The Effect of Green Credit on Enterprises’ Green Transformation under Sustainable Development: Evidence from Green Innovation in High-Pollution Enterprises in China

Abstract

:1. Introduction

2. Theoretical Analysis

2.1. Green Credit Policy and Enterprise Green Innovation

2.2. Heterogeneity Factors and Green Credit and Enterprise Innovation Relationship

3. Empirical Design

3.1. Model Settings

3.1.1. Benchmark Model

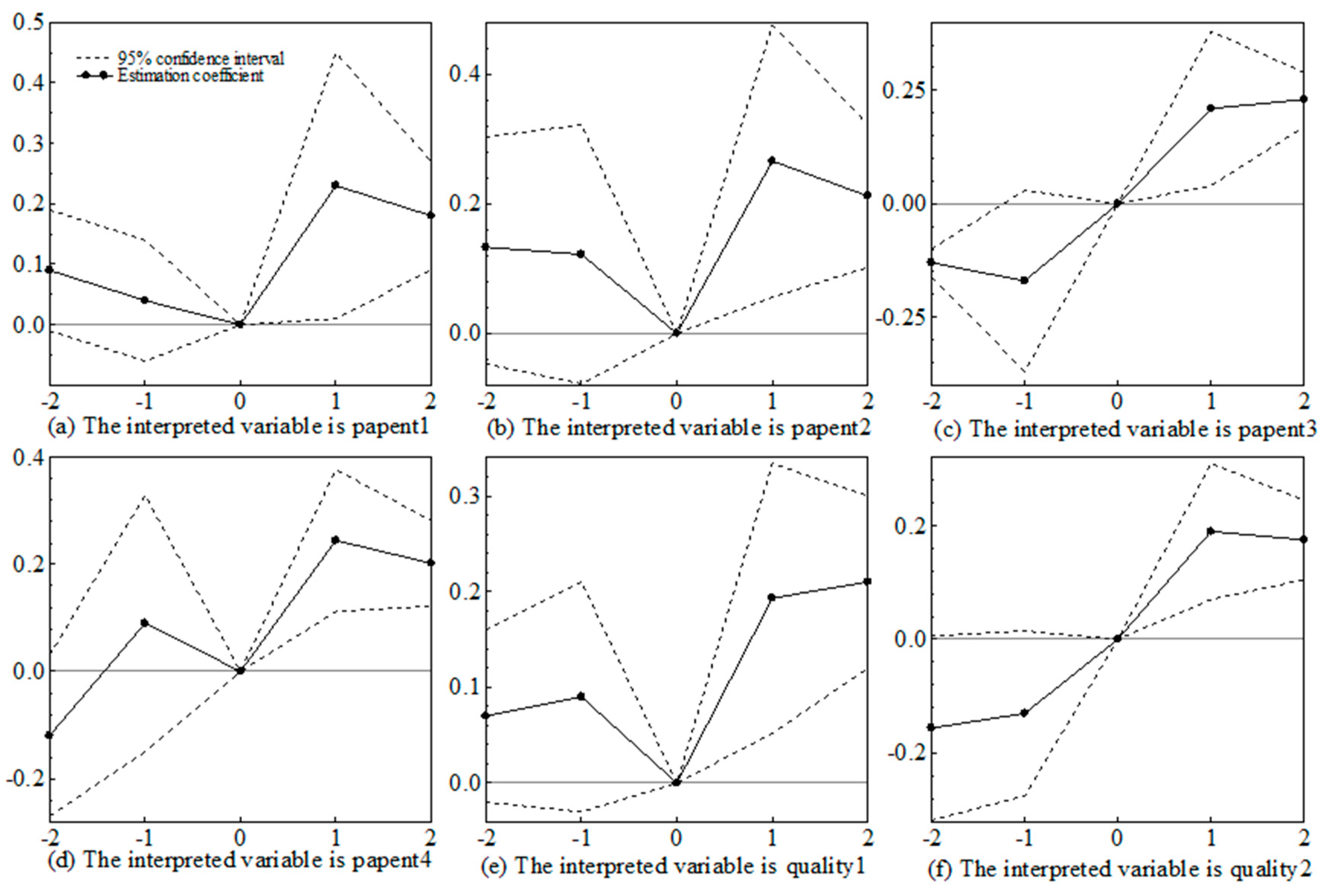

3.1.2. Parallel Trend Testing and Policy Dynamic Effect Testing

3.2. Data Description

3.2.1. Sample Selection

3.2.2. Variable Definition

4. Result Analysis

4.1. The Impact of Green Credit on the Green Transformation of High-Pollution Enterprises

4.2. Robustness Analysis

4.2.1. Parallel Trend Test

4.2.2. PSM-DID Inspection

4.3. Further Analysis

4.3.1. Nature of Ownership

4.3.2. Regional Financial Development Degree

5. Conclusions and Enlightenment

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Wang, X.; Wang, Y. Research on promoting green innovation through green credit policies. J. Manag. World 2021, 37, 137–188. [Google Scholar]

- Zhou, X.; Jia, M.; Zhao, X. Evolutionary game dynamic analysis and empirical research on green finance boosting enterprise green technology innovation. China Indust. Econ. 2023, 6, 43–61. [Google Scholar]

- Ma, T.; Han, T. Empirical research on the impact of financial development on innovative and green development: Based on the perspective of China’s industrial chain. Macroecon 2023, 7, 21–34. [Google Scholar]

- Wei, L.; Yang, Y. Research on the Evolution Logic and Environmental Effects of China’s Green Finance Policy. J. Northwest Norm. Univ. Soc. Sci. Ed. 2020, 57, 101–111. [Google Scholar]

- Salazar, J. Environmental finance: Linking two worlds. In Proceedings of the A Workshop on Financial Innovations for Biodiversity, Bratislava, Czech Republic, 1–3 May 1998; Volume 1, pp. 2–18. [Google Scholar]

- Labatt, S.; White, R. Environmental Finance: A Guide to Environmental Risk Assessment and Financial Products; John Wiley & Sons: Hoboken, NJ, USA, 2002. [Google Scholar]

- Ambec, S.; Barla, P. A theoretical foundation of the Porter hypothesis. Econ. Lett. 2002, 75, 55–360. [Google Scholar] [CrossRef]

- Guan, S.; Liu, J.; Liu, Y.; Du, M. The nonlinear influence of environmental regulation on the transformation and upgrading of industrial structure. Int. J. Environ. Res. Public Health 2022, 19, 8378. [Google Scholar] [CrossRef] [PubMed]

- Song, Y.; Ma, J.; Guan, S.; Liu, Y. Fiscal Decentralization, Regional Innovation and Industrial Structure Distortions in China. Sustainability 2022, 15, 710. [Google Scholar] [CrossRef]

- Jaffe, A.; Palmer, K. Environmental regulation and innovation: A panel data study. Rev. Econ. Stat. 1997, 79, 610–619. [Google Scholar] [CrossRef]

- Shao, S.; Hu, Z.; Cao, J. Environmental regulation and enterprise innovation: A review. Bus. Strateg. Environ. 2020, 29, 1465–1478. [Google Scholar] [CrossRef]

- Wang, Y.; Lei, X.; Long, R. Has the green credit policy improved the investment efficiency of enterprises—From the perspective of financial resource allocation for heavily polluting enterprises. Chin. J. Popul. Resour. 2021, 31, 123–133. [Google Scholar]

- Guo, J.; Fang, Y. Green credit, financing structure, and enterprise environmental investment. J. World Econ. 2022, 45, 57–80. [Google Scholar]

- Si, L.; Cao, H. Can green credit policies improve corporate environmental and social responsibility: From the perspective of external constraints and internal concerns. China Indust. Econ. 2022, 4, 137–155. [Google Scholar]

- Hu, Y.; Jiang, H.; Zhong, Z. Impact of green credit on industrial structure in China: Theoretical mechanism and empirical analysis. Environ. Sci. Pollut. Res. 2020, 27, 10506–10519. [Google Scholar] [CrossRef] [PubMed]

- Xu, X.; Li, J. Asymmetric impacts of the policy and development of green credit on the debt financing cost and maturity of different types of enterprises in China. J. Clean. Prod. 2020, 264, 121574. [Google Scholar] [CrossRef]

- Zhang, S.; Wu, Z.; Wang, Y. Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. J. Environ. Manag. 2021, 296, 113159. [Google Scholar] [CrossRef] [PubMed]

- Gu, X.; An, X.; Hou, Y. Financing constraints or transformation incentives—Research on the impact of green credit on TFP of heavy polluting enterprises in China. Theor. Pract. Financ. Econ. 2023, 44, 26–33. [Google Scholar]

- Tian, L.; Nie, Y. A review of green credit research in China based on knowledge graph. Sci. Res. Manag. 2023, 44, 97–104. [Google Scholar]

- Xiao, X.; Tian, Q.; Wang, Z. Can stakeholder environmental orientation promote green innovation—A moderated mediation effect model. Sci. Res. Manag. 2021, 42, 159–166. [Google Scholar]

- Zhang, Z.; Mu, T.; Yu, X. A study on the impact of the quality of corporate social responsibility information disclosure on green innovation: Evidence from listed manufacturing companies. J. Shandong Unvi. Financ. Econ. 2023, 35, 98–107. [Google Scholar]

- Yu, F.; Yuan, S.; Hu, Z. Research on the impact of knowledge base and knowledge distance on green innovation of enterprises. Sci. Res. Manag. 2021, 42, 100–112. [Google Scholar]

- Wang, X.; Chu, X. A study on the same group effect of green technology innovation in manufacturing enterprises: A reference role based on multilevel context. Nankai Bus. Rev. 2022, 25, 68–81. [Google Scholar]

- Shen, L.; Fan, R.; Wang, Y. Impacts of environmental regulation on the green transformation and upgrading of manufacturing enterprises. Int. J. Environ. Res. Public Health 2020, 17, 7680. [Google Scholar] [CrossRef] [PubMed]

- Zhang, B.; Yu, L.; Sun, C. How does urban environmental legislation guide the green transition of enterprises? Based on the perspective of enterprises’ green total factor productivity. Energy Econ. 2022, 110, 106032. [Google Scholar] [CrossRef]

- Lu, Y.; Gao, Y.; Zhang, Y. Can the green finance policy force the green transformation of high-polluting enterprises? A quasi-natural experiment based on “Green Credit Guidelines”. Energy Econ. 2022, 114, 106265. [Google Scholar] [CrossRef]

- Yao, X.; Chen, L.; Zhang, Y. Carbon trading mechanism and green innovation of enterprises: Based on the triple difference model. Sci. Res. Manag. 2022, 43, 43–52. [Google Scholar]

- Wang, X.; Zhang, X.; Zhu, R. The value creation effect of “environmental supervision” from the perspective of enterprise green innovation: A quasi-experimental study based on environmental interviews. Sci. Res. Manag. 2021, 42, 102–111. [Google Scholar]

- Liu, J.; Xiao, Y.; Zhu, R. China’s environmental protection tax and green innovation: Leveraging effect or crowding out effect? Econ. Res. J. 2022, 57, 72–88. [Google Scholar]

- Tian, C.; Li, X.; Xiao, L. Exploring the impact of green credit policy on green transformation of heavy polluting industries. J. Clean. Prod. 2022, 335, 130257. [Google Scholar] [CrossRef]

- Chen, B.; Luo, P.; Yang, J. Interaction between bank and tax, financing constraints, and investment and financing of small and micro enterprises. Econ. Res. J. 2021, 56, 77–93. [Google Scholar]

- Wang, H.; Wang, S.; Miao, Z.; Li, X. The heterogeneous threshold effect of R&D investment on green innovation efficiency: An empirical study based on China’s high-tech industry. Sci. Res. Manag. 2016, 37, 63–71. [Google Scholar]

- Cai, Q.; Chen, Y.; Lin, K. Availability of credit resources and enterprise innovation: Incentives or restraints-micro evidence based on bank outlet data and financial geographic structure. Econ. Res. J. 2020, 55, 124–140. [Google Scholar]

- Zhang, F.; Yu, H. Has the green credit policy driven green innovation in heavily polluting enterprises-Empirical testing based on the theory of enterprise life cycle. Nankai Bus. Rev. 2023, 1, 1–22. [Google Scholar]

- He, L.; Liu, R.; Zhong, Z. Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renew. Energy. 2019, 143, 974–984. [Google Scholar] [CrossRef]

- Zhang, J.; Luo, Y.; Ding, X. Can green credit policy improve the overseas investment efficiency of enterprises in China? J. Clean. Prod. 2022, 340, 130785. [Google Scholar] [CrossRef]

- Chen, Y.; Guan, J.; Tian, D. Research on the micro effects of green credit policies: Punishment or incentives-Retesting the porter effect of green credit policy. J. Fianc. Dev. Res. 2022, 9, 50–61. [Google Scholar]

- Gu, H.; Zhu, H. Will fulfilling social responsibility affect commercial banks’ risk-taking-Based on related party transactions, loan clustering, and green credit channels. China Soft Sci. 2023, 2, 136–145. [Google Scholar]

- He, J.; Wei, Y. Research on the impact of green finance development on high quality economic growth. Finac. Econ. 2023, 7, 48–60. [Google Scholar]

- Hu, G.; Wang, X.; Wang, Y. Can the green credit policy stimulate green innovation in heavily polluting enterprises? Evidence from a quasi-natural experiment in China. Energy Econ. 2021, 98, 105134. [Google Scholar] [CrossRef]

- Wang, H.; Qi, S.; Zhou, C. Green credit policy, government behavior and green innovation quality of enterprises. J. Clean. Prod. 2022, 331, 129834. [Google Scholar] [CrossRef]

- Li, Z.; Wang, W. Can the environmental responsibility performance of “too much speech and too little action” affect bank credit acquisition: A text analysis based on the dual dimensions of “speech” and “action. Finac. Res. 2021, 12, 116–132. [Google Scholar]

- Chen, G.; Ding, S.; Zhao, X. China’s green finance policy, financing costs, and green transformation of enterprises: From the perspective of the central bank’s collateral policy. Finac. Res. 2021, 12, 75–95. [Google Scholar]

- Li, C.; Lv, X.; Wu, G. R&D investment, financing constraints and green-tech content of Chinese exports. Sci. Res. Manag. 2015, 36, 28–35. [Google Scholar]

- Petroni, G.; Bigliardi, B.; Galati, F. Rethinking the porter hypothesis: The underappreciated importance of value appropriation and pollution intensity. Rev. Policy Res. 2019, 36, 121–140. [Google Scholar] [CrossRef]

- Yu, B. How green credit policies affect technological innovation in heavily polluting enterprises. Bus. Manag. J. 2021, 43, 35–51. [Google Scholar]

- Testa, F.; Iraldo, F.; Frey, M. The effect of environmental regulation on firms’ competitive performance: The case of the building & construction sector in some EU regions. J. Environ. Manag. 2011, 92, 2136–2144. [Google Scholar]

- Lu, J.; Yan, Y.; Wang, T. Research on the micro effects of green credit policy: From the perspective of technological innovation and resource reallocation. China Indust. Econ. 2021, 1, 174–192. [Google Scholar]

- Porter, M.; Van, L. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Jiang, W. Does environmental regulation affect R&D innovation in Chinese manufacturing enterprises: Empirical research based on micro data. Finan. Res. 2015, 41, 76–87. [Google Scholar]

- Yu, X.; Zhou, Y. Green credit policy and green transformation of high polluting enterprises: From the perspective of emission reduction and development. Quant. Econ. Technol. Res. 2023, 40, 179–200. [Google Scholar]

- Su, D.; Lian, L. Does green credit affect the investment and financing behavior of heavily polluting enterprises? Finac. Res. 2018, 12, 123–137. [Google Scholar]

- Li, D.; Gou, C.; Han, M. Research on the influence mechanism of green finance on the quality of green innovation of private enterprises: Evidence from China. Environ. Sci. Pollut. Res. 2023, 30, 30905–30918. [Google Scholar] [CrossRef] [PubMed]

- Chai, S.; Zhang, K.; Wei, W. The impact of green credit policy on enterprises’ financing behavior: Evidence from Chinese heavily-polluting listed companies. J. Clean. Prod. 2022, 363, 132458. [Google Scholar] [CrossRef]

- Chen, Q.; Zhang, G. Research on the impact of green credit on corporate debt financing: Empirical data from heavy polluting enterprises. Financ. Account. Comm. 2019, 8, 36–40. [Google Scholar]

- An, S.; Li, B.; Song, D. Green credit financing versus trade credit financing in a supply chain with carbon emission limits. Eur. J. Oper. Res. 2021, 292, 125–142. [Google Scholar] [CrossRef]

- Claessens, S.; Perotti, E. Finance and inequality: Channels and evidence. J. Comp. Econ. 2007, 35, 748–773. [Google Scholar] [CrossRef]

- O’Toole, C.; Newman, C. Investment financing and financial development: Evidence from Viet Nam. Rev. Financ. 2017, 21, 1639–1674. [Google Scholar] [CrossRef]

- He, L.; Zhang, L.; Zhong, Z. Green credit, renewable energy investment and green economy development: Empirical analysis based on 150 listed companies of China. J. Clean. Prod. 2019, 208, 363–372. [Google Scholar] [CrossRef]

| Variable Symbol | Variable | Variable Definition |

|---|---|---|

| papent1 | green patent application volume | ln (green patent application volume + 1) |

| papent2 | green patent authorization volume | ln (green patent authorization volume + 1) |

| papent3 | green utility model patent application volume | ln (green utility model patent application volume + 1) |

| papent4 | green utility model patent authorization volume | ln (green utility model patent authorization volume + 1) |

| quality1 | the number of cited green patent applications | ln (the number of cited green patent authorizations + 1) |

| quality2 | the number of cited green patent authorizations | ln (the number of cited green patent authorizations + 1) |

| treat | high-pollution enterprises | virtual variable of high-pollution enterprise, value 1 |

| policy | policy year | virtual variable of policy implementation year, value 1 in 2012 and later |

| roa | return on equity | net profit/average net assets |

| lev | asset–liability ratio | total liabilities/total assets |

| liu | current ratio | current assets/current liabilities |

| size | asset size | ln (assets) |

| age | enterprise age | years of establishment of the company |

| MB | market-to-book ratio | current market value/book value |

| lar | equity concentration | shareholding ratio of the largest shareholder |

| Variable | Quantity of Green Innovation | Quality of Green Innovation | ||||

|---|---|---|---|---|---|---|

| papent1 | papent2 | papent3 | papent4 | quality1 | quality2 | |

| policy | 0.541 *** | 0.627 *** | 0.403 *** | 0.685 *** | 0.453 *** | 0.366 *** |

| (3.21) | (2.95) | (3.16) | (4.42) | (3.87) | (4.75) | |

| treat × policy | 0.213 *** | 0.255 *** | 0.198 *** | 0.236 *** | 0.187 *** | 0.176 *** |

| (4.31) | (5.06) | (4.53) | (3.89) | (4.42) | (5.01) | |

| roa | 0.223 | 0.193 | 0.174 | 0.201 | 0.322 | 0.295 |

| (1.03) | (1.34) | (0.98) | (1.23) | (1.50) | (1.47) | |

| lev | 0.104 *** | 0.133 *** | 0.127 *** | 0.108 *** | 0.125 *** | 0.119 |

| (2.78) | (2.84) | (3.02) | (3.21) | (2.92) | (3.66) | |

| liu | −0.203 * | −0.188 * | −0.075 | −0.104 | −0.122 * | −0.212 ** |

| (−1.78) | (−1.91) | (−1.52) | (−1.43) | (−1.85) | (−2.03) | |

| size | 0.004 * | 0.003 * | 0.005 ** | 0.004 * | 0.005 * | 0.003 * |

| (1.71) | (1.80) | (2.04) | (1.77) | (1.86) | (1.92) | |

| age | −0.003 * | −0.002 * | −0.001 ** | −0.002 * | −0.002 ** | −0.001 * |

| (−1.80) | (−1.73) | (−2.11) | (1.92) | (−2.32) | (1.88) | |

| MB | 0.013 *** | 0.019 *** | 0022 *** | 0.025 *** | 0.032 *** | 0.036 *** |

| (3.03) | (3.75) | (2.89) | (2.77) | (3.01) | (3.15) | |

| lar | −0.231 *** | −0.324 *** | −0.372 *** | −0.401 *** | −0.389 *** | −0.355 *** |

| (−4.32) | (−5.32) | (−3.84) | (−4.63) | (−4.59) | (−5.03) | |

| intercept | 0.641 *** | 0.753 *** | 0.712 *** | 0.474 *** | 0.783 *** | 0.722 *** |

| (5.12) | (6.83) | (4.35) | (5.13) | (5.38) | (5.81) | |

| year | YES | YES | YES | YES | YES | YES |

| industry | YES | YES | YES | YES | YES | YES |

| R2 | 0.165 | 0.148 | 0.144 | 0.157 | 0.151 | 0.138 |

| Variable | Quantity of Green Innovation | Quality of Green Innovation | ||||

|---|---|---|---|---|---|---|

| papent1 | papent2 | papent3 | papent4 | quality1 | quality2 | |

| treat × policy | 0.327 *** | 0.331 *** | 0.205 *** | 0.287 *** | 0.212 *** | 0.194 *** |

| (3.86) | (4.55) | (5.11) | (4.29) | (4.22) | (4.84) | |

| year | YES | YES | YES | YES | YES | YES |

| industry | YES | YES | YES | YES | YES | YES |

| R2 | 0.164 | 0.152 | 0.149 | 0.161 | 0.155 | 0.142 |

| Variable | State-Owned Enterprise | Non-State-Owned Enterprises | ||||

|---|---|---|---|---|---|---|

| papent2 | papent4 | quality2 | papent2 | papent4 | quality2 | |

| treat × policy | 0.022 ** | 0.027 *** | 0.031 *** | 0.017 | 0.019 | 0.02 |

| (2.43) | (2.76) | (3.01) | (1.42) | (1.38) | (0.99) | |

| year | YES | YES | YES | YES | YES | YES |

| industry | YES | YES | YES | YES | YES | YES |

| R2 | 0.241 | 0.302 | 0.328 | 0.286 | 0.277 | 0.335 |

| Variable | Financial Developed Areas | Financial Underdeveloped Areas | ||||

|---|---|---|---|---|---|---|

| papent2 | papent4 | quality2 | papent2 | papent4 | quality2 | |

| treat × policy | 0.011 *** | 0.013 *** | 0.018 *** | 0.032 *** | 0.028 *** | 0.021 *** |

| (3.74) | (3.03) | (4.55) | (3.85) | (3.10) | (2.98) | |

| year | YES | YES | YES | YES | YES | YES |

| industry | YES | YES | YES | YES | YES | YES |

| R2 | 0.424 | 0.384 | 0.411 | 0.395 | 0.416 | 0.453 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tian, S.; Zhang, H.; Xu, G. The Effect of Green Credit on Enterprises’ Green Transformation under Sustainable Development: Evidence from Green Innovation in High-Pollution Enterprises in China. Sustainability 2024, 16, 235. https://doi.org/10.3390/su16010235

Tian S, Zhang H, Xu G. The Effect of Green Credit on Enterprises’ Green Transformation under Sustainable Development: Evidence from Green Innovation in High-Pollution Enterprises in China. Sustainability. 2024; 16(1):235. https://doi.org/10.3390/su16010235

Chicago/Turabian StyleTian, Shining, Hongli Zhang, and Guangping Xu. 2024. "The Effect of Green Credit on Enterprises’ Green Transformation under Sustainable Development: Evidence from Green Innovation in High-Pollution Enterprises in China" Sustainability 16, no. 1: 235. https://doi.org/10.3390/su16010235

APA StyleTian, S., Zhang, H., & Xu, G. (2024). The Effect of Green Credit on Enterprises’ Green Transformation under Sustainable Development: Evidence from Green Innovation in High-Pollution Enterprises in China. Sustainability, 16(1), 235. https://doi.org/10.3390/su16010235