Abstract

This paper explores the direct impact of different types of supply chain integration on supply chain resilience in new energy vehicle manufacturing enterprises. It also elucidates the mediating role of supply chain risk management and the moderating role of regulatory uncertainty, proposing nine research hypotheses. Finally, it employs SPSS 26.0 software to analyze the research hypotheses using collected 309 sample data. The research results indicate the following: (1) Internal integration, supplier integration, and customer integration all positively influence supply chain resilience, with supplier integration having the most significant impact. (2) Supply chain risk management mediates the relationship between internal integration, supplier integration, customer integration, and supply chain resilience. (3) Regulatory uncertainty significantly negatively moderates the impact of internal integration and customer integration on supply chain resilience, but it does not significantly negatively moderate the impact of supplier integration on supply chain resilience.

1. Introduction

Countries worldwide have implemented a range of policies to promote the transition from traditional fossil fuels to new energy sources. New energy vehicles (NEV), a type of Alternative Fuelled Vehicle (AFV), are a key focus in the global automotive industry [1]. Research has demonstrated that the development of NEVs can significantly alleviate environmental pollution pressures [2]. However, the growth of NEV manufacturing enterprises in China faces substantial challenges due to the highly volatile industry environment, persistent supply chain risks, and the complex strategic choices surrounding supply chain integration (SCI).

Firstly, the industry environment is characterized by volatility. According to the China Passenger Car Association, in 2023, the cumulative retail sales of NEVs in China reached 7.736 million units, marking a 36.2% year-on-year increase, with a market penetration rate of 35.7%. Furthermore, cumulative exports rose to 1.048 million units, reflecting a year-on-year growth of 72.0%. Despite the overall positive trends in industry operations, the backdrop of deglobalization and economic transformation is amplifying the uncertainty within China’s business environment, significantly impacting enterprises, particularly in the manufacturing sector [3]. The NEV industry, in particular, faces intense internal competition, with market dynamics driving a stark survival of the fittest scenario, leading to industry-wide turbulence [4]. Additionally, the gradual phasing out of government subsidies and increasingly stringent market entry requirements are compelling NEV manufacturing enterprises to pursue organizational transformation, resource integration, and technological innovation [5].

Secondly, supply chain risks continue to escalate. The NEV industry is vulnerable to various “black swan” (low-probability, high-impact) and “gray rhino” (high-probability, high-impact) events, such as chip shortages and supply chain disruptions [6]. Furthermore, the industry grapples with raw material price volatility and risk spillover between raw material markets and stock markets [7]. This complex landscape of intertwined risks demands that China’s NEV manufacturing enterprises enhance their supply chain risk management (SCRM) under the new normal of ongoing risk interplay. They must leverage their existing resources to proactively seek effective pathways to mitigate risks and resume production, thereby forging supply chain resilience (SCR).

Lastly, strategic choices in SCI are crucial. To cope with the rapidly evolving industry environment and enhance supply chain operational efficiency, NEV manufacturing enterprises are increasingly pursuing both internal and external supply chain integration strategies. For instance, the emerging brand Xpeng Motors plans to establish five virtual committee organizations and three product matrix organizations to boost collaboration efficiency across its business units. Geely Holding signed a strategic cooperation agreement with Anshan Heavy Machinery in April 2022 to jointly invest in high-quality lithium resources, stabilizing its supply of battery-grade lithium carbonate. From a supply chain perspective, these integration strategies can effectively mitigate uncertainties, reduce transaction costs, and enhance corporate value when supply chain risks increase [8]. However, the differing impacts of various types of SCI and the strategic choices NEV manufacturing enterprises should make regarding internal and external resource integration require deeper exploration.

Faced with the volatile industry environment, persistent supply chain risks, and strategic choices in SCI, supply chain management has become a focal point for both enterprises and scholars. In theoretical research, Flynn et al. found that SCI can significantly improve operational performance, with internal and customer integration having a stronger impact compared to supplier integration [9]. However, other scholars have observed that higher levels of SCI may increase uncertainty and complexity, reducing flexibility and increasing risk exposure [10,11]. Although there has been research on the impact of SCI on SCR, the conclusions remain inconclusive. Additionally, past studies have often used emerging technologies like Web 3.0, digitalization, or blockchain as mediators in the relationship between SCI and SCR. These studies focus primarily on technological mediation but overlook the role of SCRM practices. Therefore, it is necessary to further validate the relationship between supply chain integration and resilience in NEV manufacturing enterprises.

To better optimize the strategic choices in SCI, strengthen SCRM, and enhance SCR, this study focuses on NEV manufacturing enterprises. It aims to explore the relationship between SCI and SCR, the mediating role of SCRM, and the moderating effect of regulatory uncertainty (RU) at the supply chain level.

2. Literature Review

2.1. Supply Chain Integration

Since the concept of the supply chain emerged, numerous scholars have emphasized the importance for manufacturers to establish close and integrated relationships with their supply chain partners [12,13]. However, with the intensification of global competition in recent years, organizational attention to supply chain integration (SCI) has only begun, prompting a re-evaluation of the necessity for cooperative and mutually beneficial relationships with supply chain partners [14,15]. In this context, the coordination and improvement of inter-organizational processes have gradually become a priority in enterprise management [16]. There is currently no unified consensus on the definition of SCI. Some scholars consider it as one of the innovative strategies for manufacturing enterprises [17]; others extend the scope of this concept to all types of enterprises [18]. Some scholars, based on the holistic view of the supply chain, define it as the consolidation of both the production and sales ends of products [19]. Further elaboration on the concept of supply chain integration, including its objects, processes, purposes, and strategic levels, has been provided by Huo Baofeng [20]. Currently, the definition proposed by Flynn et al. is widely accepted and recognized by most scholars [21,22,23]. Flynn [9] defines SCI as a strategic collaboration between manufacturers and supply chain partners, coordinating the internal and external processes of organizations with the aim of providing maximum value to customers at low cost and high speed, achieving maximum efficiency and optimal outcomes for product, information, funds, and decision-making.

Previous research on the outcome variables of SCI encompasses a wide range of dimensions. These outcomes include financial performance metrics such as sales revenue and profitability, market performance indicators like market share and competitiveness, and operational performance aspects, including cost, quality, flexibility, logistics, and partnership management [20]. Flynn [9] demonstrates that SCI significantly enhances operational performance, with internal and customer integration having a more pronounced impact compared to supplier integration. Further research indicates that SCI contributes to improved customer service levels, product quality, and production capabilities, while simultaneously reducing costs, strengthening strategic focus, and shortening production cycles [24]. Additionally, some scholars have investigated the moderating variables between SCI and its outcomes, such as supply chain complexity, business strategies, and demand uncertainty [25,26].

To better categorize the outcome variables resulting from supply chain integration (SCI), this study classifies them into four distinct types: financial performance, operational performance, market performance, and social-environmental performance. Based on this classification, we compiled and analyzed various studies on the outcomes of SCI, as detailed in Table 1 below:

Table 1.

Summary of outcome variables for SCI.

In the research on SCI, existing studies predominantly focus on the unidirectional relationship between SCI and performance, encompassing market performance, financial performance, operational performance, and socio-environmental performance. Among these categories, financial performance has been the most extensively studied. Concurrently, Only a few scholars focus on the operational performance outcomes of SCI, such as cost, quality, flexibility, logistics, and collaborative relationships. Additionally, there is a deficiency in the research on the mechanisms by which SCI impacts SCR.

2.2. Supply Chain Resilience

The concept of SCR originated from the disruptions experienced during the public protests over fuel price hikes in the UK in 2000. Since then, while different scholars may emphasize different aspects in their definitions and dimension divisions of resilience, the core concepts are fundamentally aligned. Scholars have approached the topic from diverse research perspectives, leading to a range of definitions and interpretations. Table 2 below summarizes these various scholarly viewpoints on SCR.

Table 2.

Definitions of SCR by various scholars.

Ponomarov and Holcomb offer a comprehensive definition of supply chain resilience, describing it as the supply chain’s capacity to adapt to unforeseen events and disruptions, maintaining structural and functional stability through three stages: preparation, response, and recovery [44]. Based on previous research, this paper argues that supply chain resilience is a critical management and operational capability of an enterprise. It helps supply chain entities—the enterprises—recover quickly and flexibly from disruptive events and potentially achieve breakthrough growth. This resilience enables companies to respond to various external shocks, such as natural disasters, market fluctuations, or supply chain disruptions, allowing them to gain a competitive edge in a highly competitive market environment.

Research on SCR has been explored from both qualitative and quantitative perspectives. Some scholars focus on theoretical and qualitative analyses to explain SCR. For example, Francesco and Tuncer, through a literature review, identified key factors influencing SCR, such as flexibility, agility, speed, visibility, and redundancy [45]. In another study, Osaro conducted semi-structured interviews with supply chain personnel in Malaysia’s pharmaceutical industry and found that supply chain vulnerability and capability jointly affect SCR [46]. Scholten and Schilder discussed the positive impacts of collaborative activities, like information sharing, on SCR [47]. Tukamuhabwa and colleagues, through interviews conducted in developing countries, revealed that the interplay between threats, strategies, outcomes, and the embeddedness of supply networks significantly influences SCR [48]. Quantitative methods are also employed to research SCR, providing precise measurements and a deeper understanding of its influencing factors. Scholars use statistical tools and mathematical models to analyze various aspects of SCR. For instance, some researchers use graphical modeling and interpretive structural modeling (ISM) to identify key factors affecting SCR [49]. Additionally, some scholars construct mathematical models based on SCR to find that the relationships between suppliers significantly impact resilience during demand disruptions, and partnering with resilient suppliers can enhance the overall SCR [50]. Mandal, through online surveys, investigated the impact of organizational culture on the resilience of healthcare supply chains [51]. These quantitative methods allow researchers to accurately quantify and assess SCR, providing a scientific basis for developing effective management strategies.

The analysis of the existing literature reveals that scholars, both domestically and internationally, generally classify the dimensions of supply chain resilience into two main types: core capabilities and management processes. The key difference between these approaches lies in their perspectives on supply chain resilience. The core capability perspective views resilience as the essential abilities that allow a company to respond to disruptions, emphasizing the fundamental capabilities necessary for navigating uncertainty and change. On the other hand, the management process perspective defines resilience based on the different stages of responding to disruptions, highlighting the importance and interconnection of various phases in the supply chain management process. This study defines SCR as a critical managerial capability that helps companies recover from disruptions with agility and flexibility, potentially achieving breakthrough growth. Building on the comprehensive reviews and summaries of SCR by Ponomarov and Holcomb [44], this paper summarizes the measurement items of resilience based on the defined concept.

Research on SCR predominantly focuses on evaluating an enterprise’s supply chain resilience and its impact on enterprise performance. The existing literature particularly emphasizes the influence of various technological factors on SCR but lacks comprehensive studies examining the antecedents of SCR from a strategic or supply chain management perspective. By exploring the impact of SCI on SCR, this study aims to supplement our understanding of the formation processes of SCR and enrich the theoretical framework of supply chain resilience.

2.3. Supply Chain Risk Management

Supply chain risk can be defined as the various uncertainties and potential dangers that may occur during the operation of a supply chain, potentially impacting or damaging its normal functioning and business objectives [52]. From the perspective of NEV manufacturing enterprises, supply chain risk can be categorized into three hierarchical levels: environmental-level risks, industry-level risks, and enterprise-level risks [53]. To address these levels of supply chain risk, both enterprises and governments place significant emphasis on SCRM. SCRM is typically conceptualized as the intersection of supply chain management and risk management [54]. It comprises four key components: risk identification, risk assessment, risk mitigation, and risk control [55]. These components are deemed essential for the success of any supply chain [56].

Based on the literature review, some scholars suggest that blockchain technology positively affects SCRM by enhancing the reliability of financial transactions and information [57]. Others examine the relationship between SCI and SCRM from a strategic perspective, pointing out that enterprises can improve their internal information processing capabilities through SCI and facilitate information sharing with suppliers and customers, thereby influencing SCRM [58,59].

Then, SCRM can significantly impact an enterprise’s market-related performance, financial performance, and operational performance both in the short term and long term, especially during periods of supply chain disruption [59]. Some scholars argue that effective SCRM can enhance an enterprise’s competitive advantage [60]. Researchers also focus on the influence of SCRM on operational performance, including adaptability and flexibility [61].

SCRM, as a crucial tool for enterprises to counter external risks, is typically analyzed in the literature with a focus on its relationship with enterprise performance. Some scholars have also explored the connection between SCRM processes and the formation of SCR. However, only a few studies delve into the antecedents of SCRM. Therefore, incorporating SCRM into the research model can provide a deeper investigation into the indirect pathways through which SCI influences SCR.

2.4. Regulatory Uncertainty

RU, as part of the environmental backdrop, is widely acknowledged by many scholars [62]. Changes in government regulations and policies are often frequent and unpredictable, and RU refers to the likelihood of such changes occurring [63,64]. Although industry-induced RU differences are not pronounced, it has been found that RU varies significantly across different geographical regions [65].

In the introduction, this paper mentions that the NEV industry is affected by various “black swan” (low-probability but high-impact) and “gray rhino” (high-probability and high-impact) events. RU, as a form of risk, can have a significant impact on the industry, potentially leading to the rapid growth or decline of individual companies. In turbulent environments, a company’s strategic planning or restructuring can be timely and effectively executed through supply chain risk management. This approach can improve supply chain resilience and mitigate the negative impact of risks on the business.

High levels of RU will make information processing more complex [66]. In this situation, the impact of information resource integration brought about by supply chain integration on supply chain resilience will be significantly reduced because changes in policies and regulations disrupt normal business operations [67]. Additionally, increased uncertainty in government regulations will raise the costs and development time of emerging technologies, negatively affecting technological upgrades in businesses [68]. Some scholars also point out that industries relying on government and strict regulation use most of their corporate resources to manage RU. Therefore, it is essential to explore how the impact of SCI on SCR differs under varying levels of RU.

2.5. Foundational Theories

In this study, from the perspective of the supply chain in NEV manufacturing enterprises, SCI and resource orchestration share similar processes. SCI involves reorganizing internal resources and acquiring and combining external resources to form a new system. Once this system is established, NEV manufacturing enterprises can better manage supply chain risks and maintain or enhance SCR. Thus, resource orchestration theory provides theoretical support for studying the relationship between SCI, SCRM, and SCR.

Dynamic capability theory, like resource orchestration, focuses on managing resources. It aligns well with SCRM and SCR mechanisms. Many researchers use this theory in resilience studies, suggesting that developing dynamic capabilities enhances SCR. SCR is often seen as a dynamic capability, representing the ability to maintain operations during disruptions or adapt to changes. This theory also divides resilience into dimensions like agility and preparedness, which can be linked to firm performance, providing strong theoretical support for studying SCI, SCRM, and SCR.

3. Research Hypothesis

Based on the resource orchestration theory, the value of resources and competitive advantage depends on how effectively an enterprise organizes and utilizes these resources in alignment with its strategic goals [69]. The theory comprises three stages: first, acquiring the necessary resources from both internal and external sources; second, reconfiguring these internal and external resources; and third, transforming these resources into valuable assets. Additionally, the core premise of the dynamic capabilities theory is to enable the dynamic alignment of an organization’s capabilities with the external environment [70].

SCI, as a strategic initiative, can be divided into three types: internal integration (II), supplier integration (SI), and customer integration (CI) [9]. Each of these integration processes involves the orchestration of resources within the “three flows” of the supply chain—material flow, financial flow, and information flow—to adapt to a dynamic external environment.

3.1. The Direct Impact of SCI on SCR

3.1.1. The Direct Impact of Internal Integration on SCR

II within the NEV industry refers to the coordination and alignment of various supply chain processes, encompassing user demand, product development, raw material procurement, product manufacturing, and product sales. This also includes the integration of the R&D, procurement, production, sales, and human resources departments involved in the enterprise’s operations.

Firstly, II helps eliminate barriers and fosters inter-departmental collaboration to meet customer requirements, as opposed to operating within the constraints of traditional departmental and specialized organizational structures [9]. This integration facilitates the precise transport of materials within the supply chain, ensuring sufficient resource availability when faced with risks of raw material disruptions. Secondly, II leverages platform ecosystems and data collection to manage and process information resources [22]. This capability enables quick response to disruption risks, thereby enhancing SCR. In summary, it proposes the following hypothesis:

H1a.

II positively influences SCR.

3.1.2. The Direct Impact of External Integration on SCR

External integration of an enterprise’s supply chain encompasses both SI and CI [71]. SI is defined as the comprehensive management and collaborative coordination between manufacturers and their upstream suppliers. CI, on the other hand, refers to the management and integration of channels between manufacturers and downstream distributors or retailers. The direct impact of SI and CI on SCR can be explained through the following three aspects:

Firstly, SI and CI in NEV manufacturing enterprises facilitate the consolidation of information resources. Asymmetrical information is a significant factor contributing to disruption risks and the spillover effects of upstream and downstream risks [6]. This advantage plays an indispensable role in the recovery and response of SCR [72]. Secondly, SI and CI in NEV manufacturing enterprises serve as crucial methods for optimizing resource allocation, stabilizing production and sales chains, and strengthening inherent advantages [73]. Moreover, they can help enterprises penetrate industries with high market barriers, improve operational services, and gain additional competitive advantages [74]. Thirdly, SI and CI in NEV manufacturing enterprises may result in knowledge and technology spillover effects among collaborating enterprises, directly influencing the enterprise’s technological capabilities [75]. Such collaborative innovation in technology enhances the ability to recover and improve following supply chain disruption events [76]. In summary, this study proposes the following hypotheses:

H1b.

SI positively influences SCR.

H1c.

CI positively influences SCR.

3.2. The Mediating Role of SCRM

Currently, most scholars consider emerging technologies such as Industry 4.0, digitalization, or blockchain as mediating variables between SCI and SCR [74]. However, these viewpoints predominantly focus on the intermediary role of technological means at the level of SCI influencing SCR pathways, while overlooking the role of enterprise-level supply chain management practices.

SCRM involves four key steps: risk identification, risk assessment, risk mitigation, and risk control [55]. First, SCI aids in this process by consolidating both internal and external information, enabling enterprises to anticipate potential risks early [6]. Second, SCI breaks down barriers within and outside the organization. Internally, it fosters close collaboration among functional departments for joint risk assessment [9]. Externally, it facilitates the transfer of knowledge and risk assessment experiences from supply chain partners [77], ultimately leading to more precise evaluations of risks. It is noteworthy that some studies have suggested that higher levels of SCI may increase uncertainty and complexity, thus reducing flexibility [10] and heightening risk exposure [11]. However, in the context of NEV manufacturers, these negative effects might be less pronounced.

Building on previous research, the relationship between corporate SCRM and SCR has been well established [78,79]. Firstly, once risks are identified and defined, enterprises can engage in SCRM, utilizing and allocating resources in a way that enhances the enterprise’s ability to withstand risks, thereby facilitating recovery from supply chain disruptions [80]. Additionally, scholars have suggested that enterprises that thoroughly implement SCRM can maintain SCR by reducing informational asymmetries and minimizing uncertainties [81]. In summary, it proposes the following hypotheses:

H2a.

SCRM mediates between II and SCR.

H2b.

SCRM mediates between SI and SCR.

H2c.

SCRM mediates between CI and SCR.

3.3. The Moderating Role of RU

High RU complicates information processing [66]. Under such conditions, the positive impact of information resource integration, derived from SCI, on SCR is significantly diminished. This is because changes in policies and regulations disrupt normal business operations [67]. Additionally, increased uncertainty in government regulations raises the cost and development time of emerging technologies, negatively affecting enterprises’ technological upgrades [68]. In summary, it proposes the following hypotheses:

H3a.

RU negatively moderates the impact of II on SCR.

H3b.

RU negatively moderates the impact of SI on SCR.

H3c.

RU negatively moderates the impact of CI on SCR.

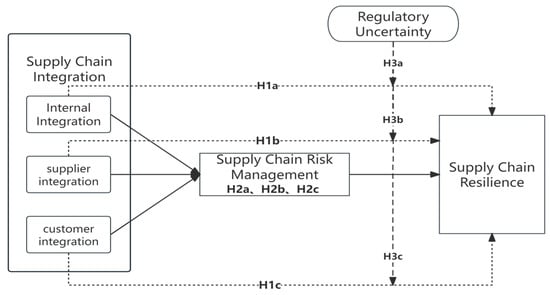

Based on the analysis of the fundamental relationships among the aforementioned variables, this study constructs a conceptual model. The specific model is illustrated in Figure 1.

Figure 1.

Research model diagram.

Compared to previous studies, the novelty of this paper’s hypothesis construction is reflected in the following aspects. First, it explores the mediating role of SCRM. By incorporating SCRM into the research model, this study addresses the limitations of previous research that often used the development of technologies like digitalization and blockchain as mediating variables [76]. Second, it introduces regulatory uncertainty as a moderating variable in the relationship between SCI and SCR, highlighting the varying impacts of SCI on SCR in different contexts. This contrasts with prior studies that focused on broader environmental uncertainty [68].

4. Methodology

4.1. Measurement of Main Variables

Based on the conceptual model of this study in Figure 1, we designed a preliminary questionnaire. The questionnaire includes 22 items in total: 11 items on SCI, 4 items on SCR, 4 items on SCRM, and 3 items on RU. It also collects basic information about the respondents, comprising a total of five sections. The questionnaire uses a 7-point Likert scale for measurement.

Incorporating feedback from experts and business managers, we refined and optimized the phrasing of items for each core variable. Original items are listed in Table 3, and the final survey questionnaire is listed in Appendix A.

Table 3.

The indicators of main variables.

In addition, to ensure the robustness of the results in research model construction, we selected enterprises’ type, enterprises’ employees, and enterprises’ age as control variables based on a comprehensive review of relevant literature on the NEV industry.

4.2. Sample Selection and Data Collection

First, this study utilized a survey method by distributing questionnaires directly via email or through a link on the Wenjuanxing platform. Second, regarding the survey area, this study selected the “New Energy Concept Stocks” published by the Eastmoney Choice database to rigorously filter for enterprises with capabilities in China’s NEV manufacturing or with subsidiaries engaged in NEV manufacturing. This resulted in a final sample of 30 listed enterprises. The survey targets employees within the supply chain departments of these 30 enterprises or their subsidiaries.

Finally, in terms of survey administration, the official survey was conducted from 1 January 2024 to 29 February 2024. The channels included on-the-job MBA students within the research team, colleagues from personal internships at car enterprises, relatives and friends, and a domestic automotive industry research institute. Each of the 30 enterprises received 12 questionnaires, and a total of 342 valid responses were collected. After excluding invalid responses, the final dataset comprised 309 valid questionnaires, resulting in a response rate of 85.83%.

5. Analysis of Results

5.1. Descriptive Statistics

In the final set of 309 valid questionnaires, information on the respondents’ gender, age, educational level, and job position and enterprises’ type, employees, and age is summarized in Table 4.

Table 4.

Respondents’ basic characteristics.

5.2. Reliability and Validity

Cronbach’s alpha is used as a metric to assess the reliability of a questionnaire. The Cronbach’s alpha of the scale after deleting any item must be higher than Cronbach’s alpha for the respective dimension before deletion. Based on the data collected from the formal survey, this study conducts reliability analysis separately for SCI, SCR, SCRM, and RU. This study will examine convergent validity by comparing the standardized factor loading, Average Variance Extracted (AVE) values, and Composite Reliability (CR) values of the related research variables. The standards for evaluating the excellence of the values are as follows: factor loading is higher than 0.7; Cronbach’s alpha is higher than 0.7; AVE is higher than 0.5; and CR is higher than 0.7. This indicates that each item strongly correlates with its underlying construct. The test indicators for each item are shown in Table 5 below.

Table 5.

Reliability and validity of the measurement model.

From Table 5, SCI was measured using 11 items across three dimensions. The overall Cronbach’s alpha is 0.894, indicating good reliability. For II, SI, and CI, Cronbach’s alpha values are 0.894, 0.929, and 0.933, respectively. SCR, SCRM, and RU are also reliable, with strong CITC values and robust Cronbach’s alphas. Table 5 results show that the standardized factor loading for all items across the six main variables is above 0.5. Additionally, the AVE and CR values for each variable meet the required standards. Therefore, the validity of the scales used in this study is considered good.

This study conducts a confirmatory factor analysis on these primary variables. The results show that the CMIN/DF value of the model is 1.216, and the RMSEA value is 0.026 (CFA = 0.993, NFI = 0.960, NNFI = 0.991). Table 6 presents the correlation coefficient and the square root of AVE. Therefore, this study has a high degree of overall model fit.

Table 6.

The correlation coefficient, the square root of AVE.

5.3. Hypothesis Testing

5.3.1. Direct Effect Model Testing

Based on the research analysis, this study proposes hypotheses H1a, H1b, and H1c. To verify the relationships between the key variables, this study uses hierarchical regression analysis in SPSS 26.0 to examine the relationship between SCI and SCR. First, the study includes enterprises’ type, enterprises’ employees, and enterprises’ age as control variables. Next, a series of models are constructed to test H1a, H1b, and H1c. The specific details can be seen in the Table 7 below.

Table 7.

Direct effect model testing.

Model 1 explores the relationship between the control variables and SCR. Model 2 builds upon Model 1 by adding the three types of SCI. Model 3 adds SCRM to Model 1. Model 4 incorporates both the three types of SCI and SCRM into Model 1. Model 5 examines the impact of the control variables on SCRM. Model 6 builds on Model 5 by including the three types of SCI.

From Model 1, we can see that the control variables (enterprise nature, enterprise size, and enterprise age) do not significantly impact SCR. In Model 2, which adds the independent variables from our study to Model 1, the data indicate that II, SI, and CI all have a significant positive impact on the SCR. Specifically, II (β = 0.258, p < 0.01), SI (β = 0.278, p < 0.01), and CI (β = 0.193, p < 0.01) show strong positive effects, thus supporting H1a, H1b, and H1c. Model 3 introduces the mediating variable on top of Model 1. The data reveal that SCRM has a significant positive effect on the SCR. Model 5 examines the influence of the control variables on SCRM. The results indicate that the control variables do not significantly impact SCRM. Model 6 builds on Model 5 by incorporating the independent variables. The data show that the three types of SCI have a significant positive impact on the SCRM.

5.3.2. Mediation Effect Model Testing

To validate the mediating effect of SCRM, this study first constructs regression Models 7, 8, and 9 by separately relating the independent variables (three types of SCI) to the dependent variable (SCR). Then, by incorporating SCRM, Models 10, 11, and 12 are formed. Detailed models and analysis results are shown in Table 8.

Table 8.

Mediation effect model testing results.

Comparing Model 7 and Model 10, after adding SCRM, the effect of II on SCR weakens, as indicated by a decrease in the regression coefficient (β = 0.445→β = 0.387, p < 0.01). Simultaneously, SCRM shows a significant positive impact on SCR (β = 0.197, p < 0.01). This suggests that SCRM plays a partial mediating role in the relationship between II and SCR, supporting H2a.

Comparing Model 8 and Model 11, when SCRM is included, the impact of SI on SCR diminishes, evidenced by a reduced regression coefficient (β = 0.445→β = 0.387, p < 0.01). Concurrently, SCRM has a significant positive effect on SCR (β = 0.190, p < 0.01). This indicates that SCRM partially mediates the relationship between SI and SCR, supporting H2b.

Comparing Model 9 and Model 12, upon adding SCRM, the influence of CI on SCR weakens, with a decrease in the regression coefficient (β = 0.391→β = 0.337, p < 0.01). Additionally, SCRM exerts a significant positive influence on SCR (β = 0.204, p < 0.01). This demonstrates that SCRM partially mediates the relationship between CI and SCR, supporting H2c.

This study employs the bootstrap analysis method to validate the mediating role of SCRM, using Model 4 from the PROCESS analysis program developed by Hayes (2013), with 5000 iterations. Detailed analysis results are presented in Table 9. Based on the bootstrap analysis results, H2a, H2b, and H2c are validated once again.

Table 9.

Bootstrap analysis results.

5.3.3. Moderation Effect Model Testing

It suggests that higher levels of RU weaken the positive impact of SCI on resilience. The corresponding H3a, H3b, and H3c are examined. The results of the moderation effect analysis are presented in Table 10.

Table 10.

Moderation effect model testing results.

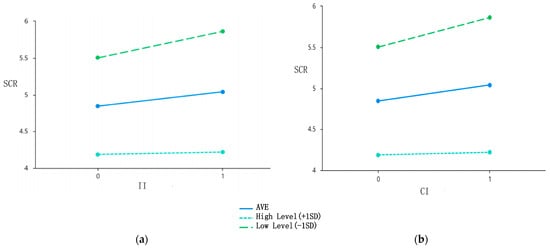

Model 13 shows that II (β = 0.304, p < 0.01) has a significant positive impact on SCR, while RU (β = −0.397, p < 0.01) has a significant negative impact on SCR. In Model 14, which builds on Model 13 by adding the interaction term between II and RU, the results indicate that II (β = 0.317, p < 0.01) continues to have a significant positive impact on SCR. Additionally, both RU (β = −0.416, p < 0.01) and the interaction term (β = −0.072, p < 0.01) have significant negative impacts on SCR. This suggests that RU negatively moderates the impact of II on SCR, thus supporting H3a.

When examining the moderating effect of RU on the relationship between SI and SCR, Model 15 shows that SI (β = 0.263, p < 0.01) has a significant positive impact on SCR, while RU (β = −0.345, p < 0.01) has a significant negative impact on SCR. In Model 16, which builds on Model 15 by adding the interaction term between SI and RU, the results indicate that SI (β = 0.274, p < 0.01) continues to have a significant positive impact on SCR. RU (β = −0.354, p > 0.05) still has a significant negative impact on SCR, but the interaction term (β = −0.034, p < 0.01) does not have a significant negative impact on SCR. This implies that RU does not significantly moderate the effect of SI on SCR, leading to the rejection of H3b.

Model 17 shows that CI (β = 0.194, p < 0.01) has a significant positive impact on SCR, and RU (β = −0.385, p < 0.01) has a significant negative impact on SCR. In Model 18, which builds on Model 17 by adding the interaction term between CI and RU, the results indicate that CI (β = 0.196, p < 0.01) continues to have a significant positive impact on SCR. Both RU (β = −0.422, p < 0.01) and the interaction term (β = −0.106, p < 0.01) have significant negative impacts on SCR. This suggests that RU negatively moderates the impact of CI on SCR, thus supporting H3c. The simple slopes are illustrated in Figure 2.

Figure 2.

(a) Description of the moderating effect of RU on the relationship between II and SCR; (b) description of the moderating effect of RU on the relationship between CI and SCR.

6. Discussion

The study results demonstrate that out of the proposed nine hypotheses, eight hypotheses are validated while one is not. The following sections will analyze and discuss the findings related to the direct effect, mediating effect, and moderating effect.

In the direct effect model of SCI on SCR, the regression coefficient for SI is greater than those for II and CI. This indicates that SI has a more significant impact on SCR compared to the other two types of integration. This finding diverges from the results of Flynn [9], who posited that II and CI are more influential in enhancing operational performance than SI. The disparity may be due to the more pronounced impact of SI in the NEV industry compared to other manufacturing enterprises. Issues with upstream suppliers in the supply chain can significantly disrupt the normal operations of NEV manufacturing enterprises. Additionally, the significant impact of II on SCR has been thoroughly demonstrated in this study. Thus, for NEV manufacturing enterprises, it is crucial not only to focus on external integration but also to enhance internal communication and collaboration within the enterprises.

The analysis of the mediating effects indicates that SCRM serves as a mediator in the relationships between the three types of SCI and SCR. This finding aligns with previous research outcomes. It suggests that managing the potential risks associated with SCI can better promote the enhancement of SCR. This insight will guide the management of NEV manufacturing enterprises, emphasizing the importance of continuous SCRM to improve SCR and, consequently, corporate performance.

The analysis of the moderating effects reveals that RU negatively moderates the relationships between II, CI, and SCR. This implies that implementing internal and CI in a low-RU environment is more effective in enhancing SCR for NEV manufacturing enterprises. It underscores the need for government agencies to ensure clear, transparent, and stable industry policies. Interestingly, RU does not negatively moderate the relationship between SI and SCR. This phenomenon could be attributed to several factors: Firstly, SI is a double-edged sword that can lower transaction costs but may also introduce temporary management costs and risk spillovers. Secondly, unlike II and CI, SI might be less controllable for NEV manufacturing enterprises and less susceptible to government regulation.

7. Conclusions and Recommendations

Based on the current challenges faced by NEV manufacturing enterprises—characterized by a volatile industry environment, persistent supply chain risks, and strategic choices for SCI—this study examines SCI, SCR, SCRM, and RU within the context of China’s NEV manufacturing enterprises. The key conclusions drawn from the research are as follows: First, all three types of SCI positively affect SCR, with SI having a more significant impact on the NEV supply chain. Second, SCRM serves as a mediator in the relationship between the three types of SCI and SCR. Third, RU negatively moderates the impact of II and CI on SCR but does not affect the relationship between SI and SCR. This could be due to the dual-edged nature of SI or because NEV manufacturing enterprises find SI less susceptible to changes in the regulatory environment compared to II and CI.

To better optimize SCI strategies for NEV manufacturing enterprises, enhance SCRM, and improve SCR, this study develops a research model encompassing SCI, SCR, SCRM, and RU. The study offers the following practical managerial insights: (1) NEV manufacturing enterprises should focus on various integration strategies, including II, SI, and CI. Special emphasis should be placed on SI. Proactively establishing robust internal collaboration and cooperative mechanisms with upstream and downstream partners can significantly enhance SCR. (2) NEV manufacturing enterprises should prioritize identifying, assessing, mitigating, and controlling supply chain risks. By effectively managing these risks, enterprises can leverage the mediating role of SCRM between SCI and SCR, enabling them to better navigate the unpredictable industry environment. (3) Government agencies should formulate complementary policies for the electric vehicle industry, ensuring these policies are forward-looking and stable. This will help create a stable and coordinated external environment for China’s NEV manufacturing enterprises, facilitating their growth and resilience.

The theoretical contributions of this study are mainly reflected in the following aspects. This study extends the theoretical framework of SCI, SCRM, and SCR based on supply chain management, resource orchestration, and dynamic capability theories, enriching the understanding of how SCI impacts SCR in the context of the NEV manufacturing industry under complex environments. The practical contributions of this study are mainly reflected in the following aspects. The study provides strategic insights for NEV manufacturing enterprises, guiding them in enhancing SCR through effective SCI and SCRM, thereby increasing their competitiveness in uncertain environments. However, this study has some limitations. It focuses on 30 listed NEV manufacturing enterprises and excludes smaller firms. Future studies could use a larger sample and include foreign brands. Data were collected through surveys, but some bias may exist. Combining surveys with secondary data could improve accuracy. Also, the study only looks at supply chain risk management, so future research could explore other factors like company culture or HR management. There has been a surge of interest in designing and implementing efficient and practical supply chain networks within the renewable energy sector [83]. In the future, research can delve deeper into supply chain network design.

Author Contributions

Conceptualization, Q.Z. and Y.F.; methodology, Y.F.; validation, Q.Z. and Y.F.; formal analysis, Y.F.; investigation, Y.F.; resources, Q.Z. and L.Y.; data curation, Y.F.; writing—original draft preparation, Y.F.; writing—review and editing, Q.Z., Y.F. and L.Y.; supervision, Q.Z. and L.Y.; project administration, Q.Z.; funding acquisition, Q.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Guangxi Science and Technology Major Program, grant number [AA23062024].

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Dataset available on request from the authors. The raw data supporting the conclusions of this article will be made available by the authors on request.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Research Questionnaire

Dear Sir/Madam,

Greetings! We sincerely appreciate your time and effort in completing this questionnaire. The purpose of this survey is to understand research related to the supply chains of new energy vehicle (NEVs) manufacturing enterprises. This survey is not a test, and there are no right or wrong answers. The reliability of the research results depends on your honest responses. We kindly ask you to answer each question carefully and ensure none are left unanswered. There are 29 questions in total, and it will take approximately 4 min to complete. Upon completing the questionnaire, you will receive a reward for your participation. We are deeply grateful for your assistance. Please rest assured that all the information you provide will be used solely for academic research and will not be used for any form of personal evaluation or commercial purposes. Your responses will remain strictly confidential. We wish you and your family good health and happiness!

- Your Gender.

○ Male ○ Female

- 2.

- Your Age.

○ 25 years old and below ○ 26–30 years old ○ 31–35 years old

○ 36–40 years old ○ 41–45 years old ○ 46 years old and above

- 3.

- Your Educational Level.

○ Associate degree or below ○ Bachelor’s degree ○ Postgraduate or above

- 4.

- Your Position.

○ Junior Staff ○ Junior Manager ○ Middle to Senior Manager

- 5.

- The Nature of Your Enterprise.

○ State-owned Enterprise ○ Private Enterprise ○ Joint Venture

- 6.

- Number of Employees in Your Enterprise.

○ Less than 1000 ○ 1000–5000 ○ 5000–10,000 ○ More than 10,000

- 7.

- Years of Establishment of Your Enterprise.

○ Less than 5 years ○ 5–10 years ○ 11–15 years ○ 16–20 years ○ More than 20 years

Please rate the following statements based on your understanding of the supply chain activities in your new energy vehicle manufacturing enterprise, including research and development, procurement, production, sales, etc. The answers are not about being right or wrong. The score ranges from 1 to 7, where 1 means “Completely Disagree” and 7 means “Completely Agree”. Choose the number that best reflects the reality of your enterprise.

- 8.

- II1: The enterprise has implemented integrated inventory management tailored to NEV production needs.

○1 ○2 ○3 ○4 ○5 ○6 ○7

- 9.

- II2: The enterprise uses cross-functional teams for optimizing processes related to NEV supply chain and production.

○1 ○2 ○3 ○4 ○5 ○6 ○7

- 10.

- II3: There is real-time integration and communication between departments within the enterprise regarding NEV production and operations.

○1 ○2 ○3 ○4 ○5 ○6 ○7

- 11.

- SI1: Our main suppliers are actively involved in our procurement and production processes, particularly for NEV components.

○1 ○2 ○3 ○4 ○5 ○6 ○7

- 12.

- SI2: Our main suppliers share their production capacity, especially related to NEV parts, with us.

○1 ○2 ○3 ○4 ○5 ○6 ○7

- 13.

- SI3: Our main suppliers provide us with real-time information about their available inventory for NEV components.

○1 ○2 ○3 ○4 ○5 ○6 ○7

- 14.

- SI4: We share our production schedules, particularly for NEV models, with our key suppliers.

○1 ○2 ○3 ○4 ○5 ○6 ○7

- 15.

- CI1: Our main customers share detailed market information, especially trends related to NEV, with us.

○1 ○2 ○3 ○4 ○5 ○6 ○7

- 16.

- CI2: We have established a rapid order processing system to cater to NEV demands with our main customers.

○1 ○2 ○3 ○4 ○5 ○6 ○7

- 17.

- CI3: We provide our main customers with real-time data about available NEV inventories.

○1 ○2 ○3 ○4 ○5 ○6 ○7

- 18.

- CI4: We share our NEV production plans with our main customers to ensure aligned operations.

○1 ○2 ○3 ○4 ○5 ○6 ○7

- 19.

- SCR1: Our enterprise is able to predict and mitigate disruptions in the NEV supply chain.

○1 ○2 ○3 ○4 ○5 ○6 ○7

- 20.

- SCR2: Our enterprise can quickly respond to NEV supply chain disruptions by reallocating resources and re-establishing normal processes.

○1 ○2 ○3 ○4 ○5 ○6 ○7

- 21.

- SCR3: Our NEV supply chain can maintain its structure and functions even during disruptions.

○1 ○2 ○3 ○4 ○5 ○6 ○7

- 22.

- SCR4: Our NEV supply chain can swiftly recover from unexpected disruptions, restoring its original state or improving it further.

○1 ○2 ○3 ○4 ○5 ○6 ○7

- 23.

- SCRM1: The potential risks in the NEV supply chain are effectively identified by the enterprise.

○1 ○2 ○3 ○4 ○5 ○6 ○7

- 24.

- SCRM2: The enterprise assesses and categorizes risks in the NEV supply chain.

○1 ○2 ○3 ○4 ○5 ○6 ○7

- 25.

- SCRM3: The enterprise actively seeks strategies to mitigate NEV supply chain risks.

○1 ○2 ○3 ○4 ○5 ○6 ○7

- 26.

- SCRM4: The enterprise strives to minimize the frequency and impact of risks in the NEV supply chain.

○1 ○2 ○3 ○4 ○5 ○6 ○7

- 27.

- RU1: Government policies and regulations related to NEV change frequently.

○1 ○2 ○3 ○4 ○5 ○6 ○7

- 28.

- RU2: Changes in NEV related government regulations significantly impact the business operations of the enterprise.

○1 ○2 ○3 ○4 ○5 ○6 ○7

- 29.

- RU3: Local authorities, such as tax and regulatory bodies, greatly influence the NEV business operations of the enterprise.

○1 ○2 ○3 ○4 ○5 ○6 ○7

References

- Zhang, Y.; Rysiecki, L.; Gong, Y.; Shi, Q. A SWOT Analysis of the UK EV Battery Supply Chain. Sustainability 2020, 12, 9807. [Google Scholar] [CrossRef]

- Patel, A.R.; Vyas, D.R.; Markana, A.; Jayaraman, R. A Conceptual Model for Integrating Sustainable Supply Chain, Electric Vehicles, and Renewable Energy Sources. Sustainability 2022, 14, 14484. [Google Scholar] [CrossRef]

- Wu, X.B.; Feng, X.Y. The impact of operational redundancy on organizational resilience in VUCA contexts: The moderating role of continuous innovation capability. J. Syst. Manag. 2022, 31, 1150–1161. (In Chinese) [Google Scholar]

- Shao, L.G.; Wang, Z.Y.; Lan, T.T. Formation mechanism and countermeasures of turbulence in China’s new energy vehicle industry. Resour. Sci. 2022, 44, 1316–1330. (In Chinese) [Google Scholar]

- Gao, Y. Policy effects and implications of the reduction of industry subsidies: A case study of China’s new energy vehicles. Soft Sci. 2020, 34, 28–32+46. (In Chinese) [Google Scholar]

- Li, H.B.; Zhao, L.B.; Zhai, R.R. New trends in global chip supply chain adjustments and China’s response. Int. Trade 2023, 2, 19–27. (In Chinese) [Google Scholar]

- Shi, Y.Y.; Feng, Y.; Zhang, Q. Does China’s new energy vehicles supply chain stock market have risk spillovers? Evidence from raw material price effect on lithium batteries. Energy 2023, 262, 125420. [Google Scholar] [CrossRef]

- Yuan, C.; Geng, C.X.; Sun, J. Vertical integration and firm value under uncertainty shocks: Evidence from a natural experiment during the COVID-19 pandemic. Q. J. Econ. 2022, 22, 633–652. (In Chinese) [Google Scholar]

- Flynn, B.B.; Huo, B.; Zhao, X. The impact of supply chain integration on performance: A contingency and configuration approach. J. Oper. Manag. 2010, 28, 58–71. [Google Scholar] [CrossRef]

- DuHadway, S.; Carnovale, S.; Hazen, B. Understanding Risk Management for Intentional Supply Chain Disruptions: Risk Detection, Risk Mitigation, and Risk Recovery. Ann. Oper. Res. 2019, 283, 179–198. [Google Scholar] [CrossRef]

- Hussain, G.; Nazir, M.S.; Rashid, M.A. From Supply Chain Resilience to Supply Chain Disruption Orientation: The Moderating Role of Supply Chain Complexity. J. Enterp. Inf. Manag. 2023, 36, 70–90. [Google Scholar] [CrossRef]

- Lambert, D.M.; Robeson, J.F.; Stock, J.R. An appraisal of the integrated physical distribution management concept. Int. J. Phys. Distrib. Mater. Manag. 1978, 9, 74–88. [Google Scholar] [CrossRef]

- Armistead, C.G.; Mapes, J. The impact of supply chain integration on operating performance. Logist. Inf. Manag. 1993, 6, 9–14. [Google Scholar] [CrossRef]

- Lambert, D.M.; Cooper, M.C. Issues in supply chain management. Ind. Mark. Manag. 2000, 29, 65–83. [Google Scholar] [CrossRef]

- Wisner, J.D.; Tan, K.C. Supply chain management and its impact on purchasing. J. Supply Chain Manag. 2000, 36, 33–42. [Google Scholar] [CrossRef]

- Zhao, X.; Huo, B.; Flynn, B.B. The impact of power and relationship commitment on the integration between manufacturers and customers in a supply chain. J. Oper. Manag. 2008, 26, 368–388. [Google Scholar] [CrossRef]

- Huang, J.J. Resource decision making for vertical and horizontal integration problems in an enterprise. J. Oper. Res. Soc. 2016, 67, 1363–1372. [Google Scholar] [CrossRef]

- Lei, X.S. The impact of vertical integration on enterprise development. Decis. Inf. Wkly. 2015, 2, 71. (In Chinese) [Google Scholar]

- Li, Y.X. Asset specificity and vertical integration. Econ. Sci. 2000, 5, 64–69. (In Chinese) [Google Scholar]

- Huo, B.F.; Li, S.Y. Supply chain integration and performance: A literature review. J. Beijing Union Univ. (Nat. Sci. Ed.) 2015, 29, 81–92. (In Chinese) [Google Scholar]

- Zhao, L.; Sun, L.Y.; Li, G. The relationship between supply chain integration and firm performance in Chinese manufacturing enterprises. J. Manag. Eng. 2011, 25, 1–9. (In Chinese) [Google Scholar]

- Schoenherr, T.; Swink, M. Revisiting the arcs of integration: Cross-validations and extensions. J. Oper. Manag. 2012, 30, 99–115. [Google Scholar] [CrossRef]

- Zeng, M.G.; Zhu, J. The impact of environmental uncertainty and government support on supply chain integration. Sci. Res. Manag. 2014, 35, 79–86. (In Chinese) [Google Scholar]

- Daugherty, P.J.; Ellinger, A.E.; Gustin, C.M. Integrated logistics: Achieving logistics performance improvements. Supply Chain Manag. 1996, 1, 25–33. [Google Scholar] [CrossRef]

- Gimenez, C.; Van der Vaart, T.; Pieter van Donk, D. Supply chain integration and performance: The moderating effect of supply complexity. Int. J. Oper. Prod. Manag. 2012, 32, 583–610. [Google Scholar] [CrossRef]

- O’Leary-Kelly, S.W.; Flores, B.E. The integration of manufacturing and marketing/sales decisions: Impact on organizational performance. J. Oper. Manag. 2002, 20, 221–240. [Google Scholar] [CrossRef]

- Frohlich, M.T. E-Integration in the supply chain: Barriers and performance. Decis. Sci. 2002, 33, 537–556. [Google Scholar] [CrossRef]

- Rosenzweig, E.D.; Roth, A.V.; Dean, J.W., Jr. The influence of an integration strategy on competitive capabilities and business performance: An exploratory study of consumer products manufacturers. J. Oper. Manag. 2003, 21, 437–456. [Google Scholar] [CrossRef]

- Rai, A.; Patnayakuni, R.; Seth, N. Firm performance impacts of digitally enabled supply chain integration capabilities. MIS Q. 2006, 30, 225–246. [Google Scholar] [CrossRef]

- Hsu, P. Commodity or competitive advantage? Analysis of the ERP value paradox. Electron. Commer. Res. Appl. 2013, 12, 412–424. [Google Scholar] [CrossRef]

- Hsin Chang, H.; Tsai, Y.; Hsu, C. E-procurement and supply chain performance. Supply Chain Manag. Int. J. 2013, 18, 34–51. [Google Scholar] [CrossRef]

- Zhang, Y.T.; Li, B. An empirical study on the key success factors of supplier integration. Res. Technol. Econ. Manag. 2018, 7, 50–56. (In Chinese) [Google Scholar]

- Munir, M.; Jajja, M.S.S.; Chatha, K.A. Supply Chain Risk Management and Operational Performance: The Enabling Role of Supply Chain Integration. Int. J. Prod. Econ. 2020, 227, 107667. [Google Scholar] [CrossRef]

- Zhang, H.; Zhou, T.T.; Wang, D. Analyzing the impact of supply chain quality integration on innovation performance in the retail industry. Commer. Econ. Res. 2023, 6, 26–29. (In Chinese) [Google Scholar]

- Su, T.Y.; Yu, Y.Z. Research on the impact of supply chain integration on the environmental performance of Chinese manufacturing enterprises. J. Soc. Sci. 2023, 6, 183–190. (In Chinese) [Google Scholar]

- Huma, S.; Ahmed, W.; Zaman, S.U. The impact of supply chain quality integration on a firm’s sustainable performance. TQM J. 2024, 36, 385–404. [Google Scholar] [CrossRef]

- Rice, J.B.; Caniato, F. Building a Secure and Resilient Supply Chain. Supply Chain Manag. Rev. 2003, 5, 22–30. [Google Scholar]

- Christopher, M.; Peck, H. Building the Resilient Supply Chain. Int. J. Logist. Manag. 2011, 15, 1–14. [Google Scholar] [CrossRef]

- Blackhurst, J.; Dunn, K.S.; Craighead, C.W. An Empirically Derived Framework of Global Supply Resiliency. J. Bus. Logist. 2011, 32, 374–391. [Google Scholar] [CrossRef]

- Acquaah, M.; Amoako-Gyampah, K.; Jayaram, J. Resilience in Family and Nonfamily Firms: An Examination of the Relationships Between Manufacturing Strategy, Competitive Strategy, and Firm Performance. Int. J. Prod. Res. 2011, 49, 5527–5544. [Google Scholar] [CrossRef]

- Pettit, T.Y.; Fiksel, Y.; Croxton, K. Ensuring Supply Chain Resilience: Development of a Conceptual Framework. J. Bus. Logist. 2011, 31, 1–21. [Google Scholar] [CrossRef]

- Ambulkar, S.; Blackhurst, J.; Grawe, S. Firm’s Resilience to Supply Chain Disruptions: Scale Development and Empirical Examination. J. Oper. Manag. 2015, 33/34, 111–122. [Google Scholar] [CrossRef]

- Yao, Y.; Fabbe-Costes, N. Can You Measure Resilience if You Are Unable to Define It? The Analysis of Supply Network Resilience (SNRES). Supply Chain Forum Int. J. 2018, 19, 255–265. [Google Scholar] [CrossRef]

- Ponomarov, S.Y.; Holcomb, M.C. Understanding the Concept of Supply Chain Resilience. Int. J. Logist. Manag. 2009, 20, 124–143. [Google Scholar] [CrossRef]

- Francesco, L.; Tuncer, O. Supply chain vulnerability and resilience: A state of the art overview. In Proceedings of the European Modeling Simulation Symposium, Amantea, Italy, 17–19 September 2008; pp. 527–533. [Google Scholar]

- Osaro, A.; Zulkilpli, G.; Radzuan, R. A framework to enhance supply chain resilience: The case of Malaysian pharmaceutical industry. Glob. Bus. Manag. Res. 2014, 6, 219–225. [Google Scholar]

- Scholten, K.; Schilder, S. The role of collaboration in supply chain resilience. Supply Chain Manag. Int. J. 2015, 20, 471–484. [Google Scholar] [CrossRef]

- Tukamuhabwa, B.R.; Stevenson, M.; Busby, M. Supply chain resilience in a developing country context: A case study on the interconnectedness of threats, strategies and outcomes. Supply Chain Manag. Int. J. 2017, 22, 486–505. [Google Scholar] [CrossRef]

- Soni, U.; Jain, V.; Kumar, S. Measuring supply chain resilience using a deterministic modeling approach. Comput. Ind. Eng. 2014, 74, 11–25. [Google Scholar] [CrossRef]

- Wang, X.; Zhao, L. Impact analysis of supplier relationship on supply chain resilience using biological cellular resilience theory. J. Southeast Univ. (Engl. Ed.) 2015, 31, 282–287. [Google Scholar]

- Mandal, S. The influence of organizational culture on healthcare supply chain resilience: Moderating role of technology orientation. J. Bus. Ind. Mark. 2017, 32, 1021–1037. [Google Scholar] [CrossRef]

- Ho, W.; Zheng, T.; Yildiz, H. Supply chain risk management: A literature review. Int. J. Prod. Res. 2015, 53, 5031–5069. [Google Scholar] [CrossRef]

- Baryannis, G.; Validi, S.; Dani, S. Supply chain risk management and artificial intelligence: State of the art and future research directions. Int. J. Prod. Res. 2018, 57, 2179–2202. [Google Scholar] [CrossRef]

- Can Saglam, Y.; Sezen, B.; Çankaya, S.Y. The inhibitors of risk information sharing in the supply chain: A multiple case study in Turkey. J. Contingencies Crisis Manag. 2020, 28, 19–29. [Google Scholar] [CrossRef]

- Liu, H.; Wei, S. Leveraging supply chain disruption orientation for resilience: The roles of supply chain risk management practices and analytics capability. Int. J. Phys. Distrib. Logist. Manag. 2022, 52, 771–790. [Google Scholar] [CrossRef]

- Shahbaz, M.S.; Rasi, R.Z.R.M.; Ahmad, M.F.B. A novel classification of supply chain risks: Scale development and validation. J. Ind. Eng. Manag. 2019, 12, 201–218. [Google Scholar] [CrossRef]

- Hong, L.; Halees, D.N. How blockchain manages supply chain risks: Evidence from Indian manufacturing companies. Int. J. Logist. Manag. 2023, 35, 1604–1627. [Google Scholar] [CrossRef]

- Phung, T.B.P.; Kim, S.; Chu, C.C. Transformational leadership, integration and supply chain risk management in Vietnam’s manufacturing firms. Int. J. Logist. Manag. 2022, 34, 236–258. [Google Scholar] [CrossRef]

- Çankaya, S.Y.; Can Saglam, Y.; Sezen, B. Mapping the landscape of organizational theories for future research themes in supply chain risk management. Asia-Pac. J. Bus. Adm. 2022, 15, 594–625. [Google Scholar]

- Li, S.T.; Xu, T.T.; Park, K.C. The effect of supply chain collaboration on firms’ risk management under technology turbulence. Prod. Plan. Control 2023, 1–16. [Google Scholar] [CrossRef]

- Morgan, T.R.; Roath, A.S.; Richey, R.G. How risk, transparency, and knowledge influence the adaptability and flexibility dimensions of the responsiveness view. J. Bus. Res. 2023, 158, 113641. [Google Scholar] [CrossRef]

- Tseng, C.H.; Lee, R.P. Host environmental uncertainty and equity-based entry mode dilemma: The role of market linking capability. Int. Bus. Rev. 2010, 19, 407–418. [Google Scholar] [CrossRef]

- Engau, C.; Hoffmann, V.H. Effects of regulatory uncertainty on corporate strategy—An analysis of firms’ responses to uncertainty about post-Kyoto policy. Environ. Sci. Policy 2009, 12, 766–777. [Google Scholar] [CrossRef]

- Wang, M.Y.; Zhang, Q.Y.; Wang, Y.G. Governing local supplier opportunism in China: Moderating role of institutional forces. J. Oper. Manag. 2016, 46, 84–94. [Google Scholar] [CrossRef]

- Hoffmann, V.H.; Trautmann, T.; Hamprecht, J. Regulatory uncertainty: A reason to postpone investments? Not necessarily. J. Manag. Stud. 2009, 46, 1227–1253. [Google Scholar] [CrossRef]

- Katsaliaki, K.; Galetsi, P.; Kumar, S. Supply Chain Disruptions and Resilience: A Major Review and Future Research Agenda. Ann. Oper. Res. 2021, 319, 965–1002. [Google Scholar] [CrossRef]

- Brown, N. Digital Business Strategising in the Context of Regulatory Uncertainty—The Case of a Financial Services Provider in South Africa. Master’s Thesis, Faculty of Commerce, Department of Information Systems, Cape Town, South Africa, 2020. Available online: http://hdl.handle.net/11427/32599 (accessed on 17 August 2024).

- Sousa, R.; Voss, C.A. Contingency research in operations management practices. J. Oper. Manag. 2008, 26, 697–713. [Google Scholar] [CrossRef]

- Dierickx, I.; Cool, K. Asset Stock Accumulation and Sustainability of Competitive Advantage. Manag. Sci. 1989, 35, 1504–1511. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Sun, K.X.; Ooi, K.B.; Tan, G.W.H. Enhancing supply chain resilience in SMEs: A deep learning-based approach to managing Covid-19 disruption risks. J. Enterp. Inf. Manag. 2023, 36, 1508–1532. [Google Scholar] [CrossRef]

- Wang, H. Analysis of Vertical Integration, R&D Investment, and Firm Performance. Stat. Decis. 2015, 16, 175–177. (In Chinese) [Google Scholar]

- Zhang, L. Motivations and Performance of Vertical Integration in Bilateral Market Business Forms: A Case Study of OTAs and Airlines. Int. Bus. (J. Univ. Int. Bus. Econ.) 2017, 6, 145–156. (In Chinese) [Google Scholar]

- Schiederig, T.; Tietze, F.; Herstatt, C. Green Innovation in Technology and Innovation Management—An Exploratory Literature Review. RD Manag. 2012, 42, 180–192. [Google Scholar] [CrossRef]

- Liu, F.; Liu, J. Review of Strategies for Coping with Supply Chain Disruptions. J. Zhongnan Univ. Econ. Law 2019, 3, 148–156. (In Chinese) [Google Scholar]

- Nakandala, D.; Yang, R.; Lau, H. Industry 4.0 technology capabilities, resilience and incremental innovation in Australian manufacturing firms: A serial mediation model. Supply Chain Manag. 2023, 28, 760–772. [Google Scholar] [CrossRef]

- Terjesen, S.; Patel, P.C.; Sanders, N.R. Managing Differentiation-Integration Duality in Supply Chain Integration. Decis. Sci. 2012, 43, 303–339. [Google Scholar] [CrossRef]

- Wieland, A.; Wallenburg, C.M. The Influence of Relational Competencies on Supply Chain Resilience: A Relational View. Int. J. Phys. Distrib. Logist. Manag. 2013, 43, 300–320. [Google Scholar] [CrossRef]

- El Baz, J.; Ruel, S. Can Supply Chain Risk Management Practices Mitigate the Disruption Impacts on Supply Chains’ Resilience and Robustness? Evidence from an Empirical Survey in a COVID-19 Outbreak Era. Int. J. Prod. Econ. 2021, 233, 107972. [Google Scholar] [CrossRef]

- Yang, J.; Xie, H.; Yu, G. Antecedents and Consequences of Supply Chain Risk Management Capabilities: An Investigation in the Post-Coronavirus Crisis. Int. J. Prod. Res. 2021, 59, 1573–1585. [Google Scholar] [CrossRef]

- Chan, C.M.; Makino, S.; Isobe, T. Does Subnational Region Matter? Foreign Affiliate Performance in the United States and China. Strateg. Manag. J. 2010, 31, 1226–1243. [Google Scholar]

- Bag, S.; Gupta, S.; Foropon, C. Examining the Role of Dynamic Remanufacturing Capability on Supply Chain Resilience in Circular Economy. Manag. Decis. 2019, 57, 863–885. [Google Scholar]

- Shenabi, H.; Sahraeian, R. Decision-Making Approach to Design a Sustainable Photovoltaic Closed-Loop Supply Chain Considering Market Share for Electric Vehicle Energy. Sustainability 2024, 16, 5763. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).