Green Finance Advancement and Its Impact on Urban Haze Pollution in China: Evidence from 283 Cities

Abstract

1. Introduction

- (1)

- This study clarifies the environmental effects of green finance on urban haze problems. With the continuous deepening and enrichment of research on green finance, there is currently no research indicating the direct effect of green finance on urban haze pollution. This article delves into the research on whether green finance can suppress urban haze pollution, enriching the current research status of green finance and providing a new path for improving urban haze pollution.

- (2)

- This study enriches the empirical analysis of green finance and urban haze issues. There is no clear and unified standard for the construction of indicators for green finance in existing research. Based on attempts to construct indicators for the green finance system, this article establishes static and dynamic spatial Durbin models to dynamically analyse the impact of green finance on urban haze pollution from the perspective of spatial spillovers. In addition, this article also explores the differences in the impact of green finance on urban haze pollution from the perspective of regional location and resource endowment level. This not only provides a new path for the joint governance of haze pollution between cities but also provides more accurate guidance for the government to formulate policies.

2. Theoretical Analysis and Hypotheses

2.1. The Direct Influence of Green Finance on the Haze Pollution Mechanism

2.2. The Spatial Impact of Green Finance on Haze Pollution: Understanding the Mechanism

2.3. The Diverse Effects of Environmentally Friendly Financing on Air Pollution

3. Methodology

3.1. Elliptical Shape Representing the Standard Deviation

3.2. Benchmark Model

3.3. Spatial Econometric Model

3.4. Spatial Autocorrelation

3.5. Spatial Weight Matrix

3.6. Variable Selection

3.6.1. Dependent Variables

3.6.2. Factors That Are Not Influenced by Other Variables

3.6.3. Control Variables

3.7. Data Sources and Descriptive Statistics

4. Results and Discussion

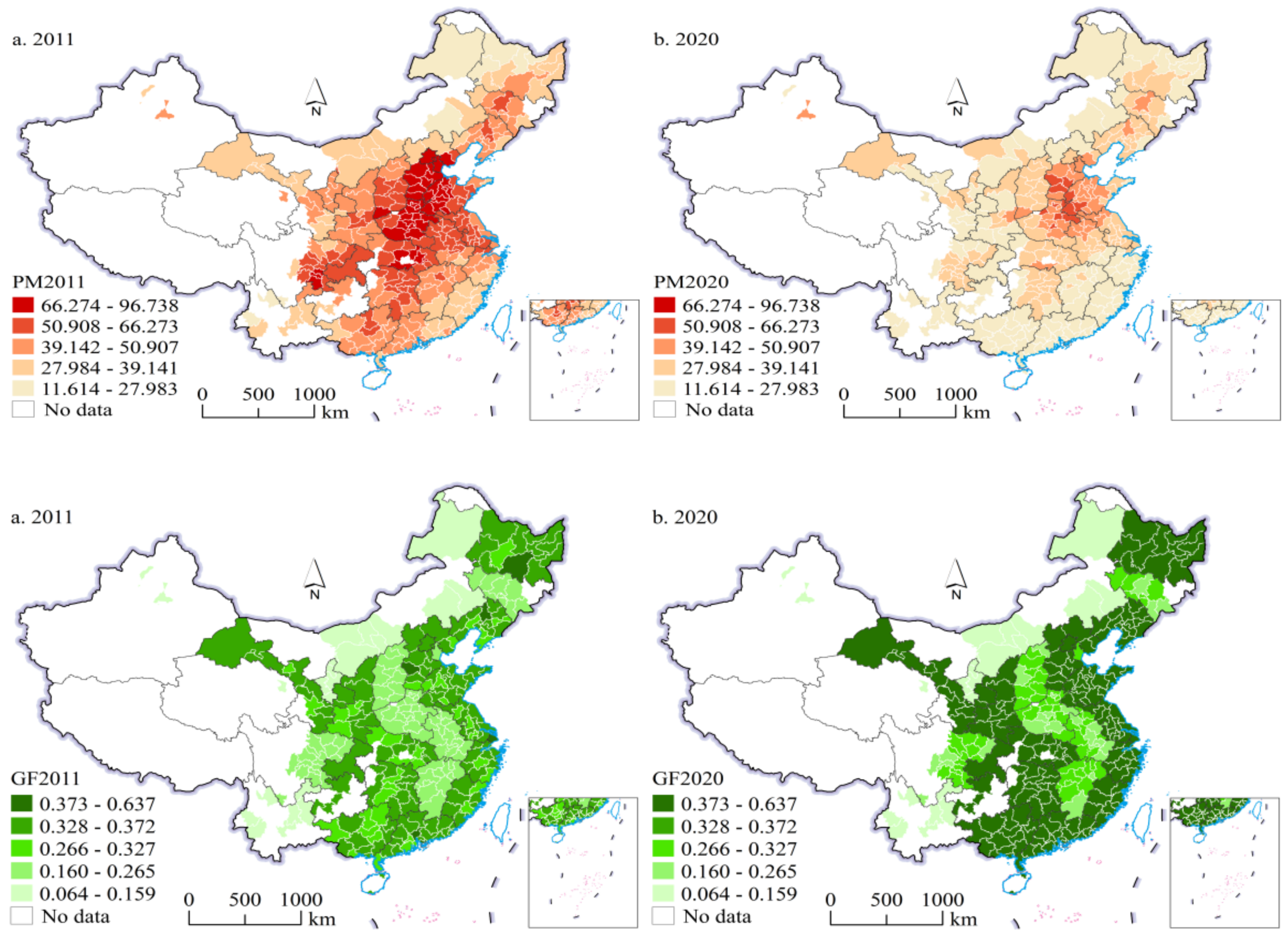

4.1. The Development of Urban Haze Pollution and Green Finance over Time and Space

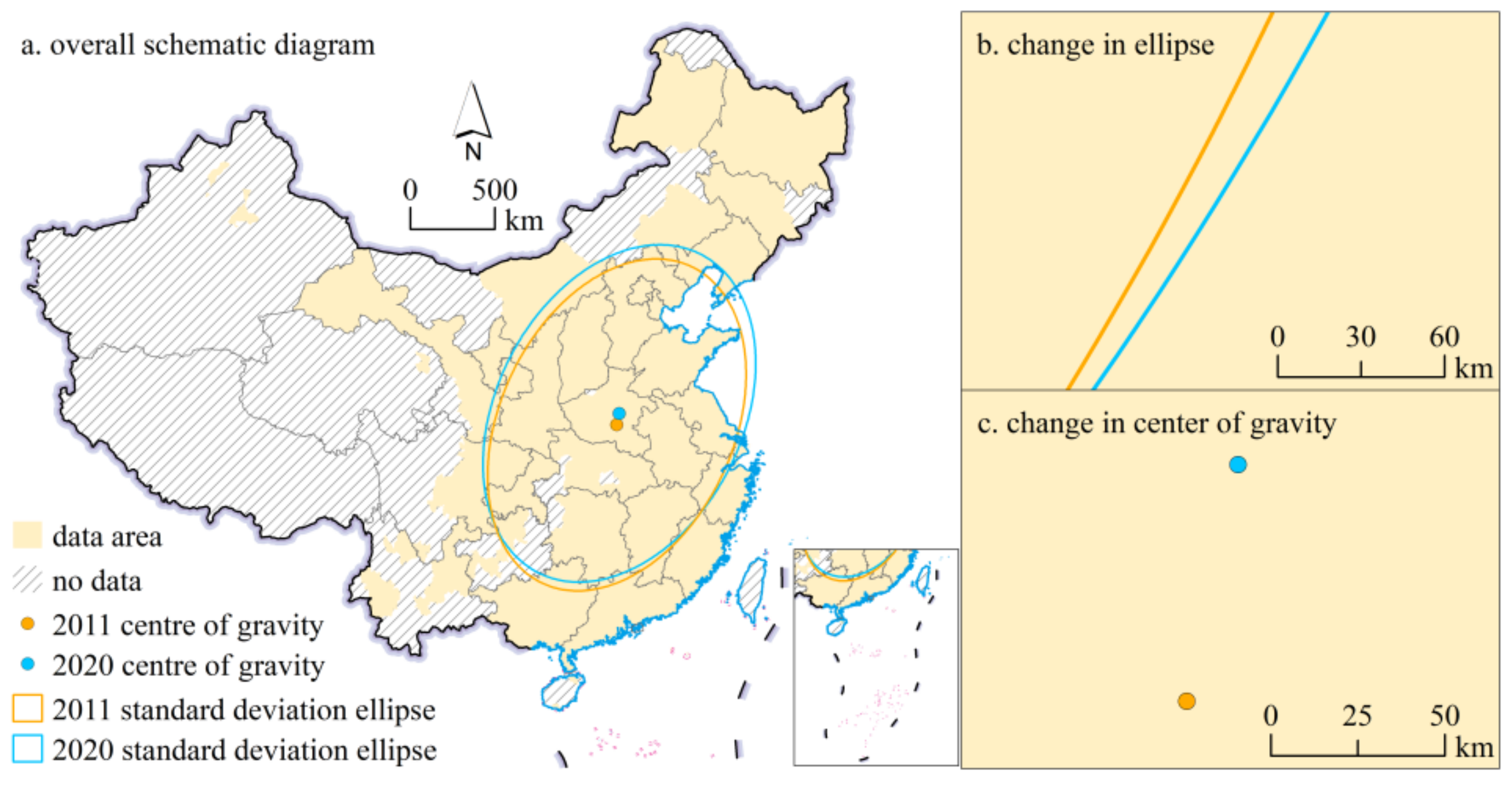

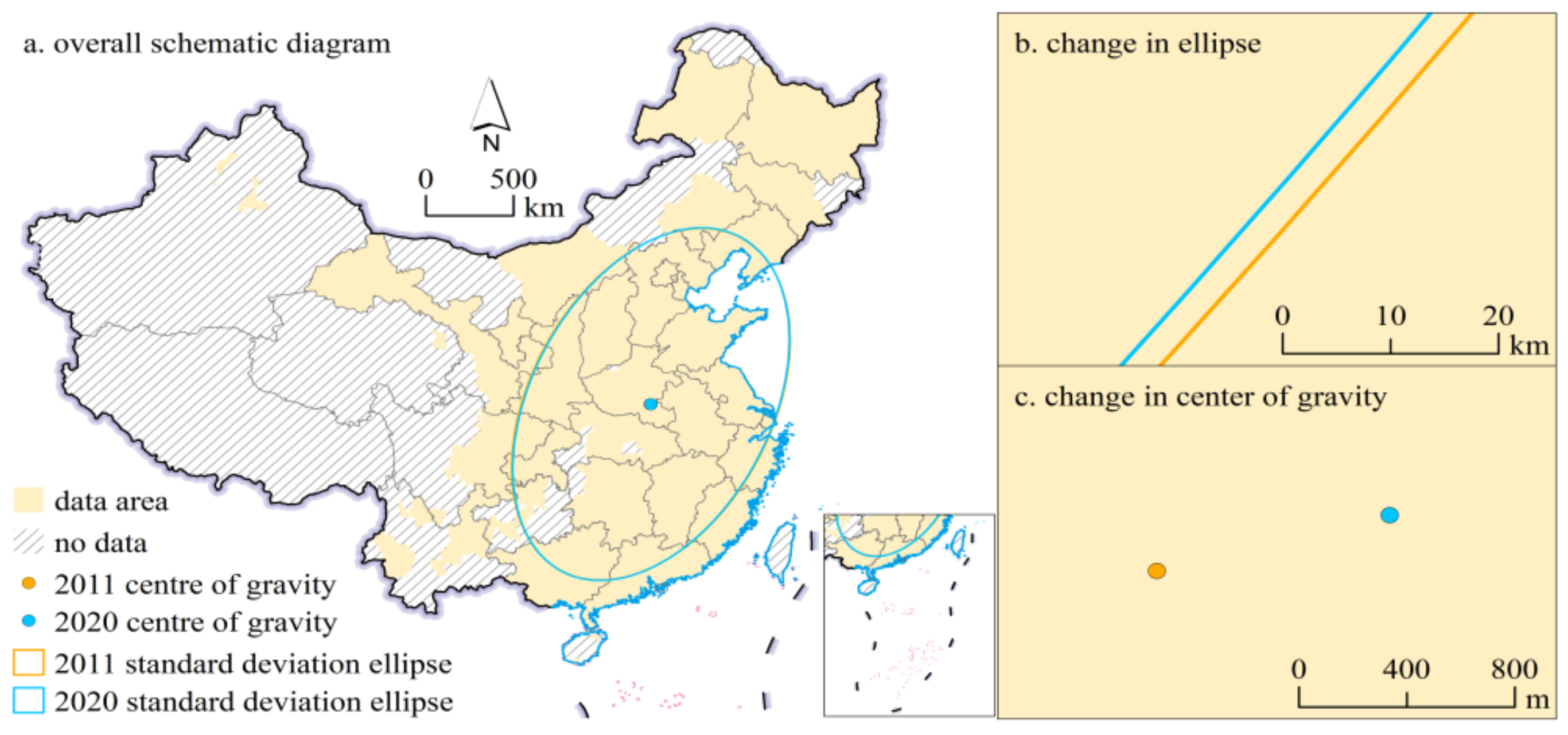

4.2. Migration of the Centre of Gravity and Discrete Trends in Urban Haze Pollution and Green Finance

4.3. Baseline Effect Analysis

4.4. Spatial Effect Analysis

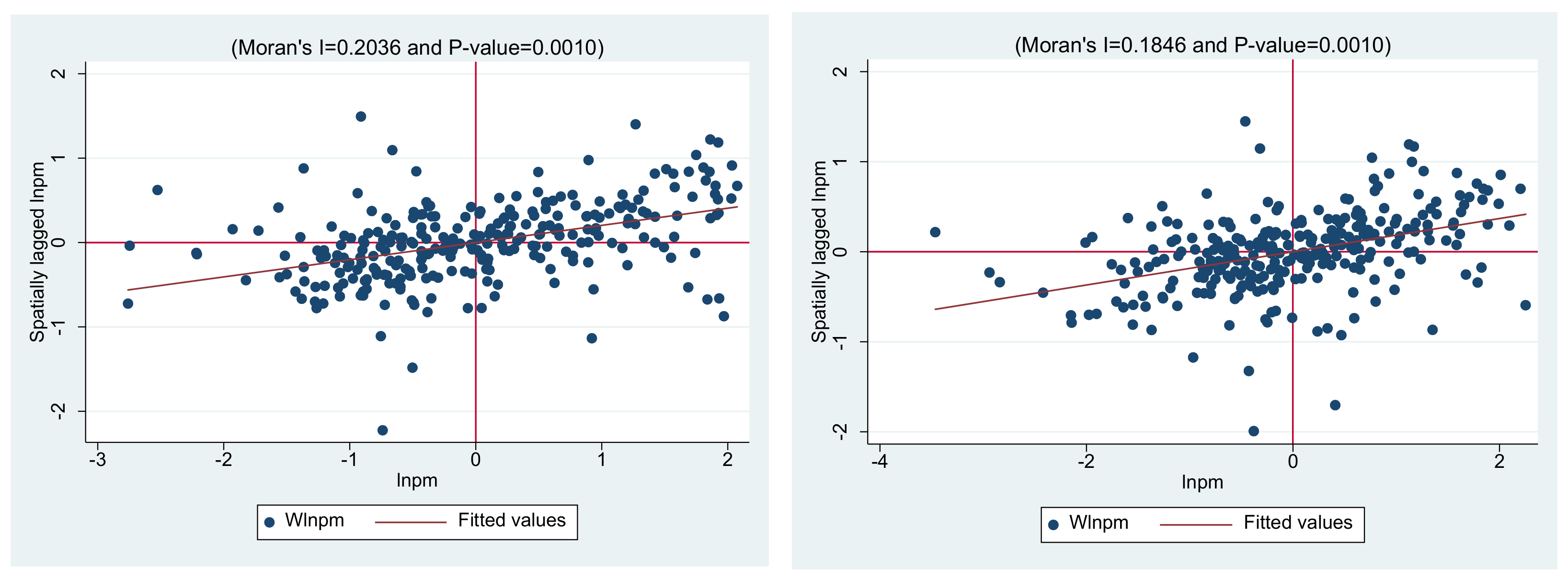

4.4.1. Spatial Autocorrelation Test

4.4.2. Analysis of the Empirical Results of the Spatial Durbin Model

4.5. Robustness and Endogeneity Tests

- (1)

- Replacing the dependent variable: In the benchmark regression, the dependent variable, urban haze pollution, was replaced with urban sulphur dioxide (SO2) emissions or nitrogen dioxide (NO2) emissions for the robustness test. As shown in columns 1 and 2 of Table 9, the robustness test outcomes align with the previous benchmark regression, affirming the reliability of the benchmark regression findings.

- (2)

- Replacing the test method: The test method replacement results in a time-dependent superposition phenomenon of urban haze pollution, where the pollution in the previous period impacts the pollution in the subsequent period. Hence, in this paper, the benchmark model was examined using the OLS and the system generalized method of moments (GMM) estimation. As shown in column 3 and 4 of Table 9, the findings indicate that green finance exerts a substantial adverse influence on urban haze pollution, thereby confirming the resilience of the benchmark regression outcomes.

- (3)

- Replacing the spatial weight matrix: By substituting the spatial weight matrix with the spatial adjacency matrix and inverse distance matrix in the spatial model, it is found that green finance has a negative spatial impact. As shown in columns 5 and 6 of Table 9, the robustness test confirms the consistency of the spatial model regression results from the previous section, validating their reliability.

- (4)

- In general, the lagged one-period explanatory variable is related to the current period explanatory variable, but the unobservable variable is not related to the current perturbation term, therefore, the lagged one-period explanatory variable has the conditions to become a tool variable. In order to avoid the possible endogenous problems, this study selected the green finance lag data to test the spatial Dubin model, and then took the lag variable as the instrumental variable, a two-stage least squares (2SLS) was used for the test and the results are shown in column 7 of Table 9. The results show that the coefficient sign is negative and consistent with the previous study, indicating that green finance can indeed suppress urban smog pollution.

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| SO2 | NO2 | OLS | Systematic GMM | Spatial Adjacency Matrix | Inverse Geography Matrix | 2SLS | |

| GF | −0.417 *** (0.0397) | −0.104 ** (0.0275) | −1.712 *** (0.2697) | −1.034 *** (0.2147) | −0.176 ** (0.0187) | −0.367 *** (0.0631) | −0.104 ** (0.0275) |

| R2 | 0.874 | 0.241 | 0.812 | 0.786 | 0.329 | 0.704 | 0.241 |

| Control variable | YES | YES | YES | YES | YES | YES | YES |

| Individual fixation | YES | YES | YES | YES | YES | YES | YES |

| Time fixation | YES | YES | YES | YES | YES | YES | YES |

| LM | 154.318 *** | ||||||

| Wald F | 481.023 ** | ||||||

| Observations | 2830 | 2830 | 2830 | 2830 | 2830 | 2830 | 2830 |

5. Heterogeneity Analysis

5.1. Analysis of Variations in Different Regions

5.2. Analysis of Resource Endowment Heterogeneity

6. Conclusions and Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Correction Statement

References

- Lv, B.; Zhang, B.; Bai, Y. A systematic analysis of PM 2.5 in Beijing and its sources from 2000 to 2012. J. Atmos. Environ. 2016, 124, 98–108. [Google Scholar] [CrossRef]

- Zhang, J.; Li, J.; Su, Y.; Chen, C.; Chen, L.; Huang, X.; Wang, F.; Huang, Y.; Wang, G. Interannual evolution of the chemical composition, sources and processes of PM2.5 in Chengdu, China: Insights from observations in four winters. J. Environ. Sci. 2024, 138, 32–45. [Google Scholar] [CrossRef] [PubMed]

- Zhang, L.; Hu, X.; Chen, S.; Chen, Y.; Lian, H.-Z. Characterization and source apportionment of oxidative potential of ambient PM2.5 in Nanjing, a megacity of Eastern China. J. Environ. Pollut. Bioavailab. 2023, 35, 2175728. [Google Scholar] [CrossRef]

- Jensen, J.; Mohlin, K.; Pittel, K.; Sterner, T. An introduction to the green paradox: The unintended consequences of climate policies. J. Rev. Environ. Econ. Policy 2015, 9, 246–265. [Google Scholar] [CrossRef]

- He, L.; Yuan, E.; Yang, K.; Tao, D. Does technology innovation reduce haze pollution? An empirical study based on urban innovation index in China. J. Environ. Sci. Pollut. Res. Int. 2021, 29, 24063–24076. [Google Scholar] [CrossRef] [PubMed]

- Li, J.; Li, F.; Li, J. Does new-type urbanization help reduce haze pollution damage? Evidence from China’s county-level panel data. J. Environ. Sci. Pollut. Res. Int. 2022, 29, 47123–47136. [Google Scholar] [CrossRef]

- Fan, F.; Cao, D.; Ma, N. Is Improvement of Innovation Efficiency Conducive to Haze Governance? Empirical Evidence from 283 Chinese Cities. Int. J. Environ. Res. Public Health 2020, 17, 6095. [Google Scholar] [CrossRef] [PubMed]

- Yanbo, L.; Mingshun, G. The impact of FDI on haze pollution: “Pollution paradise” or “pollution halo?”-Spatial analysis of PM2.5 concentration raster data in 283 cities. Front. Environ. Sci. 2023, 11, 33178. [Google Scholar] [CrossRef]

- Wang, C.; Qiao, G.; Ahmad, M.; Ahmed, Z. The Role of the Government in Green Finance, Foreign Direct Investment, Technological Innovation, and Industrial Structure Upgrading: Evidence from China. Sustainability 2023, 15, 14069. [Google Scholar] [CrossRef]

- Fang, Y.; Shao, Z. How does green finance affect cleaner industrial production and end-of-pipe treatment performance? Evidence from China. Environ. Sci. Pollut. Res. 2023, 30, 33485–33503. [Google Scholar] [CrossRef]

- Xiang, W.; Qi, Q.; Gan, L. Non-linear effects of green finance on air quality in China: New evidence from a panel threshold model. Front. Ecol. Evol. 2023, 11, 1162137. [Google Scholar] [CrossRef]

- Liu, X. Effects of urban density and city size on haze pollution in China: Spatial regression analysis based on 253 prefecture-level Cities PM2.5 data. Discret. Dyn. Nat. Soc. 2019, 17, 6754704. [Google Scholar] [CrossRef]

- Yang, J.; Song, D.; Fang, D.L.; Wu, F. Drivers of consumption-based PM2.5 emission of Beijing: A structural decomposition analysis. J. Clean. Prod. 2019, 219, 734–742. [Google Scholar] [CrossRef]

- Shi, K.; Wu, Y.Z.; Li, L.Y. Quantifying and evaluating the effect of urban expansion on the fine particulate matter (PM2.5) emissions from fossil fuel combustion in China. Ecol. Indic. 2021, 125, 107541. [Google Scholar] [CrossRef]

- Wang, R.; Feng, Y.J.; Tong, X.H.; Zhao, J.; Zhai, S. Impacts of spatial scale on the delineation of spatiotemporal urban expansion. Ecol. Indic. 2021, 129, 107896. [Google Scholar] [CrossRef]

- Luo, Y.S.; Salman, M.; Lu, Z. Heterogeneous impacts of environmental regulations and foreign direct investment on green innovation across different regions in China. Sci. Total Environ. 2021, 759, 143744. [Google Scholar] [CrossRef] [PubMed]

- Peng, X. Strategic interaction of environmental regulation and green productivity growth in China: Green innovation or pollution refuge? Sci. Total Environ. 2020, 732, 139200. [Google Scholar] [CrossRef] [PubMed]

- Lin, Y.M.; Li, M.L.; Lin, R.F. Can urban rail transit reduce haze pollution? A spatial difference-in-differences approach. Environ. Sci. Pollut. Res. 2022, 29, 81430–81440. [Google Scholar] [CrossRef]

- Chen, J.; Wu, Y.; Wan, Y.; Cai, Z. The impact of green credit on economicd evelopment quality: The mediating effect of enterprise innovation. Environ. Sci. Pollut. Res. 2023, 31, 5928–5943. [Google Scholar] [CrossRef]

- Ma, X.; Xue, Y. How does carbon emission trading scheme affect enterprise green technology innovation: Evidence from China’s A-share non-financial listed companies. Environ. Sci. Pollut. Res. 2023, 30, 35588–35601. [Google Scholar] [CrossRef]

- Kaššaj, M.; Peráček, T. Synergies and Potential of Industry 4.0 and Automated Vehicles in Smart City Infrastructure. Appl. Sci. 2024, 14, 3575. [Google Scholar] [CrossRef]

- Zhang, H.; Wang, Y.; Li, R.; Si, H.; Liu, W. Can green finance promote urban green development? Evidence from green finance reform and innovation pilot zone in China. Environ. Sci. Pollut. Res. 2022, 30, 12041–12058. [Google Scholar] [CrossRef] [PubMed]

- Chen, X.; Chen, Z. Can Green Finance Development Reduce Carbon Emissions? Empirical Evidence from 30 Chinese Provinces. Sustainability 2021, 13, 12137. [Google Scholar] [CrossRef]

- Zhang, L.; Mei, Z. Green finance and industrial pollution: Empirical research based on spatial perspective. Front. Environ. Sci. 2022, 10, 1003327. [Google Scholar] [CrossRef]

- Zhang, F.; Wang, F.; Yao, S.J. High-speed rail accessibility and haze pollution in China: A spatial econometrics perspective. Transp. Res. Part D Transp. Environ. 2021, 94, 102802. [Google Scholar] [CrossRef]

- Zhou, W.; Wu, X.; Zhou, D. Does green finance reduce environmental pollution?—A study based on China’s provincial panel data. Environ. Sci. Pollut. Res. 2023, 30, 123862–123881. [Google Scholar] [CrossRef]

- Wu, G. Research on the spatial impact and coupling coordination of green finance on the ecological development of China’s economy. Econ. Change Restruct. 2023, 56, 3353–3381. [Google Scholar] [CrossRef]

- Wei, J.; Ye, Y.; Yu, H. Manufacturing agglomeration, urban form, and haze pollution. Environ. Sci. Pollut. Res. 2022, 30, 18921–18936. [Google Scholar] [CrossRef] [PubMed]

- Tang, D.; Zhong, H.; Zhang, J.; Dai, Y.; Boamah, V. The Effect of Green Finance on the Ecological and Environmental Quality of the Yangtze River Economic Belt. Int. J. Environ. Res. Public Health 2022, 19, 12492. [Google Scholar] [CrossRef]

- He, L.Y.; Liu, L. Stand by or follow? Responsibility diffusion effects and green credit. Emerg. Mark. Financ. Trade 2018, 54, 1740–1760. [Google Scholar] [CrossRef]

- Su, C.-W.; Li, W.; Umar, M.; Lobonţ, O.-R. Can green credit reduce the emissions of pollutants? Econ. Anal. Policy 2022, 74, 205–219. [Google Scholar] [CrossRef]

- Du, J.; Shen, Z.; Song, M.; Vardanyan, M. The role of green financing in facilitating renewable energy transition in China: Perspectives from energy governance, environmental regulation, and market reforms. Energy Econ. 2023, 120, 106595. [Google Scholar] [CrossRef]

- Li, H.; Chen, C.; Umair, M. Green Finance, Enterprise Energy Efficiency, and Green Total Factor Productivity: Evidence from China. Sustainability 2023, 15, 11065. [Google Scholar] [CrossRef]

- Kong, G.; Wang, S.; Wang, Y. Fostering firm productivity through green finance: Evidence from a quasi-natural experiment in China. Econ. Model. 2022, 115, 105979. [Google Scholar] [CrossRef]

- Xia, Y.; Luo, L.; Ji, K.; Huang, C.; Wan, F.; Wang, Z. The impact of green finance and local regulations on industrial green innovation efficiency in China. Environ. Sci. Pollut. Res. 2023, 31, 1980–1994. [Google Scholar] [CrossRef] [PubMed]

- Bei, J.; Wang, C. Renewable energy resources and sustainable development goals: Evidence based on green finance, clean energy and environmentally friendly investment. Resour. Policy 2023, 80, 103194. [Google Scholar] [CrossRef]

- Zhang, M.; Zhang, X.; Song, Y.; Zhu, J. Exploring the impact of green credit policies on corporate financing costs based on the data of Chinese A-share listed companies from 2008 to 2019. J. Clean. Prod. 2022, 375, 134012. [Google Scholar] [CrossRef]

- Lin, B.; Pan, T. Financing decision of heavy pollution enterprises under green credit policy: Based on the perspective of signal transmission and supply chain transmission. J. Clean. Prod. 2023, 412, 137454. [Google Scholar] [CrossRef]

- Lin, B.; Pan, T. The impact of green credit on green transformation of heavily polluting enterprises: Reverse forcing or forward pushing? Energy Policy 2024, 184, 113901. [Google Scholar] [CrossRef]

- Yue, H.; Zhou, Z.; Liu, H. How does green finance influence industrial green total factor productivity? Empirical research from China. Energy Rep. 2024, 11, 914–924. [Google Scholar] [CrossRef]

- Liu, Z.R.; Zhang, W.J.; Si, C.N. The Development of Green Finance and the Release of Consumer Potential of Residents: An Empirical Analysis Based on Panel Data at the Provincial Level in China from 2014 to 2020. J. Xinjiang Univ. Financ. Econ. 2023, 4, 28–40. (In Chinese) [Google Scholar] [CrossRef]

- Lu, C.; Wang, D.; Meng, P.; Yang, J.; Pang, M.; Wang, L. Research on Resource Curse Effect of Resource-Dependent Cities: Case Study of Qingyang, Jinchang and Baiyin in China. Sustainability 2018, 11, 91. [Google Scholar] [CrossRef]

- Guo, W.; Yang, B.; Ji, J.; Liu, X. Abundance of natural resources, government scale and green economic growth: An empirical study on urban resource curse. Resour. Policy 2023, 87, 104303. [Google Scholar] [CrossRef]

- Popa Tache, C.E. The EU-China road to the Comprehensive Agreement on Investment. Jurid. Trib. 2022, 12, 476–494. [Google Scholar] [CrossRef]

| Level 1 Indicators | Characterization of Indicators | Variable Measurement |

|---|---|---|

| Green Credit | Percentage of credits for environmental projects | Total amount of credits for environmental projects in the city/total amount of citywide credits |

| Green Investment | Investment in environmental pollution control as a share of GDP | Investment in environmental pollution control/GDP |

| Green Insurance | Extent of the promotion of environmental pollution liability insurance | Environmental pollution liability insurance income/total premium income |

| Green Bond | Extent of green bond development | Total green bond issuance/total all bond issuance |

| Green Support | Percentage of fiscal expenditure on environmental protection | Fiscal environmental protection expenditures/fiscal general budget expenditures |

| Green Fund | Percentage of green funds | Total market capitalization of green funds/total market capitalization of all funds |

| Green Benefits | Green equity development depth | Total amount of carbon trading, energy rights trading, and emissions trading/total amount of equity market transaction |

| Variable Type | Indicator Selection | Symbol | Variable Measurement |

|---|---|---|---|

| Dependent Variable | Haze Pollution | PM | Matching the source data from the atmospheric composition analysis group with data on prefecture-level cities in China |

| Independent Variable | Green Finance | GF | The entropy weight method is used to measure the comprehensive index of green finance |

| Control Variable | Level of Economic Development | Pgdp | GDP per capita in RMB (log) |

| Investment in Science and Technology | It | Fiscal expenditure on science and technology (billion yuan)/general budget expenditure (billion yuan) | |

| Population Density | Pd | Population at the end of the year (10,000)/land area of the administrative region (square kilometers) | |

| Level of Government Intervention | Gov | General budget expenditure (billion yuan)/gross regional GDP (billion yuan) | |

| Level of Human Capital | Hum | Number of students enrolled in general undergraduate and junior colleges (persons)/population at the end of the year (10,000 persons) | |

| Greening Level | Gl | Per capita garden area and green space coverage in built-up areas |

| Vars | Observations | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| GF | 2830 | 0.328 | 0.102 | 0.064 | 0.637 |

| PM | 2830 | 42.300 | 15.120 | 11.61 | 108.5 |

| Pgdp | 2830 | 53,816 | 34,789 | 6457 | 467,749 |

| It | 2830 | 0.016 | 0.017 | 4.70 × 10−5 | 0.207 |

| Pd | 2830 | 440.800 | 349.6 | 5.093 | 2927 |

| Gov | 2830 | 0.203 | 0.103 | 0.044 | 0.916 |

| Hum | 2830 | 0.019 | 0.025 | 5.90 × 10−5 | 0.193 |

| Gl | 2830 | 17.690 | 7.367 | 1.370 | 60.070 |

| Vars | (1) | (2) | (3) | (4) | (5) | (6) | (7) |

|---|---|---|---|---|---|---|---|

| GF | −0.967 *** (0.0247) | −0.576 *** (0.0248) | −0.530 *** (0.0248) | −0.528 *** (0.0247) | −0.328 *** (0.0244) | −0.315 *** (0.0241) | −0.299 *** (0.0239) |

| Pgdp | −2.539 *** (0.0293) | −0.428 *** (0.160) | −0.478 *** (0.157) | −0.477 *** (0.156) | −0.419 *** (0.143) | −0.411 *** (0.141) | −0.392 *** (0.140) |

| Pgdp2 | 0.0270 (0.0797) | 0.0480 (0.0782) | 0.0489 (0.0780) | 0.0114 (0.0714) | 0.0195 (0.0705) | 0.0221 (0.0698) | |

| It | 0.0454 *** (0.00449) | 0.0473 *** (0.00451) | 0.0272 *** (0.00423) | 0.0229 *** (0.00420) | 0.0206 *** (0.00417) | ||

| Pd | −0.137 *** (0.0350) | −0.157 *** (0.0321) | −0.220 *** (0.0325) | −0.225 *** (0.0322) | |||

| Gov | −0.343 *** (0.0155) | −0.326 *** (0.0154) | −0.312 *** (0.0153) | ||||

| Hum | −0.0733 *** (0.00874) | −0.0666 *** (0.00871) | |||||

| Gl | −0.0821 *** (0.0114) | ||||||

| Constant | 2.539 *** (0.0293) | 7.014 *** (0.150) | 7.356 *** (0.151) | 8.129 *** (0.248) | 7.988 *** (0.227) | 7.781 *** (0.226) | 7.846 *** (0.224) |

| Observations | 2830 | 2830 | 2830 | 2830 | 2830 | 2830 | 2830 |

| Number of id | 283 | 283 | 283 | 283 | 283 | 283 | 283 |

| R-squared | 0.376 | 0.541 | 0.558 | 0.561 | 0.632 | 0.642 | 0.649 |

| Year | PM | GF |

|---|---|---|

| 2011 | 0.185 *** | 0.496 *** |

| 2012 | 0.181 *** | 0.542 *** |

| 2013 | 0.188 *** | 0.535 *** |

| 2014 | 0.171 *** | 0.579 *** |

| 2015 | 0.218 *** | 0.586 *** |

| 2016 | 0.216 *** | 0.550 *** |

| 2017 | 0.185 *** | 0.553 *** |

| 2018 | 0.201 *** | 0.543 *** |

| 2019 | 0.203 *** | 0.531 *** |

| 2020 | 0.204 *** | 0.542 *** |

| Test Type | Null Hypothesis | Statistics | |

|---|---|---|---|

| LM test | SEM | 97.85 *** | SDM |

| Robust SEM | 32.87 *** | ||

| SAR | 74.21 *** | ||

| Robust SAR | 7.13 ** | ||

| Hausman test | Random effect | 43.50 *** | Fixed effect |

| Wald test | SDM can be simplified to SEM or SAR | 14.54 ** | SDM |

| LR test | SDM can be simplified to SEM or SAR | 10.89 * | SDM |

| 11.23 * |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Vars | Main | Wx | Direct Effect | Spillover Effect | Aggregate Effect |

| GF | −0.0144 * | −0.120 *** | −0.0264 ** | −0.259 *** | −0.285 *** |

| (0.0112) | (0.0345) | (0.0119) | (0.0673) | (0.0712) | |

| Pgdp | 0.310 | −1.020 | 0.214 | −1.502 | −1.288 |

| (0.592) | (1.577) | (0.626) | (3.219) | (3.556) | |

| Pgdp2 | −0.169 | 0.467 | −0.124 | 0.650 | 0.526 |

| (0.296) | (0.788) | (0.313) | (1.608) | (1.777) | |

| It | −0.0236 *** | −0.0343 ** | −0.0284 *** | −0.0955 *** | −0.124 *** |

| (0.00611) | (0.0141) | (0.00605) | (0.0280) | (0.0302) | |

| Pd | 0.183 *** | −0.0877 *** | 0.184 *** | 0.0193 | 0.203 *** |

| (0.00613) | (0.0140) | (0.00613) | (0.0280) | (0.0303) | |

| Gov | −0.138 *** | −0.115 *** | −0.154 *** | −0.376 *** | −0.530 *** |

| (0.0182) | (0.0399) | (0.0189) | (0.0756) | (0.0821) | |

| Gl | 0.110 *** | −0.109 *** | 0.105 *** | −0.101 * | 0.00425 |

| (0.0106) | (0.0281) | (0.0118) | (0.0568) | (0.0621) | |

| Rho | 0.528 *** | 0.528 *** | 0.528 *** | 0.528 *** | 0.528 *** |

| (0.0270) | (0.0270) | (0.0270) | (0.0270) | (0.0270) | |

| Sigma2_e | 0.0489 *** | 0.0489 *** | 0.0489 *** | 0.0489 *** | 0.0489 *** |

| (0.00133) | (0.00133) | (0.00133) | (0.00133) | (0.00133) | |

| Observations | 2830 | 2830 | 2830 | 2830 | 2830 |

| R-squared | 0.463 | 0.463 | 0.463 | 0.463 | 0.463 |

| Number of id | 283 | 283 | 283 | 283 | 283 |

| Vars | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| Main | Wx | Short-Term Effect | Long-Term Effect | |||||

| Direct Effect | Spillover Effect | Aggregate Effect | Direct Effect | Spillover Effect | Aggregate Effect | |||

| L.WPM | 1.013 *** | |||||||

| (0.013) | ||||||||

| L.PM | 1.205 *** | |||||||

| (0.008) | ||||||||

| GF | 0.008 * (0.005) | 0.153 *** (0.014) | 0.029 *** (0.005) | 0.416 *** (0.041) | 0.445 *** (0.043) | −0.033 (1.894) | −0.162 (1.896) | −0.194 *** (0.016) |

| Control variable | YES | YES | YES | YES | YES | YES | YES | YES |

| Rho | 0.632 *** | 0.632 *** | 0.632 *** | 0.632 *** | 0.632 *** | 0.632 *** | 0.632 *** | 0.632 *** |

| (0.016) | (0.016) | (0.016) | (0.016) | (0.016) | (0.016) | (0.016) | (0.016) | |

| Sigma2_e | 0.008 *** | 0.008 *** | 0.008 *** | 0.008 *** | 0.008 *** | 0.008 *** | 0.008 *** | 0.008 *** |

| (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |

| Observations | 2547 | 2547 | 2547 | 2547 | 2547 | 2547 | 2547 | 2547 |

| R-squared | 0.701 | 0.701 | 0.701 | 0.701 | 0.701 | 0.701 | 0.701 | 0.701 |

| Number of IDs | 283 | 283 | 283 | 283 | 283 | 283 | 283 | 283 |

| Vars | Short-Term Effect | Long-Term Effect | ||||||

|---|---|---|---|---|---|---|---|---|

| Direct Effect | Spillover Effect | Aggregate Effect | Direct Effect | Spillover Effect | Aggregate Effect | |||

| Regional heterogeneity | East | GF | 0.118 *** | 0.104 | 0.222 ** | −1.858 | 0.205 | −1.652 ** |

| (0.032) | (0.079) | (0.087) | (2.224) | (2.376) | (0.760) | |||

| Central | GF | 0.135 | −0.323 | −0.188 *** | −0.111 *** | −0.036 *** | −0.147 *** | |

| (0.211) | (0.211) | (0.003) | (0.012) | (0.0116) | (0.002) | |||

| West | GF | −0.0188 | 0.163 ** | 0.144 *** | 0.316 | −0.247 | 0.0690 *** | |

| (0.083) | (0.081) | (0.013) | (4.723) | (4.723) | (0.006) | |||

| Resource endowment heterogeneity | Resource-based city | GF | −0.0124 | −0.158 * | −0.170 ** | 0.0531 | 0.000138 | 0.0533 ** |

| (0.008) | (0.082) | (0.087) | (1.042) | (1.041) | (0.026) | |||

| Nonresource-based city | GF | −0.00316 | 0.133 *** | 0.130 *** | 0.107 ** | −0.622 *** | −0.515 *** | |

| (0.006) | (0.020) | (0.020) | (0.050) | (0.0912) | (0.079) | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Qiang, Y.; Tang, Y.; Wang, C. Green Finance Advancement and Its Impact on Urban Haze Pollution in China: Evidence from 283 Cities. Sustainability 2024, 16, 4455. https://doi.org/10.3390/su16114455

Qiang Y, Tang Y, Wang C. Green Finance Advancement and Its Impact on Urban Haze Pollution in China: Evidence from 283 Cities. Sustainability. 2024; 16(11):4455. https://doi.org/10.3390/su16114455

Chicago/Turabian StyleQiang, Yichen, Yao Tang, and Chen Wang. 2024. "Green Finance Advancement and Its Impact on Urban Haze Pollution in China: Evidence from 283 Cities" Sustainability 16, no. 11: 4455. https://doi.org/10.3390/su16114455

APA StyleQiang, Y., Tang, Y., & Wang, C. (2024). Green Finance Advancement and Its Impact on Urban Haze Pollution in China: Evidence from 283 Cities. Sustainability, 16(11), 4455. https://doi.org/10.3390/su16114455