Value Chain Digitalization, Global Value Chain Embeddedness, and Distributed Innovation in Value Chains

Abstract

:1. Introduction

2. Literature Review

2.1. Innovation in Value Chains

2.2. Value Chain Digitalization

2.3. Technology Affordance Theory

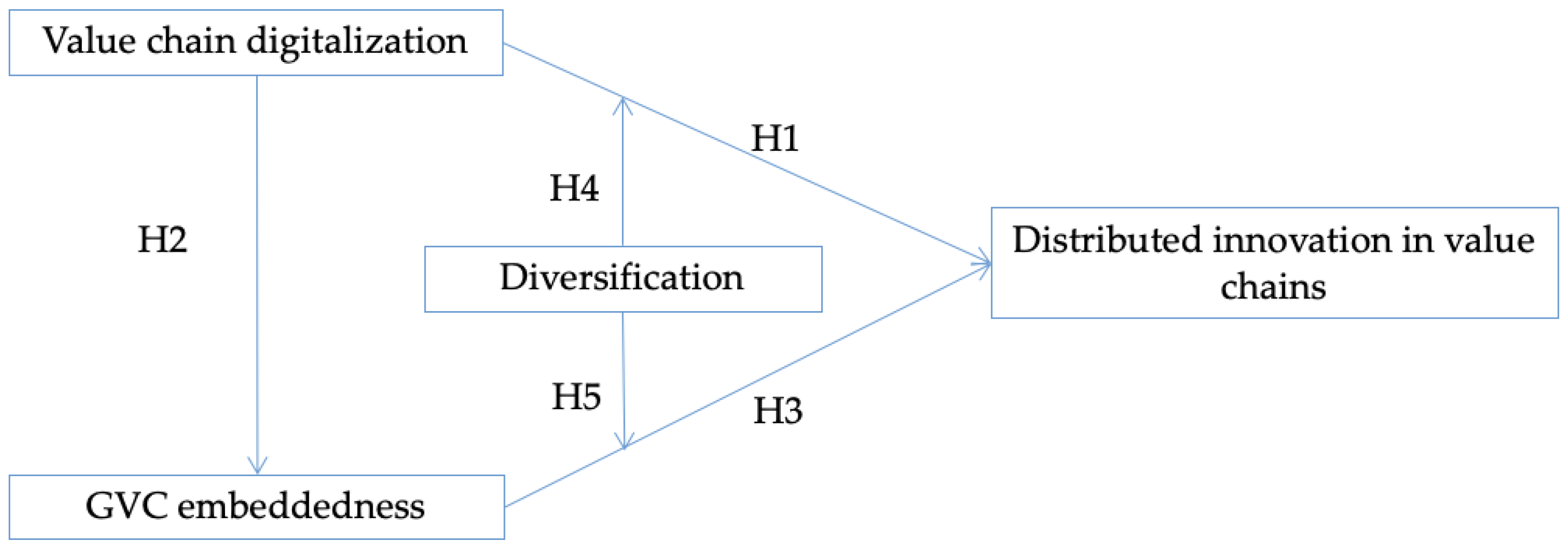

3. Theory Development and Hypotheses

3.1. Distributed Innovation in Value Chains

3.2. Value Chain Digitalization and Distributed Innovation in Value Chains

3.3. Value Chain Digitalization and GVC Embeddedness

3.4. GVC Embeddedness and Distributed Innovation in Value Chains

3.5. The Moderating Roles of Product Diversification

4. Research Methodology

4.1. Data and Sample

4.2. Measurements

4.2.1. Dependent Variable

4.2.2. Independent Variables

4.2.3. Control Variables

4.3. Analysis Method

5. Findings

5.1. Main Results

5.2. Post Hoc Robustness Tests

6. Discussion

6.1. Theoretical Contributions

6.2. Managerial Implications

6.3. Limitations and Further Research

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Porter, M.E. The Competitive Advantage: Creating and Sustaining Superior Performance; Free Press: New York, NY, USA, 1985. [Google Scholar]

- Lee, H.L.; Schmidt, G. Using value chains to enhance innovation. Prod. Oper. Manag. 2017, 26, 617–632. [Google Scholar] [CrossRef]

- Zimmermann, R.; DF Ferreira, L.M.; Carrizo Moreira, A. The influence of supply chain on the innovation process: A systematic literature review. Supply Chain Manag. Int. J. 2016, 21, 289–304. [Google Scholar] [CrossRef]

- Kano, L.; Tsang, E.W.; Yeung, H.W.C. Global value chains: A review of the multi-disciplinary literature. J. Int. Bus. Stud. 2020, 51, 577–622. [Google Scholar] [CrossRef]

- Sturgeon, T.J. How do we define value chains and production networks? IDS Bull. 2001, 32, 9–18. [Google Scholar] [CrossRef]

- Stanisławski, R. Open innovation as a value chain for small and medium-sized enterprises: Determinants of the use of open innovation. Sustainability 2020, 12, 3290. [Google Scholar] [CrossRef]

- Oborn, E.; Barrett, M.; Orlikowski, W.; Kim, A. Trajectory dynamics in innovation: Developing and transforming a mobile money service across time and place. Org. Sci. 2019, 30, 1097–1123. [Google Scholar] [CrossRef]

- Garud, R.; Tuertscher, P.; Van de Ven, A.H. Perspectives on innovation processes. Acad. Manage. Ann. 2013, 7, 775–819. [Google Scholar] [CrossRef]

- Ambos, B.; Brandl, K.; Perri, A.; Scalera, V.G.; Van Assche, A. The nature of innovation in global value chains. J. World Bus. 2021, 56, 101221. [Google Scholar] [CrossRef]

- Buciuni, G.; Pisano, G. Variety of innovation in global value chains. J. World Bus. 2021, 56, 101167. [Google Scholar] [CrossRef]

- Bogers, M.; West, J. Managing distributed innovation: Strategic utilization of open and user innovation. Creat. Innov. Manag. 2012, 21, 61–75. [Google Scholar] [CrossRef]

- Lakhani, K.R.; Panetta, J.A. The principles of distributed innovation. Innov. Technol. Gov. Glob. Summer 2007, 2, 97–112. [Google Scholar] [CrossRef]

- Von Hippel, E. Sources of Innovation; Oxford University Press: New York, NY, USA, 1988. [Google Scholar]

- Pulles, N.J.; Veldman, J.; Schiele, H. Identifying innovative suppliers in business networks: An empirical study. Ind. Mark. Manag. 2014, 43, 409–418. [Google Scholar] [CrossRef]

- Chang, J. The effects of buyer-supplier’s collaboration on knowledge and product innovation. Ind. Mark. Manag. 2017, 65, 129–143. [Google Scholar] [CrossRef]

- Saliola, F.; Zanfei, A. Multinational firms, global value chains and the organization of knowledge transfer. Res. Policy 2009, 38, 369–381. [Google Scholar] [CrossRef]

- Liu, X.; Huang, Q.; Dou, J.; Zhao, X. The impact of informal social interaction on innovation capability in the context of buyer-supplier dyads. J. Bus. Res. 2017, 78, 314–322. [Google Scholar] [CrossRef]

- Malmström, M.; Johansson, J.; Wincent, J. Gender Stereotypes and Venture Support Decisions: How Governmental Venture Capitalists Socially Construct Entrepreneurs’ Potential. Entrep. Theory Pract. 2017, 41, 833–860. [Google Scholar] [CrossRef]

- Wang, C.; Hu, Q. Knowledge sharing in supply chain networks: Effects of collaborative innovation activities and capability on innovation performance. Technovation 2020, 94–95, 102010. [Google Scholar] [CrossRef]

- Schiele, H. How to distinguish innovative suppliers? Identifying innovative suppliers as new task for purchasing. Ind. Mark. Manag. 2006, 35, 925–935. [Google Scholar] [CrossRef]

- Inemek, A.; Matthyssens, P. The impact of buyer–supplier relationships on supplier innovativeness: An empirical study in cross-border supply networks. Ind. Mark. Manag. 2013, 42, 580–594. [Google Scholar] [CrossRef]

- Pietrobelli, C.; Marin, A.; Olivari, J. Innovation in mining value chains: New evidence from Latin America. Resour. Policy 2018, 58, 1–10. [Google Scholar] [CrossRef]

- Isaksson, O.H.; Simeth, M.; Seifert, R.W. Knowledge spillovers in the supply chain: Evidence from the high tech sectors. Res. Policy 2016, 45, 699–706. [Google Scholar] [CrossRef]

- Chae, S.; Yan, T.; Yang, Y. Supplier innovation value from a buyer–supplier structural equivalence view: Evidence from the PACE awards in the automotive industry. J. Oper. Manag. 2019, 66, 820–838. [Google Scholar] [CrossRef]

- Von Hippel, E. Democratizing innovation: The evolving phenomenon of user innovation. J. Betriebswirtschaft 2005, 55, 63–78. [Google Scholar] [CrossRef]

- Lakhani, K.R.; Lifshitz-Assaf, H.; Tushman, M. Open innovation and organizational boundaries: Task decomposition, knowledge distribution and the locus of innovation. In Handbook of Economic Organization: Integrating Economic and Organization Theory; Grandori, A., Ed.; Edward Elgar: Northampton, MA, USA, 2013; Volume 355, pp. 355–382. [Google Scholar]

- Kano, L.; Hoon Oh, C. Global value chains in the post-COVID world: Governance for reliability. J. Manag. Stud. 2020, 57, 1773–1777. [Google Scholar] [CrossRef]

- Gereffi, G. What does the COVID-19 pandemic teach us about global value chains? The case of medical supplies. J. Int. Bus. Policy 2020, 3, 287–301. [Google Scholar] [CrossRef]

- Choksy, U.S.; Ayaz, M.; Al-Tabbaa, O.; Parast, M. Supplier resilience under the COVID-19 crisis in apparel global value chain (GVC): The role of GVC governance and supplier’s upgrading. J. Bus. Res. 2022, 150, 249–267. [Google Scholar] [CrossRef]

- Reddy, K.; Sasidharan, S. Digitalization and global value chain participation: Firm-level evidence from Indian manufacturing. J. Ind. Bus. Econ. 2023, 50, 551–574. [Google Scholar] [CrossRef]

- Vadana, I.-I.; Kuivalainen, O.; Torkkeli, L.; Saarenketo, S. The role of digitalization on the internationalization strategy of born-digital companies. Sustainability 2021, 13, 14002. [Google Scholar] [CrossRef]

- Yoo, Y.; Boland, R.J., Jr.; Lyytinen, K.; Majchrzak, A. Organizing for innovation in the digitized world. Org. Sci. 2012, 23, 1398–1408. [Google Scholar] [CrossRef]

- Nambisan, S.; Lyytinen, K.; Majchrzak, A.; Song, M. Digital Innovation Management: Reinventing innovation management research in a digital world. MIS Q. 2017, 41, 223–238. [Google Scholar] [CrossRef]

- Zittrain, J. The generative Internet. Harv. Law Rev. 2006, 119, 1975–2040. [Google Scholar]

- Williamson, P.J.; De Meyer, A. Ecosystem advantage: How to successfully harness the power of partners. Calif. Manag. Rev. 2012, 55, 24–46. [Google Scholar] [CrossRef]

- Gaimon, C.; Ramachandran, K. The knowledge value chain: An operational perspective. Prod. Oper. Manag. 2021, 30, 715–724. [Google Scholar] [CrossRef]

- Raz, G.; Druehl, C.T.; Pun, H. Codevelopment versus outsourcing: Who should innovate in supply chains. IEEE T. Eng. Manag. 2021, 70, 3902–3917. [Google Scholar] [CrossRef]

- Sturgeon, T.J. Modular production networks: A new American model of industrial organization. Ind. Corp. Chang. 2002, 11, 451–496. [Google Scholar] [CrossRef]

- Wagner, S.M. Supplier traits for better customer firm innovation performance. Ind. Mark. Manag. 2010, 39, 1139–1149. [Google Scholar] [CrossRef]

- Kotabe, M.; Martin, X.; Domoto, H. Gaining from vertical partnerships: Knowledge transfer, relationship duration, and supplier performance improvement in the U.S. and Japanese automotive industries. Strateg. Manag. J. 2003, 24, 293–316. [Google Scholar] [CrossRef]

- Schilling, M.A.; Phelps, C.C. Interfirm collaboration networks: The impact of large-scale network structure on firm innovation. Manag. Sci. 2007, 53, 1113–1126. [Google Scholar] [CrossRef]

- Bellamy, M.A.; Ghosh, S.; Hora, M. The influence of supply network structure on firm innovation. J. Oper. Manag. 2014, 32, 357–373. [Google Scholar] [CrossRef]

- Björkdahl, J. Strategies for digitalization in manufacturing firms. Calif. Manag. Rev. 2020, 62, 17–36. [Google Scholar] [CrossRef]

- Zhou, D.; Yan, T.; Dai, W.; Feng, J. Disentangling the interactions within and between servitization and digitalization strategies: A service-dominant logic. Int. J. Prod. Econ. 2021, 238, 108175. [Google Scholar] [CrossRef]

- Oliveira, L.; Fleury, A.; Fleury, M.T. Digital power: Value chain upgrading in an age of digitization. Int. Bus. Rev. 2021, 30, 101850. [Google Scholar] [CrossRef]

- Vadana, I.-I.; Torkkeli, L.; Kuivalainen, O.; Saarenketo, S. Digitalization of companies in international entrepreneurship and marketing. Int. Mark. Rev. 2020, 37, 471–492. [Google Scholar] [CrossRef]

- Seyedghorban, Z.; Tahernejad, H.; Meriton, R.; Graham, G. Supply chain digitalization: Past, present and future. Prod. Plan. Control 2020, 31, 96–114. [Google Scholar] [CrossRef]

- The United Nations Conference on Trade and Development (UNCTD). Information Economy Report: Digitalization, Trade and Development; 9213627874; United Nation Publication: New York, NY, USA, 2017. [Google Scholar]

- Haefner, N.; Wincent, J.; Parida, V.; Gassmann, O. Artificial intelligence and innovation management: A review, framework, and research agenda. Technol. Forecast. Soc. Chang. 2021, 162, 120392. [Google Scholar] [CrossRef]

- Becker, M.C.; Rullani, F.; Zirpoli, F. The role of digital artefacts in early stages of distributed innovation processes. Res. Policy 2021, 50, 104349. [Google Scholar] [CrossRef]

- Yoo, Y. Digitalization and Innovation; Institute of Innovation Research, Hitotsubashi University: Kunitachi, Japan, 2010. [Google Scholar]

- Radicic, D.; Petković, S. Impact of digitalization on technological innovations in small and medium-sized enterprises (SMEs). Technol. Forecast. Soc. Chang. 2023, 191, 122474. [Google Scholar] [CrossRef]

- Peron, M.; Fragapane, G.; Sgarbossa, F.; Kay, M. Digital facility layout planning. Sustainability 2020, 12, 3349. [Google Scholar] [CrossRef]

- Bharadwaj, A.; El Sawy, O.A.; Pavlou, P.A.; Venkatraman, N.v. Digital business strategy: Toward a next generation of insights. MIS Q. 2013, 37, 471–482. [Google Scholar] [CrossRef]

- Nambisan, S. Digital entrepreneurship: Toward a digital technology perspective of entrepreneurship. Entrep. Theory Prac. 2017, 41, 1029–1055. [Google Scholar] [CrossRef]

- Burström, T.; Parida, V.; Lahti, T.; Wincent, J. AI-enabled business-model innovation and transformation in industrial ecosystems: A framework, model and outline for further research. J. Bus. Res. 2021, 127, 85–95. [Google Scholar] [CrossRef]

- Loonam, J.; O’Regan, N. Global value chains and digital platforms: Implications for strategy. Strat. Chang. 2022, 31, 161–177. [Google Scholar] [CrossRef]

- Johns, J. Digital technological upgrading in manufacturing global value chains: The impact of additive manufacturing. Glob. Netw. 2021, 22, 649–665. [Google Scholar] [CrossRef]

- Li, W.; Li, Q.; Chen, M.; Su, Y.; Zhu, J. Global value chains, digital economy, and upgrading of China’s manufacturing industry. Sustainability 2023, 15, 8003. [Google Scholar] [CrossRef]

- Liu, J.; Jiang, X.; Shi, M.; Yang, Y. Impact of artificial intelligence on manufacturing industry global value chain position. Sustainability 2024, 16, 1341. [Google Scholar] [CrossRef]

- Autio, E.; Nambisan, S.; Thomas, L.D.; Wright, M. Digital affordances, spatial affordances, and the genesis of entrepreneurial ecosystems. Strat. Entrep. J. 2018, 12, 72–95. [Google Scholar] [CrossRef]

- Liu, Y.; Dong, J.; Mei, L.; Shen, R. Digital innovation and performance of manufacturing firms: An affordance perspective. Technovation 2023, 119, 102458. [Google Scholar] [CrossRef]

- Majchrzak, A.; Markus, M. Technology affordances and constraints theory (of Mis). In Encyclopedia of Management Theory; Kessler, E., Ed.; SAGE Publications: Thousand Oaks, CA, USA, 2014; pp. 832–836. [Google Scholar]

- Kafouros, M.; Wang, C.; Piperopoulos, P.; Zhang, M. Academic collaborations and firm innovation performance in China: The role of region-specific institutions. Res. Policy 2015, 44, 803–817. [Google Scholar] [CrossRef]

- Holmström, J.; Holweg, M.; Lawson, B.; Pil, F.K.; Wagner, S.M. The digitalization of operations and supply chain management: Theoretical and methodological implications. J. Oper. Manag. 2019, 65, 728–734. [Google Scholar] [CrossRef]

- Kohli, R.; Melville, N.P. Digital innovation: A review and synthesis. Inf. Syst. J. 2019, 29, 200–223. [Google Scholar] [CrossRef]

- Cheng, Q.; Liu, Y.; Peng, C.; He, X.; Qu, Z.; Dong, Q. Knowledge digitization: Characteristics, knowledge advantage and innovation performance. J. Bus. Res. 2023, 163, 113915. [Google Scholar] [CrossRef]

- Leonardi, P.M. When flexible routines meet flexible technologies: Affordance, constraint, and the imbrication of human and material agencies. MIS Q. 2011, 35, 147–167. [Google Scholar] [CrossRef]

- Howells, J.; James, A.; Malik, K. The sourcing of technological knowledge: Distributed innovation processes and dynamic change. R&D Manag. 2003, 33, 395–409. [Google Scholar] [CrossRef]

- Sanchez, R.; Mahoney, J.T. Modularity, flexibility, and knowledge management in product and organization design. Strateg. Manag. J. 1996, 17, 63–76. [Google Scholar] [CrossRef]

- Baldwin, C.Y.; Clark, K.B. Design Rules: The Power of Modularity; MIT Press: Cambridge, MA, USA, 2000; Volume 1. [Google Scholar]

- Cabigiosu, A.; Zirpoli, F.; Camuffo, A. Modularity, interfaces definition and the integration of external sources of innovation in the automotive industry. Res. Policy 2013, 42, 662–675. [Google Scholar] [CrossRef]

- Kano, L. Global value chain governance: A relational perspective. J. Int. Bus. Stud. 2018, 49, 684–705. [Google Scholar] [CrossRef]

- Deng, Z.; Ma, X.; Zhu, Z. Transactional dependence and technological upgrading in global value chains. J. Manag. Stud. 2022, 59, 390–416. [Google Scholar] [CrossRef]

- Srinivasan, R.; Giannikas, V.; McFarlane, D.; Thorne, A. Customising with 3D printing: The role of intelligent control. Comput. Ind. 2018, 103, 38–46. [Google Scholar] [CrossRef]

- Porter, M.E.; Heppelmann, J.E. How smart, connected products are transforming competition. Harv. Bus. Rev. 2014, 92, 64–88. [Google Scholar]

- Forman, C.; Van Zeebroeck, N. Digital technology adoption and knowledge flows within firms: Can the Internet overcome geographic and technological distance? Res. Policy 2019, 48, 103697. [Google Scholar] [CrossRef]

- Svahn, F.; Mathiassen, L.; Lindgren, R. Embracing digital innovation in incumbent firms. MIS Q. 2017, 41, 239–254. [Google Scholar] [CrossRef]

- Ahuja, G.; Lampert, C.M.; Novelli, E. The second face of appropriability: Generative appropriability and its determinants. Acad. Manag. Rev. 2013, 38, 248–269. [Google Scholar] [CrossRef]

- Nylén, D.; Holmström, J. Digital innovation strategy: A framework for diagnosing and improving digital product and service innovation. Bus. Horiz. 2015, 58, 57–67. [Google Scholar] [CrossRef]

- Ulrich, K. The role of product architecture in the manufacturing firm. Res. Policy 1995, 24, 419–440. [Google Scholar] [CrossRef]

- Yin, Y.; Stecke, K.E.; Swink, M.; Kaku, I. Lessons from seru production on manufacturing competitively in a high cost environment. J. Oper. Manag. 2017, 49, 67–76. [Google Scholar] [CrossRef]

- Andersson, U.; Dasí, À.; Mudambi, R.; Pedersen, T. Technology, innovation and knowledge: The importance of ideas and international connectivity. J. World Bus. 2016, 51, 153–162. [Google Scholar] [CrossRef]

- Mudambi, R. Location, control and innovation in knowledge-intensive industries. J. Econ. Geogr. 2008, 8, 699–725. [Google Scholar] [CrossRef]

- Van der Heijden, G.A.; Schepers, J.J.; Nijssen, E.J.; Ordanini, A. Don’t just fix it, make it better! Using frontline service employees to improve recovery performance. J. Acad. Mark. Sci. 2013, 41, 515–530. [Google Scholar] [CrossRef]

- Bagozzi, R.P.; Verbeke, W.J.; Van Den Berg, W.E.; Rietdijk, W.J.; Dietvorst, R.C.; Worm, L. Genetic and neurological foundations of customer orientation: Field and experimental evidence. J. Acad. Mark. Sci. 2012, 40, 639–658. [Google Scholar] [CrossRef]

- Sugheir, J.; Phan, P.H.; Hasan, I. Diversification and innovation revisited: An absorptive capacity view of technological knowledge creation. IEEE Trans. Eng. Manag. 2011, 59, 530–539. [Google Scholar] [CrossRef]

- Grant, R.M. Toward a knowledge-based theory of the firm. Strateg. Manag. J. 1996, 17, 109–122. [Google Scholar] [CrossRef]

- Arte, P.; Larimo, J. Moderating influence of product diversification on the international diversification-performance relationship: A meta-analysis. J. Bus. Res. 2022, 139, 1408–1423. [Google Scholar] [CrossRef]

- Jiao, H.; Yang, J.; Cui, Y. Institutional pressure and open innovation: The moderating effect of digital knowledge and experience-based knowledge. J. Knowl. Manag. 2022, 26, 2499–2527. [Google Scholar] [CrossRef]

- Baldwin, R.; Lopez-Gonzalez, J. Supply-chain trade: A portrait of global patterns and several testable hypotheses. World Econ. 2015, 38, 1682–1721. [Google Scholar] [CrossRef]

- Reddy, K.; Chundakkadan, R.; Sasidharan, S. Firm innovation and global value chain participation. Small Bus. Econ. 2020, 57, 1995–2015. [Google Scholar] [CrossRef]

- Kergroach, S. National innovation policies for technology upgrading through GVCs: A cross-country comparison. Technol. Forecast. Soc. Chang. 2019, 145, 258–272. [Google Scholar] [CrossRef]

- Palepu, K. Diversification strategy, profit performance and the entropy measure. Strateg. Manag. J. 1985, 6, 239–255. [Google Scholar] [CrossRef]

- Delios, A.; Beamish, P.W. Geographic scope, product diversification, and the corporate performance of Japanese firms. Strateg. Manag. J. 1999, 20, 711–727. [Google Scholar]

- Su, W.; Tsang, E.W. Product diversification and financial performance: The moderating role of secondary stakeholders. Acad. Manag. J. 2015, 58, 1128–1148. [Google Scholar] [CrossRef]

- Chen, H.; Zeng, S.; Yu, B.; Xue, H. Complementarity in open innovation and corporate strategy: The moderating effect of ownership and location strategies. IEEE Trans. Eng. Manag. 2019, 67, 754–768. [Google Scholar] [CrossRef]

- Sørensen, J.B.; Stuart, T.E. Aging, obsolescence, and organizational innovation. Adm. Sci. Q. 2000, 45, 81–112. [Google Scholar] [CrossRef]

- Xie, X.; Liu, X.; Chen, J. A meta-analysis of the relationship between collaborative innovation and innovation performance: The role of formal and informal institutions. Technovation 2023, 124, 102740. [Google Scholar] [CrossRef]

- Kraft, P.S.; Bausch, A. Managerial social networks and innovation: A meta-analysis of bonding and bridging effects across institutional environments. J. Prod. Innov. Manag. 2018, 35, 865–889. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Absorptive Capacity: A new perspective on learning and innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Elshaarawy, R.; Ezzat, R.A. Global value chains, financial constraints, and innovation. Small Bus. Econ. 2023, 61, 223–257. [Google Scholar] [CrossRef]

- Tian, Y.; Wang, Y.; Xie, X.; Jiao, J.; Jiao, H. The impact of business-government relations on firms’ innovation: Evidence from Chinese manufacturing industry. Technol. Forecast. Soc. Chang. 2019, 143, 1–8. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, X.T. Rent-seeking in bank credit and firm R&D innovation: The role of industrial agglomeration. J. Bus. Res. 2023, 159, 113454. [Google Scholar]

- Heckman, J.J. Sample selection bias as a specification error. Econometrica 1979, 47, 153–161. [Google Scholar] [CrossRef]

- Sorenson, O.; Fleming, L. Science and the diffusion of knowledge. Res. Policy 2004, 33, 1615–1634. [Google Scholar] [CrossRef]

- Fleming, L.; Sorenson, O. Technology as a complex adaptive system: Evidence from patent data. Res. Policy 2001, 30, 1019–1039. [Google Scholar] [CrossRef]

- Cloodt, M.; Hagedoorn, J.; Van Kranenburg, H. Mergers and acquisitions: Their effect on the innovative performance of companies in high-tech industries. Res. Policy 2006, 35, 642–654. [Google Scholar] [CrossRef]

- Hess, A.M.; Rothaermel, F.T. When are assets complementary? Star scientists, strategic alliances, and innovation in the pharmaceutical industry. Strateg. Manag. J. 2011, 32, 895–909. [Google Scholar]

- Guan, J.C.; Yan, Y. Technological proximity and recombinative innovation in the alternative energy field. Res. Policy 2016, 45, 1460–1473. [Google Scholar] [CrossRef]

- Lodh, S.; Battaggion, M.R. Technological breadth and depth of knowledge in innovation: The role of mergers and acquisitions in biotech. Ind. Corp. Chang. 2015, 24, 383–415. [Google Scholar] [CrossRef]

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) DIVC | 1.000 | |||||||||||

| (2) Value chain digitalization | 0.331 * | 1.000 | ||||||||||

| (3) GVC embeddedness | 0.104 * | 0.075 | 1.000 | |||||||||

| (4) Product diversification | −0.016 | −0.179 * | −0.035 | 1.000 | ||||||||

| (5) Firm age | −0.002 | 0.019 | −0.014 | 0.002 | 1.000 | |||||||

| (6) Firm size | 0.130 * | 0.149 * | 0.216 * | −0.039 | 0.104 * | 1.000 | ||||||

| (7) R&D | 0.139 * | 0.277 * | 0.086 | −0.079 | 0.019 | 0.307 * | 1.000 | |||||

| (8) Financial constraints | 0.012 | 0.125 * | −0.076 | 0.020 | 0.007 | −0.019 | 0.024 | 1.000 | ||||

| (9) Political connections | 0.075 | 0.030 | 0.009 | 0.001 | −0.032 | −0.019 | 0.015 | 0.021 | 1.000 | |||

| (10) Information sharing | 0.261 * | 0.164 * | 0.017 | −0.037 | −0.018 | 0.119 * | 0.089 * | 0.059 | −0.039 | 1.000 | ||

| (11) Manager experience | 0.003 | 0.210 * | 0.087 | −0.081 | 0.386 * | 0.179 * | 0.172 * | 0.028 | −0.016 | 0.060 | 1.000 | |

| (12) Subindustry | 0.059 | 0.030 | 0.058 | −0.042 | −0.019 | 0.109 * | 0.061 | 0.019 | −0.041 | 0.009 | −0.040 | 1.000 |

| Mean | 0.427 | 4.246 | 0.050 | 95.288 | 2.522 | 16.82 | 0.397 | 0.233 | 0.262 | 0.961 | 16.797 | 6.267 |

| SD | 0.495 | 1.444 | 0.218 | 8.801 | 0.484 | 1.617 | 0.490 | 0.423 | 1.641 | 0.839 | 7.62 | 3.359 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| DIVC | DIVC | GVC Embeddedness | DIVC | DIVC | DIVC | |

| Value chain digitalization | 0.374 *** | 0.143 * | 0.373 *** | −1.488 * | −1.529 * | |

| (0.050) | (0.069) | (0.051) | (0.709) | (0.703) | ||

| GVC embeddedness | 0.471 * | 0.432 + | −3.244 | |||

| (0.231) | (0.229) | (2.144) | ||||

| Value chain digitalization × | 0.019 ** | 0.020 ** | ||||

| Product diversification | (0.007) | (0.007) | ||||

| GVC embeddedness × | 0.039 + | |||||

| Product diversification | (0.023) | |||||

| Product diversification | 0.000 | 0.006 | −0.005 | 0.006 | −0.085 * | −0.089 ** |

| (0.006) | (0.006) | (0.008) | (0.006) | (0.034) | (0.034) | |

| Firm age | 0.023 | 0.072 | −0.137 | 0.086 | 0.066 | 0.071 |

| (0.100) | (0.105) | (0.143) | (0.106) | (0.106) | (0.106) | |

| Firm size | 0.065 * | 0.059 + | 0.257 *** | 0.045 | 0.048 | 0.051 |

| (0.031) | (0.032) | (0.047) | (0.033) | (0.033) | (0.033) | |

| R&D | 0.265 ** | 0.086 | −0.034 | 0.089 | 0.081 | 0.079 |

| (0.098) | (0.103) | (0.180) | (0.104) | (0.103) | (0.104) | |

| Financial constraints | −0.020 | −0.119 | −0.472 * | −0.101 | −0.104 | −0.104 |

| (0.106) | (0.112) | (0.240) | (0.112) | (0.113) | (0.113) | |

| Political connections | 0.070 * | 0.068 * | 0.019 | 0.067 * | 0.064 * | 0.066 * |

| (0.034) | (0.032) | (0.035) | (0.032) | (0.032) | (0.032) | |

| Information sharing | 0.412 *** | 0.385 *** | −0.048 | 0.391 *** | 0.397 *** | 0.401 *** |

| (0.054) | (0.056) | (0.103) | (0.056) | (0.057) | (0.057) | |

| Manager experience | −0.007 | −0.017 * | 0.012 | −0.018 ** | −0.018 * | −0.018 * |

| (0.007) | (0.007) | (0.011) | (0.007) | (0.007) | (0.007) | |

| Subindustry | Controlled | Controlled | Controlled | Controlled | Controlled | Controlled |

| Constant | −1.892 * | −3.876 *** | −5.970 *** | −3.701 *** | 5.104 | 5.427 |

| (0.771) | (0.861) | (1.133) | (0.866) | (3.374) | (3.362) | |

| N | 862 | 862 | 734 | 862 | 862 | 862 |

| (7) | (8) | (9) | (10) | (11) | |

|---|---|---|---|---|---|

| DIVC | GVC Embeddedness | DIVC | DIVC | DIVC | |

| Value chain digitalization | 0.448 *** | 0.191 * | 0.363 *** | −1.368 * | −1.414 * |

| (0.058) | (0.091) | (0.049) | (0.685) | (0.682) | |

| GVC embeddedness | 1.576 *** | 1.550 *** | −1.132 | ||

| (0.287) | (0.279) | (1.854) | |||

| Value chain digitalization × | 0.019 ** | 0.019 ** | |||

| Product diversification | (0.007) | (0.007) | |||

| GVC embeddedness × | 0.028 | ||||

| Product diversification | (0.019) | ||||

| Product diversification | 0.006 | −0.005 | 0.006 | −0.082 * | −0.086 ** |

| (0.006) | (0.008) | (0.006) | (0.033) | (0.033) | |

| Firm age | 0.076 | −0.144 | 0.078 | 0.054 | 0.059 |

| (0.104) | (0.141) | (0.103) | (0.101) | (0.102) | |

| Firm size | 0.046 | 0.258 *** | 0.044 | 0.044 | 0.047 |

| (0.032) | (0.047) | (0.032) | (0.031) | (0.031) | |

| R&D | 0.079 | −0.034 | 0.086 | 0.071 | 0.068 |

| (0.102) | (0.180) | (0.100) | (0.098) | (0.099) | |

| Financial constraints | −0.087 | −0.465 + | −0.092 | −0.074 | −0.076 |

| (0.110) | (0.237) | (0.109) | (0.108) | (0.108) | |

| Political connections | 0.066 * | 0.020 | 0.064 * | 0.059 * | 0.061 * |

| (0.030) | (0.035) | (0.030) | (0.029) | (0.029) | |

| Information sharing | 0.391 *** | −0.049 | 0.374 *** | 0.382 *** | 0.387 *** |

| (0.056) | (0.104) | (0.056) | (0.057) | (0.057) | |

| Manager experience | −0.017 * | 0.013 | −0.017 * | −0.017 * | −0.017 * |

| (0.007) | (0.011) | (0.007) | (0.007) | (0.007) | |

| Subindustry | Controlled | Controlled | Controlled | Controlled | 0.000 |

| Constant | −4.056 *** | −6.180 *** | −3.638 *** | 4.589 | 4.921 |

| (0.863) | (1.151) | (0.834) | (3.260) | (3.263) | |

| corr(e.GVC embeddedness, e.DIVC) | 0.145 | −0.559 *** | −0.579 *** | −0.567 *** | |

| (0.103) | (0.142) | (0.135) | (0.144) | ||

| corr(e.Value chain digitalization, e.DIVC) | −0.160 ** | −0.167 ** | −0.161 ** | ||

| (0.062) | (0.063) | (0.062) | |||

| corr(e.DVC, e.GVC embeddedness) | 0.099 | −0.093 | 0.103 | 0.103 | |

| (0.069) | (0.110) | (0.067) | (0.067) | ||

| N | 862 | 862 | 862 | 862 | 862 |

| (12) | (13) | (14) | (15) | |

|---|---|---|---|---|

| DIVC | Alternative GVC | DIVC | DIVC | |

| Value chain digitalization | 0.368 *** | 0.140 * | −1.483 * | −1.505 * |

| (0.051) | (0.065) | (0.710) | (0.703) | |

| Alternative GVC | 0.519 * | 0.493 * | −3.910 * | |

| (0.207) | (0.205) | (1.953) | ||

| Value chain digitalization × | 0.019 ** | 0.019 ** | ||

| Product diversification | (0.007) | (0.007) | ||

| Alternative GVC × | 0.047 * | |||

| Product diversification | (0.021) | |||

| Product diversification | 0.006 | −0.005 | −0.084 * | −0.089 ** |

| (0.006) | (0.008) | (0.034) | (0.034) | |

| Firm age | 0.081 | −0.082 | 0.060 | 0.067 |

| (0.107) | (0.149) | (0.107) | (0.108) | |

| Firm size | 0.039 | 0.280 *** | 0.042 | 0.046 |

| (0.033) | (0.047) | (0.033) | (0.033) | |

| R&D | 0.077 | 0.181 | 0.069 | 0.067 |

| (0.104) | (0.166) | (0.104) | (0.105) | |

| Financial constraints | −0.075 | −0.596 * | −0.077 | −0.074 |

| (0.113) | (0.235) | (0.113) | (0.114) | |

| Political connections | 0.066 * | 0.053 | 0.063 * | 0.064 * |

| (0.031) | (0.035) | (0.031) | (0.032) | |

| Information sharing | 0.381 *** | 0.042 | 0.387 *** | 0.396 *** |

| (0.057) | (0.097) | (0.058) | (0.058) | |

| Manager experience | −0.017 * | 0.009 | −0.017 * | −0.017 * |

| (0.007) | (0.011) | (0.007) | (0.007) | |

| Subindustry | Controlled | Controlled | Controlled | Controlled |

| Constant | −3.582 *** | −6.482 *** | 5.164 | 5.480 |

| (0.875) | (1.160) | (3.375) | (3.364) | |

| N | 850 | 850 | 850 | 850 |

| (16) | (17) | (18) | (19) | (20) | |

|---|---|---|---|---|---|

| DIVC | DIVC | GVC Embeddedness | DIVC | DIVC | |

| Value chain digitalization | 0.352 *** | 0.351 *** | 0.138 * | −1.477 * | −1.510 * |

| (0.053) | (0.054) | (0.068) | (0.716) | (0.709) | |

| GVC embeddedness | 0.466 * | 0.426 + | −3.421 | ||

| (0.232) | (0.230) | (2.215) | |||

| Value chain digitalization× | 0.019 * | 0.019 ** | |||

| Product diversification | (0.007) | (0.007) | |||

| GVC embeddedness × | 0.041 + | ||||

| Product diversification | (0.023) | ||||

| Product diversification | 0.004 | 0.007 | 0.015 | −0.083 * | −0.091 * |

| (0.015) | (0.016) | (0.018) | (0.037) | (0.037) | |

| Firm age | 0.073 | 0.156 | 0.367 | 0.103 | 0.015 |

| (0.368) | (0.381) | (0.418) | (0.382) | (0.360) | |

| Firm size | 0.076 | −0.048 | −0.568 | 0.008 | 0.165 |

| (0.558) | (0.579) | (0.653) | (0.583) | (0.547) | |

| R&D | 0.163 | 0.150 | −0.156 | 0.149 | 0.168 |

| (0.136) | (0.138) | (0.210) | (0.138) | (0.136) | |

| Financial constraints | −0.095 | 0.127 | 1.074 | 0.028 | −0.256 |

| (1.030) | (1.068) | (1.212) | (1.074) | (1.012) | |

| Political connections | 0.043 | 0.032 | −0.048 | 0.034 | 0.049 |

| (0.058) | (0.060) | (0.065) | (0.060) | (0.057) | |

| Information sharing | 0.383 *** | 0.397 *** | 0.018 | 0.401 *** | 0.393 *** |

| (0.076) | (0.077) | (0.113) | (0.078) | (0.077) | |

| Manager experience | −0.017 | −0.025 | −0.040 | −0.022 | −0.012 |

| (0.036) | (0.037) | (0.043) | (0.037) | (0.035) | |

| Subindustry | Controlled | Controlled | Controlled | Controlled | Controlled |

| IMR | 0.036 | −0.473 | −4.051 | −0.228 | 0.491 |

| (2.596) | (2.689) | (3.182) | (2.706) | (2.545) | |

| Constant | −4.028 | −1.270 | 13.968 | 6.076 | 2.755 |

| (13.175) | (13.652) | (15.826) | (14.065) | (13.218) | |

| N | 734 | 734 | 734 | 734 | 734 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Qin, L.; Xie, W.; Jia, P. Value Chain Digitalization, Global Value Chain Embeddedness, and Distributed Innovation in Value Chains. Sustainability 2024, 16, 2845. https://doi.org/10.3390/su16072845

Qin L, Xie W, Jia P. Value Chain Digitalization, Global Value Chain Embeddedness, and Distributed Innovation in Value Chains. Sustainability. 2024; 16(7):2845. https://doi.org/10.3390/su16072845

Chicago/Turabian StyleQin, Lingling, Weihong Xie, and Peiyi Jia. 2024. "Value Chain Digitalization, Global Value Chain Embeddedness, and Distributed Innovation in Value Chains" Sustainability 16, no. 7: 2845. https://doi.org/10.3390/su16072845