Does the Carbon Emissions Trading Pilot Policy Have a Demonstrated Impact on Advancing Low-Carbon Technology? Evidence from a Case Study in Beijing, China

Abstract

:1. Introduction

2. Literature Review and Mechanism Analysis

2.1. Research Background of Domestic and Foreign Carbon Markets

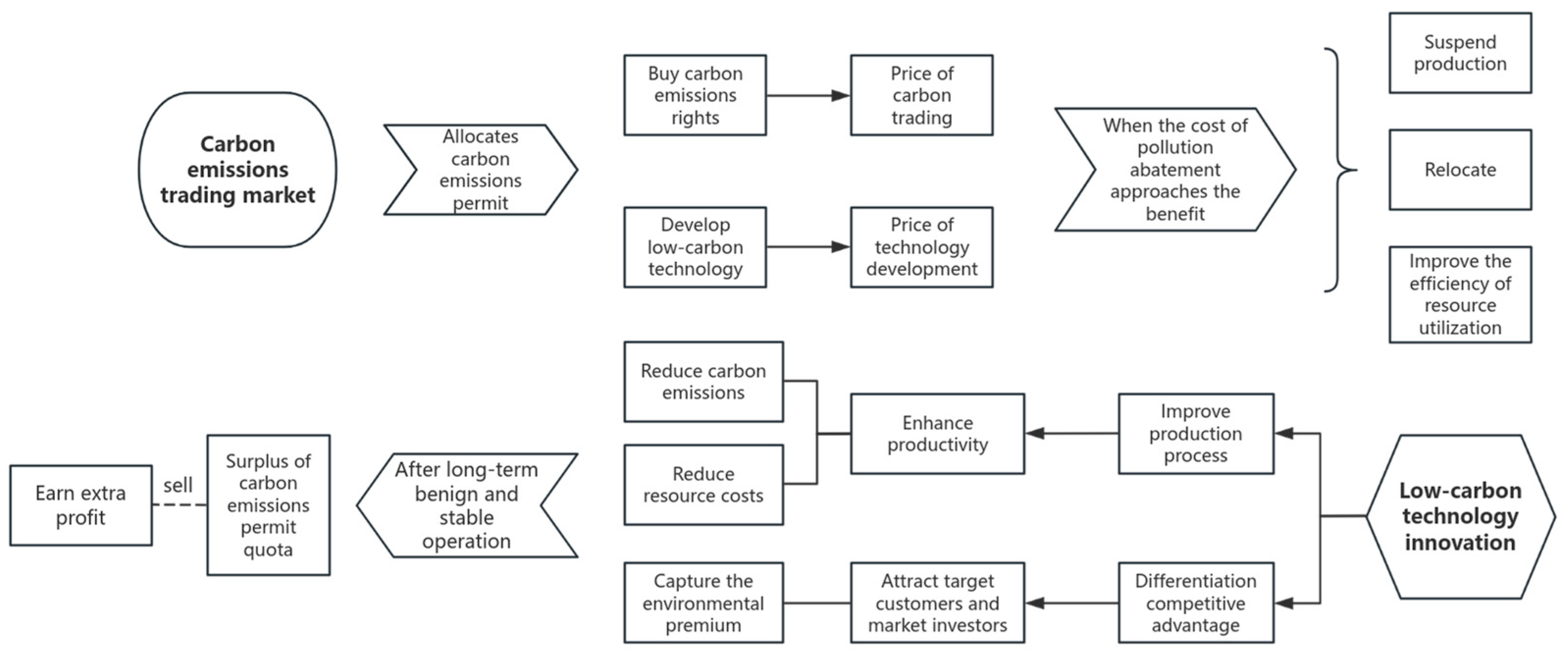

2.2. Derivation of Economic Theory

3. Methodology and Data

3.1. Assumptions

3.2. Description of Study Area

3.3. Synthetic Control Method

3.4. Selection of Variables

- (1)

- The explained variable is low-carbon technology innovation (Y02). It is believed that patent licensing standards have stability, objectivity and availability of relevant data [6]; the number of patents is a very reliable indicator and can better reflect the innovation level of a region. This study uses the Y02 classification under the Cooperative Patent Classification Method (CPC) in the IncoPat patent database to express low-carbon technological innovation [5,6]. Advanced search instructions ((AD = [20030101 TO 20201231]) AND (CPC = (Y02) AND ((PNC = “CN”)))) are used to screen the applicable conditions, in which the country and address of the applicant are all China, excluding patents applied by foreigners in China.

- (2)

- The control variables are the level of economic development, industrial structure, foreign direct investment, research and development capital and government intervention. In order to reduce heteroscedasticity, the non-dummy variables in the form of non-ratios are log-transformed. The indicators in RMB are all deflated by price indices using 2004 (the first year of study interval) as the base period.

3.5. Data Resource

4. Results

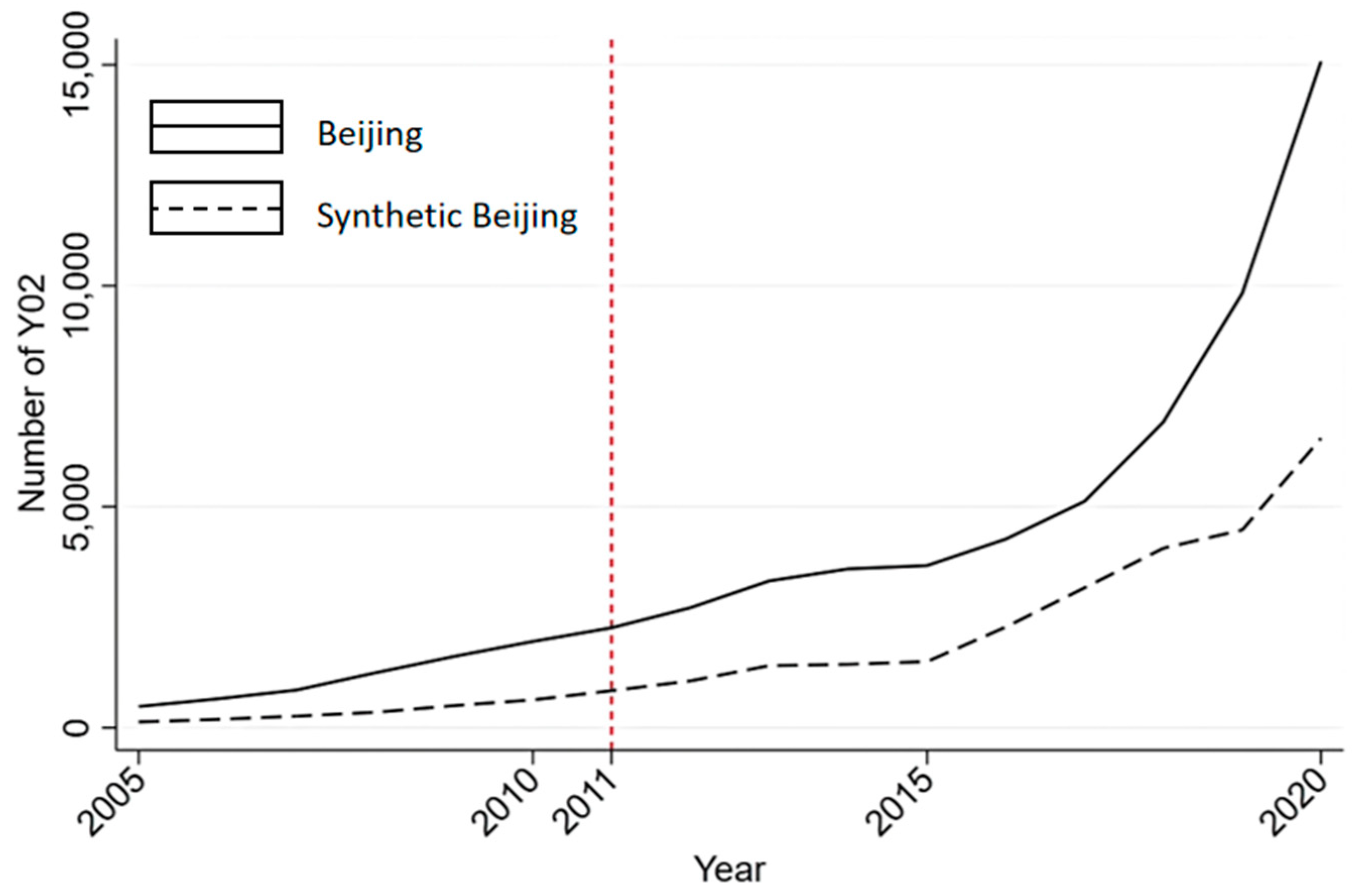

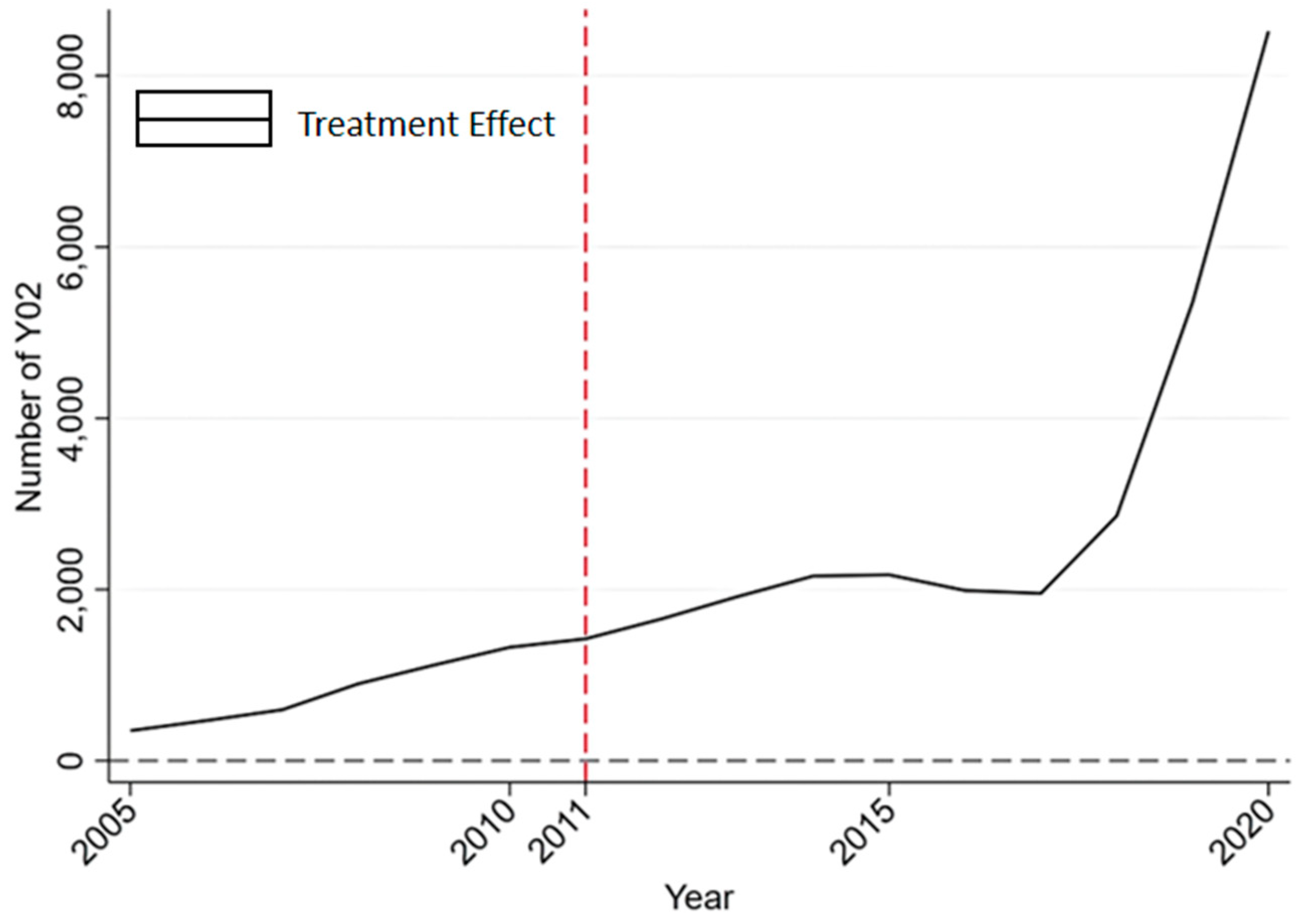

4.1. Empirical Analysis

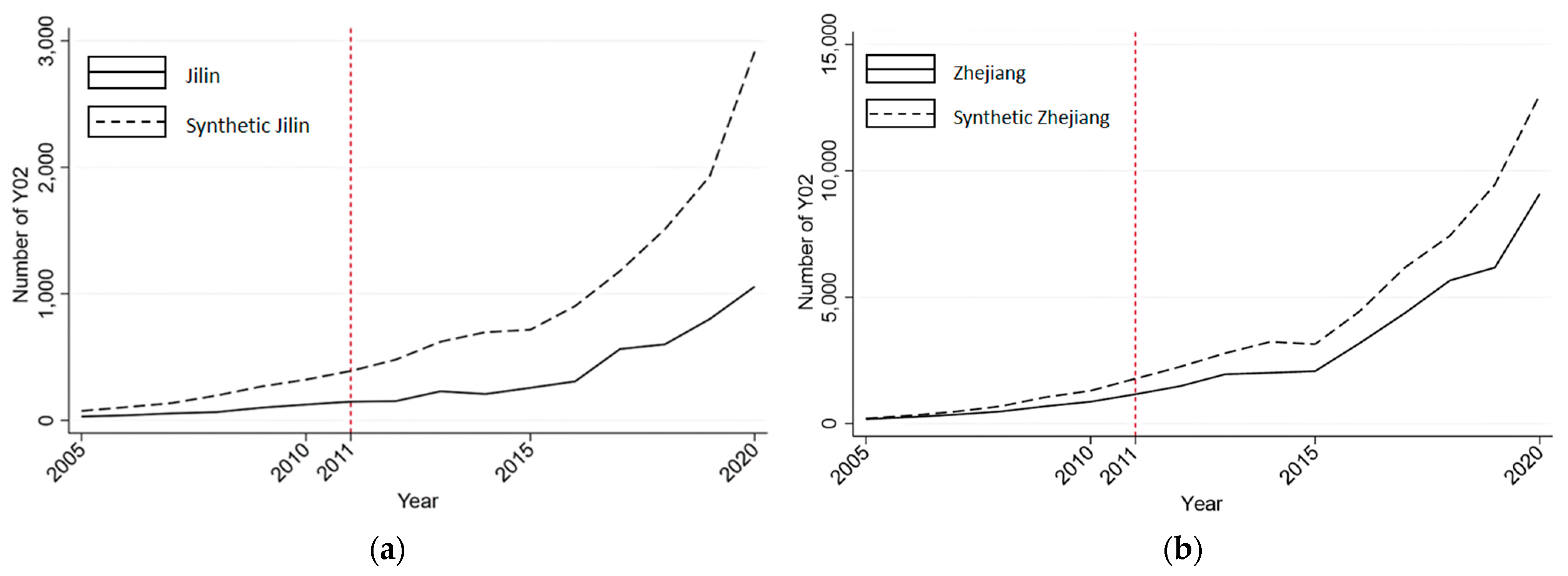

4.2. Robustness Tests

4.2.1. Placebo Test

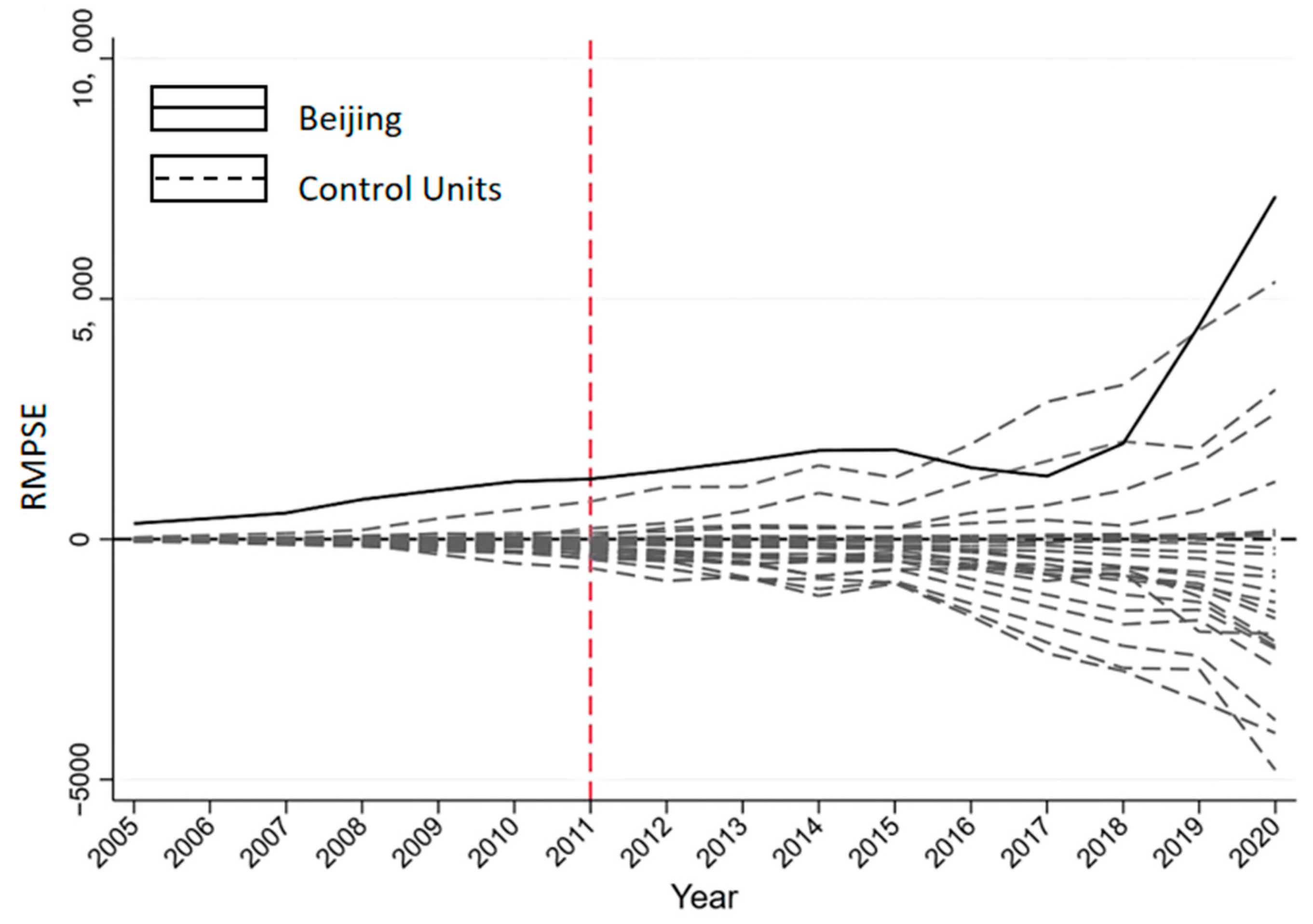

4.2.2. Permutation Test

5. Discussion

- (1)

- The implementation of the carbon emissions trading pilot policy in Beijing has promoted the level of low-carbon technology innovation in the area. In 2011, as the first carbon trading pilot city in China, Beijing set a leading example in promoting low-carbon technology and advocating environmental protection awareness. The number of low-carbon patents increased year by year; in particular, patents related to climate change adaptation, greenhouse gas capture and traffic pressure relief all ranked among the top in China.

- (2)

- The impact of the pilot policy has a certain time lag. At the beginning of implementation, which is from 2011 to 2015, the level of low-carbon technology innovation in Beijing improved slowly, which was related to the fact that relevant enterprises needed time to adapt to the new policy. In the initial policy response stage, it takes a period of response time to improve backward production equipment or implement efficient low-carbon technology.

- (3)

- The effects of the carbon trading pilot policy are vulnerable to the affects from both domestic and foreign carbon markets. By 2015, China had completed the pilot work of opening up seven pilot areas and gradually increased the number of pilot areas such as Fujian and Sichuan Provinces. In addition, during this period, the global financial crisis continued, and the future of the Kyoto Protocol was uncertain. All these factors made low-carbon technology innovation in the early stage of Beijing’s pilot policy relatively sluggish.

6. Conclusions

- Strengthen the construction of the national carbon emissions trading market and promote the application of low-carbon technology. Cultivate more professional talents and market entities to stimulate innovation vitality; it is also particularly important to issue appropriate policy subsidies to exert the government’s macro-control.

- Promote coordination and cooperation amongst various regions. Take Beijing and other areas with high levels of low-carbon technology innovation as examples to promote exchanges of experience and industrial coordination. The carbon market is essentially the redistribution of carbon emissions property rights, so regions should negotiate voluntarily and allocate effectively on the basis of clear property rights to improve the liquidity of the carbon emissions trading market [42].

- Strengthen the management of policy signals. Improving the response efficiency of the carbon emissions trading market through an open and fair carbon trading platform.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Gao, C.; Du, Y.; Zhao, Y.; Jia, Y.; Wu, J. Response of Low Carbon Level to Transportation Efficiency in Megacities: A Case Study of Beijing, China. Land 2024, 13, 1033. [Google Scholar] [CrossRef]

- Hong, C.; Burney, J.A.; Pongratz, J.; Nabel, J.E.M.S.; Mueller, N.D.; Jackson, R.B.; Davis, S.J. Global and regional drivers of land-use emissions in 1961–2017. Nature 2021, 589, 554–561. [Google Scholar] [CrossRef]

- He, Y.N. Impact and mechanism of carbon trading market on firms’ innovation strategies. China Popul. Resour. Environ. 2022, 32, 37–48. [Google Scholar]

- Geng, W.X.; Fan, Y. Does a carbon trading policy contribute to energy intensity reduction?–evidence from the Hubei carbon trading pilot. China Popul. Resour. Environ. 2021, 31, 103–104. [Google Scholar]

- Cao, X.; Su, X.E. Has the carbon emissions trading pilot policy promoted carbon neutrality technology innovation? China Popul. Resour. Environ. 2023, 33, 94–104. [Google Scholar]

- Wang, W.D.; Wang, D.; Lu, N. Research on the impact mechanism of carbon emissions trading on low-carbon innovation in China. China Popul. Resour. Environ. 2020, 30, 41–48. [Google Scholar]

- Yu, X.Y.; Chen, H.Y.; Li, Y. Impact of carbon emission trading mechanism on carbon performance based on synthetic control method. China Popul. Resour. Environ. 2021, 31, 51–61. [Google Scholar]

- Tan, J.; Zhang, J.H. Does China’s ETS Force the Upgrade of Industrial Structure—Evidence from Synthetic Control Method. Res. Econ. Manag. 2018, 39, 104–119. [Google Scholar]

- Lu, N.; Wang, W.D.; Wang, M.; Zhang, C.J.; Lu, H.L. Breakthrough low-carbon technology innovation and carbon emissions: Direct and spatial spillover effect. China Popul. Resour. Environ. 2019, 29, 30–39. [Google Scholar]

- Borghesi, S.; Cainelli, G.; Mazzanti, M. Linking emission trading to environmental innovation: Evidence from the Italian manufacturing industry. Res. Policy 2015, 44, 669–683. [Google Scholar] [CrossRef]

- Eskander, S.M.S.U.; Fankhauser, S. The Impact of Climate Legislation on Trade-Related Carbon Emissions 1996–2018. Environ. Resour. Econ. 2023, 85, 167–194. [Google Scholar] [CrossRef]

- Haites, E.; Bertoldi, P.; Koenig, M.; Bataille, C.; Creutzig, F.; Dasgupta, D.; Can, S.d.l.R.d.; Khennas, S.; Kim, Y.-G.; Nilsson, L.J.; et al. Contrib. Carbon Pricing Meet. A Mid-Century Net Zero Target. Clim. Policy 2024, 24, 1–12. [Google Scholar] [CrossRef]

- Beccarello, M.; Di Foggia, G. Carbon Emissions 1996–2018 Emissions trading system: Bridging the gap between environmental targets and fair competition. Environ. Res. Commun. 2023, 5, e085009. [Google Scholar]

- Anderson, H.M.; Gao, J.T.; Turnip, G.; Vahid, F.; Wei, W. Estimating the Effect of an EU-ETS Type Scheme in Australia Using a Synthetic Treatment Approach. Energy Econ. 2023, 125, 106789. [Google Scholar] [CrossRef]

- Zhang, X.F. Carbon Market Liquidity and Regional Low-carbon Economic Transition: An Analysis of Dual Mediation Effect Based on Low-carbon Technology Innovation. J. Nanjing Univ. Financ. Econ. 2021, 6, 88–98. [Google Scholar]

- Fang, J.C.; Zeng, L.; Zhang, X.L. Can Carbon Emission Trading promote the Low-carbon Transformation of the Regional Energy Structure? Lanzhou Acad. J. 2024, 6, 52–64. [Google Scholar]

- Yu, P.; Liu, J.X. Research the Effects of Carbon Trading Market Size on Environment and Economic Growth. China Soft Sci. 2020, 4, 46–55. [Google Scholar]

- Chai, S.L.; Sun, R.X.; Zhang, K.; Ding, Y.T.; Wei, W. Is Emissions Trading Scheme (ETS) an Effective Market-Incentivized Environmental Regulation Policy? Evidence from China’s Eight ETS Pilots. Int. J. Environ. Res. Public Health 2022, 19, 3177. [Google Scholar] [CrossRef]

- Jia, Y.B. Does carbon emissions trading affect economic growth? Macroeconomics 2017, 12, 72–81. [Google Scholar]

- Wang, B.; Xu, P.Y. Carbon Pricing, Dual Financial Friction and Dual Pillar Regulation. J. Financ. Res. 2021, 12, 57–74. [Google Scholar]

- Huang, Y.; Liu, L.; Ma, X.; Pan, X. Abatement technology investment and emissions trading system: A case of coal-fired power industry of Shenzhen, China. Clean Technol. Environ. Policy 2015, 17, 811–817. [Google Scholar] [CrossRef]

- Yang, J.Q.; Qi, J.Y. Economic consequences and mechanism of China’s carbon trading policy-a literature review. J. Intell. Soc. 2023, 2, 63–92. [Google Scholar]

- Li, H.; Zhao, Y.H.; Wang, S.; Lin, J.; Cao, Y.; Shi, Q.; Liu, Y.; Xiao, Y.; Li, J. Scenario Analysis of ETS Revenue Allocation Mechanism of China: Based on A Dynamic CGE Model. Environ. Sci. Pollut. Res. 2019, 26, 27971–27986. [Google Scholar] [CrossRef]

- Porter, M.E.; van der Linde, C. Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Hu, H.R.; Song, Y.Q. Market-motivated Environmental Regulation and Enterprise Risk-taking: A Case Study of Carbon Emissions Trading Pilot Policy. Mod. Econ. Sci. 2024, 46, 1–16. [Google Scholar]

- Wang, G.Y.; Wang, D. Porter Hypothesis, Environmental Regulation and Enterprises’ Technological Innovation--The Comparative Analysis between Central China and Eastern China. China Soft Sci. 2011, 1, 100–112. [Google Scholar]

- Yuan, Y.J.; Xie, R.H. Environmental Regulation and the‘Green’ Productivity Growth of China’s Industry. China Soft Sci. 2016, 7, 144–154. [Google Scholar]

- Lu, J.; Wang, X.F. The impact of low-carbon pilot policies on technological innovation in Chinese cities. J. China Univ. Geosci. Soc. Sci. Ed. 2019, 19, 128–141. [Google Scholar]

- Liu, Y.H.; Li, Y.H.; Wang, W.T. Challenges, opportunities and actions for China to achieve the targets of carbon peak and carbon neutrality. China Popul. Resour. Environ. 2021, 31, 1–5. [Google Scholar]

- Wang, W.D.; Lu, N.; Zhang, C.J. Low-carbon technology innovation responding to climate change based on perspective of spatial spillover effect. China Popul. Resour. Environ. 2018, 28, 22–30. [Google Scholar]

- Ma, Z.L.; Jin, Z.C. Research on the impact of carbon emission trading policies on green technology innovation. J. Jiangsu Ocean Univ. Humanit. Soc. Sci. Ed. 2024, 22, 110–122. [Google Scholar]

- Wu, Q.; Tambunlertchai, K.; Pomchaiwiseskul, P. Examining the Impact and Influencing Channels of Carbon Emission Trading Pilot Markets in China. Sustainability 2021, 13, 5664. [Google Scholar] [CrossRef]

- Qian, L.; Wang, M.X.; Xiao, R.Q. The Impact and Spillover Effects of Low-Carbon Pilot Policies on Urban Carbon Neutrality Technological Innovation. Sci. Technol. Prog. Policy 2024, 41, 1–12. [Google Scholar]

- Abadie, A.; Gardeazabal, J. The economic costs of conflict: A case study of the Basque country. Am. Econ. Rev. 2003, 93, 113–132. [Google Scholar] [CrossRef]

- Wu, Y.B. Measurement on R&D Output Elasticity of China’s Industrial Sector. China Econ. Q. 2008, 3, 869–890. [Google Scholar]

- Shang, H.P.; Liu, J.T. Research on state-level new areas driving “curving overtaking” in underdeveloped areas. Stud. Sci. Sci. 2022, 40, 2194–2204. [Google Scholar]

- Shang, H.P.; Liu, J.T. Do Policy Innovations in Underdeveloped Regions Promote “Curve Overtaking”?—A SCM Test for Big Data Development Policy Innovation in Guiyang. J. Public Manag. 2021, 18, 34–45. [Google Scholar]

- Lin, B.; Guan, C. Evaluation and determinants of total unified efficiency of China’s manufacturing sector under the carbon neutrality target. Energy Econ. 2023, 119, 106539. [Google Scholar] [CrossRef]

- Gao, D.; Feng, H.; Cao, Y.J. The spatial spillover of innovation city policy on carbon efficiency: Evidence from China. Singap. Econ. Rev. 2024. [Google Scholar] [CrossRef]

- Xiao, Q.; Zhao, Y.C.; Pu, J.W. The impact of dual pilot policy on carbon emission efficiency—Quasi-natural experiments based on low-carbon pilot cities and carbon trading pilot cities. Soc. Sci. Rev. 2024, 39, 45–53. [Google Scholar]

- Ha, M.F.; Huang, Y.H. Research on the Effects and Mechanisms of Market-Based Environmental Regulation on Carbon Emission Intensity: Empirical Evidence Based on Carbon Trading Pilot Policies. Ecol. Econ. 2024, 40, 1–15. [Google Scholar]

- Ghazouani, T.; Maktouf, S. Impact of natural resources, trade openness, and economic growth on CO2 emissions in oil-exporting countries: A panel autoregressive distributed lag analysis. Nat. Resour. Forum 2024, 48, 211–231. [Google Scholar] [CrossRef]

- Wang, M.R.; Kuusi, T. Trade flows, carbon leakage, and the EU Emissions Trading System. Energy Econ. 2024, 134, 107556. [Google Scholar] [CrossRef]

- An, Y.F.; Zhou, D.Q.; Yu, J.; Shi, X.P.; Wang, Q.W. Carbon emission reduction characteristics for China’s manufacturing firms: Implications for formulating carbon policies. J. Environ. Manag. 2021, 284, 112055. [Google Scholar] [CrossRef]

- Fontagne, L.; Schubert, K. The Economics of Border Carbon Adjustment: Rationale and Impacts of Compensating for Carbon at the Border. Annu. Rev. Econ. 2023, 15, 389–424. [Google Scholar] [CrossRef]

| Variable | Obs. | Mean | Std. Dev. | Min. | Max. |

|---|---|---|---|---|---|

| Y02 | 400 | 841.533 | 1670.311 | 1.000 | 15,078.000 |

| GDP | 400 | 8.410 | 0.906 | 6.213 | 9.944 |

| Str | 400 | 1.192 | 0.704 | 0.527 | 5.244 |

| FDI | 400 | 4.33 | 1.611 | 0.515 | 7.124 |

| R&D | 400 | 2.569 | 0.858 | 0.631 | 4.381 |

| Gov | 400 | 5.121 | 0.600 | 3.522 | 5.980 |

| Variables | Beijing | Difference Value/% | |

|---|---|---|---|

| Real | Synthetic | ||

| GDP | 8.964 | 9.078 | 0.114 |

| Str | 3.314 | 0.920 | 2.394 |

| FDI | 5.755 | 5.765 | 0.01 |

| RD | 4.336 | 3.496 | 0.84 |

| Gov | 5.207 | 5.435 | 0.228 |

| Units | Jilin | Zhejiang |

|---|---|---|

| Weight | 0.316 | 0.684 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhong, J.; Zhang, J.; Fu, M. Does the Carbon Emissions Trading Pilot Policy Have a Demonstrated Impact on Advancing Low-Carbon Technology? Evidence from a Case Study in Beijing, China. Land 2024, 13, 1276. https://doi.org/10.3390/land13081276

Zhong J, Zhang J, Fu M. Does the Carbon Emissions Trading Pilot Policy Have a Demonstrated Impact on Advancing Low-Carbon Technology? Evidence from a Case Study in Beijing, China. Land. 2024; 13(8):1276. https://doi.org/10.3390/land13081276

Chicago/Turabian StyleZhong, Jiaxin, Jianjun Zhang, and Meichen Fu. 2024. "Does the Carbon Emissions Trading Pilot Policy Have a Demonstrated Impact on Advancing Low-Carbon Technology? Evidence from a Case Study in Beijing, China" Land 13, no. 8: 1276. https://doi.org/10.3390/land13081276