1. Introduction

The creative economy sector is one of the most developing and emerging sectors in the European economy. According to UNCTAD (2022) [

1], the creative economy includes knowledge-based economic activities. Creative industries promote creative economy activities (inter alia, advertising, architecture, crafts, fashion, film, video, photography, music, publishing, software, computer games, electronic publishing, etc.) (

https://unctad.org/topic/trade-analysis/creative-economy-programme, accessed on 15 March 2023). Moreover, according to broader definitions and approaches, the creative economy includes sectors such as arts and recreation, retail sales of cultural goods, printing, manufacture, and handicrafts (e.g., manufacture of jewellery and related articles) (Ministry of Culture and Sports & Panteion University, 2017) [

2].

Boggs (2009) [

3] claims that the creative economy sector, including the sector’s jobs, is not easily measured. However, factual data illustrate that the creative economy’s added value in the GDP of developed economies has increased during the last years, while the cultural and creative industries (CCI) are gaining a dynamic impetus by fostering economic growth and creating jobs (EY Consulting, 2021) [

4]. More specifically, the CCI, in 2015, produced an added value of EUR 558 billion to the EUs GDP (4.4% of total EU GDP), while it contributed 3.8% of the total EU workforce (8.3 million full-time equivalent jobs) (van Antwerpen, Fesel and Kaltenbach 2015) [

5]. The increase in the number of creative industries and the number of persons employed in them illustrates the importance of the creative economy sector (Dronyuk, Moiseienko, Gregus, 2019) [

6].

Based on more recent data, CCI had a turnover of EUR 643 billion and a total added value of EUR 253 billion in 2019 (before COVID-19), while the core activities of the cultural and creative industries represented 4.4% of EU GDP in terms of total turnover. It is worth mentioning that since 2013, total CCI revenues have increased by EUR 93 billion and by almost 17% (EY Consulting, 2021) [

4]. Based on EY Consulting data (2021), the total turnover of the creative industries in the EU-28 was reduced to EUR 444 billion in 2020 (a net drop of EUR 199 billion from 2019). In terms of productivity, the creative sector has differentiated internal dynamics. For example, there is a differentiation between creative manufacturing (e.g., crafts) and creative services (e.g., gaming). According to Boix and Soler (2017) [

7], creative industries generated 7.8% of total production (GDP) and 7.9% of total employment, while labour productivity was 1.2% lower than the European average. However, productivity in creative manufacturing was 41% below the European average, while productivity in creative services was 9% higher than the European average.

The COVID-19 pandemic had negative consequences for the creative industries (e.g., job losses, turnover reduction, disruption of value chains) (UNESCO, 2022) [

8]. According to UNCTAD (2022) [

1] reports, during the COVID-19 pandemic, approximately 10 million jobs disappeared from the cultural and creative sectors, which contracted by USD 750 billion globally in 2020. Concretely, before COVID-19 (end of 2019), CCI employed more than 7.6 million people in the EU-28, and they have added approximately 700,000 (+10%) jobs, including authors, performers, and other creative workers, since 2013 (EY Consulting, 2021) [

4]. Next to this, the shockwaves of the COVID-19 crisis strongly affected all CCI. However, due to the current technological changes, it is anticipated that the creative industries will bounce back and retain the features to become productivity leaders, especially regarding the niches related to the technology-intensive aspects (e.g., services). The scaling up and rapid deployment of artificial intelligence (e.g., Chat GPT) is expected to rapidly change many of the processes, products, business models and activities in the CCI. However, it should be underlined that the emerging transformative artificially intelligent tools raise ethical and legal, challenges, while unearthing multifold positive and negative impacts for society and individuals (Dwivedi et al., 2023) [

9].

Additionally, sustainability is a crucial dimension for the creative industries regarding sustainable and circular activities and environmental footprint. Based on this paper’s major proposition, the creative industries are essential in accelerating sustainable consumption and production patterns and promoting regional sustainable development [

10]. Generally, as Fazlagic and Skikiewicz (2019) [

11] note, the creative economy is not a natural-resources-intensive sector, and its impact on climate change is weaker than other industries. However, beyond its economic impact, the creative economy has a growing social, political, and environmental impact in reducing carbon footprint through the circular reuse of materials (e.g., silversmithing, textiles) and by creating new jobs in the repairing and re-fabrication activities. In this vein, the link between the creative economy and sustainable development is evident. Although there are more than 300 definitions and interpretations of the concept of sustainable development (Dobson, 1996) [

12], there is a wide consensus that sustainable development addresses the needs of the society without compromising the ability of future generations to fulfil their needs (World Commission, 1987) [

13]. Thus, by promoting a non-intensive economy, the creative economy involves managing resources and the maintainability of economic development. Nevertheless, some niche parts of the CCI, such as the software developments that require large server farms, are questionable with regard to the impact of their carbon footprint; sustainability requires a new exploratory perspective.

Relatedly, the regional policies constitute a major pillar of the development and cohesion policies of the last decades in European Union. During the last few years, particularly, regional policies re-emerged as a key mechanism to promote regional development and economic growth and enhance aspects related to innovation-based economic growth, technology-enabled industrial transition, and knowledge-based economy. This paper attempts to stress the role of regional policies in enhancing the link between the creative economy and regional sustainable development. The major hypothesis of this paper is that the implementation of the entrepreneurial discovery process (EDP) constitutes a suitable and robust regional mechanism to develop well-grounded regional policy strategies and outcomes with the active participation of stakeholders. This is accomplished by presenting empirical lessons from the on-going implementation of the entrepreneurial discovery process (EDP) at the regional level, using the region of Attica, Greece, as a case study.

Our argumentation is structured as follows. It is widely accepted that “smart specialisation” constitutes a place-based approach designed with the aim to identify strategic thematic areas at a regional level, based on analysing the strengths and potential of a regional economy (Gianelle, Kyriakou, Cohen, and Przeor, 2016) [

14]. Smart specialization, as a place-based innovation-driven approach, was brought forth by Dominic Foray and the Knowledge for Growth Expert Group (K4G). A major aspect related to the work of the K4G is the active engagement of stakeholders (e.g., companies) in the process of priority setting and implementation of strategies (Foray, 2009) [

15]. Similarly, the entrepreneurial discovery process (EDP) refers to the wide stakeholder involvement in the development of a regional innovation strategy following the principles of the smart specialisation approach. In congruence with the latter, many complementary approaches have been developed during the last years regarding the major components of the enterprise development system engaging entrepreneurs, service providers, and the community, while involving aspects of full-scale strategic implementation (Lichtenstein and Lyons, 2001) [

16]. In the second section, we present the connection between the creative economy and sustainable development, as developed in the recent literature, by paying particular attention to some representative studies. In the third section, we discuss how the smart specialisation policy prioritises, through the EDP’s approach, the interconnection between the creative economy and sustainable regional growth in congruence with the regional policy model in the region of Attica. In the following section, we present the methodology followed in the region of Attica. Last but not least, in the final section, we propose some policy lessons and conclusions from the EDP to promote the linkage between creative entrepreneurship and sustainable development.

The methodology of this paper includes an action research approach (due to the opportunity to follow closely, and through active participation in, the EDP processes in the Attica region) combined with an exhaustive literature review on aspects related to the creative economy and its importance to sustainable regional growth. Furthermore, to understand the smart specialisation strategies and their potential outcomes, this paper demonstrates the major methodology followed in the regional case of Attica, as a revisited version of EDP principles and processes. Next to this, this paper illustrates the major policy lessons and conclusions obtained by presenting and analysing the aggregated outcomes derived through the EDP processes.

Overall, this paper’s contribution to the literature is twofold. Firstly, the major contribution of the present analysis is empirical. The exploration of the entrepreneurial discovery processes on the ground, through examining a specific regional case, offers the opportunity to understand and evaluate the design of a regional innovation strategy in the making. This empirical dimension is interlinked with the second aspect of this paper’s contribution: theoretical and policy lessons. The lessons derived from the data collected are inextricably associated with the significance of institutional preconditions (e.g., such as inclusive and participatory processes, structured life-cycle approach) in the smart specialisation strategies formulation.

2. Literature Review: Creative Economy and Sustainable Regional Growth

The interconnection between the creative economy and sustainable economic development constitutes an emerging topic for regional policy design and implementation. Several recent studies (see, inter alia, Falzagic and Skikiewicz 2019 and Nalkamura 2018) [

11,

17] analyse creative industries as essential drivers of sustainable development. The majority of the relevant studies focused on some particular country/region or city. For instance, according to Gruia et al. (2019) [

18], creativity is a critical prerequisite in promoting urban (sustainable) economic growth. The close conjunction between creative-cultural industries, sustainability and the growth of cities is developed in Florea (2015) [

19]. Florea shows how innovation and creativity can lead to the sustainable development of Romanian cities. In addition, the close connection between sustainability and the activity of creative industries is presented by Kirchberg and Kegan (2013) [

20], who stress the role of artists in promoting the transformation of Hamburg into a creative, sustainable city. Similarly, Rodrigues and Franco (2019) [

21] show that creative industries promote urban, economic, and social sustainability in Portuguese towns. Streimikiene and Kacerausakas (2020) [

22], in their study of the Baltic States, show that Estonia is the best-performing country in the creative economy and sustainable development.

In a similar way, Kozina, Istenic, and Komac (2019) [

23] present Ljubljana as an example of a green creative city which promotes green qualities and is branded with its culture and creativity. Ursic (2016) [

24] describes the distribution of creative industries in Ljubljana and addresses their relationship with sustainability. Ursic and Tamano (2019) [

25] discuss the importance of green amenities for small creative actors in Tokyo. Similarly, Thorsby (2015) [

26] points out that creativity, cultural sustainability, and environmental sustainability are moving in the same direction, while proposing the “creative economy” as part of the development strategies for Pacific Island economies.

The use of the circular economy model for CCI mainly refers to activities that promote the reusing of materials for other purposes such as crafts (e.g., textile, crafts), repairing used products, developing circular business models between different sub-sectors within CCI (e.g., reused materials and micro-fabrication, agro-food waste and textiles) and formulating circular ecosystems that could eliminate waste and reduce the “carbon footprint” through the reusing, remaking and re-fabricating used products. In that respect, creative industries might play a crucial role in the shift towards an environmentally oriented circular economy model for regions and cities, as proposed by the European Union.

As Kozina, Istenic, and Komac (2019) [

23] conclude, green creative environments can contribute to sustainable urban and regional development. Evidently, the 20th century promoted rapid urbanisation and industrialisation and the deterioration of the urban environment (Brilhante and Klaas, 2018) [

27]. The environmental crisis paved the way for the “green turn” in the first decades of the 21st century. This turn shifted consumer and productive patterns into more usable, repairable, recyclable, and sustainable goods and services, crucial in promoting urban and regional development.

Moreover, creative industries, among other things, mobilise cooperative entrepreneurship ventures and knowledge transfer activities through the emergence and growth of clusters and knowledge networks in several sectors (e.g., crafts, silversmithing, textiles, gaming, and media). Relatedly, the creative economy could provide a new prospect for developing countries to achieve Sustainable Development Goals (SDGs). According to UNCTAD (2022) [

1], the creative economy contributes to the SDGs in multiple ways (

Table 1), such as no poverty (Goal 1), gender equality (Goal 5), decent work and economic growth (Goal 8), industry, innovation and infrastructure (Goal 9), reduced inequalities (Goal 10), sustainable cities (Goal 11), sustainable consumption and production patterns (Goal 12), peaceful and inclusive societies (Goal 16) and the means of implementation and global partnerships (Goal 17).

Due to their accelerating growth, creative industries are critical in promoting sustainable development. Creative industries employ more young people (15–29 years old) than traditional sectors while favouring women and vulnerable people. This contribution illustrates the importance of creative industries in succeeding in the social side of SDGs. In addition, micro, small and medium-sized enterprises (MSMEs) promote creative production and have a considerable role in achieving SDGs (UNDESA 2020; Galazova 2016) [

28,

29]. Moreover, creative industries are critical in developing sustainable consumption and production patterns by investing in a circular economy and reusing, recycling, returning, and repairing intermediate materials.

Many scholars stress the need to design regional and even local policies to upgrade the role of creativity in the sustainable development of regions. This twin—creative and green—turn, as Streimikiene and Kacerausakas (2020) [

22] name it, is inseparable from the aim of sustainable development of cities and regions. Fazlagic and Skikiewicz (2019) [

11] conclude that the local government’s role in supporting creative industries’ growth is crucial in promoting sustainable development. In this vein, Kozina, Istenic, and Komac (2019) [

23] observe that providing theoretical and empirical contributions is necessary to stress the dialectical interrelations between creative industries, sustainable development, and urban/regional development. This paper attempts to provide an empirical link between the creative economy and sustainable regional growth through the analysis of a specific regional policy approach based on a smart specialisation strategy. What is shown here is that the regional policy may contribute to both enhancing the supply side (e.g., commercialisation of research results, new green technology circular infrastructures, green business models) but also increasing the demand for more sustainable products and services by promoting the twin creative and green turn of Attica through the implementation of the EDP. The EDP is crucial in making the creative economy sector a potential driver of transformative sustainability (Harper, 2021) [

30].

3. A Smart Specialisation Strategy in the Making

The major point of this section is that the evidence derived from the EDP in the region of Attica validates the entrepreneurial discovery process as an inclusive process of stakeholders’ involvement centred on “entrepreneurial discovery”, which is an interactive process in which the private sector produces information about new production and innovation activities. Generally, the smart specialisation approach (S3) is a place-based approach characterised by identifying strategic areas based on the analysis of the strengths and potential of the economy. The smart specialisation approach focuses on the policy process of prioritising thematic areas where a broad range of activities is concentrated (Foray, David, and Hall, 2009) [

31]. In a nutshell, the major principles identified based on the seminal work of Foray, David, and Hall (2009) involve the following:

- ▪

Specific priorities to generate a certain density of actors and projects dedicated to the same priority through joint innovation initiatives.

- ▪

Focus on structures (e.g., regional core industries) and the holistic transformation of these structures.

- ▪

Formulate an entrepreneurial discovery approach, meaning the targeted transformation will be discovered as the process unfolds.

As Foray et al. (2009) [

31] claim, smart specialisation strategies constitute a conceptual framework for large-scale innovation policy experiments (S3s) that took place within the framework of the European regional cohesion programs and have been characterised by emerging institutional forms (Foray, 2018a) [

32]. S3 strategies focus on mobilising the economic potential of each region of the EU by enhancing place-based and bottom-up approaches to regional growth. However, in several cases, regional strategies are loosely connected with regional conditions and mostly follow broader regional practices (Di Cataldo, Monastiriotis, and Rodríguez-Pose, 2022) [

33].

In that prism, smart specialisation strategies have played a central role in industrial modernisation in European regions (Foray, 2018b) [

34]. Based on the smart specialisation strategies, the policy process and the governance mechanisms could follow three major steps, which include (Foray, 2019a) [

35] (i) identifying priority areas in specific thematic domains; (ii) translating the priority areas into transformational roadmaps; (iii) implementing the defined activities through the deployment of an action plan. More recent approaches are also focused on shifting from a moderate innovation policy to a more radical one with the major aim of promoting radical transformations of existing structures, such as accelerating innovation to address societal challenges or upgrading traditional sectors (Foray, 2019b) [

36]. According to Benner (2019) [

37], the entrepreneurial discovery process could be defined as a systematic effort of public–private dialogue (based on quantitative and qualitative evidence), including the pooling of knowledge either multilaterally or bilaterally, while focusing on prioritisation and action planning to codify an emerging regional consensus on cross-sectoral economic development.

Overall, smart specialisation strategies embrace a place-based approach and a broad view of innovation, including technology-driven and institutional transformative approaches. Especially in the creative industries, it is evident that there is an intrinsic feature which is that there are “anchor customers”, such as publishers, streamers, and platform companies. In that respect, “knowledge clusters” constitute a standard trend within the creative economy due to the asset-light character of many activities (e.g., software, media) but also due to the intrinsic characteristics and the tacit knowledge for several sub-sectors (e.g., crafts and jewellery, textiles design and manufacturing).

As a result, it seems that the creative economy in the region is already formulated around formal or informal networks and production interlinkages, which bring together different aspects and parts of larger “value chains” or knowledge clusters at the regional level (e.g., Corallia/gi-cluster: gaming and creative technologies/applications (

https://corallia.org/, accessed on 2 March 2023) in Athens, jewellery crafts networks at the city centre of Athens). Based on the discussions conducted within the focus groups described in the following sections, the “knowledge clusters” constitute a major pillar for the entire growth of the region’s creative economy and an integral part of the regional policy design and implementation.

In that prism, the role of clusters remains essential for the regional policy design in the current programming period 2021–2027. It is widely acknowledged that the significance of “knowledge proximity” has been emphasized by several seminal approaches regarding the importance of place and the role of proximity advantages, interaction, increasing returns to scale, local labour pools (Krugman, 1995) [

38], location, and geographic concentrations of interconnected companies and institutions (clusters) (Porter, 1998) [

39]. In that respect, aspects such as the role of innovation networks and the importance of cross-fertilisation between sectors and SMEs are highly considered as a theoretical dimension, accompanied by the role of anchor firms and anchor institutions in regional economic development (Buchmann and Pyka, 2012; 2015) [

40,

41]. Relatedly, several theoretical contributions have emphasised the role of increasing returns and economic gravity in the cluster and regional development (Krugman, 1991; 1992) [

42,

43].

The specialisation strategies are mainly oriented on competitive strengths and growth potentials supported by a critical mass of activity and entrepreneurial resources. At the same time, a sound monitoring and evaluation system accompanies the implementation of strategies. The major priorities for the launch of a smart specialisation strategy necessitate a combination of research and innovation policy (Angeli, 2014) [

44]. They are usually based on two fundamental processes: (i) an EDP which utilises entrepreneurial knowledge existing in a region or country and taking an entrepreneurial approach in the sense of focusing on market opportunities involving all types of innovation actors; and (ii) a detailed and holistic analysis of the regional situation in terms of research, innovation, industrial structures, human capital demand, and innovation ecosystems. More recently, innovation policy and S3 are increasingly aligned with EU green and digital transitions to contribute to systemic transformation (Laranja, Perianez-Forte, and Reimeris, 2022) [

45], as well as to strengthen the sustainability dimension of smart specialisation strategies (Miedzinski, Coenen, Larsen, Matusiak, and Sarcina, 2022) [

46]. The following section will illustrate the recent implementation of the regional policy model in the region of Attica, emphasising the major sector of the creative economy.

The Regional Policy Model in the Region of Attica

The region of Attica (with Athens as its capital) is Greece’s largest region, home to over a third of the population and representing over 40% of its GDP. Attica is also Greece’s most important R&D region, representing over 60% of gross domestic expenditure on research and development (GERD) (EKT, 2022) [

47]. It is a metropolitan area with a dynamic service and tourism sector, and one of Greece’s major export gateways with significant growth potential. Moreover, the creative economy constitutes a significant part of the regional economy, covering sectors and topics across the economy, such as textile, crafts, jewellery, digital-enabled applications (e.g., artificial intelligence and culture), media, high-technology, and gaming. This is the major reason for selecting the creative economy as one of the three central pillars of the regional strategy, along with the sustainable economy and blue economy. Based on the EU S3 data (

https://s3platform.jrc.ec.europa.eu/, accessed on 9 March 2023) [

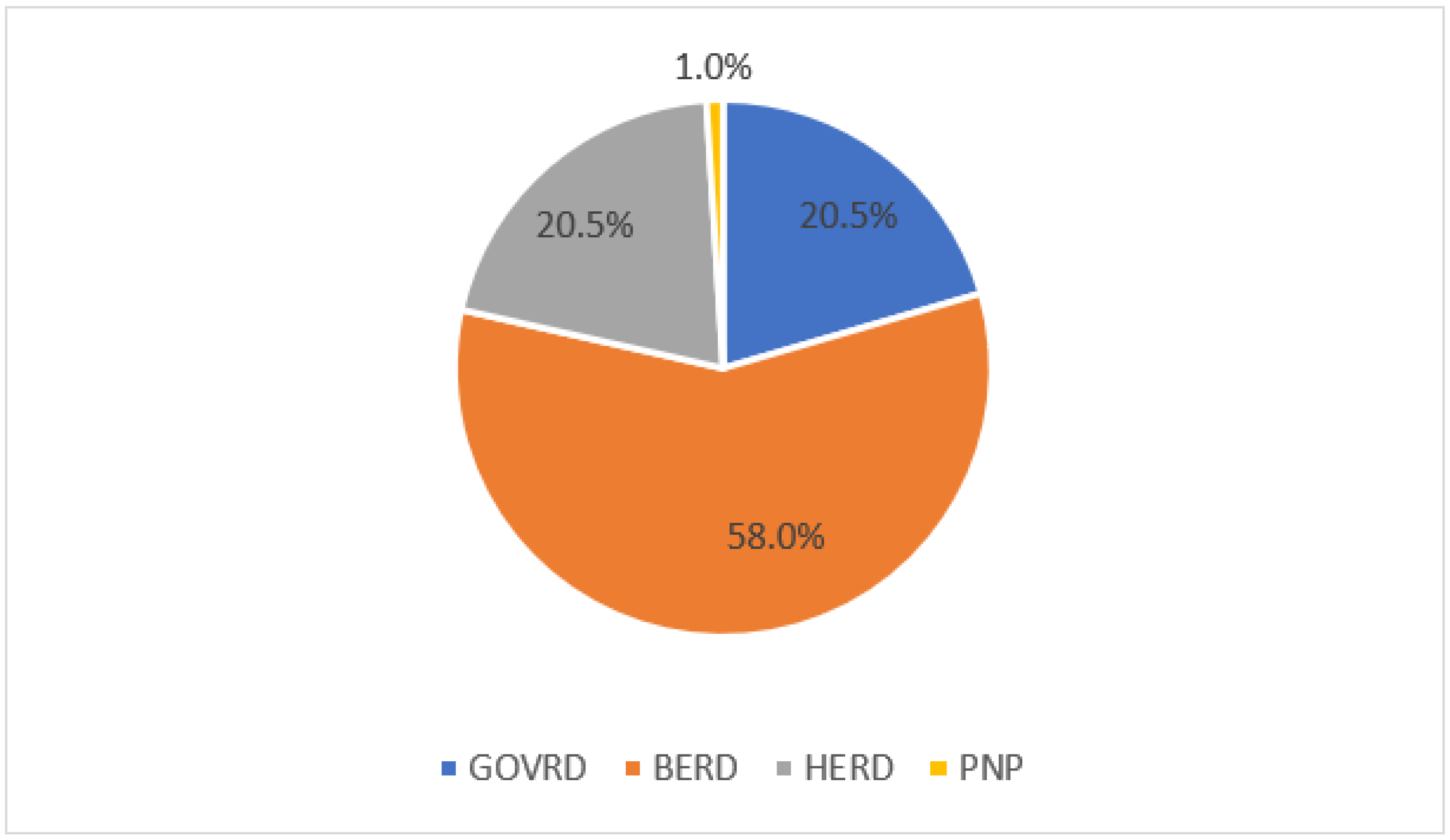

48], the Attica region has a total annual R&D (GERD) of 1.43 billion and 829 million in terms of Business R&D (BERD) (0.95% of GDP) (

Figure 1). In contrast, the average annual ESIF R&D approaches 2.91 million, and the cumulative ESIF R&D is 20.36 million.

More analytically, according to the National Documentation Centre (EKT, 2022), most of the R&D expenditure is located in the Attica region (61.1%). It is followed by the region of Kentriki Makedonia, which corresponds to 12.1% of the national expenditure, the Region of Kriti with 6.0%, and the Region of Dytiki Ellada with 4.8% (

Figure 2). In that respect, the average annual European Structural and Investment Funds R&D (for the period 2014–2020 in the region) is 2.91 million euros and the cumulative ESIF R&D is 20.26 million euros (

Figure 3).

Regarding SMEs, valid methods to monitor technological activity have been developed by the Institute of Commerce and Services (INEMY-ESEE) and the Small Enterprises Institute (IME GSEVEE) in Greece. Particularly, technological adoption remains at a low level for traditional sectors (e.g., crafts, jewellery, commerce, micro-manufacturing). Regarding digital technologies in particular, recent data (2023) reveals that micro-companies are still adopting new technologies at a slower pace, with more companies investing in digital marketing and social media (more than 60%) while investments in advanced technologies remain at a much lower level (less than 20% on average) (IME GSEVEE, 2023) [

49] (see also INEMY ESEE, 2023) [

50].

The creative economy sector in Greece faced various problems during the Greek economic crisis. According to the latest data provided by the report of the Hellenic Ministry of Culture and Sports [

2], the CCI sector has 46.370 enterprises which employ 110.668 employees (2.4 employees per enterprise). The CCI sector provides EUR 2.1 bn. added value to the Greek economy by contributing 1.4% to the GDP [*]. However, the development of the CCI sector in Greece is unequally developed and is characterised by extreme regional disparities. According to the Hellenic Ministry of Culture and Sports report, the region of Attica produces 75.5% of the gross value added to the CCI sector in Greece. Six out of ten (57.3%) CCI enterprises operate in the region of Attica, which employs 60.8% of employees. The Greek financial crisis inflicted severe impacts on the CCI sector. More specifically, according to Demertzi (2021) [

51], during the period 2011–2017, the CCI in the municipality of Athens, which is the capital of Attica, was hit by the crisis: −42% decrease in the number of creative enterprises, −27% in turnover and −29% in the number of employees. However, the historical centre of Athens, which is the hub of the CCI, showed higher resilience: −27% in the number of creative enterprises, −10% in turnover and −18% in the number of employees. This fact implies the sector’s increased resilience strengthened during the COVID-19 crisis. The data above illustrate the prospects of the CCI sector in the region of Attica. The explanation for the resiliency of the Attica region and central Athens is mostly attributed to the tourism inflows and related (as the largest region in the country) income, and the agglomeration of extended creative clusters (e.g., new media, crafts) interlinked with large-scale and dynamic sectors (e.g., tourism) and the local demand. Similarly, the productivity in the region is being positively affected by the emergence of software and new media clusters in several locations around the city of Athens and the wider metropolitan area.

The design of the regional strategy followed a structured approach for the past and the current programming period (2014–2020 and 2021–2027) in three major areas (region of Attica, 2015) [

52]. The creative economy was one of those three sectors, including traditional sub-sectors such as crafts and textiles, to high-technology sub-sectors such as gaming, media, and AI-enabled applications. The major priority areas for the smart specialisation strategy in the Attica region, regarding the current programming period, include three categories (

Figure 4):

- ▪

Creative economy: furniture, textile, crafts, jewellery and silversmiths, digital applications and gaming, educational applications, media, cinema, tourism, and cultural activities.

- ▪

Blue economy: environmental technologies, aqua-biotechnologies, nutrition, smart transport, green shipping/shipbuilding, new materials, green tourism.

- ▪

Sustainable economy: smart city, smart building, smart health, pharmaceuticals, smart grids, energy efficiency, agro-food, materials and constructions, and environmental technologies.

The dialectical relation between the smart specialisation strategy and the entrepreneurial discovery process (EDP) may be turned into a foundation stone for promoting sustainable development. The following table shows the interlinkage between Attica smart specialisation interventions and UN Sustainable Development Goals (

Table 2).

Overall, it should be mentioned that in the following pages, high-level development is tested, implicitly, through the theoretical exploitation of the regional innovation ecosystems approach, as related, among others, to local and endogenous knowledge, proximity, thematic clusters, and interactive learning. The concept of regional innovation systems is based on a vast academic literature (Doloreux, 2002; Asheim and Isaksen, 2002; Asheim and Coenen, 2005) [

53,

54,

55], while it has gained increasing attention recently (Rong, 2021; Cao et al., 2023) [

56,

57].

4. Research Methodology

In the present section, the methodology followed by the Region of Attica to successfully implement the EDP at the regional level will be described. The methodological approach followed the EU frameworks as described in the relevant key documents and manual analysed by the European Commission and the Joint Research Centre smart specialisation studies. The implementation of the process led to specific outcomes, a summary of which are presented in the following

Section 5.

Smart specialisation strategies constitute a continuous activity which involves specific requirements for public authorities related to institutional arrangements and governance, such as capacity building. As described above, the entrepreneurial discovery process (EDP) methodology was based on the structured and inclusive process of stakeholders’ involvement based on “entrepreneurial discovery”. The latter is usually an interactive process between the private sector and the research and technological regional endowments. As Gianelle et al. (2016) [

14] claim, the EDP is based on the capability to engage stakeholders throughout the different stages of the policy-making process. Moreover, Foray has described the entrepreneurial discovery logic as a targeted transformation that will not follow a path decided from the top but will be discovered as the process unfolds (Foray, 2019a) [

35]. Based on relevant evidence, the entrepreneurial discovery process’s efficient functioning requires governments to act as platforms to enable, sustain, and guide stakeholders’ participation in the policy-making process. It is worth mentioning that the entrepreneurial discovery process has evolved into a continuous activity based on identifying regional priorities during the definition of the smart specialisation strategies and involving stakeholders throughout the strategy’s implementation (Hegyi, Guzzo, Perianez-Forte and Gianelle, 2021) [

58]. As Perianez-Forte and Wilson (2021) [

59] describe, fully understanding the continuous nature of the entrepreneurial discovery process requires examining how stakeholders are engaged during the identification, definition, and re-definition of investment priorities. Following these guidelines, the policy proposal for a regulation of the European structural funds for the programming period 2021–2027 defines stakeholder collaboration (entrepreneurial discovery process) as one of the key elements for smart specialisation strategies and a fundamental element of the European Regional Development Fund (ERDF) enabling condition “Good governance of national or regional smart specialisation strategy” (Perianez-Forte and Wilson, 2021) [

59].

In the context of the region of Attica, the EDP followed the guided principles of the EU frameworks in congruence with the guidelines of the national Smart Specialisation Strategy and the relevant authorities’ key insights and support (e.g., General Secretariat for Research and Innovation; National Smart Specialisation Strategy Unit at Ministry of Development and Investments). The case study for implementing EDP in the region of Attica is based on primary methods and results collected during the recent entrepreneurial discovery process completion in the region. The whole process of the regional EDP was conducted from September 2022 to March 2023. The next stage includes the processing of the initial proposals and the consultation phase within the next period.

The design of the regional discovery method followed the basic principles of EDP along the policy cycle. More specifically, the method included setting up a new process summarised under the conceptual model: discovery, design and deployment (3Ds) (

Figure 5).

Following the European Commission’s guiding principles and the European Commission’s Joint Research Centre Smart Specialisation reports on the entrepreneurial discovery process (Marinelli and Perianez-Forte, 2017; Perianez-Forte and Wilson, 2021) [

59,

60], it is evident that the selection of the mechanisms to ensure stakeholders’ active involvement include the following:

- ▪

Agenda-setting phase: evidence-based practices as valuable data to inform discussions on priorities;

- ▪

Policy formulation and decision-making phases: inclusive mechanisms to ensure a bottom-up approach and broad participation of stakeholders;

- ▪

Implementation phase: stakeholders’ involvement in managing project calls to ensure the realisation of priorities;

- ▪

Monitoring and evaluation phases: interactive and inclusive mechanisms for continuously reflecting on market opportunities and re-assessing the previously identified investment priorities (Perianez-Forte, Marinelli and Foray, 2016) [

61].

Firstly, the discovery and design phases included four major steps. The first step includes the creation of three multilateral expert groups based on the “multiple helix” approach (Peris-Ortiz et al. 2016) [

62], with the participation of regional government, the public sector, companies, business associations and clusters. One expert group was launched for each thematic priority area (creative economy, sustainable economy, blue economy). It is noted that the co-author Antonios Angelakis has been involved in the process of regional EDP as an active participant in helping guide it and as coordinator for the expert group of the creative economy (as a member also of the Regional Research and Innovation Council of the Region of Attica). More analytically, it should be noted that the expert groups included experts from different parts of the innovation ecosystem, such as several experts from Ministries of the central Government (2 to 3 experts approximately) as well as start-ups and spin-offs (3 to 4), regional-based universities (3 to 4 experts), SMEs and larger firms (4 to 5 experts), several business associations and clusters (3 to 4 experts). At this point, it should be mentioned that the term “multiple helix” is used—based on the term “triple helix” (Etzkowitz and Leydesdorff, 1995) [

63] and the quadruple and quintuple innovation helix framework (Carayannis et al., 2012) [

64]—under the prism of engaging and mobilising a wide range of actors from several different sectors, thematic areas and cross-sectoral mechanisms (e.g., incubators, innovation hubs, funding mechanisms). The term “multiple” aims to involve all the different institutional and tacit aspects and dynamics within a regional innovation ecosystem, including local institutional mechanisms, key informants and experts, international and inter-regional networks, clusters and innovation hubs, new funding mechanisms, tacit knowledge, local synergies, or “untraded interdependencies” (Storper, 1995) [

65].

The process of EDP in the region of Attica was coordinated by Innovation Attica (Ιnnovation Center of the Region of Attica), as the major mechanism implementing and coordinating the entrepreneurial discovery process in the region. Moreover, the Research and Innovation Council of Attica retains a high-level role for designing, monitoring, and evaluating the process. For the purposes of the EDP, a steering committee was established with the participation of the region of Attica, Innovation Attica, and the Research and Innovation Council of Attica, in order to co-design concrete steps and to implement EDP in the region. The design of the process deployed was in congruence with the guidelines of the relevant national authorities and the EU frameworks.

Additionally, the expert group constitutes an effective mechanism to collect information and implement a mapping exercise focused on specific needs and trends related to technology, production, and business needs. Each expert group is coordinated by a specialised coordinator responsible for the collection of proposals, the drafting of proposals in a common framework, and the support for special issues related to the content of proposals. The expert group for the creative economy involved approximately 18 to 20 members specialised in the field across a broad spectrum of sub-topics and from all over the innovation ecosystem (e.g., universities, research centres, established business firms, start-ups and spin-offs, business associations). The “Innovation Attica” (

http://www.innovationattica.gr/index.php/en, accessed on 1 March 2023) (Ιnnovation Center of the Region of Attica) was the major mechanism supporting the whole process of the “entrepreneurial discovery” in the region.

The second step involves the design of specific milestones for the functioning of the expert groups. Notably, the expert group on each of these thematic priority areas (e.g., creative economy) constitutes an open knowledge community working on the identification of needs in each sector represented and attempting to formulate a shared vision and components (priority sub-topics) for the broader thematic priority area. Much of the evidence collected for the expert group and the EDP has been processed and paved through the group members’ data. Each expert group completed four extended focus groups to break down specific needs, exchange ideas and to co-formulate common priorities for each thematic priority area. Two focus groups were conducted, mainly oriented towards the discovery process (discovery phase). In addition, two more focus groups were run to design new priority areas and sub-topics (design phase).

The focus groups’ questions included aspects related to five major dimensions: (i) describe the major needs in terms of infrastructures, funding, skills and networking; (ii) illustrate the major priorities for your sector and/or organisation; (iii) define the major challenges for your sector and/or organisation; (iv) define major policy priorities for the Attica region in the next years; (v) describe the major opportunities policy proposals for the upgrading and transformation of your sector/organisation in the coming years; (vi) define the more suitable policy schemes and policy tools to advance your sectoral and thematic advantages and positioning (research, innovation or entrepreneurial-oriented).

The third step includes the formulation of an evidence-based strategic framework for each thematic priority area. In specific, the creative economy area had several sub-priorities regarding design-driven sectors (e.g., furniture, jewellery, textile), cultural activities and initiatives, AI-enabled applications in several sectors such as media and gaming, along with specific policy tools of intervention (e.g., digital hubs, blended finance tools, collaborative networks).

Finally, the fourth step of the discovery and design phases is combining the input from the three thematic priority areas and developing a common ground for regional policy. More analytically, a detailed discussion was conducted at this step according to the policy tools available and the suitability of the regional policy instruments available to the thematic/sectoral needs and priorities.

During the discovery and design phases, expert groups’ coordinators were responsible for reaching out to stakeholder groups or experts in specialised fields with the aim to collect new ideas and proposals or to identify crucial business needs, regional research capabilities as well as new regional advantages and niche markets. The final stage of the design phase includes the implementation of a wide-scale consultation process at a regional level. The next phase included the deployment stage, where the proposals are translated into concrete action programmes. In that prism, the sub-priorities and the recommendations are combined with the policy tools available through the regional agenda.

5. Results

This section illustrates the preliminary and provisional results derived from the EDP through the methodology applied and the implementation of focus groups aligned with the work conducted by the expert groups’ members. The results are provisional (under consideration and processing from the members of the expert groups and the region of Attica), based on the implemented focus groups. This section aims to connect the feedback from the focus groups to the hypothesis being tested and illustrate more evidence-based findings. Based on the observed data, it is evident that smart specialisation in the region of Attica constituted a place-based approach designed to address challenges related to identifying strategic thematic areas. In that prism, the entrepreneurial discovery process (EDP) motivated a wide stakeholder involvement to develop a regional innovation strategy following the principles of the smart specialisation approach.

In tandem, the regional EDP revealed regional priorities on the interface between the creative economy and sustainable regional growth. The specific interconnection is part of the initial design phase (two out of the three thematic areas are: creative economy and sustainable economy), but it is also illustrated within the policy results and proposals. It should be mentioned that the limitation of this section is that much of the evidence collected is provisional and under consideration and evaluation for the current period, since the EDP is still an ongoing process (May 2023). Moreover, many of the findings cannot be published in detail, since the EDP contains information and proposals submitted under non-disclosure status. However, some key, aggregated, and provisional evidence-based findings and are illustrated in

Table 3. Nevertheless, the policy priorities and policy tools remain under further consideration and policy discussion as to their final policy form, orientation, focus, and prioritisation.

The proposals formulated are based on a combinatorial approach to collect information from local stakeholders based on their needs and priorities. For example, regarding SMEs, access to the market (customers) or access to finance (e.g., risk capital) remain major barriers to exploring new business opportunities. Thus, the policy priorities collected are inextricably interlinked with these bottlenecks.

In a nutshell, the major findings derived from the outcomes of the EDP in the region are mostly associated with aspects related to (i) the need for access to finance and risk capital (early stage and growth capital), (ii) the business access to the university research results available at a regional level, (iii) the need for large-scale upskilling initiatives for human capital into the region, and (iv) the construction of well-established multilevel innovation-enhancing institutional infrastructures for the development, testing and deployment of new innovative elements and approaches (e.g., innovation hubs).