Abstract

This study explores the impact of regional financial development on the sustainable growth of the marine economy across 14 coastal cities in Guangdong Province from 2004 to 2022. To assess this, a comprehensive index system was developed to measure marine economic sustainability, incorporating key factors such as capital investment, production efficiency, and processing and trade. The findings indicate that financial development significantly enhances the sustainable growth of the marine economy. However, the interaction between financial development, technology digitalization, and low-carbon initiatives leads to diminishing returns in terms of sustainability. Through the use of the Moran index and the spatial Durbin model, the analysis reveals a dual outcome: while financial development positively influences a city’s marine economic sustainability, it exerts negative spillover effects on neighboring cities. Previous studies have primarily focused on the relationship between financial development and the marine economy at the national or provincial level, leaving a gap in understanding these dynamics at the city level. Furthermore, the coordination between financial development and marine economic sustainability across cities within the same region remains largely unexplored. This study addresses these gaps by investigating city-level dynamics and examining intercity coordination between financial development and marine economic growth. The results offer a novel perspective for policymakers, highlighting strategies to balance regional financing for the marine economy with targeted investments in science, technology, digitalization, and low-carbon initiatives. This approach seeks to optimize resource allocation and mitigate potential substitution effects. Ultimately, this research contributes to a more nuanced understanding of the complex interplay between financial development and the marine economy at both city and regional levels.

1. Introduction

Protecting marine ecosystems is essential for fostering a prosperous and sustainable China, as a healthy ocean is a cornerstone of maritime strength. Globally, the emphasis on sustainable marine resource management has grown, particularly in coastal nations facing the consequences of resource depletion and environmental degradation. China’s coastal regions, characterized by dense populations, concentrated industries, and high resource demand, are under significant environmental stress. These pressures have led to various ecological challenges, including marine pollution, the loss of biodiversity, and the deterioration of marine ecosystems, all of which have hindered the socioeconomic development of coastal areas. To ensure ecological security, it is critical to prioritize marine biodiversity and commit to the sustainable development of the marine economy.

Financial development plays a key role in facilitating resource allocation, contributing to the accumulation of both physical and human capital [1]. As financial development deepens and becomes more efficient, it enhances the productivity of the marine industry, thereby driving the growth of the marine economy [2]. In recent years, governments have increasingly embraced policies that promote green finance and industrial digitalization, leveraging efficient financial operations and capital allocation [3]. These efforts, coupled with modern technologies such as blockchain, big data, IoT, and AI, have advanced the integration of digitalization and low-carbon initiatives to support the development goals of the ocean economy [4,5].

To strengthen their marine economies, countries must first understand how financial development influences marine economic sustainability. Guangdong Province, which has led China’s marine economy for nearly three decades, provides a compelling example. Through comprehensive development strategies, including the implementation of policies and action plans to build a robust marine province, Guangdong has made significant progress in areas such as aquaculture, marine engineering, and offshore wind power. Its focus on technology, digitalization, and low-carbon initiatives sets a benchmark for sustainable marine economic development. With its advanced marine economy and leadership in innovation, Guangdong offers an ideal context for analyzing these dynamics. This study seeks to examine the impact of financial development on the sustainable growth of the marine economy in the region. Utilizing panel data from 14 coastal cities in Guangdong between 2004 and 2022, the study employs econometric models to assess how financial development influences various aspects of marine economic sustainability, particularly in relation to technology integration, digital transformation, and low-carbon strategies. The insights gained from this research are intended to deepen the understanding of how financial development can foster sustainable growth in marine economies. By exploring the effects of technological advancements, digitalization, and low-carbon efforts, this study aims to contribute to the broader discourse on promoting sustainability in coastal marine economies.

In the following section, we address the limitations identified in the literature and propose improvements or extensions to overcome these challenges. First, traditional research methods have primarily focused on analyzing single variables, such as the growth rate of the marine economy. While this approach helps clarify trends in the overall scale of the marine economy, it lacks a comprehensive evaluation of its sustainable development capabilities. This study introduces a sustainable development index for the marine economy, providing a more nuanced and holistic assessment of the complexity and systemic nature of sustainable marine development. Second, previous research has predominantly examined relationships between individual or limited sets of variables. In contrast, this study takes a broader view by integrating regional science and technology, digitalization, and low carbonization. By employing a multidimensional analytical framework, this research offers a more detailed understanding of how financial development impacts the sustainable development of the marine economy through various channels. Third, most studies have focused on the relationship between financial development and the marine economy at the national or provincial level. Few studies have investigated these relationships at the city level or explored the coordinating effects of financial development and the marine economy among cities in the same region. To address this gap, we incorporate spatial externalities into our research framework, fully considering the unique characteristics of each city. By utilizing Moran’s index and a spatial multi-objective model, we uncover patterns of marine economic development in this region, providing valuable samples and references for further research in other regions.

2. Literature Review and Hypotheses

2.1. Literature Review

Scholars have devoted considerable attention to the relationships between financial development and the ocean economy [2,6,7,8], technologization and the ocean economy [9,10,11], digitization and the ocean economy [12,13], and low carbonization and the ocean economy [14,15]. Previous studies have provided substantial empirical evidence from diverse perspectives for the sustainable development of the marine economy. A literature review revealed a linear or nonlinear correlation between financial development, science and technology, digitalization, low carbonization, and the marine economy.

Financial development is crucial for economic growth, with a strong demand–pull or supply–push relationship between the two [16]. Scholars have studied the impact of financial development on the marine economy, and most of the findings confirm that financial development contributes to the growth of the marine economy. Le [17] found significant positive effects of energy consumption, fixed asset investment, government expenditures, financial development, and trade openness on marine economic growth using data from 46 emerging markets and developing countries from 1990 to 2014. Nham and Ha [6] used 2009–2020 data from 24 European coastal countries to confirm that the development of financial markets and the efficiency of financial institutions positively affect marine economic growth. Wang, Lu, and Yin [2] highlighted a positive correlation between financial development and China’s marine economic growth, driven mainly by deeper financial development and improved efficiency. Moreover, some studies have identified nonlinear relationships between financial development and marine economic growth. Song, Chen, Tao, Su, and Umar [7] demonstrated a U-shaped relationship in China, suggesting that financial development fosters marine economic growth only after surpassing a certain threshold. They also noted U-shaped and inverted U-shaped relationships between financial development and different sectors of the marine industry: a U-shaped relationship with the primary and tertiary sectors, and an inverted U-shaped relationship with the secondary sector. Xu and Cui [8] found an inverted U-shaped relationship between loan, bond, and stock financing and marine economic growth in China.

According to the Cobb–Douglas production theory, technology plays a vital role in economic growth. Economic growth is facilitated by financial institutions, which provide funding for research and development (R&D) investments and the purchase of equipment and machinery necessary for production. According to transaction cost theory, digitalization—a critical aspect of information and communication technology (ICT)—has been widely applied in production and marketing at lower costs, enhancing production efficiency and improving market transactions, thereby making a significant contribution to economic growth. Financial institutions also support ICT infrastructure investment, which increases digitalization technology and further contributes to economic growth. Environmental, social, and governance (ESG) theory underscores that environmental protection is a crucial issue in economic growth. Financial institutions offer financial backing for green technologies in production processes, which reduce pollution and contribute to sustainable development. Marine economic growth, innovative development of the marine economy, and resilience to the global water crisis are three pivotal factors for the sustainable development of the marine economy [18,19]. In recent years, governments have been actively promoting marine science, technology and innovation policies, digital transformation policies, and low-carbon development policies to promote the development of the marine economy.

According to the United Nations report “10 Years of Marine Science Promoting Sustainable Development (2021–2030)”, marine science and technology innovation has also been clearly proposed as a key factor for the sustainable development of the marine economy in the future [20]. Marine science and technological innovation provide solutions to optimize the structure of the marine industry [21], enhance economic efficiency [22], and balance the relationship between ecology and development [23]. Furthermore, the development of the marine economy stimulates the demand for high-quality marine science and technology, attracting more funds and talent to invest in marine science and technology innovation, which in turn promotes the development of the marine economy. Some domestic scholars have confirmed the relationship between marine scientific and technological innovation and marine economic growth using data from coastal provinces in China, suggesting that strengthening marine scientific and technological innovation, personnel training, and marine intellectual property protection can drive the development of the marine economy [9,11].

Digitalization has proven effective in predicting demand within the marine economic chain, preventing excessive energy use and marine pollution, and driving the marine economy towards high-end, green, and integrated clustering [24]. Digitalization has proven effective in predicting demand within the marine economic chain, preventing excessive energy use and marine pollution, and driving the marine economy towards high-end, green, and integrated clustering [25,26]. Studies in the Baltic Sea region suggest that digital transformation can boost innovation and support the blue economy by investing in digital solutions and communication infrastructure, enhancing economic competitiveness and job creation [12]. Similarly, research in Saudi Arabia confirms that financial development and ICT positively affect economic growth, with a robust ICT environment amplifying the impact of financial development [27]. Specifically, the government can fully explore the potential of the “marine economy + digital economy” to increase the competitiveness of the marine economy [12,28].

Implementing low-carbon economic policies promotes a shift from traditional high-carbon models, encourages renewable energy use, reduces carbon emissions, and strengthens environmental protection [14,15]. These policies also aid in reducing marine pollution and environmental damage, fostering the sustainability of the marine economy. Studies in China and Central and Eastern European countries reveal that financial development can facilitate carbon emission reductions through clean-energy use, although short-term effects may vary [29,30]. The sustainable development of the marine economy requires a rational use of resources and a reduction in carbon emissions, which depends on substantial financial investments and technological improvements [17,31].

The literature underscores the complex interplay between financial development, technological and digital advancements, and marine economic growth. Financial support is a crucial factor in enabling innovation and economic development, but the outcomes of these interactions depend on contextual factors like technological progress and infrastructure development. This study aims to comprehensively examine the integration of financial development, marine scientific and technological innovation, digitalization, and low carbonization, considering their interactions and spatial characteristics. Emphasizing the importance of spatial factors provides a new perspective on sustainable marine economic development, influenced not only by local conditions but also by surrounding economic activities.

2.2. Hypotheses

2.2.1. Financial Development and Marine Economic Growth

Regional urban financial development plays a crucial role in providing the capital and financial tools necessary for the development of the marine economy [32]. The establishment and growth of financial markets create a more favorable trading and operating environment for the marine economy. This enables investors and enterprises to engage in trading and financing activities through financial markets, thereby increasing the feasibility and sustainability of marine economic projects [6,33].

As the economic hinterland of the Guangdong–Hong Kong–Macao Greater Bay Area, regional financial development in Guangdong Province serves as a platform for promoting ocean economic growth and international cooperation. Financial institutions not only offer cross-border transaction services but also provide financing support to ocean economic enterprises. Furthermore, regional financial development has led to an increase in professionals who can provide specialized services for the marine economic industry. Through these professional financial services, improvements in management levels are achieved along with the increased operational efficiency of marine economic enterprises, which ultimately contributes to their sustainable development [6].

On the basis of theoretical concepts and the literature, the following hypothesis is proposed in this study:

Hypothesis 1:

Regional financial development plays a pivotal role in fostering the sustainable advancement of the marine economy.

2.2.2. Financial Development, Technologization, and Marine Economic Growth

With respect to the interaction between technology and financial development, two main viewpoints are studied: complementarity and substitution [21,22,23]. This view holds that the sustainable development of the marine economy has experienced a marginal benefit increase under the joint action of these two factors. In addition, technological advances, such as blockchain technology and smart contracts, can provide more efficient, safe, and reliable financial services. These innovations can reduce intermediation costs and transaction frictions within financial services while further promoting sustainable development within the marine economy. In addition, with the increase in technology, many funds are needed to support it. However, financial development can provide necessary financing and investment channels to propel high technological content and value appreciation within marine industry development.

On the other hand, an alternative view suggests that, owing to cost-effectiveness considerations, supporting marine industry growth with substantial capital investments may be necessary. This perspective argues that as technologization increases, so do marginal costs, ultimately resulting in diminishing marginal benefits for sustainable marine economic development [32,33]. Moreover, the rise in technological demands within the marine industry may lead to increased funding flows towards technological research and development (R&D) and innovation efforts. The investment of financial capital in other key areas of the marine economy is reduced, potentially inhibiting the positive relationship between financial development and sustainable development.

On the basis of theoretical concepts and the literature, the following hypothesis is proposed in this study:

Hypothesis 2:

The integration of technology and financial development synergistically enhances the sustainable development of the marine economy.

Hypothesis 3:

The integration of technology and financial development synergistically restrains the sustainable development of the marine economy.

2.2.3. Financial Development, Digitalization, and Maritime Economic Growth

With respect to the interaction between digitalization and financial development, prior studies have confirmed the complementary effects. Alimi and Adediran [34] used data from 2005–2016 from 13 economic communities of West African State member countries to construct an ICT index in terms of fixed-line telephony, mobile telephony, and the internet and reported that financial development and the degree of digitization can contribute to economic growth. Gheraia, Abid, Sekrafi, and Abdelli [27] confirmed that financial development and ICT in Saudi Arabia have a positive influence on economic growth and that when ICT is developed, both financial development and ICT can promote regional economic growth. On the basis of the above empirical evidence, the enhancement of digitalization promotes the formation of a digital financial ecosystem, win–win cooperation between industries, the coordinated development of different fields of the marine economy, and the digital transformation and enhancement of the whole industrial chain. Certainly, related research argues that there is a substitution effect between them. Digitalization is influenced by the stock of marine financial capital, and it has a U-shaped relationship with the development of the marine economy [13]. When digitalization reaches a certain level, enterprises and individuals can obtain funds and information more directly through digital platforms, thus reducing their dependence on traditional financial intermediaries. This may lead to a decrease in the participation of financial institutions in the marine economy, and the positive relationship between financial development and the sustainable development of the marine economy may be suppressed because of the weakening role of financial intermediaries, the diversion of funds, and the lag of financial service innovation.

On the basis of theoretical concepts and the literature, the following hypothesis is proposed in this study:

Hypothesis 4:

The integration of digitalization and financial development synergistically enhances the sustainable development of the marine economy.

Hypothesis 5:

The integration of digitalization and financial development synergistically restrains the sustainable development of the marine economy.

2.2.4. Financial Development, Low Carbonization, and Marine Economic Growth

In terms of the interaction between financial development and low carbonization, there are also two competing views. The supplementary view is that financial development plays an important role in low-carbon transformation and economic development, and financial institutions can support low carbonization by providing financial services such as credit and insurance [14,15,29]. The promotion of low carbonization can be driven by demand, policy, social responsibility and international cooperation, which can promote the sustainable development of the marine economy. However, the alternative view holds that low-carbon and financial development restrict the sustainable development of the marine economy [31,35]. Moreover, the development of low-carbon lending faces greater technical risks, market risks, and policy risks. These uncertainties may make financial institutions more cautious when providing financial support. If the government’s policy guidance is insufficient and the corresponding incentives and constraints are lacking, financial institutions may lack motivation to support the sustainable development of the marine economy, and the positive role of financial development in the sustainable development of the marine economy may be inhibited [30].

On the basis of theoretical concepts and the literature, the following hypothesis is proposed in this study:

Hypothesis 6:

The integration of low carbonization and financial development synergistically enhances the sustainable development of the marine economy.

Hypothesis 7:

The integration of low carbonization and financial development synergistically restrains the sustainable development of the marine economy.

3. Model, Data, and Variables

3.1. Data and Sample

This study is underpinned by an analysis of 14 coastal cities in Guangdong Province, including Guangzhou, Shenzhen, Zhuhai, Shantou, Huizhou, Dongguan, Zhongshan, Yangjiang, Jiangmen, Shanwei, Zhanjiang, Maoming, Chaozhou, and Jieyang. The panel data were extracted from the Guangdong Provincial Statistical Yearbooks (2004–2022), the Guangdong Provincial Rural Statistical Yearbooks, and the Guangdong Provincial Market Supervision Administration.

3.2. Research Variables

3.2.1. Dependent Variable

The construction of an index system for the sustainable development of the marine economy aims to comprehensively evaluate its sustainability. Drawing on Wang, Tian, Geng, and Zhang’s [36] three industrial chains of marine resources, this study seeks to establish three core dimensions for marine resources: capital investment, production efficiency, and processing and trade. Seven specific secondary indicators are selected to quantify these dimensions. The following provides an explanation of each dimension and its corresponding secondary indicators.

Data were sourced from the Guangdong Statistical Yearbook and the Guangdong Rural Statistical Yearbook.

Capital investment is a crucial metric for evaluating resource allocation and the economic foundation of marine economic activities. It reflects the industry’s investment in expanding production capacity, improving technical capabilities, and enhancing market competitiveness. The three secondary indicators for this dimension are as follows:

- -

- Marine fishing motorboats (tons): this measures the capital intensity and technical level of the fishing industry.

- -

- Mariculture area (qing): the size of the aquaculture area directly reflects the scale of aquaculture activities and the level of capital investment.

- -

- Part-time personnel in marine fishing and mariculture (persons): this indicates the availability of labor, reflecting both talent reserves and labor inputs in the industry.

Production efficiency is a key criterion for evaluating the efficient use of resources and output capacity in marine economic activities. High production efficiency indicates that greater output is achieved with the same level of resource input. Two secondary indicators for this dimension are as follows:

- -

- Marine fishing cargo (tons): growth in fishing cargo typically signals improvements in fishing technology, better management, or resource recovery.

- -

- Quantity of mariculture fish (tons): this reflects advancements in aquaculture technology, variety improvements, and enhanced management practices.

Processing and trade are crucial for assessing the extension of the marine economic industrial chain and the promotion of value-added activities. Through deep processing and expanded trade, the value of marine products can be enhanced, boosting industrial competitiveness. The secondary indicators for this dimension are as follows:

- -

- Seawater processed products (tons): this measures the processing capacity for marine products and the extent of industrial chain development.

- -

- Port cargo throughput (10,000 tons): as a critical hub for the maritime economy, growth in cargo throughput indicates prosperity in maritime trade and regional economic expansion.

All the aforementioned secondary indicators are logarithmically transformed, as shown in Table 1.

Table 1.

Indicator system for sustainable development of the marine economy.

3.2.2. Independent Variables

In the study of Nham and Ha [6], the financial development index was constructed with three levels of composite indicators: financial institution deepening, financial institution entry, and financial institution efficiency.

Data for this study were sourced from the Guangdong Statistical Yearbook and the Guangdong Provincial Market Supervision Administration.

Financial institution deepening measures the penetration and influence of financial institutions within the economy. Three secondary indicators are used to assess this:

- -

- Ratio of loans to GDP: a higher ratio indicates that financial institutions provide a larger proportion of funding to the economy, reflecting a well-developed financial system.

- -

- Ratio of deposits to GDP: a higher ratio suggests that the financial system effectively mobilizes savings, which can then be used for investment and economic growth.

- -

- Depth of insurance: a greater depth reflects a more developed insurance sector, offering risk mitigation and financial security to individuals and businesses.

Financial institution entry evaluates the accessibility and availability of financial services. Two secondary indicators are used:

- -

- Ratio of financial institutions to the permanent population: a higher ratio suggests that financial services are more accessible, making it easier for individuals and businesses to obtain loans, savings accounts, and other financial products.

- -

- Ratio of employees in financial institutions to the permanent population: a higher ratio can indicate a more developed financial system with specialized services, though this depends on employee efficiency.

- -

- Insurance density: This measures the extent to which insurance services are utilized by the population. A higher density implies greater awareness and adoption of insurance products.

Financial institution efficiency assesses how effectively financial institutions operate:

- -

- Savings mobilization: efficient mobilization of savings is essential for economic growth, as it provides the capital needed for investment in infrastructure, businesses, and other productive activities.

In total, seven secondary indicators were selected to measure financial development, all of which are positive indicators, as shown in Table 2.

Table 2.

Indicator system for the financial development index.

3.2.3. Moderating Variables and Control Variables

Moderating variables include technology, digitalization, and low carbonization. In the studies of Le [17], economic development (gdppc), fixed-asset investment (fai), industrial development (indp), foreign direct investment (fdi), openness (open), and government intervention (gov) are added as control variables. The specific research variables are shown in Table 3.

Table 3.

Research variables.

3.3. Index Construction Methodology

The variables of this study, sustainable development of the marine economy, financial development, and degree of digitization, are measured via the entropy index, which is processed in the following steps.

The first step is to standardize the above secondary indicator factors in the following way: If the secondary factor is positive, Equation (1) is used; if the secondary factor is negative, Equation (2) is used.

The second step calculates the j-factor weight for each city according to the formula below. is the j indicator for city i with m cities.

The entropy value of factor j for each city i is calculated according to the following formula, where the constant value K = 1/m is the reciprocal of the number of cities:

Next, the coefficient of variation is calculated. The coefficient of variation gj is expressed as 1 − ej:

Next, the evaluation index weights are calculated, with ωj representing the weight of :

Ultimately, the combined factor is scored. S is the combined per-factor score for factor j for each city i.

3.4. Research Model

A fixed effects model is employed to examine the proposed research hypotheses.

beit = α0 + α1fdit + ∑ Controlit + µit + vit + εit

beit = β0 + β1fdit + β2techit + β3fdit × techit + ∑ Controlit + µit + vit + εit

beit = γ0 + γ1fdit + γ2digitalit + γ3fdit × digitalit + ∑ Controlit + µit + vit + εit

beit = θ0 + θ1fdit + θ2carbonit + θ3fdit × carbonit + ∑ Controlit + µit + vit + εit

3.5. Descriptive Analysis

Table 4 shows the descriptive analysis results, which can be used to understand the data characteristics of each variable. The dependent variable of the marine economic sustainable development index (MES index) lies between 0.000 and 0.891, with a standard deviation of 0.234, indicating that there are slight differences in the sustainable development of the marine economy of coastal cities in Guangdong. The independent variable of the financial development index (FD index) lies between 0.002 and 0.879, with a standard deviation of 0.256, indicating that there is a significant difference in the financial development of coastal cities in Guangdong. In terms of technology, digitalization, and low carbonization, some cities have a greater degree of difference in technology and digitalization, which reflects the imbalance of urban development in the Bay Area (such as Guangzhou and Shenzhen) as well as non-Bay Area cities (such as Yangjiang and Zhanjiang).

Table 4.

Descriptive analysis.

3.6. Correlation Analysis

Table 5 shows the results of the correlation analysis. The VIF values of the independent variables, moderating variables, and control variables are all greater than 1, and the average VIF is less than 10, indicating that there is no correlation and that any variable can independently explain the dependent variable.

Table 5.

Correlation analysis.

4. Results and Discussion

4.1. Regression Analysis of the Fixed Effects Model of FD and MES

We use a fixed effects model to make a preliminary judgment on the relationship between financial development (FD index) and marine economic sustainable development (MES index). R2 is the coefficient of determination, which indicates the proportion of the variation in Y that can be explained by the variation in X. R2 is a measure of how closely the regression line fits each observation. When R2 = 1, it indicates a perfect fit; when R2 = 0, it indicates that there is no linear relationship between X and Y. The higher the value of R2 is, the better the fit. In this paper, R2 is close to 1, which indicates a good fit and a linear relationship. F is used to test whether the regression relationship is significant. This paper takes p < 0.10 as more significant, p < 0.05 as significant, and p < 0.01 as very significant. All the models in this paper passed the F test, and all the regression relationships were significant.

Table 6 shows the results of this test. The empirical results of Model 1 show that the regression coefficient of financial development (FD index) is 0.177, which is significant at the p < 0.01 level, indicating that financial development has a positive effect on the sustainable development of the marine economy and supporting Research Hypothesis 1. The sustainable development of the marine economy is likely limited by the scale of capital and the efficiency of capital allocation, and as regional financial development progresses, the scale of capital gradually increases capital allocation efficiency to enhance the provision of financial services, effectively promoting the sustainable development of the marine economy. When regional financial development progresses, the scale of capital gradually increases, the efficiency of capital allocation improves, and the financial services provided can effectively promote the sustainable development of the marine economy.

Table 6.

Benchmark regression results.

Our regression analysis reveals a negative coefficient of −0.001 for the cross-multiplier term (FD index_tech) associated with the interplay between financial development and technology, yielding a significant result at the p < 0.05 threshold. This shows that when the degree of technology is improved, the improvement in the financial development level will not increase the marginal income of the sustainable development of the marine economy. This finding corroborates the presence of a substitution effect between the extent of technology and financial development, underpinning Hypothesis 3. This is likely due to the enhancement of the autonomy and competitiveness of the marine industry due to the improvement in the technological level, which reduces the demand for financial support. In this case, financial development may play a more auxiliary and supporting role. The positive impact of financial development on the sustainable development of the marine economy has been inhibited by an increase in the degree of technologization.

In addition, our regression analysis reveals a negative coefficient of −0.163 for the cross-multiplier term (FD index_digital) associated with the interplay between financial development and digital capital, yielding a significant result at the p < 0.05 threshold. This finding suggests that as the marine economy becomes more digitized, the increase in financial development does not augment the marginal benefits of sustainable development. This finding corroborates the presence of a substitution effect between the extent of digitalization and financial development, underpinning Hypothesis 5. Digitalization can mitigate resource wastage and environmental degradation, bolstering efficiency and curtailing costs, thereby diminishing the reliance on financial capital. In the wake of digitalization driving innovation as a primary impetus for marine economy advancement, the influence of financial development is relatively mitigated. Practically, it is imperative to consider the interplay between the degree of digitalization and financial development holistically, ensuring a balance and synergy in their progression to foster sustainable development within the marine economy.

Finally, our regression analysis reveals a positive coefficient of 0.005 for the cross-multiplier term (FD index_carbon) associated with the interplay between financial development and low carbonization, yielding a significant result at the p < 0.01 threshold. Since low carbonization is a negative indicator, a higher value indicates higher carbon emissions, and a lower value indicates lower carbon emissions and a higher degree of low carbonization. This finding corroborates the presence of a substitution effect between the extent of low carbonization and financial development, underpinning Hypothesis 7. Low carbonization implies a reduced dependence on fossil fuels and a more efficient use of energy, which contributes to the reduction in carbon emissions from marine economic activities. When policy guidance and market demand shift towards low-carbon industries, financial capital may flow from traditional marine industries to emerging decarbonized industries. Financial institutions usually consider the profitability and risk of projects when evaluating them, which may lead them to choose to reduce investment in marine economy-related projects when faced with the economic costs of the transition and the uncertainty of technological transformation.

4.2. Spatial Econometric Modeling Analysis

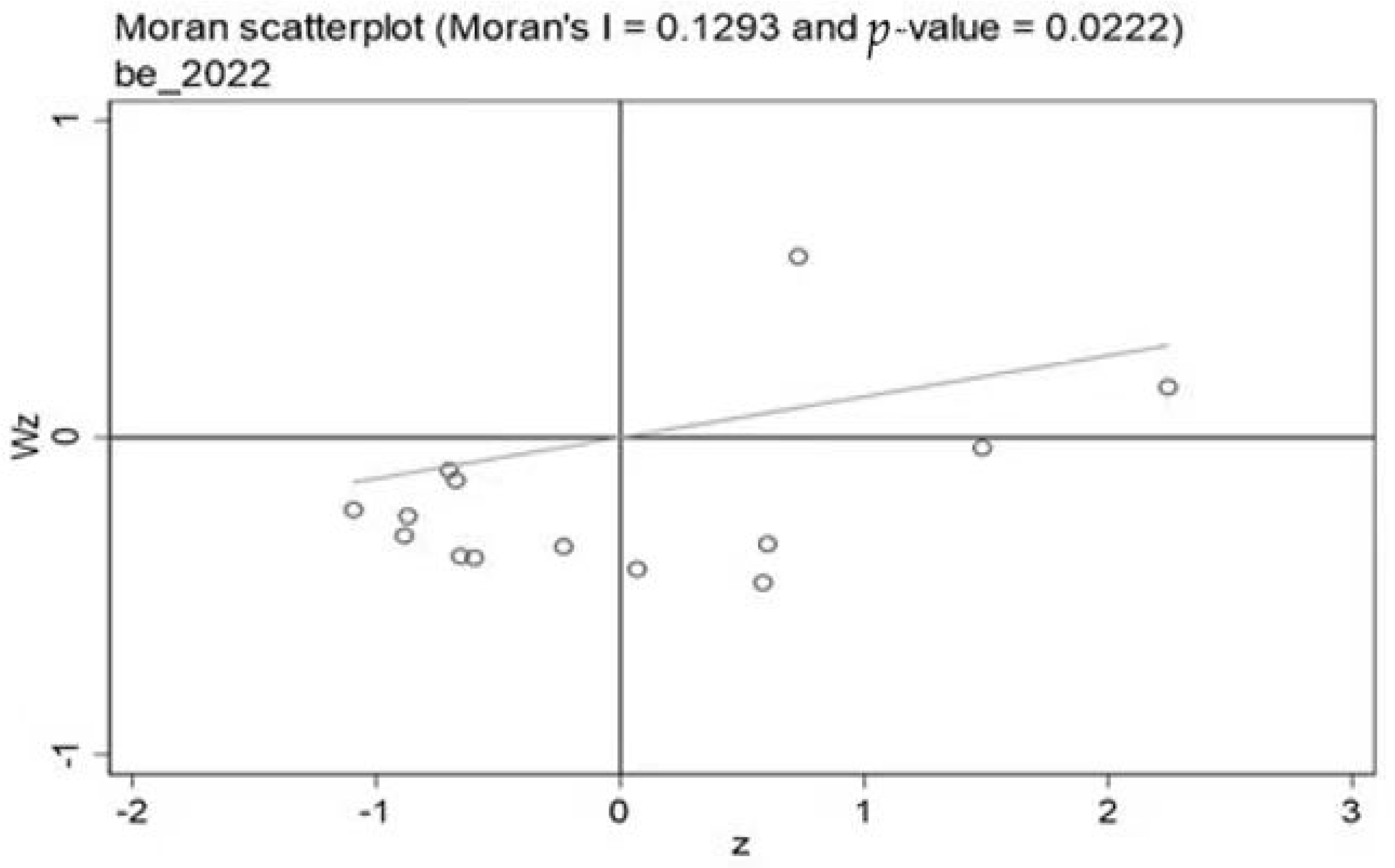

The Moran index is used to assess whether the sustainable development of the dependent marine economy is spatially correlated. Building upon the fixed effects model, the LM test results are analyzed to determine whether the model should incorporate spatial lag dependent variables or spatial error terms. On the basis of the LM test results, an appropriate spatial econometric model for the panel data is selected from among the spatial lag model (SLM), spatial error model (SEM), and spatial Durbin model (SDM).

The Moran index reflects the degree of similarity in observation values among adjacent spatial units. It assesses the overall spatial correlation within the research area, indicating whether the spatial distribution shows a pattern of clustering or dispersion, and evaluates the strength and significance of this pattern. Thus, the Moran index enables an exploration of the spatial correlation characteristics of the degree of coordination. The specific formula for calculating the Moran index is as follows:

In the context of spatial econometric analysis, let n denote the number of coastal cities in Guangdong Province. The Moran index is calculated via the spatial weight matrix, where represents the element in the i-th row and j-th column. The variable denotes the value of the j-th regional variable x, and the average value of x is the mean of all the urban variables x. The term represents the variance of all the urban variables x. The Moran index ranges from −1 to 1, where a value close to 1 indicates a positive spatial correlation (i.e., high or low clustering), a value close to −1 signifies a negative spatial correlation (i.e., high or low dispersion), and a value near 0 implies a random spatial distribution.

To assess local spatial correlation in terms of the degree of coordination, a Moran scatter plot is constructed via the local spatial autocorrelation model. In the Moran scatter plot, each data point corresponds to a spatial unit, and the points are categorized into one of four quadrants on the basis of the relative magnitude of the unit’s value and that of its neighboring units. These quadrants represent different spatial autocorrelation patterns:

First quadrant: this represents positive spatial autocorrelation, where spatial units with high values tend to be adjacent to other high-value units.

Second quadrant: indicates negative spatial autocorrelation, where units with low values are typically adjacent to units with high values.

Third quadrant: denotes positive spatial autocorrelation, with low-value units being adjacent to other low-value units.

Fourth quadrant: reflects negative spatial autocorrelation, where high-value units are generally adjacent to low-value units.

According to the global spatial autocorrelation model, we can calculate Moran’s I. As shown in Table 7, from 2004–2022, Moran’s I was significantly positive at the 1% or 5% level. This indicates that there is significant positive autocorrelation in the sustainable development of the regional marine economy, suggesting that a spatial econometric model should be considered for analysis.

Table 7.

Global geographic distance as measured by Moran’s I index (2004–2022).

The global Moran’s I index captures only the overall spatial autocorrelation of the data and does not capture the spatial agglomeration of specific regions. To visualize the spatial correlation of different regions more intuitively, a Moran’s I scatter diagram is drawn on the basis of the spatial autocorrelation model. The diagonal line typically represents the trend line of spatial positive correlation. The scatter points, on the other hand, represent the relative positional relationship between the observed values of individual cities (or spatial units) and the average observed values of their neighboring areas. In this diagram, quadrants I and III have positive spatial correlations, whereas quadrants II and IV have negative spatial correlations. Figure 1 shows that more points fall into quadrants I, II, and III, indicating that coordination is characterized mainly by high–high homogeneous aggregation and low–low homogeneous clustering, with some low–high heterogeneous clustering.

Figure 1.

Scatter plot of the Moran index of sustainable development of regional marine economy.

The results of the Lagrange multiplier (LM) or robust Lagrange multiplier (robust-LM) tests, which were applied to examine the presence of spatial autocorrelation of the dependent variable and spatial autocorrelation of the error term in the underlying regression model, are shown in Table 8. The test results of the LM-lag and robust-LM-lag tests using the geographic distance matrix under the individual and time two-way fixed model rejected the original hypothesis of no spatial autocorrelation of the dependent variable and supported the spatial lag model (SLM). Second, the LM error statistic and robust-LM error statistic also support the spatial error model (SEM).

Table 8.

LM test model selection results under the spatial weight matrix.

In addition to considering the spatial autocorrelation of the dependent variable and the error term, the spatial autocorrelation between the independent variables can also be considered; therefore, this study uses the likelihood ratio (LR) to conduct a retest to verify whether the spatial Durbin model can be degraded to a spatial lag model and a spatial error model. Table 9 shows the spatial measurement regression results after adding the geographic distance matrix, in which the LR test-related statistics test results and the statistics of the LR test under the geographic distance matrix passed the 1% significance test, indicating that the spatial Durbin model does not degenerate into a spatial lag model and a spatial error model under the geographic distance weighting matrix, which shows that the spatial Durbin model for the regression analysis is applicable to this study. In addition, the original hypothesis of being subject to random effects is rejected, as the Hausman test statistic passes the 1% significance test, and the final analysis is conducted via the fixed effects model of the spatial Durbin model. The regression coefficient of financial development (FD index) is 0.077, which is significant at the p < 0.10 level, which indicates that financial development in this city has a significant effect on the development of the marine economy in this city and supports Hypothesis 1.

Table 9.

Regression results of the spatial measurement models.

Table 10 shows the empirical results of the direct, indirect, and total effects of the spatial Durbin model. The total effect of financial development (FD index) on the sustainable development of the marine economy is −0.397, the direct effect is 0.160, the indirect effect is −0.557, and it is significant at the p < 0.01 level. These findings indicate that the financial development of this city has a significant positive effect on the sustainable development of the marine economy in this city and that the financial development of this city has a significant negative spatial spillover effect on the sustainable development of the marine economy in neighboring cities.

Table 10.

Spatial Durbin model direct, indirect, and total effects.

The specific reasons may be as follows: First, there is competition for resources. As a whole, the focus of industrial development in coastal cities is on the tertiary, secondary, and primary sectors, but in terms of individual cities, there is uneven development; for example, the financial development of the Bay Area cities in Guangdong Province (e.g., Guangzhou, Shenzhen, etc.) tends to attract a large amount of financial resources and investment, which may result in the loss of resources in surrounding non-Bay Area cities (e.g., Yangjiang, Zhanjiang, etc.). The concentrated use of these resources will cause neighboring cities to face competitive pressure in the development of the marine economy and find it difficult to obtain adequate financial support, thus affecting their sustainable development. The second is the financial center effect. The Bay Area cities in the PRD tend to have strong economic and financial agglomeration effects. When a city becomes a financial center, more financial institutions and enterprises set up headquarters and branches in that city, leading to growth in consumption and employment, further strengthening the city’s financial advantages. In contrast, neighboring cities may be unable to enjoy the same development opportunities due to a lack of financial resources and institutional support. Third, with respect to the industrial agglomeration effect, financial development may promote the industrial agglomeration of Bay Area cities, attracting more enterprises and talent to the region. This industrial agglomeration effect may further widen the development gap with neighboring cities, making neighboring cities face greater development resistance in the field of sustainable development of the marine economy.

5. Conclusions and Policy Recommendations

On the basis of the empirical results and discussion, this study draws the following conclusions and proposes corresponding policy recommendations.

5.1. Conclusions

The study concludes that financial development can indeed promote the sustainable development of the marine economy. However, there are limiting effects of technology, digitalization, and low-carbon initiatives on the relationship between financial development and the sustainable growth of the marine economy. This indicates that the effectiveness and efficiency of technology, digitalization, and low-carbon initiatives may be constrained in the coastal cities of Guangdong Province. Additionally, the study highlights a negative spillover effect, suggesting resource misallocation within the industrial structures of these coastal cities, which undermines sustainable growth through financial channels.

Economic disparities between regions in China and across national borders remain evident. Bay Area cities like Guangzhou and Shenzhen have leveraged their financial and technological strengths to serve as regional growth catalysts. This approach can be replicated in other countries or regions by developing globally competitive urban centers or clusters and using their influence to drive broader economic and social advancement in neighboring areas. Incorporating the spatial impact analysis of financial development into cross-border collaborations can foster more equitable, efficient, and sustainable international economic cooperation. This would enable balanced global economic development through the cross-border flow of financial capital and resource allocation.

Future research should consider expanding the sample range to encompass a broader coastal area and a longer time span to capture the continuous evolution of marine economic sustainability and financial development. Furthermore, enhancing the comprehensiveness and accuracy of the analysis can be achieved by incorporating a wider range of explanatory variables, such as policy interventions, international market trends, and social attitudes. In-depth case studies on selected regions or cities that have effectively balanced financial development with the sustainability of the marine economy could offer valuable insights and best practices for other regions.

5.2. Policy Recommendations

Based on the study’s conclusions, the following policy recommendations are proposed:

First, financial development plays a pivotal role in fostering the sustainable growth of the marine economy. Benefiting from its status as one of China’s well-developed coastal provinces, Guangdong Province boasts a solid foundation in financial development and the marine economy. Its robust financial industry not only provides ample financial support but also offers diverse financing channels, serving as a key driver for the growth of marine-related enterprises. Moving forward, the government should introduce policies that further support the sustainable development of the marine economy. These could include encouraging financial institutions to increase funding for the marine industry, reducing financing costs, and establishing a marine economic development fund to guide social capital toward the marine economy, fostering sustainable industry growth. Additionally, the government could promote the establishment of a marine economic insurance system, encouraging the financial sector to provide risk management and insurance services. This would help marine enterprises address various risks and improve their resilience.

Second, local governments should focus on balancing and coordinating the relationships between technologization, digitalization, low carbonization, and financial development. The financial advantages of the Guangdong–Hong Kong–Macao Greater Bay Area should be fully leveraged. Special funds for marine science and technology innovation could attract investments from Hong Kong, Macao, and international capital. Furthermore, comprehensive financial support should be provided for marine science and technology research, innovation, and high-tech enterprises [37]. Financial institutions should be encouraged to adopt digital technologies such as big data and blockchain to enhance the efficiency of marine economic and financial services, as well as risk management capabilities. Supporting the construction of digital platforms for the marine economy, integrating data on marine resources, the environment, and industry, would provide a reliable foundation for financial institutions to evaluate marine projects. Financial institutions should also be guided to innovate green financial products such as green bonds and credits. Exclusive financing schemes for low-carbon projects, clean-energy initiatives, and environmental renovation projects within the marine economy should be developed, promoting the low-carbon transformation of the marine sector.

Finally, financial development should align with each city’s industrial structure, focusing on the rational allocation and efficient use of funds to meet the needs of industrial growth. Coastal cities in the Bay Area, such as Guangzhou and Shenzhen, have natural advantages in finance, science, and technology due to their geographic location, economic foundation, and policy support. Local governments should capitalize on these strengths to foster financial and technological innovation, digital transformation, and low-carbon development. Strengthening the ripple effects from Bay Area cities can better support the sustainable growth of the marine economy in neighboring regions. For non-Bay Area cities like Zhanjiang and Yangjiang, local governments should seek policy support to encourage the development of science, technology, digitization, and low-carbon initiatives. They should actively participate in cross-regional cooperation mechanisms and platforms to enhance collaboration with Bay Area cities in finance, technology, and environmental protection, jointly exploring pathways and models for sustainable development.

In general, the government should further enhance the deep integration of finance with the marine economy and promote sustainable development within the marine industry by formulating supportive policies, fostering financial innovation, and providing comprehensive risk management and insurance services. To achieve a harmonious symbiosis between financial development and the sustainable growth of the marine economy, it is essential for the government to effectively employ a diverse array of policy instruments, strengthen guidance and support mechanisms, and advance initiatives in science and technology, digitalization, and low-carbon practices. Furthermore, enhancing international cooperation and exchanges will be crucial in promoting the financial sustainability of the marine economy while ensuring a balance among economic progressiveness, social welfare, and environmental preservation.

Author Contributions

Conceptualization, S.S.; methodology, M.T.; software, M.T.; formal analysis, S.S.; data curation, M.T.; writing—review and editing, S.S.; visualization, Z.Z.; supervision, Z.Z.; project administration, Z.Z.; funding acquisition, Z.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was financially supported by the Guangxi First-class Discipline Construction Project Fund on Applied Economics (Guijiao Scientific Research [2022] No. 1), funded by the Key Research Base of Humanities and Social Sciences of Universities in Guangxi Zhuang Autonomous Region.

Data Availability Statement

The data presented in this study are openly available in [Guangdong Statistical Yearbook] [Guangdong Rural Statistical Yearbook] and [ Statistics of Guangdong Market Supervision Administration] at [http://stats.gd.gov.cn/gdtjnj/index.html (accessed on 28 August 2024)] [https://www.shjuku.org/tag/%E5%B9%BF%E4%B8%9C%E5%86%9C%E6%9D%91%E7%BB%9F%E8%AE%A1%E5%B9%B4%E9%89%B4/ (accessed on 28 August 2024)] and [http://amr.gd.gov.cn/zwgk/sjfb/tjsj/index.html (accessed on 28 August 2024)], reference number [2004–2023]. In addition, the data presented in this study are available on request from the corresponding author.

Acknowledgments

Special thanks to Shun-he Zhu for his guidance and suggestions.

Conflicts of Interest

The authors declare that they have no conflicts of interest.

References

- Ruiz, J.L. Financial development, institutional investors, and economic growth. Int. Rev. Econ. Financ. 2018, 54, 218–224. [Google Scholar] [CrossRef]

- Wang, S.; Lu, B.; Yin, K. Financial development, productivity, and high-quality development of the marine economy. Mar. Policy 2021, 130, 104553. [Google Scholar] [CrossRef]

- Xu, S.; Gao, K. Green finance and high-quality development of marine economy. Mar. Econ. Manag. 2022, 5, 213–227. [Google Scholar] [CrossRef]

- Fruth, M.; Teuteberg, F. Digitization in maritime logistics-What is there and what is missing? Cogent Bus. Manag. 2017, 4, 1411066. [Google Scholar] [CrossRef]

- Munim, Z.H.; Dushenko, M.; Jimenez, V.J.; Shakil, M.H.; Imset, M. Big data and artificial intelligence in the maritime industry: A bibliometric review and future research directions. Marit. Policy Manag. 2020, 47, 577–597. [Google Scholar] [CrossRef]

- Nham, N.T.H.; Ha, L.T. The role of financial development in improving marine living resources towards sustainable blue economy. J. Sea Res. 2023, 195, 102417. [Google Scholar] [CrossRef]

- Song, Y.; Chen, B.; Tao, R.; Su, C.-W.; Umar, M. Too much or less? Financial development in Chinese marine economic growth. Reg. Stud. Mar. Sci. 2020, 37, 101324. [Google Scholar] [CrossRef]

- Xu, X.; Cui, Y. Is financial development good for marine economic growth? An evidence from China. J. Coast. Res. 2020, 112, 311–314. [Google Scholar] [CrossRef]

- Wu, F.; Wang, X.; Liu, T. An empirical analysis of high-quality marine economic development driven by marine technological innovation. J. Coast. Res. 2020, 115, 465–468. [Google Scholar] [CrossRef]

- Yu, D.; Zou, Z. Empirical research on the interaction between marine scientific and technological innovation and marine economic development. J. Coast. Res. 2020, 108, 7–11. [Google Scholar] [CrossRef]

- Liu, P.; Zhu, B.; Yang, M. Has marine technology innovation promoted the high-quality development of the marine economy? -Evidence from coastal regions in China. Ocean Coast. Manag. 2021, 209, 105695. [Google Scholar] [CrossRef]

- Roos, G.; Kubina, N.Y.; Farafonova, Y.Y. Opportunities for sustainable economic development of the coastal territories of the Baltic Sea Region in the context of digital transformation. Balt. Reg. 2021, 13, 7–26. [Google Scholar] [CrossRef]

- Wu, S.; Li, M.; Tang, J. Effect of digital economy on marine economic development level by big data analysis. Acad. J. Bus. Manag. 2023, 5, 143–148. [Google Scholar]

- Guan, H.; Sun, Z.; Wang, J. Decoupling analysis of net carbon emissions and economic growth pf marine aquaculture. Sustainability 2022, 14, 5886. [Google Scholar] [CrossRef]

- Dong, K.; Wang, S.; Hu, H.; Guan, N.; Shi, X.; Song, Y. Financial development, carbon dioxide emissions, and sustainable development. Sustain. Dev. 2024, 32, 348–366. [Google Scholar] [CrossRef]

- Kara, M.; Nazlıoğlu, S.; Ağırd, H. Financial development and economic growth nexus in the MENA countries: Bootstrap panel granger causality analysis. Econ. Model. 2011, 28, 685–693. [Google Scholar] [CrossRef]

- Le, H.P. The energy-growth nexus revisited: The role of financial development, institutions, government expenditure and trade openness. Heliyon 2020, 6, e04369. [Google Scholar] [CrossRef] [PubMed]

- Behnam, A. Building a blue economy: Strategy, opportunities, and partnerships in the seas of East Asia. In Proceedings of the The East Asian Seas Congress 2012, Changwon, Republic of Korea, 9–13 July 2012. [Google Scholar]

- Dolan, F.; Lamontagne, J.; Link, R.; Hejazi, M.; Reed, P.; Edmonds, J. Evaluating the economic impact of water scarcity in a changing world. Nat. Commun. 2021, 12, 1915. [Google Scholar] [CrossRef] [PubMed]

- Visbeck, M. Ocean science research is key for a sustainable future. Nat. Commun. 2018, 9, 690. [Google Scholar] [CrossRef]

- Wei, X.; Hu, Q.; Shen, W.; Ma, J. Influence of the evolution of marine industry structure on the green total factor productivity of marine economy. Water 2021, 13, 1108. [Google Scholar] [CrossRef]

- Ren, W.; Ji, J.; Chen, L.; Zhang, Y. Evaluation of China’s marine economic efficiency under environmental constraints-An empirical analysis of China’s eleven coastal regions. J. Clean. Prod. 2018, 184, 806–814. [Google Scholar] [CrossRef]

- Xie, W.; Yan, T.; Xia, S.; Chen, F. Innovation or introduction? The impact of technological progress sources on industrial green transformation of resource-based cities in China. Front. Energy Resour. 2020, 8, 598141. [Google Scholar] [CrossRef]

- Zhang, H.; Liu, Z.; Wang, S. An analysis of China’s high-quality economic development path against the background of digital economy. Bus. Econ. Res. 2019, 2, 183–186. [Google Scholar]

- Shan, S.; Liu, C. Research on the impact of financial deepening on digital economy development: An empirical analysis from China. Sustainability 2023, 15, 11358. [Google Scholar] [CrossRef]

- Tijan, E.; Jović, M.; Hadžić, A.P. Achieving blue economy goals by implementing digital technologies in the maritime transport sector. Sci. J. Marit. Res. 2021, 35, 241–247. [Google Scholar] [CrossRef]

- Gheraia, Z.; Abid, M.; Sekrafi, H.; Abdelli, H. The moderating role of ICT diffusion between financial development and economic growth: A bootstrap ARDL approach in Saidi Arabia. Inf. Technol. Dev. 2021, 28, 816–836. [Google Scholar] [CrossRef]

- Ding, C.; Liu, C.; Zheng, C.; Li, F. Digital economy, technological innovation and high-quality economic development: Based on spatial effect and mediation effect. Sustainability 2022, 14, 216. [Google Scholar] [CrossRef]

- Yuan, R.; Liao, H.; Wang, J. A nexus study of carbon emissions and financial development in China using the decoupling analysis. Environ. Sci. Pollut. Res. 2022, 29, 88224–88239. [Google Scholar] [CrossRef]

- Manta, A.G.; Florea, N.M.; Bădîrcea, R.M.; Popescu, J.; Cîrciumaru, D.; Doran, M.D. The nexus between carbon emissions, energy use, economic growth and financial development: Evidence from Central and Eastern European countries. Sustainability 2020, 12, 7747. [Google Scholar] [CrossRef]

- Alzahrani, A.; Petri, I.; Rezgui, Y.; Ghoroghi, A. Decarbonization of seaports: A review and directions for future research. Energy Strategy Rev. 2021, 38, 100727. [Google Scholar] [CrossRef]

- Rashid, A.; Ahmad, F. Financial development, innovation, and economic growth: The case of selected Asian countries. Kashmir Econ. Rev. 2018, 27, 33–44. [Google Scholar]

- Zhu, X.; Asimakopoulos, S.; Kim, J. Financial development and innovation-led growth: Is too much finance better. J. Int. Money Financ. 2020, 100, 102083. [Google Scholar] [CrossRef]

- Alimi, A.S.; Adediran, I.A. ICT diffusion and the finance-growth nexus: A panel analysis of ECOWAS countries. Future Bus. J. 2020, 6, 16. [Google Scholar] [CrossRef]

- Hou, J. Research on correlation degree between marine industry and marine economy low carbonization level based on Particle Swarm Optimization. J. Coast. Res. 2020, 111, 293–297. [Google Scholar] [CrossRef]

- Wang, S.; Tian, W.; Geng, B.; Zhang, Z. Resource constraints and economic growth: Empirical analysis based on marine field. Sustainability 2023, 15, 727. [Google Scholar] [CrossRef]

- Liu, W.; Ye, B.; Liu, Y. Marine finance and marine science-tech innovation. J. Coast. Res. 2020, 106, 276–280. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).