Energy Trading on a Peer-to-Peer Basis between Virtual Power Plants Using Decentralized Finance Instruments

Abstract

1. Introduction

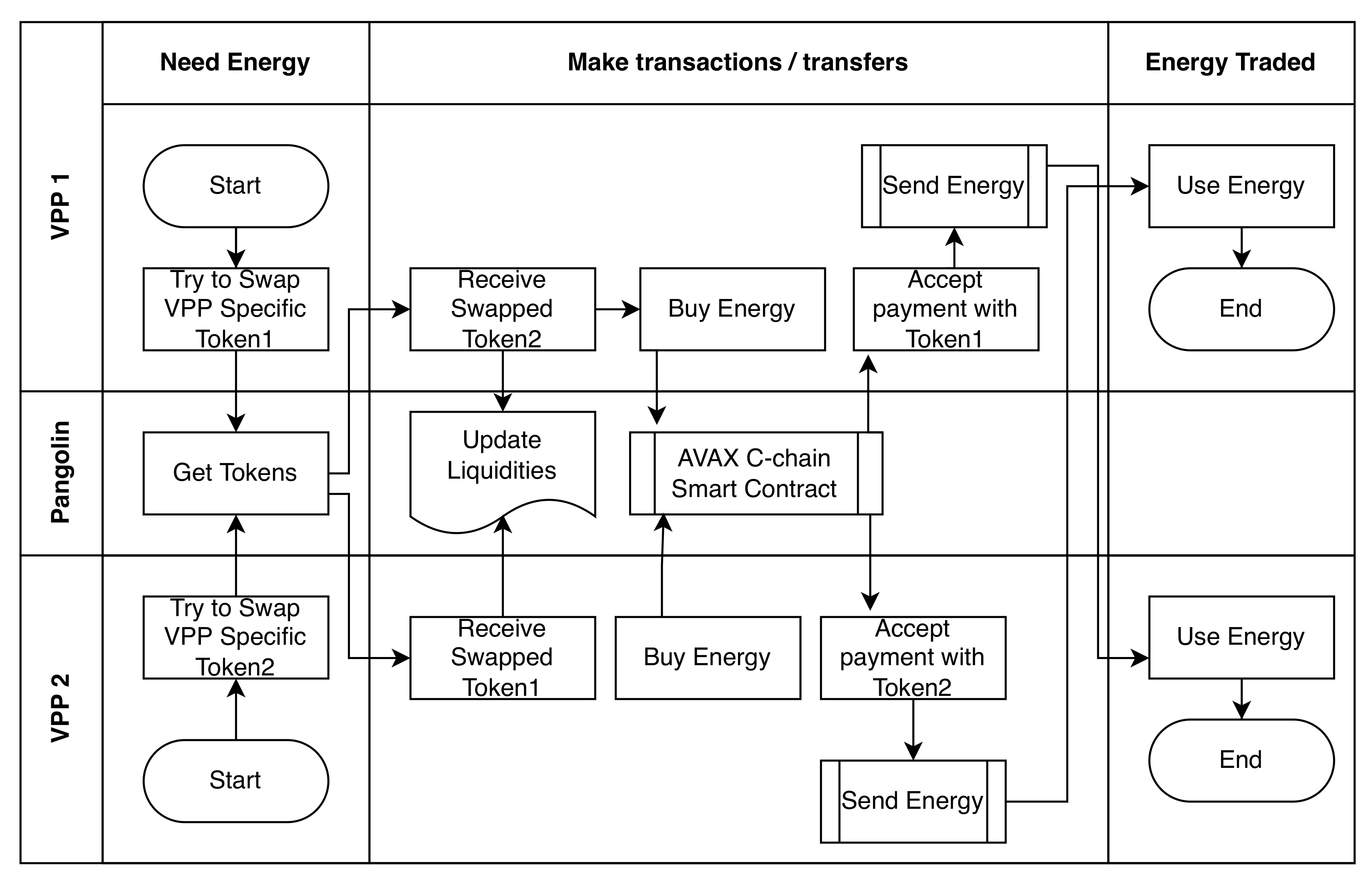

- As an extremely novel approach for a blockchain-based P2P trading scheme, trading has been realized with a workflow close to the open market mechanism in this study, which is completely distinguished from papers that feature auction or bidding.

- It has been demonstrated that the trading on a model architecture is substantially realized; this scheme and workflow may be utilized in trading between VPPs. Further, energy prices can be calculated based on supply and demand.

- A workflow and schematic are presented where VPPs using different blockchains for trading can also trade with each other.

- While peer-to-peer trading is conducted on the model architecture of the power system comprising VPPs with the proposed flow, MILP is employed to get the cost of energy transfers closer to the optimum.

2. Background Information

2.1. Avalanche Platform

2.1.1. Principles

2.1.2. The Native Token: AVAX

2.2. Decentralized Finance (DeFi)

2.3. Decentralized Exchange (DEX)

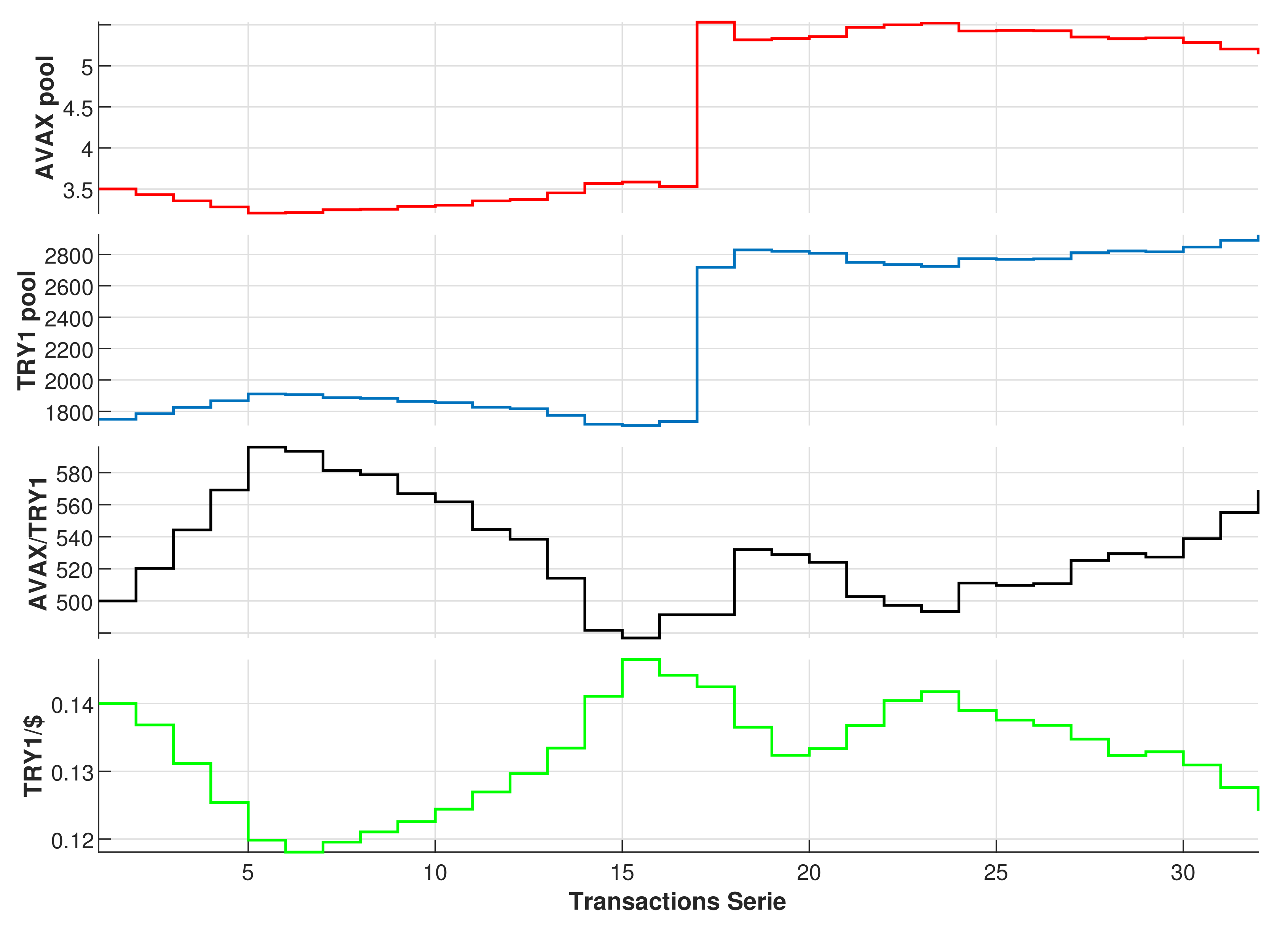

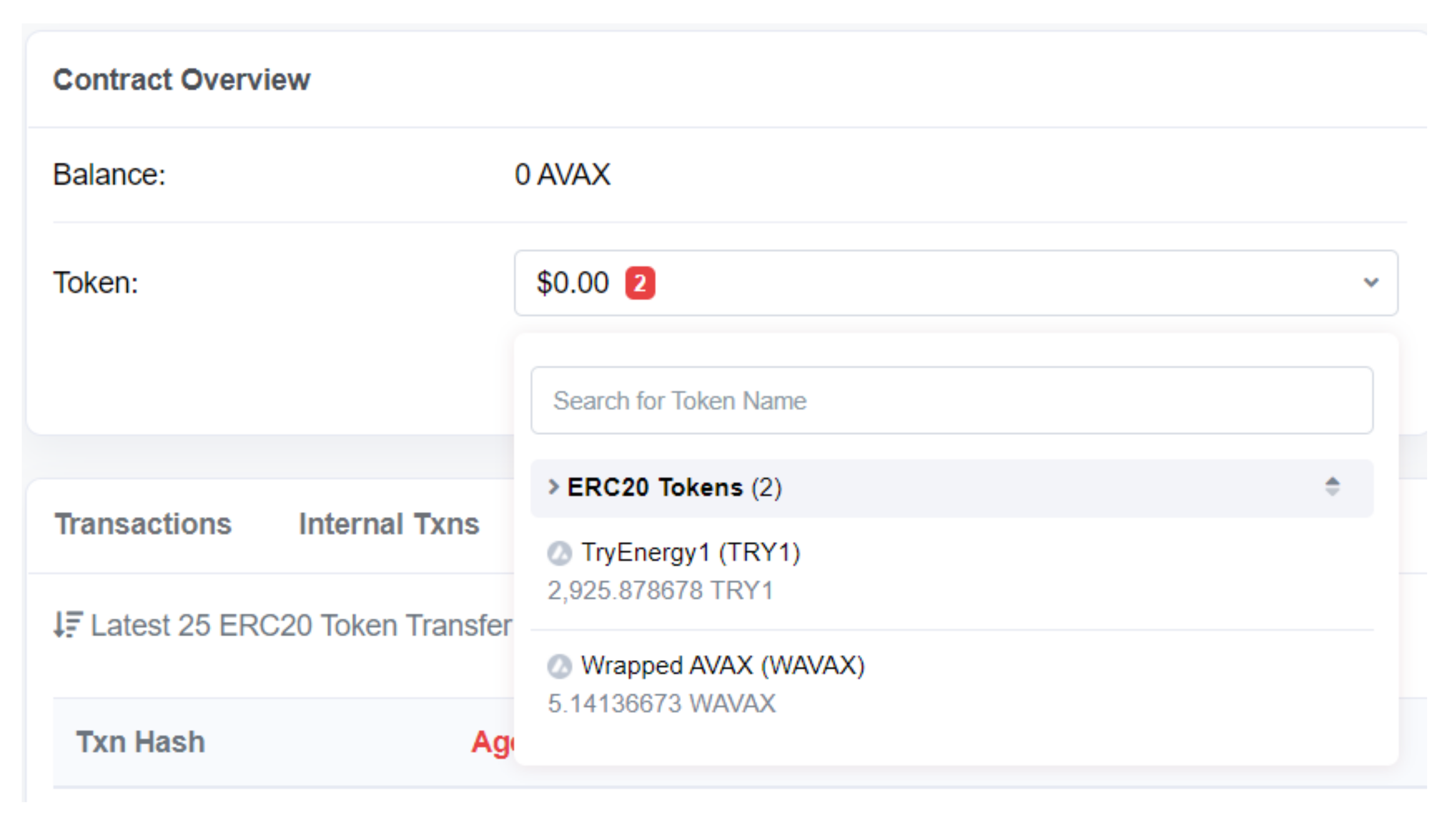

Pangolin

3. System Description

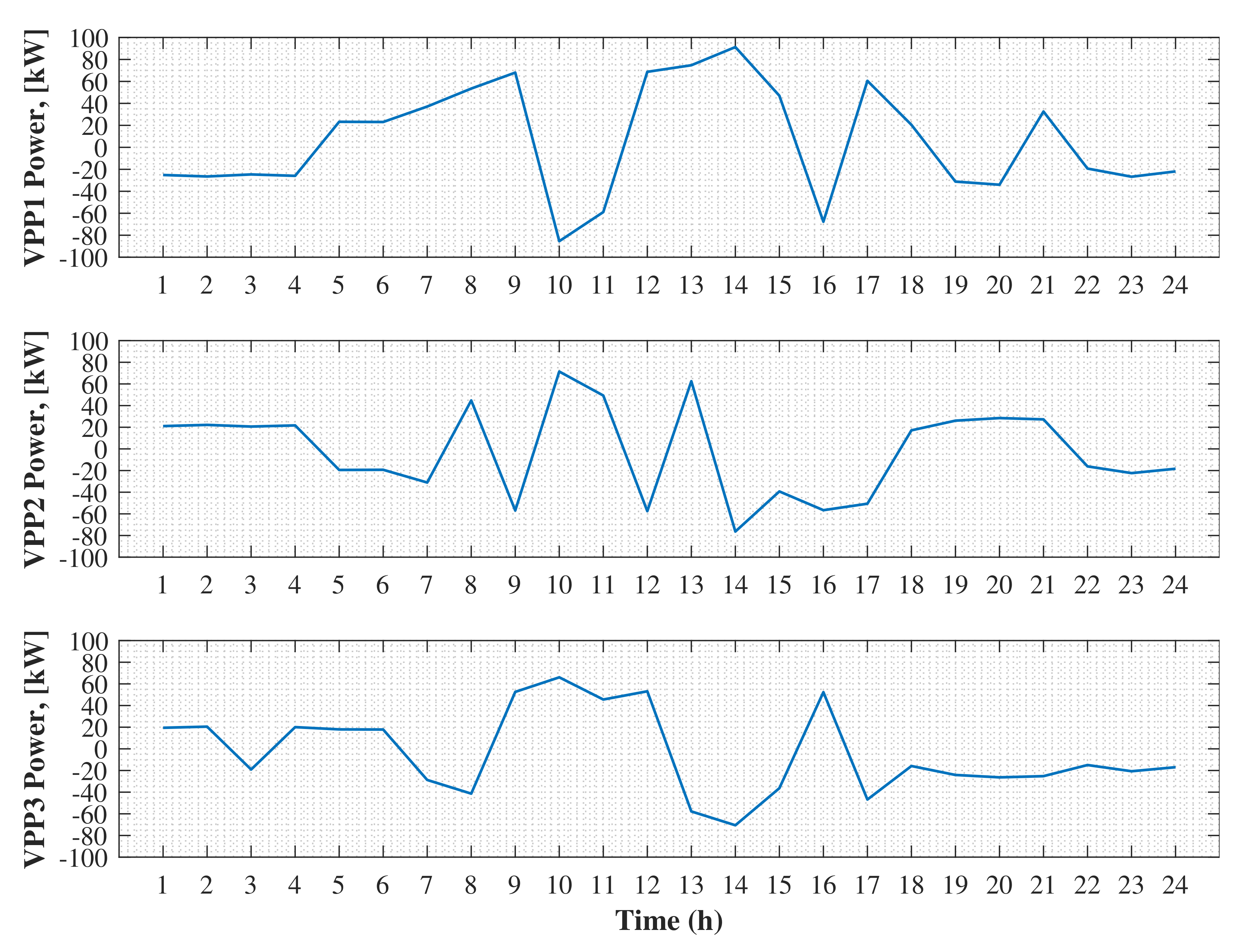

3.1. Model Architecture

3.2. Problem Formulation

4. Proposed Scheme and Flow

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| AB | Avalanche Bridge |

| ICT | Information and communication technologies |

| GAMS | General Algebraic Modeling System |

| DERs | Distributed energy resources |

| RESs | Renewable energy sources |

| P2P | Peer-to-peer |

| VPP | Virtual Power Plant |

| SC | Smart Contract |

| DApps | Decentralized applications |

| DeFi | Decentralized finance |

| DEX | Decentralized Exchanges |

| TRY | Try Energy Token |

References

- Khan, R.; Islam, N.; Das, S.K.; Muyeen, S.M.; Moyeen, S.I.; Ali, M.F.; Tasneem, Z.; Islam, M.R.; Saha, D.K.; Badal, M.F.R.; et al. Energy Sustainability–Survey on Technology and Control of Microgrid, Smart Grid and Virtual Power Plant. IEEE Access 2021, 9, 104663–104694. [Google Scholar] [CrossRef]

- Yoldaş, Y.; Önen, A.; Muyeen, S.; Vasilakos, A.V.; Alan, İ. Enhancing smart grid with microgrids: Challenges and opportunities. Renew. Sustain. Energy Rev. 2017, 72, 205–214. [Google Scholar] [CrossRef]

- Khayatian, A.; Barati, M.; Lim, G.J. Integrated Microgrid Expansion Planning in Electricity Market With Uncertainty. IEEE Trans. Power Syst. 2018, 33, 3634–3643. [Google Scholar] [CrossRef]

- Goia, B.; Cioara, T.; Anghel, I. Virtual Power Plant Optimization in Smart Grids: A Narrative Review. Future Internet 2022, 14, 128. [Google Scholar] [CrossRef]

- Yagmur, A.; Dedeturk, B.A.; Soran, A.; Jung, J.; Onen, A. Blockchain-Based Energy Applications: The DSO Perspective. IEEE Access 2021, 9, 145605–145625. [Google Scholar] [CrossRef]

- Yavuz, L.; Önen, A.; Muyeen, S.; Kamwa, I. Transformation of microgrid to virtual power plant—A comprehensive review. IET Gener. Transm. Distrib. 2019, 13, 1994–2005. [Google Scholar] [CrossRef]

- Bhuiyan, E.A.; Hossain, M.Z.; Muyeen, S.; Fahim, S.R.; Sarker, S.K.; Das, S.K. Towards next generation virtual power plant: Technology review and frameworks. Renew. Sustain. Energy Rev. 2021, 150, 111358. [Google Scholar] [CrossRef]

- Gržanić, M.; Capuder, T.; Zhang, N.; Huang, W. Prosumers as active market participants: A systematic review of evolution of opportunities, models and challenges. Renew. Sustain. Energy Rev. 2022, 154, 111859. [Google Scholar] [CrossRef]

- Pinto, T.; Vale, Z.; Widergren, S. (Eds.) Local Electricity Markets; Academic Press: London, UK, 2021. [Google Scholar]

- Zhang, C.; Wu, J.; Cheng, M.; Zhou, Y.; Long, C. A Bidding System for Peer-to-Peer Energy Trading in a Grid-connected Microgrid. Energy Procedia 2016, 103, 147–152. [Google Scholar] [CrossRef]

- Anoh, K.; Maharjan, S.; Ikpehai, A.; Zhang, Y.; Adebisi, B. Energy Peer-to-Peer Trading in Virtual Microgrids in Smart Grids: A Game-Theoretic Approach. IEEE Trans. Smart Grid 2020, 11, 1264–1275. [Google Scholar] [CrossRef]

- Ali, L.; Muyeen, S.; Bizhani, H.; Ghosh, A. A peer-to-peer energy trading for a clustered microgrid – Game theoretical approach. Int. J. Electr. Power Energy Syst. 2021, 133, 107307. [Google Scholar] [CrossRef]

- Ali, L.; Muyeen, S.M.; Bizhani, H.; Ghosh, A. A multi-objective optimization for planning of networked microgrid using a game theory for peer-to-peer energy trading scheme. IET Gener. Transm. Distrib. 2021, 15, 3423–3434. [Google Scholar] [CrossRef]

- Belgioioso, G.; Ananduta, W.; Grammatico, S.; Ocampo-Martinez, C. Operationally-Safe Peer-to-Peer Energy Trading in Distribution Grids: A Game-Theoretic Market-Clearing Mechanism. IEEE Trans. Smart Grid 2022, 13, 2897–2907. [Google Scholar] [CrossRef]

- Wang, L.; Zhang, Y.; Song, W.; Li, Q. Stochastic Cooperative Bidding Strategy for Multiple Microgrids With Peer-to-Peer Energy Trading. IEEE Trans. Ind. Inform. 2022, 18, 1447–1457. [Google Scholar] [CrossRef]

- Tushar, W.; Saha, T.K.; Yuen, C.; Smith, D.; Poor, H.V. Peer-to-Peer Trading in Electricity Networks: An Overview. IEEE Trans. Smart Grid 2020, 11, 3185–3200. [Google Scholar] [CrossRef]

- Gomes, L.; Vale, Z.A.; Corchado, J.M. Multi-Agent Microgrid Management System for Single-Board Computers: A Case Study on Peer-to-Peer Energy Trading. IEEE Access 2020, 8, 64169–64183. [Google Scholar] [CrossRef]

- Zhao, Z.; Feng, C.; Liu, A.L. Comparisons of Auction Designs through Multi-Agent Learning in Peer-to-Peer Energy Trading. IEEE Trans. Smart Grid 2022, 1. [Google Scholar] [CrossRef]

- Pankiraj, J.S.; Yassine, A.; Choudhury, S. Double-Sided Auction Mechanism for Peer-to-Peer Energy Trading Markets. In Proceedings of the 2021 IEEE International Conference on Progress in Informatics and Computing, PIC 2021, Shanghai, China, 17–19 December 2021; pp. 443–452. [Google Scholar] [CrossRef]

- Zhu, H.; Ouahada, K.; Abu-Mahfouz, A.M. Peer-to-Peer Energy Trading in Smart Energy Communities: A Lyapunov-Based Energy Control and Trading System. IEEE Access 2022, 10, 42916–42932. [Google Scholar] [CrossRef]

- Soriano, L.A.; Avila, M.; Ponce, P.; de Jesús Rubio, J.; Molina, A. Peer-to-peer energy trades based on multi-objective optimization. Int. J. Electr. Power Energy Syst. 2021, 131, 107017. [Google Scholar] [CrossRef]

- Kochupurackal, A.; Pancholi, K.P.; Islam, S.N.; Anwar, A.; Oo, A.M.T. Rolling horizon optimisation based peer-to-peer energy trading under real-time variations in demand and generation. Energy Syst. 2022, 1–25. [Google Scholar] [CrossRef]

- Cao, S.; Zhang, H.; Cao, K.; Chen, M.; Wu, Y.; Zhou, S. Day-Ahead Economic Optimal Dispatch of Microgrid Cluster Considering Shared Energy Storage System and P2P Transaction. Front. Energy Res. 2021, 9, 645017. [Google Scholar] [CrossRef]

- Zheng, B.; Fan, Y.; Wei, W.; Xu, Y.; Huang, S.; Mei, S. Distribution Optimal Power Flow With Energy Sharing Via a Peer-To-Peer Transactive Market. Front. Energy Res. 2021, 9, 1–14. [Google Scholar] [CrossRef]

- Zha, D.S.; Feng, T.T.; Gong, X.L.; Liu, S.Y. When energy meets blockchain: A systematic exposition of policies, research hotspots, applications, and prospects. Int. J. Energy Res. 2021, 46, 1–31. [Google Scholar] [CrossRef]

- Wu, Y.; Wu, Y.; Cimen, H.; Vasquez, J.C.; Guerrero, J.M. P2P energy trading: Blockchain-enabled P2P energy society with multi-scale flexibility services. Energy Rep. 2022, 8, 3614–3628. [Google Scholar] [CrossRef]

- Azim, M.I.; Tushar, W.; Saha, T.K.; Yuen, C.; Smith, D. Peer-to-peer kilowatt and negawatt trading: A review of challenges and recent advances in distribution networks. Renew. Sustain. Energy Rev. 2022, 169, 112908. [Google Scholar] [CrossRef]

- Li, B.; Yang, F.; Qi, B.; Bai, X.; Sun, Y.; Chen, S. Research on key technologies of P2P transaction in virtual power plant based on blockchain. IET Smart Grid 2022, 5, 223–233. [Google Scholar] [CrossRef]

- Cantillo-Luna, S.; Moreno-Chuquen, R.; Chamorro, H.R.; Sood, V.K.; Badsha, S.; Konstantinou, C. Blockchain for Distributed Energy Resources Management and Integration. IEEE Access 2022, 10, 68598–68617. [Google Scholar] [CrossRef]

- Nadeem, A. A survey on peer-to-peer energy trading for local communities: Challenges, applications, and enabling technologies. Front. Comput. Sci. 2022, 4, 122. [Google Scholar] [CrossRef]

- Al-Abri, T.; Onen, A.; Al-Abri, R.; Hossen, A.; Al-Hinai, A.; Jung, J.; Ustun, T.S. Review on Energy Application Using Blockchain Technology With an Introductions in the Pricing Infrastructure. IEEE Access 2022, 10, 80119–80137. [Google Scholar] [CrossRef]

- Javed, H.; Irfan, M.; Shehzad, M.; Abdul Muqeet, H.; Akhter, J.; Dagar, V.; Guerrero, J.M. Recent Trends, Challenges, and Future Aspects of P2P Energy Trading Platforms in Electrical-Based Networks Considering Blockchain Technology: A Roadmap Toward Environmental Sustainability. Front. Energy Res. 2022, 10, 1–20. [Google Scholar] [CrossRef]

- Hassan, M.U.; Rehmani, M.H.; Chen, J. Optimizing Blockchain Based Smart Grid Auctions: A Green Revolution. IEEE Trans. Green Commun. Netw. 2022, 6, 462–471. [Google Scholar] [CrossRef]

- Seven, S.; Yao, G.; Soran, A.; Onen, A.; Muyeen, S.M. Peer-to-Peer Energy Trading in Virtual Power Plant Based on Blockchain Smart Contracts. IEEE Access 2020, 8, 175713–175726. [Google Scholar] [CrossRef]

- Gourisetti, S.N.; Widergren, S.; Mylrea, M.; Wang, P.; Borkum, M.; Randall, A.; Bhattarai, B. Blockchain Smart Contracts for Transactive Energy Systems; Technical report; Pacific Northwest National Laboratory (PNNL): Richland, WA, USA, 2019. [Google Scholar] [CrossRef]

- AlSkaif, T.; Crespo-Vazquez, J.L.; Sekuloski, M.; van Leeuwen, G.; Catalao, J.P.S. Blockchain-Based Fully Peer-to-Peer Energy Trading Strategies for Residential Energy Systems. IEEE Trans. Ind. Inform. 2022, 18, 231–241. [Google Scholar] [CrossRef]

- Vieira, G.; Zhang, J. Peer-to-peer energy trading in a microgrid leveraged by smart contracts. Renew. Sustain. Energy Rev. 2021, 143, 110900. [Google Scholar] [CrossRef]

- Gough, M.; Santos, S.F.; Almeida, A.; Lotfi, M.; Javadi, M.S.; Fitiwi, D.Z.; Osorio, G.J.; Castro, R.; Catalao, J.P.S. Blockchain-Based Transactive Energy Framework for Connected Virtual Power Plants. IEEE Trans. Ind. Appl. 2022, 58, 986–995. [Google Scholar] [CrossRef]

- Eisele, S.; Laszka, A.; Schmidt, D.C.; Dubey, A. The Role of Blockchains in Multi-Stakeholder Transactive Energy Systems. Front. Blockchain 2020, 3, 1–18. [Google Scholar] [CrossRef]

- Cioara, T.; Antal, M.; Mihailescu, V.T.; Antal, C.D.; Anghel, I.M.; Mitrea, D. Blockchain-Based Decentralized Virtual Power Plants of Small Prosumers. IEEE Access 2021, 9, 29490–29504. [Google Scholar] [CrossRef]

- Wu, Y.; Li, J.; Gao, J. Real-Time Bidding Model of Cryptocurrency Energy Trading Platform. Energies 2021, 14, 7216. [Google Scholar] [CrossRef]

- Gourisetti, S.N.G.; Sebastian-Cardenas, D.J.; Bhattarai, B.; Wang, P.; Widergren, S.; Borkum, M.; Randall, A. Blockchain smart contract reference framework and program logic architecture for transactive energy systems. Appl. Energy 2021, 304, 117860. [Google Scholar] [CrossRef]

- Huang, Y.; Bian, Y.; Li, R.; Zhao, J.L.; Shi, P. Smart Contract Security: A Software Lifecycle Perspective. IEEE Access 2019, 7, 150184–150202. [Google Scholar] [CrossRef]

- Sayeed, S.; Marco-Gisbert, H.; Caira, T. Smart Contract: Attacks and Protections. IEEE Access 2020, 8, 24416–24427. [Google Scholar] [CrossRef]

- Wan, Z.; Xia, X.; Lo, D.; Chen, J.; Luo, X.; Yang, X. Smart Contract Security: A Practitioners’ Perspective. In Proceedings of the 2021 IEEE/ACM 43rd International Conference on Software Engineering (ICSE), Madrid, Spain, 22–30 May 2021; pp. 1410–1422. [Google Scholar] [CrossRef]

- Cali, U.; Sebastian-Cardenas, D.J.; Saha, S.; Chandler, S.; Gupta Gourisetti, S.N.; Hughes, T.; Khan, K.; Lima, C.; Rahimi, F.; Tillman, L.C. Standardization of Smart Contracts for Energy Markets and Operation. In Proceedings of the 2022 IEEE Power & Energy Society Innovative Smart Grid Technologies Conference (ISGT), Singapore, 24–28 April 2022; pp. 1–5. [Google Scholar] [CrossRef]

- Buterin, V. Ethereum White Paper: A Next Generation Smart Contract & Decentralized Application Platform. Whitepaper 2014, 37, 3. Available online: https://ethereum.org/669c9e2e2027310b6b3cdce6e1c52962/Ethereum_Whitepaper_-_Buterin_2014i.pdf (accessed on 20 June 2022).

- Cai, W.; Wang, Z.; Ernst, J.B.; Hong, Z.; Feng, C.; Leung, V.C.M. Decentralized Applications: The Blockchain-Empowered Software System. IEEE Access 2018, 6, 53019–53033. [Google Scholar] [CrossRef]

- Metcalfe, W. Ethereum, Smart Contracts, DApps. In Blockchain and Crypto Currency: Building a High Quality Marketplace for Crypto Data; Yano, M., Dai, C., Masuda, K., Kishimoto, Y., Eds.; Springer: Singapore, 2020; pp. 77–93. [Google Scholar]

- Qin, K.; Gervais, A. An Overview of Blockchain Scalability, Interoperability and Sustainability. Hochschule Luzern Imperial College London Liquidity Network. 2018. Available online: https://www.eublockchainforum.eu/sites/default/files/research-paper/an_overview_of_blockchain_scalability_interoperability_and_sustainability.pdf (accessed on 17 July 2022).

- Wallace, P. Layer 1 vs. Layer 2: What You Need to Know about Different Blockchain Layer Solutions. The Capital 2020. Available online: https://medium.com/the-capital/layer-1-vs-layer-2-what-you-need-to-know-about-different-blockchain-layer-solutions-69f91904ce40 (accessed on 2 June 2022).

- Berkowitz, B. What Is Ethereum 2.0 and When Will It Happen? Available online: https://www.fool.com/investing/2021/05/27/what-is-ethereum-20-and-when-will-it-happen/ (accessed on 2 June 2022).

- Sekniqi, K.; Laine, D.; Buttolph, S.; Sirer, E.G. Avalanche Platform. Available online: https://assets.website-files.com/5d80307810123f5ffbb34d6e/6008d7bbf8b10d1eb01e7e16_Avalanche%20Platform%20Whitepaper.pdf (accessed on 19 May 2022).

- Tsepeleva, R.; Korkhov, V. Building DeFi Applications Using Cross-Blockchain Interaction on the Wish Swap Platform. Computers 2022, 11, 99. [Google Scholar] [CrossRef]

- Ethereum Foundation. Decentralized Finance (DeFi)|ethereum.org. 2021. Available online: https://ethereum.org/en/defi/ (accessed on 19 May 2022).

- Pangolin. Available online: https://github.com/pangolindex/exchange-contracts (accessed on 17 May 2022).

- OpenZeppelin. Available online: https://github.com/OpenZeppelin/openzeppelin-contracts/blob/master/contracts/token/ERC20/presets/ERC20PresetMinterPauser.sol (accessed on 17 May 2022).

| Hour | V1 <> G | V2 <> G | V3 <> G | V1 <> V2 | V1 <> V3 | V2 <> V3 |

|---|---|---|---|---|---|---|

| (h) | [TRY1] | [TRY2] | [TRY3] | [TRY1/TRY2] | [TRY1/TRY3] | [TRY2/TRY3] |

| 1 | −35.24 | 10.95 | 5.62 | 0 | 0 | 0 |

| 2 | −40.69 | 11.35 | 5.85 | 0 | 0 | 0 |

| 3 | −39.86 | 10.27 | −8.56 | 0 | 0 | 0 |

| 4 | −43.44 | 10.52 | 5.68 | 0 | 0 | 0 |

| 5 | 4.13 | 0 | 5.08 | 19.45 | 0 | 0 |

| 6 | 4.16 | 0 | 4.96 | 19.30 | 0 | 0 |

| 7 | 0 | −23.08 | 0 | 8.41 | 28.72 | 0 |

| 8 | 10.06 | 17.50 | 0 | 0 | 41.37 | 0 |

| 9 | 8.58 | 0 | 11.88 | 56.89 | 0 | 0 |

| 10 | −25.76 | 0 | 14.41 | −71.44 | 0 | 0 |

| 11 | −110.33 | 18.08 | 9.52 | 0 | 0 | 0 |

| 12 | 8.24 | 0 | 10.67 | 57.48 | 0 | 0 |

| 13 | 12.79 | 23.40 | 0 | 0 | 57.79 | 0 |

| 14 | 0 | 0 | −47.16 | 76.33 | 14.93 | 0 |

| 15 | 0 | −52.03 | 0 | 10.64 | 36.33 | 0 |

| 16 | −48.65 | −96.61 | 0 | 0 | −52.34 | 0 |

| 17 | 0 | 0 | −35.45 | 50.62 | 9.90 | 0 |

| 18 | 3.94 | 9.17 | 0 | 0 | 15.85 | 0 |

| 19 | −57.37 | 0 | 0 | −1.96 | 0 | 24.12 |

| 20 | −11.13 | 0 | −20.01 | −28.47 | 0 | 0 |

| 21 | 5.58 | 14.94 | 0 | 0 | 25.20 | 0 |

| 22 | −30.53 | −17.46 | −7.23 | 0 | 0 | 0 |

| 23 | −42.90 | −24.38 | −12.80 | 0 | 0 | 0 |

| 24 | −36.06 | −20.86 | −10.78 | 0 | 0 | 0 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Seven, S.; Yoldas, Y.; Soran, A.; Yalcin Alkan, G.; Jung, J.; Ustun, T.S.; Onen, A. Energy Trading on a Peer-to-Peer Basis between Virtual Power Plants Using Decentralized Finance Instruments. Sustainability 2022, 14, 13286. https://doi.org/10.3390/su142013286

Seven S, Yoldas Y, Soran A, Yalcin Alkan G, Jung J, Ustun TS, Onen A. Energy Trading on a Peer-to-Peer Basis between Virtual Power Plants Using Decentralized Finance Instruments. Sustainability. 2022; 14(20):13286. https://doi.org/10.3390/su142013286

Chicago/Turabian StyleSeven, Serkan, Yeliz Yoldas, Ahmet Soran, Gulay Yalcin Alkan, Jaesung Jung, Taha Selim Ustun, and Ahmet Onen. 2022. "Energy Trading on a Peer-to-Peer Basis between Virtual Power Plants Using Decentralized Finance Instruments" Sustainability 14, no. 20: 13286. https://doi.org/10.3390/su142013286

APA StyleSeven, S., Yoldas, Y., Soran, A., Yalcin Alkan, G., Jung, J., Ustun, T. S., & Onen, A. (2022). Energy Trading on a Peer-to-Peer Basis between Virtual Power Plants Using Decentralized Finance Instruments. Sustainability, 14(20), 13286. https://doi.org/10.3390/su142013286