2.1. The Evolution and Development of Taxation

Many aspects must be considered and questioned in order to study the historical origins of taxes in a society where taxation and mortality are unavoidable. As a result, when it comes to backstories, the first record of structured taxes dates from around 3000 B.C. in Egypt and is recorded in various historical documents, including the Bible. The Pharaoh would send commissioners to confiscate one-fifth of all grain crops as a levy, according to the Book of Genesis, Chapter 47, verse 33. Over time, it has evolved and adapted to new economic and social realities [

25]. Tax audits and investigations have been known since the Biblical era.

Therefore, most researchers argue that the history of taxation is not known because of the early history of countries’ human development and government system. Thus, taxation is linked with the formation of the ruling group of society at the early stage of human beings. The ruling class collects taxes in kind forcefully from the existing people. The theoretical origins of the VAT are a little hazy; according to African Tax Institute [

26] and Ufier [

27], credit for the concept is widely provided to two theoreticians: an American economist, TS Adams, who first wrote on the subject in 1915 and cited for a 1921 piece, and a German economist, Wilhelm von Siemens, who wrote in 1920. Denmark, which was not a member of the Community at its implementation in 1967, was the first European country to implement a complete VAT system. France, as a founding member of the European Economic Community, had enacted the full VAT a year before, but the tax did not go into effect until 1968, when Germany enacted a similar VAT.

A country’s growth is defined by the amount of revenue earned by the government and spent on public infrastructure for the benefit of its population. Without enough resources for infrastructure development and the provision of power, public utilities, and services, no economy can grow [

12,

28]. VAT became a crucial component of an ever-increasing number of African countries’ revenue regimes in the second part of the twentieth century. External, internal, and hybrid factors all influenced the adoption of VAT regimes. Internal pressures included a lack of money from income taxes, excise taxes, and other levy collections [

29,

30].

On the contrary, VAT was introduced in Ethiopia in 2003 with the issuance of VAT Proclamation No. 285/2002 and VAT Regulation No. 79/2002 and was intended to replace the outdated sales tax, which had been collected at the manufacturing level for more than four decades [

31]. In addition, auditing dates back to the Christian period. Anthropologists have discovered auditing records dating back to the early Babylonian period (around 3000 BC). Auditing was also practiced in ancient China, Greece, and Rome [

32].

At the same time, tax audit has a long history compared to other fields of study and is directly chained with human the history and civilization of human development. Value-added tax audit started with the new commencement of VAT and was used to crosscheck the effectiveness and efficiency of tax collection performance [

33]. Tax reform has received a lot of coverage in the international literature and in South Africa, as shown by the various studies cited [

34]. Therefore, taxation has been in progress and developed according to the developed world, and VAT is one of the reform results.

2.2. Concepts and Definition of Tax

Tax is the income paid to the government to fulfill the public’s needs [

35]. According to Kowal and Przekota [

36], a tax is a mandatory levy imposed by government authority for which nothing is reimbursed and received and utilized for public investment. In addition, Krzikallová and Tošenovskỳ [

37] explained that the main role of taxes in the economy is to secure income for public budgets. Onuoha and Dada [

38] and Gomb, Vagask and Štefan [

39] reiterated that a government levies tax on a product, income, or any activity for the development of the state.

The above literature indicates that tax has different concepts and contextual definitions; therefore, the amount levied by the government on taxpayers or a company’s profit or on commodities to fund government spending. In addition, VAT is collected at every step of the manufacturing process, but all taxes paid on purchased materials are promptly returned [

36,

40,

41]. On top of these explanations, VAT is a consumption tax levied on practically all products and services supplied or consumed in the European Union (EU) [

16,

42]. Although VAT is one of the most fundamental and vital parts of taxes, it becomes a significant revenue source only when correctly executed a tax audit.

Furthermore, a VAT audit is a procedure in which the tax authorities verify whether the taxpayer declared the correct amount of tax due [

43]. Consequently, one of the tools that can be used to improve tax revenue performance is a VAT audit. Developing the digital economy is the only way to accomplish effective growth in developing economies and secure a commanding position for future development [

44]. All the concepts and definitions of tax, VAT, and audit expressed the critical values of taxation in any government.

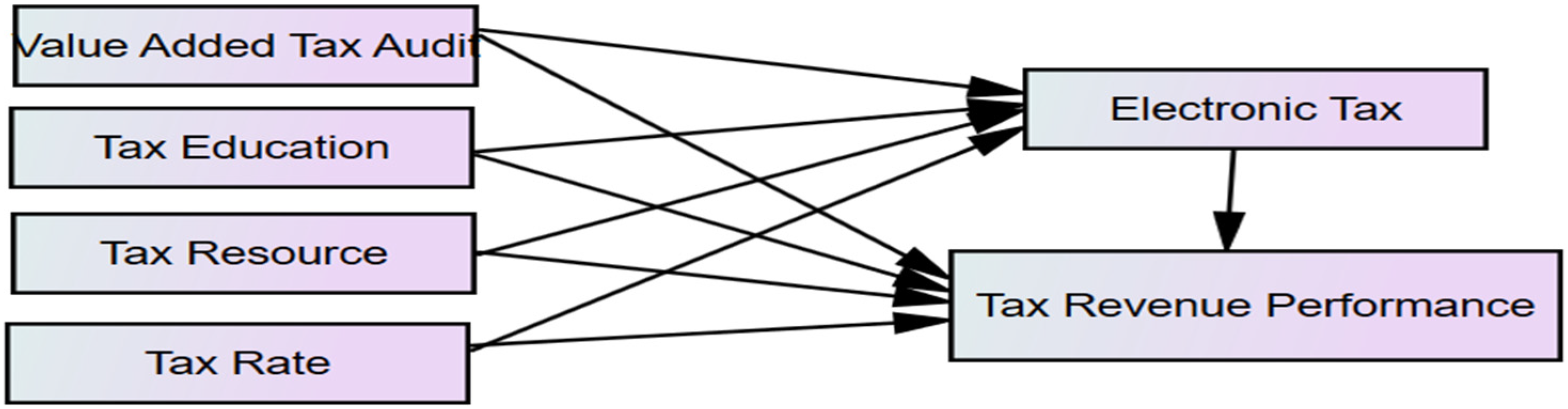

2.3. The Relationship between the Independent, the Mediating, and Dependent Variable

Tax Education and Tax Revenue Performance

Several studies have examined the impacts and correlations between tax education and tax revenue performance. Tax education highly affects tax revenue performance positively and significantly [

45]. The lack of well-organized taxpayer education and assistance programs about VAT, inadequate refund management, and low voluntary compliance of taxpayers are all challenges facing the Ethiopian tax administration [

46]. Furthermore, higher levels of education are associated with a higher likelihood of compliance. Educated taxpayers may be aware of noncompliance chances; taxpayers with a greater comprehension of the tax system and a higher moral standard, on the other hand, are more compliant and accept this viewpoint [

47,

48].

On the other hand, 35% of all registered VAT payers submit their tax returns monthly and request a refund, while 38% of taxpayers have submitted reports with no tax liability. Tax bureau officials and merchants’ relations have deteriorated due to inefficient door-to-door support and continuous follow-up, and such official aids are viewed adversely by taxpayers as an enemy [

49]. Other implications of tax education, such as perceptions, attitudes, and citizen participation, are also essential, as we will address next [

50]. Thus, most studies agreed that tax education positively and significantly affects tax revenue performance.

Hypothesis 1 (H1). Tax Education has a positive and significant impact on Tax Revenue Performance.

Tax Resource and Tax Revenue Performance

According to numerous studies, tax resource is one of the important variables that can affect the intended revenue. At a 1% significance level, the variable tax audit resource has a negative impact on revenue collection and is statistically significant [

43,

51]. According to Badra [

52], in Bauchi State, Nigeria, the tax auditors are limited in number and not equipped with the required stationaries that affect the tax audit function. Administrative limitations in resource allocation, awareness creation, training and feedback, controlling and following up to combat VAT evaders, and employee corruption are key internal factors hindering tax collection. Employees’ rent-seeking (corruption) arises due to their close connection with business people [

53].

Furthermore, the availability of tax resources through the tax audit function enhances the tax system and boosts tax revenue collection. Because of the attention paid to tax resources, countries with lower baseline compliance costs gain more from tax changes and expanding tax bases [

54]. Therefore, almost all researchers agreed that tax resources played a substantial influence on tax revenue performance and are positively and significantly interrelated to tax revenue performance.

Hypothesis 2 (H2). Tax Resource has a positive and significant impact on Tax Revenue Performance.

Tax Rate and Tax Revenue Performance

Lin and Jia [

13] and Kopeć [

55] found that a high tax rate will stifle people’s spending. Regardless of the direct tax rate level, the share of direct tax to total tax will increase. The intricacy of the tax structure influences the tax rate significantly. According to Helcmanovsk and Andrejovsk [

56], in either scenario, the variables statutory and average effective tax rates have no significant impact on corporation tax collections. Taxpayers are burdened more by a higher tax rate. It may improve revenues slightly in the short term, but it has a long-term impact. It lowers taxpayers’ disposable income, lowering their spending power [

57]. The above research indicates that the tax rate impacts tax revenue.

In addition, the Minister of Finance of South Africa announced a 1% increase in VAT to 15% in the 2018 budget. The increase in the VAT rate is part of a larger package of tax reform proposals targeted at increasing revenue [

58]. On the other hand, lower income tax rates have a more significant impact on economic development in developing countries such as Botswana, where higher tax revenue collection, revenue creation, and GDP growth are positive outcomes [

59]. Saudi Arabia previously established a 5% VAT on all goods and services; however, following the recent global epidemic of COVID-19, the kingdom has tripled this amount and will impose a 15% VAT starting in July 2020. Because economic activities have decreased and health costs have increased, the main rationale for raising this rate is to boost revenue [

60]. The introduction of the VAT Flat Rate Scheme has bettered tax revenue mobilization in a developing country such as Ghana as it has increased the number of VAT-registered retailers [

61].

In the Czech Republic, the regular VAT rate is below the revenue-maximizing rate, and lowering it would benefit both taxpayers and the state budget [

62]. The higher the rates, the greater the motive to avoid or evade taxes or close the business. Consequently, the tax rate increases tax revenue performance if it increases based on the paying capacity and a certain society limit.

Hypothesis 3 (H3). The tax rate has a positive and significant impact on Tax Revenue Performance.

VAT Audit and Tax Revenue Performance

VAT Audit and Investigation has a positive relationship with VAT and helps to generate more revenue. The study also found that efficient tax auditing and investigation might significantly reduce VAT evasion in Nigeria’s Kaduna State, resulting in significant increases in government revenue [

7,

43]. The Bauchi State Tax Authority used tax audits to meet revenue targets. Tax audits minimize tax evasion and other tax irregularities, according to the findings of [

52]. The audit work of Hawassa City, Ethiopia, is very insignificant compared to the total number of VAT registrants in the city [

53]. The VAT audit in Ethiopia is challenged by a lack of technically competent and proficient human resources, low data quality, poor intelligence inputs, low performance in terms of quality, tax yield, and revenue yield [

63]. In general, all research finding assessed and agreed that tax audit and tax revenue performance has a positive and significant relationship.

Hypothesis 4 (H4). VAT Audit has a positive and significant impact on Tax Revenue Performance.

The Mediating Effects of Electronics Tax System on Tax Revenue Performance

Adopting an electronic tax system is a partial mediator in the relationship between tax education and tax revenue; moreover, implementing an electronic tax system and having a positive attitude are linked to tax compliance or tax revenue performance [

15]. Nigeria has seen a huge reduction in tax evasion thanks to an excellent electronic tax system [

64]. Electronic tax collection has recently been a hot topic in developing countries in policy discussions [

65,

66].

Furthermore, small and micro Businesses feel that taxpayer awareness of electronic taxation positively impacts tax compliance in Lagos [

67]. According to Allahverdi et al. [

68], the rate of tax receipts to GDP in Turkey increased by 43.84 percent after implementing the electronic taxation system. On the other view, the extent to which taxpayers are aware of the electronic tax filing system influences their compliance rate; if the compliance cost is high, taxpayers may be hesitant to use it. Even though the effect of ease of use is not statistically significant, positive implies that it can affect tax performance. Gwaro et al. [

69] and Manaye [

70] revealed that VAT collection using cash register machines positively affects VAT revenue, and other independent variables significantly affect VAT. According to Eilu [

71], domestic revenue collection via taxation in many Sub-Saharan African countries is still below its capacity. Several regional states have implemented electronic fiscal devices to advance VAT collection and maximize tax revenue. However, there have been difficulties implementing electronic fiscal devices in Kenya and Tanzania. Therefore, all the existing research agrees that electronic tax has a significant influence and a critical role in increasing tax revenue performance and is used to mediate different factors and tax revenue performance.

Hypothesis 5 (H5). The electronic tax system mediates tax revenue performance.

To conclude, taxation is a critical agenda for people worldwide, particularly in developing countries, because foreign aid and grants cover the majority of their expenses. In all directions, the trend in tax revenue collection indicates complicated problems in collecting the required amount of revenue. Various studies encourage tax authorities to broaden the tax base and collect depending on regional revenue potentials. On the contrary, most researchers ignored the effects of VAT audit operations, particularly the combined impact of a VAT audit, tax education, tax resources, and tax rate. As a result, using a structural equation and a growth path model to examine the effect of the above variables on tax revenue performance, this study seeks to fill in the gaps left by prior studies by analyzing the mediating impacts of the electronic tax system.