Green Credit Guideline Influencing Enterprises’ Green Transformation in China

Abstract

:1. Introduction

2. Literature Review

2.1. Impact Study of Green Credit Policy

2.2. Research on Factors Affecting Firms’ Green Transformation

3. Research Hypothesis

3.1. Green Credit Policy and Firms’ Green Transformation

3.2. Mediating Influence of Corporate Green Technology Innovation

3.3. The Moderating Effect of Corporate Social Responsibility (CSR)

4. Study Design and Data Description

4.1. The Theoretical Framework

4.2. Enterprise Green Transformation Index Measurement

4.3. Sample and Data

4.4. Variable Construction and Interpretation

- Explained variable: corporate green transformation (GT) measured by multiple indicators with super-efficient Slacks-Based Measure and Data Envelopment Analysis (SBM-DEA) based on non-expected output and ML index.

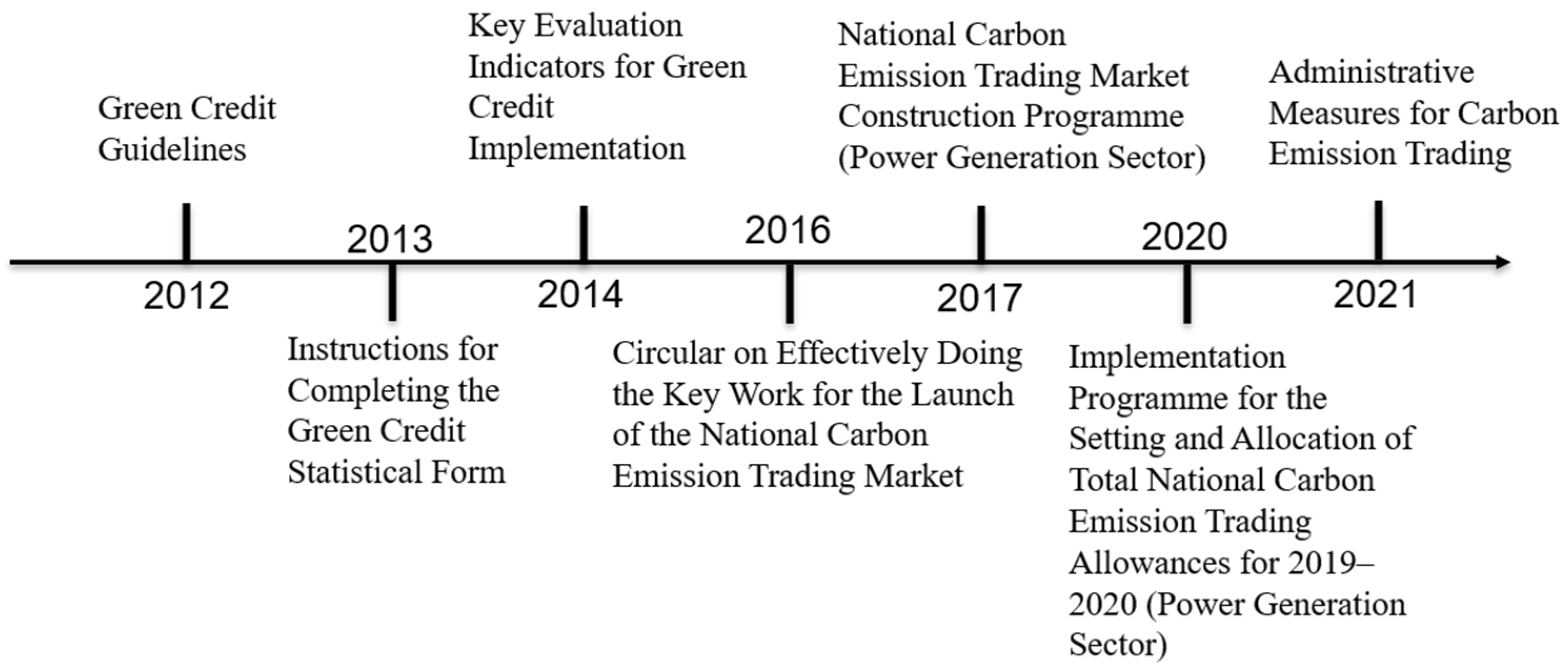

- Explanatory variable: green credit guideline (GCG) indicated by experimental dummy variable (ifhp). This paper mainly conducts quasi-natural experiments based on GCG shock, so the experimental group comprises highly polluted firms, i.e., ifhp = 1; non-polluting industrial enterprises are utilized as the control group, i.e., ifhp = 0. A time dummy variable (post): The exogenous shock policy of this paper, the green credit guidelines, was officially released on 29 January 2012. We select 2012 as the policy implementation node; before 2012, the post takes 0; after 2012, the post takes 1.

- Control variables: Profitability (profit), the return on assets of a company = operating profit/total assets. Companies with high profitability levels can have enough capital for equipment renovation and technology upgrades in the short term to improve production efficiency and competitiveness. However, for polluting enterprises, high profitability levels often come at the expense of environmental performance, leading to environmental pollution and waste of resources. Therefore, the influence of profitability levels on the transition behavior of companies, in the long run, is uncertain and may facilitate or hinder enterprises from achieving green development.

5. Empirical Analysis

5.1. Model Setting and Variable Definition

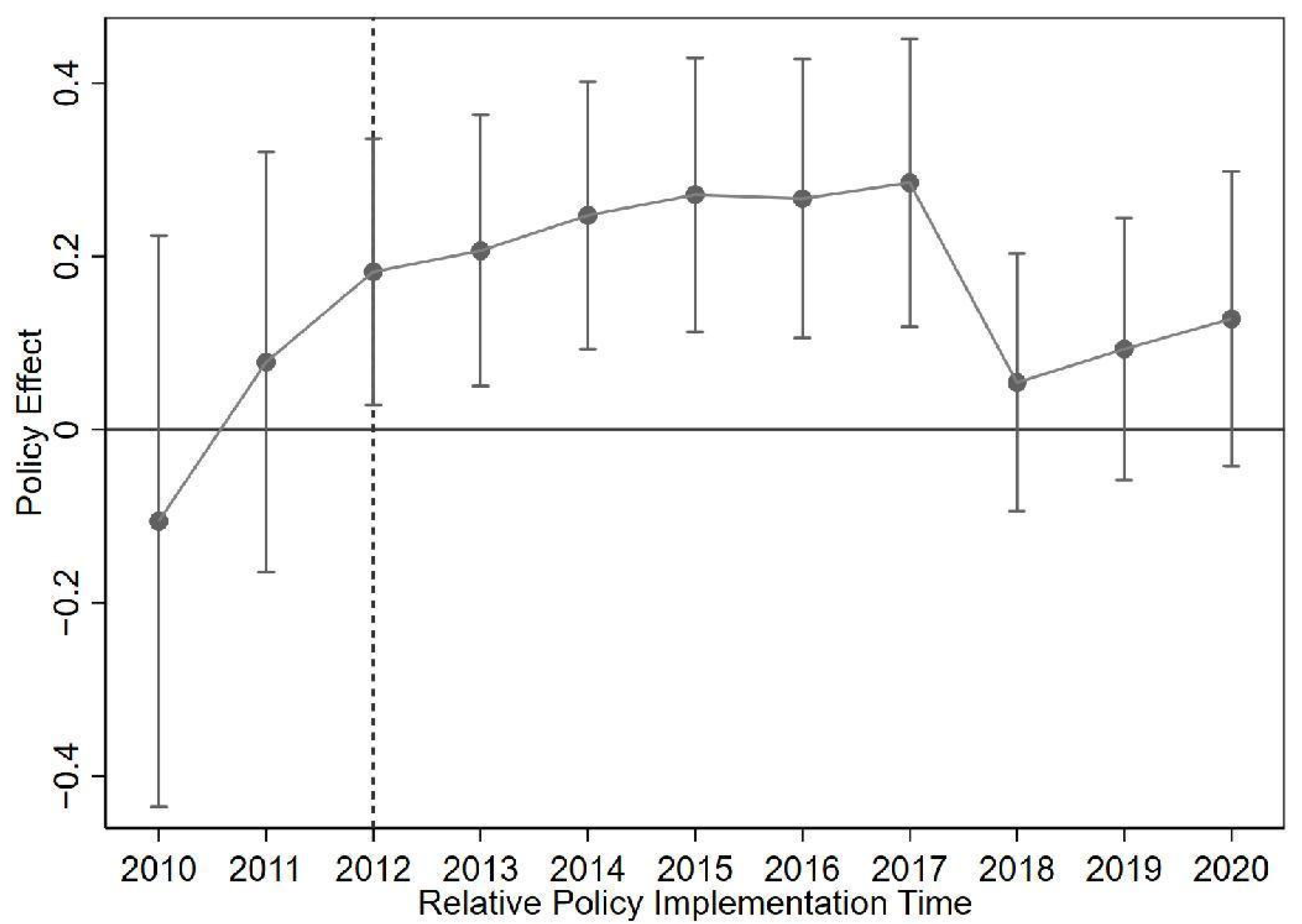

5.2. Parallel Trend Test

5.3. Basic Regression Analysis

5.4. Robustness Test

5.4.1. Test for Alternative Method by Propensity Score Matching

5.4.2. Randomly Generated Experimental Groups

5.4.3. Shorten the Time Window of the Sample

6. Testing Mechanism of Green Credit Guideline (GCG) Influencing Firms’ Green Transformation

6.1. Test Green Technology Innovation as an Intermediary Channel

6.2. Analysis of the Regulation Mechanism of CSR

7. Heterogeneity Analysis of GCG Affecting Firms’ Green Transformation

7.1. Enterprises’ Ownership Heterogeneity Analysis

7.2. Regional Heterogeneity Analysis

8. Conclusions and Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Sellitto, M.A.; Camfield, C.G.; Buzuku, S. Green innovation and competitive advantages in a furniture industrial cluster: A survey and structural model. Sustain. Prod. Consum. 2020, 23, 94–104. [Google Scholar]

- Liu, J.J.; Xiong, Z.Q.; Shi, D.Q. How does the new Environmental Protection Law affect the transformation and upgrading of heavy polluting enterprises? Based on the dual perspective of internal innovation and external competition. Soft Sci. 2023, 1–14. Available online: https://kns.cnki.net/kcms2/article/abstract?v=PlWY_BJaphxXjPM_yKuyQuFR3ejhoVnyRuma58Aop-oJYRkLapoLp5s9JJ6ZIv3gc7F_8x-Os0YILzLBorVabwm0ws4rQb-kgu3X-UiMqZ6pkF8hROMGug==&uniplatform=NZKPT&language=gb (accessed on 15 June 2023).

- Li, X.H.; Jin, Z.X. Research on the impact of environmental tax on enterprises’ green technology innovation: Based on the empirical experience of A-share industrial listed companies. Econ. Probl. 2023, 1, 61–69. (In Chinese) [Google Scholar]

- Lu, C.; Zhu, T.Q. Can overseas executives promote corporate green innovation? Based on empirical evidence of China’s A-share listed companies. J. Guizhou Univ. Financ. Econ. 2023, 1, 81–90. (In Chinese) [Google Scholar]

- Stiglitz, J.E.; Weiss, A. Credit Rationing in Markets with Rationing Credit Information Imperfect. Am. Econ. Rev. 1981, 71, 393–410. [Google Scholar]

- Olariu, G.V.; Brad, S. Preventive Risk Management of Resource Allocation in Romanian Higher Education by Assessing Relative Performance of Study Programs with DEA Method. Sustainability 2022, 14, 12527. [Google Scholar]

- Masuda, K. Eco-Efficiency Assessment of Intensive Rice Production in Japan: Joint Application of Life Cycle Assessment and Data Envelopment Analysis. Sustainability 2019, 11, 5368. [Google Scholar]

- Zhang, K.; Li, Y.C.; Qi, Y.; Shao, S. Can green credit policy improve environmental quality? Evidence from China. J. Environ. Manag. 2021, 298, 11. [Google Scholar]

- Cui, X.; Wang, P.P.; Sensoy, A.; Nguyen, D.K.; Pan, Y.Y. Green Credit Policy and Corporate Productivity: Evidence from a Quasi-natural Experiment in China. Technol. Forecast. Soc. Chang. 2022, 177, 121516. [Google Scholar]

- Chen, C.; Zhong, S.B.; Zhang, Y.L.; Bai, Y. The Economic Impact of Green Credit: From the Perspective of Industrial Structure and Green Total Factor Productivity. Sustainability 2023, 15, 1224. [Google Scholar]

- Boussemart, J.P.; Briec, W.; Kerstens, K.; Poutineau, J.C. Luenberger and Malmquist productivity indices: Theoretical comparisons and empirical illustration. Bull. Econ. Res. 2003, 55, 391–405. [Google Scholar]

- Sun, C.W.; Zhang, W.Y. Foreign direct investment and corporate green transformation: An empirical study based on micro data of Chinese enterprises. China Popul. Resour. Environ. 2022, 32, 79–91. (In Chinese) [Google Scholar]

- Liu, X.T.; Chen, S.S. Has environmental regulation facilitated the green transformation of the marine industry? Mar. Policy 2022, 144, 105238. [Google Scholar]

- Wu, C.S.; Li, Y.Y.; Qi, L.L. Assessing the Impact of Green Transformation on Ecological Well-Being Performance: A Case Study of 78 Cities in Western China. Int. J. Environ. Res. Public Health 2022, 19, 11200. [Google Scholar] [PubMed]

- Yu, Z.; Cao, Y.L. Do green credit policies affect the surplus quality of heavy polluters? Secur. Mark. Her. 2021, 5, 26–36. (In Chinese) [Google Scholar]

- Zhang, J.S.; Lu, S.S. The impact of green credit policies on firms’ innovation performance. Stat. Decis. Mak. 2022, 38, 179–183. (In Chinese) [Google Scholar]

- Fan, J.R.; Zhou, Y.N. Empirical Analysis of Financing Efficiency and Constraints Effects on the Green Innovation of Green Supply Chain Enterprises: A Case Study of China. Sustainability 2023, 15, 5300. [Google Scholar]

- Pan, X.F.; Wang, Y.Q.; Zhang, C.M.; Shen, Z.Y.; Song, M.L. The impact of platform economy on enterprise value mediated by technological innovation. J. Bus. Res. 2023, 165, 114051. [Google Scholar]

- Pan, X.F.; Li, J.M.; Shen, Z.Y.; Song, M.L. Life cycle identification of China’s regional innovation systems based on entropy weight disturbing attribute model. Habitat Int. 2023, 131, 102725. [Google Scholar]

- Li, S.H.; Liu, Q.F.; Zheng, K.X. Green policy and corporate social responsibility: Empirical analysis of the Green Credit Guidelines in China. J. Asian Econ. 2022, 82, 101531. [Google Scholar]

- Le, T.T. How do corporate social responsibility and green innovation transform corporate green strategy into sustainable firm performance? J. Clean. Prod. 2022, 362, 132228. [Google Scholar]

- Solow, R.M. The economics of resources and the resources of economics. Am. Econ. Rev. 1974, 64, 1–14. [Google Scholar]

- Lucas, R. On the mechanics of economic development. J. Monet. Econ. 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Liao, X.; Li, X.; Shi, X. Research on the influence mechanism of green investment on green welfare based on ecological civilization perspective. China Popul. Resour. Environ. 2020, 30, 148–157. (In Chinese) [Google Scholar]

- Acemoglu, D.; Aghion, P.; Bursztyn, L.; Hemous, D. The Environment and Directed Technical Change. Am. Econ. Rev. 2012, 102, 131–166. [Google Scholar] [CrossRef] [Green Version]

- Malmquist, S. Index numbers and indifference surfaces. Trab. Estad. 1953, 4, 209–242. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Chung, Y.; Fare, R. Productivity and undesirable outputs: A directional distance function approach. Microeconomics 1997, 51, 229–240. [Google Scholar]

- Wang, B.; Wu, Y.; Yan, P. Regional Environmental Efficiency and Environmental Total Factor Productivity Growth in China. Econ. Res. 2010, 45, 95–109. [Google Scholar]

- Tone, K. A slacks-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar]

- Tone, K. Dealing with Undesirable Outputs in DEA: A Slacks-based Measure (SBM) Approach. GRIPS Res. Rep. Ser. 2003, 2003. Available online: https://core.ac.uk/download/pdf/51221252.pdf (accessed on 15 June 2023).

- Cui, X.H.; Lin, M.Y. How does FDI affect the green total factor productivity of firms? An empirical analysis based on Malmquist-Luenberger index and PSM-DID. Econ. Manag. 2019, 41, 38–55. (In Chinese) [Google Scholar]

- Cui, G.H.; Jiang, Y.B. The impact of environmental regulation on firms’ environmental governance behavior—A quasi-natural experiment based on the new Environmental Protection Law. Econ. Manag. 2019, 41, 54–72. (In Chinese) [Google Scholar]

- Sun, Y.N.; Fei, J.H. Measurement, sources of variation and causes of green production efficiency of heavy polluters. China Popul. Resour. Environ. 2021, 31, 102–109. (In Chinese) [Google Scholar]

- Zhang, J.; Zheng, W.P.; Zhai, F.X. How competition affects innovation: A new test of the Chinese scenario. China Ind. Econ. 2014, 11, 56–68. (In Chinese) [Google Scholar]

- Margaritis, D.; Psillaki, M. Capital structure, equity ownership and firm performance. J. Bank. Financ. 2010, 34, 621–632. [Google Scholar] [CrossRef]

- Yu, K.X.; Hu, Y.Q.; Song, Z. Environmental regulation, government support and green technology innovation—An empirical study based on resource-based enterprises. J. Yunnan Univ. Financ. Econ. 2019, 35, 100–112. (In Chinese) [Google Scholar]

- Yang, X.Q.; Yin, X.Q.; Meng, Q.X. Who is more diversified: Industrial policy-supported or non-supported enterprises? Econ. Res. 2018, 53, 133–150. (In Chinese) [Google Scholar]

- Wen, Z.L.; Zhang, L.; Hou, J.T. Mediation effect test procedure and its application. J. Psychol. 2004, 5, 614–620. (In Chinese) [Google Scholar]

- Fang, X.M.; Na, J.L. A study on green innovation premiums of GEM listed companies. Econ. Res. 2020, 55, 106–123. (In Chinese) [Google Scholar]

- Qi, S.Z.; Lin, S.; Cui, J.B. Can environmental equity trading markets induce green innovation? Evidence from data on green patents of listed companies in China. Econ. Res. 2018, 53, 129–143. (In Chinese) [Google Scholar]

- Nie, Y.M.; Xia, L.X. Do green finance policies affect corporate finance? Empirical evidence from heavy polluters. New Econ. 2022, 1, 77–82. (In Chinese) [Google Scholar]

- Fan, G.; Wang, X.L.; Zhang, L.W. Report on the relative process of marketization in China by region. Econ. Res. 2003, 3, 9–18+89. (In Chinese) [Google Scholar]

- Wang, F.Z.; Chen, F.Y. Board governance, environmental regulation and green technology innovation—An empirical test based on listed companies in China’s heavy pollution industry. Sci. Res. 2018, 36, 361–369. (In Chinese) [Google Scholar]

- Liu, F.W.; Wu, Z.X.; Sui, Y.Y. A study on marketization, property rights and corporate tax burden fluctuation. Tax Res. 2016, 3, 103–107. (In Chinese) [Google Scholar]

- Li, Y.; Hu, H.Y.; Li, H. An empirical analysis of the impact of green credit on China’s industrial structure upgrading: Based on China’s provincial panel data. Econ. Probl. 2020, 1, 37–43. [Google Scholar]

- Pan, X.F.; Guo, S.C. Dynamic decomposition and regional differences of urban emergy ecological footprint in the Yangtze River Delta. J. Environ. Manag. 2023, 326, 116698. [Google Scholar]

| Year | Author (s) | Index and Method |

|---|---|---|

| 1953 | Malmquist [26] | First proposed concept of Malmquist (M) Index |

| 1978 | Charnes, Cooper, and Rhodes (CCR) [27] | First proposed the DEA model and called CCR model to calculate the M index |

| 1997 | Chung and Fare [28] | Further derived the M index with undesired outputs like pollutants and called Malmquist–Luenberger (ML) index |

| 2001 | Tone [30] | Proposed a new DEA model by relaxing nonproportional changes of inputs or outputs and called SBM model |

| 2003 | Tone [31] | Further extends the SBM model by integrating non-desired outputs into efficiency analysis |

| Comprehensive Index | Specific Indicators | Specific Indicators | Unit of Measurement | Property Direction |

|---|---|---|---|---|

| Corporate Green Transformation (GT) | Net fixed assets | Billion | + | |

| Inputs | Number of employees | ten thousand people | + | |

| Environmental Investment | Billion | + | ||

| Desired Outputs | Revenue from main business | Billion | + | |

| Non-desired outputs | Enterprise sewage charges and environmental protection tax | Billion | − |

| Symbols | Variables | Observations | Average Value | Standard Deviation | Minimum Value | Maximum Value |

|---|---|---|---|---|---|---|

| Corporate Green Total Factor Productivity | 3491 | 1.138 | 0.781 | 0.158 | 2.749 | |

| Experimental dummy variables | 3491 | 0.671 | 0.469 | 0 | 1 | |

| Time dummy variable | 3491 | 0.812 | 0.390 | 0 | 1 | |

| Green Credit guideline | 3491 | 0.541 | 0.498 | 0 | 1 | |

| Profit Level | 3491 | 0.027 | 0.155 | −7.242 | 0.775 | |

| Financial leverage | 3491 | 0.476 | 0.237 | 0.014 | 4.113 |

| Variables | Expected Symbols | GMM-DID (1) | GMM-DID (2) | GMM-DID (3) | GMM-DID (4) | GMM-DID (5) |

|---|---|---|---|---|---|---|

| + | 0.7441 ** | 0.8593 *** | 0.8687 *** | 0.8678 *** | 0.6949 ** | |

| (0.3694) | (0.3224) | (0.3202) | (0.3342) | (0.2959) | ||

| −0.6746 ** | −0.7754 *** | −0.7825 *** | −0.7722 ** | −0.6270 ** | ||

| (0.3414) | (0.3008) | (0.2957) | (0.3054) | (0.2691) | ||

| −0.6510 ** | −0.7188 *** | −0.7551 *** | −0.7416 *** | −0.5876 *** | ||

| (0.2696) | (0.2360) | (0.2323) | (0.2501) | (0.2200) | ||

| −0.0566 *** | −0.0932 *** | −0.2112 | −0.1616 | |||

| (0.0104) | (0.0117) | (0.1552) | (0.1491) | |||

| −0.1334 *** | −0.1719 *** | −0.1416 *** | ||||

| (0.0431) | (0.0560) | (0.0547) | ||||

| + | 0.0214 ** | 0.0208 ** | ||||

| (0.0094) | (0.0081) | |||||

| −0.0283 | ||||||

| (0.0332) | ||||||

| 0.9451 *** | 0.9261 *** | 0.9212 *** | 0.8864 *** | 0.8590 *** | ||

| (0.0348) | (0.0285) | (0.0292) | (0.0311) | (0.0280) | ||

| 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| 0.123 | 0.133 | 0.138 | 0.125 | 0.136 | ||

| 0.109 | 0.128 | 0.150 | 0.112 | 0.135 | ||

| 0.6665 ** | 0.7472 *** | 0.8486 *** | 0.8526 *** | 0.8088 *** | ||

| (0.2594) | (0.2268) | (0.2324) | (0.2354) | (0.2039) | ||

| Observations | 2977 | 2977 | 2977 | 2802 | 2802 | |

| Number of id | 504 | 504 | 504 | 489 | 489 |

| Variables | GMM-DID (6) |

|---|---|

| 0.9554 *** | |

| (0.2954) | |

| −0.8610 *** | |

| (0.2693) | |

| −0.7664 *** | |

| (0.2179) | |

| −0.0933 | |

| (0.1553) | |

| −0.1495 ** | |

| (0.0588) | |

| 0.0268 *** | |

| (0.0080) | |

| −0.0175 | |

| (0.0344) | |

| 0.8362 *** | |

| (0.0336) | |

| 0.9533 *** | |

| (0.2208) | |

| 2802 | |

| 489 |

| Variables | GMM-DID (7) | GMM-DID (8) |

|---|---|---|

| 0.6949 ** | 0.6970 *** | |

| (0.2959) | (0.2624) | |

| −0.6270 ** | −0.5634 ** | |

| (0.2691) | (0.2289) | |

| −0.5876 *** | −0.6045 *** | |

| (0.2200) | (0.1949) | |

| −0.1616 | −0.2339 | |

| (0.1491) | (0.1955) | |

| −0.1416 *** | −0.1039 | |

| (0.0547) | (0.0716) | |

| 0.0208 ** | −0.0036 | |

| (0.0081) | (0.0116) | |

| −0.0283 | 0.0024 | |

| (0.0332) | (0.0384) | |

| 0.8590 *** | 0.9001 *** | |

| (0.0280) | (0.0491) | |

| 0.8088 *** | 0.6895 *** | |

| (0.2039) | (0.2110) | |

| 2802 | 2008 | |

| 489 | 450 |

| Variables | GMM-DID (9) | GMM-DID (10) | GMM-DID (11) |

|---|---|---|---|

| 0.6949 ** | 0.3836 ** | 0.7869 ** | |

| (0.2959) | (0.1750) | (0.4009) | |

| 0.1229 ** | |||

| (0.0495) | |||

| −0.6270 ** | −0.3505 ** | −0.7259 ** | |

| (0.2691) | (0.1586) | (0.3657) | |

| −0.5876 *** | −0.2653 ** | −0.6387 ** | |

| (0.2200) | (0.1240) | (0.2884) | |

| −0.1616 | 0.0091 | −0.2252 | |

| (0.1491) | (0.0806) | (0.2827) | |

| −0.1416 *** | 0.1026 ** | −0.2515 *** | |

| (0.0547) | (0.0406) | (0.0768) | |

| 0.0208 ** | 0.0025 | 0.0182 * | |

| (0.0081) | (0.0076) | (0.0094) | |

| −0.0283 | −0.0557 ** | −0.0204 | |

| (0.0332) | (0.0246) | (0.0405) | |

| 0.8590 *** | 0.7349 *** | ||

| (0.0280) | (0.0202) | ||

| 0.6610 *** | |||

| (0.0680) | |||

| 0.8088 *** | 0.4236 *** | 1.0020 *** | |

| (0.2039) | (0.1292) | (0.2718) | |

| 2802 | 2802 | 2802 | |

| 489 | 489 | 489 |

| Variables | GMM-DID(12) | GMM-DID(13) |

|---|---|---|

| 0.3037 ** | ||

| (0.1467) | ||

| −0.0488 | ||

| (0.0719) | ||

| 0.6949 ** | 0.6805 ** | |

| (0.2959) | (0.2682) | |

| −0.6270 ** | −0.6066 ** | |

| (0.2691) | (0.2481) | |

| −0.5876 *** | −0.6211 *** | |

| (0.2200) | (0.2000) | |

| −0.1616 | −0.0049 | |

| (0.1491) | (0.2250) | |

| −0.1416 *** | −0.1348 ** | |

| (0.0547) | (0.0579) | |

| 0.0208 ** | 0.0144 * | |

| (0.0081) | (0.0082) | |

| −0.0283 | −0.0236 | |

| (0.0332) | (0.0318) | |

| 0.8590 *** | 0.8819 *** | |

| (0.0280) | (0.0293) | |

| 0.8088 *** | 0.9780 *** | |

| (0.2039) | (0.3780) | |

| 2802 | 2802 | |

| 489 | 489 |

| Variables | GMM-DID (14) Non-State-Owned Firms | GMM-DID (15) State-Owned Firms |

|---|---|---|

| 0.5143 ** | 0.3412 | |

| (0.2551) | (0.4085) | |

| −0.5090 ** | −0.2799 | |

| (0.2360) | (0.3714) | |

| −0.3310 * | −0.3473 | |

| (0.1827) | (0.3120) | |

| 0.1030 | −0.2357 | |

| (0.1854) | (0.1846) | |

| 0.0050 | −0.1940 *** | |

| (0.0806) | (0.0649) | |

| 0.0247 ** | 0.0094 | |

| (0.0110) | (0.0084) | |

| −0.0492 | −0.1295 ** | |

| (0.0303) | (0.0596) | |

| 0.8725 *** | 0.7650 *** | |

| (0.0239) | (0.0348) | |

| 0.5596 *** | 1.0090 *** | |

| (0.1782) | (0.3181) | |

| 1211 | 1591 | |

| 220 | 269 |

| Variables | GMM-DID (16) Highly Marketable Group | GMM-DID (17) Low-Marketable Group |

|---|---|---|

| 0.6150 ** | 0.4695 | |

| (0.3067) | (0.4458) | |

| −0.5514 ** | −0.4355 | |

| (0.2787) | (0.4064) | |

| −0.4745 ** | −0.3864 | |

| (0.2199) | (0.3354) | |

| −0.2635 * | 0.4649 | |

| (0.1510) | (0.2846) | |

| −0.0962 | −0.0859 | |

| (0.0672) | (0.0851) | |

| 0.0124 * | 0.0510 *** | |

| (0.0072) | (0.0154) | |

| 0.0144 | −0.2794 *** | |

| (0.0338) | (0.0607) | |

| 0.8681 *** | 0.6473 *** | |

| (0.0296) | (0.0473) | |

| 0.5671 *** | 1.4687 *** | |

| (0.2097) | (0.3814) | |

| 1943 | 859 | |

| 325 | 164 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liao, X.; Wang, J.; Wang, T.; Li, M. Green Credit Guideline Influencing Enterprises’ Green Transformation in China. Sustainability 2023, 15, 12094. https://doi.org/10.3390/su151512094

Liao X, Wang J, Wang T, Li M. Green Credit Guideline Influencing Enterprises’ Green Transformation in China. Sustainability. 2023; 15(15):12094. https://doi.org/10.3390/su151512094

Chicago/Turabian StyleLiao, Xianchun, Jie Wang, Ting Wang, and Meicun Li. 2023. "Green Credit Guideline Influencing Enterprises’ Green Transformation in China" Sustainability 15, no. 15: 12094. https://doi.org/10.3390/su151512094