The Impact of Digital Trade Barriers on Technological Innovation Efficiency and Sustainable Development

Abstract

:1. Introduction

2. Literature Review

3. Theoretical and Mechanism Analysis

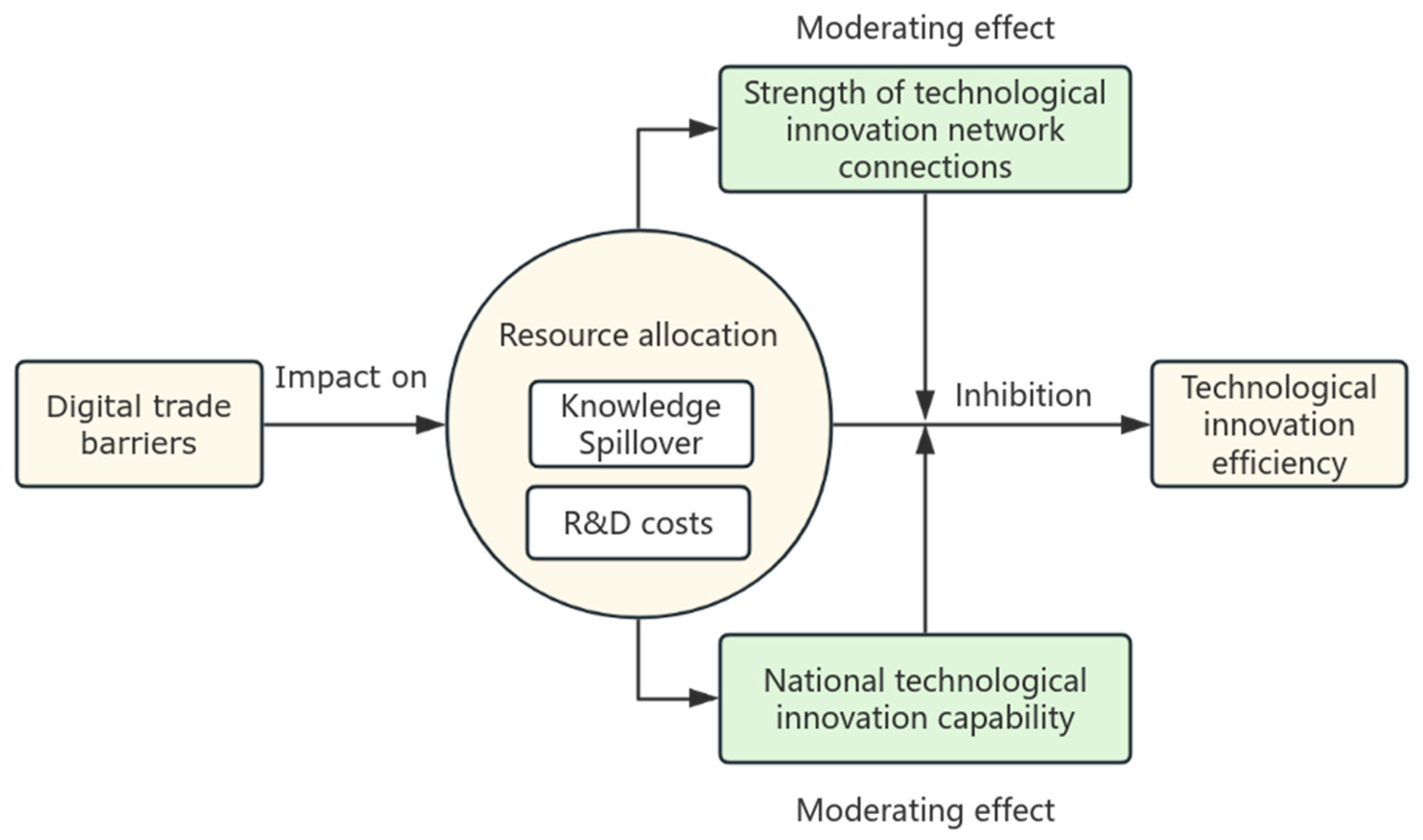

3.1. The Influence of DTB on TIE

3.2. Mechanism Analysis

3.2.1. The Moderating Effect of Technological Innovation Network Connection

3.2.2. The Moderating Effect of Innovation Capacity

4. Research Design and Variable Selection

4.1. Model Settings

4.2. Variable Definition

4.2.1. The Dependent Variable

4.2.2. Explanatory Variables

Digital Trade Barriers (DTBs): Digital Trade Restriction Index (DSTRI)

4.2.3. Control Variables

4.3. Descriptive Statistics

5. Benchmark Regression Analysis

5.1. Benchmark Regression Results

5.2. Robustness Testing

5.2.1. Replacing Core Explanatory Variables

5.2.2. Replace the Dependent Variable

5.2.3. Dealing with Endogeneity Issues

6. Heterogeneity Analysis

7. Mechanism Verification

8. Discussion

9. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variables | (1) IER | (2) IER |

|---|---|---|

| DSTRI | −0.321 *** | −0.313 *** |

| (−2.62) | (−2.97) | |

| lnPop | −1.091 *** | −1.096 *** |

| (−6.17) | (−6.80) | |

| INLK | 0.002 *** | 0.003 *** |

| (4.55) | (5.18) | |

| HT | −0.002 | −0.001 |

| (−1.47) | (−1.45) | |

| lnST | 0.066 ** | 0.075 *** |

| (2.32) | (2.95) | |

| EDU | −0.001 ** | −0.001 ** |

| (−2.08) | (−2.16) | |

| lnINT | −0.002 | −0.003 |

| (−0.21) | (−0.40) | |

| Constant | 17.495 *** | 17.387 *** |

| (5.53) | (6.01) | |

| Observations | 382 | 420 |

| Country FE | Yes | Yes |

| Year FE | Yes | Yes |

| R-squared | 0.597 | 0.628 |

References

- Tong, T.; Iqbal, K.; Rahman, A.A. Core Technological Competence and Competitive Advantage: A Study on Chinese High-Tech SMEs. Front. Psychol. 2022, 13, 959448. [Google Scholar] [CrossRef] [PubMed]

- Mengxuan, T.; Khan, K.; Cifuentes-Faura, J.; Sukumaran, S. Technological innovation and energy efficiency in central Eastern European countries. Util. Policy 2024, 88, 101761. [Google Scholar] [CrossRef]

- Fang, H.; Huo, Q.X. The Innovation Effect of Open Digital Service Trade on Enterprises. Econ. Dyn. 2023, 01, 54–72. [Google Scholar]

- Amila, P.; Hatidza, J. The adoption of inbound open innovation practices in developing countries: Empirical evidence from the manufacturing sector. Eur. J. Innov. Manag. 2022, 25, 774–790. [Google Scholar] [CrossRef]

- Ho, C.; Wang, W.; Yu, J. International knowledge spillover through trade: A time-varying spatial panel data approach. Econ. Lett. 2018, 162, 30–33. [Google Scholar] [CrossRef]

- Grossman, G.M.; Helpman, E. Trade, innovation, and growth. Am. Econ. Rev. 1990, 80, 86–91. [Google Scholar]

- Zhou, R.J. The Impact of Intellectual Property Protection and Import Trade Technology Spillovers on Innovation. Stat. Decis. Mak. 2019, 35, 90–94. [Google Scholar] [CrossRef]

- UNCTAD. Digital Economy Report 2021; UNCTAD: Geneva, Switzerland, 2021. [Google Scholar]

- Azmeh, S.; Foster, C.; Echavarri, J. The International Trade Regime and the Quest for Free Digital Trade. Int. Stud. Rev. 2020, 22, 671–692. [Google Scholar] [CrossRef]

- Haihua, L.; Peng, W.; Zejun, L. Is There Any Difference in the Impact of Digital Transformation on the Quantity and Efficiency of Enterprise Technological Innovation? Taking China’s Agricultural Listed Companies as an Example. Sustainability 2021, 13, 12972. [Google Scholar] [CrossRef]

- Hufbauer, G.C.; Lu, Z.L. The European Union’s Proposed Digital Services Tax: A De Facto Tariff. Peterson Institute for International Economics. 2018, No PB18-15. Available online: https://www.piie.com/publications/policy-briefs/european-unions-proposed-digital-services-tax-de-facto-tariff (accessed on 21 January 2016).

- Meng, X.; Sun, L.; Wang, H. The impact of digital service trade barriers and regulatory policy heterogeneity on digital delivery service trade. Asia Pac. Econ. 2020, 6, 42–52+147. [Google Scholar] [CrossRef]

- Mishrif, A.; Khan, A. Do Free Trade Agreements Facilitate FDI Spillover Effects on Domestic Firms? Empirical Evidence from Oman. Economies 2024, 12, 141. [Google Scholar] [CrossRef]

- Liebman Benjamin, H.; Reynolds Kara, M. Competitive pressure, innovation and trade protection: Evidence from US patent data. World Econ. 2019, 42, 1695–1712. [Google Scholar] [CrossRef]

- Gu, W.; Saaty, T.L.; Wei, L.R. Evaluating and Optimizing Technological Innovation Efficiency of Industrial Enterprises Based on Both Data and Judgments. Int. J. Inf. Technol. Decis. Mak. 2018, 17, 9–43. [Google Scholar] [CrossRef]

- Ge, S.Q.; Wang, X.L. The impact of digital trade rules on the export of digital delivery services: A test based on UNCTAD service trade data. Int. Econ. Trade Explor. 2023, 39, 19–34. [Google Scholar]

- Zhang, G.F.; Jiang, L.D.; Liu, S.S. Does digital trade barriers inhibit the upgrading of export product quality. Financ. Trade Econ. 2022, 43, 144–160. [Google Scholar] [CrossRef]

- Bergstrand, J.H.; Egger, P. A knowledge-and-physical-capital model of international trade flows, foreign direct investment, and multinational enterprises. J. Int. Econ. 2007, 73, 278–308. [Google Scholar] [CrossRef]

- Meltzer, J.P. Maximizing the Opportunities of the Internet for International Trade, ICTSD and World Economic Forum. 2016. Available online: https://ssrn.com/abstract=2841913 (accessed on 21 January 2016).

- Amiti, M.; Konings, J. Trade liberalization, intermediate inputs, and productivity: Evidence from Indonesia. Am. Econ. Rev. 2007, 97, 1611–1638. [Google Scholar] [CrossRef]

- Li, J.C.; Qin, X.T. Tang J, Yang L, Foreign trade and innovation sustainability: Evidence from China. J. Asian Econ. 2022, 81, 101497. [Google Scholar] [CrossRef]

- Wyszkowska-Kuna, J. Internal and External Sources of Knowledge in Manufacturing and Service Enterprises. A Comparative Analysis of European Union Countries. Comparative Economic Research. Cent. East. Eur. 2020, 23, 21–39. [Google Scholar]

- Qiao, C.X. New Changes in International Technology Transfer and Its Implications for China. Theor. J. 2015, 48–54. [Google Scholar]

- Pan, J. International Knowledge Flow, Knowledge-based Service Trade, and Economic Growth: Mechanisms, Models, and Countermeasures. Sci. Manag. Res. 2011, 29, 92–94. [Google Scholar]

- Cory, N. Cross-border Data Flows: Where Are the Barriers, and What Do They Cost? Inf. Technol. Innov. Found. 2017, 1–42. [Google Scholar]

- Gu, Z.H.; Shen, Y. Intellectual Property Protection, Technological Innovation, and Technology Transfer—From the Perspective of Developing Countries. Ind. Econ. Res. 2015, 64–73. [Google Scholar]

- Yu, C.L.; Wang, R.F. Intellectual Property Protection and Technological Innovation in Developing Countries: Is It Just a Linear Relationship. Contemp. Econ. Sci. 2009, 31, 92–100+127. [Google Scholar]

- Sun, B. Countermeasures for Technological Trade Barriers from the Perspective of Technological Innovation. Res. Sci. Manag. 2018, 36, 19–22. [Google Scholar] [CrossRef]

- Nie, H.L. The Impact of Trade Protection on Technological Progress under Open Economic Conditions. Ph.D. Thesis, Jiangxi University of Finance and Economics, Nanchang, China, 2009. [Google Scholar]

- Cheng, Z.M.; Sun, B.Q.; Yu, T. Empirical Study on the Impact of Trade Barriers on Enterprise Innovation. Stat. Decis. Mak. 2023, 39, 179–183. [Google Scholar] [CrossRef]

- Meltzer, J.P. Supporting the Internet as a Platform for International Trade: Opportunities for Small and Medium-Sized Enterprises and Developing Countries. SSRN Electron. J. 2014, 2. [Google Scholar] [CrossRef]

- Yang, Y.B. Can Enhancing Intellectual Property Protection Always Promote Innovation An analysis of the north-south framework incorporating the ‘learning by doing’ effect. World Econ. Res. 2018, 115–131+134. [Google Scholar]

- Li, P.; Tian, S.; Liu, T.H. The impact of trade barriers on China’s technological innovation—also on the role of the government. Int. Trade Issues 2014, 105–114. [Google Scholar]

- Xie, H.Y. Analysis of the Impact of Trade Barriers on China’s Technological Innovation. Foreign Econ. Trade Pract. 2015, 41–44. [Google Scholar]

- Mishra, R.; Singh, K.R.; Rana, P.N. Digital orientation, digital eco-innovation and circular economy in the context of sustainable development goals. Bus. Strategy Environ. 2023, 33, 2752–2770. [Google Scholar] [CrossRef]

- Trischler, M.F.G.; Li-Ying, J. Digital business model innovation: Toward construct clarity and future research directions. Rev. Manag. Sci. 2023, 17, 3–32. [Google Scholar] [CrossRef]

- Su, C.W.; Yue, P.; Hou, X.; Dördüncü, H. Sustainable development through digital innovation: A new era for natural resource extraction and trade. Resour. Policy 2023, 85, 103920. [Google Scholar] [CrossRef]

- Yousaf, Z.; Radulescu, M.; Sinisi, C.I.; Serbanescu, L.; Păunescu, L.M. Towards Sustainable Digital Innovation of SMEs from the Developing Countries in the Context of the Digital Economy and Frugal Environment. Sustainability 2021, 13, 5715. [Google Scholar] [CrossRef]

- Alsharah, H.; Alsaeedi, A. Digitalization Leading the Way for a Sustainable Future. Tech. Vocat. Educ. Train. 2024, 39, 259–270. [Google Scholar] [CrossRef] [PubMed]

- Annarelli, A.; Battistella, C.; Borgianni, Y.; Nonino, F. Estimating the value of servitization: A non-monetary method based on forecasted competitive advantage. J. Clean. Prod. 2018, 200, 74–85. [Google Scholar] [CrossRef]

- Wen, H.W.; Chen, W.J.; Zhou, F.X. Does digital service trade boost technological innovation? International evidence. Socio-Econ. Plan. Sci. 2023, 88, 101647. [Google Scholar] [CrossRef]

- Burri, M. Designing Future-Oriented Multilateral Rules for Digital Trade; Edward Elgar Publishing: Cheltenham, UK, 2015. [Google Scholar] [CrossRef]

- Kong, D.; Lin, C.; Wei, L.; Zhang, J. Information Accessibility and Corporate Innovation, Working article. SSRN 2018. [Google Scholar]

- Meltzer, J.P. Governing Digital Trade. World Trade Rev. 2019, 18, 1–26. [Google Scholar] [CrossRef]

- Akcigit, U.; Caicedo, S.; Miguelez, E.; Stantcheva, S.; Sterzi, V. Dancing with the Stars: Innovation Through Interactions, Working article. NBER 2018, 24466. [Google Scholar]

- Shen, G.B.; Yuan, Z.Y. The Impact of Enterprise Internetization on Chinese Enterprise Innovation and Export. Econ. Res. 2020, 55, 33–48. [Google Scholar]

- Binz, C.; Truffer, B. Global Innovation Systems—A conceptual framework for innovation dynamics in transnational contexts. Res. Policy 2017, 46, 1284–1298. [Google Scholar] [CrossRef]

- De-Prato, G.; Nepelski, D. Global technological collaboration network: Network analysis of international co-inventions. J. Technol. Transf. 2014, 39, 358–375. [Google Scholar] [CrossRef]

- Bruno, R.L.; Crescenzi, R.; Estrin, S. Multinationals, innovation, and institutional context: IPR protection and distance effects. J Int Bus Stud 2022, 53, 1945–1970. [Google Scholar] [CrossRef]

- Dai, X.; Wu, J.; Yan, L. A Spatial Evolutionary Study of Technological Innovation Talents’ Sticky Wages and Technological Innovation Efficiency Based on the Perspective of Sustainable Development. Sustainability 2018, 10, 4201. [Google Scholar] [CrossRef]

- IDB, ICTSD. Digital Trade-Related Provisions in Regional Trade Agreements: Existing Models and Lessons for the Multilateral Trade System; IDB, ICTSD: Geneva, Switzerland, 2017. [Google Scholar]

- Peng, Y.; Yang, B.Z. The Third Country Trade Effect of Digital Trade Rules in Regional Trade Agreements: Transfer or Spillover. Int. Trade Issues 2023, 36–54. [Google Scholar]

- Organisation for Economic Co-operation and Development Database. Digital Services Trade Restrictiveness Index; Organisation for Economic Co-Operation and Development Database: Paris, France, 2020. [Google Scholar]

- European Centre for International Political Economy. Digital Trade Restrictiveness Index; European Centre for International Political Economy: Brussels, Belgium, 2017. [Google Scholar]

- Congressional Research Service. Digital Trade and U.S. Trade Policy; Congressional Research Service: Washington, DC, USA, 2017. [Google Scholar]

- Hahn, J.; Liao, Z.; Liu, N.; Sheng, S. Some finite-sample results on the Hausman test. Econ. Lett. 2024, 238, 111721. [Google Scholar] [CrossRef]

- Zhao, M. Conducting R&D in countries with weak intellectual property rights protection. Manag. Sci. 2006, 52, 1185–1199. [Google Scholar]

- Gao, Q. The Impact of Intellectual Property Barriers on Export Innovation Based on PSM-DID Method. Xinjiang Soc. Sci. 2019, 41–48. [Google Scholar]

- Khouilla, H.; Bastidon, C. Does increased intellectual property rights protection foster innovation in developing countries? A literature review of innovation and catch-up. J. Int. Dev. 2023, 36, 1170–1188. [Google Scholar] [CrossRef]

- Yu, D.H.; Wang, B.H. The Research on the Endogenous of the Technology Innovation Productivity and the Stochastic Change Effect: The Differential Affection of the Knowledge Capital and Human Resource Investment. South China J. Econ. 2020, 39, 76–94. [Google Scholar]

- Stock, J.H.; Yogo, M. Testing for weak instruments in linear IV regression. In Identification and Inference for Econometric Models: Essays in Honor of Thomas Rothenberg; Chapter 5; Cambridge University Press: Cambridge, UK, 2005; pp. 80–108. [Google Scholar]

- Richard, M. GMM Analyses of the Effects of Digital Services Trade on Economic Growth of Low, Middle and High Income Countries. Asian J. Econ. Bus. Account. 2022, 22, 1–22. [Google Scholar] [CrossRef]

| Variable Category | Variable Name | Abbreviation | Observation | Mean | Median | Std. Deviation | Min | Max | Data Source |

|---|---|---|---|---|---|---|---|---|---|

| Dependent variable | Technological innovation efficiency | IER | 420 | 0.684 | 0.695 | 0.136 | 0.260 | 1.018 | WIPO |

| Explanatory variable | Digital trade barriers | DSTRI | 420 | 0.169 | 0.144 | 0.100 | 0 | 0.647 | OECD |

| Control variable | Population Size | lnPOP | 420 | 16.84 | 16.71 | 1.417 | 13.23 | 21.06 | World Bank |

| Strength of technological innovation network connections | INLK | 420 | 35.89 | 35.50 | 13.31 | 3.200 | 82.50 | WIPO | |

| High-Tech Export Dependence | HT | 420 | 15.38 | 12.36 | 12.67 | 0.257 | 67.05 | World Bank | |

| Service Trade Openness | lnST | 420 | 24.59 | 24.82 | 1.671 | 20.76 | 28.03 | World Bank | |

| Education Index | EDU | 420 | 48.78 | 51.60 | 12.94 | 10.70 | 86.30 | WIPO | |

| Internet Development Level | lnINT | 420 | 7.265 | 7.918 | 2.883 | 0.109 | 12.53 | World Bank |

| Variables | (1) IER | (2) IER | (3) IER | (4) IER | (5) IER | (6) IER |

|---|---|---|---|---|---|---|

| DSTRI | −0.214 *** | −0.196 *** | −0.212 *** | −0.210 *** | −0.210 *** | −0.208 *** |

| (−2.74) | (−2.61) | (−2.81) | (−2.81) | (−2.82) | (−2.78) | |

| lnPOP | −1.214 *** | −1.126 *** | −1.112 *** | −1.032 *** | −1.034 *** | −1.046 *** |

| (−8.10) | (−7.74) | (−7.66) | (−7.08) | (−7.13) | (−6.52) | |

| INLK | 0.003 *** | 0.003 *** | 0.002 *** | 0.003 *** | 0.003 *** | |

| (5.27) | (5.25) | (4.94) | (5.18) | (5.17) | ||

| HT | −0.002 * | −0.002 ** | −0.002 * | −0.002 * | ||

| (−1.86) | (−1.97) | (−1.77) | (−1.73) | |||

| lnST | 0.077 *** | 0.070 *** | 0.070 *** | |||

| (3.04) | (2.78) | (2.77) | ||||

| EDU | −0.001 ** | −0.001** | ||||

| (−2.22) | (−2.22) | |||||

| lnINT | −0.001 | |||||

| (−0.17) | ||||||

| Constant | 21.194 *** | 19.626 *** | 19.413 *** | 16.193 *** | 16.444 *** | 16.644 *** |

| (8.41) | (8.02) | (7.95) | (6.14) | (6.27) | (5.77) | |

| Observations | 420 | 420 | 420 | 420 | 420 | 420 |

| Country FE | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES |

| R-squared | 0.576 | 0.607 | 0.611 | 0.621 | 0.626 | 0.626 |

| Variables | (1) IER | (2) IER | (3) IER | (4) IER | (5) IER |

|---|---|---|---|---|---|

| Infrastructure and Connectivity | −0.240 *** | ||||

| (−2.72) | |||||

| Electronic Transactions | 1.189 *** | ||||

| (2.88) | |||||

| Intellectual Property Rights | 0.431 | ||||

| (0.23) | |||||

| Payment System | −0.896 | ||||

| (−1.51) | |||||

| Other Barriers | −1.390 *** | ||||

| (−3.47) | |||||

| lnPop | −1.016 *** | −0.936 *** | −1.045 *** | −1.021 *** | −0.902 *** |

| (−6.32) | (−5.69) | (−6.43) | (−6.29) | (−5.48) | |

| INLK | 0.003 *** | 0.003 *** | 0.003 *** | 0.003 *** | 0.003 *** |

| (5.16) | (5.17) | (5.26) | (5.13) | (5.19) | |

| HT | −0.002 * | −0.001 | −0.001 | −0.001 | −0.001 |

| (−1.86) | (−1.32) | (−1.39) | (−1.15) | (−1.04) | |

| lnST | 0.067 *** | 0.065 ** | 0.071 *** | 0.069 *** | 0.075 *** |

| (2.64) | (2.55) | (2.74) | (2.70) | (2.96) | |

| EDU | −0.001 ** | −0.002 *** | −0.001 ** | −0.001 ** | −0.001 ** |

| (−2.24) | (−2.60) | (−2.20) | (−2.21) | (−2.25) | |

| lnINT | −0.001 | −0.003 | −0.004 | −0.004 | 0.001 |

| (−0.13) | (−0.34) | (−0.48) | (−0.59) | (0.11) | |

| Constant | 16.220 *** | 14.881 *** | 16.608 *** | 16.246 *** | 14.087 *** |

| (5.62) | (5.06) | (5.68) | (5.58) | (4.77) | |

| Observations | 420 | 420 | 420 | 420 | 420 |

| Country FE | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES |

| R-squared | 0.626 | 0.627 | 0.618 | 0.621 | 0.631 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| K&T Outputs | K&T Outputs | R&D Index | R&D Index | R&D Index | |

| DSTRI | −9.145 ** | −14.247 *** | 8.442 * | 14.782 ** | 15.412 ** |

| (−2.14) | (−2.70) | (1.76) | (2.24) | (2.26) | |

| Control variable | YES | YES | YES | YES | YES |

| Observations | 420 | 420 | 420 | 420 | 399 |

| Country FE | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES |

| R-squared | 0.326 | 0.368 | 0.069 | 0.079 | 0.086 |

| Variables | (1) | (2) |

|---|---|---|

| DSTRI | IER | |

| DSTRI | −0.414 *** | |

| (−6.91) | ||

| L.DSTRI | 1.010 *** | |

| (56.67) | ||

| Kleibergen–Paap rk LM | 324.895 *** | |

| [0.00] | ||

| Kleibergen–Paap rk Wald F | 3211.459 *** | |

| {16.38} | ||

| Control variable | YES | YES |

| Observations | 360 | 360 |

| Country FE | YES | YES |

| Year FE | YES | YES |

| R-squared | 0.930 | 0.535 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Weak | Strong | OECD Member | Not OECD Member | |

| DSTRI | −0.238 ** | −0.137 | −0.221 * | −0.379 ** |

| (−2.10) | (−0.59) | (−1.79) | (−2.15) | |

| Control variable | YES | YES | YES | YES |

| Observations | 266 | 154 | 252 | 168 |

| Country FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| R-squared | 0.714 | 0.310 | 0.478 | 0.704 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Developed | Developing | High | Upper-Middle | Lower-Middle | Low | |

| DSTRI | −0.273 ** | −0.347 * | −0.273 ** | −0.263 | −0.963 *** | 0.225 |

| (−2.19) | (−1.92) | (−2.19) | (−1.45) | (−3.12) | (0.17) | |

| Control variable | YES | YES | YES | YES | YES | YES |

| Observations | 245 | 175 | 245 | 84 | 70 | 21 |

| Country FE | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES |

| R-squared | 0.477 | 0.707 | 0.477 | 0.871 | 0.772 | 0.900 |

| Variables | (1) IER | (2) IER |

|---|---|---|

| DSTRI | −0.774 *** | −0.719 *** |

| (−5.09) | (−3.85) | |

| DSTRI*INLK | 0.015 *** | |

| (3.90) | ||

| DSTRI*GII | 0.016 *** | |

| (3.10) | ||

| GII | 0.015 *** | 0.014 *** |

| (15.54) | (14.85) | |

| Control variable | YES | YES |

| Observations | 420 | 420 |

| Country FE | YES | YES |

| Year FE | YES | YES |

| R-squared | 0.595 | 0.815 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yan, M.; Liu, H. The Impact of Digital Trade Barriers on Technological Innovation Efficiency and Sustainable Development. Sustainability 2024, 16, 5169. https://doi.org/10.3390/su16125169

Yan M, Liu H. The Impact of Digital Trade Barriers on Technological Innovation Efficiency and Sustainable Development. Sustainability. 2024; 16(12):5169. https://doi.org/10.3390/su16125169

Chicago/Turabian StyleYan, Modan, and Haiyun Liu. 2024. "The Impact of Digital Trade Barriers on Technological Innovation Efficiency and Sustainable Development" Sustainability 16, no. 12: 5169. https://doi.org/10.3390/su16125169