Abstract

Green finance, innovation, and resource efficiency have gained significant traction recently, particularly in resource-rich countries. This study investigates the role of green finance and innovation in resource efficiency with the mediating lens of environmental regulations and market rules. The study employs a structural equation model on a panel of 15 resource-rich countries from 1995 to 2023. The findings illustrate a complicated interplay between the variables. First, the findings show that green financing positively and negatively affects resource efficiency. In contrast, green innovation constantly improves resource efficiency. Market rules have a favorable impact on resource efficiency. Environmental laws, however, hurt resource efficiency. Furthermore, the study reveals that green financing favors market regulations, implying that financial expenditures in green initiatives might strengthen regulatory frameworks that promote market efficiency. In contrast, green finance harms environmental rules, and green innovation harms both market and environmental regulations. In addition, we divided the sample into developed and developing nations and offered a sub-group analysis to take into consideration the variations in the degree of national development and green advances to further improve the analysis. Overall, the study emphasizes the multifaceted role of green finance and innovation in increasing resource efficiency within regulatory frameworks. These findings are critical for policymakers and stakeholders in resource-rich countries seeking to reconcile economic growth with sustainable development.

1. Introduction

The 21st century has witnessed an unprecedented emphasis on sustainability and environmental stewardship, driven by the escalating challenges of climate change, resource depletion, and ecological degradation. In this regard, natural resource conservation is crucial for deciding the sustainable growth path, clean energy prospects, and environmental sustainability. However, significant developments in the green transition of the economies have led to a major shift in natural resource demand. Green initiatives, while enforcing environmental sustenance, can also drive up the demand for natural resources, especially with the shift towards renewable energy sources. This demand hike poses risks of resource depletion and environmental hazards. Therefore, assessing the environmental impacts of green strategies alongside the benefits of renewable energy is vital. Green economies advocate for economic and environmental sustainability by promoting investments in renewable energy and eco-friendly technologies and advocating for sustainable production and consumption practices, including the responsible use of natural resources.

In response to resource limitations and environmental pollution, green finance (GF) and green innovation (GI) have gained significant traction worldwide. Numerous studies have emphasized these green schemes as a crucial indicator for advancing sustainability [1]. For instance, several nations have put forth programs for green development to encourage resource efficiency (RE) and environmental conservation. The need to prioritize environmental protection has led to the globalization of the green development movement. In this vein, GI and GF play a significant role in sustainable development by reducing a nation’s reliance on natural resources [2].

Prior research on natural resources has focused on CO2 emissions as a primary sustainability indicator. Natural resource extraction, however, has diverse environmental effects, and the industries interlinked with natural resources do not simply depress environmental well-being through atmospheric environmental hazards [3,4]. In this regard, RE has become a critical objective for policymakers and businesses globally [5]. It is particularly crucial for resource-rich countries facing the dual challenge of exploiting their natural wealth while preserving environmental integrity. In this context, the interplay between GF, GI, and RE warrants comprehensive examination.

Despite the growing interest in climate resilience, there is limited empirical evidence on the role of GF and GI in improving resource efficiency, particularly in resource-rich countries. These countries often grapple with the paradox of resource wealth and environmental vulnerability. Understanding how sustainable financial and innovative practices can mitigate adverse environmental effects and enhance RE is essential. Studies illustrate the significant impact of GF on the extraction and utilization of natural resources [6]. In resource-rich countries, extensive resource abstraction can lead to various adverse outcomes, including unstable economic cycles, corruption, mismanagement and social disparity [4]. This is where the role of regulatory authorities and governance becomes indispensable.

However, the role of regulatory framework, both environmental and market-based, in mediating these relationships still needs to be explored. An efficient regulatory strategy improves environmental quality and sustainability by reducing carbon emissions and other pollutants. Nevertheless, credit market rules are a widely accepted notion that helps to improve environmental quality [7,8]. Market laws can make financial transactions more efficient and transparent, reduce corruption, and ensure long-term natural resource earnings management. In contrast, inefficient market regulations encourage corruption and rent-seeking in the mining industry [9]. Therefore, these tactics encourage unethical foreign investment, as proponents of laws shift the blame for environmentally destructive activities to nations with tax rules [9,10].

Likewise, the environmental regulations set out in dealing with natural resource rents intend to balance resource misuse and conservation [11]. Environmental policies establish norms, laws, and incentives that encourage ethical resource extraction techniques, thus improving resource efficiency [11]. The policy frequently incorporates measures such as taxes, royalties, and authorizations to ensure the long-term sustainability of natural resources. Therefore, restrictions on extraction fees and pollution levels support the preservation of extinct natural resource habitats and the prediction of irreversible environmental harm [12,13]. Furthermore, environmental regulations are essential in reducing market failures [14]. The misuse of natural resources can result in negative externalities such as air and water pollution, habitat degradation, and climate change [15]. In the absence of appropriate policies, these harmful externalities can go untreated. Environmental regulations address the external costs of resource extraction by imposing taxes or levies on polluters or developing cap-and-trade systems [2]. In a broader sense, environmental regulations may encourage the transition to a circular economy, where the emphasis switches from linear resource consumption to reprocessing and reuse [16]. This evolution lessens the demand for natural resource rent and improves resource efficiency.

However, GI and GF can increase natural resource conservation in resource-rich countries, but their effects have yet to be explored. This discourse studies market regulations and environmental tax as mediating factors in the relationship between GI and GF as effectors of natural resource efficiency. Using structural equation modeling, this study analyzes connections among the variables on a panel of 15 resource-rich countries from 1995 to 2023. It is possible to understand better the underlying dynamics of phenomena using SEM, which provides a visual representation. GI and natural resources are associated. GI enhances sustainable natural resource extraction and utilization in the long run. RE is also positively impacted by GF. Natural resources can be optimized with GF by providing better access to capital, improved trading, and greater transparency. Sustainable practices can also reduce resource extraction and utilization by fostering GF and GI. The findings illustrate a complicated interplay between the variables. First, the findings show that green financing positively and negatively affects resource efficiency. In contrast, green innovation constantly improves resource efficiency. Market rules have a favorable impact on resource efficiency. Environmental rules, however, hurt resource efficiency.

Furthermore, the study reveals that green financing favors market regulations, implying that financial expenditures in green initiatives might strengthen regulatory frameworks that promote market efficiency. In contrast, green finance hurts environmental rules. Overall, the study emphasizes the multifaceted role of green finance and innovation in increasing resource efficiency within regulatory frameworks. These findings are critical for policymakers and stakeholders in resource-rich countries seeking to reconcile economic growth with sustainable development. Resource-abundant countries can promote the exploitation of natural resources by pushing for sustainable methods, reducing environmental impacts, and efficiently allocating resources. Resource-rich countries are confronted with the “resource curse” and environmental damage. To reduce risks and ensure long-term sustainability, those countries should diversify their economies and adopt more sustainable practices. Resource-rich countries can use green development to boost economic resilience and environmental performance by implementing regulations and promoting international cooperation. Green finance, innovation, and resource efficiency have been studied, but only some have examined market and environmental policies as mediators in resource-rich countries. This literature gap highlights the need for more investigation. Looking at how those policies affect the impact of green financing and innovation on usable resource performance, this study aims to enhance sustainable improvement strategies in resource-rich situations.

The primary policies encompass enforcing enduring market regulations and environmental rules, allocating financial resources for investment in sustainable energy sources, and preserving biodiversity. These policies promote environmental preservation, more environmentally friendly technology, and sustainable development, which helps conserve natural resources. Furthermore, a robust regulatory system is crucial in safeguarding natural resources from inconsistencies and reducing resource exploitation by preventing disruptive outcomes.

The rest of this paper is structured as follows. The Section 2 delves deeply into the existing literature. The Section 3 includes a comprehensive discussion of the technique used and the specific structure of the data in the research. The Section 4 part offers the estimated findings and their implications, while the Section 5 summarizes the entire debate, including any limitations and recommendations.

2. Literature Review and Theoretical Framework

The convergence of green finance, innovation, and resource efficiency has sparked widespread academic and policy interest, particularly in resource-rich countries. This section critically examines the existing literature on these topics, focusing on the direct and indirect effects of green finance and green innovation on resource efficiency, with environmental and market regulations acting as intermediaries.

Natural resources management involves implementing sustainable strategies to minimize the inimical impact of climatic changes. This can be achieved by focusing on resource conservation programs and collaboration approaches at specific levels [17,18,19]. The preservation of environmental resilience and resource conservation programs has had a significant impact on sustainable development, hence increasing environmentally sustainable activities [20,21,22].

There is a limited period during which it is possible to take action to decrease the likelihood of harm or damage in the future. The core of climate-resilient development is the dynamic interplay between development trends, green transition, and natural resource efficiency [18,19]. Much economic research continues to see resource efficiency as a collection of independent activities to be evaluated individually. This frequently involves a relatively advanced analysis of resource–climatic scenarios and uncertainties, but necessitates more discourse on broader developments at the macro level, such as industry and agriculture [21,23].

Mikhno et al. [24] investigated the potential synergy between green finance and resource efficiency in the BRICS region from 1990 to 2020, aiming to achieve sustainable environmental objectives. They considered innovation, economic growth, and natural resource rents essential indicators in the study. The BRICS economies indicate that green finance contributes to the upgrading of natural resources’ sustainability, as seen by the findings. However, resource rents and economic expansion both contribute to the degradation of the environment. Furthermore, a demonstrated causal relationship exists between finance, natural resources and environmental concerns. A unidirectional causal relationship between the environment and growth has been established. The empirical evidence indicates that BRICS countries must accelerate the progress of creating environmentally friendly financial products and enhance the volume of banks and financial institutions to provide green loans. Additional funding should be dedicated to research on mitigating the risks associated with green finance solutions. In order to improve resource efficiency, governments must promote GF, as it has a substantial impact on all aspects.

Finance and technology play a crucial role in advancing the environmentally friendly economy, as does the impact of green finance and green technology on the sustained expansion of the economic sector. Agrawal et al. [12] utilized data collected from Indian states from 2010 to 2021. This study employed the panel regression technique to examine the correlation between green finance and economic growth, utilizing a two-step generalized method of moments (GMM) approach. Multiple elements contribute to the attainment of high-quality economic growth, such as the optimization of financial efficiency, the establishment of a sound financial structure, and the safeguarding of environmental quality through initiatives such as green finance. The paper suggests establishing a comprehensive environmental disclosure framework for state governments to ensure the effectiveness of green finance.

Additionally, it proposes the development of a long-term satisfactory protocol to promote green finance beyond the public sector through external involvement. Hussain et al. [19] ascertained the influence of resource usage on the ecosystem, aligning with the growth-conservation paradigm. There is a favorable correlation between the production and utilization of renewable energy and resource efficiency. Although individual analyses for each country yielded different outcomes, the overall sample selection demonstrates the relation between the long-term and short-term effects. This guides the utilization and consumption of renewable energy. Renewable energy can bolster economic expansion with better resource allocation in developing countries. Moreover, the usage of clean energy has the potential to conserve natural resources and protect the environment.

In this regard, studies examine the effects of green financing on technological innovation and the environment. Green finance fosters the adoption of environmentally friendly manufacturing methods and the development of a greener industrial structure in enterprises [5,25,26]. The relationship between green finance and green innovation has been examined through several approaches. Green finance facilitates technological innovation by providing financial resources [19]. The empirical findings have established causal connections between green finance and sustainable development, which is essential in establishing a complete green financial system and advancing sustainable development. We utilized panel structural equation modeling and conducted a robustness test, which revealed a reciprocal causal link between the variables. This study makes multiple marginal contributions. Recent research has focused chiefly on the influential aspects and significance of the expansion of green finance and eco-efficiency advancement [21,22]. There is a need for an increased focus on natural resource conservation, green finance, and green innovation.

In addition, green innovation refers to developing products or industrial processes specifically geared towards tackling environmental issues that arise during production [3]. Zhang et al. [25] asserted that innovation methods encompass technical, administrative, and regulatory advancements that contribute to conserving the surrounding environment. In the same way, Ambec et al. [27] demonstrated a correlation between innovation and environmentally friendly products and production methods. This includes technology advancements for pollution prevention, energy saving, and waste recycling. Albrizio et al. [28] elucidated that techniques, methodologies, strategies, and products were developed to prevent or reduce environmental harm. Likewise, according to Polzin [5], innovation refers to firms adopting new technology, products, services, organizational structures, or management techniques to achieve sustainable development. Moreover, the researcher claims that green innovation involves technology, green finance, HDI, and financial development, which help minimize the negative environmental impacts and improve resource efficiency. The goal is to ensure long-term climate resilience and optimized resources for present and future generations [29,30,31].

Another body of literature on resource efficiency often points towards several aspects as impediments to progress in resource-rich countries. These factors emphasize corrupt practices, a lack of accountability and transparency, bad governance, and weak institutions [15,32]. They argue that corruption hampers transparency and accountability, contributing to resource inefficiencies. The study suggests that implementing institutions, ethics, and laws could help improve resource efficiency by curbing corruption. Similarly, Wang et al. [6] emphasized the role of regulations in natural resource depletion and its economic and social aspects. The study visualizes the theoretical bounding between regulations, resource conservation, and their socio-economic outcomes. The research implies that regulations play a significant role in the effective and sustainable management of natural resources, but are detrimental to market efficiency.

This analysis emphasizes the relevance of green financing and innovation in increasing resource efficiency, particularly in resource-rich countries. Environmental and market laws emerge as critical intermediaries in transforming green finance and innovation into practical resource efficiency gains. This analysis emphasizes the importance of comprehensive policy frameworks incorporating financial, technological, and regulatory components to support sustainable development.

Previous studies have shed light on the relationship between inexperienced finance, creativity, and aid performance, but small sample numbers and a narrow focus on case research have limited them. This study addresses those issues with a large-scale quantitative data analysis from multiple countries. We examine the mediating role of market and environmental laws to provide a more complete and nuanced understanding of sustainable development in resource-rich regions.

We mix monetary, institutional, and behavioral ideas to strengthen our study’s theory. Environmental regulations boost innovation and competitiveness. Institutional ideas show how governance institutions and policies affect green finance and innovation. Behavioral economics reveals cognitive biases and social norms that influence sustainability selection. By merging those theoretical views, we want to provide a more thorough and nuanced understanding of green finance, innovation, and resource performance. The study’s theoretical foundation is based on the company’s resource-based view (RBV), which holds that organizations can attain long-term competitive advantages by strategically managing their resources and capabilities. This perspective is expanded to include the principles of sustainable development, emphasizing the role of environmental and regulatory issues in affecting organizational strategies and outcomes. The study also draws on Institutional Theory, which emphasizes the significance of regulatory and normative influences in shaping organizational behavior. By combining these theoretical views, the study hopes to provide a comprehensive understanding of how green finance and green innovation promote resource efficiency in the face of environmental and market regulations.

2.1. Green Finance and Resource Efficiency

Green financing is a financial investment that assists with environmental sustainability projects and efforts. The literature emphasizes the beneficial effects of green financing on resource efficiency. Green finance methods, such as green bonds and loans, encourage enterprises to adopt sustainable practices, increasing resource efficiency. Furthermore, Ziolo et al. [1] discovered that nations with well-developed green finance markets had higher resource efficiency, driven by investments in energy-efficient technologies and renewable energy initiatives.

Hypothesis 1.

Green financing improves resource efficiency in resource-rich countries.

2.2. Green Innovation and Resource Efficiency

Green innovation, which includes creating and implementing environmentally friendly technologies and processes, is vital to increasing resource efficiency. Horbach et al. [31] found that green innovation considerably reduces resource consumption and waste output across several industrial sectors. Furthermore, Costantini et al. [29] underline that green innovation creates new, resource-efficient materials and processes, enabling long-term industrial growth. Rennings and Rammer [33] found that green innovation improves environmental performance and economic efficiency by optimizing resource consumption.

Hypothesis 2.

Green innovation effects resource efficiency in resource-rich countries.

2.3. Mediating Role of Environmental Regulations

Environmental rules are policies aimed at reducing environmental damage and encouraging sustainable behaviors. Several studies have examined how environmental rules influence the relationship between green financing, innovation, and resource efficiency. In Porter and van der Linde’s study [20], the “Porter Hypothesis” holds that strict environmental restrictions can boost innovation and resource efficiency. Similarly, Albrizio et al. [28] discovered that environmental rules encourage enterprises to engage in green technology, increasing resource efficiency. Furthermore, Ambec et al. [27] argued that well-designed environmental rules can bridge the gap between green finance and resource efficiency by fostering sustainable investment.

Hypothesis 3.

Environmental regulations mediate the relationship between green innovation and resource efficiency.

2.4. Mediating Role of Market Regulations

Market laws, such as policies that encourage competition and openness, are critical in supporting resource efficiency. According to Aghion et al. [34], market regulations promoting competition might motivate businesses to adopt innovative methods, such as improving resource efficiency. Furthermore, Johnstone et al. [26] found that market policies that encourage the establishment of green financial markets can improve the effectiveness of green finance in promoting resource efficiency. Hojnik and Ruzzier [35] support these findings, arguing that market laws that improve access to capital and market transparency can considerably raise green innovation and resource efficiency.

Hypothesis 4.

Market regulation mediates the relationship between green innovation and resource efficiency.

3. Data and Methodology

In order to examine the effects of green finance and innovation on resource efficiency in resource-rich nations, this study uses a quantitative research methodology. Panel data analysis is used in the study to look at how these factors relate to one another across time. The study focuses on resource-rich countries, distinguished by considerable natural resource endowments such as oil, gas, minerals, and forests. The study period ranges from 1995 to 2023, allowing for capturing both long-term trends and recent advancements in green finance, innovation, and regulatory frameworks. The availability of the necessary data set affects the selection of the period. This area of research is very influential globally in politics, economics, society, and the environment. The countries included in this study are Angola, Australia, Brazil, Canada, Chile, China, Congo, Guinea, Indonesia, Nigeria, Peru, Saudi Arabia, South Africa, the United States, and Venezuela.

The analysis focuses on the impact of resource wealth on countries’ ability to innovate in a green economy. Despite their differences, the common ground of being resource-rich allows for a comprehensive examination of whether resource availability incentivizes or discourages green innovation in different economic contexts. This understanding could lead to policy insights for both developed and developing nations.

Further, policy learning and knowledge transfer are key benefits of pooling countries with different realities. Pooling countries also allows for potential knowledge transfer, allowing less advanced countries to learn from leading green technology practices and adapt them to suit their needs. Moreover, the global push towards sustainability and green innovation is a challenge faced by all countries, regardless of their development stage. This study can provide insights into how different policy environments contribute to or hinder green growth. Addressing climate change and resource efficiency is a global challenge, and all countries must engage with it, highlighting the different approaches and obstacles faced by different regions and development stages.

However, to further strengthen the analysis, we have stratified the sample into developed and developing countries and provided a sub-group analysis to account for the differences in the level of country development and green innovations. The first group includes Australia, Canada, Chile, China, Saudi Arabia, and the United States, which are considered more developed due to their strong global economic presence. The second group includes middle-income and developing economies, including Angola, Brazil, Congo, Dem. Rep., Equatorial Guinea, Indonesia, Nigeria, Peru, South Africa, and Venezuela, which face economic development issues and infrastructure challenges.

Nevertheless, we consider structural equation modeling (SEM) to be highly suitable for our research since it can effectively examine the connections among green financing, green innovation, resource efficiency, and the intermediary functions of environmental and market laws. Some examples of first-generation multivariate data analysis techniques are multiple regression, logistic regression, and variance analysis. Scientists employ these methodologies to examine theories on the interconnections among multiple pertinent elements. Researchers from diverse fields have employed these approaches, and the outcomes have profoundly transformed our perception of the world. Although panel data approaches have their advantages, the flexibility of SEM in dealing with intricate theoretical frameworks and its ability to handle latent variables make it an appealing option for our investigation.

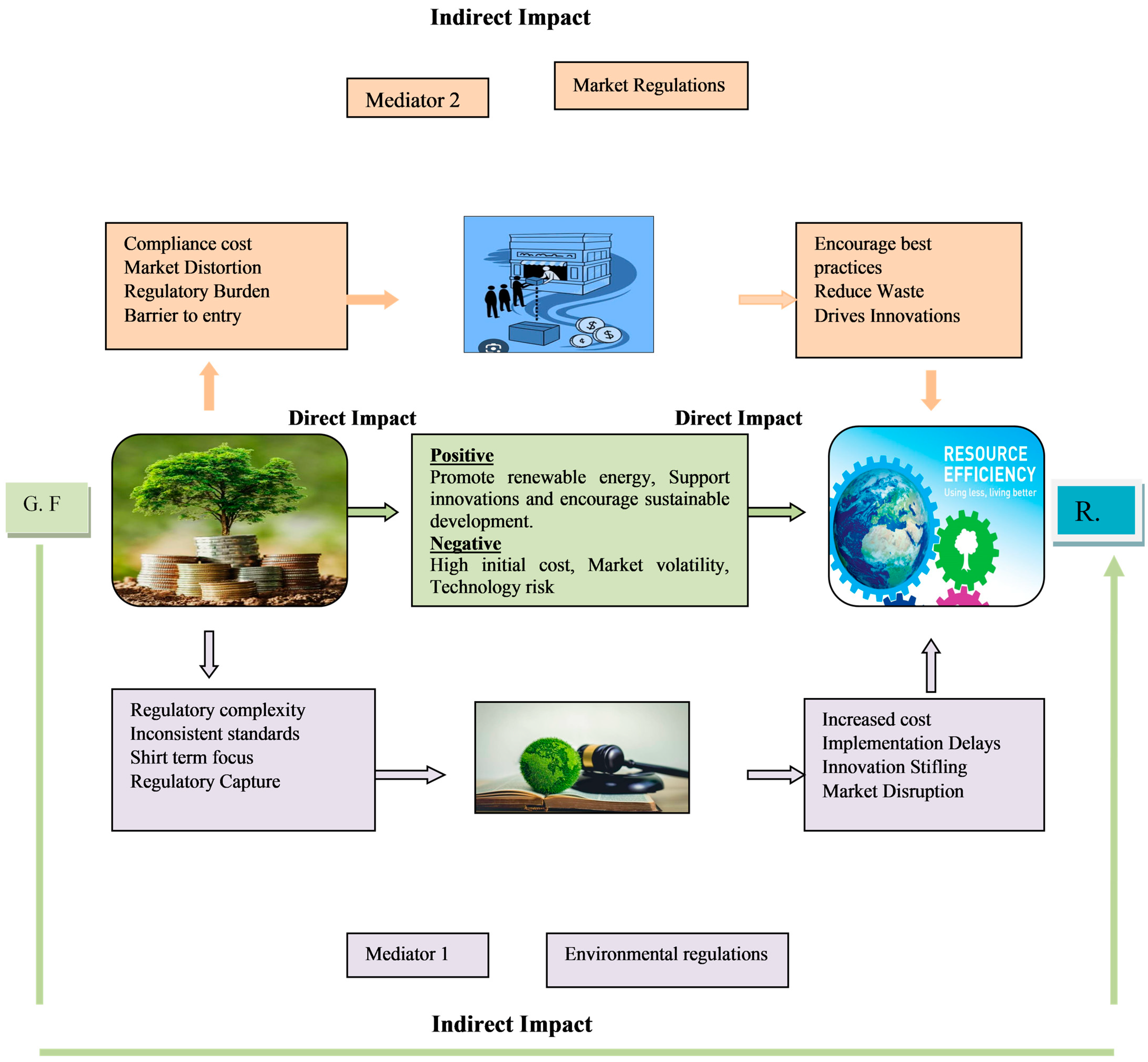

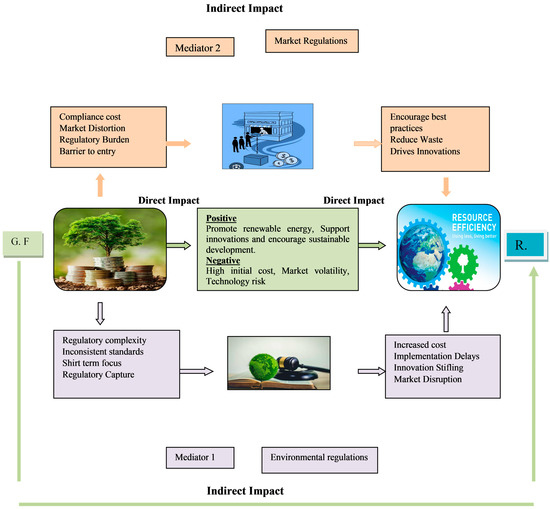

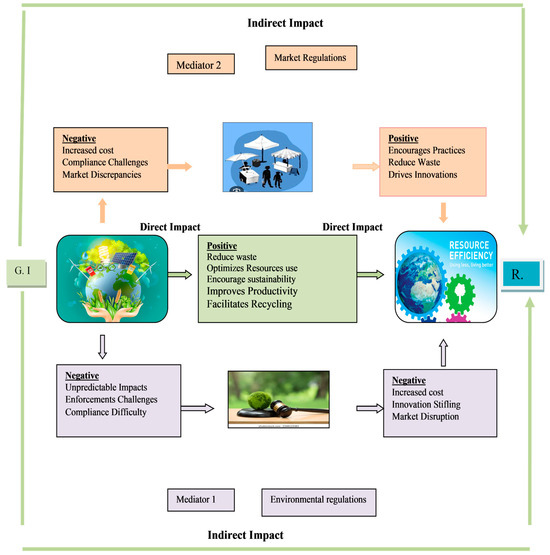

By establishing guidelines and financial incentives that motivate companies to switch to more environmentally friendly operations, market and environmental regulations serve as intermediaries on resource efficiency. While environmental regulations ensure that businesses consider the ecological impact of their operations, they can also impact how resources are allocated and consumed. This can lead to gains in efficiency and creativity in resource management. These policies balance commercial interests and environmental concerns by establishing a framework that directs companies toward more conscientious and effective resource management. Environmental regulations are measured through environmental taxes, and market regulations are measured through credit market regulations. Control variables include industry value addition (IVA), regular quality (RegQ), urbanization (UP), renewable energy (Renergy), gross fixed capital (capital), GDP, and the number of patents (Innovations). Figure 1 depicts the model of GF and RE with the mediation of environmental and market regulations.

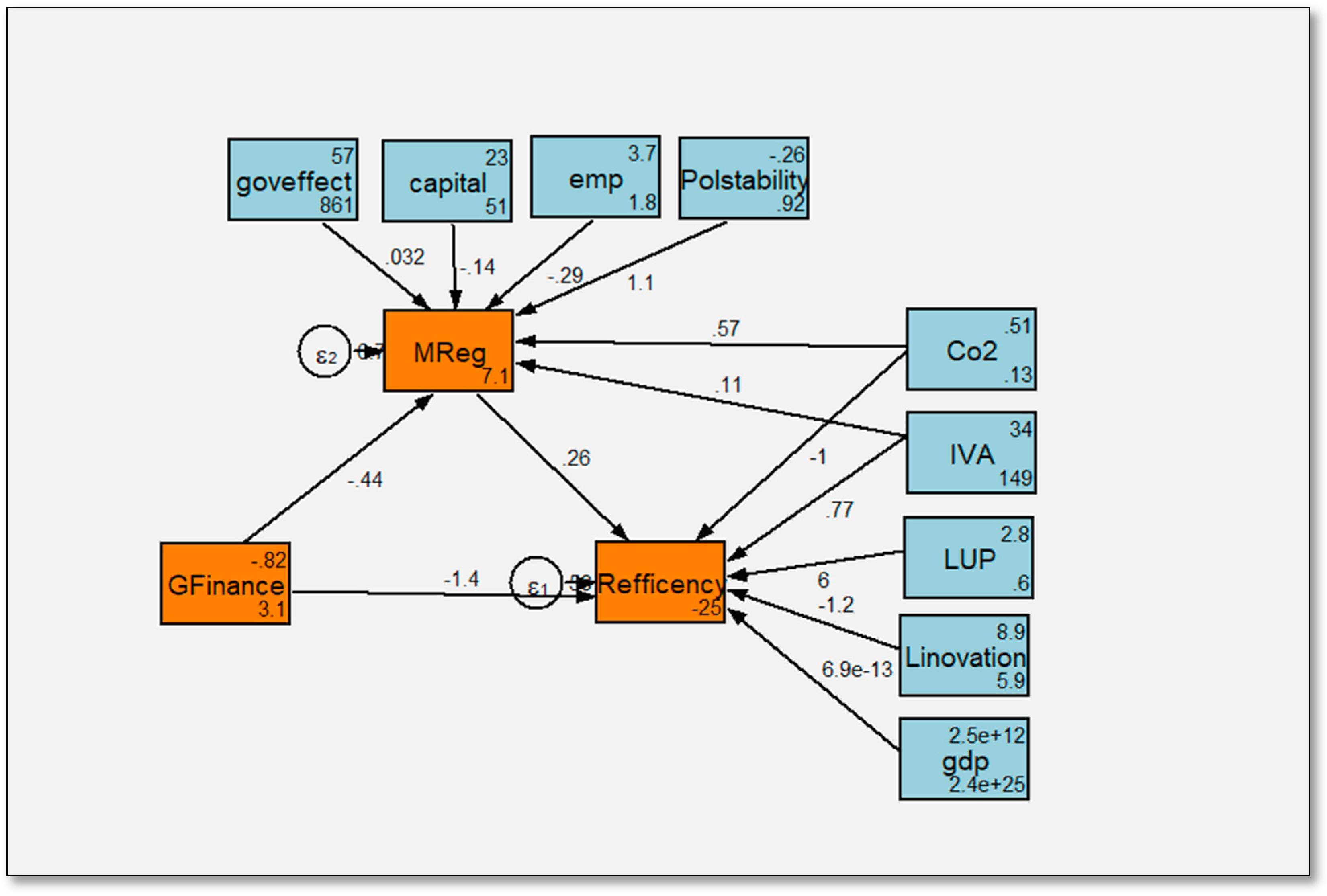

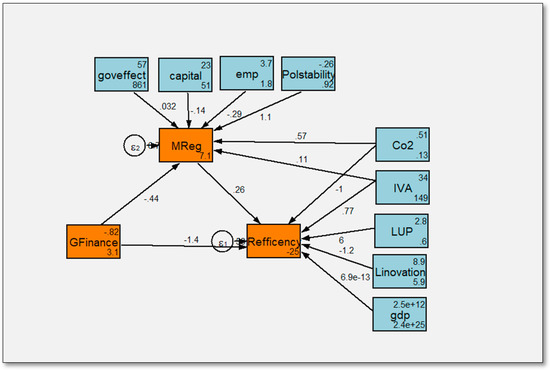

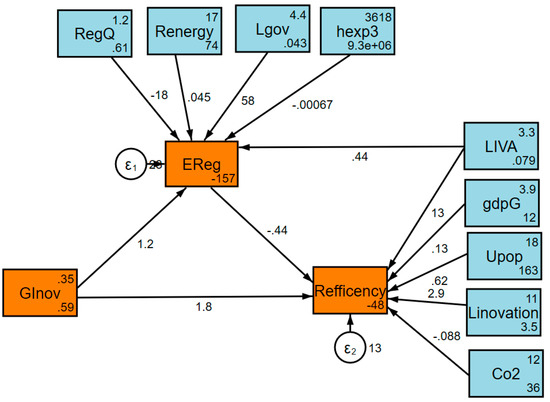

Figure 1.

Model of the study (green finance and resources efficiency).

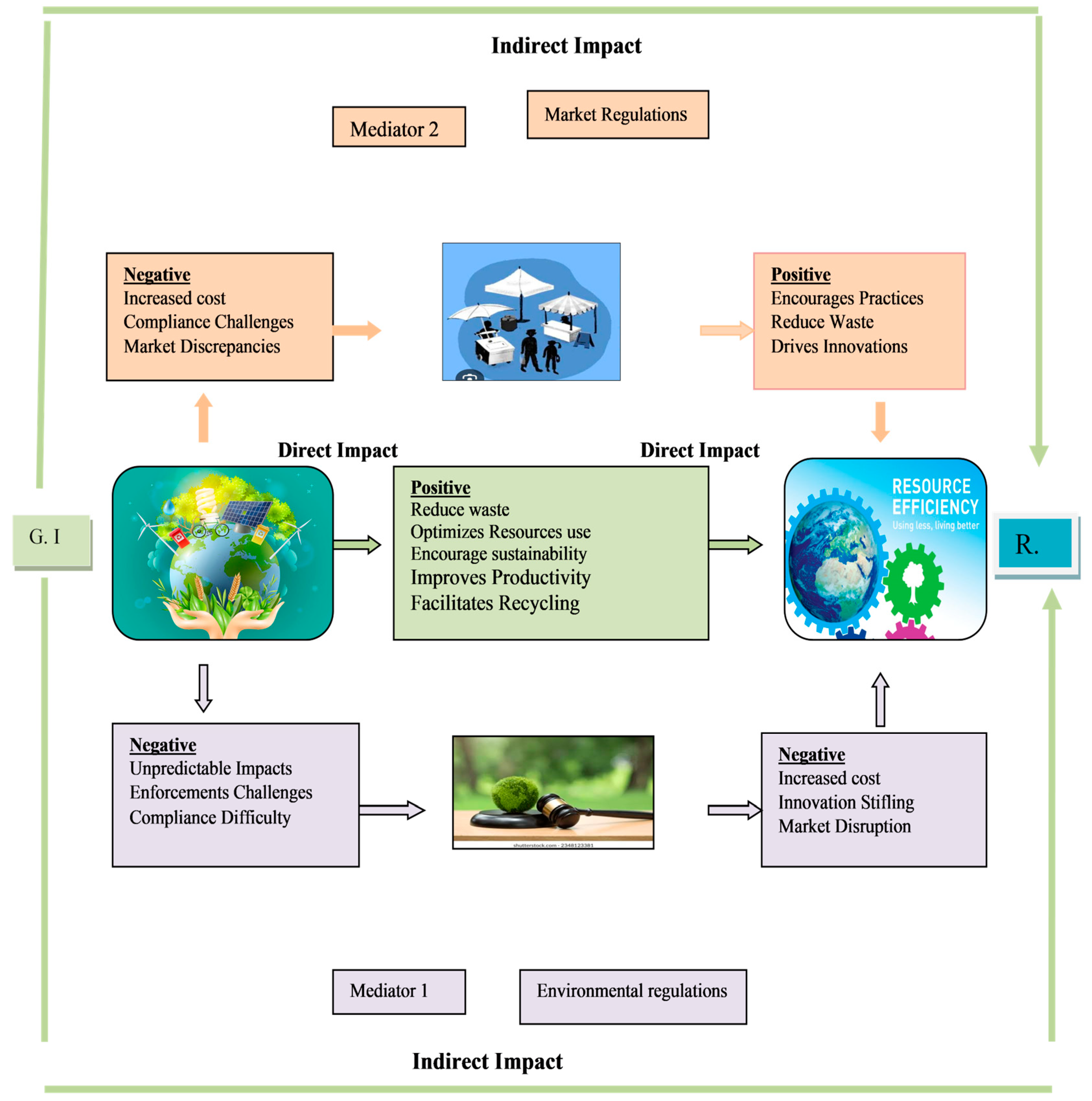

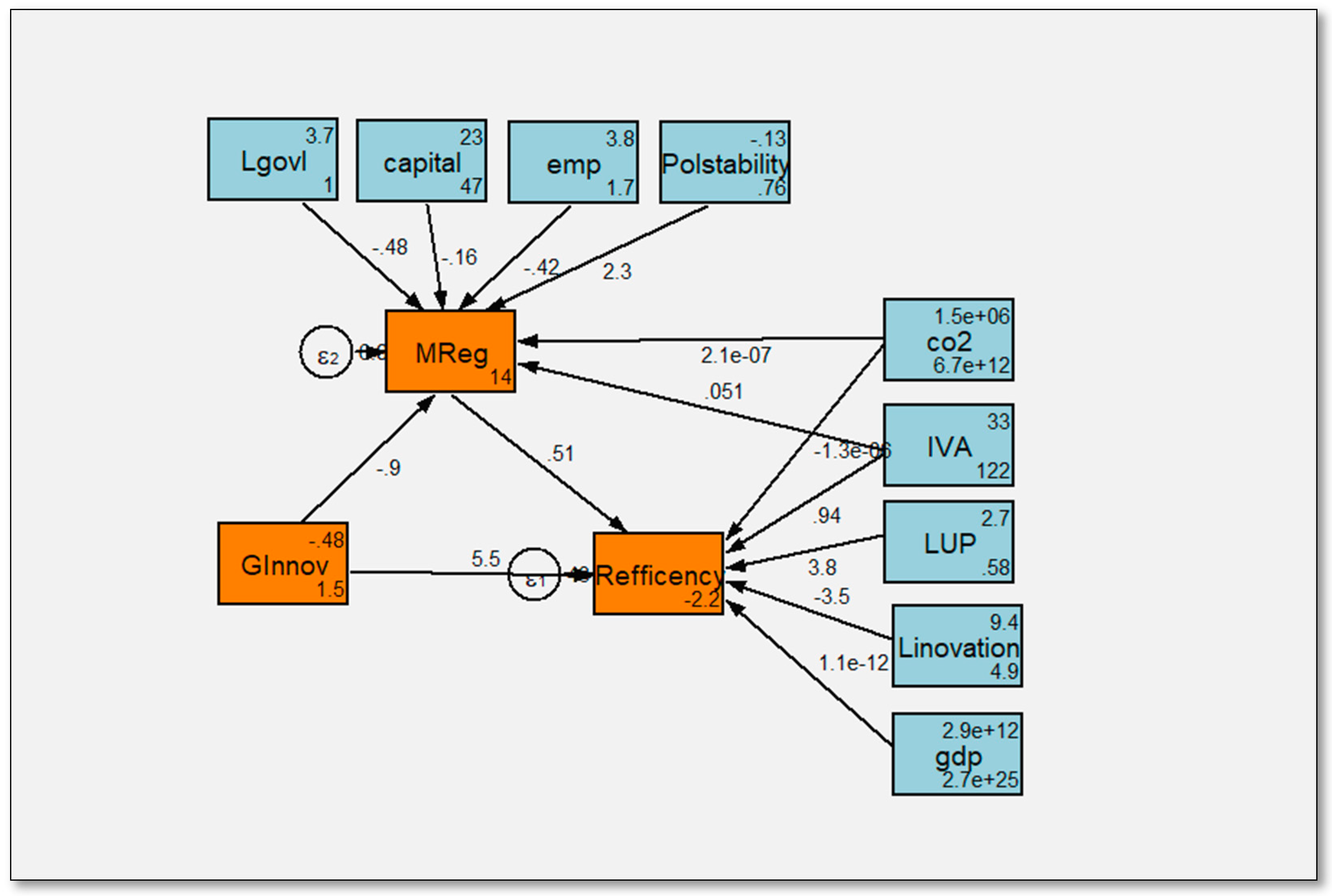

In Figure 2, we show our second model, depicting the relationship between green innovation and resource efficiency and the mediating role of environmental regulations and market rules.

Figure 2.

Model of the study (green innovation and resource efficiency).

The sources of data used in analysis are provided in Table 1—the World Development Indicators (WDI), International Monetary Fund (IMF), the OECD and the Fraser Institute.

Table 1.

Description of variables.

The statistical summary for the 435 observations of the study’s variables is displayed in Table 2.

Table 2.

Summary statistics.

The pair-wise correlation between the study variables is shown in Table 3, which is usually displayed as a matrix of the correlation coefficients. The correlation coefficients vary from −1 to =1, with the following value: A coefficient closer to +1 or −1 indicates a more excellent linear relationship between the variables. A coefficient near zero indicates an insignificant linear relationship.

Table 3.

Correlation analysis.

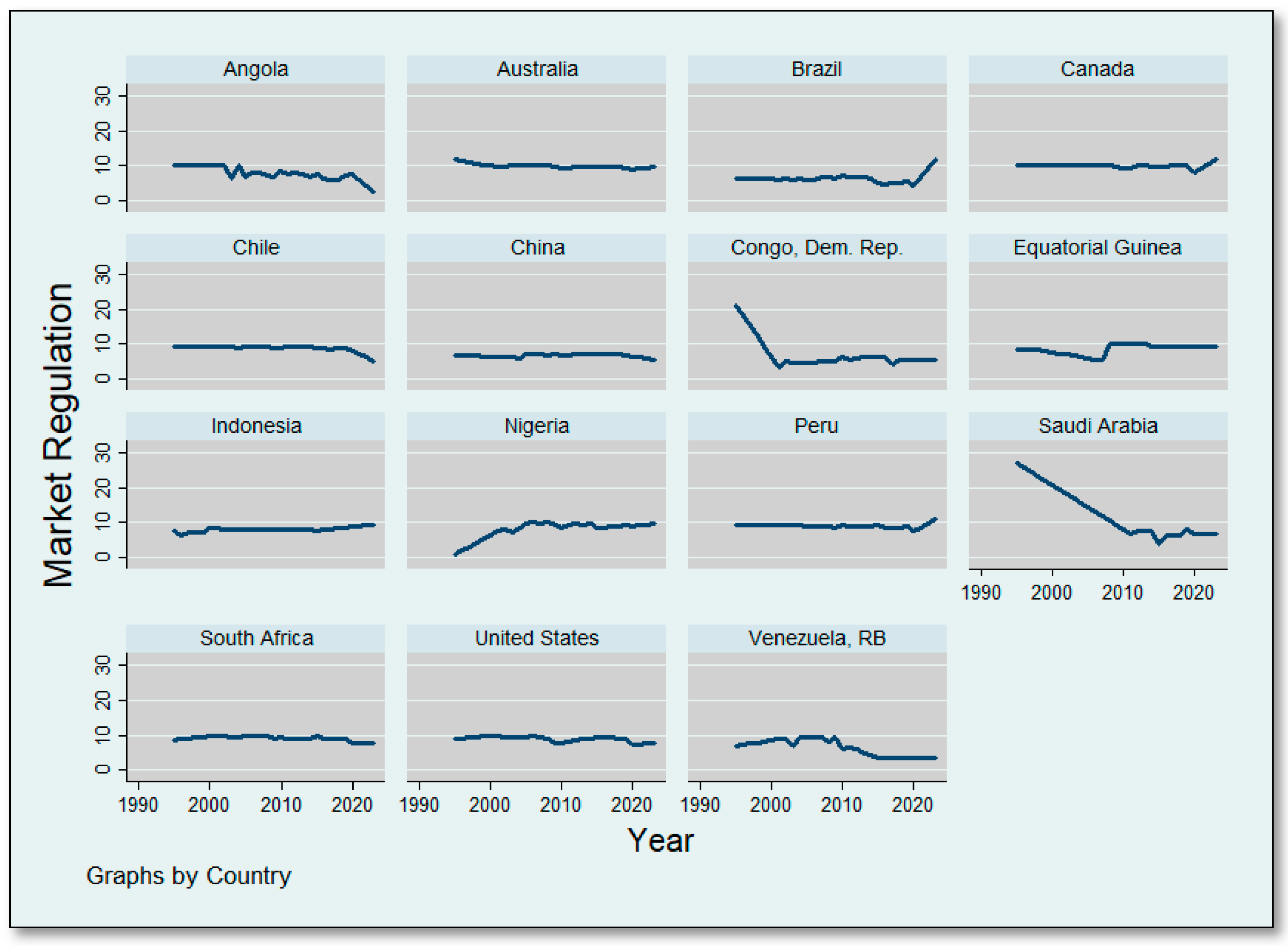

3.1. Graphical Analysis

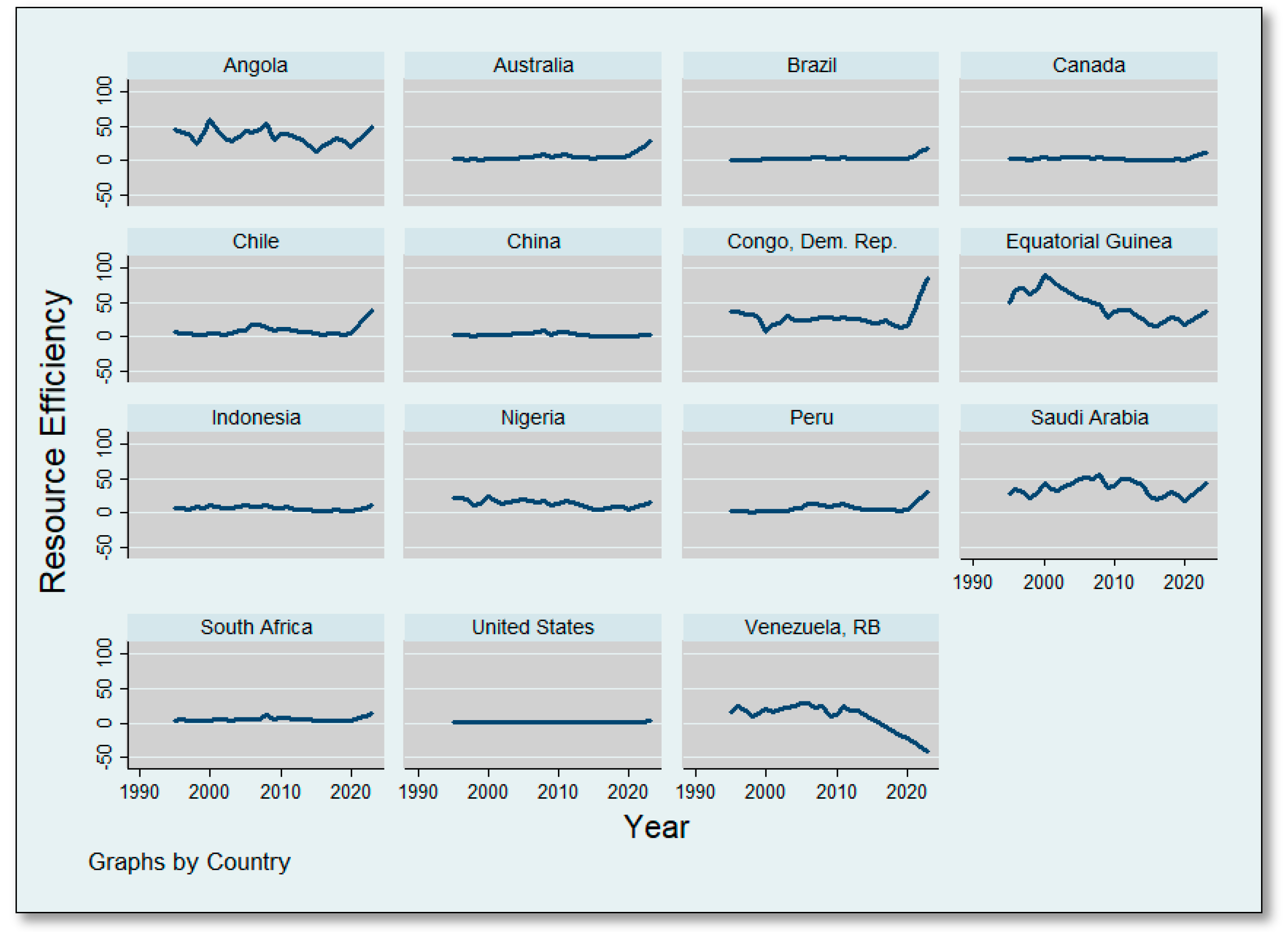

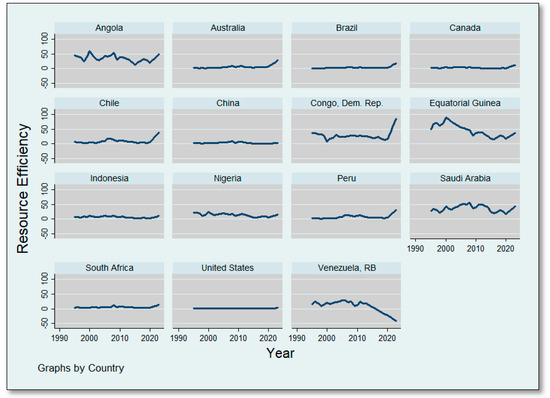

Graphical analysis is essential for graphically communicating study findings and helping interpretation (Figure 3).

Figure 3.

Trend of resource efficiency. Source—Author construction.

Countries with increasing trends are Australia, Brazil, China, Congo, Saudi Arabia, and South Africa, which have shown significant increases in resource efficiency over the study periods. Countries with stable trends are Angola, Canada, Chile, Indonesia, Peru, and the United States, which have reasonably consistent resource efficiency with just small swings. In the same way, countries with decreasing trends are Equatorial Guinea, Nigeria, and Venezuela, all of which have shown declining resource efficiency, with Venezuela having the most substantial decrease.

These graphs not only illustrate the varying levels of achievement in improving resource efficiency among countries, but also serve as a valuable tool for policymakers. The stark contrast between countries like China and Australia, which have made significant progress, and Venezuela, which has experienced severe reductions, can guide policymakers in identifying areas where greater effort is needed to improve resource efficiency (Figure 4).

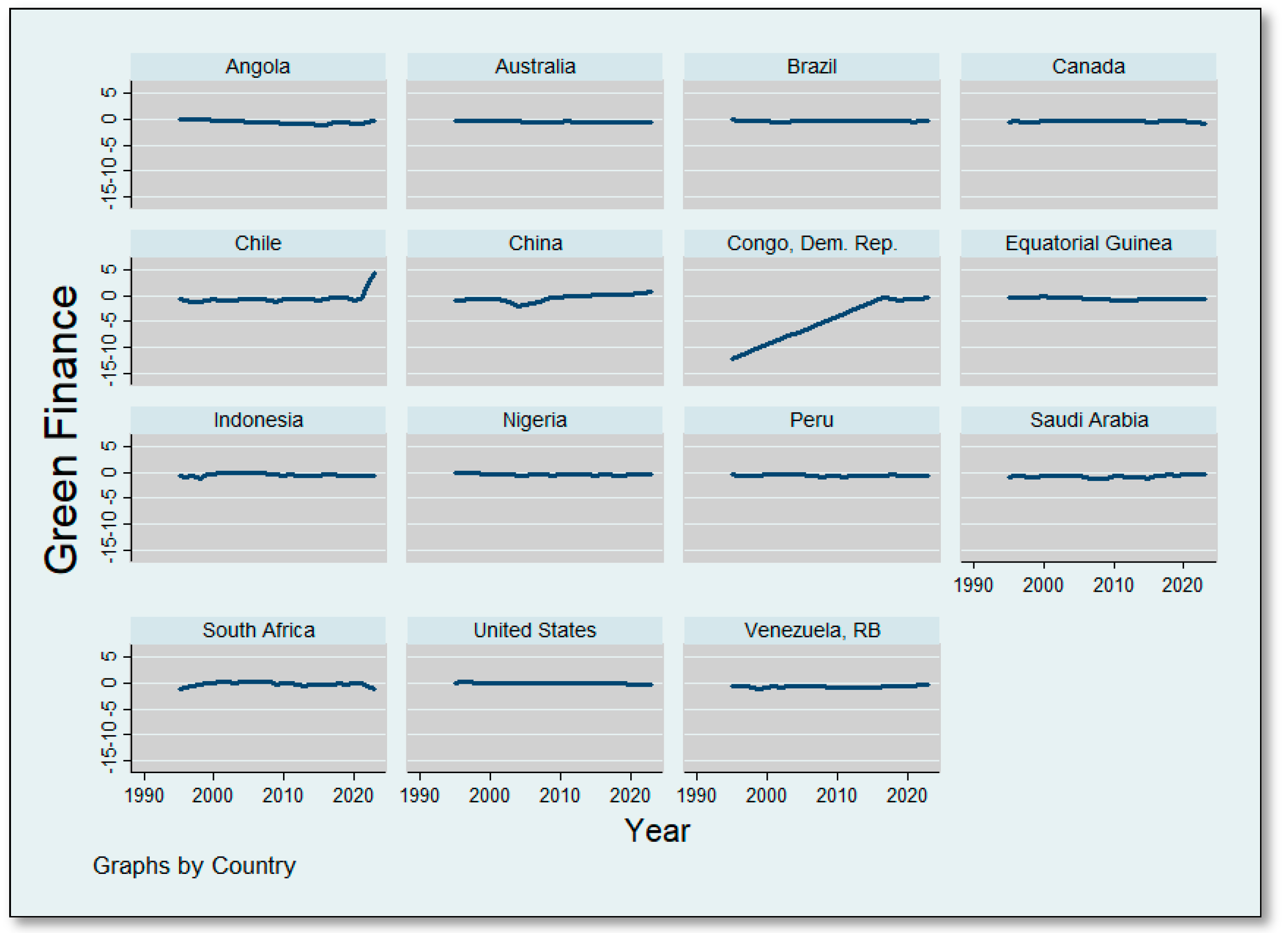

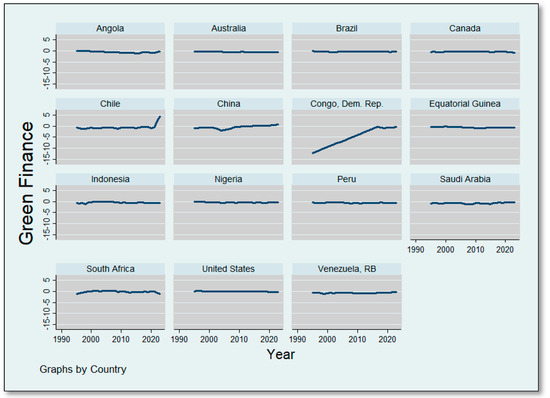

Figure 4.

Trend of green finance. Source—Author construction.

Countries with increasing trends are Chile, China, and South Africa, which have shown significant increases in green finance over the study periods. Likewise, countries with stable trends, such as Angola, Brazil, Canada, Guinea, Indonesia, Nigeria, Peru, Saudi Arabia, the United States and Venezuela, have reasonably consistent green finance with small swings. Countries with decreasing trends include Congo, showing a decline in green finance.

These graphs serve as powerful tools, effectively showcasing the diverse levels of progress in advancing green finance among countries. As a reliable guide, the data are crucial in equipping policymakers with the necessary information to make informed decisions and instill confidence in their policy choices (Figure 5).

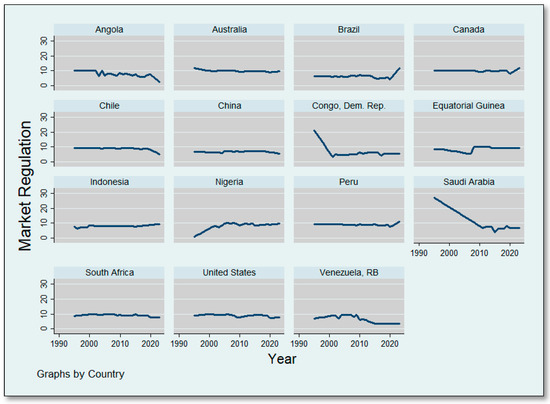

Figure 5.

Trend of market regulation. Source: Author construction.

Brazil, Canada, Indonesia, Nigeria, and Peru show significant increasing trends in market regulation over time. Australia and Canada show stability in their trends over different time periods. These graphs show the differing levels of achievement in improving market regulations among countries. The data can assist policymakers in determining where more significant effort is required to improve market regulations.

3.2. Econometric Model and Methodology

The study employs structural equation modeling (SEM) to analyze the relationships between green finance, green innovation, resource efficiency, and the mediating roles of environmental and market regulations. First-generation multivariate data analysis techniques include multiple regression, logistic regression, and variance analysis. Scientists use these approaches to investigate theories about the relationships between numerous relevant components. Scientists from various disciplines have used these methodologies, and the results have significantly altered our view of the world. These strategies are ineffective in meeting the three critical requirements for a model: (1) the model’s structure must be easily understood; (2) all variables must be observable; and (3) all variables must be precisely evaluated. Multiple regression analysis is based on the assumption that there is only one layer of dependent and independent variables. This represents the first stage of the research. This profoundly disturbs the organization. Because of this shortcoming, simplistic models cannot accurately anticipate sequential causal links, such as “A leads to B leads to C”, and complex networks with several intermediary components. The investigation of causal chains may only be carried out during periods of relative stability. Computing with a simple model can substantially impact the precision of the findings. In regression analysis, sales and age are two distinct variables that can be tracked and used in terms of amount or value.

These can be used to determine the correlation between two variables. These studies give the option of using monetary values or units of sales as the dependent variable. Before evaluating abstract notions or features of a social group or entity, confirmatory factor analysis (CFA) is required. These ideas should be given careful study. The improper use of theoretical models can present considerable obstacles. Furthermore, it is critical to recognize the possibility of inaccuracies in empirical observations, which can occur as a result of either oversight or data collection procedures. This inaccuracy can emerge in two ways, depending on the circumstances. First-generation approaches are only appropriate when there is no chance of encountering random or systematic errors in the researched factors. It is unusual to investigate the relationships between several approaches to judging theoretical reasoning. The study primarily investigates abstract notions like perception, attitude, and objective across multiple scientific domains, particularly the social sciences. The earlier versions of the methodologies required refinement, which raised difficulties in investigating these and other areas of the scientific field.

Researchers are increasingly using second-generation approaches to address their problems. Researchers can use structural equation modeling to study and forecast the complicated interactions between dependent and independent variables. Due to the inherent intricacy of the topics under consideration, direct analysis is complex and can only be done indirectly. The structural equation model considers measurement error when determining the relationships between variables. This indicates a more reliable assessment of the theoretical issues under consideration. Structured equation modeling is widely used in business, psychology, and economics. It is a strategy for evaluating multivariate data that examines the linkages and interconnections between various parameters. It can identify whether the model’s relationships are concealed, evident, or inconsistent. Furthermore, it can determine the ideal route coefficient for each variable. Given the inherent constraint of directly witnessing hidden variables, analyzing those using visible qualities is critical. Furthermore, external factors can have significant, immediate, and indirect effects on internal variables. Equation (1) is a conventional structural equation model considering internal and external factors.

η = Bη + Γξ + ζ

Resource efficiency, green finance, green innovation, market regulation, and environmental regulation are manifest variables in structural equation modeling. Finance and innovation both are as well, and they have exogenous effects on market regulation, environmental regulation, and resource efficiency. Market regulation and environmental regulation are mediating factors that directly impact resource efficiency. Green finance and green innovation have an impact on market regulation and environmental regulation, which in turn have an impact on resource efficiency both directly and indirectly. Afterward, the resource-rich countries’ resource efficiency was seen to be affected both directly and indirectly.

Above relationship can be written in econometric form as:

Market and environmental regulation are also endogenous in our defined system. Resource efficiency is measured as the total natural resources percentage of GDP. Green finance is measured through the trade balance percentage of GDP. Green innovation is measured through research and development expenditure. CO2, IVA, UP, innovation, and GDP are used as controls in the resource efficiency equation. Capital, Emp, and Polstability are used as controls in the market regulation equation. RegQ, Renergy, GovEffect, and hemp are used as controls in the environmental regulation equation.

- Empirical Evidence

We present empirical findings that examine the direct influence of green finance and the indirect influence of green innovation on resource efficiency in resource-rich nations, considering market and environmental regulation. According to our research, green finance has two effects on resource performance. Only green financing can encourage investment in sustainable technologies and practices, improving resource use efficiency. Furthermore, green finance involves the participation of financial professionals who endorse initiatives to advance a more environmentally conscious society, such as renewable energy and sustainable agriculture projects. They work together to achieve environmentally friendly innovation and promote economic progress while reducing the wasteful use of resources. This nexus highlights the importance of employing efficient strategies, such as financial inclusion and financial technology, in conjunction with the market and environmental regulations to achieve the optimal utilization of resources.

The SEM route map illustrates the interconnection of green financing, market rules, and resource efficiency. Green finance adversely affects both credit market regulations and resource efficiency. Market regulations have a beneficial impact on resource efficiency. An increase in green financing leads to enhanced resource efficiency. Market regulation significantly enhances resource efficiency, and green finance positively impacts market regulation. The mediating role is crucial as it demonstrates that effective market regulations may amplify the advantages of green finance for resource efficiency.

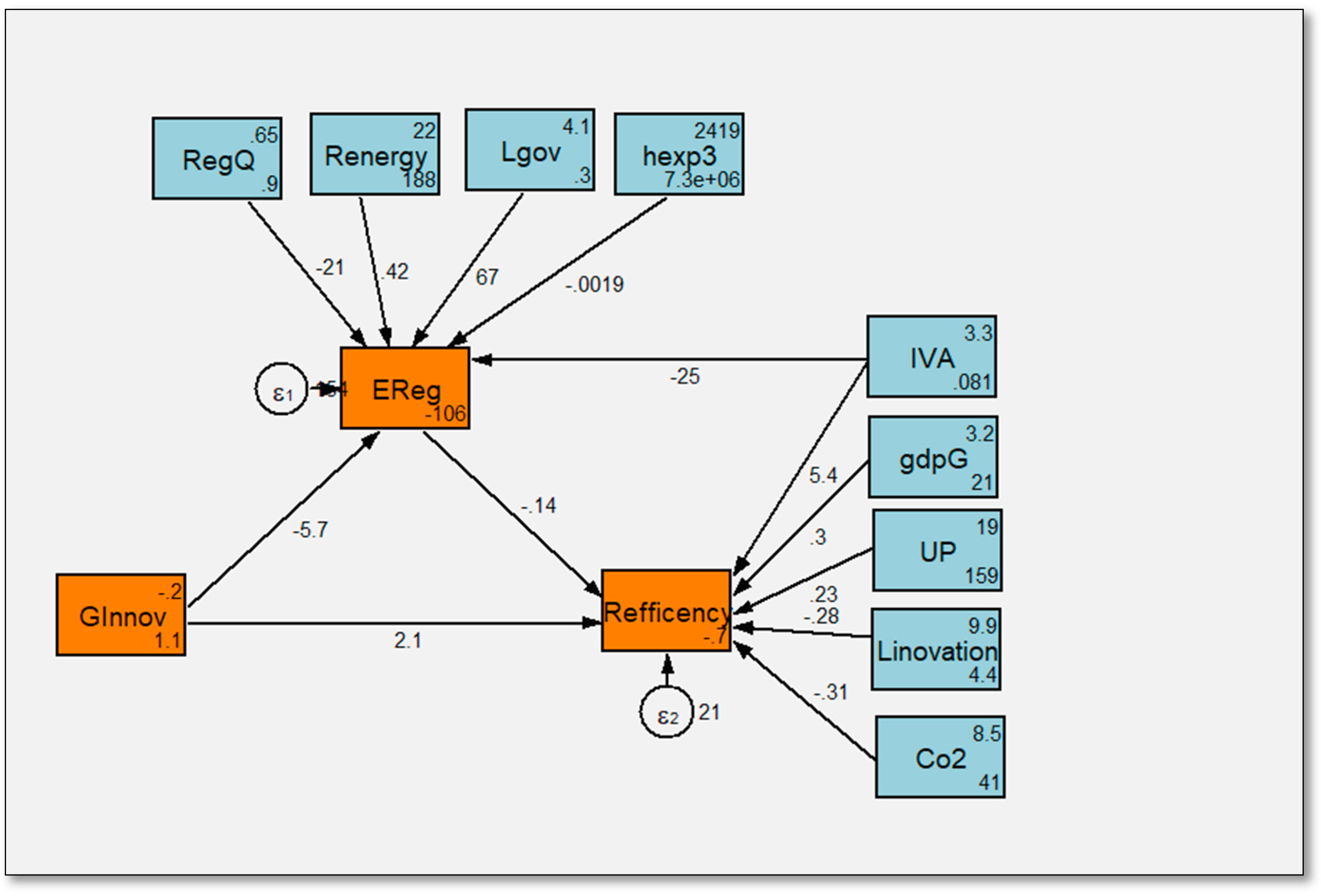

The model estimation (Table 4 and Figure 6) results illustrate that green finance typically has a direct relation with resource efficiency. Likewise, green finance also significantly impacts market regulation through an indirect channel.

Table 4.

SEM estimates from GFinance to REfficiency using MReg (STATA 15) as a mediator.

Figure 6.

SEM path. Source—Author construction.

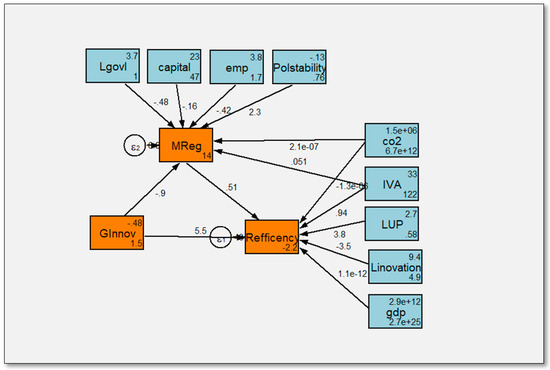

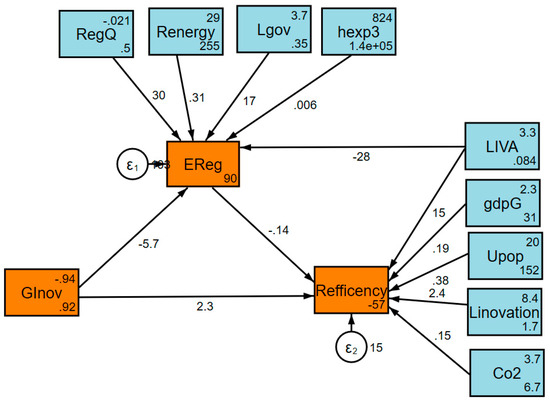

The SEM route map shows the relationship between green innovation, market regulations, and resource efficiency in Figure 7 and Table 5. Green innovation negatively impacts the credit market and positively impacts resource efficiency, while the credit market hurts resource efficiency. The finding depicts that tight lending conditions or a lack of investment in sustainable initiatives may hinder progress toward improved resource utilization. This finding aligns with discussions on the role of green innovation in facilitating sustainable development [12].

Figure 7.

SEM path diagram. Source—Author construction.

Table 5.

SEM estimates from GInovation to REfficiency using MReg as a mediator.

Table 5 reports that green innovation impacts the resource efficiency in both direct and indirect ways.

Table 6 indicates the indirect and total effects of green finance and green innovation on resource efficiency. The findings show the significant impact of GF and GI on the optimal usage of resources.

Table 6.

Direct, indirect and total effects from GFinance and GInovation on REfficiency through MReg.

Mediation exists in this study. Market regulation encourages resource efficiency through green finance and green innovation. Market regulation plays a crucial role in facilitating the relationship between green finance and resource efficiency, leading to substantial positive effects on environmental sustainability and overall economic development. Market regulations, such as subsidies for renewable energy projects, tax breaks for green technologies, and carbon pricing, foster an atmosphere conducive to investments in sustainable initiatives.

We analyze how market and environmental rules interact with green finance and innovation to affect aid efficiency. Market-based systems like carbon pricing can encourage green investments but also raise customer prices. In contrast, environmental rules can foster sustainable development but inhibit innovation. Resource efficiency requires effective marketplace and environmental enforcement. Policymakers can create regulatory frameworks that optimize the positive effects of green finance and innovation on resource efficiency by carefully considering their synergies and trade-offs.

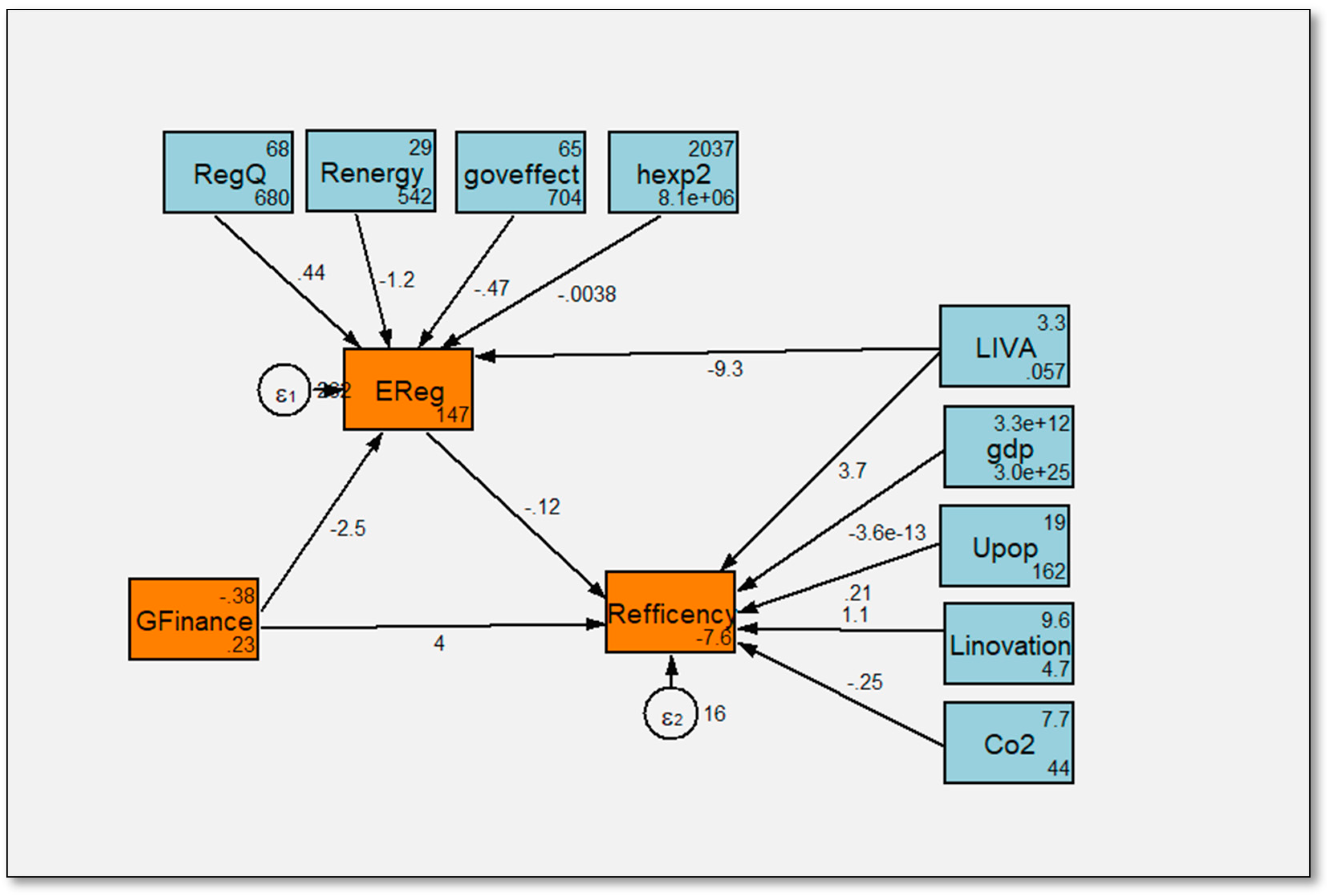

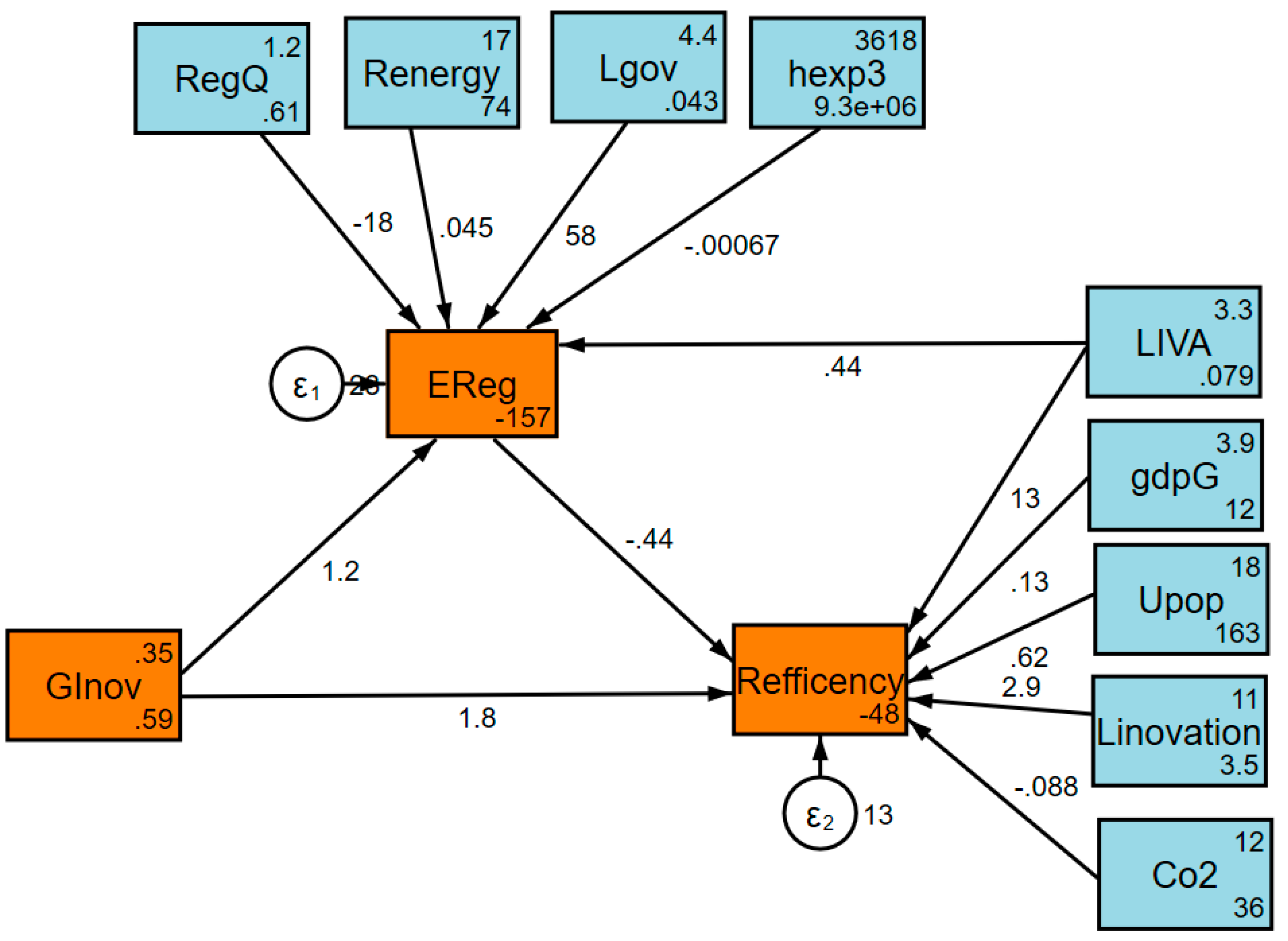

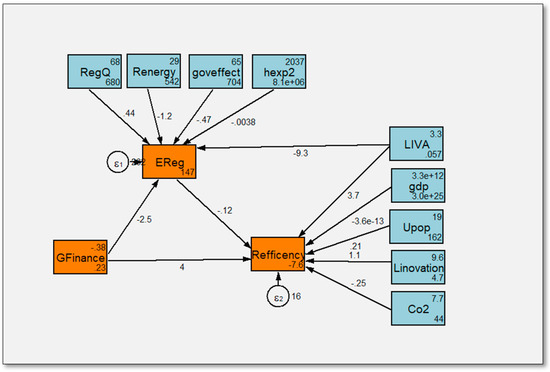

Similarly, Figure 8 shows the role of environmental regulation, which directly encourages a positive impact on green finance. Green finance impacts resource efficiency directly and through the mediator channel of environmental regulation.

Figure 8.

SEM path diagram. Source—Author construction.

Table 7 expresses the impacts of green finance on resource efficiency in both direct and indirect ways.

Table 7.

SEM estimates from Gfinance to REfficiency using EReg as a mediator.

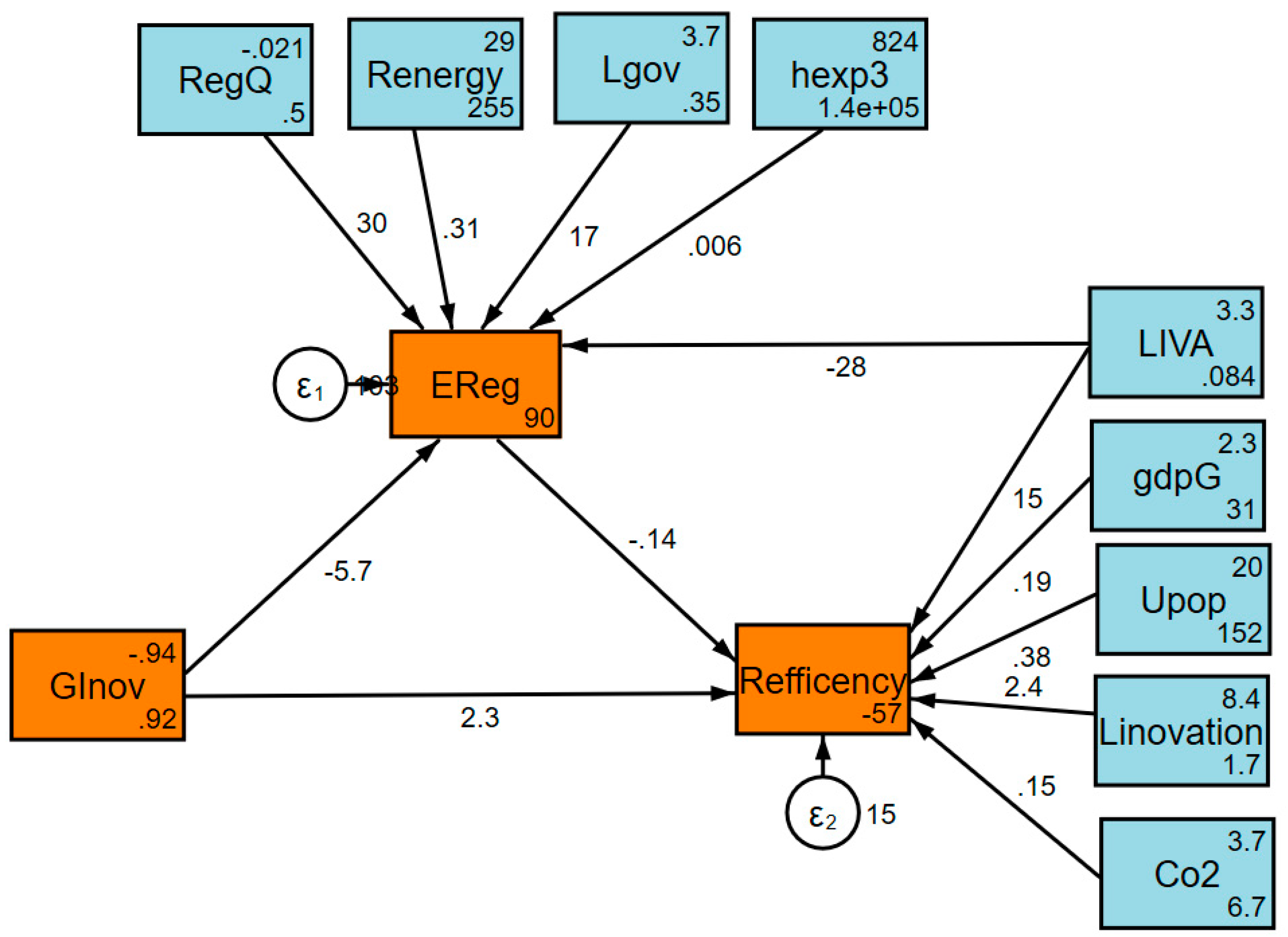

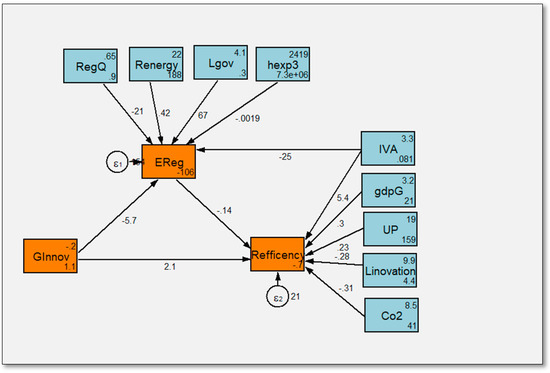

Figure 9 and Table 8 indicate the significant impacts of green innovation on resource efficiency through the mediation of environmental regulation. The arrows symbolize the connections between variables. Arrows signify a positive correlation, indicating that an increase in one variable results in a corresponding increase in another variable.

Figure 9.

SEM path diagram. Source—author construction.

Table 8.

SEM estimates from GInovation to REfficiency using EReg as a mediator.

Table 8 explains green innovation’s impact on resource efficiency through the mediator of environmental regulation.

Table 9 highlights the results of a statistical analysis (SEM). The study investigates the various elements that impact resource efficiency. The findings indicate a positive direct and indirect effect as well as a total effect of green finance and green innovation on resource efficiency.

Table 9.

Direct, indirect and total effects from GFinance and GInovation on REfficiency through EReg.

Table 10 and Figure 10 indicate the indirect and total effects of green innovation and environmental regulation on resource efficiency. The findings show the significant impacts of green innovation and environmental regulations on the optimal usage of resources in developed countries.

Table 10.

SEM estimates from GInovation and environmental regulation on REfficiency in the developed countries.

Figure 10.

SEM estimates effects of GInovation and environmental regulation on REfficiency in the developed countries.

Table 11 and Figure 11 illustrate the indirect and total effects of green innovation and environmental regulation on resource efficiency. Empirical evidence highlights the significant impact of GI and environmental rules on the optimal usage of resources in the developing countries.

Table 11.

SEM estimates effects of GInovation and environmental regulation on REfficiency in the developing countries.

Figure 11.

SEM estimates effects of GInovation and environmental regulation on REfficiency in the Developing countries.

4. Discussion

The study has yielded significant findings, illustrating a distinct and overall beneficial influence of green finance and innovation on resource efficiency in countries with abundant resources. Environmental and market regulation serves as an intermediary for these repercussions. The results are corroborated by the existing literature. The scholarly literature suggests that the use of green financing and green innovation is essential in various domains, including enhancing renewable energy and technology and promoting environmental progress [12,19]. Xiong and Dai [36] have demonstrated that resource efficiency is vital in determining a country’s wealth, and necessitates sustainable management to provide the enduring efficient usage of resources. Countries rich in resources need help managing resource use effectively while facing many hurdles.

Previous research has shown that inexperienced finance improves resource performance. Our study also sheds light on market and environmental regulations’ mediation role. Unlike earlier studies, we found that a mix of market-based and regulatory methods yields the best results. These findings support the importance of a multifaceted approach to selling sustainable development.

Green finance is illustrated by its high level of innovation, as it employs innovative technologies to revolutionize financial services regarding resource efficiency. Lin and Bai [37] assessed diverse green financial services, goods, and activities. However, green finance has the same effect on resource efficiency. Our findings also show that green financing has both a considerably beneficial and a harmful impact on resources, which tends to reduce dependency on resources. Several research studies have established an intricate correlation between green finance and resource efficiency [22,25].

Moreover, green innovation significantly influences resource efficiency. The SEM analysis results provide empirical evidence of a link between GI and resource efficiency, as depicted in a graphical representation. Sun et al. [38] successfully demonstrated a substantial cause-and-effect connection between GI and the efficient utilization of resources. Both time-varying and base models back these empirics. Similarly, Mao et al. [32] determined that green innovation consistently impacts resource efficiency, which effect may be categorized as direct, indirect, and total.

Empirical studies have proven that GF and GI enhance resource management practices by fostering green innovation [2]. Furthermore, financial inclusion and ecological innovation positively influence several systems. The research indicates that GI significantly improves green innovation and reduces resource dependence, indirectly boosting resource management and climate resilience [3,21].

Empirical data from historical and ongoing research indicate that certain resource-rich nations in specific locations tend to experience adverse effects of market regulation on resource efficiency. The negative relation refers to the adverse effect of controlled market regulation on the efficient utilization of resources and increased dependence on resources, which contradicts the supportive function of market regulation in the context of resources [11,17].

Nevertheless, there exists a robust correlation between environmental control and resource efficiency. Regulation has a beneficial effect on climate resilience when there is a substantial reliance on resources. Therefore, when all other variables stay unchanged, areas that depend on environmental management are more inclined to achieve sustainable resource utilization through human growth [3,36]. Mikhno et al. [24] discovered that environmental control has a substantial impact on improving resource efficiency.

The empirical studies have revealed causal relationships between green finance and green innovation, which are crucial for developing a comprehensive green financial system and promoting efficient resource utilization. This study makes several contributions. The current study has concentrated chiefly on the factors that impact the growth of green finance and eco-efficiency advancement. This research has also explained the importance of green innovation and finance [1,29]. Consequently, to meet the need to optimize resource utilization in areas such as climate change, environmental degradation, and green financing, it is imperative to prioritize these issues. The recent research mainly concentrates on the unidirectional correlation between green finance and resources, with less investigation into the inverse association between the two. Multiple studies showed that green financing positively boosts resource efficiency [25].

To account for the variations in the degree of national development and green innovations, we have divided the sample into developed and developing nations, and provide a sub-group analysis to further support the analysis. Due to their significant worldwide economic influence, the countries in the first group—Australia, Canada, Chile, China, Saudi Arabia, and the United States—are regarded as being more developed. The second category consists of middle-income and developing nations that struggle with infrastructure and economic development, such as Venezuela, Equatorial Guinea, Brazil, the Democratic Republic of Congo, Equatorial Guinea, Indonesia, Nigeria, Peru, South Africa, and Angola.

In addition, studies suggest that GF and GI have an identical influence on resource efficiency. The results highlight that they have a beneficial and substantial impact on managing resources. This also contributes to improving resource efficiency. Moreover, implementing green innovation and technology adaptation plays a significant role in managing the resources effectively, employing both direct and indirect approaches. The intersection of the GF and financial technology is gradually influencing green innovation, with the financial industry positively promoting green innovation. Our findings support policymakers in resource-rich countries prioritizing the following policy areas: encouraging financial diversification to reduce dependency on natural resource exports; financial incentives, tax benefits, and public–private partnerships should encourage new investments; enhancing environmental regulations and enforcement for sustainable aid control. By targeting these regions, policymakers can help resource-rich nations build a sustainable and resilient economy.

5. Conclusions

The main objective of resource-rich economies is to improve the utilization of resources. Countries are using a variety of resources to maintain and support environmental changes. Green financing and green innovation are essential factors in advancing resource efficiency. The impacts of green innovation and financial development on resource efficiency are identical [2,38]. Moreover, using traditional financial and technological approaches has a detrimental impact on the environment, leading to the inefficient use of resources. Efficiently managing these detrimental side effects is crucial for maintaining optimal resource utilization. Green finance and innovation promote management methods that can enhance sustainable development, including utilizing renewable energy sources, exploring green innovation, and acquiring new knowledge. However, detrimental factors such as pollution and climate change gradually threaten the ability of the environment to withstand and recover from disturbances.

The study examines the influence of green finance and green innovation on resource efficiency, considering the mediating role of environmental and market regulation. The study used the structural equation model, and the pre-diagnosis was conducted using data from 1995 to 2023. This study primarily examines the direct, indirect, and total effects of environmental and market regulation through the mediation channel. The data indicate that green finance significantly and positively impacts resource efficiency directly and generally. Additionally, there is a beneficial impact, both indirectly and directly, enacted through green innovation.

Similarly, both market regulation and environmental control significantly influence resource efficiency, which can be attributed to direct and indirect factors. Green funding and environmental legislation have a mutually positive impact on resource efficiency. The research suggests that new technology positively affects resource efficiency in all three aspects: directly, indirectly, and overall. Furthermore, our inquiry’s findings demonstrate that implementing environmentally sustainable innovation dramatically reduces resource dependence. Furthermore, the influence of green finance and innovation, as facilitated by environmental and market regulation, is indistinguishable. This also aids in the optimal utilization of resources.

Additionally, the study has important policy implications for policymakers. Technology must be carefully integrated to achieve resource efficiency, considering the complex connections between financial services, innovation, market regulation, and environmental legislation. To ensure long-term resource efficiency and environmental sustainability, it is crucial to develop a comprehensive strategy that considers all the various factors contributing to environmental sustainability.

To conclude, effective financial development, environmental regulations, market regulations, and the application of technology can achieve resource efficiency. The region can secure a more profitable and sustainable future if these factors are harmonized. Resource-rich countries have implemented numerous legislative measures to stimulate the expansion of financial institutions and the use of technology while mitigating energy consumption through green financing. Resultantly, using green innovation reduces the burden of utilizing damaging resources. Thus, these solutions promote the advancement of resource efficiency and sustainability.

Author Contributions

Conceptualization, S.N. and X.T.; methodology M.J.N.; software R.N.; validation, X.T., Q.W. and M.J.N.; formal analysis, R.N. and S.N.; resources S.N.; data curation, S.N.; writing—original draft preparation, P.H. and M.J.N.; writing—review and editing, X.T.; visualization, S.A.L.; supervision, M.J.N.; project administration, R.N. and X.T.; funding acquisition, X.T. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Humanities and Social Science Fund of Ministry of Education (No. 19YJC630154) and The National Social Science Fund of China (No. BJX220332).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data can be obtained from the corresponding authors upon reasonable request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Ziolo, M.; Bak, I.; Cheba, K. The role of sustainable finance in achieving sustainable development goals: Does it work? Technol. Econ. Dev. Econ. 2021, 27, 45–70. [Google Scholar] [CrossRef]

- Xu, J.; She, S.; Gao, P.; Sun, Y. Role of green finance in resource efficiency and green economic growth. J. Resour. Policy 2023, 81, 103349. [Google Scholar] [CrossRef]

- Li, X.; Ma, L.; Ruman, A.M.; Iqbal, N.; Strielkowski, W. Impact of natural resource mining on sustainable economic development: The role of education and green innovation in China. Geosci. Front. 2024, 15, 101703. [Google Scholar] [CrossRef]

- Amin, A.; Wang, Z.; Shah, A.H.; Chandio, A.A. Exploring the dynamic nexus between renewable energy, poverty alleviation, and environmental pollution: Fresh evidence from E-9 countries. Environ. Sci. Pollut. Res. 2023, 30, 25773–25791. [Google Scholar] [CrossRef] [PubMed]

- Polzin, F. Mobilizing private finance for low-carbon innovation—A systematic review of barriers and solutions. Renew. Sustain. Energy Rev. 2017, 77, 525–535. [Google Scholar] [CrossRef]

- Wang, S.; Sun, X.; Song, M. Environmental regulation, resource misallocation, and ecological efficiency. Emerg. Mark. Financ. Trade 2021, 57, 410–429. [Google Scholar] [CrossRef]

- Pan, L.; Amin, A.; Zhu, N.; Chandio, A.A.; Naminse, E.Y.; Shah, A.H. Exploring the asymmetrical influence of economic growth, oil price, consumer price index and industrial production on the trade deficit in China. Sustainability 2022, 14, 15534. [Google Scholar] [CrossRef]

- Amin, A.; Liu, Y.; Yu, J.; Chandio, A.A.; Rasool, S.F.; Luo, J.; Zaman, S. How does energy poverty affect economic development? A panel data analysis of South Asian countries. Environ. Sci. Pollut. Res. 2020, 27, 31623–31635. [Google Scholar] [CrossRef]

- Wendling, Z.; Emerson, J.; de Sherbinin, A.; Esty, D. Environmental Performance Index (Yale Center for Environmental Law & Policy). Yale University. 2020. Available online: https://epi.yale.edu/#:~:text=The%202024%20Environmental%20Performance%20Index (accessed on 28 July 2024).

- Liu, Y.; Amin, A.; Rasool, S.F.; Zaman, Q.U. The role of agriculture and foreign remittances in mitigating rural poverty: Empirical evidence from Pakistan. Risk Manag. Healthc. Policy 2020, 13, 13–26. [Google Scholar] [CrossRef]

- Yasmeen, R.; Zhang, X.; Tao, R.; Shah, W.U.H. The impact of green technology, environmental tax and natural resources on energy efficiency and productivity: Perspective of OECD Rule of Law. Energy Rep. 2023, 9, 1308–1319. [Google Scholar] [CrossRef]

- Agrawal, R.; Agrawal, S.; Samadhiya, A.; Kumar, A.; Luthra, S.; Jain, V.J. Adoption of green finance and green innovation for achieving circularity: An exploratory review and future directions. Geosci. Front. 2024, 15, 101669. [Google Scholar] [CrossRef]

- Wang, Z.; Amin, A.; Chandio, A.A.; Shah, A.H.; Ullah, M.I. Dynamical assessment of multi-dimensional energy poverty at the national and sub-national levels in Pakistan. Energy Effic. 2024, 17, 18. [Google Scholar] [CrossRef]

- Djankov, S.; La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A. The regulation of entry. Q. J. Econ. 2002, 117, 1–37. [Google Scholar] [CrossRef]

- D’Orazio, P.; Valente, M. The role of finance in environmental innovation diffusion: An evolutionary modeling approach. J. Econ. Behav. Organ. 2019, 162, 417–439. [Google Scholar] [CrossRef]

- Owusu, P.A.; Asumadu-Sarkodie, S. A review of renewable energy sources, sustainability issues and climate change mitigation. Cogent Eng. 2016, 3, 1167990. [Google Scholar] [CrossRef]

- Delmas, M.A.; Pekovic, S. Resource efficiency strategies and market conditions. Long Range Plan. 2015, 48, 80–94. [Google Scholar] [CrossRef]

- Hassan, S.T.; Xia, E.; Khan, N.H.; Shah, S.M.A. Economic growth, natural resources, and ecological footprints: Evidence from Pakistan. Environ. Sci. Pollut. Res. 2019, 26, 2929–2938. [Google Scholar] [CrossRef]

- Hussain, S.; Rasheed, A.; Rehman, S.U. Driving sustainable growth: Exploring the link between financial innovation, green finance and sustainability performance: Banking evidence. Kybernetes 2023. ahead of print. [Google Scholar] [CrossRef]

- Porter, M.E.; Linde, C.V.D. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Rana, G.; Arya, V. Green human resource management and environmental performance: Mediating role of green innovation—A study from an emerging country. Foresight 2024, 26, 35–58. [Google Scholar] [CrossRef]

- Tan, J.; Su, X.; Wang, R. The impact of natural resource dependence and green finance on green economic growth in the context of COP26. Resour. Policy 2023, 81, 103351. [Google Scholar] [CrossRef]

- Ameli, N.; Drummond, P.; Bisaro, A.; Grubb, M.; Chenet, H. Climate finance and disclosure for institutional investors: Why transparency is not enough. Clim. Chang. 2020, 160, 565–589. [Google Scholar] [CrossRef]

- Mikhno, I.; Koval, V.; Shvets, G.; Garmatiuk, O.; Tamošiūnienė, R. Green economy in sustainable development and improvement of resource efficiency. Cent. Eur. Bus. Rev. 2021, 1, 99–113. [Google Scholar] [CrossRef]

- Zhang, P.; Li, Z.; Ghardallou, W.; Xin, Y.; Cao, J. Nexus of institutional quality and technological innovation on renewable energy development: Moderating role of green finance. Renew. Energy 2023, 214, 233–241. [Google Scholar] [CrossRef]

- Johnstone, N.; Haščič, I.; Popp, D. Renewable energy policies and technological innovation: Evidence based on patent counts. Environ. Resour. Econ. 2010, 45, 133–155. [Google Scholar] [CrossRef]

- Ambec, S.; Cohen, M.A.; Elgie, S.; Lanoie, P. The Porter hypothesis at 20: Can environmental regulation enhance innovation and competitiveness? Rev. Environ. Econ. Policy 2013, 7, 1. [Google Scholar] [CrossRef]

- Albrizio, S.; Botta, E.; Koźluk, T.; Zipperer, V. Do environmental policies matter for productivity growth?: Insights from new cross-country measures of environmental policies. OECD Econ. Dep. Work. Pap. 2014. [Google Scholar] [CrossRef]

- Costantini, V.; Crespi, F.; Marin, G.; Paglialunga, E. Eco-innovation, sustainable supply chains and environmental performance in European industries. J. Clean. Prod. 2017, 155, 141–154. [Google Scholar] [CrossRef]

- Ghisetti, C.; Rennings, K.J. Environmental innovations and profitability: How does it pay to be green? An empirical analysis on the German innovation survey. J. Clean. Prod. 2014, 75, 106–117. [Google Scholar] [CrossRef]

- Horbach, J.; Rammer, C.; Rennings, K. Determinants of eco-innovations by type of environmental impact—The role of regulatory push/pull, technology push and market pull. Ecol. Econ. 2012, 78, 112–122. [Google Scholar] [CrossRef]

- Mao, J.; Xie, J.; Hu, Z.; Deng, L.; Wu, H.; Hao, Y. Sustainable development through green innovation and resource allocation in cities: Evidence from machine learning. Sustain. Dev. 2023, 31, 2386–2401. [Google Scholar] [CrossRef]

- Rennings, K.; Rammer, C. The impact of regulation-driven environmental innovation on innovation success and firm performance. Ind. Innov. 2011, 18, 255–283. [Google Scholar] [CrossRef]

- Aghion, P.; Bloom, N.; Blundell, R.; Griffith, R.; Howitt, P. Competition and innovation: An inverted-U relationship. Q. J. Econ. 2005, 120, 701–728. [Google Scholar]

- Hojnik, J.; Ruzzier, M. What drives eco-innovation? A review of an emerging literature. Environ. Innov. Soc. Transit. 2016, 19, 31–41. [Google Scholar] [CrossRef]

- Xiong, Y.; Dai, L. Does green finance investment impact on sustainable development: Role of technological innovation and renewable energy. Renew. Energy 2023, 214, 342–349. [Google Scholar] [CrossRef]

- Lin, B.; Bai, R. Nexus between green finance development and green technological innovation: A potential way to achieve the renewable energy transition. Renew. Energy 2023, 218, 119295. [Google Scholar]

- Sun, Y.; Gao, P.; Tian, W.; Guan, W. Green innovation for resource efficiency and sustainability: Empirical analysis and policy. Resour. Policy 2023, 81, 103369. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).