Business Income Tax from Profit-Seeking Enterprises and Spatial Autocorrelation: Do Local Economic Characteristics Matter?

Abstract

:1. Introduction

2. Literature Review and Development of Hypotheses

2.1. Spatial Econometric Models

2.2. Development of Hypotheses

2.2.1. Regional Economic Characteristics and PSE Income Tax

2.2.2. Employed Population Structure, Industrial Structure, and PSE Income Tax

3. Materials and Methods

Setting of Spatial Econometric Model

4. Results

4.1. Summary Statistics

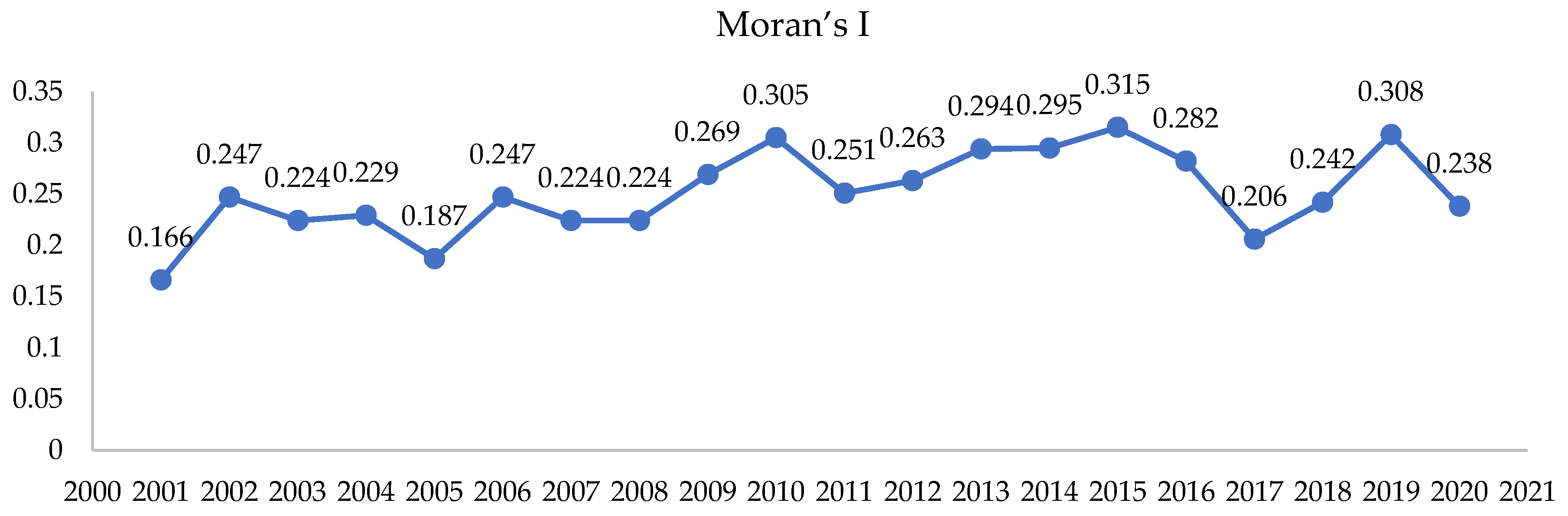

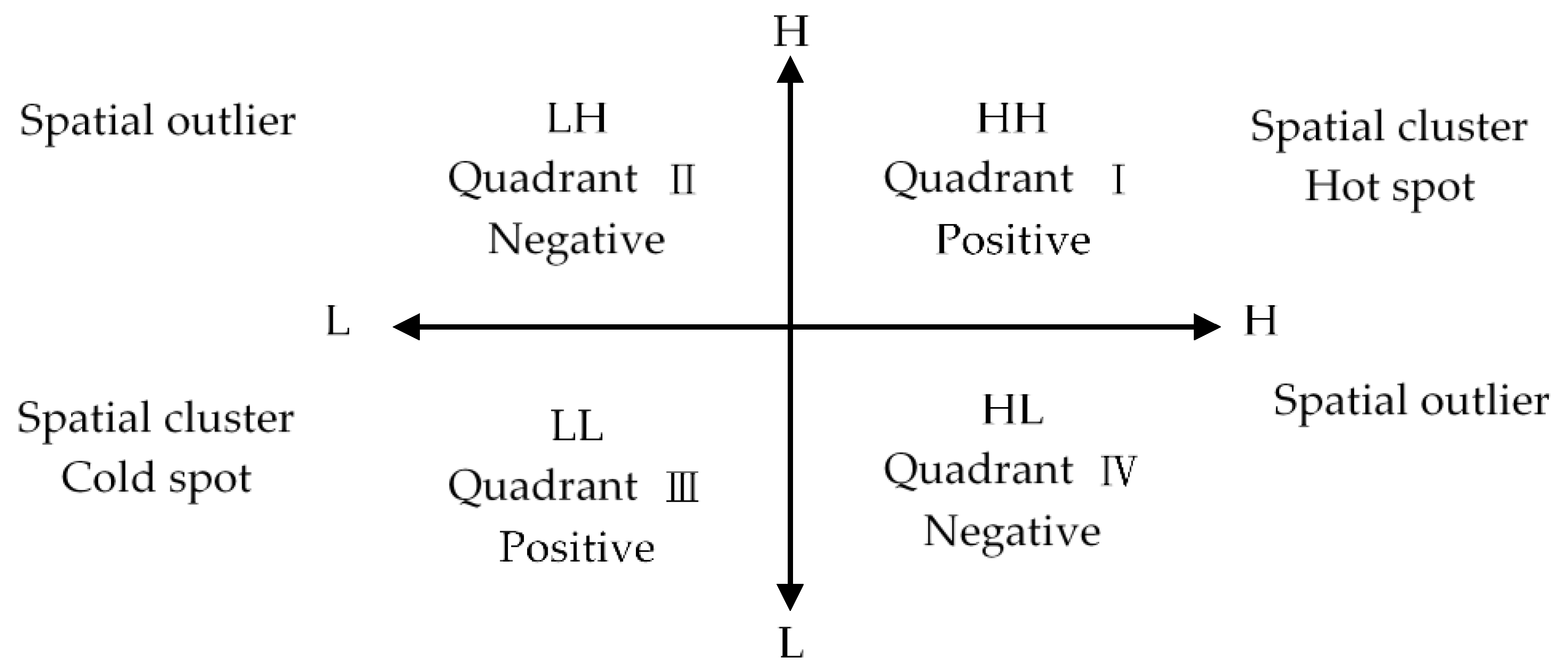

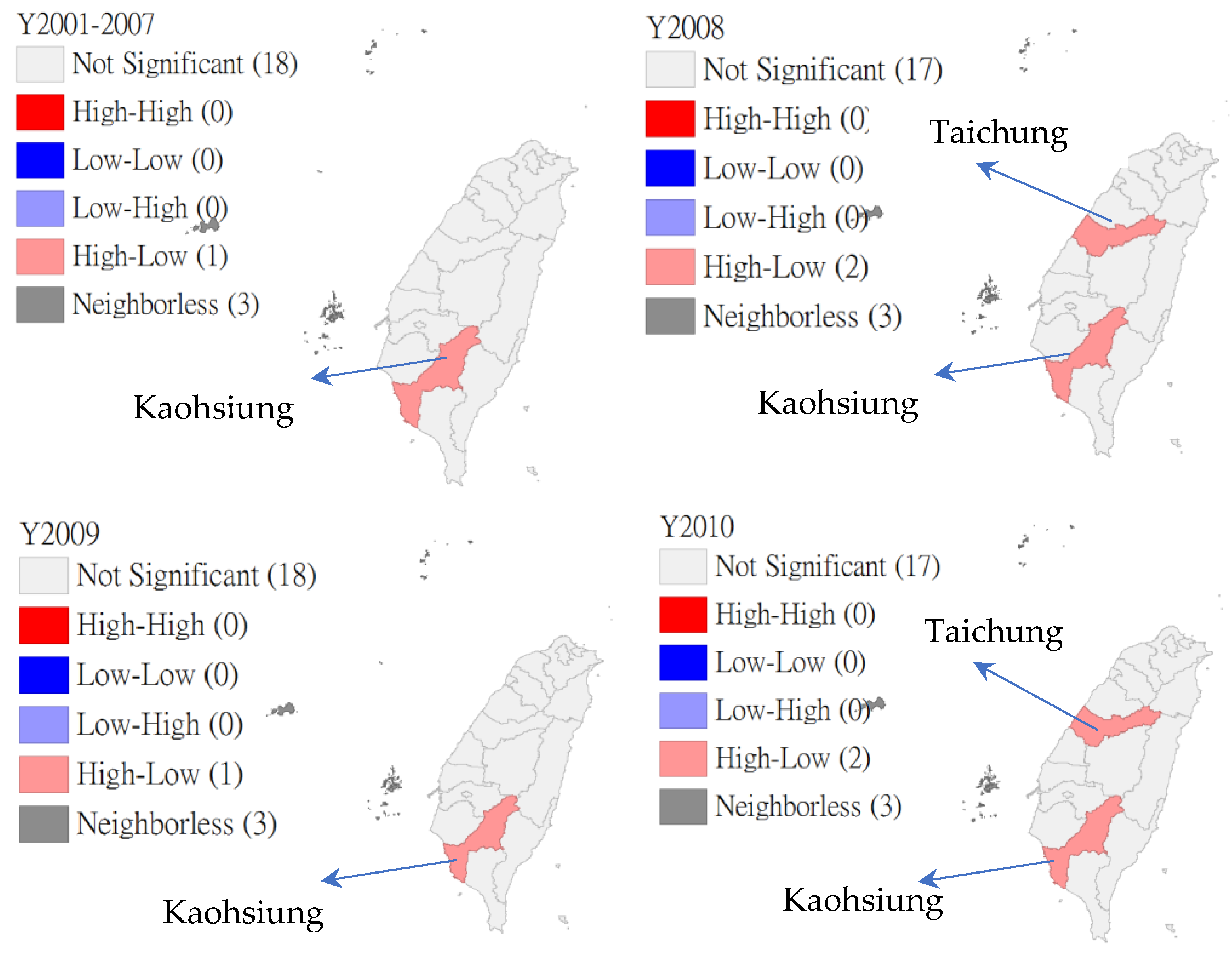

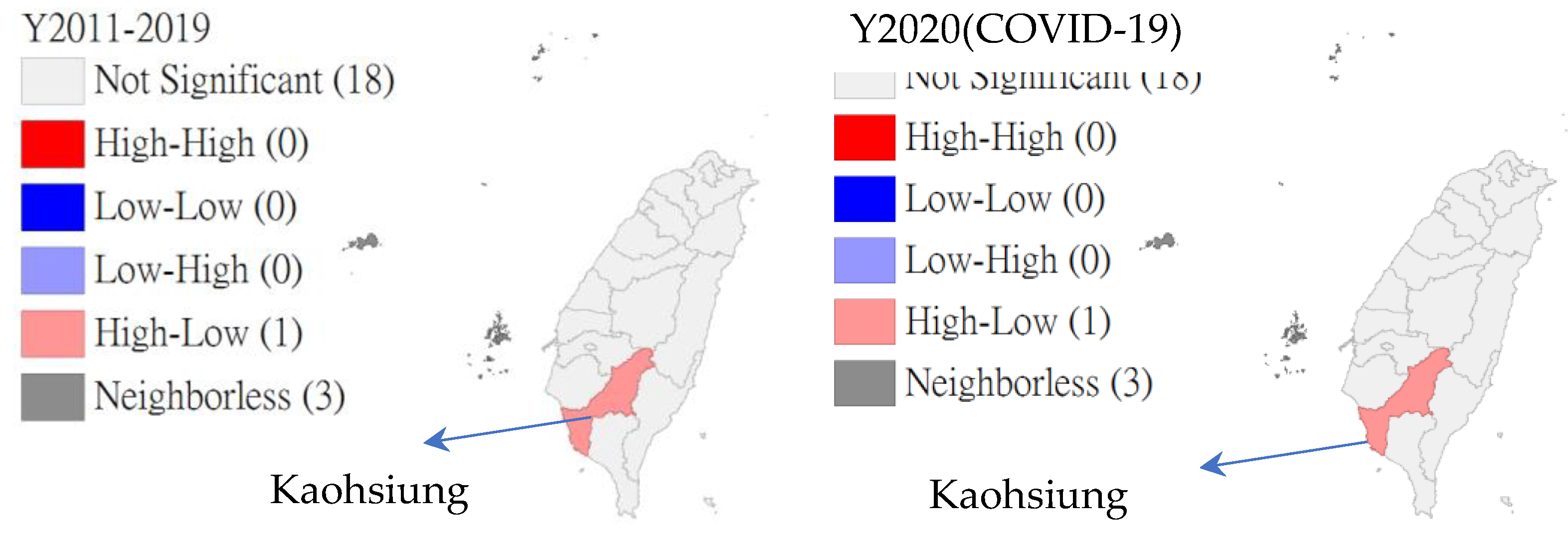

4.2. Spatial Autocorrelation Tests

4.3. Panel Unit-Root Test

4.4. Spatial Model Selection

4.5. SDMs Results

4.6. SDM, Direct, and Spillover and Spatial Fixed Effects

5. Conclusions and Implications

5.1. Conclusions

5.2. Policy Implications

5.3. Research Limitations

5.4. Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Aghion, P.; Akcigit, U.; Cagé, J.; Kerr, W.R. Taxation, corruption, and growth. Eur. Econ. Rev. 2016, 86, 24–51. [Google Scholar] [CrossRef]

- López, F.A.; Martinez-Ortiz, P.J.; Cegarra-Navarro, J.G. Spatial spillovers in public expenditure on a municipal level in Spain. Ann. Reg. Sci. 2017, 58, 39–65. [Google Scholar] [CrossRef]

- Huang, H.C.; Chu, S.H.; Peng, C.L.; Liao, T.H. The spatial spillover effect of local fiscal expenditure in regional housing market: The case of Taiwan. J. Hous. Built Environ. 2022, 37, 1339–1365. [Google Scholar] [CrossRef]

- Boarnet, M. Spillovers and the locational effects of public infrastructure. J. Reg. Sci. 1998, 38, 381–400. [Google Scholar] [CrossRef]

- Cohen, J.P.; Paul, C.J.M. Public Infrastructure Investment, Interstate Spatial Spillovers, and Manufacturing Costs. Rev. Econ. Stat. 2004, 86, 551–560. Available online: https://www.jstor.org/stable/3211646 (accessed on 22 October 2021). [CrossRef]

- LeSage, J.; Pace, R.K. Introduction to Spatial Econometrics; CRC Press, Taylor & Francis Group: New York, NY, USA, 2009. [Google Scholar] [CrossRef]

- Karkalakos, S.; Kotsogiannis, C. A Spatial Analysis of Provincial Corporate Income Tax Responses: Evidence from Canada. Can. J. Econ. 2007, 40, 782–811. Available online: http://www.jstor.org/stable/4620632 (accessed on 22 October 2021). [CrossRef]

- Rey, S.J.; Montouri, B.D. US regional income convergence: A spatial econometric perspective. Reg. Stud. 1999, 33, 143–156. [Google Scholar] [CrossRef]

- Cissé, I.; Dubé, J.; Brunelle, C. New business location: How local characteristics influence individual location decision? Ann. Reg. Sci. 2020, 64, 185–214. [Google Scholar] [CrossRef]

- Tobler, W.R. A computer movie simulating urban growth in the Detroit region. Econ. Geogr. 1970, 46, 234–240. [Google Scholar] [CrossRef]

- Cliff, A.D.; Ord, J.K. Spatial Autocorrelation; Pion: London, UK, 1973. [Google Scholar]

- Goodchild, M.F. A spatial analytical perspective on geographic information system. Int. J. Geogr. Inf. Syst. 1987, 1, 327–334. [Google Scholar] [CrossRef]

- Anselin, L. Spatial Econometrics: Methods and Models; Kluwer Academic: Dordrecht, The Netherlands, 1988. [Google Scholar] [CrossRef]

- Goodchild, M.F.; Anselin, L.; Appelbaum, R.P.; Harthorn, B.H. Toward spatially integrated social science. Int. Reg. Sci. Rev. 2000, 23, 139–159. [Google Scholar] [CrossRef]

- Schmidheiny, K. Income segregation and local progressive taxation: Empirical evidence from Switzerland. J. Public Econ. 2006, 90, 429–458. [Google Scholar] [CrossRef]

- Klemm, A.; Van Parys, S. Empirical evidence on the effects of tax incentives. Int. Tax Public Financ. 2012, 19, 393–423. [Google Scholar] [CrossRef]

- Loretz, S.; Moore, P.J. Corporate tax competition between firms. Int. Inst. Public Financ. 2013, 20, 725–752. [Google Scholar] [CrossRef]

- Kopczewska, K.; Kudła, J.; Walczyk, K.; Kruszewski, R.; Kocia, A. Spillover effects of taxes on government debt: A spatial panel approach. Policy Stud. 2016, 37, 274–293. [Google Scholar] [CrossRef]

- Cheng, X.; Pu, Y.P. Effective Tax Rates, Spatial Spillover, and Economic Growth in China: An Empirical Study Based on the Spatial Durbin Model. Ann. Econ. Financ. 2017, 18, 73–97. Available online: http://aeconf.com/Articles/May2017/aef180104.pdf (accessed on 10 July 2022).

- Qi, Y.; Peng, W.; Xiong, N.N. The effects of fiscal and tax incentives on regional innovation capability: Text extraction based on python. Mathematics 2020, 8, 1193. [Google Scholar] [CrossRef]

- Boly, A.; Coulibaly, S.; Kéré, E. Tax policy, foreign direct investment and spillover effects in Africa. J. Afr. Econ. 2020, 29, 306–331. [Google Scholar] [CrossRef]

- Liao, W.C.; Wang, X. Hedonic house prices and spatial quantile regression. J. Hous. Econ. 2012, 21, 16–27. [Google Scholar] [CrossRef]

- Tu, Y.; Sun, H.; Yu, S.M. Spatial autocorrelations and urban housing market segmentation. J. Real Estate Financ. Econ. 2007, 34, 385–406. [Google Scholar] [CrossRef]

- Elhorst, J.P.; Emili, S. A spatial econometric multivariate model of Okun’s law. Reg. Sci. Urban Econ. 2022, 93, 103756. [Google Scholar] [CrossRef]

- Li, J.; Wang, Y.; Liu, C. Spatial effect of market sentiment on housing price: Evidence from social media data in China. Int. J. Strateg. Prop. Manag. 2022, 26, 72–85. [Google Scholar] [CrossRef]

- Nanda, A.; Yeh, J.H. Spatio-temporal diffusion of residential land prices across Taipei regions. SpringerPlus 2014, 3, 505. [Google Scholar] [CrossRef] [PubMed]

- Yu, H.W.; Liao, L.Q.; Qu, S.Y.; Fang, D.B.; Luo, L.F.; Xiong, G.Q. Environmental regulation and corporate tax avoidance: A quasi-natural experiments study based on China’s new environmental protection law. J. Environ. Manag. 2021, 296, 113160. [Google Scholar] [CrossRef] [PubMed]

- Frère, Q.; Leprince, M.; Paty, S. The Impact of Intermunicipal Cooperation on Local Public Spending. Urban Stud. 2014, 51, 1741–1760. Available online: https://www.jstor.org/stable/26145822 (accessed on 10 July 2022). [CrossRef]

- Pereira, A.M.; Roca-Sagalés, O. Spillovers effects of public capital formation: Evidence from the Spanish regions. J. Urban Econ. 2003, 53, 238–256. [Google Scholar] [CrossRef]

- Kameda, T.; Namba, R.; Tsuruga, T. Decomposing local fiscal multipliers: Evidence from Japan. Jpn. World Econ. 2021, 57, 101053. [Google Scholar] [CrossRef]

- Kraftova, I.; Mateja, Z.; Prasilova, P. Economic performance: Variability of businesses within each industry and among industries. Inz. Ekon. Eng. Econ. 2011, 22, 459–467. [Google Scholar] [CrossRef]

- Simonen, J.; Svento, R.; Juutinen, A. Specialization and diversity as drivers of economic growth: Evidence from high-tech industries. Pap. Reg. Sci. 2015, 94, 229–247. [Google Scholar] [CrossRef]

- Zhao, J.F.; Tang, J.M. Industrial structure change and economic growth: A China-Russia comparison. China Econ. Rev. 2018, 47, 219–233. [Google Scholar] [CrossRef]

- Bashir, A.; Suhel, S.; Azwardi, A.; Atiyatna, D.P.; Hamidi, I.; Adnan, N. The Causality between Agriculture, Industry, and Economic Growth: Evidence from Indonesia. Etikonomi 2019, 18, 155–168. Available online: https://smartlib.umri.ac.id/assets/uploads/files/a8b8c-9428-37315-1-pb.pdf (accessed on 10 July 2022). [CrossRef]

- Fan, S.M.; Yan, J.J.; Sha, J.H. Innovation and economic growth in the mining industry: Evidence from China’s listed companies. Resour. Policy 2017, 54, 25–42. [Google Scholar] [CrossRef]

- Sawada, M. Global Spatial Autocorrelation Indices—Moran’s I, Geary’s C and the General Cross-Product Statistic; University of Ottawa: Ottawa, ON, Canada, 2004; Available online: http://www.lpc.uottawa.ca/publications/moransi/moran.htm (accessed on 22 October 2021).

- Moran, P.A.P. Notes on continuous stochastic phenomena. Biometrika 1950, 7, 17–23. [Google Scholar] [CrossRef]

- Anselin, L. Local indicators of spatial association: LISA. Geogr. Anal. 1995, 27, 93–115. [Google Scholar] [CrossRef]

- Levin, A.; Lin, C.F.; Chu, C.S.J. Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econom. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Harris, R.; Tzavalis, E. Inference for unit roots in dynamic panels where the time dimension is fixed. J. Econom. 1999, 91, 201–226. [Google Scholar] [CrossRef]

- Csíki, O.; Horváth, R.; Szász, L. A study of regional-level location factors of car manufacturing companies in the EU. Acta Oecon. 2019, 69, 13–39. [Google Scholar] [CrossRef]

- Lu, C.L.; Liao, W.C.; Peng, C.W. Developers’ perspectives on timing to build: Evidence from microdata of land acquisition and development. J. Hous. Econ. 2020, 49, 101709. [Google Scholar] [CrossRef]

- Hwang, M.; Quigley, J.M. Economic fundamentals in local housing markets: Evidence from U.S. metropolitan regions. J. Reg. Sci. 2006, 46, 425–453. [Google Scholar] [CrossRef] [Green Version]

| Variable | Definition |

|---|---|

| is the net and actually assessed business income tax from PSE of city i in year t. Business income taxes are levied from the net incomes of PSE. | |

| is the number of people on average per square kilometer of city i in year t, is calculated by dividing the number of people with household registration by the area of the land. | |

| represents expenditures related to the economic development of city i in year t, is the expenses for the city for agriculture, industry, transportation, and other economic services. | |

| is the number of companies in city i in year t with tax registration per Article 28 of Chapter 5 of the Value-added and Non-value-added Business Tax Act. | |

| is the sales of PSE in city i at year t according to tax filings or assessments. | |

| is the percentage of employees working in industrial sectors in city i in year t, is the number of employees in the industrial sectors (including mining and quarrying; manufacturing; utilities; construction) as a percentage of the total workforce (number of employees in industrial sectors/total number of employees). | |

| is the percentage of employees working in service sectors in city i in year t, is to the number of employees in the service sectors (including wholesale and retail; hotels and restaurants; transportation, warehousing and communication; finance and insurance; real estate; professional, scientific, technical and education services; health and social work activities; cultural, sport and recreational services; public administration) as a percentage of the total workforce (number of employees in service sectors/total employees). | |

| is the number of employees aged between 25 and 44/total employees in city i at year t. | |

| is the number of employees aged between 45 and 64/total employees in city i at year t. |

| Var. | Obs. | Mean | Std. Dev. | Min | 25th Perc. | Med | 75th Perc. | Max |

|---|---|---|---|---|---|---|---|---|

| NABIT | 440 | 16,579,062.6 | 32,770,355.7 | 6874.4 | 743,511.9 | 2,402,589.0 | 18,700,000.0 | 218,651,080.7 |

| PD | 440 | 1498.1 | 2165.1 | 61.2 | 304.3 | 752.1 | 1644.4 | 9951.5 |

| EED | 440 | 6588.6 | 6915.1 | 670.7 | 2303.7 | 3804.9 | 7138.7 | 36,884.3 |

| NPSE | 440 | 54,335.7 | 61,332.0 | 748.4 | 16,041.5 | 23,044.8 | 77,629.4 | 244,591.5 |

| SPSE | 440 | 1,548,995,474.7 | 2,534,559,957.5 | 1,650,626.6 | 162,000,000.0 | 399,000,000.0 | 2,070,000,000.0 | 14,085,753,950.0 |

| PEI | 440 | 32.9 | 9.8 | 14.6 | 25.0 | 31.8 | 41.2 | 52.8 |

| PES | 440 | 59.1 | 11.4 | 38.4 | 50.1 | 57.0 | 69.5 | 81.6 |

| PEY | 440 | 54.4 | 5.0 | 37.5 | 51.5 | 55.0 | 57.7 | 64.0 |

| PEM | 440 | 35.0 | 5.5 | 22.4 | 31.1 | 35.1 | 38.5 | 54.0 |

| NABIT | PD | EED | NPSE | SPSE | PEI | PES | PEY | PEM | |

|---|---|---|---|---|---|---|---|---|---|

| NABIT | 1 | ||||||||

| PD | 0.783 *** | 1 | |||||||

| EED | 0.713 *** | 0.410 *** | 1 | ||||||

| NPSE | 0.775 *** | 0.477 *** | 0.886 *** | 1 | |||||

| SPSE | 0.963 *** | 0.760 *** | 0.770 *** | 0.857 *** | 1 | ||||

| PEI | −0.056 | −0.192 *** | 0.089 | 0.173 *** | −0.008 | 1 | |||

| PES | 0.297 *** | 0.488 *** | 0.108 * | 0.110 * | 0.262 *** | −0.745 *** | 1 | ||

| PEY | 0.124 ** | 0.233 *** | 0.056 | 0.200 *** | 0.166 *** | 0.389 *** | −0.111 * | 1 | |

| PEM | 0.042 | −0.034 | 0.049 | −0.080 | −0.006 | −0.463 *** | 0.376 *** | −0.907 *** | 1 |

| Unit Root Test | Stat. | p-Value |

|---|---|---|

| Levin-Lin-Chu unit-root test H0: Panels contain unit roots | ||

| Unadjusted t | −6.104 | |

| Adjusted t* | −2.310 | 0.014 |

| Harris-Tzavalis unit-root test H0: Panels contain unit roots | ||

| Rho | 0.793 | 0.022 |

| , is the error term. | ||||||

| Var. | Model 1 SAR with spatial fixed effects | Model 2 SAR with spatial and time fixed effects | Model 3 SAR with random effects | |||

| Coef. | Std. Err. | Coef. | Std. Err. | Coef. | Std. Err. | |

| PD | 0.001 ** | 0.000 | 0.001 * | 0.000 | 0.000 | 0.000 |

| lnEED | 0.047 | 0.044 | 0.016 | 0.044 | 0.031 | 0.050 |

| lnNPSE | 0.383 * | 0.187 | −0.122 | 0.239 | 0.163 | 0.149 |

| lnSPSE | 0.986 *** | 0.119 | 0.917 *** | 0.131 | 0.930 *** | 0.114 |

| PEI | 0.018 | 0.015 | −0.002 | 0.015 | 0.026 ** | 0.010 |

| PES | 0.011 | 0.013 | 0.006 | 0.013 | 0.019 * | 0.009 |

| PEY | 0.014 | 0.013 | 0.099 *** | 0.016 | 0.029 * | 0.014 |

| PEM | −0.027 * | 0.013 | 0.040 | 0.022 | 0.034 * | 0.013 |

| Constant | −10.968 *** | 1.301 | ||||

| n | 440 | 440 | 440 | |||

| 0.399 *** | 0.041 | 0.096 | 0.059 | 0.045 * | 0.022 | |

| within R2 | 0.644 | 0.338 | 0.603 | |||

| between R2 | 0.743 | 0.843 | 0.983 | |||

| overall R2 | 0.713 | 0.812 | 0.963 | |||

| Log-likelihood | −80.155 | −41.872 | −166.972 | |||

| Wald test | = 64.30 *** p-value = 0.000 | = 74.17 *** p-value = 0.000 | = 117.24 *** p-value = 0.000 | |||

| Likelihood-ratio test | = 60.85 *** p-value = 0.000 | = 74.03 *** p-value = 0.000 | = 110.33 *** p-value = 0.000 | |||

is the error term. is the error term of spatial autocorrelation. | ||||||

| Var. | Model 4 SEM with spatial fixed effects | Model 5 SEM with spatial and time fixed effects | Model 6 SEM with random effects | |||

| Coef. | Std. Err. | Coef. | Std. Err. | Coef. | Std. Err. | |

| PD | 0.001 ** | 0.000 | 0.001 * | 0.000 | 0.000 | 0.000 |

| lnEED | 0.036 | 0.042 | 0.009 | 0.042 | 0.061 | 0.044 |

| lnNPSE | 0.295 | 0.192 | −0.087 | 0.231 | −0.033 | 0.106 |

| lnSPSE | 1.036 *** | 0.120 | 0.942 *** | 0.127 | 1.095 *** | 0.078 |

| PEI | 0.012 | 0.015 | 0.000 | 0.015 | 0.012 | 0.008 |

| PES | 0.007 | 0.013 | 0.005 | 0.013 | 0.003 | 0.007 |

| PEY | 0.047 ** | 0.015 | 0.095 *** | 0.015 | 0.049 ** | 0.015 |

| PEM | 0.014 | 0.016 | 0.041 * | 0.021 | 0.030 * | 0.015 |

| Constant | −11.400 *** | 1.412 | ||||

| n | 440 | 440 | 440 | |||

| 0.513 *** | 0.057 | 0.064 | 0.065 | 0.479 *** | 0.053 | |

| within R2 | 0.593 | 0.340 | 0.584 | |||

| between R2 | 0.840 | 0.796 | 0.990 | |||

| overall R2 | 0.819 | 0.770 | 0.966 | |||

| Log-likelihood | −88.290 | −40.610 | −138.804 | |||

| Wald test | = 67.76 *** p-value = 0.000 | = 78.60 *** p-value = 0.000 | = 120.94 *** p-value = 0.000 | |||

| Likelihood-ratio test | = 77.12 *** p-value = 0.000 | = 71.51 *** p-value = 0.000 | = 54.00 *** p-value = 0.000 | |||

is the error term. is the error term of spatial autocorrelation. | ||||||

| Var. | Model 7 SDM with spatial fixed effects | Model 8 SDM with spatial and time fixed effects | Model 9 SDM with random effects | |||

| Coef. | Std. Err. | Coef. | Std. Err. | Coef. | Std. Err. | |

| PD | 0.001 * | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| lnEED | 0.024 | 0.042 | 0.033 | 0.040 | 0.034 | 0.043 |

| lnNPSE | 0.171 | 0.189 | 0.510 * | 0.237 | 0.019 | 0.121 |

| lnSPSE | 0.866 *** | 0.120 | 1.067 *** | 0.125 | 1.027 *** | 0.091 |

| PEI | 0.021 | 0.015 | 0.018 | 0.015 | 0.017 | 0.011 |

| PES | 0.003 | 0.013 | −0.004 | 0.013 | 0.002 | 0.010 |

| PEY | 0.017 | 0.016 | 0.016 | 0.017 | 0.030 * | 0.015 |

| PEM | −0.029 | 0.018 | −0.004 | 0.021 | −0.014 | 0.016 |

| W × PD | −0.001 * | 0.000 | −0.001 * | 0.000 | 0.000 | 0.000 |

| W × lnEED | −0.078 | 0.062 | 0.002 | 0.062 | −0.021 | 0.064 |

| W × lnNPSE | 1.865 *** | 0.465 | 2.065 *** | 0.555 | 0.457 | 0.257 |

| W × lnSPSE | −0.310 | 0.221 | 0.246 | 0.254 | −0.444 * | 0.173 |

| W ×PEI | 0.038 | 0.021 | 0.020 | 0.021 | 0.032 * | 0.015 |

| W × PES | 0.032 | 0.021 | 0.007 | 0.021 | 0.030 * | 0.015 |

| W × PEY | −0.023 | 0.026 | −0.011 | 0.030 | −0.062 ** | 0.019 |

| W × PEM | −0.029 | 0.026 | −0.012 | 0.035 | −0.010 | 0.023 |

| Constant | −7.664 *** | 1.551 | ||||

| n | 440 | 440 | 440 | |||

| 0.328 *** | 0.055 | 0.035 | 0.075 | 0.340 *** | 0.050 | |

| within R2 | 0.704 | 0.672 | 0.675 | |||

| between R2 | 0.646 | 0.672 | 0.981 | |||

| overall R2 | 0.621 | 0.651 | 0.964 | |||

| Log-likelihood | −49.728 | −4.855 | −111.805 | |||

| AIC | 135.457 | 45.710 | 263.611 | |||

| BIC | 209.019 | 119.272 | 345.346 | |||

| 18.62 * | 15.29 | |||||

| Hausman p-value | 0.0170 | 0.0537 | ||||

| Variables | Direct Effect | Indirect Effect | Total Effect | |||

|---|---|---|---|---|---|---|

| Coef. | Std. Err. | Coef. | Std. Err. | Coef. | Std. Err. | |

| PD | 0.001 | 0.000 | −0.001 | 0.001 | 0.000 | 0.001 |

| lnEED | 0.017 | 0.042 | −0.082 | 0.077 | −0.066 | 0.097 |

| lnNPSE | 0.341 | 0.199 | 2.290 *** | 0.563 | 2.631 *** | 0.678 |

| lnSPSE | 0.858 *** | 0.116 | −0.017 | 0.270 | 0.841 ** | 0.314 |

| PEI | 0.025 | 0.015 | 0.054 * | 0.024 | 0.079 * | 0.032 |

| PES | 0.006 | 0.014 | 0.041 | 0.026 | 0.047 | 0.033 |

| PEY | 0.016 | 0.016 | −0.023 | 0.030 | −0.007 | 0.031 |

| PEM | −0.032 | 0.018 | −0.049 | 0.030 | −0.081 ** | 0.030 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Huang, H.-C.; Hung, C.-F.; Peng, C.-L.; Liao, T.-H. Business Income Tax from Profit-Seeking Enterprises and Spatial Autocorrelation: Do Local Economic Characteristics Matter? Land 2022, 11, 1533. https://doi.org/10.3390/land11091533

Huang H-C, Hung C-F, Peng C-L, Liao T-H. Business Income Tax from Profit-Seeking Enterprises and Spatial Autocorrelation: Do Local Economic Characteristics Matter? Land. 2022; 11(9):1533. https://doi.org/10.3390/land11091533

Chicago/Turabian StyleHuang, Hao-Chen, Chin-Fu Hung, Chi-Lu Peng, and Ting-Hsiu Liao. 2022. "Business Income Tax from Profit-Seeking Enterprises and Spatial Autocorrelation: Do Local Economic Characteristics Matter?" Land 11, no. 9: 1533. https://doi.org/10.3390/land11091533

APA StyleHuang, H.-C., Hung, C.-F., Peng, C.-L., & Liao, T.-H. (2022). Business Income Tax from Profit-Seeking Enterprises and Spatial Autocorrelation: Do Local Economic Characteristics Matter? Land, 11(9), 1533. https://doi.org/10.3390/land11091533