Abstract

Green technology innovation has become a breakthrough topic in the coordinated development of economic growth and environmental protection. Although the Internet is likely to become a key driver of transformative environmental change and innovation, studies on the impact of internet infrastructure on green innovation and analyses of the paths are still extremely scarce. Based on a sample of China’s listed companies from 2009 to 2019, this paper treats the Broadband China pilot strategy as a quasi-natural experiment and adopts the time-varying difference-in-differences (DID) model to explore the effect and the transmission path of internet infrastructure construction on green innovation. The study finds that Broadband China significantly promotes green innovation, and the result remains consistent after a series of robustness tests. The transmission path test proves that internet infrastructure construction affects green innovation by improving the degree of informatization, human capital, and internet media reports and by reducing financing constraints. Furthermore, considering the heterogeneity effect, the Broadband China strategy has a greater stimulating effect on state-owned, large-scale, high-tech enterprises; enterprises in low-competition industries; enterprises in growth and mature stages; and enterprises registered in the central and eastern regions. This paper systematically analyzes the effects of internet infrastructure on the green innovation of enterprises based on economic informatics theory, providing new insights for improving internet infrastructure and green innovation in practice.

1. Introduction

Recently, the growing challenges of climate change have forced countries to change their traditional economic growth patterns. Maintaining economic growth while improving the environment has become a common concern worldwide. After three decades of continuous and dramatic development, problems with pursuing growth at the expense of sustainability are gradually emerging, severely restricting the sustainable development of China’s economy. In September 2020, China declared a climate goal: to achieve a CO2 emission peak before 2030 and work toward carbon neutrality before 2060, which means committing to achieving the net-zero pledge in half the time of the West. China’s 2060 net-zero pledge imposes higher requirements on the sustainable development of its economy.

Green innovation provides new insights into this issue. Green innovation involves technologies, processes, and products that save energy and resources, as well as reduces the generation and emissions of pollutants [1], which has a dual externality that traditional innovation does not have. On the one hand, green innovation can save energy and resources and reduce pollution [2]. On the other hand, it helps to improve enterprises’ green competitiveness and sustainable development capacity by introducing new systems, products, and processes [3,4]. Green innovation can be considered a key path to the coordinated development of economic growth and environmental protection [5] and the achievement of carbon peak and neutrality. The Action Plan for Reaching Carbon Peak by 2030 supports enterprises in participating in the National Program for Key Science and Technology Projects, clarifying the dominant role of enterprises in the green revolution. As micro individuals of the economy, enterprises have the vital function of boosting national green science and technology innovation.

The existing literature on the innovation effect of infrastructure is generally focused on the output of transportation infrastructure construction. Most studies suggest that transportation infrastructure significantly increases innovation output from the perspective of factor mobility [6]. The basic logic is that transportation infrastructure construction reduces the social cost of innovation, thus promoting the mobility of innovation factors, such as talent and material resources, among regions [7]. It can be seen from previous studies that transportation infrastructure construction impacts enterprise innovation behavior through the spatial redistribution of innovation factors among regions. However, due to the high transportation cost and time involved in the flow of innovation factors, the driving effect of transportation infrastructure construction on the innovation is limited. In contrast, as the information superhighway, the internet infrastructure affects innovation by enhancing the flow of information, which makes it uniquely different from transportation infrastructure.

Internet infrastructure construction has created a huge change in information flow. Many new technologies that enhance the flow of information were born with the construction of internet infrastructure. Internet infrastructure breaks the boundaries of traditional geographical space [8] and enables information to be transmitted directly and transparently between computers and other communication devices through the network. Similar information technologies, such as artificial intelligence, cloud computing, and big data, are likewise products of internet infrastructure construction [9]. Moreover, access to the Internet has changed the traditional patterns of acquiring information and communicating by the public in a broader sense. For example, the Internet has changed the method of transmitting financing information [10], enabling barrier-free transmission between the two sides of supply and demand, saving time and cost on information searches [11], and, ultimately, reducing the financing constraints of enterprises. Furthermore, the Internet fosters knowledge flow [12], which helps workers to learn and accumulate knowledge, and promotes human capital. Finally, internet media is a product of internet infrastructure construction. Compared with traditional information media, information dissemination based on the Internet has a higher efficiency and wider spread, which can solve the information asymmetry problem and regulate the behavior of enterprises to some extent [13]. Therefore, with the extensive popularization of the Internet, online public opinions play an increasingly irreplaceable role in the reputation of enterprises.

Based on the theory of economic informatics, information transmission over the Internet has significant network externalities and spillovers [14]. The cost of manufacturing information may be high, but the marginal cost of replicating and transmitting it is generally low. With the continuous growth in internet users, the cost for each user to access information from the network generally decreases, while the value increases. This is called the network effect, which is a continuously reinforcing process. That is, the more Internet users there are, the greater the value of each user, and the greater the value, the more Internet users. The externalities and spillovers of access to the Internet will further facilitate innovation, which is another difference between internet and transportation infrastructure.

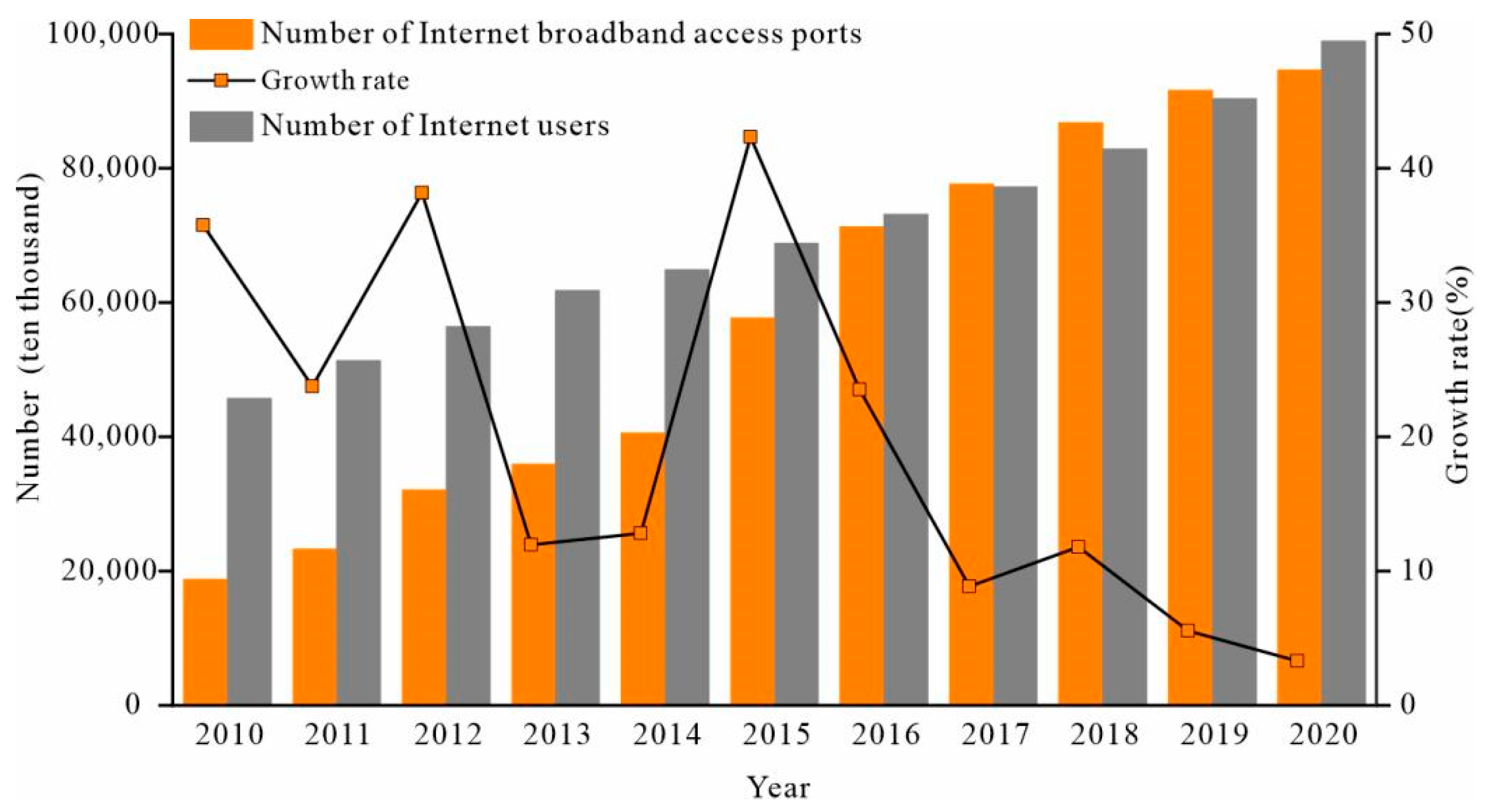

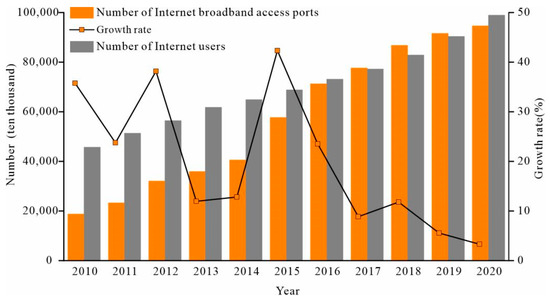

The scale of China’s internet construction infrastructure has expanded significantly in recent decades. As can be seen from the macro consecutive-year data (Figure 1), in 2014, the total internet broadband access ports increased to 405.461 million, twice as many as in 2010. The number of internet users continues to rise, and broadband access is highly correlated with use. Previous studies of green innovation mainly focused on the impacts of environmental regulations and requirements on the green innovation behavior of enterprises and studied how to internalize the externalities of environmental pollution caused by entities. However, in the internet age, the green innovation behavior of enterprises is affected not only by existing factors but also by the Internet. On the one hand, internet infrastructure changes the way information flows in many aspects of society, which encourages and regulates the green innovation behavior of enterprises. On the other hand, expanding internet infrastructure promotes the rapid development and extensive application of information technology. The combination of information technology and green business will produce new technologies, products, industries, models, and business forms in the green field. Therefore, the question being addressed is whether the internet infrastructure stimulates the green innovation of enterprises and what are the channels behind it.

Figure 1.

Growth trend of China’s internet infrastructure and users.

This paper used the Broadband China strategy as a quasi-natural experiment, evaluated the impact of internet infrastructure construction on enterprise green innovation, and analyzed the transmission paths and heterogeneity of the impact. The main contributions of this paper are reflected in the following three aspects. First, internet infrastructure construction was included in the green innovation research framework in the context of internet development and green innovation. This paper enriches the research in the fields of green innovation and infrastructure construction and provides reliable empirical evidence for internet infrastructure construction to promote green innovation. Second, different from previous research on the single mechanism of R&D investment, this paper systematically analyzed the transmission paths from both information technologies and information flow transmission, tested by four paths: informatization degree, financing constraints, human capital, and internet media reports. Third, this paper provides a comprehensive analysis of the heterogeneous impacts of internet infrastructure construction on enterprise green innovation based on the attributes of enterprises, industries, and regions.

The remainder of the paper is arranged as follows: Section 2 presents the literature review, Section 3 presents the theoretical analysis and research hypotheses, Section 4 describes the methodology and data, Section 5 reports and discusses the empirical results, and Section 6 summarizes the conclusions and policy implications and further discusses the research limitations and future directions.

2. Literature Review

2.1. Economic Effect of Internet Infrastructure Construction

The Internet has attracted the attention of scholars because of its externalities and spillovers and its capacity to rapidly amplify the spread of information. By searching through and analyzing the literature, it was found that the existing studies focus on the impacts of internet infrastructure construction on economic growth [15,16,17,18,19], green economy [20,21], and changes in management models [22], etc. A few works have examined the effects of internet infrastructure on productivity using microdata, suggesting that internet infrastructure construction promotes information development, reallocation efficiency, and innovation and reduces the transaction cost, thus increasing productivity [23].

Scholars have not reached a consensus on the innovative effect of the Internet. Some studies have found a positive impact of internet infrastructure construction on innovation from the macro perspective. For example, Zhang and Fu, using prefecture-level data and treating Broadband China as a quasi-natural experiment, it was found an innovation-driven effect of internet infrastructure construction [24]. Zhong, Gao, and Qin evaluated the impact of internet infrastructure construction on inter-urban cooperative innovation, found that Broadband China has significantly promoted such innovation [25]. Ren et al. constructed indicators of the digital economy containing internet infrastructure development, which were found to have a positive impact on technological progress and, thus, on inclusive green growth [21]. Zhong et al. took technological innovation as one of the paths between internet infrastructure construction and urban eco-efficiency and found a positive effect of this path on eco-efficiency [26].

Additionally, some studies have examined the positive innovative effects of the Internet from the micro perspective. For example, Xue, Meng, and He used the Broadband China strategy as a quasi-natural experiment and the data of listed companies for empirical analysis [27]. It was found that a developed internet infrastructure can promote not only the diffusion of companies’ technical knowledge to their internal subsidiaries but also technical cooperation with other external companies. Tang et al., using firm-level data from 2008 to 2018, found that telecommunications infrastructure promotes green technology innovation, which was also examined using macro data [28]. Wei and Sun used survey data of 334 manufacturing firms in China for analysis and found that the digital influence of internet infrastructure promotes green process innovation, the positive effect is strengthened by horizontal information sharing and technological modularization but weakened by vertical bottom-up learning [29]. Li and Shen, using the data of China’s listed companies to investigate the impact of corporate digitalization measured by regional internet infrastructure construction on corporate green innovation, found that corporate digitalization can boost green innovation, especially for enterprises with lower corporate internal control and institutional ownership [30].

However, some scholars argue that developing the internet infrastructure will not lead to an improvement in enterprise innovation. As competition increases, higher requirements are placed on enterprises to invest in green innovation. The use of internet infrastructure may lead to the reduced efficiency of enterprises in acquiring external knowledge and technology, which may have a negative impact on innovation, especially when the innovation absorption capacity of enterprises is weak [31]. Moreover, some research points out that small- and medium-sized enterprises (SMEs) may not benefit from the digital economy. For instance, Neirotti and Paolo found that SMEs rarely take advantage of their ICT-based innovation to start high-growth projects [32].

In terms of research methods, some studies have adopted single indicators or calculated indexes to measure the level of regional internet development. For example, Ren et al. constructed an index of the digital economy containing internet infrastructure development and found its positive effects on inclusive green growth [21]. In this case, internet infrastructure directly or indirectly affects green growth. In turn, green growth may also impose higher requirements on improving internet infrastructure, affecting whether a city constructs internet infrastructure [28]. The reverse causality typically makes it difficult to identify the net effect, so a better system is required to evaluate the impact of internet infrastructure on corporate innovation. The DID method provides new insights for solving the endogenous problems. For example, Zhang, Tao, and Nie used the Broadband China strategy as an exogenous shock, investigated the effect of broadband infrastructure on firm productivity [23]. The potential endogeneity is mitigated by the fact that the cities selected for the “Broadband China” strategy and the timing of selection were determined by the central government, which is exogenous to firm productivity. Furthermore, instrumental variables were used to alleviate concerns about other potential confounding factors affecting the selection of the pilot area [26,28].

2.2. Determinants of Corporate Green Innovation

Green innovation, also known as environmental innovation, ecological innovation, and sustainable innovation, has the dual externalities of economy and environment. Green innovation can reduce the generation of pollutants [5] and improve environmental performance and competitive advantage [4].

Regarding the determinants of corporate green innovation, existing works indicate that it is driven by internal factors, such as R&D investment [33], corporate profitability [34], executive background [35], and external factors, such as environmental regulations [36], public media coverage [34], and government R&D subsidies [1]. The research on internal factors focuses on the impact of R&D investment on the green innovation of enterprises. For instance, Zhang and Jin used firm-level data in China to examine the relationship between R&D expenditure and green innovation and found that R&D expenditure significantly drives green innovation, as measured by green patents [33]. Studies on external factors based primarily on stakeholder and institutional theories suggest that appropriate regulations and environmental requirements are the main factors influencing the green innovation. For example, Hu, Wang, and Wang found that as an important tool of environmental regulation, the green credit policy has a positive and significant effect on the green patent of heavily polluting enterprises [36]. In addition, financing constraints are shown to have an important effect on green innovation. Scholars have found a mediating role of financing constraints in digital finance and green innovation. For example, Lin and Ma found that digital finance indirectly improves green innovation, mainly by alleviating financing constraints [37]. Xue and Zhang took China A-shares listed companies in heavy polluting industries as samples and found that digital financial promotes the green innovation of enterprises by alleviating corporate financing constraints [38].

Studies on the determinants of green innovation have yielded fruitful results. However, the existing literature on the green innovation of enterprises principally focuses on institutional and stakeholder theories, with few studies focusing on the role of the Internet and considering the impact of the Broadband China strategy. The path by which internet infrastructure affects green innovation remains unclear. The Internet occupies an increasingly important place in the production and operation of enterprises, but there is limited micro-empirical research on the impacts of internet infrastructure. Globally, the Internet is triggering a new wave of technological innovation. Countries around the world consider the development of broadband networks as a priority action in order to gain international economic, technological, and industrial competitive advantages in the Internet age. We should pay attention to the profound changes brought by the advent of the Internet and assess the possible economic consequences, which could help us better take advantage of opportunities for future development.

3. Theoretical Analysis and Research Hypotheses

3.1. Internet Infrastructure Construction and Corporate Green Innovation

Internet infrastructure can directly affect green innovation. Theoretically, the transmission of information boosts the generation of new technologies and the dissemination of existing technologies [39]. The Internet connects the economic activities of different regions and enterprises into a whole, breaking spatial limitations in a new way of transmitting information, thus promoting explosive growth in the generation of green innovation technologies. Green innovation can usually be classified as high or low quality according to the patent type, and the quality directly determines the value of the patent. As the promoting role of information flow in green innovation does not distinguish quality and type, we believe that internet infrastructure can directly affect both high- and low-quality green innovation.

Given this, Hypothesis 1 was formulated.

Hypothesis 1a (H1a).

Internet infrastructure construction contributes to improving corporate green innovation.

Hypothesis 1b (H1b).

Internet infrastructure construction helps to improve high-quality corporate green innovation.

Hypothesis 1c (H1c).

Internet infrastructure construction helps to improve low-quality corporate green innovation.

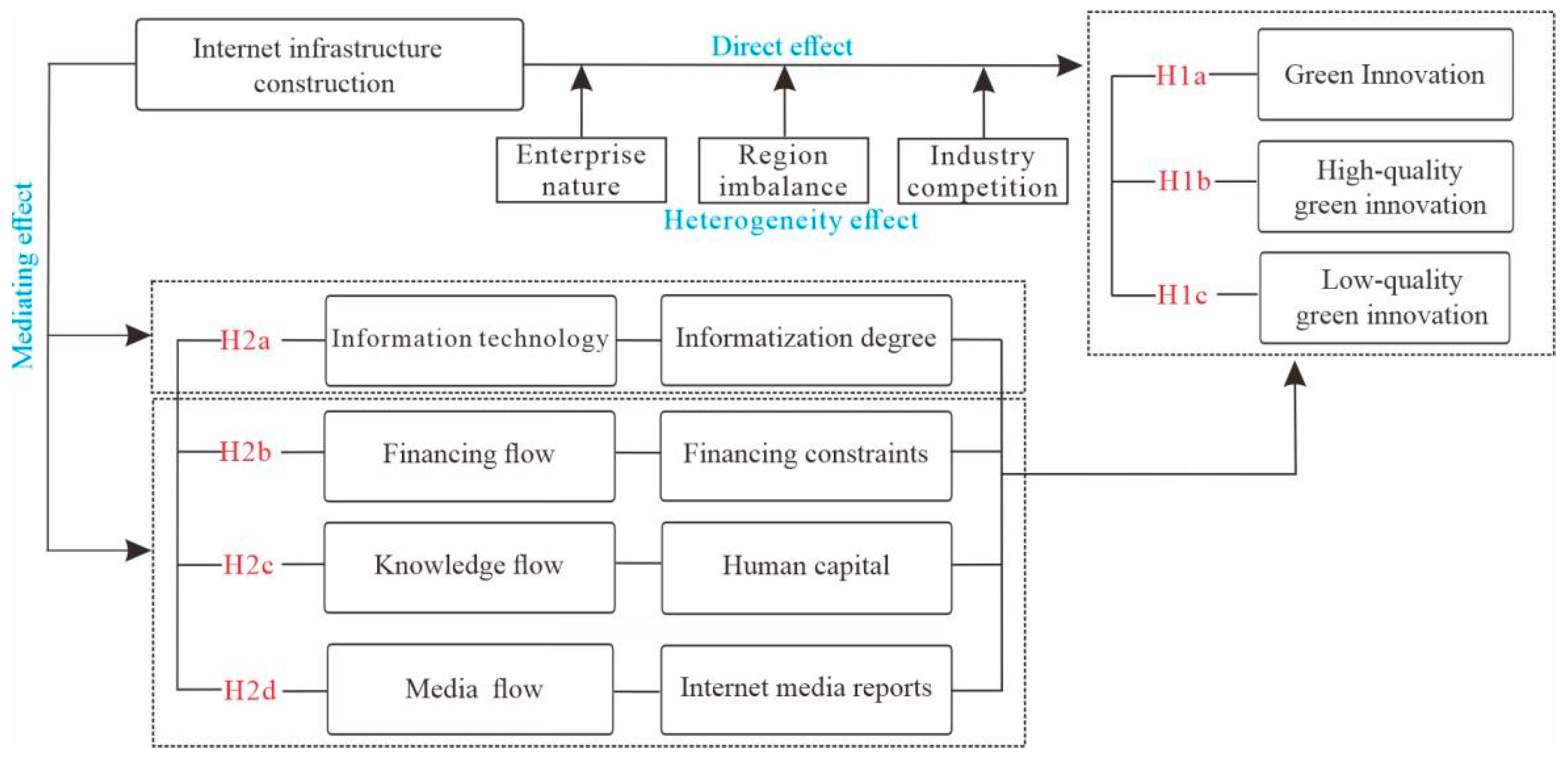

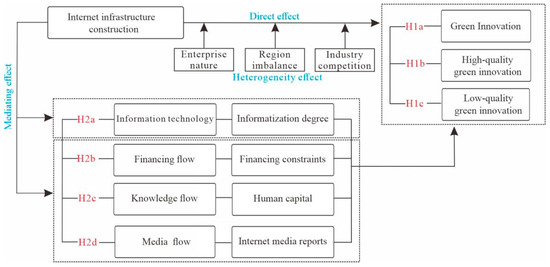

In addition, enterprises are reestablishing their business models to gain a place in the new wave [40]. For instance, the expanded scale of China’s internet infrastructure induces the rapid development of information technology. Enterprises begin to apply many types of information technology in production, operation, and management, enabling a new green form of coordination and efficiency [41]. In other respects, internet infrastructure also promotes and regulates the green innovation activities of enterprises through improving the flow of financing, knowledge, and media information. The rapid development of internet infrastructure can boost green innovation in direct and indirect ways, as shown in Figure 2.

Figure 2.

Conceptual diagram showing the direct and mediating effects of internet infrastructure on corporate green innovation in theoretical analysis and research hypotheses.

3.2. The Mechanism of Internet Infrastructure Construction Affecting Green Innovation

3.2.1. Informatization Degree

From the macro perspective, the most significant changes brought by internet infrastructure construction are improved broadband scale, penetration, capacity, and application, which together are necessary conditions for the generation and application of information technology [23]. From the micro perspective, internet infrastructure construction is intended to improve the operating environment of information technology and further apply such technology in corporate green activities.

Information technology is a product of internet infrastructure construction. As the most important information infrastructure in modern society, the Internet supports the development of high-tech industries, such as artificial intelligence, cloud computing, and big data. Restrained by the maximum speed and stability of broadband, such high technology faces limitations in performance. Taking cloud computing as an example, in a low-quality internet environment, cloud computing mostly faces latency and bandwidth problems. In contrast, these problems are solved under stable, high-speed operating environments. Therefore, the development and value realization of information technology largely depends on the operating environment created by internet infrastructure.

The use of information technology directly affects enterprise green innovation. For example, an intelligent monitoring system, which is an advanced application based on technologies including digital information technology, data integration, and data management, can monitor resource utilization, energy management, and pollution emissions in the production process [42]. Big data and machine learning models can also monitor the use and allocation of funds within a company to reduce green innovation risks [43,44]. At present, some countries have proposed using the new generation of information technology to empower green and low-carbon development, which promotes green technology, products, industries, models, and business forms. The integration of information technology and green innovation will be more reflected in the whole process of future corporate activities. Based on this, we believe that internet infrastructure construction positively impacts green innovation activities by improving the informatization degree of enterprises.

Hypothesis 2a (H2a).

The positive effect of Internet infrastructure construction on corporate green innovation is due to the improved degree of informatization.

3.2.2. Financing Constraints

The informational opacity in financial markets leads to difficulty with external financing for enterprises [45,46]. The Internet reduces corporate financing constraints by providing convenient financing information transmission services, ultimately supporting the green innovation activities of enterprises. First, the construction of internet infrastructure enables information to be transmitted without obstacles, changing the traditional path of corporate financing. Traditional offline financing has gradually been replaced by the new pattern of internet financing. Enterprises can use the Internet to search for a wider range of appropriate suppliers of funds. They can even accept funds from small-scale investors, who are the wider long-tail group in financial markets, greatly broadening financing sources [47]. Moreover, the Internet saves time and costs on information transmission, which further reduces corporate financing constraints [44]. Finally, the Internet creates the possibility to store massive amounts of information, which is of great help in the effective allocation of funds. It can be inferred that internet infrastructure construction increases the amount of financing and the speed of financing flow; that is, it promotes the transmission of financial information, thus reducing the financing constraints of enterprises.

Due to the particularity of green innovation activities, enterprises often require financial support in the form of external financing [37]. Therefore, financing constraints have long been regarded as an important factor restricting enterprise green innovation. Improving internet infrastructure construction provides a new way for green technology projects to escape the financing dilemma. Based on this, we believe that internet infrastructure construction solves the problem of corporate financing constraints, thus promoting green innovation as a whole.

Hypothesis 2b (H2b).

The positive effect of internet infrastructure construction on corporate green innovation is due to the reduction of financing constraints.

3.2.3. Human Capital

The Internet has changed the traditional way of acquiring knowledge, boosting corporate human capital by providing a more efficient, convenient, and cost-effective learning approach, thus promoting green innovation activities. First, internet infrastructure construction accelerates the transmission efficiency and expands the spread of the knowledge flow, enabling a wider range of people to enjoy convenient and efficient information services. Workers can make more convenient use of the Internet to communicate with and learn from one another, so as to accumulate knowledge [8]. Next, according to the theory of economic informatics, the marginal cost of replicating information within the network is usually very low. Compared with the traditional face-to-face or book-reading learning methods, the Internet can greatly save learning costs for workers. Finally, the Internet helps to improve workers’ initiative to acquire and share knowledge to further improve the level of human capital. The above three aspects all accelerate the process of learning by doing and contribute to the improvement of enterprise human capital.

High-quality human capital is the driving force of enterprise innovation. The participation of well-educated workers in production, operation, and management will generate direct technology spillovers, ultimately improving the green innovation output of enterprises. Based on this, we believe that internet infrastructure construction will impact the human capital of enterprises and then promote green innovation.

Hypothesis 2c (H2c).

The positive effect of internet infrastructure construction on corporate green innovation is due to the improvement of human capital.

3.2.4. Internet Media Reports

Internet infrastructure construction helps to change the way media information is transmitted. Internet media is a product of internet infrastructure construction. With the extensive popularization of the Internet, the number of users has increased, and the online space is becoming the mainstream public opinion domain. Internet media, as a disseminator of information online, can shape and guide people’s opinions on enterprises and plays an irreplaceable role in their reputation [48].

Compared with traditional media, internet media has the advantages of fast speed, low cost, and rich user interaction, which are more likely to lead to intervention by the relevant regulatory authorities. Therefore, internet media reports can force enterprises to take the corresponding environmental governance measures under the pressure of public opinion [13] and promote the willingness to carry out green innovation [28]. In addition, polluting behaviors by enterprises can feed back to the capital market through internet media, triggering reputational penalties, brand damage, and even a negative influence on stock prices [2]. Under such a reputation threat, enterprises will actively seek green transformation and deliver positive information to the public to recover their reputation. Based on this, we believe that internet infrastructure construction affects the green innovation behavior of enterprises by enhancing the influence of online media reports.

Hypothesis 2d (H2d).

The positive effect of internet infrastructure construction on corporate green innovation is due to the improvement of internet media reports.

4. Methodology and Data

4.1. Background

Since China first provided internet access to the public in 1994, its construction has experienced remarkable progress in terms of the user penetration rate, internet service price, and uploading and downloading speeds, but shortcomings such as slow speeds and regional imbalance are still obvious. To further promote internet infrastructure construction, China successively approved three batches of Broadband China cities in 2014, 2015, and 2016, which are identified in Table A1. Broadband China is a national strategy that was divided into three stages of development: the comprehensive acceleration stage (2012–2013), the popularization stage (2014–2015), and the optimization and upgrade stage (2016–2020), with goals in four aspects of user scale, penetration degree, network capability, and information application. The development goals and timetable of stages are shown in Table A2. Broadband China has brought new opportunities for enterprises to gain green competitive advantages in the internet age. In this paper, we studied whether the internet infrastructure construction represented by the Broadband China strategy stimulates corporate green innovation and the channel behind it.

4.2. Data and Variables

Dependent variable (GreenPatent): The existing research measured corporate innovation from two aspects: R&D and patent data. As part of the inputs to production activity, R&D cannot directly explain innovation outcomes. In contrast, patent data can show a more micro and direct view of corporate innovation outcomes. Referring to the research of Hu, Wang, and Wang [36], we measured corporate green innovation from the perspective of innovation outcomes, expressed as the number of green patent applications of the company. The selection of green patents was based on the International Patent Classification Green Inventory issued by the WIPO in 2010. Since design patents do not use the patent classification, this paper only considered invention and utility model patents. Additionally, invention patents can be used to measure the quality of enterprise innovation due to the fact of their attribute of higher innovativeness. This paper further distinguished high-quality (GreenInvPatent) and low-quality (GreenUtiPatent) green innovation, measured by the number of inventions and utility model patent applications, respectively.

Independent variable (DID): In this paper, we regarded the Broadband China strategy as a quasi-natural experiment and constructed the indicator variable DID for it. If the registered city of the listed company was included on the list of Broadband China demonstration cities and implemented the strategy, the company was regarded as part of the treatment group and assigned a value of 1. Otherwise, the value was 0.

Mediating variables: The mediating variables were selected as follows:

① Informatization degree (Informatization): Referring to Li and Shen [30], we carried out text analyses of annual reports to evaluate the degree of corporate informatization. Specifically, our dictionary of corporate informatization contained five dimensions: information and digital technology, cloud computing, artificial intelligence, big data, and the Internet, representing the company’s development level of information technology. The number of occurrences of keywords in each annual report was counted as an indicator of the corporate informatization degree.

② Financing constraints (Finance): Since the KZ and WW indices are constructed based on endogenous variables, in this paper we selected the SA index without the endogeneity problem proposed by Hadlock and Pierce to measure financing constraints [49]. The SA index has better applicability when determining financing constraints of listed companies in China.

③ Human capital (Human): We measured human capital by the percentage of employees with a bachelor’s degree.

④ Internet media reports (InternetMedia): We measured internet media reports by the total number of annual reports on internet media. The internet media reports came from more than 400 important online media companies and more than 400 other large websites, industry websites, or local websites. The scope of the news included individual stock news, macroeconomy reports, industry reports, etc. The data were collected using data cleaning, expert judgment, and artificial intelligence technologies, addressing the problem of incomplete data and selective bias caused by manual collection in previous studies.

Control variables (Controls): Referring to the research of Li and Shen [30], in this paper we controlled for the influencing factors of corporate green innovation at both the firm and city level. The firm-level control variables included firm size (Size), firm age (Age), largest shareholder (Shareholder), cash flow (Cash), and R&D investment (R&D). The city-level control variables included economic development level (Gdppc), foreign capital (Fdi), industrial structure (Ind), science and technology fiscal expenditure (Gfe), and regional human capital level (Hc). The statistical descriptions of the variables are shown in Table 1. The details of the variable definitions are provided in Table A3.

Table 1.

Statistical description of the main variables.

This paper used city-level data and firm-level data from A-share companies listed on the Shanghai and Shenzhen stock markets as the research sample. The patent data of the listed companies were from the State Intellectual Property Office of the People’s Republic of China, and the other financial data were obtained from the China Stock Market and Accounting Research Database (CSMAR). The data on the informatization and human capital were extracted from the annual reports of listed companies. The annual reports were obtained from the Shanghai and Shenzhen Stock Exchanges. The data on the internet media reports were obtained from the Chinese Research Data Services (CNRDS). The city-level data came from the China City Statistical Yearbook. The list of Broadband China pilot cities was obtained from the Ministry of Industry and Information Technology of China. The samples of enterprises in the demonstration cities were identified by comparing the registration city with the list of Broadband China pilot cities. We excluded companies specially processed that year and observations with incomplete data. Given the particularity of the financial industry in terms of business model and financial statement requirements, we also excluded it from the sample. Unbalanced panel data were obtained for 2414 companies from 2009 to 2019, with a total of 18,941 observations. To limit the influence of outliers, all continuous variables were winsorized at the upper and lower 1% levels. The descriptive statistics of the main variables are presented in Table 1.

4.3. Econometric Model

In this paper, we treated the Broadband China pilot project as a quasi-natural experiment to evaluate the impact of internet infrastructure construction on corporate green innovation. Since the Broadband China demonstration cities were launched in three batches in 2014, 2015, and 2016, we estimated the policy effect using the time-varying DID model proposed by Beck, Levine, and Levkov [50]. The baseline model was as follows:

where the dependent variable (GreenPatenti,t) represents corporate green innovation, measured by the number of green patent applications. The core independent variable (DIDi,t) is the dummy indicator for Broadband China. The coefficient of interest is β, which captures the direct effect of the strategy on corporate green innovation. ∑Controlsi,t is the set of control variables that may affect corporate green innovation. vt is a time effect common to all companies in period t, μi is a time-invariant effect unique to company i, and εi,t is an error term independent of μi and vt.

The premise of the DID estimation method in this study was to meet the parallel trend hypothesis; that is, the regression coefficients in Broadband China pilot cities and non-pilot cities had similar time trends before the policy implementation. According to the event research method of Jacobson et al. [51], Model (2) was set as follows:

where Dcity,t+k is a set of dummy indicator variables, representing the kth year after the company’s city was included in the Broadband China pilot list. The coefficient βk reflects the difference in the number of green patent applications between the treatment and control groups in the kth year. The value range of k was [−5,4].

To explore the channel of Broadband China affecting green innovation discussed in the foregoing theoretical analysis, we constructed mediating effect Models (3) and (4) based on Model (1). The models were set as follows:

where Mi,t represents the mediating variables, including informatization degree (Informatization), financing constraints (Finance), human capital (Human), and internet media reports (InternetMedia). Coefficient δ in Model (3) represents the impact of Broadband China on the mediating variable. If coefficients δ and γ are both significant, the mediator is the transmission path of Broadband China affecting green innovation. The setting of the remaining variables was consistent with Model (1).

5. Empirical Results

5.1. Baseline Results

The baseline regression results are shown in Table 2. Columns 1, 3, and 5 list the results without control variables, columns 2, 4, and 6 list the results with control variables included. After adding the control variables, the coefficient of the policy variable (DID) on enterprise green innovation (GreenPatent) was 0.1210, which was significant at the 1% level, indicating that the Broadband China strategy is conducive to promoting the green innovation output of enterprises, verifying H1a.

Table 2.

Impacts of internet infrastructure construction on green innovation: baseline results.

Then, we segregated innovation outcomes into high-quality (GreenInvPatent) and low-quality (GreenUtiPatent) green innovation. As can be seen from columns 3–6, the coefficients of DID for green innovation were both significantly positive at 1%. Specifically, the implementation of Broadband China led to an 8.95% ((exp(0.0857)−1) × 100%) and 10.96% ((exp(0.1040)−1) × 100%) increase in the number of green invention and utility model patent applications by companies in pilot cities, corresponding to the sample mean of columns 4 and 6, respectively. These results verify H1b and H1c.

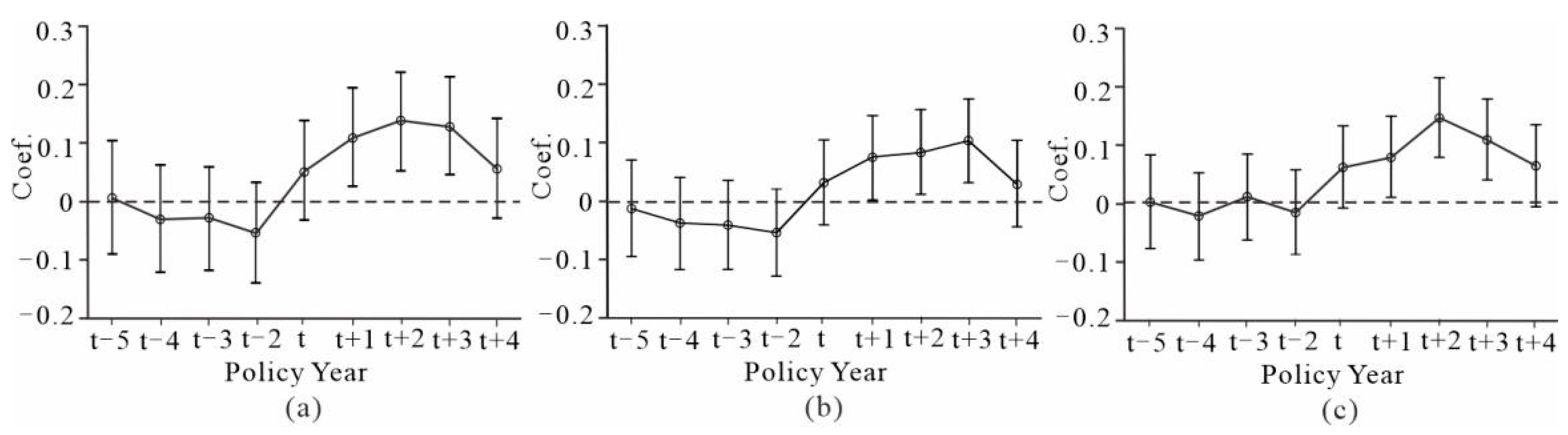

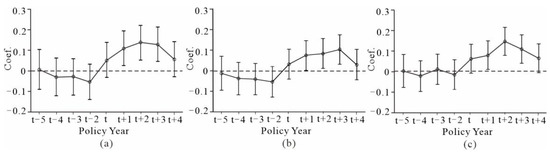

5.2. Tests for Parallel Trends

Figure 3 shows the results of the dynamic effect with GreenPatent, GreenInvPatent, and GreenUtiPatent as the explained variables. The figure plots the estimates and the 95% confidence intervals of the coefficients in the event study regressions.

Figure 3.

Tests for parallel trends: (a) GreenPatent; (b) GreenInvPatent; (c) GreenUtiPatent.

As shown in Figure 1, βk fluctuated around 0 before Broadband China was implemented (k < 0), with no significant differences between the two groups. In the year when the policy was implemented (k = 0), β0 failed to pass the 5% significance test. After that (k > 0), βk began to emerge, satisfying the hypothesis of parallel trends. We found that there was a one-year lag for the impact of Broadband China on green innovation, because technological innovation is a time-consuming process. Furthermore, the dynamic effect of the strategy was not continuously significant. In the fourth year after implementation, there was a decline in βk for the three dependent variables, indicating that internet infrastructure construction has diminishing marginal impact on the green innovation of enterprises over time.

5.3. Robustness Test

5.3.1. PSM-DID Estimation

To address the endogeneity concern due to the fact of sample selection bias, we adopted the PSM-DID method to re-examine the baseline results. The steps were as follows: First, we selected corporate characteristics, including firm size (Size), firm age (Age), largest shareholder (Shareholder), cash flow (Cash), and R&D investment (R&D), as matching variables. Then, we estimated the tendency score value by the logit model and performed PSM based on nearest neighbor matching. Finally, the DID estimators were applied to the matched samples. According to the results in Table 3, the regression coefficient of the policy variable (DID) was significant at the 1% level. The unmatched and matched samples yielded similar results, verifying the robustness of our results.

Table 3.

Robustness check: PSM-DID test results.

5.3.2. IV Estimation

Although the pilot cities were selected randomly, concerns still existed regarding the other potential confounding factors affecting the selection of the pilot city. To further address the problem of policy endogeneity, we adopted the instrumental variable approach to correct the possible bias.

We chose the terrain slope as the instrumental variable of the Broadband China strategy, which meets both relevance and exogeneity conditions. On the one hand, the difficulty degree of internet infrastructure construction is directly influenced by the terrain slope. The greater the slope of the terrain, the more difficult it is to construct internet infrastructure. More importantly, increased terrain slope also induces the instability of internet signals. On the other hand, as a natural geographic variable of cities, terrain slope does not directly affect the green innovation of enterprises but only the green innovation output by improving internet infrastructure construction.

The regression results of the instrumental variable are reported in Table 4. The coefficient of TerrainSlope in the first stage was significantly negative at 1%, indicating a negative relationship with Broadband China, which is consistent with our theoretical analysis. Moreover, the F value, Kleibergen–Paap rk and Cragg-Donald Wald F statistics of the first stage were all greater than 10, which rejects the null hypothesis of weak instruments. The coefficient of prob(DID) in the second stage shows the same direction and significance as the baseline regression results, further proving the robustness of our result showing that internet infrastructure construction promotes green innovation.

Table 4.

Robustness check: IV test results.

5.3.3. Other Robustness Tests

To ensure the reliability of the results, we conducted an additional series of robustness tests.

(1) Replacing the measuring method of the independent variable. Although the number of enterprise green patents measures green innovation output accurately, there is still a concern that other unobservable factors will influence the estimated results of the policy on green innovation, such as subsidy policies. According to the solution proposed by Popp [52], we remeasured green innovation with the ratio of green patents to all patent applications by the company in the same year. The results are shown in Table 5, columns 1–3. The coefficients of the Broadband China strategy on enterprise green innovation were all significantly positive. It is worth noting that the coefficient for the significance of the strategy on high-quality green innovation (GreenInvPatent’) was lower than that of the baseline result. After excluding the influence of other unobservable factors on patent applications, the policy effect was mainly reflected in an increased proportion of green utility model patent applications.

Table 5.

Robustness check: replacing dependent variable, removing endogenous samples, and controlling low-carbon city pilot policy.

(2) Excluding samples of enterprises registered in municipalities. Given the obvious political and economic disparities between municipalities and other prefecture-level cities, in this paper we excluded the samples of listed companies registered in Beijing, Shanghai, Tianjin, and Chongqing and then retested the impacts. The results are given in Table 5, columns 4–6, which show a slight change in the coefficient of policy variable (DID) after excluding the sample of enterprises registered in municipalities, verifying the robustness of our result.

(3) Excluding interference from the low-carbon city (LCC) pilot policy. Ma et al. studied the green transformation of enterprises and found that the LCC policy, issued in 2010, was conducive to the green innovation of enterprises [53]. The implementation time of this policy was within the time interval of our study. To accurately identify the policy effects of the Broadband China strategy, we introduced the policy variable LCC, representing the low-carbon city pilot policy as a control variable in Model (1). The result is shown in Table 5, columns 7–9. After controlling the influence of the low-carbon city pilot policy, the coefficient of the policy variable (DID) slightly decreased but was still significantly positive, which further confirms the robustness of our result.

5.4. Transmission Path Analysis

5.4.1. Informatization Degree

The regression results of informatization degree as the transmission mechanism are shown in Table 6. In column 1, the coefficient of DID is 9.0562 and significant at the 1% level, indicating that internet infrastructure construction was conducive to improving the degree of enterprise informatization. In columns 2–4, the regression coefficients of DID and informatization degree (Informatization) were positive. The coefficient of the policy variable was relatively smaller than the benchmark regression results when Informatization was included in the model, suggesting that the Broadband China strategy may have a partial mediation effect on green innovation by increasing the human capital of enterprises. The Sobel test results confirm the existence of this mediating effect (GreenPatent: z = 9.632, p = 0.000; GreenInvPatent: z = 11.23, p = 0.000; GreenUtiPatent: z = 2.999, p = 0.003). This transmission path works as follows: Broadband China encourages the utilization of information technologies, and the combination of information technology and green business promotes green innovation.

Table 6.

Channels through which internet infrastructure construction affects local corporate green innovation: informatization degree.

5.4.2. Financing Constraints

Table 7 gives the transmission path of financing constraints between internet infrastructure construction and green innovation. In column 1, the coefficient of DID is −0.0037 and significant at the 5% level, suggesting that internet infrastructure construction reduces corporate financing constraints. In columns 2–4, the coefficient of DID is slightly lower compared to the baseline results. Meanwhile, the coefficient of Finance was significantly negative at the 1% level, indicating that financing constraints act as a mediator between internet infrastructure construction and corporate green innovation. These results show that financing constraints serve as a crucial link between the Internet and corporate green innovation. The mediation effect passed the Sobel’s test (GreenPatent: z = −7.993, p = 0.000; GreenInvPatent: z = −8.676, p = 0.000; GreenUtiPatent: z = −8.123, p = 0.000). Our explanation for this transmission mechanism is that the construction of internet infrastructure fosters the transmission of financing information, which reduces the financing constraints, thus promoting green innovation.

Table 7.

Channels through which internet infrastructure construction affects local corporate green innovation: financing constraints.

5.4.3. Human Capital

Table 8 provides the estimated results for human capital as the mediating variable. The results show that the coefficient of DID was 0.6625 and significant at the 1% level. As shown in Table 8, columns 2–4, the coefficients of human capital and DID were positive. All mediation mechanisms passed the Sobel test (GreenPatent: z = 4.131, p = 0.000; GreenInvPatent: z = 4.192, p = 0.000; GreenUtiPatent: z = 3.45, p = 0.001), indicating that the policy can enhance corporate green innovation output by promoting the positive mediating effect of human capital. A possible reason for this result is that internet infrastructure construction promotes the transmission of knowledge and increases the human capital of enterprises, thus promoting green innovation.

Table 8.

Channels through which internet infrastructure construction affects local corporate green innovation: human capital.

5.4.4. Internet Media Reports

Table 9 estimates internet media reports as the mediating variable. We found that the regression coefficient of DID on green innovation was significantly positive at the 1% level. This shows that the construction of internet infrastructure promotes internet media reports. The impact coefficients of DID and InternetMedia were both positive at the 1% significance level, suggesting that the Broadband China strategy can indirectly boost green innovation by driving internet media reports. All mediation effects pass the Sobel test (GreenPatent: z = 3.022, p = 0.003; GreenInvPatent: z = 3.041, p = 0.002; GreenUtiPatent: z = 3.003, p = 0.003). The logic of this mechanism is that internet infrastructure construction helps to change the way media information is transmitted. With the extensive popularization of the Internet, media reports have become the main public opinion platform, guiding enterprises to fulfill their environmental responsibilities and promoting green innovation.

Table 9.

Channels through which internet infrastructure construction affects local corporate green innovation: internet media reports.

The above regression results of the transmission paths verify Hypothesis 2.

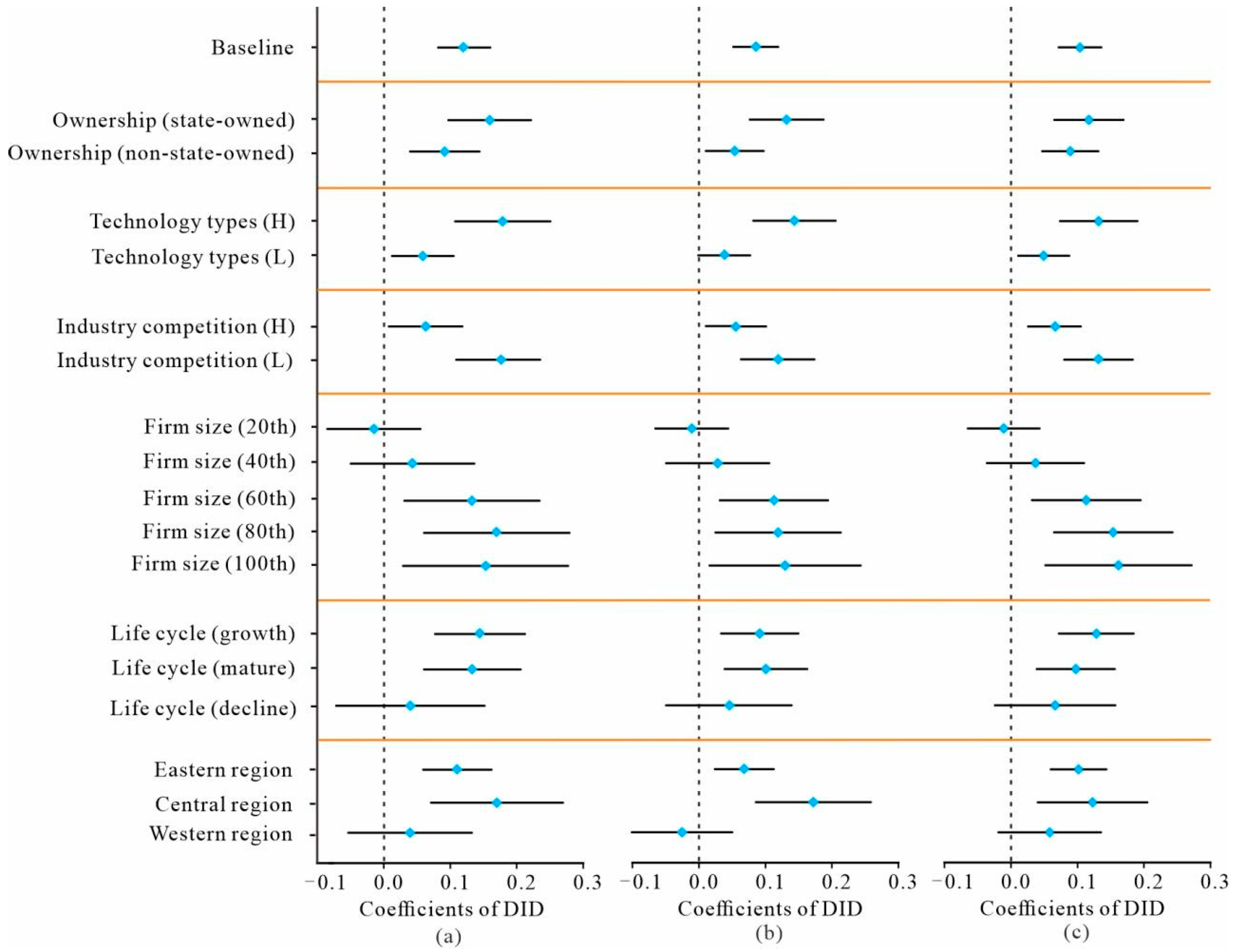

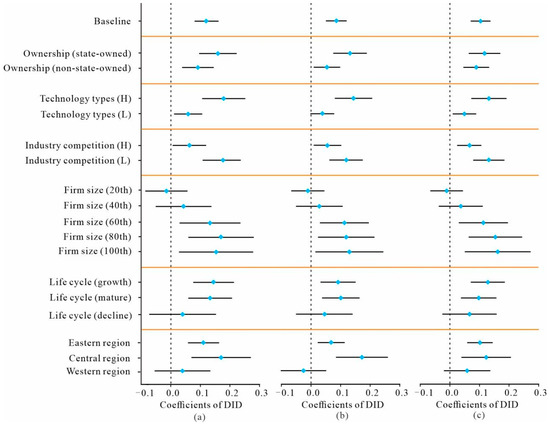

5.5. Heterogeneity Result

Given the differences in terms of the nature of enterprises, industry competition, and the imbalance of regional factor endowment, the Broadband China strategy may have varying impacts on green innovation among regions or enterprise types. The following heterogeneity analysis was conducted based on ownership, technology type, industry competition, firm size, life cycle stage, and region where the listed company was registered. The heterogeneity result is shown in Figure 4, and the results of the analysis are presented in the discussion below.

Figure 4.

Heterogeneity analysis results: (a) GreenPatent; (b) GreenInvPatent; (c) GreenUtiPatent. Blue diamonds indicate coefficients, and black lines show the 95% confidence intervals. Each row corresponds to a regression using a corresponding subsample based on model (1). Dashed, orange lines divide the heterogeneity analysis into categories (from top to bottom): enterprise ownership, technology type, industry competition, firm size, life cycles, and registered region.

5.5.1. Heterogeneity of Enterprise Ownership

The obvious differences between state-owned and non-state-owned enterprises were reflected by the differences in financial support and government intervention, causing variations in the impact of internet infrastructure construction on green innovation. In this part, we tested the impact of the Broadband China strategy on the green innovation of enterprises with different ownership, and the results are reported in Table 10, columns 1 and 2. The result shows that Broadband China had a significantly positive impact on green innovation (GreenPatent) in both state-owned and non-state-owned enterprises, with a greater impact on the former. One possible reason is that non-state-owned enterprises are more likely to face technical obstacles when constructing internet infrastructure. Additionally, green transformation requires high up-front investment by enterprises, and non-state-owned enterprises are often restricted to green transformation due to the cost pressure. On the contrary, Chinese state-owned enterprises are mostly well-funded and take the social responsibilities of strongly responding to government policies and providing public goods. Currently, state-owned enterprises have made important progress in the industrial internet, artificial intelligence, and other internet-critical fields. Therefore, the policy effects of promoting green innovation are more pronounced on state-owned than non-state-owned enterprises.

Table 10.

Heterogeneous impacts of internet infrastructure construction on corporate green innovation based on ownership and technology type.

5.5.2. Heterogeneity of Technology Types

This section divides the sample into high- and low-tech enterprises according to the qualification identification of listed companies from CSMAR and discusses the impact of the Broadband China strategy on the green innovation of enterprises with different technology types, with the results reported in Table 10, columns 3 and 4. Broadband China increased the number of green patents of high-tech enterprises, with greater and more significant policy effects than non-high-tech enterprises. First, the profitability of high-tech enterprises was highly dependent on research and development, while that of low-tech enterprises depended more on sales performance and cost management. Therefore, high-tech enterprises were more willing to innovate. Second, from the perspective of innovation characteristics, high-tech enterprises tended to develop advanced technologies, and their innovation activities were highly technology intensive, with a large investment of capital and labor in R&D; thus, they benefited more from the Broadband China policy. In contrast, traditional industries were more inclined to adopt existing technologies, so they were relatively less affected by internet infrastructure construction.

5.5.3. Heterogeneity of Industry Competition

In this part, we divide the sample into high and low competition groups according to the degree of industry competition, measured by the Herfindahl–Hirschman index (HHI), and then discuss the heterogeneous impacts of the Broadband China strategy on green innovation in enterprises with different degrees of industry competition. The results are shown in Table 11. Broadband China positively impacted the green innovation of enterprises in the two groups and had a greater impact on enterprises with a lower degree of industry competition. Increased competition typically means reduced profits, which is an important source of funds for enterprise innovation behavior. Profits are generally low in highly competitive industries. On the contrary, enterprises in less competitive industries are typically monopolistic, rich in profits, and have sufficient and stable capital and resources for innovation investment; thus, the impact of internet infrastructure construction on these enterprises is greater compared to high competition industries.

Table 11.

Heterogeneous impacts of internet infrastructure construction on corporate green innovation based on the degree of industry competition.

5.5.4. Heterogeneity of Firm Size

In this part, we study the heterogeneity effect of internet infrastructure construction on green innovation based on firm size. The results are shown in Table 12. It can be seen from Table 11 that the promotion effects of internet infrastructure construction on green innovation varied based on firm size, which was significant in the sample group of 60% largest enterprises. Only when the size of the enterprise reaches a certain degree will the Broadband China policy promote the improvement of green innovation, which is consistent with the research of Neirotti and Paolo [32]. The impact of Broadband China on the green innovation of small-sized enterprises was not significant, because it was difficult for these enterprises to take advantage of ICT-based improvements to start green innovation in the short term.

Table 12.

Heterogeneous impacts of internet infrastructure construction on corporate green innovation based on size.

5.5.5. Heterogeneity of Enterprise Life Cycles

The full-sample study ignored the potential heterogeneity in the life cycle dimension, that is, the heterogeneity of the effects of the Broadband China policy on green innovation at different life-cycle stages. Referring to Dickinson [54], this paper classified enterprise life cycles in terms of cash flow patterns in operating, investing, and financing activities. The results of life-cycle heterogeneity are shown in Table 13. The sample was divided into three stages: growth, mature, and decline. In Table 13, columns 1 and 2, the regression coefficients of DID were positive and passed the significance test at 1%, which shows that Broadband China had a significant role in promoting the green innovation of enterprises in the growth and mature stages. Moreover, the increase in the green innovation of growth-stage enterprises was greater after the strategy was implemented. One possible reason is that growth-stage enterprises are strongly motivated to gain a competitive advantage in the industry, and green innovation is one of the best choices to achieve this goal. Thus, growth-stage enterprises respond faster to external shocks such as infrastructure construction and are more willing to make adjustments to external shocks than mature enterprises with stable profitability. The regression coefficients of DID on the green innovation of decline stage enterprises were positive but did not pass the significance test, and this was because these enterprises were losing their competitive advantage, which increased financing constraints and tightened cash flow, resulting in the small possibility that they could improve green innovation through the Broadband China strategy.

Table 13.

Heterogeneous impacts of internet infrastructure construction on corporate green innovation based on life cycle.

5.5.6. Regional Heterogeneity

In this part, we divide the samples into eastern, central, and western regions to test the regional heterogeneity effect of the Broadband China strategy on corporate green innovation. As can be seen from Table 14, Broadband China only had significant promotion effects on green innovation for enterprises in the eastern and central regions and had a stronger impact in the central region. Given the good development conditions, coupled with the welfare policy in the central region, upgrading the internet infrastructure under the Broadband China strategy became a key driver of the development in this region. In contrast, due to the natural advantage of its geographical location, internet infrastructure construction induced a small marginal effect on green innovation in the eastern region. The coefficient of DID failed to pass the significance test in the western region. Due to the low population density and poor development foundation, the western region failed to effectively use the improved internet infrastructure.

Table 14.

Heterogeneous impacts of internet infrastructure construction on corporate green innovation based on region.

6. Conclusions and Policy Implications

In this paper, we regarded the implementation of the Broadband China strategy as a quasi-natural experiment and empirically tested the policy effect, mechanism, and heterogeneity of internet infrastructure construction on corporate green innovation in China. We can draw the following conclusions in three aspects: First, the Broadband China strategy stimulated the green innovation of enterprises and had significant effects on promoting both high- and low-quality innovation. This conclusion remains valid after a series of robustness tests. In addition, the results of the dynamic effect show that there was a one-year lag period in the impact of Broadband China, and the policy effects disappeared in the fourth year after the strategy was implemented. Second, the informatization degree, financing constraints, human capital, and internet media reports were the transmission paths through which internet infrastructure construction affected corporate green innovation. Third, the results of the heterogeneity analysis showed that state-owned enterprises, high-tech enterprises, enterprises in high-competition industries, medium and large enterprises, enterprises in the growth and mature periods, and enterprises registered in the central and eastern regions experienced more obvious policy effects on corporate green innovation. Based on these findings, this paper proposes the following recommendations.

First, it was found that the Broadband China policy plays an important role in enhancing the green innovation of enterprises, providing a theoretical basis and empirical evidence for the green innovative effect of internet development. Based on this, we should firmly promote internet infrastructure construction and regard the strategy as a way to promote sustainable development. Broadband is one type of infrastructure construction, which is provided by the government. Specifically, the government should continue to expand the broadband user scale and penetration degree; enhance the capacity to access broadband; improve the scale of internet users; and support the development of emerging industries such as e-commerce. For enterprises, in a global environment with increasing economic uncertainties, they should be more active in seeking changes and innovation through integrating “Internet+” with the real economy as the primary strategy.

Second, we should explore the transmission paths of Broadband China and green innovation to maximize the positive effects of the strategy. Enterprises should be encouraged to apply information technologies to achieve green development. Moreover, new businesses, such as digital finance and internet media, should also be encouraged so as to reduce barriers to achieving green innovation. Finally, workers should effectively use the Internet to acquire knowledge and improve skills so as to better meet the needs of the internet age.

Third, internet infrastructure construction policies should be implemented considering the nature of the enterprise, for example, guiding state-owned enterprises to take the lead in constructing internet infrastructure; making more efforts to improve the internet infrastructure for high-tech and large-size enterprises and enterprises in the growth and mature periods; and incentive policies should be implemented for enterprises in the growth and mature stages. Conversely, there is no need for internet investments for enterprises in the decline stage. When formulating regional policies, the development characteristics and potentials among regions should be considered, giving full consideration to the role of internet infrastructure construction.

Given the data unavailability and space considerations, there are still some limitations in this study. For example, it lacks an exploration of the mutual influences among cities and enterprises. Future research should break through the data and further study green technology diffusion among cities and enterprises. In addition, the role of internet infrastructure construction in the total factor productivity and corporate social responsibility also deserves further study.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The author declares no conflict of interest.

Appendix A

Table A1.

Batches of Broadband China demonstration cities.

Table A1.

Batches of Broadband China demonstration cities.

| Batch | Year | List of Cities (City Groups) |

|---|---|---|

| First batch | 2014 | Beijing, Tianjin, Shanghai, Changsha-Zhuzhou-Xiangtan City Group, Shijiazhuang, Dalian, Benxi, Yanbian Korean Autonomous Prefecture, Harbin, Daqing, Nanjing, Suzhou, Zhenjiang, Kunshan, Jinhua, Wuhu, Anqing, Fuzhou, Xiamen, Quanzhou, Nanchang, Shangrao, Qingdao, Zibo, Weihai, Linyi, Zhengzhou, Luoyang, Wuhan, Guangzhou Shenzhen, Zhongshan, Chengdu, Panzhihua, Ngawa Tibetan and Qiang Autonomous Prefecture, Guiyang, Yinchuan, Wuzhong, and Alar |

| Second batch | 2015 | Taiyuan, Hohhot, Ordos, Anshan, Panjin, Baishan, Yangzhou, Jiaxing, Hefei, Tongling, Putian, Xinyu, Ganzhou, Dongying, Jining, Dezhou, Xinxiang, Yongcheng, Huangshi, Xiangyang, Yichang, Shiyan, Suizhou, Yueyang, Shantou, Meizhou, Dongguan Jiangjin District of Chongqing, Rongchang District of Chongqing, Mianyang, Neijiang, Yibin, Dazhou, Yuxi, Lanzhou, Zhangye, Guyuan, Zhongwei, and Karamay |

| Third batch | 2016 | Yangquan, Jinzhong, Wuhai, Baotou, Tongliao, Shenyang, Mudanjiang, Wuxi, Taizhou, Nantong, Hangzhou, Suzhou, Huangshan, Maanshan, Ji’an, Yantai, Zaozhuang, Shangqiu, Jiaozuo, Nanyang, Ezhou, Hengyang, Yiyang, Yulin, Haikou, Jiulongpo, Beibei, Ya’an Luzhou, Nanchong, Zunyi, Wenshan Zhuang and Miao Autonomous Prefecture, Lhasa, Nyingchi, Weinan, Wuwei, Jiuquan, Tianshui, and Xining |

Table A2.

Development goals and timetable of the Broadband China strategy.

Table A2.

Development goals and timetable of the Broadband China strategy.

| Index | 2013 | 2015 | 2020 | |

|---|---|---|---|---|

| Broadband user scale | Fixed broadband access users (100 million households) | 2.1 | 2.7 | 4.0 |

| Fiber to the home (FTTH) users (100 million households) | 0.3 | 0.7 | - | |

| Urban broadband users (100 million households) | 1.6 | 2.0 | - | |

| Rural broadband users (100 million households) | 0.5 | 0.7 | - | |

| 3G, LTE users (100 million households) | 3.3 | 4.5 | 12 | |

| Broadband penetration degree | Fixed broadband household penetration rate (%) | 40 | 50 | 70 |

| Urban household penetration rate (%) | 55 | 65 | - | |

| Rural household penetration rate (%) | 20 | 30 | - | |

| 3G/LTE penetration rate (%) | 25 | 32.5 | 85 | |

| Broadband network capability | Urban broadband access capability (Mbps) | 20 ① | 20 | 50 |

| Developed cities broadband access capability (Mbps) | - | 100 ② | 1000 ③ | |

| Rural broadband access capability (Mbps) | 4 ④ | 4 | 12 | |

| Broadband access for large enterprises and institutions (Mbps) | - | <100 | <1000 | |

| Export of broadband for international internet (Gbps) | 2500 | 6500 | - | |

| 3G, LTE station scale (thousand) | 950 | 1200 | - | |

| Broadband information application | Number of internet users (100 million people) | 7.5 | 8.5 | 11.0 |

| Rural internet users (100 million people) | 1.8 | 2.0 | - | |

| Internet data volume (total bytes of web pages) (terabytes) | 7800 | 15000 | - | |

| E-commerce transaction volume (trillion yuan) | 10 | 18 | - |

Conditional goals: ① for 80% of broadband users; ② for parts of cities; ③ for parts of broadband users; ④ for 85% of broadband users.

Table A3.

Definition of the main variables.

Table A3.

Definition of the main variables.

| Variable | Symbol | Definition |

|---|---|---|

| Firm-Level Variables | ||

| Green innovation | GreenPatent | Natural logarithm of 1 plus aggregate number ofgreen patents filed in application |

| High-quality green innovation | GreenInvPatent | Natural logarithm of 1 plus aggregate number ofgreen invention patents filed in application |

| Low-quality green innovation | GreenUtiPatent | Natural logarithm of 1 plus aggregate number ofgreen utility model patents filed in application |

| Firm size | Size | Natural logarithm of total assets at fiscal year end |

| Firm age | Age | Natural logarithm of duration after registration |

| Largest shareholder | Shareholder | Percentage ownership of largest shareholder |

| Cash flow | Cash | Net cash flow from operations |

| R&D investment | R&D | Natural logarithm of total R&D investment |

| Informatization degree | Informatization | Number of occurrences of informatization keywords detected in each annual report |

| Financing constraints | Finance | Corporate SA index: SA = |−0.737 × size + 0.043 × size2−0.04 × age| |

| Human capital | Human | Percentage of employees with a bachelor’s degree |

| Internet media reports | InternetMedia | Number of internet media reports |

| City-Level Variables | ||

| Economic development level | Gdppc | Regional GDP per capita |

| Foreign capital | Fdi | Natural logarithm of foreign direct investment |

| Industrial structure | Ind | Ratio of added value of tertiary industry to secondary industry |

| Science and technology fiscal expenditure | Gfe | Ratio of science and technology expenditure to local government fiscal expenditure |

| Regional human capital level | Hc | Ratio of students at institutes of higher education to total population |

References

- Bai, Y.; Song, S.; Jiao, J.; Yang, R. The impacts of government R&D subsidies on green innovation: Evidence from Chinese energy-intensive firms. J. Clean. Prod. 2019, 233, 819–829. [Google Scholar] [CrossRef]

- Xu, Y.; Xuan, Y.; Zheng, G. Internet searching and stock price crash risk: Evidence from a quasi-natural experiment. J. Financial Econ. 2021, 141, 255–275. [Google Scholar] [CrossRef]

- Guo, L.L.; Qu, Y.; Tseng, M.-L. The interaction effects of environmental regulation and technological innovation on regional green growth performance. J. Clean. Prod. 2017, 162, 894–902. [Google Scholar] [CrossRef]

- Küçükoğlu, M.T.; Pınar, R.I. Positive Influences of Green Innovation on Company Performance. Procedia-Soc. Behav. Sci. 2015, 195, 1232–1237. [Google Scholar] [CrossRef]

- Xu, L.; Fan, M.; Yang, L.; Shao, S. Heterogeneous green innovations and carbon emission performance: Evidence at China’s city level. Energy Econ. 2021, 99, 105269. [Google Scholar] [CrossRef]

- Huang, Y.; Wang, Y. How does high-speed railway affect green innovation efficiency? A perspective of innovation factor mobility. J. Clean. Prod. 2020, 265, 121623. [Google Scholar] [CrossRef]

- Donaldson, D.; Hornbeck, R. Railroads and American economic growth: A “market access” approach. Q. J. Econ. 2016, 131, 799–858. [Google Scholar] [CrossRef]

- Ren, S.; Hao, Y.; Xu, L.; Wu, H.; Ba, N. Digitalization and energy: How does internet development affect China’s energy consumption? . Energy Econ. 2021, 98, 105220. [Google Scholar] [CrossRef]

- Ai, Y.; Peng, M.; Zhang, K. Edge computing technologies for Internet of Things: A primer. Digit. Commun. Networks 2018, 4, 77–86. [Google Scholar] [CrossRef]

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services. J. Manag. Inf. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Bollaert, H.; Lopez-De-Silanes, F.; Schwienbacher, A. Fintech and access to finance. J. Corp. Finance 2021, 68, 101941. [Google Scholar] [CrossRef]

- Santoro, G.; Vrontis, D.; Thrassou, A.; Dezi, L. The Internet of Things: Building a knowledge management system for open innovation and knowledge management capacity. Technol. Forecast. Soc. Chang. 2018, 136, 347–354. [Google Scholar] [CrossRef]

- Tang, Z.; Tang, J. Can the Media Discipline Chinese Firms’ Pollution Behaviors? The Mediating Effects of the Public and Government. J. Manag. 2016, 42, 1700–1722. [Google Scholar] [CrossRef]

- Crémer, J. Network externalities and universal service obligation in the internet. Eur. Econ. Rev. 2000, 44, 1021–1031. [Google Scholar] [CrossRef][Green Version]

- Koutroumpis, P. The economic impact of broadband on growth: A simultaneous approach. Telecommun. Policy 2009, 33, 471–485. [Google Scholar] [CrossRef]

- Salahuddin, M.; Gow, J. The effects of Internet usage, financial development and trade openness on economic growth in South Africa: A time series analysis. Telematics Informatics 2016, 33, 1141–1154. [Google Scholar] [CrossRef]

- Lin, J.; Yu, Z.; Wei, Y.D.; Wang, M. Internet Access, Spillover and Regional Development in China. Sustainability 2017, 9, 946. [Google Scholar] [CrossRef]

- Maurseth, P.B. The effect of the Internet on economic growth: Counter-evidence from cross-country panel data. Econ. Lett. 2018, 172, 74–77. [Google Scholar] [CrossRef]

- Jiao, S.; Sun, Q. Digital Economic Development and Its Impact on Econimic Growth in China: Research Based on the Prespective of Sustainability. Sustainability 2021, 13, 10245. [Google Scholar] [CrossRef]

- Liu, Y.; Yang, Y.; Li, H.; Zhong, K. Digital Economy Development, Industrial Structure Upgrading and Green Total Factor Productivity: Empirical Evidence from China’s Cities. Int. J. Environ. Res. Public Health 2022, 19, 2414. [Google Scholar] [CrossRef]

- Ren, S.; Li, L.; Han, Y.; Hao, Y.; Wu, H. The emerging driving force of inclusive green growth: Does digital economy agglomeration work? Bus. Strat. Environ. 2022, 31, 1656–1678. [Google Scholar] [CrossRef]

- Ranta, V.; Aarikka-Stenroos, L.; Väisänen, J.-M. Digital technologies catalyzing business model innovation for circular economy—Multiple case study. Resour. Conserv. Recycl. 2020, 164, 105155. [Google Scholar] [CrossRef]

- Zhang, L.; Tao, Y.; Nie, C. Does broadband infrastructure boost firm productivity? Evidence from a quasi-natural experiment in China. Finance Res. Lett. 2022, 48, 102886. [Google Scholar] [CrossRef]

- Zhang, J.; Fu, K. Can the construction of information network infrastructure drive the level of urban innovation? A quasi-natural experiment of “Broadband China” pilot policy. Ind. Econ. Res. 2021, 114, 1–14. [Google Scholar] [CrossRef]

- Zhong, Z.; Gao, Z.; Qin, C. Network Infrastructure Construction and Inter-city Cooperative Innovation: Evidence of the “Broadband China” Pilot Program and Its Spread. J. Financ. Econ. 2022, 48, 79–93. [Google Scholar] [CrossRef]

- Zhong, X.; Liu, G.; Chen, P.; Ke, K.; Xie, R. The Impact of Internet Development on Urban Eco-Efficiency—A Quasi-Natural Experiment of “Broadband China” Pilot Policy. Int. J. Environ. Res. Public Health 2022, 19, 1363. [Google Scholar] [CrossRef] [PubMed]

- Xue, C.; Meng, Q.; He, X. Network Infrastructure and the Diffusion of Technological Knowledge: Evidence from a Quasi-natural Experiment. J. Financ. Econ. 2020, 46, 48–62. [Google Scholar] [CrossRef]

- Tang, C.; Xu, Y.; Hao, Y.; Wu, H.; Xue, Y. What is the role of telecommunications infrastructure construction in green technology innovation? A firm-level analysis for China. Energy Econ. 2021, 103, 105576. [Google Scholar] [CrossRef]

- Wei, Z.; Sun, L. How to leverage manufacturing digitalization for green process innovation: An information processing perspective. Ind. Manag. Data Syst. 2021, 121, 1026–1044. [Google Scholar] [CrossRef]

- Li, D.; Shen, W. Can Corporate Digitalization Promote Green Innovation? The Moderating Roles of Internal Control and Institutional Ownership. Sustainability 2021, 13, 13983. [Google Scholar] [CrossRef]

- Crescenzi, R.; Gagliardi, L. The innovative performance of firms in heterogeneous environments: The interplay between external knowledge and internal absorptive capacities. Res. Policy 2018, 47, 782–795. [Google Scholar] [CrossRef]

- Neirotti, P.; Pesce, D. ICT-based innovation and its competitive outcome: The role of information intensity. Eur. J. Innov. Manag. 2019, 22, 383–404. [Google Scholar] [CrossRef]

- Zhang, D.; Jin, Y. R&D and environmentally induced innovation: Does financial constraint play a facilitating role? Int. Rev. Financial Anal. 2021, 78, 101918. [Google Scholar] [CrossRef]

- Li, D.; Zheng, M.; Cao, C.; Chen, X.; Ren, S.; Huang, M. The impact of legitimacy pressure and corporate profitability on green innovation: Evidence from China top. J. Clean. Prod. 2017, 141, 41–49. [Google Scholar] [CrossRef]

- Zhao, S.; Zhang, B.; Shao, D.; Wang, S. Can Top Management Teams’ Academic Experience Promote Green Innovation Output: Evidence from Chinese Enterprises. Sustainability 2021, 13, 11453. [Google Scholar] [CrossRef]

- Hu, G.; Wang, X.; Wang, Y. Can the green credit policy stimulate green innovation in heavily polluting enterprises? Evidence from a quasi-natural experiment in China. Energy Econ. 2021, 98, 105134. [Google Scholar] [CrossRef]

- Lin, B.; Ma, R. How does digital finance influence green technology innovation in China? Evidence from the financing constraints perspective. J. Environ. Manag. 2022, 320, 115833. [Google Scholar] [CrossRef] [PubMed]

- Xue, L.; Zhang, X. Can Digital Financial Inclusion Promote Green Innovation in Heavily Polluting Companies? Int. J. Environ. Res. Public Health 2022, 19, 7323. [Google Scholar] [CrossRef] [PubMed]

- Hayek, F.A. The Use of Knowledge in Society. Am. Econ. Rev. 1945, 35, 519–530. Available online: www.jstor.org/stable/1809376 (accessed on 10 June 2022).

- Bouwman, H.; Nikou, S.; de Reuver, M. Digitalization, business models, and SMEs: How do business model innovation practices improve performance of digitalizing SMEs? Telecommun. Policy 2019, 43, 101828. [Google Scholar] [CrossRef]

- Sareen, S.; Haarstad, H. Digitalization as a driver of transformative environmental innovation. Environ. Innov. Soc. Transitions 2021, 41, 93–95. [Google Scholar] [CrossRef]

- Zhang, X.; Schreifels, J. Continuous emission monitoring systems at power plants in China: Improving SO2 emission measurement. Energy Policy 2011, 39, 7432–7438. [Google Scholar] [CrossRef]

- Tian, H.; Li, Y.; Zhang, Y. Digital and intelligent empowerment: Can big data capability drive green process innovation of manufacturing enterprises? J. Clean. Prod. 2022, 377, 134261. [Google Scholar] [CrossRef]

- Liao, G.; Yao, D.; Hu, Z. The Spatial Effect of the Efficiency of Regional Financial Resource Allocation from the Perspective of Internet Finance: Evidence from Chinese Provinces. Emerg. Mark. Finance Trade 2019, 56, 1211–1223. [Google Scholar] [CrossRef]

- Myers, S.C.; Majluf, N.S. Corporate financing and investment decisions when firms have information that investors do not have. J. Financial Econ. 1984, 13, 187–221. [Google Scholar] [CrossRef]