1. Introduction

Rare-earth products play a pivotal role in modern industry and are widely used not only in traditional industries such as metallurgy, petrochemicals, glass and ceramics manufacturing, but also as an indispensable raw material for the military industry, new-energy industries, and other high-tech industries. However, rare earth resources are not evenly distributed around the world and most countries obtain them through trade. Rare earth is an important raw material for the sustainable development of all countries in the world, and the supply of rare earth is particularly important. Therefore, it is necessary to conduct research on the export of several major rare-earth-supply countries. For a long time, China has occupied the position of the largest rare-earth exporter with its rich reserves of rare-earth resources and advanced extraction and separation technology. In 2012, China’s rare-earth production reached 100,000 tonnes, accounting for 91% of the world’s total output (US Geological Survey), and has a dominant position in the international rare-earth supply chain. However, it is also noted that in recent years, the international-trade market has become increasingly volatile due to the impact of major events such as the Sino–US trade war and the COVID-19 pandemic, and the original supply chain has suffered some impact. which makes finding new supply sources one of the most important pillars of securing supply, and in 2017, the President of the United States issued an executive order titled “Federal Strategy to Ensure the Secure and Reliable Supply of Critical Minerals,” which calls for measures to ensure the security of rare-earth supply in the United States through measures such as deepening trade and investment with international partners. In this context, there is potential for a restructuring of the original rare-earth trade competitiveness pattern, with China’s share of total world output falling from 91% to 58% between 2012 and 2020, and an opportunity for some improvement in the international competitiveness of other countries. For China, the United States, Russia, and India are three competitors with abundant rare-earth resources and high technological capabilities. According to the distribution of the world’s rare-earth reserves published by the U.S. Bureau of Minerals 2022, the three countries ranked fourth, fifth, and seventh, respectively in the world in terms of rare-earth resources reserves in 2021 and have an important position in the global rare-earth market. In addition, all three countries had high rare-earth production and reserves between 2000 and 2020, and, like China, are at the centre of a geopolitical maelstrom. In recent years, the behaviour of these major powers has given rise to a number of turbulent events. Examples include the Sino–Indian Donglang border issue, the US–China Taiwan Strait issue, the US–China trade-friction issue, and the Russia–Ukraine conflict. As a sensitive strategic resource, these events have had varying degrees of impact on the development policies of the rare-earth industry and rare-earth production in various countries. For example, China promulgated the “Several Opinions of the State Council on Promoting the Sustainable and Healthy Development of the Rare Earth Industry” in 2011 to protect China’s rare-earth resources by enhancing industrial concentration and other measures, and in 2008 Putin signed the federal law “Regulations on Foreign Investment in Industries of Strategic Importance to National Defence and Security,“ which prohibits foreign investment in the development and production of special metals and alloys such as rare earths. These policies have affected the global rare-earth supply chain to varying degrees. In the context of the increasingly complex factors affecting the production and export of rare earths and the increasingly fragmented rare-earth-producing areas, a retrospective analysis of the export competitiveness of rare-earth products from China, the US, Russia, and India is useful for gaining a deeper understanding of the status of the four countries in the rare-earth trade, as well as for understanding the evolution of the international competitiveness of rare-earth products in each country.

Due to China’s important role in the supply of rare earths, many scholars have studied the issue of Chinese rare-earth exports in some detail. Sanyal et al. [

1] developed a stochastic frontier-modelling approach for the development of gravity of rare-earth trade between China and its trading partners and found that some countries may be substituting China’s rare-earth product exports. Zhang et al. [

2] used the Lerner index with a BP neural network and found that a series of rare-earth export policies introduced by China increased the market dominance and price sensitivity of Chinese rare-earth products, verifying the effectiveness of the export policies. Zhü et al. [

3] found that China’s best short-term development strategy was to establish a strategic reserve system for rare earths and to improve its technological innovation capacity through the ANP-SWOT approach. Pan et al. [

4], through the entropy-power method Ni [

5], pointed out that China’s rare-earth products need environmental protection to be strengthened and suffer from overproduction of separated products and insufficient independent innovation. Li [

6], in the context of the financial crisis, pointed out that China’s rare-earth industry still suffers from small-scale rare-earth enterprises, poor competitiveness, low market concentration, waste of resources, and serious environmental pollution.

The US was once the world’s largest exporter of rare earths, but less research has been conducted on US rare-earth exports. Goldman [

7] reviewed the growth and decline of the US rare-earth industry and highlighted the key role of state support in the development of the industry. Vekasi [

8] reviewed the mechanisms by which the dominance of the rare-earth industry shifted from the US to China after 1990 through an extensive study. Islam et al. [

9] using a newly developed intelligent calculation tool to assess a realistic view of actual commodity prices for the implementation of several CRM exploration projects and performed backwards calculations to find a feasible price for each project.Some scholars have also analysed the Russian rare-earth industry in some detail. Buynovskiy [

10] pointed out that due to the collapse of the Soviet Union, Russia, which has a large number of rare-earth resources, lacks the appropriate extraction technology, resulting in a large number of rare-earth resources not being used effectively, and suggested the establishment of various rare-earth raw-material-processing enterprises to promote the development of the rare-earth industry. Krutov et al. [

11] argued that the focus of the Russian rare-earth industry should be on developing high-technology products and stimulating demand for high-technology products and their components, and suggested that the experience of China may be useful in this regard. Gasanov et al. [

12] stated that the future direction of rare-earth development in Russia should be the development of new enterprises for the production of consumer rare earths rather than increasing the production of primary products. Cherepovitsyn and Solovyova [

13] explored the prospects for the development of the Russian rare-earth industry in the context of the global energy transition based on an extensive literature survey, arguing that the Russian rare-earth industry can contribute to the energy transition and compete with China. Kryukov et al. [

14] argued that events such as the COVID-19 pandemic in recent years that have had a negative impact on the trade environment have somewhat cut off the world’s original rare-earth supply chain and promoted the restructuring of the original competitiveness pattern, arguing that Russia, as a country with large rare-earth reserves, should seize the opportunity to shape the competitiveness of its rare-earth industry.

The development of India’s rare-earth industry has meanwhile received some scholarly attention. Chandrashekar and Sundaresan [

15] noted that India remains a low-cost supplier of rare earths and argued that the Indian rare-earth industry suffers from a disconnect between the research community and industry and lacks the support of a national strategy that would extend the rare-earth value chain.

Rare-earth trade issues have also been studied from a more international perspective. Ilankoon et al. [

16] found that the commercial uncertainty in the rare earth industry and China’s control over the global supply chain of rare earth are the dominant factors affecting the development of the rare earth industry in other countries except China.Chen et al. [

17] found through social-network analysis that the scale of rare-earth trade among countries continues to grow, but the vast majority of countries belong to the importing type of rare-earth trade, and the global rare-earth trade has sharp contradictions between supply and demand. Hau et al. [

18] used wavelet analysis with quantile nonparametric causality tests to find that in the long run, rare-earth elements are negatively related to China’s trade-policy uncertainty and positively related to US trade-policy uncertainty. Zhou et al. [

19], by analysing the responses to the supply constraints of rare earths in the world during the study period, pointed out that changes in the global rare-earth market have reduced the demand for rare earths, leading to a reduction in the dependence of countries on China’s rare earths. Pan [

20], using data on China’s rare-earth trade with 18 countries, found that different types of institutional distance have different effects on China’s rare-earth exports: Institutional distance on Freedom from Corruption and Fiscal Freedom have positive effects. In the case of Business Freedom and Trade Freedom, they have a negative impact.

The development and trade of the rare-earth industry in each country has been studied in some depth by the academic community, but studies on the country comparison of the export competitiveness of rare-earth products are still relatively scarce. In order to understand the differences in the competitiveness of rare-earth products in different countries, we need to start from three aspects: (1) What are the characteristics of rare-earth product exports in various countries? This question helps us to understand the different characteristics of the export of rare-earth products in different countries. (2) What role does the competitiveness of each country play in its export value? This question further strips the competitiveness factor from the appearance of the export value so that we can have a deeper understanding of the rare-earth trade of various countries. (3) Is the role of each country’s competitiveness in exports dynamic or static? This question will help us understand the differences in competitiveness changes across countries. To answer the above three questions this paper asks the following three questions: (1) What changes have the four countries’ rare-earth exports undergone during the study period? What are the characteristics of their market structure and commodity structure? (2) To what extent are the fluctuations in the overall and upstream, midstream, and downstream rare-earth product exports of the four countries due to changes in competitiveness? (3) What is the dynamic evolution of the competitiveness of the four countries’ rare-earth products based on the perspective of their overall competitiveness?

3. Overview of Rare-Earth Exports from China, the US, Russia, and India

The data provided by UN comtrade are problematic due to changes in national statistics and changes in government, such as missing data on rare-earth imports from Afghanistan and North Korea, whereas exports to these countries are still recorded in the data provided by exporting countries. For robustness reasons, the missing data are removed from this paper. Although this reduces the export value of the exporting countries to some extent, the remaining data are considered to be an accurate reflection of the changes in export competitiveness of each country, given that the deleted countries are mainly less-importing countries with low trade volumes and that the data for major rare-earth-importing countries or regions such as Japan, the USA, and the EU, which are more important for rare-earth trade, are still complete and accurate.

3.1. Growth in the Value of Rare-Earth Exports

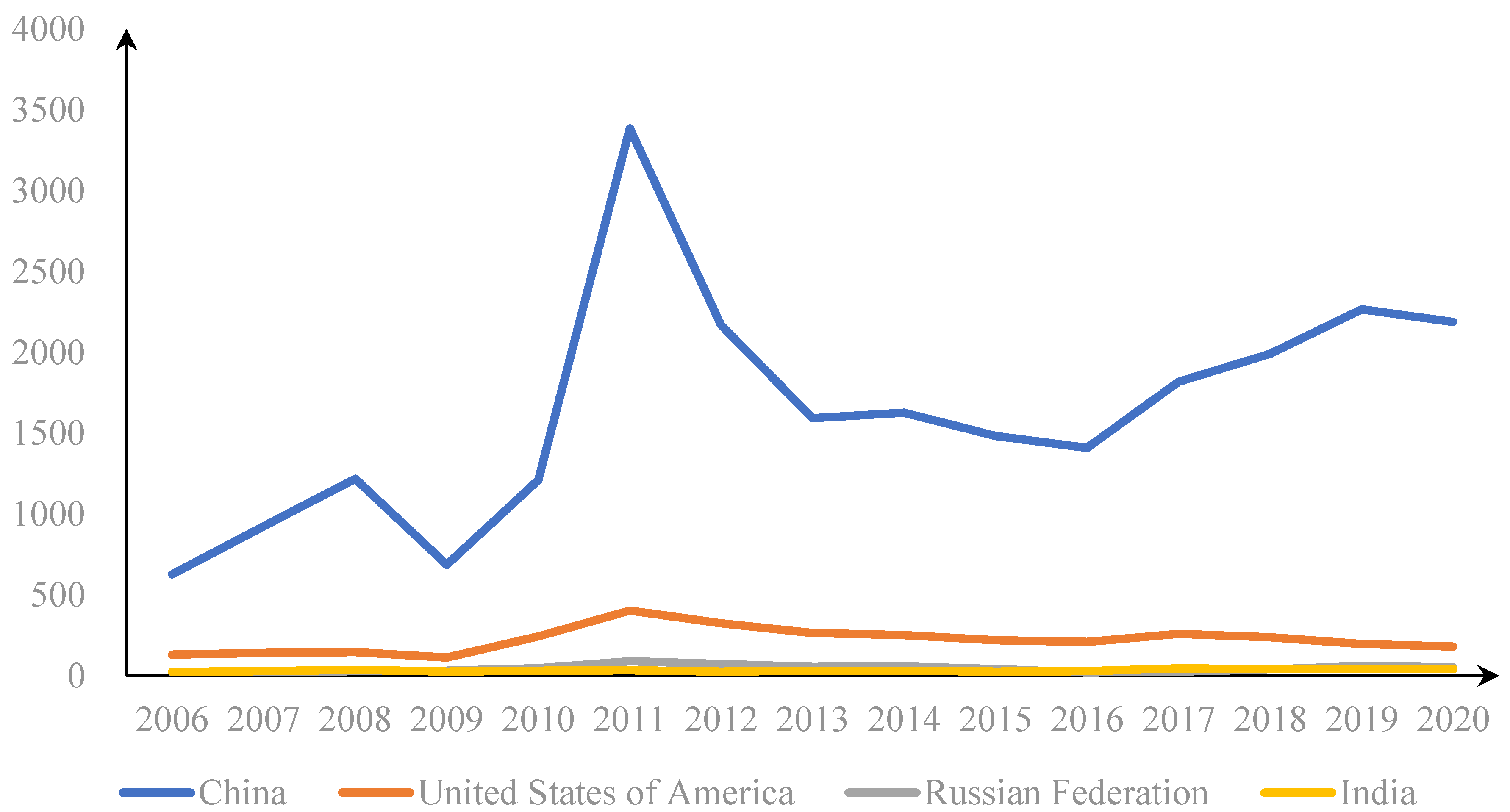

Figure 1 illustrates the value of rare-earth exports by country for the period 2006–2020.

Overall, China has been the world’s largest exporter of rare earths and has a much higher export value than other countries. China’s exports averaged USD 1.64 billion over the study period and the USA had some rare-earth exports, with an average value of USD 221.79 million, slightly higher than Russia and India. Russia and India had relatively small exports, with an average value of USD 44.33 million and USD 32.76 million, respectively.

From a dynamic perspective, it can be seen that.

(1) China’s exports of rare-earth products fluctuated considerably until 2013, after which they gradually levelled off. The development of China’s exports of rare-earth products can be divided into five periods, based on the criteria of whether they share the same development trend. The first period was 2006–2008, when China’s rare-earth exports grew rapidly from USD 627.25 million at the beginning of the period to USD 1.22 billion in 2008, an increase of 194%, despite the Chinese government’s shrinking rare-earth export quotas. The second period was from 2008 to 2009—hit by the international financial crisis, China’s rare-earth exports fell rapidly to USD 685.29 million, almost back to the level of exports in 2006. The third period was 2009–2011. In the first half of the period, 2009–2010, China’s rare-earth exports recovered rapidly as the world industry gradually moved away from the effects of the financial crisis, reaching US$1.21 billion in 2010, returning to pre-financial-crisis levels. In the second half of the period, from 2010 to 2011, against the backdrop of the Diaoyu Islands incident and the Sino–US dispute over the South China Sea, China issued an embargo on rare earths to the US and Japan, which, on the one hand, heightened concerns about the security of rare-earth supplies and, on the other, caused a sharp rise in international rare-earth prices. This represents a 280% increase compared to 2010. The fourth phase, from 2011 to 2016, saw a rapid decline in China’s rare-earth exports in the first half of the period, before slowing down and levelling off in the second half. During this period, exports declined from their peak to USD 1.41 billion at the end of the period. The fifth period, 2016–2020, saw a steady and relatively rapid development in the value of China’s rare-earth exports, which peaked at USD 2.27 billion in 2019 before declining by 3.5% to reach USD 2.19 billion in 2020, although the slight decline did not affect the overall upward trend.

(2) US rare-earth exports followed a similar “flat–rapidly rising–falling” course to that of China. Based on the same division, US rare-earth exports can be divided into six periods. The first period, 2006–2008, saw a slight increase in the value of US rare-earth exports from USD 131.38 million at the beginning of the period to USD 147.78 million. The second period, from 2008 to 2009, saw a rapid decline in US rare-earth exports to USD 112.3 million as a result of the economic crisis. The third period was from 2009 to 2011. Against the backdrop of the international economic recovery and the Chinese rare-earth embargo, US rare-earth exports were significantly exported, reaching USD 403.42 million at the end of the period, an increase of 360%. In the fourth period, 2011–2016, rare-earth exports declined rapidly to USD 209.53 million, a 50% decrease from the beginning of the period. During the fifth period, 2016–2017, US rare-earth exports increased somewhat, reaching USD 259.97 million in 2017. The sixth period, from 2017 to 2020, saw a continued decrease in the value of US rare-earth exports during this period, shrinking to USD 181.62 million in 2020.

(3) The export value of Russian rare-earth products has gone through a process of “up–down–up again–down again” and can be divided into four periods overall. The first period was from 2006 to 2011. During this period, Russia’s exports of rare-earth products grew relatively slowly from 2006 to 2009, from USD 22.01 million to USD 32.28 million, and then rapidly from 2009 to 2011, to USD 89.81 million in two years, an increase of 279%. In the second period, from 2011 to 2016, exports of rare earths were on a rapid downward trend, except for a small increase from 2013 to 2014, and fell to USD 19.3 million at the end of the period, reaching the lowest point in the study period, and in the third period, from 2016 to 2019, exports of Russian rare-earth products began to grow again, rapidly increasing from USD 19.3 million at the beginning of the period to USD 60 million in 2019, an increase of 300%. In the fourth period, from 2019 to 2020, exports contracted to USD 51.04 million at the end of the period.

(4) India’s exports of rare-earth products fluctuated most dramatically and can be divided into three periods overall. India’s exports of rare-earth products showed an almost sawtooth waveform between 2006 and 2015, rising from USD 24.32 million to USD 35.44 million between 2006 and 2008, then falling rapidly to USD 24.83 million in 2009 before rebounding to USD 34.90 million in 2011, and falling to USD 26.95 million in 2012 before rebounding to USD 32.35 million in 2014 and then falling again to USD 25.53 million in 2015. This paper divides the above volatile years into one period. The second period is from 2015 to 2017, during which India’s rare-earth exports grew rapidly to USD 45.79 million at the end of the period, an increase of 179%. The third period is from 2017 to 2020, when India’s rare-earth exports decline overall, with only a small increase from 2019 to 2020. Exports contracted to USD 41.11 million at the end of the period.

3.2. Market Structure of Rare-Earth Exports by Country

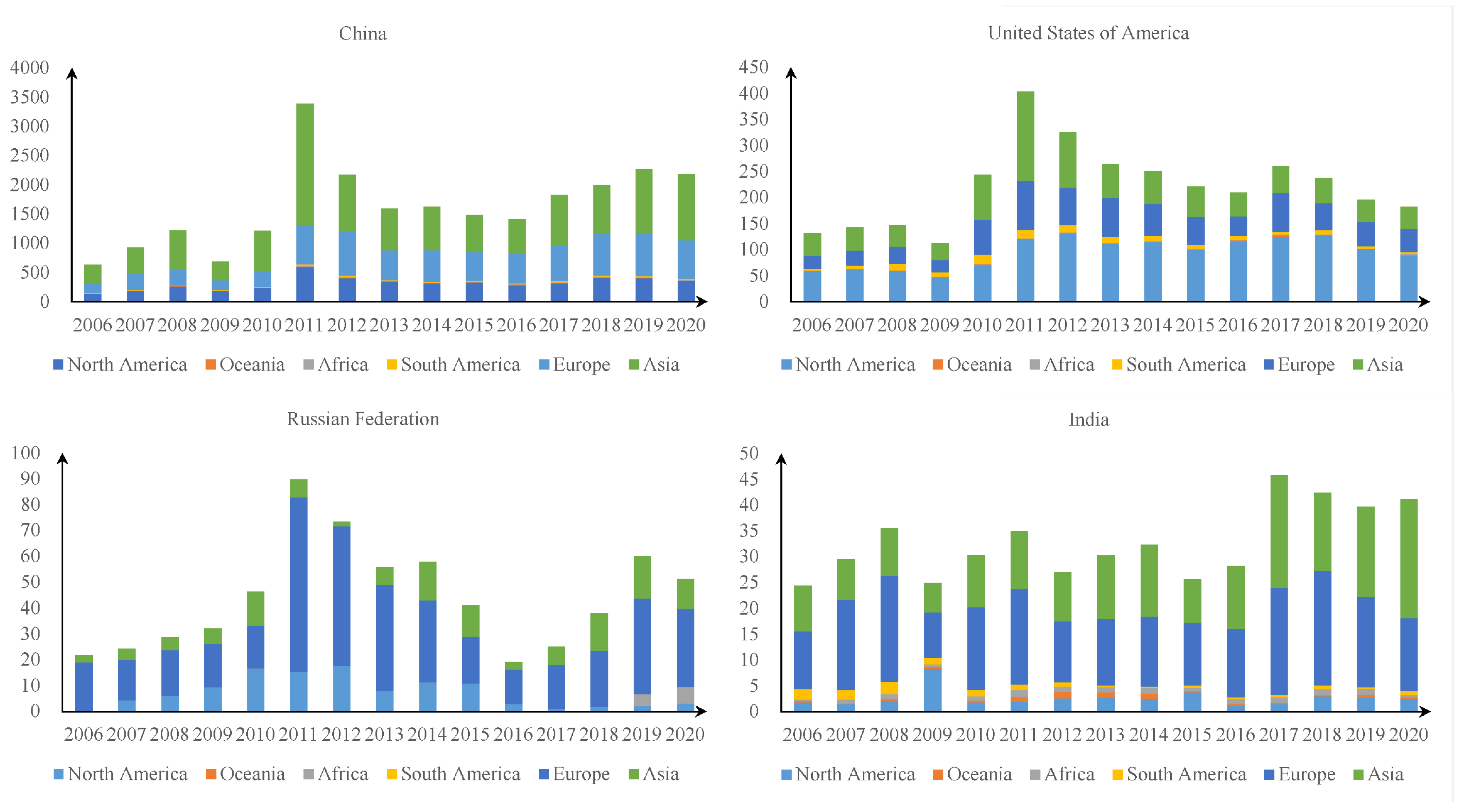

Figure 2 illustrates the market structure of rare-earth exports by country, and an analysis of the period breakdown described in 3.1 shows the following.

- (1)

China

Overall, Asia, Europe, and North America are the main export markets, with the three markets accounting for an average of 48.40%, 29.94%, and 19.98% of exports, respectively. South America, Africa, and Oceania account for a smaller share, with an overall average share of only 1.69% for the three markets. In a dynamic perspective, during the first period of growth, among the major markets, Asia contributed the most to the growth (USD 334.54 million), followed by Europe (USD 124.56 million) and then North America (USD 121.06 million). At the same time, the African, Oceanian, and South American markets also grew to some extent. In the second period, the share of exports shrank in all three main markets, with the largest decrease being in Asia (USD −338.26 million), with a decrease of almost 50%. This was followed by Europe, with a decrease of USD −116.74 million. The North American market had a smaller share of the decrease, at –USD 74.06 million. In addition, the African, Oceanian, and South American markets were also negatively affected to some extent. In the third period, three of the main export markets, particularly Asia, experienced very significant growth. Compared to the beginning of the period, exports to the Asian market increased by USD 1.38 billion in 2011, or 300%. The European market contributed the second highest growth (USD 507.12 million), with a 400% increase, the highest of the three main markets. The North American market also grew rapidly, with a growth of USD 405.27 million, or 320%. Other secondary markets also saw some growth. In the fourth period, exports to Asia declined significantly, with exports to this market falling by 73% to USD 588.09 million at the end of the period. Exports to Europe, on the other hand, were more stable, decreasing by 25% to USD 170.87 million, the smallest of the major markets. The North American market decreased by 52% to USD 306.68 million. In the final period, Asia continued to contribute the largest growth (USD 545.7 million), with Europe also showing some growth (USD 154.86 million). The North American market was more stable, with a growth of USD 70.53 million. Other markets also remained stable. There are two possible reasons for the state of China’s market structure. One is that China is the largest rare-earth exporter in Asia, and the lower transaction costs brought about by the closer distance make the Asian rare-earth market more favoured from China. Second, China is also the largest exporter of rare-earth products, and the strong demand for rare-earth products in the high-end manufacturing industries in North America and Europe has promoted North America and Europe to occupy a more important position in China’s export-market structure.

- (2)

United States

Overall, the main export markets for the USA are North America (43.84%), followed by Europe and Asia with similar shares (23.20% and 27.79%). Oceania, Africa, and South America account for a smaller share (5.18% in total). In the first period, exports to the North American market remained stable (+USD 0.3 million), exports to the Asian market decreased slightly (−USD 1.16 million), whereas growth in exports to the European (USD 7.67 million) and South American markets (USD 9.04 million) were the main sources of growth in exports during the period. In the second period, US exports to all markets declined. The Asian market contributed the largest increase in exports in the third period, followed by the European market and then the North American market. In the subsequent periods, exports to North America fluctuated around USD 100 million and remained relatively stable. The European and Asian markets, on the other hand, were more volatile and went through a process of “down–up slightly–down again” in the last three periods. Meanwhile, exports to other markets generally showed a downward trend over the last three periods. For the North American rare-earth market, importing rare earths from the closer US can provide significant cost savings, and European and Asian manufacturing demand for rare earths may shape the structure of the US market for rare-earth products.

- (3)

Russia

The European market is the main export market for Russia, with an average share of 62.28% of Russian rare-earth exports. The Asian and North American markets have similar export values (20.26% vs. 16.10%), whereas Africa (1.32%), Oceania (0.00%), and South America (0.05%) have lower market shares. From a dynamic point of view, within the four periods of change in Russian rare-earth exports, exports to the European market rose significantly in the first period, reaching USD 67.39 million in 2011, an increase of USD 44.8 million compared to the beginning of the period. In the second period, exports to the European market declined slowly, reaching a low of USD 13.58 million in 2016 before rising again and declining again in the fourth period. Exports to North America rose slowly in the first period, fluctuated in the second period, and remained stable at a lower level in the third and fourth periods. Exports to the Asian market were more volatile, with a low of USD 1.76 million in 2012 and a high of USD 16.28 million in 2019, and notably in Africa, where the share of exports in total exports jumped to 7.65% in 2019 and 2020 and grew rapidly to 11.95% in 2020. Russia has a long-term resource-cooperation relationship with Europe. The maturity of this trade has made the European market occupy a major position in Russia’s export structure. In addition, Russia also has certain geographical advantages to promote exports to Asia.

- (4)

India

The European (46.89%) market is India’s main export market, and Asia (36.80%) comes next. The North American market (8.80%) holds some size, with other markets accounting for a smaller share. Dynamically, exports to the European market are more volatile and fluctuate significantly, except for 2012 to 2016, when they remained stable at around USD 13 million. Exports to the Asian market, on the other hand, showed a fluctuating upward trend, reaching USD 22.97 million after 2019, surpassing the European market as India’s main export market. Exports to North America have remained stable at around USD 2.5 million, except for 2009, when they jumped to USD 8.28 million, making it India’s second-largest export market. Exports to Africa, Oceania, and South America have been less volatile and have remained stable at lower levels. Located in the Asian subcontinent, India has more convenient shipping conditions and a better geographical location, which enables it to save more costs in exporting rare earths to Asia and Europe. This factor may be the reason for the formation of its market structure.

Figure 2.

Export-market structure of rare-earth products from China, the US, Russia, and India.

Figure 2.

Export-market structure of rare-earth products from China, the US, Russia, and India.

3.3. Commodity Structure of Rare-Earth Exports by Country

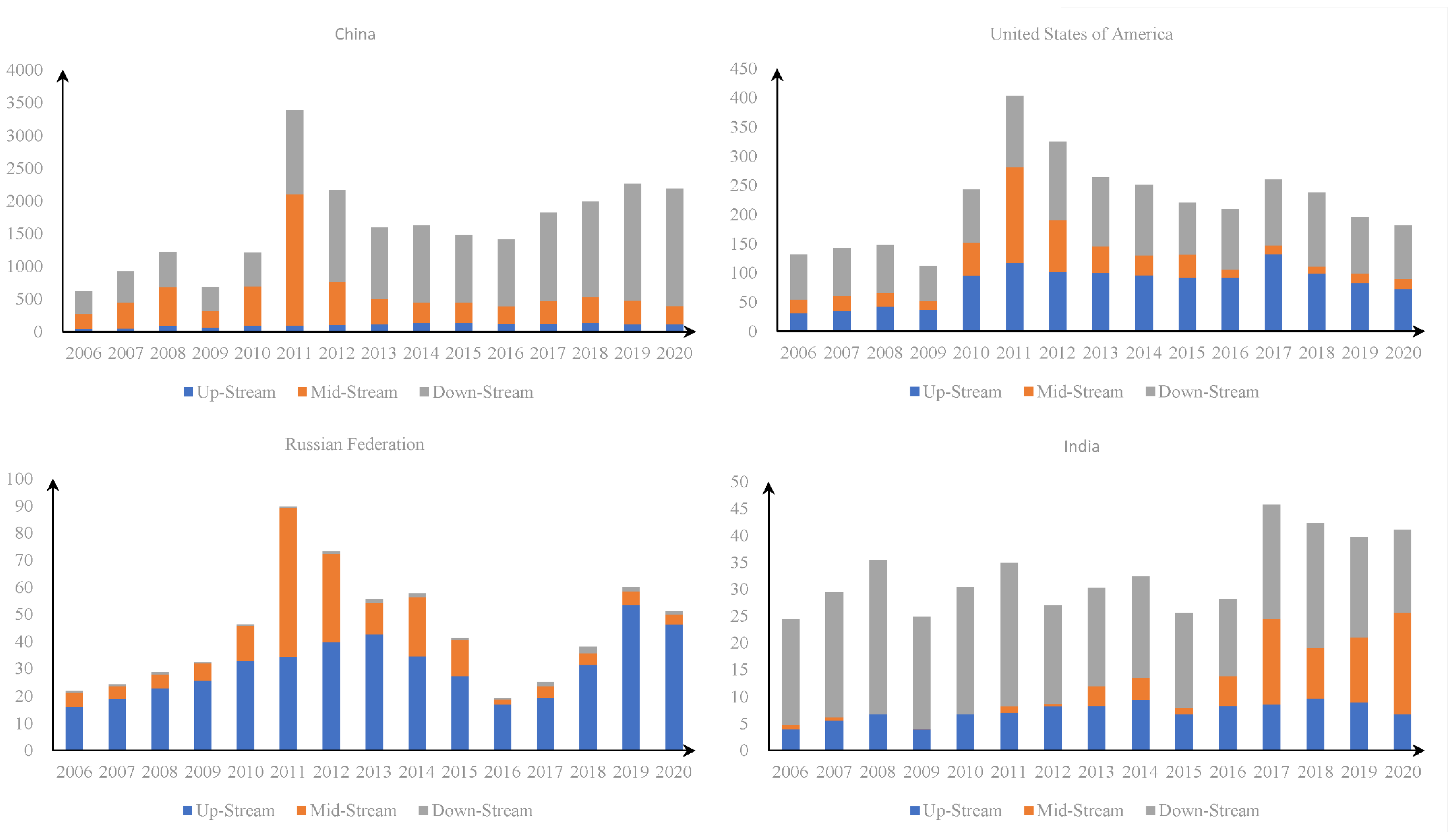

Figure 3 illustrates the commodity structure of rare-earth exports by country, from which the following can be seen.

(1) China: The most important export products are downstream products, with some exports in the midstream and to a lesser extent in the upstream.

From a dynamic point of view, downstream products generally showed an upward trend during the study period, with a stable growth rate in all years except for the second period, when exports fell due to the economic crisis, and the fourth period, when the rare-earth trade market became less hot. China’s exports of midstream products fluctuated more between the first and third periods, growing more rapidly in the first period, then declining in the second period due to the economic crisis, growing very rapidly in the third period, and finally declining and stabilising at around USD 270 million in the fourth period, but overall, midstream products were in a less important position in China’s exports of rare-earth products. Upstream exports accounted for a smaller proportion of total exports, but they still showed a slow upward trend until 2018 and then slowly declined. The maximum value of upstream rare-earth-product exports was USD 135.02 million in 2018, an increase of USD 86.18 million from USD 48.84 million in 2006. Overall, the main commodity driving the growth of China’s rare-earth-product exports was downstream rare-earth products. The formation of China’s commodity structure may come from two factors: First, China has relatively advanced rare-earth-processing and -refining technologies, which gives China a relatively strong comparative advantage in midstream and downstream rare-earth products. Second, China has strict restrictions on rare-earth mining, which makes it impossible for Chinese rare-earth production enterprises to mine unrefined rare-earth mines as the main source of profit.

(2) US: Upstream and downstream products are its main export commodities.

US upstream rare-earth products saw modest growth overall in phases I and II, accelerated significantly in phase III, and reached USD 122.41 million in 2011 before trending slowly downward and returning to a downward trajectory in 2017 after regaining growth. US downstream exports follow a similar path to upstream exports, growing slowly in the first period and increasing significantly in the third period, before maintaining a volatile and declining trend after 2012. US midstream rare-earth products, on the other hand, have remained low in all years except for the third period, when they grew rapidly, and then declined rapidly in the fourth period. Overall, the growth of US rare-earth-product exports relied heavily on upstream and downstream products, with midstream products also playing a role in specific years. The possible reasons for the U.S. commodity structure are as follows. The U.S. has a relatively advanced high-end manufacturing industry, which gives the owners of products such as rare-earth permanent magnets a strong comparative advantage. However, the U.S. lacks better rare-earth extraction and separation technologies. This makes the US’s midstream and downstream products also occupy a larger part of its export structure.

Figure 3.

Commodity structure of rare-earth exports from China, the US, Russia, and India (in USD million).

Figure 3.

Commodity structure of rare-earth exports from China, the US, Russia, and India (in USD million).

(3) Russia: Upstream products are the mainstay, complemented by midstream products, whereas downstream products account for a very small proportion of exports.

Russia’s upstream rare-earth products maintained an upward trend from 2006 to 2013, with exports of upstream products increasing from USD 16.12 million at the beginning of the period to USD 42.60 million at the end of the period, then declining to USD 16.92 million in 2016 before rising again and declining after 2019. Midstream products accounted for a relatively small proportion of exports but contributed significantly to export growth over a given period. Between 2010 and 2011, Russian exports of midstream rare-earth products increased by USD 42 million, or 424%. After that, exports of midstream products slowly declined and stabilised after 2017 at around USD 4.5 million. Downstream rare-earth products, on the other hand, remained stable at around USD 1.0 million. Overall, the growth of Russian rare-earth exports was largely dependent on upstream products. The possible cause of Russia’s export-commodity structure is that Russia lacks advanced manufacturing or processing technology, which places Russia’s export-commodity structure mainly in the middle and upstream rare-earth products, whereas the downstream rare earth products only account for a small part.

(4) India: Downstream products are its main export products.

With the exception of a steady decline from 2012 to 2015, India’s downstream rare-earth products generally showed a fluctuating downward trend during the study period, with exports of downstream products at USD 15.41 million in 2020, a decrease of USD 4.12 million from USD 19.53 million in 2006. India’s midstream rare-earth products remained steady at a low level until 2012, and began a fluctuating in an upward trend after 2012 and replaced downstream products as the most important export commodity in 2020. India’s upstream rare-earth products were the next-most-important export commodity until 2016 and maintained a slow upward trend until 2018, but after 2018 exports of this commodity began to slowly decline and fall to USD 6.72 million in 2020. Overall, India’s rare-earth-product export growth is largely dependent on midstream products. India is a country with growing scientific and technological strength. Its higher export of downstream products may be due to the continuous progress of its manufacturing industry, and its rare-earth extraction and separation technology may also be the reason for the continuous increase in the export value of its midstream products in recent years.

This section analyses the changes in the export value and market structure of rare-earth products from China, the US, Russia, and India, and the commodity structure, as a response to research question one.

6. Conclusions and Policy Recommendations

The results of the analysis of the CMS model and the WRCA index lead to the following conclusions in this paper.

(1) Changes in the competitiveness of rare-earth products in China, the US, Russia, and India differed. The competitiveness of rare-earth products in China, the US, and India generally decreased over the study period and led to a decline in the export value of rare-earth products, whereas the competitiveness of rare-earth products in Russia increased and promoted the export of rare-earth products.

(2) The factors inhibiting the further development of the competitiveness of rare-earth products in China, the US, Russia, and India were different. The factors inhibiting the development of the competitiveness of China’s and India’s rare-earth product exports were the concentration of exports in midstream and downstream products with low growth rates and the concentration of export markets in markets with low growth rates. For the US, the inhibiting factor for the competitiveness of rare-earth exports was the overall reduction in market share for rare-earth products. In the case of Russia, the inhibiting factor was the concentration of exports in markets with low growth rates of competitiveness.

(3) The overall competitiveness of rare-earth products varied greatly among the four countries. China always had the highest rare-earth export competitiveness among the four countries, whereas the US rare-earth product-export competitiveness was significantly lower than that of China, but higher than that of Russia, India. Russia and India were, on the whole, less competitive and did not have comparative advantages.

(4) China, the United States, Russia, and India had different trends in the evolution of the competitiveness of their rare-earth products. The export competitiveness of rare-earth products from China and India tended to decline in recent years, whereas the competitiveness of rare-earth products from the US and Russia tended to rise.

With these findings, this paper makes the following policy recommendations.

(1) For China, which already occupies a major position in rare-earth exports, the next goal should be to pursue high-quality development of the rare-earth industry. The first is to maintain the balance between rare-earth production and ecological maintenance. By improving the environmental-protection law, we will promote a circular economy of rare-earth resource conservation and recycling, and improve the utilization efficiency of rare-earth resources. The second is to strengthen technological-innovation capabilities, increase the added value of rare-earth products through industry–university–research cooperation and other methods, and stimulate the competitiveness of the rare-earth industry through innovation. Finally, it is recommended to extend the industrial chain, expand industrial clusters, improve the scale and quality of each industry, and enhance the overall industrial-chain competitiveness.

(2) For the United States, strengthening its leading position in high-end manufacturing can lead to better playing its role in the division of labour in the international rare-earth industry. By increasing R&D investment and enhancing the concentration of the rare-earth industry, it may be possible to create a comparative advantage in the downstream of the U.S. rare-earth industry chain.

(3) For Russia and India, the main factors that limit the competitiveness of their rare-earth products are non-resource factors such as technological constraints. Ways to improve the competitiveness of rare-earth products can include improving technological capabilities and increasing investment in scientific research systems and education; partial opening up on the premise of ensuring the security of strategic mineral supply, such as restrictions on foreign investment in the rare-earth industry; strengthening investment in infrastructure; curbing corruption and creating a better business environment; etc.

(4) Considering the volatile political situation in the world and the impact of the new COVID-19 pandemic, security and political factors may greatly affect the rare-earth trade in the future. Countries around the world have an obligation to maintain the original intention of maximising the welfare of world trade, and it is necessary to strengthen the economic dependence of countries around the world, increase the degree of cooperation among countries, and promote the healthy development of rare-earth trade and the sustainable development of countries by constructing a broader framework of cooperation, formulating fairer trade agreements, and creating a broader global trade-cooperation organisation.