1. Introduction

The current pattern of human behavior in energy consumption and pollution makes the realization of the United Nations’ Sustainable Development Goals, which aim to achieve economic, social, and environmental sustainability by 2030, far-reaching. Many pressing economic and environmental challenges are caused by individual mobility patterns, including the intensity of fossil fuel use and its ensuing effects on the supply of fossil fuels, as well as the emissions of pollutants such as nitrogen oxides (NOx) and sulfur dioxide (SO

2). As the U.S. Environmental Protection Agency [

1] pointed out, the annual carbon dioxide emissions from a typical passenger car are around 4.6 metric tons. Thus, the transition to renewable energy can reduce the production of carbon footprints [

2]

In the pursuit of energy for sustainable development, electric vehicles (EVs) and hybrid electric vehicles (HEVs) offer clean energy solutions to reduce the pollution and greenhouse gas emissions generated from fossil fuels. Graham [

3] classified EVs as Battery Electric Cars (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell electric vehicles (FCEVs). While conventional gasoline vehicles convert about 17% to 21% of the energy stored in fuel to power the wheels, EVs transfer roughly 59% to 62% of electrical energy from the power source to power the wheels [

4]. However, securing enough power output to meet the vehicle’s demands for power performance and improving energy economy are major challenges. Numerous studies have underscored lithium’s advantageous material properties, including the lightest metal and the highest electrochemical potential, as well as the advantages of lithium-ion batteries, including their high power density, high energy density, and long service life [

5]. These properties have attracted energy specialists and industrialists, so the demand for lithium is expected to increase tenfold by 2035 because of the quick adoption of EVs in the context of energy transitions [

6]. As demand increases, the world needs to raise its lithium supply to fulfill the growing demand [

7,

8]. By 2040, the demand for copper and aluminum could rise by almost a third, nickel by two-thirds, cobalt by 200%, and lithium by 600% [

9].

The lithium market is also expected to grow exponentially. In the eighth Clean Energy Ministerial meeting in June 2017, governmental and non-governmental organizations such as the EV30@30 Campaign sought to increase the market share of EVs to 30% by 2030 [

10]. This campaign was backed by China, Japan, and India, where EVs account for the bulk of vehicle sales [

11]. The global market for EVs is anticipated to reach USD 354.80 billion by 2028 [

12]. Following its commitment to achieve net zero carbon emissions by 2060, Saudi Arabia aspires for at least 30% of its cars to be electric by 2030 [

13]. Aiming to produce 150,000 vehicles annually at the King Abdullah Economic City, the EV firm Lucid revealed a long-term plan to construct the first international production facility in Saudi Arabia. The United Arab Emirate (UAE) completed its first EV production facility in Dubai Industrial City, built at a total cost of USD 408 million, to address the rising demand for green mobility and is expected to produce 55,000 automobiles annually [

14]. Oman also established its first EV factory in Suwaiq to produce 1248 cars annually as early as 2025 [

15].

To meet the growing demand for lithium-ion batteries for EVs in the Gulf and global markets, this ground-breaking study attempts to explore the potential and challenges of developing a clean energy transition through sustainable exploration and the use of lithium in Oman’s mining industry. This study explains how growing energy and environmental concerns have significantly intensified interest in EV and HEV, consequently increasing the demand for lithium exploration and production. While identifying Umm as Samim Sabhkah and Mahout as major resources for potential lithium commodities in the Sultanate of Oman, this study uses statistical data from Oman’s NCSI to determine the quantity of salt and lithium production and sales and their values to assess their commercial viability and possible installation of production facilities to manufacture lithium-ion batteries for EVs in the country.

This study makes a novel contribution in this area by evaluating the capacity of the state to develop efficient regulations and rules to govern the mining activities and state–investor relationship, protect investors’ rights, and reduce the environmental risks associated with the production and recycling of lithium-ion batteries. Although there are potential economic benefits, it is important to consider the commitment to responsible mining practices considering the current and potential environmental and social impact on the country [

16]. This study also argues that the realization of Oman’s potential for sustainable lithium exploitation and production cannot be attained until serious challenges in the country’s regulations, environment, and investment strategies are overcome. In a situation like this, where data and information are scarce, the analysis of strategic minerals, extraction methods, regulations, and bidding procedures presented here probably makes this study the first point of reference for company executives and investors when seeking mining concessions. The following section presents a review of the literature.

Section 3 describes the research material and methods.

Section 4 discusses the lithium deposits in Oman.

Section 5 and

Section 6 present the discussion and summary of the study.

3. Materials and Methods

The above review of the literature underlines the significance of the exploration and use of lithium in the manufacturing of EV batteries. The pursuit of clean energy has driven researchers and scientists to explore innovative ways to exploit natural materials and convert them into clean energy at reasonable costs to achieve sustainable development goals. In this context, this study adopts an exploratory research method that helps explain the exploration of lithium, separating it from its ore with the potential for using this mineral in manufacturing batteries for EVs. This methodological approach serves our research objectives well and enables us to shed new light on the subject area considering available data [

39]. Although the extraction of lithium as a mineral has been known globally for decades, our objective is to explore the potential and challenges of extracting this mineral from Umm as Samim Sabhkah in Al-Dhahirah Governorate and from seawater in Mahout, in Al-Wusta Governorate, Sultanate of Oman.

While considering the Sultanate of Oman as a country case study, our study reviewed the digital and print materials on lithium worldwide, particularly lithium deposits, investment potential, export capabilities, and its use in EV battery manufacturing. We conducted field visits to Mahout and Umm as Samim to meet with stakeholders and explore the nature and quality of salt and lithium in these regions during November 2022. We found a few companies of small and medium sizes operating in these regions to extract salt for oil companies, while most operations in relation to collecting and selling salt in Mahout are conducted by small local firms. During our meetings with officials from the Directorate General of Minerals, Ministry of Energy and Minerals, we learned that three mining companies have applied for concessions to extract lithium, and their applications are still under consideration (Saud Al Mahrouqi, 11 April 2023).

In terms of primary data collection, we tried hard and used several approaches to obtain primary data on the quantities, density, and proven reserves of lithium in Oman from the Directorate General of Minerals, Ministry of Energy and Minerals, with no success. As a result, we used secondary data published by the NCSI, the only governmental body that holds and publishes official data in Oman. The data collected from various annual reports covered the quantities of salt production in metric tons, the quantity of salt sales in metric tons, and the value of salt sales in Omani Rials (OMR) during the period 2015–2021.

We acknowledge the limitation of our study in the quality of lithium data because the data published by the NCSI do not specify the purity or percentage of lithium in salt and hard rocks. This underlines the significance of our analysis and opens new opportunities for further research [

40,

41].

4. Analysis and Results

4.1. Minerals Deposits and Extractions in Oman

The share of the mining sector accounted for only 0.6% of Oman’s gross domestic product (GDP) in 2021. Despite this small contribution, Oman identified mining as one of the five promising sectors for investment, development, and diversification [

42]. This potential growth is largely driven by organizational and corporate developments: the Public Authority for Mining, currently the Directorate General of Minerals, is merging into the Ministry of Energy and Minerals and placing the state-owned company Minerals Development Oman (MDO) under the management of Oman Investment Authority (OIA). The aims of this restructuring are threefold: (1) maximize the potential of the mining industry; (2) produce long-term profits for the company’s shareholders and the nation; (3) invest directly in or support upstream and downstream projects spanning a variety of material commodities and value chains.

The responsibility and functionality of each organization differ considerably. The Directorate General of Minerals is responsible for the regulatory and bidding affairs of the mining sector. The strategy of MDO aims to invest in exploration and excavation to build a strong base of mineral reserves, develop sustainable mining projects upstream to extract mineral ores, and utilize extracted raw materials by investing in value-added projects downstream. According to the MDO, this company focuses on the extraction of several metallic minerals such as copper, gold, and chromite and industrial minerals such as gypsum, limestone, silica, dolomite, and salt [

43]. Moreover, the company has several subsidiaries operating in the mining deposits, including Mazoon Mining, Oman Mining, Wafra Mining, Duqm Quarries, Naqa Salt, Ahjaar Mining, Oman Chromite, and Knooz Oman Hodling, Sohar Titanium, and Oman Synergies Casting.

Duqm Salt Factory is another company operating in the extraction of seawater salt in Mahout.

Table 3 illustrates, among all the metallic and industrial minerals, the quantity of salt production and sales between 2015 and 2021.

The extraction of minerals is governed by concession agreements that regulate the process of investing and operating in Oman’s mining sector. These agreements contain constitutional, scientific, monetary conditions, environmental constraints and specify the mechanisms and methods governing the exploration process in a specified area. These concessions allow investors to easily transition from the exploration phase to the mining phase by obtaining necessary permissions and supplying primary metallic ores in their necessary sizes and quantities to enable commercial investment in these minerals [

44].

Figure 5 identifies the main mining sites for concessions with active and potential commodities, which are in Al Sharqiah North, Al Batinah North, Al Dhahirah, Dhofar, Al Sharqiah South, Al Buraimi, Al Dakhiliyah, and Al Batinah South. They are concessions for mining and exploration; the most advanced of these areas in terms of exploration is a copper concession area with a 20 km

2 area in the Wilayat of Yanqul, Al Dhahirah.

Figure 6 also shows two large areas with active salt/potash commodities and potential lithium commodities in Umm as Samim near the Saudi borders and salt and potential lithium in Mahout on the south coast.

4.2. Lithium Mining Potentials in Oman

In Oman, the main sources of lithium are sea and rock salts. The rock salt is largely concentrated in Umm as Samim sabkha. It receives groundwater from limestone aquifers of the Tertiary Umm Er Radhuma Formation to the east and south, sediments from dunes to the west, alluvium from the Oman Mountains in the east, and sediments from dunes in the west. Umm as Samim is one of the largest sabkhas (a shallow area found only between a desert and an ocean consisting of salt, gypsum, and calcium carbonate deposits) in the Arabian Peninsula, with a surface area of around 3000 km

2 and a height of 55 m. With alluvial fans to the east and several from Widyan (valley) pouring from Al Hajar (the Oman Mountains), it is a groundwater sump that runs along the eastern edge of the Rub al-Khali desert. Wadi Aswad, Wadi Musallim, Wadi Majhul, Wadi Umayri, and Wadi Haliban regularly nourish the Umm as Samim sump [

46].

The second resource of salt in Oman is seawater, where the extraction of salt is often conducted by sun evaporation. A few local companies have realized the availability of large quantities of salt and the potential of lithium extraction. In Wilayat Mahout, almost 170 km from Duqm, the Duqm Salt Factory was founded in 2021 to produce raw and industrial salt specifically for companies working in oil fields. According to Khalid bin Ali Al Junaibi, Executive Vice President of the Global Integrated Engineering Company, the huge upsurge in demand for industrial salt by oil firms for use in drilling wells has also encouraged this company to invest OMR12 million to build a factory for salt production [

47].

Equally promising is the investment made by Naqa Salt, a joint venture between MDO and Shumookh (the investment arm of the Public Establishment for Industrial Estates—Madayn). Naqa Salt focuses on harvesting briny seawater from the Al-Wusta coast to produce high-purity sea salt that has extensive application in the hydrocarbon, petrochemical, and chemical industries. MDO has also been evaluating the potential of extracting industrial salt in commercial quantities from ‘produced water’, which is a by-product of oil production from certain oilfields in Oman. The MDO project focuses on creating high-purity salt that can be extracted from seawater in Mahout for use in a variety of industrial purposes, including exporting salt to regional and global markets. The construction of salt evaporation ponds with an annual production capacity of roughly 1.5 million tons of raw salt constitutes the intended proposal.

Figure 6 shows various images of salt production in Wilayat Mahout, Sultanate of Oman.

An analysis of the data collected from the NCSI [

42] reveals that Oman’s quantities of production and sales of salt have significantly increased since 2016.

Figure 7 shows the quantities of production and the sales of salt in metric tons between 2015 and 2021, with a production peak in 2017 and a sales peak in 2018.

Figure 8 shows the sales value of salt in the Sultanate of Oman in OMR (000) between 2015 and 2021. This figure reveals that the value of salt sold in 2016 was almost fourfold the value of that sold in the previous year. The highest value of sales recorded is OMR 461, 000.1 in 2018. This figure also shows a continuous rise in value pre-COVID-19. There was an obvious decrease in sales in 2019 due to a possible decline in demand during the COVID-19 pandemic, as the sales between 2019 and 2021 remained below their pre-pandemic value. During COVID-19, lockdown and low consumption might have contributed to lower demands. The dotted line shows the expected rise in the salt sales in Oman from 2014 to 2024 while the curved line shows the existing rise in the salt sales in Oman from 2014 to 2021.

4.3. Lithium Extraction

The main methods of lithium separation from its ore are gravity separation (Dense Media Separation), magnetic separation, and froth flotation. In recent years, sorting has also gained recognition as a viable technique. Dense Media Separation can be used to extract lithium concentrations from high-grade ores, in addition to being frequently utilized for coarse gangue rejection. Flotation is employed in the processing of feed containing small particles or when high-grade concentrates are required. To make the concentrate appropriate for use in ceramics and glass manufacture, a considerable amount of iron-bearing gangue minerals are removed using magnetic separation [

22]. The methods for extracting lithium minerals from hard rocks have significantly advanced from the conventional methods employed in favor of more sophisticated technologies, as illustrated by Qiu et al. [

48] in

Figure 9. The new method based on the KOH solution is more economical than the traditional method. This new method has a fewer number of steps as well.

Lithium is one of the minerals found in pegmatites, which are classified as “hard rock”. Pegmatites, which are intrusive rock units, are generated when mineral-rich magma intrudes from magma chambers into the crust. As the last of this lava cools, water and other minerals concentrate. These metal-rich fluids stimulate the rapid formation of enormous crystals that distinguish pegmatites from other types of rocks. Spodumene, a lithium-containing mineral found in pegmatites, is a prismatic crystal that can be white, yellowish, purple, yellowish-green, or green emerald in hue. Lithium is present in pegmatites, where it can be transformed into lithium hydroxide or lithium carbonate, the latter of which is of growing interest to the battery industry.

The market leader in terms of revenue and volume is salt in brine products. Solution mining is a mining method that is used to dissolve mine deposits to extract brine from large bodies of water. Rock salt is extracted for use in the industry and is found as sedimentary evaporite minerals. Due to the exposure of these ponds to sunshine, the substance is known as solar salt. The sun raises the pond’s temperature, which causes water to evaporate and leaves behind pure salt crystals that can be harvested [

49]. In 2019, the oil and gas industry sales of industrial salt in Oman were valued at USD 12.6 million; from 2020 to 2027, sales are projected to increase by 14.5% due to the Compound Annual Growth Rate (CAGR). Demand for goods necessary to carry out an efficient enhanced oil recovery option is projected to be the main driver of market expansion over the projection period [

49]. Using the enhanced oil recovery (EOR) method, Oman’s oil and gas operations can be carried out effectively. According to Petroleum Development Oman (PDO), by 2025, EOR projects are expected to account for about 23% of PDO production.

Figure 10 shows the lithium market, resources, and processes.

The key companies involved in the production of salt for oil and gas in Oman are the Duqm Salt, Muscat, Sultanate of Oman; Gulf Salt Company, Dammam, Saudi Arabia; Mandoos Trading Co., LLC, Muscat, Sultanate of Oman; Omani Salt Company LLC, Muscat, Sultanate of Oman; Al Riyadh Salt Factory, Riyadh, Saudi Arabia; Feiz New Works Company, Muscat, Sultanate of Oman; Delmon Salt Factory Company Ltd., Dammam, Saudi Arabia; Modern Salt Industries & Trading Co., LLC, Muscat, Sultanate of Oman [

49]. To provide PDO Oman with the best quality and value of salt products, Modern Salt Industries was founded in Oman in the year 1988 to produce PVD salt. Salt is used in oil drilling operations. In addition, the company produces graded salt and iodized salt [

51]. On 23 July 2018, Duqm Salt, a pioneering experiment of its kind that creates industrial salt from seawater, was launched. Global Integrated Engineering Company, a division of 100%, runs Oman-owned Al-Ghalbi International Engineering & Contracting LLC (Al Ghalbi), Muscat, Sultanate of Oman. This facility is in Mahout. It attempts to fulfill the demands of nearby oilfield firms [

52]. The local oil and gas industry is the primary market for the factory’s output, accounting for around 30% of its yearly use of oil fields.

4.4. Government Regulation, Block Leasing, and Bidding Process

In Oman, all mining activities, including the exploration and extraction of lithium, are currently governed by the Executive Regulations of Mining Law No. (7/2010) and Minerals Resources Law No. (19/2019). The Law No. 19/2019 confirms that all mining sites and raw materials are owned, managed, and utilized by the state (Article 2), which could put some sites up for bid for prospecting, exploration, and exploitation in conformity with the principles of openness and fair competition (Article 8), and no activities of the exploration or export of raw minerals can be undertaken without the Authority’s explicit consent (Article 12). The law establishes a specific regulation outlining the techniques and processes for contracting, bidding, awarding, and bid evaluation, which must be followed during this bidding process.

Before receiving a license, the investing company must pay the authority a financial guarantee equal to at least 1% of the authority-approved project cost (Article 15), and upon receiving the license, the company pays the authority an annual rent and royalty, which cannot be less than 5%, plus 1% to the local community authority, for the entire yearly production of raw materials that the licensee exploits (Article 16). This law also states that the licensee should not sublease the licensed area, transfer the license issued to him to third parties, or transfer the rights and obligations arising from it without written approval from the authority and the payment of prescribed fees (Article 20). It also allows the authority to cancel the license of a company that does not comply with Article 20 or does not start the work within the stipulated time (four months without giving reasons), stops the work for three months without notifying the authority, or delays making payments for rent or royalties, within (60) sixty days after the due date (Article 31). The different mining blocks that are up for bid in Oman are illustrated in

Figure 11.

As for the bidding process, the regulations define the period of the prospecting and exploration license for one year or renewable for one or more similar periods totaling, originally and in renewal, no more than three years, which is conditional on the licensee’s fulfillment of all his obligations. The issuance of the license and period of the exploitation is five years renewable for one or more similar periods, conditional on the licensee’s fulfillment of all their obligations (Articles 36 and 39). The authority may award a concession for the exploitation of minerals for a period of twenty years and no more than thirty years. The concession area should not be less than five square kilometers, as shown in

Figure 12.

It is mandatory that the concessionaire submit the technical efficiency and solvency, the economic feasibility of the concession area and production level, the environmental impact study of the concession area, surrounding areas, possible risks due to mining activity and methods of treatment, and the rehabilitation plan. After considering the license, the authority determines the means of supervision and technical and financial follow-up that guarantee good functioning in the concession area. The license holder may utilize the building materials required for the exploitation construction works only and located in the area subject to the concession agreement without paying a royalty on the condition that they inform the authority of the extracted quantities and their uses. The bidding processes for blocks available for mining exploration and concessions are shown in

Figure 12.

The regulations also stipulate the procedures of violation of the mining license agreement, with specific clauses defining the punishments and compensations to be paid by the license holder for the rehabilitation of the licensed area and the removal of any debris and deformities in accordance with environmental preservation standards (Article 34). If the concessionaire discovers any natural resources not mentioned in the concession agreement, historic sites, meteorites, fossils, or unique geological occurrences, they must immediately cease all mining operations and inform the authority; however, if they continue or extract minerals without the authority’s consent, they are punishable by imprisonment for 1–3 years and a fine of OMR 20,000–OMR 100,000. The punishment should be financially greater if the license holder intentionally extracted the mineral beyond the borders of the agreement, with imprisonment for 1–3 years and a fine of OMR 50,000–OMR 150,000 or either sanction (Article 60).

4.5. Oman Investment Strategy in the Lithium Industry

According to the Fraser Institute’s Annual Mining Survey 2021 [

53], Western Australia, Europe, the United States, and Canada are the most desirable and active mining countries to invest in. This survey did not include Oman because, like all member states of the Gulf Cooperation Council (GCC), Oman is driven more toward developing oil and gas resources than the exploration of non-hydrocarbon mineral wealth. None of the GCC countries are ranked as suitable destinations for capital inflow in the mining sector.

At the national level, Oman’s investment strategy seems to be lagging in terms of attracting domestic and foreign capital in the mining sector, particularly concerning the lithium industry. Most investments in this industry are made via OIA, which was established in 2020 to optimize investments and their returns in new sectors such as mining. There are no serious investments in the downstream lithium industry, where exploration and extraction take place. Preliminary data show that OIA is more interested in investing in upstream lithium projects by forming partnerships with international investors. For example, the OIA has invested in Group 14, a leading American company in battery materials, which specializes in manufacturing innovative silicon anodes that are used as an alternative to graphite in lithium-ion batteries. This company is backed by a group of leading investors in the field of battery materials, such as Porsche and SK Material, and several prominent financial investors, in addition to its association with 90% of the battery manufacturers in the world.

The OIA also announced its investment in the US company Ascend Elements, which specializes in recycling lithium-ion batteries that are used in electric vehicles with the aim of recycling electric batteries by 50% and reducing carbon emissions by 87%. A multinational group of strategic and monetary investors, such as Fifth Wall and SK Group, have provided the company with USD 300 million in equity financing and credit facilities, including USD 200 million in Series C equity investments.

The investment strategy adopted by OIA seems to be driven by fast returns to investment in profitable companies in the US market rather than developing the Omani mining sector. This strategy ignores the fact that extraction operations in the mining sector open opportunities to boost the national economy through job creation and the value added in manufacturing. Oman’s investment strategy has yet to develop proper public–private partnerships that allow for greater private-sector participation in the mining sector and the development of electrical grids and charging infrastructure for EVs [

54]. This trend is successfully emerging in Saudi Arabia, with Lithium Infinity obtaining a USD 6 million investment from King Abdullah University of Science and Technology (KAUST) Innovative Ventures Fund and the Saudi mining corporation Ma’aden (Lihytech). Saudi Arabia is motivated by the battery-grade lithium produced by the KAUST firm to develop the whole value chain for EVs [

55].

5. Discussion

Our analysis reveals the growing importance of lithium in the energy and industrial sectors, with the increasing utilization of the mineral in the production of aircraft, electronic equipment, pharmaceuticals, pyrotechnics, and batteries for electronic devices. The pivotal role of lithium in powering EVs, smartphones, personal electronic devices, and many more has encouraged industrialists to label it the new “white gold”. The importance of this mineral has also encouraged researchers and scientists to seek innovative lithium extraction methods and techniques, as conventional techniques are time-consuming, complicated, and energy-intensive, which causes significant pollution [

55].

The significance of lithium in clean energy transitions is underlined by the huge investments and operations conducted worldwide and the recognition made by most industrialized nations of the pivotal role of lithium in industrial development. Sales of EVs are rapidly increasing, and by 2030, at least 25% of the global fleet is predicted to be EVs, as per Morgan Stanley’s forecast. EVs currently make up a minuscule portion of all vehicles on the road. Although there are many different kinds, the performance and durability of the lithium-ion battery have made it the clear leader. As a result, the demand for batteries, and consequently the lithium needed to produce them, is increasing along with the demand for EVs.

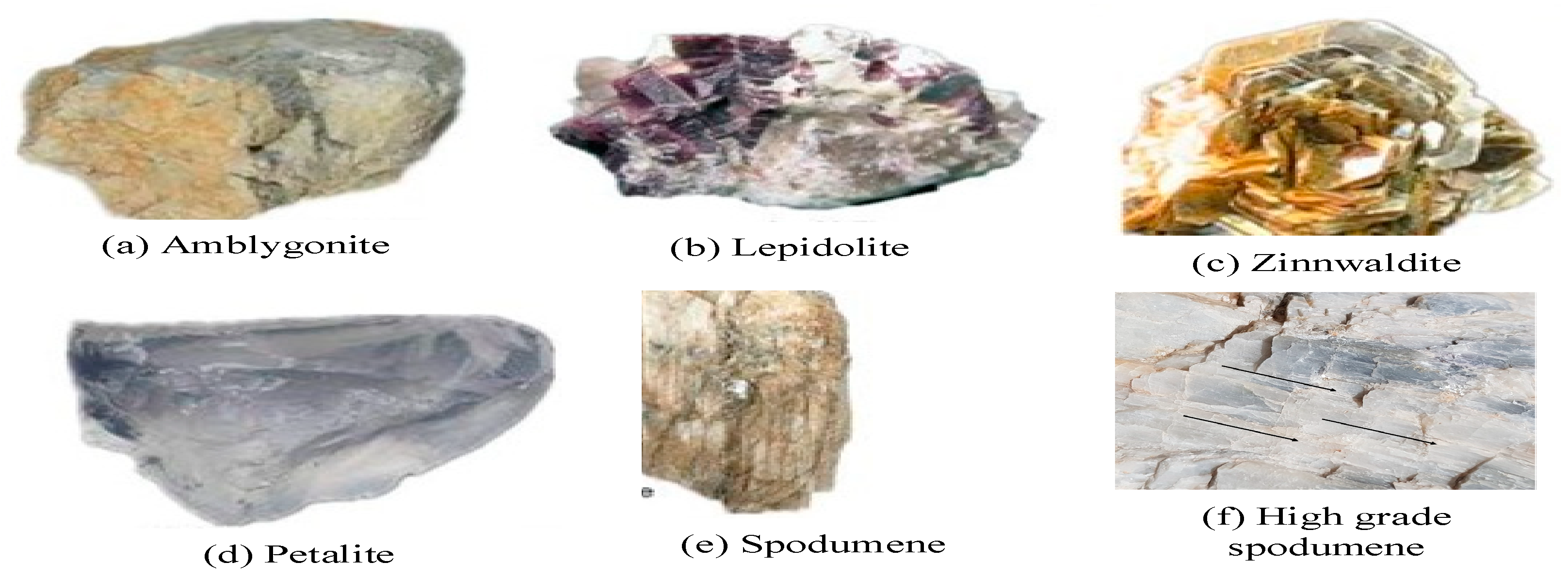

The review of the literature and analysis determined the nature of the lithium mineral. This study observed the presence of lithium in different types of rocks viz. spodumene, petalite, lepidolite, amblygonite, zinnwaldite, and eucryptite, besides brine. Moreover, the degree of purity in sea salt and hard rocks varied dramatically. Our study shows that new sources of lithium have recently been discovered, including hectorite, jadarite, and hectorite clay deposits, which were not previously thought of as a source of lithium. Although spodumene from pegmatite deposits is the main source of lithium from ores, our analysis demonstrates that this is not the only source of lithium [

22]. With 46% of lithium used in the manufacturing of batteries, the rapid uptake of EVs is highly likely to drive up the demand for lithium. This finding is supported by the increasing production and use of lithium compounds in power storage systems, portable electronics, and lithium-ion battery technology, with some analysts expecting the world’s lithium reserves to be exhausted by Tesla alone in fewer than 30 years.

One cannot underestimate the environmental impact of extraction and the use of lithium in powering so many electronic devices and batteries on the transportation sector’s emissions. While Finland is proud of using green energy in extracting and producing lithium, with more than 50% of the energy used in this process generated by wind turbines, the adoption of lithium batteries could reduce the global consumption of fossil fuels. These results support the findings by Grosjean et al. [

19], who concluded that the use of lithium-ion batteries in EVs and HEVs could reduce any potential environmental harm from traditional vehicle pollution. The German automotive company Volkswagen has taken bold steps to guarantee that lithium is mined sustainably across the global supply chain by signing the Memorandum of Understandings with lithium battery providers from Chile and Australia for its cars [

56]. Although these initiatives are novel and appreciated, the sustainability of lithium batteries requires significant improvement in its extraction process and recycling practices. Infrastructure investments for charging stations and battery developments to increase the range and lifespan and raise consumer appeal are significant obstacles that this industry must overcome before EVs can be broadly adopted.

Another major challenge facing the industry is the complexity and high costs of the exploration and extraction of lithium until it is commercially usable. In fact, the lengthy traditional methods and low-cost sources of lithium carbonate developed in the early 1990s are no longer viable to meet the sharp increase in the demand for high-grade lithium in the early 2020s. Our analysis corresponds with and supports the findings by Tadesse et al. [

22], who argued that the evaporation process typically takes between one and two years before the final product is ready for use, making brine resources less suitable for meeting unforeseen changes in demand due to the lengthy times required for lithium manufacture. Due to the requirement of high-temperature pre-treatment followed by forceful leaching, lithium extraction from mineral concentrates continues to be costly and challenging. This finding could explain why OIA prefers to invest in downstream projects in the US market rather than investing in extractive projects in its home country. This finding is also supported by the findings of Brandt and Haus [

57] and Levich [

58], who concluded that crushing and grinding account for around 50% of expenditures when converting spodumene into lithium.

Our previous case study has revealed that the mining sector in the Sultanate of Oman is relatively underdeveloped and requires considerable local and foreign investments. The Sultanate of Oman has a wide range of metals and strategic minerals that need efficient utilization. Our analysis shows that most investments are domestic funds that are small and located in low-value building materials such as marble, gypsum, and limestone. The absence of sizable investment in strategic minerals and precious metals explains the limited contribution of the mining sector to the GDP.

Indeed, the global demand for lithium creates huge business opportunities for investment in extraction and production both for local and foreign companies. Before promoting lithium for investment, authorities must create a comprehensive database that should be accessible to the business and research communities, as well as conduct a wide range of empirical studies and pre-feasibility studies outlining the potential investment opportunities in this sector. The transparency and accessibility of data and information are major challenges for both local and foreign investors. Basic information such as lithium quantity, the quality of its ore, the percentage of purity in the mineral, geographical location, and proven reserves are critical for investors’ decision on whether to invest in the Omani market.

Moreover, the present analysis has opened the debate on clean energy transition policies and their associated infrastructures, mainly the lithium mining industry development. Both foreign and local investors are critical of the limitations imposed by the regulations on the size and duration of the concession area, lengthy administrative procedures, a lack of transparency and information, the absence of reliable data, and late responses to license applications. Our concerns have been raised by Forget and Bos [

59] in the case of Chile and Argentina and by Al-Mahrouqi [

45] in the case of Oman. For example, limiting the size of this licensed area to only 5 square kilometers could be reasonable for small companies but not for large mining corporations. The restrictions imposed on the export of minerals before meeting the needs of the domestic market could deter multinational corporations from investing in Oman.

Policy changes and policy adjustments are urgently required if Oman is to attract global players operating in the industrial salt market, including the Donald Brown Group, Cape Town, South Africa; K + S Group, Kassel, Germany; Morton Salt, Chicago, IL, USA; Cargill Inc. Wayzata, MN, USA; European Salt Company, Hannover, Germany; Rio Tinto PLC, London, UK; China National Salt Industry Corporation (CNSIC), Beijing, China; INEOS Enterprises, London, UK; Tata Chemicals Limited, Mumbai, India; Mitsui & Co., Ltd. Tokyo, Japan; Delmon Salt Factory Co., Ltd. Dammam, Saudi Arabia and Compass Minerals Limited, Overland Park, Kansas, USA [

60]. We can also identify several multinational corporations operating in the lithium industry that could be attracted to exploring potential investment opportunities in Oman, such as the TRU Group Inc., Tucson, AZ, USA; Albemarle, Charlotte, CA, USA; SQM, Santiago, Chile; Ganfeng Lithium, Xinyu, China; Tianqi Lithium, Chengdu, Sichuan Province, China; Mineral Resources, Perth, Australia; Pilbara Minerals, Perth, Australia; Yongxing Special Materials Technology, Huzhou, China [

61,

62]. These corporations have the capacity to not only meet the needs of the domestic market, where imports account for practically all the demand for industrial salts until 2018 [

49], but they could also link Oman with global lithium value chains.

Finally, our analysis brings to the forefront of the debate the issue of sustainability. From the environmental perspective, our study underlines the importance of putting into practice a zero-harm policy by developing strong plans to control risks and proactive land rehabilitation dedicated to safeguarding the environment from all potential hazards and threats brought on by mining and mineral processes [

44,

63]. Our results support the findings of Dunlap and Riquito [

62], who found a negative impact from the open pit mining of lithium in the case of the Barroso Mine in northern Portugal on agricultural land. The social and economic impacts of lithium mining have also been examined in the case of Oman. Our study found the positive socioeconomic effects of lithium mining on various segments of the society in Oman. For example, social welfare could be increased by improving the job market, economic growth, and fairly distributing the one percent of sales devoted toward supporting neighborhood improvements. Also, the growing popularity of EVs has encouraged the government to facilitate energy transition further by offering subsidies, tax breaks, and free parking for EV owners [

64]. These findings support the results of Slattery et al. [

65] and Taylor and Bonner [

66], who found that employment losses because of rising automation and the detrimental effects of the growth of EVs on the gasoline and diesel industries could be mitigated by creating jobs in the renewable energy sector, expanding exploration and extraction processes, and establishing the charging infrastructure. The potential of producing lithium from brine is seen by even the oil majors, including ExxonMobil, Schlumberger, Occidental Petroleum, and Equinor. They are conducting research on whether their expertise in oil processing could help in the production of lithium from unconventional brine resources. Moreover, there are auto companies looking to establish a much stronger foothold in the lithium space. Many auto companies are looking to transform them into electric cars, so they are trying to find new sources of lithium that can be used in these vehicles [

67].

6. Conclusions

This study explored the potential use of lithium in developing a clean energy transition that could be used in the energy and industrial sectors, particularly after the cumulative demand for lithium-ion batteries associated with the upsurge in the purchase of HEVs and EVs over the past few years. It also explains the growing trend in industrialized nations to invest heavily in the exploitation of lithium-ion batteries in a range of industries, including electronic devices, telecommunications, and renewable energy.

The core content of lithium-ion batteries is lithium minerals. On the realization of lithium’s importance in the manufacture of lithium-ion batteries, the researchers in this study have explored the potential lithium mineral extraction in the Sultanate of Oman. This study has identified two large sites in the Sultanate of Oman viz. Samim and Mahout. These sites have the potential for lithium extraction as well as the manufacturing of lithium-ion batteries for EVs and HEVs. In Oman, one of the sources of lithium is brine water or salt. To facilitate this process, this study has explained the potential sites, quantities of salt productions and values, the legal and regulatory framework, and investment opportunities for local and foreign investors. It also explains the economic, social, and environmental impacts of lithium mining on the economy and society, considering the national development strategies in Oman. This country should learn from lithium mining countries and follow frameworks to reduce its environmental impact. While identifying potential global investors and multinational corporations to invest in Oman’s mining sector, the analysis warns against greenhouse gases produced during the extraction, manufacturing, and recycling of lithium-ion batteries. It also underscores the shortfalls in Oman’s investment strategy and recommends improvements in administrative and regulatory systems by streamlining application procedures, reducing the duration of responding to the application requested, and increasing the duration of licenses for exploration from one to five years and concessions for up to thirty years.

The Financial Times predicts that the value of lithium could surpass the USD 2.6 trillion oil market by 2030. Terra Lithium, a lithium technology company that is jointly owned by the US shale producer Occidental and Chevron’s chief executive, Equinor, invested in Lithium de France’s developer in 2021 [

67]. According to the oil consultancy Enverus, wastewater from shale fracking could create 225,000 tons of lithium carbonate annually in one sector alone, producing USD 19 billion in revenue [

67]. Since these oil companies, as well as the auto companies, have a big presence in the GCC region, the exploration and processing of lithium in Oman could help these companies reduce supply chain issues and production costs due to the easy accessibility and availability of brine water in Umm Samim, which is a reliable source of lithium.

This study concludes by identifying some practical implications for policy makers and company executives. For policy making, the study provides new insights for government officials to reassess the performance and contribution of the mining sector in Oman’s GDP and develop a new investment strategy that targets local and foreign investments in downstream industries such as the exploration and extraction of strategic minerals like lithium with high value added in the energy and industrial sectors. The Ministry of Energy and Minerals must create databases on all the minerals accessible to investors and researchers and conduct empirical and pre-feasibility studies on strategic minerals that could add value to the economy. OIA could revise its investment strategy and encourage its international partners in the US and Europe to explore the possibility of investing in extracting and installing production facilities for the production of lithium-ion batteries for HEVs and EVs in Oman.

In terms of managerial implications, this study could help company executives identify lithium deposits, assess their commercial viability, and understand the regulations and rules of assigning mining blocks and the specific conditions needed to fulfill the basic requirements. This knowledge can not only improve executives’ understanding of the bidding process but also help them make the right investment decision on whether to consider operating in the extraction of lithium or establishing a production facility, resulting in the creation of a new industry.