Abstract

Based on the upper echelon theory and the contingency theory, taking China’s A-share listed companies from 1993 to 2019 as a sample, this paper applies the binary logit model and multiple linear regression model to empirically study the relationship between industry life cycle, chief executive officer (CEO) functional background and corporate sustainable development. The research shows that compared with the mature stage of the industry, companies in the growth stage of the industry are more likely to appoint CEOs with a peripheral-function background and output-function background, but less likely to appoint those with a throughput-function background; matching a CEO’s functional background and industry life cycle can stimulate corporate sustainable development under certain conditions. Further research indicates that after distinguishing corporate ownership, the matching relationship is still valid, while having different effects on the sustainable development of different ownership enterprises. The conclusion of this research not only enriches the research results of the upper echelon theory, the contingency theory and corporate sustainable development, but also provides positive enlightenments for companies in CEO appointment and cultivation, and the arrangement of career planning and selection for senior executives.

1. Introduction

Since the upper echelons theory was put forward, most scholars have focused on the impact of executive characteristics on corporate behavior and corporate performance in terms of consequences. Due to the lack of concern on the influencing factors and deep motivation of the appointment of CEOs with different characteristics, no evaluation on the effectiveness of the appointment can be achieved. Few scholars have discussed the relationship between the antecedents of the external environment and executive characteristics, mainly involving general environmental factors such as social culture [1,2,3] and institutions [4]. Although industry is a task environmental factor featuring a more direct effect on corporate performance, there is little literature covering the impact of industry on the characteristics of executives. Except for the analysis from the perspective of industry stability [5] and industrial structure [6], there is still a lack of discussion on the impact of industry factors on executive characteristics. Moreover, the research is mainly limited to the more developed and stable economic environment in European and American countries and generally ignores the role of environmental antecedents on the characteristics of executive social capital [4], which is profoundly different to the corporate management practice in emerging countries such as China. In addition, the existing literature is mostly limited to the role of external environmental factors on the appointment of executives with different backgrounds, instead of discussing and testing the impact of the appointment on corporate performance. This paper attempts to make up for the above deficiencies. On the one hand, it extends the research perspective forward to study the relationship between the industry life cycle and the appointment of CEOs with different functional backgrounds in the Chinese context, revealing the motivation of companies to appoint CEOs with different functional backgrounds, thus advantageously analyzing and evaluating the effectiveness thereof to a much greater extent. On the other hand, this paper explores whether the matching relationship between industry life cycle and a CEO’s functional background has any impact on corporate sustainable development, so as to verify the economic consequences caused by the characteristics of the CEO’s functional background, thus enhancing the generality of the theory and the practical value of the research.

The contributions of this paper are mainly reflected in the following aspects. First, this paper firstly proposes exploring the impact of CEOs with different functional background and their innovation patterns on corporate sustainable development in the context of the evolution of specific industries and their industry life cycle in China. Due to the great differences in the resource constraints faced by companies in different industry life cycle stages, CEOs will have varied perceptions, explanations and reactions to these internal and external factors by virtue of the human capital and social capital as a result of their different functional backgrounds, resulting in differences in environmental and organizational results [7]. Consequently, it is of great importance to investigate a CEO’s functional background factors that may affect corporate sustainable development from the perspective of the industry life cycle. This paper leverages the medium and long-term panel data of Chinese listed companies for a longitudinal study, dynamically discusses the impact mechanism of CEOs with various functional backgrounds on the performance of corporate sustainable development, expands the existing theoretical research scope of corporate sustainable development, and enriches the research results of corporate sustainable development. Second, selecting the industry life cycle as the antecedent variable of CEO functional background, we also test the impact of the matching relationship between CEO functional background and industry life cycle on corporate sustainable development. There is a gap in both domestic and foreign literature for this study, which makes this not only a significant supplementary study of the upper echelons theory, but also provides experience for CEO appointment and training decision making of companies in the process of emerging countries’ industry development, and for executives’ career planning and career selection. Third, the test, by distinguishing corporate ownership, reveals that the impact of the matching relationship between CEO functional background and industry life cycle on corporate sustainable development will vary under different corporate ownership. The research conclusions hereof can be used to guide CEO appointment in the mixed-ownership reform, so as to facilitate corporate and individual performance and stimulate the industrial development of emerging countries. Finally, this paper uses the net entry rate method and output growth rate method to measure the industry life cycle. Most of the existing domestic studies use a single dimension to measure the industry life cycle, without clearly defining the start and end times of each stage. However, in the context of China as an emerging country, the industry life cycle evolves rapidly, and is closely related to the international transfer of industries. Some industries have undergone sudden changes such as reversals due to changes in the external environment, making it difficult to accurately determine the start and end times of different stages of the industry life cycle. Therefore, this paper judges the industry life cycle from multiple dimensions, striving to meet the research requirements of higher accuracy.

The remainder of this paper proceeds as follows. Section 2 outlines the background and develops research hypotheses. Section 3 introduces the variables employed and the research models. Section 4 provides empirical results and Section 5 conducts further research based on it, which are discussed in Section 6. Section 7 concludes the paper and Section 8 discusses the research’s implications and limitations.

2. Theoretical Analysis and Hypotheses

2.1. Theoretical Analysis

The upper echelon theory emphasizes that the characteristics of executives are affected by the corporate internal and external environment and industry is the key external environmental factor of the company. As an organic evolution system, industry keeps evolving in the interaction of external environmental changes and internal structural adjustment. As time goes by, the industry grows, matures, and finally declines, the process of which is reflected by the industry life cycle that can be generally divided into introduction stage, growth stage, maturity stage and decline stage. The key success factors of the industry are different during each stage and the core capabilities of companies also need to be adjusted accordingly to obtain competitive advantage. Therefore, companies should adopt differentiated strategies and behaviors for corresponding industry life cycle stages [8]. Jiang and Liu [9] and Wang et al. [10] used industry life cycle as an alternative variable to study the impact of Chinese industry characteristics on corporate behavior.

The characteristics of Chinese industry are obviously different from those of other countries [11]. From the perspective of the industry life cycle, as a rising power, China’s market, capital, technology and other industry development conditions are dissimilar with those of western countries, which often leads to variation in the industry life cycle. First of all, China’s industry puts both ends of the production process in the international market, arranging import and export on a big scale, which makes the evolution of the industry life cycle strongly associated with the international industrial transfer. Some industries have life cycle reversals due to the impact of international environmental changes. Secondly, China’s industrial development is often referred to as “compressed industrialization” [12], with a staggering rate of industry development [11]. Some industries rapidly enter the mature stage after only a short period of growth, and some industries almost directly enter the recession, skipping the mature stage [9]. The life cycle of the industry has been greatly shortened and the time of each stage is becoming shorter and shorter [13], resulting in particularly fierce competition among companies. In May 2014, Chinese leaders put forward the concept of “new normal” for the first time, pointing out that China’s economic development should adapt to the new normal. This means that the previous development pattern of China’s economy has gradually changed with some traditional industries facing production adjustment and some new technologies, new formats and new demands emerging, thus affecting the life cycle of the industries.

Facing the pressure brought by the rapid evolution of the industry, companies will achieve solutions in a variety of approaches. One of these strategic responses is to select executives with different characteristics [4,14]. In China, empirical research on the relationship between the internal and external environment of companies and the characteristics of executives is very important. On the one hand, as China is in the process of economic transformation, the construction of the market system is relatively inadequate and the external environment of enterprises is highly uncertain, so enterprises particularly rely on the personal role of senior executives to cover the shortcomings of the market system and protect the development of companies. On the other hand, the internal governance structure of companies is not well-organized and the organizational institutionalization level is low, which makes some CEOs monopolize the power and stamp corporate behavior with personal characteristics [15]. Among the various characteristics of a CEO, functional background experience is usually the most highly regarded in selection and recruitment practice. The research of Li and Zhang [4] also shows that compared with the characteristics of CEOs such as academic qualifications and political capital, environmental antecedents have a stronger practical impact and explanatory ability on the functional background of CEOs.

Based on the background of China’s transitional economy, this paper turns to discuss how the industry life cycle affects the appointment of CEOs with different functional backgrounds and the impact of matching the two on corporate sustainable development, and accordingly puts forward hypotheses.

2.2. Hypotheses

2.2.1. Industry Life Cycle and CEO Function Background

Functional background refers to work experience in different industries, different companies or different functional departments of the same company, which can generally be divided into three categories according to the functions and purposes of functional departments: output-function, throughput-function and peripheral-function background [16,17]. The output function emphasizes expanding market share and developing new products to meet customer needs, including product research and development, marketing and sales; the throughput function focuses on the improvement of production efficiency and cost control, including production manufacturing, equipment management, process management, financial accounting and other work; the peripheral function refers to work that frequently requires dealing with external stakeholders to obtain external resources required by the companies, such as financing and law [16]. The functional background of executives determines their unique knowledge structure, cognitive mode and value orientation in decision making, which has a direct impact on organizational strategy and performance. In different organizational scenarios, the significance/value of the characteristics such as the functional background of executives is different. Companies will choose CEOs with different characteristics according to different internal and external environments.

As a key environmental factor of an enterprise, industry constitutes an all-important background for the formulation and implementation of organizational decisions (including the selection of CEOs) and its characteristics have a direct impact on the appointment of CEOs with different functional backgrounds [5,6]. The industry life cycle mainly reflects the industrial characteristics. There are obvious differences in market demand, technology development, competition and other industry characteristics during different life cycle stages, thus affecting the appointment of CEOs with various functional backgrounds. It can be inferred that the industry life cycle has a direct impact on the CEO’s functional background as a whole. Considering that the industry life cycle has a great impact on the competitiveness of enterprises and the evolution trend of the industry life cycle in which enterprises are in is the basis for competitive strategy analysis and formulation, accordingly, we analyze and predict how the industry life cycle specifically affects the appointment of CEOs with different functional backgrounds from the perspective of enterprise competitiveness.

The environment is the source of scarce resources on which companies rely for survival. As the key “node” between companies and the social environment, CEOs shall be capable to acquire necessary external resources for corporate growth and development. The peripheral functional background directly reflects this ability of the CEO. With a peripheral functional background, CEOs have a wide range of external social resources and are good at external resource integration and capital market operation. Therefore, CEOs of this type have a strong ability to obtain the required external resources [18], which is conducive to maintaining the smooth flow of company capital chain and legal risk control [17]. It can be seen that the higher the dependence of companies on external resources, the more important and scarce the external resources they need and the greater need of CEOs with a peripheral functional background.

During the evolution of the industry life cycle, the dependence of companies on external resources varies accordingly, which will affect the needs of CEOs with a peripheral functional background. When the industry is in the growth stage, the market demand increases rapidly and the primary goal of companies is to expand the market share. Increased capital investment is of great necessity for companies, whether for new product development or production capacity expanding. In most cases, it is tough to meet the needs upon the cash flow generated by operating activities. In particular, Chinese companies are prone to form a consensus on promising industries, resulting in the “surge phenomenon” of investment [19,20]. Moreover, local governments and officials will intervene in the production and operation activities of companies under the pattern of political promotion and “competition for growth”, resulting in excessive capacity investment by companies [21], which leads to the crowding out of credit resources [22]. Therefore, companies must further increase the intensity of financing, and even strive for policy support to enter the capital market. In addition, the serious shortage of raw materials and parts and the sharp rise in the price of important raw materials are common in the growth period of the industry, which will induce companies to hoard for speculation. For example, at the end of 2007, real estate developers hoarded about 1 billion square meters. It is evident that in the face of complex situations such as large capital demand and uncertain material supply, companies are in need of CEOs who are adept at capital market operation and external resource integration to enhance personal competitive strength. Considering that dealing with government officials often emphasizes the principle of identity equivalence, the peripheral functional background or social capital of the CEO is more important. It can be seen that companies in the growth period of the industry prefer CEOs with a peripheral functional background. During the mature stage, the supply chain of the industry is stable and the cash flow generated by business activities is sufficient, which can even feed other emerging industries. Whether the company can achieve mass production at a lower cost can be regarded as the key ability to measure its survival capacity during the competition at this stage. Therefore, the acquisition of external resources by companies becomes less urgent and important and the demand for CEOs with a peripheral-function background will also be correspondingly reduced. Based on the above analysis, this paper suggests the first hypothesis:

Hypothesis 1a (H1a).

Compared with the mature stage of the industry, the growth stage of the industry will be positively associated with the likelihood of the CEO with peripheral-function background.

A prerequisite for companies to achieve competitive advantage is to understand and grasp the market environment. Therefore, companies attach great importance to whether CEOs have the experience and ability herein. The output-function background directly reflects the CEO’s ability [4]. CEOs with an output-function background have the advantage of coping with rapidly changing and uncertain environments [16]. They are featured with the greatest market sensitivity, best accessibility to the inspiration of new elements [17], better inclusiveness of new ideas and innovations, and are more inclined to discover opportunities for innovation, thus strengthening research and development (R&D) investment [23]. Moreover, the marketing and R&D capabilities of the CEO with an output-function background are the key capabilities that affect company innovation, which is conducive to improving corporate innovation performance [17]. As a consequence, the faster the market changes and the greater importance will be attached to innovation and R&D and the more output-function background CEOs are needed.

In terms of the different stages of development with a dissimilar speed of market change and the degree of technological development, there is a difference between the opportunities and capabilities of corporate innovation, generating diverse demand for CEOs with an output-function background. During the growth stage, market demand grows rapidly and presents diversification. In order to expand market share, it is possible and normally necessary for companies to frequently launch new products and increase product categories. At the same time, the technology in the industry growth stage is not yet mature, and the industry system absorbs a large number of innovative achievements. Therefore, companies must pay high attention to the external market environment, communicate frequently with customers, scientific research institutions, etc., and strengthen external learning to achieve leapfrog innovation, thus facilitating achieving competitive advantages in market value creation. In addition, the rapid growth of the industry can cover up the mistakes of the company strategy, making the company strategy experimental and fault-tolerant, which is conducive to R&D and product innovation. Due to the rapid industry development in China, companies in the growth stage of the industry are facing rapid iterations of products and technologies and objectively need to appoint CEOs with output-function backgrounds. When entering the mature stage, the market demand grows slowly, and the technology and products tend to be mature and homogeneous. It is necessary for companies in the mature industry to attach greater importance to internal cost control and reduce unprofitable projects from product categories. In terms of product innovation, the beginning of the mature stage often means that new products and applications are difficult to obtain, and breakthrough technological innovation is gradually replaced by gradual technological improvement. Therefore, when the industry matures, companies will reduce the demand for CEOs with an output-function background. Based on the above analysis, this paper suggests the following hypothesis:

Hypothesis 1b (H1b).

Compared with the mature stage of the industry, the growth stage of the industry will be positively associated with the likelihood of the CEO with output-function background.

In the market, the main goal of companies is to enhance competitiveness and achieve competitive advantage. Efficiency is an important indicator of competitiveness, with production efficiency as the essence. Especially for Chinese companies, due to being restricted to the low-end position with low technology content and low added value in the global value chain [24], production efficiency is more critical. Wang et al. studied the path to success of Chinese companies and the executives interviewed emphasized the importance of production and operation to company success [17]. Therefore, Chinese companies attach great importance to the CEO’s ability to improve production efficiency and reduce costs. This ability is mainly reflected in the throughput-function background of the CEO. Throughput-function background CEOs have a full comprehension of the production process, focus on the internal social capital of the company, and are more willing to improve the production efficiency of the company through internal efficiency means such as technology improvement, quality control and process management [17]. Therefore, the more companies tend to optimize their internal production processes, the more emphasis they place on controlling production costs and improving their production efficiency, the more they need executives with throughput-function background [25].

When the industry is in the mature stage, the industry technology is gradually improved and mature, and the product structure and function design have been relatively solidified. Companies generally promote the standardization of product design and development, and carry out large-scale production to improve production efficiency. Due to small product differences and changes, company competition is mainly focused on price, making cost control particularly important. Cost and efficiency have become the competitive themes at this stage, so companies focus more on the specific internal operation process, emphasizing gradual improvement and continuous process optimization. Especially in China, overcapacity is an incurable “chronic disease” faced by China’s industrial development over the years [22,26], and the consequent price competition occurs intensively in the mature period of the industry, making the price war particularly fierce, and even bringing loss of the whole industry. Therefore, when the industry is mature, Chinese companies are forced to pay more attention to internal operations such as cost control and efficiency improvement, and the demand for CEOs with throughput-function background will also increase. When the industry is in the growth period, despite of the certain price war, the competition is relatively mild on the whole, and there is a large space for the optimization of cost and efficiency. Among them, in terms of efficiency improvement, companies in the growth period of the industry mainly realize the rapid increase in production efficiency through breakthrough technological innovation. In terms of cost control, due to the improvement in production technology and the growth of sales, the scale effect becomes possible and the product cost decreases significantly. Moreover, as the market demand is greater than supply, costs are relatively easy to pass on to customers, making cost control less important. Therefore, companies at this stage have less preference for CEOs with a throughput-function background. Based on the above analysis, this paper proposes the following hypothesis:

Hypothesis 1c (H1c).

Compared with the growth stage of the industry, the mature stage of the industry will be positively associated with the likelihood of the CEO with throughput-function background.

2.2.2. Industry Life Cycle, CEO Function Background and Corporate Sustainable Development

The contingency theory believes that there is no theory applicable to all scenarios [27,28] and companies should adopt an expedient management method according to environmental changes. In spite of the significant function of innovation in promoting sustainable development in both emerging and developed countries, differing from the traditional product innovation methods widely used in European and American developed countries, resource constrained innovation is in greater use in emerging countries. Resource-constrained innovation is an innovation produced by emerging markets to reverse various resource constraints. Its central considerations are affordability and resource scarcity [29], including “cost innovation” [30,31], “sufficiently good innovation” [32], “frugal innovation” [33,34] and “reverse innovation” [35,36]. Among them, cost innovation and frugal innovation focus more on low-cost manufacturing, while sufficiently good innovation and reverse innovation pay more attention to product functions. Low-cost manufacturing and product functions are the keys to serving customers in emerging countries [29,37].

There are great differences in the resource constraints faced by companies in emerging countries in different stages of the industry life cycle and the emphasis on low-cost manufacturing and product functions will also be different, thus affecting the adopted resource-constrained innovation methods. When the industry is in the growth stage, the market supply is less than demand and the latter is diversified. Products and product functions are then taken more seriously. With their sensitivity to the market and R&D ability, CEOs with an output-function background will carry out good enough innovation and reverse innovation to realize product functions. Although CEOs with peripheral-function backgrounds are not good at R&D innovation, they can break through resource constraints through external resource integration and comply with the development trend of the industry in the growth stage to absorb a large number of innovative achievements and promote corporate innovation. When the industry is in the mature stage, cost and efficiency become the theme of company competition. The CEO with a throughput-function background can make full use of the personal advantages of controlling production costs and improving production efficiency to carry out cost innovation and frugal innovation. It can be seen that when the CEO’s functional background matches the industry life cycle stage, their adept innovation mode is consistent with the resource-constrained innovation mode emphasized by the company in the industry life cycle stage, which will undoubtedly promote the sustainable development of the company. Based on the above analysis, this paper proposes the following hypotheses:

Hypothesis 2a (H2a).

Matching the peripheral-function background CEO with the growth stage of the industry will positively promote corporate sustainable development.

Hypothesis 2b (H2b).

Matching the output-function background CEO with the growth stage of the industry will positively promote corporate sustainable development.

Hypothesis 2c (H2c).

Matching of throughput-function background CEO and the growth stage of the industry will be negatively related to corporate sustainable development, that is, matching of throughput-function background CEO and the mature stage of the industry will positively promote corporate sustainable development.

3. Research Design

3.1. Sample Selection and Data Source

In line with the Guidelines for Industry Classification of Listed Companies issued by the China Securities Regulatory Commission in 2001, this paper selects Chinese A-share listed companies in C11 textile industry, J01 real estate development and operation, and G83 computer and related equipment manufacturing industry from 1993 to 2019 as the research samples. These three industries are selected as research samples as the industries involved have been listed as pillar industries many times in national industrial planning, are deeply embedded in the global industrial division, or are the priority of industrial policy regulation. They are deeply branded with China’s transitional economy, which is of typical significance. During the sample study period, the C11 textile industry, J01 real estate development and business, and G83 computer and related equipment manufacturing industry were the sub industries with the largest proportion of operating income and the widest range of influence among the three pillar industries that could best reflect the industry life cycle characteristics of the corresponding pillar industries.

The collection and screening process of sample data are as follows: First, download relevant data of listed companies over the years from the database. Second, manually supplement the missing data with coding. Third, eliminate B-share and H-share companies. Fourth, exclude companies with ST, PT or negative shareholders’ equity. Fifth, exclude samples with changes in main business or unclear attribution of main business industry in the next year. Finally, eliminate samples with incomplete relevant data. Upon completion of the above steps, 218 listed companies and 2014 valid samples were finally obtained. In empirical regression, in order to eliminate extreme effects, all continuous variables are winsorized at the 5% and 95% levels.

CEO functional background, corporate size and corporate ownership data used in this paper are taken from the China Stock Market and Accounting Research (CSMAR) database, which is the main source of financial statements of listed companies in China and has been widely used in previous studies [38,39]. The number of manufacturers, industry growth rate, GDP growth rate and other data used to judge industry life cycle are from China Statistical Yearbook, China Basic Unit Statistical Yearbook, China Electronic Information Industry Yearbook and China Textile Industry Yearbook. The industry classification of listed companies comes from the results of a comparison between the CSMAR database and the Wind database. Due to the detailed data required and the large time span, a large number of data are collected and sorted out manually. Among them, the samples with an uncertain CEO functional background were obtained through Sina Finance, search engine websites and public announcements of listed companies. For the missing data of industry growth rate and the number of manufacturers, this paper also refers to the relevant information of China Economic Census Yearbook, China Textile Industry Development Report and other materials. In case of any differences in industry classification between the two databases, the annual report data of listed companies will be retrieved and judged according to the classification method of the Guidelines for Industry Classification of Listed Companies.

3.2. Econometric Modeling

For the verification of Hypothesis 1a–1c, this paper constructs the following model (1).

where FB is the dependent variable, indicating the functional background of the incumbent CEO at the end of the year, including three different types as PF, OF and TF. ILC represents the industry life cycle, and the remainder as control variables. See the following description for the measurement of specific variables.

To verify Hypothesis 2a–2c, this paper adopts the following model (2).

where CSD is the dependent variable, indicating corporate sustainable development; the other newly added variables are interactive items, which are significant variables concerned by this model. If the regression coefficient of the interaction term between CEO functional background and industry life cycle is statistically significant with its positive and negative symbols identical to the symbols of the regression coefficient of industry life cycle variables in the empirical model (1), it indicates that the matching of CEO functional background and industry life cycle promotes corporate sustainable development. Considering the lag of the consequences of company decision making, this model selects independent variables and control variables with a one-year lag.

3.3. Measurement of Variables

(1) Corporate Sustainable Development (CSD). Referring to prior research [40,41], this paper uses sustainable growth rate (SGR) to measure corporate sustainable development. The sustainable growth rate is an effective indicator to predict the future growth of enterprises. Chinese enterprises in emerging markets have a strong impulse to expand, but enterprises in rising nations are generally faced with extremely serious capital resource constraints. It can be seen that financial sustainability is the premise and key to enhance the competitiveness and financing capacity of listed enterprises and achieve sustainable development. The calculation of sustainable growth rate adopts the formula: SGR = Net sales interest rate × Total asset turnover × Equity multiplier × Retained earnings ratio.

(2) Functional Background of the CEO (FB). Referring to the prior practice [42,43,44], this paper selects the general manager, President or CEO as the CEO of a listed company for research. As for the determination of functional background, this paper draws lessons from the ideas of Li and Zhang [4] and determines the background types of peripheral function (PF), throughput function (TF) and output function (OF) according to the department in which the CEO used to be in charge and the name of the main position. When the CEO has a background in financing, law and other peripheral functions, PF takes 1, otherwise it is 0; When the CEO has an output functional background such as product research and development, marketing and sales, OF takes 1, otherwise it is 0; When the CEO has a background in throughput functions such as manufacturing, equipment management, process management and financial accounting, TF takes 1, otherwise it is 0.

For CEOs with management experience in multiple intra-industry departments, this paper refers to the research carried out by Liu et al. [45] and Liu et al. [46] and takes the CEO’s “department with the longest time of service” as the basis for functional background determination. In case of similar or undecidable time of service in multiple departments, the CEO’s “all departments that have worked” will be used as the basis for functional background determination. For the same position with different functions, determination is made upon the main functions. For example, in addition to the general contents such as corporate accounting and financial management, the work of financial executives also covers enterprise financing. According to the concept, finance can be divided into “production function” and “peripheral function”. Nevertheless, in the practice of listed companies in China, the prior responsibility of financial executives is to deal with external stakeholders such as the capital market, accounting firms, tax agencies and shareholders’ meetings, thus obtaining external resources and achieving legitimacy. Therefore, this paper regards them as CEOs with peripheral functional backgrounds.

For the “airborne” CEO transferred from other industries, considering that the company will not directly select the candidate as CEO because of his functional background outside the industry, this paper makes a comprehensive determination according to the business attributes of the company where the CEO has previously worked and whether there is an upstream and downstream relationship between the original industry and the industry. When there is a direct upstream and downstream relationship between the current and future served industries, it can be judged according to the functional support provided therefrom. For example, the general manager of a construction company can be regarded as the throughput functional background of the CEO of a real estate enterprise, and the president of a design institute can be regarded as the output functional background of the CEO of a real estate enterprise. For the other case, it is judged according to the business attributes of the previous employer. For example, those from government departments, who are conducive to strengthening political connections, or executives from financial companies, such as banks, funds and securities, who are conducive to bringing financing, are regarded as CEOs with a peripheral functional background; the functional background from marketing and commercial enterprises is classified as output type; those from unrelated research-production-marketing integrated enterprises that are conducive to bringing comprehensive management experience are regarded as throughput functional backgrounds.

(3) Industry Life Cycle (ILC). Due to the strict market access system in China’s capital market, few companies in the introduction stage of the industry life cycle can be listed. Listed companies in the decline stage of the industry either seek diversification and transformation or are backdoor restructured, resulting in changes in main businesses and industry types. Therefore, only the growth stage and mature stage are taken into account in the study. Take 1 for growth stage and 0 for maturity stage.

At present, there are many methods to judge the industrial life cycle, which can be generally divided into three aspects: technology, organization and scale. Due to the difficulty in quantifying industrial technology, scholars in empirical research mainly develop methods to divide the industrial life cycle from the perspective of industrial organization and industrial scale, including the manufacturer’s net entry rate method from the perspective of industrial organization and the output growth rate method from the perspective of industrial scale.

The manufacturer net entry rate method is one of the earliest explored and commonly used industry life cycle stage identification methods in foreign countries. This method determines the industry life cycle stages based on the comparison of the absolute number of manufacturers. McGahan and Silverman [47] used the 3-year and 5-year moving average method and took the growth rate of the manufacturers number as the division standard. When the growth rate of the manufacturers number is lower than 3% or 5%, it indicates that the industry has entered a mature stage; when the number is lower than 97% of the one in the previous period, the industry could be regarded as entering a decline stage. The manufacturer’s net entry rate method can reflect the essence and process of industrial evolution, and also provide an important basis for studying the main behaviors of enterprises at various stages. However, in China, due to the influence of government policies, there is a possibility of short-term sharp fluctuations in the number of manufacturers used in this method, which may lead to miscalculation. Therefore, using this method alone to judge the industry life cycle stage may have a greater risk of identification.

Current research in China mostly adopts the output growth rate method to divide the industry life cycle; that is, by comparing the changes of the annual average output growth rate of an industry and the average growth rate of all industries to determine the industry life cycle. If the output growth rate of the industry is higher than the average growth rate in two consecutive periods, it is a growth stage; if the early period is higher and the later period is lower than the average growth rate, it is the mature stage; if it is lower than the average growth rate in two consecutive periods, it is a decline stage. Liu et al. [48] and Zheng et al. [49] calculated the output growth rate by fixing each period as 7 years to divide the industry life cycle. By adopting the output growth rate method, the short-term impact of the overall economic growth trend on industrial output growth can be eliminated regardless of economic growth or decline. However, this method generally does not specify the starting and ending time nodes of each stage of the industrial life cycle, resulting in certain difficulty in meeting the research needs with higher accuracy requirements.

There are great differences in the empirical methods and results of industry life cycle determination between Chinese and foreign research and there are their own advantages and disadvantages which may lead to greater identification risks in the process of industry life cycle stage determination. Therefore, this paper makes a comprehensive judgment on the industry life cycle stage from multiple dimensions. Based on the research of domestic and foreign scholars [47,48,49], combined with the actual situation of China’s industrial development and the current situation of national data statistics, this paper uses the manufacturer’s net entry rate method and output growth rate method to jointly determine the life cycle of the three industries. First of all, the starting time of each stage of the industry is preliminarily judged via the net entry rate method of manufacturers. Considering the rapid change in Chinese industry life cycle [11,12,13], this paper selects the 5-year moving average method to calculate the net entry rate of manufacturers as the basis for determining the inflection point of the industry life cycle stage. Secondly, the output growth rate method is used for verification. In view of the different duration of the actual life cycle for various industries, in spite of the comparison between two consecutive periods of with same duration, there is no pre-fixed requirement for the period duration, and the years of those two periods are calculated according to the years of this stage/2. For example, when the growth stage is a 10-year period, the pre and post periods used for detailed comparison are 5 years, respectively. See Table 1 and Table 2 for the specific analysis results of the life cycle of the three industries.

Table 1.

Net entry rate of manufacturers.

Table 2.

Output growth rate.

The five-year mobile average net entry rate of the computer and related equipment manufacturing industry in 2008, though slightly higher than the standard of 5%, was still classified as the inflection point of maturity upon considering the sharp decline in the net entry rate of manufacturers compared with the previous year. According to the output growth rate method, the computer and related equipment manufacturing industry should be in the decline stage from 2008 to 2019. However, considering that the entry of manufacturers in this industry is still in the process of net growth, and its output growth rate is calculated based on the designated size of the output of the enterprises above rather than all enterprises, for which there may be deviation, it is adjusted to the maturity period according to the actual situation, with reference to the practices of Jiang and Liu [9].

(4) Control variables. Referring to previous studies, this paper controls at the level of social culture, institution and company. Taking the research of Li and Zhang [4] as a reference, this paper selects Chinese listed companies as research samples to realize the control of social cultural level and adopts corporate ownership (Ownership) and corporate size (Size) as control variables at institutional and corporate levels, respectively. Among them, Ownership is the category of the ultimate controlling shareholder of corporate’s largest shareholder, with 1 standing for state-owned and 0 for non-state-owned; size is the natural logarithm of a company’s total assets. In addition, based on the research of Qu et al. [50], corporate governance factors will affect the change of the company’s CEO. According to their suggestions and referring to the research of Lian et al. [51], this paper adds Dual, Board size, Indep, Top1 and Gshare as control variables, of which, Dual is coded as 1 if CEO is also a chairman of the board, otherwise, 0; board size is measured by the number of directors; Indep is calculated as the proportion of the number of independent directors to the number of the board of directors; Top1 is calculated as the proportion of the number of shares held by the largest shareholder in the total number of shares; and Gshare is measured by the proportion of the number of shares held by the general manager to the total number of shares. This paper achieves control of year and industry in the end.

4. Empirical Results and Analysis

4.1. Descriptive Statistics and Correlation Analysis

Table 3 lists the mean value, standard deviation and correlation coefficient of variables. It can be seen from the average value that the average values of PF, TF and OF are 0.291, 0.473 and 0.417, respectively. Compared with 0.27, 0.40 and 0.32 in the study of Wang et al. [17], the average difference is no more than 30%, with the relative size basically remaining the same. In addition to the differences caused by different sample ranges and sample cycles, they may also be mainly due to the multi-functional background of CEO experience adopted in this paper, while Wang et al. [17] only used the original functional background of a CEO in their research. As shown in the correlation coefficient matrix, the industry life cycle is significantly related to the peripheral-function, throughput-function and output-function background of the CEOs, which is basically consistent with the previous assumptions. In addition, the absolute values of the correlation coefficients between independent variables are lower than 0.40, and the variance inflation factor (VIF) of all independent variables is less than 10, indicating that there is no critical multicollinearity problem among the independent variables herein.

Table 3.

Descriptive Statistics and Correlation Analysis of Variables.

4.2. Regression Results and Analysis

Table 4 reports the empirical regression results of H1a–H1c. The results in column (1) show that when the dependent variable is peripheral-function background (PF), the regression coefficient of ILC is 0.343 and the significance level is 1%, indicating that compared with the industry maturity stage, companies in the industry growth stage are more likely to appoint CEOs with a peripheral-function background. H1a is supported. The results in column (2) show that when the dependent variable is output-function background (OF), the regression coefficient of ILC is 0.518, and the significance level is 1%, indicating that companies in the industry growth stage are more likely to appoint CEOs with an output-function background, and H1b is supported. The results in column (3) show that when the dependent variable is throughput-function background (TF), the regression coefficient of ILC is −0.481 and the significance level is 1%. It can be seen that compared with the industry growth stage, companies in the mature industry are more likely to appoint CEOs with a throughput-function background. H1c is empirically supported.

Table 4.

Regression results of industry life cycle and CEO functional background.

Table 5 reports the test results of the relationship between industry life cycle, CEO function background and corporate sustainable development. The results in column (1)–(2) show that the interaction coefficient between ILC and PF is 0.019, and has passed the significance test of 5%, while the interaction coefficient between ILC and OF is 0.025, and has passed the significance test of 1%, indicating that the matching relationship between the CEOs with peripheral-function and output-function backgrounds and the industry growth stage can have a positive impact on corporate sustainable development. The interaction coefficient of ILC with TF is non-significant, indicating that CEOs with a throughput-function background in the growth stage of the industry fail to promote corporate sustainable development. Therefore, H2a and H2b are supported, while H2c is rejected. The above empirical results (Table 4) show that in the growth stage of the industry, companies prefer hiring CEOs with peripheral and output functional backgrounds. The effectiveness of this recruitment has been directly verified. In the mature stage of the industry, companies prefer to select CEOs with a throughput-function background, but fail to verify its effectiveness in promoting corporate sustainable development.

Table 5.

Regression results of industry life cycle, CEO function background and corporate sustainable development.

5. Further Study

5.1. Sub-Sample Analysis

Due to the different nature of controlling shareholders, there are fundamental differences in corporate governance between state-owned companies and non-state-owned companies [52]. In terms of CEO appointment, there is still a noticeable administrative tendency in the appointment of CEOs of state-owned companies, which is of a considerable discrepancy from the marketization of CEO appointment of non-state-owned companies. In this case, are there differences in the relationship between the functional background and the industry life cycle of CEOs selected by companies with different ownership? Meanwhile, different ownership properties will lead to different factor endowments and governance structures, thus affecting corporate behavior and operating performance [53,54]. Under these circumstances, will companies with different ownership have a similar governance effect and promote similar strategic behaviors, thus achieving good business performance that matches with their CEO’s functional background and the industry life cycle? According to the nature of the largest shareholder, the sample companies are divided into state-owned ones and non-state-owned ones, with the above tests carried out, respectively.

Table 6 reports the sub-sample test results of the relationship between industry life cycle and CEO functional background. The results in column (1)–(6) show that the relationship between the functional background of a CEO and the industry life cycle is significant in both state-owned and non-state-owned companies, with the positive and negative signs consistent with the hypotheses and no change in conclusions.

Table 6.

Grouped by ownership: industry life cycle and CEO functional background.

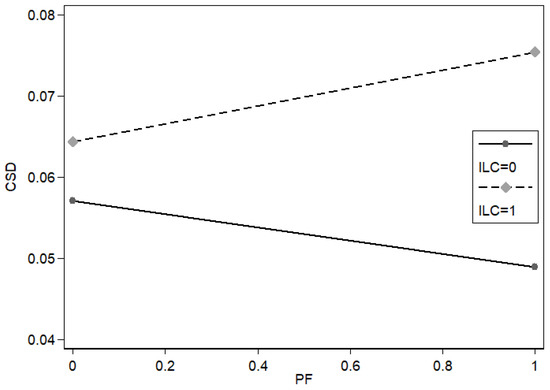

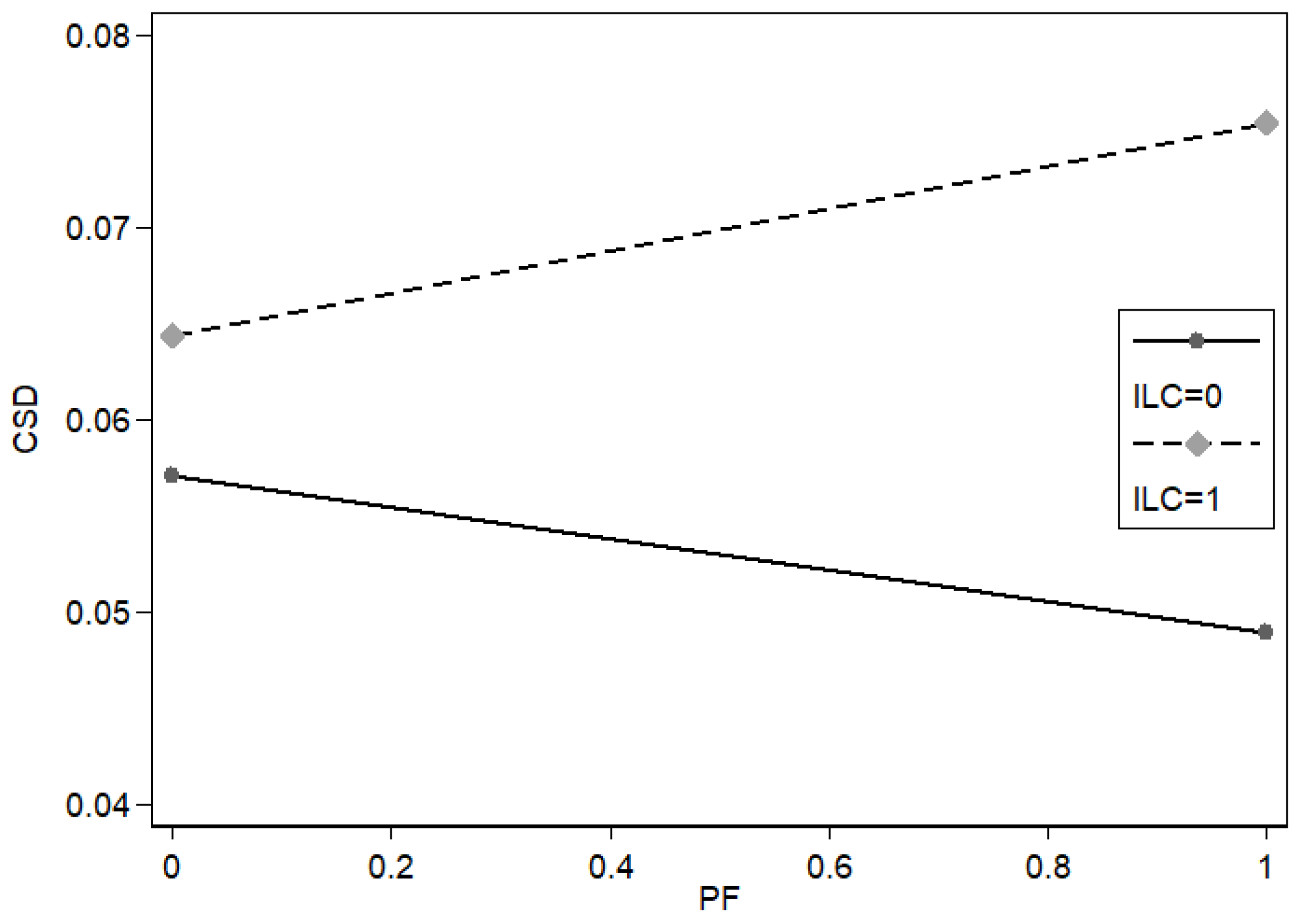

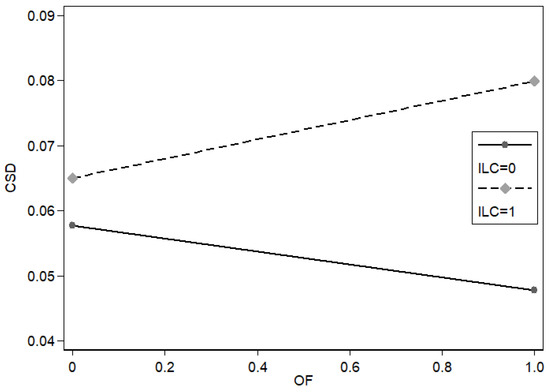

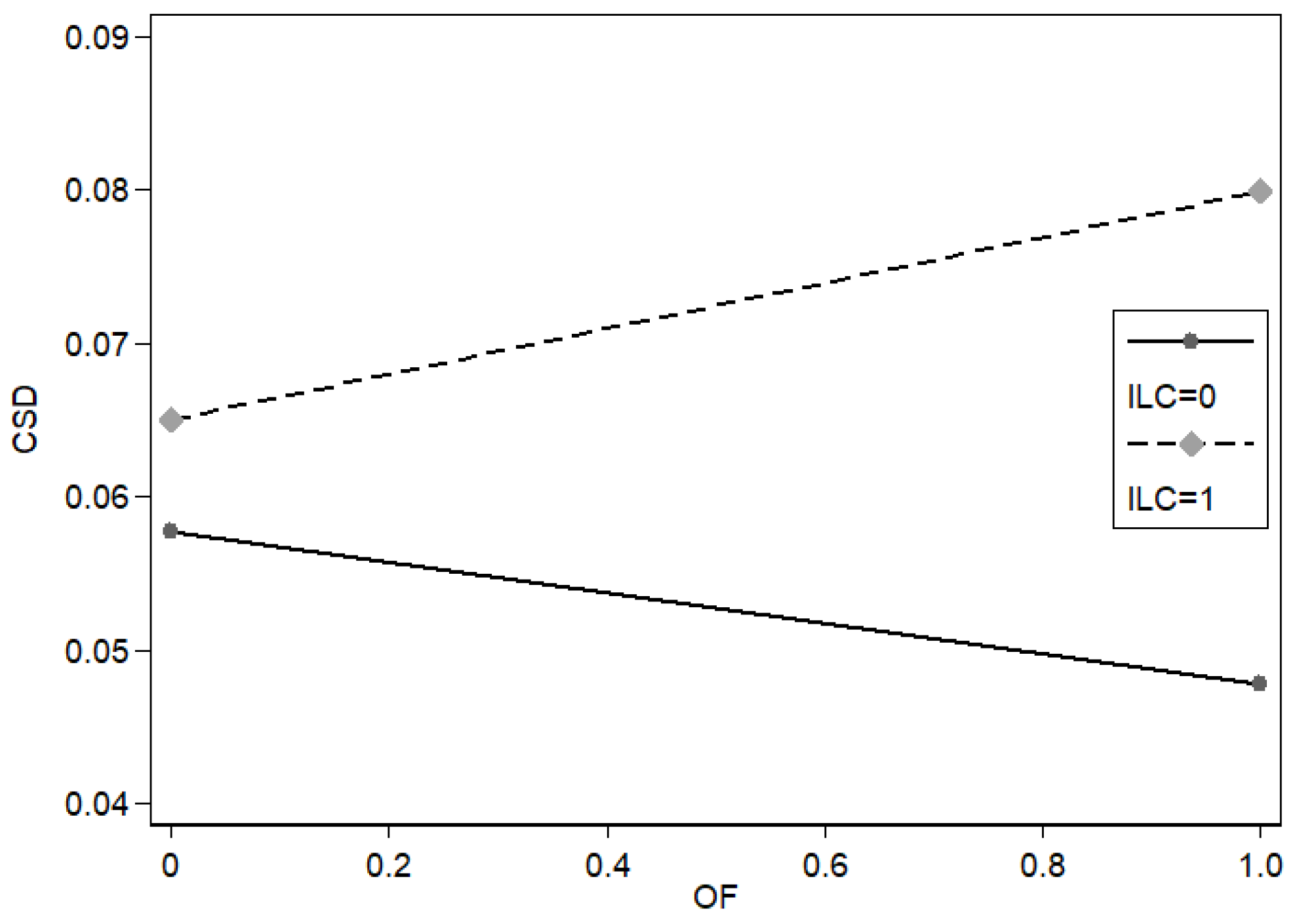

Table 7 reports the sub-sample test results of the relationship between industry life cycle, CEO functional background and corporate sustainable development. The results in column (1)–(2) show that when the sample is non-state-owned companies, the positive and negative signs and significance of each interaction coefficient are basically consistent with that of the whole sample and the conclusion has not changed. The results in column (3)–(4) show that when the sample is state-owned companies, the interaction coefficient between TF and ILC is significantly negative, indicating that the matching of the throughput-function background CEO and the industry maturity stage can promote corporate sustainable development. The corresponding moderation plot is shown in Appendix A: Figure A1 and Figure A2. The interaction coefficient between PF and OF and ILC is not significant; that is, the matching between the CEO with a output-function and peripheral-function background and the industry growth stage fails to promote corporate sustainable development. The possible reason is that the state-owned enterprises are insensitive to the market due to the low decision-making efficiency and implementation efficiency of administrative governance under the rapidly changed market during the growth stage of China’s industry, and ultimately fail to effectively stimulate corporate sustainable development.

Table 7.

Grouped by ownership: industry life cycle, CEO functional background and corporate sustainable development.

5.2. Handling of Endogenous Problems

This paper tries various possible methods to minimize the impact of endogenous variables on the research results. Firstly, the hitting-the-view environment is an exogenous factor. Generally speaking, the behavior of a company cannot affect the development of the whole industry, and there is unlikely to be a bidirectional causal relationship between the CEO’s functional background and the industry life cycle. Therefore, the endogenous problems in the hitting-the-view environment are greatly weakened. Secondly, this paper adopts the method of adding as many control variables that affect explanatory variables and dependent variables as possible, which is functioned as an effective way to alleviate endogenous issue, and has been adopted by international top journals [55,56]. In addition, this paper adopts fixed effect estimation for solutions of unobserved factors.

The following tests were performed to further alleviate the possible endogenous problem.

- (1)

- For the empirical model (1), this part uses a lagged independent variable to control the endogeneity problem. All independent variables and control variables are lagged by one year and the research conclusion has not changed.

- (2)

- For the empirical model (2), taking the change in the general manager of the company as an exogenous event, this paper tests the impact of the matching between the functional background of CEO succession and the industry life cycle on corporate sustainable development. This part refers to the practice of Xiao et al. [57] and constructs the following model.

Among them, CSD_change stands for corporate sustainable development. The change in the sustainable growth rate in the year before and after the CEO change announcement (ΔSGR) is used to measure corporate sustainable development, which is equal to the difference between the sustainable growth rate in the year after the CEO change and the sustainable growth rate in the year before the change. Match indicates the match between the CEO’s functional background and the industry life cycle. If “a company in the growth stage of the industry appoints CEOs with peripheral-function and output-function backgrounds, or a company in the mature stage of the industry appoints CEOs with throughput-function backgrounds”, the value of Match is 1, otherwise it is 0. Other control variables are defined as in model (2). All continuous variables are winsorized at the 5% and 95% levels.

The regression results in Table 8 show that the coefficient of Match is significantly positive. As a consequence, based on the test results of the general manager change event, it is further confirmed, upon the alleviation of the endogenous problem, that the matching of CEO functional background with the industry life cycle will significantly stimulate corporate sustainable development.

Table 8.

Succession events: industry life cycle, CEO function background and corporate sustainable development.

The above test results further confirmed the research conclusion on the basis of alleviating endogenous problems.

5.3. Robustness Test

There is currently no uniform standard for a robustness test and scholars will conduct robustness tests from different perspectives for their own research purposes. In the empirical process, scholars have performed robustness tests from all aspects such as data selection, variable measurement and model setting. There are many methods for carrying out a robustness test. This paper refers to the research of Li and Zong [58] and uses the data substitution method, variable substitution method, setting control variable or dummy variable and time-based regression test to conduct the robustness test.

For the empirical model (1), the following robustness tests are carried out:

- (1)

- Change the definition of CEO. According to the suggestions of Yan and Xiao [59], Li et al. [42], the chairman of state-owned companies and the general manager of non-state-owned companies are studied as CEOs.

- (2)

- Change the division method of industry life cycle stages. In view of the rapid changes in the Chinese industry life cycle, this part uses the method of McGahan and Silverman [47] for reference, selects the 3-year moving average method to calculate the net entry rate of manufacturers, and divides the industry life cycle stages based on this.

- (3)

- Change the sample period. Considering that the imperfect capital market before 1999 may cause inaccurate research results, this paper reduces the sample to 2000–2019 according to the suggestions of Jiang and Liu [9].

For the empirical model (2), the following robustness test is adopted:

- (1)

- Change the measurement indicators for the sustainable development of companies. The empirical research in this paper adopts the return on net assets (ROE) as the robustness test.

- (2)

- Add control variables. In the previously mentioned analysis, industry life cycle has an impact on CEO characteristics, which may also include other CEO demographic characteristics. In order to eliminate the potential impact, CEO age, education and political capital are added as control variables.

- (3)

- Some robustness tests above are used. (1) Select the 3-year moving average method to calculate the net entry rate of manufacturers to divide the industry life cycle stages; (2) Narrow the sample range to 2000–2019.

The above robustness test is regressed again, with the results showing no change in the research conclusion.

6. Discussion

Based on the upper echelon theory and the contingency theory, this paper analyzes the relationship between CEO functional background and industry life cycle and the impact of this relationship on corporate sustainable development. Generally consistent with our expectations, the results show that the life cycles of their industries are different and there are significant differences in the functional backgrounds of CEOs selected by companies; the matching of CEO functional background and industry life cycle can stimulate corporate sustainable development under certain conditions.

First, industry life cycle directly influences CEO functional background. Our research is based on the logic that different industry life cycles determine different situational pressures faced by enterprises. In order to cope with different pressures, enterprises need to appoint people with different functional backgrounds as CEOs. With the evolution of the industry life cycle, there is a difference in companies’ dependence on external resources, and in both the opportunities and capabilities of corporate innovation, and in their priority on cost control and efficiency promotion. As a result, the demand for CEOs with a peripheral-function background, output-function background and throughput-function background will also change. The empirical results are consistent with the theoretical predictions (Hypothesis 1a–1c). Further research indicates that the CEOs selected and recruited by state-owned companies “unexpectedly” match the industry life cycle, and even show greater relevance with the industry life cycle under their peripheral-function and output-function backgrounds, which may be caused by the timing of China’s institutional reform and the development of the industry life cycle. In the process of China’s transition from planned economic system to market economic system, the nation is in high-speed economic development, with most industries having entered and remained in the growth stage of the industry life cycle for a long time. In the same period, China has arranged six major government restructures for personnel streamlining and separation of enterprise from administration. After each adjustment, there has been a rush of government officials going into business. Since 1999, 242 scientific research institutions affiliated with 10 former national bureaus have also been transformed into companies, and the transformation of scientific research institutions has been carried out in an all-round way. These institutional reforms have diverted a large number of government officials and scientific researchers to companies and have become the peripheral-function and output-function background CEOs. As a state-owned company, it has an inextricable link with government and public institutions and naturally takes over the reposition of the major diversion personnel. Whether with or without intention, such appointment made by state-owned companies objectively meets the needs of companies in the growth stage of the industry, thus realizing the “same destination” between the administrative appointment of state-owned company CEOs and the market-oriented selection of non-state-owned company CEOs.

Secondly, the matching of CEO functional background and industry life cycle can stimulate corporate sustainable development under certain conditions. When the CEO’s output-function and peripheral-function background matches the growth stage of the industry, the innovation mode that they are adept in is consistent with the resource-constrained one stressed by the companies in the growth industry, thus promoting corporate sustainable development. The empirical results are consistent with the theoretical predictions (Hypothesis 2a and 2b). However, CEOs with a throughput-function background in the maturity stage of the industry fail to significantly promote corporate sustainable development and Hypothesis 2c has not been empirically supported. Due to the possible reason for the relatively wide scope for the definition of throughout function, the latter causes large differences in the resulting cognition and preferences among CEOs, which affect strategic choices, thus having no significant effect on corporate sustainable development. Furthermore, whether for state-owned companies or non-state-owned companies, the matching of CEO functional background and industry life cycle will promote corporate sustainable development under certain conditions, but the relationship has different effects under different ownership. This research finding conveys a more profound meaning, which is, simply, matching the CEO’s functional background with the industry life cycle cannot give full play to the CEO’s human capital and social capital. Under the realistic constraints of corporate governance differences, it is necessary to determine the governance factors that affect the performance of CEOs and consider them by comprehensively utilizing the governance advantages of different corporate ownerships through mixed ownership, in order to maximize the impact of the relationship between CEO functional background and industry life cycle on corporate sustainable development.

7. Conclusions

Logit model and multiple regression models are applied with data collected from China’s A-share listed companies during 1993–2019, and several conclusions have been drawn. Companies in the growth stage of the industry are more likely to appoint CEOs with peripheral-function and output-function backgrounds, and those in the mature stage of the industry are more likely to appoint CEOs with throughput-function backgrounds. In addition, the relationship between CEOs with peripheral-function and output-function backgrounds and the growth stage of the industry will promote corporate sustainable development, but CEOs with throughput-function backgrounds fail to significantly stimulate corporate sustainable development in the mature stage of the industry. Further sub-sample research results show that the functional background of CEOs selected either by state-owned or non-state-owned companies matches the industry life cycle, but the relationship has different effects on corporate sustainable development with different ownership. Among them, the matching between the peripheral-function and output-function background CEOs of non-state-owned companies and the growth stage of the industry can significantly promote corporate sustainable development, while the matching between the throughput-function background CEOs of state-owned companies and the maturity stage of the industry will promote the sustainable development of companies.

8. Final Considerations

8.1. Contribution or Implications

The conclusions of this research enrich the research results of the upper echelon theory, the contingency theory and corporate sustainable development. This study selects the perspective of the dynamic industry characteristics of the industry life cycle to further verify that the characteristics of CEOs are affected by the internal and external environment of the company. Meanwhile, in order to explore the rationality of CEO appointment decision, this study also tests the role of selecting CEOs with different functional backgrounds on corporate performance under different industry life cycles, because “only when performance is considered can the real contingency theory be fully reflected” [60]. This paper adopts the corporate sustainable development as an alternative variable of corporate performance. The research results are consistent with previous similar studies; that is, the matching of CEO characteristics and the internal and external environment has a positive impact on corporate performance. One possible reason for this positive impact is that there are great differences in the resource constraints faced by companies in emerging countries at different stages of the industry life cycle, which will further affect the functional background of the CEO selected and the resource-constrained innovation methods adopted. As CEO recruitment is a strategic measure of the company, the functional background of a CEO should not only contribute to the current performance enhancement, but also meet the needs of corporate sustainable development. When the CEO’s functional background matches the industry life cycle stage, the innovation mode that the CEO is adept in is consistent with the resource-constrained innovation mode that the company emphasizes in the industry life cycle stage, which will promote corporate sustainable development.

The conclusion of this paper has significant management implications for CEO appointment and training. Facing the pressure brought by the evolution of the industry life cycle, companies need to select and recruit CEOs more specifically to create a space conducive to the development of companies. At the same time, companies in emerging countries should be more cautious about training CEOs. Those companies are in a more drastically changing industry environment without a clear boundary between the growth stage and maturity stage of the industry. CEO candidates with a wider distribution of functional backgrounds are needed to stabilize the impact of the sharp fluctuations therein. Huawei’s “full succession system” and Haier’s “competition for positions” may be more suitable for companies in emerging countries.

This study can also be significant as a reference for career choices and career planning for corporate managers. First of all, if managers can grasp the needs of companies with different ownerships in the life cycle of different industries and choose a good entry time for industries and companies, it is undoubtedly more conducive to career development. Secondly, due to the rapid development of the industry and the short life span of companies, the career of the CEOs in emerging countries presents more borderless and volatile characteristics. Managers in emerging countries must manage their career planning more flexibly. They should not limit their career planning to specific occupations, companies and even industries, but lay particular emphasis on the promotion of human capital and the accumulation of social capital. Career planning that combines broad career directions with dynamic development plans may be more suitable for managers in the rapid development of the industry.

8.2. Limitations and Future Research Directions

This paper has the following limitations: (1) At present, various methods are available for the division of the industrial life cycle and there are great differences between the methods used by domestic and foreign scholars. This paper comprehensively uses the manufacturer’s net entry rate method commonly used by foreign scholars and the output growth rate method commonly used by domestic scholars to jointly judge the industrial life cycle. However, due to the short development history of China’s industry and the special national conditions, theoretical and empirical research on approaches for the development of an industrial life cycle theory and discrimination model that conforms to China’s reality is still greatly needed. Whether the method used in this paper is the best measurement method for ILC and the proper option of either the 5-year or 10-year moving average method for the manufacturer’s net entry rate method still requires further inspection and verification. (2) This paper employs the single index of sustainable growth rate to measure corporate sustainable growth. Nevertheless, other scholars have also developed multiple indicators, including economic, social and environmental indicators, to evaluate the sustainable development of enterprises, and the evaluation indicators selected by each scholar are different. What indicators should be used to build a comprehensive evaluation system for corporate sustainable development still needs further analysis. Instead of considering corporate sustainability from the (broad) perspective of “attempt to respond to environmental and social issues” [61], this paper measures corporate sustainable development from a single perspective of financial sustainability, which is not mainstream but more specific to the expanding impulse common to enterprises in emerging countries. It is hoped that the measurement of corporate sustainable development from multiple dimensions will be realized in follow-up research. (3) This paper explores the relationship among the industrial life cycle, CEO functional background and corporate sustainable development, analyzes the mechanism from the perspective of ownership and further probes into the feasibility of methods such as measuring corporate governance factors for relationship extension. Is the relationship between CEO functional background and industry life cycle still affected by internal governance factors? This is an important topic worthy of further exploration in the future.

Author Contributions

Conceptualization, Y.F. and Y.L.; methodology, Y.F. and Y.L.; software, Y.F. and Y.L.; validation, Y.F. and Y.L.; formal analysis, Y.F.; investigation, Y.F. and Y.L.; resources, Y.F. and Y.L.; data curation, Y.F. and Y.L.; writing—original draft preparation, Y.F. and Y.L.; writing—review and editing, Y.F.; visualization, Y.F. and Y.L.; supervision, Y.F.; project administration, Y.F. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Guangxi First-class Discipline Applied Economics Construction Project Fund and E-Government Governance Key Lab of Guangxi Universities Construction Project Fund.

Informed Consent Statement

Not applicable.

Data Availability Statement

The dataset used in this study is the secondary data as mentioned in the sample selection section of this research paper. It is available upon request.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

This section provides the tables of robustness test results and the moderation plot.

Table A1.

Regression results of robustness test (1): Change the definition of CEO.

Table A1.

Regression results of robustness test (1): Change the definition of CEO.

| Variables | FB | ||

|---|---|---|---|

| (1) PF | (2) OF | (3) TF | |

| ILC | 0.270 ** | 0.263 * | −0.500 *** |

| (2.404) | (1.933) | (−4.525) | |

| State | −1.038 *** | 0.598 *** | 0.085 |

| (−10.504) | (4.958) | (0.887) | |

| Size | −0.089 ** | 0.052 | 0.006 |

| (−2.177) | (1.040) | (0.159) | |

| Dual | −0.401 *** | 0.258 * | −0.043 |

| (−3.097) | (1.765) | (−0.345) | |

| Board | −0.068 ** | 0.040 | 0.007 |

| (−2.549) | (1.238) | (0.257) | |

| Indep | −0.950 ** | 1.499 ** | 1.124 ** |

| (−1.997) | (2.552) | (2.390) | |

| Top1 | −0.004 | 0.000 | 0.010 *** |

| (−1.285) | (0.027) | (3.585) | |

| Gshare | 1.073 | −8.624 *** | 8.860 *** |

| (1.136) | (−5.754) | (5.479) | |

| Constant | 3.830 *** | −4.271 *** | −0.944 |

| (4.138) | (−3.739) | (−1.062) | |

| Ind | Yes | Yes | Yes |

| N | 2100 | 2100 | 2100 |

| R2 | 0.0891 | 0.155 | 0.0623 |

| Waldchi2 | 259.28 | 371.19 | 180.25 |

Note: * p < 0.10, ** p < 0.05, *** p < 0.01. Standard errors in parentheses.

Table A2.

Regression results of robustness test (2): Change the division method of industry life cycle stages.

Table A2.

Regression results of robustness test (2): Change the division method of industry life cycle stages.

| Variables | FB | ||

|---|---|---|---|

| (1) PF | (2) OF | (3) TF | |

| ILC | 0.387 *** | 0.418 *** | −0.478 *** |

| (3.251) | (3.014) | (−4.043) | |

| State | −0.096 | 0.184 | 0.067 |

| (−0.961) | (1.592) | (0.688) | |

| Size | −0.073 | 0.129 ** | 0.125 *** |

| (−1.595) | (2.378) | (2.769) | |

| Dual | 0.002 | −0.018 | −0.011 |

| (0.019) | (−0.124) | (−0.089) | |

| Board | 0.013 | −0.074 ** | 0.033 |

| (0.422) | (−2.082) | (1.109) | |

| Indep | −0.735 | 0.419 | −0.344 |

| (−1.457) | (0.709) | (−0.676) | |

| Top1 | −0.393 | −0.092 | 0.082 |

| (−1.319) | (−0.264) | (0.277) | |

| Gshare | 0.489 | −9.153 *** | 9.638 *** |

| (0.296) | (−4.952) | (5.297) | |

| Constant | 1.784 * | −4.046 *** | −2.970 *** |

| (1.747) | (−3.305) | (−2.920) | |

| Ind | Yes | Yes | Yes |

| N | 2014 | 2014 | 2014 |

| R2 | 0.0583 | 0.136 | 0.0571 |

| Waldchi2 | 159.56 | 330.49 | 159.07 |

Note: * p < 0.10, ** p < 0.05, *** p < 0.01. Standard errors in parentheses.

Table A3.

Regression results of robustness test (3): Change the sample range.

Table A3.

Regression results of robustness test (3): Change the sample range.

| Variables | FB | ||

|---|---|---|---|

| (1) PF | (2) OF | (3) TF | |

| ILC | 0.356 *** | 0.436 *** | −0.424 *** |

| (3.077) | (3.224) | (−3.727) | |

| State | −0.077 | 0.208 * | 0.051 |

| (−0.758) | (1.772) | (0.514) | |

| Size | −0.079 * | 0.117 ** | 0.136 *** |

| (−1.704) | (2.129) | (2.978) | |

| Dual | 0.080 | 0.029 | −0.065 |

| (0.594) | (0.192) | (−0.495) | |

| Board | 0.034 | −0.062 * | 0.001 |

| (1.079) | (−1.650) | (0.032) | |

| Indep | −1.221 * | 0.016 | −0.113 |

| (−1.947) | (0.023) | (−0.182) | |

| Top1 | −0.544 * | −0.013 | 0.175 |

| (−1.785) | (−0.037) | (0.580) | |

| Gshare | 0.300 | −9.539 *** | 9.751 *** |

| (0.180) | (−5.019) | (5.308) | |

| Constant | 1.910 * | −3.847 *** | −3.009 *** |

| (1.794) | (−3.038) | (−2.847) | |

| Ind | Yes | Yes | Yes |

| N | 1926 | 1926 | 1926 |

| R2 | 0.0570 | 0.129 | 0.0526 |

| Waldchi2 | 148.83 | 298.19 | 140.28 |

Note: * p < 0.10, ** p < 0.05, *** p < 0.01. Standard errors in parentheses.

Table A4.

Regression results of robustness test (1): Change the measurement indicators of sustainable development of companies.

Table A4.

Regression results of robustness test (1): Change the measurement indicators of sustainable development of companies.

| Variables | ROE | |

|---|---|---|

| (1) | (2) | |

| ILC × PF | 0.015 * | |

| (1.705) | ||

| ILC × TF | −0.004 | |

| (−0.515) | ||

| ILC × OF | 0.016 * | |

| (1.777) | ||

| PF | 0.003 | −0.006 |

| (0.697) | (−0.968) | |

| TF | 0.005 | 0.006 |

| (1.058) | (1.017) | |

| OF | 0.007 | −0.003 |

| (1.552) | (−0.373) | |

| ILC | 0.018 ** | 0.011 |

| (2.558) | (0.954) | |

| State | 0.011 *** | 0.011 *** |

| (3.451) | (3.557) | |

| Size | 0.018 *** | 0.018 *** |

| (11.292) | (11.073) | |

| Dual | −0.009 ** | −0.009 ** |

| (−2.168) | (−2.348) | |

| Board | 0.002 ** | 0.002 ** |

| (2.160) | (2.166) | |

| Indep | −0.025 | −0.029 |

| (−0.708) | (−0.820) | |

| Top1 | 0.054 *** | 0.054 *** |

| (5.659) | (5.599) | |

| Gshare | 0.498 *** | 0.484 *** |

| (3.282) | (3.189) | |

| Constant | −0.311 *** | −0.303 *** |

| (−4.264) | (−4.144) | |

| Industry | Yes | Yes |

| Year | Yes | Yes |

| N | 2014 | 2014 |

| F | 11.41 | 10.90 |

| Adj.R2 | 0.164 | 0.168 |

Note: * p < 0.10, ** p < 0.05, *** p < 0.01. T-values are in parentheses.

Table A5.

Regression results of robustness test (2): Add control variables.

Table A5.

Regression results of robustness test (2): Add control variables.

| Variables | SGR | |

|---|---|---|

| (1) | (2) | |

| ILC × PF | 0.018 ** | |

| (2.004) | ||

| ILC × TF | 0.000 | |

| (0.044) | ||

| ILC × OF | 0.021 ** | |

| (2.263) | ||

| PF | 0.003 | −0.008 |

| (0.691) | (−1.165) | |

| TF | 0.005 | 0.004 |

| (1.149) | (0.679) | |

| OF | 0.004 | −0.008 |

| (0.853) | (−1.191) | |

| ILC | 0.023 *** | 0.010 |

| (3.129) | (0.889) | |

| age | −0.001 ** | −0.001 ** |

| (−2.029) | (−2.054) | |

| diploma | −0.002 | −0.002 |

| (−0.889) | (−0.917) | |

| PC | −0.001 | −0.001 |

| (−0.273) | (−0.189) | |