Abstract

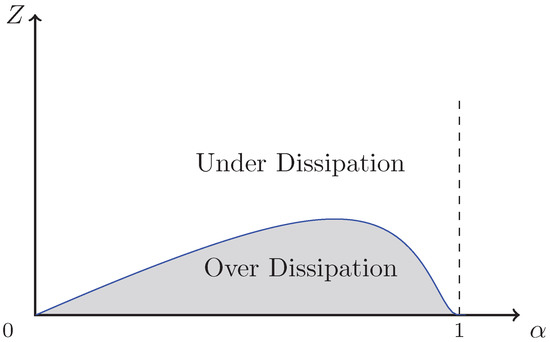

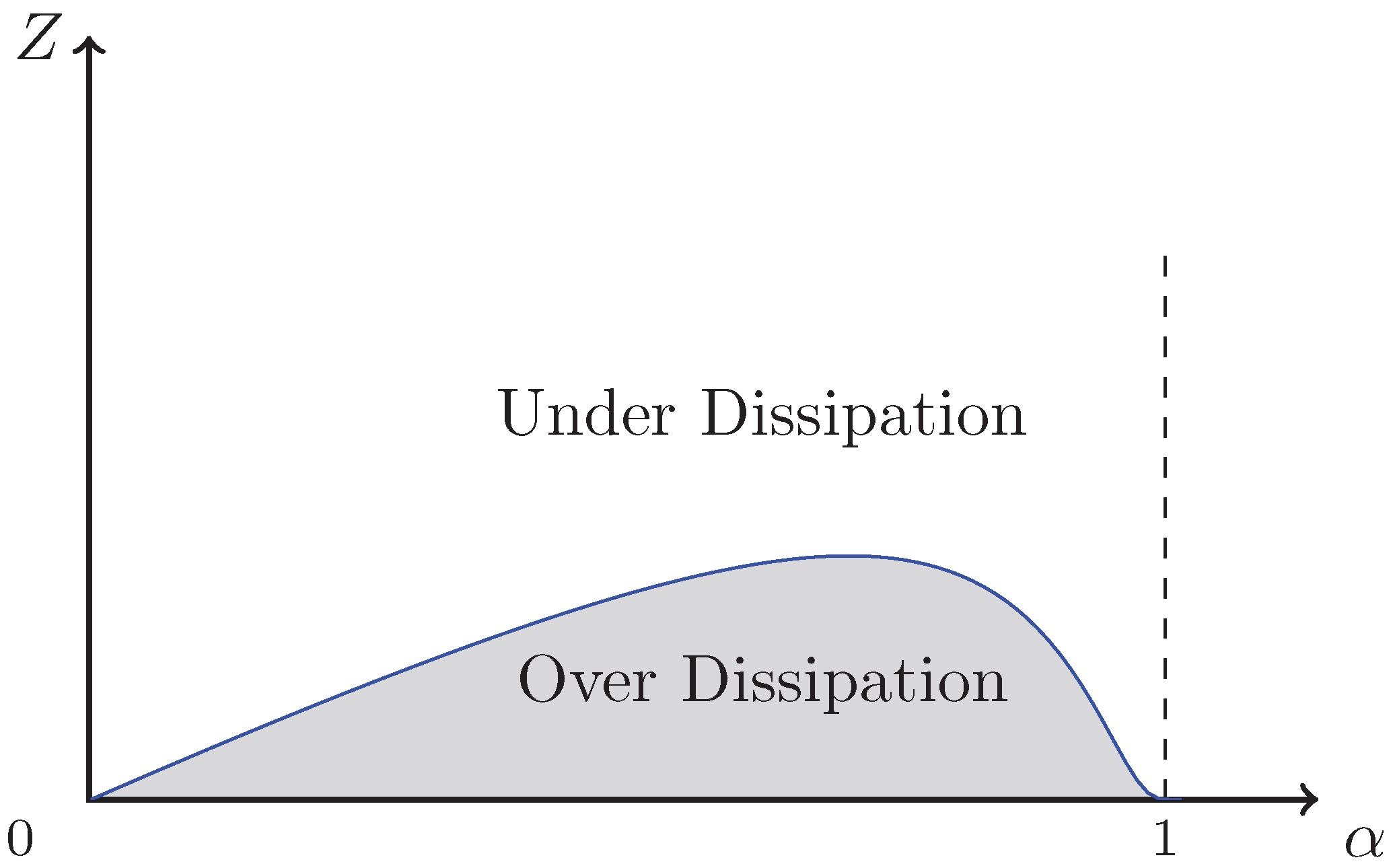

We investigate observed rent dissipation—the ratio of the total costs of rent seeking to the monetary value of the rent—in winner-take-all and share contests, where preferences are more general than usually assumed in the literature. With concave valuation of the rent, we find that contests can exhibit observed over-dissipation if the contested rent is below a threshold and yet observed under-dissipation with large rents: the nature of preferences implies contestants are relatively effortful in contesting small rents. Considering more general preferences in contests thus allows us to reconcile the Tullock paradox—where rent-seeking levels are relatively small despite the contested rent being sizeable—with observed over-dissipation of rents in experimental settings, where contested rents are arguably small.

JEL Classification:

C72; D72; H40

1. Introduction

Contests are a common phenomenon within a multitude of economic contexts. These scenarios involve agents investing sunk effort to appropriate a contestable rent, such as political rent seeking, litigation, and violent conflict, to name but a few. Due to the frequency of such activities, attention has focused on understanding the incentives to engage in contests as well as the associated costs and impacts. One fundamental concept within the study of contests is the notion of rent dissipation, which measures the total costs of rent seeking in relation to the size of the contested rent. Explaining the extent of rent dissipation can help us to estimate and anticipate the severity of possible social losses from such activities, or how a rent holder can maximize effort in their favor. Consequently, rent dissipation has been central to the discussion of contests since the first formal analysis was introduced [1].

Contest theory has been developed and extended to provide a tractable explanation of the drivers of rent-seeking activity, and the associated rent dissipation. Within this analysis, there have been two separate focal points of interest: the (i) under-dissipation; and (ii) over-dissipation of rents. Under-dissipation—also known as the so-called ‘Tullock paradox’—is where the costs of rent seeking are far lower than the value of what is being contested. Since [2], it has been questioned why real-world situations (e.g., lobbying) often involve very limited expenditures in contesting highly valuable rents. Scholars have also sought to explain over-dissipation in contests following observation of this in experimental settings (see, for instance, [3]).

The theoretical literature investigating dissipation patterns has focused on winner-take-all contests in which the rent is indivisible and a single contestant is awarded the entire rent with all other contestants receiving nothing. Contestants’ risk preferences have been studied as a source of explanation: risk aversion leads to under-dissipation of rents [4,5,6,7,8]1, while in order to explain over-dissipation contestants must be risk loving [10]. Other sources of explanation for under-dissipation include heterogeneity in valuations [11], uncertain number of contestants [12,13,14,15], and group rent seeking [16]2. Further explanations of over-dissipation have appealed to behavioral aspects such as non-monetary utility from winning, systematic mistakes by contestants, and impulsivity [3,17], or to mixed-strategy equilibria whereby the realization of players’ expenditures may exceed the expected equilibrium expenditures [18].

Share contests, in which the rent is perfectly divisible and each contestant receives a share of the rent, are arguably more appropriate for modeling rent seeking over the divisions of public funds [19,20], government policy [21,22,23] and numerous other contexts such as remuneration rewards [24] and the distribution of pollution allowances [25]3. There is a growing literature on the analysis of share contests (e.g., [26,27,28]). Ref. [28] experimentally investigate share contests and find effort levels tend to be larger than what is theoretically predicted (but smaller than effort levels in winner-take-all contests). Ref. [27] focus on share contests when agents have more general preferences and analyze the comparative statics of changing the size of the contested rent, but do not provide a full analysis of rent dissipation.

In this article, we consider observed rent dissipation—the ratio of the total costs of rent seeking to the monetary value of the rent—in both winner-take-all and share contests in a setting where contestants derive utility from the contest outcome in-and-of itself, rather than evaluating the net outcome once the cost of effort has been accounted for (which is typically studied in the literature). We find that if contestants’ evaluation of the contest outcome is sufficiently concave both share and winner-take-all contests can exhibit observed over-dissipation of small rents and under-dissipation of large rents. As such, if an observer measures dissipation as the ratio of the total costs of rent seeking to the monetary value of the rent the pattern of dissipation referred to above can be easily explained if contestants’ preferences actually exhibit sufficient concavity in the contest outcome.

Under- and over-dissipation naturally emerge at equilibrium under both sharing and winner-take-all contests: if contestants’ valuation of the rent is sufficiently larger (smaller) than the actual value of the rent, at equilibrium they will expend significantly more (less) effort than if they valued the rent at its real value, thus resulting in observed over- (under-) dissipation. Yet, beyond this straightforward observation, the potential concavity of the contestants’ utility function is also shown to play a crucial role in explaining the dissipation ratio. The intuition that with sufficiently strong diminishing marginal utility we may observe both under- and over-dissipation of rents is as follows. In share contests, when the contested rent is small diminishing marginal utility means contestants are highly sensitive to changes in the spoils they are awarded from the contest and therefore they are relatively effortful in contesting the rent, resulting in the monetary cost of rent seeking exceeding the monetary value of the rent, leading to over-dissipation. By contrast, if the rent is large and contestants are less sensitive to changes in their allocation of the rent they will be relatively less effortful leading to under-dissipation. In winner-take-all contests, sufficient concavity of the utility function implies that for small rents the contestants’ valuation of the rent is larger than the real value, hence incentivizing them to invest high effort at equilibrium and to generate over-dissipation. For high rents, the opposite will hold, thereby resulting in under-dissipation.

By accounting for concave evaluation of the contest outcome we can then elegantly, and very intuitively, reconcile the Tullock paradox, where the monetary cost of rent seeking falls short of the monetary value of the rent, and observations, for example in experimental settings, of over-dissipation where the monetary cost of rent seeking exceeds the monetary value of the rent.4 Moreover, our results reveal that depending on players’ preferences we may observe over-dissipation in share contests and under-dissipation in winner-take-all contests, or the opposite. Our article therefore reconciles seemingly contradictory findings of experimental comparisons of share contests and winner-take-all contests [28,29] and underlines that future research should carefully evaluate contestants’ preferences prior to undertaking such comparisons.

2. The Model

Consider a contest in which a set of agents expend effort to obtain a share of a perfectly divisible rent Z. Later in the article we consider the more often studied case of a winner-take-all contest in which the rent is indivisible and a single participant is awarded the entire rent. In a share contest, agent selects their effort in order to capture a share of the rent which is determined according to a ‘simple’ Tullock contest success function

where is the vector of other players’ effort choices. The rent apportioned to contestant i is then given by .

We consider that contestants are symmetric and have an additively separable utility function given by

where captures the evaluation of the rent, and captures the cost of effort in contesting that rent, measured on the same scale. We assume that the cost function satisfies: ; ; ; and for all with so its elasticity is finite for all choices of effort.

Concerning the evaluation of the rent, we assume that , and , allowing us to capture that contestants have diminishing marginal utility over the contest outcome. In the literature on share contests it is typically assumed that , so contestants care about the net outcome from the contest (or indeed some monotonic transformation of this)5. This assumes that the outcome of the contest and the cost of effort exerted in the contest are perfectly fungible, an assumption that we deviate from.

Our main motivation for considering that contestants evaluate the outcome of the contest and the effort that is put in to contesting it separately comes from considering the analogy between contests and labor markets. The effort choice of contestants in a contest setting is akin to the labor decisions of a worker in a labor market setting: both the contestant and the worker have some disutility associated with the choice (of foregone uses of effort), and both receive some benefit: the contest outcome for the contestant, and consumption possibilities for the worker that comes from the income they receive. Both settings therefore feature two ‘goods’: the residual of effort (leisure, captured by a cost of effort), and the spoils of the activity. In standard labor market models, individuals are rarely assumed to have linear preferences over the two goods under consideration: in the basic Mirrlees model utility over consumption and labor is assumed to be strictly concave [32], and models that consider separable utility impose diminishing marginal utility over consumption (see, for instance, [33,34]). Likewise, in a contest we believe it is appropriate to go beyond linear evaluation of the contest outcome, and the simplest formulation is to use a non-linear but separable payoff function as in (2) that allows us to capture diminishing marginal utility over the contest outcome itself.

Further motivation for considering that the contest outcome and the cost of effort should be evaluated separately is as follows. First, the contestant may be working within an organization but has concerns that go beyond profit (the net outcome of the contest); for example, the individual’s desire to gain status or prestige, which could be captured by evaluating the contest outcome separately [35]. Second, a contest may exhibit a delayed outcome in which case a contestant would exert effort and only after some time enjoy the contest outcome, so while the cost of effort will be accounted for, this and the contest outcome will be evaluated separately (in addition to any time preference concerns captured by discounting). Third, our setup could account for contestants gaining a utility from winning, which is relatively large when the contest outcome is modest and relatively small when the contest outcome is large.

This suggests considering a more general payoff function in contests, and when we do so we believe incorporating diminishing marginal utility in the analysis of share contests is important. For instance, in a contest over public funds it is intuitive to consider that agents may experience large marginal utility gains for initially redirected public funds but the gains to utility reduce as their captured public funds increase. Equally, for a rent-seeking game over the determination of a government policy, large gains in utility may exist when government policy moves in an agent’s favorable direction, but these marginal gains will reduce as the policy is more distant to the agent’s most desirable policy, that is, when the contested policy space is larger (e.g., [36]). As we have become accustomed in microeconomic analysis, incremental gains that improve one’s lot from a relatively poor position are worth more than those that improve it from a relatively good position. Clearly, allowing for contestants’ evaluation of the contest outcome to be different from the standard approach will lead to different behavior, and it is this—and its consequences in terms of observed dissipation—that we want to investigate.

Contestants simultaneously choose their effort to maximize their utility in a game of complete but imperfect information, and we look for a Nash equilibrium in pure strategies. Since , each contestant can be seen as solving the problem

taking the effort choices of others as given. Our assumptions on value and cost functions imply this optimization problem is globally concave and so the first-order condition is both necessary and sufficient for identifying the contestant’s best response. Letting , we denote this best response , where is the solution to

Since players are symmetric, we focus on symmetric Nash equilibria in which for all , and therefore for all . Note that the results in this article are easily extended to incorporate asymmetric contests—using the tools of aggregate games—but are omitted for the sake of brevity and because the underlying mechanisms are neatly captured in a symmetric setup. Equilibrium effort in an interior symmetric Nash equilibrium satisfies

Given strict global concavity of the objective function (along with the fact that the payoff with zero effort is zero), the symmetric pure-strategy Nash equilibrium will be unique. To ensure the existence of a symmetric pure-strategy Nash equilibrium with strictly positive effort levels, we require . Were this not to be true, individual players would face an incentive to reduce their effort to zero (given the actions of others) meaning no such equilibrium would exist.

4. Rent Dissipation in Winner-Take-All Contests

We now turn to consider the more frequently-studied winner-take-all contest in which a single contestant is awarded the entire rent, the probability of which is given by the contest success function. In this case the expected payoff takes the form7:

where is the contest success function given in (1).

If is linear, this payoff function exactly coincides with that in a share contest implying the two types of contest are strategically equivalent. As such, the results presented above for share contests carry over mutatis mutandis to winner-take-all contests.

With non-linear evaluation of the contest outcome, however, the two types of contest command separate study. In a winner-take-all contest each contestant can be seen as solving the problem

The first-order condition is both necessary and sufficient for identifying the best response function, which is given by where is the solution to

Imposing symmetry allows us to deduce that in the symmetric Nash equilibrium,

and therefore the equilibrium observed dissipation is

4.1. Constant Marginal Costs

In the case of constant marginal costs, the explicit solution for equilibrium effort is and equilibrium observed dissipation is . As in the case of share contests, it is clear that the contest outcome can exhibit both under- and over-dissipation depending on the size of the contested rent.

Proposition 5.

Assume as and as , consistent with assuming the Inada conditions apply to . Then there exists a given by such that .

Proof.

Concavity of implies is strictly decreasing in Z (since ). This, combined with the assumptions stated, means the intermediate value theorem can be applied to conclude the existence of , and that for all and for all . □

It is interesting to note that in a share contest with constant marginal costs observed dissipation is while in a winner-take-all contest it is . So there is no clear ranking in terms of the threshold rent where the respective contests switch from exhibiting under-dissipation to over-dissipation; this will depend on the concavity of the payoff function as well as the number of contestants.

In our specific example, however, there is a clear pattern.

Example 2.

Consider a winner-take-all contest in which there are n contestants each with where , , and with . Then effort in the symmetric Nash equilibrium is given by

and the dissipation ratio takes the form

It follows that where . As such, .

If then for the contest would exhibit under-dissipation if it was contested as a share contest, while it would exhibit over-dissipation if it was contested as a winner-take all contest (and vice-versa if ).

4.2. More General Costs

In a winner-take-all contest in which costs are more general, the equilibrium observed dissipation takes the form . This allows us to deduce the following.

Proposition 6.

Assume preferences are such that as and as . Then:

- 1.

- as , implying there is a such that in a contest with under-dissipation occurs; and

- 2.

- as , implying there is a such that in a contest with over-dissipation occurs.

Proof.

Straightforward given the definition of observed dissipation and the assumptions imposed on . □

5. Concluding Remarks

In this article, we have reconciled the real-world under-dissipation of rents, i.e., the Tullock paradox, and the observed over-dissipation of rents, for example, in experimental settings. Arguments in the literature so far used to rationalize the former are inconsistent with the latter, explanations of which have mostly appealed to behavioral ideas. Our approach, which consists of considering more general contestants’ utility functions, uncovers two important features of contests. First, if players’ valuation of the rent is larger (lower) than its monetary value, then their efforts will be larger (lower) than if they valued the rent at its monetary value, thus potentially leading to observed over- (under-) dissipation at equilibrium. Second, the concavity of the contestants’ utility function plays a crucial role in explaining under- and over-dissipation in a unified framework since when contestants have diminishing marginal utility over the contest outcome and this is sufficiently strong, then we can explain both over-dissipation of rents when they are small (as they arguably are in experimental settings) and under-dissipation of rents when they are large (as is arguably the case in Tullock’s observations).

The intuition is simple in both share contests and winner-take-all contests. In share contests, with sufficiently strong diminishing marginal utility, when the contested rent is small contestants are highly sensitive to changes in the spoils they are awarded from the contest and so they are relatively effortful in contesting the rent, resulting in the monetary cost of rent seeking exceeding the monetary value of the rent leading to over-dissipation; by contrast, if the rent is large the contestants are less sensitive to changes in their allocation of the rent, and they will be relatively less effortful leading to under-dissipation. In winner-take-all contests, sufficient concavity of the utility function implies that for small rents the contestants’ valuation of the rent is larger than the monetary value, thereby incentivizing them to invest high effort at equilibrium generating over-dissipation. For large rents, the opposite will hold, thereby resulting in under-dissipation.

We contribute to the literature on rent seeking by providing a rational explanation for observed phenomena, and one that relies on the backbone of microeconomic theory, namely diminishing marginal utility. Yet, upon closer observation, there is an apparent weakness of using the standard measure of dissipation—the ratio of the total costs of contesting the rent to its monetary value—when contestants value the rent, or their share of it, in a way that deviates from the simple monetary value. Further consideration, therefore, is required in future research to adequately capture rent dissipation in a way that reflects the preferences of contestants that are driving their behavior. This will add to a literature that considers measuring dissipation with endogenous rents [37] and when contestants have asymmetric valuations [38].

Author Contributions

Conceptualization, A.D., I.A.M. and P.G.S.; Formal analysis: A.D., I.A.M. and P.G.S.; Investigation, A.D., I.A.M. and P.G.S.; writing—original draft, A.D., I.A.M. and P.G.S.; writing—review and editing, A.D., I.A.M. and P.G.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

Notes

| 1 | Konrad and Schlesinger [9] establish that risk-averse players may nevertheless expend more effort than risk-neutral players in equilibrium, a finding that is of course totally compatible with the absence of overdissipation. |

| 2 | See [17] for a recent survey. |

| 3 | Indeed, even in the early literature, many of the rent-seeking applications can be interpreted as share contests. For example [2] provides examples of rent seeking of dairy farmers to obtain a share of government funds as well as lobbying for Korean steel import bans, which can be viewed as rent-seeking for an increased market share by domestic producers. |

| 4 | There exists a substantial literature on the experimental investigation of rent dissipation in contests [26,28,29,30,31]. |

| 5 | An exception is Dickson et al. [27] that considers a general formulation of utility in a share contest. |

| 6 | If is monotonically increasing in x, then the fact that with linear evaluation of the rent is monotonically increasing in Z would allow us to identify that there is a threshold rent , say, such that the associated equilibrium effort satisfies , that allows us to understand the pattern of dissipation depending on Z. In particular, we can conclude that if , consistent with the pattern of dissipation found elsewhere of over-dissipation of small rents and under-dissipation of large rents. |

| 7 | We could capture risk preferences in a winner-take-all contest by introducing an increasing function and specifying the payoff to be . The same function could be applied, for consistency, to the share contest to give a payoff but since this is just a monotonic transformation of the original payoff nothing in the analysis of share contests would change. |

References

- Tullock, G. Efficient Rent Seeking. In Toward a Theory of the Rent-Seeking Society; Buchanan, J.M., Tollison, R.D., Tullock, G., Eds.; Texas A&M University Press: College Station, TX, USA, 1980. [Google Scholar]

- Tullock, G. The Economics of Special Privilege and Rent Seeking; Springer: Berlin/Heidelberg, Germany, 1989. [Google Scholar]

- Sheremeta, R. Experimental Research on Contests. In The New Palgrave Dictionary of Economics; Palgrave Macmillan: London, UK, 2019. [Google Scholar]

- Hillman, A.L.; Katz, E. Risk-Averse Rent Seekers and the Social Cost of Monopoly Power. Econ. J. 1984, 94, 104–110. [Google Scholar] [CrossRef]

- Treich, N. Risk-aversion and prudence in rent-seeking games. Public Choice 2010, 145, 339–349. [Google Scholar] [CrossRef][Green Version]

- Cornes, R.; Hartley, R. Risk aversion in symmetric and asymmetric contests. Econ. Theory 2012, 51, 247–275. [Google Scholar] [CrossRef]

- Schroyen, F.; Treich, N. The power of money: Wealth effects in contests. Games Econ. Behav. 2016, 100, 46–68. [Google Scholar] [CrossRef][Green Version]

- Guigou, J.D.; Lovat, B.; Treich, N. Risky rents. Econ. Theory Bull. 2017, 5, 151–164. [Google Scholar] [CrossRef]

- Konrad, K.; Schlesinger, H. Risk Aversion in Rent-Seeking and Rent-Augmenting Games. Econ. J. 1997, 107, 1671–1683. [Google Scholar] [CrossRef]

- Jindapon, P.; Whaley, C.A. Risk Lovers and the Rent Over-Investment Puzzle. Public Choice 2015, 164, 87–101. [Google Scholar] [CrossRef]

- Hillman, A.L.; Riley, J.G. Politically Contestable Rents and Transfers. Econ. Politics 1989, 1, 17–39. [Google Scholar] [CrossRef]

- Myerson, R.B.; Wärneryd, K. Population Uncertainty in Contests. Econ. Theory 2006, 27, 469–474. [Google Scholar] [CrossRef]

- Münster, J. Contests with an Unknown Number of Contestants. Public Choice 2006, 129, 353–368. [Google Scholar] [CrossRef]

- Lim, W.; Matros, A. Contests with a stochastic number of players. Games Econ. Behav. 2009, 67, 584–597. [Google Scholar] [CrossRef]

- Kahana, N.; Klunover, D. A note on Poisson contests. Public Choice 2015, 165, 97–102. [Google Scholar] [CrossRef]

- Ursprung, H.W. Public Goods, Rent Dissipation, and Candidate Competition. Econ. Politics 1990, 2, 115–132. [Google Scholar] [CrossRef]

- Hillman, A.L.; Long, N.V. Rent Seeking: The Social Cost of Contestable Benefits. In The Oxford Handbook of Public Choice; Oxford University Press: Oxford, UK, 2019; Volume 1. [Google Scholar]

- Baye, M.R.; Kovenock, D.; de Vries, C.G. The incidence of overdissipation in rent-seeking contests. Public Choice 1999, 99, 439–454. [Google Scholar] [CrossRef]

- Mauro, P. Corruption and the composition of government expenditure. J. Public Econ. 1998, 69, 263–279. [Google Scholar] [CrossRef]

- Hodler, R. Rent seeking and aid effectiveness. Int. Tax Public Financ. 2007, 14, 525–541. [Google Scholar] [CrossRef]

- Epstein, G.S.; Nitzan, S. Endogenous Public Policy and Contests; Springer Science & Business Media: New York, NY, USA, 2007. [Google Scholar]

- MacKenzie, I.A. Rent creation and rent seeking in environmental policy. Public Choice 2017, 171, 145–166. [Google Scholar] [CrossRef]

- Duggan, J.; Gao, J. Lobbying as a multidimensional tug of war. Soc. Choice Welf. 2020, 54, 141–166. [Google Scholar] [CrossRef]

- Singh, P.; Masters, W.A. Performance bonuses in the public sector: Winner-take-all prizes versus proportional payments to reduce child malnutrition in India. J. Dev. Econ. 2020, 146, 102295. [Google Scholar] [CrossRef]

- MacKenzie, I.A.; Ohndorf, M. Cap-and-trade, taxes, and distributional conflict. J. Environ. Econ. Manag. 2012, 63, 51–65. [Google Scholar] [CrossRef]

- Cason, T.N.; Masters, W.A.; Sheremeta, R.M. Entry into winner-take-all and proportional-prize contests: An experimental study. J. Public Econ. 2010, 94, 604–611. [Google Scholar] [CrossRef]

- Dickson, A.; MacKenzie, I.A.; Sekeris, P.G. Rent-seeking incentives in share contests. J. Public Econ. 2018, 166, 53–62. [Google Scholar] [CrossRef]

- Cason, T.N.; Masters, W.A.; Sheremeta, R.M. Winner-take-all and proportional-prize contests: Theory and experimental results. J. Econ. Behav. Organ. 2020, 175, 314–327. [Google Scholar] [CrossRef]

- Shupp, R.; Sheremeta, R.M.; Schmidt, D.; Walker, J. Resource allocation contests: Experimental evidence. J. Econ. Psychol. 2013, 39, 257–267. [Google Scholar] [CrossRef][Green Version]

- Chowdhury, S.M.; Sheremeta, R.M.; Turocy, T.L. Overbidding and overspreading in rent-seeking experiments: Cost structure and prize allocation rules. Games Econ. Behav. 2014, 87, 224–238. [Google Scholar] [CrossRef]

- Dechenaux, E.; Kovenock, D.; Sheremeta, R.M. A survey of experimental research on contests, all-pay auctions and tournaments. Exp. Econ. 2015, 18, 609–669. [Google Scholar] [CrossRef]

- Mirrlees, J.A. An Exploration in the Theory of Optimum Income Taxation. Rev. Econ. Stud. 1971, 38, 175–208. [Google Scholar] [CrossRef]

- Boadway, R.; Cuff, K.; Marchand, M. Optimal Income Taxation With Quasi-Linear Preferences Revisited. J. Public Econ. Theory 2000, 2, 435–460. [Google Scholar] [CrossRef]

- Keane, M.P. Labor Supply and Taxes: A Survey. J. Econ. Lit. 2011, 49, 961–1075. [Google Scholar] [CrossRef]

- Dickson, A.; MacKenzie, I.A.; Sekeris, P.G. Non-linear revenue evaluation. Scott. J. Political Econ. 2022, 69, 487–505. [Google Scholar] [CrossRef]

- Persson, T.; Tabellini, G. Political Economics: Explaining Economic Policy; MIT Press: Cambridge, MA, USA, 2000. [Google Scholar]

- Chung, T.Y. Rent-seeking contest when the prize increases with aggregate efforts. Public Choice 1996, 87, 55–66. [Google Scholar] [CrossRef]

- Hurley, T.M. Rent Dissipation and Efficiency in a Contest with Asymmetric Valuations. Public Choice 1998, 94, 289–298. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).