Evaluating the Effectiveness of Investment in Boosting South Africa’s Economic Growth: A Comparative Analysis across Different Administrations

Abstract

:1. Introduction

1.1. Issues in Context

1.2. Conceptual Framework

1.3. The Interplay between Gross Fixed Capital Formation in Manufacturing/Mining and Quarrying/Electricity, Gas, and Water

2. Related Literature

2.1. The Influence of Gross Fixed Capital Formation and ICT on Economic Growth

2.2. Influence of Gross Fixed Capital Formation and Manufacturing on Economic Growth

2.3. Influence of Gross Fixed Capital Formation and Mining and Quarrying on Economic Growth

2.4. Influence of Gross Fixed Capital Formation and Electricity, Gas, and Water on Economic Growth

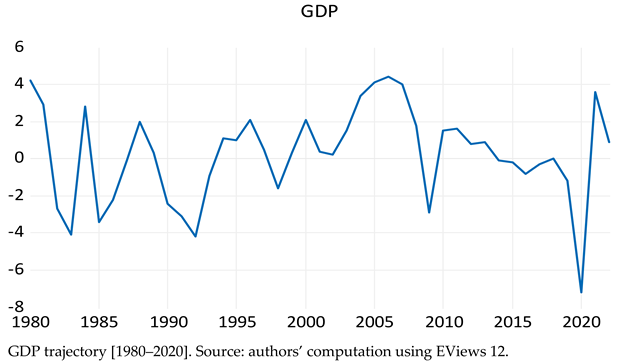

3. Economic Growth and GFCF in South Africa

Gross Fixed Capital Formation: Electricity, Gas, and Water and Economic Growth

4. Policy Thrust [Pre- and Post-Apartheid]

Policy Implications [Different Time Periods]

- Pieter Willem Botha (1978–1989)

- Frederik Willem de Klerk (1989–1994)

- Nelson Mandela (1994–1999)

- Thabo Mbeki (1999–2008)

- Jacob Zuma (2009–2018)

- Cyril Ramaphosa (Since 2018)

5. Summary

Recommendation

- This study suggests that the South African government and the Reserve Bank should increase public infrastructure investment and funding for research and development to stimulate economic growth. Additionally, the bank should direct investments in programs or infrastructure and lower interest rates to make borrowing more affordable for companies, despite the weak association between manufacturing investment and economic development.

- The South African Reserve Bank should consider easing capital adequacy requirements to allow banks to lend more money to the mining and quarrying industry, as there is no correlation between investment in these industries and economic growth. The government and central bank should employ a multifaceted strategy, including tax cuts, loan guarantees, and regulatory environments, to encourage private investment and direct investment in public infrastructure projects, such as renewable energy and water treatment facilities.

- Encouraging public–private partnerships (PPPs) can reduce government risk and utilize private sector resources. Increasing regulations’ predictability and clarity boosts investor confidence and attracts money to industries like gas, water, and electricity. South Africa can harness its potential through these policies, fostering economic expansion and a prosperous future. Diversifying investments across sectors, like renewable energy, technology, and advanced manufacturing, can mitigate the risks associated with overdependence on mining or manufacturing, promoting a future resilient economy for sustainable growth.

- South Africa needs policies to create an investment environment, such as regulatory improvements, fiscal incentives, and public–private partnerships, to attract investment in sectors like mining and quarrying. This will boost economic growth and job creation. Structural policies should address manufacturing sector challenges and enhance competitiveness and innovation to contribute to sustainable growth and job creation. Modernizing the sector and improving its productivity and access to domestic and international markets is also crucial.

- Policymakers should focus on infrastructure development, regulatory reforms, private sector investment attractiveness, and state-related enterprise efficiency to improve service delivery, productivity, and overall economic performance. When the economy is heading towards a recession, countercyclical investment policies can stabilize the economy by investing in high-multiplier projects. Holistic reviews of economic indicators, including business confidence, structural barriers to growth, and external economic factors, should be undertaken to formulate realistic policy responses. This comprehensive analysis can help identify possible policy interventions to guarantee sustainable growth and development. By doing so, policymakers can ensure sustainable growth and development.

- Policies should balance capital formation across relevant sectors, promoting growth for emerging sectors with high potential. Encouraging investments in renewable energy and advanced manufacturing can sustain economic activity and reduce overdependence on traditional sectors. Additionally, exploring industrial policy improvements that emphasize productivity, innovation, and market access can bolster industrial growth and economic development both domestically and internationally.

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Aghaei, Majid, and Mahdieh Rezagholizadeh. 2017. The impact of information and communication technology (ICT) on economic growth in the OIC Countries. Economic and Environmental Studies 17: 257–78. [Google Scholar] [CrossRef]

- Amighini, Alessia A., Margaret S. McMillan, and Macro Sanfilippo. 2017. FDI and Capital Formation in Developing Economies: New Evidence from Industry-Level Data (No. w23049). Cambridge, MA: National Bureau of Economic Research. [Google Scholar]

- Anyadike, Kennedy, and Chukunalu Mgbomene. 2023. COVID-19 pandemic and nigeria’s economic growth: A comparative analysis of pre and post 2020. International Journal of Advanced Research in Accounting, Economics and Business Perspectives 7: 94–111. [Google Scholar] [CrossRef]

- Aron, Janine, and John Muellbauer. 2002. Interest rate effects on output: Evidence from a GDP forecasting model for South Africa. IMF Staff Papers 49 (S1): 185–213. [Google Scholar]

- Ayres, Robert U. 1998. Towards a disequilibrium theory of endogenous economic growth. Environmental and Resource Economics 11: 289–300. [Google Scholar] [CrossRef]

- Ayub, Muhammad, Rabia Rasheed, Rashid Ahmad, and Furrukh Bashir. 2021. Infrastructural Investments and Economic Growth: Evidence from Pakistan. Journal of Business and Social Review in Emerging Economies 7: 591–98. [Google Scholar] [CrossRef]

- Baker, Jonathan, Kenneth Strzepek, William Farmer, and C. Adam Schlosser. 2014. Quantifying the impact of renewable energy futures on cooling water use. JAWRA Journal of the American Water Resources Association 50: 1289–303. [Google Scholar] [CrossRef]

- Baker, Lucy, Jesse Burton, Catrina Godinho, and Hilton Trollip. 2015. The Political Economy of Decarbonisation: Exploring the Dynamics of South Africa’s Electricity Sector. Cape Town: Energy Research Centre, University of Cape Town. [Google Scholar]

- Barnes, Justin, Raphael Kaplinsky, and Mike Morris. 2004. Industrial policy in developing economies: Developing dynamic comparative advantage in the South African automobile sector. Competition & Change 8: 153–72. [Google Scholar]

- Bhoola, Fatima, and Uma Kollamparambil. 2011. Trends and determinants of output growth volatility in South Africa. International Journal of Economics and Finance 3: 151–60. [Google Scholar] [CrossRef]

- Bhorat, Haroon, and Christopher Rooney. 2017. State of Manufacturing in South Africa. Cape: Development Policy Research Unit, University of Cape Town. [Google Scholar]

- Blanas, Sotiris, Adnan Seric, and Christian Viegelahn. 2019. Job quality, FDI and institutions in sub-Saharan Africa: Evidence from firm-level data. The European Journal of Development Research 31: 1287–317. [Google Scholar] [CrossRef]

- Broadhurst, Jennifer L., Jean Paul Franzidis, and Brett Cohen. 2014. Contribution of the minerals industry towards sustainable development in South Africa. African Journal of Sustainable Development 4: 207–23. [Google Scholar]

- Bucaj, Alketa. 2018. The impact of FDI in mining on Kosovo’s economic growth. International Journal of Academic Research in Business and Social Sciences 8: 260–85. [Google Scholar] [CrossRef]

- Buraimoh, Elutunji, Abayomi Aduragba Adebiyi, Oladimeji Joseph Ayamolowo, and Innocent Ewean Davidson. 2020. South Africa electricity supply system: The past, present and the future. Paper presented at 2020 IEEE PES/IAS PowerAfrica, Nairobi, Kenya, August 25–28; pp. 1–5. [Google Scholar]

- Debrah, Caleb, Amos Darko, and Albert Ping Chuen Chan. 2023. A bibliometric-qualitative literature review of green finance gap and future research directions. Climate and Development 15: 432–55. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, Asli, Leora Klapper, and Dorothe Singer. 2018. Household finance and economic development. In Handbook of Finance and Development. London: Edward Elgar Publishing, pp. 534–49. [Google Scholar]

- Dessus, Sebastien C., Marek Hanusch, and Yoko Nagashima. 2019. South Africa Economic Update: Enrollments in Tertiary Education Must Rise. Available online: https://policycommons.net/artifacts/1462587/south-africa-economic-update/2105949/ (accessed on 3 August 2023).

- Dovletmurzaeva, Malika. 2023. Development of innovative infrastructure of the industrial sector. E3S Web of Conferences 451: 02009. [Google Scholar] [CrossRef]

- Du Plessis, Stan, and Ben Smit. 2006. Economic Growth in South Africa Since 1994. Stellenbosch: University of Stellenbosch. [Google Scholar]

- Dumo, Genesis A., Harriette D. Ico, and Ederliza V. Magpantay. 2023. Applicability of Harrod-Domar Model in Explaining Economic Growth in the Philippines. Journal of Economics, Finance and Accounting Studies 5: 22–46. [Google Scholar] [CrossRef]

- Ennin, Anthony, and Emmanuel A. Wiafe. 2023. The impact of mining foreign direct investment on economic growth in Ghana. Cogent Economics & Finance 11: 2251800. [Google Scholar]

- Feddersen, Maura, Hugo Nel, and Ferdi Botha. 2017. Exports, capital formation and economic growth in South Africa. African Review of Economics and Finance 9: 213–44. [Google Scholar]

- Ferendinos, Michael Gerry. 2012. Strategies for South Africa’s Ascent in the Modern World-System. Available online: https://scholar.sun.ac.za/items/541d47a1-283e-4dc7-a91a-69004fba6742 (accessed on 25 July 2024).

- Fine, Ben. 2018. The Political Economy of South Africa: From Minerals-Energy Complex to Industrialisation. London: Routledge. [Google Scholar]

- Fourie, Thea. 2015. Rocky recovery expected for South Africa during 2015: Economy. Professional Accountant 2015: 12–13. [Google Scholar]

- Fukunishi, Takahiro. 2014. Introduction: African Farmers and Firms in a Changing World. In Delivering Sustainable Growth in Africa: African Farmers and Firms in a Changing World. London: Palgrave Macmillan UK, pp. 1–22. [Google Scholar]

- Gachunga, Muhia John. 2019. Impact of Foreign Direct Investment on economic growth in Kenya. Information Research and Review 6: 6161–63. [Google Scholar]

- Gillwald, Alison, Mpho Moyo, and Christoph Stork. 2012. Understanding What Is Happening in ICT in South Africa. A Supply—And Demand-Side Analysis of the ICT Sector. Evidence for ICT Policy Action Policy Paper 7. Available online: https://researchictafrica.net/publication/understanding-what-is-happening-in-ict-in-south-africa/ (accessed on 25 July 2024).

- Gochero, Plaxedes, and Seetanah Boopen. 2020. The effect of mining foreign direct investment inflow on the economic growth of Zimbabwe. Journal of Economic Structures 9: 54. [Google Scholar] [CrossRef]

- Groepe, Francois. 2015. François Groepe: South Africa’s Structural Unemployment Challenge—The Most Important Issues to Be Addressed to Place South Africa on a Sustainable Growth Path in an Effort to Reduce Unemployment Levels. Address by Mr François Groepe, Deputy Governor of the South African Reserve Bank, on the Occasion of the Release of the 14th UASA South African Employment Report, Johannesburg, 30 April 2015. Available online: https://www.bis.org/review/r150610e.htm (accessed on 25 July 2024).

- Gyeke-Dako, Agyapomaa, Abena D. Oduro, Festus Ebo Turkson, and Priscilla Twumasi Baffour. 2015. Employment Effects of Different Development Policy Instruments: The Case of Ghana. Rd4 Project. Available online: http://www.r4d-employment.com/papers/publications/ (accessed on 25 July 2024).

- Hibbard, Paul J., and Todd Schatzki. 2012. The interdependence of electricity and natural gas: Current factors and future prospects. The Electricity Journal 25: 6–17. [Google Scholar] [CrossRef]

- Hodge, David. 2006. Inflation and growth in South Africa. Cambridge Journal of Economics 30: 163–80. [Google Scholar] [CrossRef]

- Ikwegbue, Paul Chukwudi, Andrew O. Enaifoghe, Harris Maduku, and Leonard U. Agwuna. 2021. The challenges of COVID-19 pandemic and South Africa’s response. African Renaissance 18: 271. [Google Scholar] [CrossRef]

- Ilesanmi, Kehinde Damilola, and Devi Datt Tewari. 2017. Energy consumption, human capital investment and economic growth in South Africa: A vector error correction model analysis. OPEC Energy Review 41: 55–70. [Google Scholar] [CrossRef]

- Jayne, Thomas S., and Pedro Antonio Sanchez. 2021. Agricultural productivity must improve in sub-Saharan Africa. Science 372: 1045–47. [Google Scholar] [CrossRef]

- Kanbur, Ravi, and Akbar Noman. 2021. Book Review. Intelligent Decision Technologies 15: 173–74. [Google Scholar] [CrossRef]

- Kennedy, Solina Rose Levine, Perrine Toledano, Jennifer Rietbergen, and De Villiers-Piaget. 2020. Mining and the SDGs: A 2020 Status Update. Available online: https://www.responsibleminingfoundation.org/mining-and-the-sdgs/ (accessed on 25 July 2023).

- Kganyago, Lesetja. 2015. Lesetja Kganyago: South Africa’s Growth Performance and Monetary Policy. Paper presented at Address by Mr Lesetja Kganyago, Governor of the South African Reserve Bank at the Bureau for Economic Research, Cape Town, South Africa, October 22. [Google Scholar]

- Khaliq, Abdul, and Ilan Noy. 2007. Foreign direct investment and economic growth: Empirical evidence from sectoral data in Indonesia. Journal of Economic Literature 45: 313–25. [Google Scholar]

- Khobai, Hlalefang, Sanderson Abel, and Pierre Le Roux. 2016. An investigation into the electricity supply and economic growth nexus for South Africa. International Journal of Energy Economics and Policy 6: 701–5. [Google Scholar]

- Khonjelwayo, Bongani, and Thilivhali Nthakheni. 2020. Investment in electricity distribution capital infrastructure in South Africa: The role of regulation. South African Journal of Economic and Management Sciences 23: 1–10. [Google Scholar] [CrossRef]

- Klutse, Senanu Kwasi. 2020. The problem of economic growth in Sub-Saharan Africa–The case of Ghana, Republic of Congo, Kenya and Lesotho. In The Challenges of Analyzing Social and Economic Processes in the 21st Century. Szeged: University of Szeged Faculty of Economics and Business Administration. [Google Scholar] [CrossRef]

- Kolisi, Nwabisi. 2021. Manufacturing Sector Foreign Direct Investment and Economic Growth in South Africa. SA-TIED Working Paper 161. Available online: https://sa-tied.wider.unu.edu/sites/default/files/SA-TIED-WP161-YS.pdf (accessed on 25 July 2023).

- Latief, Rashid, and Lin Lefen. 2019. Foreign direct investment in the power and energy sector, energy consumption, and economic growth: Empirical evidence from Pakistan. Sustainability 11: 192. [Google Scholar] [CrossRef]

- Laverty, Alexander. 2007. Impact of Economic and Political Sanctions on Apartheid. The African File. Available online: https://theafricanfile.com/politicshistory/impact-of-economic-and-political-sanctions-on-apartheid/ (accessed on 25 July 2023).

- Leon, Peter. 2012. Whither the South African mining industry? Journal of Energy & Natural Resources Law 30: 5–27. [Google Scholar]

- Lienert, Martin, and Stefan Lochner. 2012. The importance of market interdependencies in modeling energy systems–the case of the European electricity generation market. International Journal of Electrical Power & Energy Systems 34: 99–113. [Google Scholar]

- Liening, Andreas. 2013. Growth Theory and Endogenous Human Capital Development: A Contribution to the Theory of Complex Systems. Available online: https://www.scirp.org/html/4-1500317_30800.htm (accessed on 25 July 2024).

- Lkhagva, Davaajargal, Zheng Wang, and Changxin Liu. 2019. Mining Booms and Sustainable Economic Growth in Mongolia—Empirical Result from Recursive Dynamic CGE Model. Economies 7: 51. [Google Scholar] [CrossRef]

- Luiz, John M., and Meshal Ruplal. 2013. Foreign direct investment, institutional voids, and the internationalization of mining companies into Africa. Emerging Markets Finance and Trade 49: 113–29. [Google Scholar] [CrossRef]

- Manyuchi, Mercy M., Charles Mbohwa, and Edison Muzenda. 2019. Mining waste management for sustainable mining practices. Paper presented at International Conference on Industrial Engineering and Operations Management, Bangkok, Thailand, July 22; pp. 137–142. [Google Scholar]

- Makoela, Pheladi Petty. 2021. A Correlation Analysis of the Effect of Internationalisation on the Global Competitiveness of the South African Mining Sector. Doctoral dissertation, University of the Witwatersrand, Johannesburg, South Africa. [Google Scholar]

- Maswana, Jean Claude. 2009. Global financial crisis and recession: Impact on Africa and development prospects. Paper presented at Japan International Cooperation Agency-Research Institute Task Force on Africa Meeting, Pretoria, South Africa, July 10. [Google Scholar]

- Matlou, Lebogang. 2019. ICT infrastructure Investment and Economic Growth in South Africa. Doctoral dissertation, Wits Business School, Johannesburg, South Africa. [Google Scholar]

- McKinney, Joseph A. 2008. United States-Canada Energy Interdependencies. Southern Journal of Canadian Studies 2: 1. [Google Scholar] [CrossRef]

- Meyer, Daniel Francois, and Kaseem Abimbola Sanusi. 2019. A causality analysis of the relationships between gross fixed Capital formation, economic growth, and employment in South Africa. Studia Universitatis Babes-Bolyai Oeconomica 64: 33–44. [Google Scholar] [CrossRef]

- Meyer, Daniel Francois, and Richard Tabang McCamel. 2017. A time series analysis of the relationship between manufacturing, economic growth and employment in South Africa. Journal of Advanced Research in Law and Economics 8: 1206–18. [Google Scholar]

- Mijiyawa, Abdoul Ganiou. 2017. Drivers of structural transformation: The case of the manufacturing sector in Africa. World Development 99: 141–59. [Google Scholar] [CrossRef]

- Montmasson-Clair, Gaylor. 2015. The Interplay between Mining and Green Economy in South Africa: An Energy Lens. SSRN 2748019. Available online: https://www.researchgate.net/publication/315013870_The_Interplay_between_Mining_and_Green_Economy_in_South_Africa_An_Energy_Lens (accessed on 23 July 2024).

- Moraka, Nthabiseng Violet, and Marie Jansen van Rensburg. 2015. Transformation in the South African mining industry-looking beyond the employment equity scorecard. Journal of the Southern African Institute of Mining and Metallurgy 115: 669–78. [Google Scholar] [CrossRef]

- Nafziger, Emerson D. 2006. Inter-and intraplant competition in corn. Crop Management 5: 1–9. [Google Scholar] [CrossRef]

- Naym, Junnatun, and Md Akram Hossain. 2016. Does investment in information and communication technology lead to higher economic growth: Evidence from Bangladesh. International Journal of Business and Management 11: 302. [Google Scholar]

- Ncanywa, Thobeka, and Lehlo Makhenyane. 2016. Can Investment Activities in the Form of Capital Formation Influence Economic Growth in South Africa? Available online: http://ulspace.ul.ac.za/bitstream/handle/10386/1653/34%20Makhenyane.pdf?sequence=1 (accessed on 25 July 2024).

- Ncanywa, Thobeka, and Ombeswa Stsaba Orienda Ralarala. 2020. Investment in selected business sectors as a catalyst for South African growth. African Journal of Development Studies 10: 79. [Google Scholar] [CrossRef]

- Nweke, Godwin Onyinye, Stephen Idenyi Odo, and Charity Ifeyinwa Anoke. 2017. Effect of capital formation on economic growth in Nigeria. Asian Journal of Economics, Business and Accounting 5: 1–16. [Google Scholar]

- Ogujiuba, Kanayo, and Ntombifithi Mngometulu. 2022. Does Social Investment Influence Poverty and Economic Growth in South Africa: A Cointegration Analysis? Economies 10: 226. [Google Scholar] [CrossRef]

- Okogun, Oluwanishola A., O. Michael Awoleye, and Willie Owolabi Siyanbola. 2012. Economic value of ICT investment in Nigeria: Is it commensurate. International Journal of Economics and Management Sciences 1: 22–30. [Google Scholar]

- Opoku, Eric Evans Osei, Muazu Ibrahim, and Yakubu Awudu Sare. 2019. Foreign direct investment, sectoral effects and economic growth in Africa. International Economic Journal 33: 473–92. [Google Scholar] [CrossRef]

- Panizza, Ugo. 2017. Non-linearities in the Relationship between Finance and Growth. Comparative Economic Studies 60: 44–53. [Google Scholar] [CrossRef]

- Pasara, Michael Takudzwa, and Rufaro Garidzirai. 2020. Causality effects among gross capital formation, unemployment and economic growth in South Africa. Economies 8: 26. [Google Scholar] [CrossRef]

- Peng, Donna, and Rahmatallah Poudineh. 2016. A holistic framework for the study of interdependence between electricity and gas sectors. Energy Strategy Reviews 13: 32–52. [Google Scholar] [CrossRef]

- Perks, Cameron. 2016. Transporting industrial minerals in Australia. Industrial Minerals 588: 26. [Google Scholar]

- Pradhan, Rudra Prakash, Mak B. Arvin, Mahendhiran Nair, Sara E. Bennett, and John Henry Hall. 2018. The dynamics between energy consumption patterns, financial sector development and economic growth in Financial Action Task Force (FATF) countries. Energy 159: 42–53. [Google Scholar] [CrossRef]

- Rahimov, Vugar. 2013. Sectoral Effects of Foreign Direct Investment on Host Country Economic Growth: Evidence from Emerging Countries. [Google Scholar]

- Raputsoane, Leroi. 2018. Quantifying Economic Recovery from the Recent Global Financial Crisis. Available online: https://mpra.ub.uni-muenchen.de/87410/ (accessed on 25 July 2024).

- Rodrik, Dani. 2008. Understanding South Africa’s economic puzzles. Economics of Transition 16: 769–97. [Google Scholar] [CrossRef]

- Romer, Paul. Michael. 1990. Endogenous technological change. Journal of Political Economy 98: S71–S102. [Google Scholar] [CrossRef]

- Saini, Varinder, Manoj K. Arora, and Ravi P. Gupt. 2017. Assessment of surface coal mining impacts using Landsat time series data. Paper presented at the 38th Asian Conference on Remote Sensing (ACRS-2017), New Delhi, India, October 23–27, vol. 10, pp. 23–27. [Google Scholar]

- Saunders, Richard. 2008. Crisis, capital, compromise: Mining and empowerment in Zimbabwe. African Sociological Review/Revue Africaine de Sociologie 12: 1. [Google Scholar] [CrossRef]

- Skaggs, Richard, Kathleen A. Hibbard, Peter Frumhoff, Thomas Lowry, Richard Middleton, Ron Pate, Vincent C. Tidwell, J. G. Arnold, Kristen Averyt, Anthony C. Janetos, and et al. 2012. Climate and Energy-Water-Land System Interactions Technical Report to the Us Department of Energy in Support of the National Climate Assessment. No. PNNL-21185. Richland: Pacific Northwest National Lab. (PNNL). [Google Scholar]

- Sookha, Keshal. 2018. The Impact of Mobile Communications Infrastructure Investment on Economic Growth in South Africa. Available online: https://open.uct.ac.za/items/bd1719cb-3c13-44d6-b237-e67482572ae2 (accessed on 25 July 2024).

- South African Reserve Bank. 1993. Annual Economic Report 1993. Available online: https://www.bing.com/ck/a?!&&p=a6efe798886985c3JmltdHM9MTcyMjY0MzIwMCZpZ3VpZD0wZDk4NTNlMS00MjgwLTZiYjUtMjc5Zi00NzhhNDM0YjZhOGQmaW5zaWQ9NTE5NA&ptn=3&ver=2&hsh=3&fclid=0d9853e1-4280-6bb5-279f-478a434b6a8d&psq=SARB+1993+pdf+recession&u=a1aHR0cHM6Ly93d3cucmVzYmFuay5jby56YS9jb250ZW50L2RhbS9zYXJiL3B1YmxpY2F0aW9ucy9yZXBvcnRzL2FubnVhbC1lY29ub21pYy1yZXBvcnRzLzE5OTMvNTU1MC9Bbm51YWwtRWNvbm9taWMtUmVwb3J0LS0tMTk5My5wZGY&ntb=1 (accessed on 25 July 2024).

- South African Reserve Bank. 1987. South African Reserve Bank Annual Economic Report. Available online: https://www.bing.com/ck/a?!&&p=edcb5c5ac9925aefJmltdHM9MTcyMjY0MzIwMCZpZ3VpZD0wZDk4NTNlMS00MjgwLTZiYjUtMjc5Zi00NzhhNDM0YjZhOGQmaW5zaWQ9NTIyOQ&ptn=3&ver=2&hsh=3&fclid=0d9853e1-4280-6bb5-279f-478a434b6a8d&psq=sarb+1987+pdf&u=a1aHR0cHM6Ly93d3cucmVzYmFuay5jby56YS9jb250ZW50L2RhbS9zYXJiL3B1YmxpY2F0aW9ucy9yZXBvcnRzL2FubnVhbC1lY29ub21pYy1yZXBvcnRzLzE5ODcvNTU1Ni9Bbm51YWwtRWNvbm9taWMtUmVwb3J0LS0tMTk4Ny5wZGY&ntb=1 (accessed on 25 July 2024).

- Syrett, Laura. 2016. African mining:: Investing against the odds? Industrial Minerals 580: 2. [Google Scholar]

- Telnova, Hanna. 2019. Conceptual approaches to economic growth: The need to transform national financial policy imperatives. Economics of Development 4: 1–10. [Google Scholar] [CrossRef]

- Tregenna, Fiona. 2008. Sectoral Engines of Growth in South Africa: An Analysis of Services and Manufacturing. No. 2008/98. WIDER Research Paper. Helsinki: The United Nations University World Institute for Development Economics Research (UNU-WIDER). [Google Scholar]

- Tryman, Mfanya Donald, and Saba Jallow. 1994. Apartheid in Retreat: Economic Sanctions and Political Reform. The Challenge to Racial Stratification 4: 245. [Google Scholar]

- Van Seventer, Dirk, Channing Arndt, Robert. J. Davies, Sherwin Gabriel, Laurence Harris, and Sherman Robinson. 2021. Recovering from COVID-19: Economic scenarios for South Africa. Northwest Washington: Intl Food Policy Res Inst, vol. 2033. [Google Scholar]

- Yousefi, Ayoub. 2011. The impact of information and communication technology on economic growth: Evidence from developed and developing countries. Economics of Innovation and New Technology 20: 581–96. [Google Scholar] [CrossRef]

- Zalk, Nimrod. 2016. Selling off the silver The imperative for productive and jobs-rich investment: South Africa. New Agenda: South African Journal of Social and Economic Policy 2016: 10–15. [Google Scholar]

- Zalk, Nimrod. 2021. Structural Change in South Africa. In Structural Transformation in South Africa: The Challenges of Inclusive Industrial Development in a Middle-Income Country. Oxford: Oxford University Press, p. 28. [Google Scholar]

- Zhang, Wei Bin. 2018. Economic Growth Theory: Capital, Knowledge, and Economic Stuctures. London: Routledge. [Google Scholar]

| Date | GDP | GFCFMQ | GFCFM | GFCFEGW |

|---|---|---|---|---|

| 1980 | 4.2 | 26.2 | 34.5 | 1.6 |

| 1981 | 2.9 | 5.5 | −3.0 | 4.5 |

| 1982 | −2.7 | −5.9 | −9.8 | 14.5 |

| 1983 | −4.1 | −9.3 | −2.9 | 7.9 |

| 1984 | 2.8 | 3.6 | −13.3 | 11.9 |

| 1985 | −3.4 | 7.5 | −26.6 | −6.3 |

| 1986 | −2.2 | 7.8 | −24.7 | −37.3 |

| 1987 | −0.1 | −1.2 | −11.9 | −9.5 |

| 1988 | 2.0 | 9.3 | 42.8 | −14.3 |

| 1989 | 0.3 | 3.2 | 35.5 | 2.5 |

| 1990 | −2.4 | −6.2 | 13.8 | −5.1 |

| 1991 | −3.1 | −6.8 | −11.7 | −20.9 |

| 1992 | −4.2 | −18.7 | −6.0 | 0.2 |

| 1993 | −0.9 | −24.9 | 3.9 | −8.2 |

| 1994 | 1.1 | 18.2 | 9.2 | 13.6 |

| 1995 | 1.0 | 4.2 | 20.6 | 20.4 |

| 1996 | 2.1 | 1.6 | 6.6 | 13.3 |

| 1997 | 0.5 | 12.7 | 3.1 | −3.5 |

| 1998 | −1.6 | 7.6 | −2.7 | −24.0 |

| 1999 | 0.3 | −4.4 | −0.1 | −18.5 |

| 2000 | 2.1 | 11.7 | 1.2 | −17.4 |

| 2001 | 0.4 | 8.0 | 6.1 | −2.2 |

| 2002 | 0.2 | 13.6 | −3.0 | 14.4 |

| 2003 | 1.5 | 5.0 | 3.6 | 33.2 |

| 2004 | 3.4 | −19.2 | 17.4 | 16.2 |

| 2005 | 4.1 | −11.6 | 9.7 | 10.8 |

| 2006 | 4.4 | 48.7 | 12.8 | 14.3 |

| 2007 | 4.0 | 28.0 | 6.4 | 37.5 |

| 2008 | 1.8 | 25.6 | 7.6 | 48.4 |

| 2009 | −2.9 | 5.8 | −30.4 | 37.7 |

| 2010 | 1.5 | −3.7 | 6.6 | −1.6 |

| 2011 | 1.6 | −3.1 | 27.9 | 3.8 |

| 2012 | 0.8 | −1.8 | −5.2 | 10.9 |

| 2013 | 0.9 | 11.7 | 9.5 | 25.3 |

| 2014 | −0.1 | −5.0 | −5.2 | −12.7 |

| 2015 | −0.2 | −28.3 | 1.3 | 6.9 |

| 2016 | −0.8 | −22.0 | 1.8 | −6.5 |

| 2017 | −0.3 | 28.1 | 1.4 | −12.8 |

| 2018 | 0.0 | 20.6 | 4.2 | −23.9 |

| 2019 | −1.2 | 8.3 | 5.4 | −0.6 |

| 2020 | −7.2 | −14.8 | −17.7 | −24.7 |

| 2021 | 3.6 | −6.4 | −7.5 | −2.5 |

| 2022 | 0.9 | 8.1 | 8.5 | −4.5 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Semenya, D.; Ogujiuba, K. Evaluating the Effectiveness of Investment in Boosting South Africa’s Economic Growth: A Comparative Analysis across Different Administrations. Adm. Sci. 2024, 14, 173. https://doi.org/10.3390/admsci14080173

Semenya D, Ogujiuba K. Evaluating the Effectiveness of Investment in Boosting South Africa’s Economic Growth: A Comparative Analysis across Different Administrations. Administrative Sciences. 2024; 14(8):173. https://doi.org/10.3390/admsci14080173

Chicago/Turabian StyleSemenya, Dikeledi, and Kanayo Ogujiuba. 2024. "Evaluating the Effectiveness of Investment in Boosting South Africa’s Economic Growth: A Comparative Analysis across Different Administrations" Administrative Sciences 14, no. 8: 173. https://doi.org/10.3390/admsci14080173