The Impact of Digital Transformation on the Export Technology Complexity of Manufacturing Enterprises: Based on Empirical Evidence from China

Abstract

1. Introduction

2. Literature Review

2.1. Research on the Connotation of Digital Transformation

2.2. Research on the Factors Influencing Export Technological Complexity

2.3. Research on the Impact Pathways of Digital Transformation on Firms’ Export Technological Complexity

2.4. Research Gap

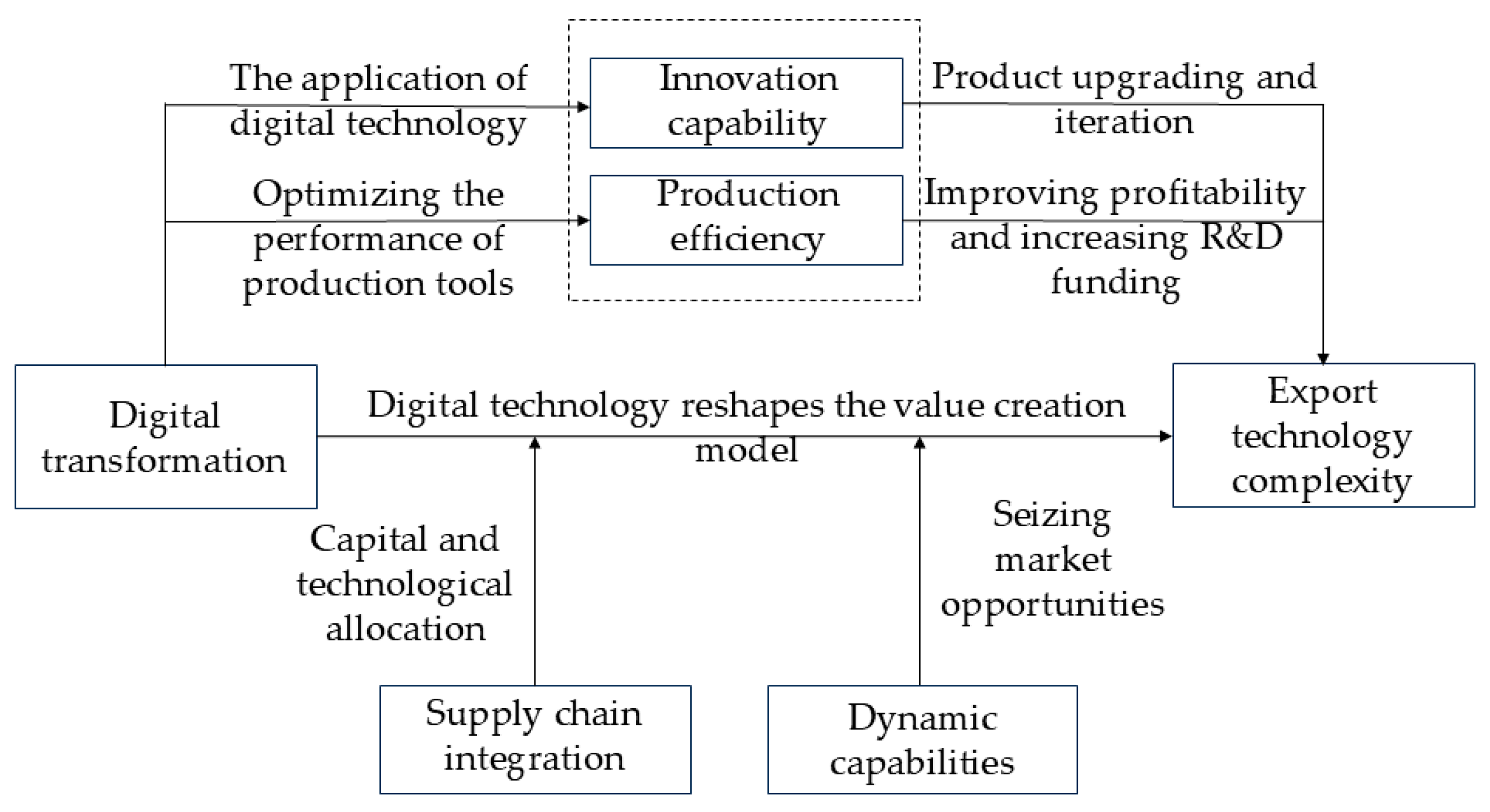

3. Theoretical Analysis and Research Hypotheses

3.1. Direct Mechanism Analysis

3.2. Indirect Mechanism Analysis

3.2.1. The Mediating Effect of Innovation Capability

3.2.2. The Mediating Effect of Production Efficiency

3.3. Moderating Mechanism Analysis

3.3.1. The Moderating Effect of Supply Chain Integration

3.3.2. The Moderating Effect of Dynamic Capabilities

4. Research Method and Data

4.1. Model Setup

4.1.1. Direct Effects Model

4.1.2. Indirect Effects Model

4.1.3. Moderating Effects Model

4.2. Variable Measurement and Description

4.2.1. Dependent Variable: Export Technological Complexity (Esi)

4.2.2. Independent Variable: Digital Transformation (Digital)

4.2.3. Mediating Variables

4.2.4. Moderating Variables

4.2.5. Control Variables

4.3. Data Sources and Descriptive Statistics

5. Results

5.1. Direct Effect Test

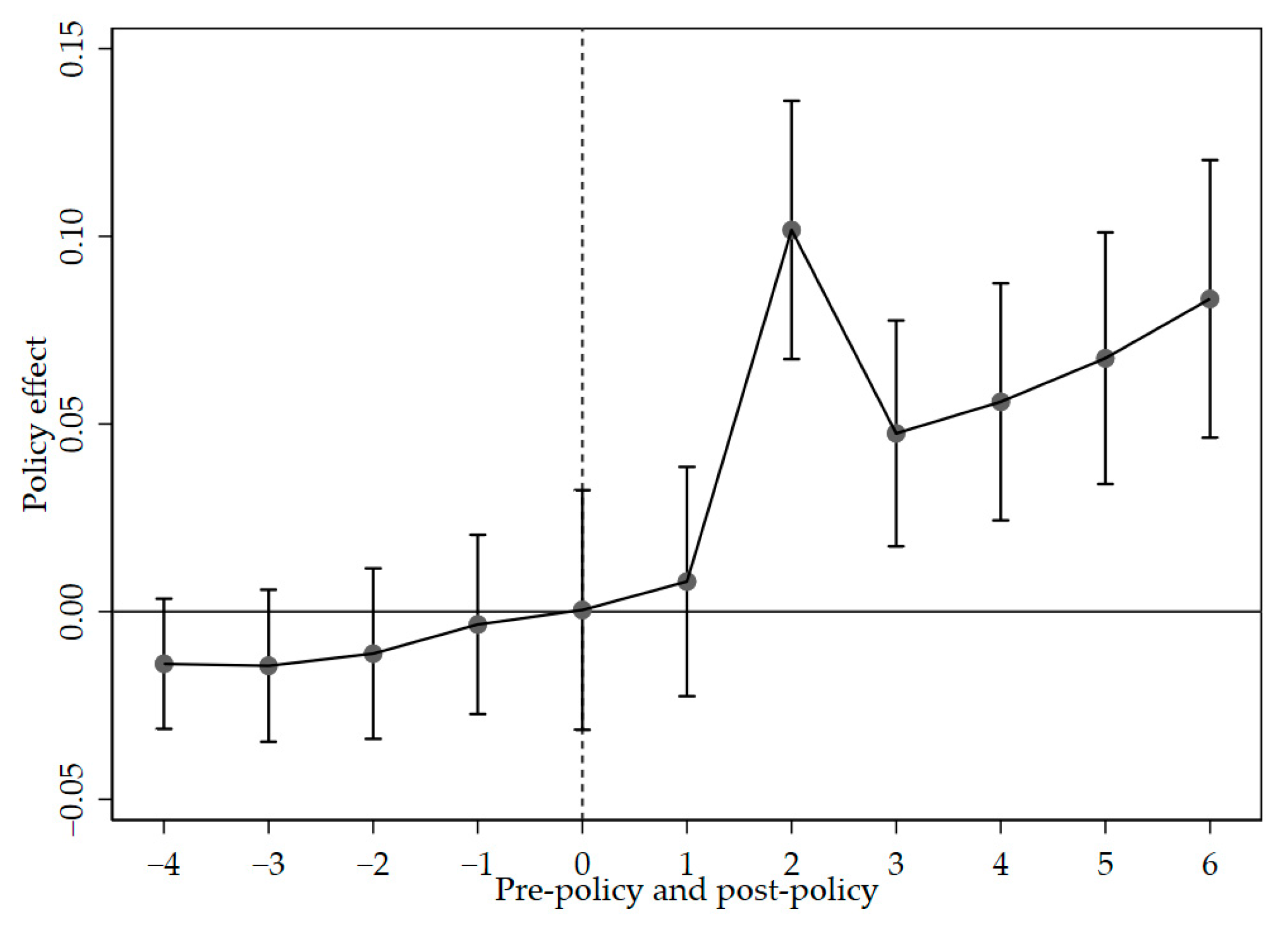

5.2. Endogeneity Test

5.2.1. Instrumental Variables Method

5.2.2. Exogenous Shock Testing Method

5.3. Robustness Test

5.4. Mechanism Test

5.4.1. Indirect Effect Test

- The mediating effect of innovation capability

- 2.

- The mediating effect of production efficiency

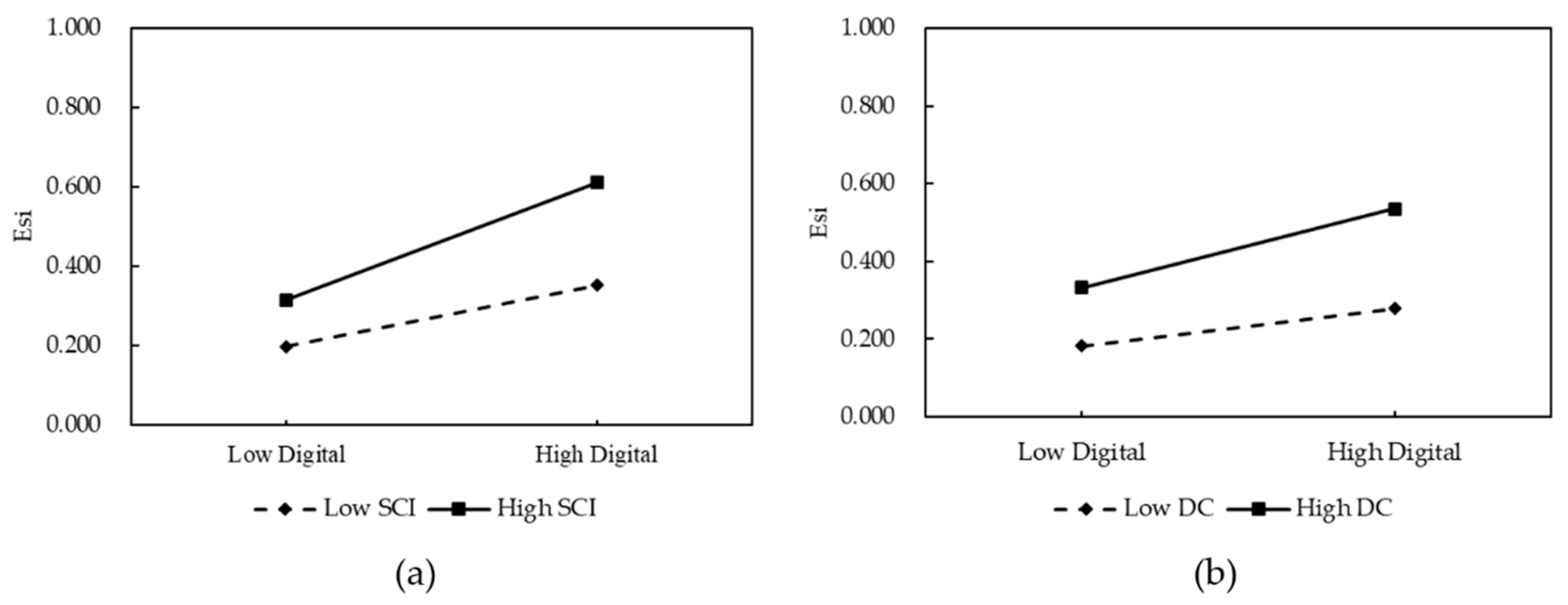

5.4.2. Moderating Effect Test

- The moderating effect of supply chain integration

- 2.

- The moderating effect of dynamic capabilities

5.5. Heterogeneity Analysis

5.5.1. Firm Heterogeneity

5.5.2. Industry Heterogeneity

- The impact of industry factor intensity

- 2.

- The impact of industry competition intensity

5.5.3. Regional Heterogeneity

5.5.4. Digital Transformation Stage Heterogeneity

6. Conclusions, Recommendations, and Research Limitations

6.1. Conclusions

- (1)

- Digital transformation enhances the export technology complexity of manufacturing enterprises. Specifically, for each 1-unit increase in the degree of digital transformation, the export technology complexity of enterprises will increase by 5.127 units. After considering a series of potential endogeneity issues, such as reverse causality, omitted variables, sample selection bias, and measurement errors, this conclusion remains robust. It may still be affected by model specification biases and measurement errors of variables, potentially leading to some degree of result bias.

- (2)

- Digital transformation indirectly boosts the export technology complexity in manufacturing enterprises by enhancing innovation capability and production efficiency. Additionally, improvements in supply chain integration and dynamic capabilities strengthen the positive impact of digital transformation on export technological complexity.

- (3)

- The heterogeneous effects of firm nature and industry characteristics are significant. The impact of digital transformation on export technology complexity is significantly stronger for state-owned enterprises than for non-state-owned enterprises. Under the promotion of digital transformation, technology-intensive enterprises experience a more significant improvement in export technology complexity compared to labor-intensive and capital-intensive enterprises. The export technology complexity improvement achieved through digital transformation is significantly greater for firms in high-competition industries than for those in low-competition industries. The effect of digital transformation on enhancing the export technological complexity of enterprises in the eastern region is significantly stronger than in other regions. Moreover, the impact of digital transformation on export technological complexity in the later stage is significantly greater than in the early stage.

6.2. Recommendations

- (1)

- Digital transformation is a vital means of improving the export technological complexity of manufacturing enterprises. The government should increase investment in the construction of new digital infrastructure, optimize the policy system related to digitalization, and provide financial support to assist enterprises in their digital transformation, for example, by implementing tax reduction policies to lower the costs of digital transformation for enterprises or providing targeted subsidies in areas such as software, cloud services, and data collection and transmission equipment to support firms’ digital transformation. Innovation capability and production efficiency are key pathways through which firms enhance the technological complexity of their exports via digital transformation. Enterprises should focus on the deep integration of digital technologies with traditional business, applying them in areas such as business model design, production process optimization, service innovation, operational model improvement, and decision-making support. By optimizing production processes and efficiently allocating resources, enterprises can achieve innovation breakthroughs, improve production efficiency, enhance the added value of export products, and thereby maintain a sustainable competitive advantage, for example, embedding sensors in production equipment to enable real-time monitoring and data analysis, optimizing production efficiency and equipment utilization, and introducing intelligent warehousing and logistics management systems to achieve automated storage and smart distribution, among others.

- (2)

- Strengthening supply chain management and leveraging the moderating role of dynamic capabilities. During the digital transformation process, firms should enhance the management capabilities of their supply chain systems by utilizing digital platforms to enable data sharing between upstream and downstream companies, thus improving inter-firm collaboration and information sharing. At the same time, firms should use digital tools to optimize supplier selection and evaluation, ensuring the stability and reliability of the supply chain. By harnessing the strength of supply chain stakeholders, firms can enhance value accumulation, fully utilize complementary resources, and optimize the allocation of innovation resources, thereby expanding their resource base. Additionally, enterprises should rely on dynamic capabilities to identify and seize market opportunities, creating a digital innovation ecosystem where multiple resources are interconnected. By optimizing organizational structure and culture, cultivating high-quality talent, and fostering proactive awareness and judgment, enterprises can gradually implement digital strategies, develop transformation strategies that match their level of development, activate innovation potential, and avoid blindly following the trend of digital transformation. Therefore, enterprise managers should build a sound resource allocation and supply chain system, improve dynamic capabilities, and effectively guide the digital transformation of the enterprise, enhance its competitive advantage, and inject continuous momentum for the enterprise’s sustainable development.

- (3)

- The government should adopt an “enterprise-specific approach” to support the digital transformation of enterprises. Enterprises in different industries have diverse needs and development directions. When encouraging digital transformation, the government should respect the inherent advantages of enterprises and assist them in exploring development paths suited to their characteristics. For example, state-owned enterprises should fully leverage their role as the main force in the new infrastructure sector by increasing investment in and the construction of foundational facilities such as 5G, industrial internet, and artificial intelligence. Additionally, they should utilize their strategic position in traditional industries to promote the digital transformation of these sectors, driving more enterprises to participate in digital transformation through demonstration projects. For non-state-owned enterprises, particularly small and medium-sized enterprises (SMEs), local governments should provide interest subsidies for digital transformation projects to address the funding shortfalls faced during the transformation process, thereby facilitating a smooth transition.

6.3. Research Limitations and Directions for Future Research

- (1)

- In terms of measuring export technological complexity, the method employed in this study, based on Hausman (2007) [5], does not fully account for the differential impact of digital transformation on the export technological complexity of enterprises across different trade models (e.g., processing trade versus general trade). Due to the limitations in data availability and research methodology, it is currently challenging to obtain sufficient data to conduct a comprehensive and in-depth analysis of the impact of digital transformation on the export technological complexity of enterprises with different trade models. Moreover, this analysis requires more complex and refined models, as well as deeper empirical research, which may necessitate additional time and resources. Therefore, we have decided to further explore this issue in future research, specifically addressing different trade methods individually.

- (2)

- This study is limited to data from a single country and a fixed period of analysis. Although the research conclusions have some reference value for the digital transformation development paths of manufacturing industries in different international regions, the data used for the study are from China, and the research methods are based on China’s national context. Therefore, the findings of this study have certain limitations. Additionally, this study is limited to data from a single country and fixed-period analysis. Future research could further expand the scope, especially in terms of the discussion on global applicability and long-term effects. The research could be extended to other countries or regions to explore the effects of digital transformation under different economic systems.

- (3)

- In terms of impact mechanisms, this study only explores four aspects: technological innovation, production efficiency, supply chain integration, with the indirect effects of innovation capability and production efficiency being relatively small. This is because many other important factors, such as costs, management systems, and corporate culture, were not included in this study. Future research could attempt a more comprehensive analysis from multiple dimensions.

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Hu, M.; Tao, C.; Zhou, H. The Influence of Industrial Structure Upgrade on Coupling and Coordinated Development—Empirical Analysis from Chinese Pharmaceutical Manufacturing and Pharmaceutical Service Industries. Front. Public Health 2021, 9, 722006. [Google Scholar] [CrossRef] [PubMed]

- Bănică, C.F.; Sover, A.; Anghel, D.C. Printing the Future Layer by Layer: A Comprehensive Exploration of Additive Manufacturing in the Era of Industry 4.0. Appl. Sci. 2024, 14, 9919. [Google Scholar] [CrossRef]

- Pohlmeyer, F.; Möbitz, C.; Gries, T.A. Sovereign and Interoperable Data Ecosystem for an Eco-Efficient Nonwovens Industry. Sustainability 2024, 16, 10735. [Google Scholar] [CrossRef]

- Xue, F.; Zhao, X.; Tan, Y. Digital transformation of manufacturing enterprises: An empirical study on the relationships between digital transformation, boundary spanning, and sustainable competitive advantage. Discrete Dyn. Nat. Soc. 2022, 2022, 4104314. [Google Scholar] [CrossRef]

- Hausmann, R.; Hwang, J.; Rodrik, D. What you Export Matters. J. Econ. Growth. 2007, 12, 1–25. [Google Scholar] [CrossRef]

- Vial, G. Understanding Digital Transformation: A Review and a Research Agenda. J. Strateg. Inf. Syst. 2019, 28, 118–144. [Google Scholar] [CrossRef]

- Gurbaxani, V.; Dunkle, D. Gearing up for Successful Digital Transformation. MIS Q. Exec. 2019, 18, 209–220. [Google Scholar] [CrossRef]

- Berman, S.J. Digital Transformation: Opportunities to Create New Business Models. Strategy Leadersh. 2012, 40, 16–24. [Google Scholar] [CrossRef]

- Knudsen, D.R. Elusive Boundaries, Power Relations, and Knowledge Production: A Systematic Review of the Literature on Digitalization in Accounting. Int. J. Account. Inf. Syst. 2020, 36, 100441. [Google Scholar] [CrossRef]

- Han, X.F.; Dong, M.F.; Li, B.X. Dynamic spillover effect of OFDI reverse green innovation in China: Based on interactive regulation of digital finance and traditional finance. Collect. Essays Financ. Econ. 2023, 39, 36. [Google Scholar]

- Warner, K.S.R.; Wäger, M. Building Dynamic Capabilities for Digital Transformation: An ongoing Process of Strategic Renewal. Long Range Plan. 2019, 52, 326–349. [Google Scholar] [CrossRef]

- Eck, K.; Huber, S. Product Sophistication and Spillovers from Foreign Direct Investment. Can. J. Econ. 2016, 49, 1658–1684. [Google Scholar] [CrossRef]

- Zhuo, C.F.; Deng, F. Infrastructure Investments and Construction of Manufacturing Trade Power—Dual Perspectives of Export Scale and Export Technological Complexity. J. Int. Trade 2018, 104–119. [Google Scholar] [CrossRef]

- Xu, B.; Lu, J. Foreign Direct Investment, Processing Trade, and the Sophistication of China’s Exports. China Econ. Rev. 2009, 20, 425–439. [Google Scholar] [CrossRef]

- Ma, Y.; Rauf, A. Indigenous Innovation, Foreign Technology Transfer and the Export Performance of China’s Manufacturing Industries. Singap. Econ. Rev. 2020, 65, 1349–1366. [Google Scholar] [CrossRef]

- Liu, J.; Xie, J. Environmental Regulation, Technological Innovation, and Export Competitiveness: An Empirical Study Based on China’s Manufacturing Industry. Int. J. Environ. Res. Public Health 2020, 17, 1427. [Google Scholar] [CrossRef]

- Anwar, S.; Sun, S. Foreign Direct Investment and Export Quality Upgrading in China’s Manufacturing Sector. Int. Rev. Econ. Financ. 2018, 54, 289–298. [Google Scholar] [CrossRef]

- Fang, M.; Yang, R. Research on Effects of Input Servitization on Export Technological Complexity of Manufacturing Industry of China. Des. Autom. Embed. Syst. 2018, 22, 279–291. [Google Scholar] [CrossRef]

- Gao, X.; Lu, C.; Mao, J. Effects of Urban Producer Service Industry Agglomeration on Export Technological Complexity of Manufacturing in China. Entropy 2020, 22, 1108. [Google Scholar] [CrossRef]

- Pan, K.; He, F.; Liu, R. Does High-tech Industry Agglomeration Promote its Export Product Upgrading? Based on the Perspective of Innovation and Openness. Sustainability 2022, 14, 8148. [Google Scholar] [CrossRef]

- Sheng, B.; Mao, Q.L. Does Import Trade Liberalization Affect Chinese Manufacturing Export Technological Sophistication. J. World Econ. 2017, 40, 52–75. [Google Scholar]

- Xiong, R.; Zhang, H.; Zhang, C.; Mu, G.; Wei, P. The Impact of Foreign Divestment on Chinese Firms’ Export Quality. Singap. Econ. Rev. 2024, 1–28. [Google Scholar] [CrossRef]

- Chai, J.W. The Impact of Green Innovation on Export Quality. Appl. Econ. Lett. 2023, 30, 1279–1286. [Google Scholar] [CrossRef]

- Zhang, C.; Qiu, P.; Zhang, L.; Hong, X.; Wang, D. The Impact of Digital Transformation on Enterprises’ Export Stability: Evidence from Listed Companies in China. Int. Rev. Financ. Anal. 2024, 96, 103582. [Google Scholar] [CrossRef]

- Zhang, Q.; Duan, Y. How Digitalization Shapes Export Product Quality: Evidence from China. Sustainability 2023, 15, 6376. [Google Scholar] [CrossRef]

- Liang, S.; Tan, Q. Can the Digital Economy Accelerates China’s Export Technology Upgrading? Based on the Perspective of Export Technology Complexity. Technol. Forecast. Soc. 2024, 199, 123052. [Google Scholar] [CrossRef]

- Luu, T.D. Digital Transformation and Export Performance: A Process Mechanism of Firm Digital Capabilities. Bus. Process Manag. J. 2023, 29, 1436–1465. [Google Scholar] [CrossRef]

- Azu, N.P.; Nwauko, P.A. Evaluating the Effect of Digital Transformation on Improvement of Service Trade in West Africa. Foreign Trade Rev. 2021, 56, 430–453. [Google Scholar] [CrossRef]

- Yu, J.J.; Yu, D.S. Government Subsidies, Industrial Competition and Enterprises’ Export Technology Complexity. J. Financ. Econ. 2018, 44, 112–124. [Google Scholar]

- Hu, J.; Xue, H.; Yu, Z. Study on the Effect of R&D Investment on Technical Progress of Manufacture in China. J. Knowl. Econ. 2024, 15, 9899. [Google Scholar]

- Atif, R.M.; Saqib, N.; Mahmood, H. Heterogeneity, Sunk Cost, and Export Performance: A Firm Level Study of Pakistan’s Textile Sector. Heliyon 2023, 9, e17548. [Google Scholar] [CrossRef] [PubMed]

- Wu, F.; Yan, X. Institutional Quality and Sustainable Development of Industries’ Exports: Evidence from China. Sustainability 2018, 10, 4173. [Google Scholar] [CrossRef]

- Zhao, X.; Chen, Q.A.; Yuan, X.; Yu, Y.; Zhang, H. Study on the Impact of Digital Transformation on the Innovation Potential based on Evidence from Chinese Listed Companies. Sci. Rep. 2024, 14, 6183. [Google Scholar] [CrossRef]

- Miao, Z.; Zhao, G. Impacts of Digital Information Management Systems on Green Transformation of Manufacturing Enterprises. Int. J. Environ. Res. Public Health 2023, 20, 1840. [Google Scholar] [CrossRef] [PubMed]

- Han, J.; Sun, R.; Zeeshan, M.; Rehman, A.; Ullah, I. The Impact of Digital Transformation on Green Total Factor Productivity of Heavily Polluting Enterprises. Front. Psychol. 2023, 14, 1265391. [Google Scholar] [CrossRef]

- Si, Y.; Liu, W.; Cao, X. The Effects of External Knowledge Source Heterogeneity on Enterprise Process and Product Innovation Performance. PLoS ONE 2020, 15, e0234649. [Google Scholar] [CrossRef] [PubMed]

- Carroll, N.; Hassan, N.R.; Junglas, I.; Hess, T.; Morgan, L. Transform or be transformed: The importance of research on managing and sustaining digital transformations. Eur. J. Inf. Syst. 2023, 32, 347–353. [Google Scholar] [CrossRef]

- Feng, Z.; Cheng, S.; Qu, G.; Cui, Y.; Ye, J. Research on Theoretical Mechanism and Promotion Path of Digital Economy Driving China’s Green Development under “Double Carbon” Background. Int. J. Environ. Res. Public Health 2022, 20, 437. [Google Scholar] [CrossRef]

- Zhao, C.; Liu, Z.; Yan, X. Does the Digital Economy Increase Green TFP in Cities? Int. J. Environ. Res. Public Health 2023, 20, 1442. [Google Scholar] [CrossRef]

- He, F.; Liu, H.X. Evaluating the performance enhancement effect of digital transformation in real enterprises from the perspective of digital economy. Reform 2019, 302, 13–148. [Google Scholar]

- Hu, Y.; Sun, S.; Jiang, M.; Dai, Y. Research on the Promoting Effect of Servitization on Export Technological Sophistication of Manufacturing Enterprises. PLoS ONE 2021, 16, e0255891. [Google Scholar] [CrossRef] [PubMed]

- Wu, K.; Liu, S.; Zhu, M.; Qu, Y. The Impact of Digital Transformation on Resource Mismatch of Chinese Listed Companies. Sci. Rep. 2024, 14, 9011. [Google Scholar]

- Li, Y.; Fei, G.Z. Network Embeddedness, Digital Transformation, and Enterprise Performance—The Moderating Effect of Top Managerial Cognition. Front. Psychol. 2023, 14, 1098974. [Google Scholar] [CrossRef] [PubMed]

- Flynn, B.B.; Huo, B.; Zhao, X. The Impact of Supply Chain Integration on Performance: A Contingency and Configuration Approach. J. Oper. Manag. 2010, 28, 58–71. [Google Scholar] [CrossRef]

- Zhao, Z. Digital Transformation and Enterprise Risk-Taking. Financ. Res. Lett. 2024, 62, 105139. [Google Scholar] [CrossRef]

- Wang, S.Y.; Xiao, X.Y. Research on the Relationship between Supply Chain Integration and Enterprise Technological Innovation Performance Based on Technology. Sci. Technol. Manag. Res. 2018, 38, 122–127. [Google Scholar]

- Li, X.; Yan, J.; Cheng, J.; Li, J. Supply-Chain Finance and Investment Efficiency: The Perspective of Sustainable Development. Sustainability 2023, 15, 7857. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic Capabilities and Strategic Management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Wang, X.; Zheng, C.; Mutuc, E.B.; Su, N.; Hu, T.; Zhou, H.; Wei, S. How does Organizational Unlearning Influence Product Innovation Performance? Moderating Effect of Environmental Dynamism. Front. Psychol. 2022, 13, 840775. [Google Scholar] [CrossRef]

- Wu, J.; Qu, X.; Sheng, L.; Chu, W. Uncovering the Dynamics of Enterprises Digital Transformation Research: A Comparative Review on Literature before and after the COVID-19 Pandemic. Heliyon 2024, 10, e26986. [Google Scholar] [CrossRef]

- Liu, L.; An, S.; Liu, X. Enterprise Digital Transformation and Customer Concentration: An Examination based on Dynamic Capability Theory. Front. Psychol. 2022, 13, 987268. [Google Scholar] [CrossRef] [PubMed]

- Xu, B. The Sophistication of Exports: Is China Special? China Econ. Rev. 2010, 21, 482–493. [Google Scholar] [CrossRef]

- Zhao, C.Y.; Wang, W.C.; Li, X.S. How does Digital Transformation Affect the Total Factor Productivity of Enterprises? Financ. Trade Econ. 2021, 42, 114–129. [Google Scholar]

- Li, C.T.; Yan, X.W.; Song, M.; Yang, W. Fintech and Corporate Innovation—Evidence from Chinese NEEQ-Listed Companies. China Ind. Econ. 2020, 1, 81–98. [Google Scholar]

- Olley, G.S.; Pakes, A. The Dynamics of Productivity in the Telecommunications Equipment Industry. Econometrica 1996, 64, 1263. [Google Scholar] [CrossRef]

- Li, Q.; Liu, L.G.; Shao, J.B. The Effects of Digital Transformation and Supply Chain Integration on Firm Performance: The Moderating Role of Entrepreneurship. Bus. Manag. J. 2021, 43, 5–23. [Google Scholar]

- Song, Z.; Yu, K.X. Capital Structure, Dynamic Capabilities, and Firm Performance—A Study Based on Data from Listed Resource-Based Companies in the Western Region. Inq. Econ. Issues 2017, 57–63. [Google Scholar]

- Mao, Q.L.; Fang, S.H. Innovation-Driven and the Export Technological Complexity of Chinese Manufacturing Enterprises. Forum World Econ. Politics 2018, 1–24. Available online: https://kns.cnki.net/kcms2/article/abstract?v=u3gpgSR0TKeS1ne5G-2NyoM6KO5TJnGLLFPVbSXuWxqaXozkGj4VV0OYK0Seba7mRkwJuQN9xuRBLAOcPHwnA1lJL9ovMLwhoqWyAFXTXpVxLmtnYfyRClcGskueVFszX2TI2INB_12Kks88qDMCVBOWhzRds1_4_GCzWxvCQmbKsbSRQ4QWea0Uybn95ClB&uniplatform=NZKPT&language=CHS (accessed on 12 March 2025).

- Li, J.Q.; Miao, E.S. Intellectual Property Protection and Enterprise’s Export Technological Sophistication under the Background of Incomplete Contract. China Ind. Econ. 2018, 369, 115–133. [Google Scholar]

- Chen, Y. The Effect of China’s PFTZ on Export Technology Upgrade—From the Perspective of Export Technology Complexity. Bachelor’s Thesis, Shandong University, Jinan, China, 2023. [Google Scholar]

- Tan, X.; Liu, G.; Cheng, S. How does ESG Performance Affect Green Transformation of Resource-based Enterprises: Evidence from Chinese Listed Enterprises. Resour. Policy 2024, 89, 104559. [Google Scholar] [CrossRef]

- Gu, S.Z.; Han, L.Y.; Zhuang, Q.Q. Strategic Thinking of Establishing a Healthy Legal Ecological Environment for Business Enterprises—Based on the Perspective of the New Edition of “Law of the People’s Republic of China on Promotion of Small and Medium-sized Enterprises”. Econ. Rev. J. 2018, 5, 30–34. [Google Scholar]

- Huang, Q.H.; Yu, Y.Z.; Zhang, S.L. Internet Development and Productivity Growth in Manufacturing Industry: Internal Mechanism and China Experiences. China Ind. Econ 2019, 5–23. [Google Scholar] [CrossRef]

- Zhao, T.; Zhang, Z.; Liang, S.K. Digital Economy, Entrepreneurship, and High-Quality Economic Development: Empirical Evidence from Urban China. J. Manag. World 2020, 36, 65–76. [Google Scholar]

- Wu, F.; Hu, H.Z.; Lin, H.Y.; Ren, X.Y. Digital Transformation of Enterprises and Capital Market Performance: Empirical Evidence from Stock Liquidity. J. Manag. World 2021, 37, 130–144+10. [Google Scholar]

- Yang, L.G.; Xie, R.; He, Z.C.; Han, F.; Sun, Y.L. Research on the Impact of Rising Labor Cost on Manufacturing Structure Upgrading—An Empirical Analysis Based on the Data of Sub-sectors of Chinese Manufacturing. China Soft Sci. 2014, 12, 136–147. [Google Scholar]

| Variable Type | Variable Name | Symbol Code | Variable Definition | Soure |

|---|---|---|---|---|

| Dependent Variable | Enterprise Export Technological Complexity | Esi | Industry export technological complexity and total factor productivity, then scaled down by a factor of 1010 | China Customs Database |

| Independent Variable | Digital Transformation | Digital | Obtained through text mining to extract keywords related to digital transformation, with the frequency of these keywords calculated using the entropy method | Annual Reports of Listed Companies in China |

| Mediating Variables | Innovation Capability | Innov | The total number of patent applications plus one, then take the logarithm | Chinese Research Data Services |

| Production Efficiency | TFP | Total factor productivity measured by the OP method | China Stock Market and Accounting Research Database (CSMAR) | |

| Moderating Variables | Supply chain Integration | SCI | The average of the sum of the ratio of the purchase amount from the top five suppliers to the total annual purchase amount and the ratio of the sales amount to the top five customers to the total annual sales amount | China Stock Market and Accounting Research Database |

| Dynamic Capability | DC | The standardized mean of the opportunity perception, resource integration, and organizational growth indicators | ||

| Control Variables | Government Subsidies | Lnsub | Government subsidies plus one, then take the logarithm for measurement | China Stock Market and Accounting Research Database |

| Firm Age | Age | The difference between the current year and the year of the company’s establishment | ||

| Firm Size | Size | The number of employees | ||

| Operating Profit Margin | Profit | The ratio of operating profit to sales revenue | ||

| Financing Constraints | Fincon | The ratio of interest to fixed assets | ||

| Capital Intensity | Lnklr | The ratio of fixed assets to the number of employees plus one, then take the logarithm | ||

| Firm Ownership | Soe | State-owned enterprises are assigned a value of 1, otherwise 0 |

| Variable | N | Mean | Std. | Min. | Max. |

|---|---|---|---|---|---|

| Esi | 15,100 | 0.301 | 0.387 | 0.0008 | 2.098 |

| Digital | 15,100 | 0.0027 | 0.0044 | 0.0001 | 0.0539 |

| Lnsub | 15,100 | 15.43 | 2.166 | 6.707 | 20.46 |

| Size | 15,100 | 4604 | 7640 | 63 | 57800 |

| Lnklr | 15,100 | 12.56 | 0.869 | 9.854 | 15.03 |

| Age | 15,100 | 16.50 | 5.819 | 1 | 64 |

| Profit | 15,100 | 0.0723 | 0.153 | −1.638 | 0.531 |

| Fincon | 15,100 | 0.0476 | 0.0634 | −0.0154 | 0.804 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Digital | 7.056 *** | 6.517 *** | 6.678 *** | 5.127 *** |

| (6.505) | (6.053) | (6.237) | (6.562) | |

| Lnsub | 0.000 | 0.000 | 0.001 | |

| (0.129) | (0.349) | (0.631) | ||

| Age | 0.021 *** | 0.021 *** | 0.022 *** | |

| (17.931) | (17.957) | (21.582) | ||

| Size | 0.000 ** | 0.000 ** | 0.000 *** | |

| (2.577) | (2.538) | (2.923) | ||

| Profit | 0.032 ** | 0.032 ** | 0.044 *** | |

| (2.321) | (2.331) | (3.864) | ||

| Fincon | 0.227 *** | 0.224 *** | 0.165 *** | |

| (2.776) | (2.733) | (3.182) | ||

| Lnklr | 0.020 | 0.016 | 0.030* | |

| (0.886) | (0.701) | (1.760) | ||

| Soe | −0.000 | −0.001 | 0.006 | |

| (−0.076) | (−0.094) | (1.128) | ||

| Constant | 0.171 *** | −0.098 | −0.254 ** | −0.519 *** |

| (30.162) | (−1.265) | (−2.525) | (−7.723) | |

| Prov effect | No | No | Yes | Yes |

| Industry effect | No | No | No | Yes |

| Observation | 15135 | 15135 | 15135 | 15135 |

| R-squared | 0.254 | 0.261 | 0.264 | 0.408 |

| Variable | (1) | (2) | (3) | (4) | (3) | (4) |

|---|---|---|---|---|---|---|

| Instrumental Variables | Exogenous Shock Test | |||||

| Digital | 3.912 *** | 21.101 ** | ||||

| (5.306) | (2.123) | |||||

| IV1 | 0.865 *** | |||||

| (52.56) | ||||||

| IV2 | 3.28 × 10−7 *** | |||||

| (2.96) | ||||||

| Did | 0.040 *** | |||||

| (5.320) | ||||||

| L. Did | 0.057 *** | |||||

| (6.371) | ||||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Prov effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Kleibergen–Paap rk LM statistic | 151.296 *** | 151.296 *** | 8.856 *** | 8.856 *** | ||

| Cragg–Donald Wald F statistic | 1.6 × 104 | 1.6 × 104 | 24.664 | 24.664 | ||

| Kleibergen–Paap rk Wald F statistic | 2762.619 | 2762.619 | 8.759 | 8.759 | ||

| Observation | 11,870 | 11,870 | 15,135 | 15,135 | 15,135 | 15,135 |

| R-squared | 0.877 | 0.877 | 0.839 | 0.839 | 0.404 | 0.408 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| Digital_wf | 0.014 *** | ||

| (6.746) | |||

| Digital | 1.447 ** | 4.866 *** | |

| (2.304) | (6.283) | ||

| Lnsub | 0.001 | 0.001 | 0.000 |

| (0.634) | (1.241) | (0.321) | |

| Age | 0.022 *** | 0.030 *** | 0.022 *** |

| (21.585) | (26.271) | (21.202) | |

| Size | 0.000 *** | 0.000 | 0.000 *** |

| (2.984) | (1.149) | (2.902) | |

| Profit | 0.048 *** | 0.067 *** | 0.043 *** |

| (4.245) | (5.769) | (3.669) | |

| Fincon | 0.186 *** | 0.013 | 0.165 *** |

| (3.512) | (0.251) | (3.172) | |

| Lnklr | 0.006 | 0.003 | 0.004 |

| (1.140) | (0.547) | (0.786) | |

| Soe | 0.029 * | −0.005 | 0.029 * |

| (1.717) | (−0.400) | (1.667) | |

| Constant | −0.534 *** | −0.643 *** | −0.506 *** |

| (−7.909) | (−5.174) | (−7.302) | |

| Prov effect | Yes | Yes | Yes |

| Industry effect | Yes | Yes | Yes |

| Observation | 15,135 | 8437 | 14,561 |

| R-squared | 0.405 | 0.298 | 0.412 |

| Variable | Innov | TFP | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Esi | Innov | Esi | Esi | TFP | Esi | |

| Digital | 5.127 *** | 1022.591 *** | 4.890 *** | 5.127 *** | 6.391 *** | 4.685 *** |

| (6.562) | (3.417) | (6.283) | (6.562) | (4.601) | (5.994) | |

| Innov | 0.0002 ** | |||||

| (5.050) | ||||||

| TFP | 0.069 *** | |||||

| (8.713) | ||||||

| Lnsub | 0.001 | 0.250 | 0.001 | 0.001 | 0.009 *** | 0.000 |

| (0.631) | (0.492) | (0.583) | (0.631) | (3.131) | (0.053) | |

| Age | 0.022 *** | 2.373 *** | 0.022 *** | 0.022 *** | 0.057 *** | 0.018 *** |

| (21.582) | (5.358) | (21.050) | (21.582) | (23.985) | (16.798) | |

| Size | 0.000 *** | 0.007 *** | 0.000 * | 0.000 *** | 0.000 *** | 0.000 ** |

| (2.923) | (8.614) | (1.734) | (2.923) | (3.326) | (2.481) | |

| Profit | 0.044 *** | 22.473 *** | 0.038 *** | 0.044 *** | 0.844 *** | −0.015 |

| (3.864) | (4.732) | (3.394) | (3.864) | (18.590) | (−1.176) | |

| Fincon | 0.165 *** | 16.443 | 0.161 *** | 0.165 *** | 2.026 *** | 0.025 |

| (3.182) | (0.833) | (3.169) | (3.182) | (14.086) | (0.504) | |

| Lnklr | 0.030 * | 3.948 * | 0.005 | 0.030 * | 0.190 *** | −0.007 |

| (1.760) | (1.908) | (0.972) | (1.760) | (12.350) | (−1.575) | |

| Soe | 0.006 | −4.806 | 0.031 * | 0.006 | 0.055 | 0.026 |

| (1.128) | (−0.912) | (1.879) | (1.128) | (1.633) | (1.598) | |

| Constant | −0.519 *** | −93.543 *** | −0.497 *** | −0.519 *** | 3.610 *** | −0.769 *** |

| (−7.723) | (−3.022) | (−7.556) | (−7.723) | (14.520) | (−9.870) | |

| Prov effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Observation | 15,135 | 15,135 | 15,135 | 15,135 | 15,135 | 15,135 |

| R-squared | 0.408 | 0.294 | 0.413 | 0.408 | 0.466 | 0.421 |

| Variable | (1) | (2) |

|---|---|---|

| SCI | DC | |

| Digital | 4.597 *** | 4.721 *** |

| (5.631) | (5.909) | |

| SCI | 0.000 | |

| (0.307) | ||

| Digital*SCI | 0.184 *** | |

| (3.884) | ||

| DC | 0.000 * | |

| (1.865) | ||

| Digital*DC | 0.009 * | |

| (1.721) | ||

| Lnsub | 0.001 | 0.000 |

| (0.612) | (0.225) | |

| Age | 0.025 *** | 0.024 *** |

| (16.694) | (20.949) | |

| Size | 0.000 *** | 0.000 *** |

| (2.709) | (2.733) | |

| Profit | 0.057 *** | 0.043 *** |

| (4.850) | (3.570) | |

| Fincon | 0.137 ** | 0.159 *** |

| (2.442) | (2.987) | |

| Lnklr | 0.000 | 0.003 |

| (0.071) | (0.508) | |

| Soe | 0.024 | 0.031 * |

| (1.365) | (1.734) | |

| Constant | −0.593 *** | −0.530 *** |

| (−7.235) | (−7.125) | |

| Prov effect | Yes | Yes |

| Industry effect | Yes | Yes |

| Observation | 11,816 | 13,741 |

| R-squared | 0.377 | 0.408 |

| Variable | (1) | (2) |

|---|---|---|

| State-Owned | Non-State-Owned | |

| Digital | 7.951 *** | 4.299 *** |

| (4.827) | (4.832) | |

| Lnsub | −0.002 | 0.002 |

| (−0.964) | (1.554) | |

| Age | 0.020 *** | 0.024 *** |

| (11.474) | (17.674) | |

| Size | 0.000 | 0.000 ** |

| (1.646) | (2.560) | |

| Profit | 0.048 ** | 0.040 *** |

| (2.063) | (3.112) | |

| Fincon | 0.125 | 0.165 *** |

| (0.994) | (3.030) | |

| Lnklr | 0.004 | 0.003 |

| (0.428) | (0.497) | |

| Constant | −0.390 *** | −0.243 *** |

| (−2.863) | (−4.145) | |

| Prov effect | Yes | Yes |

| Industry effect | Yes | Yes |

| Observation | 4644 | 10,491 |

| R-squared | 0.393 | 0.403 |

| Variable | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Labor-Intensive | Technology-Intensive | Capital-Intensive | High-Competition | Low-Competition | |

| Digital | −0.125 | 6.857 *** | 0.411 | 6.432 *** | 2.826 *** |

| (−0.527) | (7.263) | (0.753) | (5.590) | (4.408) | |

| Lnsub | 0.000 | −0.001 | 0.001 | 0.004 ** | 0.001 |

| (0.908) | (−0.328) | (1.453) | (2.417) | (0.937) | |

| Age | 0.007 *** | 0.032 *** | 0.017 *** | 0.023 *** | 0.013 *** |

| (18.820) | (15.724) | (19.719) | (18.645) | (15.681) | |

| Size | −0.000 | 0.000 | 0.000 * | 0.000 *** | 0.000 |

| (−0.351) | (0.857) | (1.936) | (4.138) | (0.171) | |

| Profit | 0.026 *** | 0.084 *** | 0.033 *** | 0.055 *** | 0.045 *** |

| (4.662) | (4.793) | (3.031) | (3.108) | (3.686) | |

| Fincon | 0.001 | 0.159 ** | 0.027 | 0.219 *** | −0.027 |

| (0.039) | (2.035) | (0.607) | (2.844) | (−0.684) | |

| Lnklr | −0.001 | −0.001 | 0.005 | 0.005 | 0.004 |

| (−0.800) | (−0.134) | (1.361) | (0.747) | (0.742) | |

| Soe | −0.000 | 0.023 | 0.023 *** | 0.026 | 0.012 |

| (−0.075) | (0.819) | (2.806) | (0.992) | (1.063) | |

| Constant | −0.027 | −0.030 | −0.223 *** | −0.549 *** | −0.262 *** |

| (−1.466) | (−0.275) | (−4.757) | (−4.744) | (−3.718) | |

| Prov effect | Yes | Yes | Yes | Yes | Yes |

| Industry effect | Yes | Yes | Yes | Yes | Yes |

| Observation | 2703 | 7540 | 4892 | 7539 | 7596 |

| R-squared | 0.669 | 0.446 | 0.473 | 0.398 | 0.436 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Eastern | Central | Western | Northeastern | |

| Digital | 3.667 *** | 1.522 | 3.736 *** | 1.501 |

| (6.830) | (1.481) | (2.622) | (0.760) | |

| Lnsub | 0.808 | −0.140 | 0.073 | −2.110 |

| (0.640) | (−0.058) | (0.020) | (−0.910) | |

| Age | 22.447 *** | 21.416 *** | 18.856 *** | 9.202 *** |

| (16.572) | (9.395) | (6.299) | (4.787) | |

| Size | 0.005 *** | 0.003 | −0.002 * | −0.007 ** |

| (2.709) | (1.353) | (−1.959) | (−2.402) | |

| Profit | 52.648 *** | 6.452 | 28.128 | 3.377 |

| (3.157) | (0.256) | (1.404) | (0.157) | |

| Fincon | 160.552 ** | 187.527 | −20.936 | 7.660 |

| (2.500) | (1.372) | (−0.250) | (0.132) | |

| Lnklr | 33.899 | 17.005 | 13.338 | 27.908 |

| (1.398) | (0.497) | (0.797) | (1.322) | |

| Soe | 10.614 * | −10.449 | −6.103 | 2.783 |

| (1.649) | (−0.923) | (−0.640) | (0.303) | |

| Constant | −536.310 *** | −235.434 * | −147.087 | 55.091 |

| (−5.850) | (−1.832) | (−1.244) | (0.465) | |

| Prov effect | Yes | Yes | Yes | Yes |

| Industry effect | Yes | Yes | Yes | Yes |

| Observation | 9988 | 2410 | 2119 | 618 |

| R-squared | 0.436 | 0.418 | 0.412 | 0.463 |

| Variable | (1) | (2) |

|---|---|---|

| Early Stage | Later Stage | |

| Digital | 3.990 | 3.504 *** |

| (0.588) | (4.520) | |

| Lnsub | 0.003 ** | −0.001 |

| (2.388) | (−0.885) | |

| Age | 0.019 *** | 0.033 *** |

| (12.776) | (17.962) | |

| Size | 0.000 | 0.000 |

| (1.012) | (1.610) | |

| Profit | 0.030 ** | 0.080 *** |

| (2.368) | (4.410) | |

| Fincon | 0.006 | 0.144 ** |

| (0.110) | (2.064) | |

| Lnklr | 0.005 | −0.003 |

| (0.952) | (−0.340) | |

| Constant | 0.006 | 0.042 |

| (0.391) | (1.595) | |

| Soe | −0.412 *** | −0.519 *** |

| (−5.510) | (−4.695) | |

| Prov effect | Yes | Yes |

| Industry effect | Yes | Yes |

| Observation | 7566 | 7569 |

| R-squared | 0.361 | 0.434 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, J.; Huang, Q. The Impact of Digital Transformation on the Export Technology Complexity of Manufacturing Enterprises: Based on Empirical Evidence from China. Sustainability 2025, 17, 2596. https://doi.org/10.3390/su17062596

Wang J, Huang Q. The Impact of Digital Transformation on the Export Technology Complexity of Manufacturing Enterprises: Based on Empirical Evidence from China. Sustainability. 2025; 17(6):2596. https://doi.org/10.3390/su17062596

Chicago/Turabian StyleWang, Jinliang, and Qian Huang. 2025. "The Impact of Digital Transformation on the Export Technology Complexity of Manufacturing Enterprises: Based on Empirical Evidence from China" Sustainability 17, no. 6: 2596. https://doi.org/10.3390/su17062596

APA StyleWang, J., & Huang, Q. (2025). The Impact of Digital Transformation on the Export Technology Complexity of Manufacturing Enterprises: Based on Empirical Evidence from China. Sustainability, 17(6), 2596. https://doi.org/10.3390/su17062596