Market Commonality and Competition in Communities—An Empirical Study Based on Bidding Data of the Construction Market

Abstract

:1. Introduction

2. Literature Review

2.1. Competition in the Construction Market

2.2. Market Commonality

2.3. The Theory of Industrial Clusters

3. Hypotheses

4. Methodology

4.1. The Materials

4.2. Measures

4.2.1. A Community Detection Model

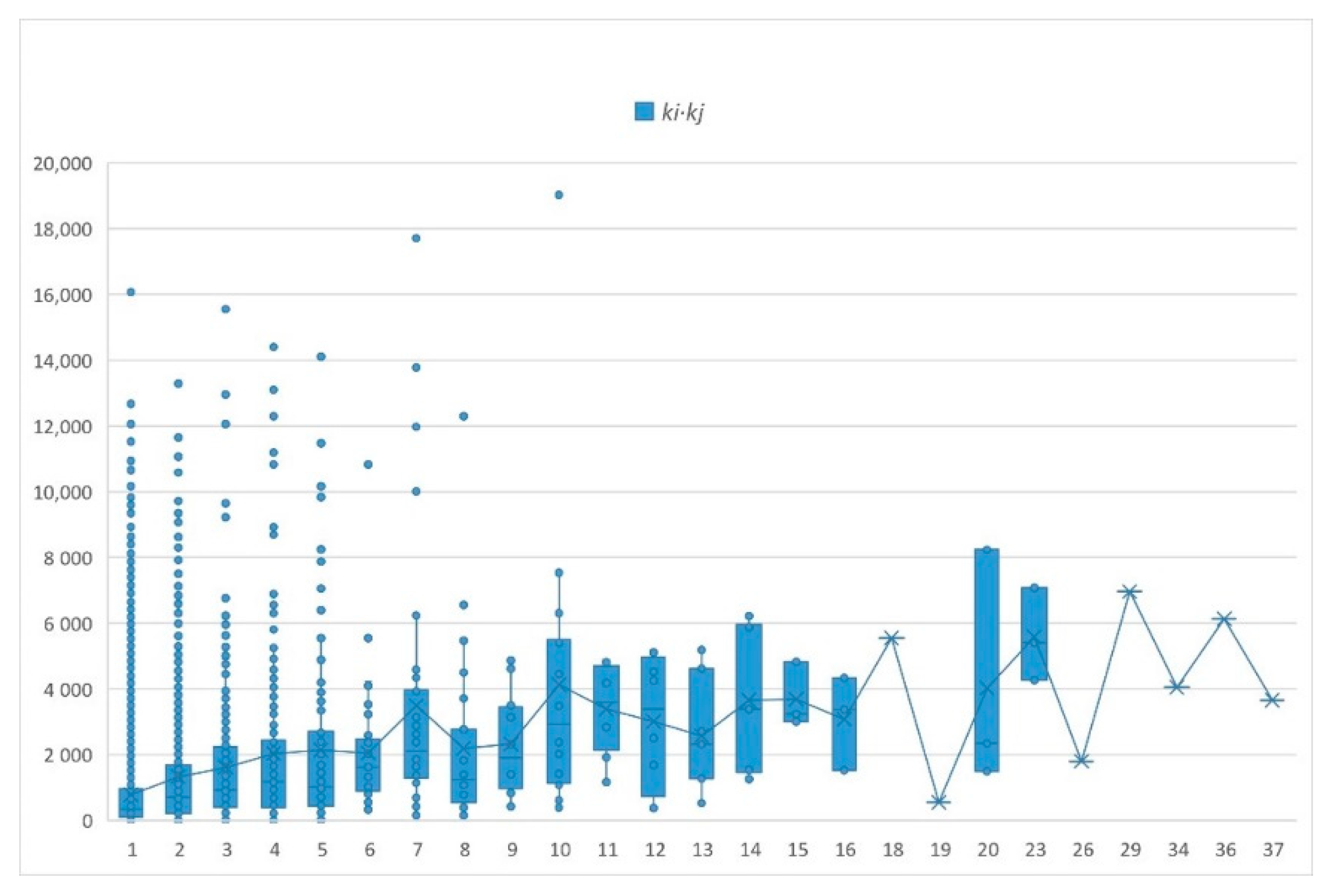

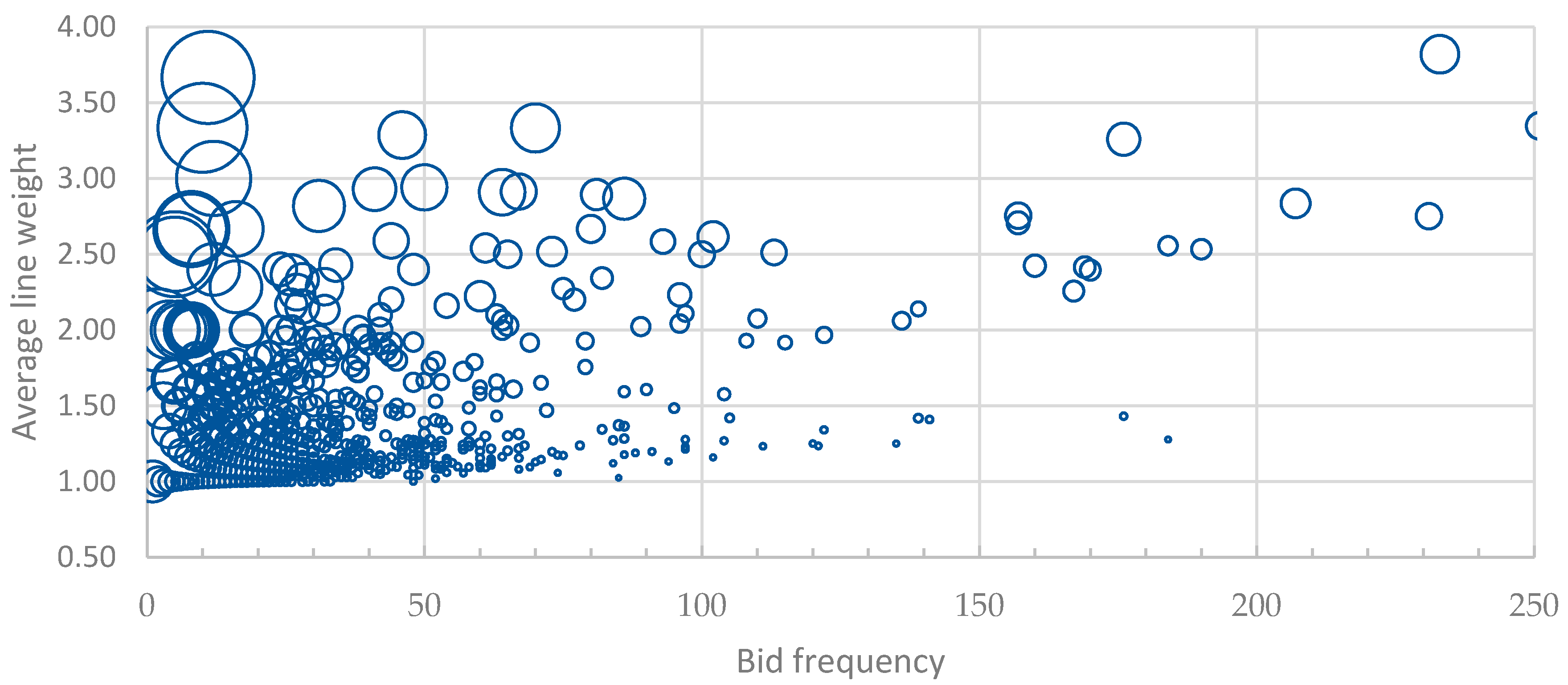

4.2.2. Distribution of Bidding Frequency

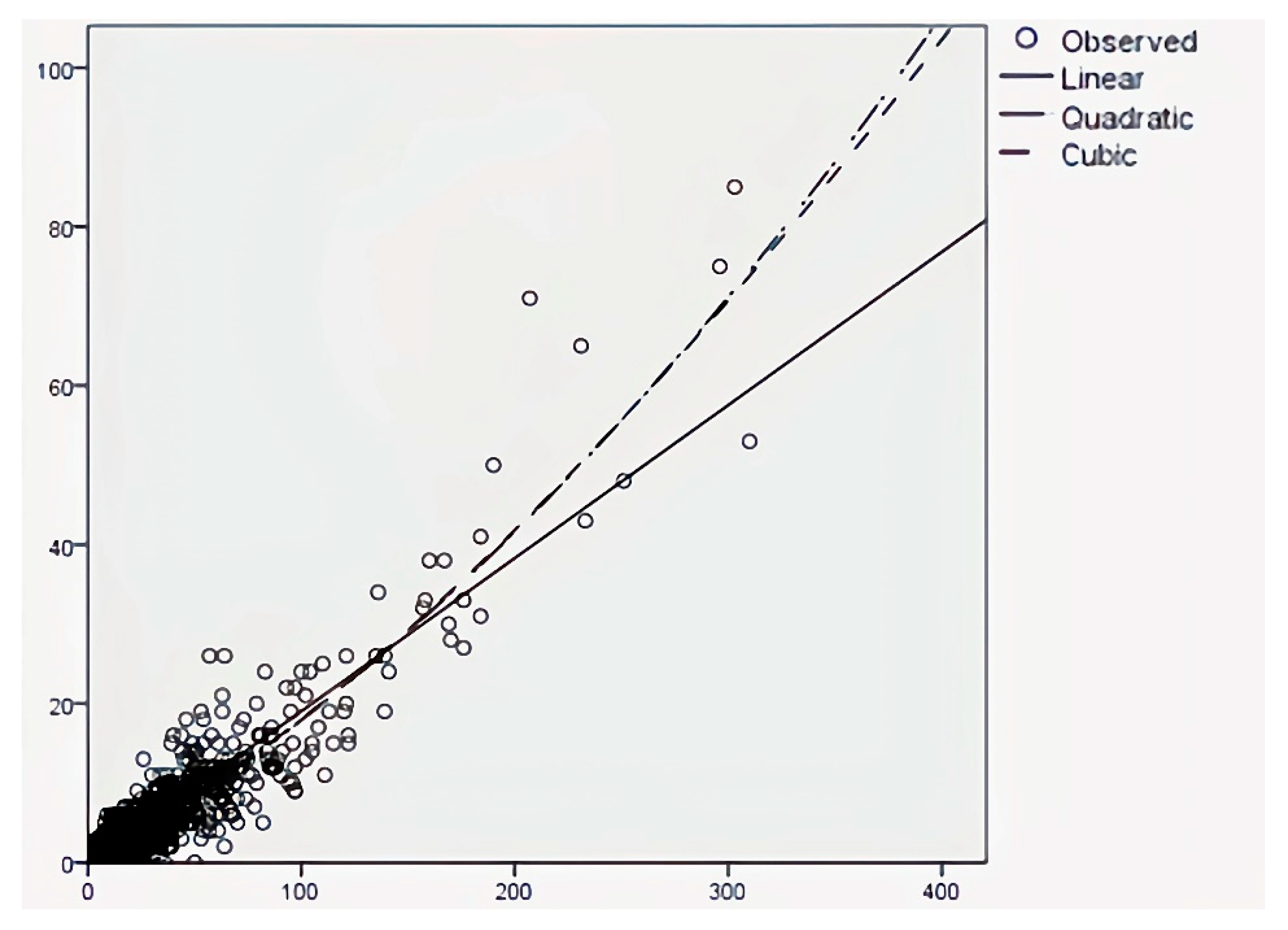

4.2.3. Prediction Model of Winning Bid Number

5. Data Analysis

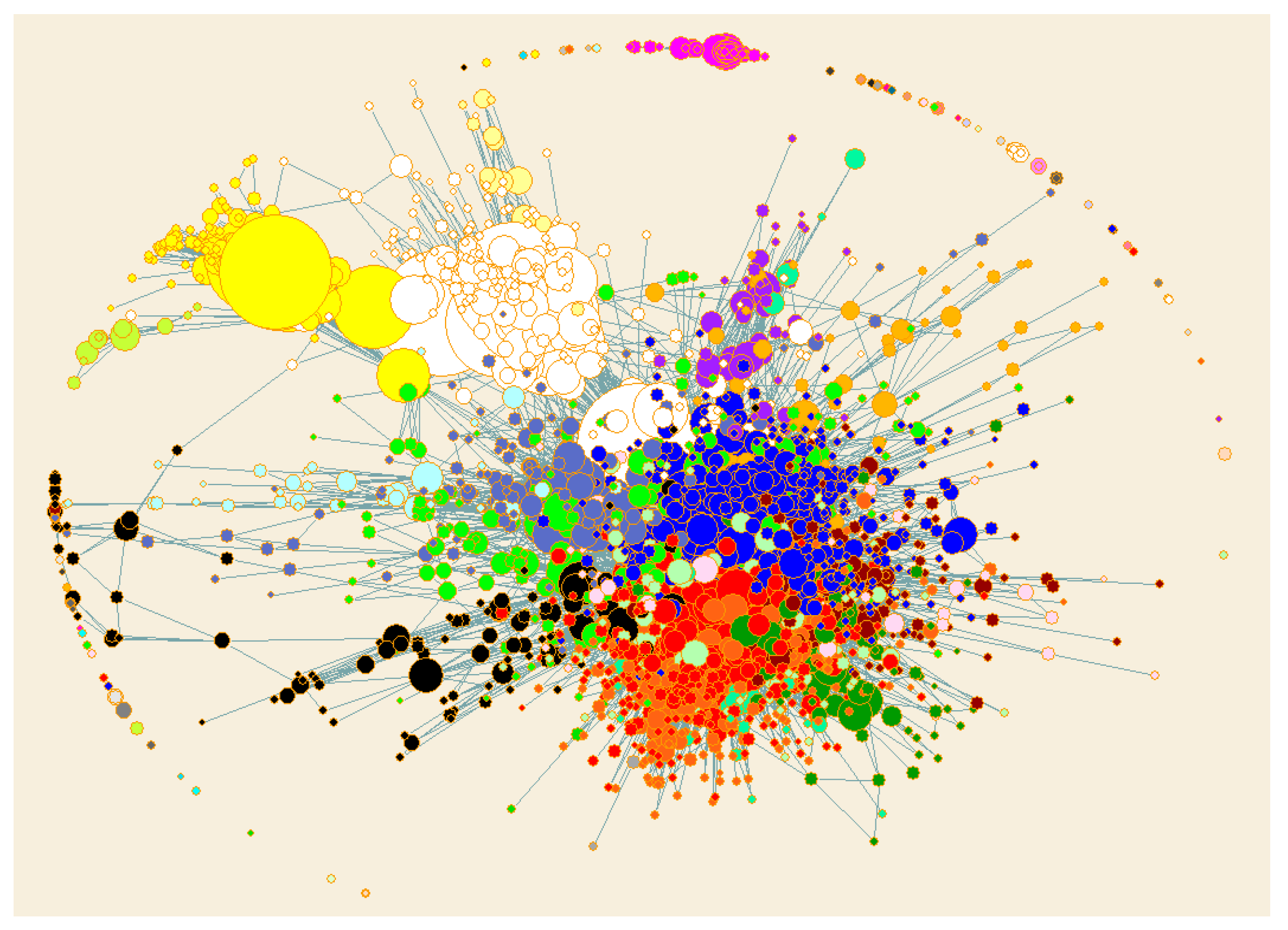

5.1. Community Detection

5.2. Distribution of Bidding Frequency

5.3. Prediction Model of Winning Bid Number

6. Findings and Discussion

6.1. Community: Different Scales but Significant Background Differences

6.2. Network Growth: Topology and Thickening

6.3. Bid Times: Scale-Free and Positively Correlated with Winning Times

7. Conclusions and Limitation

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Porter, M.E. Michael Porter on competition. Antitrust Bull. 1999, 44, 841. [Google Scholar]

- Heo, C.Y.; Blal, I.; Choi, M. What is happening in Paris? Airbnb, hotels, and the Parisian market: A case study. Tour. Manag. 2019, 70, 78–88. [Google Scholar] [CrossRef]

- Dyer, J.H. Specialized supplier networks as a source of competitive advantage: Evidence from the auto industry. Strateg. Manag. J. 1996, 17, 271–291. [Google Scholar] [CrossRef]

- Blecharz, P.; Stverkova, H.; Destech Publicat, I. Customers’ Evaluation of Coca Cola and Pepsi Cola. In Proceedings of the 2016 2nd International Conference on Education and Management Science, Beijing, China, 28–29 May 2016. [Google Scholar]

- Porter, M. Competitive Advantage of Nations. Harv. Bus. Rev. 1990, 68, 73–93. [Google Scholar]

- El-Mashaleh, M.S. Empirical Framework for Making the Bid/No-Bid Decision. J. Manag. Eng. 2013, 29, 200–205. [Google Scholar] [CrossRef]

- Zhao, Z.Y.; Xu, K.; Zuo, J.; Tang, C. Developing the International Construction Contracting Market: Enterprise Niche Approach. J. Manag. Eng. 2017, 33, 04016027. [Google Scholar] [CrossRef]

- Fountain, J.; Langar, S. Building Information Modeling (BIM) outsourcing among general contractors. Autom. Constr. 2018, 95, 107–117. [Google Scholar] [CrossRef]

- Chua, D.K.H.; Li, D.Z.; Chan, W.T. Case-Based Reasoning Approach in Bid Decision Making. J. Constr. Eng. Manag. 2001, 127, 35–45. [Google Scholar] [CrossRef]

- Tulacz, G.J. ENR 2018 Top 400 Contractors: The Market Keeps on Rolling. 2018. Available online: https://www.enr.com/articles/44507-enr-2018-top-400-contractors-the-market-keeps-on-rolling (accessed on 10 December 2019).

- Egemen, M.; Mohamed, A.N. A framework for contractors to reach strategically correct bid/no bid and mark-up size decisions. Build. Environ. 2007, 42, 1373–1385. [Google Scholar] [CrossRef]

- Setiawan, H.; Erdogan, B.; Ogunlana, S.O. Competitive Aggressiveness of Contractors: A Study of Indonesia. Procedia Eng. 2015, 125, 68–74. [Google Scholar] [CrossRef] [Green Version]

- Bageis, A.S.; Fortune, C. Factors affecting the bid/no bid decision in the Saudi Arabian construction contractors. Constr. Manag. Econ. 2009, 27, 53–71. [Google Scholar] [CrossRef]

- Olatunji, O.A.; Aje, O.I.; Makanjuola, S. Bid or no-bid decision factors of indigenous contractors in Nigeria. Eng. Constr. Arch. Manag. 2017, 24, 378–392. [Google Scholar] [CrossRef]

- Ye, K.; Jiang, W.; Shen, L. Project competition intensity (PCI) in the construction market: A case study in China. Constr. Manag. Econ. 2008, 26, 463–470. [Google Scholar] [CrossRef]

- Spence, M. Cost reduction, competition, and industry performance. Econom. J. Econom. Soc. 1984, 52, 101–121. [Google Scholar] [CrossRef]

- Ye, K.; Lu, W.; Jiang, W. Concentration in the international construction market. Constr. Manag. Econ. 2009, 27, 1197–1207. [Google Scholar] [CrossRef]

- Said, H.M.; Bartusiak, J. Regional Competition Analysis of Industrialized Homebuilding Industry. J. Constr. Eng. Manag. 2018, 144, 04017108. [Google Scholar] [CrossRef]

- Polyachenko, S.; Rankin, J.; Shukla, D.; Yevdokimov, Y. A Comparative Analysis of Perceived and Revealed Levels of Competition in the Construction Industry and Its Implications for Technological Change. In Proceedings of the Canada Canadian Society for Civil Engineering Annual Conference, CSCE 2019, Laval, QC, Canada, 12–15 June 2019. [Google Scholar]

- Wang, G.; Xia, C.; Cao, D. State and determinants of inter-regional market entry practices in the Chinese construction industry: Evidence from national quality award projects. Eng. Constr. Arch. Manag. 2020, 27, 1461–1477. [Google Scholar] [CrossRef]

- Shokri-Ghasabeh, M.; Chileshe, N. Critical factors influencing the bid/no bid decision in the Australian construction industry. Constr. Innov. 2016, 16, 127–157. [Google Scholar] [CrossRef]

- Horta, I.; Camanho, A.; Da Costa, J.M. Performance assessment of construction companies: A study of factors promoting financial soundness and innovation in the industry. Int. J. Prod. Econ. 2012, 137, 84–93. [Google Scholar] [CrossRef]

- Korkmaz, S.; Messner, J.I. Competitive positioning and continuity of construction firms in international markets. J. Manag. Eng. 2008, 24, 207–216. [Google Scholar] [CrossRef]

- Zhao, Z.-Y.; Tang, C.; Zhang, X.; Skitmore, M. Agglomeration and Competitive Position of Contractors in the International Construction Sector. J. Constr. Eng. Manag. 2017, 143, 04017004. [Google Scholar] [CrossRef] [Green Version]

- Chen, M.-J.; Miller, D. Competitive dynamics: Themes, trends, and a prospective research platform. Acad. Manag. Ann. 2012, 6, 135–210. [Google Scholar] [CrossRef]

- Lo, W.; Lin, C.L.; Yan, M.R. Contractor’s Opportunistic Bidding Behavior and Equilibrium Price Level in the Construction Market. J. Constr. Eng. Manag. 2007, 133, 409–416. [Google Scholar] [CrossRef]

- Ellis, J.; Edwards, D.; Thwala, W.; Ejohwomu, O.; Ameyaw, E.; Shelbourn, M. A Case Study of a Negotiated Tender within a Small-to-Medium Construction Contractor: Modelling Project Cost Variance. Building 2021, 11, 260. [Google Scholar] [CrossRef]

- Takano, Y.; Ishii, N.; Muraki, M. A sequential competitive bidding strategy considering inaccurate cost estimates. Omega 2014, 42, 132–140. [Google Scholar] [CrossRef]

- Kim, H.J.; Reinschmidt, K.F. A dynamic competition model for construction contractors. Constr. Manag. Econ. 2006, 24, 955–965. [Google Scholar] [CrossRef]

- De Clerck, D.; Demeulemeester, E. Creating a More Competitive PPP Procurement Market: Game Theoretical Analysis. J. Manag. Eng. 2016, 32, 04016015. [Google Scholar] [CrossRef]

- Zhu, J.; Shi, Q.; Wu, P.; Sheng, Z.; Wang, X. Complexity Analysis of Prefabrication Contractors’ Dynamic Price Competition in Mega Projects with Different Competition Strategies. Complexity 2018, 2018, 5928235. [Google Scholar] [CrossRef]

- Porter, M.E. Clusters and the new economics of competition. Harv. Bus. Rev. 1998, 76, 77–90. [Google Scholar]

- Chen, M.-J. Competitor analysis and interfirm rivalry: Toward a theoretical integration. Acad. Manag. Rev. 1996, 21, 100–134. [Google Scholar] [CrossRef]

- Smith, K.G.; Ferrier, W.J.; Ndofor, H. Competitive dynamics research: Critique and future directions. Handb. Strateg. Manag. 2001, 315, 361. [Google Scholar]

- Chen, M.-J.; Miller, D. Reconceptualizing competitive dynamics: A multidimensional framework. Strat. Manag. J. 2015, 36, 758–775. [Google Scholar] [CrossRef]

- Zhong, Z. The Identification of Enterprise Dynamic Competitor Based on Cluster Analysis. In Proceedings of the 2011 International Conference on Information Management, Innovation Management and Industrial Engineering, Shenzhen, China, 26–27 November 2011. [Google Scholar]

- Nadkarni, S.; Chen, T.; Chen, J. The clock is ticking! Executive temporal depth, industry velocity, and competitive aggressiveness. Strat. Manag. J. 2016, 37, 1132–1153. [Google Scholar] [CrossRef] [Green Version]

- Carter, C.R.; Kosmol, T.; Kaufmann, L. Toward a Supply Chain Practice View. J. Supply Chain Manag. 2016, 53, 114–122. [Google Scholar] [CrossRef]

- Delgado, M.; Porter, M.E.; Stern, S. Clusters, convergence, and economic performance. Res. Policy 2014, 43, 1785–1799. [Google Scholar] [CrossRef] [Green Version]

- Preissl, B.; Solimene, L. The Dynamics of Clusters and Innovation; Physica-Verlag: Heidelberg, Germany, 2003; Volume 62, p. 527. [Google Scholar] [CrossRef]

- Sellitto, M.A.; Luchese, J. Systemic Cooperative Actions among Competitors: The Case of a Furniture Cluster in Brazil. J. Ind. Compet. Trade 2018, 18, 513–528. [Google Scholar] [CrossRef]

- Shash, A.A. Factors considered in tendering decisions by top UK contractors. Constr. Manag. Econ. 1993, 11, 111–118. [Google Scholar] [CrossRef]

- Boss, D.S. Competitive Landscape Shifts: The Influence of Strategic Entrepreneurship on Shifts in Market Commonality. Acad. Manag. Rev. 2018, 43, 349–370. [Google Scholar]

- Hrdy, C.A. Cluster competition. Lewis Clark L. Rev. 2016, 20, 981. [Google Scholar]

- Blondel, V.D.; Guillaume, J.-L.; Lambiotte, R.; Lefebvre, E. Fast unfolding of communities in large networks. J. Stat. Mech. Theory Exp. 2008, 2008, P10008. [Google Scholar] [CrossRef] [Green Version]

- Baker, W.E.; Faulkner, R.R. The Social Organization of Conspiracy: Illegal Networks in the Heavy Electrical Equipment Industry. Am. Sociol. Rev. 1993, 58, 837. [Google Scholar] [CrossRef] [Green Version]

- Ye, K.; Zeng, D.; Wong, J. Competition Rule of the Multi-Criteria Approach: What Contractors in China Really Want? J. Civ. Eng. Manag. 2018, 24, 155–166. [Google Scholar] [CrossRef] [Green Version]

- Hu, E.-H.; Shan, H.-M.; Chen, Y. Discernment and Comprehensive Fuzzy Evaluation of Enterprises’ Core Competence. Syst. Eng. 2004, 1, 48–51. [Google Scholar]

- Zhao, Z.-Y.; Guo, X.-L.; Chang, R.-D. Market Concentration and Competitive Intensity of the International Engineering Contracting Industry. J. Constr. Eng. Manag. 2019, 145, 04019026. [Google Scholar] [CrossRef]

- Morselli, C.; Ouellet, M. Network similarity and collusion. Soc. Netw. 2018, 55, 21–30. [Google Scholar] [CrossRef]

- Kale, S.; Arditi, D. Competitive Positioning in United States Construction Industry. J. Constr. Eng. Manag. 2002, 128, 238. [Google Scholar] [CrossRef]

- Thierer, A. The Rule of Three: The Nature of Competition in the Digital Economy. 2012. Available online: https://www.forbes.com (accessed on 10 December 2019).

- Harenberg, S.; Bello, G.; Gjeltema, L.; Ranshous, S.; Harlalka, J.; Seay, R.; Padmanabhan, K.; Samatova, N. Community detection in large-scale networks: A survey and empirical evaluation. Wiley Interdiscip. Rev. Comput. Stat. 2014, 6, 426–439. [Google Scholar] [CrossRef] [Green Version]

- Traag, V.A.; Waltman, L.; van Eck, N.J. From Louvain to Leiden: Guaranteeing well-connected communities. Sci. Rep. 2019, 9, 5233. [Google Scholar] [CrossRef]

- Reina, G.J.T.A.P. ENR 2019 Top 225 International Design Firms: Market Is on an Uncertain Path. 2019. Available online: https://www.enr.com/articles/47254-enr-2019-top-225-international-design-firms-market-is-on-an-uncertain-path (accessed on 10 December 2019).

- Barrat, A.; Barthelemy, M.; Pastor-Satorras, R.; Vespignani, A. The architecture of complex weighted networks. Proc. Natl. Acad. Sci. USA 2004, 101, 3747–3752. [Google Scholar] [CrossRef] [Green Version]

- Almaas, E.; Kovács, B.; Vicsek, T.; Oltvai, Z.N.; Barabasi, A. Global organization of metabolic fluxes in the bacterium Escherichia coli. Nat. Cell Biol. 2004, 427, 839–843. [Google Scholar] [CrossRef] [Green Version]

- Marbukh, V. Effect of bounded rationality on tradeoff between systemic risks & economic efficiency in networks. In Proceedings of the 2016 Eighth International Conference on Ubiquitous and Future Networks (ICUFN), Vienna, Austria, 5–8 July 2016; pp. 353–355. [Google Scholar]

- Markman, G.D.; Gianiodis, P.T.; Buchholtz, A. Factor-Market Rivalry. Acad. Manag. Rev. 2009, 34, 423–441. [Google Scholar] [CrossRef]

- Grullon, G.; Larkin, Y.; Michaely, R. Are US Industries Becoming More Concentrated? Rev. Financ. 2019, 23, 697–743. [Google Scholar] [CrossRef] [Green Version]

- Barabási, A.-L.; Albert, R. Emergence of Scaling in Random Networks. Science 1999, 286, 509–512. [Google Scholar] [CrossRef] [Green Version]

- Hortaçsu, A.; Puller, S.L. Understanding strategic bidding in multi-unit auctions: A case study of the Texas electricity spot market. Rand J. Econ. 2008, 39, 86–114. [Google Scholar] [CrossRef]

- Betts, M.; Ofori, G. Strategic planning for competitive advantage in construction. Constr. Manag. Econ. 1992, 10, 511–532. [Google Scholar] [CrossRef]

- Miller, D.; Chen, M.-J. Sources and Consequences of Competitive Inertia: A Study of the U.S. Airline Industry. Adm. Sci. Q. 1994, 39, 1–23. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, K.; Ye, K. Market Commonality and Competition in Communities—An Empirical Study Based on Bidding Data of the Construction Market. Buildings 2021, 11, 435. https://doi.org/10.3390/buildings11100435

Chen K, Ye K. Market Commonality and Competition in Communities—An Empirical Study Based on Bidding Data of the Construction Market. Buildings. 2021; 11(10):435. https://doi.org/10.3390/buildings11100435

Chicago/Turabian StyleChen, Keda, and Kunhui Ye. 2021. "Market Commonality and Competition in Communities—An Empirical Study Based on Bidding Data of the Construction Market" Buildings 11, no. 10: 435. https://doi.org/10.3390/buildings11100435