Global Analysis Regarding the Impact of Digital Transformation on Macroeconomic Outcomes

Abstract

:1. Introduction

2. Literature Review

2.1. Digital Transformation—Concept, Causes and Effects

2.2. NRI—A Tool for Measuring the Amplitude of Digital Transformations

2.3. Evidence on the Impact of Digital Transformation on Macroeconomic Performance

3. Materials and Methods

3.1. The Sample

3.2. Variables Used and Research Hypotheses

- -

- future technologies (from the technology pillar), indicating the extent to which countries are prepared for the future of the network economy; specifically, variables such as artificial intelligence (AI), the Internet of things (IoT), and spending in emerging technologies are considered.

- -

- business (from the people pillar), which indicates the extent to which businesses are leveraging ICT and are providing funding for R&D.

- -

- economy (from the impact pillar), which reflects the economic impact of participation in the network economy.

3.3. Mathematical Modelling

4. Results and Discussion

- -

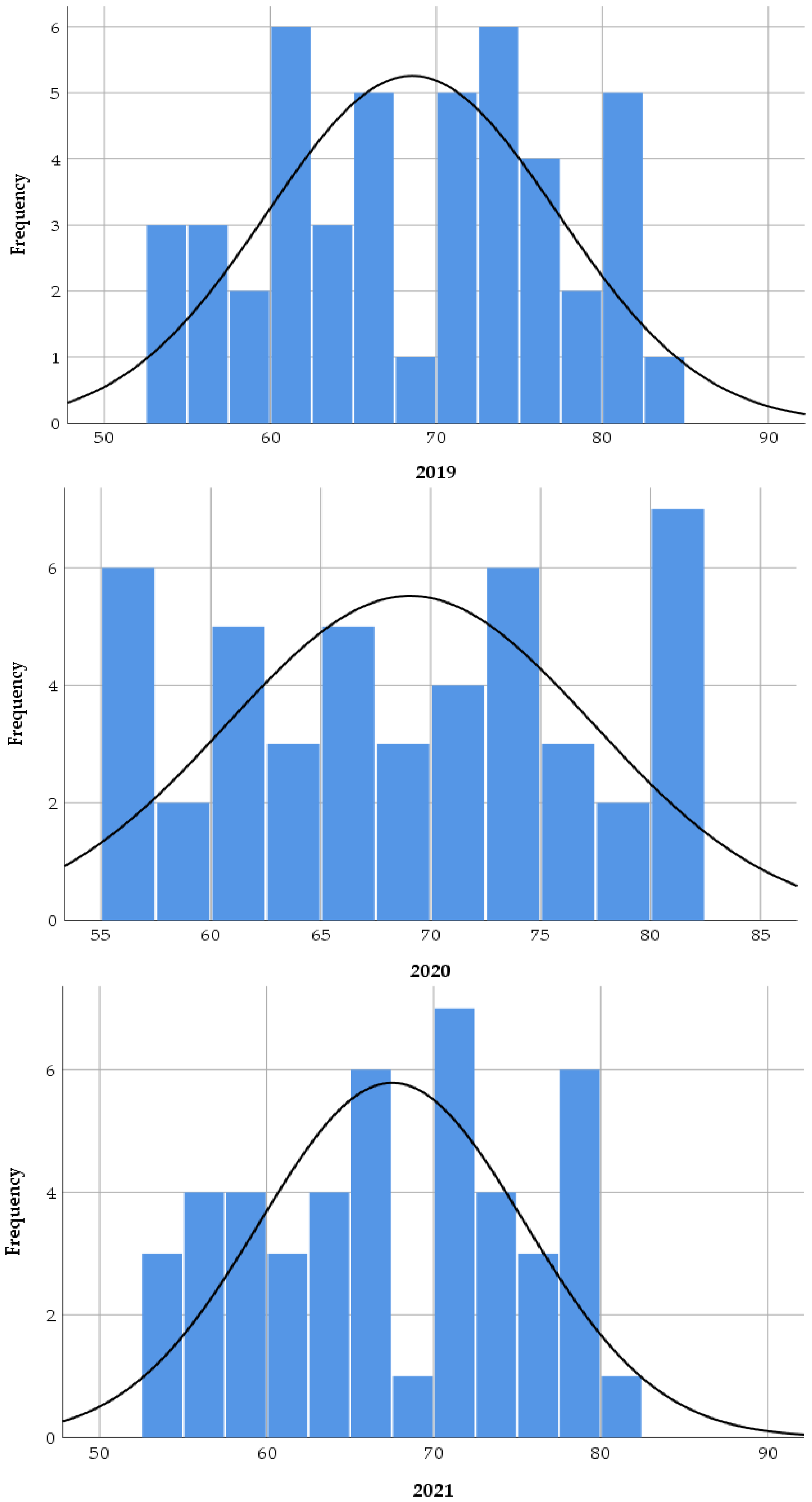

- The number of countries with an NRI below 60 decreases from 10 (in 2018) to 8 (in 2019 and 2020); then, in 2021, as an effect of global crises (we take into account the crises associated with the pandemic period), the number of countries with an NRI below 60 increases to 11. Most countries in this NRI range (50–60) belong to the groups of American (2), Arab (3), and European (6) countries.

- -

- The number of countries with an NRI between 60 and 70 increases from 14 (in 2018) to 15 (in 2019) and 16 (in 2020); in 2021, only 14 countries still fall within this NRI range (60–70).

- -

- The number of countries with an NRI between 70 and 80 increases from 14 (in 2018) to 17 (in 2019); this increase is matched by a decrease to 15 (in 2020) and a rebound in 2021, when the number of countries increases to 20. This oscillating evolution highlights that some countries have experienced difficulties in the digital transition in the context of macroeconomic imbalances. The increase in the number of countries in the 70–80 (NRI) range can be seen as evidence that the pandemic period has forced the economies of the world’s countries to pay more attention to digital transformation.

- -

- The number of countries with an NRI greater than 80 falls from 8 (in 2018) to 6 (in 2019); the two countries falling in the rankings are the United States and Norway. The year 2020 sees a slight recovery (the number of countries rises to 7, with the United States catching up, joining the countries with the highest NRI: Singapore, Sweden, Netherlands, Switzerland, Finland, and Norway); in 2021, only the United States is still in this gap (NRI > 80).

- -

- Toader et al. (2018) [18], which showed that a 1% increase in the use of ICT infrastructure can contribute to an increase in GDP per capita; this contribution varies between 0.0767% and 0.396%, depending on the type of technology examined.

- -

- Fernández-Portillo et al. (2019) [19], which showed that the sustainable economic development of nations is positively influenced by ICT (more precisely, connectivity, use of Internet and skills of human capital); their research results indicated that ICT explains 42.6% of the variance in GDP per capita.

- -

- Mayer et al. (2019) [20], which showed that investment in broadband infrastructure accelerates the transmission of information and knowledge; specifically, each 10% increase in speed produces about a 0.5% increase in GDP per capita. These authors also indicated the causes associated with an overestimation of the economic impact.

- -

- -

- Mayer et al. (2019) [20], which showed that the speed and pace of broadband network penetration influence GDP per capita differently depending on the level of development of national economies.

- -

- Chen and Ye (2021) [35], which showed that ICT effects are more consistent in developed areas (compared to less developed ones).

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Kraus, S.; Jones, P.; Kailer, N.; Weinmann, A.; Chaparro-Banegas, N.; Roig-Tierno, N. Digital Transformation: An Overview of the Current State of the Art of Research. SAGE Open 2021, 2021, 1–15. [Google Scholar] [CrossRef]

- Vial, G. Understanding digital transformation: A review and a research agenda. J. Strateg. Inf. Syst. 2019, 28, 118–144. [Google Scholar] [CrossRef]

- Zhang, Z.; Jin, J.; Li, S.; Zhang, Y. Digital transformation of incumbent firms from the perspective of portfolios of innovation. Technol. Soc. 2023, 72, 102149. [Google Scholar] [CrossRef]

- Sebastian, I.M.; Ross, J.W.; Beath, C.; Mocker, M.; Moloney, K.G.; Fonstad, N.O. How big old companies navigate digital transformation. MIS Q. Exec. 2017, 16, 197–213. [Google Scholar] [CrossRef] [Green Version]

- Skare, M.; de las Mercedes de Obesso, M.; Ribeiro-Navarrete, S. Digital transformation and European small and medium enterprises (SMEs): A comparative study using digital economy and society index data. Int. J. Inf. Manag. 2023, 68, 102594. [Google Scholar] [CrossRef]

- Hinings, B.; Gegenhuber, T.; Greenwood, R. Digital innovation and transformation: An institutional perspective. Inf. Organ. 2018, 28, 52–61. [Google Scholar] [CrossRef]

- Berman, S.J. Digital transformation: Opportunities to create new business models. Strategy Leadersh. 2012, 40, 16–24. [Google Scholar] [CrossRef]

- Liere-Netheler, K.; Packmohr, S.; Vogelsang, K. Drivers of Digital Transformation in Manufacturing; HICSS: Waikoloa Beach, HI, USA, 2018; pp. 3926–3935. Available online: http://hdl.handle.net/10125/50381 (accessed on 12 December 2022).

- Aagaard, A.; Presser, M.; Andersen, T. Applying IoT as a leverage for business model innovation and digital transformation. In Proceedings of the 3rd Global IoT Summit (GIoTS), Aarhus, Denmark, 17–21 June 2019. [Google Scholar] [CrossRef]

- Chesbrough, H. To recover faster from COVID-19, open up: Managerial implications from an open innovation perspective. Ind. Mark. Manag. 2020, 88, 410–413. [Google Scholar] [CrossRef]

- Ciriello, R.F.; Richter, A.; Schwabe, G. Digital innovation. Bus. Inf. Syst. Eng. 2018, 60, 563–569. [Google Scholar] [CrossRef]

- Sorescu, A.; Schreier, M. Innovation in the digital economy: A broader view of its scope, antecedents, and consequences. J. Acad. Mark. Sci. 2021, 49, 627–631. [Google Scholar] [CrossRef]

- Verhoef, P.C.; Broekhuizen, T.; Bart, Y.; Bhattacharya, A.; Qi Dong, J.; Fabian, N.; Haenlein, M. Digital transformation: A multidisciplinary reflection and research agenda. J. Bus. Res. 2021, 122, 889–901. [Google Scholar] [CrossRef]

- Roman, A.; Rusu, V.D. Digital technologies and the performance of small and medium enterprises. Stud. Bus. Econ. 2022, 17, 190. [Google Scholar] [CrossRef]

- Andriole, S.J. Five myths about digital transformation. MIT Sloan Manag. Rev. 2017, 58, 20–22. [Google Scholar]

- Röller, L.; Waverman, L. Telecommunications infrastructure and economic development: A simultaneous approach. Am. Econ. Rev. 2001, 91, 909–923. [Google Scholar] [CrossRef] [Green Version]

- Vu, K.M. ICT as a source of economic growth in the information Age: Empirical evidence from the 1996–2005 period. Telecommun. Policy 2011, 35, 357–372. [Google Scholar] [CrossRef]

- Toader, E.; Firtescu, B.N.; Roman, A.; Anton, S.G. Impact of Information and Communication Technology Infrastructure on Economic Growth: An Empirical Assessment for the EU Countries. Sustainability 2018, 10, 3750. [Google Scholar] [CrossRef] [Green Version]

- Fernández-Portillo, A.; Almodóvar-González, M.; Coca-Pérez, J.L.; Jiménez-Naranjo, H.V. Is Sustainable Economic Development Possible Thanks to the Deployment of ICT? Sustainability 2019, 11, 6307. [Google Scholar] [CrossRef] [Green Version]

- Mayer, W.; Madden, G.; Wu, C. Broadband and economic growth: A reassessment. Inf. Technol. Dev. 2019, 26, 128–145. [Google Scholar] [CrossRef]

- Soava, G.; Mehedintu, A.; Sterpu, M. Analysis and Forecast of the Use of E-Commerce in Enterprises of the European Union States. Sustainability 2022, 14, 8943. [Google Scholar] [CrossRef]

- Afonasova, M.A.; Panfilova, E.E.; Galichkina, M.A.; Slusarczyk, B. Digitalization in Economy and Innovation: The effect on social and economic processes. Pol. J. Manag. Stud. 2019, 19, 22–23. [Google Scholar] [CrossRef]

- Sitnicki, M.; Netreba, I. Interdependence assessing for Networked Readiness Index economic and social informative factors. Balt. J. Econ. Stud. 2020, 6, 47–53. [Google Scholar] [CrossRef]

- Agustina, N.; Pramasa, S. The Impact of Development and Government Expenditure for Information and Communication Technology on Indonesian Economic Growth. Asian J. Bus. Environ. 2019, 9, 5–13. [Google Scholar] [CrossRef]

- Georgescu, A.; Tudose, M.B.; Avasilcăi, S. DIHs and the impact of digital technology on macroeconomic outcomes. Rev. Manag. Econ. Eng. 2022, 21, 248–260. [Google Scholar]

- Borovskaya, M.A.; Masych, M.A.; Fedosova, T.V. The potential for labor productivity growth in the context of digital transformation. Terra Econ. 2020, 18, 47–66. [Google Scholar] [CrossRef]

- De la Hoz-Rosales, B.; Camacho Ballesta, J.A.; Tamayo-Torres, I.; Buelvas-Ferreira, K. Effects of Information and Communication Technology Usage by Individuals, Businesses, and Government on Human Development: An International Analysis. IEEE Access 2019, 7, 129225–129243. [Google Scholar] [CrossRef]

- Stavytskyy, A.; Kharlamova, G.; Stoica, E.A. The Analysis of the Digital Economy and Society Index in the EU. TalTech J. Eur. Stud. 2019, 9, 245–261. [Google Scholar] [CrossRef] [Green Version]

- Olczyk, M.; Kuc-Czarnecka, M. Digital transformation and economic growth—DESI improvement and implementation. Technol. Econ. Dev. Econ. 2022, 28, 775–803. [Google Scholar] [CrossRef]

- Corejova, T.; Chinoracky, R. Assessing the Potential for Digital Transformation. Sustainability 2021, 13, 11040. [Google Scholar] [CrossRef]

- Bondar, S.; Hsu, J.C.; Pfouga, A.; Stjepandić, J. Agile digital transformation of system-of-systems architecture models using Zachman framework. J. Ind. Inf. Integr. 2017, 7, 33–43. [Google Scholar] [CrossRef]

- Niu, Y.; Wen, W.; Wang, S.; Li, S. Breaking barriers to innovation: The power of digital transformation. Financ. Res. Lett. 2023, 51, 103457. [Google Scholar] [CrossRef]

- Tian, G.; Li, B.; Cheng, Y. Does digital transformation matter for corporate risk-taking. Financ. Res. Lett. 2022, 49, 103107. [Google Scholar] [CrossRef]

- Pagani, M.; Pardo, C. The impact of digital technology on relationships in a business network. Ind. Mark. Manag. 2017, 67, 185–192. [Google Scholar] [CrossRef]

- Chen, W.; Zhang, L.; Jiang, P.; Meng, F.; Sun, Q. Can digital transformation improve the information environment of the capital market? Evidence from the analysts’ prediction behaviuor. Account. Financ. 2021, 62, 2543–2578. [Google Scholar] [CrossRef]

- Wu, K.; Fu, Y.; Kong, D. Does the digital transformation of enterprises affect stock price crash risk. Financ. Res. Lett. 2022, 48, 102888. [Google Scholar] [CrossRef]

- Legner, C.; Eymann, T.; Hess, T.; Matt, C.; Böhmann, T.; Drews, P.; Mädche, A.; Urbach, N.; Ahlemann, F. Digitalization: Opportunity and challenge for the business and information systems engineering community. Bus. Inf. Syst. Eng. 2017, 59, 301–308. [Google Scholar] [CrossRef]

- Subramaniam, M.; Iyer, B.; Venkatraman, V. Competing in Digital Ecosystems. Bus. Horiz. 2019, 62, 83–94. [Google Scholar] [CrossRef]

- Okorie, O.; Russell, J.; Cherrington, R.; Fisher, O.; Charnley, F. Digital transformation and the circular economy: Creating a competitive advantage from the transition towards Net Zero Manufacturing. Resour. Conserv. Recycl. 2023, 189, 106756. [Google Scholar] [CrossRef]

- Li, L.; Su, F.; Zhang, W.; Mao, J.Y. Digital transformation by SME entrepreneurs: A capability perspective. Inf. Syst. J. 2017, 28, 1129–1157. [Google Scholar] [CrossRef]

- Bouncken, R.B.; Kraus, S.; Roig-Tierno, N. Knowledge- and innovation-based business models for future growth: Digitalized business models and portfolio considerations. Rev. Manag. Sci. 2021, 15, 1–14. [Google Scholar] [CrossRef]

- European Commission. The Digital Economy and Society Index (DESI). 2022. Available online: https://digital-strategy.ec.europa.eu/en/policies/desi (accessed on 23 December 2022).

- OECD. Toolkit for Measuring the Digital Economy G20 Report. 2018. Available online: https://www.oecd.org/g20/summits/buenos-aires/G20-Toolkit-for-measuring-digital-economy.pdf (accessed on 20 December 2022).

- USAID. Digital Ecosystem Country Assessments. Available online: https://www.usaid.gov/digital-strategy/implementation-tracks/track1-adopt-ecosystem/digital-ecosystem-country-assessments (accessed on 12 January 2023).

- Dutta, S.; Lanvin, B. The Network Readiness Index 2019: Towards a Future-Ready Society; Portulans Institute: Washington, DC, USA, 2019; Available online: https://www.insead.edu/sites/default/files/assets/dept/globalindices/docs/nri-2019.pdf (accessed on 20 November 2022).

- Dutta, S.; Lanvin, B. The Network Readiness Index 2021: Shaping the Global Recovery; Portulans Institute: Washington, DC, USA, 2021; Available online: https://networkreadinessindex.org/wp-content/uploads/reports/nri_2021.pdf (accessed on 12 November 2022).

- Stoianenko, I.; Kondratiuk, O.; Mostova, A.; Pikus, R.; Kachan, H.; Ilchenko, V. Digitization of the Economy Under the Influence of the COVID-19 Pandemic. Postmod. Open 2022, 13, 127–141. [Google Scholar] [CrossRef]

- Matthess, M.; Kunkel, S. Structural change and digitalization in developing countries: Conceptually linking the two transformations. Technol. Soc. 2020, 63, 101428. [Google Scholar] [CrossRef]

- Humenna, Y.G.; Tyutyunyk, I.V.; Tverezovska, O.I. The Effects of Digitalization on Macroeconomic Stability in the Context of the COVID-19 Pandemic: EU Practice. J. V. N. Karazin Kharkiv Natl. Univ. Ser. Int. Relat. Econ. Ctry. Stud. Tour. 2021, 13, 70–77. [Google Scholar] [CrossRef]

- Stanley, T.; Doucouliagos, C.; Steel, P. Does ICT Generate Economic Growth? A Meta-Regression Analysis. J. Econ. Surv. 2018, 32, 705–726. [Google Scholar] [CrossRef]

- Dutta, S.; Lanvin, B. The Network Readiness Index 2022. In Stepping into the New Digital Era. How and Why Digital Natives Will Change the World; Portulans Institute: Washington, DC, USA, 2022; Available online: https://networkreadinessindex.org/wp-content/uploads/reports/nri_2022.pdf (accessed on 28 October 2022).

- Dogruel, M.; Firat, S.U. Prediction of Innovation Values of Countries Using Data Mining Decision Trees and a Comparative Application with Linear Regression Model. Istanb. Bus. Res. 2021, 50, 465–493. [Google Scholar] [CrossRef]

- Dutta, S.; Lanvin, B. The Network Readiness Index 2020: Accelerating Digital Transformation in a Post-COVID Global Economy; Portulans Institute: Washington, DC, USA, 2020; Available online: https://networkreadinessindex.org/wp-content/uploads/2020/10/NRI-2020-Final-Report-October2020.pdf (accessed on 28 October 2022).

- Pal, D.; Mitra, S.K.; Chatterjee, S. Does “investment climate” affect GDP? Panel data evidence using reduced-form and stochastic frontier analysis. J. Bus. Res. 2022, 138, 301–310. [Google Scholar] [CrossRef]

- Kelsey, D.; le Roux, S. Strategic ambiguity and decision-making: An experimental study. Theory Decis. 2018, 84, 387–404. [Google Scholar] [CrossRef] [Green Version]

- Asongu, S.; Odhiambo, N. Challenges of Doing Business in Africa: A Systematic Review. J. Afr. Bus. 2019, 20, 259–268. [Google Scholar] [CrossRef] [Green Version]

- Niebel, T. ICT and economic growth—Comparing developing, emerging and developed countries. World Dev. 2018, 104, 197–211. [Google Scholar] [CrossRef] [Green Version]

- David, O.O.; Grobler, W. Information and communication technology penetration level as an impetus for economic growth and development in Africa. Econ. Res.-Ekon. Istraz. 2020, 33, 1394–1418. [Google Scholar] [CrossRef]

- Galor, O. From stagnation to growth: Unified growth theory. In Handbook of Economic Growth; Aghion, P., Durlauf, S.N., Eds.; Elsevier: Amsterdam, The Netherlands, 2005; Volume I, Part A; pp. 171–293. [Google Scholar]

- Azarnert, L.V. Redistribution, fertility and growth: The effect of the opportunities abroad. Eur. Econ. Rev. 2004, 48, 785–795. [Google Scholar] [CrossRef]

- Galor, O.; Mountford, A. Trading population for productivity: Theory and evidence. Rev. Econ. Stud. 2008, 75, 1143–1179. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Azarnert, L.V. Free education, fertility and human capital accumulation. J. Popul. Econ. 2010, 23, 449–468. [Google Scholar] [CrossRef]

- Georgescu, A.; Avasilcai, S.; Peter, M.K. Digital Innovation Hubs—The present future of collaborative research, business and marketing development opportunities. In Marketing and Smart Technologies; Rocha, Á., Reis, J., Peter, M., Bogdanović, Z., Eds.; Springer: Singapore, 2021; Volume 205, pp. 363–374. [Google Scholar] [CrossRef]

| Regions | Countries |

|---|---|

| Americas States | United States (1), Canada (11), Chile (43), Uruguay (47) |

| Arab States | United Arab Emirates (28), Saudi Arabia (35), Qatar (42), Oman (53), Bahrain (54) |

| Asia and Pacific | Singapore (2), Korea, Rep. (9), Japan (13), Australia (14), Israel (15), New Zealand (19), Hong Kong, China (30) |

| Europe | Sweden (3) Netherlands (4), Switzerland (5), Denmark (6), Finland (7), Germany (8), Norway (10), United Kingdom (12), France (16), Luxembourg (17), Austria (18), Ireland (20), Belgium (21), Estonia (22), Iceland (24), Czech Republic (25), Spain (26), Slovenia (27), Portugal (29), Malta (31), Italy (32), Lithuania (33), Poland (34), Slovakia (37), Cyprus (38), Latvia (39), Hungary (41), Croatia (45), Greece (49), Romania (52) |

| N | Minimum | Maximum | Mean | Std. Deviation | Skewness | Kurtosis | |

|---|---|---|---|---|---|---|---|

| NRI | 184 | 52.87 | 82.75 | 68.54 | 8.40 | −0.07 | −1.18 |

| FTH | 184 | 16.47 | 90.60 | 50.68 | 16.55 | 0.12 | −0.81 |

| BUS | 184 | 26.98 | 88.39 | 60.19 | 13.64 | −0.41 | −0.31 |

| ECN | 184 | 15.53 | 84.71 | 47.32 | 14.31 | 0.12 | −0.72 |

| GDP | 184 | −10.82 | 13.48 | 1.57 | 4.33 | −0.58 | 0.37 |

| GDPc | 184 | 12,398.98 | 135,682.79 | 41,215.83 | 23,247.89 | 1.18 | 1.74 |

| L-GDPc | 184 | 4.09 | 5.13 | 4.55 | 0.24 | 0.03 | −0.92 |

| EDB | 184 | 61.03 | 87.02 | 76.95 | 5.76 | −0.58 | 0.09 |

| NRI | FTH | BUS | ECN | GDP | GDPc | L-GDPc | EDB | |

|---|---|---|---|---|---|---|---|---|

| NRI | 1 | 0.844 ** | 0.834 ** | 0.752 ** | −0.038 | 0.694 ** | 0.795 ** | 0.635 ** |

| FTH | 0.844 ** | 1 | 0.690 ** | 0.741 ** | −0.107 | 0.640 ** | 0.751 ** | 0.475 ** |

| BUS | 0.834 ** | 0.690 ** | 1 | 0.695 ** | 0.082 | 0.525 ** | 0.608 ** | 0.556 ** |

| ECN | 0.752 ** | 0.741 ** | 0.695 ** | 1 | −0.127 * | 0.504 ** | 0.592 ** | 0.459 ** |

| GDP | −0.038 | −0.107 | 0.082 | −0.127 * | 1 | 0.118 | 0.086 | 0.040 |

| GDPc | 0.694 ** | 0.640 ** | 0.525 ** | 0.504 ** | 0.118 | 1 | 0.954 ** | 0.292 ** |

| L-GDPc | 0.795 ** | 0.751 ** | 0.608 ** | 0.592 ** | 0.086 | 0.954 ** | 1 | 0.405 ** |

| EDB | 0.635 ** | 0.475 ** | 0.556 ** | 0.459 ** | 0.040 | 0.292 ** | 0.405 ** | 1 |

| Equations | Multiple R | R Square | Adjusted R Square | Standard Error |

|---|---|---|---|---|

| (2) | 0.092 | 0.008 | −0.003 | 4.336 |

| (4) | 0.72 | 0.518 | 0.513 | 16,226.831 |

| (5) | 0.293 | 0.086 | 0.066 | 4.186 |

| (7) | 0.653 | 0.423 | 0.413 | 17,809.197 |

| Results | Models | ||||

|---|---|---|---|---|---|

| ANOVA | GDPit = β1 NRIit + β2 EDBit + uit (2) | ||||

| Sum of Squares | df | Mean Square | F | Mr | |

| Regression | 28.966 | 2 | 14.483 | 0.770 | 0.464 |

| Residual | 3403.351 | 181 | 18.803 | ||

| Total | 3432.317 | 183 | |||

| ANOVA | GDPcit = β1 NRIit + β2 EDBit + uit (4) | ||||

| Sum of Squares | df | Mean Square | F | Mr | |

| Regression | 5.1 × 1010 | 2 | 2.5 × 1010 | 97.311 | 0.000 |

| Residual | 4.7 × 1010 | 181 | 2.6 × 108 | ||

| Total | 9.9 × 1010 | 183 | |||

| ANOVA | GDPit = β1 FTHit + β3 BUSit + β3 ECNit + β4 EDBit + uit (5) | ||||

| Sum of Squares | df | Mean Square | F | Mr | |

| Regression | 295.331 | 4 | 73.833 | 4.213 | 0.003 |

| Residual | 3136.986 | 179 | 17.525 | ||

| Total | 3432.317 | 183 | |||

| ANOVA | L-GDPcit = β1 FTHit + β3 BUSit + β3 ECNit + β4 EDBit + uit (7) | ||||

| Sum of Squares | df | Mean Square | F | Mr | |

| Regression | 4.2 × 1010 | 4 | 1.1 × 1010 | 33.210 | 0.000 |

| Residual | 5.7 × 1010 | 179 | 3.2 × 1010 | ||

| Total | 9.9 × 1010 | 183 | |||

| Equations/ Variables | Unstandardized Coefficients | Standardized | t | Sig. | Collinearity Statistics | |||

|---|---|---|---|---|---|---|---|---|

| B | Std. Error | Coefficients—Beta | Tolerance | VIF | ||||

| (4) GDPc | (Constant) | −42,916.162 | 16,067.611 | −2.671 | 0.008 | |||

| NRI | 2357.528 | 184.862 | 0.852 | 12.753 | 0.000 | 0.596 | 1.677 | |

| EDB | −1006.584 | 269.502 | −0.250 | −3.735 | 0.000 | 0.596 | 1.677 | |

| (5) GDP | (Constant) | −1.832 | 4.337 | −0.422 | 0.673 | |||

| FTH | −0.048 | 0.030 | −0.185 | −1.611 | 0.109 | 0.387 | 2.582 | |

| BUS | 0.118 | 0.036 | 0.371 | 3.299 | 0.001 | 0.404 | 2.477 | |

| ECN | −0.081 | 0.035 | −0.269 | −2.336 | 0.021 | 0.386 | 2.591 | |

| EDB | 0.034 | 0.065 | 0.045 | 0.519 | 0.604 | 0.673 | 1.485 | |

| (7) GDPc | (Constant) | 5263.530 | 18,448.462 | 0.285 | 0.776 | |||

| FTH | 755.275 | 127.795 | 0.538 | 5.910 | 0.000 | 0.387 | 2.582 | |

| BUS | 321.132 | 151.941 | 0.188 | 2.114 | 0.036 | 0.404 | 2.477 | |

| ECN | 13.014 | 148.097 | 0.008 | 0.088 | 0.930 | 0.386 | 2.591 | |

| EDB | −289.427 | 278.339 | −0.072 | −1.040 | 0.300 | 0.673 | 1.485 | |

| Americas States | Arab States | Asia and Pacific | Europe | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Models | Models | Models | Models | |||||||||

| (4) | (5) | (7) | (4) | (5) | (7) | (4) | (5) | (7) | (4) | (5) | (7) | |

| NRI | 0.000 (+1966) | 0.004 (+3038) | 0.054 (+936) | 0.000 (+2735) | ||||||||

| EDB | 0.714 | 0.968 | 0.249 | 0.114 | 0.976 | 0.222 | 0.283 | 0.984 | 0.502 | 0.000 (−1609) | 0.942 | 0.104 |

| FTH | 0.875 | 0.001 (+893) | 0.548 | 0.363 | 0.291 | 0.724 | 0.068 | 0.002 (+687) | ||||

| BUS | 0.399 | 0.159 | 0.621 | 0.008 (−747) | 0.908 | 0.160 | 0.001 (+0.237) | 0.011 (+808) | ||||

| ECN | 0.213 | 0.289 | 0.953 | 0.000 (+1580) | 0.477 | 0.249 | 0.004 (−0.146) | 0.783 | ||||

| Sig. (1) | 0.000 | 0.541 | 0.000 | 0.014 | 0.944 | 0.001 | 0.066 | 0.876 | 0.371 | 0.000 | 0.001 | 0.000 |

| R2 | 0.954 | 0.229 | 0.961 | 0.394 | 0.046 | 0.673 | 0.195 | 0.049 | 0.163 | 0.541 | 0.114 | 0.470 |

| 2018–2019 | 2020–2021 | |||||

|---|---|---|---|---|---|---|

| Models | Models | |||||

| (4) | (5) | (7) | (4) | (5) | (7) | |

| NRI | 0.000 (+2474) | 0.000 (+2283) | ||||

| EDB | 0.000 (−1233) | 0.111 | 0.370 | 0.064 | 0.575 | 0.707 |

| FTH | 0.008 (−0.051) | 0.002 (+614) | 0.104 | 0.000 (+856) | ||

| BUS | 0.634 | 0.368 | 0.002 (+0.217) | 0.031 (+507) | ||

| ECN | 0.586 | 0.242 | 0.089 | 0.334 | ||

| Sig. (1) | 0.000 | 0.013 | 0.000 | 0.000 | 0.015 | 0.000 |

| R2 | 0.779 | 0.365 | 0.689 | 0.671 | 0.361 | 0.636 |

| Tolerance | <2.0 | <0.7 | <0.7 | <0.7 | <0.8 | <0.8 |

| VIF | <0.6 | <0.4 | <4.0 | <1.6 | <2.4 | <2.4 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tudose, M.B.; Georgescu, A.; Avasilcăi, S. Global Analysis Regarding the Impact of Digital Transformation on Macroeconomic Outcomes. Sustainability 2023, 15, 4583. https://doi.org/10.3390/su15054583

Tudose MB, Georgescu A, Avasilcăi S. Global Analysis Regarding the Impact of Digital Transformation on Macroeconomic Outcomes. Sustainability. 2023; 15(5):4583. https://doi.org/10.3390/su15054583

Chicago/Turabian StyleTudose, Mihaela Brindusa, Amalia Georgescu, and Silvia Avasilcăi. 2023. "Global Analysis Regarding the Impact of Digital Transformation on Macroeconomic Outcomes" Sustainability 15, no. 5: 4583. https://doi.org/10.3390/su15054583

APA StyleTudose, M. B., Georgescu, A., & Avasilcăi, S. (2023). Global Analysis Regarding the Impact of Digital Transformation on Macroeconomic Outcomes. Sustainability, 15(5), 4583. https://doi.org/10.3390/su15054583