Energy communities (ECs), introduced by the RED II Directive [

1], are emerging as a promising solution to combat climate change and expedite the transition to renewable energy sources. These communities comprise individuals, households, businesses, or public institutions that collectively generate, consume, share, and manage locally produced energy. (ECs) prioritize energy efficiency at the local level and aim to create a sustainable electricity system through the participation of local actors [

2]. This active citizen participation fosters democracy and resilience at the local level [

3]. The Integrated European Market Directive (IEM, 2019/944 [

4]) envisions the participation of citizens, businesses, and public entities in electricity markets through aggregate forms. This necessitates investments in innovative technologies, such as internet and communication, energy management, blockchain, and more, to enable the end users’ proactive involvement [

5]. Energy communities come in various forms, ranging from small-scale local initiatives to large-scale urban developments, and are supported by diverse technologies, financing, and legal arrangements [

6]. They emphasize energy justice, equity, fair transition, empowerment, and involvement, requiring the development of new consumption models and solutions using structured methodologies. By efficiently utilizing local energy resources, energy communities seek to generate inclusive benefits, pursuing environmental, social, and economic goals [

7], as well as addressing issues related to energy security, greenhouse gas emissions, and energy efficiency. However, energy communities face challenges, such as regulatory barriers, technical limitations, and social acceptance. Another pivotal challenge is their optimal sizing in terms of consumption and production to locally balance the EC load and, at the same time, generate the best obtainable value for all stakeholders.

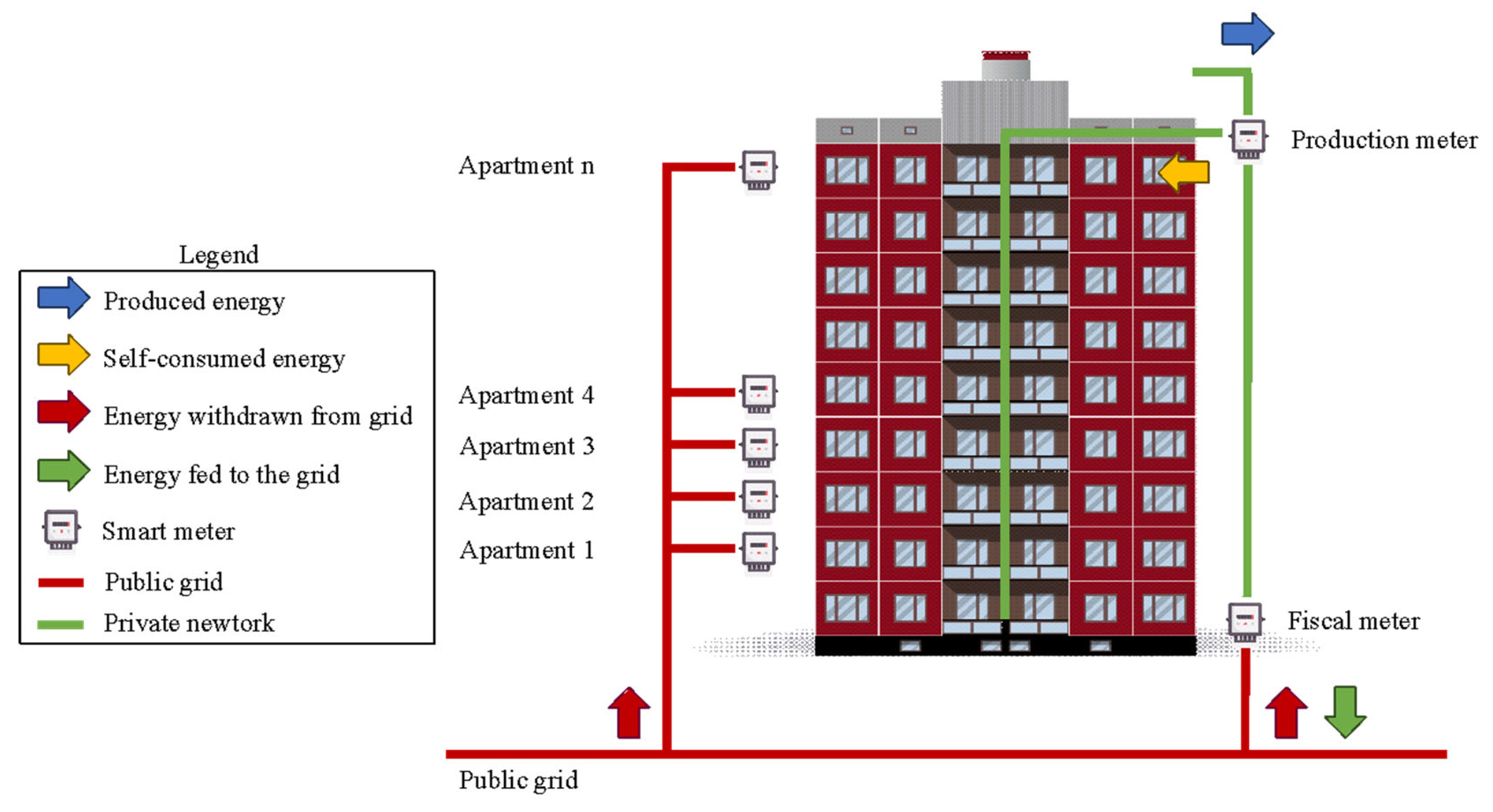

In Italy, two models have been defined to promote energy communities: renewable energy communities (RECs) and collective self-consumption groups (CSGs). While both aim to increase the share of renewable energy in the country’s energy mix, there are significant differences between the two. RECs are typically implemented on a larger scale, involving multiple stakeholders collaborating to develop and manage large renewable energy projects. CSGs, on the other hand, focus on single buildings, such as condominiums. The incentive framework for both models encourages energy sharing among users, but the amount granted differs for CSGs and RECs. The management model also varies depending on the territorial extent and nature of participants in each form of aggregation. RECs require the establishment of a legal entity, while CSGs, associated with single buildings, are considered a “management entity” under Italian legislation.

The authors consider that the results generated by the developed tools can be helpful for a variety of expert and non-expert profiles, helping to evaluate possible solutions that best suit the needs of the CSG. This contribution is aimed at facilitating its successful realization and, ultimately, aligning with the decarbonization and sustainable goals of the UN agenda.

Literature Review

According to the Circularity Gap Report 2023 [

11], the building sector is responsible for approximately 40% of the global greenhouse gas (GHG) emissions in the environment as a result of activities such as the production of building materials and building operations (which are responsible for approximately 55% of the global electricity consumption). Moreover, the construction industry is one of the most energy-intensive sectors: approximately 40% of total consumption is intended for energy services such as heating, lighting, and cooling of buildings.

GHG emissions from the building sector represented 35% of energy-related EU emissions in 2020 [

12]. Similar percentages are recorded in Italy, where the high energy consumption is mainly due to the age of the buildings and their state of conservation [

13]. According to the real estate market observatory (Osservatorio Mercato Immobiliare, OMI) [

14], the Italian real estate stock registered consists of almost 78 million properties, of which 35.5 million are for residential use.

The majority of Italian buildings (85%) were built before 1991, before the introduction of the regulatory framework for building-energy performance introduced with Law 10 of 9 January 1991. With the aforementioned law, Italy regulated the design and management of the building/plant system, introducing the concept of energy efficiency certification [

13]. Only 6.8% of buildings were built after 2005. More precisely, most of Italy’s residential building stock was built after the Second World War, with a massive growth in the 60s and 70s, then slowing down in the following decades. The need for a fast reconstruction in the post-war period is often reflected in an often poor architectural quality and energy efficiency, particularly under current standards [

15], causing high levels of energy consumption [

16]. This important aspect, which also includes large-size building blocks, such as social housing districts [

17], needs comprehensive improvement to foster deep energy renovations and reduce buildings’ energy consumption [

18] at different urban scales, within a broader regeneration strategy of the built environment, in line with the new circular economy model [

19].

According to data published by Terna [

20], the operator of the Italian electricity transmission grid, the annual electricity consumption in 2022 amounted to 295.8 TWh. Between 2021 and 2022, there was a 1.7% (−5 TWh) decline in electricity consumption in Italy. In particular:

- -

The industry experienced a 4.2% fall, reaching 130.0 TWh. The most significant drops in absolute value were found in metallurgy (−2.3 TWh, equal to −9.4%), in the paper industry (−0.6 TWh, equal to −7.5%), and in the ceramics, glass, and cement sector (−0.6 TWh, equal to −6.4%).

- -

Services, on the other hand, increased by 3.6%, to 94.7 TWh. The greatest increase in absolute value affected tourism, i.e., hotels, restaurants, and bars (+0.9 TWh, equal to 8.2%), as well as the other scientific and technical professional activities class (+1.6 TWh, equal to 16.1%).

- -

Agriculture recorded a decline of 1.4%, with a consumption of 6.6 TWh.

- -

Household consumption decreased by 3.8% to 64.5 TWh.

Extending the analysis to the energy consumption from different sources [

21], a constant growth in solar and wind energy consumption can be observed in the decades 1990, 2000, 2010 and 2020, up until 2022 (

Figure 2). Hydroelectric energy consumption, however, recorded a decline in 2020 compared to 2010, a trend that also occurred in 2022.

In contrast to the energy consumption from renewable sources, consumption from fossil sources—gas, coal, and oil—decreased from 1990 to 2020, with the exception of 2010, which saw an increase in energy consumption from gas and coal. International geoeconomic and geopolitical events are among main causes of the increase in energy consumption from coal and oil in recent years.

In light of these figures of energy consumption, it should be specified that Article 7 of the Energy Efficiency Directive (2012/27/EU) promotes interventions for energy requalification and renovation of the building stock, which mainly involve the buildings’ external surfaces, such as facades and roofs, and the energy plant components [

22].

Incentive policies for improving the energy efficiency of the building stock have gradually created the preconditions for a scenario favorable for the widespread development of energy communities, a new dimension to support the transition towards clean, democratic and accessible energy. As a matter of fact, the scientific debate on the energy transition [

23,

24,

25] may also be interpreted as the right to access electricity or the primary services that energy makes possible, such as heating, lighting, mobility, etc. [

26,

27]. Furthermore, another important distinction is that between the right to access and the right to use energy, with particular reference to the need to face and alleviate energy poverty through new energy policies and instruments, such as RECs and CSGs [

28,

29].

In particular, incentive policies, which mainly consist of tax deductions for energy efficiency interventions on existing building stock, were introduced by the Law no. 296 (27 December 2006) and still constitute the most used measures today to achieve energy efficiency in residential buildings, generating almost 1 Mtep/year of final energy savings in 2018, corresponding to over 2 million tons per year of CO2 not being emitted into the atmosphere [

30].

Tax deductions constitute the main strategic government policy for achieving the energy transition objectives of the existing building stock, in line with the mid-century zero emissions strategy for the EU [

31].

In Italy, the incentives between 2011 and 2021 activated investments of €310,789 million, and generated employment for approximately 3,093,000 people [

32]. The energy savings resulting from tax deductions (i.e., Ecobonus, Bonus Casa, Superbonus, Bonus Facciate) amounted to 0.33 Mtep/year for 2021 and are expected to be 1.65 Mtep/year for 2025 [

16]. In particular, the “Bonus Facciate” and the “Superbonus” had a strong impact in terms of private investments and public finance [

33,

34]. The “Superbonus”, implemented from December 2020 to April 2023, involved over 400,000 buildings, corresponding to approximately 3.3% of existing buildings, allowing for an overall energy savings of 1.21 MTep [

35].

Furthermore, the combined action of tax incentives and energy policies in Italy contributed to the 35% decrease in total GHG emissions from the EU buildings sector between 2005 and 2020 [

12]. Within a significant framework of policies aimed at reducing GHG emissions and energy use from buildings, in line with the ambitious objectives and targets of the European Green Deal strategy [

31], it is estimated that this positive trend will continue.

However, this is an ambitious objective that requires the increase in energy production from renewable sources, as well as through the establishment of renewable energy communities and collective self-consumption groups.

In Italy, thermoelectric energy still represents the pillar of the national electricity system [

36]. In addition, hydroelectric generation, among the renewable resources, has seen a decrease in its share due to the impact of climate change, together with a reduction in the maintenance of the dedicated water basins. On the other hand, the improvements in technological performance and efficiency favor the production of wind and solar plants, with a significant increase compared to 2021 (+11% for photovoltaic; +5.1% for wind) [

37].

Figure 3 shows the trend in renewable energy generation by source in Italy, between 1965 and 2022 [

21], revealing the constant growth in energy production from solar and wind systems and the significant decline in hydroelectric energy production since 2020. The transition towards the implementation of renewable energy plants, the promotion of energy efficiency policies, especially in the construction sector, as well as the reduction of dependence on Russian natural gas imports, thanks to the acquisition of alternative suppliers (gas pipelines and LNG infrastructure), are in line with Italy’s climate objectives.

According to the Legambiente Report [

38], realized in 2022, in Italy, there are approximately 1.35 million renewable energy plants, with a total installed power of 60 GW, located in over 7000 municipalities. Although the outcomes are noteworthy, if the installation rate in the upcoming years mirrors the total power added over the past three years, it would still fall short of achieving the anticipated target of 85 GW by 2030 [

39]. In fact, at the current pace, this goal would not be reached for another 40 years. A significant installation rate higher than that observed so far would therefore be needed to accomplish the 2030 target, together with the development of different policies.

Within this short overview, RECs, although historically widespread in the form of energy cooperatives in many EU countries, from Denmark (the wind cooperatives of the 70s) to Italy (the energy cooperatives of South Tyrol) [

40], are now recognized as legal entities by the Renewable Energy Directive (RED II) in 2018 (revised in 2021) and the Clean Energy for all Europeans Package (2019). In Italy, renewable energy communities are regulated by Article 42-bis of the Milleproroghe Decree 162/2019 (enacted by Law n. 8/2020 of 28 February 2020) [

41]. Preliminary studies show that RECs can be beneficial for the local territory [

42]. The progressive growth of RECs and CSGs [

43,

44,

45] may be associated with the triple model of economic, environmental, and social benefits between the global and local levels [

46,

47]. RECs and CSGs represent an opportunity to reduce GHG emissions and, therefore, to address problems related to climate change, but also to promote the use of local resources, democratic access to energy, and sustainable behavior within communities. In addition, they contribute to new economic investment and create local jobs.

The promotion of RECs and CSGs in Italy is supported by the combined action of direct economic contributions and tax incentives (tax deductions) [

48] and digital monitoring tools (production and consumption). The map of primary cabins for renewable energy communities [

49], introduced by the Energy Services Manager (GSE), represents another useful tool that allows stakeholders to programmatically promote RECs and CSGs. The map geolocalizes the areas served by the primary substations in Italy (2107), thus facilitating the localization of the service connection points for diffused self-consumption.

With the Integrated National Energy and Climate Plan (INECP) for the period 2021–2030 (2019) [

50], the combined action of energy efficiency interventions of the building stock and self-consumption (single and/or collective) is confirmed to achieve the minimum quota of renewable sources in new buildings or renovations, in line with the objectives of nearly zero-emission buildings (NZEB).

Then, moving on to the neighborhood scale, within the concept of positive energy districts (PEDs) [

51], highly energy-efficient buildings, smart grid technologies, and other sustainable practices are promoted to produce more renewable energy than they consume, resulting in zero net greenhouse gas emissions and a reduction in the carbon footprint [

52]. Norway and Italy are among the European countries with the largest number of PED projects [

53].

These interventions are fundamental to reaching the Italian target for the minimum cumulative final energy savings, to be achieved in the period 2021–2030, corresponding to approximately 51.4 Mtep (corresponding to over 9.35 Mtep of annual savings by 2030) [

50].

In this sense, the harmonization of urban planning tools and financial incentives, in line with European policies, constitute a key factor in achieving full economic feasibility for RECs, CSGs, and other more ambitious policies. In particular, participatory urban planning actions contribute to progressive awareness for a just energy transition [

48]. In the same COP 21 in Paris, the conference where global agreement for the reduction of emissions into the atmosphere was discussed, the central role of the Just Transition [

54] was stressed, with explicit reference to a fair and balanced energy transition. More precisely, with an explicit reference to energy communities and their multiple organizational models, the aim is to deal with climate change, fight poverty, and promote the sustainable development of local communities [

55].