Impacts of Carbon Border Adjustment Mechanism on the Development of Chinese Steel Enterprises and Government Management Decisions: A Tripartite Evolutionary Game Analysis

Abstract

1. Introduction

2. Literature Review

2.1. The Current State of Research on the Impact of the CBAM on China

2.2. The Current State of Research on Carbon Tax Policies

2.3. The Application of Evolutionary Game Theory in the Steel Industry

2.4. Summary

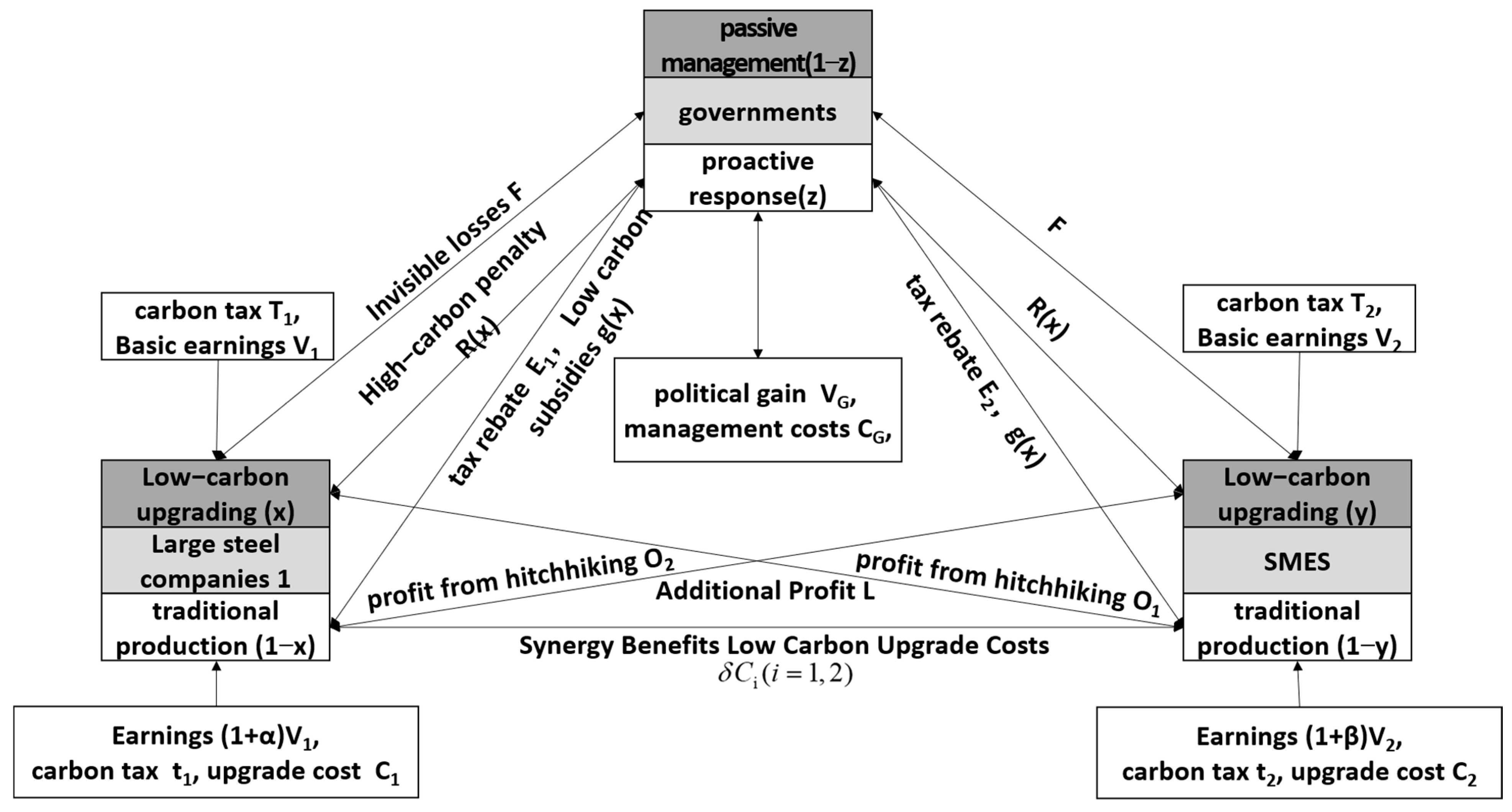

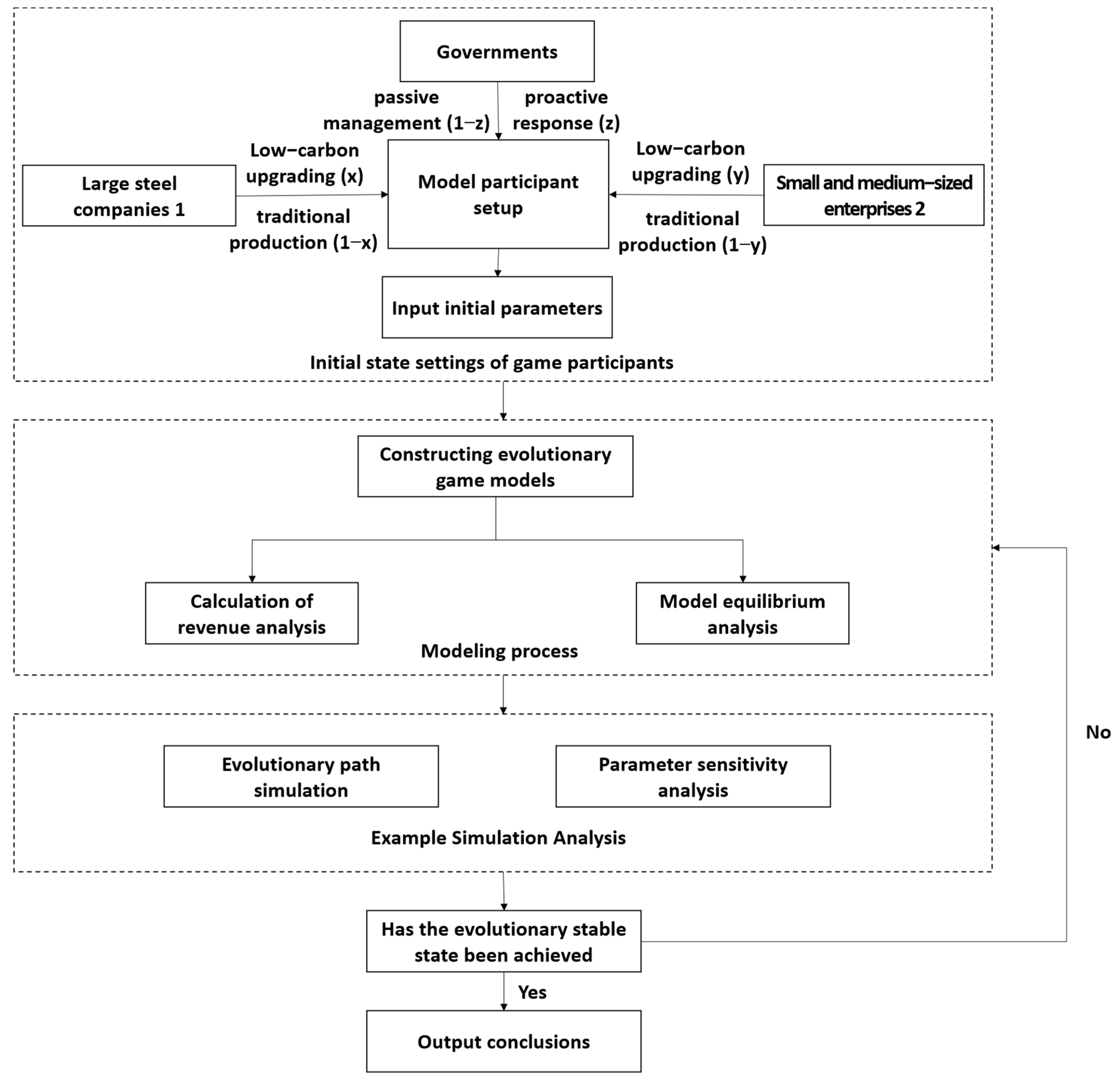

3. Construction of a Tripartite Evolutionary Model

3.1. Description of the Problem

3.2. Methodological Design

3.3. Model Assumptions

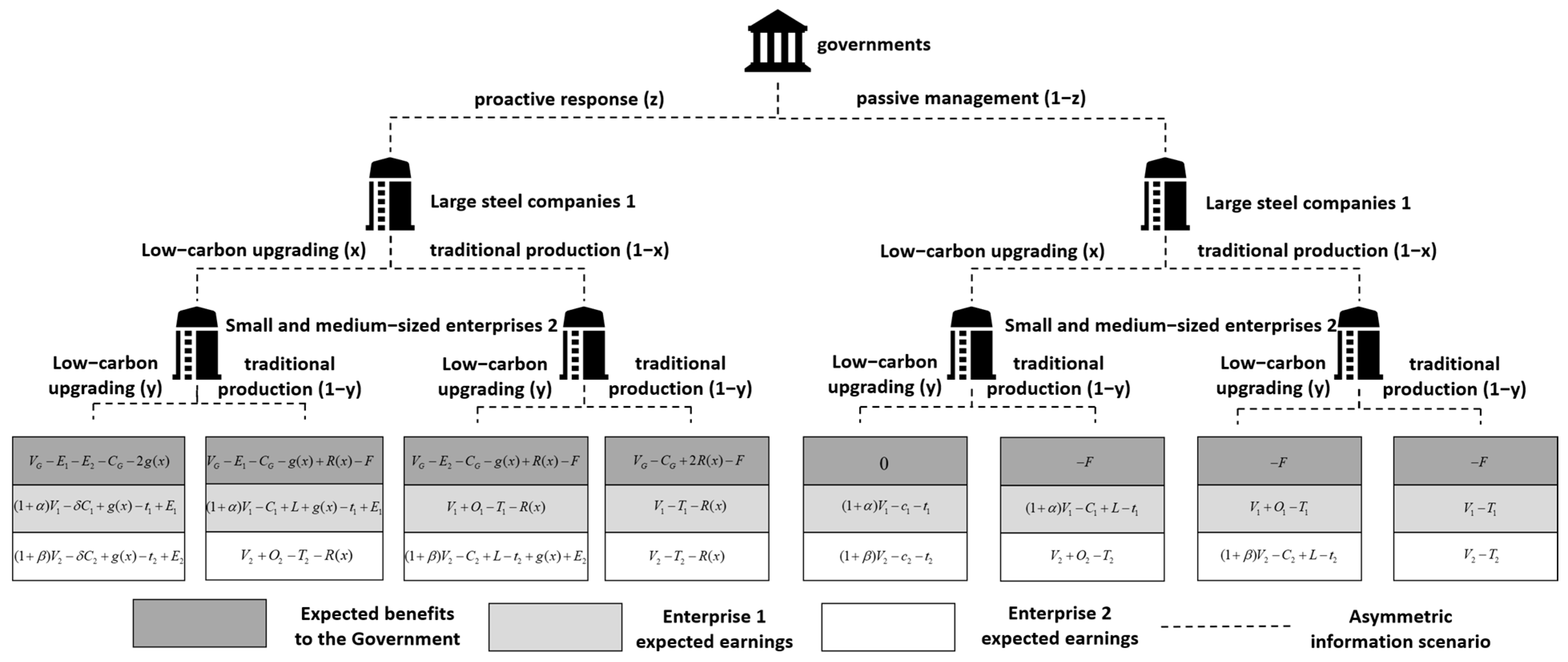

4. Model Analysis

4.1. Analysis of Replication Dynamics

- 1.

- Large Steel Enterprise 1

- 2.

- Small- and Medium-Sized Steel Companies, 2

- 3.

- Government

4.2. Stable Equilibrium Analysis

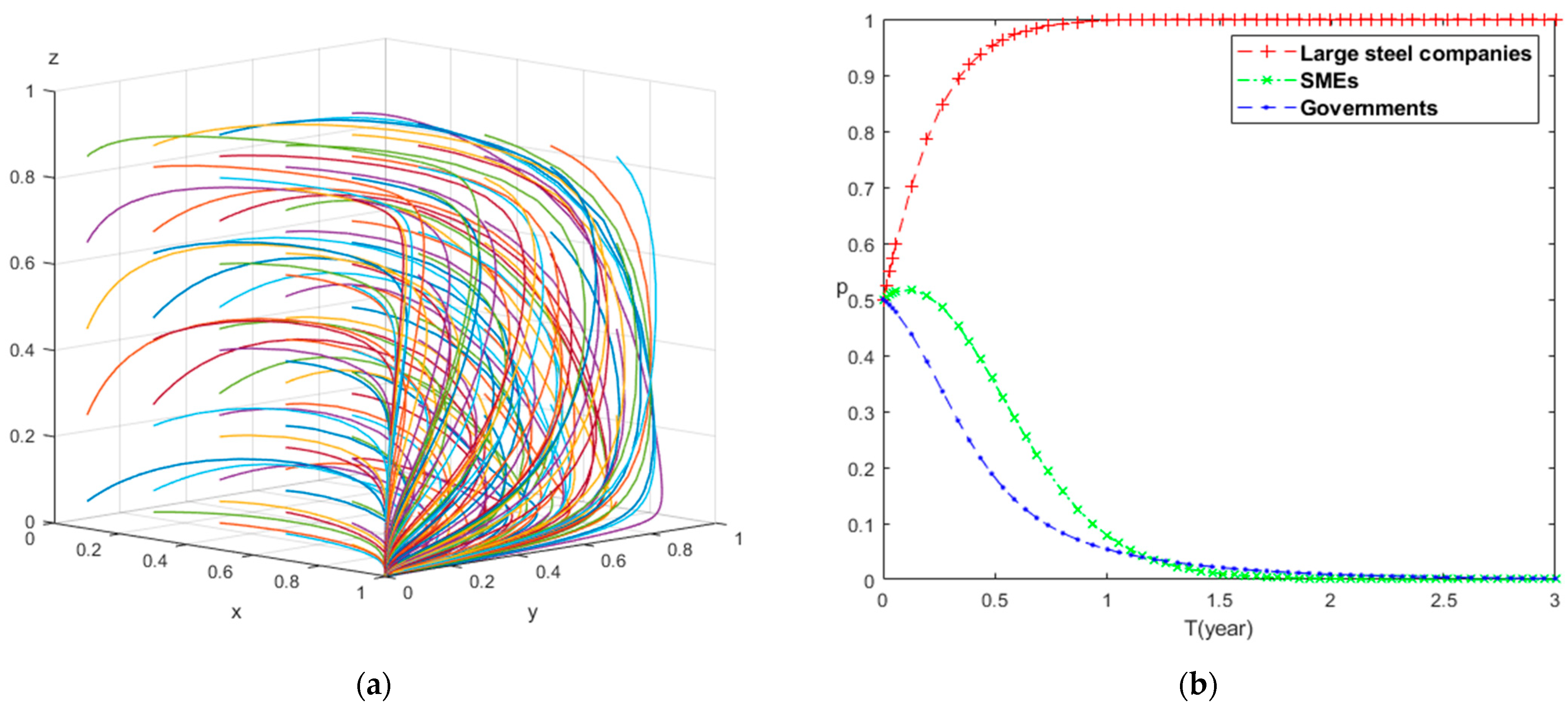

5. Evolutionary Numerical Modeling Simulation

5.1. Parameter Sources and Settings

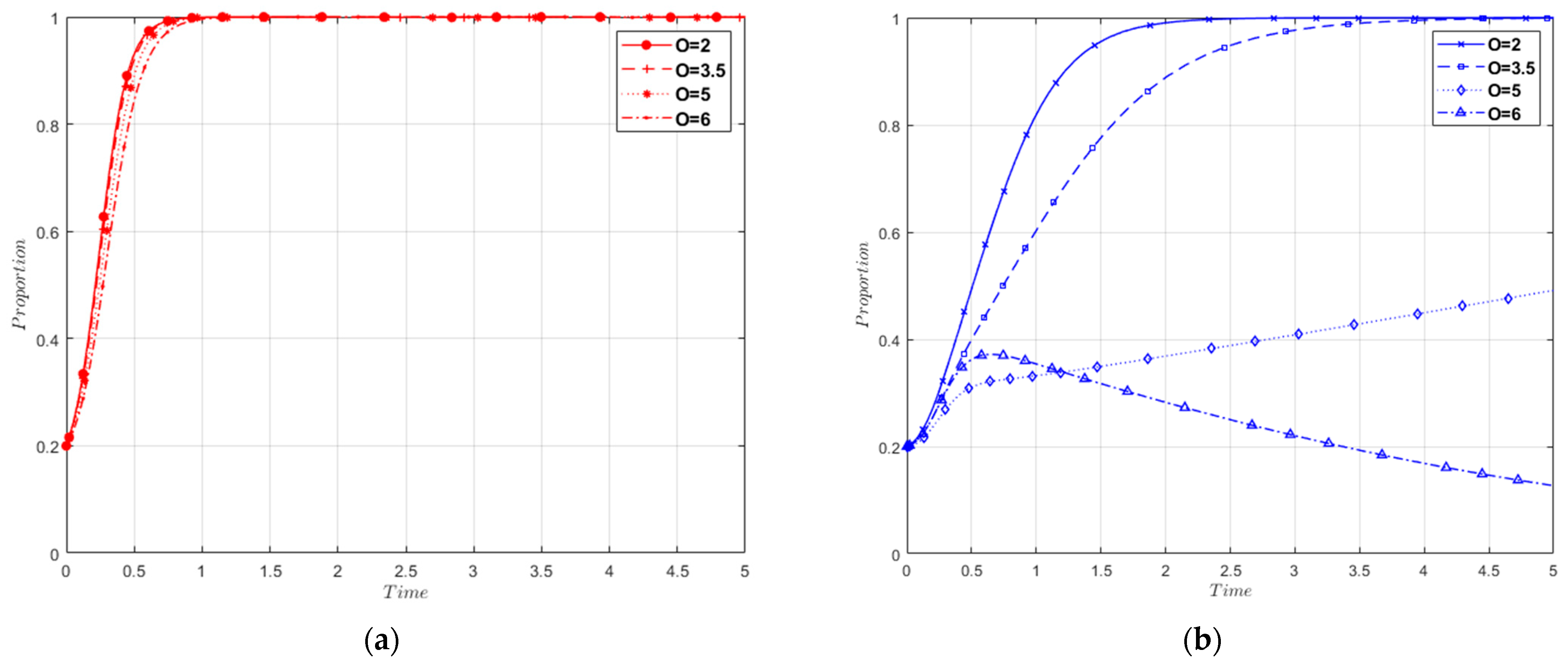

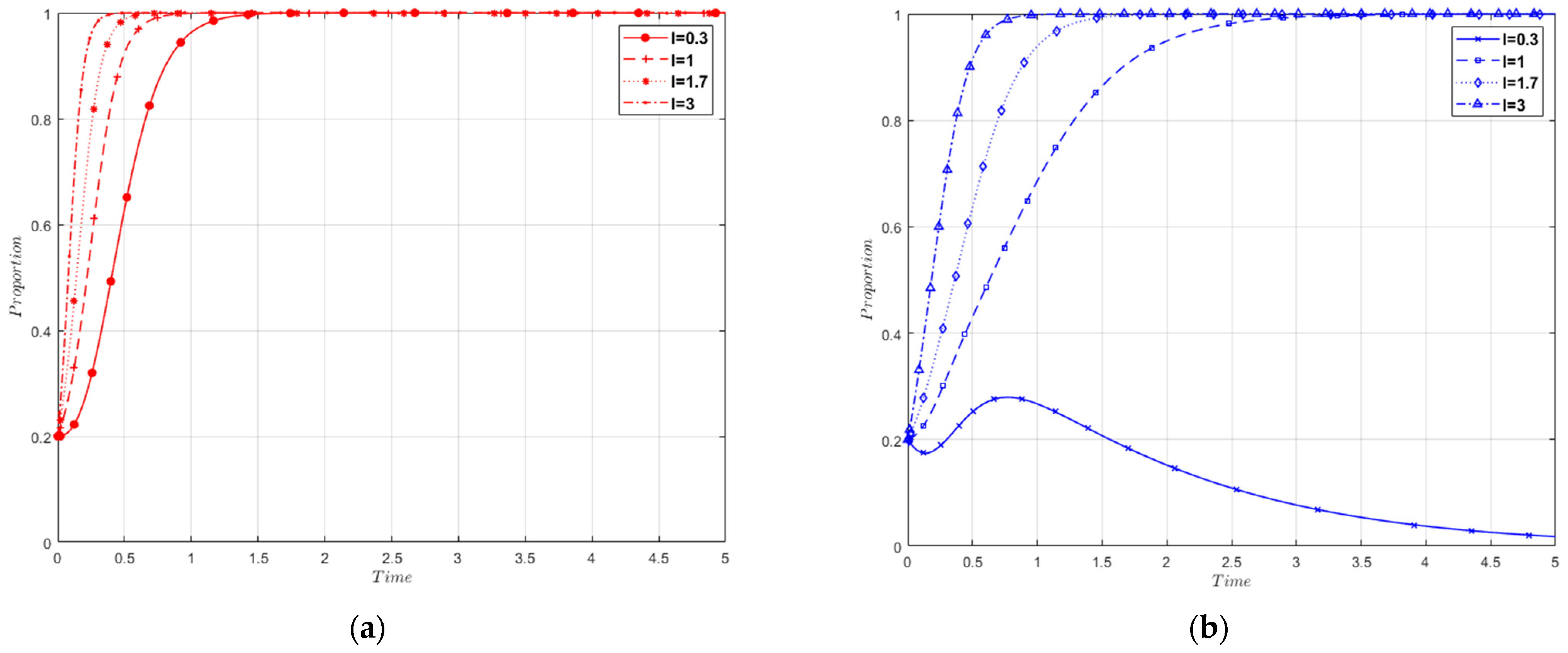

5.2. Results of Evolutionary Paths at Different Stages

- (1)

- The evolutionary paths of stakeholders during the CBAM window stage are as follows:

- (2)

- Evolutionary Paths of Stakeholders in the CBAM Transition Stage

- (3)

- Stakeholder Evolutionary Paths in the CBAM Implementation Phase

- (4)

- Stakeholder Evolutionary Paths in the CBAM Enhancement Phase

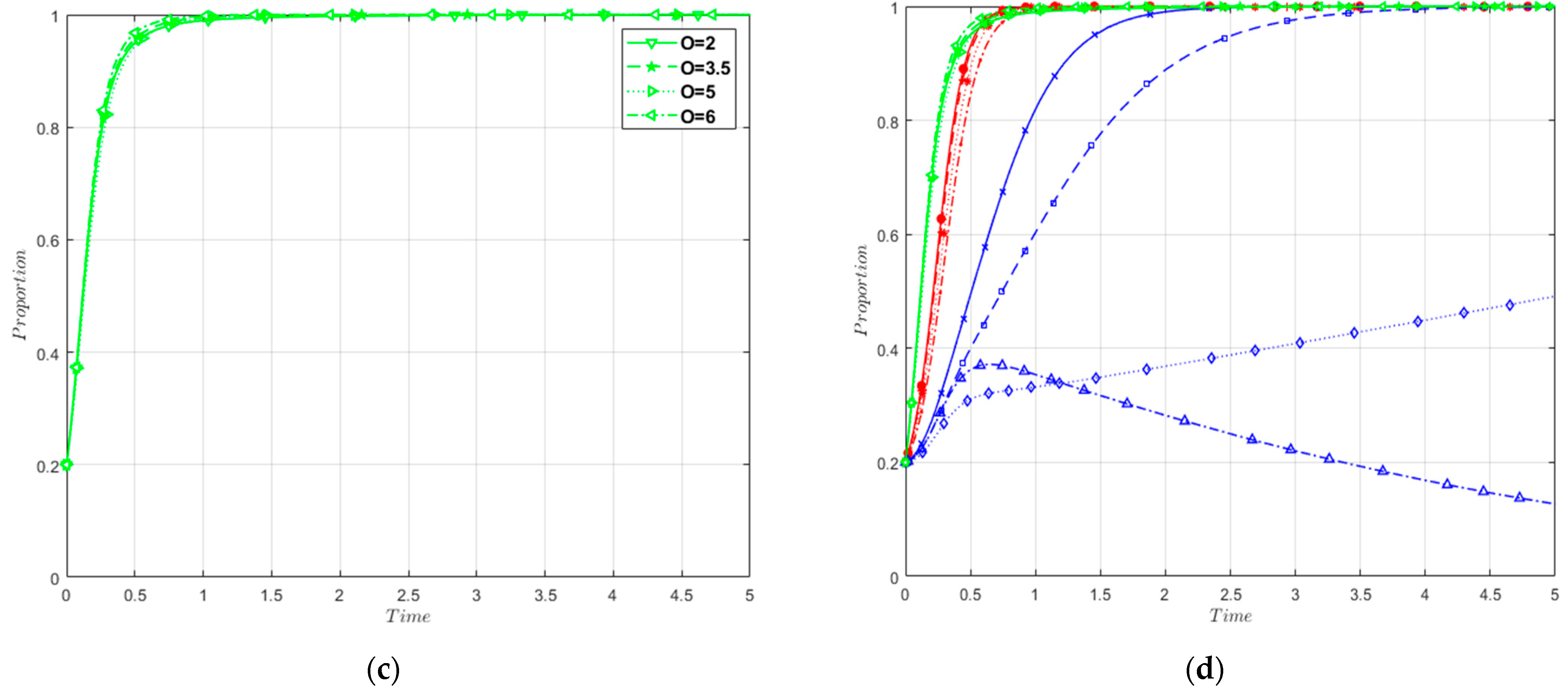

5.3. Sensitivity Analysis of Key Variables to Tripartite Evolutionary Systems

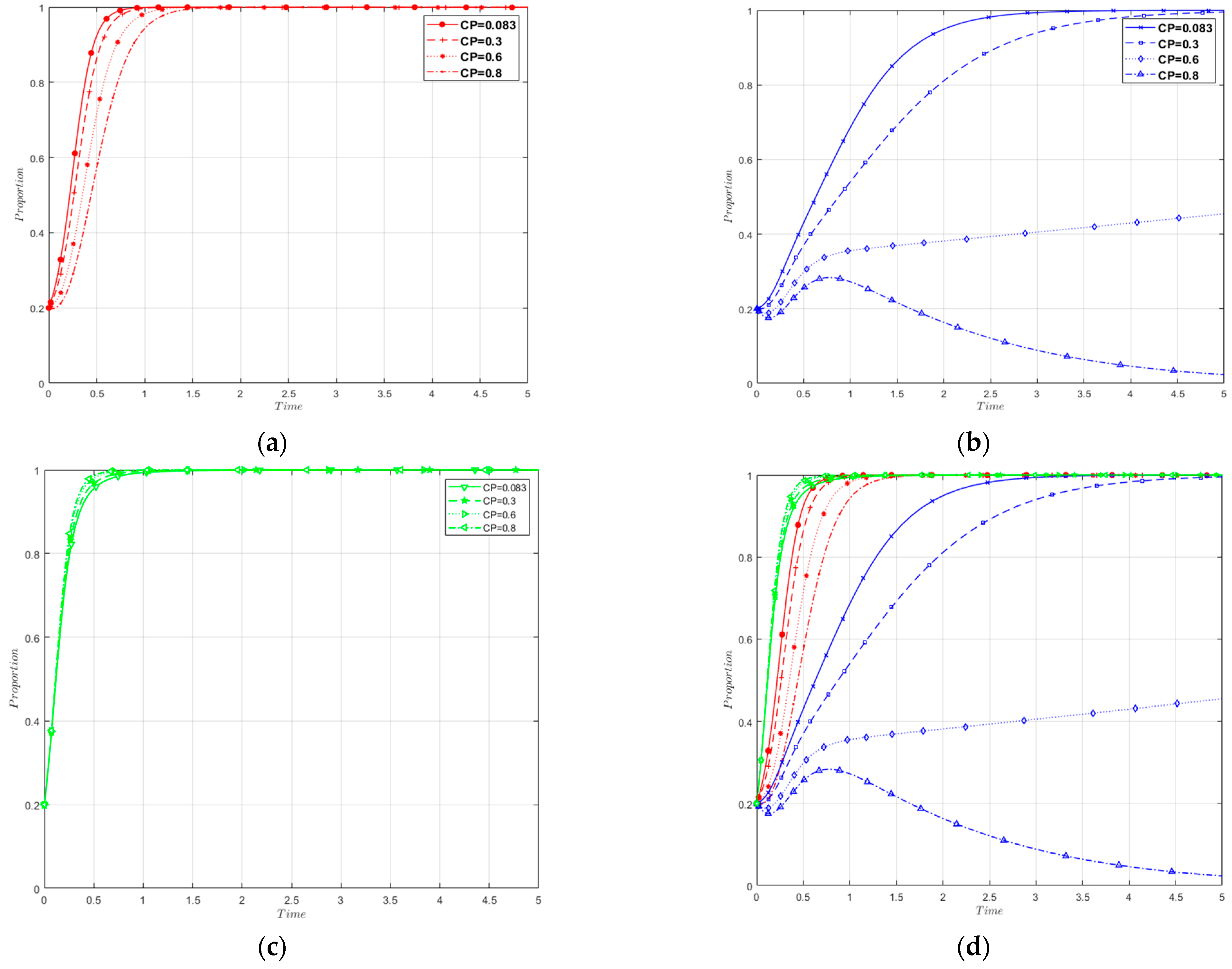

- (1)

- Impact of Changes in Free-Riding Effect

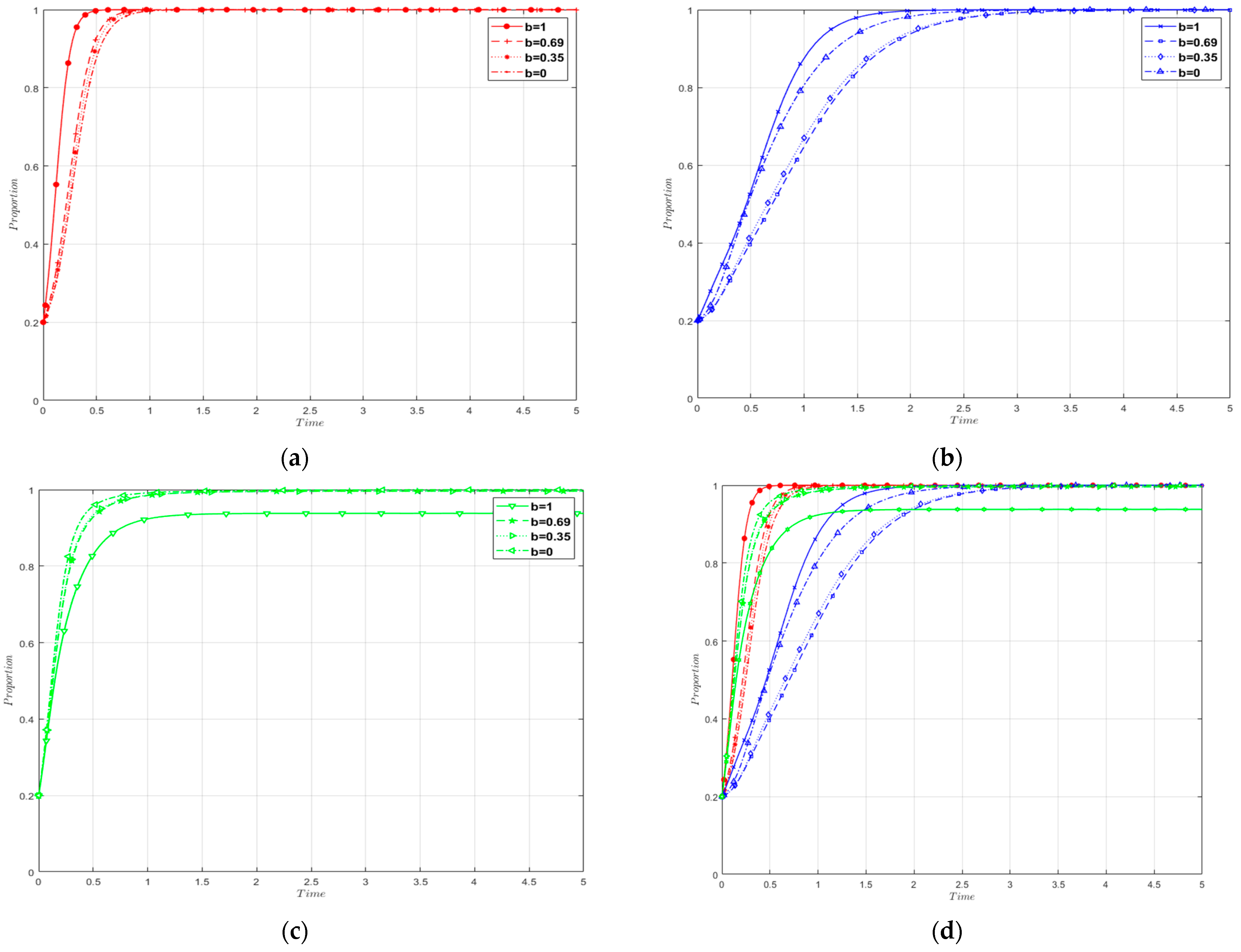

- (2)

- The Impact of Changes in the Chinese Carbon Market Prices

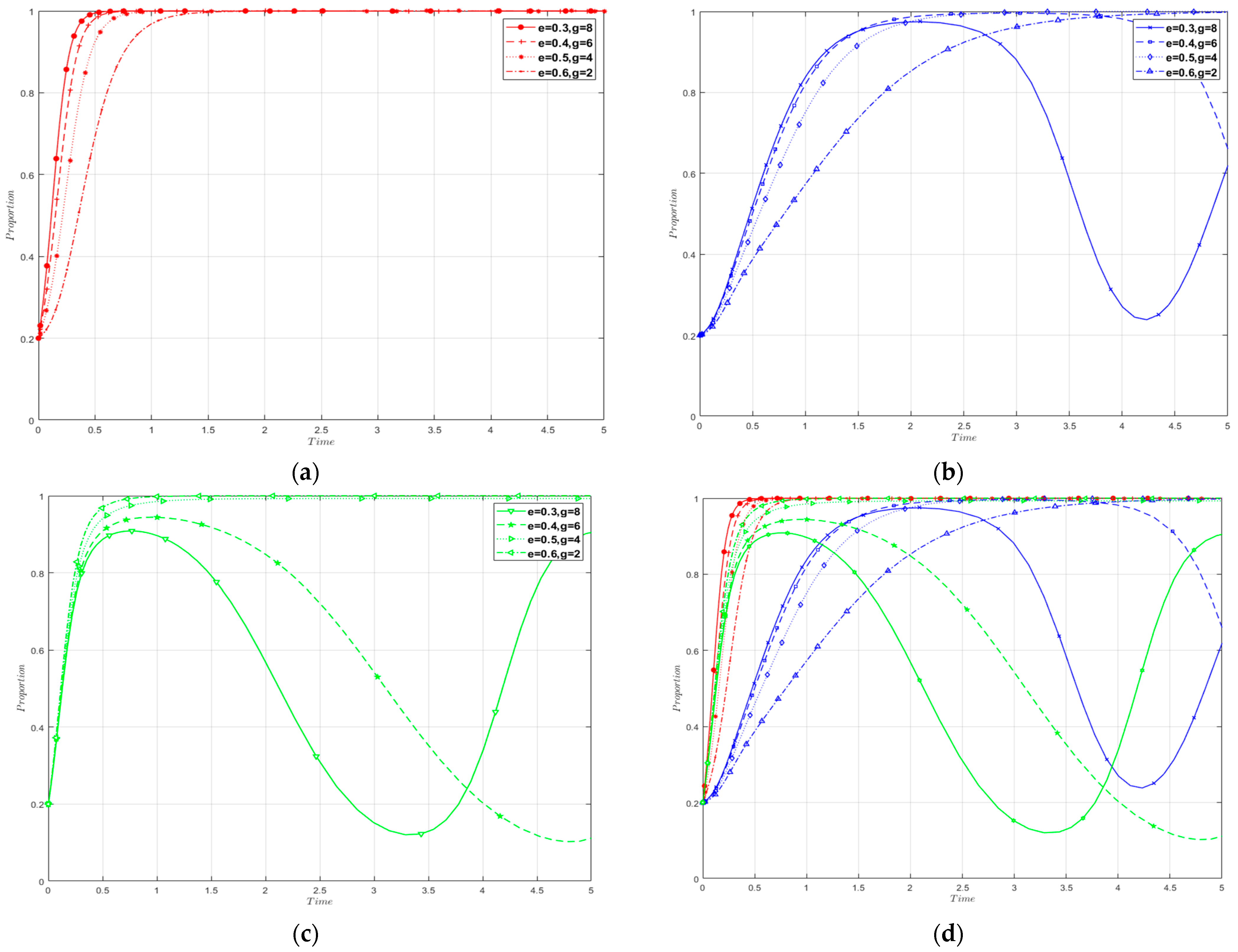

- (3)

- The Impact of Changes in the EU’s Free Carbon Allowances

- (4)

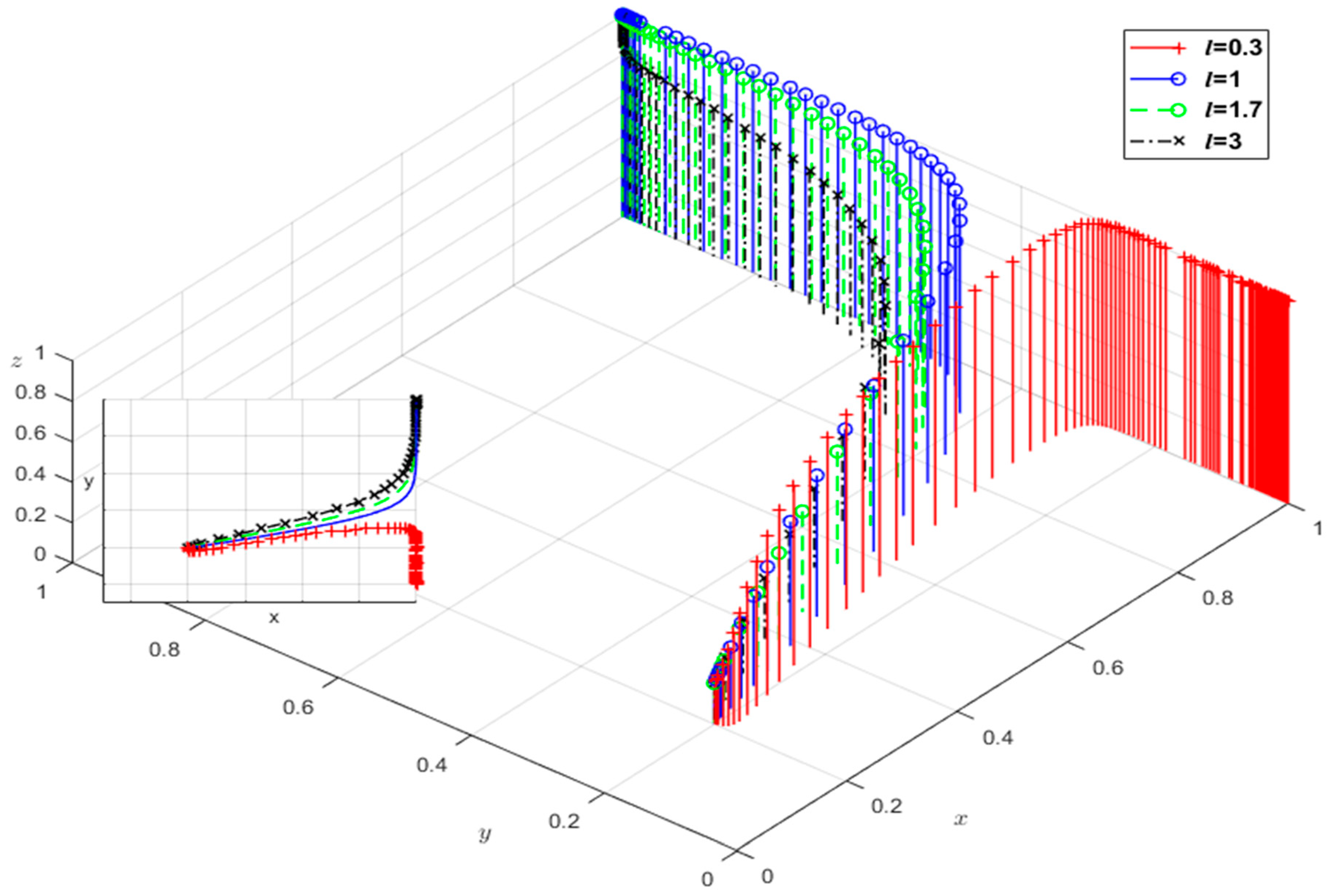

- The Impact of Dynamic Subsidy Intensity Changes by the Government

6. Discussion

7. Conclusions

7.1. Results

- (1)

- The larger-scale steel enterprises are more significantly impacted by the CBAM and exhibit higher sensitivity to policies. This results in larger-scale steel enterprises prioritizing low-carbon upgrade strategies, leading to shorter decision stability times. As the CBAM matures and is implemented, government management strategies transition from passive management to active response. During the CBAM strengthening phase, constrained by fiscal expenditures and changes in enterprise behavior, governments ultimately opt for passive strategies. This finding is consistent with the research outcomes of Raudla et al. [67], which suggests that government management choices are constrained by fiscal and policy factors. Additionally, the decision-making of small- and medium-sized enterprises relies more on government management strategies.

- (2)

- The issue of free-riding benefits emerges as a significant impediment to an enterprise’s adoption of low-carbon upgrades. Excessive benefits derived from free-riding may perpetuate enterprises’ adherence to high-carbon production practices, thereby exacerbating environmental strain. Effective mitigation of this issue necessitates enhanced governmental oversight and intervention to curtail inter-enterprise free-riding benefits. By carrying this out, a conducive environment for small- and medium-sized enterprises to undertake low-carbon transformation and upgrading initiatives is ensured.

- (3)

- The export volume of steel products plays a decisive role in enterprises’ decisions to pursue low-carbon upgrades. As the export volume increases, steel enterprises tend to make the decision to upgrade to low-carbon production in shorter timeframes and at faster rates. However, higher export volumes may lead to excessive fiscal expenditures on tax refunds by the government. Excessive fiscal expenditures hinder the government’s proactive response to the CBAM, thereby slowing down the evolution of the system toward stability. This conclusion aligns with the findings of Zhou et al. [68], indicating that excessive fiscal expenditures impede the government’s proactive attitude toward regulations, exacerbate environmental degradation, and undermine the sustainable development of local environments.

- (4)

- As the CBAM legislation is progressively implemented, the gradual reduction in free carbon allowances by the European Union will not exert a decisive influence on the decision-making of the three parties involved. Instead, it will only alter the time required to evolve toward a stable state. With the reduction in free carbon allowances, the time needed to reach a stable state will be prolonged.

- (5)

- The increase in carbon market prices in China serves as an effective measure to address the CBAM. As the Chinese carbon market gradually matures and the gap between domestic carbon prices and EU carbon prices narrows, the increase becomes more conducive to alleviating the economic pressure brought about by the CBAM. The rate of evolution of enterprises slows down, and with the increase in carbon prices, the impact of the CBAM on the production structure of Chinese domestic steel enterprises diminishes.

- (6)

- Government dynamic subsidies and penalties for enterprises should be optimized within a certain range. In the model, low-carbon subsidies at levels between 2 and 4 produce the optimal incentives and punitive effects with minimal fiscal expenditure. Excessive penalties or subsidies are not conducive to the sustainable development of enterprises’ choices for low-carbon production modes, as they can exacerbate the financial burden on both enterprises and the government. This conclusion is consistent with the research findings of Wang et al. [69] Small- and medium-sized steel enterprises exhibit greater sensitivity to government policies, resulting in their evolution being influenced by changes in government strategies.

7.2. Policy Implications

- (1)

- To prevent free-riding phenomena and expedite the low-carbon transformation of steel enterprises, the government should enact effective environmental policies and regulations. This includes establishing an accelerated system for low-carbon standards, increasing government attention to the sustainable development of the steel market, and implementing regulations that raise the costs of free-riding for both small and large enterprises. By minimizing the benefits derived from free-riding behavior, the government can reduce instances of free-riding, thereby facilitating the low-carbon transition of enterprises and safeguarding the environmental sustainability of businesses.

- (2)

- Enhancing the mechanism of China’s carbon trading market and narrowing the gap between Chinese and international carbon prices are essential steps. Establishing a robust carbon pricing mechanism and gradually integrating the steel industry into the Chinese carbon market will provide a stable external environment for the sustainable development of the steel sector. Additionally, this will help alleviate the carbon tax pressure resulting from the CBAM’s implementation. Moreover, it will ensure that products from steel enterprises maintain high competitiveness in the international market.

- (3)

- The government should implement appropriate penalties and fiscal support to encourage enterprises to transition toward strategies of “low-carbon upgrading” and actively engage in industrial low-carbon upgrade reforms. When providing subsidies and penalties, the government should adopt a graded approach based on the scale of different enterprises to determine the levels of penalties and low-carbon subsidies. This measure aims to prevent individual enterprises from exploiting low-carbon subsidies while also avoiding additional fiscal pressure on the government due to high levels of fiscal expenditure. Through appropriate penalty and subsidy measures, the government can incentivize the entire steel industry to undergo low-carbon upgrades, thereby leveraging its regulatory guidance role to steer enterprises from high-carbon production toward low-carbon sustainable development.

7.3. Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Nomenclature

| Basic corporate earnings | |

| Enterprise 2 input–output ratio | |

| Synergy coefficient | |

| Share of low-carbon enterprises | |

| Maximum penalty | |

| Length, m | |

| Upgraded emission intensity | |

| Export volume | |

| CBAM free carbon allowance | |

| China carbon trading price | |

| Low-carbon production CBAM tax | |

| Government management costs | |

| High-carbon hidden losses | |

| Enterprise 1 input–output ratio | |

| Low-carbon upgrade costs | |

| Additional benefits | |

| Maximum government subsidy | |

| Profit from hitchhiking | |

| Width, m | |

| Conventional emission intensity | |

| European steel emission intensity | |

| EU carbon trading price | |

| Traditional production CBAM taxes | |

| Chinese government political gains | |

| Tax rebate | |

References

- Beck, U.R.; Kruse-Andersen, P.K.; Stewart, L.B. Carbon leakage in a small open economy: The importance of international climate policies. Energy Econ. 2023, 117, 106447. [Google Scholar] [CrossRef]

- European Union. Commission Implementing Regulation (EU) 2023/1773 of 17 August 2023 laying down the rules for the application of Regulation (EU) 2023/956 of the European Parliament and of the Council as Regards Reporting Obligations for the Purposes of the Carbon Border Adjustment Mechanism during the Transitional Period. Off. J. Eur. Union 2023, 228, 94–195. Available online: http://data.europa.eu/eli/reg_impl/2023/1773/oj (accessed on 25 December 2021).

- Carbon Border Adjustment Mechanism. Available online: https://ec.europa.eu/taxation_customs/green-taxation-0/carbon-border-adjustment-mechanism_en (accessed on 25 December 2021).

- Xu, J.; Lu, C.; Ruan, S.; Xiong, N.N. Estimating the efficiency and potential of China’s steel products export to countries along the “Belt and Road” under interconnection: An application of extended stochastic frontier gravity model. Resour. Policy 2022, 75, 102513. [Google Scholar] [CrossRef]

- Zhu, N.; Qian, L.; Jiang, D.; Mbroh, N. A simulation study of China’s imposing carbon tax against American carbon tariffs. J. Clean. Prod. 2020, 243, 118467. [Google Scholar] [CrossRef]

- Calı, M.; Ghose, D.; Montfaucon, A.F.L.; Ruta, M. Trade Policy and Exporters’ Resilience: Evidence from Indonesia; The World Bank: Washington, DC, USA, 2022. [Google Scholar]

- Ren, Y.; Liu, G.; Shi, L. The EU Carbon Border Adjustment Mechanism will exacerbate the economic-carbon inequality in the plastic trade. J. Environ. Manag. 2023, 332, 117302. [Google Scholar] [CrossRef] [PubMed]

- Marron, D.B.; Toder, E.J. Tax policy issues in designing a carbon tax. Am. Econ. Rev. 2014, 104, 563–568. [Google Scholar] [CrossRef]

- Khastar, M.; Aslani, A.; Nejati, M. How does carbon tax affect social welfare and emission reduction in Finland? Energy Rep. 2020, 6, 736–744. [Google Scholar] [CrossRef]

- Mildenberger, M.; Lachapelle, E.; Harrison, K.; Stadelmann-Steffen, I. Limited impacts of carbon tax rebate programmes on public support for carbon pricing. Nat. Clim. Chang. 2022, 12, 141–147. [Google Scholar] [CrossRef]

- Nong, D.; Simshauser, P.; Nguyen, D.B. Greenhouse gas emissions vs CO2 emissions: Comparative analysis of a global carbon tax. Appl. Energy 2021, 298, 117223. [Google Scholar] [CrossRef]

- Perdana, S.; Vielle, M. Making the EU Carbon Border Adjustment Mechanism acceptable and climate friendly for least developed countries. Energy Policy 2022, 170, 113245. [Google Scholar] [CrossRef]

- Overland, I.; Sabyrbekov, R. Know your opponent: Which countries might fight the European carbon border adjustment mechanism? Energy Policy 2022, 169, 113175. [Google Scholar] [CrossRef]

- Tarr, D.G.; Kuznetsov, D.E.; Overland, I.; Vakulchuk, R. Why carbon border adjustment mechanisms will not save the planet but a climate club and subsidies for transformative green technologies may. Energy Econ. 2023, 122, 106695. [Google Scholar] [CrossRef]

- Bellora, C.; Fontagné, L. EU in search of a Carbon Border Adjustment Mechanism. Energy Econ. 2023, 123, 106673. [Google Scholar] [CrossRef]

- Jakob, M. Why carbon leakage matters and what can be done against it. One Earth 2021, 4, 609–614. [Google Scholar] [CrossRef]

- Rossetto, D. The carbon border adjustment mechanism: What does it mean for steel recycling? Sustain. Horiz. 2023, 5, 100048. [Google Scholar] [CrossRef]

- Rossetto, D. The long-term feasibility of border carbon mechanisms: An analysis of measures proposed in the European Union and the United States and the steel production sector. Sustain. Horiz. 2023, 6, 100053. [Google Scholar] [CrossRef]

- Hofbauer, J.; Sigmund, K. Evolutionary Games and Population Dynamics; Cambridge University Press: Cambridge, UK, 1998. [Google Scholar]

- Liu, Z.; Qian, Q.; Hu, B.; Shang, W.-L.; Li, L.; Zhao, Y.; Zhao, Z.; Han, C. Government regulation to promote coordinated emission reduction among enterprises in the green supply chain based on evolutionary game analysis. Resour. Conserv. Recycl. 2022, 182, 106290. [Google Scholar] [CrossRef]

- Wang, J.; Qin, Y.; Zhou, J. Incentive policies for prefabrication implementation of real estate enterprises: An evolutionary game theory-based analysis. Energy Policy 2021, 156, 112434. [Google Scholar] [CrossRef]

- Ma, L.; Zhang, L. Evolutionary game analysis of construction waste recycling management in China. Resour. Conserv. Recycl. 2020, 161, 104863. [Google Scholar] [CrossRef]

- Gu, R.; Guo, J.; Huang, Y.; Wu, X. Impact of the EU carbon border adjustment mechanism on economic growth and resources supply in the BASIC countries. Resour. Policy 2023, 85, 104034. [Google Scholar] [CrossRef]

- Lin, B.; Zhao, H. Evaluating current effects of upcoming EU Carbon Border Adjustment Mechanism: Evidence from China’s futures market. Energy Policy 2023, 177, 113573. [Google Scholar] [CrossRef]

- Qi, S.; Xu, Z.; Yang, Z. China’s carbon allowance allocation strategy under the EU carbon border adjustment mechanism: An integrated non-parametric cost frontier approach. Sci. Total Environ. 2022, 831, 154908. [Google Scholar] [CrossRef] [PubMed]

- Yang, C.; Yan, X. Impact of carbon tariffs on price competitiveness in the era of global value chain. Appl. Energy 2023, 336, 120805. [Google Scholar] [CrossRef]

- Yu, Y.Y.; Liu, L.J.; Wang, H.J. Who is most affected by carbon tax? Evidence from Chinese residents in the context of aging. Energy Policy 2024, 185, 113956. [Google Scholar] [CrossRef]

- Naef, A. The impossible love of fossil fuel companies for carbon taxes. Ecol. Econ. 2024, 217, 108045. [Google Scholar] [CrossRef]

- Wang, Z.J.; Zhou, R.F.; Ma, Y.F.; Wang, Y.J. Carbon tax and low-carbon credit: Which policy is more beneficial to the capital-constrained manufacturer’s remanufacturing activities? Environ. Res. 2024, 246, 118079. [Google Scholar] [CrossRef] [PubMed]

- Lamb, W.F.; Antal, M.; Bohnenberger, K.; Brand-Correa, L.I.; Müller-Hansen, F.; Jakob, M.; Minx, J.C.; Raiser, K.; Williams, L.; Sovacool, B.K. What are the social outcomes of climate policies? A systematic map and review of the ex-post literature. Environ. Res. Lett. 2020, 15, 113006. [Google Scholar] [CrossRef]

- Von Neumann, J.; Morgenstern, O. Theory of Games and Economic Behavior, 2nd ed.; Princeton University Press: Princeton, NJ, USA, 1947. [Google Scholar]

- Zhou, W.; Zhao, T.; Cao, X.; Li, J. Government regulation, horizontal coopetition, and low-carbon technology innovation: A tripartite evolutionary game analysis of government and homogeneous energy enterprises. Energy Policy 2024, 184, 113844. [Google Scholar] [CrossRef]

- Meng, L.; Liu, K.; He, J.; Han, C.; Liu, P. Carbon emission reduction behavior strategies in the ship** industry under government regulation: A tripartite evolutionary game analysis. J. Clean. Prod. 2022, 378, 134556. [Google Scholar] [CrossRef]

- Yuan, M.; Li, Z.; Li, X.; Li, L.; Zhang, S.; Luo, X. How to promote the sustainable development of prefabricated residential buildings in China: A tripartite evolutionary game analysis. J. Clean. Prod. 2022, 349, 131423. [Google Scholar] [CrossRef]

- Zhang, C.; Zhang, X. Evolutionary game analysis of air pollution co-investment in emission reductions by steel enterprises under carbon quota trading mechanism. J. Environ. Manag. 2022, 317, 115376. [Google Scholar] [CrossRef]

- Liu, Y.; Cui, M.; Gao, X. Building up scrap steel bases for perfecting scrap steel industry chain in China: An evolutionary game perspective. Energy 2023, 278, 127742. [Google Scholar] [CrossRef]

- Zhang, Y.; He, Q. Evolutionary game analysis and computer simulation of iron ore price negotiation. In Proceedings of the 2013 6th International Conference on Information Management, Innovation Management and Industrial Engineering, Xi’an, China, 23–24 November 2013; Volume 1, pp. 409–412. [Google Scholar]

- Lin, M.; Liu, S.Q.; Luo, K.; Burdett, R. Dynamic incentives to promote green production of the iron and steel industry in the post-pandemic period. Ann. Oper. Res. 2023, 1–37. [Google Scholar] [CrossRef]

- Han, S. Strongly robust equilibrium and competing-mechanism games. J. Econ. Theory 2007, 137, 610–626. [Google Scholar] [CrossRef]

- Hu, J. Synergistic effect of pollution reduction and carbon emission mitigation in the digital economy. J. Environ. Manag. 2023, 337, 117755. [Google Scholar] [CrossRef] [PubMed]

- Muslemani, H.; Liang, X.; Kaesehage, K.; Ascui, F.; Wilson, J. Opportunities and challenges for decarbonizing steel production by creating markets for ‘green steel’products. J. Clean. Prod. 2021, 315, 128127. [Google Scholar] [CrossRef]

- Uyarra, E.; Shapira, P.; Harding, A. Low carbon innovation and enterprise growth in the UK: Challenges of a place-blind policy mix. Technol. Forecast. Soc. Chang. 2016, 103, 264–272. [Google Scholar] [CrossRef]

- Zhang, Z.; Shang, Y.; Zhang, G.; Shao, S.; Fang, J.; Li, P.; Song, S. The pollution control effect of the atmospheric environmental policy in autumn and winter: Evidence from the daily data of Chinese cities. J. Environ. Manag. 2023, 343, 118164. [Google Scholar] [CrossRef] [PubMed]

- Xu, S.; Tang, H.; Lin, Z.; Lu, J. Pricing and sales-effort analysis of dual-channel supply chain with channel preference, cross-channel return and free riding behavior based on revenue-sharing contract. Int. J. Prod. Econ. 2022, 249, 108506. [Google Scholar] [CrossRef]

- Schreurs, M.A.; Economy, E. (Eds.) The Internationalization of Environmental Protection; Cambridge University Press: Cambridge, UK, 1997. [Google Scholar]

- Gaines, S.E. Rethinking Environmental Protection, Competitiveness, and International Trade. Univ. Chic. Lagal Forum 1997, 1997, 9. [Google Scholar]

- Weiss, E.B.; Jacobson, H.K. (Eds.) Engaging Countries: Strengthening Compliance with International Environmental Accords; MIT Press: Cambridge, MA, USA, 2000. [Google Scholar]

- Ekins, P.; Speck, S. Competitiveness and exemptions from environmental taxes in Europe. Environ. Resour. Econ. 1999, 13, 369–396. [Google Scholar] [CrossRef]

- Liang, Q.M.; Wang, T.; Xue, M.M. Addressing the competitiveness effects of taxing carbon in China: Domestic tax cuts versus border tax adjustments. J. Clean. Prod. 2016, 112, 1568–1581. [Google Scholar] [CrossRef]

- Landrigan, P.J.; Fuller, R. Environmental pollution: An enormous and invisible burden on health systems in low-and middle-income counties. World Hosp. Health Serv. 2012, 50, 35. [Google Scholar]

- National Research Council. Hidden Costs of Energy: Unpriced Consequences of Energy Production and Use; National Academies Press: Washington, DC, USA, 2010. [Google Scholar]

- Nilsson, U.S.; Uggla, C.; Wainwright, J. A dynamical systems approach to geodesics in Bianchi cosmologies. Gen. Relativ. Gravit. 2000, 32, 1319–1343. [Google Scholar] [CrossRef]

- Lyapunov, A.M. The general problem of the stability of motion. Int. J. Control 1992, 55, 531–534. [Google Scholar] [CrossRef]

- Ritzberger, K.; Weibull, J.W. Evolutionary selection in normal-form games. Econom. J. Econom. Soc. 1995, 63, 1371–1399. [Google Scholar] [CrossRef]

- Chen, G. Impact of carbon border adjustment mechanism on China’s manufacturing sector: A dynamic recursive CGE model based on an evolutionary game. J. Environ. Manag. 2023, 347, 119029. [Google Scholar] [CrossRef] [PubMed]

- Jiang, S.; Wei, X.; Jia, J.; Ma, G. Toward sustaining the development of green residential buildings in China: A tripartite evolutionary game analysis. Build. Environ. 2022, 223, 109466. [Google Scholar] [CrossRef]

- Lin, B.; Zhang, A. Government subsidies, market competition and the TFP of new energy enterprises. Renew. Energy 2023, 216, 119090. [Google Scholar] [CrossRef]

- Chu, Z.; Bian, C.; Yang, J. Air pollution regulations in China: A policy simulation approach with evolutionary game. Problemy Ekorozwoju 2022, 17, 222–233. [Google Scholar] [CrossRef]

- Mörsdorf, G. A simple fix for carbon leakage? Assessing the environmental effectiveness of the EU carbon border adjustment. Energy Policy 2022, 161, 112596. [Google Scholar] [CrossRef]

- Tsai, I.C. Impact of proximity to thermal power plants on housing prices: Capitalizing the hidden costs of air pollution. J. Clean. Prod. 2022, 367, 132982. [Google Scholar] [CrossRef]

- Wang, X.; Zhu, L. How does export VAT rebates policy affect corporate investment efficiency? Evidence from corporate tax stickiness. Pac.-Basin Financ. J. 2023, 82, 102130. [Google Scholar] [CrossRef]

- Chang, K.; Long, Y.; Yang, J.; Zhang, H.; Xue, C.; Liu, J. Effects of subsidy and tax rebate policies on green firm research and development efficiency in China. Energy 2022, 258, 124793. [Google Scholar] [CrossRef]

- Li, F.; Xu, X.; Li, Z.; Du, P.; Ye, J. Can low-carbon technological innovation truly improve enterprise performance? The case of Chinese manufacturing companies. J. Clean. Prod. 2021, 293, 125949. [Google Scholar] [CrossRef]

- Li, X. Study on the impact of energy rebound effect on carbon emission reduction at different stages of urbanization in China. Ecol. Indic. 2021, 120, 106983. [Google Scholar] [CrossRef]

- Chen, P.; Liu, X.; Wang, Q.; Zhou, P. The implications of competition on strategic inventories considering manufacturer-to-consumer rebates. Omega 2022, 107, 102541. [Google Scholar] [CrossRef]

- Yan, H.E.; Guo, F.; Zhang, B.; Chan, Y.K.; Zhou, H.; Sun, L.; He, T.; Tang, J.; Chen, H.; Tan, W.; et al. Sustainability assessment during machining processes: Evidence from the econ-environmental modelling. J. Clean. Prod. 2024, 448, 141612. [Google Scholar] [CrossRef]

- Raudla, R.; Douglas, J.W.; Savi, R.; Randma-Liiv, T. Fiscal crisis and expenditure cuts: The influence of public management practices on cutback strategies in Europe. Am. Rev. Public Adm. 2017, 47, 376–394. [Google Scholar] [CrossRef]

- Zhou, K.; Qu, Z.; Wei, Z.; Zhao, J. Does government fiscal pressure matter for firm environmental performance? The role of environmental regulation and tax competition. Econ. Anal. Policy 2023, 80, 1187–1204. [Google Scholar] [CrossRef]

- Wang, X.; Han, S. Optimal operation and subsidies/penalties strategies of a multi-period hybrid system with uncertain return under cap-and-trade policy. Comput. Ind. Eng. 2020, 150, 106892. [Google Scholar] [CrossRef]

- Gu, Y.; Liu, W.; Wang, B.; Tian, B.; Yang, X.; Pan, C. Analysis and Prediction of Energy, Environmental and Economic Potentials in the Iron and Steel Industry of China. Processes 2023, 11, 3258. [Google Scholar] [CrossRef]

| Game Participants | Governments | ||||

|---|---|---|---|---|---|

| Proactive Response (z) | Passive Management (1 − z) | ||||

| Small- and Medium-Sized Enterprises 2 | |||||

| Low-Carbon Upgrading (y) | Traditional Production (1 − y) | Low-Carbon Upgrading (y) | Traditional Production (1 − y) | ||

| Large steel companies 1 | Low-carbon upgrading (x) | ||||

| traditional production (1 − x) | |||||

| Equilibrium Point | |||

|---|---|---|---|

| Equilibrium Point | Stability | Stability Conditions |

|---|---|---|

| saddle point | - | |

| ESS | ||

| ESS | ||

| ESS | ||

| ESS | ||

| ESS | ||

| ESS | ||

| ESS |

| Parameter Value | Window Stage | Transition Phase | Implementation Phase | Intensive Phase |

|---|---|---|---|---|

| V1 | 15 | 15 | 15 | 15 |

| V2 | 10 | 10 | 10 | 12 |

| α | 0.35 | 0.35 | 0.35 | 0.35 |

| β | 0.25 | 0.25 | 0.25 | 0.25 |

| C1 | 12 | 12 | 12 | 12 |

| C2 | 10 | 10 | 10 | 10 |

| δ | 0.75 | 0.75 | 0.75 | 0.75 |

| e | 0.4 | 0.4 | 0.5 | 0.5 |

| g | 2 | 2 | 3 | 3 |

| r | 3 | 3 | 4 | 4 |

| Oi | 3 | 5 | 3 | 2 |

| L | 5 | 5 | 4 | 4 |

| N1 | 15 | 15 | 14 | 14 |

| N2 | 12 | 10 | 10 | 10 |

| M1 | 8 | 8 | 8 | 8 |

| M2 | 6 | 6 | 6 | 6 |

| ES | 6 | 6 | 6 | 6 |

| b | 1 | 0.9 | 0.5 | 0 |

| EP | 1 | 1 | 1 | 1 |

| CP | 0.083 | 0.083 | 0.083 | 0.083 |

| l | 1 | 1 | 1 | 2 |

| Vg | 10 | 10 | 10 | 10 |

| Cg | 6 | 6 | 6 | 6 |

| F | 5 | 8 | 15 | 8 |

| E1 | 4 | 4 | 4 | 4 |

| E2 | 3 | 3 | 3 | 3 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tian, B.; Zheng, M.; Liu, W.; Gu, Y.; Xing, Y.; Pan, C. Impacts of Carbon Border Adjustment Mechanism on the Development of Chinese Steel Enterprises and Government Management Decisions: A Tripartite Evolutionary Game Analysis. Sustainability 2024, 16, 3113. https://doi.org/10.3390/su16083113

Tian B, Zheng M, Liu W, Gu Y, Xing Y, Pan C. Impacts of Carbon Border Adjustment Mechanism on the Development of Chinese Steel Enterprises and Government Management Decisions: A Tripartite Evolutionary Game Analysis. Sustainability. 2024; 16(8):3113. https://doi.org/10.3390/su16083113

Chicago/Turabian StyleTian, Borui, Mingyue Zheng, Wenjie Liu, Yueqing Gu, Yi Xing, and Chongchao Pan. 2024. "Impacts of Carbon Border Adjustment Mechanism on the Development of Chinese Steel Enterprises and Government Management Decisions: A Tripartite Evolutionary Game Analysis" Sustainability 16, no. 8: 3113. https://doi.org/10.3390/su16083113

APA StyleTian, B., Zheng, M., Liu, W., Gu, Y., Xing, Y., & Pan, C. (2024). Impacts of Carbon Border Adjustment Mechanism on the Development of Chinese Steel Enterprises and Government Management Decisions: A Tripartite Evolutionary Game Analysis. Sustainability, 16(8), 3113. https://doi.org/10.3390/su16083113