Abstract

Saudi Arabia aims to build a sustainable and diversified economy by 2030. The automotive industry presents a key opportunity to achieve these goals through localization and the adoption of Industry 4.0 technologies. This research analyzes the impact of a developed localized production model for the automotive industry. The model promotes economic sustainability through domestic manufacturing, job creation and reduced oil dependence; environmental sustainability via the Industry 4.0 approach, which enhances customization, and social sustainability by developing human capital, transferring advanced technologies and stimulating job creation, thereby balancing the three spheres of sustainability. To attain the aim of the research, data were collected from 106 Saudi automobile companies. For the data collection, a questionnaire was designed, and authentication was performed according to the average level of use of Industry 4.0 and analysis of the level of implementation of the developed localized production model for the automotive industry of the Kingdom of Saudi Arabia. The results shows that large automobile companies in the Kingdom of Saudi Arabia are employing the developed localized production model more than medium and smaller automobile companies, and as a result of this model employment, automobile companies’ customer satisfaction through customization and revenue has improved in an agile and lean manner.

1. Introduction

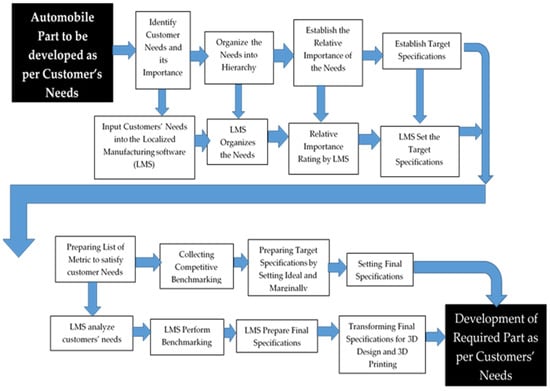

The Kingdom of Saudi Arabia aims to establish a sustainable, diversified and globally competitive localized automotive production industry aligned with its Vision 2030 goals [1]. This requires embracing advanced Industry 4.0 technologies to enhance efficiency, productivity, quality and sustainability across automobile design, manufacturing, service and end-of-life management [2]. As Figure 1 illustrates, a localized production model (LPM) integrating elements like automation, customization and micro factories has been proposed specifically for the Saudi automotive industry [3]. This research analyzes the sustainability implications of implementing this model to transform the domestic automotive manufacturing sector.

Figure 1.

Developed model for localized manufacturing [3].

Industry 4.0 solutions like the internet of things, big data analytics, 3D printing, additive manufacturing, artificial intelligence and advanced robotics are rapidly transforming production systems by increasing connectivity, intelligence and flexibility [4,5]. The automotive industry is expected to be at the forefront of this transformation given its technological leadership and heavy investments in smart manufacturing [6]. For Saudi Arabia, this represents an opportunity to deploy cutting-edge Industry 4.0 innovations to build a sustainable domestic auto production capability.

Saudi Vision 2030 mainly focuses on raising its global ranking in the Logistics Performance Index from 49 to 25. This will ensure the Kingdom is a regional leader in logistics manufacturing. Integrating Industry 4.0 with manufacturing brings significant advantages for enhancing manufacturing efficiency and sustainability, i.e., enhanced efficiency and productivity, automation, real-time monitoring, enhanced quality control, precision manufacturing, flexibility in customization, cost reduction, improved safety, resource efficiency, waste reduction and cleaner production, as well as advanced technologies to facilitate the efficient disposal and recycling of products.

While the Industry 4.0 technique was developed in Germany, Industry 4.0 has the potential to deliver significant benefits to Saudi Arabia due to a variety of factors that align well with the country’s economic goals, infrastructure capabilities and strategic vision. Saudi Arabia’s Vision 2030 is a strategic framework aimed at reducing the country’s dependence on oil, diversifying its economy and developing public service sectors. Industry 4.0 aligns perfectly with these goals by promoting industrial diversification and technological innovation. The Saudi government has shown strong commitment to industrial and technological advancement through initiatives such as the National Industrial Development and Logistics Program (NIDLP). Significant investments in infrastructure, technology and education pave the way for Industry 4.0 adoption. With substantial financial resources from its oil revenue, Saudi Arabia can afford the investments required for advanced manufacturing technologies, which is critical for implementing Industry 4.0. By developing advanced manufacturing sectors, Saudi Arabia can create high-skill jobs for its young population, addressing unemployment and fostering economic stability. Saudi Arabia’s strategic location at the crossroads of major international trade routes positions it as a key logistical hub. Industry 4.0 can enhance the efficiency and competitiveness of its logistics and supply chain management. Saudi Arabia has a significant domestic market that can absorb advanced manufactured goods, providing a solid foundation for Industry 4.0-driven production. With Industry 4.0, Saudi manufacturers can produce high-quality, competitive products for export, creating a skilled workforce capable of supporting Industry 4.0 technologies. Saudi Arabia’s commitment to environmental sustainability and reducing carbon emissions aligns with the principles of Industry 4.0, which promotes resource-efficient and sustainable manufacturing processes.

Localization refers to the process of the manufacturing/production of parts to fulfill the specific needs/demands of local markets. In the context of Industry 4.0, localization involves adopting advanced technologies like 3D printing and additive manufacturing to enhance the efficiency, customization, flexibility and responsiveness of localized manufacturing/production.

Currently, Saudi Arabia lacks a robust local automotive production base, importing over 98% of vehicles sold domestically. However, plans to manufacture half a million cars annually by 2030 highlight the government’s commitment to localization [7]. This aligns with the overarching Vision 2030 goals for economic diversification, job creation and sustainable development [8]. Establishing an advanced automotive manufacturing ecosystem can also catalyze innovation across related sectors, supporting the growth of a vibrant knowledge economy [9].

The localized production model developed [3] proposes an implementation roadmap to help Saudi automotive firms of all sizes transition to smart, sustainable manufacturing [3]. It incorporates elements like training, circularity, micro factories and customization solutions enabled by Industry 4.0 technologies [10]. Effective adoption of this model can significantly enhance sustainability across the automotive value chain. Firstly, real-time data collection and analytics allow for continuous monitoring and the optimization of materials, customization and energy flows on the factory floor, thereby improving resource efficiency [11]. Secondly, leveraging predictive maintenance and smart automation minimizes production downtime and waste generation, facilitating circular economy approaches [12]. Thirdly, flexible solutions like industrial 3D printing enable mass customization and on-demand production of spare parts, aligned with sustainability principles [13]. Localized automotive production aided by Industry 4.0 advancements also presents notable sustainability benefits for Saudi Arabia, such as the following:

- ▪

- Shortened, resilient local supply chains reducing transportation emissions, enhanced customization and reduced energy usage [14].

- ▪

- Skilling, upskilling and job creation for the domestic workforce through advanced technology transfer [15].

- ▪

- Potential to implement eco-friendly manufacturing techniques like renewables, recycling, etc. [16].

- ▪

- Innovation in designing products tailored to domestic customer needs and expectations [17].

The transition to smart, sustainable production is an evolutionary process needing a phased approach [18]. Large Saudi automotive firms are early adopters of the localized production model [3], reporting increased revenue and customer satisfaction. Small firms also demonstrate interest in embracing such technologies. Cross-sector collaboration and policy directives can drive holistic ecosystem development [19].

In summary, effectively integrating Industry 4.0 innovations under a localized manufacturing model can significantly advance Saudi Arabia’s economic prosperity, environmental sustainability and social development objectives. It could also accelerate the country’s strategic vision to be a global leader in future automotive technologies [7]. This research provides insights into how regional production models can leverage smart solutions to enable sustainability across the automotive value chain.

2. Literature Review

It is universally believed that the Fourth Industrial Revolution has certainly transformed the manufacturing industries in particular and engineering enterprises in general [20]. For an industry to be successful, it is necessary to adopt advanced technologies, i.e., Industry 4.0 [21]. In fact, Industry 4.0 has the capability to transform manufacturing and automobile companies to meet the unique needs/demand of customers [22,23,24]. Using Industry 4.0 technologies, the number of errors and accidents in the workplace are naturally reduced [25]. It is recommended by experts to digitize all processes and invest in the latest technologies. Automobile industries need to focus on Industry 4.0 to meet future customer needs/demands [26].

Industry 4.0 technologies enhance production efficiency, flexibility and sustainability by enabling real-time data analysis and decision-making [27]). Research indicates that Industry 4.0 significantly impacts operational performance. According to Liao et al. [28], the adoption of Industry 4.0 technologies results in improved productivity, quality and agility in manufacturing. Moreover, the implementation of these technologies can lead to the development of new business models and revenue streams [29]. However, the transition to Industry 4.0 is not without challenges. Companies must overcome significant barriers, including high investment costs and the need for a skilled workforce [30]. Additionally, the integration of these advanced technologies requires substantial changes in organizational culture and processes [31].

Localized manufacturing, also known as distributed or on-demand manufacturing, refers to the practice of producing goods closer to the point of consumption. This approach contrasts with traditional centralized manufacturing, where production facilities are often located far from the end consumers. The localized manufacturing model offers several advantages, including reduced transportation costs, shorter lead times and enhanced customization capabilities [32]. The rise of additive manufacturing (AM), commonly known as 3D printing, has been a significant driver of localized manufacturing. AM technologies enable the production of complex parts with minimal waste, facilitating small-batch production and rapid prototyping [33]. By decentralizing production, companies can respond more quickly to market demands and reduce their environmental footprint [34].

Sustainability in manufacturing encompasses practices that minimize negative environmental impacts, conserve energy and natural resources and improve the health and safety of employees and communities. Sustainable manufacturing practices are essential for addressing the pressing global challenges of climate change, resource depletion and environmental degradation [35]. The integration of Industry 4.0 technologies can play a pivotal role in enhancing the sustainability of manufacturing processes. Additionally, smart factories can optimize resource usage and enhance the efficiency of production processes through advanced data analytics and automation [36]. Localized manufacturing also contributes to sustainability by reducing the need for long-distance transportation, thereby lowering the carbon emissions associated with logistics [37]. Furthermore, the ability to produce goods on demand reduces inventory levels and associated waste, promoting a more circular economy [38].

The convergence of Industry 4.0, localized manufacturing and sustainability represents a transformative shift in the manufacturing landscape. Industry 4.0 technologies enable smarter, more efficient production processes, while localized manufacturing brings production closer to consumers, enhancing responsiveness and reducing environmental impacts. Together, these trends contribute to the development of a more sustainable manufacturing ecosystem.

The Kingdom of Saudi Arabia has around 160 automobile manufacturing factories, and they produce a range of cars, engine parts and accessories, including some dedicated to electric vehicles. The Saudi Ministry of Industry and Mineral Resources has publicized that out of these factories, 33 factories are for auto parts and accessory manufacturing, 21 factories are for engine and structure manufacturing, including processing works, and 106 automobile factories are for trailer and semi-trailer vehicles or trucks. The Kingdom of Saudi Arabia aims to manufacture about 300,000 cars by 2030 and will account for 50 percent of car sales in the Gulf Cooperation Council countries by 2025 from around 1.15 million cars [39]. The Kingdom of Saudi Arabia plans to target extraordinary and sustainable human capital localization as per its Vision 2030. It has recently launched a Lucid Future Talent program—in collaboration with the Human Resources Development Fund—and plans to inculcate the technical training to develop and train local human resources to fill the gap in upcoming job opportunities in the Kingdom of Saudi Arabia [40]. The Kingdom of Saudi Arabia’s ambitions are to be the main hub for the automotive industry in the region due to its strategic location and adopt modern technologies to become a leader in the automobile industry. The Kingdom of Saudi Arabia plans to localize half of the production of currently imported vehicles and create 1.6 million manufacturing jobs by 2030 [41]. It is the general practice of affluent families in the Kingdom of Saudi Arabia to procure higher-end automobiles, with frequent changes in adoption of the latest trends. Further, the Kingdom of Saudi Arabia’s automobile users are in the top twenty car users in terms of car demand without a local or regional production hub. Automobile requirements have constantly increased by three percent annually over the past four years [42]. This is expected even to enhance by nine percent by 2025 since more women are driving automobiles as a result of the lift of the ban in June 2018 on women driving, and their demands and requirements are totally unique and personal [43]. The female population is expected to reach more than fifteen million, out of whom more than three million will begin driving based on both “age and income qualifications”, in addition to the 500,000 men reaching driving age.

3. Methodology

3.1. Research Goal

The automobile industry of the Kingdom of Saudi Arabia is ever-flourishing, with huge and unique demands for the latest models and designs. It is expected that the automobile industry of the Kingdom of Saudi Arabia will be one of the main contributors to its GDP by 2030. Fourth Industrial Revolution technologies, i.e., 3D printing and additive manufacturing, are playing a major role in meeting customers’ unique demands and needs. The aim of this research is to evaluate the automobile companies of the Kingdom of Saudi Arabia in light of Industry 4.0 technologies and analyze the impact of the developed localized manufacturing model for the Kingdom of Saudi Arabia’s automotive industry in relation to Industry 4.0. This type of research has not yet been conducted to assess the level of implementation of Industry 4.0 and the unique model developed for the automobile industry of the Kingdom of Saudi Arabia. The aim of this research was to analyze the impact of Industry 4.0 and the developed model for the automobile industry of the Kingdom of Saudi Arabia; to fulfill this aim, a questionnaire was designed, and responses were sought from automobile companies’ representatives. Closed-ended questions were asked from the respondents on a Likert scale from 1 to 5, i.e., 1—Strongly Disagree, 2—Disagree, 3—No Comment/Not Yet, 4—Agree/Partially Agree, 5—Strongly Agree. An expert validation technique was used to validate the questionnaire. To validate the developed questionnaire, the expert validation technique was employed, i.e., experts from industry, as well as from academia, were consulted who had related experience of more than five years in a similar field to confirm the validity of the developed questionnaire. Based on the recommendations/suggestions of the experts, the questionnaire was redesigned again and again, and this finally concluded after incorporating all the suggestions/recommendations.

For a deeper analysis of the results, automobile companies of the Kingdom of Saudi Arabia were divided according to the size of the automobile companies on the basis of number of employees, i.e., small companies (up to 50 employees), medium companies (between 51 and 100 employees) and large companies (more than 100 employees).

3.2. Research Sample Size and Data Collection

For the data collection, a questionnaire was designed to gain insight into the companies in terms of their readiness for Industry 4.0 and adaptation of the developed localized manufacturing model for the Kingdom of Saudi Arabia in the automobile industry and its impact on industry financial gains. The questions were designed keeping in view the theoretical review of the literature. This research was conducted for only Saudi automobile companies, with a focus on the analysis of the developed localized production model for the automotive industry, built into the concept of Industry 4.0 in the Kingdom of Saudi Arabia. The automobile companies were categorized into three categories, i.e., small-, medium- and large-sized automobile companies. The automobile companies selected were automobile manufacturers and manufacturers of auto parts and components for automobiles. The questionnaire was sent to about 126 automobile companies in the Kingdom of Saudi Arabia (11 small-sized, 56 medium-sized and 59 large-sized companies). The questionnaire was sent to operations managers/technical managers of automobile companies. The questionnaire was received back from 103 companies, resulting in a response rate of around 81%.

4. Results

For analysis of the level of implementation of the developed localized production model for the automotive industry, built into the concept of Industry 4.0 in the Kingdom of Saudi Arabia in the automotive industry, a questionnaire was designed, and data were collected from 126 automobile companies in the Kingdom of Saudi Arabia. These companies were categorized as large, medium or small depending upon the size of the companies, i.e., small (up to 50 employees), medium (between 51 and 100 employees) and large (more than 100 employees).

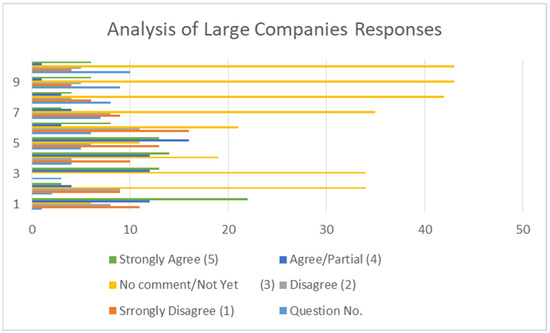

The results of the data collection from these automobile companies are shown in Figure 2, Figure 3 and Figure 4, along with the questions asked shown in Table 1. Respondents were asked to rate the level of implantation/adoption of the developed model of localized manufacturing for the Kingdom of Saudi Arabia in the automobile industry on a Likert scale of 1–5, where 1 indicates strongly disagree with the statement, 2 indicates disagree with the statement, 3 indicates as no comment/not yet, 4 indicates strongly agree with the statement and 5 indicates as strongly agree with the statement. The results of the responses from large automobile companies in the Kingdom of Saudi Arabia, as shown in Figure 2, indicate that around 57% of companies know about the developed localized production model for the automotive industry, built into the concept of Industry 4.0 in the Kingdom of Saudi Arabia, but only 11 percent have adopted it, and as a result of its implementation, customer satisfaction, company revenue and product specifications have improved, and costs have become competitive. Data analysis also shows that only 18% of the automobile companies have the expertise to adopt it. However, 42% of large automobile companies intend to adopt it in the near future.

Figure 2.

Summary of responses from large automobile companies.

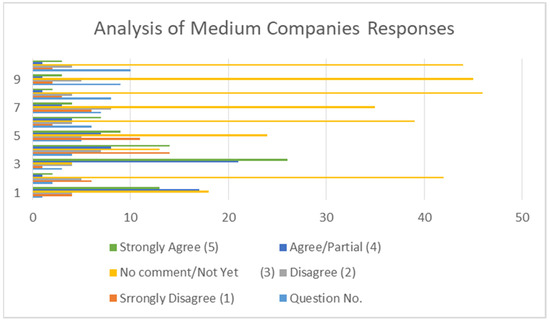

Figure 3.

Summary of responses from medium automobile companies.

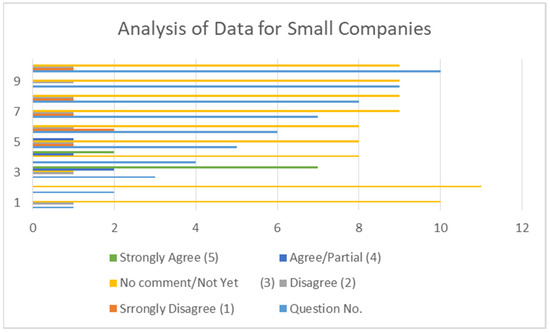

Figure 4.

Summary of responses from small automobile companies.

Table 1.

Comparison of responses from automobile companies.

After analyzing the responses from medium-size automobile companies of the Kingdom of Saudi Arabia, as shown in Figure 3, they indicate that around 50% of companies know about the developed localized production model for the automotive industry, built into the concept of Industry 4.0 in the Kingdom of Saudi Arabia, but only 5% have adopted it as of yet, and as a result of its implementation, customer satisfaction, company revenue and product specifications have considerably improved, and costs have become competitive. The data also show that only 17% of the companies have the expertise to adopt it. However, 82% of medium-size automobile companies intend to adopt it in the near future.

The results of the responses from small-size automobile companies of the Kingdom of Saudi Arabia, as shown in Figure 4, indicate that only 18% of companies know about the developed localized production model for the automotive industry, built into the concept of Industry 4.0 in the Kingdom of Saudi Arabia, but no company has adopted it, as they also do not have the expertise to adopt it. However, 81% of companies intend to adopt it in the near future.

After looking in depth at the analysis of the responses received, it is observed that as per the industry categorization of this research, the highest level of implementation of the developed localized production model for the automotive industry, built into the concept of Industry 4.0 in the Kingdom of Saudi Arabia, was in large-size automobile companies of the Kingdom of Saudi Arabia, and these large automobile companies also have the expertise to shift to Industry 4.0 technologies through this developed model. However, small automobile companies have neither the capability nor know-how about the developed model of localized manufacturing for the Kingdom of Saudi Arabia of the automobile industry and do not have the expertise to shift to Industry 4.0 technologies through the developed localized manufacturing model; however, they intend to explore these technologies in the near future. In contrast, medium automobile companies have some know-how about the developed localized production model for the automotive industry, built into the concept of Industry 4.0 in the Kingdom of Saudi Arabia, a limited capability to adopt the Industry 4.0 concept and willingness to adopt the developed model of localized manufacturing for the Kingdom of Saudi Arabia automobile industry in the near future.

Further analysis of the results reveals that about 43% of the respondents from large automobile companies of the Kingdom of Saudi Arabia indicated that they do not yet know about the developed localized production model for the automotive industry, built into the concept of Industry 4.0 in the Kingdom of Saudi Arabia, and that it needs to be adopted in the near future. The automobile companies that have adopted it have much better customer satisfaction, increased revenue and a reduced production time. It is evident as a result of this research that by adopting the developed localized production model for the automotive industry, built into the concept of Industry 4.0 in the Kingdom of Saudi Arabia, localization and customization can be attained in the automobile companies of the Kingdom of Saudi Arabia as per Saudi Vision 2030, i.e., a vibrant society, a thriving economy and an ambitious nation.

By comparing the responses among different types of automobile companies, as shown in Table 1, large and medium-sized companies are more aware of the latest technologies and are adopting them at a faster pace than smaller companies; however, smaller companies, after learning about the latest technologies, have shown interest in adopting these technologies in the near future as well, as these companies have experts to implement these technologies. Large and medium-sized companies have also taken on more customer opinions/their needs to customize their products, and as a result, customer satisfaction and company revenue have increased as compared to those of smaller automobile companies in the Kingdom of Saudi Arabia.

5. Discussion

As a result of implementation of the LPM, the following benefits can be achieved:

5.1. Advantages of the Developed Localized Production Model for the Automotive Industry, Built into the Concept of Industry 4.0 in the Kingdom of Saudi Arabia

The benefits that can be achieved by automobile companies in the Kingdom of Saudi Arabia by implementing the developed localized production model for the automotive industry, built into the concept of Industry 4.0 in the Kingdom of Saudi Arabia, are as follows:

- Enhanced customization of automobile parts as per customers’ demands/needs,

- Increased efficiency,

- Reduced production cost,

- Digitization of paper documents,

- Elimination of errors and faults,

- Increased product quality,

- Simplification of production processes,

- Increased safety and protection at work.

5.2. Opportunities for Small and Medium-Sized Enterprises (SMEs) and Large Enterprises in Implementing the Localized Production Model

The implementation of the LPM in Saudi Arabia may have the following opportunities for small and medium-sized enterprises (SMEs) and large enterprises. The performances of these two types of enterprises in adopting the LPM may differ according to resource availability, organizational flexibility, market reach and technological capability.

5.2.1. Performance of SMEs in Implementing the Localized Production Model Are as Follows:

- (a)

- Flexibility and Adaptability: SMEs tend to be more agile and can quickly adapt to changes in local market demands and production requirements. This agility allows them to efficiently implement localized production models.

- (b)

- Niche Market Focus: SMEs often target niche markets with specialized products, which can benefit from localization by closely aligning production with specific local needs and preferences.

- (c)

- Community Integration: SMEs can integrate more easily into local communities, building strong relationships and trust with local suppliers and customers. This integration can facilitate smoother implementation of localized production.

- (d)

- Challenges: Resource Constraints: SMEs typically have limited financial and human resources, which can hinder their ability to invest in new technologies and the infrastructure necessary for the LPM.

- (e)

- Economies of Scale: SMEs often lack the economies of scale that large enterprises benefit from, making it more difficult to reduce production costs and compete in terms of price.

- (f)

- Access to Technology: Limited access to advanced manufacturing technologies and innovation can slow down the adoption of efficient localized production practices.

5.2.2. The Performance of Large Enterprises in Implementing the Localized Production Model Are as Follows:

- (a)

- Resource Availability: Large enterprises have substantial financial and human resources, enabling significant investment in technology, infrastructure and R&D for localized production.

- (b)

- Economies of Scale: They benefit from economies of scale, reducing production costs and allowing for competitive pricing, even when producing locally.

- (c)

- Advanced Technology and Innovation: Large enterprises often have access to cutting-edge technology and innovation, enhancing efficiency and productivity in localized production models.

5.3. Underlying Reasons for Performance Differences

Resource Availability and Financial Capability: Large enterprises generally have more capital to invest in local production facilities and technologies, whereas SMEs often struggle with funding and access to credit. This disparity affects the speed and scale of LPM implementation.

Technological Capabilities: Advanced technologies required for efficient localized production, such as automation and the IoT, are more accessible to large enterprises due to their investment capabilities. SMEs might lack the necessary technological infrastructure.

Market Reach and Supply Chain Complexity: Large enterprises operate with complex global supply chains that can complicate the shift to localized production. SMEs, with simpler and more localized supply chains, can more easily adapt to local production models.

Regulatory and Policy Environment: Government policies and incentives in Saudi Arabia aimed at promoting localized production might be more beneficial to large enterprises that have the capacity to meet regulatory requirements and take advantage of subsidies and tax incentives. SMEs may find navigating regulatory landscapes more challenging.

Organizational Structure and Culture: SMEs typically have flatter organizational structures, allowing for quicker decision-making and adaptation. Large enterprises, with their hierarchical structures, might face slower decision-making processes and resistance to change.

5.4. Policy Recommendations for Developing a Localized Manufacturing Model in Saudi Arabia

Based on the performance differences between SMEs and large enterprises in implementing the localized production model (LPM), the following specific and actionable policy recommendations are recommended to the Saudi Arabian government:

- (a)

- Financial Support and Incentives: To provide targeted subsidies and grants to SMEs to invest in localized production technologies.

- (b)

- Tax Incentives: To offer tax reductions for both SMEs and large enterprises that establish local production facilities and source local materials.

- (c)

- Low-Interest Loans: To provide low-interest loans specifically for SMEs to reduce the financial burden of transitioning to localized production.

Technology and Innovation Support:

- (a)

- Technology Transfer Programs: To develop schemes to facilitate the transfer of advanced manufacturing technologies to SMEs, possibly through partnerships with large enterprises or international technology providers.

- (b)

- Innovation Hubs: To establish innovation hubs and incubators that can provide SMEs with access to cutting-edge technologies, technical expertise and collaborative opportunities.

- (c)

- R&D Grants: To offer grants for research and development focused on localized production processes, materials and technologies.

- (d)

- Training and Skill Development: To introduce vocational training and certification programs to develop a skilled workforce capable of supporting localized manufacturing.

- (e)

- Management Training: To provide training for SME managers on the best practices in local production, production optimization and Industry 4.0 technology adoption.

- (f)

- Collaboration with Educational Institutions: To encourage partnering with universities and technical institutions to align their curricula with the needs of localized manufacturing industries.

Infrastructure Development: To develop specialized industrial zones with the necessary infrastructure to support localized manufacturing, including access to utilities, transportation and communication networks.

- (a)

- Digital Infrastructure: To invest in robust digital infrastructure to support the integration of the IoT, AI and other digital technologies into manufacturing processes.

- (b)

- Regulatory and Policy Framework: To regulate processes to make it easier for SMEs to set up and operate localized production facilities.

- (c)

- Quality Standards: To develop and enforce quality standards for locally produced goods to ensure they meet international benchmarks, fostering trust and competitiveness.

5.5. Sustainability Implications of the Localized Production Model Integrating Industry 4.0

The localized production model developed for the Saudi Arabian automotive industry integrates advanced Industry 4.0 technologies like automation, digitization, artificial intelligence, additive manufacturing and the internet of things [3]. Effective adoption of this model carries profound sustainability implications across the economic, environmental and social dimensions [1,2,4,5].

5.6. Economic Sustainability

Localizing automotive production within Saudi Arabia can significantly contribute to economic diversification, a key pillar of Vision 2030 [44]. Currently, over 98% of vehicles sold domestically are imported, resulting in lost opportunities [1]. Establishing an indigenous automotive manufacturing ecosystem will create jobs in production, R&D, sales and ancillary services [45]. This model encourages joint ventures between local and international firms, enabling technology transfer and boosting local capabilities. Robust supply chains linking manufacturers, parts suppliers, raw material providers and ancillary industries promote further economic activities [46].

Industry 4.0 solutions enhance productivity, efficiency and agility, characteristics vital for global competitiveness [47]. Real-time data analytics allows for on-demand production with minimal inventory, following just-in-time principles [48]. By linking intelligent machines, localized flexible manufacturing enables mass customization attuned to domestic market needs [21,22]. Significant evidence confirms that large domestic automakers have achieved higher revenue and customer satisfaction by adopting this model. Hence, the localized production model creates a digitally transformed automotive manufacturing ecosystem meeting the Society 5.0 goals of value creation and economic advancement [49].

5.7. Environmental Sustainability

Localized automotive production integrated with Industry 4.0 technologies allows for significant improvements in energy and resource efficiency [50]. Sensors and the internet of things facilitate real-time monitoring of electricity, water and material usage on production floors [51]. Big data analytics enables continuous process optimization to minimize wastage [52]. Machine learning algorithms further allow for predictive maintenance scheduling, reducing equipment downtime [53].

Deploying robots enhances manufacturing precision, lowering the amount of scrap and number of defects [54]. Industrial 3D printing adopted under the model reduces material waste during production [55]. The circular economy approach is also bolstered, with interconnected systems enabling product refurbishment, remanufacturing and recycling [56]. Moreover, shortened local supply chains lower the carbon footprint compared to imported vehicles and components [57].

Saudi Arabia is endowed with abundant solar energy resources. The model provides the opportunity to power manufacturing facilities through solar farms, aligning with the Saudi Green Initiative [58]. Waste heat can also be captured for reuse in heating or cooling processes [59]. Furthermore, designing products specifically for domestic requirements prevents the production of unpopular models. Overall, the localized model aids Saudi Arabia’s climate action commitments through energy efficiency, renewable integration and circularity [60].

5.8. Social Sustainability

The localized production model contributes to human capital development in Saudi Arabia [61]. Training programs upskill workers in operating advanced Industry 4.0 machines. This exposure provides avenues for career progression, boosting job satisfaction [62]. Young graduates are attracted to an industry deploying cutting-edge technologies like robotics and 3D printing [63]. Consequently, the brightest talents are retained within the country.

Implementing collaborative robots enhances occupational safety, preventing workplace injuries [64]. The automation of strenuous and repetitive tasks provides ergonomic benefits [65]. Barriers restricting women from automotive jobs are also overcome by deploying robots. Overall, the model promotes diversity and inclusivity in the manufacturing workforce [66].

Creating stable middle-class jobs stimulates community development and raises living standards, important social sustainability factors [67]. Tier 2 and 3 suppliers clustered around automotive hubs provide neighboring opportunities. Corporate Social Responsibility (CSR) initiatives further improve public infrastructure and facilities [68]. Thereby, the localized production model delivers positive societal outcomes aligning with Saudi Vision 2030.

In summary, integrating advanced technologies within a localized manufacturing model will allow the Saudi automotive industry to achieve the triple bottom line of sustainable development [69]. Far-reaching economic benefits arise from job creation, supply chain development, technology absorption and global competitiveness. Environmental sustainability is attained through renewable energy usage, closed-loop material cycles and lower carbon footprints. Progress in terms of human capital, occupational safety and community upliftment constitutes the social sustainability aspects. Therefore, the localized production model provides a pathway for Saudi Arabia to fulfill its strategic vision through holistic and sustainable industrial advancement.

5.9. Directions for Future Research

The following are directions for future research:

- (a)

- Impact Assessment: Undertake longitudinal studies to assess the long-term economic, social and environmental impacts of localized manufacturing on different sectors in Saudi Arabia.

- (b)

- Technology Adoption: Investigate the adoption rates and impacts of specific technologies (e.g., the IoT, AI, 3D printing) on localized manufacturing efficiency and sustainability.

- (c)

- Consumer Preferences: Study consumer preferences and perceptions of locally produced goods to better tailor production and marketing strategies.

5.10. Limitations of the Study and Potential

- (a)

- Improvement Data Availability: The study may be limited by the availability and broadness of the data on localized manufacturing practices and performance in Saudi Arabia.

- (b)

- Generalizability: Findings specific to Saudi Arabia may not be directly applicable to other regions with different economic, cultural and regulatory contexts.

- (c)

- Scope: The focus on SMEs and large enterprises may overlook the role of micro-enterprises and informal sector participants in localized manufacturing.

5.11. Potential Improvements

- (a)

- Improve the data collection methods to gather broader and more comprehensive data on localized manufacturing activities.

- (b)

- Broader Stakeholder Engagement: Engage a wider range of stakeholders, including micro-enterprises, industry associations and consumer groups, to gain a more holistic understanding of the localized manufacturing landscape.

By implementing these policy recommendations and addressing the limitations through further research, Saudi Arabia can effectively develop and enhance its localized manufacturing model, fostering economic growth, sustainability and resilience in its manufacturing sector.

6. Conclusions

This research conducted an in-depth analysis and evaluation of the localized production model for the automotive industry in Saudi Arabia integrating advanced Industry 4.0 technologies. The model aims to establish a sustainable, diversified and globally competitive localized automotive manufacturing ecosystem aligned with Saudi’s Vision 2030 goals. The study reveals that effectively adopting this model can have profound economic, environmental and social sustainability implications for the Kingdom.

Locally producing vehicles leveraging smart solutions results in positive outcomes across multiple dimensions. By stimulating domestic manufacturing, this model creates direct and indirect jobs across production, supply chains and ancillary services. It promotes technology absorption and transfer through joint ventures between local and international firms. Robust local supply chains are developed, linking parts manufacturers, raw material providers, distribution channels, etc., thereby promoting further economic activities. Industry 4.0 technologies like automation, data analytics and AI boost productivity, efficiency and agility to enhance global competitiveness. Mass customization and on-demand production attuned to local market aesthetics and requirements are also enabled. The evidence confirms model adoption has increased revenue and customer satisfaction for large Saudi automakers.

Notable environmental sustainability benefits also arise. Real-time monitoring and predictive optimization driven by AI enhance customization and reduce material and energy consumption on production floors. Deploying advanced robotics augments manufacturing precision, minimizing scrap and defects. Circular economy approaches like product refurbishment, remanufacturing and recycling are promoted by connecting intelligent machines. Localized supply chains shrink the carbon footprint compared to imported vehicles. Opportunities to integrate renewable energy, recover waste heat, etc., in alignment with sustainability goals, are provided.

Significant social sustainability aspects are also covered. The model facilitates extensive skilling, upskilling and the development of human capital for Industry 4.0. Automating strenuous tasks improves occupational safety and ergonomics. Gender barriers are reduced, and diversity/inclusivity in manufacturing is promoted. Job creation and ancillary economic activities stimulate community development and upliftment. Thus, the model encapsulates strategies to advance sustainable development across the economic, environmental and social dimensions in a synergistic fashion.

However, this study indicates a lag in the adoption of the model, especially among small and medium-sized automotive enterprises. Barriers like inadequacies in awareness, human capital, infrastructure and cultural resistance impede a rapid transition. A systematic framework assessing readiness across the strategy, technology, operations, workforce, management and culture dimensions should be developed. Focused interventions can then overcome critical capability gaps through collaborative networks, incentives, education programs, infrastructure integration and change management techniques. A phased roadmap would provide a structured pathway aligning investments with the expected outcomes.

A holistic policy approach is imperative for nationwide implementation across the Saudi automotive industry. The Ministry of Industry and Mineral Resources can coordinate this initiative, integrated into the National Industrial Strategy. Pragmatic supportive policies addressing all the readiness aspects will be key to unlocking widespread adoption. A bold vision backed by a well-planned transition framework is essential to systematically harness the transformative potential of bringing cutting-edge technologies and domestic production together.

This research makes valuable contributions both theoretically and practically. It enriches our scholarly understanding of how regionalized automotive production models can effectively leverage Industry 4.0 solutions to achieve economic, environmental and social sustainability objectives simultaneously. For Saudi policymakers, it provides evidence-based insights into the sustainability benefits of localizing automotive manufacturing using smart technologies. Recommendations for accelerating adoption across small, medium-sized and large firms through a systematic readiness assessment and development framework are also outlined.

There are certain limitations providing avenues for future work. Incorporating multiple case studies could generate more nuanced insights into the implementation challenges. Quantifying sustainability metrics would further reinforce the benefits. Investigating mechanisms to enhance adoption like incentives, partnerships and infrastructure warrants dedicated focus. Therefore, extensive future research across disciplines can enrich the understanding and effective translation of the localized production model to realize Saudi Arabia’s sustainability goals.

In conclusion, this study strongly validates how establishing localized smart manufacturing powered by Industry 4.0 can holistically advance the sustainability of Saudi Arabia’s automotive sector, fulfilling the strategic Vision 2030. It outlines an implementation framework to systematically harness the transformative potential of integrating cutting-edge technologies into domestic production. Thereby, the research provides valuable perspectives both theoretically and practically into how localizing automotive manufacturing using Industry 4.0 solutions can foster economic prosperity, environmental responsibility and social development.

Author Contributions

Abstract, introduction, S.A.M.; methodology, discussion, conclusion, J.A.T.; data collection, analysis, A.A.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding authors.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Khan, M.K.; Khan, M.B. Research, Innovation and Entrepreneurship in Saudi Arabia Vision 2030; Routledge Publishing: London, UK, 2020. [Google Scholar] [CrossRef]

- Jena, M.C.; Mishra, S.K.; Moharana, H.S. Application of Industry 4.0 to enhance sustainable manufacturing. Environ. Prog. Sustain. Energy 2020, 39, 13360. [Google Scholar] [CrossRef]

- Aljuaid, A.A.; Masood, S.A.; Tipu, J.A.K.; Shah, I. Development of a localized production model for the automotive industry, built into the concept of industry 4.0 in the Kingdom of Saudi Arabia. East.-Eur. J. Enterp. Technol. 2023, 124, 101–113. [Google Scholar] [CrossRef]

- Adams, D.Q.; Mpofu, K.M. What has Industry 4.0 got to do with us? A review of the literature. In Proceedings of the International Conference on Industrial Engineering and Operations Management, Pretori, South Africa, 29 October–1 November 2018. [Google Scholar]

- Bhatia, M.S.; Kumar, S. Critical success factors of industry 4.0 in automotive manufacturing industry. IEEE Trans. Eng. Manag. 2020, 69, 2439–2453. [Google Scholar] [CrossRef]

- Fatorachian, H.; Kazemi, H. A critical investigation of Industry 4.0 in manufacturing: Theoretical operationalisation framework. Prod. Plan. Control 2018, 29, 633–644. [Google Scholar] [CrossRef]

- Park, Y.E. The endless challenges of KIA motors for globalization: A case study on Kia in Saudi Arabia. J. Ind. Distrib. Bus. 2018, 9, 45–52. [Google Scholar] [CrossRef]

- Ajel, K. Electric Cars in the Gulf Area an Investment Market and Challenges to Spread. Master’s Thesis, Technische Universität Wien, Wien, Austria, 2023. [Google Scholar]

- Byat, A.B.; Sultan, O. The United Arab Emirates: Fostering a unique innovation ecosystem for a knowledge-based economy. Glob. Innov. Index 2014, 101. Available online: https://www.wipo.int/edocs/pubdocs/en/wipo_pub_gii_2014-chapter6.pdf (accessed on 9 April 2024).

- Ivascu, L. Measuring the implications of sustainable manufacturing in the context of industry 4.0. Processes 2020, 8, 585. [Google Scholar] [CrossRef]

- Ghashghaee, P. Smart Manufacturing: Role of Internet of Things in Process Optimization. Master’s Thesis, Tampere University of Technology, Tampere, Finland, 2016. [Google Scholar]

- Jasiulewicz-Kaczmarek, M.; Legutko, S.; Kluk, P. Maintenance 4.0 technologies—New opportunities for sustainability driven maintenance. Manag. Prod. Eng. Rev. 2020, 11, 74–87. [Google Scholar] [CrossRef]

- Javaid, M.; Haleem, A.; Singh, R.P.; Suman, R.; Rab, S. Role of additive manufacturing applications towards environmental sustainability. Adv. Ind. Eng. Polym. Res. 2021, 4, 312–322. [Google Scholar] [CrossRef]

- Al-Banna, A.; Rana, Z.A.; Yaqot, M.; Menezes, B. Interconnectedness between Supply Chain Resilience, Industry 4.0, and Investment. Logistics 2023, 7, 50. [Google Scholar] [CrossRef]

- Chenoy, D.; Ghosh, S.M.; Shukla, S.K. Skill development for accelerating the manufacturing sector: The role of ‘new-age’skills for ‘Make in India’. Int. J. Train. Res. 2019, 17 (Suppl. S1), 112–130. [Google Scholar] [CrossRef]

- Javaid, M.; Haleem, A.; Singh, R.P.; Khan, S.; Suman, R. Sustainability 4.0 and its applications in the field of manufacturing. Internet Things Cyber-Phys. Syst. 2022, 2, 82–90. [Google Scholar] [CrossRef]

- Marcon, É.; Le Dain, M.A.; Frank, A.G. Designing business models for Industry 4.0 technologies provision: Changes in business dimensions through digital transformation. Technol. Forecast. Soc. Chang. 2022, 185, 122078. [Google Scholar] [CrossRef]

- Ren, S.; Zhang, Y.; Liu, Y.; Sakao, T.; Huisingh, D.; Almeida, C.M. A comprehensive review of big data analytics throughout product lifecycle to support sustainable smart manufacturing: A framework, challenges and future research directions. J. Clean. Prod. 2019, 210, 1343–1365. [Google Scholar] [CrossRef]

- Gamidullaeva, L.; Tolstykh, T.; Bystrov, A.; Radaykin, A.; Shmeleva, N. Cross-sectoral digital platform as a tool for innovation ecosystem development. Sustainability 2021, 13, 11686. [Google Scholar] [CrossRef]

- Kohnová, L.; Papula, J.; Salajová, N. Internal factors supporting business and technological transformation in the context of Industry 4.0. Bus. Theory Pract. 2019, 20, 137–145. [Google Scholar] [CrossRef]

- Koch, V.; Kuge, S.; Geissbauer, R.; Schrauf, S. Industry 4.0: Opportunities and challenges of the industrial internet. Strategy PwC 2014, 5–50. Available online: https://www.pwc.nl/en/assets/documents/pwc-industrie-4-0.pdf (accessed on 9 April 2024).

- Monye, S.I.; Afolalu, S.A.; Lawal, S.L.; Oluwatoyin, O.A.; Adeyemi, A.G.; Ughapu, E.I.; Adegbenjo, A. Impact of Industry (4.O) in Automobile Industry. E3S Web Conf. 2023, 430. [Google Scholar] [CrossRef]

- Cassia, F.; Ferrazzi, M. The Economics of Cars; Agenda Publishing: Newcastle upon Tyne, UK, 2018; pp. 1–119. [Google Scholar]

- Ivanov, D.; Dolgui, A.; Sokolov, B. The impact of digital technology and Industry 4.0 on the ripple effect and supply chain risk analytics. Int. J. Prod. Res. 2019, 57, 829–846. [Google Scholar] [CrossRef]

- Zhou, K.; Liu, T.; Liang, L. From cyber-physical systems to Industry 4.0: Make future manufacturing become possible. Int. J. Manuf. Res. 2016, 11, 167–188. [Google Scholar] [CrossRef]

- Helper, S.; Martins, R.; Seamans, R. Who profits from industry 4.0? Theory and evidence from the automotive industry. In Theory and Evidence from the Automotive Industry; NYU Stern School of Business: New York, NY, USA, 2019. [Google Scholar]

- Schwab, K. The Fourth Industrial Revolution; Crown Business: New York, NY, USA, 2017. [Google Scholar]

- Liao, Y.; Deschamps, F.; Loures, E.D.F.R.; Ramos, L.F.P. Past, present and future of Industry 4.0—A systematic literature review and research agenda proposal. Int. J. Prod. Res. 2017, 55, 3609–3629. [Google Scholar] [CrossRef]

- Gilchrist, A. Industry 4.0: The Industrial Internet of Things; Apress: New York, NY, USA, 2016. [Google Scholar]

- Rojko, A. Industry 4.0 concept: Background and overview. Int. J. Interact. Mob. Technol. 2017, 11, 77–90. [Google Scholar] [CrossRef]

- Hermann, M.; Pentek, T.; Otto, B. Design Principles for Industrie 4.0 Scenarios: A Literature Review; Technische Universität Dortmund: Dortmund, Germany, 2016. [Google Scholar]

- Zhong, R.Y.; Xu, X.; Klotz, E.; Newman, S.T. Intelligent manufacturing in the context of Industry 4.0: A review. Engineering 2017, 3, 616–630. [Google Scholar] [CrossRef]

- Gebler, M.; Uiterkamp, A.J.M.S.; Visser, C. A global sustainability perspective on 3D printing technologies. Energy Policy 2014, 74, 158–167. [Google Scholar] [CrossRef]

- Holmström, J.; Holweg, M.; Khajavi, S.H.; Partanen, J. The direct digital manufacturing (r)evolution: Definition of a research agenda. Oper. Manag. Res. 2016, 9, 1–10. [Google Scholar] [CrossRef]

- Garetti, M.; Taisch, M. Sustainable manufacturing: Trends and research challenges. Prod. Plan. Control 2012, 23, 83–104. [Google Scholar] [CrossRef]

- Kagermann, H.; Wahlster, W.; Helbig, J. Recommendations for Implementing the Strategic Initiative INDUSTRIE 4.0; acatech–National Academy of Science and Engineering: Munich, Germany, 2013. [Google Scholar]

- Srai, J.S.; Kumar, M.; Graham, G.; Phillips, W.; Tooze, J.; Ford, S.; Gregory, M. Distributed manufacturing: Scope, challenges and opportunities. Int. J. Prod. Res. 2016, 54, 6917–6935. [Google Scholar] [CrossRef]

- Bocken, N.M.P.; de Pauw, I.; Bakker, C.; van der Grinten, B. Product design and business model strategies for a circular economy. J. Ind. Prod. Eng. 2016, 33, 308–320. [Google Scholar] [CrossRef]

- Tausif, M.R.; Haque, M.I. Market dynamics and future prospects of the automobile industry in Saudi Arabia. Probl. Perspect. Manag. 2018, 16, 246–258. [Google Scholar]

- Albahussain, S.A.M.A. Human Resource Development: An Investigation into the Nature and Extent of Training and Development in the Saudi Private Manufacturing Sector. Ph.D. Dissertation, University of Bradford, Bradford, UK, 2011. [Google Scholar]

- Kinninmont, J. Vision 2030 and Saudi Arabia’s Social Contract. Austerity and Transformation; Chattham House: London, UK, 2017. [Google Scholar]

- Saudi Arabia’s 160 vehicle plants reshaping the Kingdom’s industry. Arab News. 28 January 2024. Available online: https://www.arabnews.com/node/2283656/%7B%7B (accessed on 9 April 2024).

- Macias-Alonso, I.; Kim, H.; González, A.L. Self-driven Women: Gendered mobility, employment, and the lift of the driving ban in Saudi Arabia. Gend. Place Cult. 2023, 30, 1574–1593. [Google Scholar] [CrossRef]

- Alqublan, L.F. The Adoption of Technologies in The Kingdom of Saudi Arabia’s Sovereign Wealth Fund in Propelling Its Attainment of Vision 2030 Goals (No. 9y86p); Center for Open Science: Charlottesville, VA, USA, 2023. [Google Scholar]

- Gupta, R.; Mejia, C.; Gianchandani, Y.; Kajikawa, Y. Analysis on formation of emerging business ecosystems from deals activities of global electric vehicles hub firms. Energy Policy 2020, 145, 111532. [Google Scholar] [CrossRef]

- Barnes, J.; Morris, M. Staying alive in the global automotive industry: What can developing economies learn from South Africa about linking into global automotive value chains? Eur. J. Dev. Res. 2008, 20, 31–55. [Google Scholar] [CrossRef]

- Bal, H.Ç.; Erkan, Ç. Industry 4.0 and competitiveness. Procedia Comput. Sci. 2019, 158, 625–631. [Google Scholar] [CrossRef]

- Peron, M.; Alfnes, E.; Sgarbossa, F. Best practices of just-in-time 4.0: Multi case study analysis. In Advanced Manufacturing and Automation; Springer: Singapore, 2021. [Google Scholar]

- Aquilani, B.; Piccarozzi, M.; Abbate, T.; Codini, A. The role of open innovation and value co-creation in the challenging transition from industry 4.0 to society 5.0: Toward a theoretical framework. Sustainability 2020, 12, 8943. [Google Scholar] [CrossRef]

- Meng, Y.; Yang, Y.; Chung, H.; Lee, P.H.; Shao, C. Enhancing sustainability and energy efficiency in smart factories: A review. Sustainability 2018, 10, 4779. [Google Scholar] [CrossRef]

- Shrouf, F.; Miragliotta, G. Energy management based on Internet of Things: Practices and framework for adoption in production management. J. Clean. Prod. 2015, 100, 235–246. [Google Scholar] [CrossRef]

- Rane, N. Integrating leading-edge artificial intelligence (AI), internet of things (IOT), and big data technologies for smart and sustainable architecture, engineering and construction (AEC) industry: Challenges and future directions. Engineering and Construction (AEC) Industry: Challenges and Future Directions (September 24, 2023). SSRN Electron. J. 2023. [Google Scholar] [CrossRef]

- Çınar, Z.M.; Abdussalam Nuhu, A.; Zeeshan, Q.; Korhan, O.; Asmael, M.; Safaei, B. Machine learning in predictive maintenance towards sustainable smart manufacturing in industry 4.0. Sustainability 2020, 12, 8211. [Google Scholar] [CrossRef]

- Azamfirei, V. Robotic In-Line Quality Inspection for Changeable Zero Defect Manufacturing; Malardalen University: Västerås, Sweden, 2021. [Google Scholar]

- Nascimento, D.L.M.; Alencastro, V.; Quelhas, O.L.G.; Caiado, R.G.G.; Garza-Reyes, J.A.; Rocha-Lona, L.; Tortorella, G. Exploring Industry 4.0 technologies to enable circular economy practices in a manufacturing context: A business model proposal. J. Manuf. Technol. Manag. 2019, 30, 607–627. [Google Scholar] [CrossRef]

- Camilleri, M.A. A circular economy strategy for sustainable value chains: A European perspective. In Global Challenges to CSR and Sustainable Development: Root Causes and Evidence from Case Studies; Springer: Cham, Switzerland, 2021; pp. 141–161. [Google Scholar]

- Jin, M.; Granda-Marulanda, N.A.; Down, I. The impact of carbon policies on supply chain design and logistics of a major retailer. J. Clean. Prod. 2014, 85, 453–461. [Google Scholar] [CrossRef]

- Remsey, D.N. The Impact of the Renewable Energy Transition on Rentier Structures: A Case Study of Saudi Arabia since the 2014 Oil Price Plunge; Univerzita Karlova: Prague, Czech Republic, 2023. [Google Scholar]

- Ebrahimi, K.; Jones, G.F.; Fleischer, A.S. A review of data center cooling technology, operating conditions and the corresponding low-grade waste heat recovery opportunities. Renew. Sustain. Energy Rev. 2014, 31, 622–638. [Google Scholar] [CrossRef]

- Almulhim, A.I.; Cobbinah, P.B. Framing resilience in Saudi Arabian cities: On climate change and urban policy. Sustain. Cities Soc. 2024, 101, 105172. [Google Scholar] [CrossRef]

- Al-Asfour, A.; Khan, S.A. Workforce localization in the Kingdom of Saudi Arabia: Issues and challenges. Hum. Resour. Dev. Int. 2014, 17, 243–253. [Google Scholar] [CrossRef]

- Buhagiar, S. Exploring Industry 4.0 Technologies & Skills in Maltese Manufacturing. Master’s Thesis, University of Malta, Msida, Malta, 2023. [Google Scholar]

- Marr, B. Tech Trends in Practice: The 25 Technologies That Are Driving the 4th Industrial Revolution; John Wiley & Sons: Hoboken, NJ, USA, 2020. [Google Scholar]

- Realyvásquez-Vargas, A.; Arredondo-Soto, K.C.; García-Alcaraz, J.L.; Márquez-Lobato, B.Y.; Cruz-García, J. Introduction and configuration of a collaborative robot in an assembly task as a means to decrease occupational risks and increase efficiency in a manufacturing company. Robot. Comput.-Integr. Manuf. 2019, 57, 315–328. [Google Scholar] [CrossRef]

- Faber, M.; Bützler, J.; Schlick, C.M. Human-robot cooperation in future production systems: Analysis of requirements for designing an ergonomic work system. Procedia Manuf. 2015, 3, 510–517. [Google Scholar] [CrossRef]

- Shore, L.M.; Cleveland, J.N.; Sanchez, D. Inclusive workplaces: A review and model. Hum. Resour. Manag. Rev. 2018, 28, 176–189. [Google Scholar] [CrossRef]

- Roseland, M. Sustainable community development: Integrating environmental, economic, and social objectives. Prog. Plan. 2000, 54, 73–132. [Google Scholar] [CrossRef]

- Lund-Thomsen, P.; Lindgreen, A.; Vanhamme, J. Industrial clusters and corporate social responsibility in developing countries: What we know, what we do not know, and what we need to know. J. Bus. Ethics 2016, 133, 9–24. [Google Scholar] [CrossRef]

- Baeshen, Y.; Soomro, Y.A.; Bhutto, M.Y. Determinants of green innovation to achieve sustainable business performance: Evidence from SMEs. Front. Psychol. 2021, 12, 767968. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).