Abstract

This research aimed to investigate the relationship between climate policy uncertainty (CPU), clean energy (ENERGY), carbon emission allowance prices (CARBON), and Bitcoin returns (BTC) for the period from August 2012 to August 2022. The empirical analysis strategies utilized in this study included the Fourier Bootstrap ARDL long-term coefficient estimator, the Fourier Granger Causality, and the Fourier Toda–Yamamoto Causality methods. Following the confirmation of cointegration among the variables, we observed a positive relationship between BTC and CARBON, a positive relationship between BTC and CPU, and a negative relationship between BTC and ENERGY. In terms of causal associations, we identified one-way causality running from CARBON to BTC, BTC to CPU, and BTC to the ENERGY variable. The study underscores the potential benefits and revenue opportunities for investors seeking diversified investment strategies in light of climate change concerns. Furthermore, it suggests actionable strategies for policymakers, such as implementing carbon taxes and educational campaigns, to foster a transition towards clean energy sources within the cryptocurrency mining sector and thereby mitigate environmental impacts.

1. Introduction

Climate change is an urgent and escalating phenomenon that presents a shared challenge for humanity. The detrimental consequences of climate change can lead to more frequent extreme weather events and pose significant risks to public health. According to the Intergovernmental Panel on Climate Change [1], a rise of 1.5 °C in global temperatures from pre-industrial levels could trigger irreversible environmental impacts, such as the loss of Arctic ice and rising sea levels. The substantial surge in global carbon dioxide (CO2) emissions serves as a primary catalyst for global warming, further intensifying the threats posed by climate change to the well-being of our planet. It is imperative that we take swift and unified action to achieve a carbon-neutral transition, focusing on mitigating the adverse effects of climate change and addressing sustainability challenges [2]. Climate change not only traps people in poverty but also decelerates economic growth [3]. Much like economic growth, climate change also has repercussions for finance and investments [4,5,6].

The escalating ecological deterioration resulting from the use of fossil fuels has sparked widespread environmental concerns, largely due to global climate change. Simultaneously, the alternative energy industries have experienced substantial growth in response to the surging global desire for clean energy, aligning with the shift towards low-carbon power sources over the last twenty years [7,8]. Nations committed to attaining sustainable development have demonstrated a resolute determination to mitigate carbon emissions and actively engage in global climate governance. These countries have implemented climate policies aimed at limiting carbon emissions. Nonetheless, the uncertainty surrounding climate change poses challenges and uncertainty to the corresponding climate policy implementation within this process [9].

Climate policy reveals uncertainty with different consequences. Climate policies have been implemented to encourage investments in measures that can encourage increased investment in renewable energy and reduce carbon emissions [10]. Due to the compelling empirical evidence highlighting the considerable effect of climate policy uncertainty (CPU) on economic and financial systems, scholars have displayed a notable inclination towards examining the ramifications of climate change on financial markets [9,11,12]. In this respect, Hsu et al. [13] found evidence that uncertainty in environmental policies and regulations significantly impacts the returns of emissions’ portfolios. In addition, there are empirical findings that climate risk also affects companies’ investment decisions [14]. The findings suggest that the uncertainty surrounding climate policy regulation positively influences a business’s inclination to mitigate its carbon footprint [10]. In other words, when concerns about climate change increase, investors switch from brown firms to green firms, causing green stocks to outperform brown stocks [15].

It is important to emphasize that in the absence of clean energy policies, the energy market often gravitates towards established fossil fuels due to existing infrastructure and lower immediate costs. This situation can lead to prolonged dependence on fossil fuels. For instance, in scenarios where punitive carbon taxes are absent, site regulation policies might prove more effective in curbing the carbon emissions from Bitcoin blockchain operations [16]. Consequently, governments worldwide are encouraged to take measures to limit carbon emissions from Bitcoin mining and to adopt environmentally friendly technologies that reduce Bitcoin’s energy dependence [17].

It is worth mentioning that cryptocurrencies, including Bitcoin, come with their own climate risks as they utilize ample amounts of energy, which ultimately have environmental consequences. Owing to climate change concerns, investors opt for alternative investment strategies, especially eco-friendly investments, which could decline the market outlook for Bitcoin. In recent years, academic discourse has extensively addressed the efficacy of climate policy within the renewable energy market, considering the growing influence of climate factors. Kettner and Kletzan-Slamanig [18] assert a profound interconnectedness between energy and climate policies, given the inherent connection between greenhouse gas emissions and energy production and consumption. Extensive research has elucidated the impact of climate policy changes on the operational performance of carbon-intensive industries, thereby extending their influence to the financial market [14,19,20]. Over the past few years, scholars have displayed a keen interest in valuing climate risks and evaluating the impact of climate policies.

Besides energy consumption, technological innovations can also impact climate uncertainty. The advent of technological advancements has introduced fresh opportunities with accompanying environmental implications. As a result, the market capitalization of the cryptocurrency industry has experienced a substantial surge over the past decade [21]. The increasing energy consumption of Bitcoin, the leading cryptocurrency, has reached significant amounts [22]. Based on the calculations provided by Cambridge University’s Bitcoin Electricity Consumption Index, Bitcoin’s energy consumption is estimated to be 0.38% of the total global electricity usage, surpassing the energy consumption of countries like Belgium and Finland. The primary cause of Bitcoin’s significant energy consumption is the computationally intensive consensus mechanisms employed by the cryptocurrency ecosystem, which verify transactions and safeguard the network’s security. Nevertheless, rapid advances in blockchain technology and the cryptocurrency market could potentially hinder worldwide endeavors to mitigate climate change [16,23,24,25]. Hence, gaining a comprehensive understanding of the environmental consequences associated with cryptocurrency mining is imperative in the context of climate change.

In 2021, Gavriilidis [26] devised the US climate policy uncertainty index, which measures the level of uncertainty in climate policies based on significant climate-related occurrences and articles from eight prominent US newspapers. Climate policy uncertainty encompasses the ambiguity arising from climate events and the uncertainty surrounding the US government’s decisions concerning reducing climate risks. The notion that Bitcoin and climate policy uncertainty go hand in hand is significant as they are closely linked. Bitcoin necessitates a substantial amount of energy, the main source of which is fossil fuels. The already heightened CPU would definitely push Bitcoin to utilize non-renewable sources of energy. The CPU index was created using the text-based approach of Baker et al. [27].

The primary objective of this research is to examine the interplay among climate policy uncertainty, the green energy index, carbon emission allowance prices, and Bitcoin returns. Specifically, this study endeavors to fill the existing void by investigating the relationships between cryptocurrency and policy reforms in the realm of clean energy, considering the escalating concerns regarding the environmental implications associated with bitcoin mining. Moreover, we intend to utilize the novel Fourier Bootstrap ARDL long-term coefficient estimator, the Fourier Granger Causality, and the Fourier Toda–Yamamoto Causality methods for empirical estimations.

This study is poised to contribute to the literature in three distinct ways. First, to the best of our knowledge, the relationship between CPU, the clean energy index, carbon emission allowance prices, and Bitcoin variables has yet to be explored in existing research. There is a need for further investigation to unravel the complex relationships among these variables. Second, utilizing a newly developed index offers an opportunity to uncover fresh insights into the impact of climate policy uncertainty across various dimensions. Additionally, these insights are expected to be of significant value to investors for portfolio diversification and risk management purposes. Third, it is also important to highlight that climate policy uncertainty may promote increased carbon awareness among investors, encouraging a shift towards investments in clean energy sources. The findings from this research are anticipated to offer valuable perspectives for a wide array of stakeholders, including policymakers, regulators, and investors.

This paper is organized into five sections. Following the introduction, the Section 2 summarizes a literature review that provides an overview of empirical research related to climate policy uncertainty. The Section 3 presents a detailed description of this study’s variables, model, and methodology. Subsequently, the Section 4 delivers an in-depth analysis of the results obtained and discusses their implications comprehensively. The final section summarizes the study’s findings and suggests relevant policy recommendations.

2. Literature Review

Numerous studies in the existing literature have attempted to explain the fluctuations in Bitcoin prices. Initially, these investigations might have seemed like mere flights of fancy, focusing on what Wenker [28] described as historical curiosities. They evolved from associating Bitcoin with markets for crime and illegal transactions [29] to recognizing it as a viable financial investment tool, a perspective solidified by the work of Ciaian and Rajcaniova [30]. Currently, a substantial portion of research delves into the correlation between Bitcoin prices and a wide range of macroeconomic indicators [31] as well as financial investment instruments.

While some studies explore the relationship between Bitcoin and subsequent cryptocurrencies, others assess the market perceptions influenced by the cryptocurrency markets at large. For instance, Sehgal, Pandey, and Deisting [32] examine the relationship between Bitcoin prices and traditional currencies. Corbet, Lucey, and Yarovaya [33] investigated various aspects of cryptocurrencies, focusing on market efficiency, price dynamics, and market risk, with data collected daily from multiple cryptocurrencies. Elsayed et al. [34] examine the causality dynamic between Bitcoin and other cryptocurrencies and nine major foreign currency markets. Bitcoin shows a strong interconnectedness with other cryptocurrencies, particularly Litecoin, and plays a significant role as a net transmitter of volatility within the cryptocurrency market. Its relationship with traditional currencies is more limited, with a notable exception being its unique relationship with the Chinese Yuan. Additionally, studies argue that Bitcoin is viewed as an alternative investment tool [35,36].

Efforts have been undertaken to explore the relationship between Bitcoin prices and global political risk and uncertainty indicators. Studies have suggested that Bitcoin prices are influenced by economic and policy uncertainties [37,38,39]. Notably, recent research by Hung et al. [40] delves into the impact of economic policy uncertainty on the Bitcoin market, employing six major uncertainty indices: Global Economic Policy Uncertainty, Equity Market Volatility, Twitter-based Economic Uncertainty, Geopolitical Risk Index, the Cryptocurrency Policy Uncertainty Index, and the Cryptocurrency Price Uncertainty Index. Importantly, this study incorporates two innovative cryptocurrency uncertainty indices introduced by Lucey et al. [41]. Their findings reveal a negative association between Bitcoin prices and the selected uncertainty indices, indicating that higher levels of uncertainty lead to reduced Bitcoin price fluctuations over time and across different frequencies. However, Wang et al. [42] found evidence suggesting that Bitcoin returns are not influenced by economic uncertainty and volatility indices. This conclusion is attributed to the significant energy consumption of the Bitcoin network, which exceeds that of many countries. As a result, transactions within the Bitcoin network contribute to what industry observers have termed a “growing energy problem” [43].

Recently, the exploration of the relationship between Bitcoin mining’s energy consumption and environmental factors has attracted considerable attention. This interest has spurred research into how Bitcoin prices affect the renewable energy market and the stock performance of companies in this sector. Such studies seek to deepen the understanding of the complex relationship between Bitcoin prices, climate policy uncertainty, and renewable energy indices. The environmental repercussions of the “growing energy problem” are deemed inescapable, a concern underscored by the work of Browne [44], Mora et al. [45], Li et al. [46], Jiang et al. [16], and Corbet et al. [22]. In an effort to address these issues, Wang et al. (2022) [47] attempted to measure the scope of media discourse regarding the environmental impact of cryptocurrencies by creating the Cryptocurrency Environmental Attention Index (CEAI).

Environmental concerns linked to significant events that impact digital asset prices have revealed a notable correlation between Bitcoin and the UCRY indices. In this vein, Baur et al. [48] and Egiyi and Ofoegbu [49] promote the use of renewable energy sources, such as hydrogen and solar energy, to lessen the adverse environmental effects of Bitcoin mining. In a similar exploration, Zhang et al. [21] found a direct relationship between the energy usage of Bitcoin mining (measured by hash rate) and CO2 emissions. These authors emphasize the critical need for technological advancements in energy-efficient decentralized finance consensus algorithms, aiming to evolve the cryptocurrency market into an arena more attuned to climate concerns, thereby offering a sustainable solution to existing environmental issues. On the other hand, research by Masanet et al. [50] and Huynh et al. [51] presents a different viewpoint, suggesting that the energy consumption associated with Bitcoin mining does not have a direct correlation with the carbon footprint, highlighting the varied perspectives within the academic community on this matter.

The academic literature clearly highlights that the environmental impacts of the commodity prices (such as coal, oil, and gas) utilized in Bitcoin mining are significant factors pertinent to this study’s focus. China is a critical case in point, with its substantial dependence on coal for electricity generation. Research examining the effect of coal prices on Bitcoin prices in China [52] has uncovered a link between the two [53], underscoring the negative implications for health and climate in both the USA and China [54]. Further investigations into dynamic interconnectedness reveal that coal prices serve as the primary disruptor, whereas climate policy uncertainty and carbon pricing often emerge as the primary receivers of these shocks. Moreover, findings by Stoll et al. [55] corroborate the significant contribution of Bitcoin mining’s electricity consumption to overall carbon emissions. Nevertheless, the research pointing to Bitcoin’s impact on prices [56] also suggests a positive role for Bitcoin in promoting clean energy and carbon management initiatives.

Additionally, we aim to highlight studies that investigate the relationship between climate policy uncertainty and renewable energy prices [9,57]. In a thorough examination of the impact of the CPU index on global renewable energy market returns, significant insights have been uncovered. This research indicates that a higher CPU index possesses enhanced predictive power for renewable energy market returns compared to a lower CPU index. Notably, the influence of the CPU index on forecasting renewable energy market returns becomes more pronounced following the Paris Agreement’s implementation, highlighting the market’s sensitivity to climate policy changes [11]. The study also found that climate policy uncertainty, in conjunction with geopolitical risk, the Global Political Risk Index, and the Global Risk Perception Index, adversely affects the renewable energy market’s volatility.

Sailor et al. [58] argued that climate change significantly impacts wind energy production, predicting a substantial 40% reduction in electricity generation during the summer. Furthermore, research by Venturini [59] and Bartram et al. [60] indicates that climate uncertainties influence the stock returns of companies. Hsu et al. [13] concluded that major climate policy changes trigger volatility in the share returns of energy companies, a finding supported by Diaz-Rainey et al. [61].

Nam [62] discovered that climate uncertainty exerts inflationary pressures on agricultural food, non-energy, and energy products. Tian et al. [63] analyzed the Infectious Disease Capital Market Volatility (IDEMV), CPU, the CBOE Crude Oil Volatility Index (OVX), and Geopolitical Risks (GPR) variables within samples from the USA, China, and Europe. The study concluded that uncertainties exhibit an asymmetrical relationship, impacting the USA and Europe in the long term and China in the short term. Hoque et al. [64] investigated the interconnectedness and spillover effects of climate policy uncertainty in the United States on energy stocks, alternative energy stocks, and carbon emissions futures. Interestingly, the analysis revealed a noticeable increase in the impact of climate measures following the Paris Agreement, highlighting a strengthened global commitment to addressing climate change. In research by Bouri et al. [4], the relationship between climate uncertainty and the performance of green versus brown energy stocks was explored. The study’s outcomes indicate a market trend where heightened climate policy uncertainty led investors to reallocate their investments from brown to green energy stocks, resulting in green stocks outperforming their brown counterparts.

In conclusion, the complex relationship between Bitcoin, economic fluctuations, environmental issues, and climate policy underscores an urgent need for a nuanced approach to cryptocurrency within our global economy. This research spotlights the pivotal balance between leveraging the financial potential of Bitcoin and mitigating its ecological footprint amidst an uncertain economic and policy milieu. By dissecting the nexus among climate policy uncertainty, green energy initiatives, carbon pricing, and Bitcoin’s market performance, this study aims to contribute significantly to a more sustainable and economically viable future.

3. Materials and Methods

3.1. Materials

In this subsection, we describe variables that underpin our investigation into the interplay among climate policy uncertainty, clean energy initiatives, carbon emission allowance prices, and Bitcoin returns. The primary objective of this research is to methodically explore and analyze the relationship between these variables, aiming to shed light on their dynamic interactions. To facilitate this endeavor, we have compiled Table 1, which succinctly outlines the variables under consideration, their definitions, and the data sources from which they were derived. Monthly data for the period August 2012–August 2022 were used.

Table 1.

Variables and data sources.

3.2. Methods

In our research’s methodological framework, we adopt a systematic and sequential approach to explore the dynamic relationships among the variables of interest. Our first step involves using the Fourier-Augmented Dickey–Fuller test [67] to analyze the stationarity of the time series data, a critical prerequisite for ensuring the validity of further analyses. After confirming stationarity, we proceed with the fractional frequency flexible Fourier Bootstrap Autoregressive Distributed Lag test to investigate the cointegration relationships among the variables. This test helps us to ascertain the existence of a long-term equilibrium relationship between them. Finally, to uncover causal links, we utilize two causality tests: the Fourier-Granger causality test [68] and the Toda–Yamamoto causality test [69]. These tests are crucial for determining the direction and nature of causal relationships among the variables, offering a detailed insight into their interactions.

Regime changes over time can significantly impact the outcomes of a time series analysis. To guarantee the accuracy of the analysis results, it is crucial to account for regime shifts within the series during model estimation. In this research, Fourier models are utilized because of their ability to accommodate both abrupt (hard) and gradual (soft) regime changes, thus ensuring a comprehensive consideration of fluctuations within the series.

Enders and Lee [67] introduced an enhancement to the Augmented Dickey–Fuller (ADF) type unit root test, incorporating the Fourier function to acknowledge a specific frequency dimension. This adaptation facilitates the detection of both nonlinear regime shifts and unknown smooth transition changes in the deterministic component of the model, achieved through the integration of the Fourier function.

In the Fourier ADF [67] unit root test, the basic hypothesis was formed as ‘There is a unit root in the series’ ( ). The equations for this test are as follows:

The Fourier estimation function y, as detailed in the equations, uses ‘t’ to denote the time trend, ‘k’ for the appropriate frequency value (where 1 ≤ k ≤ 5), and ‘T’ to signify the observation size. If the calculated statistical value τDF-τ from estimating the model exceeds the absolute value of the critical values established by Enders and Lee [68], it indicates the absence of a unit root in the series.

Pesaran et al. [70] developed the Autoregressive Distributed Lag (ARDL) approach to estimate the cointegration relationship between variables possessing differing levels of stationarity. This method emphasizes the significance of the error correction term and the statistical relevance of the coefficients for lagged independent variables, employing both lower and upper bound testing, particularly focusing on the first condition. To address the limitation regarding assumptions on the order of integration of variables, McNown et al. [71] proposed the Bootstrap ARDL test. Pesaran et al. [70] introduced the F-overall and t-dependent statistics. Expanding upon this, McNown et al. [71] proposed the F-independent ( statistic. Solarin [72] enhanced the Bootstrap ARDL model of 2018 by incorporating Fourier terms, addressing the oversight of regime changes in prior models and aiming for more robust analysis outcomes. Following this, Yılancı et al. [73] introduced a fractional frequency flexible Fourier equation into the Fourier Bootstrap ARDL framework, culminating in the fractional frequency flexible Fourier Bootstrap ARDL test. This test, leveraging the single-frequency approach, builds on the methodologies of Becker et al. [74] and Ludlow and Enders [75]. The equation of the test is presented as follows:

In the equation, the first difference ∆, along with the specified lag number ‘p‘, incorporates to represent the error term, characterized by a zero mean and finite variance. If the statistical value derived from the test exceeds the critical values determined through bootstrap simulation, it signifies the establishment of a cointegration relationship among the series.

Enders and Jones [68] developed the Fourier Granger causality test in response to the limitations of the traditional Granger [76] causality test, which is conducted using the vector autoregressive (VAR) model introduced by Sims [77]. The traditional method often falls short as it overlooks regime changes and frequently fails to accurately identify relationships through linear specifications. The Fourier Granger causality test addresses these shortcomings by incorporating Gallant’s [78] Fourier functions into the VAR model, thereby detecting regime changes that were previously indiscernible.

The basic hypothesis of the Fourier Granger [68] causality test is articulated as ‘There is no causal relationship between the series’ ( ). The test’s equation is presented as follows:

In the Toda and Yamamoto [69] causality test, the series are analyzed using the VAR(p+dmax) model, which increases the lag without accounting for the series’ stationarity or cointegration relationships. Recognizing that this approach neglects regime changes, Nazlıoğlu et al. [79] introduced the Fourier Toda–Yamamoto causality test. This adaptation incorporates Fourier functions to define regime changes within the series, adding Fourier terms to the VAR model in place of the constant term.

The main hypothesis of the Fourier Toda–Yamamoto [68] causality test is that there is no causal relationship between the series’ (H0: β = 0). The equation of the test is as follows:

In the equation, d indicates the maximum degree of cointegration, and p indicates the optimal lag length. If the calculated Wald or F test statistic is greater than the asymptotic and bootstrap p values, it is concluded that there is no causal relationship between the series.

4. Results and Discussion

This section of our study presents a detailed analysis of the findings derived from applying the Fourier ADF unit root test, the fractional frequency flexible Fourier Bootstrap ARDL test, and the Fourier Granger and Toda–Yamamoto causality tests. This section articulately encapsulates the essence of our findings, providing a clear and comprehensive exposition of the empirical evidence gathered through our research.

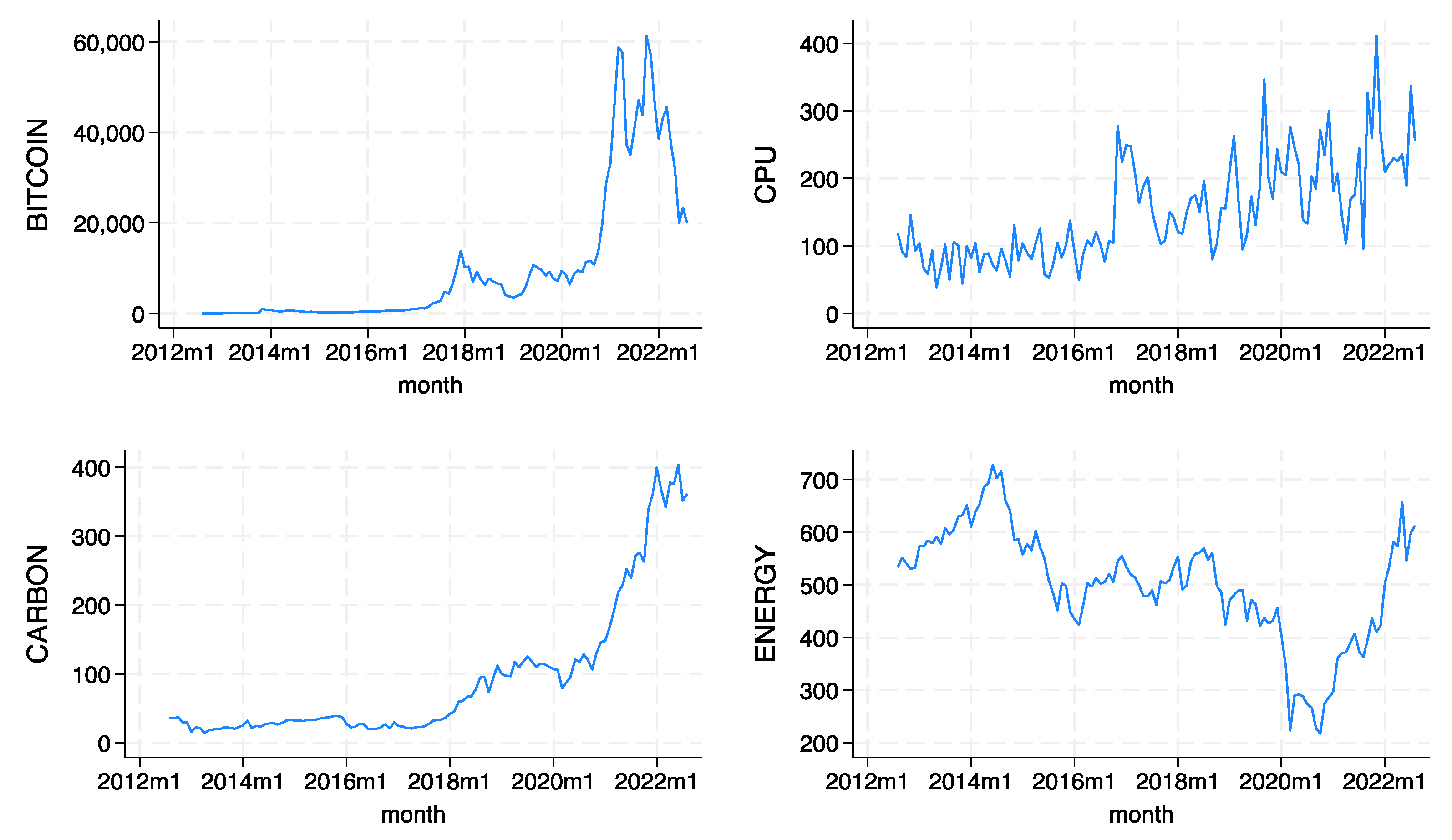

Table 2 presents the descriptive statistics of the variables analyzed in this study. The skewness and kurtosis values of the variables suggest that they are approximately normally distributed. Figure 1 illustrates a significant increase in both Bitcoin prices and carbon emission allowance prices since 2021. Meanwhile, the climate policy uncertainty variable has exhibited substantial volatility since 2016. The S&P 500 energy index was notably impacted during the COVID-19 pandemic.

Table 2.

Descriptive statistics.

Figure 1.

Bitcoin and carbon emission allowance prices, climate policy uncertainty, and S&P 500 energy indexes.

The results of the Fourier ADF unit root test, designed to analyze soft-transition structural breaks, are detailed in Table 3. It was observed that all variables exhibit a unit root at their respective levels and achieve stationarity when differenced, with the exception of CPU. CPU demonstrates a stationary structure at its level. Given this scenario, the application of the Fourier Bootstrap ARDL bounds test was deemed suitable. This test accommodates different levels of integration and accounts for smooth transitional structural breaks.

Table 3.

Fourier ADF Unit Root Test Results.

Based on the results from the Fourier Bootstrap ARDL bounds test, the Fa and Fb statistics were found to be significant at the 1% level, and the T statistics at the 10% level. Our analysis, detailed in Table 4, reveals that the variables included in the model demonstrate a long-term cointegration relationship. Essentially, despite short-term fluctuations, they share a stable, long-term equilibrium relationship, indicating that any changes in one variable are likely to be mirrored by the others in the long run. After confirming the cointegration relationship between the variables, as showcased in Table 5, we proceed to discuss the positive and negative associations of the variables included in the model. According to the findings, a positive relationship was identified between BTC (Bitcoin) and carbon allowance prices, as well as between BTC and CPU, and a negative relationship was found between BTC and the S&P 500 energy index. In quantitative terms, an increase of 1.00 in carbon prices leads to a 1.30 unit increase in BTC prices. A 1.00 unit increase in CPU results in a 1.23 unit increase in BTC prices. Lastly, a 1.00 unit increase in the Global Clean Energy Index is associated with a 0.61 unit decrease in BTC prices.

Table 4.

Fourier Bootstrap ARDL Bounds Test Results.

Table 5.

Fourier Bootstrap ARDL Long-Run Coefficient Estimation.

The observed increase in energy consumption with rising carbon prices, leading to greater Bitcoin production and interest, which subsequently drives up BTC prices, reflects a complex interplay between environmental policies and cryptocurrency market dynamics [43]. The literature highlights the significant energy consumption of the Bitcoin network, a factor contributing to what has been termed a “growing energy problem” [47]. This energy-intensive nature of Bitcoin mining, despite the environmental concerns it raises, appears to foster a scenario where increased carbon pricing paradoxically encourages more Bitcoin production, driven by the financial incentives of higher BTC prices.

Further complexity is introduced with the finding that an increase in climate policy uncertainty exacerbates pollution levels, contributing to the rise in BTC prices. This relationship underscores the impact of environmental and policy uncertainty on the cryptocurrency market, where economic and policy uncertainties influence Bitcoin prices [37,38,39]. The literature suggests that Bitcoin is an alternative investment tool in times of uncertainty, including climate policy uncertainty, highlighting its role in a broader economic and environmental context.

The negative correlation between BTC and the S&P 500 Global Clean Energy Index, alongside the observed one-way causality from carbon emission pricing to BTC, from BTC to CPU, and from BTC to the S&P 500 Energy Index (Table 6), indicates the potential for these variables to be grouped together in investment portfolios as alternative assets. This suggests that investors may view Bitcoin and clean energy stocks as complementary investments, diversifying portfolios to hedge against various risks associated with traditional financial markets and environmental policies. Such findings highlight the intricate relationships between the cryptocurrency market, environmental policies, and the global energy market, suggesting a nuanced approach to integrating Bitcoin into broader financial and environmental strategies [4,11].

Table 6.

Fourier Granger Causality and Fourier Toda–Yamamoto Causality Results.

5. Conclusions and Policy Implications

Climate change has emerged as a significant concern for the financial sector, prompting researchers to investigate its implications for financial stability and sector performance. Similarly, the impact of climate change on cryptocurrencies, which serve as both alternative payment methods and popular financial assets, is under scrutiny in global markets. A broad spectrum of investors favors cryptocurrencies due to their ease of transaction, liquidity, and transferability. However, operating within the cryptocurrency system, particularly in mining and distribution processes, entails substantial electricity consumption.

This study has highlighted the intricate relationships between climate policy uncertainty, global clean energy initiatives, carbon emission allowance prices, and Bitcoin returns, particularly from August 2012 to August 2022. Significant insights have been uncovered by applying econometric methods, such as the Fourier Bootstrap ARDL, Fourier Granger Causality, and Fourier Toda–Yamamoto Causality. These insights reveal that climate policy uncertainty and the global clean energy index positively and significantly influence Bitcoin returns. Moreover, a negative and significant relationship was observed between Bitcoin and the energy index. A notable discovery was the one-way causality from carbon emission allowance prices to Bitcoin returns, highlighting the complex interplay between environmental policy and cryptocurrency valuations.

These results have significant implications for both investors and policymakers. It was observed that the European Union Allowance has become increasingly important as an investment instrument, displaying characteristics of a financial asset and demonstrating a high level of liquidity. The global markets for clean energy, Bitcoin, and EUA offer opportunities for investors to enhance portfolio diversification in terms of financial assets. These findings highlight the potential benefits and revenue opportunities for investors pursuing diversified investment strategies. Furthermore, climate policy regulators have the option to impose sanctions to increase carbon awareness among businesses and direct them towards clean energy sources. Climate policy uncertainty introduces ambiguities in opting for clean energy sources for Bitcoin mining due to potentially vague policy directions for the industry. Governments and regulatory bodies should strive to facilitate the transition to clean energy in Bitcoin mining, including offering tax breaks to Bitcoin miners. Implementing carbon taxing can also serve as a tool to discourage using carbon-intensive elements, such as fossil fuels, in Bitcoin mining operations.

Additionally, governments can initiate educational campaigns to inform various stakeholders about the environmental consequences of Bitcoin mining. International agreements on using clean energy in the Bitcoin industry are indispensable for reducing carbon emissions. It is important to note that many jurisdictions are pushing for Bitcoin miners to use renewable energy. Additionally, the idea of funding renewable energy development through Bitcoin mining has been proposed in various regions. Our study’s empirical findings also inform investors to make educated decisions based on the underlying relationships between variables included in the study. An interesting solution is the recent establishment of several Bitcoin spot ETFs in the United States, which is already changing investment patterns.

However, the study’s scope and findings suggest avenues for further research, particularly in evaluating the impact of climate policy uncertainty across different periods and employing varied estimation methodologies. Future studies could also explore the relationship between CPU and environmental, social, and governance indices, as well as the effects of CPU on a broader spectrum of cryptocurrency assets, including non-fungible tokens, decentralized finance, and the Metaverse. Such explorations could enrich the existing literature and offer deeper insights into developing a sustainable cryptocurrency ecosystem. Addressing these gaps remains a priority for our future research endeavors, with the aim of contributing further to the understanding of the nexus between climate policy, sustainable finance, and the expanding field of cryptocurrencies.

Author Contributions

Conceptualization, S.G., M.D., F.Z. and N.G.; methodology, F.Z.; investigation, S.G., B.J., M.D., F.Z. and N.G.; writing—original draft preparation, S.G., B.J., M.D., F.Z. and N.G.; writing—review and editing, S.G., M.D., B.J. and N.G.; visualization, M.D. and B.J.; supervision, M.D. and B.J.; project administration, B.J.; funding acquisition, B.J. All authors have read and agreed to the published version of the manuscript.

Funding

The APC was funded by the John Paul II Catholic University of Lublin, Poland.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data (variables) can be found at: www.policyuncertainty.com (Economic Policy Uncertainty Index) (accessed on 3 February 2024); www.spglobal.com (S&P Global) (accessed on 3 February 2024), and www.investing.com (accessed on 1 February 2024).

Conflicts of Interest

The authors declare no conflicts of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

References

- IPCC. Summary for Policymakers. In Global Warming of 1.5 °C. An IPCC Special Report on the Impacts of Global Warming of 1.5 °C above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change, Sustainable Development, and Efforts to Eradicate Poverty; Masson-Delmotte, V., Zhai, P., Pörtner, H.-O., Roberts, D., Skea, J., Shukla, P.R., Pirani, A., Moufouma-Okia, W., Péan, C., Pidcock, R., et al., Eds.; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2018; pp. 3–24. [Google Scholar]

- IPCC. Climate Change 2022: Impacts, Adaptation, and Vulnerability. Contribution of Working Group II to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change; Pörtner, H.-O., Roberts, D.C., Tignor, M., Poloczanska, E.S., Mintenbeck, K., Alegría, A., Craig, M., Langsdorf, S., Löschke, S., Möller, V., et al., Eds.; Cambridge University Press: Cambridge, UK, 2022. [Google Scholar]

- Tol, R.S.J. Poverty Traps and Climate Change. In ESRI Working Paper No. 413; The Economic and Social Research Institute: Dublin, Ireland, 2011. [Google Scholar]

- Bouri, E.; Iqbal, N.; Klein, T. Climate Policy Uncertainty and the Price Dynamics of Green and Brown Energy Stocks. Financ. Res. Lett. 2022, 47, 102740. [Google Scholar] [CrossRef]

- Ren, X.; Zhang, X.; Yan, C.; Gozgor, G. Climate Policy Uncertainty and Firm-Level Total Factor Productivity: Evidence from China. Energy Econ. 2022, 113, 106209. [Google Scholar] [CrossRef]

- Wu, Y.; Miao, C.; Fan, X.; Gou, J.; Zhang, Q.; Zheng, H. Quantifying the Uncertainty Sources of Future Climate Projections and Narrowing Uncertainties with Bias Correction Techniques. Earth’s Future 2022, 10, e2022EF002963. [Google Scholar] [CrossRef]

- Zhao, X. Do the Stock Returns of Clean Energy Corporations Respond to Oil Price Shocks and Policy Uncertainty? J. Econ. Struct. 2020, 9, 53. [Google Scholar] [CrossRef]

- Sarker, P.K.; Bouri, E.; Marco, C.K.L. Asymmetric Effects of Climate Policy Uncertainty, Geopolitical Risk, and Crude Oil Prices on Clean Energy Prices. Environ. Sci. Pollut. Res. 2023, 30, 15797–15807. [Google Scholar] [CrossRef] [PubMed]

- Xu, Y.; Li, M.; Yan, W.; Bai, J. Predictability of the Renewable Energy Market Returns: The Informational Gains from the Climate Policy Uncertainty. Resour. Polic. 2022, 79, 103141. [Google Scholar] [CrossRef]

- Lopez, J.M.R.; Sakhel, A.; Busch, T. Corporate Investments and Environmental Regulation: The Role of Regulatory Uncertainty, Regulation-Induced Uncertainty, and Investment History. Eur. Manag. J. 2017, 35, 91–101. [Google Scholar] [CrossRef]

- Liang, C.; Umar, M.; Ma, F.; Huynh, T.L.D. Climate Policy Uncertainty and World Renewable Energy Index Volatility Forecasting. Technol. Forecast. Soc. Chang. 2022, 182, 121810. [Google Scholar] [CrossRef]

- He, Y.; Zheng, H. Do Environmental Regulations Affect Firm Financial Distress in China? Evidence from Stock Markets. Appl. Econ. 2022, 54, 4384–4401. [Google Scholar] [CrossRef]

- Hsu, P.H.; Li, K.; Tsou, C.Y. The Pollution Premium. J. Financ. 2023, 78, 1343–1392. [Google Scholar] [CrossRef]

- Engle, R.F.; Giglio, S.; Kelly, B.; Lee, H.; Stroebel, J. Hedging Climate Change News. Rev. Financ. Stud. 2020, 33, 1184–1216. [Google Scholar] [CrossRef]

- Pástor, Ľ.; Stambaugh, R.F.; Taylor, L.A. Sustainable Investing in Equilibrium. J. Financ. Econ. 2021, 142, 550–571. [Google Scholar] [CrossRef]

- Jiang, S.; Li, Y.; Lu, Q.; Hong, Y.; Guan, D.; Xiong, Y.; Wang, S. Policy Assessments for the Carbon Emission Flows and Sustainability of Bitcoin Blockchain Operation in China. Nat. Commun. 2021, 12, 1938. [Google Scholar] [CrossRef] [PubMed]

- Xiao, Z.; Cui, S.; Xiang, L.; Liu, P.J.; Zhang, H. The Environmental Cost of Cryptocurrency: Assessing Carbon Emissions from Bitcoin Mining in China. J. Digit. Econ. 2023, 2, 119–136. [Google Scholar] [CrossRef]

- Kettner, C.; Kletzan-Slamanig, D. Is There Climate Policy Integration in European Union Energy Efficiency and Renewable Energy Policies? Yes, No, Maybe. Environ. Police Gov. 2020, 30, 141–150. [Google Scholar] [CrossRef]

- Le, T.-H.; Chang, Y.; Park, D. Renewable and Nonrenewable Energy Consumption, Economic Growth, and Emissions: International Evidence. Energy J. 2020, 41, 73–92. [Google Scholar] [CrossRef]

- Schlenker, W.; Taylor, C.A. Market Expectations of a Warming Climate. J. Financ. Econ. 2021, 142, 627–640. [Google Scholar] [CrossRef]

- Zhang, D.; Chen, X.H.; Lau, C.K.M.; Xu, B. Implications of Cryptocurrency Energy Usage on Climate Change. Technol. Forecast. Soc. Chang. 2023, 187, 122219. [Google Scholar] [CrossRef]

- Corbet, S.; Lucey, B.; Yarovaya, L. Bitcoin-Energy Markets Interrelationships—New Evidence. Resour. Police 2021, 70, 101916. [Google Scholar] [CrossRef]

- Gaies, B.; Nakhli, M.S.; Sahut, J.M.; Guesmi, K. Is Bitcoin Rooted in Confidence?—Unraveling the Determinants of Globalized Digital Currencies. Technol. Forecast. Soc. Chang. 2021, 172, 121038. [Google Scholar] [CrossRef]

- Baur, D.G.; Oll, J. Bitcoin Investments and Climate Change: A Financial and Carbon Intensity Perspective. Financ. Res. Lett. 2022, 47, 102575. [Google Scholar] [CrossRef]

- Yan, L.; Mirza, N.; Umar, M. The Cryptocurrency Uncertainties and Investment Transitions: Evidence from High and Low Carbon Energy Funds in China. Technol. Forecast. Soc. Chang. 2022, 175, 121326. [Google Scholar] [CrossRef]

- Gavriilidis, K. Measuring Climate Policy Uncertainty. SSRN Electron. J. 2021. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring Economic Policy Uncertainty*. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Wenker, N. Online Currencies, Real-World Chaos: The Struggle to Regulate the Rise of Bitcoin. Tex. Rev. L. Pol. 2014, 19, 145. [Google Scholar]

- Grinberg, R. Bitcoin: An Innovative Alternative Digital Currency. Hastings Sci. Tech. L. J. 2012, 4, 159. [Google Scholar]

- Ciaian, P.; Rajcaniova, M.; Kancs, D. Virtual Relationships: Short- and Long-Run Evidence from BitCoin and Altcoin Markets. J. Int. Financ. Mark. Inst. Money 2018, 52, 173–195. [Google Scholar] [CrossRef]

- Przyłuska-Schmitt, J.; Jegorow, D.; Bučková, J. The Dynamics of Cryptocurrency Price Volatility in the Face of the Crisis on the Example of Bitcoin and Ethereum. Ann. Univ. Mariae Curie-Skłodowska Sect. H–Oeconomia 2023, 57, 101–113. [Google Scholar]

- Sehgal, S.; Pandey, P.; Diesting, F. Examining Dynamic Currency Linkages amongst South Asian Economies: An Empirical Study. Res. Int. Bus. Financ. 2017, 42, 173–190. [Google Scholar] [CrossRef]

- Corbet, S.; Lucey, B.; Urquhart, A.; Yarovaya, L. Cryptocurrencies as a Financial Asset: A Systematic Analysis. Int. Rev. Financ. Anal. 2019, 62, 182–199. [Google Scholar] [CrossRef]

- Elsayed, A.H.; Gozgor, G.; Lau, C.K.M. Causality and Dynamic Spillovers among Cryptocurrencies and Currency Markets. Int. J. Financ. Econ. 2022, 27, 2026–2040. [Google Scholar] [CrossRef]

- Paule-Vianez, J.; Prado-Román, C.; Gómez-Martínez, R. Economic Policy Uncertainty and Bitcoin. Is Bitcoin a Safe-Haven Asset? Eur. J. Manag. Bus. Econ. 2020, 29, 347–363. [Google Scholar] [CrossRef]

- Colon, F.; Kim, C.; Kim, H.; Kim, W. The Effect of Political and Economic Uncertainty on the Cryptocurrency Market. Financ. Res. Lett. 2021, 39, 101621. [Google Scholar] [CrossRef]

- Demir, E.; Gozgor, G.; Lau, C.K.M.; Vigne, S.A. Does Economic Policy Uncertainty Predict the Bitcoin Returns? An Empirical Investigation. Financ. Res. Lett. 2018, 26, 145–149. [Google Scholar] [CrossRef]

- Fang, L.; Bouri, E.; Gupta, R.; Roubaud, D. Does Global Economic Uncertainty Matter for the Volatility and Hedging Effectiveness of Bitcoin? Int. Rev. Financ. Anal. 2019, 61, 29–36. [Google Scholar] [CrossRef]

- Cai, Y.; Zhu, Z.; Xue, Q.; Song, X. Does Bitcoin Hedge against the Economic Policy Uncertainty: Based on the Continuous Wavelet Analysis. J. Appl. Econ. 2022, 25, 983–996. [Google Scholar] [CrossRef]

- Hung, N.T.; Huynh, T.L.D.; Nasir, M.A. Cryptocurrencies in an Uncertain World: Comprehensive Insights from a Wide Range of Uncertainty Indices. Int. J. Financ. Econ. 2023. [Google Scholar] [CrossRef]

- Lucey, B.M.; Vigne, S.A.; Yarovaya, L.; Wang, Y. The Cryptocurrency Uncertainty Index. Financ. Res. Lett. 2022, 45, 102147. [Google Scholar] [CrossRef]

- Wang, G.-J.; Xie, C.; Wen, D.; Zhao, L. When Bitcoin Meets Economic Policy Uncertainty (EPU): Measuring Risk Spillover Effect from EPU to Bitcoin. Financ. Res. Lett. 2019, 31. [Google Scholar] [CrossRef]

- de Vries, A. Bitcoin’s Growing Energy Problem. Joule 2018, 2, 801–805. [Google Scholar] [CrossRef]

- Browne, R. Bitcoin’s Wild Ride Renews Worries About Its Massive Carbon Footprint. CNBC Sustain. Energy Blog. 2021. Available online: https://www.cnbc.com/2021/02/05/bitcoin-btc-surge-renews-worries-about-its-massive-carbon-footprint.html (accessed on 3 February 2024).

- Mora, C.; Rollins, R.L.; Taladay, K.; Kantar, M.B.; Chock, M.K.; Shimada, M.; Franklin, E.C. Publisher Correction: Bitcoin Emissions Alone Could Push Global Warming above 2 °C. Nat. Clim. Chang. 2019, 9, 80. [Google Scholar] [CrossRef]

- Li, J.; Li, N.; Peng, J.; Cui, H.; Wu, Z. Energy Consumption of Cryptocurrency Mining: A Study of Electricity Consumption in Mining Cryptocurrencies. Energy 2019, 168, 160–168. [Google Scholar] [CrossRef]

- Wang, Y.; Lucey, B.; Vigne, S.A.; Yarovaya, L. An Index of Cryptocurrency Environmental Attention (ICEA). China Financ. Rev. Int. 2022, 12, 378–414. [Google Scholar] [CrossRef]

- Baur, D.G.; Oll, J. The (Un-)Sustainability of Bitcoin Investments. SSRN Electron. J. 2019. [Google Scholar] [CrossRef]

- Egiyi, M.A.; Ofoegbu, G.N. Cryptocurrency and Climate Change: An Overview. Int. J. Mech. Eng. Technol. 2020, 11, 15–22. [Google Scholar]

- Masanet, E.; Shehabi, A.; Lei, N.; Vranken, H.; Koomey, J.; Malmodin, J. Implausible Projections Overestimate Near-Term Bitcoin CO2 Emissions. Nat. Clim. Chang. 2019, 9, 653–654. [Google Scholar] [CrossRef]

- Huynh, T.L.D.; Ahmed, R.; Nasir, M.A.; Shahbaz, M.; Huynh, N.Q.A. The Nexus between Black and Digital Gold: Evidence from US Markets. Ann. Oper. Res. 2024, 334, 521–546. [Google Scholar] [CrossRef] [PubMed]

- Umar, M.; Ji, X.; Kirikkaleli, D.; Alola, A.A. The Imperativeness of Environmental Quality in the United States Transportation Sector amidst Biomass-Fossil Energy Consumption and Growth. J. Clean. Prod. 2021, 285, 124863. [Google Scholar] [CrossRef]

- Goodkind, A.L.; Jones, B.A.; Berrens, R.P. Cryptodamages: Monetary Value Estimates of the Air Pollution and Human Health Impacts of Cryptocurrency Mining. Energy Res. Soc. Sci. 2020, 59, 101281. [Google Scholar] [CrossRef]

- Yan, W.-L.; Cheung, A. The Dynamic Spillover Effects of Climate Policy Uncertainty and Coal Price on Carbon Price: Evidence from China. Financ. Res. Lett. 2023, 53, 103400. [Google Scholar] [CrossRef]

- Stoll, C.; Klaaßen, L.; Gallersdörfer, U. The Carbon Footprint of Bitcoin. Joule 2019, 3, 1647–1661. [Google Scholar] [CrossRef]

- Dogan, E.; Majeed, M.T.; Luni, T. Are Clean Energy and Carbon Emission Allowances Caused by Bitcoin? A Novel Time-Varying Method. J. Clean. Prod. 2022, 347, 131089. [Google Scholar] [CrossRef]

- Magazzino, C.; Bekun, F.V.; Etokakpan, M.U.; Uzuner, G. Modeling the Dynamic Nexus among Coal Consumption, Pollutant Emissions and Real Income: Empirical Evidence from South Africa. Environ. Sci. Pollut. Res. 2020, 27, 8772–8782. [Google Scholar] [CrossRef] [PubMed]

- Sailor, D.J.; Smith, M.; Hart, M. Climate Change Implications for Wind Power Resources in the Northwest United States. Renew. Energy 2008, 33, 2393–2406. [Google Scholar] [CrossRef]

- Venturini, A. Climate Change, Risk Factors and Stock Returns: A Review of the Literature. Int. Rev. Financ. Anal. 2022, 79, 101934. [Google Scholar] [CrossRef]

- Bartram, S.M.; Hou, K.; Kim, S. Real Effects of Climate Policy: Financial Constraints and Spillovers. J. Financ. Econ. 2022, 143, 668–696. [Google Scholar] [CrossRef]

- Diaz-Rainey, I.; Gehricke, S.A.; Roberts, H.; Zhang, R. Trump vs. Paris: The Impact of Climate Policy on US Listed Oil and Gas Firm Returns and Volatility. Int. Rev. Financ. Anal. 2021, 76, 101746. [Google Scholar] [CrossRef]

- Nam, K. Investigating the Effect of Climate Uncertainty on Global Commodity Markets. Energy Econ. 2021, 96, 105123. [Google Scholar] [CrossRef]

- Tian, H.; Long, S.; Li, Z. Asymmetric Effects of Climate Policy Uncertainty, Infectious Diseases-Related Uncertainty, Crude Oil Volatility, and Geopolitical Risks on Green Bond Prices. Financ. Res. Lett. 2022, 48, 103008. [Google Scholar] [CrossRef]

- Hoque, M.E.; Soo-Wah, L.; Bilgili, F.; Ali, M.H. Connectedness and Spillover Effects of US Climate Policy Uncertainty on Energy Stock, Alternative Energy Stock, and Carbon Future. Environ. Sci. Pollut. Res. 2023, 30, 18956–18972. [Google Scholar] [CrossRef] [PubMed]

- Febo, E.D.; Ortolano, A.; Foglia, M.; Leone, M.; Angelini, E. From Bitcoin to Carbon Allowances: An Asymmetric Extreme Risk Spillover. J. Environ. Manag. 2021, 298, 113384. [Google Scholar] [CrossRef]

- Cheng, Y.; Gu, B.; Tan, X.; Yan, H.; Sheng, Y. Allocation of Provincial Carbon Emission Allowances under China’s 2030 Carbon Peak Target: A Dynamic Multi-Criteria Decision Analysis Method. Sci. Total Environ. 2022, 837, 155798. [Google Scholar] [CrossRef] [PubMed]

- Enders, W.; Lee, J. The Flexible Fourier Form and Dickey–Fuller Type Unit Root Tests. Econ. Lett. 2012, 117, 196–199. [Google Scholar] [CrossRef]

- Enders, W.; Jones, P. Grain Prices, Oil Prices, and Multiple Smooth Breaks in a VAR. Stud. Nonlinear Dyn. Econ. 2016, 20, 399–419. [Google Scholar] [CrossRef]

- Toda, H.Y.; Yamamoto, T. Statistical Inference in Vector Autoregressions with Possibly Integrated Processes. J. Econ. 1995, 66, 225–250. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds Testing Approaches to the Analysis of Level Relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- McNown, R.; Sam, C.Y.; Goh, S.K. Bootstrapping the Autoregressive Distributed Lag Test for Cointegration. Appl. Econ. 2018, 50, 1509–1521. [Google Scholar] [CrossRef]

- Solarin, S.A. Modelling the Relationship between Financing by Islamic Banking System and Environmental Quality: Evidence from Bootstrap Autoregressive Distributive Lag with Fourier Terms. Qual. Quant. 2019, 53, 2867–2884. [Google Scholar] [CrossRef]

- Yilanci, V.; Bozoklu, S.; Gorus, M.S. Are BRICS Countries Pollution Havens? Evidence from a Bootstrap ARDL Bounds Testing Approach with a Fourier Function. Sustain. Cities Soc. 2020, 55, 102035. [Google Scholar] [CrossRef]

- Becker, R.; Enders, W.; Lee, J. A Stationarity Test in the Presence of an Unknown Number of Smooth Breaks. J. Time Ser. Anal. 2006, 27, 381–409. [Google Scholar] [CrossRef]

- Ludlow, J.; Enders, W. Estimating Non-Linear ARMA Models Using Fourier Coefficients. Int. J. Forecast. 2000, 16, 333–347. [Google Scholar] [CrossRef]

- Granger, C.W.J. Investigating Causal Relations by Econometric Models and Cross-Spectral Methods. Econometrica 1969, 37, 424. [Google Scholar] [CrossRef]

- Sims, C.A. Macroeconomics and Reality. Econometrica 1980, 48, 1. [Google Scholar] [CrossRef]

- Gallant, R. On the Basis in Flexible Functional Form and an Essentially Unbiased Form: The Flexible Fourier Form. J. Econom. 1981, 15, 211–245. [Google Scholar] [CrossRef]

- Nazlioglu, S.; Gormus, N.A.; Soytas, U. Oil Prices and Real Estate Investment Trusts (REITs): Gradual-Shift Causality and Volatility Transmission Analysis. Energy Econ. 2016, 60, 168–175. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).