Abstract

In the midst of the development of international frameworks for the dissemination of information on sustainability, the European Union published the Corporate Sustainability Reporting Directive (CSRD) in order to meet user requirements on sustainability. To achieve its objectives, the Directive assigns large companies and investors a key role in the transmission of sustainability-related information, leveraging their capacity to influence. An increased separate use of the term “investor” has been noted in the sustainability-related literature regarding the overall “stakeholder” that contains it. Our research applies a methodology based on analysis of the content of the abstracts from 260 articles published prior to the approval of the CSRD, with the aim of identifying whether that separate use implied that investors’ interests are concentrated on sustainability-related aspects. The results of the research concluded that there is no statistical significance between the separate, growing use of the term “investor” and a generalised use in the lexical field related to sustainability that might characterise the influence of investors. This work encourages future research directions to examine how the enactment of the CSRD may affect the trend in investor influence on the dissemination of sustainability-related information.

1. Introduction

In the European regulatory sphere, it is recognised that a level of information of sufficient quality has not been achieved to reduce the asymmetry between the information provided by organisations and that required by users. This mainly affects the information needed by investors to assess the risks and opportunities that should be disclosed in each of their investment decisions.

The Corporate Sustainability Reporting Directive (CSRD), together with the European Sustainability Reporting Standards (ESRS) adopted in 2023, aims, among other things, to strengthen the mechanisms for communicating sustainability information in order to overcome the problems of asymmetry, the diversity of applied reporting frameworks, and the heterogeneity of the material means of dissemination. This is a clear effort to achieve a high degree of uniformity, which primarily concerns the largest organisations and their value chains, even beyond the legal context of the European Union (EU), and companies from third countries when the subsidiaries established in the territory of the EU have their dominant entities outside this territory.

The CSRD distinguishes between stakeholders on the basis of the information requirements they explicitly request and the benefits they expect to derive from the information in light of their own objectives and interests. Throughout the text of the Directive, the stakeholder group of investors and asset managers also plays a key role, and they need to know, on the one hand, the risks and opportunities that sustainability issues present for their investments and, on the other hand, the impact of their investments on people and on the environment.

The distinction between stakeholders and the allocation of differentiated roles contained in the CSRD has been common practice since the definition of the term “stakeholder”. Currently, the transmission mechanism of sustainability aspects through the interrelationships that take place in the global system gives it a new dimension, which must be to extend sustainable values to the entire structure of relations by “filtering”.

The dissemination scheme for these sustainability values and concepts depends on the specific features of the CSRD and ESRS, among which is the primacy of the interests of investors as the main user group, even considering that this group may have a certain tendency to temporarily overreact to changes in the context of sustainability information dissemination [1]. Thus, the basic subjective scope in which they can apply and the recognition of the existence of a trickle-down effect in the transmission of information are determining elements of the dissemination scheme.

In this context, between 2014 and 2022, in the scientific literature and other publications, there was an increase in the use of the term “investor” separately from the univocal group to which it belongs, namely, “stakeholders”, when the term “sustainability” was also present, as well as a tendency to reinforce the distinction through textual formulas, such as “investors and other stakeholders”. The statement “…ensuring compatibility and interconnectedness of investor-focused baseline sustainability information that meets the needs of the capital markets, with information intended to serve the needs of a broader range of stakeholders” [2] may represent a clear example of this.

In this paper, we analyse whether this separate use of the terms investors and stakeholders in the scientific literature is complemented by the presence of sustainability-related vocabulary, which may reveal a link between investors’ interest and sustainability that, with the publication of the CSRD, can be extended by trickle-down to the system as a whole.

A linear regression on the results of the textual analysis of the paper abstracts published between 2014 and 2022 and included in the Web of Science (WoS) database corresponding to the presence of all three terms suggests that the growth of the separate presence of the word “investor” in the literature is only related to terms that are traditionally part of the lexical context of these stakeholders. However, it is not related to the vocabulary connected to sustainability issues. In any case, it is possible that the implementation of the ESRS from 2023 may lead to a stronger link in the scientific literature between the vocabulary of sustainability and investors as a result of the requirements that affect investors in this area and the uniformity in the information to be disseminated expected from the CSRD implementation.

This paper is organised as follows: Section 2 presents the literature review and the research hypotheses, Section 3 presents the research methodology while Section 4 presents the research results, Section 5 discusses the results, also discussing some limitations and directions for future research, and Section 6 presents the conclusions.

2. Conceptual Framework

2.1. Definition and Interdependence of Stakeholders and Organisations

The definition of the concept of “stakeholder” within organisational theories, the boundaries of their interrelationship with those stakeholders, and even their origin and meaning have always been difficult to define [3,4,5]. Originally, in the definition of the Stanford Research Institute’s internal memo in 1963 [3], the term included those entities that supported the survival of organisations.

This first approach to the definition of the term “stakeholder” divided opinions, differentiating and complementing each other depending on the discipline and the approach from which the content and validity of the term was studied. From the perspective of organisational planning, the contingent nature of stakeholders was emphasised [3,6], so their identification and number could change over time, depending on the circumstances affecting the organisations. The authors of systems theory renewed the views of Chester Barnard [7], arguing that the “support and interaction” of stakeholders could solve various social problems [8]. From the perspective of social responsibility, the shift in the orientation of stakeholder action towards participatory rather than influential positions was emphasised [9], and from organisational theory, stakeholders were restricted to those groups that could make claims on firms and those on whom the firm might have claims [10]. Freeman [3], from a strategic management perspective, sought a broader definition of the term to include in his famous description all groups that could affect or be affected by the “purpose of an organisation”.

In the context of sustainability, the various definitions of the term that have been proposed since then agree in pointing out the interdependence of the interests of the groups or individuals that make up the system [11,12], whether they belong to organisations or not, in an interconnected model or system of relationships [4,12,13].

At a corporate level, there is a widespread view that stakeholders drive the sustainability strategies of organisations and that their influence is a function of, among others, the degree of mutual influence that can be exerted [14,15] and their level of power [16], with power being understood as the predictable ability to impose one’s will on a social action, even against the opposition of the other participants [17]. The intensity and direction in which both manifest themselves will depend on the degree of dependence of one party on the other to achieve the expected results [11,12]. Other authors link stakeholder relations to resource dependency theory, according to which the survival of organisations depends on their ability to acquire critical resources from the external environment [18].

The widespread but also controversial stakeholder theory [19,20] has established an internal division of stakeholders according to the type of interdependence they have with organisations [3,21]. This division groups together, firstly, stakeholders without whose participation the organisation could not survive, which are referred to as “primary stakeholders”, and secondly, those who maintain a degree of mutual influence but are not directly involved in the organisations’ transactions and are, therefore, not dependent on or essential for their survival, which are referred to as “secondary stakeholders”.

Organisations can be seen as a “nexus of contracts” between themselves and stakeholders, with each party seeking to maximise its utility in the relationship [22,23,24]. From this perspective, stakeholders have also been distinguished between those whose relationship is contractual in nature, who have been called “primary”, and those who do not have a contractual relationship but who nevertheless have some kind of power over the organisations, referred to as “secondary” [21,25,26]. In stakeholder theory, this distinction categorises the ways in which relationships between organisations and stakeholders are managed, with those defined as primary focusing on managing the interests of both parties, and those defined as secondary focusing on achieving a form of equilibrium in which relationships with them are relational rather than contractual.

Stakeholder theory implicitly contains a theory of the instrumental dimension [27,28], which links the interests of organisations to those of their environment, extending the boundaries of the organisation to all stakeholders [19,29]. All of them, in proportion to their capacity for intervention or pressure, are given the quality of modulating the structures and decisions of the organisations themselves. The instrumental perspective of stakeholder theory answers the question “what happens if?” [28] and aims to describe what happens when corporate managers make differentiated decisions in the context of their relationships with stakeholders.

In addition to the instrumental theory mentioned above, there are also descriptive and normative theories [27] that implicitly coexist with it and that try to explain the behaviour of corporate managers and the way in which they should behave towards stakeholders, answering the questions “what happens?” and “what should happen?”, respectively [28]. Both, together with instrumental theory, comprise a way of describing the behaviour of organisations towards stakeholders or a group of them.

The description of the behaviour of organisations in the field of sustainability has been translated over time into voluntary or mandatory formulas for the communication of non-financial information (now defined in European regulations as sustainability reporting) to all stakeholders, with the aim of being used by them in different areas and for different purposes, ranging from knowledge of the risks and opportunities arising from the actions of organisations and the demand for greater accountability to monitoring environmental and social trends in order to contribute to the modulation of public policies, which has become a fundamental aspect of investment decisions [30,31].

2.2. The Treatment of Stakeholders in the CSRD and the Trickle-Down Effect

The traditional division between stakeholder groups has been maintained in European regulatory guidance, both in the proposal to amend the EU Directive 2013/34/EU [32,33] on non-financial reporting and in its current text, as amended by the CSRD [30], which, as a continuation of EU Directive 2014/95/EU [34], represents the political and societal demand for more information from companies [35] and, consequently, for a better description of organisations’ sustainability performance.

The CSRD does not explicitly clarify the reasons why it promotes a distinction between stakeholders according to the use and benefit that each stakeholder group makes or derives from the sustainability information it receives or expects to receive. However, it does describe what it expects to happen with the dissemination of sustainability information, understood as a description of organisational behaviour that improves the management of sustainability-related risks and opportunities for both organisations and stakeholders [30] within the system of interrelationships in which they coexist.

Specifically, the CSRD expects that sustainability information, which should favour the management of risks and opportunities, is carried out from the momentum of the dialogical engagement between organisations and stakeholders, which has previously been described by other authors ([36,37,38], among others). It also allows the foundations to be laid for close collaboration between all parties as a means of preserving the value of organisations [39], promotes the dissemination of relevant information on sustainability, protects the interests of stakeholders, and describes the way in which this objective is achieved within the framework of “responsible business conduct” [30], which goes beyond its economic function [40].

Both the CSRD and its predecessor distinguish between the interests of a first group of stakeholders, consisting of investors and asset managers who are said to “want to better understand the risks and opportunities that sustainability issues pose to their investments and the impacts of those investments on people and the environment” ([30], p. L322/18), and those of a second group of stakeholders, consisting of non-governmental organisations and social partners and other stakeholders, who are said to expect a form of scrutiny [33] of the impact of organisations’ activities, with the aim of holding them to a higher level of accountability for their impact on people and the environment [30,33].

Other standard setters in the field of sustainability disclosure have followed a similar line of distinction, recognising that the objective of their sustainability reporting frameworks focuses on interconnecting sustainability information that meets the needs of capital markets with the needs of other stakeholders [2,41].

In both cases, therefore, the aim was to ensure, on the one hand, that organisations disclose sustainability information to investors according to their specific needs and, on the other hand, to provide other stakeholders with a source of information on the behaviour of organisations, which, in line with the CSRD, should serve as a means of demanding greater accountability for the impact of organisations’ activities on people and the environment. This should be the basis for comparative analysis across and within market sectors, as a source of information on risks and opportunities, and monitoring trends in the context of public policymaking [30].

EU Directive 2014/95/EU [34], which first reformed Directive 2013/34/EU [32], currently amended by the CSRD, aims to reduce the asymmetry between organisations and stakeholders through greater information dissemination while maintaining the perspective of agency models in the management organisation. This was in exchange for greater power and an improvement in terms of the legitimacy potentially provided by the disclosure of their social responsibility [42], but without a change in the organisational model and, therefore, without a change in behaviour [35].

The distinction between stakeholder groups in the current European directive and in other non-financial reporting standards now introduces a novel asymmetry or dichotomy [41] between the different classes that are defined, assigning each of them a differentiated role according to the expected benefits that each of them will obtain from the sustainability information. Thus, investors, despite being one of the least studied groups in terms of sustainability [43], seem to be at the centre of the requirements to be met by the dissemination of non-financial information, while the other stakeholders are apparently assigned a differentiated role based on making judgements, rather than a central role.

From a European regulatory perspective, specific regulations, which embrace specific transparency requirements on the integration of sustainability risks and the description of the negative impacts of investment decisions and financial product disclosures, have been adopted. These regulations affect the stakeholder group, including investors and asset managers [44]. It follows that this stakeholder group will be affected by the sustainability aspects of investment risk, sustainability opportunities, and the specific regulatory framework, which will logically lead to an ex ante attitude towards the actions of organisations, while the majority of “secondary” stakeholders, which are not affected by specific sustainability regulations, will maintain their critical interest ex post. Thus, it does not appear that the nature and direction of the relationship between the two groups of stakeholders and the organisations described in the European directive are symmetrical, since the first group, the investors, acts ex ante on the action of the organisations, and the second group acts ex post, with the former actively modulating it in defence of its interests, obligations, and for the opportunities that may arise, and the latter critically examining it once the action has been completed.

The main role attributed to investors is related to the fact that this group has previously demanded more high-quality sustainability information [43,45] in order to properly assess their investment strategies and related risks, as well as implicitly diffuse, through a trickle-down effect, the ESRS from obligated organisations (listed and larger companies) to small- and medium-sized enterprises (SMEs) integrated in their value chain that are not obligated by the CSRD.

The formal authority of obligated organisations in their value chain, as well as the frequency of interaction and the intra-organisational distance between the two subjects, play a crucial role in the mode of influence and behaviour of organisations [17,46], whose “indirect” reporting obligations are subsumed within and driven by the legal obligations of the primary reporter, creating a layered system of influences that may suggest that the quality level of the obligated organisation flows in a trickle [47] through its value chain when it is not obligated to report.

The consequences of such an effect have been assessed by the European Financial Reporting Advisory Group (EFRAG) in its role as technical advisor to the European Commission on sustainability reporting, from the perspective of the indirect costs for the group of companies (SMEs) that are not subject to annual sustainability reporting under European standards [48].

As far as we are aware, the EFRAG has not promoted a concrete assessment of this trickle-down perspective in terms of its impact on the behaviour of the value chain of obligated organisations, nor of the extent to which this influence may be appropriate in terms of its homogenising effects, taking into account that a group of stakeholders with sufficient power may be able to influence the behaviour of an organisation in line with its own interests or replace it with other competitors with closer values [49], regardless of whether or not such behaviour is in line with the law [50].

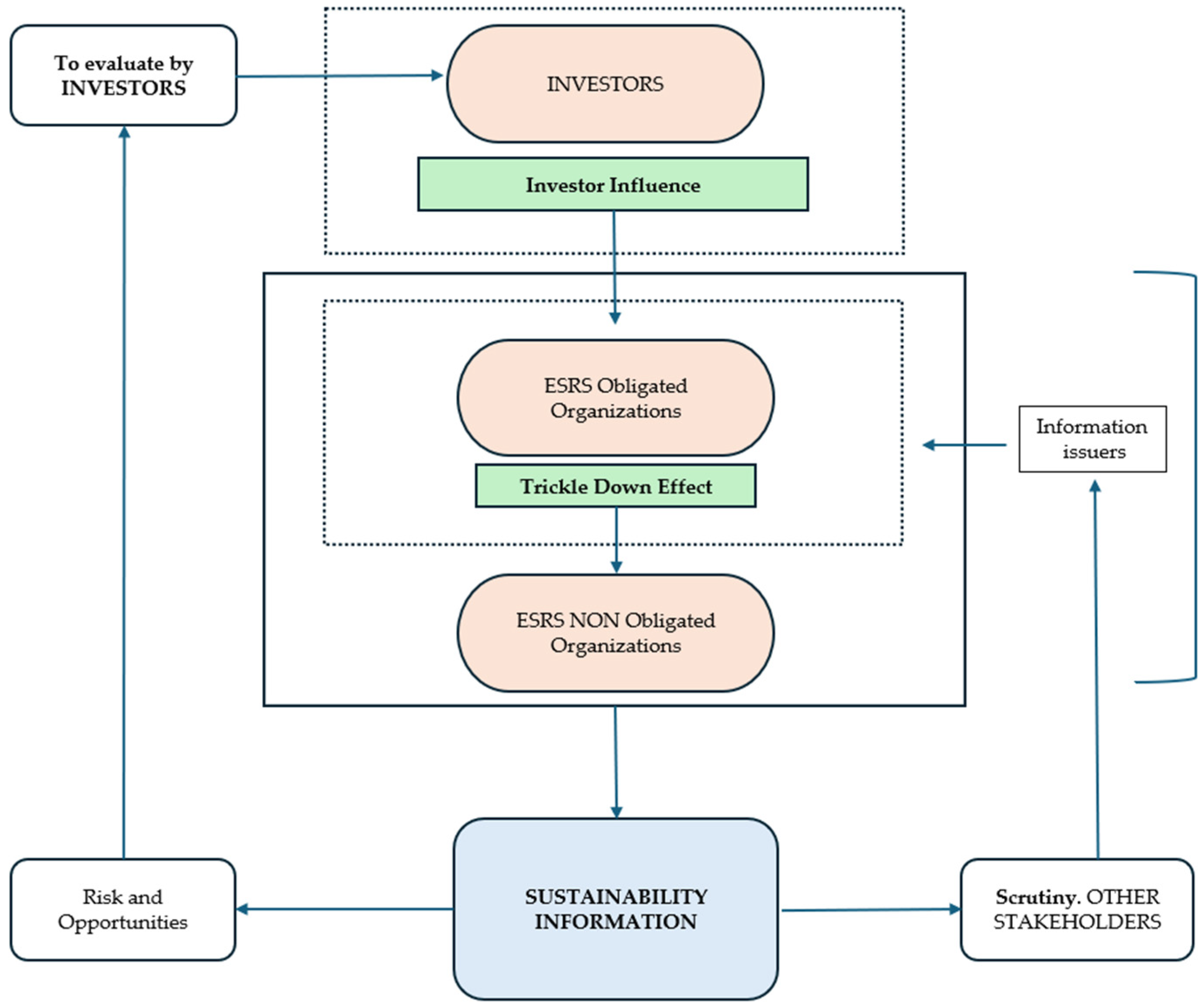

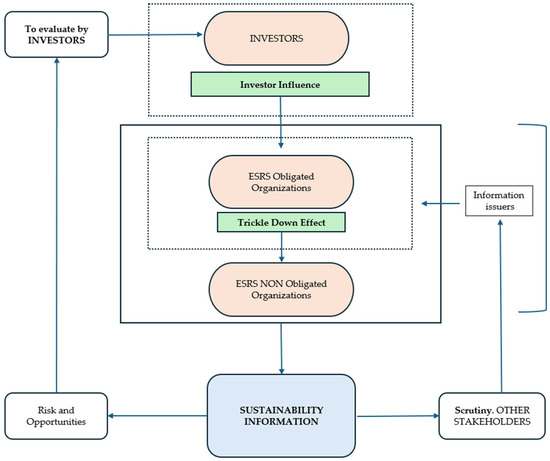

The scheme of relations between the different groups, as well as the sense of mutual influence between investors, stakeholders, and organisations proposed by the European Community legislation, is schematically illustrated in Figure 1. This scheme represents the mode of transmission of influence from the stakeholder group constituted by investors to the set of organisations legally obliged to disclose sustainability information and, through the trickle-down effect, to the non-obligated ones, both interdependent of the system together with their stakeholders [13], transferring the characteristics of the behaviour of the influential group to the whole.

Figure 1.

Scheme of relationships in the transmission of influence.

Based on the scheme of influences described in Figure 1, considering that the traditional stakeholder distinction and the one introduced by the CSRD [30] have not changed the fundamentals of sustainability concerns, it is to be expected that the stakeholder distinction does not affect the extent to which sustainability focuses on material social and environmental aspects but rather the way in which these fundamentals are “filtered” through the interrelationships of organisations.

2.3. Interdependence of Stakeholders, Organisations, and CSRD

If we accept organisations as adaptive individuals, they will tend to behave homogeneously when exposed to similar cues produced in the environment according to the principles of social information processing theory, so they will adapt their attitudes and behaviour to the context of the system [19,42] in a form of alignment with external attitudes that reflect ideal or desirable behaviour, becoming more isomorphic over time as they conform to institutionalised norms [51,52], even unconsciously [53].

In Section 2.1, we described the way in which the division between stakeholder types has traditionally been maintained. Moreover, in Section 2.2, we pointed out the way in which the stakeholders have been dealt with in the CSRD, and how a kind of separation has also been maintained between stakeholders who want to know the scope of the risks and opportunities that directly affect their interests (fundamentally investors) and those who are expected to maintain an attitude of verification regarding the impact of the organisations on sustainability-related factors.

On the other hand, the CSRD excludes 98% of the total of 31 million companies operating in the European Union in 2021 from reporting on sustainability matters, representing 35% of the added value generated [54], but it assumes the existence of a cost arising from such organisations as a consequence of the need to report that affects large companies with regard to their own chain of value, and investors due to the requirements arising from regulations related to sustainable investments (i.e., [44]). The mechanism imposed by the CSRD thus reasonably supposes an indirect means of transmission of sustainability-related information by the organisations excluded.

However, the CSRD has not specifically appraised the possibility that the trickle-down effect may not only affect the cost borne by the non-obliged organisations but may also influence the trend that large companies and investors may exert in relation to a specific way of approaching the content and scope of the sustainability-related information, which may contribute to uniformity in the information disseminated according to the degree of influence of both.

For these reasons, in this work, we ask in what way sustainability-related aspects have been dealt with in the context of the group of stakeholders who constitute the investors prior to the CSRD coming into force and, thus, what are the aspects one might expect to be transmitted to the overall system through the trickle-down effect.

2.4. Research Hypothesis

Based on the CSRD guidelines [30] and the differentiated role and specific expectations they identify for the first group of stakeholders (mainly investors but also asset managers), we would like to know what sustainability-related aspects have been associated with this group of stakeholders in the scientific literature, which could be extended to obligated organisations and the rest of the system through the interrelationships on which it is based and through the trickle-down mechanism.

Firstly, it should be noted that, in the scientific literature, the group of stakeholders who have control over financial resources, with current or potential contractual relationships with organisations, may have received more attention between 2014 and 2022 than the univocal set of individuals represented by the term “stakeholder”. This may be an intention to address, with greater intensity and attention, the examination of their interests, expectations, and influence on sustainability issues considering the relevance of their role in the context of organisational management.

In this context, this research has its origin in the observation of the increasing and separate use of the term “investor” with respect to the term “stakeholder” in scientific articles when, concurrently, the term “sustainability” is present (Table 1). The same circumstance occurs in other informative publications or in regulatory language, where it is common to find expressions describing conditions affecting investors as the main group, with the generic term “other stakeholders” being added to describe the rest of the stakeholder groups that may be affected.

Table 1.

Number of publications per year.

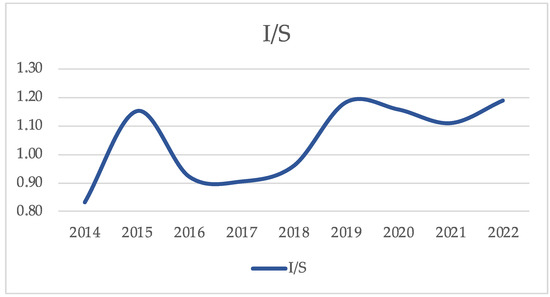

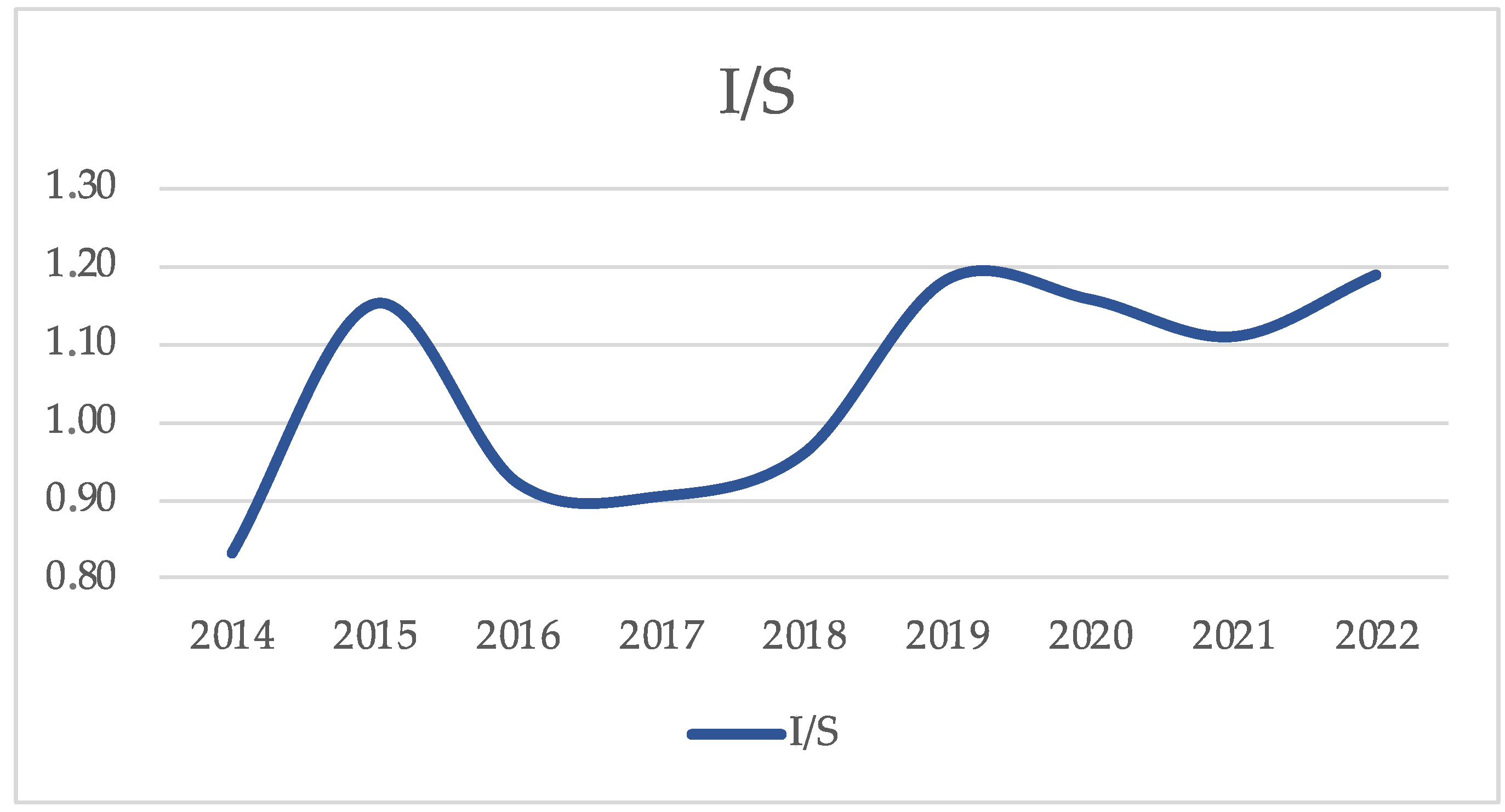

This growth can be measured by the rate of variation in the occurrence of the first term in relation to the second (investors/stakeholders—I/S) and can be correlated with the other sustainability-related terms identified in the selected scientific literature review. As far as we are aware, there is no measurement in the sense we propose in the scientific literature, so it should be considered a contribution of this article.

Furthermore, we would expect the literature to relate the main interests of investors to the above-mentioned aspects of sustainability, considering that this stakeholder group will maintain their usual attention and interest in this matter [55], to protect the interests of their investments, alleviate the associated risks, and maintain the existing opportunities and the regulatory requirements to which they are subject.

Hence, the purpose of this research is to determine whether, in the context of sustainability, the separate and growing presence of the term “investor” in the scientific literature is due to the fact that this primary group of stakeholders is establishing new relationships with terms related to the vocabulary of sustainability, understood as a set of customs or words that contain meanings that enable interlocutors to understand each other [56].

We, therefore, propose the following hypotheses:

H1.

The growth of the I/S index is directly related to those concepts having traditionally been linked to the control group of financial resources.

H2.

The growth of the I/S index is related to an increased and generalised use of the sustainability lexicon.

3. Materials and Methods

The method used in this research is based on the application of the content analysis technique [57,58,59] to a set of generic units consisting of a certain number of scientific articles published between 2014 and 2022 in international journals indexed in the Web of Science Core Collection (WoS) database, which, in the presence of the term “sustainability”, also included the terms “investor” and “stakeholder” in the abstract. Techniques based on linear regression models were also used to determine the degree of correlation between the terms resulting from the content analysis (log units) and the index of variation (I/S).

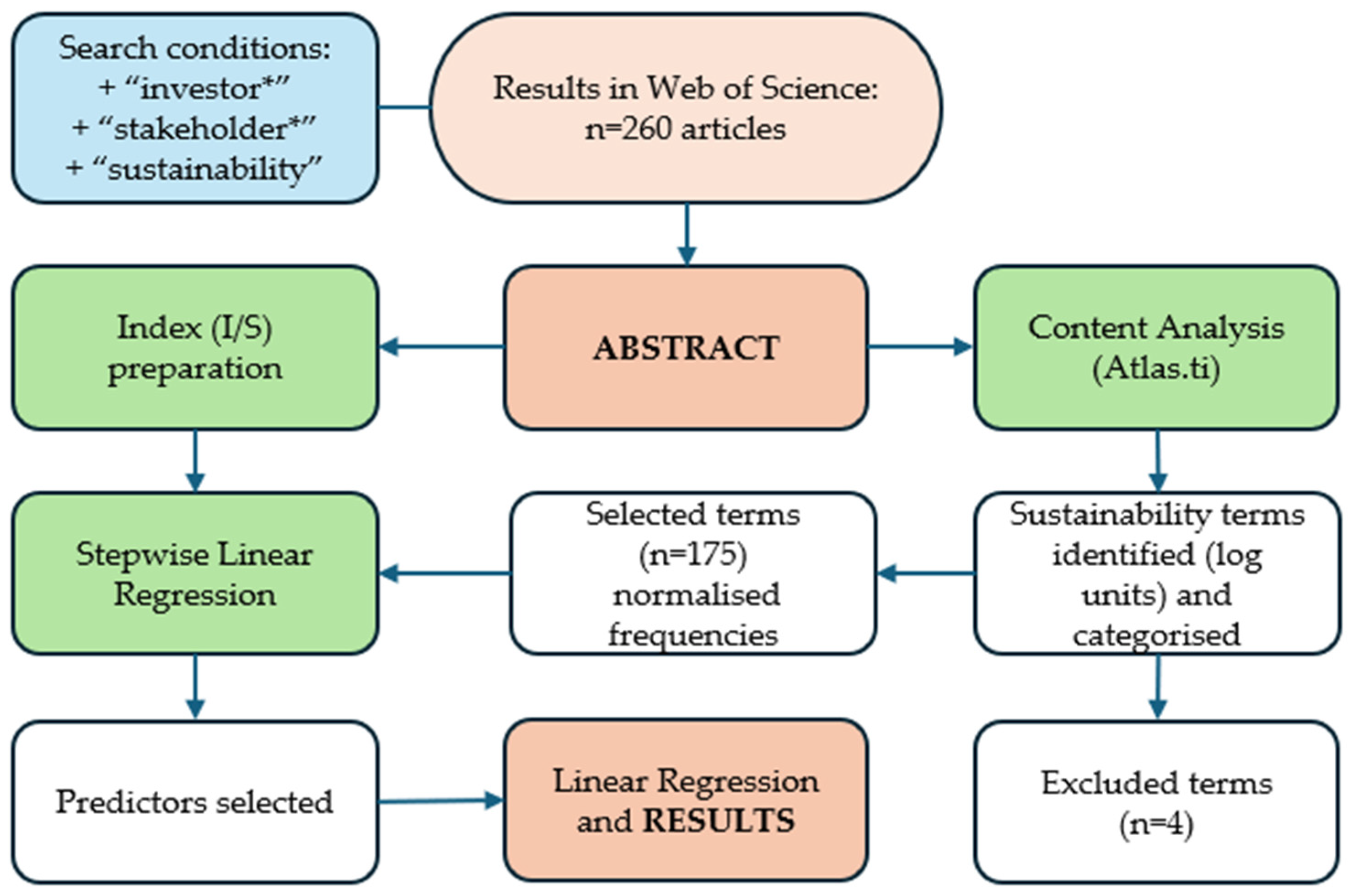

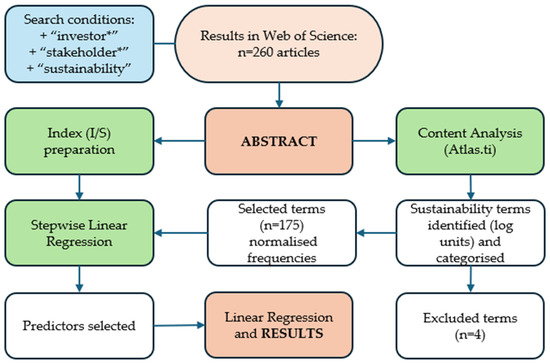

A systematic bibliography was designed to achieve the objectives stated in order to obtain a basis for analysis in which one might identify their objectives and materials and, thus, ensure that the results are explicit and reproducible [60,61]. The methodology adapted to the specific case was designed in the following phases, considering that the articles must comply with the conditions cited (the abstracts concurrently contain the terms “sustainability”, “investor”, and “stakeholder”): (i) database selection and identification of the articles to be examined, (ii) identification, extraction, and encoding of the terms or sequences of sustainability-related words contained in the abstracts of the articles selected, and the grouping of the terms by categories, (iii) calculation of the standardised frequency of appearance of the terms encoded, and (iv) evaluation of the data. See the graphic description of the methodology applied in Figure 2 (a similar graphic representation scheme to that applied in [62] has been followed).

Figure 2.

Methodology process.

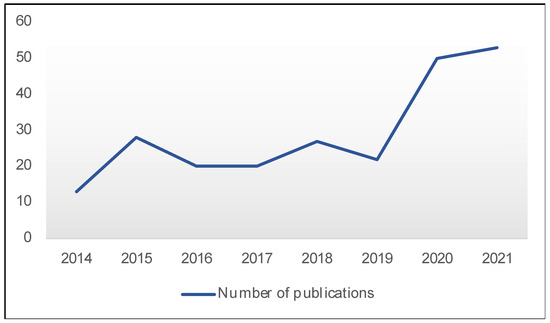

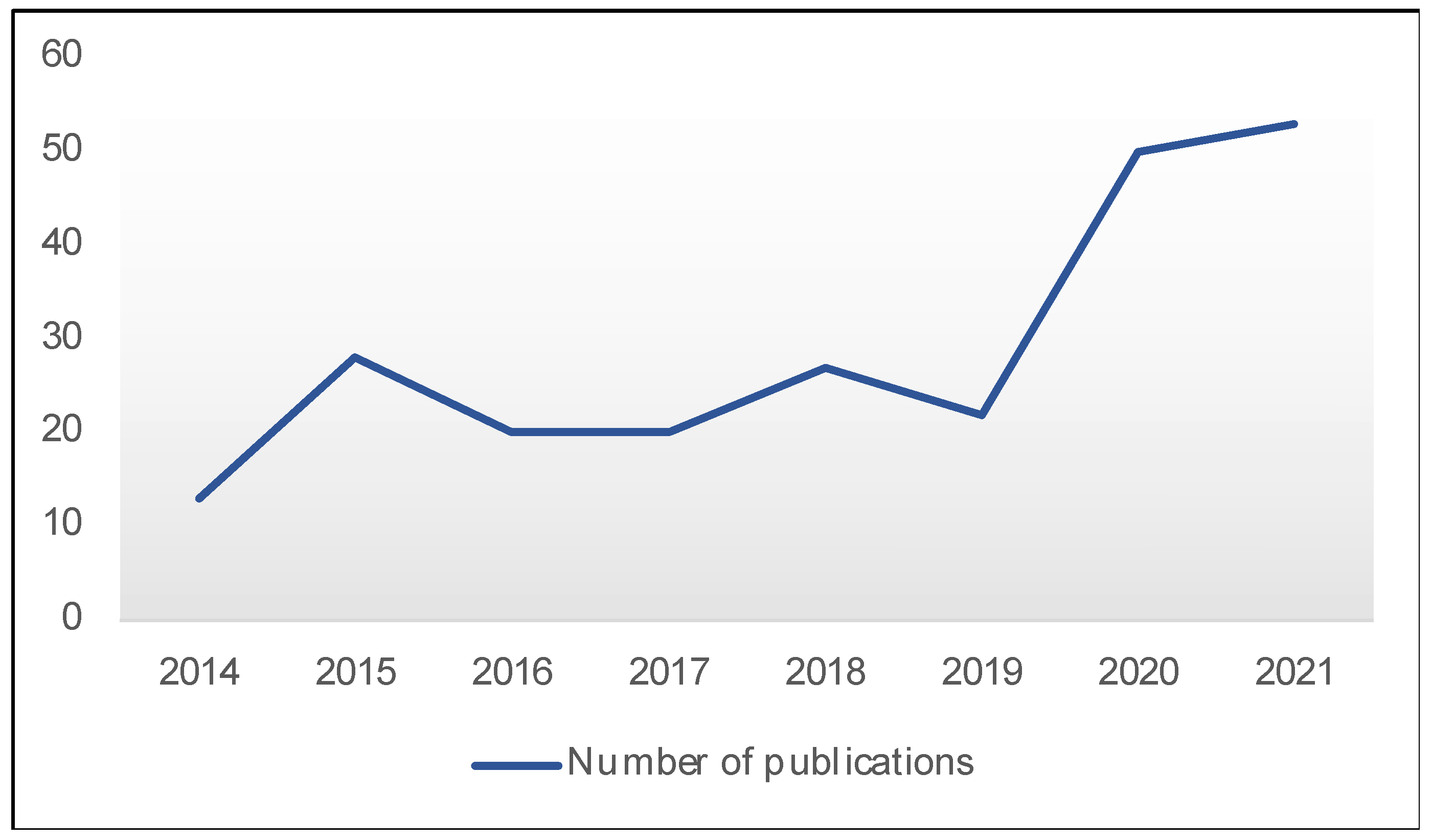

- The research involved reading and analysing 260 paper abstracts (Supplementary Materials, Table S1) that met the above selection criteria. The generic units of analysis were selected using the WoS database, as it is one of the most widely used in the scientific field [61]. The selection field in the database was “Topic”, and the search structure was as follows: “investor*” + “stakeholder*” + “sustainability”.The number of publications selected from the WoS database fulfilling the designed conditions is presented in Table 1 and Figure 3. For presentation purposes, the year 2022 has been removed from Figure 3, as it does not correspond to a complete exercise since the database was obtained on 4 June 2022 and, therefore, only contains articles published up to that date.

Figure 3.

Evolution of the number of publications (WoS).

Figure 3.

Evolution of the number of publications (WoS).

- The entire content analysis was carried out using the Atlas.ti application, version 23.1.0, by processing the abstract; sequentially, the processing of the documentation consisted of the following successive steps:

- Loading the document to be analysed. Unique identification of the abstract.

- Reading.

- Selection of terms (citations) and coding of log units.

- Assignment of log units to categories.

- Reading review.

- Calculation of absolute and normalised frequency of occurrence.

- Database retrieval: log unit frequencies.In this research, the log units [63,64] are words or sequences of words with some kind of connection to the sustainability lexicon. It is assumed that the significance of a term or record unit increases with its frequency of occurrence and that they all have the same value [63].The final analysis and drawn conclusions were estimated for words or sequences of words irrespective of their assignment to the eight categories included in Table 2 and are intended only to group them according to their own nature. Due to space constraints, the terms or log units grouped by the categories described in Table 2 are shown in Appendix B and Table A5 and Table A6, together with the absolute frequencies (“Abs.Fr”) obtained in each of them.

Table 2.

Categories.

Table 2.

Categories.

| Categories | |

|---|---|

| 1 | General sustainability terms |

| 2 | Barriers to sustainability |

| 3 | Dimensions of sustainability |

| 4 | International reporting frameworks |

| 5 | Theories and approaches |

| 6 | Materiality and asymmetry |

| 7 | Stakeholder groups |

| 8 | Zones |

- The frequencies of the terms were estimated without any kind of weighting, and for only two terms, the resulting frequencies are not the result of counting their occurrence, with the exception of the following: (i) the frequencies of occurrence of Category 8 terms were estimated according to their presence in the text, regardless of whether the zone of reference was described more than once in each abstract, and (ii) the particular term “stakeholder decoupling” describes the presence or absence of an explicit way of separating the terms “investor” and “stakeholder” in specific textual contexts, e.g., in the class “investors and other stakeholders”. In these cases, the presence was assigned a frequency value of 1 and the absence a value of 0, which was assigned to the abstract examined as a whole.For each of the 178 terms or log units that were coded and classified in the above-mentioned categories (Table 2), the normalised value of their absolute frequency of occurrence in the abstracts analysed was obtained. The standardisation corrects the distortion caused by the different sizes of the generic units, i.e., abstracts, and consequently of the number of “citations” contained in each of them. The “citations” were generated from the identification of each of the log units and are linked to the generic unit by a specific code.

- Finally, and as a basic element of the analysis, an index was calculated for each abstract relating to the presence of the terms “investor” and “stakeholder”. The index was constructed as a ratio between the terms “investor” and “stakeholder” (I/S) to serve as a dependent variable in the quantitative analyses. See Figure 4 for a representation of the index I/S values per year. Computer techniques were applied to the database containing the set of attributes of each of the selected articles to obtain the absolute frequency of occurrence of each of the terms that make up the index, namely, “investor” and “stakeholder”, as well as their plurals.

Figure 4. I/S index per year.Figure 4. I/S index per year.

Figure 4. I/S index per year.Figure 4. I/S index per year. The explanatory variables of the model consisted of the terms/units of meaning (178) coded in the content analysis to which an additional non-categorised variable was added. This variable consists of the year of publication of the source document. Finally, the set of explanatory variables amounted to 179, although 4 of them were excluded from the analysis because they were themselves part of the index estimation (I/S) or of the context of the conditions established for the selection in the WoS database, namely, “stakeholders partial item”, “stakeholders global item”, “investors”, and “sustainability”. The aim was to eliminate possible interdependencies between the variables involved in the construction of the index (I/S).For the quantitative analysis, a stepwise linear regression was applied, generating different models. From these, the model with the best predictors was selected and analysed again using linear regression. The whole process of quantitative analysis was carried out using SPSS 27 in MS-Windows.

The explanatory variables of the model consisted of the terms/units of meaning (178) coded in the content analysis to which an additional non-categorised variable was added. This variable consists of the year of publication of the source document. Finally, the set of explanatory variables amounted to 179, although 4 of them were excluded from the analysis because they were themselves part of the index estimation (I/S) or of the context of the conditions established for the selection in the WoS database, namely, “stakeholders partial item”, “stakeholders global item”, “investors”, and “sustainability”. The aim was to eliminate possible interdependencies between the variables involved in the construction of the index (I/S).For the quantitative analysis, a stepwise linear regression was applied, generating different models. From these, the model with the best predictors was selected and analysed again using linear regression. The whole process of quantitative analysis was carried out using SPSS 27 in MS-Windows.

4. Results

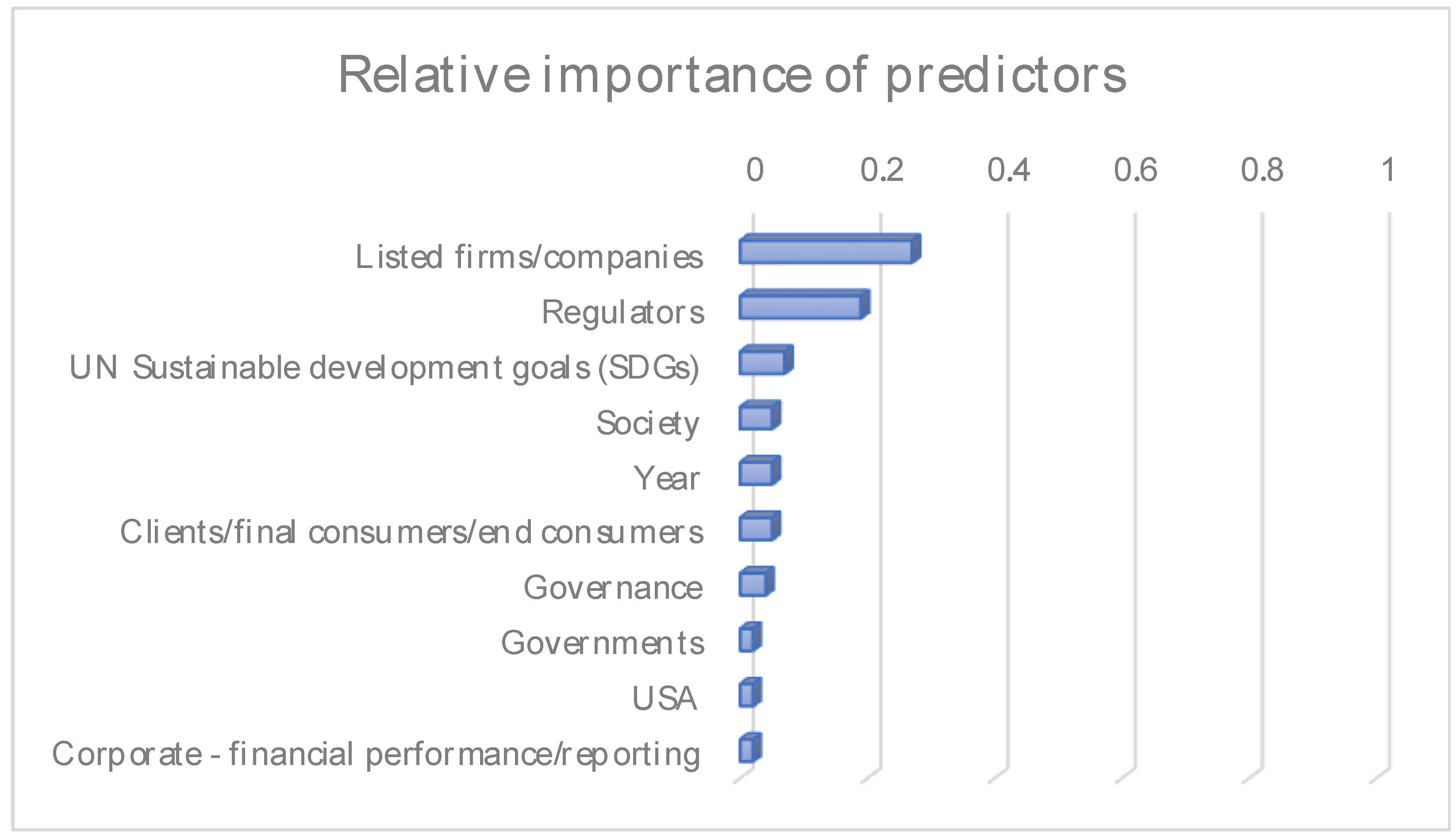

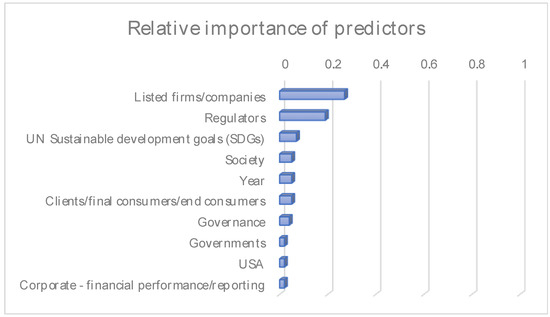

The predictors obtained from the resulting model are presented in Table 3, where they are ranked in order of relative importance, together with the category to which they belong (see Figure 5 for details of the relative importance of the predictors). The relative importance of the predictors refers to the importance obtained for each of the terms in the estimation of the prediction models (see the models obtained and relative importance values of each term in Appendix A, Table A1, Table A2, Table A3 and Table A4).

Table 3.

Predictors by category.

Figure 5.

Relative importance of predictors.

Firstly, the analysis concluded that there was no statistical significance between the term “stakeholders decoupling” and the growth of the index (I/S), which means that the index did not change upwards as a result of the separation of the terms “stakeholder” and “investor” in textual contexts, in which a “decoupling” mode of the general expression “stakeholder” into two or more groups of them could be observed. The expressions identified in this case were “investors and other stakeholders” and other similar expressions.

The frequencies of occurrence associated with each of the resulting predictors are shown in Table 4. For each of them, we included the value of the frequency of the terms in the category to which it belongs, as well as the representativeness of the selected predictor in the whole of that category.

Table 4.

Frequency of predictors.

The categories accumulated the frequencies of the log units (words or relevant word sequences) and are shown in Table 5.

Table 5.

Frequencies of categories.

Once the independent variables (predictors) with the greatest relevance in the model were obtained, another model was constructed in order to estimate the statistical significance of each of the predictors in relation to the dependent variable constituted by the index (I/S); on this assumption, a linear regression was carried out, with the results shown in Table 6 and Table 7.

Table 6.

Model summary.

Table 7.

Model coefficients.

Secondly, the results showed that three terms (log units) that are directly related to investors before and after the generalisation of sustainability as a social objective were statistically significant with respect to the index (I/S), namely, (i) Governance, in the sustainability dimensions category, and (ii) Listed Companies and Regulators, in the stakeholder groups category (see Table 7).

Therefore, we concluded that there was no statistical significance between the index (I/S) and 172 of the terms coded in the content analysis (Table A5 and Table A6, Appendix B), meaning none of them maintained a relationship between their frequency of appearance and the growing evolution of the index in the period 2014 to 2022, going against our hypothesis H2. Among them, some of those that would have been expected to have a relationship with the growth of the index (I/S) stood out, as shown in Table 8.

Table 8.

Terms without statistical significance.

It is important to highlight that the variable “Year” did not maintain statistical significance with respect to the index (I/S), considering that the scientific production of articles related to sustainability has maintained an increasing tone in the series of years analysed (Table 1) and, in particular, from 2018 onwards.

We conclude that the separate and growing literary use of the term “investor” was only related to aspects within a narrow framework of traditional investor interests and, in particular, to listed companies, forms of governance, and regulatory bodies, and not to other aspects specifically related to the sustainability lexicon. Therefore, we did not find that the growth of the index (I/S) and the subjective distinction it implies was directly related to an increase in the use of terms related to sustainability in the scientific literature examined when the terms “sustainability”, “investor”, and “stakeholder” were used in the articles in this study between 2014 and 2022.

5. Discussion

The division between stakeholder groups from different perspectives is a fact that has accompanied the term since its definition. The nature of each group, the description of their interests, and the implication of their interrelationship with organisations have occupied much of the theories developed around them (i.e., [3,21,25,26]).

The way in which the relationship between stakeholders and organisations could be strategically managed, as well as its different capacities for influence, constitutes a determining element in the nominal division of stakeholders into categories or groups when, originally, they were limited univocally to those whose behaviour could affect the survival of the organisations and thus had the same intersubjective meaning (i.e., [3,14,15,16,17]).

General interests in sustainability are divided when each group is assigned, a priori, a certain orientation to its interests according to its belonging to one or another interest group, creating a form of asymmetric relationship (i.e., [41]).

The asymmetry increases between different groups of stakeholders when the legal or voluntary framework assigns them a certain role that implies differentiated behaviour. The asymmetry and its degree are also influenced by the capacity of each group to influence the organisations and, specially, by the time at which this influence is exercised so that the groups with greater lobbying capacity will generally play their role ex ante and those with less capacity ex post, once the action has been complete (i.e., [17,46]).

In the context of sustainability disclosure, the general interests of stakeholders are shared through the effect of frameworks for sustainability reporting that standardise the way in which the understanding of what is material or relevant is achieved, the way in which organisations’ sustainability performance should be described and communicated, and the extent of their responsibility for sustainability when their activities can have an impact or be affected.

The CSRD [30], with regard to sustainability reporting by organisations, and the ESRS promoted on its basis, recognise the existence of a trickle-down effect [48] through the stratified relationships between reporting parties. This has been assessed from the perspective of the cost assumed for its presence, but not from the level of influence on the behaviour between the different components of the interrelationships.

It would be expected for the trickle-down effect to produce an extension of the concepts particularly connected to sustainability through the layered system of relationships and, in particular, from investors to the organisations in which they invest throughout the value chain. This is considering that both in the scientific literature and in other texts, there was an increase in the separate use of the term “investor” from the generic group into which it is formally integrated, namely, “stakeholders”, as a form of extension of the division among stakeholder classes. This separation may represent a greater particular interest in describing their concerns, and this increase is measured by the relative appearance index of each term with respect to the other (I/S) when the word “sustainability” is present at the same time.

5.1. Contribution to Theory

This study contributes to the existing literature to the extent that it links the traditional distinction between groups of stakeholders with the framework of interests of investors, as a separate group, that different authors have related to sustainability in the period from 2014 to 2022, in a context in which the CSRD (published in December 2022) suggests a means of transmission of the principles of sustainability from major companies and investors through interrelations within the global system of organisations.

It also contributes to the mixed methodology used, as systematic review procedures are applied to the bibliography, content analysis, and econometric techniques to evaluate the results, allowing one to relate the variation index in use of one term in the scientific literature with regard to another one belonging to the same lexical field (this being understood as a set of terms applicable to the same theme), including the main determining factors and an evaluation of their motivations and consequences.

5.2. Managerial and Policy Implications

This work contributes to the development of the implementation of the CSRD and its future through the ESRS, to the extent that this emphasises the foreseeable effect of the main trickle-down effect of the principles and requirements of sustainability-related dissemination within the territorial scope of application of the Directive. It also calls attention to the scarce interest among investors that has been emphasised in the scientific literature from 2014 to 2022 regarding other sustainability aspects, apart from those that form part of the traditional context of action by this group of stakeholders that, undoubtedly, will have contributed to less development in this matter prior to the enactment of the CSRD, and that is emphasised among their own motivations.

We consider that the trickle-down effect that has been described by the CSRD as an element may be evaluated from the perspective of cost transmitted to the set of entities not subject to the dissemination obligation imposed by the Directive; however, taking into account the role assigned to large companies, investors, and asset managers, as well as the interrelations inherent to the global system of organisations, this will drive a common dissemination system in which all the participants, obliged and non-obliged, shall influence each other reciprocally with regard to their capacity to enforce their own criteria in matters of sustainability-related information dissemination.

Thus, in practical terms, this work may help the regulatory bodies to emphasise the importance of all the organisations being able to disseminate sustainability-related information uniformly, in a comparable, verifiable manner, as expected in the CSRD. This occurs within a framework of independence in which an organisation provides reports regarding its evaluation of the effects of its activities on the environment and social settings, including those arising from the financial scope of the organisations, as well as on orientation and the way in which the sustainability gap is specifically dealt with.

The ambition shown by the European text may act as a driving factor for better and increased dissemination regarding sustainability due to it being linked to different strategies that are included in the European Green Deal, the principles of climate neutrality, and ecosystem and biodiversity protection, even aiming to indirectly extend its effects beyond the jurisdictional context of the European Union. However, exclusion of the information obligation for a highly relevant set of small- and medium-sized organisations from the CSRD, especially based on the cost of undertaking processing of the information to be disseminated, may amount to a barrier or limitation for it to be able to fulfil its objectives to the extent that it grants a decisive role to large companies, which could potentially impose their own criteria throughout the value chain.

5.3. Research Limitations and Future Research Directions

As a first limitation to this work, one must emphasise the lower number of published articles it was possible to select from the WoS database due to the conditions that had to be fulfilled to be eligible for this study. This fact may be related to the observation made by the CSRD regarding the limited effectiveness of the European Directive it amends being maintained during the term on which its principles and requirements have remained in force, and with the diverse conceptual frameworks for sustainability-related information applicable in other jurisdictions. The foreseeable standardisation of criteria among them all must, however, increase interest in the matter, as one may conclude from the increase in articles published as of 2023.

As a limitation to the interpretation of the results, it should be noted that the characteristics of the technique applied to obtain the data imply paying attention to the context from which the data originate. Hence, the results may reflect the specific characteristics of the sources of information.

On the other hand, it is necessary to point out that the content analysis technique is a method for inducing causes from the indicators contained in the texts, but it maintains limitations in terms of its predictive capacity; therefore, the obtained result should only be interpreted in that context, and is limited to concluding on the relationship between some determining aspects and the growth of the index (I/S), as well as to discarding, in terms of causality, the influence on its growth of other related terms with regard to sustainability that would also be expected to form part of the set of the most significant factors.

The interpretation of the findings is also limited by the fact that the reviewed scientific literature predates the publication of the CSRD in December 2022, and that the CSRD is a product of the fact that European Directive 2013/34/EU [32], which it amends, and the guidelines implemented on its basis, did not improve the quality of the dissemination of sustainability information, despite contrary evidence being found by some authors, at least in the framework of the Sustainable Development Goals, regarding the information available to stakeholders, in line with [65]. Consequently, this legal framework did not guarantee the reporting needs of users [33], while other non-financial reporting frameworks in jurisdictions other than the European one were also in full development (e.g., those of the Sustainability Accounting Standard Board (SASB)).

Finally, related research in the future could examine the effect of the transmission of sustainability concepts through the value chain as a result of the trickle-down effect in the layered system of organisational relationships, the extent of behavioural changes in organisations that may be implied, and the actual influence of particular stakeholder groups on organisational behaviour as a result of investor pressure in the sustainability framework, even beyond the boundaries of the jurisdictions of the organisations in which the investments materialise.

6. Conclusions

In order to determine which concepts are at the centre of investors’ interests and, therefore, which could have “filtered” from investors to organisations, an analysis was carried out based on the scientific literature published between 2014 and 2022, in which the terms “investor” and “stakeholder” and their plurals, as well as “sustainability”, appeared concurrently in their abstracts, relating the growth of the index (I/S) to the frequency of the appearance of sustainability concepts in the same texts.

The findings indicate that the increase in the investor/stakeholder (I/S) ratio in the literature has a direct relationship with three concepts that have traditionally been linked to the control group of financial resources, partially confirming our first hypothesis (H1), and no statistically significant relationship with aspects linked to the sustainability vocabulary described in this paper, which is against our second hypothesis (H2). Considering the results obtained, we should not expect investor-related transmissions of the concepts of sustainability through the trickle-down effect and, consequently, an impact on the sustainable behaviour of the system of organisations derived from this circumstance.

On the other hand, we found no statistical significance between the growth of the index (I/S) and the concept of “stakeholder-decoupling” as an expression of the presence of textual contexts in which investors are explicitly separated from other stakeholders.

The causes of this effect may include, firstly, the immaturity of the regulatory framework for sustainability and even the extent of change it represents in the management framework of organisations, but also the diverse range of views on who is subject to basic sustainability reporting obligations and how to satisfy the different desires of stakeholders.

Secondly, the different orientations between jurisdictions regarding the voluntary and mandatory nature of sustainability disclosure; the asymmetry in the views of “primary” and “secondary” stakeholders regarding the extent of sustainability obligations and requirements; the difficulties in concluding on the subjective framework within which such obligations should be implemented, with fierce opposition from organisations representing small- and medium-sized enterprises, and the proportionality advocated by all parties regarding the measures to be adopted in the regulatory framework considering the cost of capturing, processing, and disseminating the sustainability information that is claimed to be ensured, may also be at the origin of this fact.

It is possible that all, or a combination of, the above circumstances are at the root of the fact that the authors of the articles published between 2014 and 2022 have focused on “traditional” relationships between investors and the sustainability framework.

Supplementary Materials

The following supporting information can be downloaded at: https://www.mdpi.com/article/10.3390/su16083393/s1.

Author Contributions

J.O.F., writing—original draft preparation, writing—review and editing, visualisation, conceptualisation, formal analysis, data curation; C.d.C., writing—original draft preparation, writing—review and editing, supervision, methodology, conceptualisation; E.U.-G., writing—review and editing, supervision. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data that support the findings of this study are available from the authors upon request.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Table A1.

Prediction models (1–7).

Table A1.

Prediction models (1–7).

| Model (Ranked in Order of Importance of the Terms They Contain) | 1 | 2 | 3 | 4 | 5 | 6 | 7 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Terms/Gr = Frequency; RI = Relative Importance | Sig | RI | Sig | RI | Sig | RI | Sig | RI | Sig | RI | Sig | RI | Sig | RI |

| STK25 Listed firms/companies, Gr = 56 | 0.008 | 0.27 | - | - | - | - | - | - | - | - | - | - | - | - |

| STK49 Regulators, Gr = 42 | 0.033 | 0.19 | 0.029 | 0.19 | - | - | - | - | - | - | - | - | - | - |

| GI52 UN Sustainable development goals (SDGs), Gr = 51 | 0.442 | 0.07 | 0.499 | 0.07 | 0.597 | 0.07 | - | - | - | - | - | - | - | - |

| STK53 Society, Gr = 26 | 0.205 | 0.05 | 0.138 | 0.05 | 0.111 | 0.05 | 0.130 | 0.05 | - | - | - | - | - | - |

| YEAR | 0.326 | 0.05 | 0.204 | 0.05 | 0.177 | 0.05 | 0.105 | 0.05 | 0.114 | 0.05 | - | - | - | - |

| STK6 Clients/final consumers/end consumers, Gr = 57 | 0.496 | 0.05 | 0.297 | 0.05 | 0.247 | 0.05 | 0.260 | 0.05 | 0.240 | 0.05 | 0.241 | 0.05 | - | - |

| DI6 Governance, Gr = 105 | 0.045 | 0.04 | 0.058 | 0.04 | 0.065 | 0.04 | 0.056 | 0.04 | 0.055 | 0.04 | 0.075 | 0.04 | 0.055 | 0.04 |

| STK19 Governments, Gr = 59 | 0.317 | 0.02 | 0.200 | 0.02 | 0.230 | 0.02 | 0.232 | 0.02 | 0.208 | 0.02 | 0.261 | 0.02 | 0.303 | 0.02 |

| ZON17 USA, Gr = 14 | 0.090 | 0.02 | 0.129 | 0.02 | 0.133 | 0.02 | 0.157 | 0.02 | 0.154 | 0.02 | 0.171 | 0.02 | 0.175 | 0.02 |

| GI4 Corporate—financial performance/reporting, Gr = 64 | 0.518 | 0.02 | 0.230 | 0.02 | 0.276 | 0.02 | 0.366 | 0.02 | 0.503 | 0.02 | 0.326 | 0.02 | 0.317 | 0.02 |

| GI2 Climate change/Carbon requirements, Gr = 107 | - | - | 0.190 | 0.02 | 0.212 | 0.02 | 0.195 | 0.02 | 0.207 | 0.02 | 0.228 | 0.02 | 0.238 | 0.02 |

| GI51 Sustainable/development/performance, Gr = 152 | - | - | - | - | 0.754 | 0.02 | 0.726 | 0.02 | 0.787 | 0.02 | 0.958 | 0.02 | 0.947 | 0.02 |

| STK10 Corporations/Companies, Gr = 116 | - | - | - | - | - | - | 0.140 | 0.02 | 0.121 | 0.02 | 0.172 | 0.02 | 0.157 | 0.02 |

| GI8 Disclosure, Gr = 216 | - | - | - | - | - | - | - | - | 0.603 | 0.02 | 0.457 | 0.02 | 0.396 | 0.02 |

| LE7 Stakeholder theory, Gr = 20 | - | - | - | - | - | - | - | - | - | - | 0.671 | 0.01 | 0.703 | 0.01 |

| GI15 Financial reporting/expertise, Gr = 47 | - | - | - | - | - | - | - | - | - | - | - | - | 0.885 | 0.01 |

Sig.: statistical significance. STK, GI, LE, ZON, and DI are category codes (Table 2): stakeholder groups (STK), general sustainability items (GI), theories and approaches (LE), zones (ZON), and dimensions of sustainability (DI).

Table A2.

Prediction models (8–14).

Table A2.

Prediction models (8–14).

| Model (Ranked in Order of Importance of the Terms They Contain) | 8 | 9 | 10 | 11 | 12 | 13 | 14 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Terms/Gr = Frequency; RI = Relative Importance | Sig | RI | Sig | RI | Sig | RI | Sig | RI | Sig | RI | Sig | RI | Sig | RI |

| STK19 Governments, Gr = 59 | 0.181 | 0.02 | - | - | - | - | - | - | - | - | - | - | - | - |

| ZON17 USA, Gr = 14 | 0.203 | 0.02 | 0.171 | 0.02 | - | - | - | - | - | - | - | - | - | - |

| GI4 Corporate—financial performance/reporting, Gr = 64 | 0.293 | 0.02 | 0.237 | 0.02 | 0.261 | 0.02 | - | - | - | - | - | - | - | - |

| GI2 Climate change/Carbon requirements, Gr = 107 | 0.281 | 0.02 | 0.270 | 0.02 | 0.277 | 0.02 | 0.244 | 0.02 | - | - | - | - | - | - |

| GI51 Sustainable/development/performance, Gr = 152 | 0.870 | 0.02 | 0.891 | 0.02 | 0.875 | 0.02 | 0.805 | 0.02 | 0.815 | 0.02 | - | - | - | - |

| STK10 Corporations/Companies, Gr = 116 | 0.172 | 0.02 | 0.192 | 0.02 | 0.173 | 0.02 | 0.137 | 0.02 | 0.144 | 0.02 | 0.145 | 0.02 | - | - |

| GI8 Disclosure, Gr = 216 | 0.535 | 0.02 | 0.438 | 0.02 | 0.360 | 0.02 | 0.373 | 0.02 | 0.479 | 0.02 | 0.464 | 0.02 | 0.427 | 0.02 |

| LE7 Stakeholder theory, Gr = 20 | 0.694 | 0.01 | 0.737 | 0.01 | 0.734 | 0.01 | 0.840 | 0.01 | 0.905 | 0.01 | 0.926 | 0.01 | 0.970 | 0.01 |

| GI15 Financial reporting/expertise, Gr = 47 | 0.911 | 0.01 | 0.856 | 0.01 | 0.876 | 0.01 | 0.919 | 0.01 | 0.801 | 0.01 | 0.787 | 0.01 | 0.759 | 0.01 |

| ZON2 Asia, Gr = 17 | 0.297 | 0.01 | 0.449 | 0.01 | 0.493 | 0.01 | 0.543 | 0.01 | 0.522 | 0.01 | 0.541 | 0.01 | 0.695 | 0.01 |

| STK38 Ownership structure - shareholder, Gr = 66 | - | - | 0.404 | 0.01 | 0.447 | 0.01 | 0.471 | 0.01 | 0.414 | 0.01 | 0.391 | 0.01 | 0.513 | 0.01 |

| LE9 Voluntary, Gr = 39 | - | - | - | - | 0.584 | 0.01 | 0.616 | 0.01 | 0.531 | 0.01 | 0.531 | 0.01 | 0.471 | 0.01 |

| DI7 Social, Gr = 207 | - | - | - | - | - | - | 0.379 | 0.01 | 0.399 | 0.01 | 0.392 | 0.01 | 0.382 | 0.01 |

| STK4 Board of directors/directors, Gr = 82 | - | - | - | - | - | - | - | - | 0.675 | 0.01 | 0.667 | 0.01 | 0.698 | 0.01 |

| STK13 Employees, Gr = 35 | - | - | - | - | - | - | - | - | - | - | 0.621 | 0.01 | 0.560 | 0.01 |

| STK7 Community/Communities, Gr = 24 | - | - | - | - | - | - | - | - | - | - | - | - | 0.461 | 0.01 |

Sig.: statistical significance. STK, GI, LE, ZON, and DI are category codes (Table 2): stakeholder groups (STK), general sustainability items (GI), theories and approaches (LE), zones (ZON), and dimensions of sustainability (DI).

Table A3.

Prediction models (15–21).

Table A3.

Prediction models (15–21).

| Model (Ranked in Order of Importance of the Terms They Contain) | 15 | 16 | 17 | 18 | 19 | 20 | 21 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Terms/Gr = Frequency; RI = Relative Importance | Sig | RI | Sig | RI | Sig | RI | Sig | RI | Sig | RI | Sig | RI | Sig | RI |

| LE7 Stakeholder theory, Gr = 20 | 0.941 | 0.01 | - | - | - | - | - | - | - | - | - | - | - | - |

| GI15 Financial reporting/expertise, Gr = 47 | 0.731 | 0.01 | 0.733 | 0.01 | - | - | - | - | - | - | - | - | - | - |

| ZON2 Asia, Gr = 17 | 0.703 | 0.01 | 0.701 | 0.01 | 0.694 | 0.01 | - | - | - | - | - | - | - | - |

| STK38 Ownership structure - shareholder, Gr = 66 | 0.488 | 0.01 | 0.487 | 0.01 | 0.476 | 0.01 | 0.469 | 0.01 | - | - | - | - | - | - |

| LE9 Voluntary, Gr = 39 | 0.577 | 0.01 | 0.574 | 0.01 | 0.603 | 0.01 | 0.587 | 0.01 | 0.548 | 0.01 | - | - | - | - |

| DI7 Social, Gr = 207 | 0.350 | 0.01 | 0.351 | 0.01 | 0.339 | 0.01 | 0.334 | 0.01 | 0.320 | 0.01 | 0.320 | 0.01 | - | - |

| STK4 Board of directors/directors, Gr = 82 | 0.657 | 0.01 | 0.657 | 0.01 | 0.679 | 0.01 | 0.669 | 0.01 | 0.711 | 0.01 | 0.651 | 0.01 | 0.733 | 0.01 |

| STK13 Employees, Gr = 35 | 0.547 | 0.01 | 0.546 | 0.01 | 0.549 | 0.01 | 0.533 | 0.01 | 0.536 | 0.01 | 0.531 | 0.01 | 0.549 | 0.01 |

| STK7 Community/Communities, Gr = 24 | 0.493 | 0.01 | 0.495 | 0.01 | 0.499 | 0.01 | 0.441 | 0.01 | 0.330 | 0.01 | 0.331 | 0.01 | 0.355 | 0.01 |

| GI28 Integrated report, Gr = 68 | 0.901 | 0.01 | 0.900 | 0.01 | 0.931 | 0.01 | 0.917 | 0.01 | 0.895 | 0.01 | 0.828 | 0.01 | 0.895 | 0.01 |

| LE8 Stakeholders decoupling, Gr = 139 | - | - | 0.950 | 0.01 | 0.956 | 0.01 | 0.994 | 0.01 | 0.989 | 0.01 | 0.975 | 0.01 | 0.840 | 0.01 |

| GI7 Corporate/supply chain transparency, Gr = 32 | - | - | - | - | 0.880 | 0.00 | 0.885 | 0.00 | 0.881 | 0.00 | 0.799 | 0.00 | 0.870 | 0.00 |

| STK28 Managers, Gr = 55 | - | - | - | - | - | - | 0.806 | 0.00 | 0.870 | 0.00 | 0.870 | 0.00 | 0.805 | 0.00 |

| FR5 GRI, Gr = 35 | - | - | - | - | - | - | - | - | 0.787 | 0.00 | 0.760 | 0.00 | 0.754 | 0.00 |

| STK42 Policymakers, Gr = 53 | - | - | - | - | - | - | - | - | - | - | 0.747 | 0.00 | 0.824 | 0.00 |

| GI6 Corporate social respon/sustain (CSR)/CSM/CSP), Gr = 136 | - | - | - | - | - | - | - | - | - | - | - | - | 0.637 | 0.00 |

Sig.: statistical significance. STK, GI, LE, ZON, and DI are category codes (Table 2): stakeholder groups (STK), general sustainability items (GI), theories and approaches (LE), zones (ZON), and dimensions of sustainability (DI).

Table A4.

Prediction models (22–27).

Table A4.

Prediction models (22–27).

| Model (Ranked in Order of Importance of the Terms They Contain) | 22 | 23 | 24 | 25 | 26 | 27 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Terms/Gr = Frequency; RI = Relative Importance | Sig | RI | Sig | RI | Sig | RI | Sig | RI | Sig | RI | Sig | RI |

| STK13 Employees, Gr = 35 | 0.556 | 0.01 | - | - | - | - | - | - | - | - | - | - |

| STK7 Community/Comunities, Gr = 24 | 0.351 | 0.01 | 0.375 | 0.01 | - | - | - | - | - | - | - | - |

| GI28 Integrated report, Gr = 68 | 0.899 | 0.01 | 0.934 | 0.01 | 0.870 | 0.01 | - | - | - | - | - | - |

| LE8 Stakeholders decoupling, Gr = 139 | 0.814 | 0.01 | 0.726 | 0.01 | 0.691 | 0.01 | 0.684 | 0.01 | - | - | - | - |

| GI7 Corporate/supply chain transparency, Gr = 32 | 0.895 | 0.00 | 0.881 | 0.00 | 0.840 | 0.00 | 0.842 | 0.00 | 0.840 | 0.00 | - | - |

| STK28 Managers, Gr = 55 | 0.817 | 0.00 | 0.786 | 0.00 | 0.718 | 0.00 | 0.721 | 0.00 | 0.722 | 0.00 | 0.554 | 0.00 |

| FR5 GRI, Gr = 35 | 0.800 | 0.00 | 0.807 | 0.00 | 0.742 | 0.00 | 0.745 | 0.00 | 0.728 | 0.00 | 0.743 | 0.00 |

| STK42 Policymakers, Gr = 53 | 0.806 | 0.00 | 0.839 | 0.00 | 0.856 | 0.00 | 0.863 | 0.00 | 0.867 | 0.00 | 0.918 | 0.00 |

| GI6 Corporate social respon/sustain (CSR)/CSM/CSP), Gr = 136 | 0.632 | 0.00 | 0.675 | 0.00 | 0.707 | 0.00 | 0.702 | 0.00 | 0.665 | 0.00 | 0.619 | 0.00 |

| GI34 Non financial and corporate sustainability reporting, Gr = 165 | 0.837 | 0.00 | 0.855 | 0.00 | 0.994 | 0.00 | 1.000 | 0.00 | 0.969 | 0.00 | 0.985 | 0.00 |

| ZON7 European, Gr = 60 | - | - | 0.523 | 0.00 | 0.546 | 0.00 | 0.545 | 0.00 | 0.575 | 0.00 | 0.668 | 0.00 |

| STK2 Auditors assurance providers/Assurance, Gr = 84 | - | - | - | - | 0.579 | 0.00 | 0.584 | 0.00 | 0.640 | 0.00 | 0.646 | 0.00 |

| STK43 Practitioners, Gr = 15 | - | - | - | - | - | - | 0.971 | 0.00 | 0.975 | 0.00 | 0.981 | 0.00 |

| STK22 Larger firms/Multinationals, Gr = 17 | - | - | - | - | - | - | - | - | 0.594 | 0.00 | 0.606 | 0.00 |

| STK60 Sustainability institutions, Gr = 1 | - | - | - | - | - | - | - | - | - | - | 0.032 | 0.00 |

Sig.: statistical significance. STK, GI, LE, and ZON are category codes (Table 2): stakeholder groups (STK), general sustainability items (GI), theories and approaches (LE), and zones (ZON).

Appendix B

Table A5.

List of terms or log units grouped by categories (i).

Table A5.

List of terms or log units grouped by categories (i).

| Barriers | Abs.Fr. | Dimensions | Abs.Fr. | Frameworks | Abs.Fr. | General Items | Abs.Fr. |

|---|---|---|---|---|---|---|---|

| Economic | 2 | Environmental | 259 | GRI | 35 | Sustainability | 514 |

| Social | 2 | Social | 207 | IIRC | 27 | Disclosure | 216 |

| Technical | 2 | Governance | 105 | IFRS reporting standards | 15 | Non-financial and corporate sustainability report | 165 |

| Regulatory barriers | 1 | Economic | 76 | SASB | 10 | Sustainable/development/performance | 152 |

| ESG/EGSEE | 74 | King IV | 4 | Corporate social response/sustain (CSR)/CSM/CSP) | 136 | ||

| TBL | 10 | AA | 2 | Climate change/carbon requirements | 107 | ||

| Ethical | 7 | Deep ESG | 2 | Integrated report | 68 | ||

| Cultural | 3 | EFFAS | 1 | Corporate—financial performance/reporting | 64 | ||

| FEE | 1 | UN Sustainable Development Goals (SDGs) | 51 | ||||

| ISO | 1 | Corporate social performance | 48 | ||||

| Legal framework | 1 | Financial reporting/expertise | 47 | ||||

| OCDE | 1 | Corporate/supply chain transparency | 32 | ||||

| SEC | 1 | Supply chain management | 27 | ||||

| UNGC | 1 | Financial markets/capital markets | 12 | ||||

| Accountability | 11 | ||||||

| Common good | 8 | ||||||

| Human resource management | 7 | ||||||

| Greenwashing | 6 | ||||||

| Integrated thinking | 6 | ||||||

| Resilience | 6 | ||||||

| FinTech | 5 | ||||||

| Green bonds | 5 | ||||||

| Greenhouse gas | 5 | ||||||

| Self-consumption | 5 | ||||||

| Emerging economies | 4 | ||||||

| Socially responsible investing | 4 | ||||||

| Societal development | 4 | ||||||

| Stakeholder priorities and perceptions | 4 | ||||||

| Ecological Balance Sheet (EBS) | 3 | ||||||

| Firm risk | 3 | ||||||

| Life cycle | 3 | ||||||

| Unfavourable information | 3 | ||||||

| Favourable information | 2 | ||||||

| Financial incentives | 2 | ||||||

| Stakeholder pressure | 2 | ||||||

| Stakeholders’ value | 2 | ||||||

| Stakeholders’ behaviour | 2 | ||||||

| Stand-alone non-financial reports | 2 | ||||||

| Environmental psychology theory | 1 | ||||||

| Green constituting | 1 | ||||||

| Green financed projects | 1 | ||||||

| Green investment | 1 | ||||||

| Human capital | 1 | ||||||

| Impact washing | 1 | ||||||

| Institutional ownership | 1 | ||||||

| Intellectual capital | 1 | ||||||

| KPIs | 1 | ||||||

| Multi stakeholders’ standards | 1 | ||||||

| Non-sustainable | 1 | ||||||

| Paris Agreement | 1 | ||||||

| Reporting standards | 1 | ||||||

| Stand-alone reports | 1 | ||||||

| Stock performance | 1 | ||||||

| United Nations Global Compact | 1 | ||||||

| Whitewashing | 1 | ||||||

| WWF | 1 | ||||||

| Absolute frequency | 7 | 741 | 102 | 1761 |

Table A6.

List of terms or log units grouped by categories (ii).

Table A6.

List of terms or log units grouped by categories (ii).

| Legislation/Theories | Abs.Fr. | Materiality–Asymmetry | Abs.Fr. | Stakeholders | Abs.Fr. | Zones | Abs.Fr. |

|---|---|---|---|---|---|---|---|

| Stakeholders decoupling | 139 | Materiality concept | 32 | Investors | 359 | European | 60 |

| Voluntary | 39 | Asymmetry | 14 | Stakeholders global item | 259 | Asia | 17 |

| Stakeholder theory | 20 | Financially material | 4 | Stakeholders partial item | 186 | Oceania | 14 |

| Legitimacy theory | 14 | Introspective materiality | 2 | Corporations/companies | 116 | USA | 14 |

| Agency theory | 12 | Auditors’ assurance providers/assurance | 84 | Middle East | 9 | ||

| Mandatory | 10 | Board of directors/directors | 82 | Africa | 7 | ||

| EU Directive | 7 | Ownership structure—shareholder | 66 | India | 7 | ||

| Green deal | 2 | Governments | 59 | South Africa | 7 | ||

| EU Clean Energy Package | 1 | Clients/final consumers/end consumers | 57 | China | 6 | ||

| Listed firms/companies | 56 | South America | 4 | ||||

| Managers | 55 | North America | 3 | ||||

| Policymakers | 53 | South Asian | 3 | ||||

| Banks/financial institutions | 47 | Turkish | 3 | ||||

| Regulators | 42 | Russia | 2 | ||||

| Employees | 35 | Canadian | 1 | ||||

| Society | 26 | Caribbean | 1 | ||||

| Community/communities | 24 | Central America | 1 | ||||

| Other stakeholders (investors) | 18 | ||||||

| Larger firms/multinationals | 17 | ||||||

| Suppliers | 17 | ||||||

| Practitioners | 15 | ||||||

| Public–private partnerships | 13 | ||||||

| SMEs | 13 | ||||||

| Academicians | 11 | ||||||

| Other stakeholders (no investors) | 9 | ||||||

| Creditors | 8 | ||||||

| NGOs | 8 | ||||||

| Researchers | 8 | ||||||

| Funds | 6 | ||||||

| Competitors | 5 | ||||||

| Business actors | 4 | ||||||

| Contractors | 4 | ||||||

| Organisations | 4 | ||||||

| Pension funds | 4 | ||||||

| Public companies/entities | 4 | ||||||

| Developers | 3 | ||||||

| Lenders | 3 | ||||||

| Local community | 3 | ||||||

| Market forces | 3 | ||||||

| Media | 3 | ||||||

| Rating agencies | 3 | ||||||

| Funders | 2 | ||||||

| Integrated report preparers | 2 | ||||||

| Producers | 2 | ||||||

| Villagers | 2 | ||||||

| Environmental organisations | 1 | ||||||

| Future generations | 1 | ||||||

| General public | 1 | ||||||

| Lawyers | 1 | ||||||

| Loan providers | 1 | ||||||

| Marketplaces | 1 | ||||||

| Non-listed companies | 1 | ||||||

| Non-profit organisations | 1 | ||||||

| Partners | 1 | ||||||

| Payors | 1 | ||||||

| Property sector | 1 | ||||||

| Shareholder advisory firms | 1 | ||||||

| Stock exchanges | 1 | ||||||

| Supranational bodies | 1 | ||||||

| Sustainability data providers | 1 | ||||||

| Sustainability institutions | 1 | ||||||

| Sustainability practitioners | 1 | ||||||

| Sustainability standard setters | 1 | ||||||

| Sustainable innovators | 1 | ||||||

| The public | 1 | ||||||

| Worker’s associations | 1 | ||||||

| Absolute frequency | 244 | 52 | 1821 | 159 |

References

- Can, R. Investor Overreaction in the BIST Sustainability Index: An Empirical Analysis from 2014–2022. J. Corp. Gov. Insur. Risk Manag. 2023, 10, 196–207. [Google Scholar] [CrossRef]

- IFRS. IFRS Foundation and GRI to Align Capital Market and Multi-Stakeholder Standards to Create an Interconnected Approach for Sustainability Disclosures. Available online: https://www.ifrs.org/news-and-events/news/2022/03/ifrs-foundation-signs-agreement-with-gri/ (accessed on 24 January 2024).

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Cambridge University Press: New York, NY, USA, 2010. [Google Scholar]

- Freeman, R.E.; Phillips, R.; Sisodia, R. Tensions in Stakeholder Theory. Bus. Soc. 2020, 59, 213–231. [Google Scholar] [CrossRef]

- Sen, S.; Cowley, J. The Relevance of Stakeholder Theory and Social Capital Theory in the Context of CSR in SMEs: An Australian Perspective. J. Bus. Ethics 2013, 118, 413–427. [Google Scholar] [CrossRef]

- Ansoff, I. Corporate Strategy; McGraw-Hill, Inc.: New York, NY, USA, 1965. [Google Scholar]

- Barnard, C. The Function of the Executive; Harvard University Press: Cambridge, MA, USA, 1938. [Google Scholar]

- Ackoff, R. Creating the Corporate Future: Plan or be Planned for; Willey and Sons: New York, NY, USA, 1981. [Google Scholar]

- Dill, W. Public Participation in Corporate Planning: Strategic Management in a Kibitzer’s World. Long Range Plan. 1975, 8, 57–63. [Google Scholar] [CrossRef]

- Rhenman, E. Industrial Democracy and Industrial Management; Tavistock Publications Ltd.: London, UK, 1968. [Google Scholar]

- Geyskens, I.; Steenkamp, J.-B.E.M.; Scheer, L.K.; Kumar, N. Effects of trust and interdependence on relationship commitment. Int. J. Res. Mark. 1996, 16, 6–7. [Google Scholar]

- Wicks, A.C.; Berman, S.L.; Jones, T.M. The Structure of Optimal Trust: Moral and Strategic Implications. Acad. Manag. Stable 1999, 24, 99–116. [Google Scholar] [CrossRef]

- Crane, B. Revisiting Who, When, and Why Stakeholders Matter: Trust and Stakeholder Connectedness. Bus. Soc. 2020, 59, 263–286. [Google Scholar] [CrossRef]

- Darnall, N.; Henriques, I.; Sadorsky, P. Adopting proactive environmental strategy: The influence of stakeholders and firm size. J. Manag. Stud. 2010, 47, 1072–1094. [Google Scholar] [CrossRef]

- Wolf, J. The Relationship Between Sustainable Supply Chain Management, Stakeholder Pressure and Corporate Sustainability Performance. J. Bus. Ethics 2014, 119, 317–328. [Google Scholar] [CrossRef]

- Eesley, C.; Lenox, M.J. Firm responses to secondary stakeholder action. Strateg. Manag. J. 2006, 27, 765–781. [Google Scholar] [CrossRef]

- Merton, R.K. The Role-Set: Problems in Sociological Theory. Br. J. Sociol. 1957, 8, 106–120. [Google Scholar] [CrossRef]

- Pfeffer, J.; Salancik, G. A Social Information Processing Approach to Job Attitudes and Task Design. Adm. Sci. Q. 1978, 23, 224–253. [Google Scholar] [CrossRef]

- Antonacopoulou, E.P.; Méric, J. A critique of stake-holder theory: Management science or a sophisticated ideology of control? Corp. Gov. 2005, 5, 22–33. [Google Scholar] [CrossRef]

- Barney, J.B.; Harrison, J.S. Stakeholder Theory at the Crossroads. Bus. Soc. 2020, 59, 203–212. [Google Scholar] [CrossRef]

- Clarkson, M.B.E. A Stakeholder Framework for Analyzing and Evaluating Corporate Social Performance. Acad. Manag. Rev. 1995, 20, 92–117. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Mitchell, R.K.; Agle, B.R.; Wood, D.J. Toward a theory of stakeholder identification and salience: Defining the principle of who and what really counts. Acad. Manag. Rev. 1997, 22, 853–886. [Google Scholar] [CrossRef]

- Pérez, A.; López, C.; García-De los Salmones, M.d.M. An empirical exploration of the link between reporting to stakeholders and corporate social responsibility reputation in the Spanish context. Account. Audit. Account. J. 2017, 30, 668–698. [Google Scholar] [CrossRef]

- Fernandez-Feijoo, B.; Romero, S.; Ruiz, S. Effect of Stakeholders’ Pressure on Transparency of Sustainability Reports within the GRI Framework. J. Bus. Ethics 2014, 122, 53–63. [Google Scholar] [CrossRef]

- Jahn, J.; Brühl, R. How Friedman’s View on Individual Freedom Relates to Stakeholder Theory and Social Contract Theory. J. Bus. Ethics 2018, 153, 41–52. [Google Scholar] [CrossRef]

- Donaldson, T.; Preston, L.E. The Stakeholder Theory of the Corporation: Concepts, Evidence, and Implications. Acad. Manag. Rev. 1995, 20, 65–91. [Google Scholar] [CrossRef]

- Jones, T.M. Instrumental Stakeholder Theory: A Synthesis of Ethics and Economics. Acad. Manag. Rev. 1995, 20, 404–437. [Google Scholar] [CrossRef]

- Mainardes, E.W.; Alves, H. Stakeholder theory: Issues to resolve. Manag. Decis. 2011, 49, 226–252. [Google Scholar] [CrossRef]

- The European Parliament and the Council of the European Union. Directive 2022/2464 of the European Parliament and of the Council of 14 December 2022 amending Directive 2013/34/EU, Directive 2004/109/EC, Directive 2006/43/EC and Regulation (EU) No 537/2014, as regards corporate sustainability reporting. Off. J. Eur. Union 2022. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32022L2464&qid=1713287906082 (accessed on 24 January 2024).

- IFRS. NIIF S1 General Requirements for Financial Information Disclosures Related to Sustainability. Available online: https://www.ifrs.org/issued-standards/ifrs-sustainability-standards-navigator/ifrs-s1-general-requirements/ (accessed on 24 January 2024).

- The European Parliament and the Council of the European Union. Directive 2013/34/EU of the European Parliament and of the Council of 26 June 2013 on the annual financial statements, consolidated financial statements and related reports of certain types of undertakings, amending Directive 2006/43/EC of the European Parliament and of the Council and repealing Council Directives 78/660/EEC and 83/349/EEC. Off. J. Eur. Union 2013. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32013L0034&qid=1713288041910 (accessed on 24 January 2024).

- The European Parliament and the Council of the European Union. Proposal for a directive of the European Parliament and of the Council amending Directive 2013/34/EU, Directive 2004/109/EC, Directive 2006/43/EC and Regulation (EU) No 537/2014, as regards corporate sustainability reporting. Off. J. Eur. Union 2021. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52021PC0189&qid=1713288433704 (accessed on 24 January 2024).

- The European Parliament and the Council of the European Union. Directive 2014/95/EU of the European Parliament and of the Council of 22 October 2014 amending Directive 2013/34/EU as regards disclosure of non-financial and diversity information by certain large undertakings and groups. Off. J. Eur. Union 2014. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32014L0095&qid=1713288519351 (accessed on 24 January 2024).