Research on the Dynamic Characteristics of Photovoltaic Power Production and Sales Based on Game Theory

Abstract

:1. Introduction

- In the dynamic game model for trading between PVPs and PVDs, the payoff bimatrices provided for the PVD market and PVP market reflect the impact of the supply and demand relationship of green electricity on transaction pricing.

- A game can be transformed into its algebraic form by using the STP. This algebraic form makes it more convenient for us to study the game. Therefore, the STP is an effective method for analyzing the dynamic characteristics of game models.

- During the trading process, the strategies of all participants are constantly changing to obtain more profits rather than stable at a traditional Nash equilibrium point.

2. Materials and Methods

2.1. Preliminaries

- : the set of all n-dimensional real vectors;

- (): the set of -dimensional real (logical) matrices;

- (): the ith column (row) of matrix M;

- : the dimensional identity matrix;

- , the ith column of ;

- , the set of all columns of ;

- , a logical matrix.

- (1)

- denotes n players;

- (2)

- , expresses the strategy set of player i, and is the set of strategy profiles;

- (3)

- is the payoff function of player i;

- (4)

- In a multiround game, the players follow the ultimate goal of maximizing their own profits and use this goal as a guiding principle for adjusting their strategies.

- For any matrix M, n-dimensional column vector X, and n-dimensional row vector Y, the following two equalities holdand

- For any two column vectors and , the following equality holds:whereis a swap matrix.

- For any , the following equality holds:where , and is a power-reducing matrix.

2.2. Problem Analysis

- Individual users can become both suppliers and demanders of photovoltaic power in the transactions. As the suppliers, individual users produce sufficient electricity by installing photovoltaic power generation systems, which can not only meet household requirements but also sell their remaining electricity to energy companies and earn profits. On the demand side, individual users need to purchase green electricity when their production is insufficient.

- Enterprise users often appear as demanders. With the increasing awareness of corporate social responsibility and regulatory restrictions on energy consumption, more and more enterprises are purchasing green electricity to reduce their dependence on traditional energy and improve their sustainable development level.

- Energy companies obtain green power through construction and operation of renewable energy generation projects and then sell the green power to individual users and/or enterprise users to obtain profits.

3. Results

3.1. Transaction Process

- (1)

- All PVPs and PVDs engage in bidding transactions on the same third-party platform.

- (2)

- According to the real-time market conditions, all participants bid once a day.

- (3)

- For a given PVP, if there is at least a PVD whose quotation is not lower than that of the PVP, then a transaction will be conducted. Otherwise, the deal fails and they wait for the next bidding. When conducting transactions, an introduction is given in the following section about how to determine the transaction price.

- (1)

- In a PVDs’ market, the lowest quotation from the above PVPs will be used as the transaction price.

- (2)

- In a PVPs’ market, the transaction price is the highest quotation of the above PVDs.

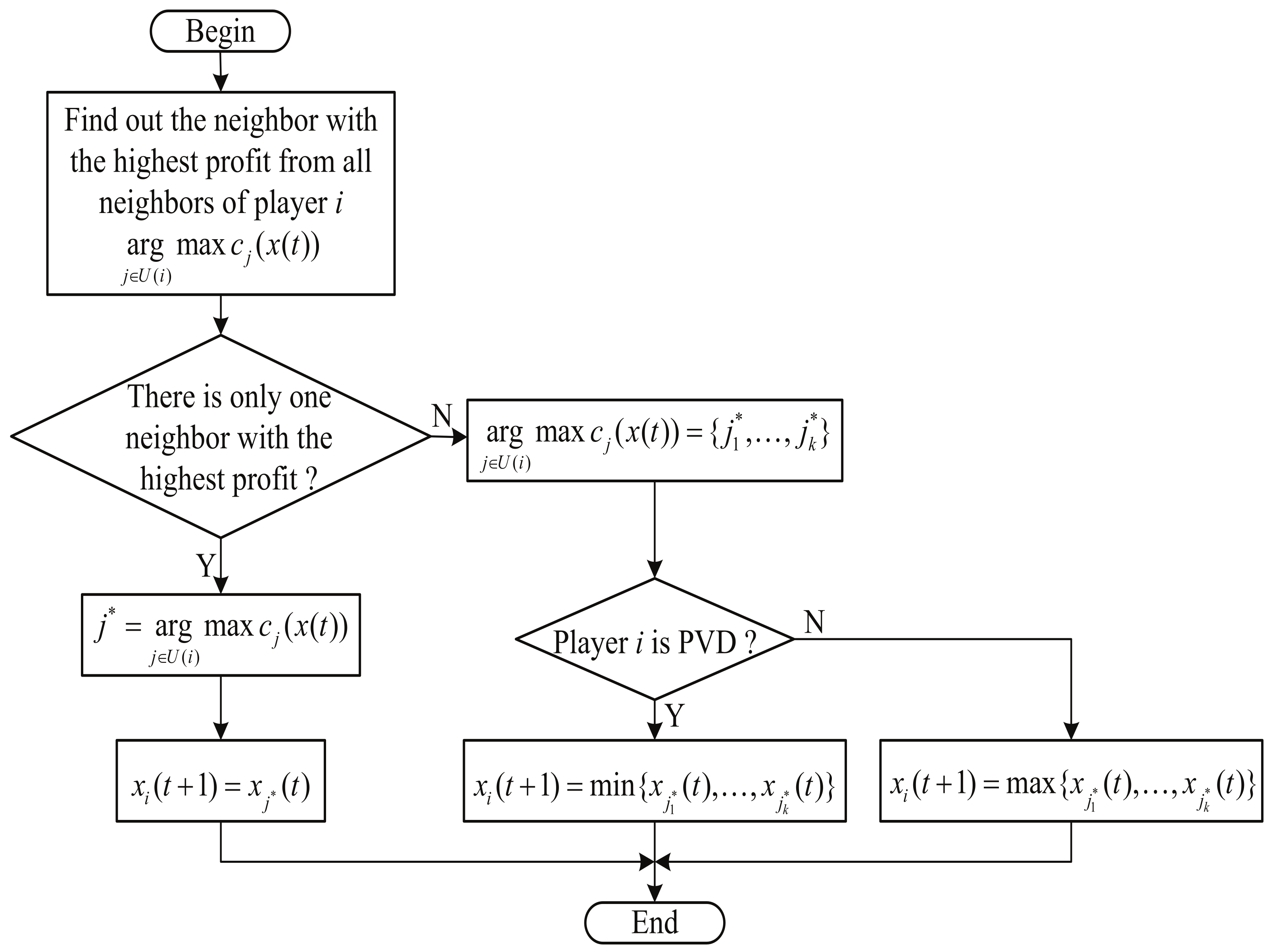

3.2. Strategy-Updating Rule

- If player i is a PVD, their neighbor players are PVPs. The PVD prefers to make the next deal with one of the PVPs at the lowest possible price. So,

- If player i is a PVP, all of their neighbors are PVDs. The PVP tends to make the next transaction with one of the PVDs at the highest price. Then,

3.3. Payoff Bimatrix

3.4. Dynamic Characteristic Analysis

- 1.

- For any state , Col(Row)) = 1 holds;

- 2.

- for any integer l (), there is a state , such that Col(Row.

| Algorithm 1: Compute the set of states contained in all limit cycles of length k. |

| 1: . |

| 2: for to do |

| 3: initialize: . |

| 4: for to do |

| 5: if Col(Row))=1 holds, then |

| 6: . |

| 7: end if |

| 8: end for |

| 9: return , and the length of attractor . |

| 10: end for |

| Algorithm 2: Compute the attractor C of (3) with length k. |

| 1: for to do |

| 2: denote the potential of as r. |

| 3: for to r do |

| 4: return , |

| 5: . |

| 6: end for |

| 7: end for |

4. Discussion

- When the initial state is chosen from , for example, the initial state is taken as , which is equivalent to , according to Table 5, and it is updated to , which is equivalent to . Similarly, the follow-up actions can be obtained . The system (6) will be stable at the Nash equilibrium (meaning strategy profile ). Figure 4 gives the state trajectories for all players.

- If players choose an initial strategy profile from , the strategy profile will be stable at (meaning strategy profile ) to achieve the maximum revenue.

- If the initial strategy profile is chosen from , it will reach and be stable at (meaning strategy profile ) to make as much profit as possible.

- For other strategy profiles, they are not stable at any state but oscillate between two states: (meaning strategy profile ) and (meaning strategy profile ). To a certain extent, it can also be considered stable on a limit cycle.

5. Conclusions

- Different from the existing relevant literature, two kinds of payoff bimatrices were provided in the dynamic game model for trading between PVPs and PVDs. One corresponds to a PVDs’ market and the other to a PVPs’ market. They reflect the impact of photovoltaic power supply and demand on transaction pricing.

- The game model established above was equivalently transformed into its algebraic form using the STP method. This algebraic form makes it more convenient to study the game. Therefore, the STP is an effective method for analyzing the dynamic characteristics of game models.

- During the trading process, the strategies of all participants are mostly changing to obtain more profits rather than stable at a traditional Nash equilibrium point.

- The method and results are applicable to other distributed low-carbon energies, contributing to the development of sustainable energy systems.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Nomenclature

| Sets | |

| Set of all n-dimensional real vectors | |

| Set of dimensional real matrices | |

| Set of dimensional logical matrices | |

| Set of all columns of | |

| Set of profiles | |

| Set of n players | |

| Set of neighbors of player i | |

| Strategy set of player i | |

| Parameters | |

| Transaction price | |

| Production price | |

| Government subsidy | |

| Traditional electricity price | |

| Compensation costs | |

| Variables and Functions | |

| Payoff function of player i | |

| Strategy of player i at time t | |

| Strategy of all players at time t | |

| Notations | |

| dimensional identity matrix | |

| ith column of matrix M | |

| ith row of matrix M | |

| ith column of | |

| Logical matrix | |

| Strategy profile | |

| Least common multiplier of n and p | |

| ⊗ | Kronecker product of matrices |

| ⋉ | STP of matrices |

| Swap matrix | |

| Power-reducing matrix | |

| C | Limit cycle |

| Acronyms | |

| PVP | Photovoltaic power producer |

| PVD | Photovoltaic power demander |

| STP | Semitensor product |

| DER | Distributed energy resource |

| P2P | Peer-to-peer |

References

- Zhang, Y.; Zhang, N.; Dai, H.; Zhang, S.; Wu, X.; Xue, M. Model construction and pathways of low-carbon transition of China’s power system. Electr. Power 2021, 54, 1–11. [Google Scholar]

- Ren, D.; Xiao, J.; Hou, J.; Du, E.; Jin, C.; Liu, Y. Construction and evolution of China’s new power system under dual carbon goal. Power Syst. Technol. 2022, 46, 3831–3839. [Google Scholar]

- Wei, L.; Feng, Y.; Fang, J.; Ai, X.; Wen, J. Impact of renewable energy integration on market-clearing results in spot market environment. J. Shanghai Jiao Tong Univ. 2021, 55, 1631–1639. [Google Scholar]

- Pan, X.; Xu, H.; Feng, S. The economic and environment impacts of energy intensity target constraint: Evidence from low carbon pilot cities in China. Energy 2022, 261, 125250. [Google Scholar] [CrossRef]

- Hirsch, A.; Parag, Y.; Guerrero, J. Microgrids: A review of technologies, key drivers, and outstanding issues. Renew. Sustain. Energy Rev. 2018, 90, 402–411. [Google Scholar] [CrossRef]

- Liu, Z.; Gao, J.; Yu, H.; Wang, X. Operation mechanism and strategies for transactive electricity market with multi-micro grid in grid-connected mode. IEEE Access 2020, 8, 79594–79603. [Google Scholar] [CrossRef]

- Boudoudouh, S.; Maâroufi, M. Multi agent system solution to microgrid implementation. Sustain. Cities Soc. 2018, 39, 252–261. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Garttner, J.; Rock, K.; Kessler, S.; Orsini, L. Designing microgrid energy markets: A case study-the Brooklyn microgrid. Appl. Energy 2018, 210, 870–880. [Google Scholar] [CrossRef]

- Teng, F.; Zhang, Y.; Yang, T.; Li, T.; Xiao, Y.; Li, Y. Distributed Optimal Energy Management for We-Energy Considering Operation Security. IEEE Trans. Netw. Sci. Eng. 2023, 1–11. [Google Scholar] [CrossRef]

- Keshta, H.; Ali, A.; Saied, E.; Bendary, F. Real-time operation of multi-micro-grids using a multi-agent system. Energy 2019, 174, 576–590. [Google Scholar] [CrossRef]

- Meryem, H.; Abdelhadi, R.; Omar, B. Sustainable Intelligent Energy Management System for Microgrid Using Multi-Agent Systems: A Case Study. Sustainability 2023, 15, 12546. [Google Scholar]

- Eddy, Y.; Gooi, H.; Chen, S. Multi-Agent System for Distributed Management of Microgrids. IEEE Trans. Power Syst. 2015, 30, 24–34. [Google Scholar] [CrossRef]

- Hamidi, M.; Raihani, A.; Youssfi, M.; Bouattane, O. A new modular nanogrid energy management system based on multi-agent architecture. Int. J. Power Electron. Drive Syst. 2022, 13, 178. [Google Scholar] [CrossRef]

- Andoni, M.; Robu, V.; Flynn, D.; Abram, S.; Geach, D.; Jenkins, D.; McCallum, P.; Peacock, A. Blockchain technology in the energy sector: A systematic review of challenges and opportunities. Renew. Sustain. Energy Rev. 2019, 100, 143–174. [Google Scholar] [CrossRef]

- Roth, T.; Utz, M.; Baumgarte, F.; Rieger, A.; Sedlmeir, J.; Strüker, J. Electricity powered by blockchain: A review with a European perspective. Appl. Energy 2022, 325, 119799. [Google Scholar] [CrossRef]

- Kim, M.; Song, S.; Jun, M. A study of block chain-based peer-to-peer energy loan service in smart grid environments. Adv. Sci. Lett. 2016, 22, 2543–2546. [Google Scholar] [CrossRef]

- Bürer, M.; de Lapparent, M.; Pallotta, V.; Capezzali, M.; Carpita, M. Use cases for Blockchain in the Energy Industry Opportunities of emerging business models and related risks. Comput. Ind. Eng. 2019, 137, 106002. [Google Scholar] [CrossRef]

- Aitzhan, N.; Svetinovic, D. Security and privacy in decentralized energy trading through multi-signatures, blockchain and anonymous messaging streams. IEEE Trans. Dependable Secur. Comput. 2018, 15, 840–852. [Google Scholar] [CrossRef]

- Paudel, A.; Sampath, L.; Yang, J.; Gooi, H. Peer-to-peer energy trading in smart grid considering power losses and network fees. IEEE Trans. Smart Grid 2020, 11, 4727–4737. [Google Scholar] [CrossRef]

- Gupta, R.; Goswami, M.; Daultani, Y.; Biswas, B.; Allada, V. Profitability and pricing decision-making structures in presence of uncertain demand and green technology investment for a three tier supply chain. Comput. Ind. Eng. 2023, 179, 109190. [Google Scholar] [CrossRef]

- Ma, L.; Liu, N.; Zhang, J.; Wang, L. Real-time rolling horizon energy management for the energy-hub-coordinated prosumer community from a cooperative perspective. IEEE Trans. Power Syst. 2019, 34, 1227–1242. [Google Scholar] [CrossRef]

- Jiang, A.; Yuan, H.; Li, D. A two-stage optimization approach on the decisions for prosumers and consumers within a community in the Peer-to-peer energy sharing trading. Int. J. Electr. Power Energy Syst. 2021, 125, 106527. [Google Scholar] [CrossRef]

- Tan, J.; Li, Y. Review on transaction mode in multi-energy collaborative market. Proc. CSEE 2019, 39, 6483–6496. (In Chinese) [Google Scholar]

- Lian, X.; Li, X.; Lu, Y.; Ding, Y.; Li, C. Dynamic electricity trading strategy for multi-microgrid under transactive energy framework. Electr. Power Constr. 2020, 41, 18–27. (In Chinese) [Google Scholar]

- Li, Y.; Zhao, T.; Wang, P.; Gooi, H.; Wu, L.; Liu, Y.; Ye, J. Optimal operation of multimicrogrids via cooperative energy and reserve scheduling. IEEE Trans. Ind. Inform. 2018, 14, 3459–3468. [Google Scholar] [CrossRef]

- Tan, C.; Geng, S.; Tan, Z.; Wang, G.; Pu, L.; Guo, X. Integrated energy system-Hydrogen natural gas hybrid energy storage system optimization model based on cooperative game under carbon neutrality. J. Energy Storage 2021, 38, 102539. [Google Scholar] [CrossRef]

- Diao, L.; Li, G.; Song, X.; Degjizhv; Tan, Z. Comprehensive evaluation method based on game for multi-entity benefit under the proportional penetration of new energy. Electr. Power Constr. 2022, 43, 43–55. [Google Scholar]

- Liu, W.; Gu, W.; Wang, J.; Yu, W.; Xi, X. Game theoretic non-cooperative distributed coordination control for multi-microgrids. IEEE Trans. Smart Grid 2018, 9, 6986–6997. [Google Scholar] [CrossRef]

- Alhasnawi, B.; Jasim, B.; Sedhom, B.; Guerrero, J. Consensus Algorithm-based Coalition Game Theory for Demand Management Scheme in Smart Microgrid. Sustain. Cities Soc. 2021, 74, 103248. [Google Scholar] [CrossRef]

- Javanmard, B.; Tabrizian, M.; Ansarian, M.; Ahmarinejad, A. Energy management of multi-microgrids based on game theory approach in the presence of demand response programs, energy storage systems and renewable energy resources. J. Energy Storage 2021, 42, 102971. [Google Scholar] [CrossRef]

- AlSkaif, T.; Zapata, M.; Bellalta, B.; Nilsson, A. A distributed power sharing framework among households in microgrids: A repeated game approach. Computing 2017, 99, 23–37. [Google Scholar] [CrossRef]

- Luo, X.; Shi, W.; Jiang, Y.; Liu, Y.; Xia, J. Distributed peer-to-peer energy trading based on game theory in a community microgrid considering ownership complexity of distributed energy resources. J. Clean. Prod. 2022, 351, 131573. [Google Scholar] [CrossRef]

- Modarresi, J. Coalitional game theory approach for multi-microgrid energy systems considering service charge and power losses. Sustain. Energy Grids Netw. 2022, 31, 100720. [Google Scholar] [CrossRef]

- Wu, Q.; Xie, Z.; Li, Q.; Ren, H.; Yang, Y. Economic optimization method of multi-stakeholder in a multi-microgrid system based on Stackelberg game theory. Energy Rep. 2022, 8, 345–351. [Google Scholar] [CrossRef]

- Sun, L.; Xu, Q.; Chen, X.; Fan, Y. Day-ahead economic dispatch of microgrid based on game theory. Energy Rep. 2020, 6, 633–638. [Google Scholar] [CrossRef]

- Zheng, X.; Li, Q.; Bai, C.; Nie, Y.; Huang, C. Energy trading management based on Stackelberg game theory to increase independence of microgrids. Energy Rep. 2022, 8, 771–779. [Google Scholar] [CrossRef]

- Amin, W.; Huang, Q.; Afzal, M.; Khan, A.; Ahmed, S. A converging non-cooperative and cooperative game theory approach for stabilizing peer-to-peer electricity trading. Electr. Power Syst. Res. 2020, 183, 106278. [Google Scholar] [CrossRef]

- Nash, J. The Bargaining Problem; Princeton University Press: Princeton, NJ, USA, 2002; pp. 37–48. [Google Scholar]

- Jiang, A.; Yuan, H.; Li, D. Energy management for a community-level integrated energy system with photovoltaic prosumers based on bargaining theory. Energy 2021, 225, 120272. [Google Scholar] [CrossRef]

- Mohseni, S.; Pishvaee, M. Energy trading and scheduling in networked microgrids using fuzzy bargaining game theory and distributionally robust optimization. Appl. Energy 2023, 350, 121748. [Google Scholar] [CrossRef]

- Saeian, H.; Niknam, T.; Zare, M.; Aghaei, J. Coordinated optimal bidding strategies methods of aggregated microgrids: A game theory-based demand side management under an electricity market environment. Energy 2022, 245, 123205. [Google Scholar] [CrossRef]

- Esfahani, M.; Hariri, A.; Mohammed, O. A Multiagent-Based Game-Theoretic and Optimization Approach for Market Operation of Multimicrogrid Systems. IEEE Trans. Ind. Inform. 2019, 15, 280–292. [Google Scholar] [CrossRef]

- Rezaei, N.; Meyabadi, A.; Deihimi, M. A game theory based demand-side management in a smart microgrid considering price-responsive loads via a twofold sustainable energy justice portfolio. Sustain. Energy Technol. Assessments 2022, 52, 102273. [Google Scholar] [CrossRef]

- Zheng, Z.; Tian, H.; Zhu, P.; Chi, Y.; Liu, Y.; Jia, X. Research on strategy of green electricity acquisition transaction of park-level energy internet by using STP. Front. Energy Res. 2022, 10, 953039. [Google Scholar] [CrossRef]

- Robert, G. A Primer in Game Theory; Prentice-Hall: Upper Saddle River, NJ, USA, 1999. [Google Scholar]

- Cheng, D.; He, F.; Qi, H.; Xu, T. Modeling, analysis and control of networked evolutionary games. IEEE Trans. Autom. Contr. 2015, 60, 2402–2415. [Google Scholar] [CrossRef]

- Cheng, D.; Qi, H. Controllability and observability of boolean control networks. Automatica 2009, 45, 1659–1667. [Google Scholar] [CrossRef]

- Cheng, D.; Qi, H. A linear representation of dynamics of boolean networks. IEEE Trans. Autom. Control. 2010, 55, 2251–2258. [Google Scholar] [CrossRef]

- Cheng, D.; Qi, H.; Li, Z. Analysis and Control of Boolean Networks: A Semi-Tensor Product Approach; Springer: London, UK, 2011. [Google Scholar]

- Nowak, M.; May, R. Evolutionary games and spatial chaos. Nature 1992, 359, 826–829. [Google Scholar] [CrossRef]

| Method | Related Achievements | The Characteristics of the Method | |

|---|---|---|---|

| Cooperative game | [28,29,30,31,32,33] |

| |

| Non-cooperative game | Stackelberg game | [34,35,36,37] |

|

| Nash bargaining game | [38,39,40,41,42,43] |

| |

| Networked evolutionary game | [44] |

| |

| PVP∖PVD | 1 | 2 | ⋯ | n | |

|---|---|---|---|---|---|

| 1 | ⋯ | ||||

| 2 | ⋯ | ||||

| ⋯ | ⋯ | ⋯ | ⋯ | ⋯ | ⋯ |

| ⋯ | |||||

| n | ⋯ |

| PVP∖PVD | 1 | 2 | ⋯ | n | |

|---|---|---|---|---|---|

| 1 | ⋯ | ||||

| 2 | ⋯ | ||||

| ⋯ | ⋯ | ⋯ | ⋯ | ⋯ | ⋯ |

| ⋯ | |||||

| n | ⋯ |

| PVP∖PVD | 1 | 2 |

|---|---|---|

| 1 | ||

| 2 |

| Profile | 11111 | 11112 | 11121 | 11122 | 11211 | 11212 | 11221 | 11222 |

|---|---|---|---|---|---|---|---|---|

| 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

| 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

| 1 | 1 | 1 | 1 | 0 | 2 | 2 | 2 | |

| 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | |

| 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | |

| 1 | 2 | 2 | 2 | 1 | 2 | 2 | 2 | |

| 1 | 2 | 2 | 2 | 1 | 2 | 2 | 2 | |

| 1 | 2 | 2 | 2 | 1 | 2 | 2 | 2 | |

| 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

| 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

| Profile | 12111 | 12112 | 12121 | 12122 | 12211 | 12212 | 12221 | 12222 |

| 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

| 0 | 2 | 2 | 2 | 0 | 2 | 2 | 2 | |

| 1 | 1 | 1 | 1 | 0 | 2 | 2 | 2 | |

| 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | |

| 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | |

| 1 | 2 | 2 | 2 | 1 | 2 | 2 | 2 | |

| 1 | 2 | 2 | 2 | 1 | 2 | 2 | 2 | |

| 1 | 2 | 2 | 2 | 1 | 2 | 2 | 2 | |

| 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

| 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

| Profile | 21111 | 21112 | 21121 | 21122 | 21211 | 21212 | 21221 | 21222 |

| 0 | 2 | 2 | 2 | 0 | 2 | 2 | 2 | |

| 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

| 1 | 1 | 1 | 1 | 0 | 2 | 2 | 2 | |

| 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | |

| 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | |

| 1 | 2 | 2 | 2 | 1 | 2 | 2 | 2 | |

| 1 | 2 | 2 | 2 | 1 | 2 | 2 | 2 | |

| 1 | 2 | 2 | 2 | 1 | 2 | 2 | 2 | |

| 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

| 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

| Profile | 22111 | 22112 | 22121 | 22122 | 22211 | 22212 | 22221 | 22222 |

| 0 | 2 | 2 | 2 | 0 | 2 | 2 | 2 | |

| 0 | 2 | 2 | 2 | 0 | 2 | 2 | 2 | |

| 1 | 1 | 1 | 1 | 0 | 2 | 2 | 2 | |

| 2 | 2 | 2 | 2 | 0 | 0 | 1 | 1 | |

| 2 | 2 | 2 | 2 | 0 | 1 | 0 | 1 | |

| 1 | 2 | 2 | 2 | 1 | 2 | 2 | 2 | |

| 1 | 2 | 2 | 2 | 1 | 2 | 2 | 2 | |

| 1 | 1 | 2 | 2 | 1 | 2 | 2 | 2 | |

| 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | |

| 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hou, Y.; Tian, H. Research on the Dynamic Characteristics of Photovoltaic Power Production and Sales Based on Game Theory. Sustainability 2023, 15, 14645. https://doi.org/10.3390/su151914645

Hou Y, Tian H. Research on the Dynamic Characteristics of Photovoltaic Power Production and Sales Based on Game Theory. Sustainability. 2023; 15(19):14645. https://doi.org/10.3390/su151914645

Chicago/Turabian StyleHou, Yanfang, and Hui Tian. 2023. "Research on the Dynamic Characteristics of Photovoltaic Power Production and Sales Based on Game Theory" Sustainability 15, no. 19: 14645. https://doi.org/10.3390/su151914645