Relationship between the Degree of Internationalization and Greenwashing of Environmental Responsibilities in China-Based on the Legitimacy Perspective

Abstract

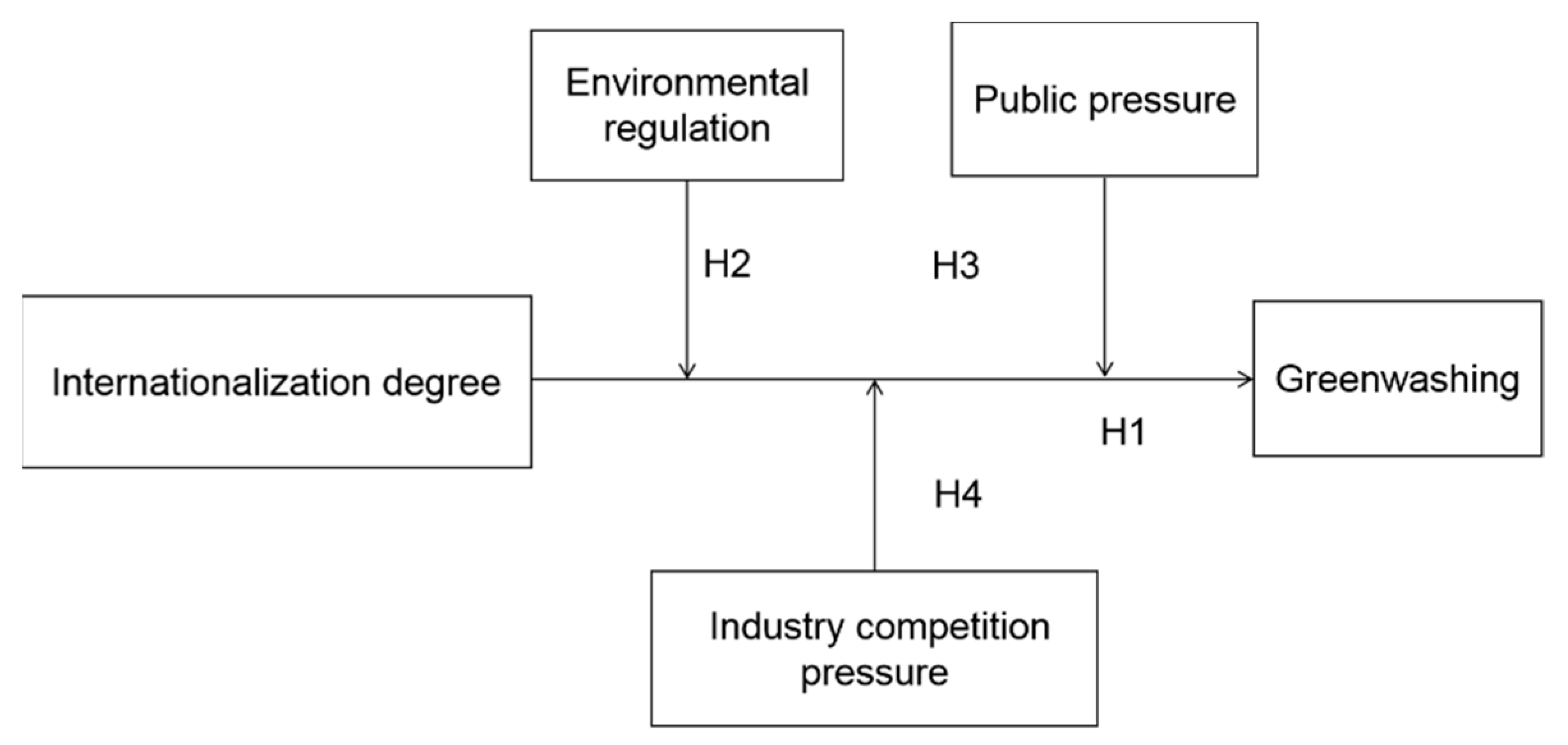

:1. Introduction

- How will internationalization degree affect the greenwashing of CMCs?

- What are the effects of different isomorphic pressures or legitimacy pressures of the home country institutions on the greenwashing behavior of MNCs in the process of internationalization?

2. Theoretical Analysis and Hypotheses

2.1. Degree of Internationalization and Corporate Greenwashing

2.2. The Influence of Domestic Pressure on International Greenwashing

2.2.1. Environmental Regulation and Greenwashing Behavior of Multinational Corporations

2.2.2. Public Pressure and International Greenwashing

2.2.3. Industrial Competition Pressure and Greenwashing Behavior of MNCs

3. Methodology

3.1. Sample

3.2. Variables and Measurements

3.2.1. Dependent Variable

3.2.2. Independent Variables

3.2.3. Moderating Variables

3.2.4. Control Variables

3.3. Model Setting

4. Empirical Analysis

4.1. Multicollinearity Analysis

4.2. Regression Results

4.2.1. Endogeneity Test

4.2.2. Full-Sample Regression of Domestic Pressures

4.3. Robustness Test

4.3.1. Robustness Test of Full-Sample Regression Results

4.3.2. Robustness Test of Heterogeneity Analysis under the 2SLS Method

4.3.3. Robustness Test of Heterogeneity Analysis by Changing Variables

5. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Industry composition of international firms

| Industry | Firms |

| Professional technical service industry | 2 |

| Special equipment manufacturing industry | 23 |

| Internet and related services | 11 |

| Instrumentation manufacturing | 4 |

| Insurance | 2 |

| Other manufacturing | 4 |

| Other financial industry | 6 |

| Agriculture, animal husbandry, and fishery | 3 |

| Agricultural and sideline food processing industry | 4 |

| Chemical raw materials and chemical products manufacturing | 26 |

| Pharmaceutical manufacturing | 22 |

| Health industry | 2 |

| Business service industry | 11 |

| Civil engineering construction industry | 18 |

| Building decoration and other construction industry | 2 |

| Mining support activities | 2 |

| Real estate industry | 20 |

| Wholesale industry | 12 |

| News and publishing industry | 4 |

| Nonferrous metal smelting and rolling processing industry | 21 |

| Nonferrous metal mining and dressing industry | 6 |

| Rubber and plastic products industry | 6 |

| Transportation | 17 |

| Automotive manufacturing | 15 |

| Coal mining and washing industry | 4 |

| Water and gas production and supply industry | 5 |

| Ecological protection and environmental governance industry | 5 |

| Telecommunications, radio, and television and satellite transmission services | 3 |

| Electricity and heat production and supply industry | 7 |

| Electrical machinery and equipment manufacturing | 23 |

| Oil and gas extraction industry | 4 |

| Research and experimental development | 1 |

| Textile industry | 4 |

| Textile and apparel, apparel industry | 7 |

| Comprehensive industry | 2 |

| Computer, communications, and other electronic equipment manufacturing | 43 |

| Monetary and financial services | 6 |

| Capital market services | 12 |

| Software and information technology service industry | 18 |

| General equipment manufacturing | 12 |

| Paper and paper products industry | 3 |

| Postal industry | 2 |

| Liquor, beverage, and refined tea manufacturing | 5 |

| Metal products industry | 4 |

| Railway, shipbuilding, aerospace, and other transportation equipment manufacturing | 4 |

| Retail | 8 |

| Nonmetallic mineral products industry | 14 |

| Food manufacturing | 7 |

| Ferrous metal smelting and rolling processing industry | 8 |

| Total firms | 454 |

Appendix B. Evaluation index of greenwashing behavior of Chinese companies

| Input management | Dedicated funds |

| Green supplier | |

| Environmental cost | |

| Green materials | |

| Production process | Green process |

| Green research | |

| Use of clean energy | |

| Products and business | Green business development |

| Green market | |

| Output control | Risk analysis |

| Waste reduction | |

| Pollution monitoring | |

| Recycling | |

| Ecological restoration | |

| Resources efficiency | |

| Environmental governance structure | Environmental department |

| Programs and certification | Certification |

| Appraisal and reward | |

| Staff management | Staff training |

| Green working | |

| Planning and rules | |

| Image management | Mission statement |

| Environmental coalition | |

| Environmental charity |

References

- Tashman, P.; Marano, V.; Kostova, T. Walking the walk or talking the talk? Corporate social responsibility decoupling in emerging market multinationals. J. Int. Bus. Stud. 2019, 50, 153–171. [Google Scholar] [CrossRef]

- Leonidou, L.C.; Leonidou, C.N.; Fotiadis, T.A.; Zeriti, A. Resources and capabilities as drivers of hotel environmental marketing strategy: Implications for competitive advantage and performance. Tour. Manag. 2013, 35, 94–110. [Google Scholar] [CrossRef]

- Delmas, M.A.; Burbano, V.C. The Drivers of Greenwashing. Calif. Manag. Rev. 2011, 54, 64–87. [Google Scholar] [CrossRef] [Green Version]

- Walker, K.; Wan, F. The Harm of Symbolic Actions and Green-Washing: Corporate Actions and Communications on Environmental Performance and Their Financial Implications. J. Bus. Ethics 2012, 109, 227–242. [Google Scholar] [CrossRef] [Green Version]

- DiMaggio, P.J.; Powell, W.W. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. Am. Sociol. Rev. 1983, 48, 147–160. [Google Scholar] [CrossRef] [Green Version]

- Suchman, M.C. Managing legitimacy: Strategic and institutional approaches. Acad. Manag. Rev. 1995, 20, 571–610. [Google Scholar] [CrossRef]

- Meyer, J.W.; Rowan, B. Institutionalized organizations: Formal structure as myth and ceremony. Am. J. Sociol. 1977, 83, 340–363. [Google Scholar] [CrossRef] [Green Version]

- Xu, D.; Meyer, K.E. Linking theory and context: ‘Strategy research in emerging economies’ after Wright et al. (2005). J. Manag. Stud. 2013, 50, 1322–1346. [Google Scholar] [CrossRef]

- Morgeson, F.P.; Aguinis, H.; Waldman, D.A.; Siegel, D.S. Extending corporate social responsibility research to the human resource management and organizational behavior domains: A look to the future. Pers. Psychol. 2013, 66, 805–824. [Google Scholar] [CrossRef]

- Berrone, P.; Fosfuri, A.; Gelabert, L.; Gomez Mejia, L.R. Necessity as the mother of ‘green’ inventions: Institutional pressures and environmental innovations. Strateg. Manag. J. 2013, 34, 891–909. [Google Scholar] [CrossRef]

- Li, J.; Xie, Z. Examining the cross-border acquisition strategy of Chinese companies: The moderating roles of state ownership and institutional transition. J. Leadersh. Organ. Stud. 2013, 20, 436–447. [Google Scholar] [CrossRef]

- Delgado-Ceballos, J.; Aragón-Correa, J.A.; Ortiz-de-Mandojana, N.; Rueda-Manzanares, A. The effect of internal barriers on the connection between stakeholder integration and proactive environmental strategies. J. Bus. Ethics 2012, 107, 281–293. [Google Scholar] [CrossRef]

- Murillo Luna, J.L.; Garcés Ayerbe, C.; Rivera Torres, P. Why do patterns of environmental response differ? A stakeholders’ pressure approach. Strateg. Manag. J. 2008, 29, 1225–1240. [Google Scholar] [CrossRef]

- Chelli, M.; Durocher, S.; Richard, J. France’s new economic regulations: Insights from institutional legitimacy theory. Account. Audit. Account. J. 2014, 27, 283–316. [Google Scholar] [CrossRef]

- De Villiers, C.; Rinaldi, L.; Unerman, J. Integrated Reporting: Insights, gaps and an agenda for future research. Account. Audit. Account. J. 2014, 27, 1042–1067. [Google Scholar] [CrossRef] [Green Version]

- Cozza, C.; Rabellotti, R.; Sanfilippo, M. The impact of outward FDI on the performance of Chinese firms. China Econ. Rev. 2015, 36, 42–57. [Google Scholar] [CrossRef]

- Piperopoulos, P.; Wu, J.; Wang, C. Outward FDI, location choices and innovation performance of emerging market enterprises. Res. Policy 2018, 47, 232–240. [Google Scholar] [CrossRef]

- Hao, Y.; Guo, Y.; Guo, Y.; Wu, H.; Ren, S. Does outward foreign direct investment (OFDI) affect the home country’s environmental quality? The case of China. Struct. Chang. Econ. Dyn. 2020, 52, 109–119. [Google Scholar] [CrossRef]

- Jude, C.; Levieuge, G. Growth effect of foreign direct investment in developing economies: The role of institutional quality. World Econ. 2017, 40, 715–742. [Google Scholar] [CrossRef]

- Boiral, O.; Raineri, N.; Talbot, D. Managers’ citizenship behaviors for the environment: A developmental perspective. J. Bus. Ethics 2018, 149, 395–409. [Google Scholar] [CrossRef]

- Campbell, T.C.; Gallmeyer, M.; Johnson, S.A.; Rutherford, J.; Stanley, B.W. CEO optimism and forced turnover. J. Financ. Econ. 2011, 101, 695–712. [Google Scholar] [CrossRef]

- Marquis, C.; Toffel, M.W.; Zhou, Y. Scrutiny, norms, and selective disclosure: A global study of greenwashing. Organ. Sci. 2016, 27, 483–504. [Google Scholar] [CrossRef]

- Brammer, S.; Millington, A. Corporate reputation and philanthropy: An empirical analysis. J. Bus. Ethics 2005, 61, 29–44. [Google Scholar] [CrossRef]

- Zeng, S.X.; Xu, X.D.; Dong, Z.Y.; Tam, V.W. Towards corporate environmental information disclosure: An empirical study in China. J. Clean. Prod. 2010, 18, 1142–1148. [Google Scholar] [CrossRef]

- Marquis, C.; Qian, C. Corporate social responsibility reporting in China: Symbol or substance? Organ. Sci. 2014, 25, 127–148. [Google Scholar] [CrossRef] [Green Version]

- Brown, W.O.; Helland, E.; Smith, J.K. Corporate philanthropic practices. J. Corp. Financ. 2006, 12, 855–877. [Google Scholar] [CrossRef] [Green Version]

- Attig, N.; Boubakri, N.; El Ghoul, S.; Guedhami, O. Firm internationalization and corporate social responsibility. J. Bus. Ethics 2016, 134, 171–197. [Google Scholar] [CrossRef]

- Guo, R.; Tao, L.; Li, C.B.; Wang, T. A path analysis of greenwashing in a trust crisis among Chinese energy companies: The role of brand legitimacy and brand loyalty. J. Bus. Ethics 2017, 140, 523–536. [Google Scholar] [CrossRef]

- Testa, F.; Boiral, O.; Iraldo, F. Internalization of environmental practices and institutional complexity: Can stakeholders pressures encourage greenwashing? J. Bus. Ethics 2018, 147, 287–307. [Google Scholar]

- Yang, Z.; Nguyen, T.T.H.; Nguyen, H.N.; Nguyen, T.T.N.; Cao, T.T. Greenwashing behaviours: Causes, taxonomy and consequences based on a systematic literature review. J. Bus. Econ. Manag. 2020, 21, 1486–1507. [Google Scholar] [CrossRef]

- Bondy, K.; Moon, J.; Matten, D. An institution of corporate social responsibility (CSR) in multi-national corporations (MNCs): Form and implications. J. Bus. Ethics 2012, 111, 281–299. [Google Scholar] [CrossRef] [Green Version]

- DiMaggio, P. Interest and agency in institutional theory. In Institutional Patterns and Organizations Culture and Environment; Ballinger Publishing Company: Pensacola, FL, USA, 1988; pp. 3–21. [Google Scholar]

- Li, F.; Ding, D.Z. The effect of institutional isomorphic pressure on the internationalization of firms in an emerging economy: Evidence from China. Asia Pac. Bus. Rev. 2013, 19, 506–525. [Google Scholar] [CrossRef]

- Bowen, F.; Aragon-Correa, J.A. Greenwashing in Corporate Environmentalism Research and Practice: The Importance of What We Say and Do. Organ. Environ. 2014, 27, 107–112. [Google Scholar] [CrossRef] [Green Version]

- Gou, Q.W. Can Both Substantive and Symbolic Environmental Management get Paid?—An Empirical Study Based on China Listing Corporation. In Advanced Materials Research; Trans Tech Publications, 2013; pp. 760–763. Available online: https://doi.org/10.4028/www.scientific.net/AMR.807-809.760 (accessed on 20 January 2022).

- Roulet, T.J.; Touboul, S. The intentions with which the road is paved: Attitudes to liberalism as determinants of greenwashing. J. Bus. Ethics 2015, 128, 305–320. [Google Scholar] [CrossRef] [Green Version]

- Jin, Y. Research on Environmental Regulation, Greenwashing Behavior and Enterprise R&D Investment. 2018. Available online: https://cdmd.cnki.com.cn/Article/CDMD-10070-1019094657.htm (accessed on 20 January 2022).

- Lu, J.W.; Beamish, P.W. International diversification and firm performance: The S-curve hypothesis. Acad. Manag. J. 2004, 47, 598–609. [Google Scholar]

- Morck, R.; Yeung, B. Why investors value multinationality. J. Bus. 1991, 64, 165–187. [Google Scholar] [CrossRef]

- Chen, L.; Liu, J.; Zhang, S. Influence of mimetic isomorphism on firms’ internationalization-performance relationship—an empirical study based on legitimacy perspective in institutional theory. China Industrial Economics 2016, 9, 127–143. [Google Scholar]

- Zhen, P.; Yang, L.; Yin, H. The Effect of Chinese Enterprises Internationalization on Corporate Social Responsibility. Bus. Manag. J. 2020, 42, 27–48. (In Chinese) [Google Scholar]

- Becker, R.; Henderson, V. Effects of air quality regulations on polluting industries. J. Politi. Econ. 2000, 108, 379–421. [Google Scholar] [CrossRef]

- Xing, Y.; Kolstad, C.D. Do lax environmental regulations attract foreign investment? Environ. Resour. Econ. 2002, 21, 1–22. [Google Scholar] [CrossRef]

- Zhang, P. End-of-pipe or process-integrated: Evidence from LMDI decomposition of China’s SO2 emission density reduction. Front. Environ. Sci. Eng. 2013, 7, 867–874. [Google Scholar] [CrossRef]

- Wang, C.; Wu, J.; Zhang, B. Environmental regulation, emissions and productivity: Evidence from Chinese COD-emitting manufacturers. J. Environ. Econ. Manag. 2018, 92, 54–73. [Google Scholar] [CrossRef]

- Zhou, Y.; Jiang, J.; Ye, B.; Hou, B. Green spillovers of outward foreign direct investment on home countries: Evidence from China’s province-level data. J. Clean. Prod. 2019, 215, 829–844. [Google Scholar] [CrossRef]

- Copeland, B.R.; Taylor, M.S. Trade, growth, and the environment. J. Econ. Lit. 2004, 42, 7–71. [Google Scholar] [CrossRef]

- Huang, G. PM2. 5 opened a door to public participation addressing environmental challenges in China. Environ. Pollut. 2015, 197, 313–315. [Google Scholar] [CrossRef] [PubMed]

- Luo, G.; Zhang, L.; Hu, X.; Qiu, R. Quantifying public health benefits of PM2.5 reduction and spatial distribution analysis in China. Sci. Total Environ. 2020, 719, 137445. [Google Scholar] [CrossRef] [PubMed]

- Tucker, W.G. An overview of PM2. 5 sources and control strategies. Fuel Process. Technol. 2000, 65, 379–392. [Google Scholar] [CrossRef]

- Liu, A.; Gu, X. Environmental regulation, technological progress and corporate profit: Empirical research based on the threshold panel regression. Sustainability 2020, 12, 1416. [Google Scholar] [CrossRef] [Green Version]

- Clarkson, P.M.; Li, Y.; Richardson, G.D.; Vasvari, F.P. Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Account. Organ. Soc. 2008, 33, 303–327. [Google Scholar] [CrossRef]

- Schwens, C.; Eiche, J.; Kabst, R. The moderating impact of informal institutional distance and formal institutional risk on SME entry mode choice. J. Manag. Stud. 2011, 48, 330–351. [Google Scholar] [CrossRef]

- Hofstede, G. Dimensionalizing cultures: The Hofstede model in context. Online Read. Psychol. Cult. 2011, 2. [Google Scholar] [CrossRef]

- Kogut, B.; Singh, H. The effect of national culture on the choice of entry mode. J. Int. Bus. Stud. 1988, 19, 411–432. [Google Scholar] [CrossRef]

- 1Cheng, J.L.; Kesner, I.F. Organizational slack and response to environmental shifts: The impact of resource allocation patterns. J. Manag. 1997, 23, 1–18. [Google Scholar] [CrossRef]

- Yu, H.; Liao, L.; Qu, S.; Fang, D.; Luo, L.; Xiong, G. Environmental regulation and corporate tax avoidance: A quasi-natural experiments study based on China’s new environmental protection law. J. Environ. Manag. 2021, 296, 113160. [Google Scholar] [CrossRef] [PubMed]

- Groves, T.; Hong, Y.; McMillan, J.; Naughton, B. Autonomy and incentives in Chinese state enterprises. Q. J. Econ. 1994, 109, 183–209. [Google Scholar] [CrossRef]

- Bose, S.; Khan, H.Z.; Monem, R.M. Does green banking performance pay off? Evidence from a unique regulatory setting in Bangladesh. Corp. Gov. Int. Rev. 2021, 29, 162–187. [Google Scholar]

- Dam, L.; Scholtens, B. The curse of the haven: The impact of multinational enterprise on environmental regulation. Ecol. Econ. 2012, 78, 148–156. [Google Scholar] [CrossRef]

- Albrizio, S.; Kozluk, T.; Zipperer, V. Environmental policies and productivity growth: Evidence across industries and firms. J. Environ. Econ. Manag. 2017, 81, 209–226. [Google Scholar] [CrossRef]

- Liao, X. Public appeal, environmental regulation and green investment: Evidence from China. Energy Policy 2018, 119, 554–562. [Google Scholar] [CrossRef]

- Zhang, Q.; Cai, L.; Sun, X. Green Resource Integration Capacity, Greenwashing Behavior and Enterprise Performance—The Moderated Mediation Role of Dysfunctional Competition. J. Ind. Technol. Econ. 2017, 35, 141–145. [Google Scholar]

- Du, X.; Zeng, Q.; Zhang, Y. Talk the talk, but walk the walk: What do we know about marital demography and corporate greenwashing? J. Manag. Organ. 2021, 1–42. [Google Scholar] [CrossRef]

- Buckley, P.J.; Doh, J.P.; Benischke, M.H. Towards a renaissance in international business research? Big questions, grand challenges, and the future of IB scholarship. J. Int. Bus. Stud. 2017, 48, 1045–1064. [Google Scholar] [CrossRef] [Green Version]

- Ren, S.; He, D.; Zhang, T.; Chen, X. Symbolic reactions or substantive pro-environmental behaviour? An empirical study of corporate environmental performance under the government’s environmental subsidy scheme. Bus. Strategy Environ. 2019, 28, 1148–1165. [Google Scholar] [CrossRef]

- Vayssières, J.F.; Korie, S.; Coulibaly, O.; Van Melle, C.; Temple, L.; Arinloye, D. The mango tree in central and northern Benin damage caused by fruit flies (Diptera Tephritidae) and computation of economic injury level. Fruits 2009, 64, 207–220. [Google Scholar] [CrossRef]

- De Freitas Netto, S.V.; Sobral, M.F.F.; Ribeiro, A.R.B.; Da Luz Soares, G.R. Concepts and forms of greenwashing: A systematic review. Environ. Sci. Eur. 2020, 32, 19. [Google Scholar] [CrossRef] [Green Version]

- Harlan, T. Green development or greenwashing? A political ecology perspective on China’s green Belt and Road. Eurasian Geogr. Econ. 2021, 62, 202–226. [Google Scholar] [CrossRef]

- Conner, K.R.; Prahalad, C.K. A resource-based theory of the firm: Knowledge versus opportunism. Organ. Sci. 1996, 7, 477–501. [Google Scholar] [CrossRef]

- Du, M.; Boateng, A.; Newton, D. The impact of state ownership, formal institutions and resource seeking on acquirers’ returns of Chinese M&A. Rev. Quant. Financ. Account. 2016, 47, 159–178. [Google Scholar]

- Xiao, C.; Wang, Q.; van Donk, D.P.; van der Vaart, T. When are stakeholder pressures effective? An extension of slack resources theory. Int. J. Prod. Econ. 2018, 199, 138–149. [Google Scholar] [CrossRef]

| Year | Panel A: All the Firms | Panel B: Internationalized Firms | Panel C: Noninternationalized Firms |

|---|---|---|---|

| 2007 | 10 | 0 | 10 |

| 2008 | 512 | 110 | 402 |

| 2009 | 547 | 127 | 420 |

| 2010 | 621 | 133 | 488 |

| 2011 | 683 | 179 | 504 |

| 2012 | 706 | 210 | 496 |

| 2013 | 719 | 234 | 485 |

| 2014 | 735 | 266 | 469 |

| 2015 | 760 | 309 | 451 |

| 2016 | 793 | 346 | 447 |

| 2017 | 807 | 383 | 424 |

| 2018 | 786 | 396 | 390 |

| Total samples | 7679 | 2693 | 4986 |

| Code | Environmental Items | Definition or Explanations |

|---|---|---|

| 1 | Environmental strategy and planning | Company environmental protection plan or system construction |

| 2 | Staff training | Training activities to enhance staff’s environmental awareness |

| 3 | Special fund plan | Future investment in environmental protection |

| 4 | Establishment of the environmental protection department | The company establishes an independent environmental protection department |

| 5 | Environmental risk analysis | Consider possible environmental hazards in production and operation |

| 6 | Environmental auditing | Evaluate, punish, or reward projects |

| 7 | Participation of environmental organizations | Cooperation with environmental organizations |

| 8 | Environmental charity | Environmental charity donation or charity activity |

| 9 | Green business development | Expand the company’s green business |

| 10 | Process improvement | Improvement of production process and other aspects |

| 11 | Industrial waste discharge management | The company’s efforts in reducing and managing industrial waste |

| 12 | Energy saving and efficiency increasing | Save energy and improve production efficiency |

| 13 | Technological development | Clean technology research and development |

| 14 | Pollution monitoring and control | Monitoring of pollutant concentration |

| 15 | Green working | Electronic administration |

| 16 | Ecological restoration | Ecological restoration of land, water, mines, and other damages |

| 17 | Green market | Products are certified green |

| 18 | Environmental cost accounting | Financial accounting after environmental management |

| 19 | Use of clean energy | Use wind, water, solar power, and so on. |

| (1) | (2) | (3) | ||

|---|---|---|---|---|

| Model 2 | Model 3 | Model 4 | ||

| Variables | Greenwa | Greenwa | Greenwa | |

| H1 | lnArea | 0.0819 *** | 0.0804 *** | 0.0810 *** |

| (0.0232) | (0.0251) | (0.0215) | ||

| H2 | lnp25m_lnArea | −0.0697 ** | ||

| (0.0286) | ||||

| lnp25m | 0.0441 | 0.0472 | 0.0492 | |

| (0.0604) | (0.0554) | (0.0597) | ||

| H3 | media_lnArea | −0.0130 | ||

| (0.0181) | ||||

| media | −0.172 *** | −0.168 *** | −0.168 *** | |

| (0.0238) | (0.0238) | (0.0246) | ||

| H4 | HHI_A_lnArea | −0.0291 | ||

| (0.112) | ||||

| HHI_A | −0.173 | −0.183 | −0.186 | |

| (0.165) | (0.163) | (0.164) | ||

| Controls | YES | YES | YES | |

| Observations | 2512 | 2512 | 2512 | |

| R-squared | 0.066 | 0.065 | 0.065 | |

| (1) | (2) | (3) | ||

|---|---|---|---|---|

| East | Central | West | ||

| Model 2 | Model 2 | Model 2 | ||

| Variables | Greenwa | Greenwa | Greenwa | |

| H1 | lnArea | 0.0285 | 0.204 *** | 0.108 ** |

| (0.0242) | (0.0551) | (0.0414) | ||

| H2 | lnp25m_lnArea | 0.0133 | 0.381 * | −0.445 *** |

| (0.0465) | (0.186) | (0.0943) | ||

| lnp25m | 0.0441 | −0.0810 | 0.597 *** | |

| 0.0285 | 0.204 *** | 0.108 ** | ||

| Controls | YES | YES | YES | |

| Observations | 1476 | 349 | 687 | |

| R-squared | 0.084 | 0.202 | 0.109 | |

| (1) | (2) | (3) | (5) | (6) | ||

|---|---|---|---|---|---|---|

| East | Central | West | SOES | NSOES | ||

| Model 3 | Model 3 | Model 3 | Model 3 | Model 3 | ||

| Variables | Greenwa | Greenwa | Greenwa | Greenwa | Greenwa | |

| H1 | lnArea | 0.0241 | 0.282 *** | 0.150 *** | 0.0731 *** | 0.0762 ** |

| (0.0361) | (0.0573) | (0.0263) | (0.0229) | (0.0320) | ||

| H3 | media_lnArea | −0.0477 ** | 0.123 * | 0.00640 | 0.0193 | −0.0581 ** |

| (0.0155) | (0.0601) | (0.0438) | (0.0117) | (0.0211) | ||

| media | −0.141 *** | −0.227 * | −0.148 *** | −0.0996 *** | −0.225 *** | |

| (0.0255) | (0.111) | (0.0421) | (0.0312) | (0.0430) | ||

| Controls | YES | YES | YES | YES | YES | |

| Observations | 1476 | 349 | 687 | 1386 | 1126 | |

| R-squared | 0.085 | 0.196 | 0.095 | 0.071 | 0.100 | |

| (1) | (2) | (3) | (4) | (5) | (6) | ||

|---|---|---|---|---|---|---|---|

| Eastern SOES | Central SOES | Western SOES | Eastern NSOES | Central NSOES | Western NSOES | ||

| Model 4 | Model 4 | Model 4 | Model 4 | Model 4 | Model 4 | ||

| Variables | Greenwa | Greenwa | Greenwa | Greenwa | Greenwa | Greenwa | |

| H1 | lnArea | 0.0440 | 0.180 * | −0.00702 | −0.0285 | 0.285 ** | 0.344 *** |

| (0.0374) | (0.0950) | (0.0598) | (0.0203) | (0.113) | (0.101) | ||

| H4 | HHI_A_lnArea | 0.647 *** | −0.512 | −0.747 | −0.399 ** | 3.368 *** | −0.248 |

| (0.0932) | (0.408) | (0.514) | (0.155) | (0.903) | (0.333) | ||

| HHI_A | 0.0188 | −1.459 ** | 1.051 *** | 0.0103 | −1.984 ** | −1.778 *** | |

| (0.170) | (0.618) | (0.231) | (0.187) | (0.684) | (0.230) | ||

| Controls | YES | YES | YES | YES | YES | YES | |

| Observations | 823 | 210 | 353 | 653 | 139 | 334 | |

| R-squared | 0.142 | 0.263 | 0.098 | 0.111 | 0.367 | 0.270 | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| All Sample | SOES | NSOES | East | Middle | West | |

| Variables | Earth | Earth | Earth | Earth | Earth | Earth |

| lnp25m | −0.0324 | −0.0832 | 0.0929 | 0.105 | 0.00232 | −0.108 |

| (0.0445) | (0.0598) | (0.0693) | (0.0655) | (0.0953) | (0.0994) | |

| AmountCOST | −0.0561 | −0.0271 | −0.418 | −0.703 | −1.957 | 4.634 *** |

| (0.200) | (0.744) | (0.633) | (0.583) | (1.640) | (1.112) | |

| HHI_A | −0.0545 | −0.0804 | 0.0128 | 0.0895 | −0.776 ** | −0.297 |

| (0.0989) | (0.132) | (0.154) | (0.121) | (0.336) | (0.219) | |

| media | 0.222 *** | 0.216 *** | 0.149 *** | 0.168 *** | 0.531 *** | 0.200 *** |

| (0.0313) | (0.0447) | (0.0462) | (0.0401) | (0.0989) | (0.0622) | |

| ManFee | −0.0508 | 0.618 *** | −0.140 | 0.0653 | −0.519 | −0.0700 |

| (0.0456) | (0.180) | (0.101) | (0.0887) | (0.334) | (0.0799) | |

| lnTA | 0.272 *** | 0.323 *** | 0.306 *** | 0.233 *** | 0.240 *** | 0.404 *** |

| (0.0130) | (0.0178) | (0.0243) | (0.0165) | (0.0360) | (0.0296) | |

| fapatent | 0.000526 | −0.000164 | 0.0628 *** | −0.000468 | 0.00810 | 0.0977 *** |

| (0.00136) | (0.00130) | (0.0168) | (0.00128) | (0.0108) | (0.0230) | |

| top1 | −0.00675 *** | −0.00786 *** | −0.00148 | −0.00410 *** | −0.0148 *** | −0.00808 *** |

| (0.00104) | (0.00142) | (0.00160) | (0.00143) | (0.00272) | (0.00201) | |

| SharStock | 0.0122 *** | 0.0307 ** | 0.00608 *** | 0.0128 *** | 0.00002 *** | 0.0177 *** |

| (0.00183) | (0.0150) | (0.00203) | (0.00258) | (0.00563) | (0.00342) | |

| itang | −0.573 *** | −0.709 *** | 0.200 | −0.0153 | −0.769 | −1.278 *** |

| (0.207) | (0.241) | (0.440) | (0.290) | (0.567) | (0.380) | |

| ROAA | 0.272 ** | 0.114 | 0.379 | 0.299 * | −0.746 | 0.135 |

| (0.138) | (0.0873) | (0.246) | (0.166) | (0.583) | (0.450) | |

| Observations | 7583 | 4414 | 3169 | 4146 | 1417 | 2020 |

| Prob>chi2 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| Pseudo R2 | 0.1158 | 0.1290 | 0.1269 | 0.0979 | 0.1483 | 0.2030 |

| LR chi2 | 1114.97 | 708.37 | 523.53 | 528.76 | 234.68 | 525.78 |

| (1) | (2) | (3) | (4) | (5) | (6) | ||

|---|---|---|---|---|---|---|---|

| Heckman | 2SLS | ||||||

| Model 2 | Model 3 | Model 4 | Model 2 | Model 3 | Model 4 | ||

| Variables | Greenwa | Greenwa | Greenwa | Greenwa | Greenwa | Greenwa | |

| H1 | lnArea | 0.0798 *** | 0.0787 *** | 0.0791 *** | 0.083 ** | 0.076 ** | 0.082 ** |

| (0.0222) | (0.0232) | (0.0204) | (0.034) | (0.034) | (0.034) | ||

| H2 | lnp25m_lnArea | −0.0747 ** | −0.161 | ||||

| (0.0310) | (0.113) | ||||||

| lnp25m | 0.0573 | 0.0596 | 0.0615 | 0.119 | 0.121 | 0.101 | |

| (0.0562) | (0.0514) | (0.0550) | (0.077) | (0.077) | (0.077) | ||

| H3 | media_lnArea | −0.0104 | −0.007 | ||||

| (0.0188) | (0.046) | ||||||

| media | −0.254 ** | −0.243 ** | −0.245 ** | −0.234 *** | −0.219 ** | −0.223 *** | |

| (0.0824) | (0.0842) | (0.0826) | (0.087) | (0.088) | (0.086) | ||

| H4 | HHI_A_lnArea | −0.0237 | 0.191 | ||||

| (0.111) | (0.205) | ||||||

| HHI_A | −0.148 | −0.162 | −0.164 | −0.206 | −0.206 | −0.257 | |

| (0.181) | (0.180) | (0.181) | (0.156) | (0.156) | (0.156) | ||

| imr | −0.659 | −0.603 | −0.618 | −0.455 | −0.384 | −0.387 | |

| (0.525) | (0.539) | (0.520) | (0.610) | (0.614) | (0.609) | ||

| Controls | YES | YES | YES | YES | YES | YES | |

| Observations | 2512 | 2512 | 2512 | 2049 | 2034 | 2050 | |

| R-squared | 0.073 | 0.072 | 0.072 | 0.076 | 0.072 | 0.073 | |

| Underidentification test | 811 | 875.2 | 1216 | ||||

| p-Value | 0 | 0 | 0 | ||||

| Weak identification test | 661.7 | 757.2 | 1474 | ||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | ||

|---|---|---|---|---|---|---|---|---|---|

| Environmental Regulation | Public Pressure | ||||||||

| East | Central | West | East | Central | West | SOES | NSOES | ||

| Model 2 | Model 2 | Model 2 | Model 3 | Model 3 | Model 3 | Model 3 | Model 3 | ||

| Variables | Greenwa | Greenwa | Greenwa | Greenwa | Greenwa | Greenwa | Greenwa | Greenwa | |

| H1 | lnArea | 0.020 | 0.165 | 0.115 | 0.010 | 0.239 * | 0.188 ** | 0.056 | 0.062 |

| (0.042) | (0.116) | (0.080) | (0.042) | (0.135) | (0.079) | (0.040) | (0.064) | ||

| H2/H3 | lnp25m_lnArea/media_lnArea | 0.015 | 0.741 ** | −0.867 *** | −0.036 | 0.002 | 0.011 | 0.045 | −0.112 |

| (0.141) | (0.298) | (0.249) | (0.048) | (0.180) | (0.094) | (0.052) | (0.094) | ||

| lnp25m | 0.157 | −0.135 | 0.833 *** | −0.267 ** | −0.276 | −0.206 | −0.359 *** | −0.126 | |

| (0.104) | (0.181) | (0.179) | (0.108) | (0.366) | (0.186) | (0.118) | (0.147) | ||

| imr | −0.927 | 0.154 | −1.571 | −1.045 | −0.057 | −0.551 | −1.992 ** | 0.533 | |

| (0.756) | (2.471) | (1.233) | (0.756) | (2.482) | (1.261) | (0.860) | (1.032) | ||

| Controls | YES | YES | YES | YES | YES | YES | YES | YES | |

| Observations | 1210 | 275 | 564 | 1196 | 276 | 562 | 1138 | 896 | |

| R-squared | 0.102 | 0.205 | 0.117 | 0.100 | 0.196 | 0.093 | 0.085 | 0.122 | |

| Underidentification test | 155.1 | 133.6 | 193.8 | 136.3 | 87.04 | 268 | 567.1 | 267.1 | |

| p-Value | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Weak identification test | 185.2 | 116.2 | 140 | 134 | 56.89 | 243 | 550.7 | 184.2 | |

| (1) | (2) | (3) | (4) | (5) | (6) | ||

|---|---|---|---|---|---|---|---|

| Eastern SOES | Central SOES | Western SOES | Eastern NSOES | Central NSOES | Western NSOES | ||

| Model 4 | Model 4 | Model 4 | Model 4 | Model 4 | Model 4 | ||

| Variables | Greenwa | Greenwa | Greenwa | Greenwa | Greenwa | Greenwa | |

| H1 | lnArea | 0.025 | 0.181 | −0.064 | −0.024 | 0.464 ** | 0.525 *** |

| (0.045) | (0.169) | (0.101) | (0.076) | (0.215) | (0.136) | ||

| H4 | HHI_A_lnArea | 0.860 *** | 0.530 | −2.005 ** | −0.399 | 3.886 | 0.615 |

| (0.274) | (1.075) | (0.826) | (0.409) | (2.429) | (0.778) | ||

| HHI_A | 0.060 | −2.428 ** | 0.562 | −0.034 | −2.334 * | −2.005 *** | |

| (0.230) | (1.195) | (0.519) | (0.337) | (1.289) | (0.408) | ||

| imr | −2.529 ** | −1.180 | −3.988 ** | 0.122 | −4.561 | 0.958 | |

| (1.085) | (4.145) | (2.007) | (1.268) | (4.718) | (2.077) | ||

| Controls | YES | YES | YES | YES | YES | YES | |

| Observations | 680 | 170 | 294 | 530 | 106 | 270 | |

| R-squared | 0.166 | 0.277 | 0.115 | 0.136 | 0.331 | 0.286 | |

| Underidentification test | 416 | 8.764 | 29.47 | 279.2 | 59.02 | 134.8 | |

| p-Value | 0 | 0.00307 | 0.000 | 0.000 | 0.000 | 0.000 | |

| Weak identification test | 512.9 | 13.38 | 21.99 | 278.9 | 48.37 | 120.2 | |

| (1) | (2) | (3) | ||

|---|---|---|---|---|

| Model 2 | Model 3 | Model 4 | ||

| Variables | Greenwa | Greenwa | Greenwa | |

| H1 | lnArea | 0.0820 *** | 0.0814 *** | 0.0821 *** |

| (0.0168) | (0.0207) | (0.0172) | ||

| H2 | ECI_lnArea | −0.0133 | ||

| (0.0448) | ||||

| ECI | −0.0103 | −0.0119 | −0.0108 | |

| (0.0326) | (0.0358) | (0.0356) | ||

| H3 | lnNumPress_lnArea | −0.0106 | ||

| (0.0214) | ||||

| lnNumPress | −0.254 *** | −0.250 ** | −0.254 *** | |

| (0.0774) | (0.0835) | (0.0792) | ||

| H4 | HHI_C_lnArea | 0.0275 | ||

| (0.201) | ||||

| HHI_C | −0.0428 | −0.0423 | −0.0360 | |

| (0.116) | (0.115) | (0.154) | ||

| imr | −0.553 | −0.538 | −0.559 | |

| (0.482) | (0.506) | (0.476) | ||

| Controls | YES | YES | YES | |

| Observations | 2512 | 2512 | 2512 | |

| R-squared | 0.065 | 0.065 | 0.065 | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | ||

|---|---|---|---|---|---|---|---|---|---|

| Environmental Regulation | Public Pressure | ||||||||

| East | Central | West | East | Central | West | SOES | NSOES | ||

| Model 2 | Model 2 | Model 2 | Model 3 | Model 3 | Model 3 | Model 3 | Model 3 | ||

| Variables | Greenwa | Greenwa | Greenwa | Greenwa | Greenwa | Greenwa | Greenwa | Greenwa | |

| H1 | lnArea | 0.0125 | 0.370 *** | 0.185 *** | 0.0236 | 0.281 *** | 0.140 *** | 0.0603 *** | 0.0796 ** |

| (0.0192) | (0.105) | (0.0432) | (0.0321) | (0.0651) | (0.0246) | (0.0172) | (0.0327) | ||

| H2/H3 | ECI_lnArea/lnNumPress_lnArea | −0.0914 ** | 0.899 ** | −0.0977 | −0.0510 ** | 0.102 | 0.0207 | 0.0316 ** | −0.0704 *** |

| (0.0337) | (0.285) | (0.0611) | (0.0176) | (0.0597) | (0.0483) | (0.0105) | (0.0211) | ||

| ECI | −0.134 *** | 0.206 | 0.148 | −0.253 * | −0.548 ** | −0.264 ** | −0.352 ** | −0.191 ** | |

| (0.0201) | (0.214) | (0.0909) | (0.114) | (0.230) | (0.0939) | (0.157) | (0.0638) | ||

| imr | −0.875 | −2.262 | −0.469 | 1476 | 349 | 687 | 1386 | 1126 | |

| (0.616) | (1.558) | (0.500) | 0.090 | 0.187 | 0.085 | 0.072 | 0.084 | ||

| Controls | YES | YES | YES | YES | YES | YES | YES | YES | |

| Observations | 1476 | 349 | 687 | 1476 | 349 | 687 | 1386 | 1126 | |

| R-squared | 0.090 | 0.216 | 0.086 | 0.090 | 0.187 | 0.085 | 0.072 | 0.084 | |

| (1) | (2) | (3) | (4) | ||

|---|---|---|---|---|---|

| East | Central | West | All Sample | ||

| Model 2 | Model 2 | Model 2 | Model 2 | ||

| Variables | Greenwa | Greenwa | Greenwa | Greenwa | |

| H1 | lnArea | 0.0596 ** | 0.216 *** | 0.113 ** | 0.0844 *** |

| (0.0255) | (0.0585) | (0.0421) | (0.0235) | ||

| H2 | Prov_lnArea | −0.146 *** | 0.312 * | −0.308 *** | −0.0709 * |

| (0.0374) | (0.170) | (0.0368) | (0.0338) | ||

| Prov | 0.0251 | −0.142 | 0.433 ** | −0.0589 | |

| (0.0270) | (0.236) | (0.142) | (0.0511) | ||

| Controls | YES | YES | YES | ||

| Observations | 1476 | 356 | 688 | 2520 | |

| R-squared | 0.085 | 0.209 | 0.092 | 0.066 | |

| (1) | (2) | (3) | (4) | (5) | (6) | ||

|---|---|---|---|---|---|---|---|

| Eastern SOES | Central SOES | Western SOES | Eastern NSOES | Central NSOES | Western NSOES | ||

| Model 4 | Model 4 | Model 4 | Model 4 | Model 4 | Model 4 | ||

| Variables | Greenwa | Greenwa | Greenwa | Greenwa | Greenwa | Greenwa | |

| H1 | lnArea | 0.0220 | 0.157 | −0.0232 | −0.0241 | 0.302 ** | 0.297 *** |

| (0.0303) | (0.112) | (0.0707) | (0.0212) | (0.103) | (0.0868) | ||

| H4 | HHI_C_lnArea | 1.033 *** | −1.107 * | −0.465 | −0.820 *** | 5.736 *** | −0.702 * |

| (0.195) | (0.553) | (0.433) | (0.186) | (1.474) | (0.345) | ||

| HHI_C | 0.0629 | −2.028 ** | 1.685 *** | −0.0257 | −2.450 ** | −2.204 *** | |

| (0.149) | (0.826) | (0.381) | (0.342) | (0.908) | (0.349) | ||

| imr | −2.214 ** | 0.484 | −2.723 | −0.132 | −2.373 | 2.354 ** | |

| (0.867) | (2.022) | (3.012) | (0.488) | (3.385) | (0.806) | ||

| Controls | YES | YES | YES | YES | YES | YES | |

| Observations | 823 | 210 | 353 | 653 | 139 | 334 | |

| R-squared | 0.157 | 0.246 | 0.126 | 0.111 | 0.390 | 0.207 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, K.; Pan, Z.; Janardhanan, M. Relationship between the Degree of Internationalization and Greenwashing of Environmental Responsibilities in China-Based on the Legitimacy Perspective. Sustainability 2022, 14, 2794. https://doi.org/10.3390/su14052794

Zhang K, Pan Z, Janardhanan M. Relationship between the Degree of Internationalization and Greenwashing of Environmental Responsibilities in China-Based on the Legitimacy Perspective. Sustainability. 2022; 14(5):2794. https://doi.org/10.3390/su14052794

Chicago/Turabian StyleZhang, Kesen, Zhen Pan, and Mukund Janardhanan. 2022. "Relationship between the Degree of Internationalization and Greenwashing of Environmental Responsibilities in China-Based on the Legitimacy Perspective" Sustainability 14, no. 5: 2794. https://doi.org/10.3390/su14052794

APA StyleZhang, K., Pan, Z., & Janardhanan, M. (2022). Relationship between the Degree of Internationalization and Greenwashing of Environmental Responsibilities in China-Based on the Legitimacy Perspective. Sustainability, 14(5), 2794. https://doi.org/10.3390/su14052794