How Do International Contractors Choose Target Market Based on Environmental, Social and Governance Principles? A Fuzzy Ordinal Priority Approach Model

Abstract

1. Introduction

2. Theoretical Background

2.1. Factors Influencing Market Choice for International Contractors

2.2. The Effect of ESG Performance on Market Choice

3. Model Development

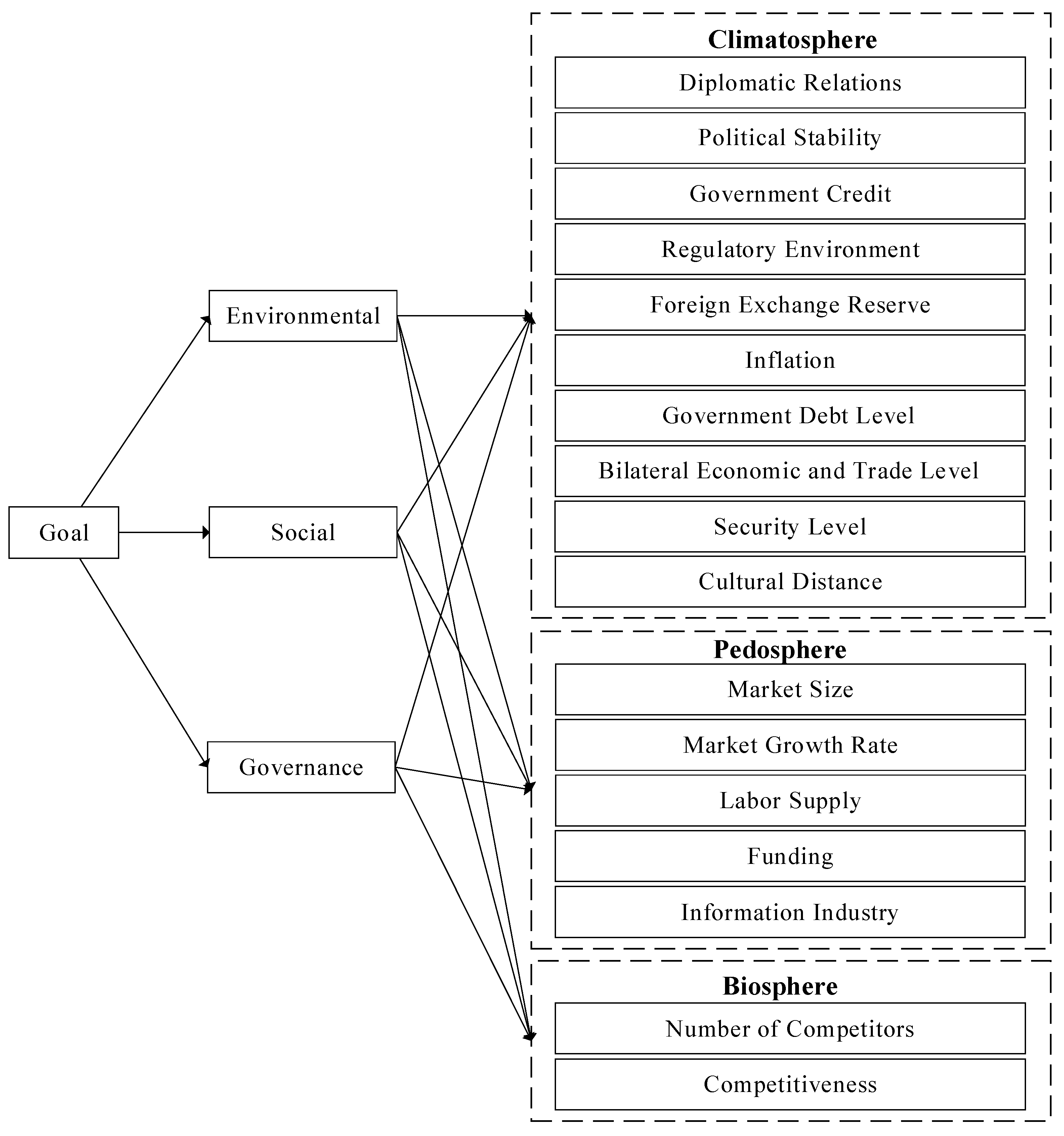

3.1. Problem Statement

3.2. Weighting Values among Criteria through OPA-F

3.3. Measurement of Criteria

3.3.1. Climatic Factors

3.3.2. Soil Factors

3.3.3. Biological Factors

- Y—normalized data;

- a—data to be normalized;

- min—minimum value of this type of data;

- max—maximum value of this type of data.

4. Case Study

4.1. Case Profiles

4.2. Data Collection

4.3. Results of the Case Study

4.3.1. Weighting Results among Criteria

4.3.2. Data Analysis by Country

Analysis of Climate Indicators

Analysis of Soil Indicators

Analysis of Biology Indicators

Analysis on Candidate Markets

5. Discussion

5.1. Priority of Criteria Based on ESG

5.2. Advantage of the Proposed Model

5.3. Application of the Model

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Tan, Y.; Ochoa, J.J.; Langston, C.; Shen, L. An empirical study on the relationship between sustainability performance and business competitiveness of international construction contractors. J. Clean. Prod. 2015, 93, 273–278. [Google Scholar] [CrossRef]

- Ayalp, G.; Civici, T. Factors affecting the performance of construction industry during the COVID-19 pandemic: A case study in Turkey. Eng. Constr. Archit. Manag. 2023, 30, 3160–3202. [Google Scholar] [CrossRef]

- Lee, K.-W.; Kim, D.Y. Market Structure Analysis of International Construction Revenue: A Country Level Analysis. Ksce J. Civ. Eng. 2022, 26, 4960–4970. [Google Scholar] [CrossRef]

- Chetty, S.; Agndal, H. Role of inter-organizational networks and interpersonal networks in an industrial district. Reg. Stud. 2008, 42, 175–187. [Google Scholar] [CrossRef]

- Clark, D.R.; Li, D.; Shepherd, D.A. Country familiarity in the initial stage of foreign market selection. J. Int. Bus. Stud. 2018, 49, 442–472. [Google Scholar] [CrossRef]

- Knight, G. International Marketing Blunders by American Firms in Japan—Some Lessons for Management. J. Int. Mark. 1995, 3, 9. [Google Scholar] [CrossRef]

- Dalgic, T.; Heijblom, R. Educator Insights: International Marketing Blunders Revisited—Some Lessons for Managers. J. Int. Mark. 1996, 4, 81–91. [Google Scholar] [CrossRef]

- Chen, C.; Wang, Q.; Martek, I.; Li, H. International Market Selection Model for Large Chinese Contractors. J. Constr. Eng. Manag. 2016, 142, 04016044. [Google Scholar] [CrossRef]

- Viswanathan, S.K.; Jha, K.N. Factors Influencing International Market Selection for Indian Construction Firms. J. Manag. Eng. 2019, 35, 05019006. [Google Scholar] [CrossRef]

- Zolfani, S.H.; Torkayesh, A.E.; Ecer, F.; Turskis, Z.; Saparauskas, J. International market selection: A MABA based EDAS analysis framework. Oeconomia Copernic. 2021, 12, 98–123. [Google Scholar] [CrossRef]

- Shipley, M.F.; Johnson, M.; Pointer, L.; Yankov, N. A fuzzy attractiveness of market entry (FAME) model for market selection decisions. J. Oper. Res. Soc. 2013, 64, 597–610. [Google Scholar] [CrossRef]

- Wu, Q.; Liu, X.; Qin, J.; Zhou, L.; Mardani, A.; Deveci, M. An integrated generalized TODIM model for portfolio selection based on financial performance of firms. Knowl.-Based Syst. 2022, 249, 108794. [Google Scholar] [CrossRef]

- Yan, H.; Hu, X.; Liu, Y. The international market selection of Chinese SMEs: How institutional influence overrides psychic distance. Int. Bus. Rev. 2020, 29, 101703. [Google Scholar] [CrossRef]

- Li, K.-S.; Xiong, Y.-Q. Host country’s environmental uncertainty, technological capability, and foreign market entry mode: Evidence from high-end equipment manufacturing MNEs in emerging markets. Int. Bus. Rev. 2022, 31, 101900. [Google Scholar] [CrossRef]

- Isa, C.M.M.; Saman, H.M.; Nasir, S.R.M. Specific-factors influencing market selection decision by Malaysian construction firms into international market. In Proceedings of the 2nd International Conference on Innovation, Management and Technology Research (ICIMTR), Negeri Sembilan, Malaysia, 9–10 September 2013; pp. 4–10. [Google Scholar]

- Li, L.; Martek, I.; Chen, C. Institutional Factors Impacting on International Construction Market Selection: Evidence from Chinese Contractors. Buildings 2022, 12, 543. [Google Scholar] [CrossRef]

- Ozturk, A.; Joiner, E.; Cavusgil, S.T. Delineating foreign market potential: A tool for international market selection. Thunderbird Int. Bus. Rev. 2015, 57, 119–141. [Google Scholar] [CrossRef]

- Ding, Z.; Hu, M.; Huang, S. Diplomatic Relations and Firm Internationalization Speed: The Moderating Roles of Trade Openness and Firm Ownership. Manag. Int. Rev. 2023, 63, 911–941. [Google Scholar] [CrossRef]

- Li, J.; Meyer, K.E.; Zhang, H.; Ding, Y. Diplomatic and corporate networks: Bridges to foreign locations. J. Int. Bus. Stud. 2018, 49, 659–683. [Google Scholar] [CrossRef]

- Quer, D. Location decisions of Chinese firms in the global tourism industry: The role of prior international experience and diplomatic relations. J. Hosp. Tour. Manag. 2021, 46, 62–72. [Google Scholar] [CrossRef]

- Lemma, T.; Lulseged, A.; Mlilo, M.; Negash, M. Political stability, political rights and earnings management: Some international evidence. Account. Res. J. 2019, 33, 57–74. [Google Scholar] [CrossRef]

- Abdullah, M.; Chowdhury, M.A.F.; Karmaker, U.; Fuszder, M.H.R.; Shahriar, M.A. Role of the dynamics of political stability in firm performance: Evidence from Bangladesh. Quant. Financ. Econ. 2022, 6, 518–536. [Google Scholar] [CrossRef]

- Zhou, Q.; Bao, Y.; Zhao, Y.; He, X.; Cui, C.; Liu, Y. Impacts of Government Credit on Government Performance of Public-Private Partnership Project in China: A WSR System Theory Perspective. Sustainability 2022, 14, 6886. [Google Scholar] [CrossRef]

- Yu, J.; Wei, W.; Butler, J.S. Fiscal Transparency and Government Credit Quality: Evidence from the US States. Public Perform. Manag. Rev. 2021, 44, 378–403. [Google Scholar] [CrossRef]

- Li, L.; Chen, C.; Martek, I.; Li, G. An integrated model for international market and entry mode selections for Chinese contractors. Eng. Constr. Archit. Manag. 2023. [Google Scholar] [CrossRef]

- Li, H.; Li, B.; Yang, G.; Chen, C.; Chen, Y.; Zhao, C. Evaluating the Regulatory Environment of Overseas Electric Power Market Based on a Hybrid Evaluation Model. Int. J. Fuzzy Syst. 2020, 22, 138–155. [Google Scholar] [CrossRef]

- Markscheffel, J.; Plouffe, M. Multilevel determinants of MNC corruption risk. J. Int. Bus. Policy 2022, 5, 512–528. [Google Scholar] [CrossRef]

- Bian, S.; Liu, W.; Zhang, D. The sovereign credit and the limited foreign exchange outflow and the liquidity management of foreign exchange reserves. J. Oper. Res. Soc. 2019, 70, 867–871. [Google Scholar] [CrossRef]

- Matsumoto, H. Foreign reserve accumulation, foreign direct investment, and economic growth. Rev. Econ. Dyn. 2022, 43, 241–262. [Google Scholar] [CrossRef]

- Ashley, N.L.; Mbuya, F.F.; Vögel, A.J. The internationalisation of South African enterprises: A focus on international market selection. Acta Commer. 2022, 22, 1–10. [Google Scholar] [CrossRef]

- Magnani, G.; Zucchella, A.; Floriani, D.E. The logic behind foreign market selection: Objective distance dimensions vs. strategic objectives and psychic distance. Int. Bus. Rev. 2018, 27, 1–20. [Google Scholar] [CrossRef]

- Chien, F.; Chau, K.Y.; Sadiq, M.; Hsu, C.-C. The impact of economic and non-economic determinants on the natural resources commodity prices volatility in China. Resources Policy 2022, 78, 102863. [Google Scholar] [CrossRef]

- Peng, C.; Da, F.; Wu, J.; Li, G. China’s local government debt risk assessment and countermeasures under the influence of COVID-19. In Proceedings of the 8th International Conference on Information Technology and Quantitative Management (ITQM)—Developing Global Digital Economy after COVID-19, Chengdu, China, 9–11 July 2021; pp. 354–360. [Google Scholar]

- Chen, W.; Zhu, Y.; He, Z.; Yang, Y. The effect of local government debt on green innovation: Evidence from Chinese listed companies. Pac.-Basin Financ. J. 2022, 73, 101760. [Google Scholar] [CrossRef]

- Vu Hong, V.; Nguyen Thi Thanh, H.; Nguyen Khanh, D. Does Institutional Similarity Necessarily Lead to Increased Bilateral Trade? J. Int. Commer. Econ. Policy 2022, 13, 2250005. [Google Scholar] [CrossRef]

- Yazdani, M.; Pirpour, H. Evaluating the effect of intra-industry trade on the bilateral trade productivity for petroleum products of Iran. Energy Econ. 2020, 86, 103933. [Google Scholar] [CrossRef]

- Ball, K.; Esposti, S.D.; Dibb, S.; Pavone, V.; Santiago-Gomez, E. Institutional trustworthiness and national security governance: Evidence from six European countries. Gov.—Int. J. Policy Adm. Inst. 2019, 32, 103–121. [Google Scholar] [CrossRef]

- Shabbir, G.; Naveed, A.; Khan, M.A.; Syed, S.H. Does Peace Promote Bilateral Trade Flows? An Economic Analysis of Panel Data in Asian Perspective. Comp. Econ. Stud. 2022, 64, 143–158. [Google Scholar] [CrossRef]

- Moalla, E.; Mayrhofer, U. How does distance affect market entry mode choice? Evidence from French companies. Eur. Manag. J. 2020, 38, 135–145. [Google Scholar] [CrossRef]

- Ha, N.M.; Binh, Q.M.Q.; Dang, P.P. Cultural Distance and Entry Modes in Emerging Markets: Empirical Evidence in Vietnam. J. Risk Financ. Manag. 2020, 13, 14. [Google Scholar] [CrossRef]

- Laufs, K.; Schwens, C. Foreign market entry mode choice of small and medium-sized enterprises: A systematic review and future research agenda. Int. Bus. Rev. 2014, 23, 1109–1126. [Google Scholar] [CrossRef]

- Song, S. Determining investment size and local embeddedness under host market uncertainty and growth rates. Int. Bus. Rev. 2022, 31, 101945. [Google Scholar] [CrossRef]

- Brinca, P.; Duarte, J.B.; Faria-e-Castro, M. Measuring labor supply and demand shocks during COVID-19. Eur. Econ. Rev. 2021, 139, 103901. [Google Scholar] [CrossRef]

- Vyas, L. “New normal” at work in a post-COVID world: Work-life balance and labor markets. Policy Soc. 2022, 41, 155–167. [Google Scholar] [CrossRef]

- Deaza, J.; Díaz, N.; Castiblanco Moreno, S.; Barbosa-Camargo, M. International market selection models: A literature review. Tendencias 2020, 21, 191–217. [Google Scholar] [CrossRef]

- Fornes, G.; Cardoza, G.; Altamira, M. Do political and business relations help emerging markets’ SMEs in their national and international expansion? Evidence from Brazil and China. Int. J. Emerg. Mark. 2022, 17, 2084–2109. [Google Scholar] [CrossRef]

- Lewandowska, A.; Bilan, Y.; Mentel, G. The Impact of Financial Innovation Investment Support on SME Competitiveness. J. Compet. 2021, 13, 92–110. [Google Scholar] [CrossRef]

- Polat, G.; Donmez, U. Marketing management functions of construction companies: Evidence from turkish contractors. J. Civ. Eng. Manag. 2010, 16, 267–277. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z.; Song, M. Economic Impact of Information Industry Development and Investment Strategy for Information Industry. J. Glob. Inf. Manag. 2021, 29, 22–43. [Google Scholar] [CrossRef]

- Musteen, M.; Datta, D.K.; Butts, M.M. Do International Networks and Foreign Market Knowledge Facilitate SME Internationalization? Evidence From the Czech Republic. Entrep. Theory Pract. 2014, 38, 749–774. [Google Scholar] [CrossRef]

- Gimmon, E.; Aiche, A. The effect of number of competitors in SME markets. Isr. Aff. 2021, 27, 773–783. [Google Scholar] [CrossRef]

- Xiao, R.; Ma, C.-A.; Song, G.-R.; Chang, H.-Y. Does peer influence improve firms’ innovative investment? Evidence from China. Energy Rep. 2022, 8, 1143–1150. [Google Scholar] [CrossRef]

- Li, T.-T.; Wang, K.; Sueyoshi, T.; Wang, D.D. ESG: Research Progress and Future Prospects. Sustainability 2021, 13, 11663. [Google Scholar] [CrossRef]

- Yu, J.T. Research on fuzzy evaluation in the enterprise competitiveness. In Proceedings of the International Conference on Mechatronics Engineering and Computing Technology (ICMECT), Shanghai, China, 9–10 April 2014. [Google Scholar]

- Artan Ilter, D. Analysis of Environmental Performance of Turkish Contractors. Tek. Dergi 2017, 28, 7795–7822. [Google Scholar] [CrossRef]

- Anuchitworawong, C. Ownership-based Incentives, Internal Corporate Risk and Firm Performance; Center for Economic Institutions, Institute of Economic Research, Hitotsubashi University: Tokyo, Japan, 2018. [Google Scholar]

- Kim, S.; Li, Z. Understanding the Impact of ESG Practices in Corporate Finance. Sustainability 2021, 13, 3746. [Google Scholar] [CrossRef]

- Ge, G.; Xiao, X.; Li, Z.; Dai, Q. Does ESG Performance Promote High-Quality Development of Enterprises in China? The Mediating Role of Innovation Input. Sustainability 2022, 14, 3843. [Google Scholar] [CrossRef]

- Park, E.; Kim, Y.; Lee, A.; Kim, J.; Kong, H. Study on the Global Sustainability of the Korean Construction Industry Based on the GRI Standards. Int. J. Environ. Res. Public Health 2023, 20, 4231. [Google Scholar] [CrossRef] [PubMed]

- Jiang, H.; Zhan, J.; Chen, D. Covering-Based Variable Precision (,)-Fuzzy Rough Sets With Applications to Multiattribute Decision-Making. IEEE Trans. Fuzzy Syst. 2019, 27, 1558–1572. [Google Scholar] [CrossRef]

- Mahmoudi, A.; Javed, S.A.; Mardani, A. Gresilient supplier selection through Fuzzy Ordinal Priority Approach: Decision-making in post-COVID era. Oper. Manag. Res. 2022, 15, 208–232. [Google Scholar] [CrossRef]

- Sadeghi, M.; Mahmoudi, A.; Deng, X. Blockchain technology in construction organizations: Risk assessment using trapezoidal fuzzy ordinal priority approach. Eng. Constr. Archit. Manag. 2023, 30, 2767–2793. [Google Scholar] [CrossRef]

- Sadeghi, M.; Mahmoudi, A.; Deng, X.; Luo, X. Prioritizing requirements for implementing blockchain technology in construction supply chain based on circular economy: Fuzzy Ordinal Priority Approach. Int. J. Environ. Sci. Technol. 2023, 20, 4991–5012. [Google Scholar] [CrossRef]

- Mahmoudi, A.; Sadeghi, M.; Deng, X. Performance measurement of construction suppliers under localization, agility, and digitalization criteria: Fuzzy Ordinal Priority Approach. Environ. Dev. Sustain. 2022, 1–26. [Google Scholar] [CrossRef]

- Chang, T.; Deng, X.; Hwang, B.-G.; Zhao, X. Improving Quantitative Assessment of Political Risk in International Construction Projects: The Case of Chinese Construction Companies. J. Constr. Eng. Manag. 2019, 145, 04019083. [Google Scholar] [CrossRef]

- Baena-Rojas, J.J.; Mackenzie-Torres, T.M.; Cuesta-Giraldo, G.; Tabares, A. A hybrid multi-criteria decision-making technique for international market selection in SMEs. Pol. J. Manag. Stud. 2023, 27, 26–45. [Google Scholar] [CrossRef]

- Duong, T.T.T.; Thao, N.X. TOPSIS model based on entropy and similarity measure for market segment selection and evaluation. Asian J. Econ. Bank. 2021, 5, 194–203. [Google Scholar] [CrossRef]

- Christian, A.V.; Zhang, Y.; Salifou, C.K.J.M.E. Country selection for international expansion: TOPSIS method analysis. Mod. Econ. 2016, 7, 470–476. [Google Scholar] [CrossRef]

| Category | No. | Factor | Reference | Influence | |

|---|---|---|---|---|---|

| A | Political law (A1) | X1 | Diplomatic relations | [18,19,20] | Positive |

| X2 | Political stability | [8,21,22] | Positive | ||

| X3 | Government credit | [9,23,24] | Positive | ||

| X4 | Regulatory environment | [25,26,27] | Positive | ||

| Economic (A2) | X5 | Foreign exchange reserve | [25,28,29] | Positive | |

| X6 | Inflation | [30,31,32] | Negative | ||

| X7 | Government debt level | [31,33,34] | Negative | ||

| X8 | Bilateral economic and trade level | [16,35,36] | Positive | ||

| Culture and public security (A3) | X9 | Security level | [21,37,38] | Negative | |

| X10 | Cultural distance | [8,39,40] | Negative | ||

| B | International engineering enterprise market (B1) | X11 | Market size | [8,25,41] | Positive |

| X12 | Market growth rate | [18,25,42] | Positive | ||

| Resource availability (B2) | X13 | Labor supply | [30,43,44] | Positive | |

| X14 | Fund supply | [45,46,47] | Positive | ||

| Developments in related industries (B3) | X15 | Information industry | [46,48,49] | Positive | |

| C | Competitor (C1) | X16 | Number of competitors | [15,50,51] | Negative |

| X17 | Competitiveness | [8,15,52] | Negative | ||

| Linguistic Variables | TFN for Criteria | The Rank (r) |

|---|---|---|

| Very Low (VL) | (0,0,0.1) | 1 |

| Low (L) | (0,0.1,0.3) | 2 |

| Medium Low (ML) | (0.1,0.3,0.5) | 3 |

| Medium (M) | (0.3,0.5,0.7) | 4 |

| Medium High (MH) | (0.5,0.7,0.9) | 5 |

| High (H) | (0.7,0.9,1) | 6 |

| Very High (VH) | (0.9,1,1) | 7 |

| Sets | |

|---|---|

| I | Set of experts, ∀ i ∈ I |

| J | Set of criteria/attributes, ∀ j ∈ J |

| K | Set of alternatives, ∀ k ∈ K |

| Indexes | |

| i | Index of the experts (1, 2, …, p) |

| j | Index of the preference of the attribute (1, 2, …, n) |

| k | Index of the alternatives (1, 2, …, m) |

| Parameters | |

| aij | Fuzzy linguistic variables for attribute j by expert i |

| r | The rank of the linguistic variable |

| aijk | Fuzzy linguistic variables for attribute j by expert i for alternative k |

| Variables | |

| Z | Fuzzy objective function |

| Wij | Fuzzy weight of attribute j for expert i |

| Sijk | Fuzzy score of the alternative k based on attribute j and expert i |

| TSk | Total fuzzy score of the alternative k |

| No. | Factor | Data Sources |

|---|---|---|

| X1 | Diplomatic relations | The official website of the Chinese Ministry of Foreign Affairs |

| X2 | Political stability | The Worldwide Governance Indicators |

| X3 | Government credit | Dagong International Credit Rating Co., Ltd. |

| X4 | Regulatory environment | The World Bank |

| X5 | Foreign exchange reserve | TRADING ECONOMICS |

| X6 | Inflation | TRADING ECONOMICS |

| X7 | Government debt level | TRADING ECONOMICS |

| X8 | Bilateral economic and trade level | TRADING ECONOMICS |

| X9 | Security level | Institute of Economics and Peace |

| X10 | Cultural distance | The Hofstede Centre database |

| X11 | Market size | Engineering News-Record and TRADING ECONOMICS |

| X12 | Market growth rate | Engineering News-Record |

| X13 | Labor supply | TRADING ECONOMICS |

| X14 | Fund supply | TRADING ECONOMICS |

| X15 | Information industry | TRADING ECONOMICS |

| X16 | Number of competitors | Engineering News-Record |

| X17 | Competitiveness | TRADING ECONOMICS |

| No. | U.S.A. | Australia | Britain | The Netherlands | France | Germany | Italy | Spain | Japan | South Korea | Canada |

|---|---|---|---|---|---|---|---|---|---|---|---|

| X1 | 0.0000 | 0.6667 | 0.6667 | 0.3333 | 0.6667 | 0.6667 | 0.6667 | 0.6667 | 0.3333 | 1.0000 | 0.6667 |

| X2 | 0.0000 | 0.6848 | 0.3902 | 0.8295 | 0.2326 | 0.5995 | 0.4289 | 0.4393 | 1.0000 | 0.5142 | 0.8424 |

| X3 | 0.2500 | 1.0000 | 0.5000 | 0.7500 | 0.5000 | 0.7500 | 0.0000 | 0.2500 | 0.5000 | 0.7500 | 0.7500 |

| X4 | 0.9000 | 0.7000 | 0.8000 | 0.1000 | 0.2000 | 0.6000 | 0.0000 | 0.3000 | 0.4000 | 1.0000 | 0.5000 |

| X5 | 0.0000 | 0.2018 | 0.2487 | 0.3409 | 0.0263 | 0.3335 | 0.3576 | 0.1832 | 1.0000 | 0.8113 | 0.2621 |

| X6 | 0.5478 | 0.6261 | 0.3826 | 0.0000 | 0.7217 | 0.3565 | 0.2261 | 0.6261 | 1.0000 | 0.7739 | 0.6609 |

| X7 | 0.5611 | 1.0000 | 0.7399 | 0.9291 | 0.6655 | 0.8556 | 0.5002 | 0.6438 | 0.0000 | 0.9530 | 0.6655 |

| X8 | 0.1589 | 1.0000 | 0.0820 | 0.7139 | 0.0299 | 0.2285 | 0.0287 | 0.0000 | 0.2467 | 0.7569 | 0.1407 |

| X9 | 0.0000 | 0.5081 | 0.0383 | 0.5806 | 0.0806 | 0.0464 | 0.2560 | 0.4234 | 0.7056 | 1.0000 | 0.2177 |

| X10 | 0.1535 | 0.0215 | 0.3600 | 0.0000 | 0.6894 | 0.8412 | 0.7965 | 0.7181 | 0.7531 | 1.0000 | 0.3523 |

| X11 | 0.0984 | 0.5738 | 0.2623 | 0.9016 | 0.1148 | 0.0000 | 0.0492 | 0.1148 | 0.0164 | 0.0328 | 1.0000 |

| X12 | 0.6841 | 0.7128 | 0.8872 | 0.6759 | 0.8021 | 0.8472 | 0.7477 | 1.0000 | 0.5713 | 0.0000 | 0.5323 |

| X13 | 0.8963 | 0.3785 | 0.4340 | 0.4137 | 0.1495 | 0.0000 | 0.0340 | 0.0951 | 0.0691 | 0.0286 | 1.0000 |

| X14 | 1.0000 | 0.4561 | 0.5809 | 0.7842 | 0.3143 | 0.0104 | 0.0861 | 0.0778 | 0.0000 | 0.0112 | 0.7405 |

| X15 | 0.4930 | 0.0957 | 0.3986 | 0.4227 | 0.0799 | 0.3147 | 0.0000 | 0.3245 | 0.5667 | 1.0000 | 0.3616 |

| X16 | 0.0000 | 0.9867 | 0.9733 | 0.9867 | 0.9733 | 1.0000 | 0.9067 | 0.9467 | 0.9200 | 0.9200 | 1.0000 |

| X17 | 0.0000 | 0.8000 | 0.4000 | 0.1000 | 0.7000 | 0.3000 | 1.0000 | 0.9000 | 0.2000 | 0.5000 | 0.6000 |

| Attribute | Total Weight Value |

| Economic performance | 0.609882 |

| Social performance | 0.286477 |

| Environmental performance | 0.103641 |

| Habitat Factor | Total Weight Value |

| Diplomatic relations | 0.0571502 |

| Political stability | 0.1149121 |

| Government credit | 0.1689370 |

| Regulatory environment | 0.0431405 |

| Foreign exchange reserve | 0.0349679 |

| Inflation | 0.0635414 |

| Government debt level | 0.0278217 |

| Bilateral economic and trade level | 0.0746296 |

| Security level | 0.0304554 |

| Cultural distance | 0.0888628 |

| Market size | 0.0270842 |

| Market growth rate | 0.0293476 |

| Labor supply | 0.0255764 |

| Funding | 0.0844996 |

| Information industry | 0.0597126 |

| Number of competitors | 0.0320588 |

| Competitiveness | 0.0373022 |

| Country | Climatosphere | Pedosphere | Biosphere | Goal | ||||

|---|---|---|---|---|---|---|---|---|

| A1 | A2 | A3 | B1 | B2 | B3 | C1 | ||

| South Korea | 0.2861 | 0.1605 | 0.1193 | 0.0009 | 0.0017 | 0.0597 | 0.0481 | 0.6764 |

| Australia | 0.3159 | 0.1493 | 0.0174 | 0.0365 | 0.0482 | 0.0057 | 0.0615 | 0.6345 |

| Canada | 0.2832 | 0.0802 | 0.0379 | 0.0427 | 0.0881 | 0.0216 | 0.0544 | 0.6082 |

| Netherlands | 0.2454 | 0.0910 | 0.0177 | 0.0443 | 0.0768 | 0.0252 | 0.0354 | 0.5358 |

| Japan | 0.2357 | 0.1169 | 0.0884 | 0.0172 | 0.0018 | 0.0338 | 0.0370 | 0.5308 |

| Germany | 0.2596 | 0.0752 | 0.0762 | 0.0249 | 0.0009 | 0.0188 | 0.0432 | 0.4987 |

| Britain | 0.2019 | 0.0597 | 0.0332 | 0.0331 | 0.0602 | 0.0238 | 0.0461 | 0.4580 |

| Spain | 0.1438 | 0.0641 | 0.0767 | 0.0325 | 0.0090 | 0.0194 | 0.0639 | 0.4093 |

| France | 0.1579 | 0.0675 | 0.0637 | 0.0266 | 0.0304 | 0.0048 | 0.0573 | 0.4083 |

| U.S.A. | 0.0811 | 0.0623 | 0.0136 | 0.0227 | 0.1074 | 0.0294 | 0.0000 | 0.3166 |

| Italy | 0.0874 | 0.0429 | 0.0786 | 0.0233 | 0.0081 | 0.0000 | 0.0664 | 0.3067 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, W.; Xia, S.; Ye, J.; Zhang, N. How Do International Contractors Choose Target Market Based on Environmental, Social and Governance Principles? A Fuzzy Ordinal Priority Approach Model. Sustainability 2024, 16, 1203. https://doi.org/10.3390/su16031203

Zhou W, Xia S, Ye J, Zhang N. How Do International Contractors Choose Target Market Based on Environmental, Social and Governance Principles? A Fuzzy Ordinal Priority Approach Model. Sustainability. 2024; 16(3):1203. https://doi.org/10.3390/su16031203

Chicago/Turabian StyleZhou, Wang, Shuyue Xia, Jinglei Ye, and Na Zhang. 2024. "How Do International Contractors Choose Target Market Based on Environmental, Social and Governance Principles? A Fuzzy Ordinal Priority Approach Model" Sustainability 16, no. 3: 1203. https://doi.org/10.3390/su16031203

APA StyleZhou, W., Xia, S., Ye, J., & Zhang, N. (2024). How Do International Contractors Choose Target Market Based on Environmental, Social and Governance Principles? A Fuzzy Ordinal Priority Approach Model. Sustainability, 16(3), 1203. https://doi.org/10.3390/su16031203