Impacts of Power Structure on Introduction of Green Store Brand

Abstract

:1. Introduction

- What are the conditions for the retailer to introduce the green store brand?

- How will the manufacturer and retailer develop their pricing decisions to maximize their own profits before and after the introduction of a green store brand under different power structures?

- What are the impacts of the power structure on the retailer’s decision on the introduction of a green store brand and how the power structure and green store brand affect the interaction between supply chain members?

2. Literature Review

3. The Model

3.1. Demand and Profit Models

- i.

- The demand functions for national brand product before the introduction of the green store brand are as follows:

- ii.

- The demand functions for both brand products after the introduction of the green store brand are as follows:

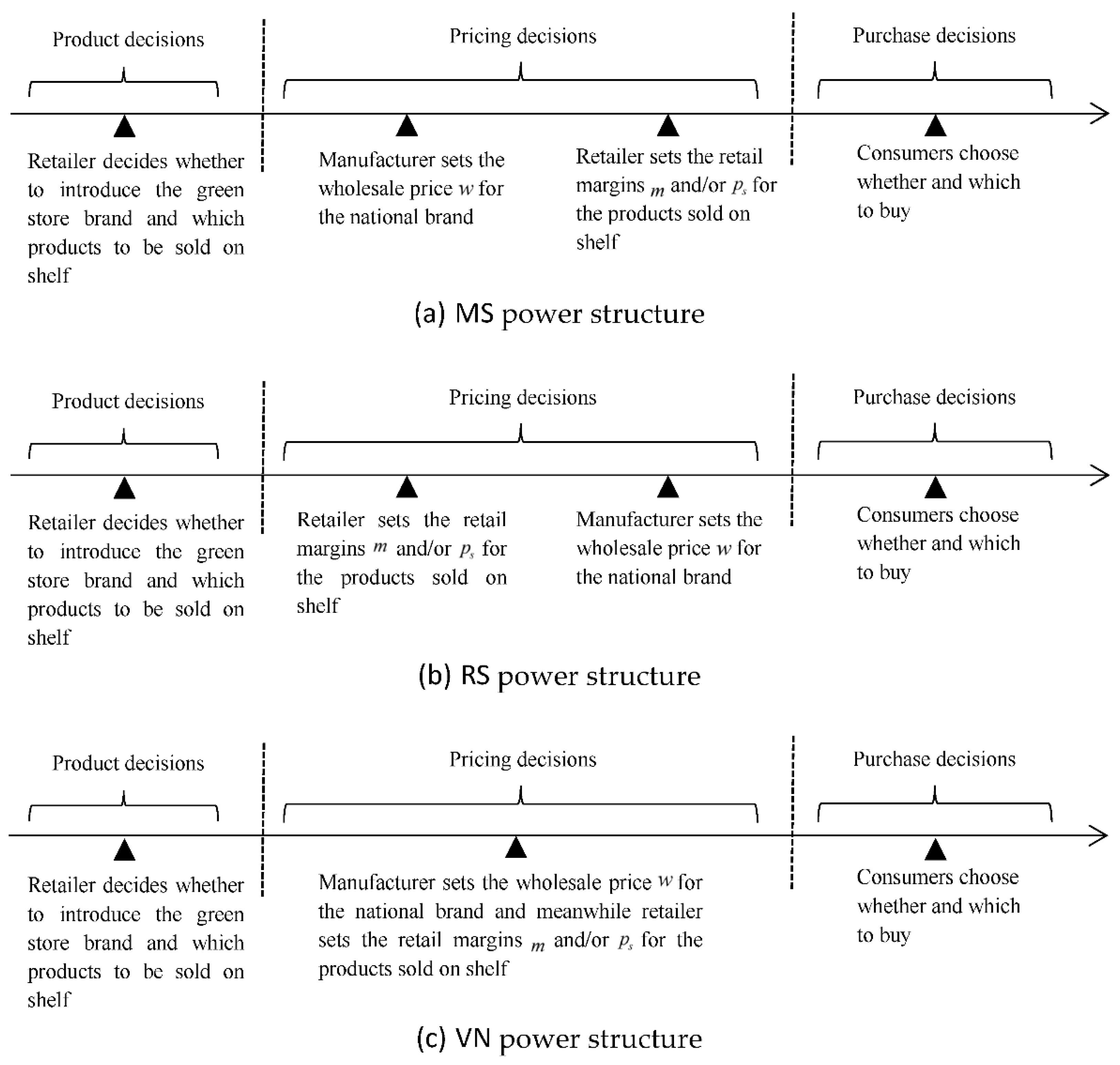

3.2. Supply Chain Power Structure

4. Equilibrium

4.1. Equilibrium in the MS Power Structure

4.1.1. Pricing Decision before the Introduction of Green Store Brand

4.1.2. Pricing Decision after the Introduction of Green Store Brand

4.1.3. Retailer’s Introduction Decision

- (i)

- if, the retailer sells national brand only;

- (ii)

- if, the retailer sells both brands, but only the national brand has sales;

- (iii)

- if, the retailer sells both brands, and both have sales;

- (iv)

- if, the retailer introduces the green store brand and sells the store brand only.

4.2. Equilibrium in the RS Power Structure

4.2.1. Pricing Decision before the Introduction of Green Store Brand

4.2.2. Pricing Decision after the Introduction of Green Store Brand

4.2.3. Retailer’s Introduction Decision

- (i)

- if, the retailer sells national brand only;

- (ii)

- if, the retailer sells both brands, but only national brand has sales;

- (iii)

- if, the retailer sells both brands, and both have sales;

- (iv)

- if, the retailer introduces the green store brand and sells the store brand only.

4.3. Equilibrium in the VN Power Structure

4.3.1. Pricing Decision before the Introduction of Green Store Brand

4.3.2. Pricing Decision after the Introduction of Green Store Brand

4.3.3. Retailer’s Introduction Decision

- (i)

- if, the retailer sells national brand only;

- (ii)

- if, the retailer sells both brands, but only the national brand has sales;

- (iii)

- if, the retailer sells both brands, and both have sales;

- (iv)

- if, the retailer introduces the green store brand and sells the store brand only.

5. Model Analysis

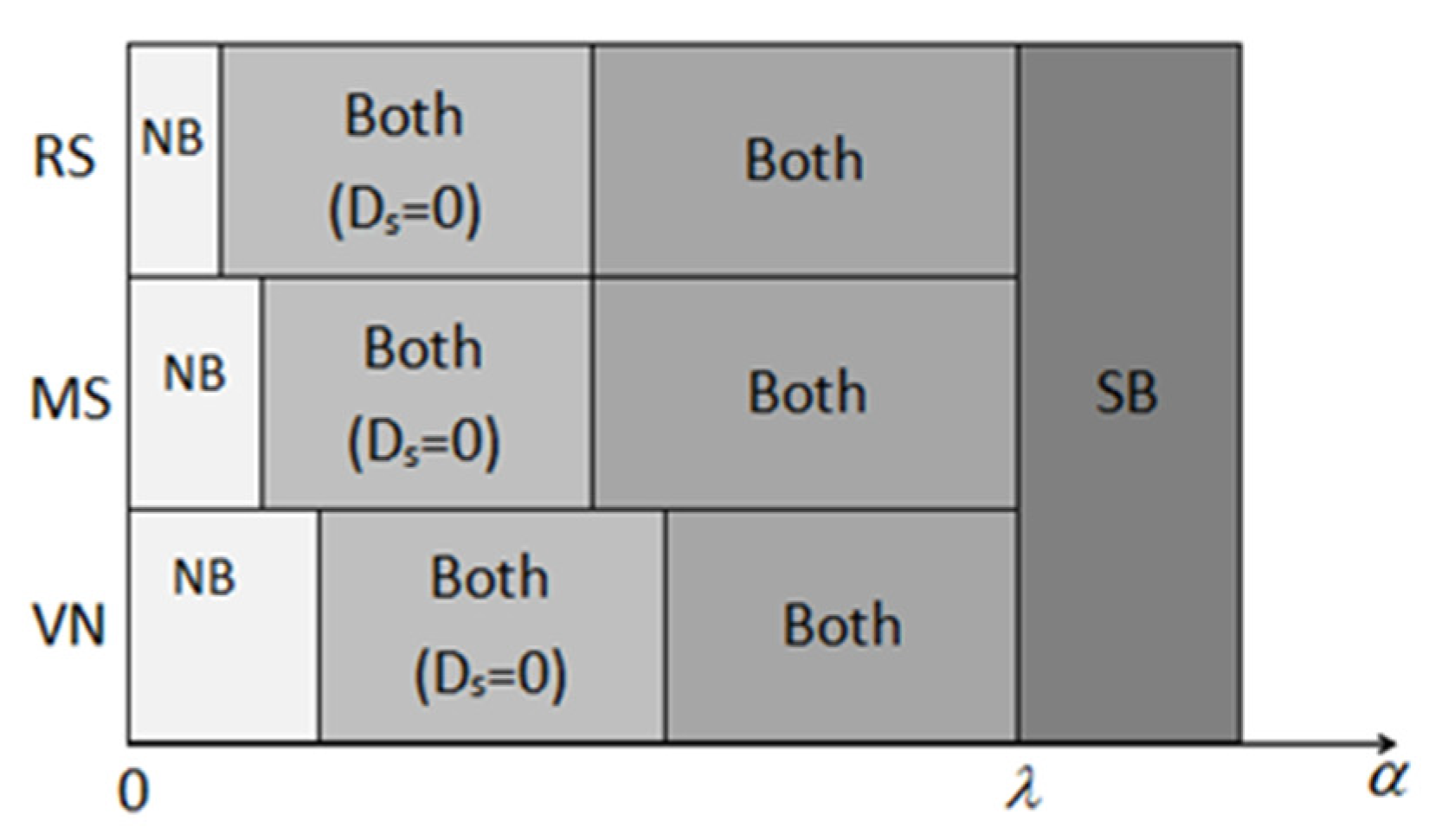

5.1. Impact of Power Structure on the Introduction of Green Store Brand

- (i)

- ;

- (ii)

- ;

- (iii)

- ;

- (iv)

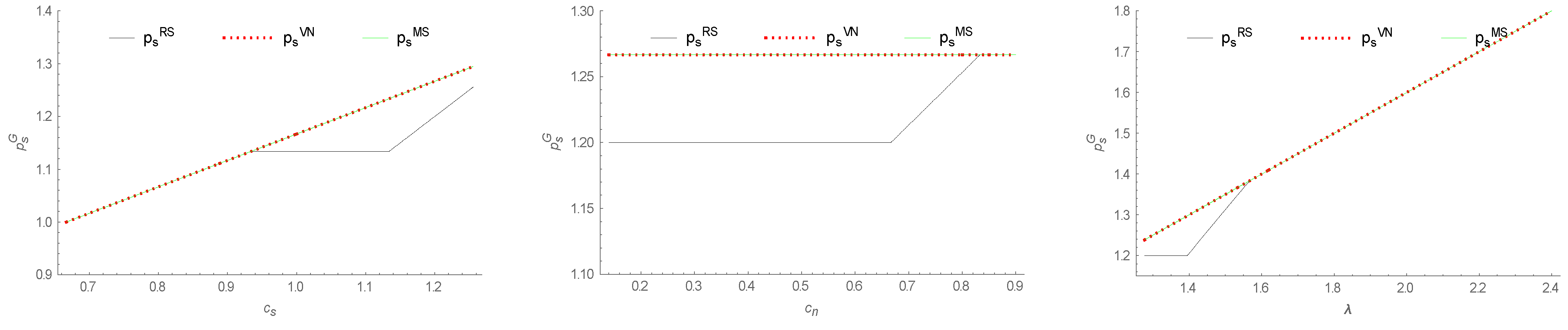

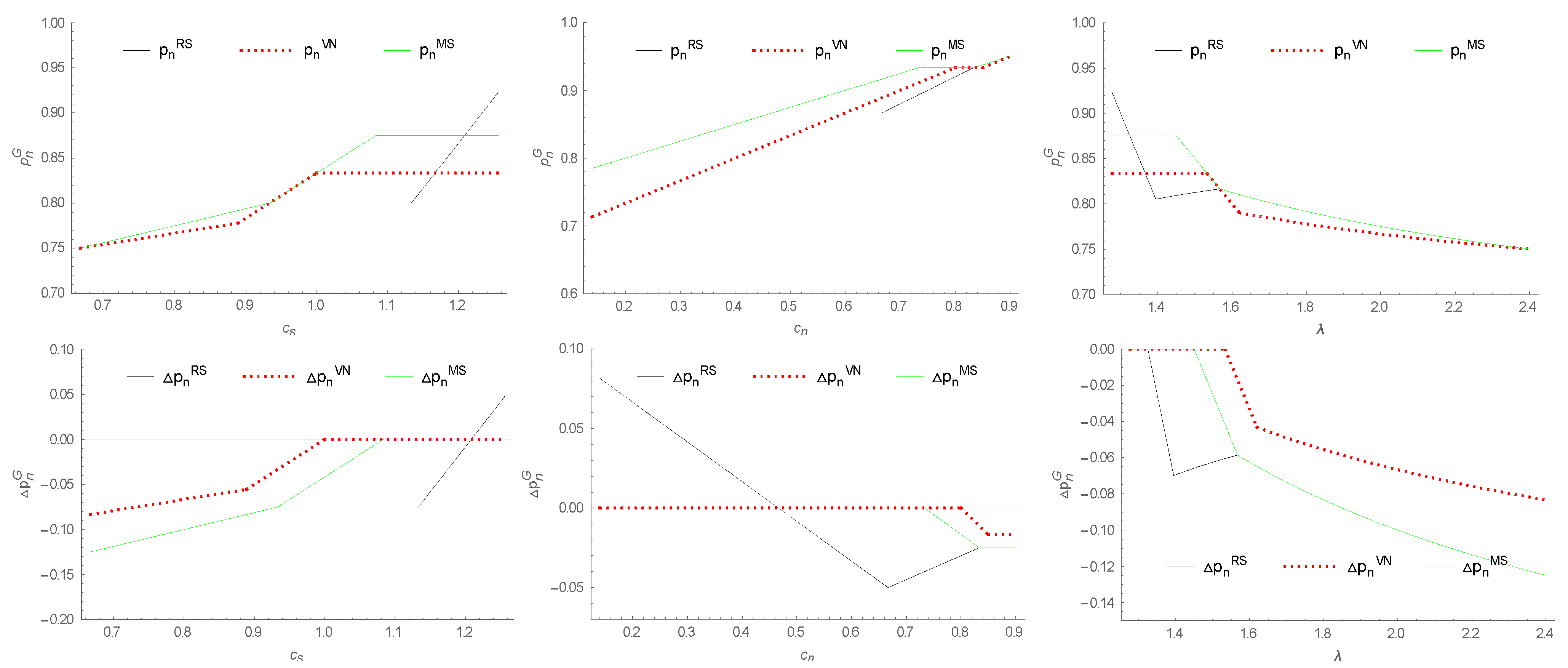

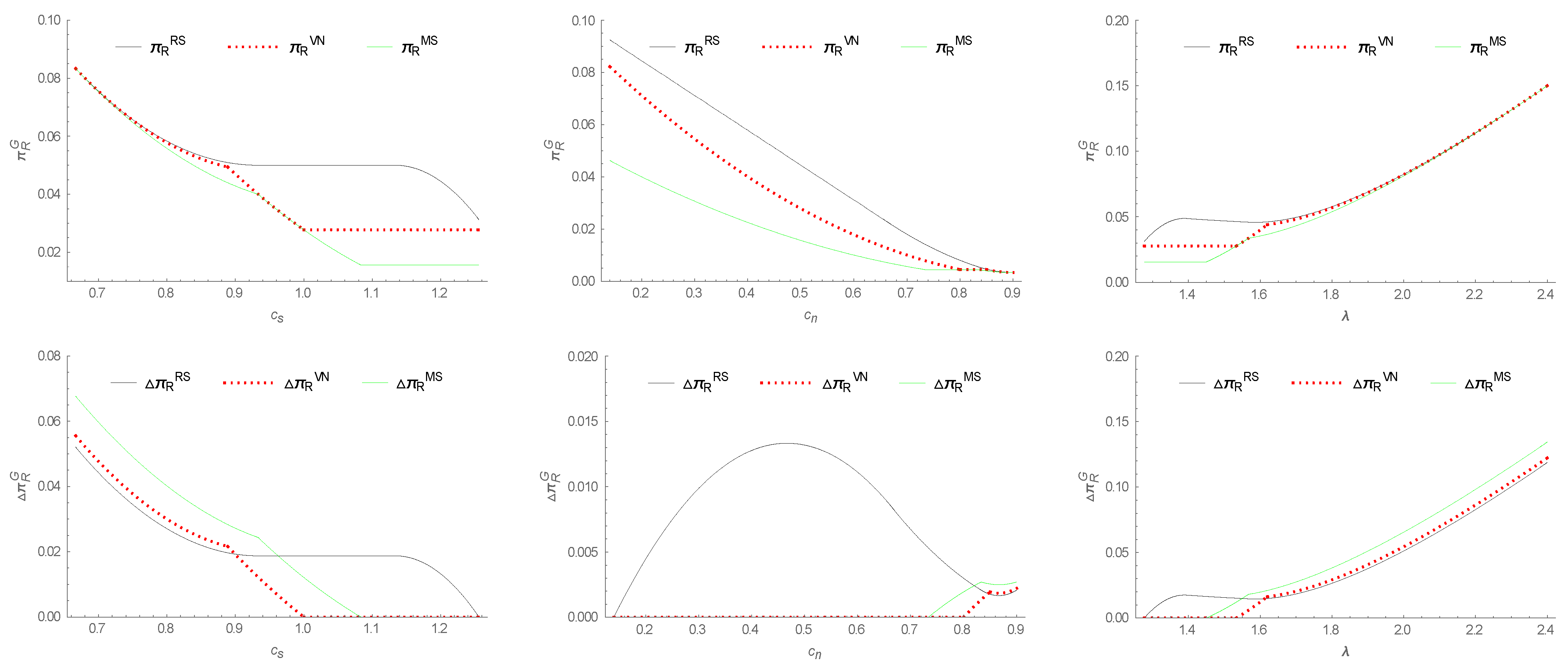

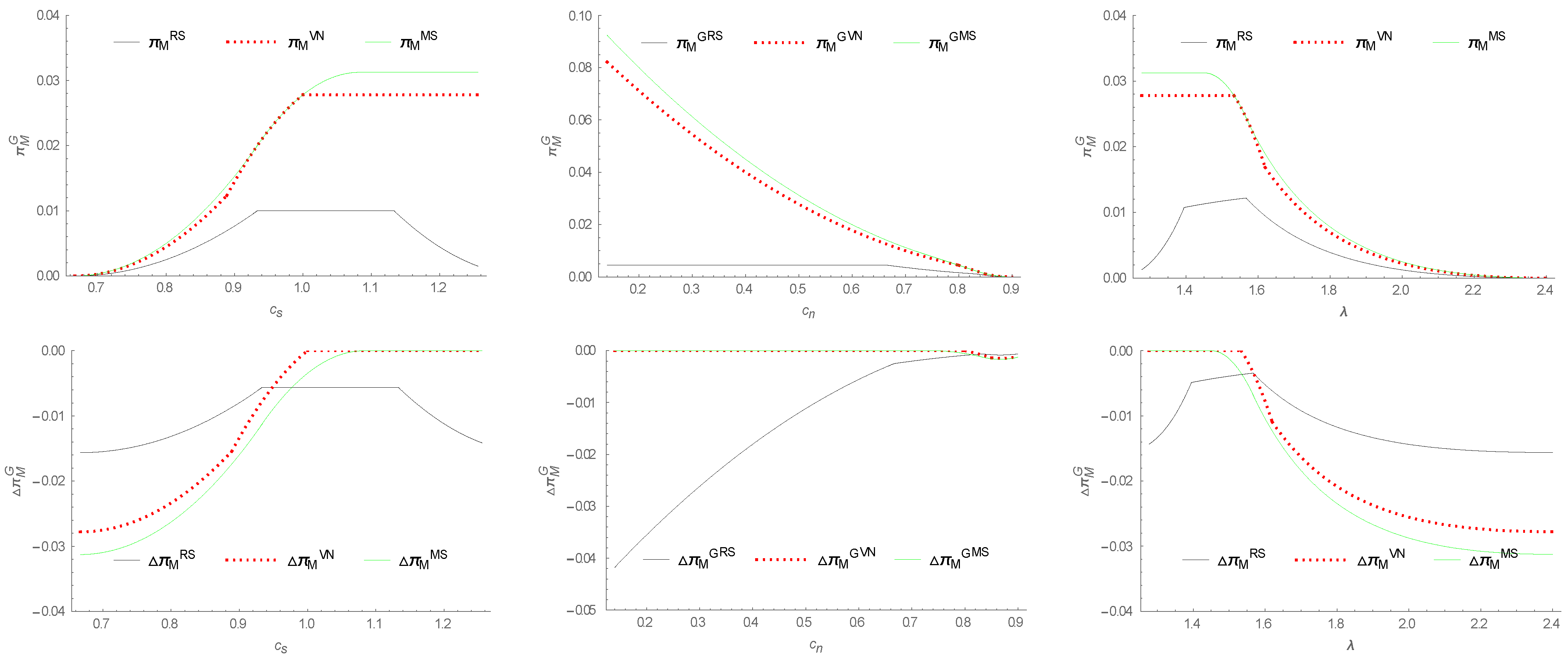

5.2. Impacts of Power Structure and Green Store Brand on the Supply Chain Performance

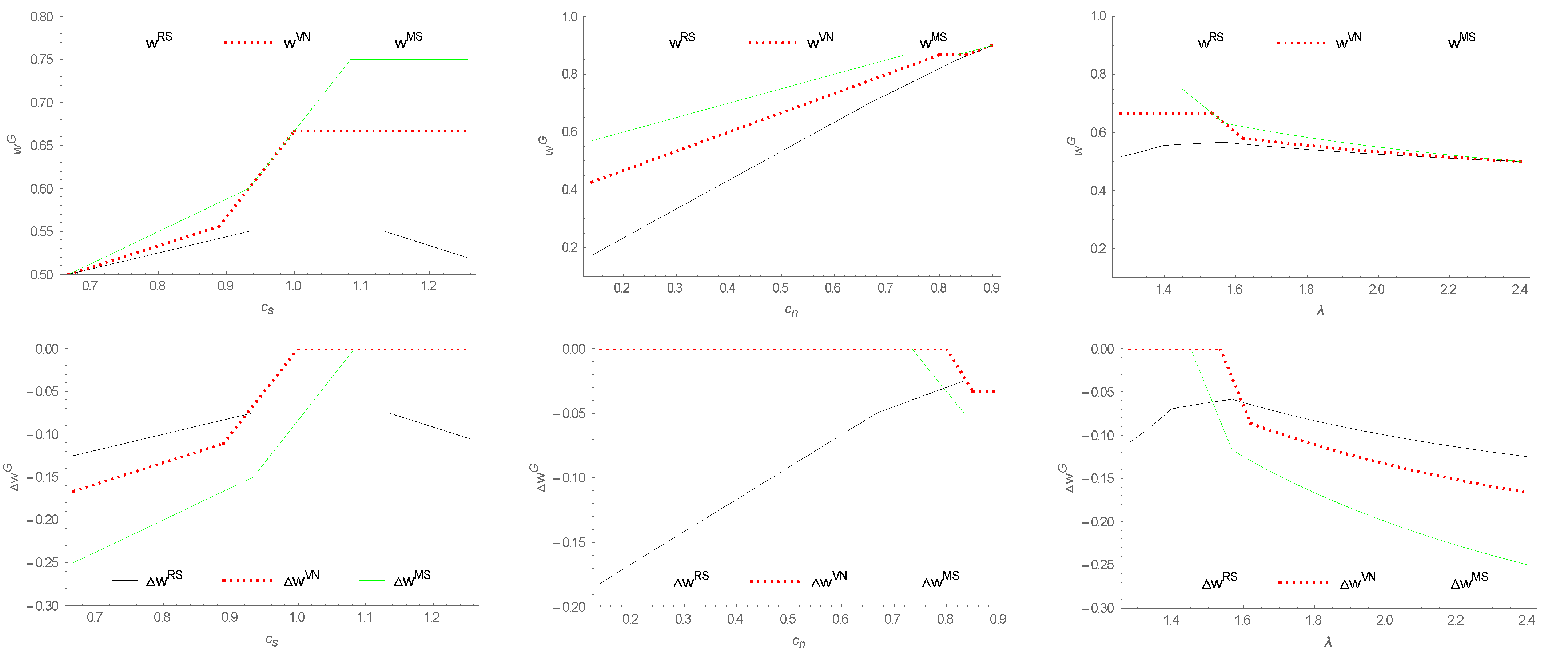

- (i)

- The equilibrium wholesale prices under different power structures are compared as follows:

- (ii)

- The difference values in wholesale price under different power structures are compared as follows:

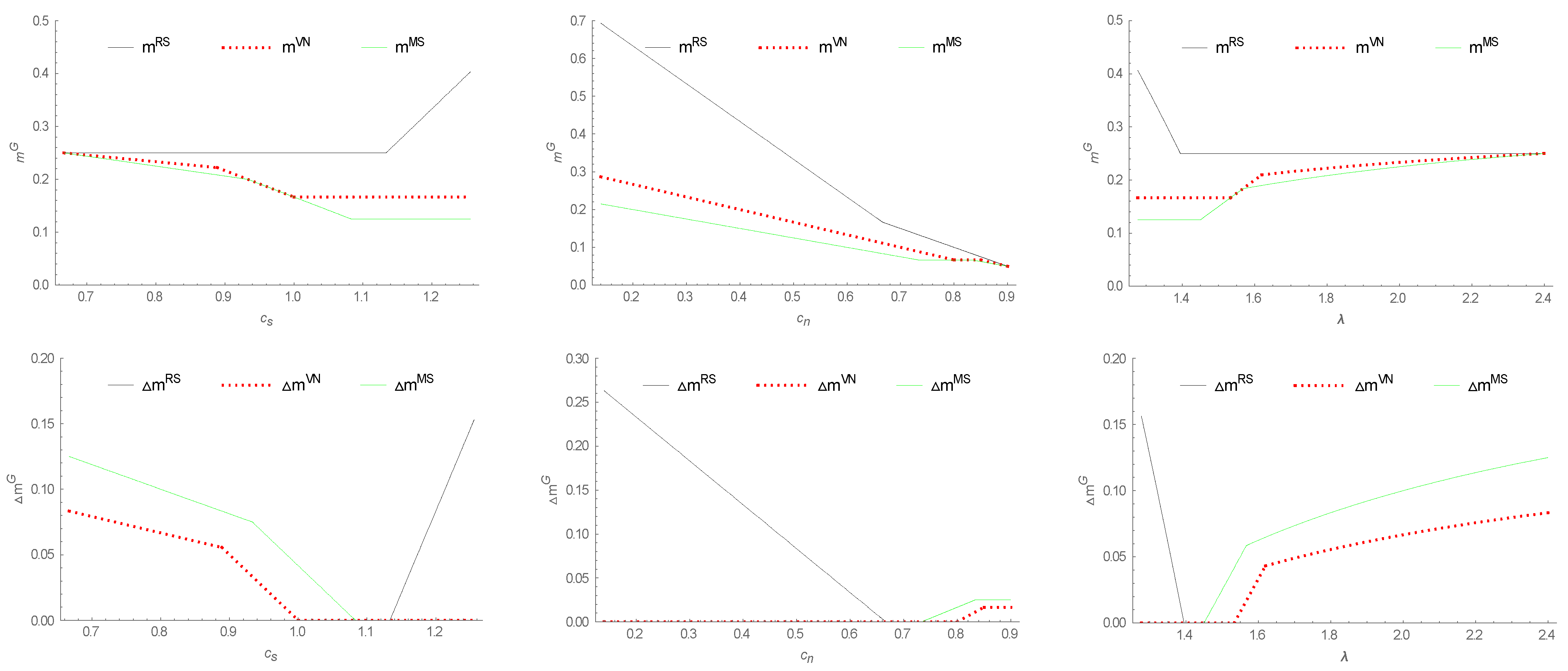

- (i)

- The equilibrium retail margins of the national brand under different power structures are compared as follows:

- (ii)

- The equilibrium retail prices of green store brand (if introduced) under different power structures are compared as follows:

- (iii)

- The difference values in retail margins of national brand under different power structures are compared as follows:

- (i)

- The equilibrium retail prices of national brand under different power structures are compared as follows:

- and

- (ii)

- The difference values in retail margins of national brand under different power structures are compared as follows:

- (i)

- The equilibrium profits of the retailer under different power structures are compared as follows:

- and

- (ii)

- The equilibrium profits of the manufacturer under different power structures are compared as follows:

- and

6. Conclusions

6.1. Theoretical Implications

6.2. Managerial Implications

6.3. Limitation and Future Research

Author Contributions

Funding

Conflicts of Interest

Appendix A

- (1)

- (2)

- (3)

- (1)

- (2)

- (3)

- (1)

- (2)

- (3)

- (1)

- (2)

- (3)

- (4)

References

- Maurer, M.; Koulouris, P.; Bogner, F.X. Green awareness in action—How energy conservation action forces on environmental knowledge, values and behavior in adolescents’ school life. Sustainability 2020, 12, 955. [Google Scholar] [CrossRef]

- Zhen, L. Yard template planning in transshipment hubs under uncertain berthing time and position. J. Oper. Res. Soc. 2013, 64, 1418–1428. [Google Scholar] [CrossRef]

- Zhen, L. Tactical berth allocation under uncertainty. Eur. J. Oper. Res. 2015, 247, 928–944. [Google Scholar] [CrossRef]

- Dunne, D.; Narasimhan, C. The new appeal of private labels. Harv. Bus. Rev. 1999, 77, 41. [Google Scholar]

- Zhen, L. Container yard template planning under uncertain maritime market. Transp. Res. Part E 2014, 69, 199–217. [Google Scholar] [CrossRef]

- Banterle, A.; Stranieri, S. Sustainability standards and the reorganization of private label supply chains: A Transaction Cost Perspective. Sustainability 2013, 5, 5272–5288. [Google Scholar] [CrossRef]

- Pacheco, F.A.L. Sustainable use of soils and water: The role of environmental land use conflicts. Sustainability 2020, 12, 1163. [Google Scholar] [CrossRef]

- Zhang, H.; Su, X. The Applications and complexity analysis based on supply chain enterprises’ green behaviors under evolutionary game framework. Sustainability 2021, 13, 10987. [Google Scholar] [CrossRef]

- Margariti, K. “White” space and organic claims on food packaging: Communicating sustainability values and affecting young adults’ attitudes and purchase intentions. Sustainability 2021, 13, 11101. [Google Scholar] [CrossRef]

- Sayman, S.; Raju, J.S. How category characteristics affect the number of store brands offered by the retailer: A model and empirical analysis. J. Retail. 2004, 80, 279–287. [Google Scholar] [CrossRef]

- Braak, A.; Geyskens, I.; Dekimpe, M.G. Taking private labels upmarket: Empirical generalizations on category drivers of premium private label introductions. J. Retail. 2014, 90, 125–140. [Google Scholar] [CrossRef]

- Ru, J.; Shi, R.; Zhang, J. Does a store brand always hurt the manufacturer of a competing national brand? Prod. Oper. Manag. 2015, 24, 272–286. [Google Scholar] [CrossRef]

- Mills, D.E. Why retailers sell private labels. J. Econ. Manag. Strategy 1995, 4, 509–528. [Google Scholar] [CrossRef]

- Raju, J.S.; Sethuraman, R.; Dhar, S.K. The introduction and performance of store brands. Manag. Sci. 1995, 41, 957–978. [Google Scholar] [CrossRef]

- Chen, L.; Gilbert, S.M.; Xia, Y.S. Private labels: Facilitators or impediments to supply chain coordination. Decis. Sci. 2011, 42, 689–720. [Google Scholar] [CrossRef]

- Fang, X.; Gavirneni, S.; Rao, V.R. Supply chains in the presence of store brands. Eur. J. Oper. Res. 2013, 224, 392–403. [Google Scholar] [CrossRef]

- Luo, Z.; Chen, X.; Chen, J.; Wang, X.J. Optimal pricing policies for differentiated brands under different supply chain power structures. Eur. J. Oper. Res. 2017, 259, 437–451. [Google Scholar] [CrossRef]

- Morton, F.S.; Zettelmeyer, F. The strategic positioning of store brand in retailer-manufacture negotiations. Rev. Ind. Organ. 2004, 24, 161–194. [Google Scholar] [CrossRef]

- Jin, Y.; Wu, X.; Hu, Q. Interaction between channel strategy and store brand decisions. Eur. J. Oper. Res. 2016, 256, 911–923. [Google Scholar] [CrossRef]

- Horowitz, I. An option-pricing look at the introduction of private labels. J. Oper. Res. Soc. 2000, 51, 221–230. [Google Scholar] [CrossRef]

- Choi, S.C.; Coughlan, A.T. Private label positioning: Quality versus feature differentiation from the national brand. J. Retail. 2006, 82, 79–93. [Google Scholar] [CrossRef]

- Schnittka, O. Are they always promising? An empirical analysis of moderators influencing consumer preferences for economy and premium private labels. J. Retail. Consum. Serv. 2015, 24, 94–99. [Google Scholar] [CrossRef]

- Masuda, K.; Kushiro, S. Influence of brand equity on the price premium for private labels in fresh produce: A contingent valuation survey. Agribusiness 2018, 34, 338–350. [Google Scholar] [CrossRef]

- Hara, R.; Matsubayashi, N. Premium store brand: Product development collaboration between retailers and national brand manufacturers. Int. J. Prod. Econ. 2017, 185, 128–138. [Google Scholar] [CrossRef]

- Li, X.; Cai, X.Q.; Chen, J. Quality and private label encroachment strategy. Prod. Oper. Manag. Soc. 2021, 31, 374–390. [Google Scholar] [CrossRef]

- Choi, S.C. Price competition in a channel structure with a common retailer. Mark. Sci. 1991, 10, 271–296. [Google Scholar] [CrossRef]

- Shi, R.X.; Zhang, J.; Ru, J. Impacts of power structure on supply chains with uncertain demand. Prod. Oper. Manag. Soc. 2013, 22, 1232–1249. [Google Scholar] [CrossRef]

- Chung, H.; Lee, E. Asymmetric relationships with symmetric suppliers: Strategic choice of supply chain price leadership in a competitive market. Eur. J. Oper. Res. 2017, 259, 564–575. [Google Scholar] [CrossRef]

- Ghosh, D.; Shah, J. A comparative analysis of greening policies across supply chain structures. Int. J. Prod. Econ. 2012, 135, 568–583. [Google Scholar] [CrossRef]

- Choi, S.; Fredj, K. Price competition and store competition: Store brands Vs. national brand. Eur. J. Oper. Res. 2013, 225, 166–178. [Google Scholar] [CrossRef]

- Ma, W.M.; Cheng, R.; Ke, H. Impacts of power structure on supply chain with a store brand. Asia-Pac. J. Oper. Res. 2018, 35, 1850020. [Google Scholar] [CrossRef]

- Wu, S.; Wen, S.; Zhou, Q.; Qin, X. Coordination of store brand product’s green supply chain based on negotiation. Sustainability 2020, 12, 3637. [Google Scholar] [CrossRef]

- Huang, L.; Zhen, L.; Wang, J.; Zhang, X. Blockchain implementation for circular supply chain management: Evaluating critical success factors. Ind. Mark. Manag. 2022, 102, 451–464. [Google Scholar] [CrossRef]

- Ghosh, D.; Shah, J. Supply chain analysis under green sensitive consumer demand and cost sharing contract. Int. J. Prod. Econ. 2015, 164, 319–329. [Google Scholar] [CrossRef]

- Chiang, W.K.; Chhajed, D.; Hess, J.D. Direct marketing, indirect profits: A strategic analysis of dual- channel supply-chain design. Manag. Sci. 2003, 49, 1–20. [Google Scholar] [CrossRef]

- Gupta, R.; Biswas, I.; Kumar, S. Pricing decisions for three-echelon supply chain with advertising and quality effort-dependent fuzzy demand. Int. J. Prod. Res. 2019, 57, 2715–2731. [Google Scholar] [CrossRef]

- Gupta, R.; Biswas, I.; Mohanty, B.K.; Kumar, S. Performance of three-echelon supply chain under uncertainty: Influence of contract sequence and individual rationality. Benchmarking Int. J. 2022. ahead-of-print. [Google Scholar] [CrossRef]

| Notation | Definition |

|---|---|

| Subscript, index of brand; for national brand, and for store brand | |

| Subscript, index of supply chain member; for manufacturer, and for retailer | |

| Superscript, index of supply chain power structure; | |

| Consumers’ willingness to pay for the unit perceived value | |

| Consumers’ green preference | |

| Unit cost of product | |

| Wholesale price of national brand product | |

| Retailer’s margin on national brand product | |

| Retail price of product | |

| Demand quantity of product | |

| Profit of supply chain member |

| PS | |||||||||

| MS | N/A | 0 | |||||||

| 0 | |||||||||

| N/A | N/A | N/A | 0 | 0 | |||||

| RS | N/A | 0 | |||||||

| 0 | |||||||||

| 0 | |||||||||

| N/A | N/A | N/A | 0 | 0 | |||||

| VN | N/A | 0 | |||||||

| 0 | |||||||||

| N/A | N/A | N/A | 0 | 0 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhong, J.; Huo, J. Impacts of Power Structure on Introduction of Green Store Brand. Sustainability 2022, 14, 11995. https://doi.org/10.3390/su141911995

Zhong J, Huo J. Impacts of Power Structure on Introduction of Green Store Brand. Sustainability. 2022; 14(19):11995. https://doi.org/10.3390/su141911995

Chicago/Turabian StyleZhong, Junyi, and Jiazhen Huo. 2022. "Impacts of Power Structure on Introduction of Green Store Brand" Sustainability 14, no. 19: 11995. https://doi.org/10.3390/su141911995

APA StyleZhong, J., & Huo, J. (2022). Impacts of Power Structure on Introduction of Green Store Brand. Sustainability, 14(19), 11995. https://doi.org/10.3390/su141911995