Abstract

Building on updated estimates of the social cost of carbon obtained from the most recent literature, this article proposes a social cost of carbon-based benchmark for carbon pricing to drive world countries’ carbon pricing policies up to 2050, consistent with the Paris Agreement targets. By using a dataset on net effective carbon rates developed by the Organisation for Economic Co-operation and Development (OECD), we firstly compare both explicit and implicit carbon pricing in 2021 in 71 OECD and non-OECD countries with the social cost of carbon benchmark for 2021 and calculate the degree of internalization of the social cost of carbon averagely related to their carbon pricing instruments. We find that there is a serious gap in current climate policies, which are far from creating optimal pricing conditions to reduce global emissions to levels needed by the Paris Agreement. The economic and distributional feasibility of a full implementation of the carbon pricing benchmark is tested in the same set of countries using two indicators, which are calculated for 2025, 2030, 2040 and 2050. Since the test results are income-regressive among income country groups, benchmark implementation by countries within the cooperative approaches of Paris Agreement art. 6 should be accompanied by the creation of an international cooperative fund aimed to recycle at least part of the revenues collected by high-income countries to compensate affected population in lower-income countries.

1. Introduction

According to the last World Bank report on carbon pricing [1], there are 75 carbon taxes and emissions trading schemes in operation worldwide. Even if some countries are making progress, current carbon pricing instruments only cover around 24% of global greenhouse gas emissions. Carbon price levels of most instruments are lower than those needed in the long run to induce, through research into innovative technologies and changes in lifestyles, the containment of global emissions required by the Paris Agreement goal.

The context of this article is the international debate on effective carbon pricing levels needed to prevent as much climate change as possible in a cost-effective way. Building on updated estimates of the social cost of carbon (SCC) obtained from the most recent literature, we propose an SCC-based benchmark for carbon pricing for the transition period (up to 2050) that is consistent with the Paris Agreement temperature mitigation goal [2]. The main function of the SCC benchmark is to allow the assessment of the degree of internalization of the external costs of carbon dioxide (CO2) emissions by state-regulated carbon pricing instruments (carbon taxes, cap and trade emission trading systems—ETS, energy taxes). Through the suggested benchmark, world governments can understand their positioning in carbon pricing during the transition and voluntarily raise carbon pricing rates (directly or indirectly, by reducing the emission cap in emission trading systems) with the aim of preventing future climate damages in a cost-effective way. In a “cap and trade” system, such as the EU-ETS, the market price of emission permits reflects the marginal cost of reducing emissions for a given cap: since a full internalization of the external costs of CO2 emissions is not guaranteed, the SCC can be used as a benchmark to assess the degree of internalization of the external costs of CO2 emissions into the permits market price, as proposed in this article, providing useful information to adjust the emission cap of the emission trading scheme. The benchmark is useful both for the domestic and the international dimension of carbon pricing instruments. For example, it can be used to further develop the cooperative approaches between countries foreseen by art. 6 of the Paris Agreement [2] (bilateral or multilateral agreements between countries on both market and non-market emission reduction measures). Art. 6 aims to increase the level of emission reduction ambition of each party’s pledges, embodied in its Nationally Determined Contributions (NDC), through three main types of voluntary bilateral or multilateral cooperative approaches [3]: (1) by transferring Internationally Transferred Mitigation Outcomes (ITMO) from one country to another for use towards achieving its NDC, avoiding double counting (art. 6.2); (2) through a United Nation Framework Convention on Climate Change (UNFCCC) centralized baseline-and-crediting cooperative mechanism for companies authorized by parties (6.4), that will update and substitute the Clean Development Mechanism introduced by Article 12 of the Kyoto Protocol; (3) finally, articles 6.8–9 provide a very general framework for non-market cooperative approaches (approaches that do not involve the transfer of ITMO), that in principle includes also bilateral or multilateral coordination between countries on mitigation measures that do not involve trading of emission permits, such as energy and carbon taxes, or carbon border tariffs.

Some definitions and preliminary clarifications are needed. The SCC represents the value in monetary terms of the long-term global damages of climate change attributable to the emission in a certain year of an additional ton of carbon or carbon dioxide into the atmosphere. The SCC is a form of environmental externality; specifically, it measures the pre-tax marginal external costs of CO2 emissions [4]. The utility of measuring the SCC is related to the wide range of applications of external cost measurement, among which are cost-benefit analysis, monetary based life-cycle environmental impact assessment, and environmental pricing (“internalization” of external costs through taxes or market-based instruments). According to some environmental economists [5,6,7], the SCC should be used to calculate the optimal level of the carbon tax (the point where the cost of emissions reduction equals the marginal social cost of carbon emissions), meaning that society is better off reducing emissions until the benefits continue to outweigh the costs.

Carbon taxes and other carbon pricing instruments, such as cap-and-trade schemes and carbon border taxes, are key tools for governments to reduce greenhouse gas emissions in a cost-effective way [8]. The Organisation for Economic Cooperation and Development (OECD) [9] and many other authors [10] believe that energy taxes based on a fixed rate per fuel quantity (e.g., excise duties on fossil fuels) should be included within the range of carbon pricing instruments, given that they specifically apply to a tax base that is directly proportional to CO2 emissions. Following the definitions of the OECD [9], we prefer to refer to “effective carbon pricing”, a concept that includes both explicit carbon pricing (the tax base is the carbon content of the fuel) and implicit carbon pricing (even if the tax base is different, it is directly proportional to CO2 emissions, allowing the calculation of the implicit carbon rate). Implicit forms have the same influence on relative product prices as a carbon tax.

For a long time, environmental economists have recommended carbon pricing instruments as the most cost-effective policy option for reducing emissions. In a critical review of previous literature, Baranzini et al. [11] present and discuss seven reasons for using carbon pricing in climate policy, among which is the empirical observation that when making purchase decisions, most consumers are more influenced by prices than by environmental concerns. More recently, Sterner et al. [12] recap the three main arguments for the superiority of carbon pricing mechanisms for allocating available financial resources to support the achievement of ambitious environmental targets: (1) pricing mechanisms are compatible with market competition rules, allowing the shifting of emission abatement measures between firms with different skills, technologies and abatement costs, thus enabling the world community to save huge amounts of financial resources to reduce emissions (static efficiency); (2) the level of the carbon price signal speeds up research and investments aimed at developing alternative low- and zero-carbon technologies (dynamic efficiency gain); (3) carbon pricing is not only a cost for firms and consumers but it is also an opportunity for governments, that can rely on its revenues to finance research, to incentivize the market uptake of low carbon innovations and to cope with distributional issues that could compromise its feasibility.

After the Paris Agreement, the debate on the carbon pricing benchmark enlarged from the SCC approach, suggested by mainstream economic theory, to the cost of emission reduction approach and other, more pragmatic, trial and error approaches. Both the High-Level Commission report on carbon pricing [13] and, a few years later, that of the OECD on effective carbon pricing [9], two major contributions suggesting a worldwide carbon pricing benchmark, criticized the uncertainty of SCC estimates and the low levels of the most authoritative ones (36 USD(2007)/t CO2 for year 2015 in the central estimate by the Intergovernmental Working Group (IWG) [14]; 31 USD(2010)/t CO2 for 2015 in Nordhaus [15]). These works questioned the ability of the SCC approach to recommend carbon price levels that could significantly slow down the projected increase in global temperature and suggested reference values based on alternative second-best approaches, such as the cost of emission reduction (see Section 2). Among supporters of the latter, Kaufman et al. [16] argued that the temperature target of the Paris Agreement provides an acceptable reference to calculate the optimal (expected) marginal cost of emissions reductions needed to achieve the target. This task requires fair conventional supply-demand models of the future energy system and its technologies, avoiding much more complex climate-economy modelling. However, supporters of the cost-benefit approach (involving SCC calculation) highlighted that the uncertainties encountered by the emission reduction cost method to define optimal carbon pricing are not less than those of the SCC [17,18]. Aldy et al. [18] highlight that a policy-consistent carbon price calculation depends not only on long-term subjectively determined assumptions about future policies but also on critical assumptions about technologies that are not commercially available today. Moreover, they underline the importance of measuring the benefits of addressing climate change as a means for evaluating and justifying climate policy. Replacing cost-benefit analysis and SCC measurement with cost-effectiveness analysis could slow down and delay the implementation of climate policies that are instead urgently required and justified by the scale of climate risks. The goal of reducing the uncertainty of the SCC estimates can be achieved by adopting transparent science-based protocols in the various steps of SCC calculation, as done since 2009 by the IWG in the US [14,19,20,21].

Our article intervenes in this debate by fully supporting the arguments of Aldy et al. [18] in favor of an SCC-based approach in cost-benefit appraisal of carbon policies and by advancing a policy proposal where this approach is applied in the context of carbon pricing. Building on a recent critical literature review on the SCC [17]), updated to the outcomes of the Environmental Protection Agency—EPA report of November 2023 [22] and its preparatory studies, we believe that the time is ripe to use the SCC as an international benchmark for assessing the adequacy of carbon pricing policies worldwide. In the last 5–10 years, SCC estimates have tended to be much higher and more accurate than previously estimated [17,21,22,23,24]. We believe that the objections to using too low and under-estimated SCC values, raised firstly by the High-Level Commission [13] and then by OECD [9] in their respective contributions proposing a carbon pricing benchmark, have been overcome by the most recent estimates of the SCC.

Comparing countries’ effective carbon pricing with the optimal cost of mitigation [16] might be considered practical, but it is counterproductive (not to say dangerous) for several reasons. The main reason is that the cost of reducing emissions to a policy target is not able to represent the size of the climate risks. As shown by the IPCC Special Report on 1.5 °C [25], the Paris Agreement’s temperature mitigation target reduces the expected damage from climate change but does not avoid it altogether. We need a benchmark for carbon pricing that raises the ambition from minimum costs of (partial) mitigation to the much higher benefits of climate change mitigation.

Another reason is that increasing taxes is socially difficult and the cost of the emission reduction approach shows taxation only as a further cost for people. On the contrary, an SCC-based benchmark allows measurement of the economic return of emission reduction in terms of avoided economic damage: it conceives effective carbon pricing not as a cost but as an investment with high social returns, and this could make the difference in public communication. When cost-benefit analysis is applied to carbon taxation, the two approaches are complementary and should be used for their respective purposes. The SCC is needed to establish the optimal level of carbon taxation while the cost of emissions reduction is needed to find the new optimal level of emissions reduction given the tax, which means balancing the cost with the climate benefits of emissions reduction.

Our main motivations for an SCC-based benchmark for carbon pricing can be summarized as follows: (a) the opportunity for countries to follow a common price signal of the economic convenience of investing in emission reduction measures that reflects a science-based estimate of the benefits (the avoided climate damage related to emission reductions); (b) the relevance of this information in enabling public communication to explain to people why carbon taxes are an opportunity (they have an economic return in terms of avoided damage) and not just an additional cost; (c) a uniform benchmark for all countries in the world that covers the external costs of CO2 emissions would re-establish fair environmental competition in international trade, avoiding free riders and global CO2 emissions waste (carbon leakage).

How would the proposed benchmark work? Bearing in mind that the full framework of the policy proposal is developed in the article through the implementation of our methodology, that includes a feasibility test for major challenges, the basic elements of our policy proposal can be anticipated as follows:

- −

- Yearly benchmark for carbon pricing conventionally expressed in USD/t CO2 emitted in a certain year, uniform for all countries, that increases each year of a given period (for example 2025–2050).

- −

- Internationally agreed science-based procedure to estimate the SCC value path to use as a benchmark (possibly under the auspices of the UNFCCC and IPCC).

- −

- An international competent body (or a task force) responsible for calculating the SCC under the procedure.

- −

- Environmental tax reform (revenue neutral tax reform) to favor country-level implementation of the SCC benchmark.

- −

- Compensation fund to manage distributional impacts in lower-income countries.

- −

- Rulebook to promote bilateral and multilateral agreements between high-income countries and lower-income countries under Articles 6.8–9 of the Paris Agreement. The rulebook is dedicated to implementing an SCC-based carbon pricing benchmark through national measures.

Once the SCC-based benchmark is established by the international competent body, governments can assess the average degree of internalization of the CO2 external cost related to their carbon pricing instruments by comparing the ratio between the carbon pricing revenues and CO2 emissions in a given year (including non-priced emissions, reduced rates or free emission permits allocations—so called “effective carbon pricing rates” [9]) with the worldwide SCC-based benchmark for the same year. The comparison can be made in various ways: considering all carbon pricing instruments, or single instruments; considering emissions of the whole economy or specific sectors only. Our article provides a first example of how the benchmark can be used by assessing the internalization of the CO2 emissions external costs considering all main effective carbon pricing schemes (carbon taxes + ETS + energy taxes) currently in force at the national scale (all economy sectors) in 71 Countries, using the OECD dataset on effective carbon rates [26].

Our analysis highlights that the world is currently far from the path of carbon pricing that fully internalizes the external costs of CO2 emissions, and which would enable deep CO2 emission reductions in line with the Paris Agreement goals. Not all hope is lost: our projections at 2050 simulating an immediate political turning point on carbon pricing (full and homogenous implementation of the SCC-based benchmark starting from 2025 up to 2050) suggest that the economic incidence of the tax burden on gross domestic product (GDP) would not be unrealistic for most of the high-income countries, while regressive effects for lower-income countries could be totally absorbed through an international compensation fund financed through just a part of the tax revenues collected in high-income countries. Finally, we show that the current Paris Agreement framework already has some rules and mechanisms that could be used to jointly enhance international cooperation on emissions trading mechanisms, carbon and energy taxation, and financial support for lower-income countries, but further political action is needed to further develop the needed regulations and to find coordinated and mutually convenient solutions.

Given that the aim of this article is to propose and discuss a global SCC-based benchmark to driving countries’ effective carbon pricing policies in the 2025–2050 timeframe, it is important to highlight its boundaries. Collateral—even if important—topics related to carbon pricing instruments, such as the effectiveness of different carbon pricing instruments, optimal design of carbon pricing revenue recycling, how to extend domestic carbon pricing coverage, or how to link different emission trading systems currently in force in different regions, remain outside of the scope of this article.

Our policy proposal substantially differs from other scholars’ contributions on how to increase carbon pricing worldwide after the Paris Agreement for its emphasis on the social cost of carbon as a science-based indicator to establish a dynamic international benchmark for countries’ carbon pricing policies, rather than an empirically adjusted benchmark to reach an agreed level of emission reduction [16,27,28]. In our approach, international negotiations on carbon pricing would be boosted by science and research rather than being held back by the inevitable contingent constraints that hinder an ambitious political objective.

The structure of the article is described as follows. Section 2 deepens the literature review on carbon pricing benchmarks with a particular focus on previous proposals and on distributional impacts, allowing the methodology to evaluate the main challenges and barriers to the implementation of the SCC benchmark. Section 3 illustrates the methodology with which we develop, test and improve our policy proposal, and briefly describes the dataset used for its implementation. Section 4 implements the first step of our methodology (setting the benchmark), by selecting SCC benchmarks over the period 2021–2050 through a review of the latest SCC literature. Section 5 corresponds to the second step of our methodology (benchmark use) and shows the results of an exercise where we use the benchmark to assess the degree of internalization of the CO2 external costs at the country level (comparison of current average country carbon rates with the SCC benchmark level). In Section 6, we test our main policy proposal by exploring the countries’ economic capacity to implement the SCC benchmark during the transition (up to 2050) and suggest complementary measures within the framework of the Paris Agreement. The main aim is to quantify the distributional disparities between groups of countries of a full implementation of the SCC benchmark, that must and can be overcome through a proper reallocating of expected revenues from carbon pricing. Section 7 is dedicated to the conclusions by recapping the main results, limits of the analysis and policy implications.

2. Literature Review on Carbon Pricing Benchmarks and Distributional Impacts

One of the most authoritative proposals for an international benchmark for carbon pricing has been developed in the OECD report on Effective Carbon Rates [9], in the framework of its work on energy taxation and effective carbon pricing at the global scale (OECD Series on Carbon Pricing and Energy Taxation [29]), with which the OECD monitors carbon taxes, CO2 emission permits prices and fuel excise duties rates in the OECD and many non-OECD countries. With the Inventory on fossil fuel support measures [30] the OECD also monitors subsidies that lower pre-tax fossil fuel prices for domestic use (direct subsidies), tax exemptions and tax allowances on energy products (indirect subsidies), allowing a more precise picture of effective carbon pricing that goes well beyond what default energy tax rates say. The OECD’s report on Effective Carbon Rates [9] suggests an international benchmark for carbon pricing (Section 3. “How far do we need to go to decarbonise?”) with three different levels: the first two levels (30 EUR/t CO2 by 2025 and 60 EUR/t CO2 by 2030) are consistent with a slow decarbonization scenario, in which net zero emissions are achieved by 2060; the third value (120 EUR/t CO2 by 2030) is consistent with a faster decarbonization scenario (net zero emissions are achieved by mid-century) and is presented as “a new benchmark that allows assessing progress towards carbon prices in the near future that are in line with current decarbonisation goals” [9], p. 8. If we look at sources supporting the OECD’s choice of these benchmark levels, we find that they are obtained from Kaufman et al. [16], whose “near term to net zero CO2” approach is based on energy-economy modelling and a long-term assessment of technology costs needed to abate CO2 emissions consistently with the Paris Agreement 1.5–2.0 °C goal. The OECD [9] renounces the climate damage assessment approach to define a benchmark for carbon pricing with the arguments that SCC estimates are uncertain due to the high variability of climate damage modelling results and that a second-best, more practical approach is available, based on costs of emission reductions needed to achieve a policy target. Unfortunately, these claims are not based on an updated literature review on the SCC and the range of variability of the CO2 cost estimates obtained with the cost of emissions reduction approach is not lower than that of the damage approach [17,18,25]. The IPCC special report on 1.5 °C [25] estimates a cost variability range of the emission reduction cost approach applied to a long-term stabilization scenario at 1.5 °C, which is between 15 and over 1,000 USD/t CO2 in 2030 (a year for which it is relatively easier to predict costs), and it increases to 200–10,000 USD/t CO2 in 2070. When implementing the cost of emission reduction approach consistently with a long-term temperature target, it is necessary to make long-term forecasts of the most promising technological innovations, their learning curves, the economies of scale, the regulatory policies, and of the size of subsidies needed for the commercial maturation of innovations as compared with the prevailing technologies: the evaluator who applies the mitigation cost approach at 1.5–2.0 °C no less relies on subjective/political choices than the climate change damage modeler does.

Besides the OECD, other authoritative sources contributed to the debate on the carbon pricing benchmark. At the end of 2016, the Carbon Pricing Leadership Coalition activated a High-level Commission on Carbon Prices, led by Nobel laureate Joseph Stiglitz and Lord Nicholas Stern, with the objective of identifying indicative corridors of carbon prices that can be used to guide the design of carbon-pricing instruments to deliver on the ambition of the Paris Agreement and support the achievement of the Sustainable Development Goals. The report of the High-level Commission on Carbon Prices [13] concludes that the explicit carbon-price corridor consistent with the achievement of the Paris Agreement should be at least 40–80 USD/t CO2 by 2020 and 50–100 USD/t CO2 by 2030. These ranges are based on a wide body of cost valuations that exclude the estimate of the climate change damage that would be avoided by reducing carbon emissions. “The Commission’s conclusions are based on its members’ experience and judgment, and draw on multiple lines of evidence—including technological roadmaps and technology assessments, national pathway analyses, and integrated assessment models—taking into account the strengths and limitations of these various information sources” [13], p. 50. The Commission renounced the use of estimates of the SCC, since “many of the impact functions used in modeling exercises to calculate the social costs of carbon are biased downward” [13], p. 52. In France, the Quinet Commission [31] recommends a much higher 250 EUR/t CO2 from 2030, 500 EUR/t CO2 from 2040 and 775 EUR/t from 2050. Unfortunately, the French benchmarks for carbon pricing are also “shadow prices” based on studies of technology and energy system costs needed to achieve substantial emissions reductions. Among the representatives of the pragmatic approach, van den Bergh et al. [27] suggest a dynamic strategy to upscale carbon pricing based on gradual steps along two parallel tracks: (1) founding a carbon pricing coalition among the most ambitious nations to implement a uniform carbon price at least as high as the minimum of the carbon taxes or carbon market prices in the member economies; (2) reorienting climate negotiations to a focus on global carbon pricing. The coalition should put increasing pressure on non-members to join by applying a uniform border carbon tariff (with a rate not higher than the minimum carbon price) on imports of goods and raw materials from non-members. In this approach, the carbon price benchmark is both the starting point (for member countries) and the target to reach (non-members), while the benchmark increase is left to negotiations ultimately driven by the Paris Agreement goal (“The starting price could then be increased regularly with an announced amount until emissions reduction conforms to a plausible pathway to the 1.5 or 2 °C temperature target” [27], p. 1063).

In recent years, the mainstream literature on the need to increase the level of carbon pricing for achieving net zero emissions has been paralleled by a new stream of literature more focused on the social acceptability of carbon pricing in relation to income distribution issues [32,33,34]. Existing evidence of distributional impacts of carbon pricing shows ambiguous results, often related to the income level of countries. Dorband et al. [35] find progressive distributional effects for countries with per capita incomes of below USD 15,000 per year at PPP-adjusted USD(2011), while carbon pricing tends to be regressive in higher-income countries depending on the pattern of energy expenditure among income groups. By dynamically analyzing the EU case in the context of international value chains, Merkle and Dolphin [36] find that a full uniformization of carbon prices within EU countries as well as across countries would have made policies less regressive in most EU countries over 2010–2020. This is because carbon pricing exemptions, such as on imports of goods or air travel, have benefited higher-income households more than lower-income ones. Corresponding to these developments, the literature on how to reduce or reverse the regressive effects of carbon pricing is also experiencing a fertile moment. Boyce [37] and Budolfson et al. [38] demonstrate that equal per capita payments from carbon revenue (equal carbon dividends) can successfully address the distributional and political challenges of carbon pricing. Oswald et al. [39] propose a carbon tax with differentiated rates in relation to the distinction between basic and luxury consumption. Corvino [40] discusses the ethical arguments of a combination of a uniform carbon tax plus equal per capita revenue dividends plus a “limitarian” tax to restrict rich people’s wasteful emissions.

The awareness of the distributional effects of carbon pricing is high in the international negotiations as well, and it is probably the main reason why the Paris 21st Conference of the Parties—COP [2] did not succeed in agreeing a mechanism for setting a global price on carbon [12]. After a first period of discouragement due to this outcome, economists started to look with greater attention at the regulatory framework offered by the agreement text, particularly art. 6 on voluntary cooperative mechanisms [41,42,43]. More and more bilateral and multilateral initiatives are being launched between countries in a bottom-up implementation of carbon credit trading under Article 4 (Nationally Determined Contributions—NDCs) and Article 6 (Cooperative Mechanisms) of the Paris framework [3,44,45]. Leveraging a growing awareness that carbon pricing revenues can and should be recycled by governments to mitigate distributional impacts of carbon pricing and increase cooperation between rich and poor countries, on 8 September 2023, African leaders adopted the Nairobi Declaration [46] urging world leaders for a global carbon tax on fossil fuels to accelerate action against climate change. In the same period, the European Commission President Ursula von der Leyen [47] asked G20 leaders to join a proposal for “Paris Aligned Carbon Markets” [48], that aims at accelerating the development of domestic carbon pricing and the implementation of the Paris Agreement art. 6 rulebook for international compliance carbon markets agreed in Glasgow at COP 26 [49]. COP 28 in Dubai (December 2023) agreed to “Transitioning away from fossil fuels in energy systems, in a just, orderly and equitable manner, accelerating action in this critical decade, so as to achieve net zero by 2050 in keeping with the science” [50], p. 5 but no substantial advance was made on the issues related to carbon pricing, particularly on the possibility of further developing art. 6.8–9 (Cooperative Non-Market Approaches) to strengthen international cooperation on domestic energy tax policies [51]. The COP 28 Earth Negotiations Bulletin writes: “Under the SBSTA, parties discussed draft SBSTA conclusions containing a progress report of the Glasgow Committee on Non-Market Approaches, and a draft CMA decision on recommendations regarding ongoing and future work. In the decision text, parties debated a reference to carbon pricing as a domestic fiscal measure to implement climate policies. Many developing country groups opposed this, stating that carbon pricing is a market approach. Some also opposed a reference to nature-based solutions on the same basis. The EU supported the inclusion, observing that levies and taxes are economic, but not market instruments” [51], p. 11.

3. Methods and Materials

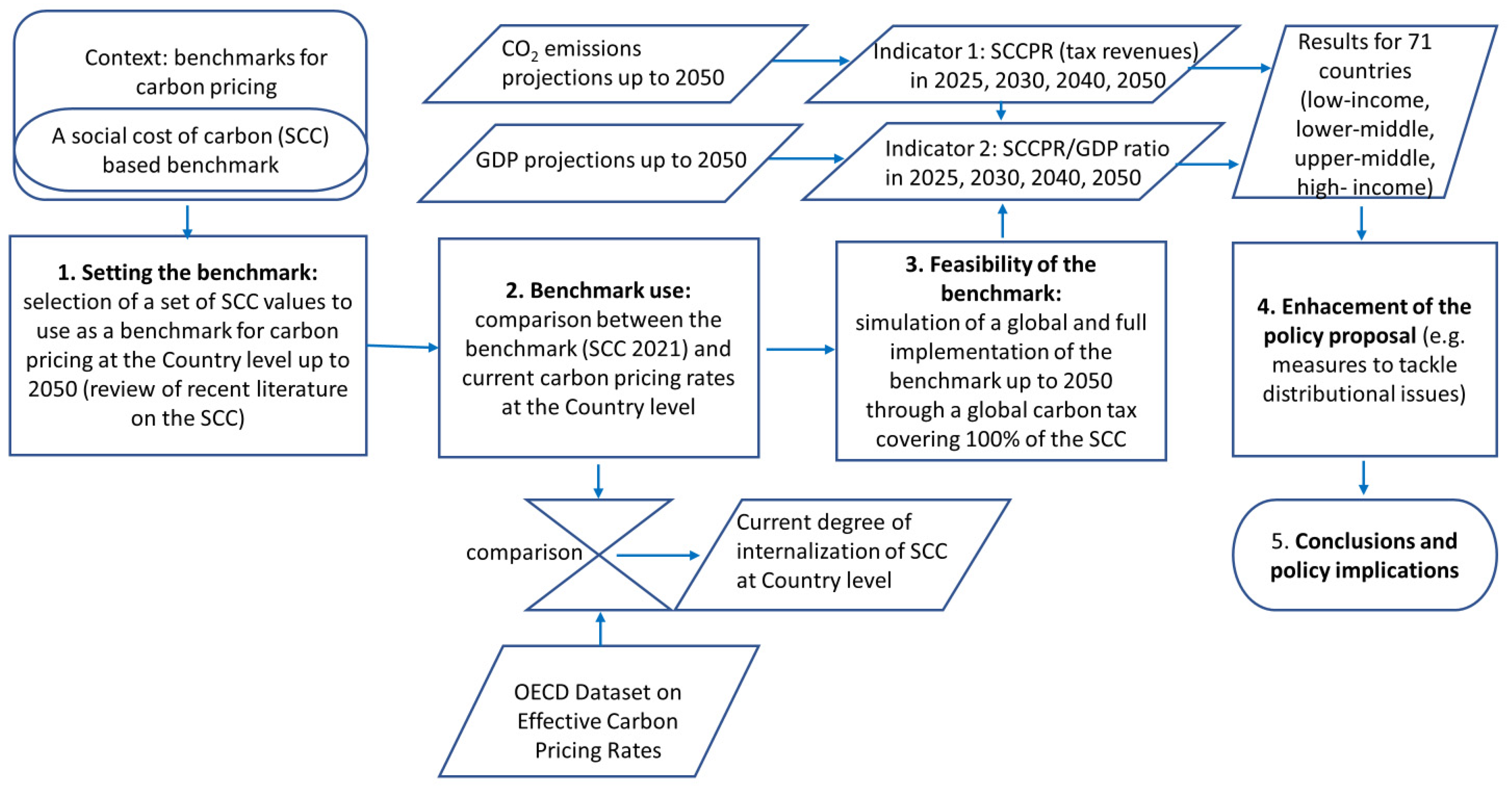

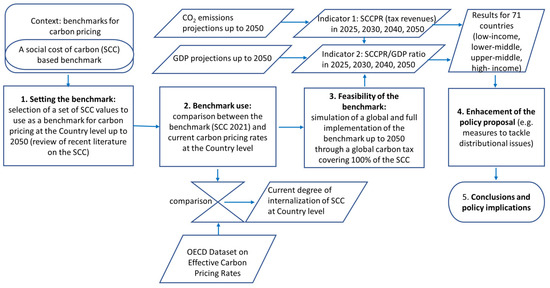

The aim of the methodology of the article is to develop, apply, test and refine our policy proposal, based on an SCC benchmark for carbon pricing. During the exposition of the various steps of the methodology, we will also describe the main literature sources and dataset used. Figure 1 provides an overview of the method and data sources used in this article to propose and discuss an SCC-based benchmark for carbon pricing.

Figure 1.

Methodology overview (steps, datasets [26], indicators).

We have not applied any original integrated assessment model to develop and test the SCC benchmark. The originality of our analysis consists in organizing in a consistent framework what is to our belief the “best available” knowledge and data offered in the different areas under study (SCC, carbon pricing, emissions scenarios, GDP and population projections).

The first objective of our method is the establishment of a carbon pricing benchmark based on the SCC (step 1). In this article, we obtain the SCC through a literature review that is a shorter and more dedicated version of a much more detailed literature review of the SCC made by one of the authors [17]. Section 4 is dedicated to describing how and why we selected the contribution of Azar et al. [52] for the task of providing a set of SCC values for yearly emissions 2021–2050, to use as a benchmark for countries’ carbon pricing policies. Outside this article, we recommend that this fundamental step of the methodology is accomplished by an international competent body, responsible for calculating the reference SCC values under established scientific protocols. The protocols developed by the US-IWG (including the EPA in this group) to provide SCC reference values are based on the transparent use of previously validated Integrated Assessment Models—IAM (or individual modules, such as damage functions or discounting procedure) developed in collaboration with academics and scholars following the recommendations of an authoritative third-party body [53]. The US case represents a best practice to be transferred to the UNFCCC/IPCC framework. A description of these protocols is directly provided by the IWG [19,21] and EPA [22]. Molocchi [17] provides a critical review of the US case providing motivations for the transfer of this experience to the European and international context.

The step 2 objective (benchmark use) is to provide an example of benchmark use by assessing the gap of current countries’ carbon pricing policies in the internalization of CO2 emission external costs (comparison between the current level of the SCC benchmark and effective carbon pricing rates at the country level). The results of this exercise are presented in Section 5. For the comparison, we rely on the OECD database of effective carbon rates [26], which offers a homogeneous and complete picture of current average carbon pricing rates at the country level. More precisely, this database monitors the net Effective Carbon Rates (ECR) and CO2 emissions for 71 countries (38 OECD, 33 non-OECD) by considering energy taxes, carbon taxes and CO2 tradable permits, net of direct fossil fuel subsidies that decrease pre-tax fossil fuel prices. The database focuses on pricing instruments that specifically apply to a tax base that is directly proportional to CO2 emissions or energy use, offering a representation of net average ECR for emissions of energy use sectors (road, off-road, electricity, industry, buildings, agriculture and fisheries), detailed by fuel type (coal, fuel oil, diesel, kerosene, gasoline, LPG, natural gas, other fossil fuels and non-renewable waste). It therefore excludes taxes and fees that are only partially correlated with CO2 emissions or energy use, such as value added taxes, vehicle circulation taxes, or other environmental taxes not related to CO2 emissions. The dataset excludes royalties on the extraction or exploitation of fossil resources that are applied in some countries. Direct subsidies are also considered in the OECD’s net ECR indicator through an accurate country-level monitoring of these forms of support through the Inventory of fossil fuel support measures [30]. Data on CO2 emissions regulated by emissions trading schemes are obtained from official registries and the average ECR takes into account the allocation of free permits. Tax rates and permit prices refer to the same base year [26].

In contrast to other approaches that exclude energy taxes in monitoring carbon pricing worldwide [1,54] the OECD data base includes both explicit (the tax base is the carbon content of the fuel) and implicit carbon pricing measures (even if the tax base is not the fuel carbon content, it is directly proportional to CO2 emissions, allowing the calculation of the implicit carbon rate). Our main motivation in adopting the OECD data base is that implicit forms, such as excise duties on fossil fuels, have wide diffusion in most countries: a benchmark analysis based just on explicit instruments inevitably provides a limited picture of effective carbon pricing instruments affecting CO2 emissions.

Overall, the OECD database covers 88% of 2021 world fossil fuel CO2 emissions [55] and 91% of GDP [56]. Since the last available OECD data on ECR are related to year 2021, the step 2 comparison between countries’ ECP with the SCC benchmark (calculation of the current degree of internalization of the SCC at the country level) is referred to year 2021.

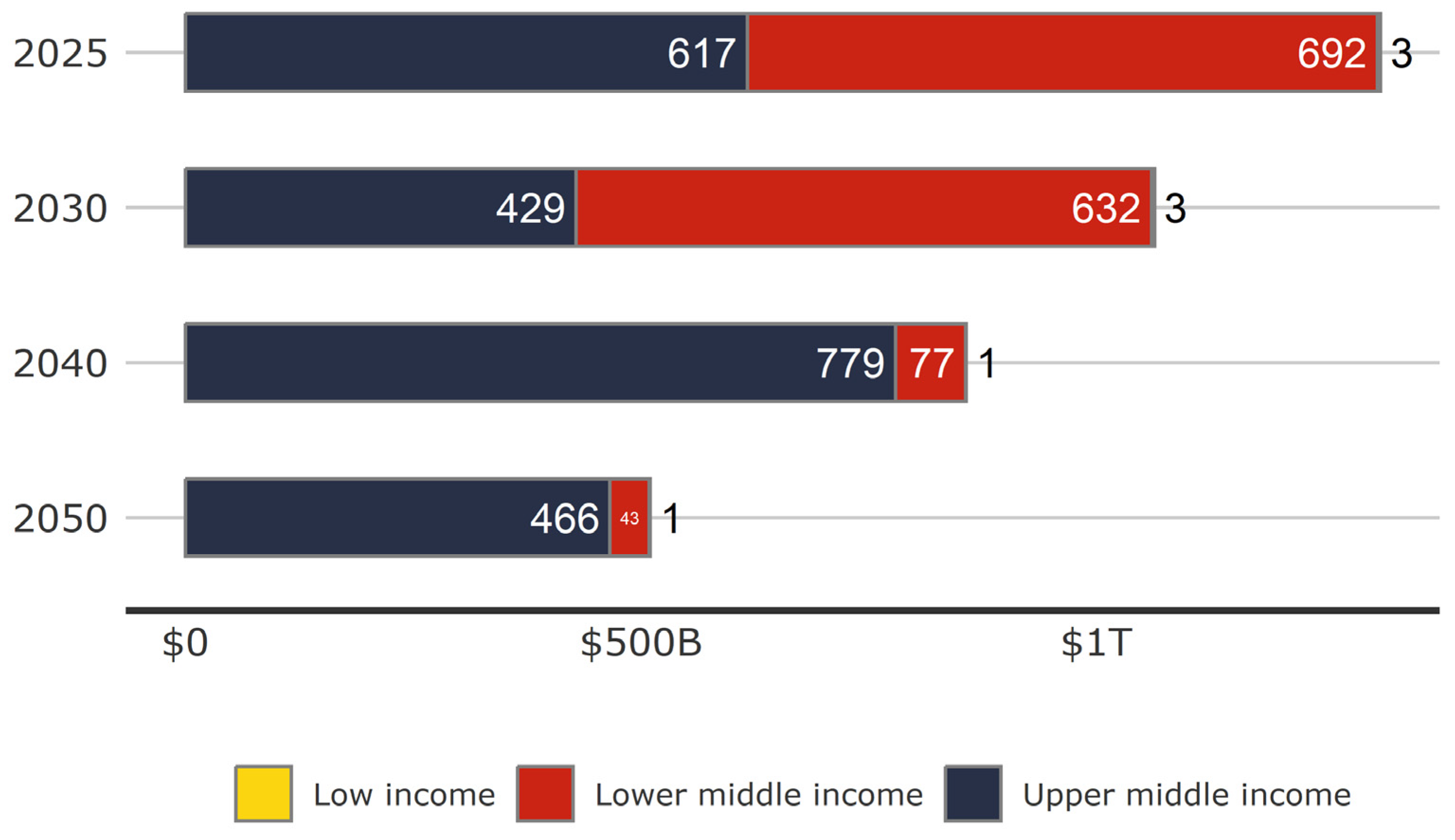

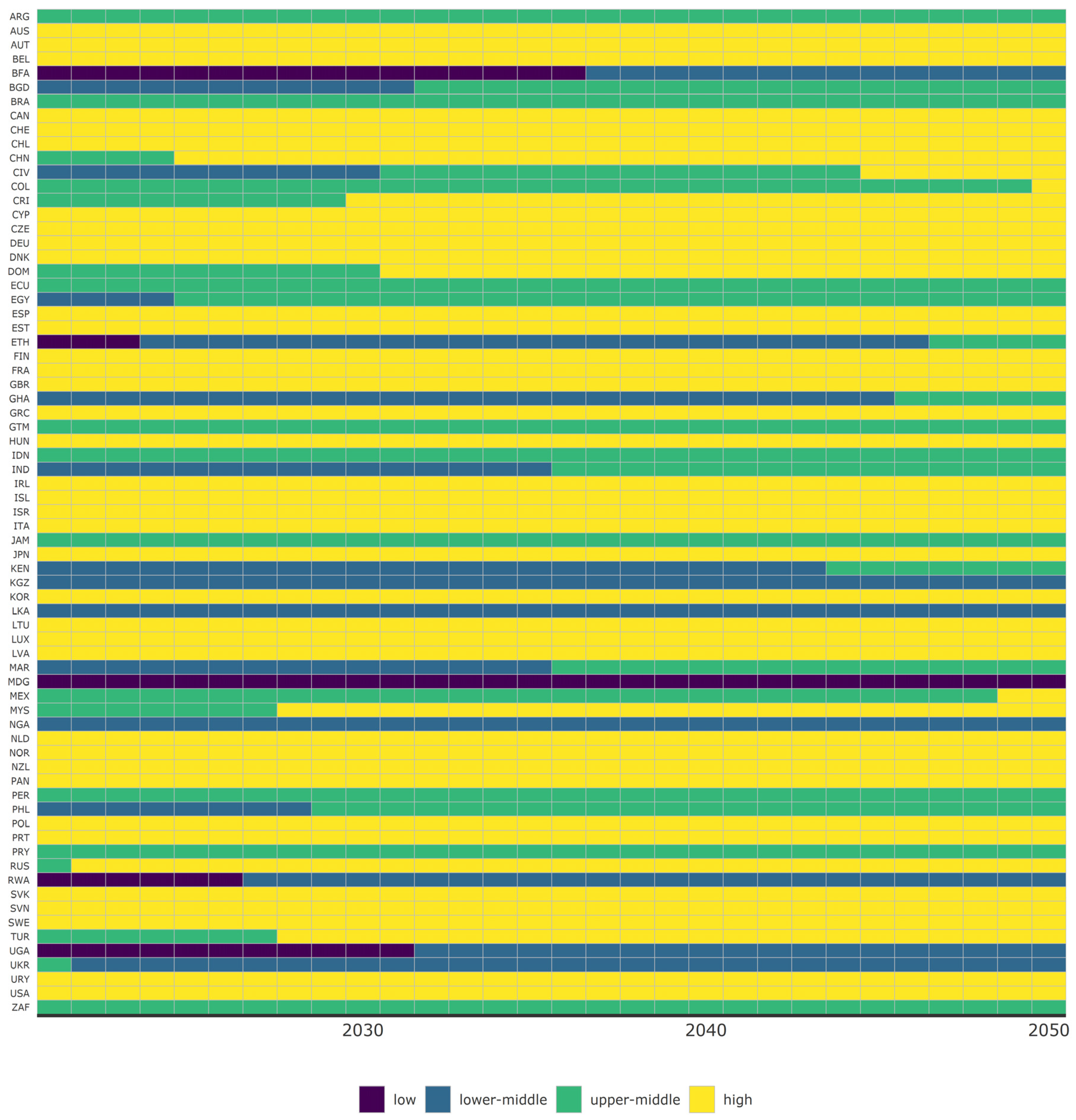

In step 3 (feasibility of the benchmark), the objective is to make a test to explore both the economic capacity of countries (particularly low- and middle-income countries) to implement the benchmark during the transition towards net zero emissions (until 2050), and the opportunities offered by carbon pricing revenues to manage the regressive effects on income. To do this, we assume an immediate (from 2025), full (100%) and worldwide implementation of the benchmark through an SCC-based uniform tax until the year 2050. This is an extreme scenario, voluntarily chosen to understand the main economic challenges of our policy proposal (starting from distributional implications), to eventually improving its main features. For the test, we use two linked indicators: the Social Cost of Carbon Pricing Revenue (SCCPR), which measures the country-level expected carbon tax revenue (obtained by multiplying the expected CO2 emissions by the SCC-based tax) and the SCCPR to GDP ratio, which measures incidence of the expected carbon tax revenue in GDP. The former offers information on financial resources that would be collected by states and potentially available to compensate distributional impacts, both domestically and in international cooperation; the latter provides information on the economic capacity of countries with a different income to sustain intense carbon pricing policies: low-income countries are in a worse position to afford high carbon prices (EUR/t) rather than high-income countries, so we need to monitor in order that the ratio between the expected carbon pricing revenue and GDP in low-income countries does not assume extreme values, much higher than in high-income countries. The proposed indicators have been chosen to explore and discuss the main challenges posed by the benchmark. A high SCCPR to GDP ratio does not necessarily mean that the uniform SCC-based benchmark is economically unfeasible, for at least three reasons: (1) carbon pricing policies can and should be implemented in a “tax revenue neutral” fiscal framework (so-called environmental fiscal reform, see Section 6); (2) high incidence in GDP means also high revenues that can be at least in part recycled by each government to compensate the most vulnerable layers of the domestic population; (3) impacts in poor countries can be totally relieved by appropriate (cooperation-based) transfer of resources collected through carbon pricing measures in high-income countries to compensate distributional impacts in low-income countries. The two indicators provide useful information to assess in advance distributional issues and consequently design appropriate (bilateral or multilateral) cooperative mechanisms between countries aimed at a full and homogenous implementation of the SCC-based benchmark for carbon pricing, avoiding distributional impacts (for example, the redistribution of all carbon tax revenues to all populations through an equal per capita lump-sum would have a progressive effect, as suggested by Boyce [37] and Budolfson et al. [38]). In Section 6, the two indicators are calculated in years 2025, 2030, 2040 and 2050 for the same set of 71 countries of the OECD dataset [26], and then reaggregated into four income per capita groups of countries by relying on the World Bank classification into high/upper middle/lower middle/low-income countries [57].

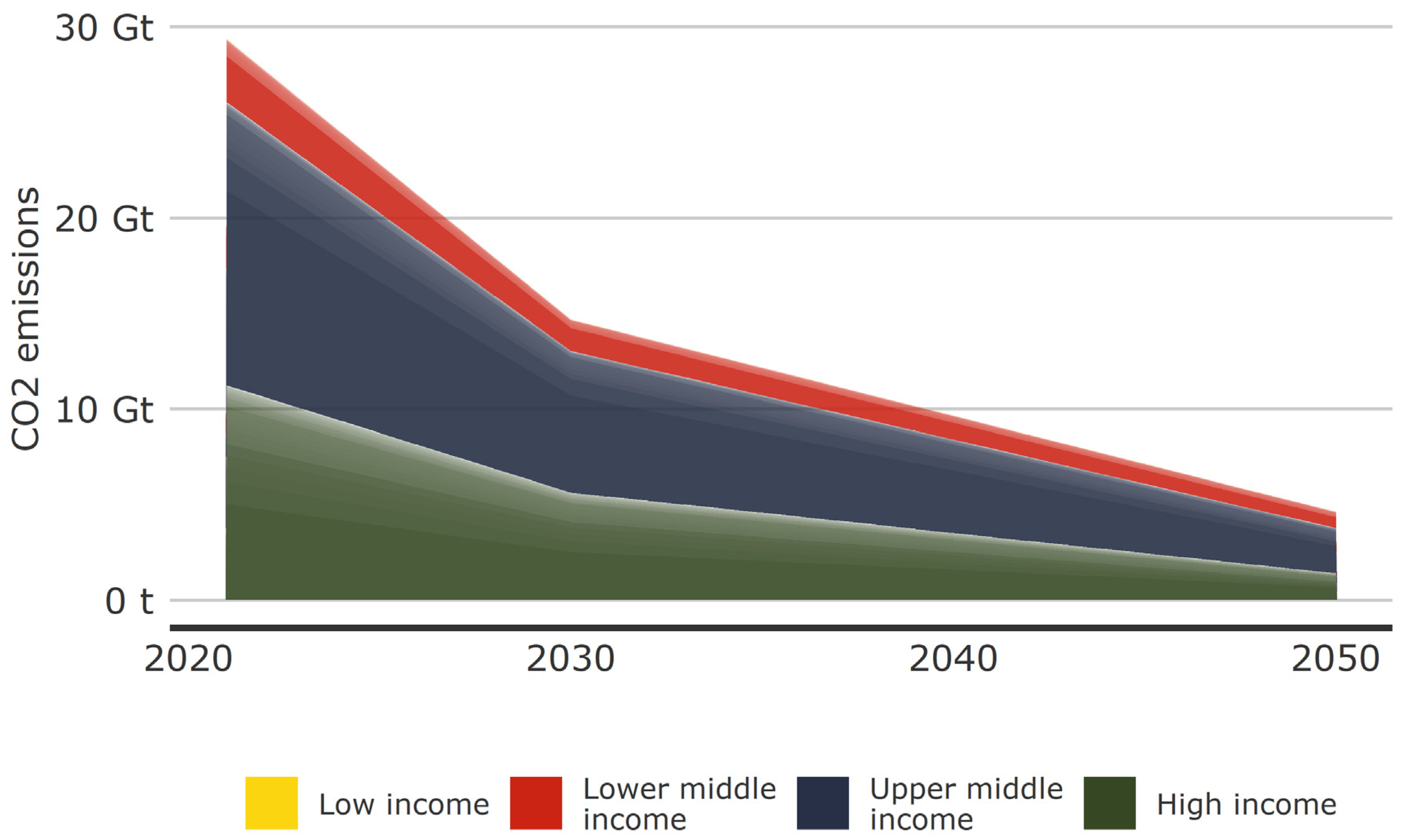

Regarding projected CO2 emissions (the potential tax base needed for calculating indicator 1 in Figure 1), we traced for the set of 71 countries the same emission reduction path obtained by Azar et al. [52] for global emissions in their optimal tax scenario. In the original contribution by Azar et al. [52], emissions are projected to decrease in the optimal scenario (with the carbon tax) by 50% in 2030 (reaching 20 Mt CO2) and by 70% in 2050 (12 Mt CO2). Subsequently, they become negative from 2065 onwards. We differentiated emission reductions between countries of the OECD database by using the modelled domestic emissions projections at 2050 compatible with the 1.5 °C temperature goal of the Paris Agreement elaborated by Carbon Action Tracker [58]. Regarding GDP projections needed for indicator 2 in Figure 1, we reconstruct the expected growth dynamic until 2050 by applying the OECD long-term forecast of real GDP for OECD countries [59]. The OECD forecast is based on an assessment of the economic climate in individual countries and the world economy, using a combination of model-based analyses and expert judgement [59]. This indicator is measured in USD at constant prices and Purchasing Power Parities (PPPs) using 2015 as the base year. For countries not covered by the OECD forecast, we made projections at 2050 based on the countries’ average annual GDP growth rate over 2013–2022 [60]. Moreover, we assume that in the 2023–2050 period, countries can reach higher income classes by making a projection of their Gross National Income (GNI) per capita at 2050 based on the average annual GNI growth over 2013–2022 [61] and on population forecast [62]. More detailed information on the methods used in the test (step 3) is provided in Appendix A (CO2 emissions and GDP projections) and B (country classification by income between 2025–2050).

The step 4 objective is fine-tuning of our policy proposal of an SCC-based benchmark for carbon pricing. After discussing the results of the test simulations, in Section 6 we add more elements and details of the policy proposal by suggesting complementary measures to tackle the regressive effects for low and middle-income countries and by exploring the opportunities to integrate the carbon pricing benchmark in the current Paris Agreement text, particularly through the cooperative approaches of art. 6.

Lastly, the method allows us to draw the policy implications of an SCC-based benchmark in the context of the Paris Agreement and future negotiations for its full implementation (step 5, Section 7).

4. Establishing an SCC-Based Benchmark for Carbon Pricing

In this section, we obtain the SCC values to use as a benchmark for carbon pricing through a literature review that is a shorter and more dedicated version of a much more detailed literature review of the SCC made by one of the authors [17]. While we focus here on a few recent SCC estimates for carbon pricing, it is important to introduce the scope and selection criteria of the original literature review. Molocchi [17] analyses literature reviews published in 2017–2023 and selected original contributions in 2012–2023 to find out and discuss a set of best values to use in cost-benefit analysis. One of its purposes is to provide a proposal of SCC values to update the external cost values for CO2 emissions recommended by the EC Handbook on external cost of transport [4]. His article develops and applies a qualitative and critical method for selecting the best SCC estimates which starts from analyzing values estimated under study reviews conducted within institutional processes [21,22,23,63], and then analyses the study reviews and meta-analysis made in academic or research contexts, and in the end delves into selected academic studies that provide original estimates of the social cost of carbon. The method proposed by Molocchi [17] relies on a priority principle that implicitly reflects the degree of third-party screening and discussion of the SCC values deemed to be the preferred values by authors. This method for reviewing literature on the SCC is the opposite to the conventional one that finds out and lays down for statistical analysis all possible estimates of the SCC ever published in the academic literature. Overall, this work analyzed 53 studies, 33 of which produced quantitative estimates of SCC. A subset of six works [22,52,64,65,66,67] that meet minimum quality standard criteria—such as update to the latest science and modelling, accuracy in the various steps of SCC calculation (particularly regarding completeness in the coverage of damage types and robustness of damage functions) and transparency—is finally selected and discussed. A comparison of these selected estimates, made by the author at the same discount rate and currency price, shows in all cases much higher SCC levels than those estimated by the US-IWG [21], which were rushed out in February 2021 pending completion of the SCC update process during the Biden administration. A distinctive position among these studies is that of the EPA, which is a member of the IWG. In November 2023, the EPA released the final version of its report on the social cost of the three main greenhouse gases (SC-GHG), which finally incorporates numerous methodological updates compared to previous IWG reports, as recommended by the scientific community [18,53,68].

The EPA report represents a qualitative leap from previous IWG studies. Even if the main purpose of its report is to produce SC-GHG estimates to use in Cost-Benefit Analysis (CBA) and regulatory impact assessment under US federal laws (and not in carbon pricing), it is worth synthesizing its features to highlight recent advancements in SCC modelling and estimation. The SC-GHG best estimates of the new EPA report no longer rely on the three IAMs used in previous IWG works (DICE, FUND, PAGE [19]). The EPA addresses the near-term recommendations of the NASEM [53] by adopting a modular approach to SC-GHG estimation where each module of the calculation process draws on the updated knowledge from the relevant scientific disciplines, assembled in a single integrated assessment model developed by the EPA itself [17,22]. For each emission year in the period 2020–2080, the EPA obtains a frequency distribution of the SC-GHG by averaging Montecarlo results for the combination of three alternative climate damage functions and three near-term discount rates (1.5%, 2.0% and 2.5%), given the same probabilistic socio-economic and emission scenario [69]. Assuming the central rate of 2%, the average of the SC-CO2 frequency distribution estimated by the EPA [22] for the year 2020 is 193 USD(2020)/t CO2. In the period up to 2050 (the time horizon assumed in this article), the EPA’s SC-CO2 grows quite linearly, increasing to 230 USD(2020)/t CO2 in 2030 and reaching 308 USD(2020)/t CO2 in 2050. Innovations introduced by the EPA report result in a much higher SC-CO2 than previous IWG reports. If one compares the SCC estimated by the EPA [22] with the IWG’s latest value [21] in the same year (2020) and at the same discount rate (2.5%) –thus comparing all the methodological updates introduced by EPA, except discounting– the new SCC value increases by 54%. If the comparison is made assuming the central social discount rate (SDR) recommended by the two reports (respectively 51 USD(2020)/t CO2 at SDR 3.0% in IWG and 193 USD(2020)/t CO2 at SDR 2.0% in EPA), the increase of the SCC reaches +278% [17].

As anticipated, the EPA’s SCC yearly values are not designed for use in carbon taxation. They reflect very accurate and updated baseline scenario assumptions that exclude the simulation of a global carbon tax. For example, the IAM developed by the EPA [22] is not designed to provide information on the possible emission reduction response of world economies to a full and immediate implementation of an SCC-based pricing scheme. In a carbon pricing context, the EPA’s new estimates for the SCC are meaningful to define the starting level for optimal carbon pricing for the first year only (2020).

At least two recent studies, included in Molocchi’s [17] selection of best recent works, should be mentioned for estimating the SCC within a broader model suitable for carbon taxation: Hänsel et al. [65] and Azar et al. [52]. Both contributions extend and update DICE (Dynamic Integrated model of Climate and the Economy), the IAM originally developed by Nobel laureate Nordhaus [7]. DICE not only calculates the SCC under a baseline/no additional climate policy scenario; one of its main features is the inclusion of a CO2 abatement marginal cost function and the possibility to simulate a global carbon tax policy scenario, finding the optimal emission, temperature and carbon tax dynamic trajectories by balancing the cost of emissions reductions and the marginal damage of climate change. Even if the stated aims of the two studies differ (the aim of Hänsel et al. [65] is to verify if an economically optimal climate policy based on a dynamic SCC tax is consistent with the Paris Agreement goal of limiting temperature increase well below 2° C and possibly 1.5 °C, while Azar et al. [52] aim to estimate the social cost of methane (SCM) in a modelling framework consistent with the social cost of carbon dioxide, thus proposing the SCM/SC-CO2 as an alternative indicator to the widely known Global Warming Potential – GWP), they use the same economic damage function, obtained from the econometric meta-analysis by Howard and Sterner [70], that in principle includes all climate damages except catastrophic-type damages. Both contributions show that when using updated versions of DICE, the SCC calculated under the “optimization scenario” (with a carbon tax equalling the SCC) allows fast and substantial CO2 emission reductions, consistent with the Paris Agreement goal of limiting temperature increase to well below 2 °C and possibly 1.5 °C. In Hänsel [65], two different discounting approaches are adopted, following Drupp et al. [71] where experts’ preferred long run specifications of the Ramsey formula are investigated. In the median expert’s view, full decarbonization (zero emissions) takes place by 2065 and temperature increase is mitigated to 1.4 °C by 2100 (with a slight overshoot), while with the median expert path full decarbonization results in 2080 and temperature increase is mitigated to 1.8 °C by the same year. In the median expert path, each expert’s chosen pair of discounting parameters is used to run the calculation of the SCC and the median SCC is taken on runs for all experts. In the median expert’s view, the median values of each Ramsey parameter resulting from the expert survey are considered (Pure Rate of Time Preference—PRTP = 0.5% and Elasticity of Marginal Utility—EMU = 1.0%). In Azar et al. [52] the median expert’s view, which is used for discounting damage in the calculation of the optimal SCC, allows to cut global CO2 emissions by 50% at 2030 as compared to 2020 (reaching about 20 Gt CO2), and by 70% at 2050 (reaching about 12 Gt CO2); CO2 emissions become negative in 2066 and go on declining to about −17 Gt CO2 in 2085 (afterwards, they stabilize at that level). Their model shows that it is optimal to limit the global average surface temperature increase to 1.5 °C above the 1850–1900 average by 2100 after peaking at almost 1.7 °C in 2070. Even if no detailed information is provided on marginal CO2 abatement cost curves assumed in these works, technology readiness level of promising innovations is to a certain degree taken into account, at least in the long term. In fact, both studies include negative emission technologies (carbon dioxide removal technologies such as biomass energy with carbon capture and storage, afforestation programs and direct air capture) within the model authors use for their preferred estimates and discuss their role in influencing the speed of decarbonization and the effectiveness of an SCC-based tax.

If we consider the SCC results obtained by the two studies under the same discounting assumptions (“median expert view”), Hänsel et al. [65] estimate 208 USD(2015)/t CO2 for 2020 emissions, while Azar et al. [52] estimate for the same year 192 USD(2015)/t CO2. To compare with the EPA’s estimate (expressed in USD(2020)), the two inflation-updated values become respectively 226 USD(2020)/t CO2 and 208 USD(2020)/t CO2, that are slightly higher than EPA’s 193 USD(2020)/t CO2 calculated with a 2.0% near term discount rate. It’s worth to note that comparison with this value is appropriate since the calibrated Ramsey formula parameters used by the EPA (2023) to calculate the 2.0% rate case are PRTP (pure rate of time preferences) 0.2 and EMU (elasticity of marginal utility in respect to consumption per capita) 1.24. The equivalent consumption per capita growth rate that equates the Ramsey formula to obtain 2.0% with these parameters is 1.45. Combining the Ramsey parameters of “the median expert view” of Hänsel et al. [65] and Azar et al. [52] (PRTP 0.5% and EMU 1.0 in both cases) with a 1.45 growth rate, we obtain a near term discount rate of 1.95%, that can be approximated to the EPA near term 2.0% rate. Both works provide SCC values that are quantitavely consistent with those of the EPA, with the key difference that they offer an SCC path for future years that is calculated under a policy scenario with a worldwide implementation of a carbon tax fully aligned with the SCC, while the EPA’s SCC values reflect a baseline scenario for CO2 emissions without such an assumption. More precisely, while in the EPA’s baseline scenario (taken from Rennert et al. [69]) world CO2 emissions slowly decline from the current 42 Gt CO2 to 33 Gt CO2 by 2050, in the optimal scenario by Azar et al. [52] the emission reduction path is much more radical: global emissions reduce to 12 Gt CO2 by 2050 and become negative from 2065 onwards. To represent the SCC benchmark under an optimized global carbon tax scenario, we have a slight preference for Azar et al. [52] rather than Hänsel et al. [65], since the former updates the original DICE-2016R2 model by including methane emissions and an atmospheric methane cycle, an improved carbon cycle and energy balance model, enabling an estimation of the social cost of methane (SCM) and of the SC-CO2 in a consistent framework.

As a sensitivity analysis of our preferred SCC estimate for 2020 emissions (208 USS(2020)/t CO2 [52]), we can make reference to a few other estimates based on the same 2% near term discount rate, included by Molocchi [17] in its subset of selected best values:

- (a)

- 185 USD(2020)/t CO2: this is the best estimate provided by Rennert et al. [67] by using the Greenhouse Gas Impact Value Estimator (GIVE) model with a sectoral type of damage module (damage in different sectors or of different types are summed up to obtain an aggregate figure). GIVE damage module has been adopted by the EPA [22] as one of its three alternative damage functions (results with the three options are averaged by EPA to obtain final SSC estimates). The GIVE damage module [67] includes estimation of climate damage occurring in four sectors or impact categories: health (heat and cold-related mortality), energy expenditures for space heating and cooling (buildings only), agriculture (welfare changes due to crop productivity loss using a general computable equilibrium model) and coastal regions (various impact-pathways of sea level rise). Even if GIVE includes also two tipping points related to sea level rise (the melting effects of the Antarctic Ice Sheet—AIS and Greenland Ice Sheet—GIS on sea level rise [72]), it cannot cover the wider range of tipping points currently analyzed in the economic literature [73]. Considering the limited coverage of tipping points, GIVE estimates are much more comparable to SCC estimates limited to non-catastrophic damages.

- (b)

- 205 USD(2020)/t CO2: this is a sensitivity case provided by Rennert et al. [67] where the GIVE model runs a global GDP damage function elaborated by Howard and Sterner [70] representing non-catastrophic damage, which has been adopted by the EPA (with corrections) as the second of its alternative three damage functions [22].

- (c)

- 438 USD(2020)/t CO2: a further sensitivity case where Molocchi [17] assumes that the GIVE framework by Rennert et al. [67] uses, instead of the EPA-corrected Howard and Sterner damage function (non-catastrophic damage), an alternative damage function that includes both non-catastrophic and catastrophic damage (spec. 7, Table 2 in Howard and Sterner [70]). Even if both parameters of Howard and Sterner’s [70] econometric analysis of this function are statistically significant, in the EPA’s [22] review of their work the total damage (catastrophic and non-catastrophic) function calculated by Howard and Sterner is deemed an ill-grounded estimate because original observations do not reflect a detailed modelling of climate tipping points (which is why the EPA considers only the non-catastrophic coefficient of the econometric specification 7 in Table 2 of Howard and Sterner [70]).

Catastrophic damage (so called “climate tipping points”) is indeed relevant. Examples are the thawing of permafrost (due to the feedback effect on carbon dioxide and methane emissions), the disintegration of the ice cap, or a change in the circulation of important sea currents. In the literature on SCC, this set of phenomena (not to be confused with the impacts of extreme meteorological events related to long-term temperature increase) is denoted with the term “tipping points”, defined as “subsystems of the Earth system, present on a sub-continental scale which, under certain circumstances, small or slow perturbations can transform into a state qualitatively different from the ordinary one” [73], p. 1. Even if the economic literature on tipping points is fast developing [66,72,73,74,75], economic damage estimates of these complex phenomena are still too uncertain and specific to be included in a comprehensive and robust estimate of the SCC [17]. Following the judgment of the EPA [22], we prefer not to include tipping points in our preferred estimate of the SCC, and to consider the SCC estimate that includes this type of damage (438 USD(2020)/t CO2 for 2020 emissions) as a possible upper level for our benchmark, for sensitivity analysis purposes.

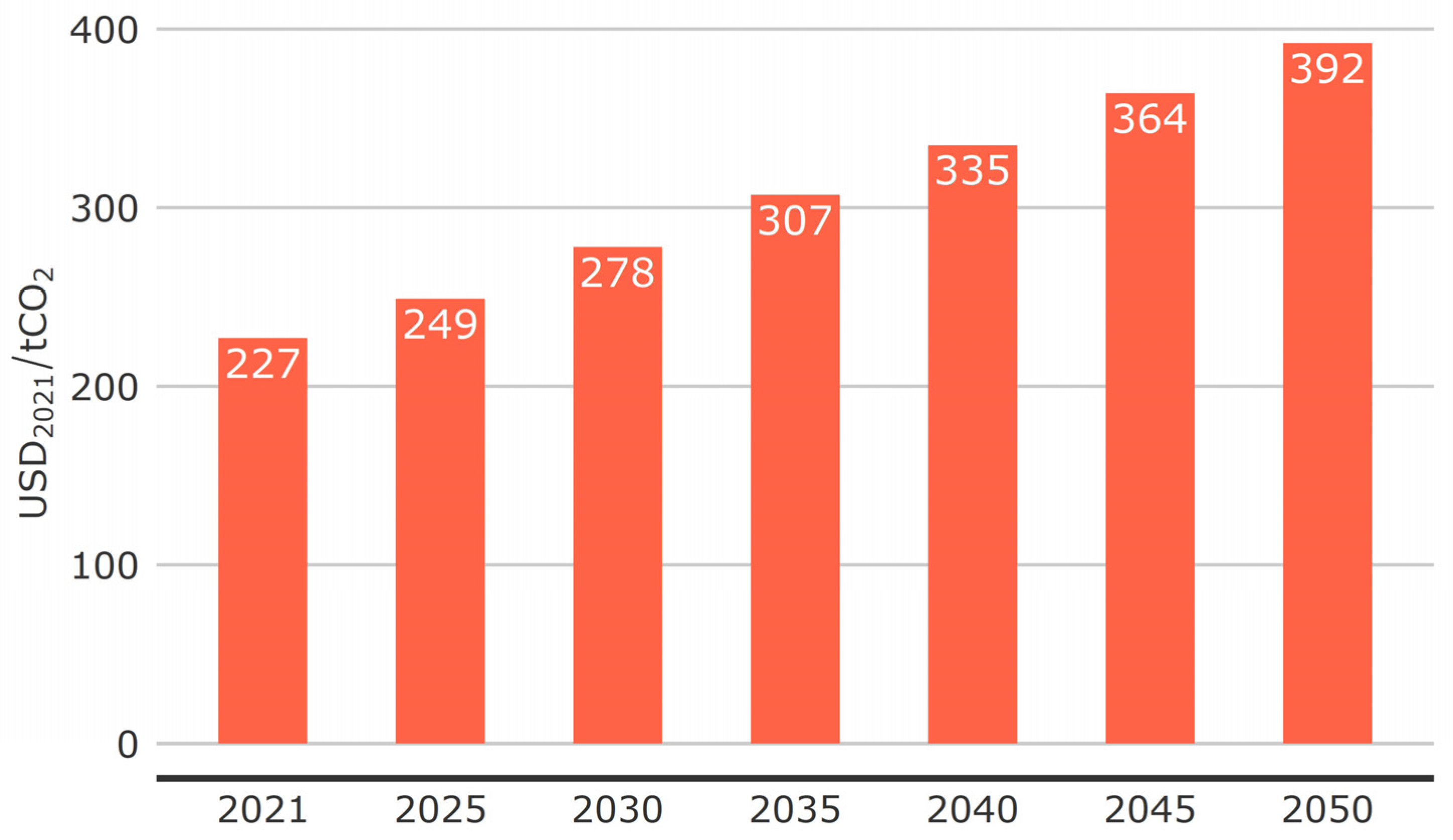

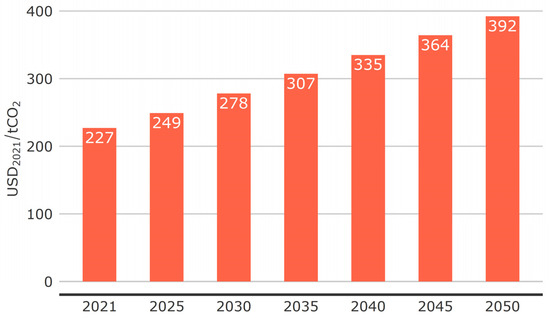

To recap, Figure 2 shows the SCC optimal path taken from Azar et al. [52], adopted in this article to represent the international benchmark for carbon pricing in the 2021–2050 period (all values are updated to constant USD(2021)). The SCC increases over the period with a clear linear trend, due to a combination of climate and economic factors (the projected growth of GDP increases future willingness to pay to avoid climate damages, increasing the SCC in time).

Figure 2.

SC-CO2 in the DICE optimized emissions reduction path 2021–2050 (USD(2021)/t CO2). Source: elaboration of Azar et al. [52]. Original values are updated to 2021 prices. SCC data for 2021–2050 have been extracted from the original graph by using a data extraction tool (Plotdigitizer). Since the obtained rough data show a small dispersion both above and below a linear trend, for the benchmark we linearly interpolated the extracted data.

If we compare our suggested SCC-based benchmark with the highest of the three levels of benchmark adopted by the OECD [9] in its report on effective carbon pricing (120 EUR/t CO2 by 2030, unspecified currency year), our benchmark for emissions in the same year (278 USD(2021)/t CO2 by 2030) is equivalent to 235 EUR(2021)/t CO2: it nearly doubles (+96%) the most ambitious of the OECD’s. This is not the only difference with the OECD: our benchmark provides yearly differentiated (increasing) reference values from 2021 to 2050, providing the opportunity for governments to make ex post yearly comparisons with their effective carbon rates (see Section 5 for a comparison in 2021) and to make forecast comparisons with their carbon price strategies on a longer time period than 2030, consistent with the timing of a net zero emission scenario by 2050, as needed by the Paris Agreement goal [16].

5. Using the Benchmark: Where Do Countries Stand in the Internalization of the SCC?

What is the current situation on effective carbon pricing and where do world countries stand as compared to the SCC benchmark? In this section, we present the results of a comparison between the current level of effective (both implicit and explicit) carbon pricing and the proposed SCC-based benchmark, and we highlight the main differences with the benchmark adopted by the OECD (2021).

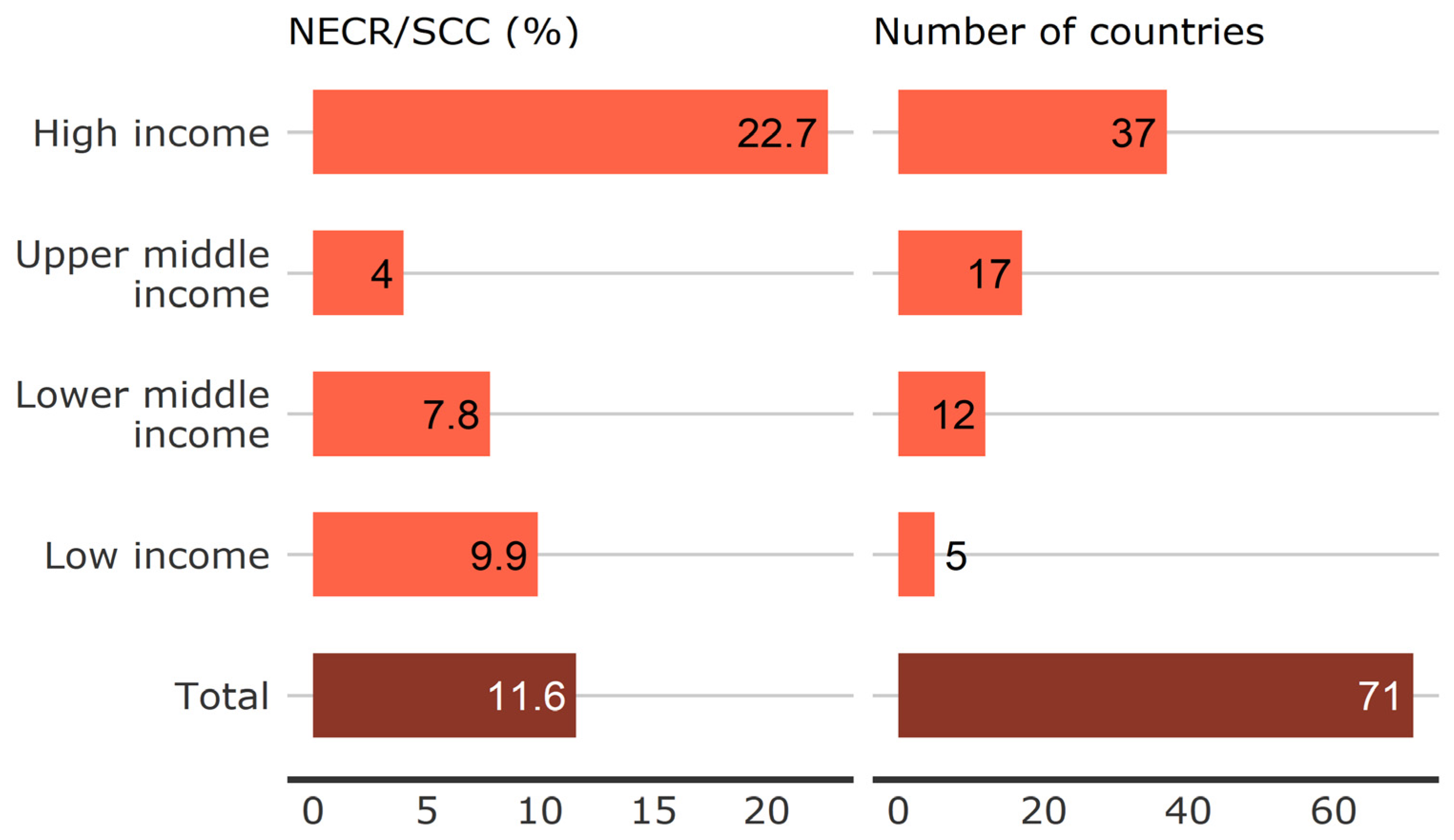

For the comparison, we assume the same currency (USD(2021)) and the same year (SCC 2021), since 2021 is the last available year of the OECD database on Net Effective Carbon Rates—NECR [26] (NECR values of the data base are measured in EUR(2021). The average exchange rate for 2021 is 1 EUR(2021) = 1.183 USD(2021)). As stated in Section 3 (Methods and Materials), the carbon pricing instruments covered by the OECD dataset are energy taxes, carbon taxes and CO2 tradable permits. Internalization in energy prices is calculated by also considering the role of direct subsidies to fossil fuels (financial transfers that decrease pre-tax fossil fuel prices) that are still present in some middle- and low-income countries. We have elaborated the dataset to obtain the average level of internalization of the SCC in four subsets of countries by using the World Bank [57] thresholds to classify countries in high/higher middle/lower middle/low-income groups. High-income economies are those in which 2022 GNI per capita (inflation adjusted to 2023) was more than USD 13,845, upper-middle-income economies are those in which 2022 GNI per capita was between USD 4,466 and USD 13,845, lower-middle-income economies between USD 1,136 and USD 4,465, low-income economies USD 1,135 or less. In Appendix B, we provide more information on how we elaborated the dynamic country classifications by income per capita from 2021 to 2050.

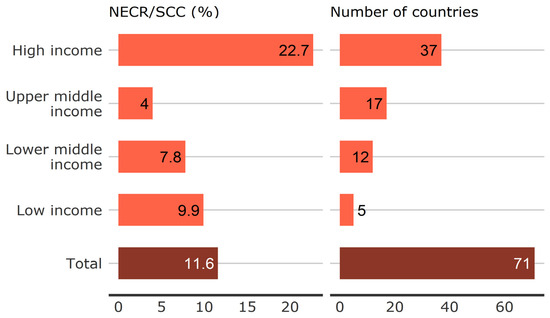

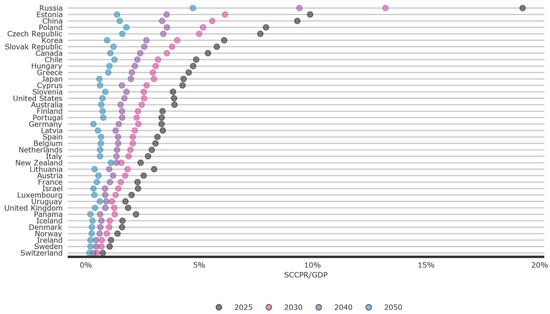

Figure 3 shows that the degree of internalization of the SCC-based benchmark for year 2021 (227 USD(2021)/t CO2) for the total set of 71 countries is very low (11.6%) and a similar result is obtained in the four income country groups: the ratio between NECR and the SCC benchmark is low not only in lower-income groups, as expected, but also in the high-income group of countries (22.7%), which should lead other countries in reducing emissions. Figure 3 highlights a serious delay of national climate policies in establishing the optimal pricing conditions needed to invert (in the short term) the historical increase in global CO2 emissions and then to achieve (in a longer term) deep cuts in CO2 emissions.

Figure 3.

Average internalization of the SCC (NECR/SCC) in 2021, set of 71 countries (38 OECD, 33 non-OECD). Source: authors’ elaboration of OECD ([26] and Azar et al. [52].

For sensitivity analysis purposes, if the upper value of 438 USD(2020)/t CO2 suggested in Section 4 [67,73], that represents a more uncertain SCC estimate that includes catastrophic damage, is used as a benchmark for carbon pricing for 2021 emissions (457 USD(2021)/t CO2), the degree of internalization of the external costs would reduce to 5.7% for the 71 states (11.2% for high-income countries), highlighting an even wider gap in current carbon pricing policies compared to the SCC benchmark.

Table 1 offers additional information on the current situation by calculating either the absolute revenues (Net Effective Carbon Pricing Revenue—NECPR, penultimate column, obtained by multiplication of each country’s average NECR with its potential tax base in terms of CO2 emissions from fossil fuels) and the NECPR to GDP ratio (last column), an indicator that expresses both the potential difficulty of countries in bearing the costs of pricing and the financial opportunities related to a growing amount of revenues.

Table 1.

Net effective carbon rate (NECR), net effective carbon pricing revenue (NECPR) and NECPR incidence in GDP in year 2021. Source: elaboration of OECD ECR database [26].

Current revenues from implicit and explicit carbon pricing in the whole set of 71 countries amount to USD 772 billion in 2021. NECPR incidence in GDP for the whole set of 71 countries is 0.86%, with a percentage for high-income countries (1.03%) that is slightly higher than the average. Paradoxically, the percentage of the lower-middle-income group (1.04%) exceeds those of the upper-middle- (0.48%) and high-income groups. This outcome is mainly related to the significant role of road transport energy taxes in some lower-income countries, rather than to explicit forms of carbon pricing. For example, India (lower-middle-income group) shows an economy-wide NECR of 22.2 USD(2021)/t CO2) and an average NECPR to GDP ratio of 1.7%, which is much higher than the high-income average. According to the detailed sectoral data provided by the OECD’s dataset [26], the average carbon rate of gasoline tax in the Indian road transport sector is 198 USD(2021)/t CO2 and that of the diesel tax is 162 USD(2021)/t CO2. No carbon taxes or ETS are in force in 2021 (India is planning an ETS from 2025 [1]). In China (upper middle-income country group in 2021), the economy-wide NECPR to GDP ratio is 0.48% (NECR is 8.5 USD(2021)/t CO2). According to the detailed sectoral data [26], the gasoline tax for road transport in China is equivalent to 104 USD(2021)/t CO2, the diesel tax is 70 USD(2021)/t CO2, while the average carbon pricing rate of the newly introduced ETS (2021), calculated on fossil fuel emissions in the electricity sector, is much lower, at 6.4 USD(2021)/t CO2.

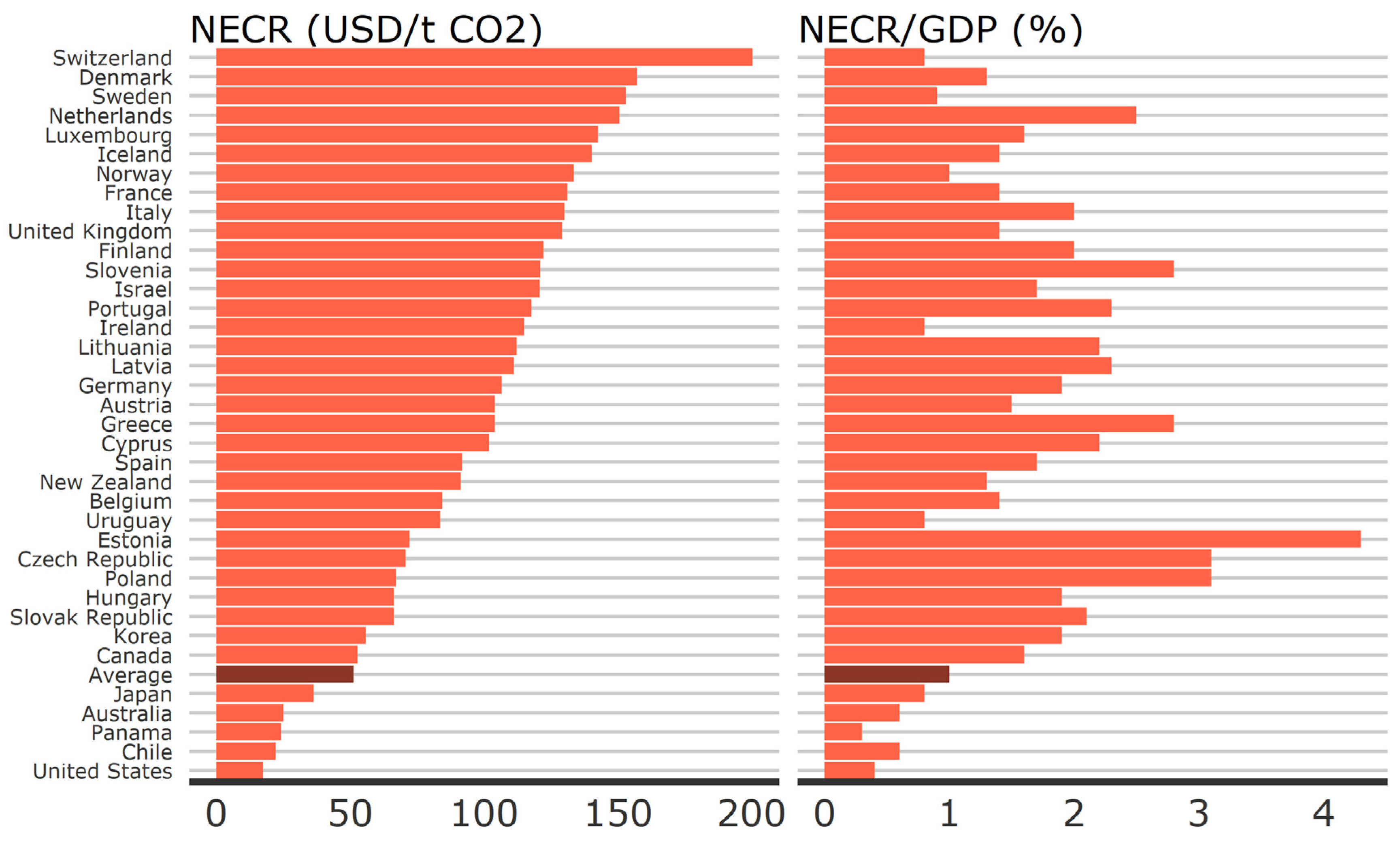

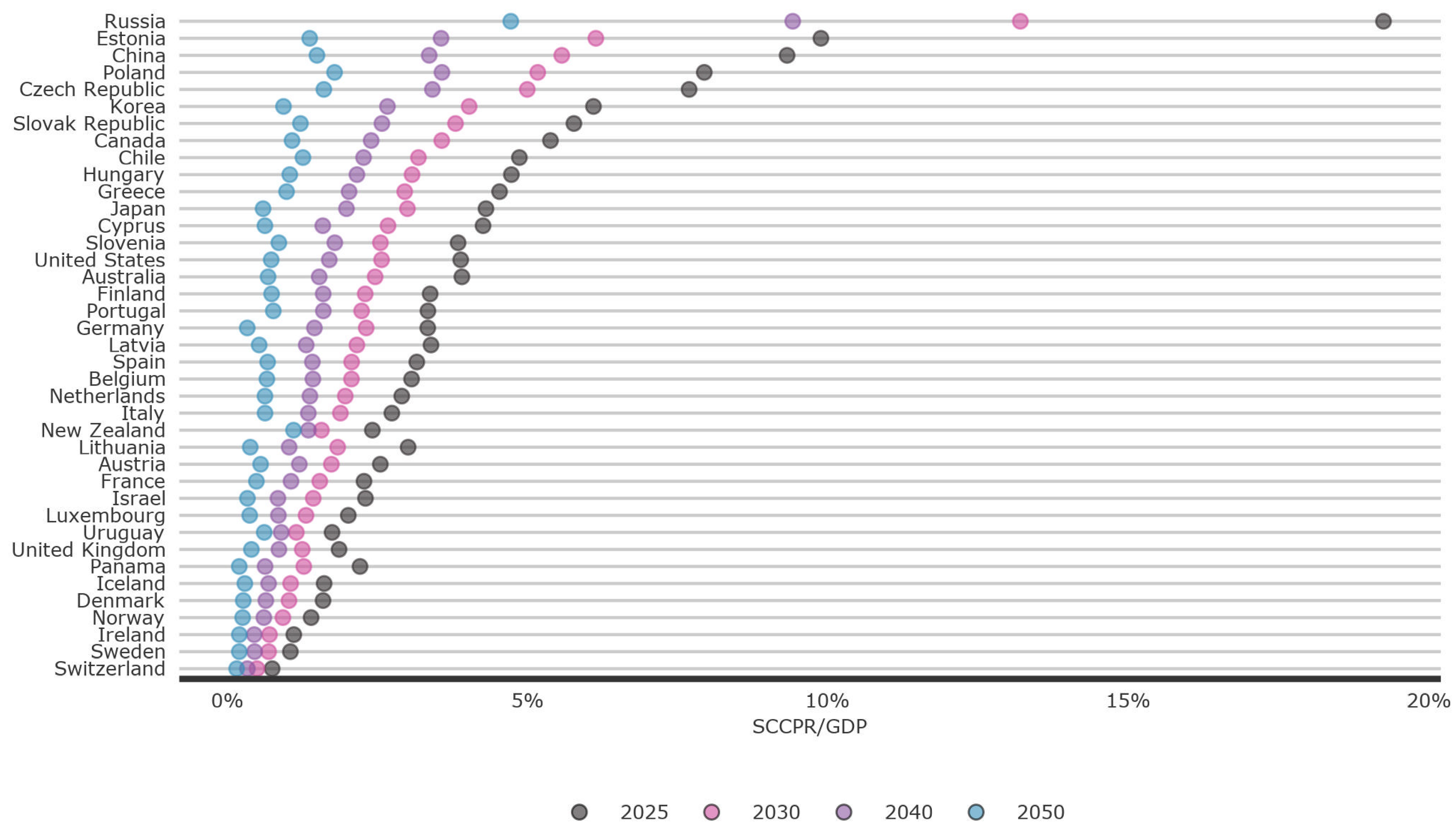

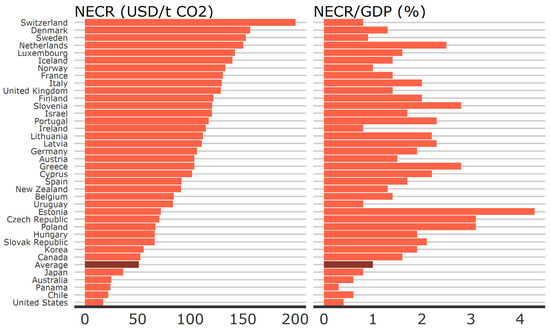

The poor performance of high-income countries in current levels of carbon pricing finds a better clarification in Figure 4, that highlights unpleasant disparities between countries in a group that should be much more ambitious and cohesive in its carbon pricing policies. While the average NECR for these countries is 51.4 USD(2021)/t CO2 (1.03% of GDP), the USA pays on average 17.4 USD(2021) (a ridiculous 0.37% of GDP), Australia 25.1 USD(2021) (0.57% GDP), Japan 36.4 USD(2021) (0.84% GDP). On the other side, other high-income countries pay per ton of CO2 more than double the group average: Germany 106.7 USD(2021) (1.94% GDP), UK 129.2 USD(2021) (1.36% GDP), Italy 130.1 USD(2021) (1.97% GDP), France 131.2 USD(2021) (1.42% GDP). There is a group of eastern European countries with even higher revenue to GDP ratios, such as Estonia (4.25%), Czech Republic (3.14%) and Poland (3.12%), notwithstanding their NECR is around 70 USD(2021)/t CO2 (this is due to their relatively high CO2 emissions as compared to GDP). Some high-income countries pay a higher NECR, such as Switzerland (200.3 USD(2021)/t CO2) and Denmark (157.2 USD(2021)/t CO2), but due to their relatively low CO2 emissions and high GDP their revenue to GDP ratio is much lower (respectively 0.83% and 1.31%).

Figure 4.

Net Effective Carbon Rate (USD(2021)/t CO2) and Net Effective Carbon Pricing Revenue by GDP (%) in year 2021, 37 high-income countries. Source: authors’ elaboration of OECD [26] and World Bank [56].

In the lower middle- and low-income countries of the dataset, some stand out as best cases in effective carbon pricing at the world level, given that they achieve an internalization degree of the SCC which is even above the high-income countries’ average of 22.7%: Uganda 45% (120.7 USD(2021)/t CO2), Kenya 35% (92.8 USD(2021)/t CO2), Rwanda 29% (77.9 USD(2021)/t CO2). To complete the picture, in the 17 upper middle-income group of countries, we still find some best-case countries (Costa Rica pays 115.1 USD(2021)—that is, 43% of the SCC benchmark—and Paraguay 63 USD(2021), 24% of the SCC), but we also find very important countries with an internalization of the external costs that is lower than 5%: Brazil pays only 0.2 USD(2021)/t CO2, Russia 5.3 USD(2021) and China 8.5 USD(2021)/t CO2 (internalization of the SCC benchmark is 3.2%).

We can present some more examples of the specific carbon pricing instruments that produce these results. In the EU member states, the high average NECR values result from high energy taxes in the road transport sector and—to a lesser but increasing extent—the price of ETS permits, which increased from 35 to 85 EUR/t CO2 during 2021 (41–100 USD(2021)). In Italy, 85.1% of overall CO2 emissions from energy use were priced in 2021. Even though no carbon tax is in force, the gasoline tax in transport is equivalent to 381 USD(2021)/t CO2, the diesel tax net of the duty rebate in road freight sector is 274 USD(2021)/t CO2, natural gas excise duty revenue in the building sector is equivalent to 79 USD(2021)/t CO2, while the average ETS revenue is equivalent to 63 USD(2021)/t CO2 in the electricity sector and 44 USD(2021)/t CO2 in industry (only a share of industry emissions are covered by the ETS). If we use the SCC 2021 benchmark of 227 USD(2021)/t CO2 for the Italian case, a good potential for increased revenue is mainly found in the expansion of the ETS in the residential, aviation and maritime transport sectors and in the elimination of the numerous energy tax rebates and exemptions in all sectors [76].

For comparison with Italy, we can take the US case, where 32% of country emissions are priced (62% less than Italy’s) and the country NECR is 17.4 USD(2021) (87% less). There are three active ETS in the US: California, Washington, and the Regional Greenhouse Gas Initiative (RGGI), participated by eleven Northeast states (Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, Vermont). Energy taxes in the US transport sector are much lower than in Italy (both gasoline and diesel are around 53 USD(2021)/t CO2), fuel taxes in non-road sectors (buildings, industry, agriculture and off-road transport) are on average close to zero (0.9 USD(2021)/t CO2), no carbon tax revenue is registered and the average carbon rate generated by the three regional ETS is negligible (1.3 USD(2021)/t CO2 in the electricity sector, 1.2 USD(2021) in the building sector and 0.7 USD(2021) in industry). When the SCC benchmark for 2021 (227 USD(2021)/t CO2) is used to assess carbon pricing policies in the US, the poor performance of regional and scattered carbon pricing initiatives becomes clear. Moreover, the benchmark highlights the extent of the gap in the US between the level of pricing required for full internalization of climate damage and the persistent domestic willingness to defend the competitiveness of industry by not raising energy taxes on fossil fuels. As a measure of CO2 external costs, the SCC aims to establish a level playing field for environmentally fair competition in the global economy.

In terms of internalization of the external costs of CO2 emissions at the country level, to present some examples in the high-income groups based on our SCC-based benchmark value for 2021 (227 USD(2021)/t CO2), Switzerland ranks first with 75%, followed by Denmark (59%), Sweden (57%), Netherlands (56%); France and Italy are at 49%, Germany 40%. All the above-mentioned countries stay above the average internalization degree of high-income countries of 22.7%. Very rich countries in the high-income groups have an internalization degree of the CO2 external costs that is incredibly low: USA 6.5%, Australia 9.4%, Japan 13.6%.

We can also compare our results for country groups in terms of current degree of internalization of the SCC benchmark with those achieved by the same set of countries using the OECD benchmark (OECD, 2021). Since effective carbon pricing data refer to the year 2021, we refer to the closest benchmark level proposed by the OECD [9] (30 EUR/t for the year 2025, that is 34.2 USD(2021)). The outcome would be:

- −

- in the set of 71 countries, the average internalization of the OECD benchmark in 2021 would increase to 76.8% (average NECR is 26.3 USD(2021)/t CO2, that is 76.8% of the 34.2 USD(2021) benchmark);

- −

- the high-income countries group (37 countries) would reach an average NECR of 51.4 USD(2021)/t CO2, that is 50% above the OECD benchmark (the benchmark is achieved by high-income countries 4 years before 2025);

- −

- the other country groups of the available dataset (34 countries) would remain far below the OECD benchmark, precisely at 25.7% by the 17 countries of the upper middle-income group (9.1 USD(2021)/t CO2), 49.6% by the 12 countries of the lower-middle-income group (17.6 USD(2021)/t CO2) and 63.1% by the five countries of the low-income group (22.4 USD(2021)/t CO2).

The main message that comes out from this analysis using the OECD benchmark for 2025 is this: high-income countries have already done the job, now it is the turn of lower-income countries. This message would be completely misleading. On the contrary, the main message provided by the exercise presented in this section, in which we use a science-based benchmark that represents a conservative estimate of climate damage (non-catastrophic damage), is as follows:

- −

- all countries, some more than others, are lagging behind. The carbon pricing levels reached by European countries (mostly through high energy taxes and the UE-ETS permit price) are still far from reaching a sustainable path for carbon pricing;

- −

- all countries should be involved in reaching the SCC benchmark (the SCC is global by definition);

- −

- since all countries must be involved, given the different economic responsibilities and capacities, all high-income countries should take the lead as compared to lower-income countries.

With an SCC benchmark, carbon pricing free riders among high-income countries would be exposed to the public with economic arguments based on climate science. As anticipated in the introduction, we believe that high-income countries would adopt and implement the SCC-based benchmark for a mix of informative, economic and policy drivers:

- −

- greater awareness for countries of their effective positioning on carbon pricing;

- −

- stronger arguments for governments in their communication with citizens on tax issues (SCC pricing is not a cost but an investment with global returns);

- −

- science-based level playing field in economic competition, based on the internalization of climate risk into prices, avoiding trade wars between environmental forerunners and free riders;

- −

- opportunity to raise higher revenues for financing climate transition costs while supporting lower-income countries;

- −

- a more cooperative international scenario.

6. Discussion of the SCC-Based Benchmark and Fine-Tuning of the Policy Proposal

How high could the revenues by GDP become due to a carbon pricing strategy of full implementation of the SCC benchmark? How can distributional issues be integrated in an SCC-based benchmark for carbon pricing involving all countries in its implementation? In this section, we improve our main policy proposal by discussing two major challenges to implementing the SCC-based benchmark on a global scale: countries’ economic capacity to afford high carbon pricing levels and equity issues (regressive distributional effects). We will do this through a “stress test” aimed at exploring both the economic capacity of countries to implement the benchmark during the transition towards net zero emissions (until 2050), and the opportunities offered by carbon pricing revenues to absorb regressive income effects.

The feasibility test assumes the same carbon pricing scenario as in Azar et al.’s [52] optimal scenario, meaning that all countries adopt a carbon tax (or any other implicit or explicit carbon pricing measure that applies to a tax base that is directly proportional to CO2 emissions, as in OECD [9]), let us say from 2025, by immediately applying 100% of the recommended SCC up to year 2050, without any differentiation between rich and poor countries. This is an extreme case, voluntarily chosen to understand the main economic challenges or obstacles to our policy proposal and, consequently, to suggest complementary conditions or measures to better manage them. Note that the SCC-based benchmark for 2021–2050 CO2 emissions proposed in Section 3 assumes that all world countries apply the same carbon tax rate. Any free rider could compromise the successful achievement of emission reductions that are implicit in the model with which the optimal carbon tax is calculated. An equal SCC for all countries would help restore conditions of fair competition from the point of view of climate change. Brown technologies would homogenously pay more for their carbon emissions in all sectors and countries, thus stimulating the diffusion of alternative green technologies worldwide.

For the test, we will use the two projection-based indicators presented in Section 3 (Methods and Materials): the Social Cost of Carbon Pricing Revenue (SCCPR) and its incidence in GDP (SCCPR to GDP ratio).

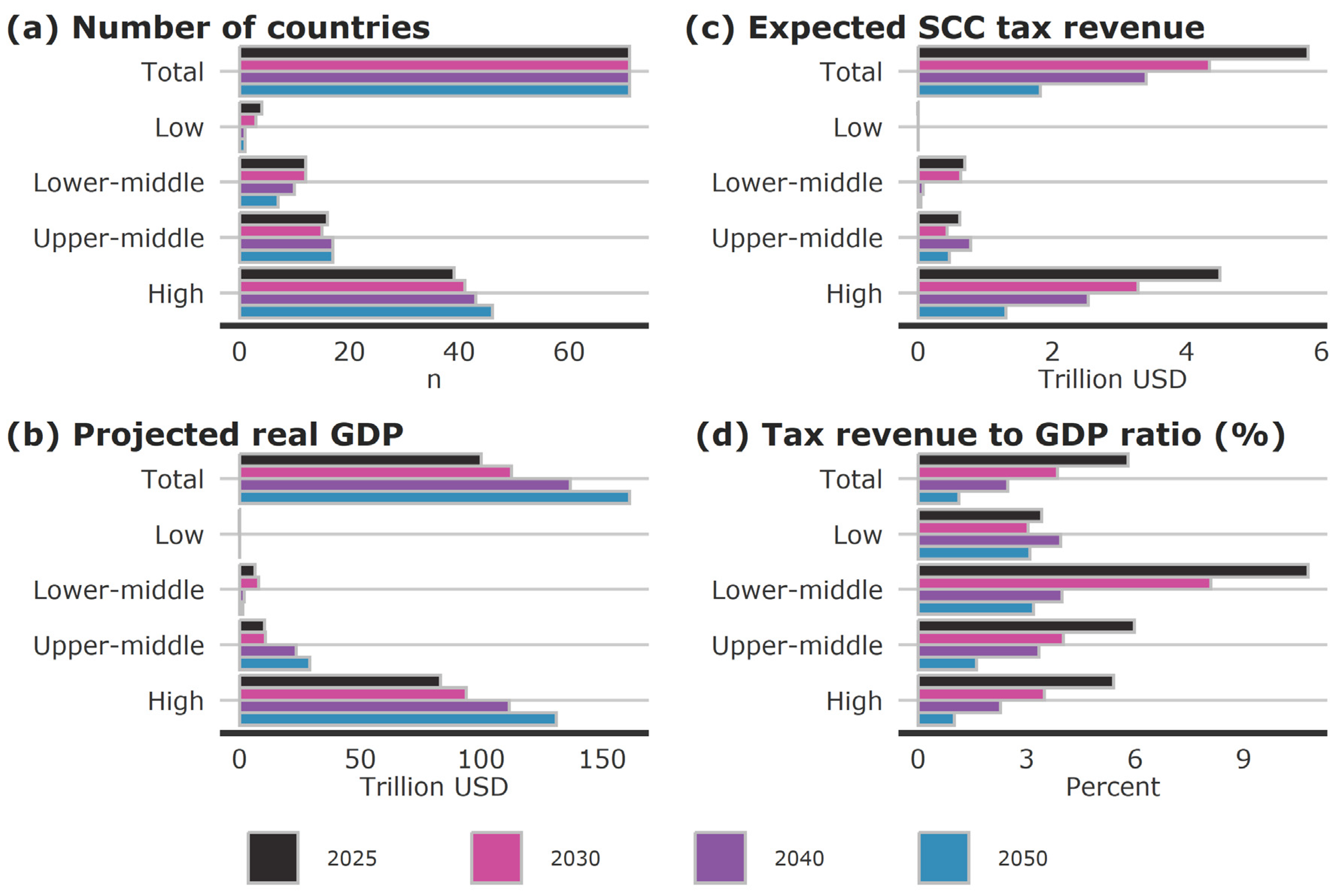

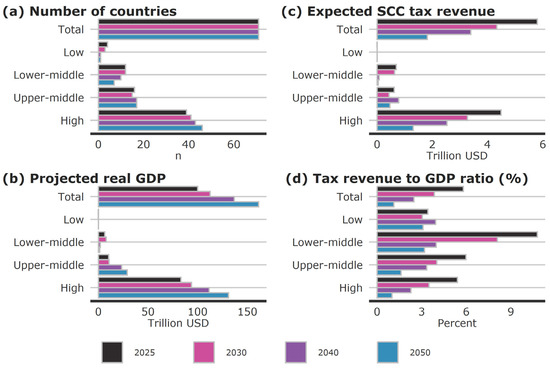

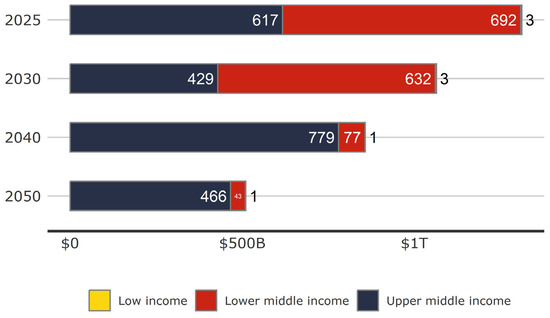

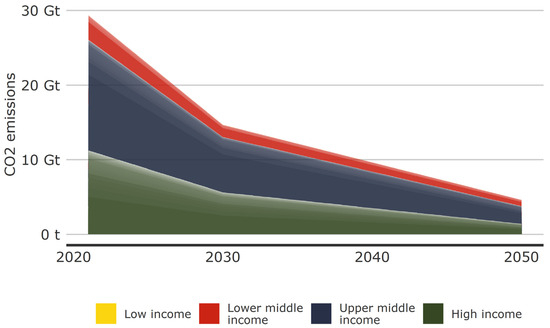

Due to data constraints, the test is limited to the same set of 71 countries of the OECD database [26]. Appendix A recaps the main assumptions and dataset used for the simulation. Results for years 2025, 2030, 2040 and 2050 are shown in Figure 5 for the whole set of 71 countries and each income group; results at the country level are provided in the text.

Figure 5.

Final results of the simulation of the Social Cost of Carbon Pricing Revenue (SCCPR) on GDP, 2025, 2030, 2040, 2050.

Graphs (c) and (d) in Figure 5 show that the larger economic impacts are expected in the first period of implementation of the uniform SCC-based carbon tax, after which both revenues (c) and ratios (d) decline year by year until 2050. This result is due to two factors: (1) in an SCC-based carbon pricing scenario, CO2 emissions are projected to decline very fast in the OECD set of countries (−47% in 2021–2030, −84% in 2021–2050) and (2) GDP is expected to grow by 81% in 2021–2050.