.; Guagnano, G.A. A Brief Inventory of Values. Educ. Psychol. Meas. 1998, 58, 984–1001. [Google Scholar] [CrossRef]

- Zheng, H.Y.; Wu, C.F.; Xu, Z.G.; Huang, J.H. Rethinking and reshaping the perception of land value for the construction of ecological civilization. China Land. Sci. 2020, 34, 10–17. (In Chinese) [Google Scholar]

- Awasthi, M.K. Socioeconomic determinants of farmland value in India. Land Use Policy 2014, 39, 78–83. [Google Scholar] [CrossRef]

- Kollmuss, A.; Agyeman, J. Mind the Gap: Why Do People Act Environmentally and What Are the Barriers to Pro-Environmental Behavior? Environ. Educ. Res. 2002, 8, 239–260. [Google Scholar] [CrossRef] [Green Version]

- Issahaku, G.; Abdulai, A. Sustainable land management practices and technical and environmental efficiency among smallholder farmers in Ghana. J. Agric. Appl. Econ. 2020, 52, 96–116. [Google Scholar] [CrossRef] [Green Version]

- Ajzen, I. The theory of planned behavior. Organ. Behav. Hum. Dec. Proc. 1991, 50, 179–211. [Google Scholar] [CrossRef]

- Meijer, S.S.; Catacutan, D.; Sileshi, G.W.; Nieuwenhuis, M. Tree planting by smallholder farmers in Malawi: Using the theory of planned behaviour to examine the relationship between attitudes and behaviour. J. Environ. Psychol. 2015, 43, 1–12. [Google Scholar] [CrossRef] [Green Version]

- Sarma, P.K. Farmer behavior towards pesticide use for reduction production risk: A Theory of Planned Behavior. Clean. Circ. Bioecon. 2022, 1, 100002. [Google Scholar] [CrossRef]

- Feng, L.; Zhang, M.; Li, Y.; Jiang, Y. Satisfaction principle or efficiency principle? Decision-making behavior of peasant households in China’s agricultural land market-ScienceDirect. Land Use Policy 2020, 99, 104943. [Google Scholar] [CrossRef]

- Hu, L.F. The power and boundary of “three rights” in the capitalization of agricultural land in China. Rural Econ. 2020, 18–26. (In Chinese) [Google Scholar]

- Xu, Q.; Lu, Y.F. Non-agricultural employment, social security function of land, and agricultural land transfer. China Popul. Sci. 2018, 5, 30–41+126–127. (In Chinese) [Google Scholar]

- Shi, H.; Sui, D.; Xu, T.; Zhao, M. The influence mechanism of ecological value cognition on farmers’ willingness to participate in ecological management: An example from Weihe Basin in Shaanxi Province. China Rural Sur. 2017, 2, 68–80. (In Chinese) [Google Scholar]

- Shi, Y.X.; Li, C.Q.; Zhao, M.J. The impact of non-market value cognition and social capital on farmers’ willingness in farmland protection cooperation. China Popul. Res. Environ. 2019, 29, 94–103. (In Chinese) [Google Scholar]

- Michelini, J.J. Small farmers and social capital in development projects: Lessons from failures in Argentina’s rural periphery. J. Rural Stud. 2013, 30, 99–109. [Google Scholar] [CrossRef]

- Xiao, Y.; Wei, C.F.; Yin, K. Analysis on Farmers’ willingness to demand rural “three rights” mortgage loans and its influencing factors—Based on the survey data of 1141 farmers in 22 counties (districts) of Chongqing. China Rural Econ. 2012, 9, 88–96. (In Chinese) [Google Scholar]

- Cao, Y.; Luo, J.C.; Li, Y. An empirical study on Farmers’ willingness to mortgage financing of land property rights in Northwest China—Based on the survey data of 370 farmers in Shaanxi and Ningxia. Financ. Trad. Res. 2014, 25, 54–61. (In Chinese) [Google Scholar]

- Niu, X.D.; Luo, J.C.; Niu, X.Q. Analysis on the willingness of farmers with different income levels to participate in the mortgage financing of agricultural land contracted management right—Verification Based on the survey data of farmers in Shaanxi and Ningxia. Econ. Theor. Econ. Manag. 2015, 9, 101–112. (In Chinese) [Google Scholar]

- Peng, W.L.J.; Liu, W.B. Willingness and influencing factors of rural land management right mortgage financing demand of large farmers majoring in planting and Breeding—An Empirical Study Based on the investigation of four pilot counties in Hunan. Econ. Geogr. 2018, 38, 176–182. (In Chinese) [Google Scholar]

- Lin, L.F.; Gu, Q.K. Analysis on the potential demand and influencing factors of farmers’ professional cooperatives for mortgage loans of agricultural land management rights. China Land. Sci. 2017, 31, 28–36. (In Chinese) [Google Scholar]

- Cheng, J.; Kong, X.B.; Li, J.; Zhang, X.L. The Relationship between substitution degree of farmland social insurance function and farmland transfer based on 330 peasant household surveys on the Jingji plains. Res. Sci. 2014, 36, 17–25. (In Chinese) [Google Scholar]

- Liu, T.S.; Niu, L.T. Rural-household differentiation, willingness of land usufruct abdication and farmers’ choice preference. China J. Popul. Res. Environ. 2014, 24, 114–120. (In Chinese) [Google Scholar]

- Yan, J.; Yang, Y.; Xia, F. Subjective land ownership and the endowment effect in land markets: A case study of the farmland “three rights separation” reform in China. Land Use Policy 2021, 101, 105–137. [Google Scholar] [CrossRef]

- Yang, Q.; Zhu, Y.; Liu, L.; Wang, F. Land tenure stability and adoption intensity of sustainable agricultural practices in banana production in China. J. Clean. Prod. 2022, 338, 130553. [Google Scholar] [CrossRef]

- Chen, X.T.; Feng, Z.C.; Huang, W.H.; Qi, Z.H.; Yang, C.Y. Study on the impact of business scale on Farmers’ heterogeneous ecological production behavior. Res. Environ. Yangtze Riv. Basin. 2021, 30, 1252–1263. (In Chinese) [Google Scholar]

- Yu, L.H.; Lan, Q.G.; Dai, L. Differences and influencing factors of rural land management right mortgage financing needs of farmers of different sizes -- Based on the micro survey data of 626 farmers. Financ. Trad. Econ. 2015, 04, 74–84. (In Chinese) [Google Scholar]

- Kassie, M.; Jaleta, M.; Shiferaw, B.; Mmbando, F.; Mekuria, M. Adoption of interrelated sustainable agricultural practices in smallholder systems: Evidence from rural Tanzania. Technol. Forecast. Soc. Chang. 2013, 80, 525–540. [Google Scholar] [CrossRef]

- Kotu, B.H.; Oyinbo, O.; Hoeschle-Zeledon, I.; Nurudeen, A.R.; Kizito, F.; Boyubie, B. Smallholder farmers’ preferences for sustainable intensification attributes in maize production: Evidence from Ghana. World Dev. 2022, 152, 105789. [Google Scholar] [CrossRef]

- Wu, Q. Some cognitions on the theoretical innovation of asset value and equity of cultivated land resources with Chinese characteristics. Dynam. Land. Sci. 2020, 6, 7–9. (In Chinese) [Google Scholar]

- Nguyen, N.; Drakou, E.G. Farmers intention to adopt sustainable agriculture hinges on climate awareness: The case of Vietnamese coffee-ScienceDirect. J. Clean. Prod. 2021, 303, 126828. [Google Scholar] [CrossRef]

- Xu, M.Y. The impact of migrant workers’ citizenization and land value demand on transfer out Intention—An Empirical Analysis Based on 1371 questionnaires in 4 provinces and 9 cities. J. North. Agric. Univ. 2020, 18, 8–19. (In Chinese) [Google Scholar]

| Item | Category | Percent (%) | Item | Category | Percent (%) |

|---|---|---|---|---|---|

| Household Gender | Male | 58.1 | Household member count | 1–2 | 1.9 |

| Female | 41.9 | 3–4 | 49.8 | ||

| Age | 20–30 | 13.1 | 5–6 | 38.4 | |

| 30–40 | 16.4 | 7 and above | 9.9 | ||

| 40–50 | 41.2 | Proportion of nonagricultural income | 20% and below | 32.3 | |

| 50–60 | 22.2 | 20–40% | 14.6 | ||

| 60 and above | 7.1 | 40–60% | 19.2 | ||

| Education | Elementary and below | 14.6 | 60–80% | 15.1 | |

| Middle school | 37.2 | 80% and above | 18.8 | ||

| High school | 28.8 | Agricultural land area | 0–5 mu | 64.4 | |

| College and above | 19.4 | 5–10 mu | 17.5 | ||

| Business type | Ordinary farmers | 82.6 | 10–20 mu | 8.1 | |

| New forms of business entities | 17.4 | 20 mu and above | 10.0 |

| Dimension | Measured Item | Measurement |

|---|---|---|

| Perception of economic value | Agree that agricultural land has economic income value, such as obtaining rent and dividends | Assigned value 1–5 |

| Agree that agricultural land has capital value, such as guaranteeing financing from financial institutions | Assigned value 1–5 | |

| Perception of social security value | Agree that agricultural land has value for growing crops to ensure basic subsistence | Assigned value 1–5 |

| Agree that agricultural land has value for securing farmers’ retirement | Assigned value 1–5 | |

| Agree that agricultural land has value for securing employment for farmers | Assigned value 1–5 | |

| Perception of ecological value | Agree that agricultural land has value for purifying air and conserving water | Assigned value 1–5 |

| Agree that agricultural land has value for beautifying the environment and preserving biodiversity | Assigned value 1–5 | |

| Perception of emotional value | Agree that agricultural land has value for identity and cultural heritage | Assigned value 1–5 |

| Agree that agricultural land has value for emotional support and nostalgic comfort | Assigned value 1–5 |

| Dimension | Measured Item | Measurement |

|---|---|---|

| Social network | Number of friends and relatives who are village officials or work in government departments or financial institutions 0–5 people = 1; 5–10 people = 2; 10–15 people = 3; 15–20 people = 4; 20 or more people = 5 | Assigned value 1–5 according to the interval |

| Number of people who can lend money in case of difficulty 0–5 people = 1; 5–10 people = 2; 10–15 people = 3; 15–20 people = 4; 20 or more people = 5 | Assigned value 1–5 according to the interval | |

| Total gift expenditure in one year 0–1000 RMB = 1; 1000–2000 RMB = 2; 2000–3000 RMB = 3; 3000–4000 RMB = 4; more than 4000 RMB = 5 | Assigned value 1–5 according to the interval | |

| Social trust | Level of trust in relatives and friends | Assigned value 1–5 |

| Trust in village officials | Assigned value 1–5 | |

| Trust in credit officers | Assigned value 1–5 | |

| Social participation | Frequency of participation in village collective activities | Assigned value 1–5 |

| How much attention you pay to regional events and social news | Assigned value 1–5 | |

| How often you communicate and have discussions with people in your village | Assigned value 1–5 |

| Variable Type | Variable | Value Assignment | Mean | Standard Deviation | |

|---|---|---|---|---|---|

| Dependent variable | Intend to finance agricultural land (Y) | Yes = 1; no = 0 | 0.516 | 0.500 | |

| Core independent variable | Perception of agricultural land (VC) | Entropy method obtained | 0.613 | 0.149 | |

| Group variable | Business type (BT) | Ordinary farmers = 1; new forms of business entities = 2 | 1.170 | 0.378 | |

| Control variable | Individual conditions | Age (X1) | 20–30 years old = 1; 30–40 years old = 2; 40–50 years old = 3; 50–60 years old = 4; 60 years old and older = 5 | 2.340 | 1.015 |

| Education (X2) | Elementary and below = 1; middle school = 2; high school = 3; college and above = 4 | 2.990 | 0.990 | ||

| Family characteristics | Household member count (X3) | Total household members (persons) | 4.710 | 1.934 | |

| Percent of non-agricultural income (X4) | Annual non-agricultural income/family total income | 0.472 | 0.434 | ||

| Resource endowment | Agricultural land area (X5) | Sum of area of owned land and transferred land (mu) | 14.130 | 70.932 | |

| Logarithmic value of fixed assets (X6) | Total value of owned agricultural production facilities, machinery and equipment and other fixed assets (yuan) | 2.146 | 1.789 | ||

| Financing experience | Knowledge of farmland financing guarantee policies (X7) | Very little = 1; relatively little = 2; average = 3; relatively much = 4; very much = 5 | 2.264 | 0.917 | |

| Have formal credit experience (X8) | Yes = 1; no = 0 | 1.786 | 0.410 | ||

| Land market | Agricultural land transfer market construction (X9) | Very imperfect = 1; imperfect = 2; average = 3; relatively perfect = 4; very perfect = 5 | 2.850 | 0.690 | |

| Capital market | Ease of access to microfinancing (X10) | Very difficult = 1; more difficult = 2; fair = 3; easier = 4; very easy = 5 | 2.839 | 0.772 | |

| Job market | Difficulty working outside the home for employment (X11) | Very difficult = 1; more difficult = 2; fair = 3; easier = 4; very easy = 5 | 2.758 | 0.811 | |

| Social security | Participate in social pension insurance (X12) | Yes = 1; no = 0 | 1.420 | 0.494 | |

| Variable | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 |

|---|---|---|---|---|---|

| Economic value perception (VC1) | 3.243 *** (0.272) | ||||

| Social security value perception (VC2) | −11.736 *** (0.511) | ||||

| Ecological value perception (VC3) | −9.710 *** (0.442) | ||||

| Emotional value perception (VC4) | −8.574 *** (0.375) | ||||

| Sustainability value perception (VC total) | −11.170 *** (0.477) | ||||

| Controlled variables (X) | Controlled | Controlled | Controlled | Controlled | Controlled |

| Log likelihood | −961.4 | −346.9 | −496.1 | −526.3 | −556.1 |

| Prob > chi2 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| PseudoR2 | 0.150 | 0.693 | 0.561 | 0.535 | 0.508 |

| Variable | Model 6 |

|---|---|

| Social capital multiplied by sustainability value perception (SC × VC total) | −5.410 * (2.629) |

| Social capital (SC) | 5.227 ** (1.769) |

| Sustainability value perception (VC total) | −8.164 ** (1.280) |

| Controlled variables (X) | Controlled |

| Log likelihood | −378.1 |

| Prob > chi2 | 0.000 |

| PseudoR2 | 0.481 |

| Variable | Model 7 |

|---|---|

| Perception of value of sustainable development (VCtotal) | 0.133 *** |

| (0.010) | |

| Other variables | Controlled |

| Constant | 0.654 *** |

| (0.177) | |

| N | 1652 |

| Variable | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 |

|---|---|---|---|---|---|

| Economic value perception multiplied by business type (VC1 × BT) | 0.884 *** (0.137) | ||||

| Social security value perception multiplied by business type (VC2 × BT) | −3.805 *** (1.091) | ||||

| Ecological value perception multiplied by business type (VC3 × BT) | −4.996 (0.982) | ||||

| Emotional value perception multiplied by business type (VC4 × BT) | −6.135 *** (0.898) | ||||

| Sustainability value perception multiplied by business type (VC total × BT) | −3.891 *** (0.981) | ||||

| Controlled variables (X) | Controlled | Controlled | Controlled | Controlled | Controlled |

| Log likelihood | −470.0 | −523.2 | −312.5 | −402.1 | −417.7 |

| Prob > chi2 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| PseudoR2 | 0.584 | 0.537 | 0.724 | 0.644 | 0.631 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kan, L.; Liu, R.; Su, F.; Bao, Y. Effect of Farmers’ Perceptions of Sustainable Development Value on Their Willingness for Agricultural Land Secured Financing. Sustainability 2022, 14, 5984. https://doi.org/10.3390/su14105984

Kan L, Liu R, Su F, Bao Y. Effect of Farmers’ Perceptions of Sustainable Development Value on Their Willingness for Agricultural Land Secured Financing. Sustainability. 2022; 14(10):5984. https://doi.org/10.3390/su14105984

Chicago/Turabian StyleKan, Lina, Ranran Liu, Fang Su, and Yan Bao. 2022. "Effect of Farmers’ Perceptions of Sustainable Development Value on Their Willingness for Agricultural Land Secured Financing" Sustainability 14, no. 10: 5984. https://doi.org/10.3390/su14105984

APA StyleKan, L., Liu, R., Su, F., & Bao, Y. (2022). Effect of Farmers’ Perceptions of Sustainable Development Value on Their Willingness for Agricultural Land Secured Financing. Sustainability, 14(10), 5984. https://doi.org/10.3390/su14105984