Integrated Pricing and Inventory Decisions for Product Quality-Driven Extended Warranty Services

Abstract

1. Introduction

2. Literature Review

2.1. Product Extended Warranty

2.2. Extended Warranty Pricing Strategy

2.3. Coordination Contract

2.4. Analysis of Current Research Status

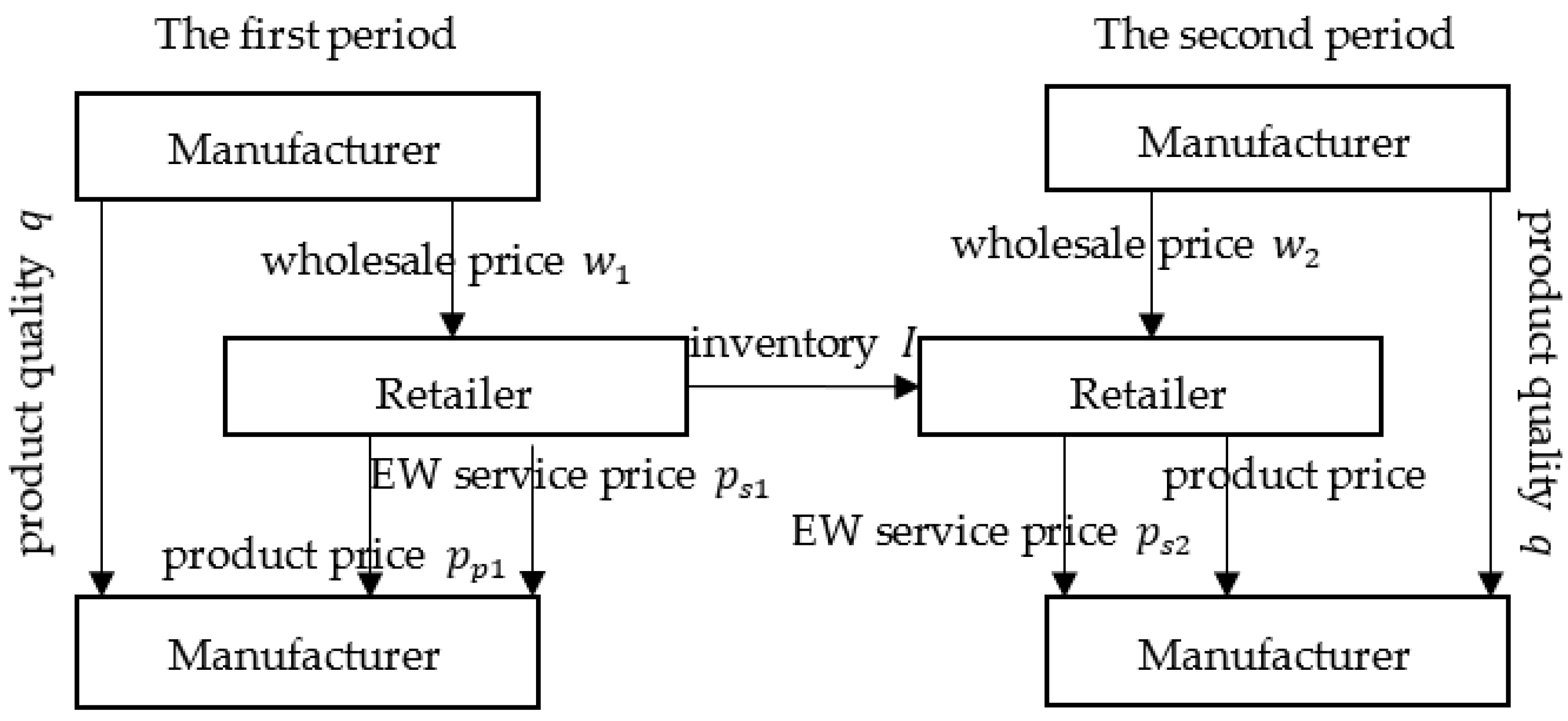

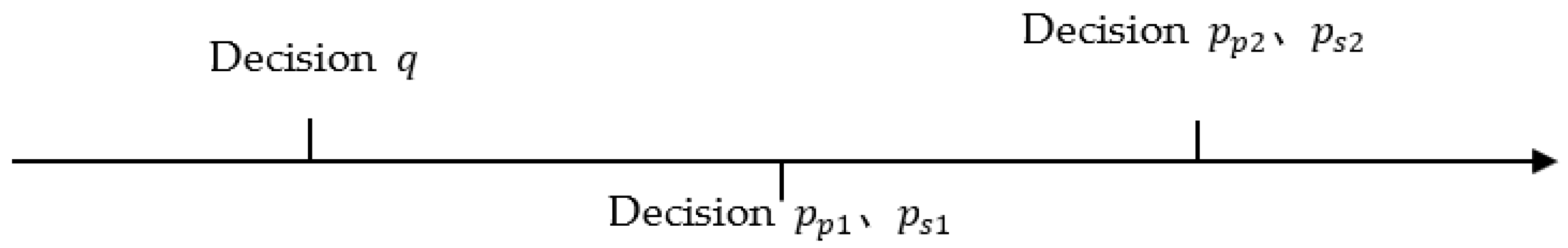

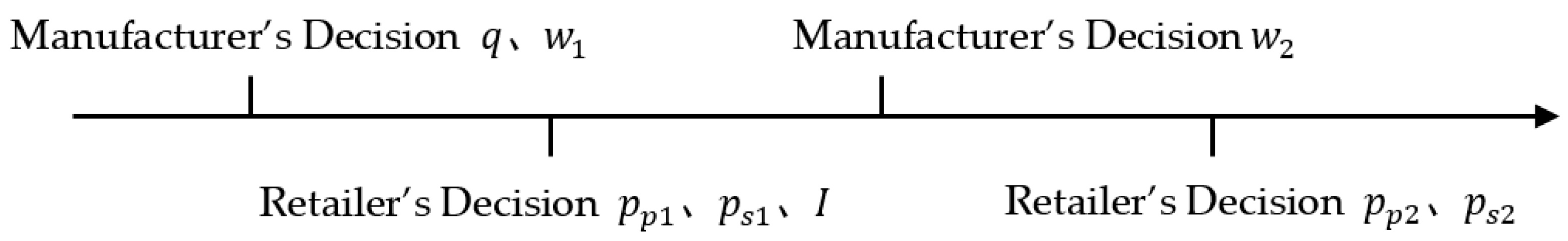

3. Supply Chain Decision Model for Two-Period Product Extended Warranty Service

3.1. Core Assumptions

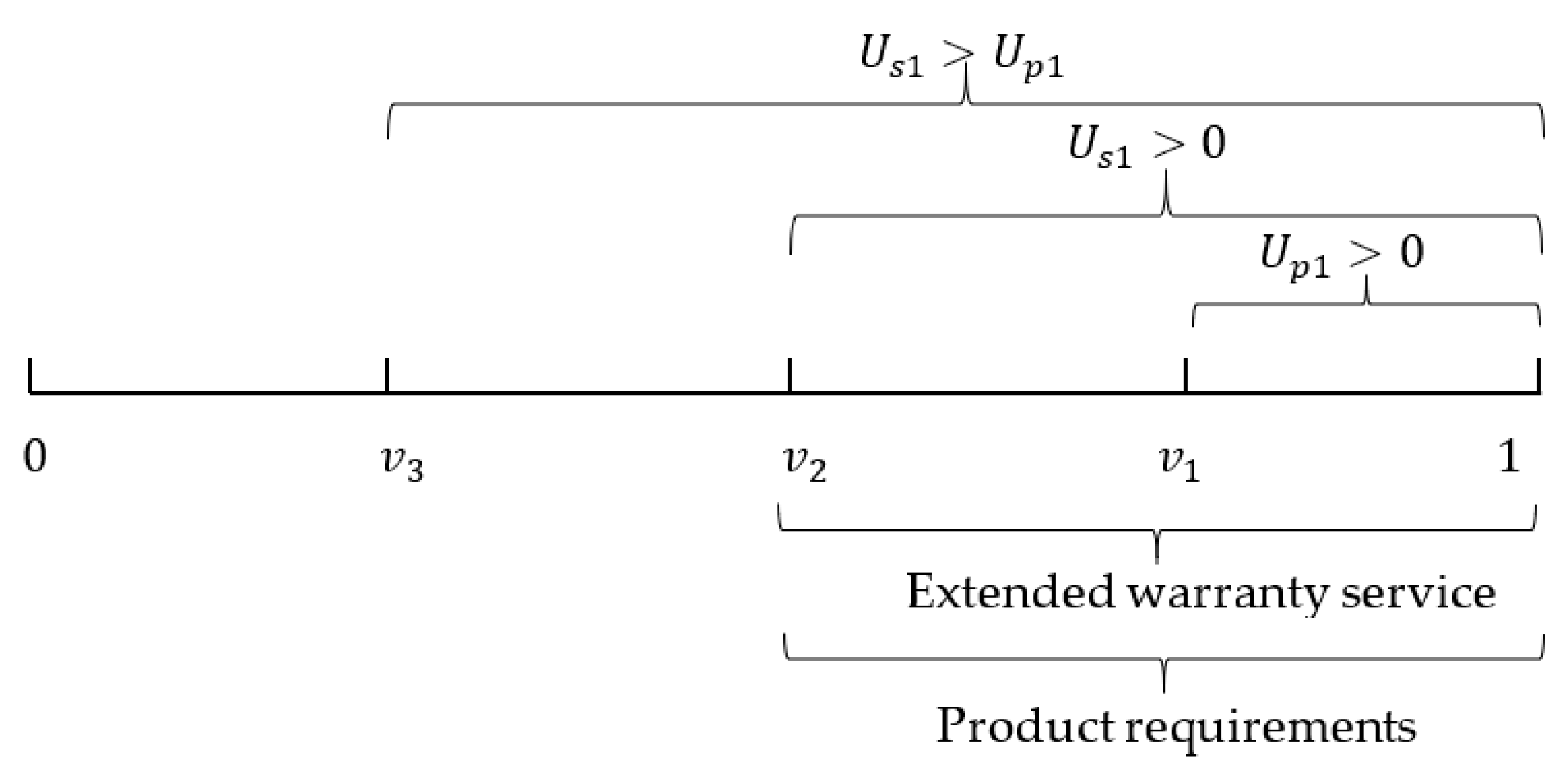

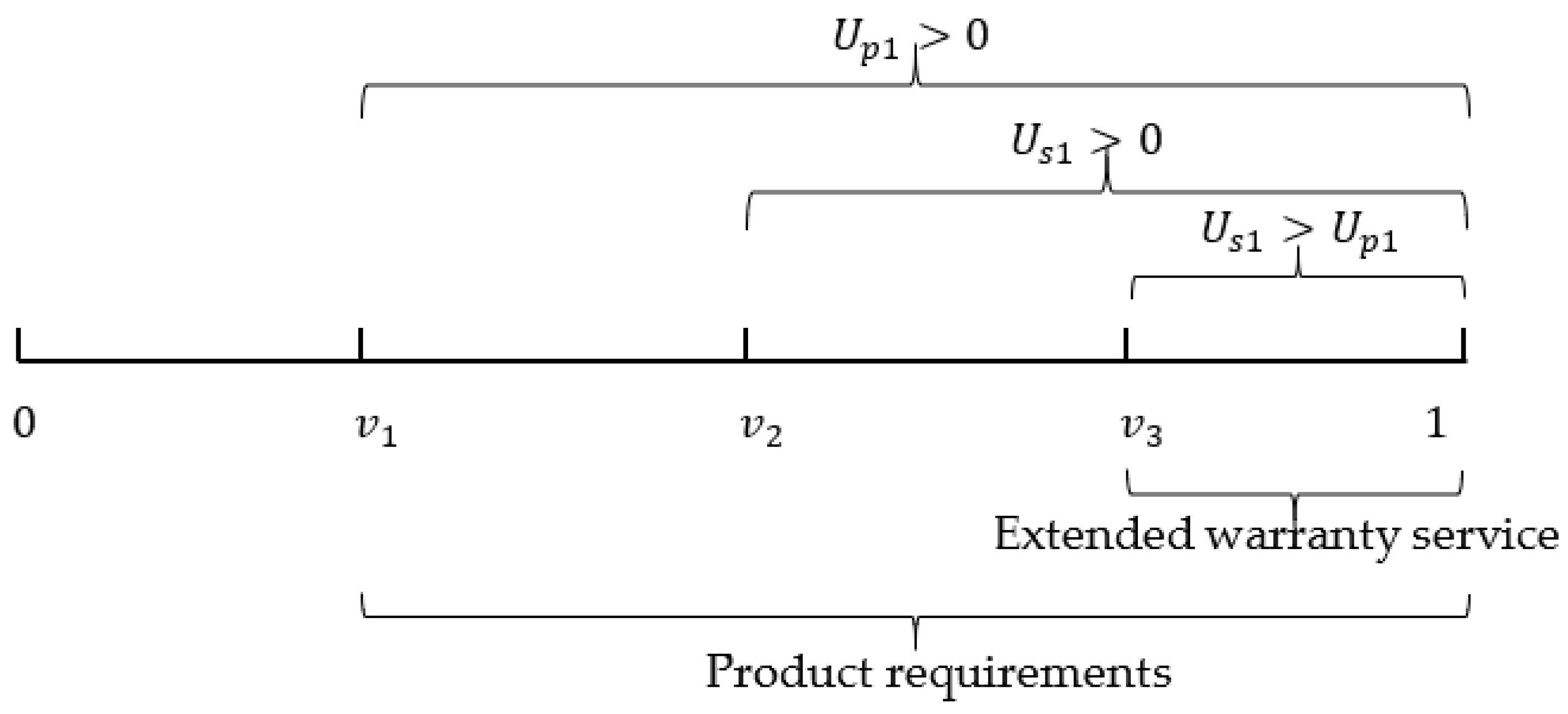

3.2. Model Construction and Solving

3.2.1. Centralized Decision-Making Model

3.2.2. Decentralized Decision-Making Model

3.3. Model Analysis

3.3.1. Analysis of Unit Inventory Cost Factors

3.3.2. Analysis of Product Cost Factors

4. Supply Chain Coordination Contract Model Based on Extended Warranty Service

4.1. Basic Assumptions

4.2. Model Building and Solving

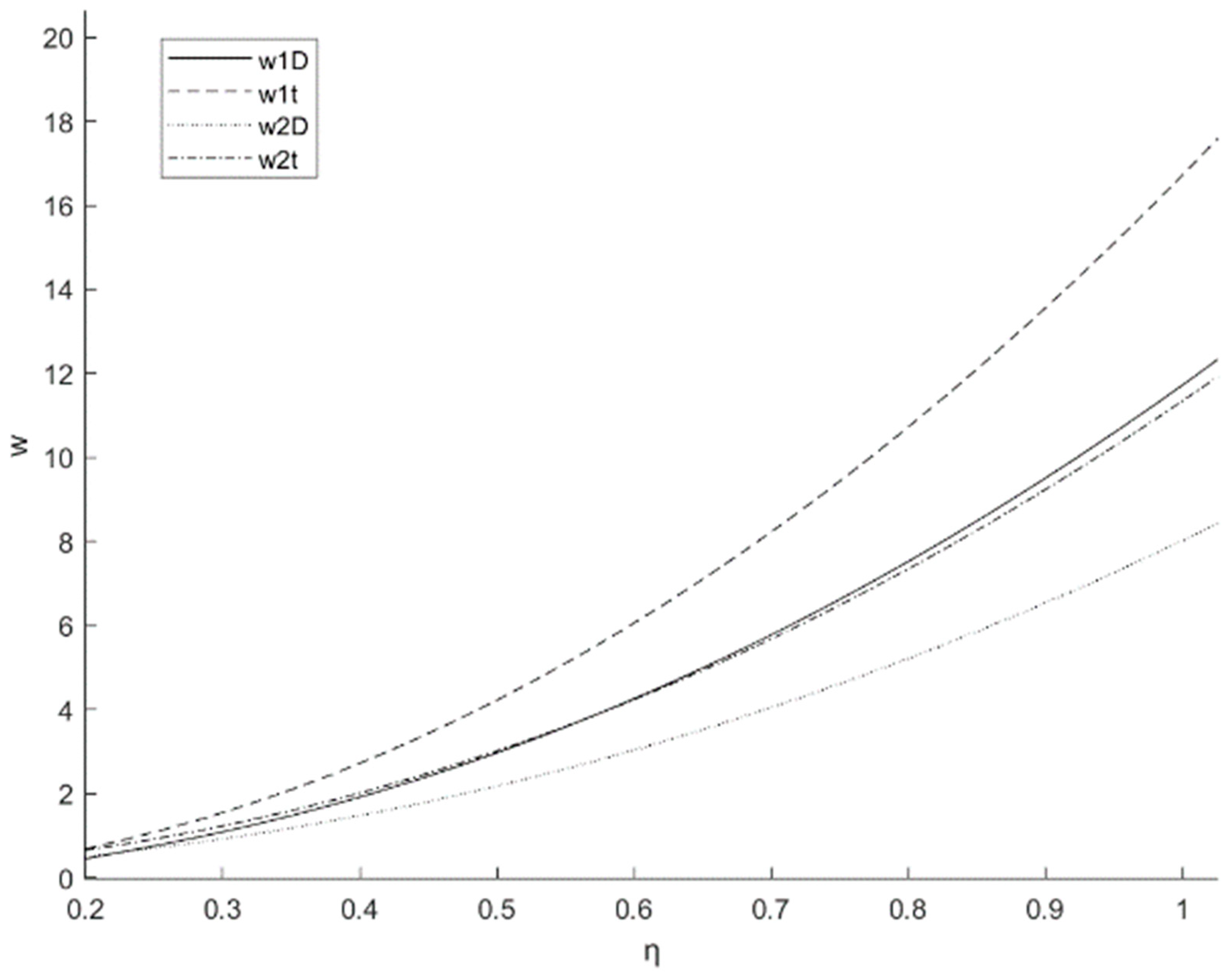

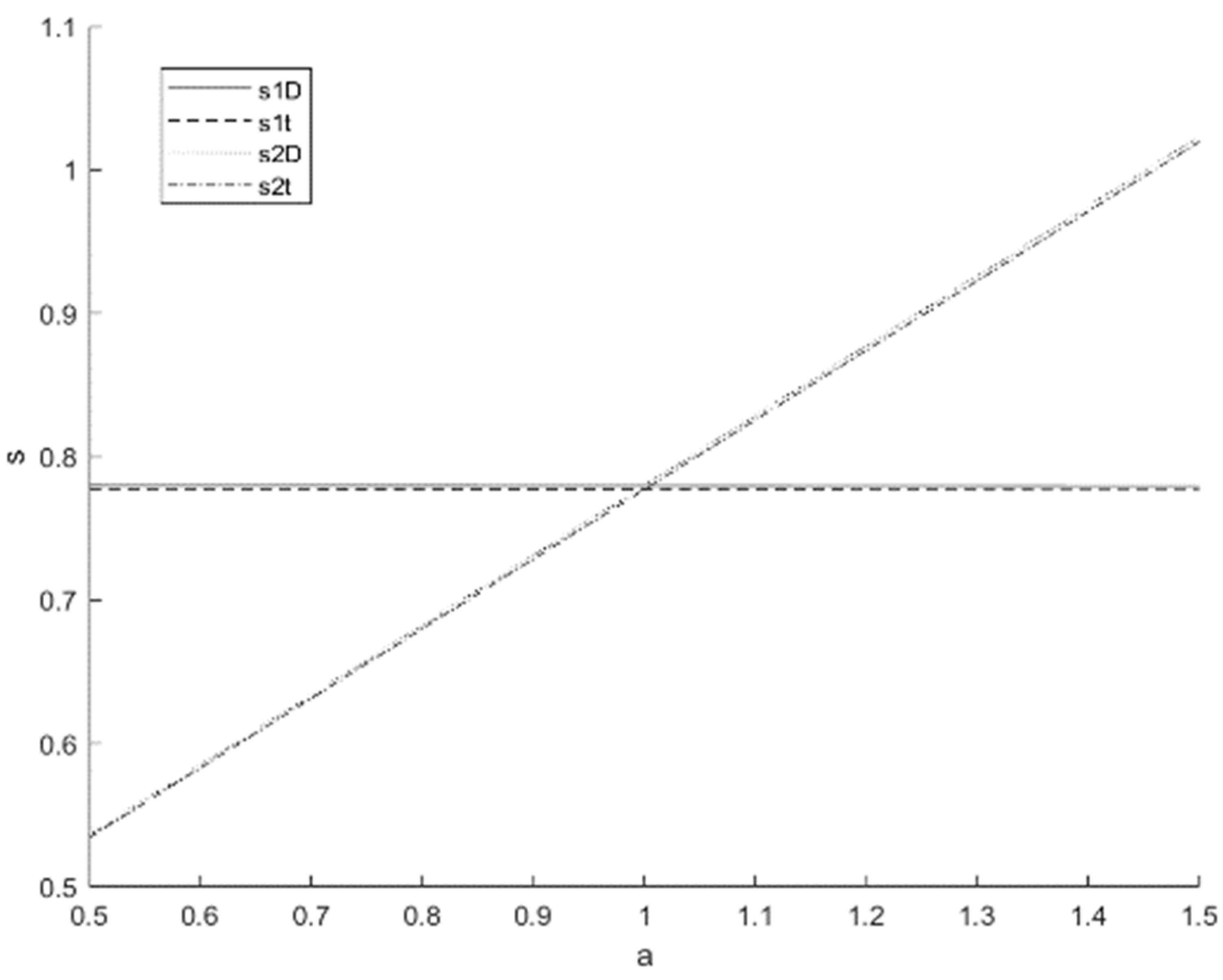

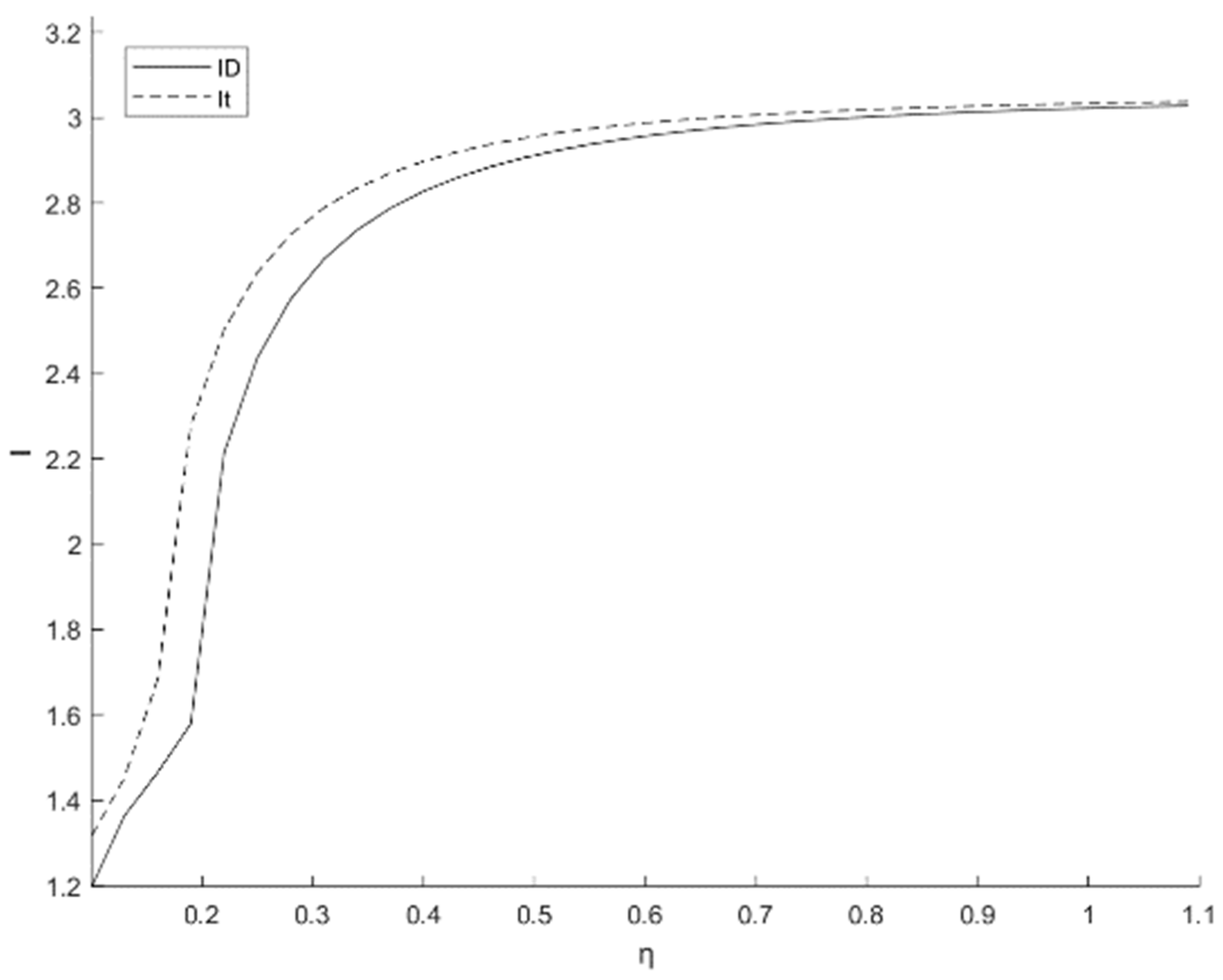

5. Numerical Simulation and Analysis

5.1. Numerical Simulation

5.2. Analysis and Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Nomenclature

| Variable | Description |

| c | Product cost |

| q | Product quality level |

| Q | Quantity of product purchased by the retailer |

| I | Inventory for the second period |

| h | Unit product inventory cost |

| Unit product extended warranty service cost (repair and maintenance cost) | |

| δ | Product failure rate |

| η | Failure coefficient |

| v | Product value perceived by consumers |

| a | Coefficient representing product evaluation change in the second period |

| , | Wholesale price in the first/second sales period |

| , | Product demand in the first/second period |

| , | Product price in the first/second sales period |

| , | Extended warranty service demand in the first/second period |

| , | Extended warranty service price in the first sales period |

References

- Day, E.; Fox, R.J. Extended Warranties, Service Contracts, and Maintenance Agreements—A Marketing Opportunity? J. Consum. Mark. 1985, 2, 77–86. [Google Scholar] [CrossRef]

- Ma, X.; Fu, Y.; Gao, K.; Sadollah, A.; Wang, K. Integration routing and scheduling for multiple home health care centers using a multi-objective cooperation evolutionary algorithm with stochastic simulation. Swarm Evol. Comput. 2022, 75, 101175. [Google Scholar] [CrossRef]

- Kim, D.; Nayakankuppam, D. When to present an extended warranty: Pre- vs. post-purchasing a product. Psychol. Mark. 2023, 40, 1821–1829. [Google Scholar] [CrossRef]

- Chen, R.; Luo, Z.; Ren, H.; Huang, X.; Xiao, S. A Study of Electronic Product Supply Chain Decisions Considering Extended Warranty Services and Manufacturer Misreporting Behavior. Sustainability 2024, 16, 6195. [Google Scholar] [CrossRef]

- Zheng, R.; Fang, H.; Hu, C. Joint optimization of inspection and condition-based maintenance for a deteriorating product under extended warranty. Reliab. Eng. Syst. Saf. 2024, 245, 110043. [Google Scholar] [CrossRef]

- Wu, Z.; Zhou, R.; Goh, M.; Wang, Y.; Xu, Z.; Song, W. A digital twin-based modularized design approach for smart warehouses. Int. J. Comput. Integr. Manuf. 2023, 37, 1404–1425. [Google Scholar] [CrossRef]

- Aksezer, S.Ç. Sustainability via Extended Warranty Contracts: Design for a Consumer Electronics Retailer. Sustainability 2024, 16, 300. [Google Scholar] [CrossRef]

- Liu, Z.; Chen, J.; Diallo, C.; Venkatadri, U. Optimal extended warranty pricing and retailing strategies in a closed-loop supply chain. Int. J. Prod. Res. 2023, 61, 3435–3458. [Google Scholar] [CrossRef]

- Li, J.; He, S.; Chen, J.; He, Z. Optimal extended warranty strategy for a two-sided platform under agency selling. Comput. Ind. Eng. 2023, 178, 109129. [Google Scholar] [CrossRef]

- Cui, X.; Zhou, C.; Yu, J.; Khan, A.N. Interaction between manufacturer’s recycling strategy and e-commerce platform’s extended warranty service. J. Clean. Prod. 2023, 399, 136659. [Google Scholar] [CrossRef]

- Zhang, Q.; Gao, J. Transferability of extended warranty in the presence of a P2P secondary market. Comput. Ind. Eng. 2021, 160, 107541. [Google Scholar] [CrossRef]

- Wang, D.; He, Z.; He, S.; Zhang, Z.; Zhang, Y. Dynamic pricing of two-dimensional extended warranty considering the impacts of product price fluctuations and repair learning. Reliab. Eng. Syst. Saf. 2021, 210, 107516. [Google Scholar] [CrossRef]

- Fu, Y.; Tian, G.; Li, Z.; Wang, Z. Parallel machine scheduling with dynamic resource allocation via a master–slave genetic algorithm. IEEJ Trans. Electr. Electron. Eng. 2018, 13, 748–756. [Google Scholar] [CrossRef]

- He, Z.; Huang, D.; He, S. Design of extended warranty service in a dual supply channel. Total Qual. Manag. Bus. Excell. 2018, 29, 1089–1107. [Google Scholar] [CrossRef]

- Salmasnia, A.; Baratian, M. Optimization of maintenance policy under warranty length-based demand with consideration of both manufacturer and buyer satisfaction. Appl. Stoch. Models Bus. Ind. 2020, 36, 586–603. [Google Scholar] [CrossRef]

- Fu, Y.; Gao, K.; Wang, L.; Huang, M.; Liang, Y.C.; Dong, H. Scheduling stochastic distributed flexible job shops using an multi-objective evolutionary algorithm with simulation evaluation. Int. J. Prod. Res. 2024, 1–18. [Google Scholar] [CrossRef]

- Zheng, B.; Bian, Y.; Sun, Y.; Ding, H. Optimal extended warranty strategy: Uniform or nonuniform pricing? Int. Trans. Oper. Res. 2021, 28, 1441–1464. [Google Scholar] [CrossRef]

- Ai, X.; Li, X.; Zheng, C.; He, H. Channel coordination with extended warranty when retailers compete. J. Oper. Res. Soc. 2023, 74, 826–839. [Google Scholar] [CrossRef]

- Zhang, J.; Wang, M. Pricing and warranty decisions in a dual-channel supply chain with warranty’s quality signal. Procedia Comput. Sci. 2023, 225, 198–207. [Google Scholar] [CrossRef]

- Ma, J.; Si, F.; Zhang, Q.; Wang, Z. Impact of extended warranty service on product pricing in online direct retailers’ competitive market. Energy Econ. 2024, 129, 107217. [Google Scholar] [CrossRef]

- Gupta, S.K.; Mukhopadhyay, I.; Chatterjee, A. Two-dimensional extended warranty length design from incomplete warranty data based on a new price curve considering different maintenance policies. Comput. Ind. Eng. 2022, 170, 108323. [Google Scholar] [CrossRef]

- Qu, S.; Zhou, Y.; Ji, Y.; Dai, Z.; Wang, Z. Robust maximum expert consensus modeling with dynamic feedback mechanism under uncertain environments. J. Ind. Manag. Optim. 2024. [Google Scholar] [CrossRef]

- Liu, B.; Shen, L.; Xu, J.; Zhao, X. A complimentary extended warranty: Profit analysis and pricing strategy. Int. J. Prod. Econ. 2020, 229, 107860. [Google Scholar] [CrossRef]

- Vafaeinejad, K.; Sajadieh, M.S. Trade-in price and base warranty length: A heuristic algorithm for concurrent optimization. Comput. Ind. Eng. 2022, 171, 108504. [Google Scholar] [CrossRef]

- Zhu, Y.; Xia, T.; Chen, Z.; Zheng, M.; Pan, E.; Xi, L. Joint optimization of price, warranty and service investment for capital-intensive equipment considering maintenance capacity limits. Comput. Ind. Eng. 2022, 169, 108152. [Google Scholar] [CrossRef]

- Zhang, Z.; He, S.; He, Z.; Wang, D.; Dong, F. A systematic warranty-reliability-price decision model for two-dimensional warranted products with heterogeneous usage rates. Comput. Ind. Eng. 2022, 163, 107820. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Mokhtarzadeh, M. Pricing and two-dimensional warranty policy of multi-products with online and offline channels using a value-at-risk approach. Comput. Ind. Eng. 2020, 148, 106674. [Google Scholar] [CrossRef]

- Liang, D.; Wang, L.; Liu, S.; Li, S.; Zhou, X.; Xiao, Y.; Zhong, P.; Chen, Y.; Wang, C.; Xu, S.; et al. Global Incidence of Diarrheal Diseases-An Update Using an Interpretable Predictive Model Based on XGBoost and SHAP: A Systematic Analysis. Nutrients 2024, 16, 3217. [Google Scholar] [CrossRef]

- Cui, Y.; Hu, Z.; Duan, X. Optimal Pricing of Public Electric Vehicle Charging Stations Considering Operations of Coupled Transportation and Power Systems. IEEE Trans. Smart Grid 2021, 12, 3278–3288. [Google Scholar] [CrossRef]

- Pasternack, B.A. Optimal Pricing and Return Policies for Perishable Commodities. Mark. Sci. 2008, 27, 33–140. [Google Scholar]

- Zhang, Z.P.; Fu, Y.P.; Gao, K.Z.; Pan, Q.K.; Huang, M. A learning-driven multi-objective cooperative artificial bee colony algorithm for distributed flexible job shop scheduling problems with preventive maintenance and transportation operations. Comput. Ind. Eng. 2024, 196, 110484. [Google Scholar] [CrossRef]

- Yu, T.; Guan, Z.; Zhang, J.; Dong, J. Blockchain adoption and contract coordination of poverty alleviation supply chain considering altruistic preference. Comput. Ind. Eng. 2024, 188, 109879. [Google Scholar] [CrossRef]

- Peng, Q.; Wang, C.; Goh, M. Green innovation decision and coordination of supply chain under corporate social responsibility and risk preferences. Comput. Ind. Eng. 2023, 185, 109703. [Google Scholar] [CrossRef]

- Yuxiang, Z.; Weijun, Z.; Shu-e, M. Supply chain coordination by manufacturer reward contract. Oper. Res. Lett. 2023, 51, 432–438. [Google Scholar]

- Luo, T.; Chang, D.; Xu, Z.; Hu, X. Empty container leasing and channel coordination in a Dual-Channel container transportation service chain based on joint contracts. Comput. Ind. Eng. 2023, 181, 109334. [Google Scholar] [CrossRef]

- Liang, P.; Fu, Y.; Gao, K. Multi-product disassembly line balancing optimization method for high disassembly profit and low energy consumption with noise pollution constraints. Eng. Appl. Artif. Intell. 2024, 130, 107721. [Google Scholar] [CrossRef]

- Zhu, X.; Ding, L.; Guo, Y.; Zhu, H. Decision and coordination analysis of extended warranty service in a remanufacturing closed-loop supply chain with dual price sensitivity under different channel power structures. RAIRO—Oper. Res. 2022, 56, 1149–1166. [Google Scholar] [CrossRef]

- Feldman, P.; Frazelle, A.E.; Swinney, R. Managing Relationships Between Restaurants and Food Delivery Platforms: Conflict, Contracts, and Coordination. Manag. Sci. 2022, 69, 812–823. [Google Scholar] [CrossRef]

- Yan, B.; Han, L. Decisions and coordination of retailer-led fresh produce supply chain under two-period dynamic pricing and portfolio contracts. RAIRO—Oper. Res. 2022, 56, 349–365. [Google Scholar] [CrossRef]

- Fu, Y.P.; Zhou, M.C.; Guo, X.; Qi, L.; Gao, K.; Albeshri, A. Multiobjective Scheduling of Energy-Efficient Stochastic Hybrid Open Shop With Brain Storm Optimization and Simulation Evaluation. IEEE Trans. Syst. Man Cybern. Syst. 2024, 54, 4260–4272. [Google Scholar] [CrossRef]

- Ma, H.; Lou, G.; Fan, T.; Chan, H.K.; Chung, S.H. Conventional automotive supply chains under China’s dual-credit policy: Fuel economy, production and coordination. Energy Policy 2021, 151, 112166. [Google Scholar] [CrossRef]

- Wang, Y.; Yu, Z.; Jin, M.; Mao, J. Decisions and Coordination of Retailer-led Low-carbon Supply Chain under Altruistic Preference. Eur. J. Oper. Res. 2021, 293, 910–925. [Google Scholar] [CrossRef]

- Lin, Z.; Chen, R.; Luo, L.; Ren, H. Research on Coordination of Fresh Supply Chain Considering Supplier Misreporting and Consumer Return. Sustainability 2024, 16, 6225. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zha, W.; Wu, Z.; Tan, J.; Chen, Y.; Fu, Y.; Xu, Z. Integrated Pricing and Inventory Decisions for Product Quality-Driven Extended Warranty Services. Sustainability 2024, 16, 8769. https://doi.org/10.3390/su16208769

Zha W, Wu Z, Tan J, Chen Y, Fu Y, Xu Z. Integrated Pricing and Inventory Decisions for Product Quality-Driven Extended Warranty Services. Sustainability. 2024; 16(20):8769. https://doi.org/10.3390/su16208769

Chicago/Turabian StyleZha, Wendi, Zhenyong Wu, Jianxin Tan, Yiming Chen, Yaping Fu, and Zhitao Xu. 2024. "Integrated Pricing and Inventory Decisions for Product Quality-Driven Extended Warranty Services" Sustainability 16, no. 20: 8769. https://doi.org/10.3390/su16208769

APA StyleZha, W., Wu, Z., Tan, J., Chen, Y., Fu, Y., & Xu, Z. (2024). Integrated Pricing and Inventory Decisions for Product Quality-Driven Extended Warranty Services. Sustainability, 16(20), 8769. https://doi.org/10.3390/su16208769