Abstract

The rapid advancement of digital technologies presents new opportunities and challenges for companies concerning their environmental, social, and corporate governance (ESG) performance. As organizations increasingly prioritize sustainable development, it becomes essential to investigate the role of digital technology in enhancing ESG outcomes. Utilizing data from 35,650 Chinese listed companies spanning 2009 to 2021, this study employs a double fixed-effects model to analyze the dual pathways through which digital technology adoption influences ESG performance. The findings indicate that the adoption of digital technologies positively affects both current and future ESG performance; however, this impact diminishes over time. The breadth and depth of digital technologies offer complementary approaches to improving ESG performance. Specifically, the breadth of digital technologies enhances ESG performance by improving information transparency and alleviating financing constraints, while the depth of digital technologies further bolsters firms’ ESG initiatives by increasing operational efficiency. Additionally, this study reveals significant variations in the impact of digital technologies on ESG performance across different sectors, particularly between manufacturing and highly polluting firms. Notably, the adoption of digital technologies fosters opportunities for the standardization of information regarding firms’ ESG ratings.

1. Introduction

The extensive ramifications of digital technology have prompted the Chinese government to accord it a position of paramount importance, reflecting a heightened emphasis and strategic focus. The publication of the Chinese government’s “Strategic Plan for the Development of New Generation Artificial Intelligence” underscores the continuous expansion of the digital industry [1]. It was anticipated that by 2023, the value added by the core sectors of China’s digital economy would constitute 10% of the national GDP, with projections indicating that by 2030, the scale of the core artificial intelligence industry is poised to exceed 1 trillion yuan [1]. Concurrently, within the framework of the “Key Focus Areas for China’s Digital Economy in 2024”, the Chinese government emphasizes the critical importance of digital technology adoption [2].

The continuous and unwavering evolution of digital technology is reshaping the landscape for companies. Digital technology influences firms’ value activities in two primary ways: by enhancing access to information [3,4,5] and optimizing resource allocation [6,7]. Wu et al. (2022) demonstrate that digital technologies such as blockchain, IoT, and AI can simplify the processing of firm reports and improve their transparency, security, and credibility, thereby enhancing firms’ attention to best practices [8]. Smart manufacturing, an essential component of digital technology adoption, optimizes production processes and reduces resource waste through real-time monitoring and data analysis [9].

The adoption of digital technology yields numerous beneficial impacts on firms, including cost reduction [10], enhanced internal control [11], optimization of internal operational processes [12], facilitation of specialization [4,5], and driving business model innovation [13]. A study of 527 large U.S. firms from 1987 to 1994 revealed that firms exhibited higher productivity when investments in digital technology were combined with job restructuring and the utilization of skilled labor [14].

Although existing studies have verified the potential influence of digital technology on ESG performance [14,15,16,17,18], there still exist dual theoretical gaps in its mechanism of action. From the perspective of resource allocation, current research has failed to disclose how digital technologies improve ESG performance by optimizing the allocation of enterprise resources (such as AI-driven energy efficiency management and blockchain-enabled supply chain transparency). The key question lies in whether the application of technology genuinely enhances resource utilization efficiency or whether it requires deep integration with the existing capabilities of the organization to release value. From the perspective of information asymmetry, the existing literature has overlooked the core role of digital technologies (such as big data analysis and cloud computing) in alleviating the information gap among stakeholders. For example, how does the sharing of supply chain information weaken the behavior of “greenwashing”?

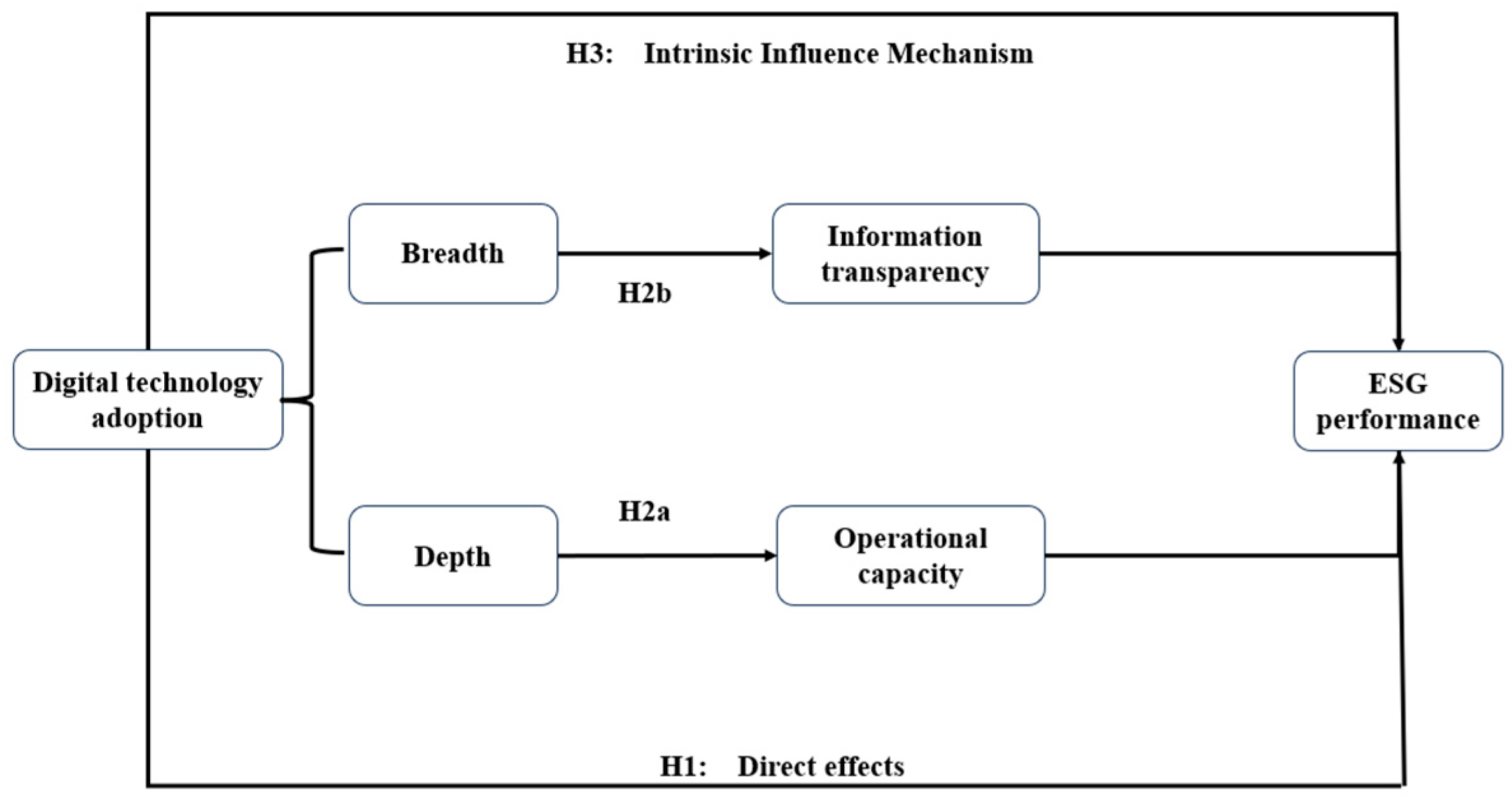

Based on the resource-based view (Barney, 1991) [19] and the theory of information asymmetry (Akerlof, 1970) [20], this study constructs a two-dimensional analytical framework of “breadth and depth of technology application” with a focus on the roles of technologies such as artificial intelligence and blockchain in the following two paths. How do digital technologies dynamically adjust the input of environmental governance resources (such as the deployment of carbon emission monitoring systems) and the allocation of social responsibility resources (such as labor data tracking)? Through what channels does the application of technology reduce ESG information asymmetry (such as supply chain traceability reducing moral hazard and AI algorithms enhancing the credibility of ESG ratings)?

This study provides empirical evidence that the adoption of digital technology exerts a significant and sustainable impact on current ESG performance. Categorizing digital technology adoption into two dimensions—depth and breadth—elucidates how such adoption enhances ESG performance through improved information transparency and operational efficiency. Specifically, a broader scope of digital technology adoption facilitates greater access to information and alleviates the detrimental effects of information asymmetry. In contrast, the depth of adoption enhances ESG performance by integrating digital technologies with traditional industries, thereby optimizing the allocation of limited resources. Moreover, the implementation of digital technologies diminishes the variability in ESG ratings, with an expanded breadth of adoption contributing to more consistent ESG assessments.

This study offers several significant contributions by analyzing the behaviors of businesses that adopt digital technologies. It categorizes digital technology adoption into two dimensions: breadth and depth. The findings reveal a substantial impact of digital technology adoption on ESG performance, providing empirical evidence for two distinct forms of digital transformation undertaken by firms. Furthermore, the analysis indicates the enduring effects of digital technologies by comparing results with a 1-year lag to those with a 2-year lag, emphasizing the long-term benefits associated with digital technology. Finally, this paper contributes to the extant literature on the relationship between ESG uncertainty and investor and equity risk by proposing a novel idea regarding the impact of digital technology applications on ESG rating uncertainty. The findings of this study demonstrate that the integration of digital technologies leads to a reduction in the variability of ESG ratings and unveils the nuances in the scope and depth of digital technology applications.

2. A Literature Review

The term “digital technology adoption” refers to the utilization of digital technologies, including artificial intelligence, blockchain, cloud computing, and big data [21]. These technologies are fundamental to the digital economy and merit further examination. This analysis will be conducted from three perspectives: the theoretical foundation, the practical application of digital technology, and the ESG performance associated with digital technology.

2.1. Theoretical Foundation

In alignment with the principles of information asymmetry, digital technologies significantly reduce the challenges organizations face in acquiring information [22,23,24] and substantially influence the value-adding activities of those who utilize information. Within the realm of corporate sustainability and responsible investment, information asymmetry can lead to an underestimation or misunderstanding of companies’ ESG efforts [25]. Even when companies have made substantial investments and advancements in ESG, these achievements may go unnoticed by the external community due to inadequate communication channels [23,26]. This situation can adversely affect these companies’ ability to attract responsible investments as well as their incentives to improve their ESG performance. Moreover, information asymmetries can allow companies to exploit this opaque environment to engage ins “greenwashing” [27], in which they exaggerate or misrepresent their environmental and social performance to mislead investors and the public. Digital technologies can bridge the information gap by improving access to and processing of information [28,29] and by promoting communication and collaboration among stakeholders.

The concept of resource allocation theory, as articulated by Powers and McDougall (2005), relates to the process of modifying resource distribution within a firm based on its production methodologies [30]. At the firm level, rational resource allocation can lower transaction costs, enhance capital utilization efficiency, facilitate growth, assist in developing unique competitive capabilities, and play a crucial role in sustaining the firm’s competitive advantage while contributing to positive performance outcomes. Additionally, the adoption of digital technology can optimize production and operational management processes [31] while reducing the waste of raw materials [32], energy, and other resources through real-time monitoring and data analysis [33,34]. This empowerment fosters the initiation of improved production methodologies and industrial interconnectivity to drive high-quality economic development [29].

2.2. The Practical Adoption of Digital Technology

The constant updating and adoption of digital technology can help create a social network that is easier to use and more effective. This approach also creates a clear structure for how different groups of people can interact. It allows for direct communication and improved efficiency, which can lead to better economic results [35,36,37]. Liu et al. (2022) developed a city-level digital technology development index for China. This index is based on three key areas: digital infrastructure, digital factor inputs, and the level of comprehensive digital technology development [38]. This study highlights the crucial role of digital technology in driving macroeconomic growth. Lo et al. (2023) discovered that the implementation of digital technology in tangible industrial contexts can facilitate the optimization of industrial structural adjustment [39], enhance the quality of enterprise production and production efficiency, and promote the synergistic effect of resources [38,40,41]. Richardson (2023) observed that the advancement of the digital economy has prompted enterprises to augment their investment in sophisticated technologies, which has resulted in the development of innovative products and intelligent production processes, thereby enhancing governance efficiency [41]. However, an excessive reliance on digital technologies can diminish firms’ capacity for innovation due to homogenization. The current limitations of measuring digital technologies may also impede the innovative effects of digital technologies. For example, imitation behavior among firms can negate the positive impact of digital technologies [42,43].

2.3. The ESG Performance of Digital Technology

While the majority of research has focused on the impact of digital technologies on various value activities within firms, it is imperative to delve into their effects on the sustainable development of businesses. In 2023, the Intergovernmental Panel on Climate Change released its Sixth Assessment Report Synthesis Report: Climate Change 2023 [13]. The report makes it clear that human activities contribute to global warming, mainly in the form of greenhouse gas emissions, and that global surface temperatures between 2011 and 2020 are 1.1 °C higher than in 1850–1900 [13]. This means that we cannot afford to ignore the importance of sustainability. ESG performance as a key indicator of the consistency of corporate ESG principles [14] will be the focus of this paper.

The analysis of factors affecting ESG performance from a firm’s perspective is concerned with both the firm’s own characteristics and the external environment. The firm’s own characteristics encompass aspects such as the gender diversity of executives, R&D investment, and other pertinent factors [44]. The performance of ESG metrics is enhanced when women occupy a more prominent role within the executive management structure. Moreover, firms with a greater degree of ESG specialization tend to exhibit high R&D intensity, a characteristic that is particularly evident in R&D-intensive firms [45]. Feng and Yuan (2024) demonstrate that not only do internal financing constraints enhance firms’ ESG performance, but external public environmental issues can also achieve the same effect [45]. The external environment encompasses not only the public as a monitor but also the uncertainty of the macro environment. The public, in its capacity as the representative of external monitoring of the firm, has the capacity to report instances of poor conduct on the part of the firm through the medium of the media. This facilitates the identification of any discrepancies between the firm’s stated image and its actual performance. The heightened level of public interest in environmental issues exerts external pressure on firms [46,47], which may result in the phenomenon of “money votes” in the capital market. In this context, investors show preferential treatment to firms with superior ESG performance. Conversely, macro-environmental uncertainty has been shown to have a detrimental impact on firms’ ESG performance, particularly when environmental uncertainty rises, and firms’ ESG scores and ESG ratings decline [48]. Such decline can be attributed to factors such as financial constraints and industry competition [22]. Consequently, promoting more responsible firm behavior can be achieved by increasing stakeholder engagement and influence [49].

As ongoing research delves into the economic growth ramifications of digital technologies, the enduring sustainability of their economic impacts emerges as a critical concern [50]. Consequently, scholars have shifted their focus to investigate the complex relationship between digital technologies and firms’ ESG performance. This shift has led to an increased discourse on this evolving nexus. On the environmental side, digital technology innovations accelerate the dissemination and exchange of information and knowledge [51], helping firms to understand complex and dynamic environments in real time and provide timely feedback. Continuously iterative digital technologies can optimize production processes and product performance to improve environmental performance [52,53]. Utilizing the threshold effect of green technology innovation can reduce the problem of carbon emissions in the digital economy, which has important theoretical and practical value for developing countries to reduce carbon emissions [54]. In addition, the advent of digital technology has had a significant impact on the environmental awareness of managers. This heightened awareness is influenced by external environmental regulation [55], thereby enhancing the efficacy and systematic nature of firm green innovation [55,56,57].

In terms of social impact, digital technology enables firms to streamline the production and operation of their activities, thereby delivering benefits to society. The application of digital technology has been demonstrated to effectively address the demands of customers seeking digital products, thereby enhancing the quality of products and services already available on the market. This, consequently, leads to an augmentation in the value added to consumers [4,5]. New digital technologies provide firms with the opportunity to make timely adjustments to economic conditions based on real-time information, thereby avoiding the unnecessary waste of resources and increasing the efficiency of production and operations [58] in order to improve customer satisfaction. To illustrate, digital, virtual, and other technologies can facilitate pre-test simulation and prediction, thereby mitigating the risk of failure in manufacturing firms. This approach can lead to cost savings, enhanced research and development capabilities, improved innovation performance, and contributions to sustainable development [59].

In the context of corporate governance, the pervasive adoption of digital technology effectively dismantles the barriers to data and information flow. This not only enables managers to allocate resources in a more optimal manner [32] but also mitigates information asymmetry and enhances the transparency and dissemination of information. Furthermore, digital innovation enhances the efficacy of firm resource integration by diminishing information asymmetry [60] and optimizes firm corporate governance. Liu et al. (2023) demonstrate, through empirical research, that digital innovation not only improves innovation efficiency [60] but also optimizes internal operational efficiency through information management. This, in turn, leads to additional financial profits and improves firm performance [61,62]. Wu et al. (2022) demonstrate that digital technologies can streamline the processing of ESG reports, enhancing transparency, security, and credibility and, thus, fostering a greater focus on ESG practices by firms [8]. Na et al. (2022) posit that the digital transformation of the value chain (encompassing Digital Manufacturing Transformation, Digital Marketing Transformation, and Digital Management Transformation) effectively transforms stakeholder needs into value-creating activities, thereby enhancing the social responsibility capabilities of firms [63]. Consequently, digital technology adoption has the potential to enhance ESG capabilities [63,64,65,66].

Despite the advent of digital technologies across various sectors, there remains a dearth of comprehensive insight into the mechanisms through which digital technology applications influence ESG performance. This study posits that such applications can be examined in terms of both the breadth and depth of digital technology, thus facilitating an understanding of the pathways through which they affect ESG performance.

3. Digital Technology Adoption and ESG Performance: Hypothesis Construction

3.1. The Direct Effect of Digital Technology Adoption on ESG Performance

The latest developments in digital technologies assist organizations in the identification of reliable information in a prompt manner [51] and the establishment of effective information management systems [67]. Within the digital environment, the goal of firms to integrate supply and demand is realized through the implementation of several mechanisms. These mechanisms include the use of individual demand data, interaction with partners, the application of algorithms to the production process, and predictive analytics [67]. The utilization of digital technologies to construct network relationships [68] can facilitate improvements in a firm’s ESG performance. Firms’ reliance on network relationships constructed by digital technologies can improve firms’ ESG performance. This is manifested in the timely adjustment of economic conditions based on real-time information and the optimization of resource allocation to improve ESG performance [69]. Business digitization and digital public services improve environmental health with advanced technologies, highlighting the importance of digital skills and business digitization for ecosystem vitality [70]. In addition, the application of digital technologies establishes avenues for stakeholders to convey information, thereby enhancing its reliability. This development fosters the exchange of knowledge among businesses, supply chain partners, and consumers and paves the way for collaboration. Digital technologies make data collection, analysis, and reporting more accurate and efficient [57,58,63] and are powerful tools for firms to detect and manage. For example, the application of new digital technologies can monitor firms’ ESG performance and effectively reduce greenwash behavior [71] in order to establish a good firm image.

To summarize, digital technology adoption provides firms with the opportunity to balance economic interests and social responsibilities and to promote sustainable development and the transformation of a more sustainable business model. This paper derives the following hypotheses:

H1:

Digital technology adoption can significantly improve firms’ ESG performance.

3.2. Influencing Mechanism of Digital Technology Adoption on ESG Performance

The term “breadth of digital technology adoption” is used to describe the scope of digital technology applications. The extensive utilization of digital technology can effectively dismantle information barriers. This utilization has been shown to alleviate the issue of information asymmetry and enhance the transparency and dissemination of information. On the one hand, digital technology is more efficient and accurate in identifying and obtaining shareholders’ information [70], which greatly expands the breadth of corporate information disclosure and optimizes the quality of information disclosure [72]. To illustrate, Wu et al. (2022) demonstrate that digital technologies, including blockchain, IoT, and AI, can streamline the processing of corporate ESG reports, enhance their transparency, security, and credibility, and, thus, foster greater corporate attention to ESG practices [8]. On the other hand, digital technologies can facilitate communication between stakeholders and enterprises, thereby enhancing information sharing and cross-sectoral cooperation [8]. Furthermore, investors and consumers are provided with a more reliable information base, which, in turn, promotes the improvement of ESG performance. The utilization of digital platforms and social media by companies facilitates enhanced interactions with customers, suppliers, employees and communities. The provision of greater transparency of information and opportunities for engagement by digital technology applications contributes to the establishment of trusting relationships and an increase in stakeholder satisfaction.

In conclusion, the breadth of digital technology adoption provides significant assistance in enhancing the ESG performance of firms by facilitating greater transparency of information. The enhancement of information transparency has been demonstrated to facilitate communication and relationships between firms and stakeholders. Furthermore, it has been shown to provide investors and consumers with a more reliable information base, which, in turn, contributes to improved ESG performance. Therefore, this paper derives the following hypothesis:

H2a:

The breadth of digital technology adoption significantly improves firms’ ESG performance by increasing firms’ information transparency.

The depth of digital technology application can be defined as the extent to which digital technology is integrated with physical industry sectors. The depth of digital technology adoption fosters a high degree of agility toward forward-looking technologies [3] and improves operational models and product services [4]. The advent of new digital operating models has the potential to optimize production processes [58] while simultaneously facilitating the dismantling of technological barriers to production, thereby enhancing the efficiency of firms’ production operations [55]. Kame Babilla (2023) and Liu (2023) have demonstrated that digital technologies can optimize the efficiency of internal operations, which can, in turn, lead to additional financial profits [60,61]. Furthermore, from a perspective of resource utilization, digital technologies facilitate the rationalization of resource allocation, thereby increasing the rate of resource reuse. From an environmental standpoint, digital business processes can serve to mitigate detrimental impacts on the environment, including reductions in greenhouse gas emissions and inefficient energy use [73]. From a societal perspective, Richardson’s findings indicate that advances in digital technology have prompted companies to increase their investment in complex technologies that are further integrated with physical operations. This has contributed to the advancement of innovative products and smart production processes, as well as other related technological innovations. From a governance perspective, digital technology applications can enhance governance performance by reducing the cost of internal control or agency costs of firms [72,74]. In conclusion, the depth of digital technology adoption has a considerable impact on the improvement of a company’s ESG performance, mainly through the improvement of its operational efficiency. Based on the aforementioned evidence, the following hypotheses are developed:

H2b:

The depth of digital technology adoption significantly improves firms’ ESG performance by increasing firms’ operational efficiency.

3.3. Heterogeneity Effect of Digital Technology Adoption on ESG Performance

This paper considers the specific circumstances of different industries and firms in order to gain a comprehensive understanding of the impact of digital technology adoption on ESG performance. The results demonstrate that the influence of digital economic development on ESG performance is heterogeneous, exhibiting varying degrees of impact contingent on factors such as firm size, industry, equity type, and market environment. Additionally, the degree of impact on non-state-owned firms and firms in developed regions of China [75], non-manufacturing and industrial digitalized firms, and firms in polluting and competitive industries differ [62]. With regard to the internal characteristics of firms, the responsiveness of firms’ ESG performance improvement is influenced by the attributes of the firms in question. State-owned enterprises and heavily polluted industries are subject to greater public scrutiny and demonstrate a heightened awareness of ESG practices, which, in turn, leads to a diminished responsiveness of digitalization to ESG performance improvement. The manufacturing and high-tech industries have markedly disparate production flow lines, given the distinctive characteristics of each. The manufacturing industry’s reliance on repetitive operations renders it susceptible to the impact of digital technology adoption. Conversely, the high-tech industry is poised to become more efficient as a result of digital technology. From an external environmental perspective, China’s economic development level and institutional environment across different regions exhibit notable disparities. The eastern region demonstrates a more advanced degree of digital governance, a more developed digital economic environment, and a significantly higher level of “Internet +” adoption compared to other regions. In light of the aforementioned considerations, this paper puts forth the following hypotheses:

H3:

The internal characteristics and external environment of firms produce heterogeneity in the relationship between digital technology adoption and firms’ ESG performance.

In conclusion, as illustrated in Figure 1, the adoption of digital technology exerts a considerable influence on the ESG performance of firms, which is affected by a number of channels. Furthermore, this paper presents an empirical analysis of the impact of diverse digital technology adoption on ESG performance, with the objective of providing specific guidance and recommendations for firms seeking to achieve sustainable development goals.

Figure 1.

Mechanism of firms’ digital technology adoption on ESG performance.

4. Methodology and Data

4.1. Sample and Data

This paper takes Chinese A-share listed companies from 2009–2021 as the initial sample and finally obtains 35,475 company-year observations after eliminating the missing samples of relevant variables. The sources of sample data for this paper are (1) basic information about the listed companies, and data related to governance are mainly from the China Stock Market and Accounting Research Database (CSMAR). This database is recognized as the largest and most accurate comprehensive economic and financial research database in China. (2) Data related to digital patents are obtained from the State Intellectual Property Office. (3) Information about ESG ratings of listed companies is obtained from the WIND database. In order to reduce the influence of outliers, this paper shrinks the continuous variables at the 1% and 99% levels.

4.2. Definition of Variables

Digital technology adoption. In accordance with the findings of prior research conducted by Yang et al. (2024), it is possible to divide digital technology applications into two categories: digital technology breadth and digital technology depth [75]. The term “breadth of digital technology” refers to the extent of utilization of digital technologies, specifically measured by the frequency of use of various digital tools. This study aims to identify and match keywords such as Artificial Intelligence, Big Data, Internet of Things, Blockchain, and Cloud Computing within annual reports to ascertain their presence and frequency. Consequently, Breadth is quantified through the frequency of relevant terminology associated with these digital technologies. In contrast, the “depth of digital technology” encompasses four domains: digital production, digital management, digital marketing, and digital products. This analysis utilizes Yang et al.’s (2024) framework to assess the level of integration between digital technologies and the physical industry. The findings suggest that a greater breadth of digital technology often correlates with advancements in Depth, indicating that frequent use of digital tools can facilitate deeper integration across various domains. Furthermore, the interaction between these dimensions may reveal pathways for industries to innovate and adapt, ultimately enhancing their competitiveness. Future research could further explore how this relationship varies across sectors, potentially uncovering unique strategies employed by different industries to effectively leverage digital technologies.

ESG Performance. In light of the findings of previous studies on ESG information [30], this paper employs ESG ratings as a means of measuring ESG performance (ESG). Considering data availability, the analysis employs the Huazheng ratings of Chinese listed companies from the WIND database, covering the period from 2009 to 2021 as the primary dataset. The ESG ratings provided by CSI are based on a nine-point scale, where AAA-rated firms exhibit the highest performance and C-rated firms demonstrate the lowest outcomes. To facilitate comparisons of subsequent effects, this paper assigns values in accordance with the rating results, where the “AAA-C” rating corresponds to a score range of “9–1.” In this context, total performance is denoted as ESG, environmental performance as E, social performance as S, and corporate governance performance as G. Furthermore, ESG performance can be analyzed in conjunction with the ESG Bloomberg rating results (ESGP) available in the WIND database.

Mediator variables. In this study, we draw on seminal works such as Dechow and Dichev (2002) [76] to assess corporate information transparency. To this end, we obtain the composite results (Trans) from three dimensions: surplus quality, evaluation results of listed companies’ disclosure in the CSMAR database, and the number of analysts. Furthermore, the method proposed by Kim and Verrecchia (2001) [77] allows for the use of the KV value as a robustness test, thereby providing a new perspective for measuring information transparency. It is noteworthy that a higher KV value indicates a higher level of corporate disclosure. With regard to the operating capacity indicator, this paper employs the total asset turnover ratio (ATR) from the CSMAR database as a measure of operating efficiency and utilizes two distinct calculation methods as a robustness test.

Control Variables. Drawing on the previous literature of Bose et al. (2022) [40] and Dhaliwal et al. (2011) [78], this paper adds the following control variables to the model: firm size (SIZE), litigation risk (LITG), return on assets (ROA), industry competition (HHI), level of internationalization (GLOBAL), liquidity (LIQUIDITY), TOBINQ, Debt Ratio (LEV), Duality (DUAL), Board Size (BOARD) and Number of Independent Directors (INDEP).

4.3. Model Setting

Drawing on previous studies by Huang et al. (2023) [79] and Li et al. (2023) [35], this paper constructs the following model to explore the impact of digital technology adoption on firms’ ESG performance:

where the variable subscripts i, k, and t denote company, industry, and time, respectively. The explanatory variable is the ESG performance of firm i in year t; the core explanatory variable denotes the level of digital technology adoption of firm i in year t, and is the control variable mentioned above. In view of the time lag inherent in the rating of ESG performance by third-party organizations, it is not necessary to lag the explanatory variables by one period in order to mitigate the issue of simultaneity. Furthermore, this paper incorporates a series of fixed effects into the model. In light of the varying degrees of acceptance of digital technologies across different industries, this paper incorporates a set of fixed effects into the model. These are represented by and , which denote time-fixed effects and industry-fixed effects, respectively. This paper focuses on the significance of the coefficient of in the model (1). According to the previous research hypothesis, if the coefficient is significantly positive, it means that digital technology adoption will enhance firms’ ESG performance.

On the basis of model (1) and referring to the model settings in the previous study [28], the mediation models (2) and (3) are obtained in this paper:

This paper investigates the mechanism of digital technology adoption on firms’ ESG performance as four mediating effects, including two mediating variables: information transparency and operating capacity. This paper focuses on the significance of the coefficient of the two mediating variables. In the case where , , and are significant, the mediating effect is significant. If the sign of is the same as that of , it is a positive effect, and if the sign is different, it is a negative effect.

5. Results

5.1. Descriptive Statistics

Table 1 presents the descriptive statistics for the primary variables. The mean value of digital technology adoption is 14.003, with a standard deviation of 28.657, indicating that over 50% of businesses have embraced digital technology. As noted by Cai et al. (2023) [17], the adoption of digital technology is becoming increasingly prevalent. This trend not only signifies a shift in operational strategies but also suggests a potential transformation in competitive dynamics. Firms that leverage digital tools can enhance efficiency and innovate more rapidly, thereby reshaping market landscapes. Moreover, the significant standard deviation implies a diverse range of adoption levels, necessitating a closer examination of the factors influencing this disparity, such as industry type, organizational size, and leadership vision. The average total performance score for ESG is 4.093, which corresponds to an average rating of approximately B. Among the three dimensions of performance, corporate governance (G) scores the highest at 5.373, whereas environmental performance (E) scores the lowest at 1.889. This indicates that listed companies generally exhibit subpar environmental performance.

Table 1.

Descriptive statistics of main variables.

5.2. Benchmark Regression

Table 2 displays the outcomes of the benchmark regressions, highlighting how the adoption of digital technology affects firms’ ESG performance. Consistent with the findings of Kuzovkova et al. (2021) [66], the results indicate that the incorporation of digital technology significantly enhances corporate ESG performance. Additionally, insights from Ha et al. (2022) [69] and Zhang (2023) [70] further support the notion that utilizing data analytics and intelligent decision-making systems allows organizations to more effectively assess environmental risks and social responsibilities. As a result, companies are better equipped to formulate innovative strategies that foster sustainable development. This study utilizes a year-industry fixed effects model to investigate both current and future perspectives. Columns (1) and (2) illustrate the relationship between digital technology adoption and present ESG performance. The following columns (3–6) explore the effects of digital technology adoption on ESG performance in the subsequent year and the two years thereafter. It is important to note that columns (1), (3), and (5) do not include additional control variables in their empirical analysis, while the other columns do.

Table 2.

Digital technology adoption and firms’ ESG performance.

Table 3 illustrates a positive correlation between firms’ utilization of digital technology and their ESG performance, both in the present and projected into the future. Notably, the influence of ESG performance on the subsequent year is less significant than its current impact. This study underscores the advantageous role of digital technology in enhancing ESG performance, emphasizing its effect on both present and future sustainability metrics. According to Liu et al. (2023) [60], in complex and technology-driven environments, the effective deployment of digital technology is crucial for promoting sustainable ESG practices and building resilience against ongoing environmental and social challenges.

Table 3.

The breadth and depth of digital technology adoption and firms’ ESG performance.

5.3. Robustness Test

Endogeneity test. To address the issue of endogeneity arising from the reciprocal relationship between ESG performance and digital technology adoption, this study utilizes the instrumental variable (IV) method to validate the robustness of the findings. The instrumental variable employed is the level of digital technology adoption lagged by one period. The results indicate that the effect of firm digital technology adoption on ESG performance remains significant, with a positive regression coefficient (Table 4).

Table 4.

Endogeneity test for benchmark regression.

Exogenous impacts. This paper draws on a series of practices of the double-difference model (DID) [81] and adopts the exogenous shock of the implementation of the strategy of “Smart City Pilot Policy” as a proxy for measuring the level of digital technology adoption. The specific settings are as follows: if the city where the firm is located is the pilot implementation city of “Smart City Pilot Policy”, is assigned to 1; otherwise, it is assigned to 0; in the year of the implementation of the strategy of “Smart City Pilot Policy” and after, is assigned to 0, and is assigned to 1. is assigned as 1; otherwise, it takes the value of 0; the interaction term denotes the firms that are impacted by the implementation of “Smart City Pilot Policy” strategy.

Table 5 shows the impact of digital technology adoption on ESG performance under policy shocks, and finds that the results are robust regardless of whether control variables are added.

Table 5.

ESG impact of digital technology adoption under policy shocks.

Other robustness tests. This study employs three additional methodologies to ensure the robustness of the findings. Firstly, the VIF is utilized to test for multicollinearity, with all VIFs being less than 10, indicating that multicollinearity is not a problem in the model. Secondly, the ESG-Bloomberg data are used instead of the ESG-Huazheng data. Finally, a transition from a double-fixed model to the OLS model is made. The relevant data are presented in Table 6. The findings consistently indicate that digital technology applications significantly enhance both the current and future ESG performances of firms. The results provide essential technological and informational support for promoting sustainable corporate development. Additionally, this research explores the effects of digital technology applications on environmental, social, and corporate governance performance, revealing a strong positive impact on both environmental and social performance.

Table 6.

Robustness Tests of Changing Key Variables and Models.

5.4. Mechanism Analysis

5.4.1. Digital Technology Adoption, Information Transparency, and ESG Performance

The results presented in Table 7 illustrate the effectiveness of various key performance metrics utilized in the research sample, providing evidence that the adoption of digital technology significantly enhances corporate ESG performance by promoting greater transparency of corporate information. In line with information asymmetry theory, the integration of digital technology allows firms to access both internal and external data through multiple channels [3], thereby improving information transparency [74]. Noteworthy financing mechanisms, including internet finance, blockchain technology, and big data risk assessment [68], serve as essential tools that facilitate more accessible financial support for companies. Consequently, this leads to enhanced performance in environmental, social, and corporate governance. As shown in Table 6, the statistical significance for both transparency coefficients, which are 0.9535 and 0.2244, is at the 1% level. These findings support the predictions outlined in Hypothesis 2a. Furthermore, the mediating effects of information transparency were determined to be statistically significant, as indicated by the results of the Sobel test.

Table 7.

Digital technology adoption, information transparency, and ESG performance.

5.4.2. Digital Technology Adoption, Operating Capacity and ESG Performance

Table 8 illustrates that the depth of digital technology application significantly enhances companies’ ESG performance by improving operational capabilities. According to resource allocation theory, a deeper adoption of digital technology optimizes resource allocation, resulting in more efficient utilization and operations. Kame Babilla (2023) [61] and Belousova (2022) [72] indicate that the adoption of digital technology not only facilitates effective management of supply chains and product life cycles but also strengthens firms’ capabilities in environmental stewardship, employee relations, and community engagement, thereby enhancing overall environmental, social, and governance performance. The coefficients for operational capabilities are 0.0226 and 0.0145, both significant at the 1% level.

Table 8.

Digital technology adoption, operational capacity, and ESG performance.

5.5. Heterogeneity Analysis

This study investigates heterogeneity by analyzing the influence of firm characteristics and geographic location. Companies are grouped into three categories based on their industry and location for an in-depth assessment. Using the Fisher Combined Probability Test (Permutation test), the research measures the significance of differences between groups. This approach includes bootstrap sampling to evaluate the statistical relevance of the differences in group coefficients, with 1000 resampling iterations performed to identify these variances. Additionally, the heterogeneity analysis accounts for industry and year, along with key control variables, with results summarized in Table 8 for specific insights.

Industry-specific impacts: The integration of digital technologies notably benefits manufacturing firms. As shown in Panel A of Table 9, the implementation of digital technology correlates with enhanced ESG performance in these companies, with coefficients of 0.0247 (t = 2.2033) and 0.06 (t = 3.8981), indicating a positive association. This positive correlation suggests that the adoption of digital technologies not only drives efficiency but also fosters a culture of sustainability. By leveraging data analytics and automation, manufacturing firms can optimize resource allocation, reduce waste, and improve supply chain transparency.

Table 9.

Heterogeneity analysis of digital technology adoption and ESG performance.

Greater benefits in high-pollution sectors: The positive effect of digital technology is even more significant in heavily polluting industries. Belousova (2022) suggests that digital integration can lower GHG emissions and energy waste, thus improving ESG outcomes [72]. Panel B reveals coefficients of 0.1135 and 0.1697 at the 5% significance level, highlighting the role of digital technologies in promoting sustainable practices within these sectors. This indicates a transformative shift in operational paradigms as industries traditionally associated with high emissions begin to leverage digital tools for enhanced efficiency. Furthermore, the interplay between digital technology and regulatory frameworks could catalyze a broader adoption of sustainable practices, fostering a culture of innovation that prioritizes environmental stewardship. Such advancements may not only mitigate ecological impacts but also create competitive advantages, positioning these sectors favorably in an increasingly eco-conscious marketplace.

5.6. Further Analysis

The preceding study demonstrates that digital technology applications exert a considerable influence on the enhancement of ESG performance. The extent and complexity of digital technology applications can impact the accessibility and dependability of the information obtained. The introduction and utilization of digital technologies, including those pertaining to big data and blockchain, can markedly enhance data analysis capabilities, thereby facilitating a greater uniformity in the factors deemed important by disparate groups and ultimately leading to more consistent outcomes across organizational entities. Given the disparate methodologies employed by third-party organizations in evaluating ESG performance, our objective is to assess the influence of digital technology applications on ESG uncertainty. In this paper, we employ the methodology proposed by Avramov et al. (2022) to assess ESG performance [81], utilizing data from prominent foreign rating agencies, such as Lufthansa, to quantify rating uncertainty. Six ESG rating agencies in China were selected for analysis: CSI, Bloomberg, Shangdao Ronglv, Wind, Russell, and Allied Wave. The ESG uncertainty index for listed companies in the six rating agencies is presented in Table 10. The incorporation of digital technologies can mitigate uncertainties related to environmental, social, and corporate governance by broadening their application avenues. Wu et al. (2022) [8] and Na et al. (2022) [63]’s findings indicate that this integration not only enhances operational efficiency but also fosters transparency and accountability. By leveraging real-time data analytics and open platforms, companies can improve their engagement with stakeholders, thereby bolstering social trust. Moreover, this integration is poised to generate innovative business models that facilitate sustainable development, ultimately establishing a virtuous cycle that strengthens overall economic resilience.

Table 10.

Digital technology adoption and the uncertainty of ESG performance.

6. Conclusions and Policy Implications

6.1. Discussion

This research presents several important contributions by exploring how organizations leverage digital technologies. It distinguishes the adoption of these technologies along two primary dimensions: breadth and depth. The results reveal that the integration of digital technologies significantly influences ESG performance, offering empirical evidence for companies to engage in two different forms of digital transformation. The lasting effects of digital technologies are demonstrated through a comparison of outcomes with one-year and two-year delays, emphasizing their long-term advantages. While Huang et al. (2023) [80] and Li et al. (2023) [35] provide a robust empirical framework for assessing the influence of digital technologies on environmental, social, and governance outcomes, they tend to oversimplify the concept of digital technologies and mainly focus on their immediate impacts. In contrast, this study clarifies the complexities of digital technologies and introduces the notion of digital technology depth as a strategy for resource integration. Additionally, the findings related to text persistence underscore the enduring benefits of digital technologies.

Furthermore, the results of the industry heterogeneity analysis underscore the effectiveness of digital technologies in heavily polluting sectors, indicating that these technologies provide governance strategies for environmental optimization. This finding aligns with the conclusions presented by Cai (2023) [17] and Lin et al. (2024) [34]. However, they overlook the fact that ESG performance is quantified by an ESG score issued by an ESG rating agency. It is crucial to acknowledge that there is variability in the results when utilizing rating scores from different sources [81]. Consequently, we examine whether the adoption of digital technology influences ESG uncertainty. By analyzing the effects of breadth and depth on ESG uncertainty, this study demonstrates that firms adopting multiple digital technologies are more likely to attain stable ESG ratings. This stability in ESG ratings not only boosts investor confidence but also cultivates a culture of accountability within organizations. Moreover, as companies innovate and integrate these technologies, they can identify new pathways for sustainable practices, ultimately contributing to a more resilient corporate ecosystem that prioritizes long-term value creation over short-term gains. This comprehensive approach to digital transformation highlights the potential for technology to drive meaningful change within the ESG landscape.

This study offers several significant contributions by analyzing the behaviors of businesses that adopt digital technologies. Firstly, to make it easier to see the different levels of digital technology, we have divided digital technology adoption into two categories. Zhu and Jin (2023) [11], and Cai et al. (2023) [17] measure digital transformation by the frequency of words in annual reports that are closely related to the type of digitization. The type of digital technology used by Li et al. (2022) [55] to indicate the degree of digital technology adoption also shows that the adoption of multiple digital technologies by a firm is only one aspect of a firm’s digital technology adoption. So, it is important to remember that small and medium-sized businesses (SMEs) are very different from each other. Secondly, this paper analyses the long-term impact of digital technology adoption. Wang et al. (2023) [7] analyzed and empirically tested the direct impact of digital transformation on current ESG performance by focusing on digital transformation within firms. This paper demonstrates the long-term benefits of digital technology by comparing the results with one-year and two-year lags. Finally, this paper contributes to the extant literature on the relationship between ESG uncertainty and investor and equity risk by proposing a novel idea regarding the impact of digital technology applications on ESG rating uncertainty [82]. The findings of this study demonstrate that the integration of digital technologies leads to a reduction in the variability of ESG ratings and unveils the nuances in the scope and depth of digital technology applications.

6.2. Conclusions

This study examines the influence of digital technology adoption on firms’ ESG performance and internal operations, utilizing data from Chinese-listed firms from 2009 to 2021. Grounded in the theories of information asymmetry and resource allocation, the adoption of digital technologies is conceptualized in terms of both depth and breadth, thereby facilitating an exploration of the dual pathways through which it impacts ESG performance.

Initially, this study identifies a robust positive correlation between the adoption of digital technologies by firms and their ESG performance, steering firms’ activities toward a more sustainable trajectory. Furthermore, this study reveals the long-term effects of digital technology adoption on ESG performance over the subsequent one- and two-year periods. Secondly, the transformative effects of digital technology adoption are evident within emerging ESG ecosystems, particularly regarding information transparency and operational capabilities. Concurrently, firms are expanding their scope of digital technology adoption through enhanced information sources and transparency, enabling them to elevate their ESG performance standards. Thirdly, the impact of digital technology adoption is particularly pronounced in manufacturing firms and those engaged in highly polluting activities, indicating that digital technologies provide new avenues for transformation and advancement in traditional industries. Additionally, the implementation of digital technology has been shown to reduce the variability of ESG ratings across different rating agencies. In conclusion, this study elucidates the intricate interconnections between digital technology innovation and ESG performance. It highlights the diverse impacts of digital technologies on various aspects of sustainable development, thereby establishing a foundation for advancing sustainable development practices in the contemporary business environment.

Drawing upon information asymmetry theory (Akerlof, 1970) [20] and resource allocation theory (Powers and McDougall, 2005) [30], we have strengthened the theoretical foundation from two sides. From a breadth perspective, digital technology adoption mitigates information asymmetry across organizational boundaries. From a depth perspective, resource allocation theory explains why firms develop heterogeneous capabilities in technology internalization. Our analysis reveals that deep adopters allocate 2.26% more resources to R&D investment (Table 8), creating path-dependent competitive advantages. This dual theoretical lens addresses Barney’s (1991) [19] call for examining both “resource picking” (breadth) and “capability building” (depth) mechanisms.

6.3. Policy Implications

This study focuses on listed companies in China and identifies potential avenues for the development of digital technology in emerging economies. Promoting the application of digital technologies in these regions enhances the efficiency of information exchange and significantly improves business operations, thereby fostering sustainable social development. These initiatives play a pivotal role in optimizing environmental, social, and corporate governance, which is essential for promoting climate action in emerging countries. Therefore, for emerging nations seeking to strengthen their environmental, social, and governance frameworks, the adoption of a diverse range of cutting-edge digital technologies and their integration with the real sector represent strategic pathways for advancement. Embracing advanced digital tools and adapting to new technological breakthroughs are indispensable strategies for guiding these countries toward a future characterized by sustainability and resilience.

6.4. Future Reaches

This paper identifies several limitations, particularly concerning ESG (Environmental, Social, and Governance) performance indicators. Different ESG rating agencies employ their own assessment criteria, resulting in significant discrepancies in their ratings due to varying objectives and focal points. Billio et al. (2021) emphasize notable variations in ESG rating outcomes among the four major global rating agencies, observing that the correlation between MSCI and RobecoSAM is approximately 43%. Moreover, the correlation among all four major global rating agencies is similarly low [83]. Although this study suggests that digital technology has the potential to mitigate these discrepancies among rating agencies, it does not delve into this aspect in depth. The present study focuses exclusively on Chinese A-share listed companies, a factor that significantly limits the generalizability of the findings. It is, therefore, important to note that the results may not be applicable to different economic or regulatory environments.

Scholars have highlighted the importance of advanced digital technologies, such as big data and blockchain, in enhancing data analytics [84]. These technological advancements not only attract investors but also assist companies in shaping their image and communicating growth strategies to external stakeholders. External factors, including corporate reputation and investor engagement, are particularly critical when evaluating firms’ ESG practices. However, this study is limited to the examination of internal information dissemination and resource allocation mechanisms. Future research should explore the influence of corporate reputation and investor attention on the value delivery of digital technologies.

Furthermore, the widespread adoption of digital technology has introduced new challenges, such as data security and privacy protection. Enterprises must strengthen their data management and security measures while capitalizing on the benefits of digitization. Concurrently, some small and medium-sized enterprises (SMEs) are under dual pressures of technology and capital during their digital transformation, which may disadvantage them amid policy shocks. Therefore, the government and relevant organizations should enhance support and training to assist these enterprises in overcoming the challenges they face.

In conclusion, the application of digital technologies, influenced by policies, has positively affected firms’ performance in environmental, social, and governance dimensions. Moving forward, enterprises should prioritize sustainable development goals during their digital transformation, actively seek collaboration with stakeholders to enhance overall performance, and simultaneously strengthen risk management to achieve a balance between economic benefits and social responsibility.

Author Contributions

Y.W., conceptualization, software, formal analysis, writing—original draft preparation and writing—review and editing; D.D.W., supervision. All authors have read and agreed to the published version of this manuscript.

Funding

This research was funded by Academic Innovation Team of Capital University of Economics and Business (Grant Number: XSCXTD202404).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available upon request from the corresponding author.

Conflicts of Interest

The authors declare no potential conflicts of interest with respect to the research, authorship, and/or publication of this article.

References

- Strategic Plan for the Development of New Generation Artificial Intelligence. Available online: https://www.ndrc.gov.cn/xwdt/ztzl/szjj/zcwj/202406/t20240607_1386724.html (accessed on 20 October 2024).

- National Development and Reform Commission, the National Data Administration. Highlights of the Digital Economy 2024. Available online: https://www.ndrc.gov.cn/xwdt/ztzl/szjj/zcjd/202406/t20240607_1386754.html (accessed on 20 October 2024).

- Du, X.; Jiang, K. Promoting enterprise productivity: The role of digital transformation. Borsa Istanb. Rev. 2022, 22, 1165–1181. [Google Scholar] [CrossRef]

- Hanelt, A.; Firk, S.; Hildebrandt, B.; Kolbe, L.M. Digital M&A, digital innovation, and firm performance: An empirical investigation. Eur. J. Inf. Syst. 2021, 30, 3–26. [Google Scholar] [CrossRef]

- Nylén, D.; Holmström, J. Digital innovation strategy: A framework for diagnosing and improving digital product and service innovation. Bus. Horiz. 2015, 58, 57–67. [Google Scholar] [CrossRef]

- Du, Q.; Sun, Z.; Chen, S. Digital technology and ESG performance in ecosystem-based business models: Perspective of environmental regulation and green innovation in China. Asia Pac. Bus. Rev. 2024, 1–24. [Google Scholar] [CrossRef]

- Wang, H.; Jiao, S.; Bu, K.; Wang, Y.; Wang, Y. Digital transformation and manufacturing companies’ ESG responsibility performance. Financ. Res. Lett. 2023, 58, 104370. [Google Scholar] [CrossRef]

- Wu, W.; Fu, Y.; Wang, Z.; Liu, X.; Niu, Y.; Li, B.; Huang, G.Q. Consortium blockchain-enabled smart ESG reporting platform with token-based incentives for corporate crowdsensing. Comput. Ind. Eng. 2022, 172, 108456. [Google Scholar] [CrossRef]

- Fang, Z.; Razzaq, A.; Mohsin, M.; Irfan, M. Spatial spillovers and threshold effects of internet development and entrepreneurship on green innovation efficiency in China. Technol. Soc. 2022, 68, 101844. [Google Scholar] [CrossRef]

- Liao, F.; Hu, Y.; Chen, M.; Xu, S. Digital transformation and corporate green supply chain efficiency: Evidence from China. Econ. Anal. Policy 2024, 81, 195–207. [Google Scholar] [CrossRef]

- Zhu, Y.; Jin, S. How Does the Digital Transformation of Banks Improve Efficiency and Environmental, Social, and Governance Performance? Systems 2023, 11, 328. [Google Scholar] [CrossRef]

- Cheng, R.; Ho, C.-Y.; Huang, S. Digitalization and firm performance: Channels and heterogeneities. Appl. Econ. Lett. 2023, 30, 2401–2406. [Google Scholar] [CrossRef]

- Loebbecke, C.; Picot, A. Reflections on societal and business model transformation arising from digitization and big data analytics: A research agenda. J. Strateg. Inf. Syst. 2015, 24, 149–157. [Google Scholar] [CrossRef]

- Brynjolfsson, E.; Hitt, L.M. Computing Productivity: Firm-Level Evidence. Rev. Econ. Stat. 2003, 85, 793–808. [Google Scholar] [CrossRef]

- Calvin, K.; Dasgupta, D.; Krinner, G.; Mukherji, A.; Thorne, P.W.; Trisos, C.; Romero, J.; Aldunce, P.; Barrett, K.; Blanco, G.; et al. Climate Change 2023: AR6 Synthesis Report; IPCC: Geneva, Switzerland, 2023. [Google Scholar] [CrossRef]

- Lin, Z. Does ESG performance indicate corporate economic sustainability? Evidence based on the sustainable growth rate. Borsa Istanb. Rev. 2024, 24, 485–493. [Google Scholar] [CrossRef]

- Cai, C.; Tu, Y.; Li, Z. Enterprise digital transformation and ESG performance. Financ. Res. Lett. 2023, 58, 104692. [Google Scholar] [CrossRef]

- Ding, X.; Sheng, Z.; Appolloni, A.; Shahzad, M.; Han, S. Digital transformation, ESG practice, and total factor productivity. Bus. Strateg. Environ. 2024, 33, 4547–4561. [Google Scholar] [CrossRef]

- Barney, J.B. Firm Resources and Sustained Competitive Advantage. In Economics Meets Sociology in Strategic Management; Emerald Group Publishing Limited: Leeds, UK, 1991; pp. 203–227. [Google Scholar] [CrossRef]

- Akerlof, G.A. The Market for “Lemons”: Quality Uncertainty and the Market Mechanism. Q. J. Econ. 1970, 84, 488. [Google Scholar] [CrossRef]

- Mubarak, M.F.; Tiwari, S.; Petraite, M.; Mubarik, M.; Rasi, R.Z.R.M. How Industry 4.0 technologies and open innovation can improve green innovation performance? Manag. Environ. Qual. An. Int. J. 2021, 32, 1007–1022. [Google Scholar] [CrossRef]

- He, F.; Ding, C.; Yue, W.; Liu, G. ESG performance and corporate risk-taking: Evidence from China. Int. Rev. Financ. Anal. 2023, 87, 102550. [Google Scholar] [CrossRef]

- Rastogi, S.; Singh, K.; Kanoujiya, J. Firm’s value and ESG: The moderating role of ownership concentration and corporate disclosures. Asian Rev. Account. 2023, 32, 70–90. [Google Scholar] [CrossRef]

- Lou, Y.; Rahi, R. Information, market power and welfare. J. Econ. Theory 2023, 214, 105756. [Google Scholar] [CrossRef]

- Rau, P.R.; Yu, T. A survey on ESG: Investors, institutions and firms. China Financ. Rev. Int. 2023, 14, 3–33. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Li, Y.; Richardson, G.D. The Market Valuation of Environmental Capital Expenditures by Pulp and Paper Companies. Account. Rev. 2004, 79, 329–353. [Google Scholar] [CrossRef]

- Zhang, L.; Li, D.; Cao, C.; Huang, S. The influence of greenwashing perception on green purchasing intentions: The mediating role of green word-of-mouth and moderating role of green concern. J. Clean. Prod. 2018, 187, 740–750. [Google Scholar] [CrossRef]

- Mu, W.; Liu, K.; Tao, Y.; Ye, Y. Digital finance and corporate ESG. Financ. Res. Lett. 2023, 51, 103426. [Google Scholar] [CrossRef]

- Heo, P.S.; Lee, D.H. Evolution of the linkage structure of ICT industry and its role in the economic system: The case of Korea. Inf. Technol. Dev. 2019, 25, 424–454. [Google Scholar] [CrossRef]

- Powers, J.B.; McDougall, P.P. University start-up formation and technology licensing with firms that go public: A resource-based view of academic entrepreneurship. J. Bus. Ventur. 2005, 20, 291–311. [Google Scholar] [CrossRef]

- Liu, X.; Chong, Y.; Di, D.; Li, G. Digital financial development, synergistic reduction of pollution, and carbon emissions: Evidence from biased technical change. Environ. Sci. Pollut. Res. 2023, 30, 109671–109690. [Google Scholar] [CrossRef]

- Peng, Y.; Qiu, Y.; Li, Y.; Peng, X. Does digital inclusive finance promote carbon emission reduction of enterprises. PLoS ONE 2024, 19, e0302826. [Google Scholar] [CrossRef]

- Shen, Y.; Yang, Z.; Zhang, X. Impact of digital technology on carbon emissions: Evidence from Chinese cities. Front. Ecol. Evol. 2023, 11, 1166376. [Google Scholar] [CrossRef]

- Lin, Y.; Zhao, X.; Chen, L. A Multi-Case Study of Business Innovation Models for Manufacturing Capacity Sharing Platforms, Based on a Resource Orchestration Perspective. Eng. Manag. J. 2024, 36, 92–102. [Google Scholar] [CrossRef]

- Li, Z.; Huang, Z.; Su, Y. New media environment, environmental regulation and corporate green technology innovation:Evidence from China. Energy Econ. 2023, 119, 106545. [Google Scholar] [CrossRef]

- Li, S.; Gao, L.; Han, C.; Gupta, B.; Alhalabi, W.; Almakdi, S. Exploring the effect of digital transformation on Firms’ innovation performance. J. Innov. Knowl. 2023, 8, 100317. [Google Scholar] [CrossRef]

- Li, F.; Zhao, Y.; Ortiz, J.; Chen, Y. How Does Digital Technology Innovation Affect the Internationalization Performance of Chinese Enterprises? The Moderating Effect of Sustainability Readiness. Sustainability 2023, 15, 11126. [Google Scholar] [CrossRef]

- Liu, J.; Yu, Q.; Chen, Y.; Liu, J. The impact of digital technology development on carbon emissions: A spatial effect analysis for China. Resour. Conserv. Recycl. 2022, 185, 106445. [Google Scholar] [CrossRef]

- Lo, K.L.; Zhang, J.; Xia, F. Does digital technology innovation work better for industrial upgrading? An empirical analysis of listed Chinese manufacturing firms. Appl. Econ. Lett. 2023, 30, 2504–2509. [Google Scholar] [CrossRef]

- Bose, S.; Ali, M.J.; Hossain, S.; Shamsuddin, A. Does CEO–Audit Committee/Board Interlocking Matter for Corporate Social Responsibility? J. Bus. Ethics 2022, 179, 819–847. [Google Scholar] [CrossRef]

- Richardson, S. Over-investment of free cash flow. Rev. Account. Stud. 2006, 11, 159–189. [Google Scholar] [CrossRef]

- Usai, A.; Fiano, F.; Petruzzelli, A.M.; Paoloni, P.; Briamonte, M.F.; Orlando, B. Unveiling the impact of the adoption of digital technologies on firms’ innovation performance. J. Bus. Res. 2021, 133, 327–336. [Google Scholar] [CrossRef]

- Meng, X.; Zhu, P. Females’ social responsibility: The impact of female executives on ESG performance. Appl. Econ. Lett. 2023, 31, 1292–1297. [Google Scholar] [CrossRef]

- Fu, L.; Boehe, D.; Orlitzky, M. Are R&D-Intensive firms also corporate social responsibility specialists? A multicountry study. Res. Policy 2020, 49, 104082. [Google Scholar] [CrossRef]

- Feng, J.; Yuan, Y. Green investors and corporate ESG performance: Evidence from China. Financ. Res. Lett. 2024, 60, 104892. [Google Scholar] [CrossRef]

- Flammer, C. Corporate Social Responsibility and Shareholder Reaction: The Environmental Awareness of Investors. Acad. Manag. J. 2013, 56, 758–781. [Google Scholar] [CrossRef]

- Kumar, N.C.A.; Smith, C.; Badis, L.; Wang, N.; Ambrosy, P.; Tavares, R. ESG factors and risk-adjusted performance: A new quantitative model. J. Sustain. Financ. Investig. 2016, 6, 292–300. [Google Scholar] [CrossRef]

- Carney, R.W.; El Ghoul, S.; Guedhami, O.; Lu, J.W.; Wang, H. Political corporate social responsibility: The role of deliberative capacity. J. Int. Bus. Stud. 2022, 53, 1766–1784. [Google Scholar] [CrossRef]

- Imran, F.; Shahzad, K.; Butt, A.; Kantola, J. Digital Transformation of Industrial Organizations: Toward an Integrated Framework. J. Change Manag. 2021, 21, 451–479. [Google Scholar] [CrossRef]

- Di Vaio, A.; Palladino, R.; Pezzi, A.; Kalisz, D.E. The role of digital innovation in knowledge management systems: A systematic literature review. J. Bus. Res. 2021, 123, 220–231. [Google Scholar] [CrossRef]

- Albort-Morant, G.; Leal-Millán, A.; Cepeda-Carrión, G. The antecedents of green innovation performance: A model of learning and capabilities. J. Bus. Res. 2016, 69, 4912–4917. [Google Scholar] [CrossRef]

- Leal-Rodríguez, A.L.; Ariza-Montes, A.J.; Morales-Fernández, E.; Albort-Morant, G. Green innovation, indeed a cornerstone in linking market requests and business performance. Evidence from the Spanish automotive components industry. Technol. Forecast. Soc. Change 2018, 129, 185–193. [Google Scholar] [CrossRef]

- Hou, J.; Bai, W.; Sha, D. Does the Digital Economy Successfully Facilitate Carbon Emission Reduction in China? Green Technology Innovation Perspective. Sci. Technol. Soc. 2023, 28, 535–560. [Google Scholar] [CrossRef]

- Qi, Y.; Xie, X.; Chen, X. Effects of environmental regulation and corporate environmental commitment: Complementary or alternative? Evidence from China. J. Clean. Prod. 2023, 423, 138641. [Google Scholar] [CrossRef]

- Li, G.; Zhang, R.; Feng, S.; Wang, Y. Digital finance and sustainable development: Evidence from environmental inequality in China. Bus. Strateg. Environ. 2022, 31, 3574–3594. [Google Scholar] [CrossRef]

- Tan, Y.; Zhu, Z. The effect of ESG rating events on corporate green innovation in China: The mediating role of financial constraints and managers’ environmental awareness. Technol. Soc. 2022, 68, 101906. [Google Scholar] [CrossRef]

- Zhai, Y.; Cai, Z.; Lin, H.; Yuan, M.; Mao, Y.; Yu, M. Does better environmental, social, and governance induce better corporate green innovation: The mediating role of financing constraints. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 1513–1526. [Google Scholar] [CrossRef]

- Lokuge, S.; Sedera, D.; Grover, V.; Dongming, X. Organizational readiness for digital innovation: Development and empirical calibration of a construct. Inf. Manag. 2019, 56, 445–461. [Google Scholar] [CrossRef]

- Svahn, F.; Mathiassen, L.; Lindgren, R. Embracing Digital Innovation in Incumbent Firms: How Volvo Cars Managed Competing Concerns. MIS Q. 2017, 41, 239–253. [Google Scholar] [CrossRef]

- Liu, Y.; Dong, J.; Mei, L.; Shen, R. Digital innovation and performance of manufacturing firms: An affordance perspective. Technovation 2023, 119, 102458. [Google Scholar] [CrossRef]

- Babilla, T.U.K. Digital innovation and financial access for small and medium-sized enterprises in a currency union. Econ. Model. 2023, 120, 106182. [Google Scholar] [CrossRef]

- Li, N.; Wang, X.; Wang, Z.; Luan, X. The impact of digital transformation on corporate total factor productivity. Front. Psychol. 2022, 13, 1071986. [Google Scholar] [CrossRef]

- Na, C.; Chen, X.; Li, X.; Li, Y.; Wang, X. Digital Transformation of Value Chains and CSR Performance. Sustainability 2022, 14, 10245. [Google Scholar] [CrossRef]

- Wang, Q.; Wang, H.; Feng, G.; Chang, C. Impact of digital transformation on performance of environment, social, and governance: Empirical evidence from China. Bus. Ethics Environ. Responsib. 2023, 32, 1373–1388. [Google Scholar] [CrossRef]

- Wang, J.; Song, Z.; Xue, L. Digital Technology for Good: Path and Influence—Based on the Study of ESG Performance of Listed Companies in China. Appl. Sci. 2023, 13, 2862. [Google Scholar] [CrossRef]

- Kuzovkova, T.A.; Saliutina, T.Y.; Sharavova, O.I. The Impact of Digital Platforms on the Business Management Information System. In Proceedings of the 2021 Systems of Signal Synchronization, Generating and Processing in Telecommunications (SYNCHROINFO), Kaliningrad, Russia, 30 June–2 July 2021; pp. 1–5. [Google Scholar] [CrossRef]

- Wang, L.; Qi, J.; Zhuang, H. Monitoring or Collusion? Multiple Large Shareholders and Corporate ESG Performance: Evidence from China. Financ. Res. Lett. 2023, 53, 103673. [Google Scholar] [CrossRef]

- Zhong, Y.; Zhao, H.; Yin, T. Resource Bundling: How Does Enterprise Digital Transformation Affect Enterprise ESG Development? Sustainability 2023, 15, 1319. [Google Scholar] [CrossRef]

- Ha, L.T.; Huong, T.T.L.; Thanh, T.T. Is digitalization a driver to enhance environmental performance? An empirical investigation of European countries. Sustain. Prod. Consum. 2022, 32, 230–247. [Google Scholar] [CrossRef]

- Zhang, D. Can digital finance empowerment reduce extreme ESG hypocrisy resistance to improve green innovation? Energy Econ. 2023, 125, 106756. [Google Scholar] [CrossRef]

- Baker, E.D.; Boulton, T.J.; Braga-Alves, M.V.; Morey, M.R. ESG government risk and international IPO underpricing. J. Corp. Financ. 2021, 67, 101913. [Google Scholar] [CrossRef]

- Belousova, V.; Bondarenko, O.; Chichkanov, N.; Lebedev, D.; Miles, I. Coping with Greenhouse Gas Emissions: Insights from Digital Business Services. Energies 2022, 15, 2745. [Google Scholar] [CrossRef]

- Ghobakhloo, M.; Fathi, M. Corporate survival in Industry 4.0 era: The enabling role of lean-digitized manufacturing. J. Manuf. Technol. Manag. 2019, 31, 1–30. [Google Scholar] [CrossRef]

- Tian, G.; Li, B.; Cheng, Y. Does digital transformation matter for corporate risk-taking? Financ. Res. Lett. 2022, 49, 103107. [Google Scholar] [CrossRef]

- Yang, P.; Yin, Z.; Zhang, Z. Enterprise digital technology application and patent quality improvement-theoretical mechanism and empirical facts. Stat. Res. 2024, 41, 98–110. [Google Scholar] [CrossRef]

- Dechow, P.M.; Dichev, I.D. The Quality of Accruals and Earnings: The Role of Accrual Estimation Errors. Account. Rev. 2002, 77, 35–59. [Google Scholar] [CrossRef]

- Kim, O.; Verrecchia, R.E. The Relation among Disclosure, Returns, and Trading Volume Information. Account. Rev. 2001, 76, 633–654. [Google Scholar] [CrossRef]

- Dhaliwal, D.S.; Li, O.Z.; Tsang, A.; Yang, Y.G. Voluntary Nonfinancial Disclosure and the Cost of Equity Capital: The Initiation of Corporate Social Responsibility Reporting. Account. Rev. 2011, 86, 59–100. [Google Scholar] [CrossRef]

- Huang, Q.; Fang, J.; Xue, X.; Gao, H. Does Digital Innovation Cause Better ESG Performance? An Empirical Test of a-Listed Firms in China. Res. Int. Bus. Financ. 2023, 66, 102049. [Google Scholar] [CrossRef]

- Amihud, Y.; Mendelson, H. Asset Pricing and the Bid-Ask Spread. J. Financ. Econ. 1986, 17, 223–249. [Google Scholar] [CrossRef]

- Avramov, D.; Cheng, S.; Lioui, A.; Tarelli, A. Sustainable investing with ESG rating uncertainty. J. Financ. Econ. 2022, 145, 642–664. [Google Scholar] [CrossRef]

- Yu, D.; Meng, T.; Zheng, M.; Ma, R. ESG uncertainty, investor attention and stock price crash risk in China: Evidence from PVAR model analysis. Humanit. Soc. Sci. Commun. 2024, 11, 1152. [Google Scholar] [CrossRef]

- Billio, M.; Costola, M.; Hristova, I.; Latino, C.; Pelizzon, L. Inside the ESG ratings: (Dis)agreement and performance. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 1426–1445. [Google Scholar] [CrossRef]

- Wu, L.; Hitt, L.; Lou, B. Data Analytics, Innovation, and Firm Productivity. Manag. Sci. 2020, 66, 2017–2039. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).