Impact of Corporate Social Responsibility on Organizational Resilience in Construction Firms—A Study from China

Abstract

1. Introduction

2. Theoretical Background

2.1. CSR

2.2. Organizational Resilience

2.2.1. The Connotation of Organizational Resilience

2.2.2. Organizational Resilience of Construction Companies

3. Hypothesis Development

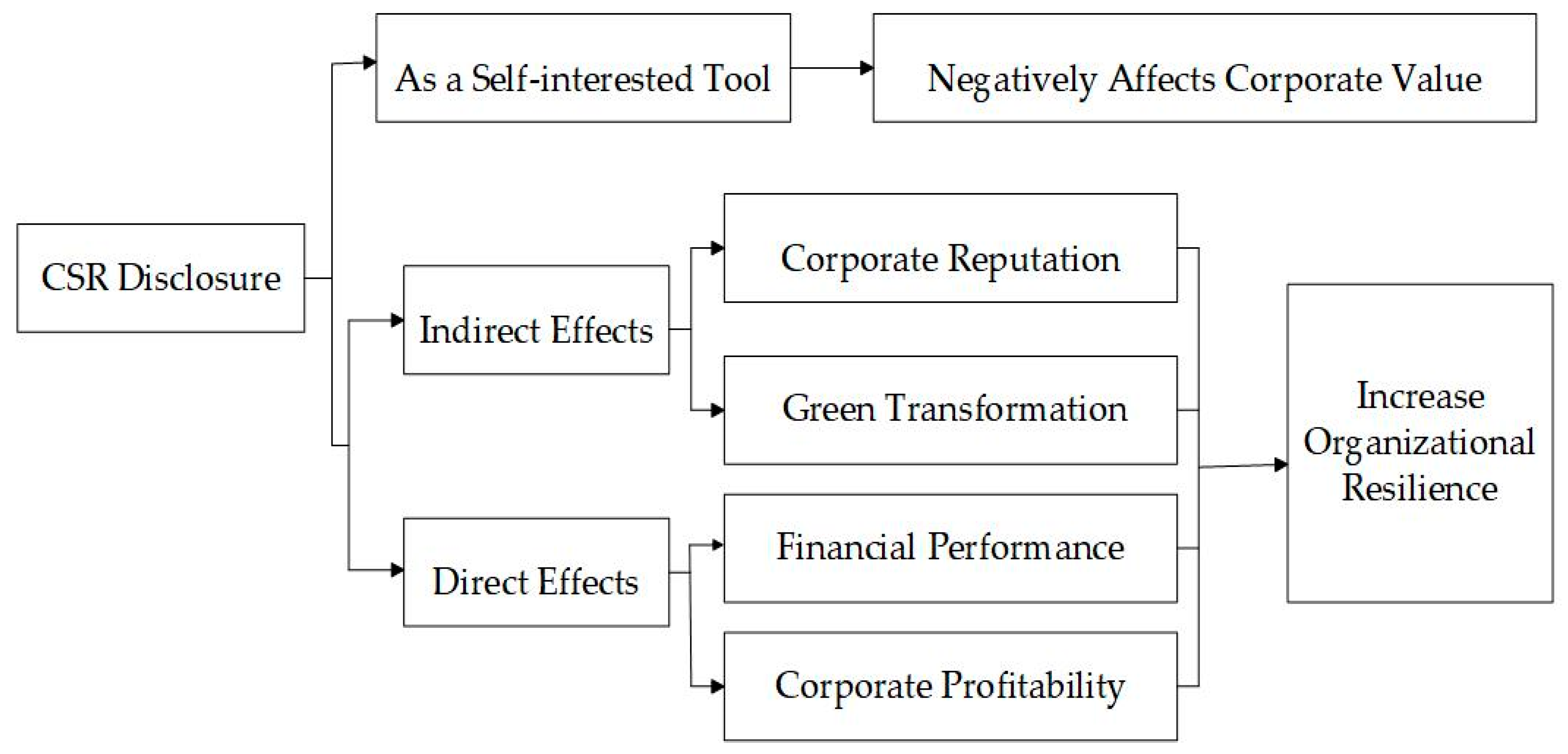

3.1. CSR Disclosure and Organizational Resilience

3.2. CSR Inputs and Organizational Resilience

- (1)

- Corporate responsibility to shareholders

- (2)

- Corporate Responsibility to Employees

- (3)

- Corporate responsibility to society

4. Research Design

4.1. Sample Selection and Data Sources

4.2. Variable Selection

4.2.1. Organizational Resilience

4.2.2. Social Responsibility Disclosure

4.2.3. CSR Inputs

4.2.4. Control Variables

4.3. Measurement Model

5. Empirical Research

5.1. Correlation Analysis

5.2. Analysis of Regression Results

5.3. Endogeneity Test

5.4. Robustness Check

6. Conclusions and Implications of the Study

6.1. Conclusions and Discussion

6.2. Theoretical and Practical Insights

6.3. Limitations

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Leslie, M. Construction Industry Innovation Takes Aim at Reducing Carbon Emissions. Engineering 2022, 19, 7–10. [Google Scholar] [CrossRef]

- Xu, X.C.; Tang, Y.; Jing, Q.Y. Analysis of China’s Economic Situation in 2021 and Outlook for 2022. Econ. Perspect. 2022, 63, 3–17. [Google Scholar]

- Su, K.; Liu, C.; Zhang, M. The optimization of a corporate social responsibility management system based on service-orientated architecture under the concept of sustainable development. Technol. Forecast. Soc. Chang. 2024, 200, 123102. [Google Scholar] [CrossRef]

- Xie, Y.; Chen, R.; Cheng, J. How can new-energy vehicle companies use organizational resilience to build business ecological advantages? The role of ecological niche and resource orchestration. J. Clean. Prod. 2023, 415, 137765. [Google Scholar] [CrossRef]

- Mirghaderi, S.A.; Aboumasoudi, A.S.; Amindoust, A. Developing an open innovation model in the startup ecosystem industries based on the attitude of organizational resilience and blue ocean strategy. Comput. Ind. Eng. 2023, 181, 109301. [Google Scholar] [CrossRef]

- Li, P.; Zhu, J.Z. Organizational resilience: An updated literature review. Foreign Econ. Manag. 2021, 43, 25–41. [Google Scholar] [CrossRef]

- Zhou, J.N.; Yang, L. Network-Based Research on Organizational Resilience in Wuhan Thunder God Mountain Hospital Project during the COVID-19 Pandemic. Sustainability 2022, 14, 10064. [Google Scholar] [CrossRef]

- Bühler, M.M.; Hollenbach, P.; Michalski, A.; Meyer, S.; Birle, E.; Off, R.; Lang, C.; Schmidt, W.; Cudmani, R.; Fritz, O.; et al. The Industrialisation of Sustainable Construction: A Transdisciplinary Approach to the Large-Scale Introduction of Compacted Mineral Mixtures (CMMs) into Building Construction. Sustainability 2023, 15, 10677. [Google Scholar] [CrossRef]

- AlMaian, R.; Qammaz, A.B. The Organizational Learning Role in Construction Organizations Resilience during the COVID-19 Pandemic. Sustainability 2023, 15, 1082. [Google Scholar] [CrossRef]

- Yapicioglu, B. Navigating Turbulent Environments: Exploring Resilience in SMEs through Complex Adaptive Systems Perspective. Sustainability 2023, 15, 9118. [Google Scholar] [CrossRef]

- Wang, Y.X.; Ren, J.L.; Zhang, L.; Liu, D.L. Research on Resilience Evaluation of Green Building Supply Chain Based on ANP-Fuzzy Model. Sustainability 2023, 15, 285. [Google Scholar] [CrossRef]

- Sheldon, O. The Philosophy of Management. Sir I. Pitman & Sons: London, UK, 1923; pp. 145–296. [Google Scholar]

- Zhu, W.M.; Chen, X.Y. Corporate Social Responsibility: The Basis for Strategic Corporate PR. Contemp. Financ. Econ. 2004, 65–68+73. Available online: https://kns.cnki.net/nzkhtml/xmlRead/trialRead.html?dbCode=CJFD&tableName=CJFDTOTAL&fileName=DDCJ200408011&fileSourceType=1&invoice=o6BMCstvhFcdZwgb0Mp4tMrynIExz3CUQiFRyHE2NY4HiJCFkjvGzXNthVqH1UictG%2f8IldF1kGwxy0rIR8wi0NDb0w3iERCxJP2wWxNFP36mQzHK3TBxayer8G9NIG%2bNI1g2XnRx%2f%2bLPnsIt2%2fw3Q2k9YHaFK5nTetRNEwqIxM%3d&appId=KNS_BASIC_PSMC (accessed on 18 September 2024).

- Neal, R.; Cochran, P.L. Corporate social responsibility, corporate governance, and financial performance: Lessons from finance. Bus. Horiz. 2008, 51, 535–540. [Google Scholar] [CrossRef]

- Carter, C.R.; Kale, R.; Grimm, C.M. Environmental purchasing and firm performance: An empirical investigation. Transp. Res. Part E 2000, 36, 219–228. [Google Scholar] [CrossRef]

- Shi, F.A.; Li, X.D.; Ma, Y.J. Research on the driving model of corporate social responsibility in the context of ESG. Financ. Account. Mon. 2023, 44, 26–35. [Google Scholar] [CrossRef]

- Yang, Z.; Ling, H.C.; Chen, J. Does social trust help companies to fulfill their social responsibility? Sci. Res. Manag. 2021, 42, 143–152. [Google Scholar] [CrossRef]

- Xiao, H.J.; Yang, Z.; Zhang, Z. The effect of party organization embeddedness and entrepreneurial status on corporate social responsibility in private firms. Chin. J. Manag. 2022, 19, 495–505. [Google Scholar]

- Govindan, K.; Kilic, M.; Uyar, A.; Karaman, A.S. Drivers and value-relevance of CSR performance in the logistics sector: A cross-country firm-level investigation. Int. J. Prod. Econ. 2021, 231, 107835. [Google Scholar] [CrossRef]

- Chen, G.M. The Construction of Social Responsibility Power Mechanism of Small and Medium-sized Private Enterprises under the Goal of Common Wealth. Enterp. Econ. 2023, 42, 22–31. [Google Scholar] [CrossRef]

- Minh, T.N.; Quang, T.T. The effects of corporate social responsibility on firm efficiency: Inside the matrix of corporate finance. Financ. Res. Lett. 2022, 46, 102500. [Google Scholar] [CrossRef]

- Tuyen, B.Q.; Phuong Anh, D.V.; Mai, N.P.; Long, T.Q. Does corporate engagement in social responsibility affect firm innovation? The mediating role of digital transformation. Int. Rev. Econ. Financ. 2023, 84, 292–303. [Google Scholar] [CrossRef]

- Khan, S.A.R.; Sheikh, A.A.; Ahmad, Z. Developing the interconnection between green employee behavior, tax avoidance, green capability, and sustainable performance of SMEs through corporate social responsibility. J. Clean. Prod. 2023, 419, 138236. [Google Scholar] [CrossRef]

- Streimikiene, D.; Simanaviciene, Z.; Kovaliov, R. Corporate social responsibility for implementation of sustainable energy development in Baltic States. Renew. Sustain. Energy Rev. 2009, 13, 813–824. [Google Scholar] [CrossRef]

- Meyer, A. Adapting to Environmental Jolts. Adm. Sci. Q. 1983, 27, 515–537. [Google Scholar] [CrossRef]

- Wang, Q. Highly Resilient Organizations in the Digital Age: People as a Single Unit. Tsinghua Bus. Rev. 2020, 10, 96–100. [Google Scholar]

- Hu, Y.Y.; Chen, S.M.; Qiu, F.J. Digital Strategy Orientation, Market Competitiveness and Organizational Resilience of Enterprises. China Soft Sci. 2021, 36, 214–225. [Google Scholar]

- Lengnick-Hall, C.A.; Beck, T.E.; Lengnick-Hall, M.L. Developing a capacity for organizational resilience through strategic human resource management. Hum. Resour. Manag. Rev. 2011, 21, 243–255. [Google Scholar] [CrossRef]

- Chen, X.L.; Mi, Y.X. Exploring the Path of Cultivating Organizational Resilience in Small and Medium-sized Enterprises in the Context of Digitalization. Trade Fair Econ. 2023, 42, 75–77. [Google Scholar] [CrossRef]

- Madni, A.M.; Jackson, S. Towards a Conceptual Framework for Resilience Engineering. IEEE Syst. J. 2009, 3, 181–191. [Google Scholar] [CrossRef]

- Shan, Y.; Xu, H.; Zhou, L.X.; Zhou, Q. Digital Intelligence Empowerment: How is Organizational Resilience Formed in Crisis Situations? An exploratory case study based on Lin Ching-Hsien’s turnaround from crisis to opportunity. J. Manag. World 2021, 37, 84–104. [Google Scholar] [CrossRef]

- Li, L.; Zhong, W.G.; Peng, S.Q.; Hao, D.H.; Wang, Y.F. Business Resilience and Entrepreneurship under the Crisis of the New Crown Pneumonia Epidemic—A Special Investigation Report on the Growth and Development of Chinese Entrepreneurs in 2021-China. Nankai Bus. Rev. 2022, 25, 50–64. [Google Scholar]

- Shiha, A.; Dorra, E.M. Resilience Index Framework for the Construction Industry in Developing Countries. J. Constr. Eng. Manag. 2023, 149. [Google Scholar] [CrossRef]

- Miao, X.; Fu, Y.; Liu, J.W.; Chen, S.; Xi, W.Q.; Wu, S.R. Research on Science and Technology Innovation Efficiency of Listed Construction Enterprises in China Based on Innovation Value Chain Theory. Sci. Technol. Manag. Res. 2023, 43, 73–79. [Google Scholar]

- Zhao, X.; Liu, Y.M.; Jiang, W.C.; Wei, D.R. Study on the Factors Influencing and Mechanisms Shaping the Institutional Resilience of Mega Railway Construction Projects. Sustainability 2023, 15, 8305. [Google Scholar] [CrossRef]

- Wang, D.D.; Wang, P.; Liu, Y.J. The Emergence Process of Construction Project Resilience: A Social Network Analysis Approach. Buildings 2022, 12, 822. [Google Scholar] [CrossRef]

- Qian, Y.T.; Liu, H.; Mao, P.; Zheng, X.D. Evaluation of Safety Management of Smart Construction Sites from the Perspective of Resilience. Buildings 2023, 13, 2205. [Google Scholar] [CrossRef]

- Cai, B.P.; Xie, M.; Liu, Y.H.; Liu, Y.L.; Feng, Q. Availability-based engineering resilience metric and its corresponding evaluation methodology. Reliab. Eng. Syst. Saf. 2018, 172, 216–224. [Google Scholar] [CrossRef]

- Nie, X. Research on the Motivation and Quality Influencing Factors of Corporate Social Responsibility Information Disclosure. Mod. Econ. Inf. 2019, 40, 80–81. [Google Scholar]

- Nguyen, T.H.; Vu, Q.T.; Nguyen, D.M.; Le, H.L. Factors Influencing Corporate Social Responsibility Disclosure and Its Impact on Financial Performance: The Case of Vietnam. Sustainability 2021, 13, 8197. [Google Scholar] [CrossRef]

- Li, Q.J.; Yin, S. Research on the Influencing Factors of Social Responsibility Information Disclosure of Listed Companies on Growth Enterprise Market. Commun. Financ. Account. 2014, 35, 99–101. [Google Scholar] [CrossRef]

- Duque-Grisales, E.; Aguilera-Caracuel, J. Environmental, Social and Governance (ESG) Scores and Financial Performance of Multilatinas: Moderating Effects of Geographic International Diversification and Financial Slack. J. Bus. Ethics 2019, 168, 1–20. [Google Scholar] [CrossRef]

- Li, Z. A Study on the Correlation between Corporate Social Responsibility and Corporate Value—Empirical Evidence from Shanghai Listed Companies. China Ind. Econ. 2006, 77–83. [Google Scholar] [CrossRef]

- Ninlaphay, S.; Mahatham, A. Social responsibility disclosure quality and ongoing firm sustainability: Evidence from ISO 14,000 businesses in Thailand. J. Int. Bus. Econ. 2014, 14, 115–128. [Google Scholar] [CrossRef]

- Araújo, J.; Pereira, I.V.; Santos, J.D. The Effect of Corporate Social Responsibility on Brand Image and Brand Equity and Its Impact on Consumer Satisfaction. Adm. Sci. 2023, 13, 118. [Google Scholar] [CrossRef]

- Wang, X.Q.; Ning, J.H. Can Mandatory Social Responsibility Disclosure Drive Corporate Green Transformation?—Evidence based on green patent data of listed companies in China. J. Audit. Econ. 2020, 35, 69–77. [Google Scholar]

- Hashem, A.; Husam, A.; Huthaifa, A.-H.; Obeid, A.S.M. Do different dimensions of corporate social responsibility disclosure have different economic consequence: Multi-approaches for profitability examination. Compet. Rev. Int. Bus. J. 2023, 33, 240–263. [Google Scholar] [CrossRef]

- Chen, C.; Wang, Z.J.; Ye, Y. A Study on the Impact of Corporate Social Responsibility Disclosure on Financial Performance from the Perspective of Signaling Theory. Chin. J. Manag. 2019, 16, 408–417. [Google Scholar]

- Zhang, Z.G.; Jin, X.C.; Li, G.Q. An Empirical Study on the Interactive Cross-period Effect between Corporate Social Responsibility and Financial Performance. Account. Res. 2013, 8, 32–39+96. [Google Scholar]

- Megumi, S.; Hitoshi, T. Impact of corporate social responsibility intensity on firm-specific risk and innovation: Evidence from Japan. Soc. Responsib. J. 2022, 18, 484–500. [Google Scholar] [CrossRef]

- Zhu, D.Y.; Li, X.H. A study of the impact of CSR investment on organizational resilience in manufacturing firms. Chin. J. Manag. 2023, 20, 1023–1033. [Google Scholar]

- Zhu, Y.M.; Li, J.; Li, J. The Impact of Corporate Social Responsibility on Corporate Performance: Based on Meta-Analysis. Financ. Account. Mon. 2021, 42, 27–36. [Google Scholar] [CrossRef]

- Angelopoulos, G.; Parnell, J.A.; Scott, G.J. Performance satisfaction, shareholder and stakeholder orientations: Managers’ perceptions in three countries across continents. S. Afr. J. Econ. Manag. Sci. 2013, 16, 199–215. [Google Scholar] [CrossRef][Green Version]

- Pham, N.T.; Tuan, T.H.; Le, T.D.; Nguyen, P.N.D.; Usman, M.; Ferreira, G.T.C. Socially responsible human resources management and employee retention: The roles of shared value, relationship satisfaction, and servant leadership. J. Clean. Prod. 2023, 414, 137704. [Google Scholar] [CrossRef]

- Lee, P.K.C.; Lau, A.K.W.; Cheng, T.C.E. Employee rights protection and financial performance. J. Bus. Res. 2013, 66, 1861–1869. [Google Scholar] [CrossRef]

- Zhao, D.H.; Chen, Y.H.; Zheng, W.B. Perceived Social Responsibility Oriented Human Resource Management and Employee Advocacy Behavior: Based on Social Exchange Theory. Hum. Resour. Dev. China 2019, 36, 91–104. [Google Scholar] [CrossRef]

- Jin, L.Y. Empirical Study on the Measurement Indicator System of Corporate Social Responsibility Movement: Consumer Perspective. China Ind. Econ. 2006, 24, 114–120. [Google Scholar] [CrossRef]

- Wang, H.M.; Song, T. An Empirical Study on Social Responsibility and Corporate Performance of Listed Companies in China: Empirical Evidence from SSE 180 Index. J. Nanjing Norm. Univ. (Soc. Sci. Ed.) 2007, 52, 58–62+75. Available online: https://kns.cnki.net/nzkhtml/xmlRead/trialRead.html?dbCode=CJFD&tableName=CJFDTOTAL&fileName=NJSS200702009&fileSourceType=1&invoice=YtD0o%2booUb%2bci0%2bOj%2b9c9Q7EHoOF0lhc7ETc2w8DXptvX07%2frNKcx7RIj8r2XfunTeCpltPkPdjh4vESQeHE1wdlVwAIJBn4tOzIoEhtICoN0U4e1%2f5%2bAdzmGo4OJq53%2fhIWgZlYDzns6gSKp2r0YePhr1TQo7TdUSo2kK9LrgI%3d&appId=KNS_BASIC_PSMC (accessed on 18 September 2024).

- Wei, W.C. A Study of the Relationship between Drivers and Performance of Corporate Philanthropy Activities. J. Commer. Econ. 2012, 31, 84–85. [Google Scholar]

- George, A.K.; Kayal, P.; Maiti, M. Nexus of Corporate Social Responsibility Expenditure (CSR) and financial performance: Indian banks. Q. Rev. Econ. Financ. 2023, 90, 190–200. [Google Scholar] [CrossRef]

- Ortiz-de-Mandojana, N.; Bansal, P. The long-term benefits of organizational resilience through sustainable business practices. Strateg. Manag. J. 2015, 37, 1615–1631. [Google Scholar] [CrossRef]

- Lv, W.; Wei, Y.; Li, X.; Lin, L. What Dimension of CSR Matters to Organizational Resilience? Evidence from China. Sustainability 2019, 11, 1561. [Google Scholar] [CrossRef]

- Liu, B.; Tan, S.L. The Impact of Corporate Social Responsibility on Organizational Resilience Innovation—A Multidimensional Empirical Analysis Based on Listed Companies in the Chinese Manufacturing Industry. Enterp. Econ. 2022, 41, 113–121. [Google Scholar] [CrossRef]

- Wang, Y. A Study of the Relationship Between Organizational Resilience, Strategic Capabilities, and the Growth of New Ventures. J. Univ. Chin. Acad. Soc. Sci. 2019, 41, 68–77. [Google Scholar]

- Ambulkar, S.; Blackhurst, J.; Grawe, S. Firm’s resilience to supply chain disruptions: Scale development and empirical examination. J. Oper. Manag. 2015, 33–34, 111–122. [Google Scholar] [CrossRef]

- Nayal, O.E.; Slangen, A.; Oosterhout, J.H.; Essen, M. Towards a Democratic New Normal? Investor Reactions to Interim—Regime Dominance during Violent Events Studies. J. Manag. 2020, 57, 505–536. [Google Scholar] [CrossRef]

- Xie, W.M.; Wei, H.Q. Market Competition, Organizational Redundancy and Corporate R&D Investment. China Soft Sci. 2016, 31, 102–111. [Google Scholar]

- Essuman, D.; Bruce, P.A.; Ataburo, H.; Asiedu-Appiah, F.; Boso, N. Linking resource slack to operational resilience: Integration of resource-based and attention-based perspectives. Int. J. Prod. Econ. 2022, 254, 108652. [Google Scholar] [CrossRef]

- Li, H.; Pournader, M.; Fahimnia, B. Servitization and organizational resilience of manufacturing firms: Evidence from the COVID-19 outbreak. Int. J. Prod. Econ. 2022, 250, 108685. [Google Scholar] [CrossRef]

- Zhang, M.Y.; Zhang, S.T. The Impact of Relationship Networks on Organizational Resilience—The Mediating Role of Dual Innovation. Sci. Res. Manag. 2022, 43, 163–170. [Google Scholar] [CrossRef]

- Tanner, S.; Prayag, D.G.; Coelho Kuntz, D.J. Psychological capital, social capital and organizational resilience: A Herringbone Model perspective. Int. J. Disaster Risk Reduct. 2022, 78, 103149. [Google Scholar] [CrossRef]

- Li, Y.; Wang, X.; Gong, T.; Wang, H. Breaking out of the pandemic: How can firms match internal competence with external resources to shape operational resilience? J. Oper. Manag. 2022, 69, 384–403. [Google Scholar] [CrossRef]

- Bai, X.Y.; Zhai, G.F.; He, Z.Y. International Experiences and Insights on Organizational Resilience Enhancement. J. Catastrophol. 2017, 32, 183–190. [Google Scholar]

- Song, X.Z.; Hu, J.; Li, S.H. Social Responsibility Disclosure and Stock Price Crash Risk—A Path Analysis Based on Information Effect and Reputation Insurance Effect. J. Financ. Res. 2017, 60, 161–175. [Google Scholar]

- Inoue, Y.; Lee, S. Effects of different dimensions of corporate social responsibility on corporate financial performance in tourism-related industries. Tour. Manag. 2011, 32, 790–804. [Google Scholar] [CrossRef]

- Wang, X.W.; Chen, H. A Study on the Relationship between Corporate Social Responsibility and Corporate Value Based on Stakeholders. J. Manag. Sci. 2011, 24, 29–37. [Google Scholar]

- Li, X.H.; Zhou, C. The Meaning of Corporate Survival: From Shareholder Interest Theory to Corporate Interest Theory. Financ. Res. 2022, 08, 3–13. [Google Scholar] [CrossRef]

- Yan, Y.J.; Wang, X.J.; Zhang, G. The Effect of Highly Distributive Dividend Policies on Firm Performance. Co-Oper. Econ. Sci. 2023, 39, 88–91. [Google Scholar] [CrossRef]

- Koo, J.E.; Ki, E.S. Corporate Social Responsibility and Employee Safety: Evidence from Korea. Sustainability 2020, 12, 2649. [Google Scholar] [CrossRef]

- Ding, D.H.; Chen, X.M. An empirical study on the relationship between social responsibility and corporate performance: Evidence from Chinese listed companies. Study Explor. 2013, 35, 101–106. [Google Scholar]

- Inoue, Y.; Kent, A.; Lee, S. CSR and the Bottom Line: Analyzing the Link Between CSR and Financial Performance for Professional Teams. J. Sport Manag. 2011, 25, 531–549. [Google Scholar] [CrossRef]

- Flammer, C. Does Corporate Social Responsibility Lead to Superior Financial Performance? A Regression Discontinuity Approach. Manag. Sci. 2015, 61, 2549–2568. [Google Scholar] [CrossRef]

- Aguinis, H.; Glavas, A. Embedded Versus Peripheral Corporate Social Responsibility: Psychological Foundations. Ind. Organ. Psychol. 2013, 6, 314–332. [Google Scholar] [CrossRef]

| Dimension | Delegate | Definition |

|---|---|---|

| Resistance | Wang [26] | Ability to survive a crisis |

| Hu et al. [27] | Resilience of firms to systemic shocks | |

| Resilience | Lengnick-Hall [28] | Extent to which the system can withstand sustained interference |

| Chen and Mi [29] | Ability of an enterprise to respond quickly and maintain normal order and stable productivity | |

| Transcendence | Madni and Jackson [30] | Dynamic capability that needs to be continuously strengthened and invested in |

| Shan et al. [31] | Dynamic ability of an organization to reinvent and upgrade in the VUCA context | |

| Li et al. [32] | Ability to recover from setbacks and even grow through them |

| Variable | Variable Symbol | Measurement Indicator | Mean | Std. Dev |

|---|---|---|---|---|

| Organizational Resilience | OR | Three Years of Financial Growth | −0.012 | 0.900 |

| Social Responsibility Disclosure | Treat | Treat = 0,the enterprise does not publish a CSR report; Treat = 1, discloses it | 0.806 | 0.396 |

| Social CSR Inputs | Social CSR | CSR Scores | 4.310 | 3.545 |

| Shareholder CSR Inputs | Shareholder CSR | CSR Scores | 13.315 | 5.394 |

| Employee CSR Inputs | Employee CSR | CSR Scores | 3.281 | 3.450 |

| Firm Age | Age | Age of Business Establishment | 18.452 | 6.245 |

| Organizational Redundancy | Slack | Total Borrowing/Total Assets | 0.198 | 0.124 |

| Return on Assets | ROA | Net Profit/Total Assets | 0.022 | 0.044 |

| Corporate Social Capital | Network size | The total number of partners and the number of suppliers and customers per year | 16.309 | 16.043 |

| Provincial GDP Growth | GDP growth | 0.095 | 0.049 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) |

|---|---|---|---|---|---|---|---|---|---|---|

| (1) OR | 1 | |||||||||

| (2) Treat | 0.126 ** | 1 | ||||||||

| (3) Social CSR | 0.152 ** | −0.022 * | 1 | |||||||

| (4) Shareholder CSR | 0.214 ** | 0.053 | 0.233 ** | 1 | ||||||

| (5) Employee CSR | 0.190 ** | 0.167 ** | 0.105 ** | 0.293 ** | 1 | |||||

| (6) Age | −0.335 ** | 0.118 ** | 0.008 | 0.197 ** | −0.254 ** | 1 | ||||

| (7) Slack | −0.008 | −0.062 | 0.084 * | −0.235 ** | −0.059 | −0.068 | 1 | |||

| (8) ROA | 0.014 | −0.065 | 0.199 ** | 0.735 ** | 0.084 * | −0.080 * | −0.237 ** | 1 | ||

| (9) Network size | 0.128 ** | 0.117 ** | −0.013 | 0.074 * | −0.132 ** | 0.137 ** | 0.054 | 0.021 | 1 | |

| (10) GDP growth | 0.023 | −0.290 ** | 0.084 * | 0.036 | 0.101 ** | −0.251 ** | 0.034 | 0.116 ** | −0.060 | 1 |

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |

|---|---|---|---|---|---|---|

| Treat | 0.2982 *** (3.51) | 0.256 *** (3.18) | 0.1793 ** (2.32) | |||

| Social CSR | 0.0459 *** (3.98) | 0.0261 ** (2.58) | 0.0358 *** (3.54) | |||

| Shareholder CSR | 0.0559 *** (6.10) | 0.0272 *** (5.34) | 0.0414 *** (5.00) | |||

| Employee CSR | 0.0461 *** (4.12) | 0.0345 *** (2.69) | 0.0208 * (1.81) | |||

| Age | −0.0611 *** (−7.61) | −0.0647 *** (−7.80) | −0.0539 *** (−6.72) | −0.0596 *** (−7.52) | −0.0545 *** (−7.28) | |

| Slack | −0.1710 (−0.90) | −0.3675 *** (−2.01) | −0.0052 (−0.03) | −0.083 (−0.45) | −0.1243 (−0.68) | |

| ROA | −0.0967 *** (−0.29) | −0.9307 ** (−2.36) | −5.0317 *** (−5.31) | −0.2208 (−0.63) | −4.4141 *** (−4.95) | |

| Network Size | 0.0074 *** (2.85) | 0.0076 *** (2.95) | 0.0059 * (2.37) | 0.0075 *** (2.92) | 0.0066 *** (2.64) | |

| GDP Growth | 0.5174 (0.71) | 0.4122 (0.56) | 0.6387 (0.86) | 0.7121 (0.337) | 0.5758 (0.80) | |

| △R2 | 0.1874 | 0.2054 | 0.2204 | 0.2017 | 0.1006 | 0.2518 |

| F | 4.85 | 5.69 | 5.69 | 5.14 | 4.15 | 5.02 |

| FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Model 1 | Model 2 | |

|---|---|---|

| Treat | 0.189 ** (2.29) | 0.213 *** (2.63) |

| Social CSR | 0.020 ** (2.08) | 0.028 *** (3.06) |

| Shareholder CSR | 0.021 *** (3.16) | 0.038 *** (3.98) |

| Employee CSR | 0.026 *** (2.64) | 0.009 (0.87) |

| Control Variable | No | Yes |

| △R2 | 0.054 | 0.190 |

| F | 10.64 | 18.47 |

| Model 1 | Model 2 | Model 3 | Model 4 | |

|---|---|---|---|---|

| Treat | 0.4958 *** (5.29) | 0.3771 *** (4.27) | ||

| Tax/Revenue | 0.2971 *** (3.54) | 0.3208 *** (8.05) | 0.2900 *** (3.99) | 0.3084 *** (4.24) |

| Control Variable | No | No | Yes | Yes |

| △R2 | 0.0739 | 0.0929 | 0.2367 | 0.2563 |

| F | 2.20 | 7.04 | 4.75 | 4.75 |

| FE | Yes | Yes | Yes | Yes |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ma, T.; Wang, H.; Qu, Y. Impact of Corporate Social Responsibility on Organizational Resilience in Construction Firms—A Study from China. Sustainability 2024, 16, 8366. https://doi.org/10.3390/su16198366

Ma T, Wang H, Qu Y. Impact of Corporate Social Responsibility on Organizational Resilience in Construction Firms—A Study from China. Sustainability. 2024; 16(19):8366. https://doi.org/10.3390/su16198366

Chicago/Turabian StyleMa, Teng, Huiling Wang, and Ying Qu. 2024. "Impact of Corporate Social Responsibility on Organizational Resilience in Construction Firms—A Study from China" Sustainability 16, no. 19: 8366. https://doi.org/10.3390/su16198366

APA StyleMa, T., Wang, H., & Qu, Y. (2024). Impact of Corporate Social Responsibility on Organizational Resilience in Construction Firms—A Study from China. Sustainability, 16(19), 8366. https://doi.org/10.3390/su16198366