Abstract

This paper examines the intertwined dynamics among digital transformation, IT innovation, and sustainability and their collective influence on firm performance in response to the evolving business landscape characterized by digitalization, IT innovation, and sustainability concerns. The study investigates how these factors collectively impact firm performance by analyzing a panel dataset of 1510 global companies from 2013–2023. The model utilizes a multiple linear regression analysis to incorporate firm performance scores as the dependent variable. At the same time, digital transformation, IT innovation, and sustainability factors are the independent variables, alongside firm-level control variables. The results reveal that digital transformation positively influences IT innovation and strategic business model (BM) development, confirming its direct impact on firm performance. Additionally, firms with simpler and younger structures achieve better outcomes than larger and more established ones. However, the study has limitations, as it is based on a panel dataset spanning 11 years; extending the analysis to a different and longer period could provide insights into the evolving nature of digital transformation, which is inherently dynamic. This study is groundbreaking in exploring these factors, offering a unique perspective through its analysis of an 11-year panel and its focus on assessing dynamic business models.

1. Introduction

Throughout history, companies have had to deal with the succession of different shifts in technological paradigms that, now as then, have presented opportunities and threats to other types of production and modes of production. The rapid technological change typical of the 21st century and the increased complexity of markets due to the close dependence of consumer preferences and legal compliance have imposed higher quality and quantity standards on global industries than ever before [1]. This has resulted in challenging situations within the business environment, where multiple new technological opportunities are recognized amidst uncertainty regarding their application and implementation, particularly regarding product and service offerings [2]. One of the most interesting approaches to new business transformations is provided by Lazonick [3], one of the first scholars to theorize the concept of Business Models (BM), which he defines as the set of strategies and operations that each firm deploys to remain competitive over time and achieve desired outcomes.

Digital transformation (DT) has gained significant attention recently [4,5]. Digital transformation, or “digitization,” refers to incorporating digital technologies into business processes [6]. By leveraging these digital technologies, companies can integrate products and services across functional, organizational, and geographical boundaries [7]. As a result, digital technologies accelerate the pace of change and bring about substantial transformations in various industries [8,9], with the potential to disrupt existing systems and establish a new technological paradigm [8]. Digital technologies have revolutionized the way industries operate [10], introducing the concept of “Industry 4.0” or the “smart factory” [11]. Digital platforms have created a new way of operating for companies and organizations with a view to a new BM [12], leading to changing dynamics in value networks [13].

The integrated use of IT technologies enables companies to succeed by optimizing resource utilization, reducing costs, increasing employee productivity and labor efficiency, streamlining supply chains, and enhancing customer loyalty and satisfaction [14,15,16,17]. However, the growing number of opportunities stemming from digitization pressures companies to innovate their current strategies, systematically identify new business opportunities related to the emerging IT innovation paradigm, and require management to adapt and evolve their business models promptly [18] or even design entirely new ones. In a recent survey on digitization [19], executives reported that CEOs are dedicating significant energy to the digital transformation of their companies but simultaneously face challenges in adapting digital transformation to daily production activities. These issues arise from critical factors such as company size, governance structure, supply chain, and human capital [20,21].

In this context, it can be inferred that digitization effectively impacts various business activities, leading to interconnected processes that, in turn, generate new influences that determine the innovativeness of business models for each enterprise. The study analyzes business activities in the 11 most recent years, i.e., from 2013 to 2023. It investigates the possible effects of digitization processes related to sustainability and IT innovation on the performance of emerging global enterprises.

Despite the increasing focus on digital transformation (DT) and IT innovation, the current literature focuses mainly on established companies or specific industries, neglecting the unique dynamics of emerging companies. Emerging companies, characterized by leaner organizational structures and greater flexibility, provide an ideal context for studying the impact of DT and IT innovation, as shown in recent studies that have drawn attention to the importance of innovating firms’ strategies [22,23]. However, these companies face specific challenges, such as limited ability to invest in advanced technologies and difficulty integrating sustainable practices, which may affect their ability to compete in an increasingly digitized global market [24,25].

This study aims to fill this gap in the literature by investigating how DT and IT innovation affect the business performance of emerging firms, with a specific focus on their ability to rapidly adapt to technological and market changes. It aims to highlight how emerging firms can capitalize on the most advanced know-how available in the market, achieving high-performance levels in a shorter time than established firms, which are often characterized by complex and less agile organizational structures. It also explores the role of sustainable practices in this context, analyzing their impact on short-term economic performance. The research is notable for taking a longitudinal approach, analyzing data from global companies collected over the past decade (2013–2023), and focusing on the interplay between technological and organizational factors in shaping the business models of emerging companies.

In this context, the research question guiding the paper is to demonstrate how digital transformation and IT innovation affect the business performance of emerging firms and what role sustainable practices play in this process, as well as charting the increasing pressures in recent years in CSR issues and how they impact short-term economic performance. This approach contributes to a deeper understanding of the dynamics of digitization in emerging companies and offers practical implications for managers and policymakers by providing guidelines for promoting competitiveness and sustainability in an increasingly digital business environment.

2. Theoretical Background

2.1. Digital Transformation and Business Model

In recent years, DT has been a key focus for corporate management and researchers to research and implement new strategies [26,27,28,29]. Companies see DT as an opportunity to increase their competitive advantage and evolve Business Models (BM) in line with new trends. Recent studies, such as that of Masoud [30], show that the adoption of digital technologies (DT), along with IT innovation and improved customer experience, positively affects business performance, with the latter emerging as the most impactful factor. Rachinger [1] defines DT as one of the biggest positive opportunities for companies to innovate their BM and improve competitiveness over time.

Dynamic capabilities, a concept introduced by David J. Teece, Gary Pisano, and Amy Shuen [31], represent a company’s ability to respond to external changes, such as new technologies, consumer behaviors, or regulations [32,33,34]. It is not just about reacting, but anticipating and leading change. Dynamic capabilities fit within the new concept of Created Shared Value (CSV), with new management theories aimed at a proactive approach toward solving problems by turning them into opportunities by overcoming the trade-offs of CSR theory [35,36,37]. Corporate resources, such as technology, human and physical capital, and patents, are what a company possesses, while dynamic capabilities, on the other hand, are what a company can do with these resources to generate sustainable competitive advantage, in line with what W. Lazonick [38] stated on the concept of the New Economy Business Model. Both emphasize the importance of innovation and continuous learning. Companies must develop new skills and unlearn obsolete practices by anticipating new standard trends in time and adapting their offerings accordingly [39,40].

DT offers a new environment where companies must continuously adapt to new technologies, reorganize business processes, and respond to changing customer expectations in a very tight timeframe due to the dematerialization of products and processes [41,42]. Digitizing enhances a company’s resilience, since what is dematerialized can be easily transferred or upgraded. Just think of recent high-tech products that feature simplified hardware with few physical buttons or sensors in favor of a dynamic and smart software interface that can be improved and upgraded remotely by implementing remote user support [43,44,45]. Dynamic capabilities provide a theoretical framework for understanding how companies can maintain a competitive advantage in a rapidly changing world. This concept is useful in explaining how emerging and established companies can meet the challenges of digital transformation and innovation in business models with greater advantages than established companies [46,47,48,49].

In line with the recent studies mentioned above, the research hypothesis is as follows:

H1.

How can DT impact BM, and does it influence Firm Performance?

Ritter and Pedersen [50] highlight the close link between DT and BM and theorize their close interdependence. This study also places a very important focus on BMs of “born digitized” firms (e.g., Amazon, Google, SAP) versus the transformation of established BMs into digital BMs. The substantial difference is that non-digitized native BMs, unlike digitized natives, have more difficulties and peculiarities in facing a digitization process imposed by the current technological paradigm. This structural gap results in the slower performance of companies that must commit resources to DT compared to those already born with a strongly DT-oriented structure [38,51,52]. Ribeiro-Navarrete [53] investigates causal links between young and old organizations concerning DT processes. Therefore, the following hypothesis is formulated:

H2.

How can DT impact BM, and does it influence Firm Performance for different firm age?

2.2. DT and Innovation

Digitalization fosters novel forms of innovation that transcend traditional industry boundaries, integrating digital and physical resources while leveraging ecosystems, communities, and networks [54,55]. Digital infrastructure and platforms offer new features that support innovation, creating opportunities and generating broader value creation and acquisition effects [56,57]. In addition, the use of Information and Communication Technologies (ICTs) fosters the collection of information and big data from internal and external sources, improving innovation processes both within (in-house) and between (open innovation) organizations and contributing to improved overall innovation performance [58]. Furthermore, according to Appio [55], digital transformation affects several aspects of industries and businesses in a digitized environment, including competition, organization for innovation, development of new products and services, and management of human resources involved in innovation.

Innovations driven by big data are significantly shaped by social media and IT platforms, amplifying the impact of a company’s social and relational capital on its technological advancements [59,60]. Adopting DT in digitized business processes increases the number of business innovations in both processes, products, and innovative services [55]. The following assumptions are made:

H3.

DT is positively related to IT Innovation and it improves this process.

H4.

How does DT through IT Innovation impact Firm Performance?

2.3. Digital Transformation and Sustainability

DT plays an important role not only from the point of view of technological innovation, economic performance, increased competitiveness, and future potential, but also facilitates business processes and strategies committed to the goals of energy transition and social and environmental sustainability [61]. Muthuraman [62] thus speaks of implementing strategic and competitive but equally sustainable BM by calling it a “Digital Sustainable Business Model”. The role of sustainability, noted in the materiality matrices of the various Not Financial Disclosure (DNFs), shows how a company’s economic development is closely related to its sustainable development and that, increasingly, stakeholder-oriented markets incentivize companies to adopt increasingly green regulations and standards [63,64].

When effectively implemented, sustainability initiatives offer significant long-term benefits for organizations, industries, and society [65,66]. These benefits include enhanced brand reputation, increased customer loyalty, operational efficiencies, reduced regulatory risks, and the ability to attract and retain talent. Moreover, sustainability fosters innovation by encouraging companies to rethink traditional practices and develop new solutions that align with environmental, social, and governance (ESG) principles [67,68]. However, achieving these long-term advantages often entails short-term trade-offs, particularly in terms of financial performance and operational adjustments [69,70]. Companies that adopt sustainable practices position themselves as industry leaders, creating a competitive edge as consumers increasingly favor brands that demonstrate environmental and social responsibility. Over time, sustainability can be a differentiator, attracting ethically conscious customers and investors. Sustainable practices, such as energy-efficient processes or waste reduction strategies, often lead to cost savings in the long term. At the same time, investments in renewable energy or circular economy initiatives reduce dependency on finite resources and lower operational costs [71]. Furthermore, adopting sustainable practices helps companies mitigate risks related to climate change, resource scarcity, and tightening regulations, enabling them to adapt to future market conditions and regulatory environments. Sustainability is also a priority for investors, as companies with strong ESG performance secure better access to capital and enjoy higher valuation multiples due to their perceived lower risk and alignment with long-term trends [72,73].

Despite these long-term benefits, sustainability initiatives often come at a cost in the short term. The implementation of sustainable practices typically requires significant investments in technology, infrastructure, and human capital, which can strain financial resources and negatively impact profitability in the early stages. Transitioning to sustainable practices often entails higher initial costs, particularly for companies in resource-intensive sectors like manufacturing that face challenges in digitizing and decarbonizing their processes. Internal and external resistance can also hinder the immediate success of sustainability initiatives, as employees may resist new workflows, and customers may hesitate to accept higher prices for sustainable products [74,75,76]. Additionally, long-term sustainability strategies often require companies to deprioritize short-term objectives, such as maximizing quarterly profits or scaling rapidly, creating tension between immediate shareholder expectations and strategic goals.

The Creating Shared Value (CSV) concept, introduced by Michael Porter and Mark Kramer [77], provides a framework for addressing these short-term challenges while pursuing long-term sustainability goals. CSV emphasizes the integration of business success with societal progress, suggesting that companies can achieve economic gains by addressing social and environmental issues. By aligning sustainability initiatives with core business strategies, companies can create value for themselves and society. CSV also encourages innovation by prompting companies to rethink products, services, and processes, enabling them to capitalize on new market opportunities while addressing societal challenges [78]. Furthermore, CSV fosters collaboration with stakeholders, including governments, NGOs, and communities, to amplify the impact of sustainability initiatives and bridge the gap between short-term sacrifices and long-term gains [79,80].

While sustainability initiatives often require short-term sacrifices, companies can adopt strategies to mitigate these impacts. The gradual adoption of sustainable practices allows firms to spread costs over time and minimize disruptions while identifying and achieving quick wins, such as reducing energy consumption or waste, which can generate immediate benefits and build momentum for broader initiatives [81,82]. Transparent communication with stakeholders about the long-term vision and short-term trade-offs fosters trust and support. In conclusion, sustainability initiatives represent a strategic investment in the future. While they may challenge short-term financial performance, their long-term benefits outweigh the initial costs. The adoption of new business models imprinted with the IT and DT revolution improves the sustainable impact on the three ESG dimensions as it offers smart and up-to-date models: smart working, work-life balance, new skills and knowledge, and increased dissemination of practical knowledge [83,84].

However, it is relevant to test the following hypotheses:

H5.

DT is positively related to Sustainability and it improves it

H6.

How does Sustainable DT impact Firm Performance?

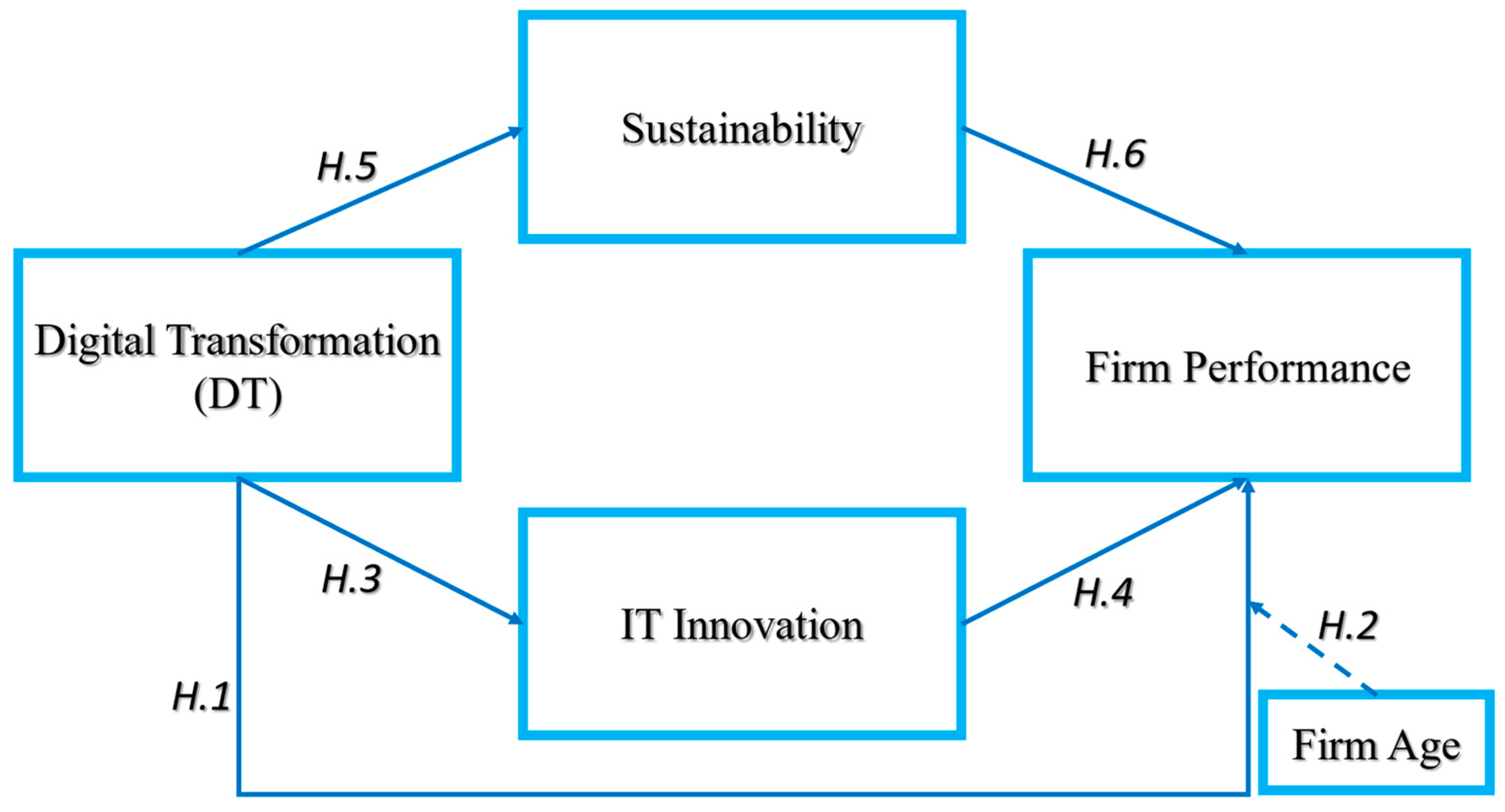

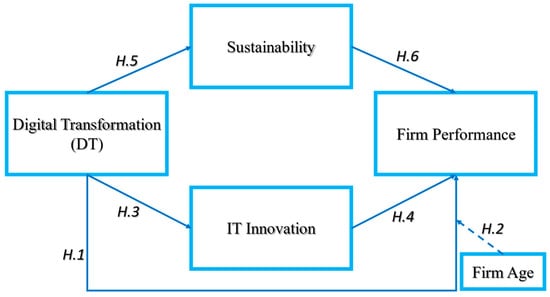

Figure 1 shows the theoretical framework based on the assumptions described above.

Figure 1.

Theoretical framework.

3. Methodology and Data

3.1. Sample

Data concerning firms and constituents were downloaded from Bloomberg in January 2024, an international and widely used database frequently used in other studies, such as Aresu et al., 2023 and Berg et al., 2022 [63,85]. The Bloomberg database selects companies from the MSCI (Morgan Stanley Capital International) Index. The index represented the companies with the largest capitalization operating in international contexts. The number of companies analyzed in the 2013–2023 time interval of 11 years is 1510 with different origins, as shown in Table 1 (nationality refers to the registered office of different companies as listed on the stock exchange). Therefore, the number of variable observations per year is 16,610, as shown in Table 2.

Table 1.

Firms by country.

Table 2.

Descriptive Statistics.

Table 1 presents the distribution of the analyzed sample of firms categorized by their country of origin. For 39% of the sample, firms are of U.S. origin, and 19% are Japanese. For EU countries, the percentage of presence is about the same for each, just to name a few: France (5%), Germany (3%), and Sweden (2%). Due to the proportionality of country size and number of firms in the sample, we can call the sample well-balanced and well-representative of the overall proportions of the organizations.

3.2. Variables

3.2.1. Dependent Variable

Business performance encompasses a firm’s operational efficiency and outcomes, including financial and non-financial dimensions [86]. The empirical literature employs various metrics to evaluate corporate performance. Commonly used indicators include sales outcomes measured by gross profit margin and net profit margin, profitability assessed through return on assets and profit margin before interest and taxes [87], enterprise value measured by economic value added [88], net income linked to return on capital and Tobin’s Q value, and customer-focused metrics such as customer satisfaction [6]. Among these, Tobin’s Q value is particularly effective in capturing digital technology applications’ long-term growth potential and future value. Consequently, this study adopts Tobin’s Q value as the primary measure of business performance, consistent with prior research, including França et al. (2023), Jardak and Ben Hamad (2022), Mithas et al. (2013), and Wang et al. (2023) [89,90,91,92].

3.2.2. Independent Variables

To test the model presented in Figure 1, the following variables best represent each construct (Table 2). First, each construct is characterized by the time variable represented by the 11 years of observation of the phenomena that determine the data matrix in panel format. Therefore, each of the following variables takes a so-called time-varying form since the same variable for the same firm is repeated 11 times, i.e., for the observed period. For the DT construct, we opted to use the “Digital Transformation Index” by the Guangdong University of Finance, according to the method used by Yang and Han (2023) [93].

The expansion of digital activities has emerged as a prominent research focus. A widely adopted approach in this field is analyzing the frequency of specific keywords in the annual reports of publicly listed companies, using this as a proxy indicator to assess the extent of their digital transformation.

Firms’ age represents the company’s seniority, i.e., how many years it has existed from the founding date to the base year of observation. To measure the degree of technological innovation in digital technologies and firms’ commitment to investment, the variable IT Innovation was obtained from the “Bloomberg IT Innovation Index”, with scores from 0 to 1 (Table 2). Similarly, to assess the degree of sustainability of each enterprise at the whole level, i.e., Environmental, Social, and Governance, Bloomberg’s ESG score was used [93]

3.2.3. Control Variables

To provide a more precise analysis of the effects of corporate digital transformation on firm performance, this study incorporates control variables based on existing literature. These include corporate size (size), measured as the natural logarithm of total assets, Return on Investment (ROI), and leverage, calculated as the ratio of total debt to EBITDA. Table 2 presents the descriptive statistics and values for each variable used in the model, and these are illustrated in Figure 1.

3.3. Model OLS Regression

This study used the panel data analysis technique: OLS multivariate regression analysis with fixed effects by STATA 18.0 software. If left unchecked, these characteristics could cause bias in the results because they could affect both the independent and dependent variables. For example, in the present analysis, intrinsic characteristics such as IT Innovation, ESG racing, and Turnover may be constant over time but significantly affect the results. This approach focuses on variations within each subject over time rather than differences between subjects. It makes it possible to analyze how a change in digitization or IT innovation within a specific company affects its performance, regardless of structural differences between companies. In complex contexts, multivariate fixed-effects analysis allows multiple variables to be included simultaneously, assessing each variable’s interactions and specific contributions to the phenomenon studied by enhancing temporal information. In panel data, the temporal component is often crucial to understanding the dynamics of change. The fixed effects approach enhances this dimension, allowing us to observe how variables evolve and interact over time.

To test the hypotheses in Figure 1, we performed an OLS multivariate regression analysis for the years 2013–2023, applying the following model (Equation (1)):

4. Results

4.1. Correlation Matrix

A linear correlation analysis and CADF unit root test were performed on the sample data, following the approach of Yang and Han (2023) [93]. The correlation coefficient matrix results (Table 3) indicated no significant multi-collinearity within the model while revealing a positive association between digital transformation and firm performance. The CADF panel unit root test also demonstrated that the core variables become stationary after first-order differencing.

Table 3.

Correlation Matrix.

Table 4 shows the results of the multivariate analysis.

Table 4.

Regression results.

4.2. Benchmark Regression Results

Following the pretest, regression analysis was conducted according to the model depicted in Figure 1, with the results presented in Table 4. The beta coefficient reflects the direct impact of digital transformation (DT) on firm performance. In the following section, we examine the interactions of each variable, as shown in Table 4. The beta coefficient for the IT innovation construct is 0.333, which is significant at the 1% level. The pragmatic significance of this result is that DT significantly promoted firm performance, which is in line with the studies [1,30,93]. For every 1 unit increase in IT innovation, the firm performance score increased by 0.333. Table 2 shows that the firm performance variable has a minimum value of 0.318. This means that for just a 1 unit increase in IT innovation, which is a unit-based indicator, so we talk about a 0.001 increase (Table 2), firm performance will increase by its minimum observation value. The coefficient of the variable DT has a value of 0.093 and is significant at the 1% level. Thus, as DT increases by 1 unit, which takes values from 1 to 5 (Table 2), firm performance will increase by 0.093, which is three times its minimum observed value. DT represents the observed correlation in Table 4 with a higher beta coefficient (net of control variables).

The ESG coefficient beta is −0.01, in contrast to what has been observed previously; the sustainability score is negatively correlated with corporate performance. The significance level is 1%. Although the beta value of ESG remains very low, it shows a 1 unit increase in ESG score, the −0.01 reduction in corporate performance. Similarly, the Firm age variable with a beta value of −0.002 also shows a significant negative correlation at the 1% level. In addition to the main explanatory variables, firm size is unfavorable in firm performance in the DT technology paradigm among the control variables. This result is not in line with what is defined by Yang and Han (2023) [93] since, in their sample, the observed firms with more complex and large sizes and structures are the best performers due to the connections and know-how accumulated over time. In the sample observed in this study, age and firm size act as a proxy for growth restraint concerning those digitization processes faced in firms with very complex internal structures and organizations [20,21,94]. Younger, more dynamic firms with simple, linear structures are found to be leaner and more resilient concerning the rapid changes that the global market of digital transformation imposes [95,96,97,98].

Based on the results discussed, four main drivers are proposed to support companies in making the digital transition and fostering innovation: the adoption of digital technologies, the promotion of IT innovation, the integration of sustainable practices, and the implementation of simple organizational structures. Encouraging digital technology adoption based on the positive beta coefficient of digital transformation (0.093, significant at 1%), it is recommended that companies prioritize investments in digital technologies to enhance business performance. It is further suggested that firms develop targeted strategies to implement these technologies gradually and sustainably. Promoting IT innovation, considering the significant impact of IT innovation (beta = 0.333), is advised for companies to focus on technological advancements that facilitate the integration of processes and products, thereby maximizing efficiency and competitiveness. Addressing sustainability challenges despite the negative ESG coefficient (−0.01), it is proposed that companies balance the adoption of sustainable practices with maintaining strong performance. Strategies should be developed to integrate sustainability more effectively into the digitization process. Concerning adopting lean organizational structures, the findings indicate that younger firms with simpler organizational structures exhibit greater resilience to rapid digital transformations. It is recommended that larger companies streamline their internal processes and adopt a more dynamic and adaptable corporate culture to better navigate the challenges of digital transformation.

5. Conclusions

This paper examines the relationship between digital transformation (DT), IT innovation, sustainability, and firm performance while also investigating the moderating role of firm age in this connection. Our findings demonstrate that DT activities significantly boost IT innovation, positively influencing firm performance. The positive effect of DT on firm performance plays a crucial role in the evolution of new strategic and resilient business models (BMs) over time [99].

The results also show that digital transformation (DT) significantly impacts IT innovation, highlighting that successful digital transformations can enhance a company’s IT innovativeness. Given that DT involves adopting technology, and IT innovation refers to innovations driven by technology, this finding aligns with previous studies demonstrating the positive effects of IT infrastructure and technology adoption on business innovation [100,101,102].

One of the main assets, a driver of innovation and DT, is the human capital that each company is endowed with both as individual capital (skills of the individual) [103,104,105] and as collective capital at Penrose (skills beyond the simple summation of individual skills) [106]. The degree of resilience and, thus, adaptability to new trends and the use of increasingly complex technologies must come through continuous training and periodic updating of the skills and knowledge of all company stakeholders (from employees to suppliers). Companies should increase the average length of stay of employees and suppliers within the company itself to maximize the skills of each and thus give rise to a true corporate culture [107,108,109]. To do this, companies should employ incentives and smart ideas aimed at active stakeholder participation in business transformation processes by making them participants in decisions [110,111]. Opportunities for professional growth and better economic treatment could foster a better employee retention rate by preventing flight to competitors [112,113,114]. In recent years, there have been changes in the employee philosophy, which are no longer primarily related to compensation and benefits but rather to improving the work-life balance. Studies show how improving working-life balance can positively impact the short- and long-term performance of companies with an increase in the average retention rate of their employees, including managerial areas [115,116,117,118].

On the contrary, sustainability has a strong negative correlation with corporate performance; however, this is relevant as, empirically, the −0.01 reduction in corporate performance (Table 4) is a good trade-off against a 1 unit increase in corporate performance improvement. The sustainability construct expressed through the ESG score shows how engagement with the environment and society negatively impacts economic performance in the short run. Still, in the long run, these gradually reduce to minimization as observed in the 11 years of this study’s sample (−0.01) against significant improvement. DT helps in minimizing environmental impacts and improving the economy-environment relationship. However, it remains a very important break for some sectors, such as raw material production and semi-finished goods production, as those processes are not 100% digitizable as for other sectors, e.g., food and steel [119,120,121]. Adopting sustainable technologies or strategies aimed at creating shared value that sees environmental and social sustainability at the forefront entails an increase in initial costs associated with investments in technology and human capital that take time before having a positive impact in economic terms [122,123,124,125]. In the short term, there are difficulties associated with using new technology, such as resistance to change from customers selling modified products/services and companies seeing their business processes and established practices evolve [126,127,128]. In this context, it is useful for companies to mitigate the effects of long-term assets with easily achievable short-term goals that can cushion any market distortions related to the transition to new technologies [129,130].

Size variables such as firm age and total assets demonstrate, in this sample, how large global firms recorded inversely proportional performance levels to younger, less complex firms with simpler, more linear structures [97,98]. Digitally native BMs and leaner organizations allow for a degree of permeability of innovation by ensuring resilience and responsiveness to the constant changes firms face [38,51,52]. If you think about the structure of big data multinationals, it is not far from a simple, linear enterprise idea of small teams coordinating simultaneously [131]. The products and processes are highly technological, and the rate of innovation is very high; reflexively, so is the human capital.

The results in Table 4 indicate a negative impact of firm size on firm performance, measured through the natural logarithm of total assets (beta = −0.185, p < 0.01). These findings challenge traditional theories on economies of scale, which suggest that larger firms benefit from cost efficiencies and resource advantages that enhance performance. However, within the paradigm of digital transformation (DT), this outcome necessitates a re-evaluation. Digital transformation often requires agility, rapid decision-making, and adaptability, characteristics more commonly associated with smaller, less complex organizations [132]. Larger firms, with their intricate hierarchies, legacy systems, and protocols for decision-making, may face greater inertia and resistance to change, limiting their ability to capitalize on the opportunities offered by DT [30]. This aligns with the notion that scale advantages may diminish in highly dynamic and technology-driven environments, where responsiveness and innovation outweigh traditional efficiency gains. Moreover, the significant positive coefficient for IT innovation (beta = 0.333, p < 0.01) underscores its critical role in driving firm performance. IT innovation appears to be a key enabler of digital transformation, fostering process optimization, product development, and enhanced customer engagement [30]. However, the mechanisms through which IT innovation mediates the relationship between digital transformation and firm performance warrant further exploration. For instance, IT innovation may amplify the benefits of DT by facilitating the seamless integration of new technologies, improving data-driven decision-making, and enabling firms to develop competitive advantages in rapidly evolving markets [133,134,135].

Contextualizing these findings within the digital transformation framework highlights the need for a nuanced understanding of how firm size and IT innovation interact to influence performance [9,30,97]. Larger firms may need to adopt targeted strategies to overcome structural rigidity, such as fostering decentralized decision-making, investing in agile methodologies, and cultivating a culture of continuous innovation. Simultaneously, a deeper investigation into the mediating role of IT innovation could provide valuable insights into how organizations can effectively leverage technology to bridge the gap between scale and performance in the digital era [28,48]. To address the study’s practical implications, actionable recommendations are provided to guide different sectors in aligning digital transformation (DT) with sustainability and maximizing its benefits. For resource-intensive industries, such as manufacturing and raw material production, adopting strategies that integrate DT with sustainable practices is crucial. These strategies may include investing in energy-efficient technologies, implementing circular economy principles, and utilizing digital tools to optimize resource management. These industries can reduce their environmental impact by aligning DT with sustainability goals while maintaining competitive performance [136,137,138].

For small and medium-sized enterprises (SMEs), which often face resource constraints, the focus should be on prioritizing scalable and cost-effective digital solutions. SMEs can benefit from cloud-based platforms, digital marketing tools, and process automation technologies that are both affordable and impactful [139,140,141]. Additionally, fostering partnerships with technology providers and engaging in digital upskilling initiatives can enable SMEs to fully capitalize on the opportunities offered by DT [139,141,142]. These recommendations emphasize the need for a holistic approach to DT, in which technological advances are strategically aligned with sustainability and social equity goals. In this way, organizations can improve their performance and contribute to a more sustainable and inclusive future.

From a broader societal perspective, DT has significant potential to advance global goals such as achieving zero net carbon emissions and reducing social inequality. Digital technologies can be key in tracking and minimizing carbon footprints, enabling transparent reporting, and promoting green innovation in all sectors. This includes emissions reporting according to the international GHG (Greenhouse House Protocol), which imposes three different levels of focus that also consider indirect emissions, such as those produced by the entire supply chain. In addition, DT can help reduce inequality by democratizing access to information, education, and economic opportunities, especially in underserved regions. Policymakers and industry leaders should work together to ensure that DT initiatives are inclusive and equitable for all countries, ensuring that the infrastructure is conducive to the full deployment of these technologies by promoting sustainable development on a global scale.

In conclusion, the present study’s results support previous studies’ findings and thus help to confirm that DT positively influences IT innovation and strategic BM development, confirming its direct influence on company performance.

Digital transformation (DT) is a key concept for a company’s competitiveness and survival in the current technological revolution, where businesses are evolving alongside economies. Both DT and IT innovation are essential to maintaining a competitive edge. The sustainable economic development of any business continues to be a primary objective, and the opportunities are vast in a landscape increasingly driven by digital technologies.

Author Contributions

Conceptualization, A.B. (Andrea Billi) and A.B. (Alessandro Bernardo); methodology, A.B. (Alessandro Bernardo); software, A.B. (Alessandro Bernardo); validation, A.B. (Andrea Billi) and A.B. (Alessandro Bernardo); formal analysis, A.B. (Alessandro Bernardo); investigation, A.B. (Andrea Billi); resources, A.B. (Andrea Billi); data curation, A.B. (Alessandro Bernardo); writing original draft preparation, A.B. (Andrea Billi) and A.B. (Alessandro Bernardo); writing review and editing, A.B. (Andrea Billi) and A.B. (Alessandro Bernardo); visualization, A.B. (Alessandro Bernardo); supervision, A.B. (Andrea Billi); project administration, A.B. (Andrea Billi). All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Rachinger, M.; Rauter, R.; Müller, C.; Vorraber, W.; Schirgi, E. Digitalization and Its Influence on Business Model Innovation. J. Manuf. Technol. Manag. 2019, 30, 1143–1160. [Google Scholar] [CrossRef]

- Lerch, C.; Gotsch, M. Digitalized Product-Service Systems in Manufacturing Firms: A Case Study Analysis. Res.-Technol. Manag. 2015, 58, 45–52. [Google Scholar] [CrossRef]

- Lazonick, W. Innovative Business Models and Varieties of Capitalism: Financialization of the US Corporation. Bus. Hist. Rev. 2010, 84, 675–702. [Google Scholar] [CrossRef]

- FitzGerald, E.; Ferguson, R.; Adams, A.; Gaved, M.; Mor, Y.; Thomas, R. Augmented Reality and Mobile Learning: The State of the Art. Int. J. Mob. Blended Learn. (IJMBL) 2013, 5, 43–58. [Google Scholar] [CrossRef]

- Kane, V.R.; Cansler, C.A.; Povak, N.A.; Kane, J.T.; McGaughey, R.J.; Lutz, J.A.; Churchill, D.J.; North, M.P. Mixed Severity Fire Effects within the Rim Fire: Relative Importance of Local Climate, Fire Weather, Topography, and Forest Structure. For. Ecol. Manag. 2015, 358, 62–79. [Google Scholar] [CrossRef]

- Liu, X.X.; Yang, Y.Q.; Sun, Z.J. The Construction and Evolutionary Development of Enterprise Digital Capabilities: A Multi-Case Exploratory Study Based on Leading Digital. Enterp. Reform 2022, 344, 45–64. [Google Scholar]

- Ross, J.; Beath, C.; Sebastian, I.M. How to Develop a Great Digital Strategy; MIT Sloan Management Review: Cambridge, MA, USA, 2016. [Google Scholar]

- Bharadwaj, A.; El Sawy, O.A.; Pavlou, P.A.; Venkatraman, N.V. Digital Business Strategy: Toward a next Generation of Insights. MIS Q. 2013, 37, 471–482. [Google Scholar] [CrossRef]

- Frank, A.G.; Mendes, G.H.S.; Ayala, N.F.; Ghezzi, A. Servitization and Industry 4.0 Convergence in the Digital Transformation of Product Firms: A Business Model Innovation Perspective. Technol. Forecast. Soc. Chang. 2019, 141, 341–351. [Google Scholar] [CrossRef]

- Dal Mas, F.; Massaro, M.; Rippa, P.; Secundo, G. The Challenges of Digital Transformation in Healthcare: An Interdisciplinary Literature Review, Framework, and Future Research Agenda. Technovation 2023, 123, 102716. [Google Scholar] [CrossRef]

- Lasi, H.; Fettke, P.; Kemper, H.-G.; Feld, T.; Hoffmann, M. Industry 4.0. Bus. Inf. Syst. Eng. 2014, 6, 239–242. [Google Scholar] [CrossRef]

- Presch, G.; Dal Mas, F.; Piccolo, D.; Sinik, M.; Cobianchi, L. The World Health Innovation Summit (WHIS) Platform for Sustainable Development: From the Digital Economy to Knowledge in the Healthcare Sector. In Intellectual Capital in the Digital Economy; Routledge: London, UK, 2020; pp. 19–28. [Google Scholar]

- Gray, P.; El Sawy, O.A.; Asper, G.; Thordarson, M. Realizing Strategic Value through Center-Edge Digital Transformation in Consumer-Centric Industries. MIS Q. Exec. 2013, 12, 1. [Google Scholar]

- Breznik, L.; Lahovnik, M. Renewing the Resource Base in Line with the Dynamic Capabilities View: A Key to Sustained Competitive Advantage in the IT Industry. J. East Eur. Manag. Stud. 2014, 19, 453–485. [Google Scholar] [CrossRef]

- Kagermann, H. Change through Digitization—Value Creation in the Age of Industry 4.0. In Management of Permanent Change; Springer: Berlin/Heidelberg, Germany, 2014; pp. 23–45. [Google Scholar]

- Labaran, M.J.; Masood, T. Industry 4.0 Driven Green Supply Chain Management in Renewable Energy Sector: A Critical Systematic Literature Review. Energies 2023, 16, 6977. [Google Scholar] [CrossRef]

- Loebbecke, C.; Picot, A. Reflections on Societal and Business Model Transformation Arising from Digitization and Big Data Analytics: A Research Agenda. J. Strateg. Inf. Syst. 2015, 24, 149–157. [Google Scholar] [CrossRef]

- Wirtz, B.; Daiser, P. Business Model Innovation Processes: A Systematic Literature Review. J. Bus. Models 2018, 6, 40–58. [Google Scholar]

- Khan, N.; Sikes, J. IT Under Pressure: McKinsey Global Survey Results; McKinsey & Company: Chicago, IL, USA, 2014. [Google Scholar]

- Eller, R.; Alford, P.; Kallmünzer, A.; Peters, M. Antecedents, Consequences, and Challenges of Small and Medium-Sized Enterprise Digitalization. J. Bus. Res. 2020, 112, 119–127. [Google Scholar] [CrossRef]

- Radicic, D.; Petković, S. Impact of Digitalization on Technological Innovations in Small and Medium-Sized Enterprises (SMEs). Technol. Forecast. Soc. Chang. 2023, 191, 122474. [Google Scholar] [CrossRef]

- Bernardo, E.; Sousa, N.; Kastenholz, E. Souvenirs in tourism studies: A bibliometric retrospective and future research agenda. Tour. Hosp. Manag. 2023, 29, 249–264. [Google Scholar] [CrossRef]

- Silva, R.; Coelho, A.; Sousa, N.; Quesado, P. Family Business Management: A Case Study in the Portuguese Footwear Industry. J. Open Innov. Technol. Mark. Complex. 2021, 7, 55. [Google Scholar] [CrossRef]

- Alake, O.R.; Adegbuyi, O.; Babajide, A.A.; Salau, O.P.; Onayemi, O.O.; Joel, O.O.; Adesanya, O.D. Business Model Innovation and SMEs’ Resilience: Technological Roadmap in Nigeria. Bus. Theory Pract. 2024, 25, 614–624. [Google Scholar] [CrossRef]

- Nkwinika, E.; Akinola, S. The Importance of Financial Management in Small and Medium-Sized Enterprises (SMEs): An Analysis of Challenges and Best Practices. Technol. Audit. Prod. Reserves 2023, 5, 12–20. [Google Scholar] [CrossRef]

- Ziyadin, S.; Suieubayeva, S.; Utegenova, A. Digital Transformation in Business. In Proceedings of the Digital Age: Chances, Challenges and Future 7; Springer: Berlin/Heidelberg, Germany, 2020; pp. 408–415. [Google Scholar]

- Adama, H.E.; Okeke, C.D. Digital Transformation as a Catalyst for Business Model Innovation: A Critical Review of Impact and Implementation Strategies. Magna Sci. Adv. Res. Rev. 2024, 10, 256–264. [Google Scholar] [CrossRef]

- van Tonder, C.; Schachtebeck, C.; Nieuwenhuizen, C.; Bossink, B. A Framework for Digital Transformation and Business Model Innovation. Manag. J. Contemp. Manag. Issues 2020, 25, 111–132. [Google Scholar] [CrossRef]

- Vaska, S.; Massaro, M.; Bagarotto, E.M.; Dal Mas, F. The Digital Transformation of Business Model Innovation: A Structured Literature Review. Front. Psychol. 2021, 11, 539363. [Google Scholar] [CrossRef]

- Masoud, R.; Basahel, S. The Effects of Digital Transformation on Firm Performance: The Role of Customer Experience and IT Innovation. Digital 2023, 3, 109–126. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic Capabilities and Strategic Management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Ellström, D.; Holtström, J.; Berg, E.; Josefsson, C. Dynamic Capabilities for Digital Transformation. J. Strategy Manag. 2021, 15, 272–286. [Google Scholar] [CrossRef]

- Kaur, V. Knowledge-Based Dynamic Capabilities: A Scientometric Analysis of Marriage between Knowledge Management and Dynamic Capabilities. J. Knowl. Manag. 2023, 27, 919–952. [Google Scholar] [CrossRef]

- Pitelis, C.N.; Teece, D.J.; Yang, H. Dynamic Capabilities and MNE Global Strategy: A Systematic Literature Review-based Novel Conceptual Framework. J. Manag. Stud. 2024, 61, 3295–3326. [Google Scholar] [CrossRef]

- Abbas, J. Does the Nexus of Corporate Social Responsibility and Green Dynamic Capabilities Drive Firms toward Green Technological Innovation? The Moderating Role of Green Transformational Leadership. Technol. Forecast. Soc. Chang. 2024, 208, 123698. [Google Scholar] [CrossRef]

- Aftab, J.; Abid, N.; Sarwar, H.; Amin, A.; Abedini, M.; Veneziani, M. Does Corporate Social Responsibility Drive Financial Performance? Exploring the Significance of Green Innovation, Green Dynamic Capabilities, and Perceived Environmental Volatility. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 1634–1653. [Google Scholar] [CrossRef]

- Sarwar, H.; Aftab, J.; Ishaq, M.I.; Atif, M. Achieving Business Competitiveness through Corporate Social Responsibility and Dynamic Capabilities: An Empirical Evidence from Emerging Economy. J. Clean. Prod. 2023, 386, 135820. [Google Scholar] [CrossRef]

- Lazonick, W.; Mazzucato, M. The Risk-Reward Nexus in the Innovation-Inequality Relationship: Who Takes the Risks? Who Gets the Rewards? Ind. Corp. Chang. 2013, 22, 1093–1128. [Google Scholar] [CrossRef]

- Biletska, I.O.; Paladieva, A.F.; Avchinnikova, H.D.; Kazak, Y.Y. The Use of Modern Technologies by Foreign Language Teachers: Developing Digital Skills. Linguist. Cult. Rev. 2021, 5, 16–27. [Google Scholar] [CrossRef]

- Shakina, E.; Parshakov, P.; Alsufiev, A. Rethinking the Corporate Digital Divide: The Complementarity of Technologies and the Demand for Digital Skills. Technol. Forecast. Soc. Chang. 2021, 162, 120405. [Google Scholar] [CrossRef]

- Paredes-Frigolett, H.; Pyka, A. Global Dematerialization, the Renaissance of Artificial Intelligence, and the Global Stakeholder Capitalism Model of Digital Platforms: Current Challenges and Future Directions. J. Evol. Econ. 2023, 33, 671–705. [Google Scholar] [CrossRef]

- Taffel, S. Fantasies of Dematerialization: (Un) Sustainable Growth and Digital Capitalism. In Digital Technologies for Sustainable Futures; Routledge: London, UK, 2024; pp. 17–31. [Google Scholar]

- Englander, I.; Wong, W. The Architecture of Computer Hardware, Systems Software, and Networking: An Information Technology Approach; John Wiley & Sons: Hoboken, NJ, USA, 2021; ISBN 1119495202. [Google Scholar]

- Klimushyn, P.; Solianyk, T.; Mozhaev, O.; Nosov, V.; Kolisnyk, T.; Yanov, V. Hardware Support Procedures for Asymmetric Authentication of the Internet of Things. Innov. Technol. Sci. Solut. Ind. 2021, 4, 31–39. [Google Scholar] [CrossRef]

- Wang, S.R.; Chen, Z.Y.; Chen, S.N.; Dai, J.Y.; Zhang, J.W.; Qi, Z.J.; Wu, L.J.; Sun, M.K.; Zhou, Q.Y.; Li, H.D. Simplified Radar Architecture Based on Information Metasurface. arXiv 2024, arXiv:2410.07576. [Google Scholar]

- Bresciani, S.; Huarng, K.-H.; Malhotra, A.; Ferraris, A. Digital Transformation as a Springboard for Product, Process and Business Model Innovation. J. Bus. Res. 2021, 128, 204–210. [Google Scholar] [CrossRef]

- Favoretto, C.; Mendes, G.H.D.S.; Filho, M.G.; Gouvea de Oliveira, M.; Ganga, G.M.D. Digital Transformation of Business Model in Manufacturing Companies: Challenges and Research Agenda. J. Bus. Ind. Mark. 2022, 37, 748–767. [Google Scholar] [CrossRef]

- Klos, C.; Spieth, P.; Clauss, T.; Klusmann, C. Digital Transformation of Incumbent Firms: A Business Model Innovation Perspective. IEEE Trans. Eng. Manag. 2021, 70, 2017–2033. [Google Scholar] [CrossRef]

- Ancillai, C.; Sabatini, A.; Gatti, M.; Perna, A. Digital Technology and Business Model Innovation: A Systematic Literature Review and Future Research Agenda. Technol Forecast. Soc Chang. 2023, 188, 122307. [Google Scholar] [CrossRef]

- Ritter, T.; Pedersen, C.L. Digitization Capability and the Digitalization of Business Models in Business-to-Business Firms: Past, Present, and Future. Ind. Mark. Manag. 2020, 86, 180–190. [Google Scholar] [CrossRef]

- Lazonick, W. The Innovative Firm. In The Oxford Handbook of Innovation; Oxford University Press: Oxford, UK, 2006. [Google Scholar]

- Markova, M. Digitalization in Finnish Technology Non-Native SMEs: Guidelines for SMEs in Digital Consulting Provided by the DigiStep Project. Bachelor’s Thesis, LAB University of Applied Sciences, Lahti, Finland, 2023. [Google Scholar]

- Ribeiro-Navarrete, S.; Botella-Carrubi, D.; Palacios-Marqués, D.; Orero-Blat, M. The Effect of Digitalization on Business Performance: An Applied Study of KIBS. J. Bus. Res. 2021, 126, 319–326. [Google Scholar] [CrossRef]

- Almaazmi, J.; Alshurideh, M.; Al Kurdi, B.; Salloum, S.A. The Effect of Digital Transformation on Product Innovation: A Critical Review. In Proceedings of the International Conference on Advanced Intelligent Systems and Informatics; Springer: Berlin/Heidelberg, Germany, 2020; pp. 731–741. [Google Scholar]

- Appio, F.P.; Frattini, F.; Petruzzelli, A.M.; Neirotti, P. Digital Transformation and Innovation Management: A Synthesis of Existing Research and an Agenda for Future Studies. J. Prod. Innov. Manag. 2021, 38, 4–20. [Google Scholar] [CrossRef]

- Bonina, C.; Koskinen, K.; Eaton, B.; Gawer, A. Digital Platforms for Development: Foundations and Research Agenda. Inf. Syst. J. 2021, 31, 869–902. [Google Scholar] [CrossRef]

- Aksoy, C. Digital Business Ecosystems: An Environment of Collaboration, Innovation, and Value Creation in the Digital Age. J. Bus. Trade 2023, 4, 156–180. [Google Scholar] [CrossRef]

- Soto Setzke, D.; Riasanow, T.; Böhm, M.; Krcmar, H. Pathways to Digital Service Innovation: The Role of Digital Transformation Strategies in Established Organizations. Inf. Syst. Front. 2023, 25, 1017–1037. [Google Scholar] [CrossRef]

- Agnihotri, R. From Sales Force Automation to Digital Transformation: How Social Media, Social CRM, and Artificial Intelligence Technologies Are Influencing the Sales Process. In A Research Agenda for Sales; Edward Elgar Publishing: Cheltenham, UK, 2021; pp. 21–47. [Google Scholar]

- Feitosa Jorge, L.; Mosconi, E.; Santa-Eulalia, L.A. Enterprise Social Media Platforms for Coping with an Accelerated Digital Transformation. J. Syst. Inf. Technol. 2022, 24, 221–245. [Google Scholar] [CrossRef]

- Broccardo, L.; Zicari, A.; Jabeen, F.; Bhatti, Z.A. How Digitalization Supports a Sustainable Business Model: A Literature Review. Technol. Forecast. Soc. Chang. 2023, 187, 122146. [Google Scholar] [CrossRef]

- Muthuraman, S. Digital Business Models for Sustainability. Gedrag Organ. Rev. 2020, 33, 1095–1102. [Google Scholar] [CrossRef] [PubMed]

- Aresu, S.; Hooghiemstra, R.; Melis, A. Integration of CSR Criteria into Executive Compensation Contracts: A Cross-Country Analysis. J. Manag. 2023, 49, 2766–2804. [Google Scholar] [CrossRef]

- Dhaliwal, D.S.; Radhakrishnan, S.; Tsang, A.; Yang, Y.G. Nonfinancial Disclosure and Analyst Forecast Accuracy: International Evidence on Corporate Social Responsibility Disclosure. Account. Rev. 2012, 87, 723–759. [Google Scholar] [CrossRef]

- Jacobo-Hernandez, C.A.; Jaimez-Valdez, M.A.; Ochoa-Jimenez, S. Benefits, Challenges and Opportunities of Corporate Sustainability. Management 2021, 25, 51–74. [Google Scholar] [CrossRef]

- Moslehpour, M.; Chau, K.Y.; Tu, Y.-T.; Nguyen, K.-L.; Barry, M.; Reddy, K.D. Impact of Corporate Sustainable Practices, Government Initiative, Technology Usage, and Organizational Culture on Automobile Industry Sustainable Performance. Environ. Sci. Pollut. Res. 2022, 29, 83907. [Google Scholar] [CrossRef] [PubMed]

- Annesi, N.; Battaglia, M.; Ceglia, I.; Mercuri, F. Navigating Paradoxes: Building a Sustainable Strategy for an Integrated ESG Corporate Governance. Manag. Decis. 2024. ahead-of-print. [Google Scholar] [CrossRef]

- Tantia, V.; Sukanya, R. Reinventing the Business Model to Navigate the Evolving Business Landscape. In ESG and Ecosystem Services for Sustainability; IGI Global: Hershey, PA, USA, 2024; pp. 259–282. [Google Scholar]

- Hauschild, M.Z.; McKone, T.E.; Arnbjerg-Nielsen, K.; Hald, T.; Nielsen, B.F.; Mabit, S.E.; Fantke, P. Risk and Sustainability: Trade-Offs and Synergies for Robust Decision Making. Environ. Sci. Eur. 2022, 34, 11. [Google Scholar] [CrossRef]

- Henao, R.; Sarache, W. Sustainable Performance in Manufacturing Operations: The Cumulative Approach vs. Trade-Offs Approach. Int. J. Prod. Econ. 2022, 244, 108385. [Google Scholar] [CrossRef]

- Șimandan, R.; Păun, C. The Costs and Trade-Offs of Green Central Banking: A Framework for Analysis. Energies 2021, 14, 5168. [Google Scholar] [CrossRef]

- Caiazza, S.; Galloppo, G.; Paimanova, V. The Role of Sustainability Performance after Merger and Acquisition Deals in Short and Long-Term. J. Clean. Prod. 2021, 314, 127982. [Google Scholar] [CrossRef]

- Wenjuan, S.; Zhao, K. Balancing Fiscal Expenditure Competition and Long-Term Innovation Investment: Exploring Trade-Offs and Policy Implications for Local Governments. PLoS ONE 2023, 18, e0293158. [Google Scholar] [CrossRef] [PubMed]

- Adelusola, M. Sustainable Business Practices: Overcoming Barriers and Leveraging Enablers for Organizational Adoption. 2024. Available online: https://www.researchgate.net/profile/Michael-Adelusola/publication/385652688_Sustainable_Business_Practices_Overcoming_Barriers_and_Leveraging_Enablers_for_Organizational_Adoption/links/672df86b2326b47637d198eb/Sustainable-Business-Practices-Overcoming-Barriers-and-Leveraging-Enablers-for-Organizational-Adoption.pdf (accessed on 16 December 2024).

- Omowole, B.M.; Olufemi-Philips, A.Q.; Ofadile, O.C.; Eyo-Udo, N.L.; Ewim, S.E. Barriers and Drivers of Digital Transformation in SMEs: A Conceptual Analysis. Int. J. Frontline Res. Multidiscip. Stud. 2024, 5, 19–36. [Google Scholar]

- Talwar, S.; Dhir, A.; Islam, N.; Kaur, P.; Almusharraf, A. Resistance of Multiple Stakeholders to E-Health Innovations: Integration of Fundamental Insights and Guiding Research Paths. J. Bus. Res. 2023, 166, 114135. [Google Scholar] [CrossRef]

- Kramer, M.R.; Porter, M. Creating Shared Value; FSG: Boston, MA, USA, 2011; Volume 17. [Google Scholar]

- Kallio, J. Management of Societal Value Creation Through “Creating Shared Value”–Making Corporate Sustainability More Systematic. 2021. Available online: https://www.utupub.fi/bitstream/handle/10024/152938/Kallio_Jarno_opinnayte.pdf?sequence=1 (accessed on 16 December 2024).

- Royo-Vela, M.; Cuevas Lizama, J. Creating Shared Value: Exploration in an Entrepreneurial Ecosystem. Sustainability 2022, 14, 8505. [Google Scholar] [CrossRef]

- Halldén, M.; Domeij, S. Why Creating Shared Value Matters: A Qualitative Multiple Case Study on How CSV Initiatives Can Contribute to Sustainable Value Chains within the Swedish Fashion Industry. 2022. Available online: https://www.diva-portal.org/smash/record.jsf?pid=diva2:1669391 (accessed on 16 December 2024).

- Khan, T.; Emon, M.M.H.; Siam, S.A.J. Impact of Green Supply Chain Practices on Sustainable Development in Bangladesh. 2024. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4958443 (accessed on 16 December 2024).

- Yadav, S.; Samadhiya, A.; Kumar, A.; Majumdar, A.; Garza-Reyes, J.A.; Luthra, S. Achieving the Sustainable Development Goals through Net Zero Emissions: Innovation-Driven Strategies for Transitioning from Incremental to Radical Lean, Green and Digital Technologies. Resour. Conserv. Recycl. 2023, 197, 107094. [Google Scholar] [CrossRef]

- Chen, Y.; Ren, J. How Does Digital Transformation Improve ESG Performance? Empirical Research from 396 Enterprises. Int. Entrep. Manag. J. 2025, 21, 27. [Google Scholar] [CrossRef]

- Hou, D.; Liu, Z.; Zahid, R.M.A.; Maqsood, U.S. ESG Dynamics in Modern Digital World: Empirical Evidence from Firm Life-Cycle Stages. Environ. Dev. Sustain. 2024, 1–26. [Google Scholar] [CrossRef]

- Berg, F.; Koelbel, J.F.; Rigobon, R. Aggregate Confusion: The Divergence of ESG Ratings. Rev. Financ. 2022, 26, 1315–1344. [Google Scholar] [CrossRef]

- Meng, W.; Yang, W. Research on the Performance Relationship between Resource Integration, Dual Cooperation and Focus Enterprises in the Alliance Portfolio. Sci. Sci. Technol. Manag. 2018, 2, 85–94. [Google Scholar]

- Zhang, J.; Zhang, Y. Chairman-General Manager Heterogeneity, Power Gap and Rapport and Organizational Performance–Evidence from Listed Companies. J. Manag. World 2016, 50, 110–120. [Google Scholar]

- Yang, H.; Zheng, Y.; Zhao, X. Exploration or Exploitation? Small Firms’ Alliance Strategies with Large Firms. Strateg. Manag. J. 2014, 35, 146–157. [Google Scholar] [CrossRef]

- França, A.; López-Manuel, L.; Sartal, A.; Vázquez, X.H. Adapting Corporations to Climate Change: How Decarbonization Impacts the Business Strategy–Performance Nexus. Bus. Strategy Environ. 2023, 32, 5615–5632. [Google Scholar] [CrossRef]

- Jardak, M.K.; Ben Hamad, S. The Effect of Digital Transformation on Firm Performance: Evidence from Swedish Listed Companies. J. Risk Financ. 2022, 23, 329–348. [Google Scholar] [CrossRef]

- Mithas, S.; Tafti, A.; Mitchell, W. How a Firm’s Competitive Environment and Digital Strategic Posture Influence Digital Business Strategy. MIS Q. 2013, 37, 511–536. [Google Scholar] [CrossRef]

- Wang, Z.; Lin, S.; Chen, Y.; Lyulyov, O.; Pimonenko, T. Digitalization Effect on Business Performance: Role of Business Model Innovation. Sustainability 2023, 15, 9020. [Google Scholar] [CrossRef]

- Yang, Y.; Han, J. Digital Transformation, Financing Constraints, and Corporate Environmental, Social, and Governance Performance. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 3189–3202. [Google Scholar] [CrossRef]

- Abou-Foul, M.; Ruiz-Alba, J.L.; Soares, A. The Impact of Digitalization and Servitization on the Financial Performance of a Firm: An Empirical Analysis. Prod. Plan. Control 2021, 32, 975–989. [Google Scholar] [CrossRef]

- Grooss, O.F. Digitalization of Maintenance Activities in Small and Medium-Sized Enterprises: A Conceptual Framework. Comput. Ind. 2024, 154, 104039. [Google Scholar] [CrossRef]

- Klohs, K.; Sandkuhl, K. Digitalization of Small and Medium-Sized Enterprises: An Analysis of the State of Research. In Proceedings of the Business Information Systems Workshops: BIS 2020 International Workshops, Colorado Springs, CO, USA, 8–10 June 2020; Revised Selected Papers 23. Springer: Berlin/Heidelberg, Germany, 2020; pp. 21–33. [Google Scholar]

- Yuleva-Chuchulayna, R.E. Digitalization and Innovation as a Factor in Increasing the Competitiveness of Small and Medium-Sized Enterprises. Knowl.-Int. J. 2021, 45, 83–87. [Google Scholar]

- Buer, S.-V.; Strandhagen, J.W.; Semini, M.; Strandhagen, J.O. The Digitalization of Manufacturing: Investigating the Impact of Production Environment and Company Size. J. Manuf. Technol. Manag. 2020, 32, 621–645. [Google Scholar] [CrossRef]

- Sestino, A.; Prete, M.I.; Piper, L.; Guido, G. Internet of Things and Big Data as Enablers for Business Digitalization Strategies. Technovation 2020, 98, 102173. [Google Scholar] [CrossRef]

- Nambisan, S.; Wright, M.; Feldman, M. The Digital Transformation of Innovation and Entrepreneurship: Progress, Challenges and Key Themes. Res. Policy 2019, 48, 103773. [Google Scholar] [CrossRef]

- Scuotto, V.; Santoro, G.; Bresciani, S.; Del Giudice, M. Shifting Intra-and Inter-organizational Innovation Processes towards Digital Business: An Empirical Analysis of SMEs. Creat. Innov. Manag. 2017, 26, 247–255. [Google Scholar] [CrossRef]

- Sestino, A.; Kahlawi, A.; De Mauro, A. Decoding the Data Economy: A Literature Review of Its Impact on Business, Society and Digital Transformation. Eur. J. Innov. Manag. 2023, 28, 298–323. [Google Scholar] [CrossRef]

- Dong, J.Q.; He, J.; Karhade, P. The Penrose Effect in Resource Investment for Innovation: Evidence from Information Technology and Human Capital. In Proceedings of the 21st European Conference on Information Systems, Utrecht, The Netherlands, 5–8 June 2013. [Google Scholar]

- Pitelis, C.; Verbeke, A. Introduction: Edith Penrose and the Future of the Multinational Enterprise: New Research Directions. MIR Manag. Int. Rev. 2007, 47, 139–149. [Google Scholar]

- Spender, J.C.; Marr, B. How a Knowledge-Based Approach Might Illuminate the Notion of Human Capital and Its Measurement. Expert Syst. Appl. 2006, 30, 265–271. [Google Scholar] [CrossRef]

- Penrose, E.T. The Theory of the Growth of the Firm; Oxford University Press: Oxford, UK, 2009; ISBN 0199573840. [Google Scholar]

- Azeem, M.; Ahmed, M.; Haider, S.; Sajjad, M. Expanding Competitive Advantage through Organizational Culture, Knowledge Sharing and Organizational Innovation. Technol. Soc. 2021, 66, 101635. [Google Scholar] [CrossRef]

- Kotter, J.P. Corporate Culture and Performance; Simon and Schuster: New York, NY, USA, 2008; ISBN 1439107602. [Google Scholar]

- Umair, M.; Dilanchiev, A. Economic Recovery by Developing Business Starategies: Mediating Role of Financing and Organizational Culture in Small and Medium Businesses. In Proceedings of the 4th International CEO Communication, Economics, Organization & Social Sciences Congress 2022, Udaipur Rajasthan, India, 20–22 May 2022. [Google Scholar]

- Ortner, T.; Hautz, J.; Stadler, C.; Matzler, K. Open Strategy and Digital Transformation: A Framework and Future Research Agenda. Int. J. Manag. Rev. 2024, 1–22. [Google Scholar] [CrossRef]

- Bühler, M.M.; Nübel, K.; Jelinek, T.; Riechert, D.; Bauer, T.; Schmid, T.; Schneider, M. Data Sharing and the Digital Transformation of the Construction Sector. Buildings 2023, 13, 442. [Google Scholar] [CrossRef]

- Isiramen, O.M. Ethical Leadership and Employee Retention. GPH-Int. J. Bus. Manag. 2021, 4, 10–26. [Google Scholar]

- Parmenter, J.; Barnes, R. Factors Supporting Indigenous Employee Retention in the Australian Mining Industry: A Case Study of the Pilbara Region. Extr. Ind. Soc. 2021, 8, 423–433. [Google Scholar] [CrossRef]

- Werner, S.; Balkin, D.B. Strategic Benefits: How Employee Benefits Can Create a Sustainable Competitive Edge. J. Total Reward. 2021, 30, 8–22. [Google Scholar]

- Kehinde, S.; Moses, C.; Borishade, T.; Kehinde, O.; Simon-Ilogho, B.; Kehinde, K. A Study of Great Resignation on Work-Life Balance: Global Perspective. Int. J. Financ. Econ. Bus. 2023, 2, 280–300. [Google Scholar] [CrossRef]

- Irawanto, D.W.; Novianti, K.R.; Roz, K. Work from Home: Measuring Satisfaction between Work–Life Balance and Work Stress during the COVID-19 Pandemic in Indonesia. Economies 2021, 9, 96. [Google Scholar] [CrossRef]

- Shirmohammadi, M.; Au, W.C.; Beigi, M. Remote Work and Work-Life Balance: Lessons Learned from the COVID-19 Pandemic and Suggestions for HRD Practitioners. Hum. Resour. Dev. Int. 2022, 25, 163–181. [Google Scholar] [CrossRef]

- Waworuntu, E.C.; Kainde, S.J.R.; Mandagi, D.W. Work-Life Balance, Job Satisfaction and Performance among Millennial and Gen Z Employees: A Systematic Review. Society 2022, 10, 384–398. [Google Scholar] [CrossRef]

- Branca, T.A.; Fornai, B.; Colla, V.; Murri, M.M.; Streppa, E.; Schröder, A.J. The Challenge of Digitalization in the Steel Sector. Metals 2020, 10, 288. [Google Scholar] [CrossRef]

- Demartini, M.; Pinna, C.; Tonelli, F.; Terzi, S.; Sansone, C.; Testa, C. Food Industry Digitalization: From Challenges and Trends to Opportunities and Solutions. IFAC-PapersOnLine 2018, 51, 1371–1378. [Google Scholar] [CrossRef]

- Eerola, T.; Eilu, P.; Hanski, J.; Horn, S.; Judl, J.; Karhu, M.; Kivikytö-Reponen, P.; Lintinen, P.; Långbacka, B. Digitalization and Natural Resources. Geol. Surv. Finl. Open File Res. Rep. 2021, 50, 2021. [Google Scholar]

- Anwar, G.; Abdullah, N.N. The Impact of Human Resource Management Practice on Organizational Performance. Int. J. Eng. Bus. Manag. (IJEBM) 2021, 5, 35–47. [Google Scholar] [CrossRef]

- Khan, Z.; Hossain, M.R.; Badeeb, R.A.; Zhang, C. Aggregate and Disaggregate Impact of Natural Resources on Economic Performance: Role of Green Growth and Human Capital. Resour. Policy 2023, 80, 103103. [Google Scholar] [CrossRef]

- Iorember, P.T.; Gbaka, S.; Işık, A.; Nwani, C.; Abbas, J. New Insight into Decoupling Carbon Emissions from Economic Growth: Do Financialization, Human Capital, and Energy Security Risk Matter? Rev. Dev. Econ. 2024, 28, 827–850. [Google Scholar] [CrossRef]

- Pomi, S.S.; Sarkar, S.M.; Dhar, B.K. Human or Physical Capital, Which Influences Sustainable Economic Growth Most? A Study on Bangladesh. Can. J. Bus. Inf. Stud. 2021, 3, 101–108. [Google Scholar]

- Alzoubi, H.; Alshurideh, M.; Kurdi, B.; Akour, I.; Aziz, R. Does BLE Technology Contribute towards Improving Marketing Strategies, Customers’ Satisfaction and Loyalty? The Role of Open Innovation. Int. J. Data Netw. Sci. 2022, 6, 449–460. [Google Scholar] [CrossRef]

- Lim, M.K.; Li, Y.; Song, X. Exploring Customer Satisfaction in Cold Chain Logistics Using a Text Mining Approach. Ind. Manag. Data Syst. 2021, 121, 2426–2449. [Google Scholar] [CrossRef]

- Recuero-Virto, N.; Valilla-Arróspide, C. Forecasting the next Revolution: Food Technology’s Impact on Consumers’ Acceptance and Satisfaction. Br. Food J. 2022, 124, 4339–4353. [Google Scholar] [CrossRef]

- Ari, M.A.; Engler, P.; Li, G.; Patnam, M.; Valderrama, M.L. Energy Support for Firms in Europe: Best Practice Considerations and Recent Experience; International Monetary Fund: Bretton Woods, NH, USA, 2023; ISBN 9798400255007. [Google Scholar]

- de Vries, K.; Erumban, A.; van Ark, B. Productivity and the Pandemic: Short-Term Disruptions and Long-Term Implications: The Impact of the COVID-19 Pandemic on Productivity Dynamics by Industry. Int. Econ. Econ. Policy 2021, 18, 541–570. [Google Scholar] [CrossRef]

- Bresciani, S.; Ciampi, F.; Meli, F.; Ferraris, A. Using Big Data for Co-Innovation Processes: Mapping the Field of Data-Driven Innovation, Proposing Theoretical Developments and Providing a Research Agenda. Int. J. Inf. Manag. 2021, 60, 102347. [Google Scholar] [CrossRef]

- Shams, S.M.R.; Vrontis, D.; Weber, Y.; Tsoukatos, E.; Iaia, L. Technology, Business and Sustainable Development: Advances for People, Planet and Profit; Taylor & Francis: Abingdon, UK, 2023; ISBN 1000902609. [Google Scholar]

- Hossain, M.A. Data-Driven Decision Making: Enhancing Quality Management Practices Through Optimized MIS Frameworks. Innov. Eng. J. 2024, 1, 117–135. [Google Scholar] [CrossRef]

- Martínez-Peláez, R.; Escobar, M.A.; Félix, V.G.; Ostos, R.; Parra-Michel, J.; García, V.; Ochoa-Brust, A.; Velarde-Alvarado, P.; Félix, R.A.; Olivares-Bautista, S. Sustainable Digital Transformation for SMEs: A Comprehensive Framework for Informed Decision-Making. Sustainability 2024, 16, 4447. [Google Scholar] [CrossRef]

- Rai, P.R.; Nanjundan, P.; George, J.P. Enhancing Industrial Operations through AI-Driven Decision-Making in the Era of Industry 4.0. In AI-Driven IoT Systems for Industry 4.0; CRC Press: Boca Raton, FL, USA, 2024; pp. 42–55. [Google Scholar]

- Challoumis, C. The circular economy of ai-creating value for enterprises and investors. In Proceedings of the XIV International Scientific Conference, Toronto, ON, Canada, 14–15 November 2024; pp. 234–262. [Google Scholar]

- D’Amico, G.; Arbolino, R.; Shi, L.; Yigitcanlar, T.; Ioppolo, G. Digital Technologies for Urban Metabolism Efficiency: Lessons from Urban Agenda Partnership on Circular Economy. Sustainability 2021, 13, 6043. [Google Scholar] [CrossRef]

- Turskis, Z.; Šniokienė, V. IoT-Driven Transformation of Circular Economy Efficiency: An Overview. Math. Comput. Appl. 2024, 29, 49. [Google Scholar] [CrossRef]

- Bradač Hojnik, B.; Huđek, I. Small and Medium-Sized Enterprises in the Digital Age: Understanding Characteristics and Essential Demands. Information 2023, 14, 606. [Google Scholar] [CrossRef]

- Johnson, E.; Seyi-Lande, O.B.; Adeleke, G.S.; Amajuoyi, C.P.; Simpson, B.D. Developing Scalable Data Solutions for Small and Medium Enterprises: Challenges and Best Practices. Int. J. Manag. Entrep. Res. 2024, 6, 1910–1935. [Google Scholar] [CrossRef]

- Yilmaz, G.; Qurban, K.; Kaiser, J.; McFarlane, D.C. Cost-Effective Digital Transformation of SMEs through Low-Cost Digital Solutions. In Proceedings of the Low-Cost Digital Solutions for Industrial Automation (LoDiSA 2023), Cambridge, UK, 25–26 September 2023. [Google Scholar]

- Roman, A.; Rusu, V.D. Digital Technologies and the Performance of Small and Medium Enterprises. Stud. Bus. Econ. 2022, 17, 190–203. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).