Abstract

The objective of this study is to establish an efficient contractual coordination model for advancing the supply chain (SC) towards sustainability with blockchain technology. The problem of SC unsold product remanufacturing is investigated under the influence of efforts on recovery quality and information sharing within blockchain technology. Firstly, a functional model describes how the recovery quality affected by the added effort and demand of the remanufactured products is affected by the price. Secondly, the downstream SC faced market uncertainty with consumer sensitivity analyzed, and the SC information-sharing systems were reconsidered in order to improve consumer satisfaction. Then, under the conditions of information sharing and recovery quality efforts, the decentralized SC decision-making mode is discussed. The above demonstrates that the SC unsold products remanufacturing under the decentralized decision-making mode cannot be coordinated. To prove the efficiency of unsold products remanufacturing we investigated the centralized SC mode as a benchmark, which is known as the most efficient system. Finally, in order to effectively coordinate the whole chain, a mechanism of “cost and revenue sharing” is proposed, and the constraints of supplier’s choice of remanufacturing are given. The results show that the “cost and revenue sharing” mechanism can effectively coordinate the SC and the expected profits of downstream and upstream will be in win–win condition. Moreover, the “cost and revenue sharing” mechanism in a sustainable SC unsold product remanufacturing essentially builds an incentive among members to improve the efficiency of existing resource usage and the environmental implications.

1. Introduction

1.1. Sustainable Supply Chain Remanufacturing

Over the past two decades, the study of closed-loop supply chain (CLSC) attracted the attention of researchers and existing research has been of great help to the SC development. The literature that examines the sustainable development within CLSC mainly from different operational aspects has been of concern by both researchers and practitioners. The CLSC is a study approach that can help reduce the environmental impacts and achieve sustainable development. One of the theoretical concepts of sustainable development within CLSC management is the simultaneous consideration of financial and environmental aspects. The management of CLSC aims to improve the efficiency of the entire SC in order to maximize the profit through the fuller use of existing resources. In recent years, most of the research advancements have been on specifying environmental policies. In order to improve sustainability and to provide incentives for the CLSC upstream members, governments have developed a range of environmental policies. Accordingly, the remanufacturers, as well as their chain profitability, are affected by governmental regulative policies with reduction strategies [1], such as the carbon tax policy (CTP), cap-and-trade system (CTS), and remanufacturing subsidy policy [2]. These are major regulations for accelerating and controlling carbon emission in CLSC remanufacturing [3]. The existing study shows that the CLSC unsold product remanufacturing can also decrease the consumption of energy resources and carbon emissions to the environment with profitability [4]. Numerous publications have dealt with CLSC: remanufacturing and recycling point of location [5], production planning and control [6,7,8,9], inventory control [10,11], and material planning. Moreover, the problems of pricing decisions [12], mode selection [13] and decisions on a manufacturing and remanufacturing combination have been studied. While these efforts have been largely effective in improving the performances of sustainable development in different industries, existing contributions are unproven in the case of retailers’ unsold product remanufacturing. The remanufacturers of unsold products hold a large amount of unsold product supply disruptions, as well as a uncertain demand for the secondary market place. CLSC sustainable remanufacturing of unsold products is different from traditional SC. Due to the increase in sustainable development and with the market uncertainty, downstream demand becomes increasingly complex. It is becoming more difficult to determine where the performances need to be effectively improved within economical profitability. The CLSC coordination strategy helps simultaneously improve the performances of sustainability and profitability. Therefore, coordination mechanisms are necessary to incentivize decision-makers on environmental sustainability and profitability. The coordination mechanisms include the SC contracts, which formally rule the transactions between the SC members.

1.2. Contractual Coordination Mechanisms

In the literature, it is well advocated that coordination mechanisms can help damped the inefficiency problem and achieve the coordination of SC. There are several available studies that have developed two common forms of contractual coordination: revenue sharing and cost sharing. Cost sharing is an effective way to improve SC performance. In recent years, Ghosh and Shah studied the influence of green cost allocation and green SC performance [14]. Wang Wenbi’s study considers a CLSC including manufacturer, retailer, recycler, and consumer. The study shows the decision-making issues of CLSC members, where the manufacturer shares the fixed investment cost of a recycler. Pourjavad and Mayorga proposed a fuzzy multi-objective mixed integer linear programming model in order to minimize the cost of environmental effects and maximize the social impact in CLSC [4]. The uncertainty in model decision elements adds more complexity to the proposed model. Zou and Ye studied the CLSC pricing strategy and coordination mechanisms, where the remanufacturing cost is random, caused by the proportion of reusability parts in the design stage and quality condition of the recycling product [13]. The study results show that the wholesale price and retail price values are negatively correlated, while the recycling rate and total profit of SC are positively correlated. Shantanu Bhattacharya et al. studied the implications of the downstream retailer decision-making structure on the optimal ordering decisions [15]. The existing studies have been of great help to the SC development. However, one of the main issues in CLSC is how to maintain unsold product recovery while avoiding the extra expenses. Additionally, growing customer satisfaction and sensitivity makes the modern-day market place more complete. Rice and Hoppe suggest that organizations that are looking for to coordinate themselves around a strategic SC can achieve this by three independent segments of coordination: information system coordination; logistics process coordination; contractual coordination [16]. The improvement of contractual coordination mechanisms (incentivization) makes SC members’ decisions internally coherent. In particular, the incentives let the risk and the revenue be shared by all SC members [17]. The contractual coordination mechanism allows for the achievement of two main objectives in SC management: (i) Increasing the total SC profit, so that it approaches the profit resulting from a centralized control; and (ii) Sharing the risks among the SC members [18]. SC contracts are effective in coordinating activities among members in SCs. To improve the overall performance of CLSC, the members may behave as a part of unified system and coordinate with each other towards sustainability.

1.3. Blockchain-Enabled SC Information Sharing

A transparent SC refers to the practice that provides visibility and availability of information among all SC members, including consumers. Blockchain technology can help SC industries to permanently record and track all the information related to quality details and other sourcing conditions. Blockchain technology adoption in SC helps in achieving end-to-end product tracking from the procurement of sourcing materials to product consumption. The availability of reliable information by a single member of an SC increases the traceability of products within the overall SC. This will help the business and consumers to ensure product quality and standards [19].

Blockchain-enabled technology affects the SC members’ information sharing and as a system can provide accurate forecasting due to the traceable nature of the blockchain. Thus, the management of matching supply and demand can be handled effectively. Additionally, the blockchain-enabled technology increases trust among SC members by providing proof of identity and enabling the validation of information flow in SC [20]. Samant Saurabh and Kushankur Dey identified potential drivers of blockchain technology adoption, considering the grape wine SC and employing a rating-based conjoint analysis. The study found that coordination and control can influence the chain members’ adoption–intention decision. Moreover, adoption factors further rationalize the design for a cost-effective architecture of SC integration and sustainability [21]. Susanne Köhler and Massimo Pizzol studied sustainability improvements in food SC to provide new critical insights on how blockchain-enabled technologies can be implemented in SC. The authors pointed out that the data storage can be an issue within blockchain-enabled technology, both in terms of speed and costs [22]. Silvana Secinaro et al. investigated blockchain systems in the accounting, auditing and accountability fields. In that study, the authors noticed cost reduction possibilities in the accounting, auditing and accountability fields [23]. Additionally, Xiaohong Li et al. investigated and analyzed sustainable electronic agriculture based on blockchain technology, and the application prospects and challenges of blockchain in the agricultural field. The authors pointed out one of the main issues of information-processing management; that the efficient management of data information also increases the cost of developing IoT. The joint development and adoption of blockchain and IoT enable cost minimization in maintenance and network development [24].

The blockchain-enabled information sharing will lead to costly efforts, and the SC total profit will rise due to both higher sale volumes and higher product prices [25]. The price is an important economic attribute of SCs, which depends on the quality of products, resources and capabilities of the chain member. Since blockchain-integrated technology may be relatively costlier to adopt, SC members need to share the adoption cost and revenue through a shared platform of data ownership infrastructure. Sharing and pricing strategies can further strengthen the performance metrics of SC members, such as the return on investment and return on equity [21].

There is a limited number of studies on blockchain technology cost-sharing in SC. Moreover, the literature does not deal with the application of the “cost and revenue sharing” mechanism in CLSC sustainable remanufacturing with random demand, where the demand is affected by the effort of unsold product recovery quality and information sharing under blockchain technology. This study considers a random demand market place faced by the downstream SC at the end of the selling season, where an upstream supplier takes the remanufacturing decision on the retailer’s unsold inventory. To establish the contractual coordination model in CLSC sustainable remanufacturing studies, this paper analyzes different remanufacturing SC structures under profit changes.

The study is organized as follows. Section 2 describes the study model, hypotheses and parameters. Section 3 shows the model establishment and implementation under a decentralized decision-making scenario and a centralized decision-making scenario. Section 4 examines coordination conditions through the “cost and revenue sharing” mechanism. Section 5 uses some numerical examples for the simulation analysis. Section 6 concludes.

2. Model Description, Hypotheses and Parameters

In this study the terms supplier, manufacturer, upstream and remanufacturer have been used interchangeably to mean a CLSC member who is able to remanufacture an unsold product inventory with extra efforts. The study considers a two-stage CLSC consisting of one supplier and one retailer in the random demand marketplace. The (initial market) demand uncertainty leads to the possibility of unsold product inventory in the downstream CLSC system. The upstream supplier will remanufacture the retailer’s unsold products inventory and then sells remanufactured products to the secondary market. We assume that the consumers differ in their valuation of remanufactured products and in their sensitivity. Therefore, SC members can influence the market demand by exerting extra effort on unsold product recovery quality with information sharing under blockchain technology. We denote the “Information Trustworthy” under blockchain technology and consumer sensitivity to remanufactured products’ information as a “Trustworthy Level”. To ensure the efficiency of blockchain technology investment and consumer satisfaction, CLSC members coordinate by sharing cost and revenue. To address this issue, the CLSC contractual coordination model in this paper is based on the following assumptions:

Hypothesis 1:

Before the selling season a retailer determines order quantity based on forecasting information (primary market place), when the final demand is realized a downstream retailer faces the unsold products inventory. Primary market demand (random demand) is and , denote the probability density function (PDF) and the cumulative distribution function (CDF), respectively. We assume an increase in and .

Hypothesis 2:

The supplier (manufacturer) can take the decision of remanufacturing unsold products and then sell the remanufactured products to the secondary market. Under normal circumstances, the greater the added recovering effort, the lower the loss of remanufacturing products and the better the quality of unsold product recovery, the lower the cost of remanufacturing. Therefore, the cost of remanufacturing products is:

where is the unit cost of remanufacturing using the retailer’s unsold inventory product, indicates maximum remanufacturing cost, and indicate the efficiency of added efforts. The greater the values of and , the better the supplier’s unit recovery will be, to reduce the cost of remanufacturing. The recovery effort with R&D investment is and the remanufactured product information availability level is .

Hypothesis 3:

Secondary market demand (sensitive demand) has a sensitivity to the remanufacturing products (environmental awareness) with the price sensitivity. is negatively correlated with the remanufactured product information trustworthy level and product retail price in the secondary market place. At this point, without the loss of generality, we assume that the secondary market demand function for the remanufactured products is expressed as:

where is the secondary market potential, indicates the price sensitivity coefficient, and the greater the value of , the more sensitive consumers are to the remanufactured product’s price, . is the consumers’ sensitivity to the remanufactured products (environmental awareness) with information trustworthy level . We denote the “Information Trustworthy” level, and for analytic simplicity we assume it falls in the range of [0, 1], with = 0 and density of = 1 representing the consumers’ satisfaction, where the range of [0, 1] represents a “partial availability” and “trustworthy or full availability” of remanufactured products’ information, respectively. To ensure that the remanufactured production is always positive, we assume that it is .

Hypothesis 4:

The CLSC upstream supplier (remanufacturer) is a Stackelberg Leader (SL), and the downstream retailer is the Stackelberg Follower (SF).

The parameters in this study have the following meanings, as shown in Table 1:

Table 1.

Nomenclature.

3. Model Establishment and Implementation

This section derives two different decision-making scenarios under the Stackelberg Game theory with a CLSC unsold product; for the simplicity of comparison, the study examined a decentralized decision-making mode, where the CLSC members make their own decisions based on their own single-entity interest. Secondly, we examined the benchmark centralized CLSC mode, which is known as the most efficient system but hardly achievable in the reality.

3.1. Decentralized Decision-Making Scenario

Under the decentralized CLSC decision-making mode, is indicates the order quantity set of the retailer, and the repurchasing price of the retailer’s inventory product is , where . In this case, the supplier’s unit unsold product remanufacturing cost is , and the demand for the remanufactured products in the secondary market is . The decentralized CLSC supplier’s expected profit function can be expressed as follows:

In the bellow formula, indicates the manufacturer’s sales revenue, indicates the manufacturer’s production cost, represents the supplier’s remanufactured product sales revenue from the secondary market, indicates the supplier’s remanufacturing cost, indicates the cost of unit unsold product, indicates the cost coefficient of the supplier’s cost reduction efforts through the remanufacturing and blockchain investment.

According to Formula (3), the supplier’s expected profit function can be simplified as:

Under decentralized decision-making, the expected profit function of the retailer is as follows:

In the upper formula, represents the retailer’s sales revenue, indicates the revenue from the retailer’s inventory product remanufacturing decision, represents a retailer’s product purchase cost.

First, we solve the profit function of the retailer from Equation (5) by using the inverse induction method. We obtain the first partial derivative of .

Then, from Equation (6), we find that when , is a concave function of . Next, we set the first derivatives of to equal zero and obtain the optimal order quantity of the retailer. Thus, Proposition 1 can be obtained.

Proposition 1.

Under the decentralized decision-making scenario, the retailer’s optimal order quantity meets the condition of

We substitute with and the optimal value of manufacturer is

We obtain the first derivatives of with respect to and , and find that

We obtain second partial derivatives with respect to and

Then, we obtained , which is equivalent to

where is a joint concave function of and . From Equations (9) and (10), we can obtain the optimal price, , and optimal recovery effort, . Thus, Proposition 2 can be obtained:

Proposition 2.

Under decentralized decision-making

The existence of the only optimal price and the optimal recovery effort maximize , which is the manufacturer’s expected profit, and the optimal satisfies

At this point, the optimal expected profits of manufacturers and retailers are

3.2. Centralized Decision-Making Scenario

In the centralized decision-making scenario, supplier and retailer are treated as one entity. The supplier and retailer no longer make individual decisions, but rather they make optimal decision to maximize their joint total profit. The profit function of the centralized SC follows from Equations (3) and (5). At this point, the expected profit function of the centralized SC can be obtained as follows

we know that the equation can be expressed by simplifying Equation (16)

We obtain the first derivatives of with respect to , and

According to Equations (17) and (18), we can obtain the optimal values of the centralized decision-making mode . At this point, the optimal expected profit of SC is

Equations (13) and (19) show that centralized decision-making optimal values are the same as the optimal values of and under the decentralized decision mode. Therefore, the CLSC can be coordinated as follows.

Proposition 3.

The optimal order quantity is not equal under centralized decision-making and decentralized decision-making. It can be observed that ; thus, SC under decentralized decision-making cannot achieve coordination.

4. Contractual Coordination via “Cost and Revenue Sharing” Mechanism

In this section, we examined a closed-loop SC unsold product remanufacturing mode under the influence of the efforts on unsold product recovery, quality improvement and blockchain-based information transparency. The following scenario is presented under the Stackelberg leader–follower power structure and it is designed to be a strategical approach via cost-sharing, as well as with revenue-sharing coordination mechanisms. The above demonstrates that the closed-loop SC unsold product remanufacturing mode under the decentralized decision-making scenario cannot be coordinated, so in order to maximize the profit of the whole closed-loop SC, this section designed the “cost and revenue sharing” contractual coordination mechanism. For the sake of making the mechanism convenient, we denote sharing coefficients as follows

- (a)

- The retailers will benefit from percentage given to manufacturers. The manufacturer receives a profit from the retailer , ;

- (b)

- The supplier shares percentage from the secondary market revenue with the retailer and the retailer obtains the supplier’s revenue as , ;

- (c)

- The retailer shares the remanufacturing costs of suppliers with percentage. The remanufacturing cost shared by the retailer is , ;

- (d)

- The retailer shares percentage of the cost of the remanufactured product quality improvement and blockchain investment. The cost of effort shared by the retailer is , .

In summary, under the coordination mechanism of “cost and revenue sharing”, the expected profits of CLSC downstream supplier and retailer are as follows

Based on the above, we can derive Proposition 4.

Proposition 4.

If the coefficient satisfies , and , the SC can be coordinated

With the coordination of the SC, the expected profits of the manufacturers and retailers are

If the coefficient satisfies the expected profit of the manufacturer and retailer will achieve a “win–win” condition

Proof.

Formula (23) substitutes (21) and (22), which can be

Therefore, the “cost and revenue sharing” mechanism can coordinate the SC. □

In addition, manufacturers and retailers are willing to participate in the mechanism under the constraint condition of and .

5. Simulation Analysis

This section investigates the study modes under simulation analysis. To verify the correctness of the above study contribution, we assigned the values without the loss of generality in Table 2, and we assume that .

Table 2.

Numerical values.

In order to illustrate the simulation within the feasibility region, we assign the values to parameters with changes to the similar research of Ghosh and Shan’s [14] and H. Song and X. Gao [16] study. Assuming that the consumers’ sensitivity to price is uniformly distributed from 0 to 1, with a density of 1, similar to the study of Chiang et al. [26]. The CLSC remanufactured product information availability we assume is in the range of [0, 1], with = 0 and a density of = 1 representing consumer satisfaction, where the range of [0, 1]. To ensure that the remanufacturer production is always positive, we assume that the secondary market consumers are more sensitive to the remanufactured product price (or just as sensitive) than the information trustworthy .

5.1. Coordination Analysis

The results show in Table 3 that the optimal expected profit of CLSC under a decentralized decision is obviously less than that under a centralized decision, that is .

Table 3.

Comparative analysis of different modes.

Under the coordination mechanism, the expected profit of the retailer increases with the increase of the coefficient . Additionally, the manufacturer’s expected profit decreases with the increase of the coefficient . When the coefficient value is general, that is , CLSC upstream and downstream achieve Pareto improvement within their own expected profits.

5.2. Sensitivity Analysis of Effort Cost Factor , and Both Sensitivities of and

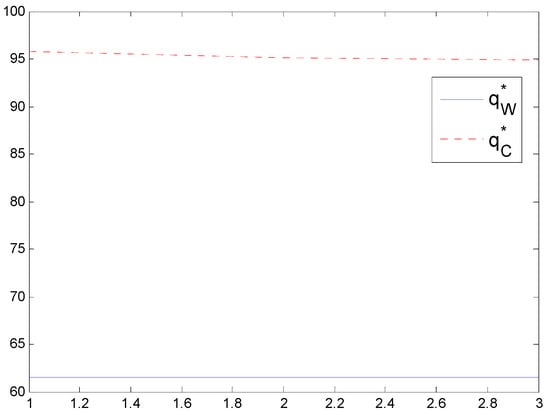

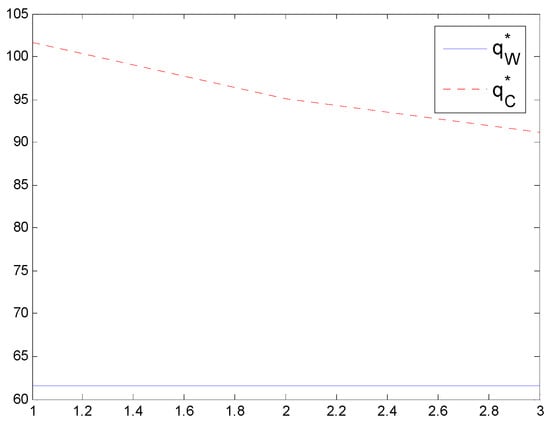

The illustrations of Figure 1 and Figure 2 show that: (1) Under decentralized decision-making, effort cost factor and both sensitivities and have no impact on retailers’ order quantity; (2) Under centralized decision-making, retailers’ order quantity increases with the price sensitivity coefficient; (3) The optimal order quantity under centralized decision is greater than that under the decentralized decision-making mode.

Figure 1.

CLSC remanufacturers’ effort cost factor impact on order quantity.

Figure 2.

Sensitivity and impact on order quantity.

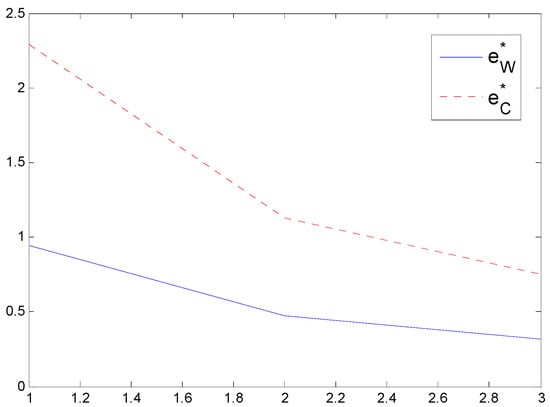

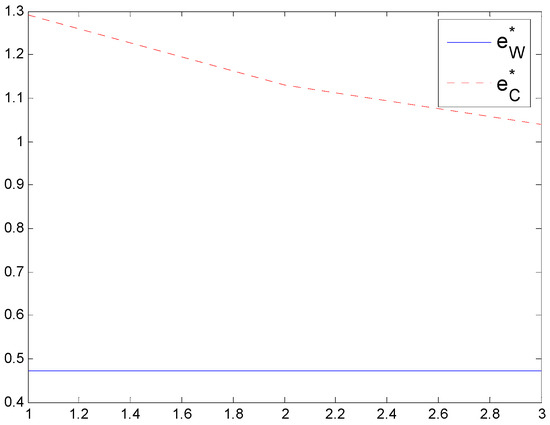

The illustration of Figure 3 and Figure 4 show that: (1) Under decentralized decision-making and centralized decision-making, the manufacturer’s efforts decrease with the increase of the effort cost factor ; (2) Under centralized decision-making, the remanufacturer’s effort decreases with the increase of and sensitivities. Under the decentralized decision-making mode, sensitivities of and have no effect on the remanufacturer’s effort; (3) The optimal recovery effort under centralized decision is greater than that under the decentralized decision mode.

Figure 3.

CLSC remanufacturers’ effort cost factor impact on effort manufacturer’s.

Figure 4.

Sensitivity and impact on remanufacturer’s effort.

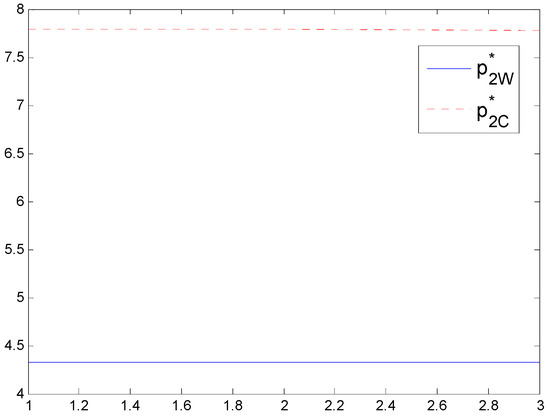

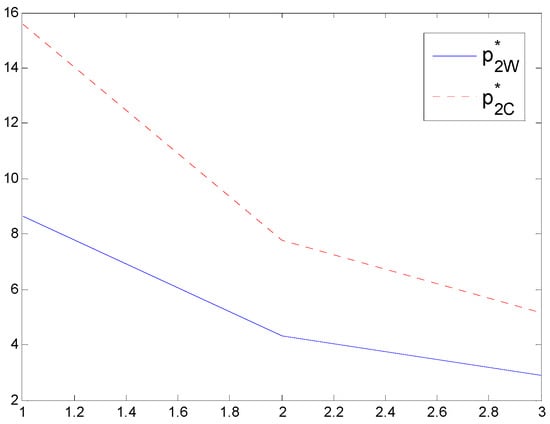

The illustrations in Figure 5 and Figure 6 show that: (1) Under decentralized decision-making and centralized decision-making modes, remanufacturers’ effort cost factor has no effect on its optimal price; (2) Under decentralized decision-making and centralized decision-making modes, the product price decreases with the increase of the sensitivities of and ; (3) The optimal price of the remanufacturers under the centralized decision is greater than the level of the decentralized decision-making mode.

Figure 5.

CLSC remanufacturers’ effort cost factor impact on secondary market price.

Figure 6.

Sensitivity and impact on secondary market price.

6. Conclusions

This study considered two-stage CLSC consisting of a Stackelberg leader remanufacturer and a Stackelberg follower retailer in the random demand marketplace. The demand uncertainty leads to the possibility of unsold product inventories in the downstream SC. This study assumed that a supplier will remanufacture the retailer’s unsold product inventory and then sell the remanufactured products to a secondary market. Before the selling season a retailer determines order quantity based on forecasting information, when the final demand is realized a downstream retailer faces the unsold product inventory. The upstream supplier will remanufacture the retailer’s unsold product inventory and then sell the remanufactured products to the secondary market. The secondary market consumers are different in their valuation of remanufactured products and in their sensitivity. Therefore, SC members influence the market demand by exerting extra effort on unsold product recovery quality with information sharing under blockchain technology, where the CLSC members make their own decisions based on their own without coordination. To ensure the efficiency of blockchain technology investment and consumer satisfaction in the secondary market place, CLSC members coordinate by sharing cost and revenue.

To address this issue, this study derives two different decision-making scenarios under the Stackelberg game theory with a CLSC unsold product. The CLSC members influence on the market demand by exerting extra effort on unsold products’ recovery quality with information sharing under blockchain technology was analyzed. Particularly, the CLSC model based on recovery quality is affected by the remanufacturer’s recycling effort and product price in the sensitive secondary market.

This study used comparative analysis of centralized decision-making and decentralized decision making and designed the mechanism of “cost and revenue sharing”, which can coordinate the CLSC model. Through full-text analysis, the following conclusions can be obtained:

1. Under the decentralized decision-making SC scenario exists the unique Nash equilibrium, where the mode coefficient satisfies

2. Centralized SC decision-making as the benchmark mode was obtained and the analysis demonstrates that the CLSC under decentralized decision-making cannot achieve the coordination;

3. The impacts of remanufacturer’s effort cost factor and both the sensitivities of and to the optimal order quantity under the centralized decision-making mode are greater than the level under the decentralized decision-making mode;

4. The “Cost and revenue sharing” contractual mechanism can effectively coordinate the CLSC so that the remanufacturers and retailers can distribute profits arbitrarily. In particular, when the profit distribution coefficient value is general, that is, , the expected profits of remanufacturers and retailers will achieve the “win–win” solution.

The mechanism of contractual coordination is proposed in order to efficiently share cost and revenue. Moreover, the “cost and revenue sharing” mechanism in a CLSC essentially builds an incentive among the chain members to improve the efficiency of unsold product remanufacturing.

Author Contributions

Conceptualization, J.S.; Software, T.K.M.; Writing—original draft, S.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Wang, Q.; He, L. Incentive Strategies for Low-Carbon Supply Chains with Asymmetric Information of Carbon Reduction Efficiency. Int. J. Environ. Res. Public Health 2018, 15, 2736. [Google Scholar] [CrossRef] [PubMed]

- Yu, J.J.; Tang, C.S.; Shen, Z.M.; Yu, J.J.; Tang, C.S.; Max, Z. Improving consumer welfare and manufacturer profit via government subsidy programs: Subsidizing consumers or manufacturers? Manuf. Serv. Oper. Manag. 2018, 20, 752–766. [Google Scholar] [CrossRef]

- Feng, D.; Ma, L.; Ding, Y.; Wu, G.; Zhang, Y. Decisions of the dual-channel supply chain under double policy considering remanufacturing. Int. J. Environ. Res. Public Health 2019, 16, 465. [Google Scholar] [CrossRef] [PubMed]

- Pourjavad, E.; Mayorga, R.V. Optimization of a sustainable closed loop supply chain network design under uncertainty using multi-objective evolutionary algorithms. Adv. Prod. Eng. Manag. 2018, 13, 216–228. [Google Scholar] [CrossRef]

- Alimoradi, A.; Yussuf, R.M.; Zulkifli, N. A hybrid model for remanufacturing facility location problem in a closed-loop supply chain. Int. J. Sustain. Eng. 2011, 4, 16–23. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, J.; Chen, J.; Cai, X. Optimal solution structure for multi-period production planning with returned products remanufacturing. Asia-Pacific J. Oper. Res. 2010, 27, 629–648. [Google Scholar] [CrossRef]

- Grubbström, R.W.; Tang, O. Optimal production opportunities in a remanufacturing system. Int. J. Prod. Res. 2006, 44, 3953–3966. [Google Scholar] [CrossRef]

- Polotski, V.; Kenné, J.; Gharbi, A. Production control of hybrid manufacturing—Remanufacturing systems under demand and return variations. Int. J. Prod. Res. 2019, 57, 100–213. [Google Scholar] [CrossRef]

- Lage, M.; Filho, M.G. Production planning and control for remanufacturing: Exploring characteristics and difficulties with case studies. Prod. Plan. Control 2016, 27, 212–225. [Google Scholar] [CrossRef]

- Wang, Q.; Wu, J.; Zhao, N.; Zhu, Q. Inventory control and supply chain management: A green growth perspective. Resour. Conserv. Recycl. 2019, 145, 78–85. [Google Scholar] [CrossRef]

- Kim, E.; Saghafian, S.; Oyen, M.P. Van Joint control of production, remanufacturing, and disposal activities in a hybrid manufacturing—Remanufacturing system. Eur. J. Oper. Res. 2013, 231, 337–348. [Google Scholar] [CrossRef]

- Karimabadi, K.; Naderi, B. Optimal pricing and remanufacturing decisions for a fuzzy dual-channel supply chain. Int. J. Syst. Sci. Oper. Logist. 2019, 7, 248–261. [Google Scholar] [CrossRef]

- Zou, Q.; Ye, G. Pricing-Decision and Coordination Contract considering Product Design and Quality of Recovery Product in a Closed-Loop Supply Chain. Math. Probl. Eng. 2015, 2015, 593123. [Google Scholar] [CrossRef]

- Ghosh, D.; Shah, J. Supply chain analysis under green sensitive consumer demand and cost sharing contract. Int. J. Prod. Econ. 2015, 164, 319–329. [Google Scholar] [CrossRef]

- Bhattacharya, S.; Guide, V.D.R., Jr.; Van Wassenhove, L.N. Optimal Order Quantities with Remanufacturing Across New Product Generations. Prod. Oper. Manag. 2006, 15, 421–431. [Google Scholar] [CrossRef]

- Rice, J.B., Jr.; Hoppe, R.M. Network master & three dimensions of supply network coordination: An introductory essay. Supply Chain. Manag. Rev. 2002. Available online: https://web.mit.edu/supplychain/repository/network_v25.pdf (accessed on 3 November 2022).

- Giannoccaro, I.; Pontrandolfo, P. Supply chain coordination by revenue sharing contracts. Int. J. Prod. Econ. 2004, 89, 131–139. [Google Scholar] [CrossRef]

- Tsay, A.A.; Lovejoy, W.S. Quantity Flexibility Contracts and Supply Chain Performance. Manuf. Oper. Manag. 1999, 1, 89–111. [Google Scholar] [CrossRef]

- Santhi, A.R.; Muthuswamy, P. Influence of Blockchain Technology in Manufacturing Supply Chain and Logistics. Logistics 2022, 6, 15. [Google Scholar] [CrossRef]

- Pournader, M.; Shi, Y.; Seuring, S.; Koh, S.C.L. Blockchain applications in supply chains, transport and logistics: A systematic review of the literature. Int. J. Prod. Res. 2020, 58, 2063–2081. [Google Scholar] [CrossRef]

- Saurabh, S.; Dey, K. Blockchain technology adoption, architecture, and sustainable agri-food supply chains. J. Clean. Prod. 2021, 284, 124731. [Google Scholar] [CrossRef]

- Köhler, S.; Pizzol, M. Technology assessment of blockchain-based technologies in the food supply chain. J. Clean. Prod. 2020, 269, 122193. [Google Scholar] [CrossRef]

- Secinaro, S.; Dal Mas, F.; Brescia, V.; Calandra, D. Blockchain in the accounting, auditing and accountability fields: A bibliometric and coding analysis. Account. Audit. Account. J. 2021, 35, 168–203. [Google Scholar] [CrossRef]

- Li, X.; Wang, D.; Li, M. Convenience analysis of sustainable E-agriculture based on blockchain technology. J. Clean. Prod. 2020, 271, 122503. [Google Scholar] [CrossRef]

- Hayrutdinov, S.; Saeed, M.S.R.; Rajapov, A. Coordination of Supply Chain under Blockchain System-Based Product Lifecycle Information Sharing Effort. J. Adv. Transp. 2020, 2020, 5635404. [Google Scholar] [CrossRef]

- Chiang, W.K.; Chhajed, D.; Hess, J.D. Direct Marketing, Indirect Profits: A Strategic Analysis of Dual-Channel Supply-Chain Design. Manag. Sci. 2003, 49, v–viii. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).