Energy Sector Development: System Dynamics Analysis

Abstract

:1. Introduction

2. Research Method

2.1. Formulating a Simulation Model

Delimitations

- Nuclear power is excluded because it is not included in total Australian energy production. It is only produced for export and it seems unlikely to be used to generate power in the near future due to public opposition and high capital cost.

- Oil is excluded as Australia’s oil production already reached its peak in 2000, and reserves are declining with time [28]. In addition, most of Australia’s oil production is exported because the characteristics of Australian oil are not suited to Australia’s refineries [29]. However, CO2 emissions resulting from imported and exported oil are considered in the model.

- LPG is excluded as it depends on oil production, which is already excluded, and on natural gas production, which is already included.

- Solar hot water is excluded from the total supply of solar power due to slow growth and small capacities. Strong growth has been demonstrated for photovoltaic cells, which are included in the model.

- Biogas and biofuels are excluded from the total supply of biopower due to slow growth and small capacities. Strong growth and big amounts are only available for wood, wood waste and bagasse, which are included in the model. Although biomass releases CO2 emissions resulting from burning, it is excluded from the CO2 emissions model, as they are carbon-neutral energy resources. In other words, they captured already a nearly equivalent amount of CO2 through photosynthesis during their lifecycle.

- Geothermal is excluded as there has been no growth since 2004 with very small generated energy (0.5 GWh) since that time.

- Due to the data availability and small capacities of wind and solar power, historical data started from 2005, 2010 for wind and solar, respectively.

2.2. Model Validating/Testing

2.3. Policy Design and Evaluation

3. Results

3.1. The Simulation Model

3.1.1. Energy Resources Extraction Pipeline Model (Dispatchable Resources)

3.1.2. Energy Resources Extraction Pipeline Model (Non-Dispatchable Resources)

3.1.3. CO2 Emissions Model

3.2. Model Testing and Validation

3.2.1. Structural Tests

3.2.2. Behavioural Tests

3.3. Policy Design and Evaluation

4. Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Variable Name | Units | Parameter Value | References |

|---|---|---|---|

| Reserves (black coal) | GWh | 532,415,833.75 | [39] |

| Capital employed (black coal) | $ | 3,000,000,000 | |

| Capacity under construction (black coal) | GWh | 400,000 | |

| Energy production capacity (black coal) | GWh | 1,176,111.11 | |

| Reserves (brown coal) | GWh | 209,681,944.61 | [39] |

| Capital employed (brown coal) | $ | 200,000,000 | |

| Capacity under construction (brown coal) | GWh | 40,000 | |

| Energy production capacity (brown coal) | GWh | 125,194.44 | |

| Reserves (gas) | GWh | 37,420,833.36 | [39] |

| Capital employed (gas) | $ | 1,000,000,000 | |

| Capacity under construction (gas) | GWh | 80,000 | |

| Energy production capacity (gas) | GWh | 221,472.22 | |

| Capital employed (wind power) | $ | 100,000,000 | |

| Capacity under construction (wind power) | GWh | 500 | |

| Energy production capacity (wind power) | GWh | 885 | |

| Capital employed (solar power) | $ | 50,000,000 | |

| Capacity under construction (solar power) | GWh | 400 | |

| Energy production capacity (solar power) | GWh | 425 | |

| Capital employed (hydropower) | $ | 1,000,000,000 | |

| Capacity under construction (hydropower) | GWh | 3,000 | |

| Energy production capacity (hydropower) | GWh | 14,880 | |

| Capital employed (biopower) | $ | 4,000,000,000 | |

| Capacity under construction (biopower) | GWh | 1000 | |

| Energy production capacity (biopower) | GWh | 49,833.32 |

| Variable Name | Units | Parameter Value |

|---|---|---|

| New discoveries | GWh/year | 0 |

| Depletion | GWh/year | (pulse (“Energy extraction for electricity production”+”Energy extraction for non-electric purposes”,2017,1)) * (“Energy production capacity”/”Gross demand”) |

| Capex | $/year | “Capex costs” * ”New capacity start-up” |

| Depreciation | $/year | “Capital employed”/20 |

| New capacity orders | GWh/year | “Desired new capacity addition” |

| New capacity start-up | GWh/year | “Capacity under construction”/”Construction delay” |

| Capacity retirement | GWh/year | “Energy production capacity”/”Capacity lifespan” |

| Capacity bankruptcy | GWh/year | “Energy production capacity” * ”Unprofitable capacity “/100 |

| Variable Name | Units | Parameter Value |

|---|---|---|

| Capacity lifespan | year | 20 (coal and gas), 25 (wind and solar power), 50 (hydropower), 30 (biopower) |

| Construction delay | year | 5 (coal), 3 (gas), 2 (wind and solar power), 3 (hydro and biopower) |

| Desired new capacity addition | GWh/year | max (0,“Energy production capacity” * “Approved %”/100) |

| Approved % | % | “ROIC” - “Min% to invest” |

| Min % to invest | % | 10 |

| ROIC | % | (“Net profit”/“Capital employed”) * 100 |

| Net profit | $/year | (“Sales” * ”Net profit”) − “Depreciation” |

| Sales | GWh/year | if “Surplus or shortfall” > 0 then “Energy production capacity”*(1-“Surplus or shortfall”/100) else “Energy production capacity” |

| Net profit | $/GWh | “Wholesale price” - “Total supply cost” |

| Total supply cost | $/GWh | “Capital employed”/”Energy production capacity” |

| Wholesale price | $/GWh | “Adjustment factor” * “Total supply cost” * (“Gross demand”/“Energy production capacity”) + ((“Surplus or shortfall”/10)^3) |

| Adjustment factor | 1.35 (coal and gas), 1.4 (wind power), 1.25 (solar power), 1.3 (hydro and biopower) | |

| Surplus or shortfall | % | (“Energy production capacity”/“Gross demand”-1) * 100 |

| Gross demand | GWh/year | “Total supply” |

| Energy extraction for non-electric purposes | GWh/year | “Total supply”-“Energy extraction for electricity production” |

| Energy % for electricity production | % | “Energy extraction for electricity production”/“Total supply” * 100 |

| Energy % for non-electric purposes | % | “Energy extraction for non-electric purposes”/“Total supply”*100 |

| Total (CO2-e) | ton/year | “Black coal (CO2-e)” + “Brown coal (CO2-e)” + “Gas (CO2-e)” + “Oil (CO2-e)” |

| (CO2-e) | ton/GWh | 300 (coal), 250 (oil), 150 (gas) |

| (CO2-e) | ton/year | “Total net consumption” * “(CO2-e)” |

| Total net consumption | GWh/year | “Energy production capacity” * “Domestic consumption of total production”/100 |

| Australia’s domestic CO2 % footprint | % | “Total CO2 emissions of total consumption”/“Global CO2 emissions” * 100 |

| Australia’s global CO2 % footprint | % | “Total CO2 emissions of total production”/“Global CO2 emissions” * 100 |

| Total CO2 emissions of total production | ton/year | (“Energy production capacity (black coal)” * “Black coal-(CO2-e)”) + (“Energy production capacity (brown coal)” * “Brown coal-(CO2-e)”) + (“Total net oil consumption” * “Oil-(CO2-e)”) + (“Energy production capacity (gas)” * “Gas-(CO2-e)”) + (“Oil production”*250) |

| Oil dependency | % | “Total net oil consumption”/“Total energy consumption” * 100 |

| Total energy production | GWh | “Total non-RE production” + “Total RE” |

| Total non-RE production | GWh | “Oil production” + “Energy production capacity (black coal)” + “Production Capacity (brown coal)” + “Energy Production Capacity (gas)” |

| Renewable electricity | % | “Total RE”/“Total electricity generation” * 100 |

| Total energy consumption | GWh | (“Total non-RE” + “Total RE”) |

References

- Laimon, M.; Mai, T.; Goh, S.; Yusaf, T. A Systems—Thinking Approach to Address Sustainability Challenges to the Energy Sector. RSER. (under review).

- Narayan, P.K.; Smyth, R. Electricity consumption, employment and real income in Australia evidence from multivariate Granger causality tests. Energy Policy 2005, 33, 1109–1116. [Google Scholar] [CrossRef]

- Narayan, P.K.; Narayan, S.; Popp, S. Energy consumption at the state level: The unit root null hypothesis from Australia. Appl. Energy 2010, 87, 1953–1962. [Google Scholar] [CrossRef]

- Hunt, L.C.; Judge, G.; Ninomiya, Y. Underlying trends and seasonality in UK energy demand: A sectoral analysis. Energy Econ. 2003, 25, 93–118. [Google Scholar] [CrossRef]

- Barak, S.; Sadegh, S.S. Forecasting energy consumption using ensemble ARIMA–ANFIS hybrid algorithm. Int. J. Electr. Power Energy Syst. 2016, 82, 92–104. [Google Scholar] [CrossRef] [Green Version]

- Kankal, M.; Akpınar, A.; Kömürcü, M.İ.; Özşahin, T.Ş. Modeling and forecasting of Turkey’s energy consumption using socio-economic and demographic variables. Appl. Energy 2011, 88, 1927–1939. [Google Scholar] [CrossRef]

- Pao, H.-T.; Tsai, C.-M. Modeling and forecasting the CO2 emissions, energy consumption, and economic growth in Brazil. Energy 2011, 36, 2450–2458. [Google Scholar] [CrossRef]

- Kalogirou, S.A. Applications of artificial neural-networks for energy systems. Appl. Energy 2000, 67, 17–35. [Google Scholar] [CrossRef]

- Geem, Z.W.; Roper, W.E. Energy demand estimation of South Korea using artificial neural network. Energy Policy 2009, 37, 4049–4054. [Google Scholar] [CrossRef]

- Sözen, A.; Arcaklioğlu, E.; Özkaymak, M. Turkey’s net energy consumption. Appl. Energy 2005, 81, 209–221. [Google Scholar] [CrossRef]

- Pi, D.; Liu, J.; Qin, X. A grey prediction approach to forecasting energy demand in China. Energy Sources Part A Recovery Util. Environ. Eff. 2010, 32, 1517–1528. [Google Scholar] [CrossRef]

- Lin, C.-S.; Liou, F.-M.; Huang, C.-P. Grey forecasting model for CO2 emissions: A Taiwan study. Appl. Energy 2011, 88, 3816–3820. [Google Scholar] [CrossRef]

- Tsai, S.-B. Using grey models for forecasting China’s growth trends in renewable energy consumption. Clean Technol. Environ. Policy 2016, 18, 563–571. [Google Scholar]

- Ciscar, J.C.; Russ, P.; Parousos, L.; Stroblos, N. Vulnerability of the EU economy to oil shocks: A general equilibrium analysis with the GEM-E3 model. In 13th Annual Conference of the European Association of Environmental and Resource Economics; Citeseer: Budapest, Hungary, 2004. [Google Scholar]

- Syed, A. Australian Energy Projections to 2049–50; BREE: Canberra, Australia, 2014. [Google Scholar]

- Suppiah, R.; Hennessy, K.; Whetton, P.; McInnes, K.; Macadam, I.; Bathols, J.; Ricketts, J.; Page, C. Australian climate change projections derived from simulations performed for the IPCC 4th Assessment Report. Aust. Meteorol. Mag. 2007, 56, 131–152. [Google Scholar]

- Wei, Y.-M.; Wu, G.; Fan, Y.; Liu, L.-C. Progress in energy complex system modelling and analysis. Int. J. Glob. Energy Issues 2005, 25, 109–128. [Google Scholar] [CrossRef]

- Davies, E.G.; Simonovic, S.P. Energy Sector for the Integrated System Dynamics Model for Analyzing Behaviour of the Social-Economic-Climatic Model; Department of Civil and Environmental Engineering; The University of Western Ontario: London, ON, Canada, 2009. [Google Scholar]

- Mai, T.; Smith, C. Scenario-based planning for tourism development using system dynamic modelling: A case study of Cat Ba Island, Vietnam. Tourism Management 2018, 68, 336–354. [Google Scholar] [CrossRef]

- Mai, T.; Smith, C. Addressing the threats to tourism sustainability using systems thinking: A case study of Cat Ba Island, Vietnam. J. Sustain. Tour. 2015, 23, 1504–1528. [Google Scholar] [CrossRef]

- Mai, T.; Mushtaq, S.; Loch, A.; Reardon-Smith, K.; An-Vo, D.-A. A systems thinking approach to water trade: Finding leverage for sustainable development. Land Use Policy 2019, 82, 595–608. [Google Scholar] [CrossRef]

- Sterman, J.D. Business Dynamics: Systems Thinking and Modeling for a Complex World; Irwin/McGraw-Hill: Boston, MA, USA, 2000. [Google Scholar]

- Maani, K.; Cavana, R.Y. Systems Thinking, System Dynamics: Managing Change and Complexity; Prentice Hall: Auckland, New Zealand, 2007. [Google Scholar]

- Kelly, R.A.; Jakeman, A.J.; Barreteau, O.; Borsuk, M.E.; ElSawah, S.; Hamilton, S.H.; Henriksen, H.J.; Kuikka, S.; Maier, H.R.; Rizzoli, A.E. Selecting among five common modelling approaches for integrated environmental assessment and management. Environ. Model. Softw. 2013, 4, 159–181. [Google Scholar]

- Pruyt, E. Small System Dynamics Models for Big Issues: Triple Jump towards Real-World Complexity; TU Delft Library: Delft, The Netherlands, 2013. [Google Scholar]

- Zuo, Y.; Shi, Y.-L.; Zhang, Y.-Z. Research on the Sustainable Development of an Economic-Energy-Environment (3E) System Based on System Dynamics (SD): A Case Study of the Beijing-Tianjin-Hebei Region in China. Sustainability 2017, 9, 1727. [Google Scholar] [CrossRef] [Green Version]

- MacKay, D. Sustainable Energy-Without the Hot Air; UIT Cambridge: Cambridge, UK, 2008. [Google Scholar]

- Trading Economics. Australia Crude Oil Production. Available online: https://tradingeconomics.com/australia/crude-oil-production (accessed on 16 July 2019).

- Thurtell, D.; Nguyen, T.; Moloney, J.; Philalay, M.; Drahos, N.; Coghlan, J.; Nguyen, T.; Bath, A. Resources and Energy Quarterly-March 2019; DIIS: Canberra, Australia, 2019. [Google Scholar]

- Barlas, Y. Formal aspects of model validity and validation in system dynamics. Syst. Dyn. Rev. J. Syst. Dyn. Soc. 1996, 12, 183–210. [Google Scholar] [CrossRef]

- Ltd. S.D. Sysdea. Available online: https://sysdea.com/ (accessed on 11 December 2019).

- Barlas, Y. Multiple tests for validation of system dynamics type of simulation models. Eur. J. Oper. Res. 1989, 42, 59–87. [Google Scholar] [CrossRef]

- Blakers, A.; Lu, B.; Stocks, M. 100% renewable electricity in Australia. Energy 2017, 133, 471–482. [Google Scholar] [CrossRef]

- Parra, P.Y.; Hare, B.; Hutfilter, U.F.; Roming, N. Evaluating the Significance of Australia’s Global Fossil Fuel Carbon Footprint; Climate Analytics and Policy Institute: Berlin, Germany, 2019; p. 28. [Google Scholar]

- Canavan, H.M. Australia World’s Top Gas Exporter. Available online: https://www.minister.industry.gov.au/ministers/canavan/media-releases/australia-worlds-top-gas-exporter (accessed on 29 July 2019).

- Clarke, D.K. Wind Power Cost: The Facts. Available online: https://ramblingsdc.net/Australia/WindPowerCost.html (accessed on 30 July 2019).

- Winning, M.; Price, J.; Ekins, P.; Pye, S.; Glynn, J.; Watson, J.; McGlade, C. Nationally Determined Contributions under the Paris Agreement and the costs of delayed action. Climate Policy 2019, 19, 1–12. [Google Scholar] [CrossRef]

- McGlade, C.; Ekins, P. The geographical distribution of fossil fuels unused when limiting global warming to 2 C. Nature 2015, 517, 187. [Google Scholar] [CrossRef]

- BP. BP Statistical Review of World Energy 2018; Pureprint Group: London, UK, 2018. [Google Scholar]

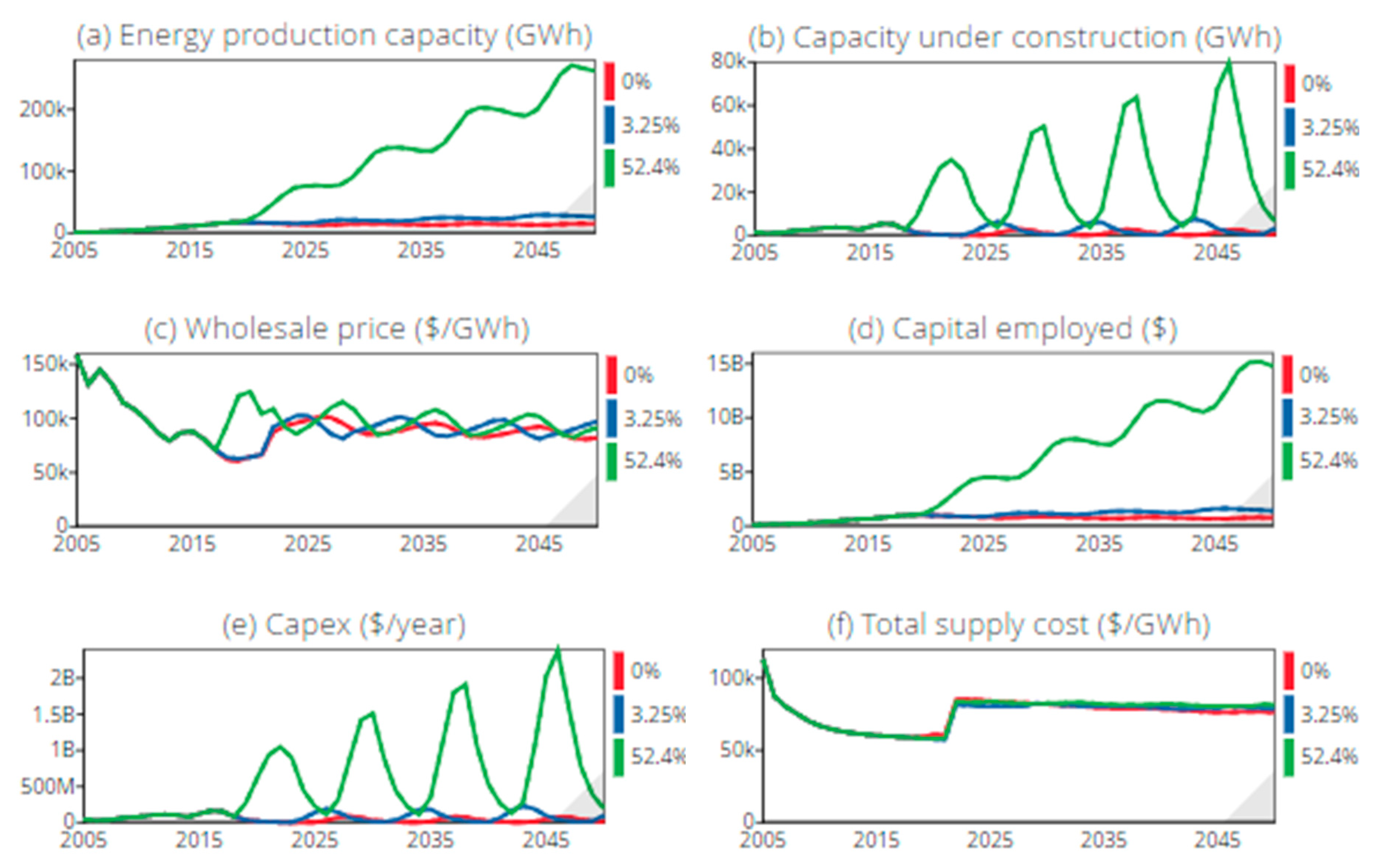

| Model Parameters | Scenario 1 (No Growth) | Scenario 2 (Base Case) | Scenario 3 (Likely Happen) |

|---|---|---|---|

| Black coal demand growth rate | 0% | 0% | 3.9% |

| Brown coal demand growth rate | 0% | −8% | −0.02% |

| Gas demand growth rate | 0% | 22.7% | 9.4% |

| Wind power demand growth rate | 0% | 3.25% | 16.9% |

| Solar demand growth rate | 0% | 18% | 59.2% |

| Hydropower demand growth rate | 0% | 6.3% | 3.4% |

| Bio demand growth rate | 0% | 4.71% | 0.65% |

| Scenarios | Oil Dependency | Australia’s Global CO2 Footprint | Australia’s Domestic CO2 Footprint | Reserves (Black Coal/Gas) | Renewable Electricity | ||

|---|---|---|---|---|---|---|---|

| Year | 2030 | 2050 | 2030 | 2030 | 2030 | 2050 | |

| Scenario 1 | 34% | 28% | 9% | 2.5% | 2158/2046 | 37% | 33.5% |

| Scenario 2 | 43% | 47% | 12% | 2.5% | 2158/2032 | 62.5% | 93.5% |

| Scenario 3 | 40% | 41% | 14% | 2.5% | 2082/2035 | 72% | 125% |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Laimon, M.; Mai, T.; Goh, S.; Yusaf, T. Energy Sector Development: System Dynamics Analysis. Appl. Sci. 2020, 10, 134. https://doi.org/10.3390/app10010134

Laimon M, Mai T, Goh S, Yusaf T. Energy Sector Development: System Dynamics Analysis. Applied Sciences. 2020; 10(1):134. https://doi.org/10.3390/app10010134

Chicago/Turabian StyleLaimon, Mohamd, Thanh Mai, Steven Goh, and Talal Yusaf. 2020. "Energy Sector Development: System Dynamics Analysis" Applied Sciences 10, no. 1: 134. https://doi.org/10.3390/app10010134