A Simulation-Based Study on the Optimal Pricing Strategy of Supply Chain System

Abstract

:1. Introduction

- (1)

- In contrast to the models and design approaches used in other literature, this paper introduces a novel multi-intelligence consistency theory for the supply chain pricing strategy. Through the establishment of a common objective function, a model of fair competition and cooperative relationships between manufacturers and retailers is constructed to achieve free bidding between manufacturers and retailers and eventually price consistency.

- (2)

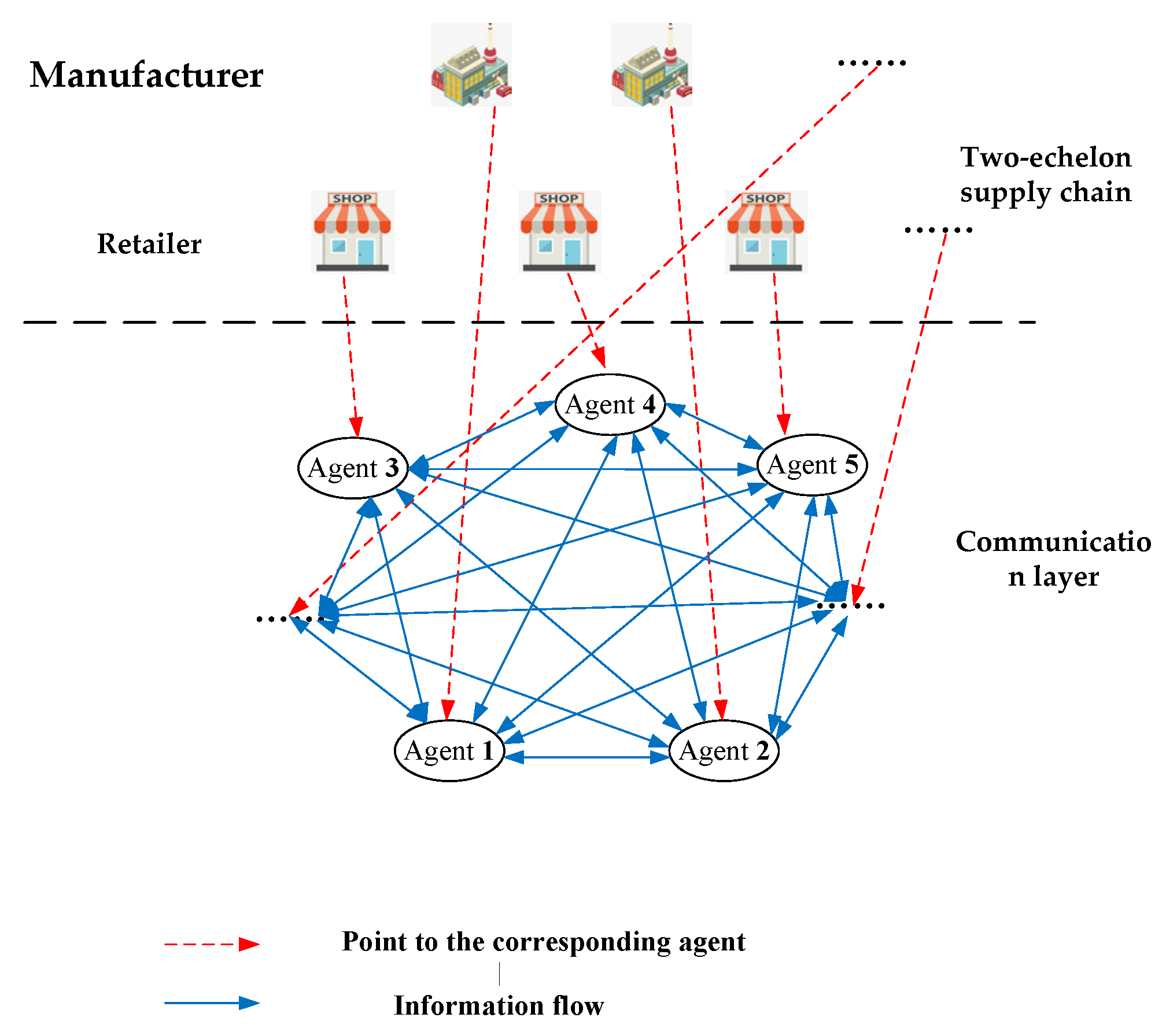

- In this paper, a multi-agent system is constructed with multiple manufacturers and retailers as the nodes in the supply chain. Additionally, a distributed consensus protocol based on the information of each agent and its neighbors is formulated, and the optimal pricing and order/production policies of the supply chain are provided. This is carried out by avoiding contractual constraints as well as information asymmetry in competition, and manufacturers and retailers trading at this price are capable of maximizing supply chain benefits.

- (3)

- The transmission of information and the material disseminated through the network medium will inevitably lead to delays in the transmission of lost network information, which will be considered in the controller design.

- (4)

- The impact of retailer prices, manufacturer parameters for consistency agreements, and decision models are explored to provide relational models for reference in price setting. We carefully analyze different operational modes under these settings to present recommendations for managers to select the most appropriate policy to be implemented in practice.

2. Preliminary Knowledge and Problem Description

2.1. Network Model

2.2. Supply Chain Model

- (1)

- Retailer model

- The utility function is a non-decreasing function;

- The derivative of the utility function decreases as demand increases;

- Zero-quantity demand has zero satisfaction, and it is constant when the quantity of that demand is greater than a certain level.

- (2)

- Manufacturer model

3. Design of the Coordination Mechanism for the Supply Chain

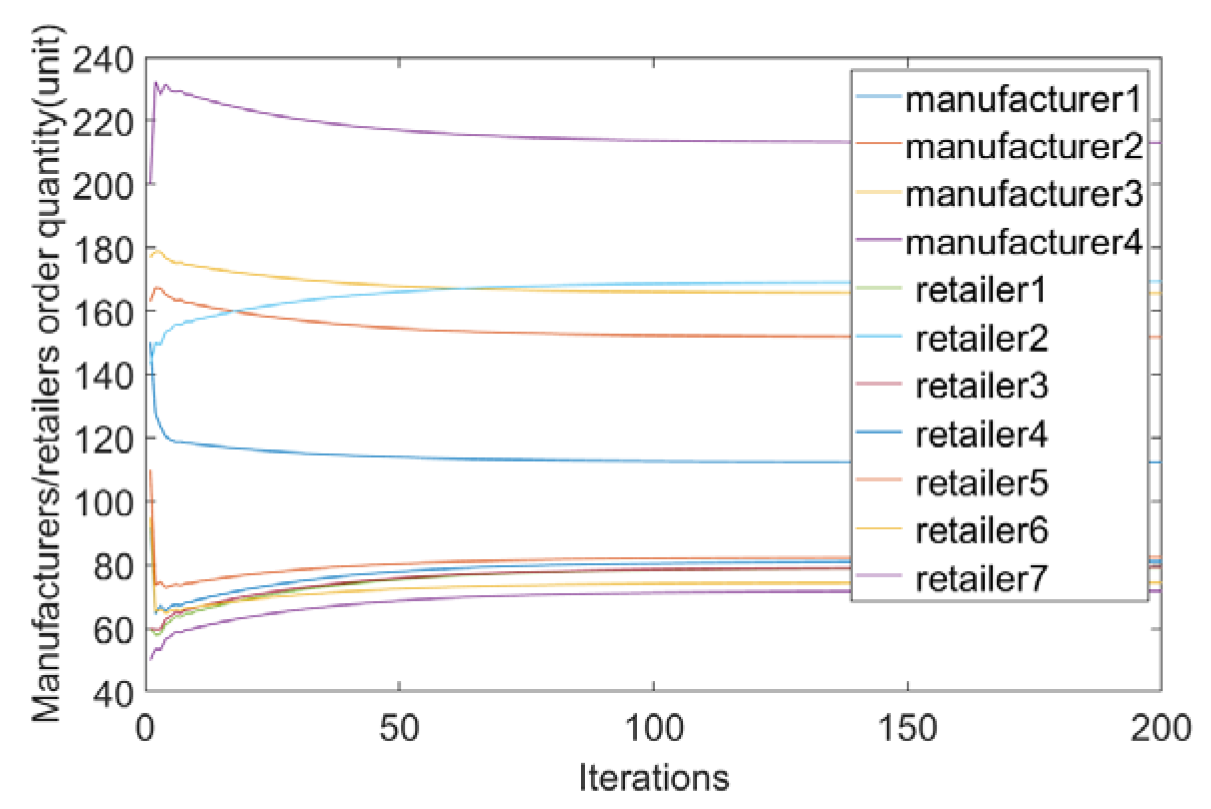

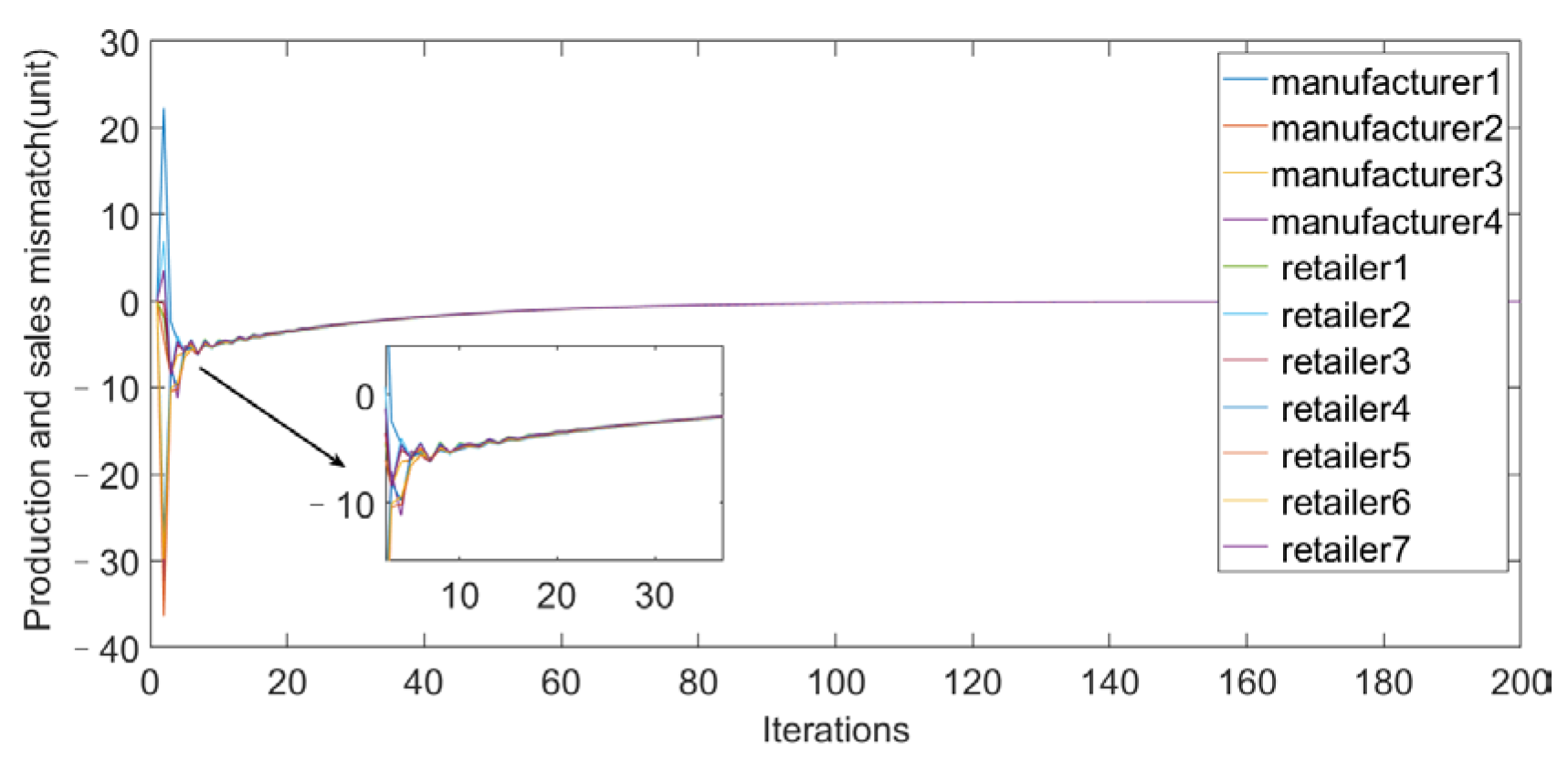

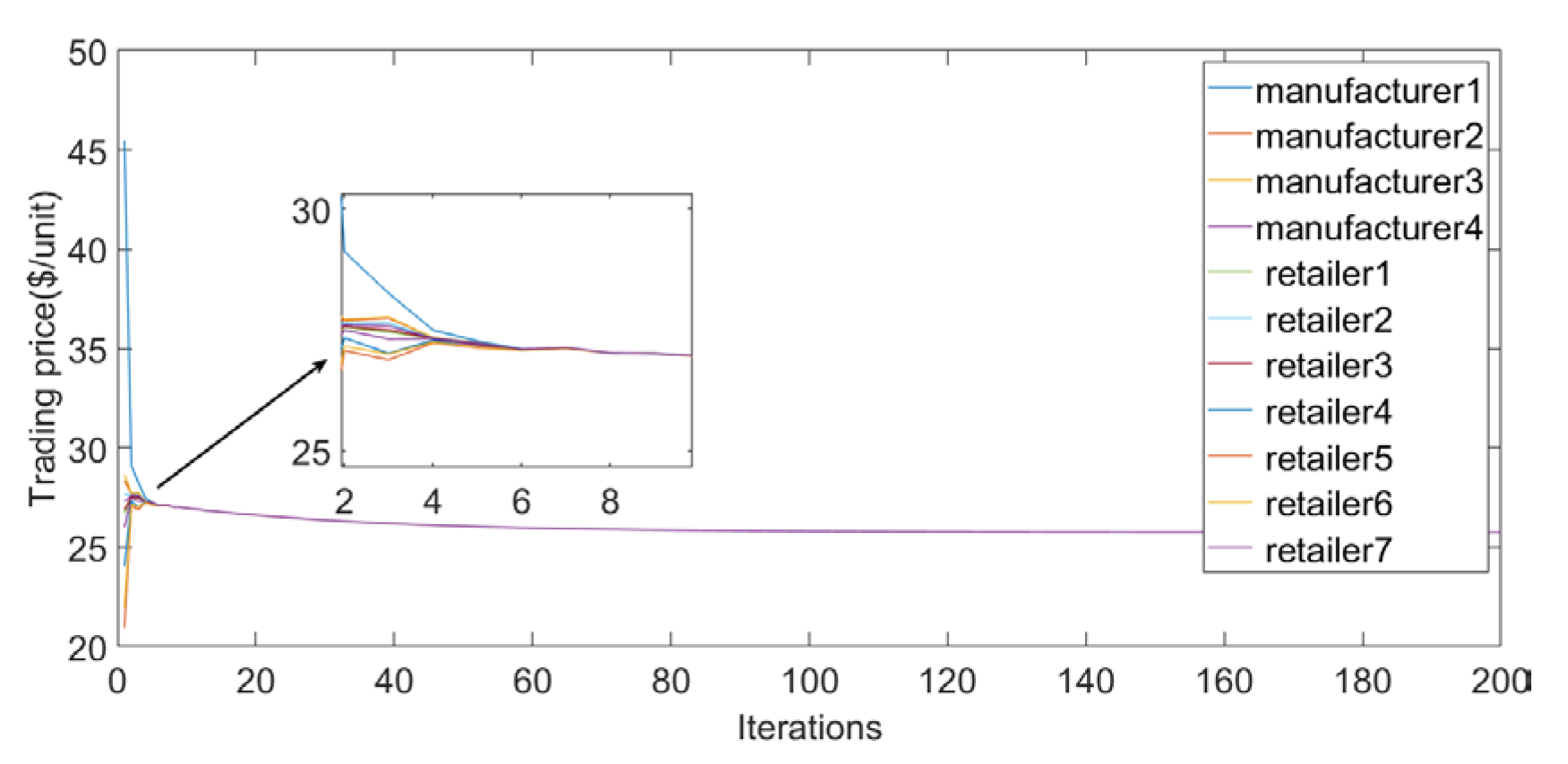

4. Simulation

5. Conclusions

- (1)

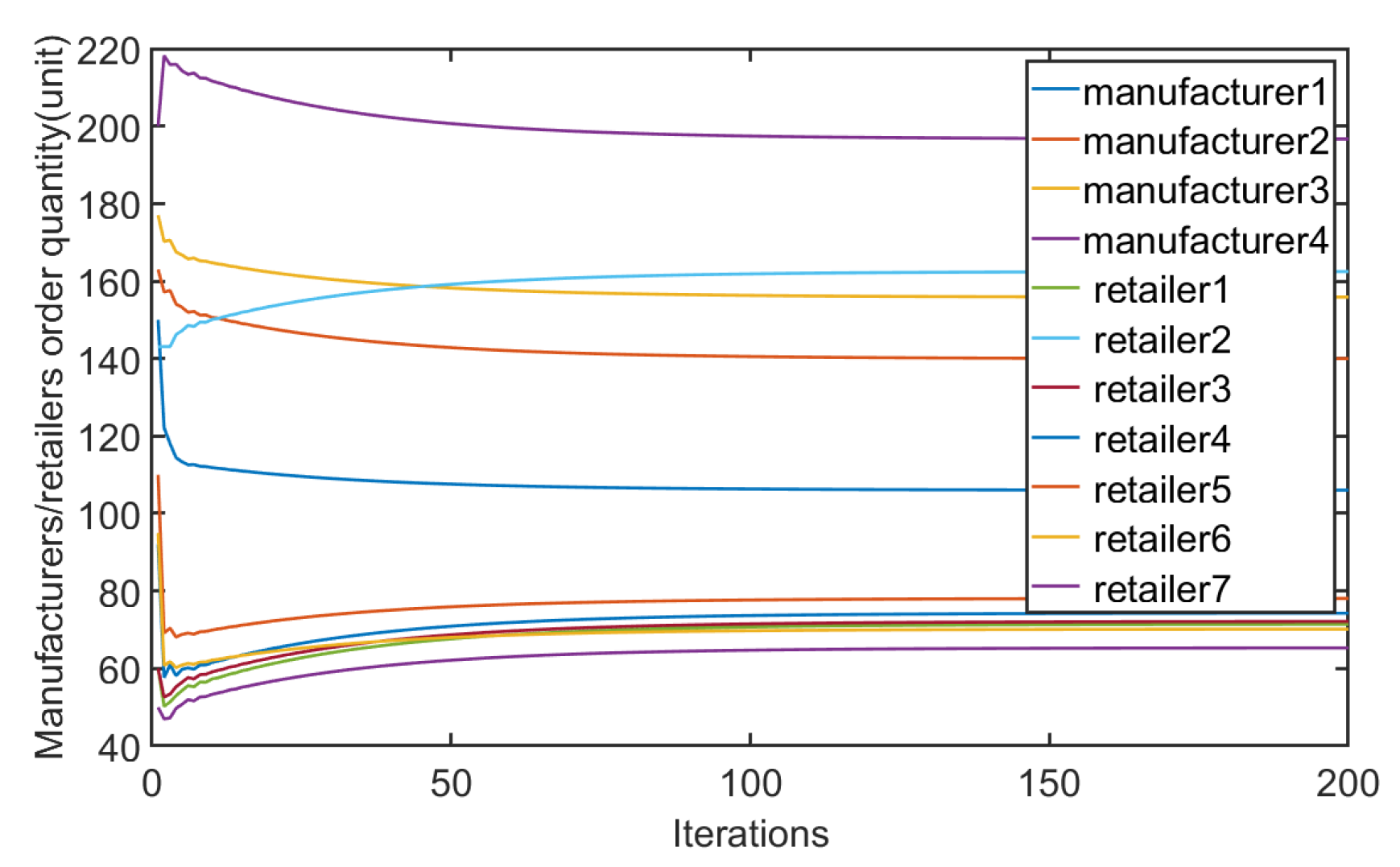

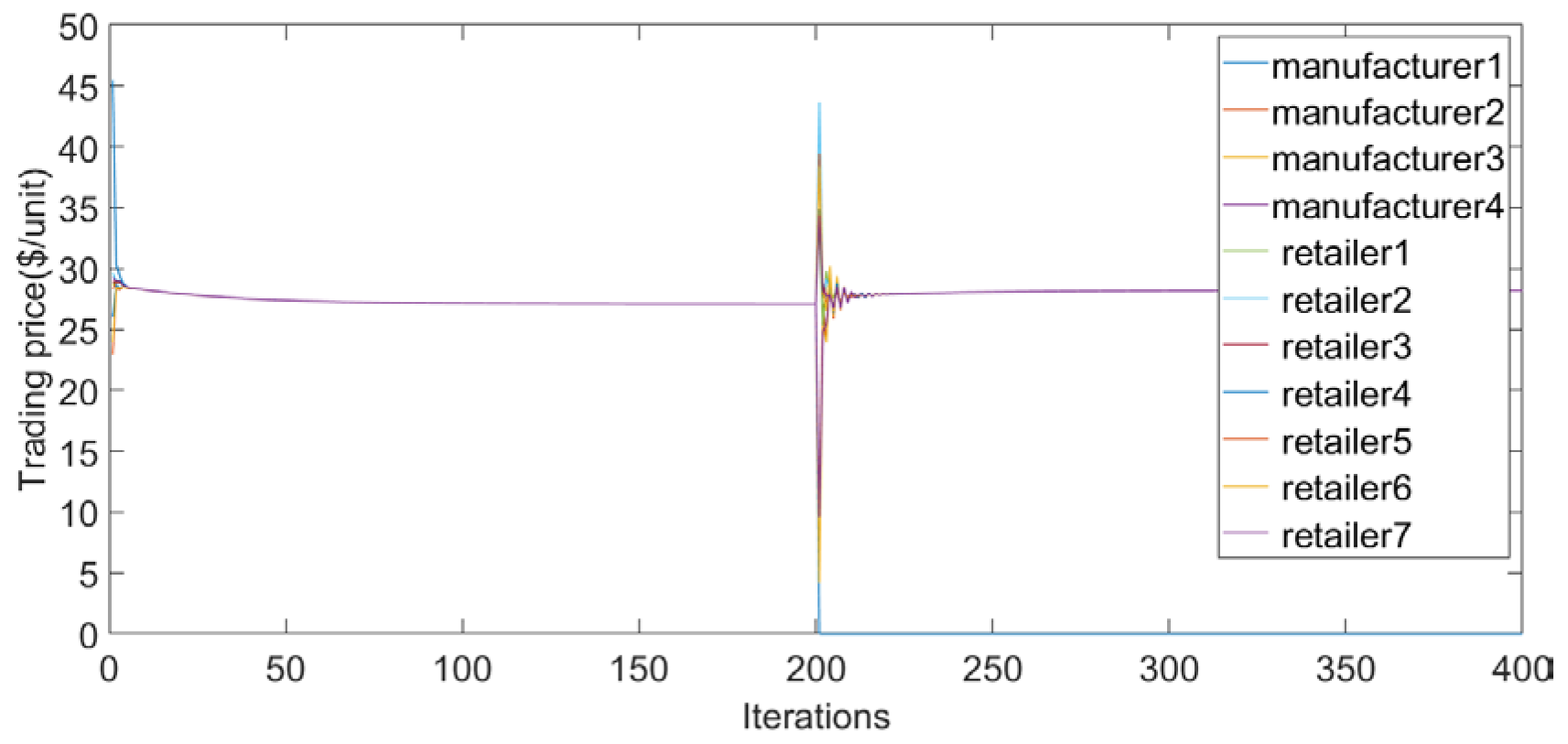

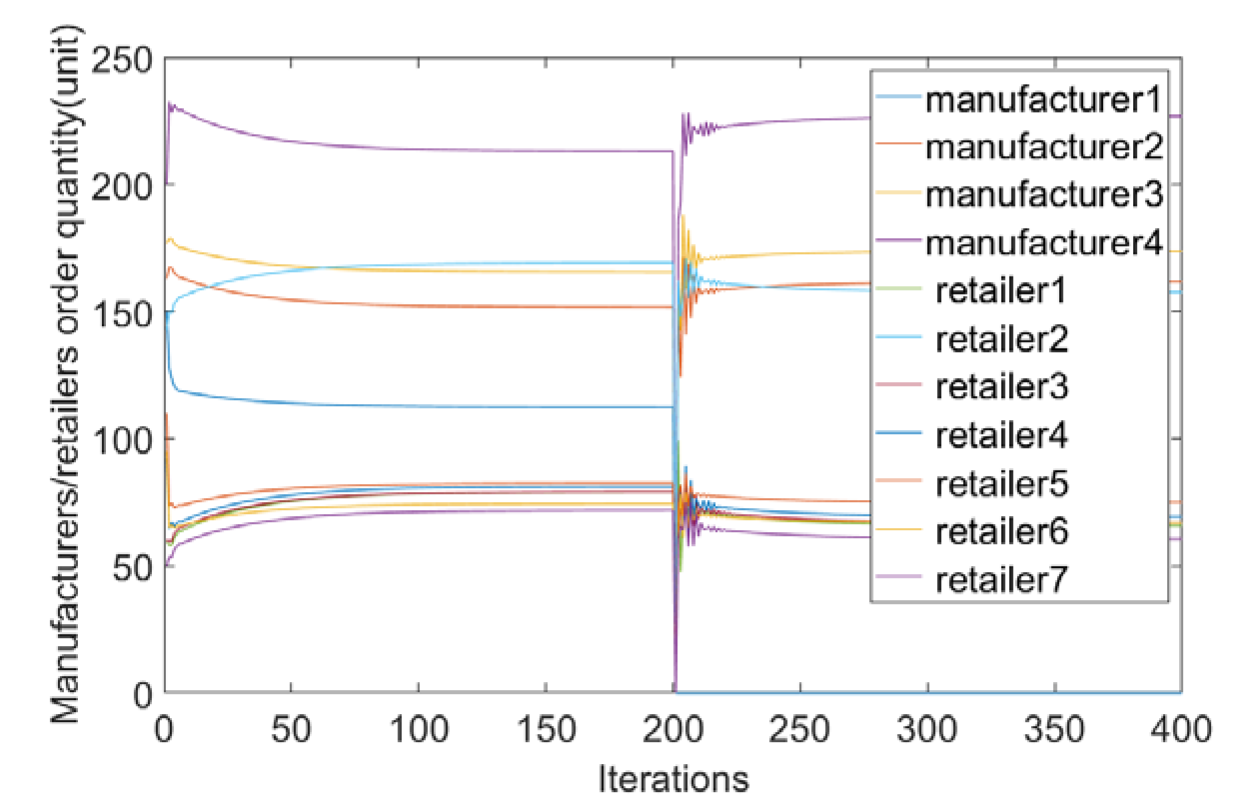

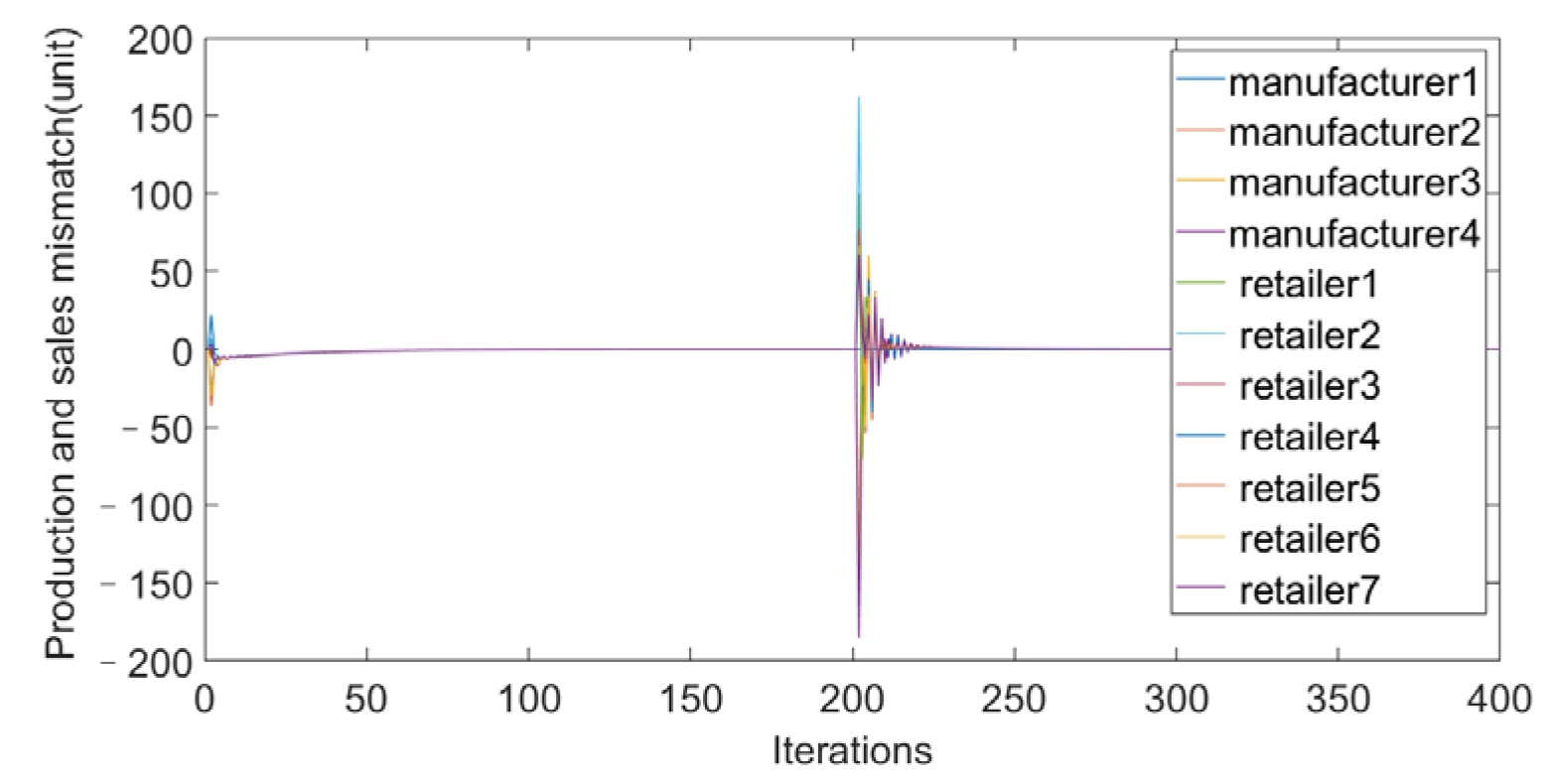

- The interests of each node in the supply chain are regarded as a whole and are boiled down to an optimal problem. A multi-agent consensus algorithm suitable for the supply chain is developed considering the random delay of distributed unit communication, and the optimal transaction price and order quantity of the supply chain are determined.

- (2)

- Changes in sensitivity factors have an impact on both price and quantity. The retailer increases the expected demand according to (6), and the price changes inversely. When the sensitivity coefficient decreases, the expected demand and the consistent price increase, which leads the manufacturer to increase the output under the constraint of supply and demand balance (11), to maximize the overall supply chain benefit. Therefore, setting a reasonable price is the premise for ensuring the profits of retailers and manufacturers.

- (3)

- When a manufacturer or retailer in the supply chain network fails in a sudden situation, the transaction price will increase and the overall profit will decrease, indicating that supply chain members should cooperate with each other in order to avoid the loss of market profit.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Savaskan, R.C.; Bhattacharya, S.; Wassenhove, L.N.V. Closed-loop supply chain models with product remanufacturing. Manag. Sci. 2004, 50, 239–252. [Google Scholar] [CrossRef] [Green Version]

- Ferguson, M.E.; Toktay, L.B. The effect of competition on recovery strategies. Prod. Oper. Manag. 2010, 15, 351–368. [Google Scholar] [CrossRef] [Green Version]

- Shi, T.Q.; Chhajed, D.; Wan, Z.X.; Liu, Y. Distribution channel choice and divisional conflict in remanufacturing operations. Prod. Oper. Manag. 2020, 29, 1702–1719. [Google Scholar] [CrossRef]

- Ullah, M.; Asghar, I.; Zahid, M.; Omair, M.; AlArjani, A.; Sarkar, B. Ramification of remanufacturing in a sustainable three-echelon closed-loop supply chain management for returnable products. J. Clean. Prod. 2021, 290, 125609. [Google Scholar] [CrossRef]

- Hanh, N.T.M.; Chen, J.M.; Van Hop, N. Pricing strategy and order quantity allocation with price-sensitive demand in three-echelon supply chain. Expert Syst. Appl. 2022, 206, 117873. [Google Scholar] [CrossRef]

- Sasan, K.; Mehdi, S.; Bahman, N. A four-echelon supply chain network design with shortage: Mathematical modeling and solution methods. J. Manuf. Syst. 2015, 35, 164–175. [Google Scholar]

- Giria, B.C.; Sarker, B.R. Improving performance by coordinating a supply chain with third party logistics outsourcing under production disruption. Comput. Ind. Eng. 2017, 103, 168–177. [Google Scholar] [CrossRef]

- Yulin, S.; Simon, C.G.; Xueping, L. An order-splitting model for supplier selection and order allocation in a multi-echelon supply chain. Comput. Oper. Res. 2022, 137, 105515. [Google Scholar]

- Feng, W.; Yunquan, D. A Power-Balanced Pareto-Equilibrium Profit Allocation in Supply Chain. IEEE Access 2019, 7, 24889–24897. [Google Scholar]

- Xu, G.; Yue, D. Pricing Decisions in a Supply Chain Consisting of One Manufacturer and Two Retailers Under a Carbon Tax Policy. IEEE Access 2021, 9, 3054776. [Google Scholar] [CrossRef]

- Chen, T.H. Effects of the Pricing and Cooperative Advertising Policies in a Two-echelon Dual-channel Supply Chain. Comput. Ind. Eng. 2015, 87, 250–259. [Google Scholar] [CrossRef]

- Xiao, T.S.J. Pricing and Supply Priority in a Dual-channel Supply Chain. Eur. J. Oper. Res. 2016, 254, 813–823. [Google Scholar] [CrossRef]

- Zhao, J.; Hou, X.; Guo, Y.; Wei, J. Pricing Policies for Complementary Products in a Dual-channel Supply Chain. Appl. Math. Model. 2017, 49, 437–451. [Google Scholar] [CrossRef]

- Iyer, G.; Villasboas, J.M. A Bargaining Theory of Distribution Channels. J. Mark. Res. 2003, 40, 80–100. [Google Scholar] [CrossRef] [Green Version]

- Dukes, A.J.; Galor, E.; Srinivasan, K. Channel Bargaining with Retailer Asymmetry. J. Mark. Res. 2006, 43, 84–97. [Google Scholar] [CrossRef]

- Zhang, P.; Xu, X.; Shi, V.; Zhu, J. Simultaneous inventory competition and transshipment between retailers. Int. J. Prod. Econ. 2020, 230, 107781. [Google Scholar] [CrossRef]

- Sun, Z.; Xu, Q.; Liu, J. International Journal of Production Economics. Prod. Oper. Manag. 2021, 233, 108011. [Google Scholar]

- Zhong, F.; Zhou, Z.; Leng, M. Negotiation-sequence, pricing, and ordering decisions in a three-echelon supply chain: A coopetitive-game analysis. Eur. J. Oper. Res. 2021, 294, 1096–1107. [Google Scholar] [CrossRef]

- Ran, W.X.; Xu, T. Low-Carbon Supply Chain Coordination Based on Carbon Tax and Government Subsidy Policy. Sustainability 2023, 15, 1135. [Google Scholar] [CrossRef]

- Hossein, M.; Hamed, S.; Keith, W. A robust optimization model for green supplier selection and order allocation in a closed-loop supply chain considering cap-and-trade mechanism. Expert Syst. Appl. 2023, 228, 120423. [Google Scholar]

- Yang, H.X.; Chen, X.R.; Li, L. Supply chain decision-making of green products considering a retailer’s fairness concerns under a pre-sale model. J. Clean. Prod. 2023, 414, 137457. [Google Scholar] [CrossRef]

- Liu, Z.; Wan, M.D.; Zheng, X.X.; Koh, S.L. Fairness concerns and extended producer responsibility transmission in a circular supply chain. Ind. Market. Manag. 2022, 102, 216–228. [Google Scholar] [CrossRef]

- Fox, M.S.; Chionglo, J.F.; Barbuceanu, M. The Integrated Supply Chain Management System; Department of Industrial Engineering, University of Toronto: Toronto, ON, Canada, 1993. [Google Scholar]

- Frayret, J.M.; Damours, S.; Rousseau, A.; Harvey, S.; Gaudreault, J. Agent-based supply-chain planning in the forest products industry. Int. J. Flex. Manuf. Syst. 2007, 19, 358–391. [Google Scholar] [CrossRef]

- Shen, W.; Norrie, D.H. Agent-based systems for intelligent manufacturing: A state-of-the-art survey. Knowl. Inf. Syst. 1999, 1, 129–156. [Google Scholar] [CrossRef]

- Fox, M.S.; Barbuceanu, M.; Teigen, R. Agent-oriented supply-chain management. Int. J. Flex. Manuf. Syst. 2000, 12, 165–188. [Google Scholar] [CrossRef]

- Shen, W.; Kremer, R.; Ulieru, M.; Norrie, D. A collaborative agent-based infrastructure for Internet-enabled collaborative enterprises. Int. J. Prod. Res. 2003, 41, 1621–1638. [Google Scholar] [CrossRef]

- Ramezani, M.; Bashiri, M.; Reza, T.M. A robust design for a closedloop supply chain network under an uncertain environment. Int. J. Adv. Manuf. Technol. 2013, 66, 825–843. [Google Scholar] [CrossRef]

- Olfati-Saber, R.; Fax, J.A.; Murray, R.M. Consensus and cooperation in networked multiagent systems. Proc. IEEE 2007, 95, 215–233. [Google Scholar] [CrossRef]

- Zhou, Y.J.; Hu, F.Y.; Zhou, Z.L. Pricing decisions and social welfare in a supply chain with multiple competing retailers and carbon tax policy. J. Clean. Prod. 2018, 190, 752e777. [Google Scholar] [CrossRef]

- Colub, G.H.; Van Loan, C.F. Matrix Computations; Posts and Telecom Press: Beijing, China, 2009; pp. 359–363. [Google Scholar]

- Meyer, C.D. Matrix Analysis and Applied Linear Algebra; Society for Industrial and Applied Mathematics: Philadelphia, PA, USA, 2000. [Google Scholar]

| Retailer Parameters | ||||

|---|---|---|---|---|

| Node | ||||

| 1 | 0.043 | 33.8 | 0 | 120 |

| 2 | 0.049 | 43.66 | 0 | 190 |

| 3 | 0.047 | 34.52 | 0 | 100 |

| 4 | 0.048 | 34.87 | 0 | 120 |

| 5 | 0.075 | 39.45 | 0 | 120 |

| 6 | 0.075 | 38.4 | 0 | 125 |

| 7 | 0.051 | 34.4 | 0 | 90 |

| Manufacturer Parameters | ||||

| Node | ||||

| 1 | 0.105 | 3.47 | 0 | 150 |

| 2 | 0.057 | 9.78 | 0 | 200 |

| 3 | 0.069 | 4.23 | 0 | 200 |

| 4 | 0.041 | 9.61 | 0 | 250 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Y.; Wang, J. A Simulation-Based Study on the Optimal Pricing Strategy of Supply Chain System. Sustainability 2023, 15, 11307. https://doi.org/10.3390/su151411307

Li Y, Wang J. A Simulation-Based Study on the Optimal Pricing Strategy of Supply Chain System. Sustainability. 2023; 15(14):11307. https://doi.org/10.3390/su151411307

Chicago/Turabian StyleLi, Yuxian, and Jiuhe Wang. 2023. "A Simulation-Based Study on the Optimal Pricing Strategy of Supply Chain System" Sustainability 15, no. 14: 11307. https://doi.org/10.3390/su151411307

APA StyleLi, Y., & Wang, J. (2023). A Simulation-Based Study on the Optimal Pricing Strategy of Supply Chain System. Sustainability, 15(14), 11307. https://doi.org/10.3390/su151411307