4.1. Overview of China’s Energy Transition and Vulnerabilities

In this section, the authors provide an empirical analysis of the energy security landscape of China. This part of the study attempts to figure out what China has acquired from its transition from coal-induced energy consumption to one based on fossil and non-fossil fuels along with coal. This section also derives the link between China’s energy transition and its dependence on overseas fossil fuels. Furthermore, it explores China’s futuristic plan for energy sector development, thus, assessing the impacts left by this transition not only on China’s energy security but also on its energy diplomacy.

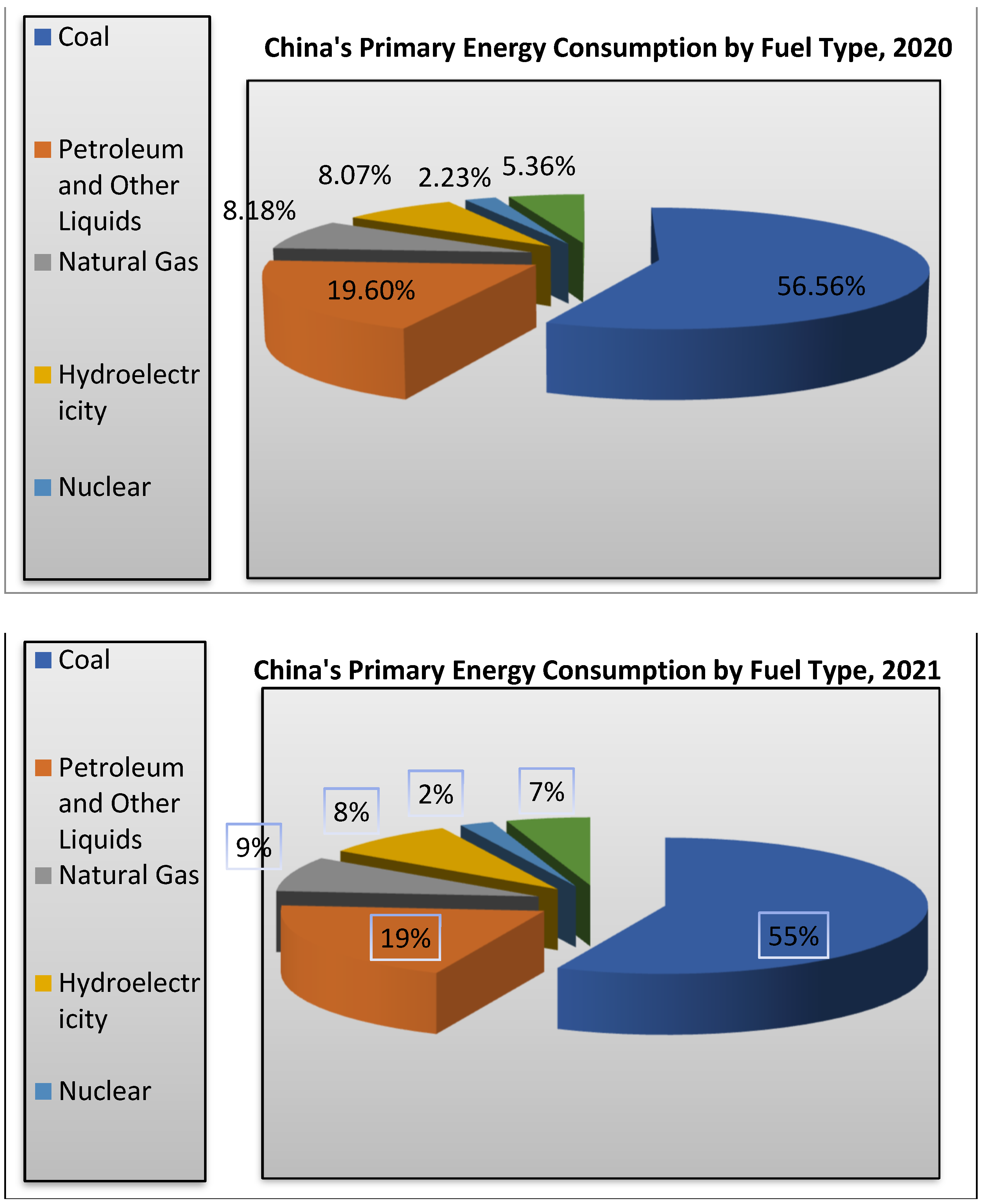

As far as Chinese energy composition is concerned, coal has long been and still is the dominant part of China’s primary energy. Due to the recent shift towards cleaner and environment-friendly fuels, the Chinese government is projecting not only to diversify but also to reduce the proportion of coal in its primary energy mix slowly and gradually.

Figure 1 reflects a trend toward decreasing the level of coal and petroleum and other liquids in the primary energy mix of China. While the proportion of natural gas, hydroelectricity, nuclear and other renewables is slightly rising, as shown in

Figure 1.

The Chinese share of coal has been gradually declining in its primary energy mix [

45].

Figure 2 highlights a downward trend in coal production from 2013, and consumption kept increasing until 2014 and then gradually declined until 2016, when it gradually started increasing again. Coal that is utilised for centralised consumption accounts for more than 50 per cent of its energy consumption, while the remaining is mostly unregulated and decentralised. It could lead to overwhelming air pollution and inefficiency of energy. Even after diversifying energy supplies and replacing coal and oil with relatively minimal but growing amounts of cleaner and environment-friendly fuels, Beijing set the target of keeping coal concentration in its primary energy mix under 58 per cent for 2020 [

46]. China’s consumption of coal for 2019, 2020, and 2021 falls well within its set targets [

47].

A gradual increase has been recorded in coal consumption from 2016 to 2020 after many years of decline, as shown in

Figure 2. As far as coal production in China is concerned, a huge increase was observed from 2016 to 2020 ranging from 70 and 82 to 80 and 91, as reflected in

Figure 2. In 2018, the highest usage of coal was recorded for the power sector, which is almost 60 per cent, while the remaining came from industry and residential heating [

48]. As far as future Chinese demand for coal is concerned, it is likely to be determined by various factors such as the aftermath of the COVID-19 pandemic and government policies towards problems of air quality and diversification and replacement in the primary energy mix. The shift in government policies towards cleaner fuels, a less energy-intensive economy, and an ongoing trade war between the US and China will likely decrease the demand for coal in the years to come. However, coal is still expected to be the major fuel in the primary energy mix of China due to the excessive demand from the power sector and the government’s plan of enhanced utilisation of clean coal technology.

After coal, petroleum and other liquids meet the second major proportion of Chinese primary energy. Although ranked fifth in petroleum production in 2019, most of its production came from legacy fields [

46]. After a nominal decline in production for three years, China recorded its production in petroleum at 7.99 Exajoules in 2019, as shown in

Figure 3. While making a comparison of China’s oil production and consumption, a huge gap can be observed from the figure given below, which is widening gradually.

As shown in

Figure 3, China’s oil consumption is more than three times its production, and the rest of its oil demands are met by oil imports from different regions of the world. Responding to increasing Chinese consumption of overseas oil, Beijing started emphasising and requiring the energy state-owned enterprises to raise levels of oil production domestically in 2018 [

46]. The upward trend in oil pricing that started in 2016 made it possible and profitable for China to develop technically challenging fields that were quite costly earlier to develop [

45]. Due to these factors, 30 and 23 per cent increase in joint upstream investment was made by major state-owned energy enterprises of China in 2018 and 2019, respectively [

49]. The downward trend in oil prices worldwide because of the COVID-19 pandemic poses a serious threat to the upstream investments made by Chinese National Oil Corporations and domestic oil production levels in the years to come. Therefore, imports of crude oil, until the oil prices are reversed, are likely to increase in the future for China.

Natural gas only accounts for about 9 per cent of China’s primary energy consumption, but it is heavily emphasised in the energy mix as a clean and environment-friendly fuel. The shift towards green energy requires the incorporation of cleaner fuels such as natural gas, and to fulfil this growing demand, natural gas production has been on the rise in China for the last many years (as shown in

Figure 4); it also presents that natural gas that is produced by Chinese NOCs in 2020 is recorded at 6.98 Exajoules.

Figure 4 illustrates that there is a substantial gap between natural gas production and consumption in China that leaves China to depend on overseas natural gas supplies for the years to come. As far as natural gas production from unconventional sources is concerned, such as shale gas, it is increasing substantially with every passing year.

In order to alleviate the level of pollution caused by the excessive use of coal, the Chinese government is projecting to increase the share of natural gas in its primary energy consumption from 10 per cent in 2020 to 14 per cent in 2030 [

50]. Although it accounts for a small proportion of China’s energy mix, it is projected to be a significant fuel source. A consistent and substantial increase has been observed in China’s natural gas consumption in the last decade, by about 13 per cent every year, making China the third-largest consumer of natural gas in the world behind the US and the Russian Federation [

51]. The main factors contributing to growing natural gas consumption include air pollution caused by excessive coal use, low prices, and the growing use in the transportation industry. In order to bridge the gap between natural gas consumption and production, it seems likely for China to keep importing natural gas in the near future by taking into consideration the limited domestic production of natural gas. Central Asia is one of the regions that supply China with huge amounts of natural gas [

52].

China is ranked first not only in energy consumption but also in environment polluter regarding CO

2 emissions [

45]. This is the case mostly because of the excessive use of coal, which emits huge amounts of CO

2 into the environment. After China, the US and India are other major CO

2 emitters [

46]. Given the environmental challenges facing China in particular and the world in general, it has become an urgent matter of business for China to bring the CO

2 emissions to a certain level to provide its citizens with a healthy environment, and that requires replacing coal with environment-friendly fuels gradually. A huge gap can be witnessed between the US and China in terms of CO

2 emissions, as presented in below

Figure 5. It shows that there is a consistent increase in Chinese CO

2 emissions from 2016 to 2020, while the CO

2 emissions from the US are declining consistently from 2018 onward. Therefore, in order to keep the CO

2 emissions level well under stipulated targets, it is imperative for China to keep importing huge amounts of natural gas, as its domestic production of natural gas is quite limited.

Huge energy demand was recorded by China in 2020, primarily because of the rapid economic recovery from the COVID-19 pandemic. China is among the fewest countries that experienced huge energy demand last year after the pandemic hit the entire world economy very hard [

46]. The renewables consumption growth of China accounts for slightly over a third of world growth in renewables consumption last year.

Figure 6 below shows that the primary energy mix of China is continually moving towards a greener one, replacing coal with clean fuels slowly and gradually.

Regarding the generation of renewable energy by source,

Figure 7 presents the proportion of renewable energy generated by solar, wind, and other renewable sources. China’s wind power generation reached 656.6 Terawatt-hours in 2021 against 446.5 Terawatt-hours in 2020. Moreover, solar power generation in China was recorded at 327 Terawatt-hours in 2021 against 261.1 in 2020, as reflected in

Figure 7.

The data presented in

Figure 7 above reflect Beijing’s commitment to bringing reforms to its energy industry. However, non-fossil fuels represent only 15 per cent of the overall energy consumption in China, as reflected in

Figure 1. It seems quite challenging for China to sustain this growth rate in a renewable generation because it might result in compromising economic growth targets, a reduction in manpower, and rising costs of social welfare. The shift in the primary energy mix from fossil to non-fossil fuels, particularly from coal to renewables, will be gradual and slow to maintain the levels of economic growth. Therefore, dependency on fossil fuel imports will remain certain for years to come for China, and diversifying regions of energy imports is inevitable to manage the Malacca Strait dilemma for China.

From the statistics presented in China National Renewable Energy Centre reports about Chinese renewable energy, the government has set the target of coal consumption at 47 per cent for 2030, far less than 64 per cent in 2015 [

53]. This demonstrates that China will keep relying on coal resources to ensure its energy security for many years to come. However, its reliance on coal is still quite extensive, and its domestic coal reserves are depleting with great speed. From the current rate of coal consumption of national reserves, they are projected to be gone by 2050 [

53]. This presents China with two scenarios: either Chinese imports of oil and natural gas dependency will be increased, or they will become dependent on imports of coal as well as their national coal reserves will be depleted.

Regarding China’s strength and ambitious plans regarding renewable energy (RE), President Xi made an ambitious and surprise pledge at the UN general assembly session of 2020 to achieve carbon neutrality by 2060, where RE would contribute 80% to China’s primary energy mix [

54]. The ongoing trade war between the US and China and a recent rift over Nancy Pelosi’s visit to Taiwan, which resulted in the suspension of cooperation with the US over climate change, makes the prospects of achieving these ambitious RE targets by 2050 more bleak and gloomy. Similar apprehensions have also been expressed by Cory Combs, senior analyst at Beijing-based consultancy Trivium China in the following words: “at present, we see no real chance of Beijing targeting 100 per cent renewables by 2050—and without that target, it is unlikely China could reach that milestone by market forces alone” [

54]. Keeping in view the aforementioned limitations to shifting from fossil to non-fossil fuels without compromising economic development, this ambitious plan of achieving carbon neutrality by 2050 in China seems improbable and unrealistic.

Even with the introduction of huge investments into the energy sector and the government’s commitment and political will toward green reforms, and the reduction in fossil fuels into the primary energy mix, the Chinese system of energy consumption might still not change much and will keep heavily dependent on fossil fuels. Resultantly, China will keep relying on its fossil fuel imports to maintain its economic growth. When it comes to meeting its voluntary commitments made in Paris Agreement 2015—even though China fulfills its commitments to bring fossil-fuels proportion less than 20 per cent of its overall energy mix by 2030—it would just account for 6 per cent decrease in the current accumulative usage of fossil fuels. Moreover, the Chinese government is interested in reducing coal consumption, and that 6 per cent decrease in fossil fuels will certainly come from coal; hence, China will keep relying on imports of oil and natural gas.

4.2. What Are the Characteristics of Chinese Energy Diplomacy, and What Are the Factors That Provoke Transformations?

The global energy order is going through transformations, which require countries, especially the major powers such as China, to adjust their energy-related policies. Against this backdrop, this study aims to explore the transformations in Chinese energy diplomacy by examining its characteristics and both the internal and external factors that provoke transformations. This section of the study analyses Chinese energy diplomacy toward the Central Asian region. It also explores the ways and means through which the Chinese have secured their access to the energy resources of Central Asia and secured their modern energy demands. Moreover, it seeks to evaluate the major hypothesis of this study that Chinese energy diplomacy remains neo-mercantilist for most of its history, if not for long. In addition, it analyses the strategic relevance of Central Asia for Chinese energy security.

Starting in the 21st century, the energy imports of China raised, and eventually, it had to look to overseas energy resources to meet its increasing energy demands. Therefore, China, along with its state-owned energy firms, started looking toward various regions replete with energy resources. Moreover, deep-rooted diplomatic ties of China with Russia were emphasised to acquire more oil and gas deals. By the closing of the 20th century, Chinese energy enterprises started looking for countries to invest in the energy sector, and China is still obtaining huge supplies of energy from those countries. These countries include Sudan (Africa), Iraq, Iran (the Middle East), and Venezuela (Latin America) [

55].

Regarding the energy policies of China, the official narrative reflected through the Chinese White Paper asserts that China, being a major international player in the global energy market, is playing a crucial role in diversifying and expanding international access to resources of energy, enhancing international energy supplies, diversifying routes of energy supplies, and stabilisation of energy price at the global energy market [

56].

Furthermore, overseas investments in energy made by the Chinese are illustrated in the Chinese White Paper as the energy companies of China are increasingly engaged with international energy firms to develop an infrastructure of energy. They are also collaborating in expanding cooperation in the domain of engineering and services, hence strengthening and diversifying supply mechanism in the international energy market [

56].

The White Paper describes Chinese energy diplomacy as a “positive force.” It describes the task of attaining “self-growth” as a complementary factor facilitating economic interdependence, international energy collaboration, and economic prosperity. However, it remains silent on the global criticism that is leveled against Chinese energy diplomacy for being neo-mercantilist.

4.3. Role/Case Study of Central Asia

Central Asia’s attraction for countries worldwide, especially Russia and China, is mostly because of the energy reserves. Both of them have shown great interest in Central Asia. However, Central Asian republics became concerned about Russia due to its monopoly over the region’s pipeline infrastructure, which Russia has previously exploited for political objectives. Russia has always tried hard to restrict any other country from influencing the affairs of the Central Asian region [

16]. Russia has a history of exploiting Central Asian energy resources for both its domestic use and exports to Europe because of their economic aspects [

57]. Therefore, restricting Central Asian energy to have access to the international market best serves Russian interest; therefore, it is a matter of national importance for Russia to refrain other countries from having access to the energy reserves of Central Asia and restrict the Russian monopoly over the pipeline infrastructure of the region by establishing alternate pipeline network to bypass Russian monopoly [

16].

It was until the financial crunch of 2008 that Russia was able to restrict rising Chinese influence in Central Asia. The world’s economies struggled because of the economic slump of 2008, and Russia and China were no exceptions in this regard, and both of them needed capital fusion badly [

58]. However, the Chinese were of those few countries that not only recovered quickly from that but also made incredible breakthroughs in economic development. Resultantly, the Chinese had significant leverage over other countries, and they utilised it to reshape the power balance in their favour by employing neo-mercantilist methods. The huge investments made by the Chinese in the region through their state-owned firms, loans for energy contracts, and status-seeking development schemes helped them extend their influence in Central Asia [

58]. Eventually, the energy projects and pipelines that could not be materialised for years were completed. The multibillion-dollar loan acquired by Kazakhstan from China helped it extend its current influence in Kazakhstan [

16]. Despite Kazakhstan’s attempts to maintain its grip over the domestic energy market, the Chinese purchased huge shares of Kazakh’s oil and gas firms in 2009. For instance, only in 2010, the Chinese bought 50–100% of shares of fifteen of Kazakhstan’s energy enterprises. Chinese hold on the oil sector of Kazakhstan could be witnessed through the amount of oil that was shipped to China in 2010, which was 26 million tons out of its overall production of 80 million tons [

58]. The Western concerns and campaign to malign China through the “debt-trap” philosophy have been exposed by Ramay in the following words: “the Western campaign of the debt trap is actually an effort to hide the Western debt trap” [

23].

Turkmenistan is the richest country in the region in terms of natural gas reserves, and China was the first country that succeeds in transhipping gas from Turkmenistan to China by constructing a pipeline bypassing the Russian pipeline infrastructure in 2009. That newly constructed pipeline delivered 40 million cubic metres of natural gas on a daily basis in 2009. That was the highest quantity of Central Asian natural gas exports that did not utilise the Russian pipeline network. Such development might not have been possible without the neo-mercantilist policies of China, as 4 billion US dollars were lent by the Chinese government for pipeline construction and the other 3 billion for gas site development to the Turkmen government [

16].

Furthermore, though nuclear energy was regarded as significant and given priority to the Chinese, it was also imperative for the Chinese to maintain a stronghold in Central Asia. Keeping in mind uranium reserves, Kazakhstan holds 12 per cent of global uranium reserves. Another significant fact is that it is the biggest producer of uranium in the world, and 20 per cent of its production in uranium was imported by the Chinese in 2011 [

16]. That uranium export to China went up to 55 per cent in 2014 [

59].

However, Central Asia carries immense weight in the Chinese scheme of interest. Russians are hesitant to let the Chinese dominate the affair in Central Asia. Russia is also concerned about the increasing economic presence of China in the region. Chinese presence and influence in Central Asia do not go unattended by Central Asians as they are suspicious of Chinese intentions in the region. They are sceptical of whether China is truly interested in the region’s economic development or simply extracting energy resources is its only priority [

60]. Chinese practices in Kazakhstan, i.e., regarding the employment of locals in various projects, have been criticised and regarded as discriminatory and unfair [

61].

Chinese deep-rooted interests and penetration in Central Asia can also be visualised through the lens of politics, with the establishment of their new international regimes. Beijing projects these new regimes as novel economic opportunities for the region by diversifying its connectivity with Europe and Asia through interconnected infrastructure. They also provide China with an opportunity to present itself as a responsible major player in Central Asia, rendering China end up with easy access to the natural riches of the region [

17].

Moving the traditional alliances in the region closer to itself and away from Russia is another way of enhancing its influence in Central Asia. Chinese regimes can effectively help to increase their hold in Central Asia by employing strategies to ensure enhanced access, greater legitimacy, and an increasing level of prestige, which would ultimately provide China with greater leverage for negotiating more equity contracts for resources of energy. This would result in marginalising the hold of Russia in Central Asia further [

26]. From the neo-mercantilist paradigm, Chinese and Russian presence in the region can be categorised as a “zero-sum” game. One’s gains in terms of territory and influence in the region will be the other’s losses, which might result in a conflict between them in the future. This is an ongoing phenomenon in Central Asia that is described as a “new great game”. With analysis through the lens of neo-liberal institutionalism, the activities of China in the Central Asian region might be seen as detrimental to Russian interests in the region by Kremlin. However, it is perhaps imperative for China to revise and coordinate its policy not to harm Russian interests in the region to the extent of conflict with Russia in the years to come. China arguably feels at ease as long as the Middle Eastern energy market remains stable. It also provides greater leverage to China to address its conflict with Russia through dialogue and negotiations [

62].

Concluding the analysis, Chinese policies and practices toward the Central Asian region can be categorised as neo-mercantilist. The economic anxiety in Central Asian republics caused by the economic slump of 2008 was exploited by China to secure access to the Central Asian energy reserves by providing loans for pipeline construction and energy site development. China is a country that has established a new pipeline infrastructure in the region, which reduced the Russian monopoly over the Central Asian energy market. This has helped China secure cheaper energy deals on the one hand and hurt Russian interests in the region on the other hand.

Nonetheless, the element of economic interdependence does find its presence in Central Asia. The interests of all these three players, such as Russia, China, and Central Asian republics, align pretty well where Central Asian republics lack energy importers and China has abundant needs for energy in the future. Furthermore, for China, strong ties with the region mean security against the volatile situation of the Middle East. By keeping in view the rising demand for gas for China’s future use, it might prioritise facilitating increased economic interdependence in the region. Chinese projected increase in gas demands from 193 billion cubic meters in 2015 to 510 bcm in 2030 speaks for increased economic interdependence [

63]. In order to avoid too much dependency on Russia for its gas supplies, China is very likely to keep its presence in the region as an alternative to the disruption of gas supplies from Russia. Resultantly, continuing with enhanced economic interdependence in Central Asia, China might end up building more prestige and repute for itself as a responsible and reliable player, which ensures everlasting energy security for China.

By analyzing Central Asia through the lens of Dent’s framework for energy diplomacy analysis, China’s energy diplomacy towards Central Asia seems more inclined towards neo-mercantilism but also shows increasing signs of economic internationalisation trends. Firstly, due to China’s developmental statist and its tradition of socialist-market, there has been an inclination towards mercantilist practices in its energy diplomacy in general, whereby states’ governments try to extend their control as far as possible over overseas energy supplies by employing specific transaction mechanisms. The aforementioned presence of China’s state-owned energy enterprises in Central Asia to secure energy deals is a glaring example of “political” transaction mechanisms for securing overseas energy resources. The predilection for this approach may be illustrated by the acute energy import dependency experienced by China for years, along with other factors where near-absolute reliance on global energy markets is not without great risks to national security.

Secondly, as a result of the phenomenon of issue-linkage in energy diplomacy, a good number of agential actors have become thoroughly engaged with the strategising and decision-making process of energy diplomacy now. For instance, the inclusion of environmental agencies has a strong impact on energy diplomacy practice as both energy and environmental diplomacy conflate to a great extent. In addition, this process usually ends up drawing more competing stakeholders, which helps shape energy diplomacy formation, making the three-level game dynamics increasingly intricate.

Finally, an increasing trend towards multilateral energy cooperation can be found in China’s energy diplomacy practices. Regardless of the resilience shown by the interests of national security in the scheme of strategising energy diplomacy, China has become increasingly involved in both regional and international energy-related platforms and organisations. This particular development could help ease China’s mercantilist impulses of only serving its own national interests. However, it is still not an assured outcome. Additionally, the growing dependence on sourcing overseas energy will end up making it excessively dependent on relatively stable global energy markets.

4.4. How Do the New Global Institutions—AIIB and BRI—Complement Chinese Transforming Energy Diplomacy?

The global energy order that is in remaking is strongly impacted by the Chinese regimes in the BRI and the AIIB. In this case, this study seeks to explore the complementary or non-complementary role of the BRI and the AIIB towards Chinese energy diplomacy. This section analyses the role of new Chinese regimes, whether they complement their energy diplomacy or not. Starting with the BRI, the objective is to establish land and maritime infrastructure to enhance inter-regional connectivity [

64]. Its goal, as identified in the official policy report, is “common development and mutual prosperity” [

64]. Regarding energy infrastructure development, the policy report states that cooperation should be sought for greater connectivity of infrastructure of energy, and security of pipelines and routes for energy transportation should be ensured [

64]. However, the following aspects have been highlighted by critics to comprehend BRI’s importance for China.

Firstly, it tries to open up new avenues for trade and economic development not only for China but for all the participants involved in the project. Central Asia is given special treatment by the Chinese due to its untapped energy resources. It is also emphasised because it helps to enhance its connectivity to comparatively less-developed western regions of China [

65].

Secondly, diversifying the energy transportation network through BRI in Central Asia and the Middle East would help reduce China’s dependency on the Malacca Strait, which is prone to piracy, and reduces its vulnerability because 80 per cent of its energy imports are still carried out through this route [

65].

Thirdly, the BRI presents China with an opportunity to manage its decreasing domestic infrastructure construction demand by exporting this industry overseas. The BRI is aimed at creating opportunities for China to relieve pressures on its overcapacity in steel caused by the lowering of domestic demand, which has the potential to slow down its economic growth [

15]. Under the umbrella of BRI, energy cooperation assumes a vital position in the energy diplomacy of China because it involves a wide-ranging infrastructure development program, diversification of overseas energy investments, and the development of energy governance. Since the beginning of the BRI, Beijing’s energy diplomacy towards Central Asia has become more dynamic and diversified. In order to facilitate the BRI implementation, a state-run Silk Road Fund was established by China in December 2014.

Back in 2016, China came up with a new initiative to establish the “Asian Infrastructure Investment Bank”, claiming that it would improve connectivity and economic integration in Asia. The AIIB was represented by 57 founding members at the time of its launch. Almost all the regions had their representation in it except North America. Within a time span of just six years, its membership almost became double, with the bank approving 105 members [

66].

From the critics’ remarks about the key functions of AIIB, it is to lend money to the countries involved or around China’s “Silk Road Economic Belt” to facilitate the BRI. In order to materialise this objective, around 140 billion US dollars have been spared for AIIB only by the Chinese [

65]. Another critical aspect of AIIB highlighted by critics is its significance in providing China with an opportunity to strengthen its institutional reach and improve its image, which has been damaged due to its neo-mercantilist practices in different regions of the world [

15]. Therefore, for the success of BRI, it is imperative for China to make the world realise that it is a responsible lender and is concerned with the sustainable development of not only China but also the recipient countries.

Though China has secured a strong footing in the Central Asian region after the economic slump of 2008, it still could not win the trust of Central Asian republics as they are sceptical of being exploited by China. Therefore, AIIB is provided with the opportunity to improve Chinese prestige in Central Asia on the one hand, and BRI can be utilised as an instrument of economic bargaining for increasing energy access and equity contracts on the other hand. A critical approach towards BRI might claim that it can be viewed through the lens of new mercantilism that would end up providing China with enhanced access to energy-rich regions and establishing strategically relevant networks that would later turn into additional consumer markets of Chinese goods. An increasingly promising and liberal perspective would contend that BRI offers huge benefits for the region’s one-dimensional economies, which remained dependent on Russia for driving their economies until the recent past. If Central Asian republics correctly capitalise on the opportunities offered by the BRI, it can change their fate. Nonetheless, it is highly challenging for Central Asian republics to achieve this goal as Central Asian products do not compete with Chinese goods both in pricing and innovation [

13].

Even though Central Asian republics fail to take real benefit presented by the new infrastructure for exporting products, it might, at least, end up having increased connectivity for the energy exports of Central Asia not only to China but also to Europe and other regions, which is potentially capable of accelerating their economic development. Chinese novel global regimes in the BRI, however, can help facilitate not only economic interdependence but also to mutual interests of the concerned parties, even if the measures taken by China are inclined or close to neo-mercantilist practices that the Chinese can manipulate in their own favour more.

When it comes to strengthening collaboration over energy infrastructure, the figures indicate success for both AIIB and BRI. For instance, 14.5 billion US dollars were invested by China in 2016 along the BRI, and the first “Belt and Road Forum for International Cooperation” was hosted by China in 2017, which was attended by 27 countries [

67].

The completion of the first energy projects launched under BRI also speaks of the success of the BRI. Around 5 billion bcm of Central Asian natural gas will be supplied to China annually through the China–Kazakhstan gas pipeline, which was opened in April 2017. An oil pipeline was opened between China and Burma in 2017, which has the capacity to transport 22 million tons of oil annually [

68]. Regarding the gas pipeline network, China has already stretched extensive infrastructure for gas transport in Burma, which transhipped 3.4 bcm of natural gas to China in 2016 [

68]. Therefore, one can conclude that Chinese new global regimes have successfully facilitated cooperation in energy deals, trade agreements, and infrastructure contracts in Central Asia, among other regions. Moreover, though the parties involved in the projects under BRI might be of deep concern that BRI serves more the economic and geopolitical designs of China, the participant countries, most of the time, dare not or cannot afford to refuse to be part of the project. Nonetheless, for consistent success with these new global regimes, it is required by China to establish itself a repute as a responsible development model.