Impact of Climate Change on Inflation in 26 Selected Countries

Abstract

:1. Introduction

2. Literature Review and Hypotheses Creation

2.1. The Concept and Measurement of Climate Change

2.2. Macroeconomic Implications of Climate Change

2.3. Effects of Climate Change on Inflation

2.4. Channels through Which Climate Change Affects Inflation

3. Materials and Methods

3.1. Measurement Model Setting

3.1.1. Baseline Regression Model Setting

3.1.2. Panel Threshold Model Setting

3.1.3. Intermediate Effect Model

3.2. Variable Description

3.2.1. Explanatory Variables

3.2.2. Core Explanatory Variables

3.2.3. Intermediate Variables

3.2.4. Control Variables

3.3. Data and Descriptive Statistics

4. Results

4.1. Baseline Regression Results

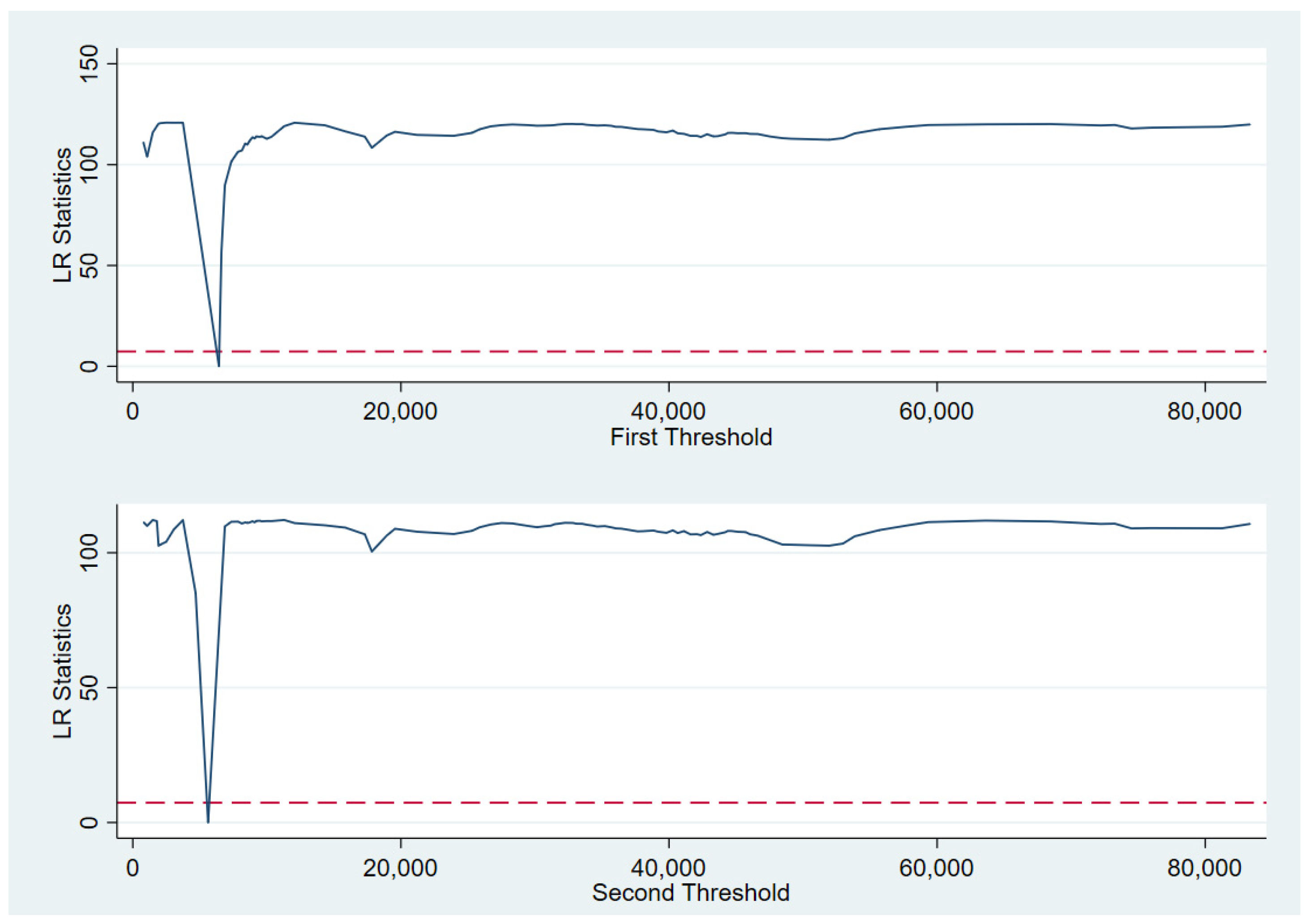

4.2. Threshold Effect (Double Threshold)—GDP per Capita

4.3. Mechanism Test

4.4. Robustness Test

4.4.1. Substitution of Explanatory Variables

4.4.2. Adjust the Research Year Interval

4.4.3. Excluded Hyperinflationary Countries

4.4.4. Endogeneity Issues

4.5. Heterogeneity Test

4.5.1. Income Grouping—High-Income and Lower-Middle-Income Country Groupings

4.5.2. Temperature Grouping (High-Temperature Group and Low-Temperature Group)

5. Discussion

6. Conclusions

Author Contributions

Funding

Informed Consent Statement

Conflicts of Interest

References

- Enete, A.A.; Amusa, T.A. Challenges of agricultural adaptation to climate change in Nigeria: A synthesis from the literature. Field Actions Sci. Rep. J. Field Actions 2010, 4. Available online: http://journals.openedition.org/factsreports/678 (accessed on 29 July 2023).

- Rudebusch, G.D. Climate change and the Federal Reserve. FRBSF Econ. Lett. 2019, 9, 33–52. [Google Scholar]

- Bansal, R.; Ochoa, J. Temperature, Aggregate Risk, and Expected Returns; National Bureau of Economic Research, Inc.: Cambridge, MA, USA, 2011. [Google Scholar]

- Bo, L.; Yunqi, L.; Yinjuan, J. Climate Changes and the Total Factor Productivity of Manufacturing Enterprises: Mechanism Analysis and EmpiricalTests. J. Hunan Univ. (Soc. Sci.) 2023, 37, 78–87. [Google Scholar] [CrossRef]

- Dell, M.; Jones, B.F.; Olken, B.A. Temperature shocks and economic growth: Evidence from the last half century. Am. Econ. J. Macroecon. 2012, 4, 66–95. [Google Scholar] [CrossRef]

- Minghui, L.; Jianglong, L.; Guanfei, M.; Xiuwang, Y. How Does Temperature Shocks Affect Household Energy Consumption? In sights from Demand Heterogeneity. J. Xi’an Jiaotong Univ. (Soc. Sci.) 2022, 42, 74–85. [Google Scholar]

- Kotseva-Tikova, M.; Dvorak, J. Climate Policy and Plans for Recovery in Bulgaria and Lithuania. Rom. J. Eur. Aff. 2022, 22, 79–99. [Google Scholar] [CrossRef]

- Batten, S.; Sowerbutts, R.; Tanaka, M. Climate change: Macroeconomic impact and implications for monetary policy. In Ecological, Societal, and Technological Risks and the Financial Sector; Palgrave Macmillan: Cham, Switzerland, 2020; pp. 13–38. [Google Scholar] [CrossRef]

- Doyle, L.; Noy, I. The short-run nationwide macroeconomic effects of the Canterbury earthquakes. N. Z. Econ. Pap. 2015, 49, 134–156. [Google Scholar] [CrossRef]

- Faccia, D.; Parker, M.; Stracca, L. Too Hot for Stable Prices? International Evidence on Climate Change and Inflation; European Central Bank: Frankfurt, Germany, 2020. [Google Scholar]

- Heinen, A.; Khadan, J.; Strobl, E. The price impact of extreme weather in developing countries. Econ. J. 2019, 129, 1327–1342. [Google Scholar] [CrossRef]

- Klomp, J.; Sseruyange, J. Earthquakes and economic outcomes: Does central bank independence matter? Open Econ. Rev. 2021, 32, 335–359. [Google Scholar] [CrossRef]

- Mukherjee, K.; Ouattara, B. Climate and monetary policy: Do temperature shocks lead to inflationary pressures? Clim. Chang. 2021, 167, 32. [Google Scholar] [CrossRef]

- Lanzafame, M. Temperature, rainfall and economic growth in Africa. Empir. Econ. 2014, 46, 1–18. [Google Scholar] [CrossRef]

- Colacito, R.; Hoffmann, B.; Phan, T. Temperature and growth: A panel analysis of the United States. J. Money Credit Bank 2019, 51, 313–368. [Google Scholar] [CrossRef]

- Acevedo, S.; Mrkaic, M.; Novta, N.; Pugacheva, E.; Topalova, P. The effects of weather shocks on economic activity: What are the channels of impact? J. Macroecon. 2020, 65, 103207. [Google Scholar] [CrossRef]

- Chandio, A.A.; Jiang, Y.; Rehman, A.; Rauf, A. Short and long-run impacts of climate change on agriculture: An empirical evidence from China. Int. J. Clim. Chang. Strateg. Manag. 2020, 12, 201–221. [Google Scholar] [CrossRef]

- De Bandt, O.; Jacolin, L.; Thibault, L. Climate Change in Developing Countries: Global Warming Effects, Transmission Channels and Adaptation Policies: Banque de France Working Paper 822. 2021. Available online: https://EconPapers.repec.org/RePEc:hal:cesptp:hal-03948704 (accessed on 29 July 2023).

- Odongo, M.T.; Misati, R.N.; Kamau, A.W.; Kisingu, K.N. Climate change and inflation in Eastern and Southern Africa. Sustainability 2022, 14, 14764. [Google Scholar] [CrossRef]

- Ciccarelli, M.; Kuik, F.; Hernández, C.M. The Asymmetric Effects of Weather Shocks on Euro Area Inflation; European Central Bank: Frankfurt, Germany, 2023. [Google Scholar]

- Kotz, M.; Kuik, F.; Lis, E.; Nickel, C. The Impact of Global Warming on Inflation: Averages, Seasonality and Extremes. 2023. Available online: https://EconPapers.repec.org/RePEc:ecb:ecbwps:20232821 (accessed on 29 July 2023).

- Benson, C.; Clay, E.J. The Impact of Drought on Sub-Saharan African Economies: A Preliminary Examination; World Bank Publications: Washington, DC, USA, 1998; Volume 401. [Google Scholar]

- Lesk, C.; Rowhani, P.; Ramankutty, N. Influence of extreme weather disasters on global crop production. Nature 2016, 529, 84–87. [Google Scholar] [CrossRef] [PubMed]

- Parker, M. The impact of disasters on inflation. Econ. Disasters Clim. Chang. 2018, 2, 21–48. [Google Scholar] [CrossRef]

- Strobl, E. The economic growth impact of natural disasters in developing countries: Evidence from hurricane strikes in the Central American and Caribbean regions. J. Dev. Econ. 2012, 97, 130–141. [Google Scholar] [CrossRef]

- Debelle, G. Climate Change and the Economy; Speech at Public Forum Hosted by Centre for Policy Development: Sydney, Australia, 2019; Volume 2019. [Google Scholar]

- Kunawotor, M.E.; Bokpin, G.A.; Asuming, P.O.; Amoateng, K.A. The impacts of extreme weather events on inflation and the implications for monetary policy in Africa. Prog. Dev. Stud. 2022, 22, 130–148. [Google Scholar] [CrossRef]

- Fratzscher, M.; Grosse-Steffen, C.; Rieth, M. Inflation targeting as a shock absorber. J. Int. Econ. 2020, 123, 103308. [Google Scholar] [CrossRef]

- Beirne, J.; Dafermos, Y.; Kriwoluzky, A.; Renzhi, N.; Volz, U.; Wittich, J. Natural Disasters and Inflation in the Euro Area; Verein für Socialpolitik/German Economic Association: Berlin, Germany, 2022. [Google Scholar]

- Hsiang, S.M.; Jina, A.S. The Causal Effect of Environmental Catastrophe on Long-Run Economic Growth: Evidence from 6700 Cyclones; National Bureau of Economic Research: Cambridge, MA, USA, 2014. [Google Scholar]

- Nordhaus, W. Projections and uncertainties about climate change in an era of minimal climate policies. Am. Econ. J. Econ. Policy 2018, 10, 333–360. [Google Scholar] [CrossRef]

- Feitelson, E.; Tubi, A. A main driver or an intermediate variable? Climate change, water and security in the Middle East. Glob. Environ. Chang. 2017, 44, 39–48. [Google Scholar] [CrossRef]

- Pugatch, T. Tropical storms and mortality under climate change. World Dev. 2019, 117, 172–182. [Google Scholar] [CrossRef]

- Cavallo, E.; Galiani, S.; Noy, I.; Pantano, J. Catastrophic natural disasters and economic growth. Rev. Econ. Stat. 2013, 95, 1549–1561. [Google Scholar] [CrossRef]

- Abe, N.; Moriguchi, C.; Inakura, N. The Effects of Natural Disasters on Prices and Purchasing Behaviors: The Case of the Great East Japan Earthquake; Research Center for Economic and Social Risks, Institute of Economic Research, Hitotsubashi University: Tokyo, Japan, 2014. [Google Scholar]

- Cevik, S.; Jalles, J. Eye of the Storm: The Impact of Climate Shocks on Inflation and Growth; International Monetary Fund. 2023. Available online: https://0-doi-org.library.svsu.edu/10.5089/9798400241307.00 (accessed on 29 July 2023).

- Cashin, P.; Mohaddes, K.; Raissi, M. Fair weather or foul? The macroeconomic effects of El Niño. J. Int. Econ. 2017, 106, 37–54. [Google Scholar] [CrossRef]

- Kim, H.S.; Matthes, C.; Phan, T. Extreme Weather and the Macroeconomy. 2021. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3918533 (accessed on 29 July 2023).

- Yusifzada, T. Response of Inflation to the Climate Stress: Evidence from Azerbaijan. 2022. Available online: https://www.researchsquare.com/article/rs-1513451/v1 (accessed on 29 July 2023).

- Islam, M.S.; Okubo, K.; Islam, A.H.M.S.; Sato, M. Investigating the effect of climate change on food loss and food security in Bangladesh. SN Bus. Econ. 2022, 2, 1–24. [Google Scholar] [CrossRef]

- Kabundi, A.; Mlachila, M.; Yao, J. How Persistent Are Climate-Related Price Shocks? Implications for Monetary Policy. 2022. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4272242 (accessed on 29 July 2023).

- Natoli, F. Temperature Surprise Shocks. 2022. Available online: https://mpra.ub.uni-muenchen.de/112568/ (accessed on 29 July 2023).

- Deschênes, O.; Greenstone, M. Climate change, mortality, and adaptation: Evidence from annual fluctuations in weather in the US. Am. Econ. J. Appl. Econ. 2011, 3, 152–185. [Google Scholar] [CrossRef]

- Fikru, M.G.; Gautier, L. The impact of weather variation on energy consumption in residential houses. Appl. Energy 2015, 144, 19–30. [Google Scholar] [CrossRef]

- de Galhau, V. Climate Change: Central Banks Are Taking Action. In Financial Stability Review; Banque de France: Paris, France, 2019; p. 7. [Google Scholar]

- Atalla, T.; Gualdi, S.; Lanza, A. A global degree days database for energy-related applications. Energy 2018, 143, 1048–1055. [Google Scholar] [CrossRef]

- Yuping, Z.; Yang, L. A Literature Reviewof the Impact of Climate Changeon Financial Stability and Monetary Policy. J. Contemp. Financ. Res. 2021, Z2, 79–89. [Google Scholar]

- Yalew, S.G.; van Vliet, M.T.; Gernaat, D.E.; Ludwig, F.; Miara, A.; Park, C.; Byers, E.; De Cian, E.; Piontek, F.; Iyer, G. Impacts of climate change on energy systems in global and regional scenarios. Nat. Energy 2020, 5, 794–802. [Google Scholar] [CrossRef]

- Congmou, Z.; Wuyan, L.; Yingying, D.; Hongwei, X.; Ke, W. Spatial-temporal change, trade-off and synergy relationships of cropland multifunctional value in Zhejiang Province. Trans. Chin. Soc. Agric. Eng. 2020, 36, 263–272. [Google Scholar]

- Mengyang, H.; Shunbo, Y. Spatial spillover effects and threshold characteristics of rural labor transfer on agricultural eco-efficiency in China. Resour. Sci. 2018, 40, 2475–2486. [Google Scholar]

- Hansen, B.E. Threshold effects in non-dynamic panels: Estimation, testing, and inference. J. Econom. 1999, 93, 345–368. [Google Scholar] [CrossRef]

- Wen, Z.; Ye, B. Analyses of Mediating Effects: The Development of Methods and Models. Adv. Psychol. Sci. 2014, 22, 731. [Google Scholar] [CrossRef]

- Ruqing, W.; Lekai, Z. The Impact of Global Value Chain Division on Inflation and Its Mechanism Analysis. Inq. Econ. Issues 2022, 43, 134–148. [Google Scholar]

- Yuan, Y.; Cheng, J.; Xu, D.; Cui, X. New Test of the Impact of Exports on the Green Production Efficiency of Enterprises. J. China Univ. Geosci. Soc. Sci. Ed. 2020, 20, 68–82. [Google Scholar]

| Symbol | Variable | Meaning |

|---|---|---|

| Inflation | Inflation | Inflation, as measured by the Consumer Price Index, reflecting the annual percentage change in the cost of a basket of goods and services purchased by the average consumer |

| GDP deflator | GDP deflator annual growth rate | Inflation rate indicating the rate of price change in the economy as a whole |

| TEMPworld | Average temperature | Average annual temperature |

| STEMP | Average temperature | Standardized mean temperature |

| TEMPFAO | Temperature change | Mean surface change temperature over land |

| lnUrban | Urbanization rate | Logarithmic value of the share of urban population in the total population |

| lnPRE | Precipitation | Average annual precipitation |

| lnGDPpercapita | GDP per capita | Logarithm of GDP per capita in constant 2015 dollars |

| lnEMP | Unemployment rate | Logarithm of the unemployed population as a percentage of the labor force |

| lnM2 | Broad money supply | Logarithmic value of broad money supply |

| lnEC | Energy consumption | Total primary energy consumption, primary energy includes raw coal, crude oil, natural gas, hydropower, and nuclear power |

| Carbon dioxide emissions | Carbon dioxide emissions are those stemming from the burning of fossil fuels and the manufacture of cement |

| Variable | Sample Size | Average | Standard Deviation | Maximum | Minimum |

|---|---|---|---|---|---|

| Inflation | 702 | 4.75 | 12.03 | 197.41 | −4.48 |

| GDPdeflator | 702 | 5.09 | 12.08 | 144.01 | −16.91 |

| TEMPworld | 702 | 11.85 | 8.40 | 26.95 | −5.27 |

| STEMP | 702 | 0.00 | 1.00 | 1.80 | −2.04 |

| TEMPFAO | 702 | 1.10 | 0.60 | 3.69 | −0.79 |

| lnUrban | 702 | 4.27 | 0.26 | 4.59 | 3.28 |

| lnPRE | 702 | 6.67 | 0.65 | 8.10 | 4.43 |

| lnGDPpercapita | 702 | 9.95 | 1.08 | 11.40 | 6.43 |

| lnEMP | 702 | 1.84 | 0.46 | 3.26 | 0.53 |

| lnM2 | 702 | 13.20 | 1.43 | 17.44 | 9.93 |

| lnEC | 702 | 1.83 | 1.22 | 5.06 | −0.74 |

| 702 | 7.86 | 4.43 | 0.73 | 20.29 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Inflation | Inflation | GDP Deflator | GDP Deflator | |

| TEMPworld | 0.948 | 1.894 ** | 1.031 | 1.791 ** |

| (0.912) | (0.842) | (0.907) | (0.842) | |

| lnUrban | 24.95 ** | 12.99 | ||

| (9.683) | (9.686) | |||

| lnPRE | −1.922 | −0.976 | ||

| (3.232) | (3.233) | |||

| lnGDPpercapita | 5.375 | 9.056 ** | ||

| (3.951) | (3.952) | |||

| lnEMP | −5.951 *** | −6.330 *** | ||

| (1.563) | (1.563) | |||

| lnM2 | −16.60 *** | −16.45 *** | ||

| (1.578) | (1.578) | |||

| Constant | 8.761 | 68.01 * | 6.744 | 75.59 ** |

| (10.62) | (38.03) | (10.56) | (38.04) | |

| National fixed | Yes | Yes | Yes | Yes |

| Year fixed | Yes | Yes | Yes | Yes |

| Observations | 702 | 702 | 702 | 702 |

| 0.136 | 0.293 | 0.132 | 0.282 | |

| Number of ID | 26 | 26 | 26 | 26 |

| Threshold Test | Original Hypothesis | F-Value | p-Value | Threshold | ||

|---|---|---|---|---|---|---|

| 10% | 5% | 1% | ||||

| Single Threshold | : No threshold value | 44.490 | 0.026 | 28.973 | 36.088 | 55.259 |

| Double Threshold | : A threshold value exists | 113.67 | 0.000 | 12.315 | 15.373 | 21.032 |

| Three Thresholds | : Two thresholds exist | 11.240 | 0.680 | 138.243 | 153.626 | 197.605 |

| Threshold Variable | Number of Thresholds | Threshold | 95% Confidence Interval |

|---|---|---|---|

| GDP per capita | Single Threshold | 5618.951 | (4686.859, 6868.704) |

| Double Threshold | 6427.308 | (6022.847, 6613.991) |

| Variable | Estimated Value |

|---|---|

| GDP per capita (GDP per capita ≤ 5618.951) | −0.548 (0.665) |

| GDP per capita (5618.951 < GDP per capita ≤ 6427.308) | 5.049 (0.001) |

| GDP per capita (GDP per capita > 6427.308) | 1.882 (0.225) |

| Control variables | Yes |

| National fixed | Yes |

| Time fixed | Yes |

| 0.3345 | |

| N | 702 |

| Variable | (1) Inflation | (2) lnEC | (3) Inflation |

|---|---|---|---|

| TEMPworld | 1.8941 ** | −0.0295 *** | 2.2413 *** |

| (2.2492) | (−2.9630) | (2.6675) | |

| lnEC | 11.7676 *** | ||

| (3.5636) | |||

| lnM2 | −16.6006 *** | 0.1647 *** | −18.5385 *** |

| (−10.5199) | (8.8244) | (−11.1965) | |

| lnPRE | −1.9215 | −0.0583 | −1.2351 |

| (−0.5946) | (−1.5262) | (−0.3849) | |

| lnUrban | 24.9546 ** | 0.9791 *** | 13.4335 |

| (2.5771) | (8.5496) | (1.3266) | |

| lnGDPpercapita | 5.3751 | 0.3496 *** | 1.2608 |

| (1.3606) | (7.4835) | (0.3089) | |

| lnEMP | −5.9506 *** | 0.0725 *** | −6.8036 *** |

| (−3.8084) | (3.9226) | (−4.3421) | |

| National fixed | Yes | Yes | Yes |

| Year Fixed fixed | Yes | Yes | Yes |

| _cons | 68.0125 * | −7.3106 *** | 154.0407 *** |

| (1.7886) | (−16.2569) | (3.4419) | |

| N | 702 | 702 | 702 |

| 0.2928 | 0.7036 | 0.3065 |

| Type of Effect | Coefficient | Standard Error | 95% Confidence Interval | |

|---|---|---|---|---|

| Lower Limit | Upper Limit | |||

| Indirect_bs_1 | −0.091 *** | 0.035 | −0.159 | −0.022 |

| Direct_bs_2 | −0.243 *** | 0.088 | −0.417 | −0.070 |

| Variable | (1) Inflation | (2) GDP Deflator | (3) Inflation | (4) GDP Deflator |

|---|---|---|---|---|

| TEMPFAO | 1.407 * | 1.771 ** | ||

| (0.855) | (0.854) | |||

| STEMP | 15.90 ** | 15.03 ** | ||

| (7.068) | (7.070) | |||

| lnUrban | 22.26 ** | 10.36 | 24.95 ** | 12.99 |

| (9.640) | (9.627) | (9.683) | (9.686) | |

| lnPRE | −2.119 | −1.140 | −1.922 | −0.976 |

| (3.236) | (3.231) | (3.232) | (3.233) | |

| lnGDPpercapita | 6.323 | 10.21 ** | 5.375 | 9.056 ** |

| (3.988) | (3.983) | (3.951) | (3.952) | |

| lnEMP | −5.920 *** | −6.248 *** | −5.951 *** | −6.330 *** |

| (1.567) | (1.565) | (1.563) | (1.563) | |

| lnM2 | −16.79 *** | −16.79 *** | −16.60 *** | −16.45 *** |

| (1.604) | (1.602) | (1.578) | (1.578) | |

| Constant | 94.31 *** | 99.61 *** | 90.46 ** | 96.81 *** |

| (35.88) | (35.83) | (35.89) | (35.90) | |

| _cons | 702 | 702 | 702 | 702 |

| National fixed | Yes | Yes | Yes | Yes |

| Year Fixedfixed | Yes | Yes | Yes | Yes |

| 0.290 | 0.281 | 0.293 | 0.282 | |

| N | 26 | 26 | 26 | 26 |

| Variables | (1) | (2) | (4) | (3) |

|---|---|---|---|---|

| Inflation | GDP Deflator | Inflation | GDP Deflator | |

| TEMPworld | 2.360 *** | 2.164 ** | 2.200 ** | 1.891 ** |

| (0.874) | (0.880) | (0.896) | (0.772) | |

| lnUrban | 27.32 *** | 14.26 | 34.30 *** | 23.06 ** |

| (10.31) | (10.37) | (10.60) | (9.126) | |

| lnPRE | −2.431 | −1.414 | −2.910 | −2.652 |

| (3.392) | (3.414) | (3.468) | (2.987) | |

| lnGDPpercapita | 3.750 | 7.696 * | 2.971 | 6.330 * |

| (4.170) | (4.197) | (4.295) | (3.699) | |

| lnEMP | −5.463 *** | −5.953 *** | −4.617 *** | −4.489 *** |

| (1.620) | (1.631) | (1.645) | (1.417) | |

| lnM2 | −16.06 *** | −15.92 *** | −16.39 *** | −15.53 *** |

| (1.645) | (1.656) | (1.721) | (1.483) | |

| Constant | 64.24 | 74.76 * | 49.78 | 54.72 |

| (40.20) | (40.46) | (40.88) | (35.21) | |

| National fixed | Yes | Yes | Yes | Yes |

| Year fixed | Yes | Yes | Yes | Yes |

| Observations | 650 | 650 | 598 | 598 |

| 0.294 | 0.279 | 0.302 | 0.332 | |

| Number of ID | 26 | 26 | 26 | 26 |

| Variable | (1) | (2) |

|---|---|---|

| Inflation | GDP Deflator | |

| TEMPworld | 0.600 * | 0.933 ** |

| (0.339) | (0.465) | |

| lnUrban | −8.972 ** | −11.27 ** |

| (3.897) | (5.338) | |

| lnPRE | −0.981 | −0.479 |

| (1.217) | (1.667) | |

| lnGDPpercapita | 2.338 | 4.491 ** |

| (1.593) | (2.183) | |

| lnEMP | −0.972 | −1.113 |

| (0.644) | (0.883) | |

| lnM2 | −1.024 | −2.737 *** |

| (0.757) | (1.038) | |

| Constant | 34.79 ** | 37.69 * |

| (14.27) | (19.54) | |

| National fixed | Yes | Yes |

| Year fixed | Yes | Yes |

| Observations | 594 | 594 |

| 0.159 | 0.133 | |

| Number of ID | 22 | 22 |

| Variable | (1) Inflation | (2) GDP Deflator |

|---|---|---|

| TEMPworld | 2.078 ** | 2.007 ** |

| (0.854) | (0.859) | |

| lnUrban | 19.13 ** | 16.27 ** |

| (2.78) | (3.13) | |

| lnPRE | 0.256 | 0.432 |

| (0.80) | (0.66) | |

| lnGDPpercapita | −8.524 ** | −6.822 *** |

| (−3.10) | (−3.62) | |

| lnEMP | −1.014 | −1.294 * |

| (−1.61) | (−2.15) | |

| lnM2 | −2.002 *** | −2.155 *** |

| (−4.41) | (−4.77) | |

| Constant | 54.19 *** | 45.66 *** |

| (6.38) | (5.36) | |

| Kleibergen−Paap rk LM statistic | 17.536 (0.00) | 17.536 (0.00) |

| Kleibergen−Paap rk Wald F statistic | 53.778 (0.00) | 53.778 (0.00) |

| National fixed | Yes | Yes |

| Year fixed | Yes | Yes |

| Observations | 702 | 702 |

| 0.2265 | 0.2818 | |

| Number of ID | 26 | 26 |

| Variable | High-Income Countries | Low- and Middle-Income Countries | ||

|---|---|---|---|---|

| (1) Inflation | (2) GDP Eflator | (3) Inflation | (4) GDP Deflator | |

| TEMPworld | −0.213 | 0.0699 | 8.903 *** | 7.047 ** |

| (0.188) | (0.343) | (3.066) | (3.043) | |

| lnUrban | 6.526 * | −2.351 | 100.2 *** | 56.86 * |

| (3.669) | (6.684) | (29.84) | (29.62) | |

| lnPRE | −0.660 | −0.364 | −4.314 | −0.0287 |

| (0.678) | (1.236) | (14.93) | (14.82) | |

| lnGDPpercapita | −6.281 *** | −5.548 *** | 15.69 | 31.69 ** |

| (1.044) | (1.903) | (13.35) | (13.24) | |

| lnEMP | −1.617 *** | −2.067 *** | −19.47 *** | −20.76 *** |

| (0.354) | (0.646) | (5.526) | (5.484) | |

| lnM2 | −1.752 *** | −3.858 *** | −27.30 *** | −27.66 *** |

| (0.459) | (0.837) | (4.301) | (4.268) | |

| Constant | 72.30 *** | 125.6 *** | −217.1 | −174.1 |

| (22.13) | (40.31) | (132.8) | (131.8) | |

| National fixed | Yes | Yes | Yes | Yes |

| Year fixed | Yes | Yes | Yes | Yes |

| Observations | 513 | 513 | 189 | 189 |

| 0.342 | 0.189 | 0.613 | 0.592 | |

| Number of ID | 19 | 19 | 7 | 7 |

| Variable | High-Temperature Group | Low-Temperature Group | ||

|---|---|---|---|---|

| (1) Inflation | (2) GDP Deflator | (3) Inflation | (4) GDP Deflator | |

| TEMPworld | −0.267 | 0.951 | 3.175 *** | 2.125 ** |

| (1.368) | (1.754) | (1.224) | (0.925) | |

| lnUrban | −49.88 *** | −61.86 *** | 64.39 *** | 50.48 *** |

| (13.58) | (17.42) | (14.94) | (11.30) | |

| lnPRE | 0.404 | 2.980 | −3.017 | −1.711 |

| (3.566) | (4.574) | (6.873) | (5.196) | |

| lnGDPpercapita | 8.711 * | 13.07 ** | 1.998 | 1.249 |

| (4.726) | (6.062) | (6.872) | (5.195) | |

| lnEMP | −9.452 *** | −11.38 *** | −4.818 * | −3.567 * |

| (1.861) | (2.387) | (2.603) | (1.968) | |

| lnM2 | −17.79 *** | −20.34 *** | −18.76 *** | −14.71 *** |

| (1.905) | (2.444) | (2.679) | (2.025) | |

| Constant | 382.3 *** | 389.9 *** | −26.75 | −20.58 |

| (63.14) | (80.98) | (59.49) | (44.98) | |

| Observations | 351 | 351 | 351 | 351 |

| 0.443 | 0.388 | 0.304 | 0.326 | |

| Number of ID | 13 | 13 | 13 | 13 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, C.; Zhang, X.; He, J. Impact of Climate Change on Inflation in 26 Selected Countries. Sustainability 2023, 15, 13108. https://doi.org/10.3390/su151713108

Li C, Zhang X, He J. Impact of Climate Change on Inflation in 26 Selected Countries. Sustainability. 2023; 15(17):13108. https://doi.org/10.3390/su151713108

Chicago/Turabian StyleLi, Cunpu, Xuetong Zhang, and Jing He. 2023. "Impact of Climate Change on Inflation in 26 Selected Countries" Sustainability 15, no. 17: 13108. https://doi.org/10.3390/su151713108

APA StyleLi, C., Zhang, X., & He, J. (2023). Impact of Climate Change on Inflation in 26 Selected Countries. Sustainability, 15(17), 13108. https://doi.org/10.3390/su151713108