Abstract

In this paper, the government behavior of leasing different land use rights in Beijing, China, is analyzed using data analysis based on the multinomial logit model. The factors that lead the government to lease different land use rights are considered from the aspects of the land features, geographical location of the land, district economic development, government finance and political tenure of the district head, etc. Considering the factors as the variables, the multinomial logit model is presented to analyze the factors that affect the district government behavior on leasing different land use rights. The data of the variables are obtained in Beijing at the district level from 2004 to 2015. From the results, we can see that the area and price of the land, gross domestic product, foreign direct investment, distance of the land from airport, distance of the land from city center, distance of the land from the nearest industrial park, government fiscal deficit and tenure of the district head all influence the district government behavior on leasing land. Finally, the policy implications are proposed. The results and implications can be referenced by other metropolises in China and other developing countries with public ownership of land.

1. Introduction

Urban renewal is an important issue for urban development, especially for the metropolitan areas in China, such as Beijing, Shanghai, etc., where land is managed by the municipal government which generally authorizes the district government to lease land [1]. Urban renewal is the improvement of urban planning, which is related to the land leasing activity of the local government. Reasonable land leasing is not only conducive to the upgrading of industrial structure and sustainable land development, but also promotes the integrated development of urban and rural areas and urban renewal. Analyzing the land leasing behavior of the government of the metropolitan areas in China is very important for urban sustainable development.

According to Interim Regulations on the Assignment and Leasing of the Right to the Use of State Owned Land in Cities and Towns of the People’s Republic of China, land leasing refers to the behavior of the state government leasing land use rights to land users within a certain period of time, and the land users pay the land use right leasing fees to the state. Land use rights can be leased by listing, tender and auction. There are various land use types, such as residential, industrial, commercial and comprehensive land, in the metropolitan areas of China. Comprehensive land combines multiple land use purposes. Different land use types show different characteristics of the land, and there are wide variations in the prices of land use types. Land leasing revenues make great contributions to local income and infrastructure finance, and the government hopes to increase revenues through land leasing, which leads to land oversupply and housing affordability in the real estate market [2]. With the increase in land revenues and decrease in cultivated land and farmland [3,4,5,6,7], the balance of urban construction land and cultivated land is very important [8]. By studying the district government choices on leasing different land use types in Shanghai, the corresponding land policy is discussed [9]. Wang et al. applied a dynamic model to reform residential land supply policy and relieve housing pressure in China [10]. Due to the regional differences in the construction land allocation, formulating specific regional planning of land use is vital [11]. Therefore, it is necessary to explore the district government behavior on leasing land to achieve a balanced and sustainable development of urban land planning.

There are many factors influencing land leasing. Land leasing is suggested to be closely related to regional economic development, and differences in regional industrial structures and levels of urbanization lead to differences in the characteristics of land leasing [12]. Land leasing and sales are claimed to have a lag effect on economic growth and can increase productivity [13,14]. Land leasing is suggested to affect local economic growth through financial relations, and the financial behavior and economic indicators of local governments are claimed to influence the land leasing scale and price [15]. The increase in gross domestic product (GDP) is suggested to have a close relationship with the change in land use [16]. Economic growth is claimed to be stimulated by the increase in industrial land, which can attract foreign investment and maintain infrastructure investments [16]. The imbalance of land development is claimed to influence local finance, and the higher the imbalance of land development, the more serious the financial situation [17]. The government plays an essential role in land leasing, and land leasing is suggested to have an impact on revenues [18]. Land leasing modes are claimed to be influenced by local finance [19].

Land leasing in China is progressively responding to the improvement of the governance system, and the land market is claimed to depend on the type of land tenure system and the existing governance system [20]. Leadership tenure and political turnover are suggested to influence land revenue and finance, and even the development and fluctuation of the local economy [21]. In some cities, because the prices of residential and commercial land are much higher than prices of industrial land, to obtain high financial revenues, governments are claimed to be more willing to lease commercial and residential land [22]. Government behavior is suggested to influence land leasing, which reduces the efficiency of the residential land market [23]. Compared with policy interventions, industrial subtype, land lease year and land scale are claimed to have greater impacts on industrial land [24]. Local governments are suggested to influence land leasing prices because of the administrative levels and the choice of transaction approaches. In order to improve profits, they hope to push up the prices of commercial and residential land and control the prices of industrial land [25]. State intervention in land leasing is claimed to shape real estate investment; there exists a significant positive relationship between them [26].

Land price and land development density are suggested to decrease with the increase in the distance between the land and the city center [27]. The closer the land is to the city center, the higher its price [28]. Rail transits are claimed to have effects on land development. In more accessible areas near railway stations, there will be greater development intensity and more intensive land use [29]. The investment in mass transit is suggested to have a positive effect on land prices and promote land development [30]. Xu et al. investigated the correlation between rail transit and commercial house prices, and the results showed that modified, transit-oriented development can promote urban sustainable development [31]. Public transit infrastructures, such as subway stations, are suggested to have effects on housing prices [32,33,34,35] and land prices [36].

Previous publications mainly studied the relationship between land leasing, the housing market and land use efficiency, as well as government behavior and intervention in land leasing and the housing market. The research on the factors influencing land leasing primarily refers to factors affecting land prices or house prices. Few studies have paid attention to the factors affecting the government behavior on leasing different land use rights.

Beijing is a metropolis in China where the resident population has reached more than 21.7 million, and GDP amounted to 670.8 billion CNY in 2015 according to the Statistical Yearbook. It is one of the most important cities in China, with polity, culture, scientific and technological innovation, and international exchange. The country’s central government is located in Beijing, where the district government has authority to manage and lease land. Therefore, the district-level data should be used to analyze the land leasing behavior of the district government.

In this paper, the government behavior of leasing different land use rights in Beijing of China is analyzed using data analysis based on the multinomial logit model. Considering the factors that affect the government to lease different land use rights as the variables, the multinomial logit model is presented. The regression results are obtained based on the data of the variables in Beijing on a district level from 2004 to 2015. The results are discussed, and policy implications are proposed.

The contributions of this paper are as follows: (1) the data in Beijing on a district level are used due to the district government managing and leasing land in Beijing; (2) four categories of variables are proposed from the aspects of the features of the land, economic development of the districts, geographical location of the land, government finance and political tenure, etc., and some new variables are considered based on the literature; (3) the multinomial logit model is presented to analyze the factors that affect the district government behavior on leasing residential land, industrial land, commercial land or comprehensive land; (4) the policy implications are proposed by analyzing the regression results.

2. Methodology

Due to the importance of data, the data analysis method is used to explore the government behavior on leasing different land use rights in Beijing.

In discussing the variables affecting land leasing, the multinomial logit model is selected as the mathematical model to analyze the factors that affect the district government behavior on leasing land, including residential land, industrial land, commercial land and comprehensive land. Moreover, the probability of the district government leasing certain land use types can be estimated and predicted based on the influencing factors.

To present the model, the variables in the model are considered. The factors affecting the district government behavior on land leasing are proposed based on the features of the land, district economic development, geographical locations of the land, government finance and political tenure of the district head, etc. Considering these variables, the district government behavior on leasing land can be reflected more comprehensively.

The data of the variables include four types of land leasing, GDP, foreign direct investment (FDI), government fiscal deficit and tenure of the district head, and distance data in Beijing on a district level from 2004 to 2015. From the model, the regression results can be obtained by using the software Stata. Then, the results are used to discuss the factors affecting the district government behavior on leasing residential land, industrial land, commercial land or comprehensive land. Policy implications are proposed by analyzing the regression results.

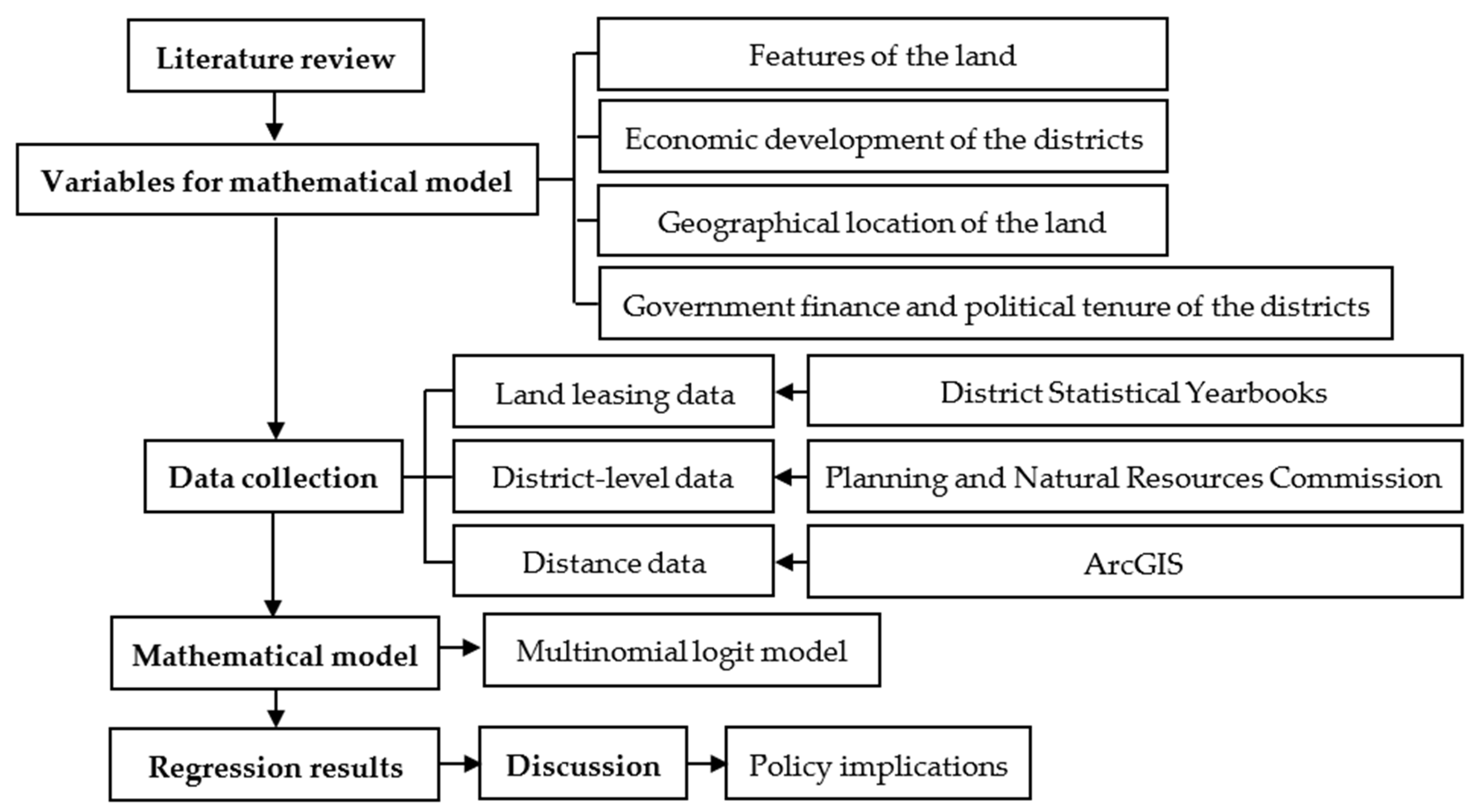

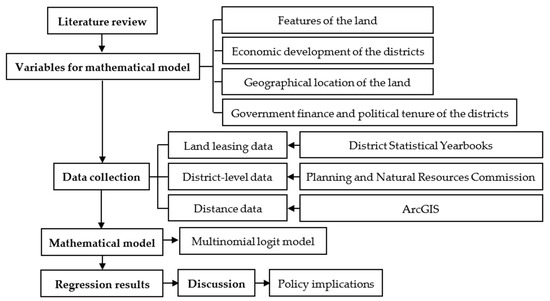

The methodology of the paper is shown in Figure 1.

Figure 1.

The methodology of the paper.

3. Variables of Mathematical Model

In the mathematical model, the four categories of variables are the features of the land, district economic development, geographical location of the land and government finance and political tenure.

3.1. Features of the Land

The features of the land include the area and transaction price of every piece of land.

The area and price of the land are the basic features of the leased land, and these may be determinants in government land leasing behavior. The leased land area influences the land leasing price [37,38]. The size of leased land has a great impact on land leasing [24].

3.2. Economic Development of the Districts

The economic development of the districts includes GDP and FDI of the districts.

Land leasing is closely related to regional economic development [12,16] that can promote urban economic growth [14] and increase productivity [13]. The local governments’ financial behavior and economic indicators influence the scale and price of land leasing [15]. Land availability has an impact on economic growth, FDI, labor supply and government expenditure [39]. Urban economic openness, such as FDI, influences the housing market. A 1% increase in economic openness of the city will result in real estate prices increasing by 0.282% [40]. FDI has a negative correlation with land prices [37].

3.3. Geographical Location of the Land

Geographical location of the land includes the distances of each piece of land from the city center, the district center, airports, the Beijing Railway Station and the nearest industrial parks.

Tiananmen Square is considered as the city center of Beijing, and it is located in Dongcheng District. The district government’s locations are in the center of the district in Beijing. Land price and land development density decrease with the increase in the distance between the land and the city center [27]. The closer the land to the city center, the higher its price [28]. The geographical location of the land can affect the land prices [41].

There were two airports in Beijing from 2004 to 2015. Beijing Capital International Airport was built in 1958, and officially put into use in 1980. It is located in Shunyi District 25 km from the center of Beijing. Nanyuan Airport was completed and opened in 1910, and it is located in Fengtai District 13 km from the center of Beijing. The Beijing Railway Station is located in Dongcheng District and was built in 1901. Some important transportation nodes, such as airports, have important effects on land prices [28]. In the more accessible areas near the railway station, there will be higher development intensity and higher intensive land use [29].

Industrial parks play key roles in regional planning for developing countries, which can improve economic and environmental efficiency [42]. The distance of land to industrial parks can affect the government behavior on leasing land, especially for industrial land.

3.4. Government Finance and Political Tenure of the District Head

Government finance and political tenure include the government fiscal deficit of the districts and tenure of the district head.

Local fiscal deficit has a significant impact on the real estate and housing markets [43]. Local finance has an influence on different land leasing modes [19]. The government’s budget deficit positively affects land prices [44].

Land leasing is affected by political competition, and more intense political competition can decrease the amount of new land for development purposes [45]. Leadership tenure and political turnover influence land revenue and finance, and even the development and fluctuation of local economy [21]. The tenure of the district mayor has a negative correlation with land prices [37]. Local governments can impact land leasing prices through their administrative levels, choices of transaction methods and land leasing decisions [25].

Compared with Cheng [9], some new variables are considered in this work—such as price of the land; the distance of the land to airports, railway station and the nearest industrial park; and tenure of the district head—to investigate the district government behavior on leasing land more comprehensively and specifically.

4. Data

The land leasing data from 2004 to 2015 in Beijing, including area, transaction price and geographical location of the land, were collected from the Beijing Municipal Commission of Planning and Natural Resources. The data of 2004–2015 were used in this study because the policy of land leasing was reformed in 2002, with the state stipulating that the use rights of profit-oriented land must be leased by tender, auction or listing, which abolished the negotiation of land leasing, based on the Regulations of Tender, Auction, and Listing of Leasing the Right to the Use of the State-owned Land. According to the land leasing data, there was only one piece of industrial land leased in 2003, and the data after 2015 are not complete. Thus, the data from 2004 to 2015 were used in this work to achieve a long-term perspective of government behavior on land leasing.

The data of GDP, FDI, government fiscal deficit and tenure of the district head during the period from 2004 to 2015 on the district level were collected and calculated from the Beijing District Statistical Yearbook.

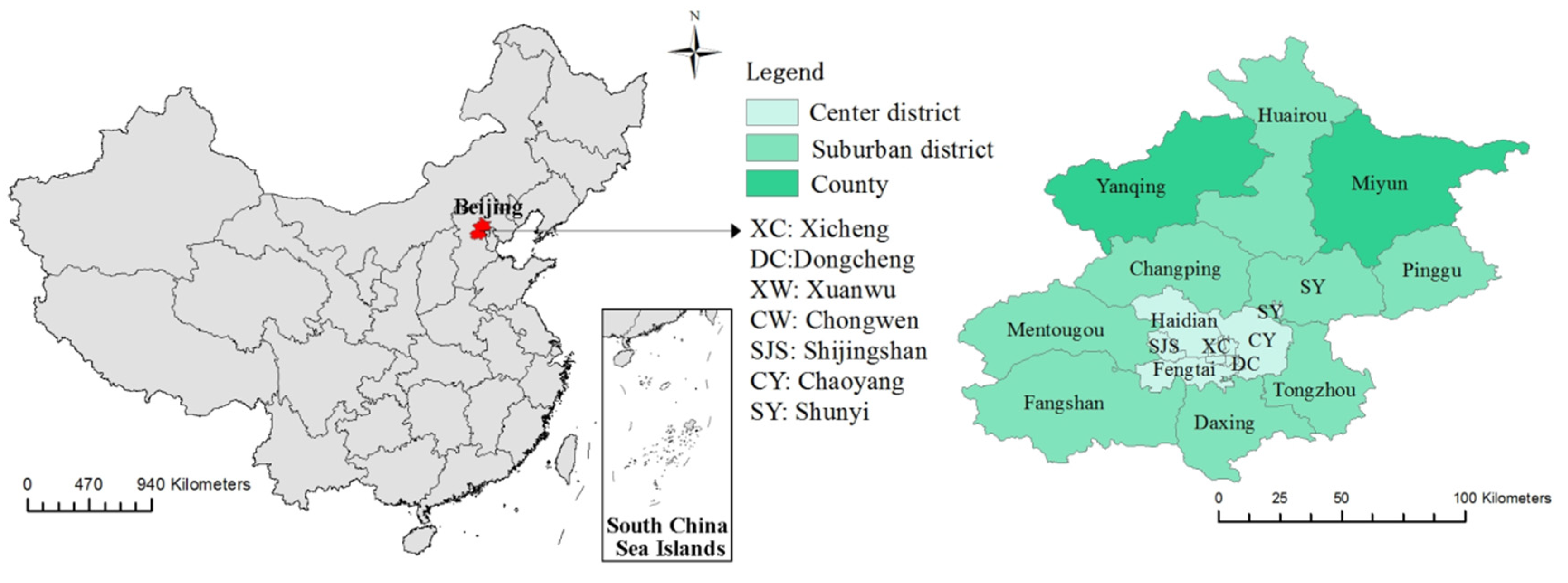

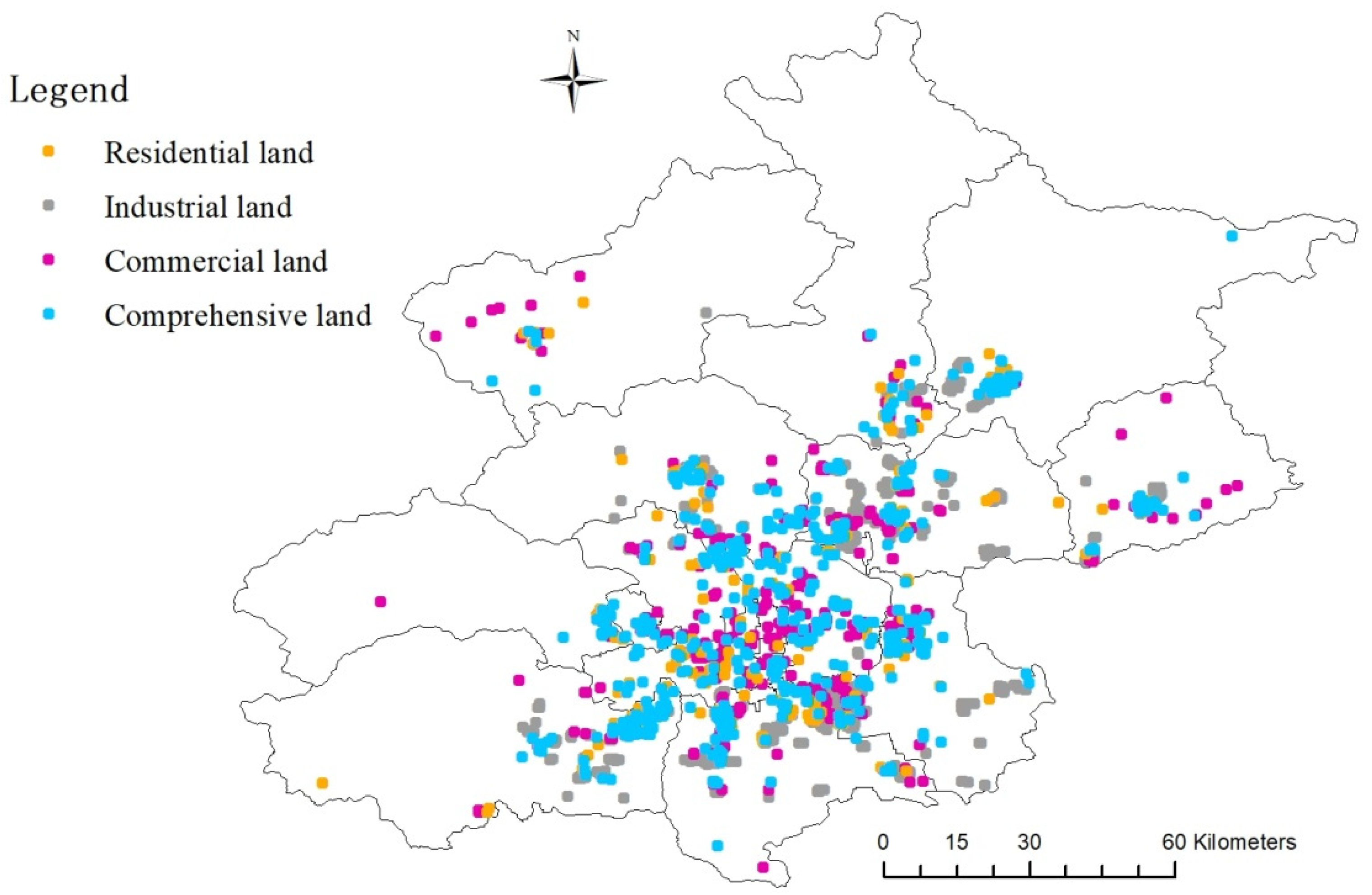

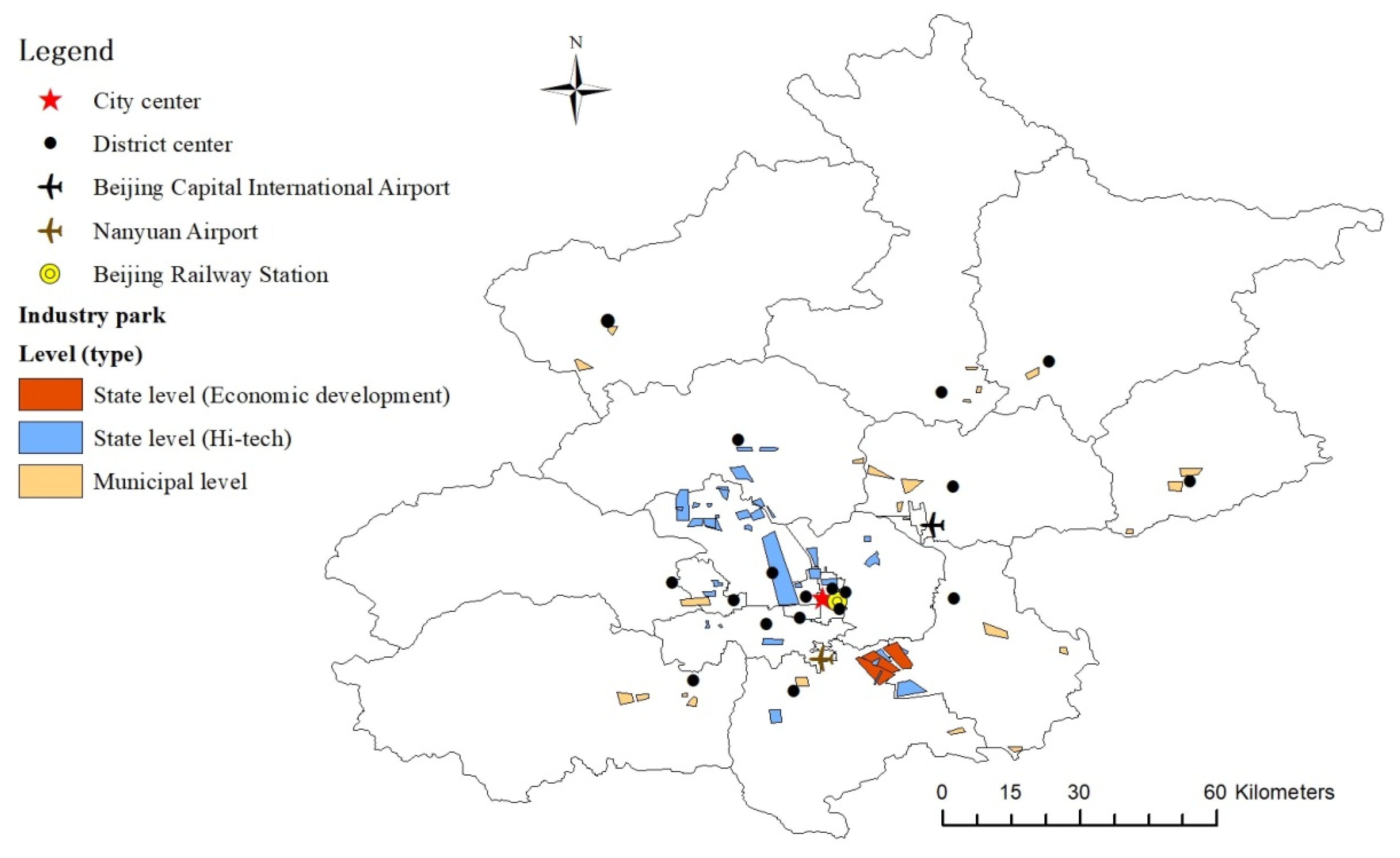

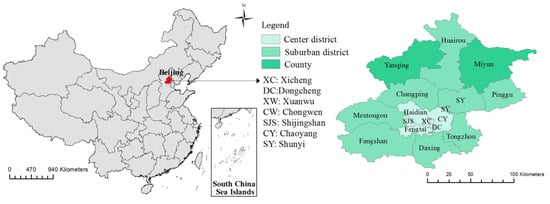

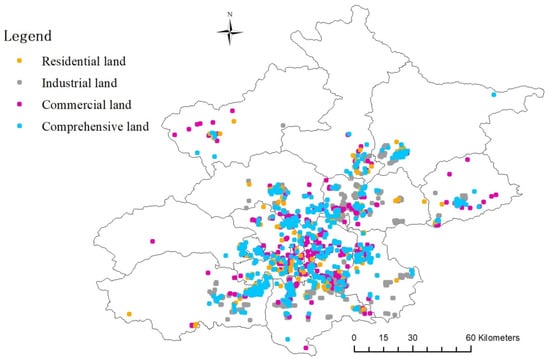

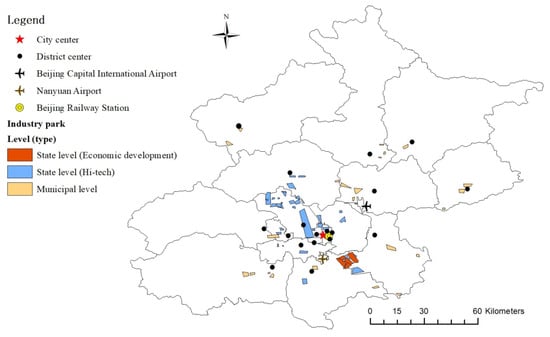

The data of the land geographical location, including the distances between every piece of land and the city center, airports, the Beijing Railway Station, the district center and the nearest industrial parks, were computed from ArcGIS, which is a geographic information system, according to each land location. Figure 2 shows the location of Beijing in China. Figure 3 shows the distribution of four types of land leased from 2004 to 2015 in Beijing. There were 1811 pieces of land leased during this period in Beijing. Figure 4 shows the locations of the city center, district center, airports, Beijing Railway Station and industrial parks in Beijing.

Figure 2.

The location of Beijing in China (Cheng, 2021a).

Figure 3.

The distribution of four types of land leased from 2004 to 2015 in Beijing.

Figure 4.

The locations of the city center, district center, airports, Beijing Railway Station and industrial parks in Beijing.

5. Mathematical Model

The multinomial logit model is extensively applied in many research areas, such as planning [46,47], transportation [48,49], marketing [50,51], education [52], accidents [53], traveling [54], etc. Xu et al. analyzed the change in cultivated land use in the Pinggu District of Beijing by using the multinomial logit model to determine the spatial driving factors affecting the change in cultivated land use [46]. Krisztin et al. proposed a Bayesian multinomial logit model to analyze the spatial pattern of urban expansion [47]. Choo and Mokhtarian explored the relationship between the factors and individual model selection, and applied the multinomial logit model based on these factors and typical demographic variables [48]. Bhat and Guo used the multinomial logit model to examine the impact of the built environment, transportation network attributes and demographic characteristics on housing selection and car ownership decisions [49]. Cao et al. presented a product family optimization model integrating supplier selection decision based on multiple logit consumer selection rules [50]. Greene and Hensher applied the multinomial logit model to the long-distance travel choice of three road types in New Zealand [51]. Breen and Jonsson applied the logit model to a large longitudinal data set in Sweden to investigate the class stratification [52]. Malyshkina and Mannering proposed a two-state Markov switching the multinomial logit model for the statistical modeling of accident injury severity [53]. Hensher compared the travel time savings based on multinomial logit and mixed logit models [54].

In this study, based on the variables discussed above, the multinomial logit model is presented to analyze the influencing factors of land leasing, and estimate and predict the probability of the district government leasing certain land use types.

Based on the variables discussed above, the multinomial logit model presented in this paper for the government behavior on leasing different land use rights in Beijing is [55]

where represents the land use types, such as residential (), industrial (), commercial () and comprehensive (), in district .

where is the leased land area, is the transaction price of the leased land, is the GDP of the district, is the FDI of the district, is the distance of the land to Tiananmen Square, is the distance of the land from the district government, is the distance of the land to Beijing Capital International Airport, is the distance of the land to Nanyuan Airport,

is the distance of the land to the Beijing Railway Station, is the distance of the land to the nearest industrial park, is the district government fiscal deficit, is the tenure of the district head and is the constant. The description and descriptive statistics of the variables in the multinomial logit model are shown in Table 1.

Table 1.

The description and descriptive statistics of the variables.

To test the assumption of the multinomial logit model, the Wald test is applied by using Stata.

The results show that the hypotheses that all variables affecting the government behavior on leasing different land use rights are simultaneously equal to zero can be rejected at the 0.01 level (chi-square = 17.66, degree of freedom = 25, < 0.01).

6. Results and Discussion

By using Stata, the regression results of the multinomial logit model of land leasing are obtained (see Table 2). In Table 2, z is z-statistics. Due to the similar characteristics of residential land, commercial land and comprehensive land uses, the result for industrial land use is regarded as the base outcome. The probability of the district government leasing certain land use types is calculated using Stata, as shown in Table 3.

Table 2.

The results of the multinomial logit model.

Table 3.

Probability of the district government leasing different land use types.

The results in Table 2 are discussed considering the features of the land, the economic development of the districts, the geographical location of the land and government finance and political tenure.

Regarding the features of the land, the land area is very significant with negative coefficients, and the transaction price of the land is very significant with positive coefficients for residential land, commercial land and comprehensive land. Compared with residential, commercial and comprehensive land, the district government prefers to lease industrial land when the area of the land is larger. Beijing is a cultural city with lots of industrial heritage of historical value, and thus the district government may pay more attention to reusing the industrial heritage based on the protection to offer more land for industrial use, which is also helpful for urban sustainable development. The higher the price of land is, the more the district government prefers to lease it as residential, commercial or comprehensive. This is mainly because residential, commercial and comprehensive land can attract more investment and generate more revenue for the government.

It is shown that both variables of the features of the land are significant. The larger the area of the land is, the more willing the district government is to lease it as industrial land. The higher the land price is, the more profits that can be obtained from leasing it as residential, commercial or comprehensive land.

Concerning the economic development of the districts, GDP is very significant with negative coefficients, and FDI is very significant with positive coefficients for the three land use types. When GDP is at a low level, the district government is likely to lease residential land, commercial land and comprehensive land to increase investment and promote the GDP of the district. The greater the FDI is, the more the district government prefers to lease residential land, commercial land and comprehensive land, which means that the government does not need FDI to improve the revenues of industry.

When the economic development of a district is poor, it is more favorable to lease residential, commercial and comprehensive land, so higher financial revenue can be obtained [22]. In order to improve the profits, the governments hope to push up the prices of commercial and residential land by controlling prices of industrial land [25]. When FDI is low, more industrial land can be leased to attract more foreign investment in order to promote economic growth [40].

Regarding the geographical location of land, the distance between the land and city center is significant for residential land, and it is insignificant for land with commercial and comprehensive purposes. The distance of land to the nearest industrial park is significant for residential land, and very significant for commercial land. The distances to the two airports are significant for three types of land. The shorter the distance of land to the city center of Beijing, the more the district government prefers to lease residential land than industrial land. The shorter the distance between the land and the nearest industrial park, the more the district government prefers to lease it as industrial land rather than residential and commercial land. Residential land approaches the city center, because there are more complete transportation, infrastructure, and resident services and amenities around the city center, and the house prices are also higher. Industrial land usually has a longer distance from the city center due to generating environmental and noise pollution; thus, industrial land is leased near industrial parks. Favorable characteristics and better accessibility (such as highways) for industrial land are around industrial parks. Compared with residential land, commercial land and comprehensive land, the district government prefers to lease industrial land near airports. It has more convenient logistics to transport products for external trade; thus, more industrial parks and high-tech industrial parks are located around airports.

It is shown that when land is located close to the city center, the district government is willing to lease residential land rather than industrial land due to the more complete infrastructures and convenient services. When land is close to industrial parks, the district government prefers to lease industrial land rather than residential land and commercial land because of the favorable characteristics and better accessibility around industrial parks. When land is close to airports, the district government tends to lease industrial land, because there are more convenient logistics systems near airports for the transportation of products.

Concerning government finance and political tenure of the district head, the government fiscal deficit is very significant for three land types. The tenure of the district head shows very significant for residential land, and significant for commercial land. When the government fiscal deficit is larger, the district government tends to lease industrial land than the other three land types. Leasing the land for industrial use can attract more foreign investment to decrease the gap of government deficit. When the tenure of the district head is shorter, the district government prefers to lease residential land, commercial land or comprehensive land rather than industrial land, which can rapidly generate revenues in the short term and achieve more sustainable development in the long term.

It is shown that when the government fiscal deficit is large, industrial land can be leased to attract more foreign investment in order to decrease this deficit. When the district head has a short term of office, he/she will lease residential, commercial or comprehensive land for short-term return [40].

From the results in Table 3, the probability of the district government leasing residential land, industrial land, commercial land and comprehensive land is 10.41%, 38.98%, 23.89% and 26.73%, respectively, which shows that the district government leases more industrial land than the other three types of land. The district government in Beijing focuses more on urban sustainable development through leasing industrial land, and it is also helpful for promoting the urban industrial development and reducing the government fiscal deficit. The district government in Beijing leases less residential land, and the reason may be that less residential land is available for leasing, and the government may prefer to focus on commercial and comprehensive land, which combines residential and commercial purposes to formulate a more integrated pattern for urban development and gain more revenues.

Thus, the government in Beijing focuses more on industrial land to achieve long-term sustainable development and attract more investment from international exchange. In addition, the comprehensive land is leased more to formulate an integrated pattern for urban development and gain more revenues.

In conclusion, it is shown that the area and price of the land; GDP; FDI; distances between the land and city center, airport and the nearest industrial park; government fiscal deficit and tenure of the district head influence the district government behavior on leasing land. In addition, the district government in Beijing focuses more on industrial land than the other three types of land in order to achieve long-term urban sustainable development, attract more international investment and reduce the government fiscal deficit.

To validate the multinomial logit model, the variable of district mayor is omitted to show the robustness of the model. The results derived from the software Stata are shown in Table 4.

Table 4.

The results of the validation of the multinomial logit model.

From Table 4, it is indicated that most variables show the same significance level as the variables in Table 2, except the distance to the Beijing Railway Station for commercial land and the distance to industrial parks for comprehensive land, which have weak effects (significant at the 10 percent level).

Moreover, the positive or negative signs of all the variables are the same as those of the variables in Table 2.

From the above analysis, the multinomial logit model in this paper is validated.

7. Conclusions and Implications

In this paper, the government behavior on leasing different types of land use rights in Beijing, China, is explored using data analysis based on the multinomial logit model. The factors affecting the leasing of different land use rights are considered as the variables in the multinomial logit model.

The results show that the land area; land price; GDP; FDI; distances between the land and city center, airport and the nearest industrial park; government fiscal deficit and tenure of the district head all influence the district government behavior on leasing land. In addition, the district government in Beijing focuses more on industrial land than other types of land in order to achieve sustainable development in the long term, attract more international investment and reduce the government fiscal deficit.

Based on our conclusions, the policy implications are presented as follows.

Firstly, the district government can lease industrial land to attract more foreign investment and reduce the deficit, especially when the district head has a longer office term, as long-run profits will be obtained and urban sustainable development will be achieved.

Secondly, more commercial land can be combined with residential purposes to be leased to formulate comprehensive communities, such as knowledge-based communities, which can encourage a more comprehensive and integrated pattern of the city.

Thirdly, the transportation infrastructures can be completed in the range of the city center and airports. More subway stations can be established near the city center to provide more accessibility to residential properties, and more highways can be built near the airports to improve the transportation of products, internal exchange and communication.

The results and implications of this paper can be referenced by other metropolises in China and other developing countries with public ownership of land. The methodology used in this paper can also be applied to investigate the government behavior on leasing land in other countries.

Author Contributions

Conceptualization, J.C.; methodology, J.C.; validation, J.C.; formal analysis, J.C.; investigation, J.C.; data curation, J.C.; writing—original draft preparation, J.C.; writing—review and editing, X.L.; supervision, X.L.; project administration, X.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

All data used during the study are available from the corresponding author by request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Cheng, J. Analysis of commercial land leasing of the district governments of Beijing in China. Land Use Policy 2021, 100, 104881. [Google Scholar] [CrossRef]

- Tian, L.; Ma, W.J. Government intervention in city development of China: A tool of land supply. Land Use Policy 2009, 26, 599–609. [Google Scholar] [CrossRef]

- Liu, Y.S.; Wang, J.Y.; Long, H.L. Analysis of arable land loss and its impact on rural sustainability in Southern Jiangsu Province of China. J. Environ. Manag. 2010, 91, 646–653. [Google Scholar] [CrossRef] [PubMed]

- Liu, Y.S.; Wang, G.G.; Zhang, F.G. Spatio-temporal dynamic patterns of rural area development in eastern coastal China. Chin. Geogr. Sci. 2013, 23, 173–181. [Google Scholar] [CrossRef]

- Kanianska, R.; Kizekova, M.; Novacek, J.; Zeman, M. Land-use and land-cover changes in rural areas during different political systems: A case study of Slovakia from 1782 to 2006. Land Use Policy 2014, 36, 554–566. [Google Scholar] [CrossRef]

- Liu, Y.S.; Yang, R.; Long, H.L.; Gao, J.; Wang, J.Y. Implications of land-use change in rural China: A case study of Yucheng, Shandong province. Land Use Policy 2014, 40, 111–118. [Google Scholar] [CrossRef]

- Yang, Y.Y.; Liu, Y.S.; Li, Y.R.; Du, G.M. Quantifying spatio-temporal patterns of urban expansion in Beijing during 1985–2013 with rural-urban development transformation. Land Use Policy 2018, 74, 220–230. [Google Scholar] [CrossRef]

- Liu, Y.S.; Fang, F.; Li, Y.H. Key issues of land use in China and implications for policy making. Land Use Policy 2014, 40, 6–12. [Google Scholar] [CrossRef]

- Cheng, J. Analyzing the factors influencing the choice of the government on leasing different types of land uses: Evidence from Shanghai of China. Land Use Policy 2020, 90, 104303. [Google Scholar] [CrossRef]

- Wang, W.; Wu, Y.Z.; Sloan, M. A framework & dynamic model for reform of residential land supply policy in urban China. Habitat Int. 2018, 82, 28–37. [Google Scholar] [CrossRef]

- Liu, Y.S.; Zhang, Z.W.; Zhou, Y. Efficiency of construction land allocation in China: An econometric analysis of panel data. Land Use Policy 2018, 74, 261–272. [Google Scholar] [CrossRef]

- Jin, W.F.; Zhou, C.S.; Zhang, G.J. Characteristics of state-owned construction land supply in Chinese cities by development stage and industry. Land Use Policy 2020, 96, 104630. [Google Scholar] [CrossRef]

- Deininger, K.; Jin, S.Q.; Nagarajan, H.K. Determinants and consequences of land sales market participation: Panel evidence from India. World Dev. 2009, 37, 410–421. [Google Scholar] [CrossRef] [Green Version]

- Wu, J.Y.; Guo, Q.; Hewings, G.J.D. Land regulating economy as a policy instrument in urban China. Cities 2019, 94, 225–234. [Google Scholar] [CrossRef]

- Zhang, H.; Zhang, Y.; Chen, T.T. Land remise income and remise price during China’s transitional period from the perspective of fiscal decentralization and economic assessment. Land Use Policy 2016, 50, 293–300. [Google Scholar] [CrossRef]

- He, C.F.; Huang, Z.J.; Wang, R. Land use change and economic growth in urban China: A structural equation analysis. Urban Stud. 2014, 51, 2880–2898. [Google Scholar] [CrossRef]

- Cao, R.F.; Zhang, A.L.; Cai, Y.Y.; Xie, X.X. How imbalanced land development affects local fiscal condition? A case study of Hubei Province, China. Land Use Policy 2020, 99, 105086. [Google Scholar] [CrossRef]

- Cai, M.N. Revenue, time horizon, and land allocation in China. Land Use Policy 2017, 62, 101–112. [Google Scholar] [CrossRef] [Green Version]

- Tao, R.; Su, F.B.; Liu, M.X.; Cao, G.Z. Land leasing and local public finance in China’s regional development: Evidence from prefecture-level cities. Urban Stud. 2010, 47, 2217–2236. [Google Scholar] [CrossRef]

- Koroso, N.H.; van der Molen, P.; Tuladhar, A.M.; Zevenbergen, J.A. Does the Chinese market for urban land use rights meet good governance principles? Land Use Policy 2013, 30, 417–426. [Google Scholar] [CrossRef]

- Chiang, T.F.; Hou, J.; Tsai, P.H. Fiscal incentives and land finance cycles of prefectures in China. World Econ. 2021. [Google Scholar] [CrossRef]

- Sun, W.Z.; Song, Z.D.; Xia, Y.H. Government-enterprise collusion and land supply structure in Chinese cities. Cities 2020, 105, 102849. [Google Scholar] [CrossRef]

- Peng, L.; Thibodeau, T.G. Government interference and the efficiency of the land market in China. J. Real Estate Financ. Econ. 2012, 45, 919–938. [Google Scholar] [CrossRef]

- Tu, F.; Yu, X.F.; Ruan, J.Q. Industrial land use efficiency under government intervention: Evidence from Hangzhou, China. Habitat Int. 2014, 43, 1–10. [Google Scholar] [CrossRef]

- Yuan, F.; Wei, Y.H.D.; Xiao, W.Y. Land marketization, fiscal decentralization, and the dynamics of urban land prices in transitional China. Land Use Policy 2019, 89, 104208. [Google Scholar] [CrossRef]

- Su, X.; Qian, Z. State intervention in land supply and its impact on real estate investment in China: Evidence from prefecture-level cities. Sustainability 2020, 12, 1019. [Google Scholar] [CrossRef] [Green Version]

- Ding, C.R. Urban spatial development in the land policy reform era: Evidence from Beijing. Urban Stud. 2004, 41, 1889–1907. [Google Scholar] [CrossRef]

- Li, L.H. The dynamics of the Shanghai land market—An intra city analysis. Cities 2011, 28, 372–380. [Google Scholar] [CrossRef] [Green Version]

- Pan, H.X.; Zhang, M. Rail transit impacts on land use: Evidence from Shanghai, China. Transp. Res. Rec. J. Transp. Res. Board 2008, 2048, 16–25. [Google Scholar] [CrossRef]

- Zhang, M.; Wang, L.L. The impacts of mass transit on land development in China: The case of Beijing. Res. Transp. Econ. 2013, 40, 124–133. [Google Scholar] [CrossRef]

- Xu, T.; Zhang, M.; Aditjandra, P.T. The impact of urban rail transit on commercial property value: New evidence from Wuhan, China. Transp. Res. Part A 2016, 91, 223–235. [Google Scholar] [CrossRef] [Green Version]

- Zheng, S.Q.; Kahn, M.E. Land and residential property markets in a booming economy: New evidence from Beijing. J. Urban Econ. 2008, 63, 743–757. [Google Scholar] [CrossRef]

- Sun, W.Z.; Zheng, S.Q.; Wang, R. The capitalization of subway access in home value: A repeat-rentals model with supply constraints in Beijing. Transp. Res. Part A 2015, 80, 104–115. [Google Scholar] [CrossRef]

- Yang, J.W.; Chen, J.X.; Le, X.H.; Zhang, Q. Density-oriented versus development oriented transit investment: Decoding metro station location selection in Shenzhen. Transp. Policy 2016, 51, 93–102. [Google Scholar] [CrossRef]

- Zheng, S.Q.; Hu, X.K.; Wang, J.H.; Wang, R. Subways near the subway: Rail transit and neighborhood catering businesses in Beijing. Transp. Policy 2016, 51, 81–92. [Google Scholar] [CrossRef]

- Zheng, S.Q.; Sun, W.Z.; Wang, R. Land supply and capitalization of public goods in housing prices: Evidence from Beijing. J. Reg. Sci. 2014, 54, 5500568. [Google Scholar] [CrossRef]

- Cheng, J. Data analysis of the factors influencing the industrial land leasing in Shanghai based on mathematical models. Math. Probl. Eng. 2020, 2020, 9346863. [Google Scholar] [CrossRef] [Green Version]

- Cheng, J. Residential land leasing and price under public land ownership. J. Urban Plan. Dev. 2021, 147, 05021009. [Google Scholar] [CrossRef]

- Ding, C.R.; Lichtenberg, E. Land and urban economic growth in China. J. Reg. Sci. 2011, 51, 299–317. [Google Scholar] [CrossRef]

- Wang, S.T.; Yang, Z.; Liu, H.Y. Impact of urban economic openness on real estate prices: Evidence from thirty-five cities in China. China Econ. Rev. 2011, 22, 42–54. [Google Scholar] [CrossRef]

- An, P.; Li, C.; Duan, Y.; Ge, J.; Feng, X. Inter-metropolitan land price characteristics and pattern in the Beijing-Tianjin-Hebei urban agglomeration, China. PLoS ONE 2021, 16, e0256710. [Google Scholar] [CrossRef] [PubMed]

- Arabsheibani, R.; Sadat, Y.K.; Abedini, A. Land suitability assessment for locating industrial parks: A hybrid multi criteria decision-making approach using Geographical Information System. Geogr. Res. 2016, 54, 446–460. [Google Scholar] [CrossRef]

- Pan, J.N.; Huang, J.T.; Chiang, T.F. Empirical study of the local government deficit, land finance and real estate markets in China. China Econ. Rev. 2015, 32, 57–67. [Google Scholar] [CrossRef]

- Wu, G.Y.L.; Feng, Q.; Li, P. Does local governments’ budget deficit push up housing prices in China? China Econ. Rev. 2015, 35, 183–196. [Google Scholar] [CrossRef] [Green Version]

- Solé-Ollé, A.; Viladecans-Marsal, E. Lobbying, political competition, and local land supply: Recent evidence from Spain. J. Public Econ. 2012, 96, 10–19. [Google Scholar] [CrossRef] [Green Version]

- Xu, Y.Q.; McNamara, P.; Wu, Y.F.; Dong, Y. An econometric analysis of changes in arable land utilization using multinomial logit model in Pinggu district, Beijing, China. J. Environ. Manag. 2013, 128, 324–334. [Google Scholar] [CrossRef]

- Krisztin, T.; Piribauer, P.; Wögerer, M. A spatial multinomial logit model for analysing urban expansion. Spat. Econ. Anal. 2021, 1–22. [Google Scholar] [CrossRef]

- Choo, S.; Mokhtarian, P.L. What type of vehicle do people drive? The role of attitude and lifestyle in influencing vehicle type choice. Transp. Res. Part A 2004, 38, 201–222. [Google Scholar] [CrossRef] [Green Version]

- Bhat, C.R.; Sen, S.; Eluru, N. The impact of demographics, built environment attributes, vehicle characteristics, and gasoline prices on household vehicle holdings and use. Transp. Res. Part B 2009, 43, 1–18. [Google Scholar] [CrossRef] [Green Version]

- Cao, Y.; Luo, X.G.; Kwong, C.K.; Fu Tang, J.F.; Zhou, W. Joint optimization of product family design and supplier selection under multinomial logit consumer choice rule. Concurr. Eng. Res. Appl. 2012, 20, 335–347. [Google Scholar] [CrossRef]

- Greene, W.H.; Hensher, D.A. A latent class model for discrete choice analysis: Contrasts with mixed logit. Transp. Res. Part B 2003, 37, 681–698. [Google Scholar] [CrossRef]

- Breen, R.; Jonsson, J.O. Analyzing educational careers: A multinomial transition model. Am. Sociol. Rev. 2000, 65, 754–772. [Google Scholar] [CrossRef]

- Malyshkina, N.V.; Mannering, F.L. Markov switching multinomial logit model: An application to accident-injury severities. Accid. Anal. Prev. 2009, 41, 829–838. [Google Scholar] [CrossRef] [Green Version]

- Hensher, D.A. The valuation of commuter travel time savings for car drivers: Evaluating alternative model specifications. Transportation 2001, 28, 101–118. [Google Scholar] [CrossRef]

- Wooldridge, J.M. Introductory Econometrics: A Modern Approach, 5th ed.; Cengage Learning: Boston, MA, USA, 2013. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).