Optimal Operation of a Residential Battery Energy Storage System in a Time-of-Use Pricing Environment

Abstract

:1. Introduction

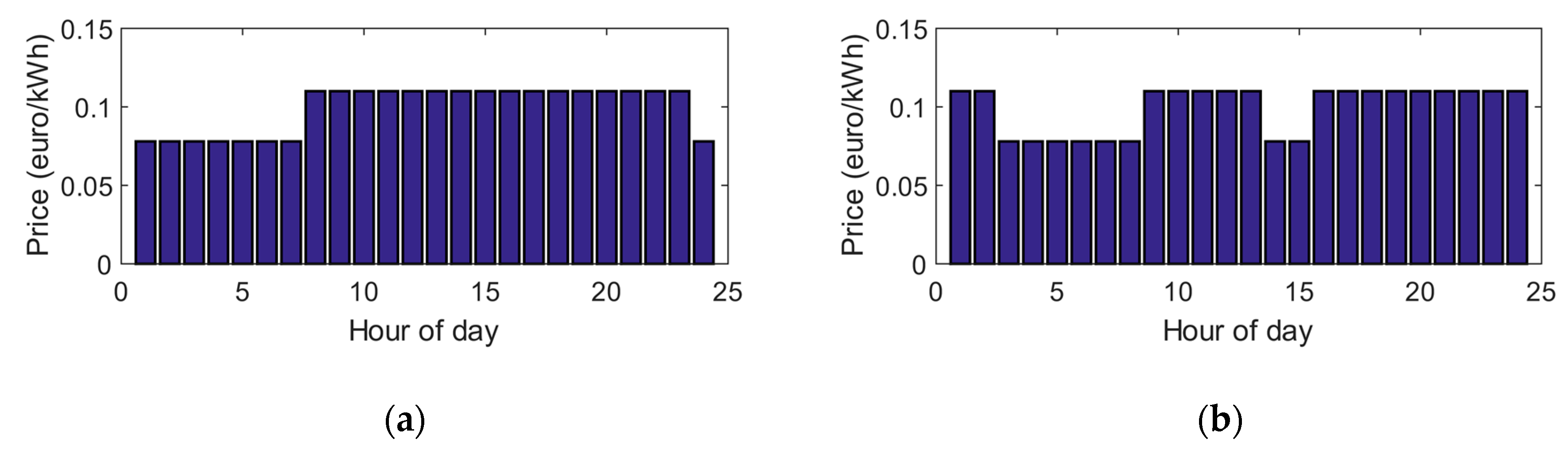

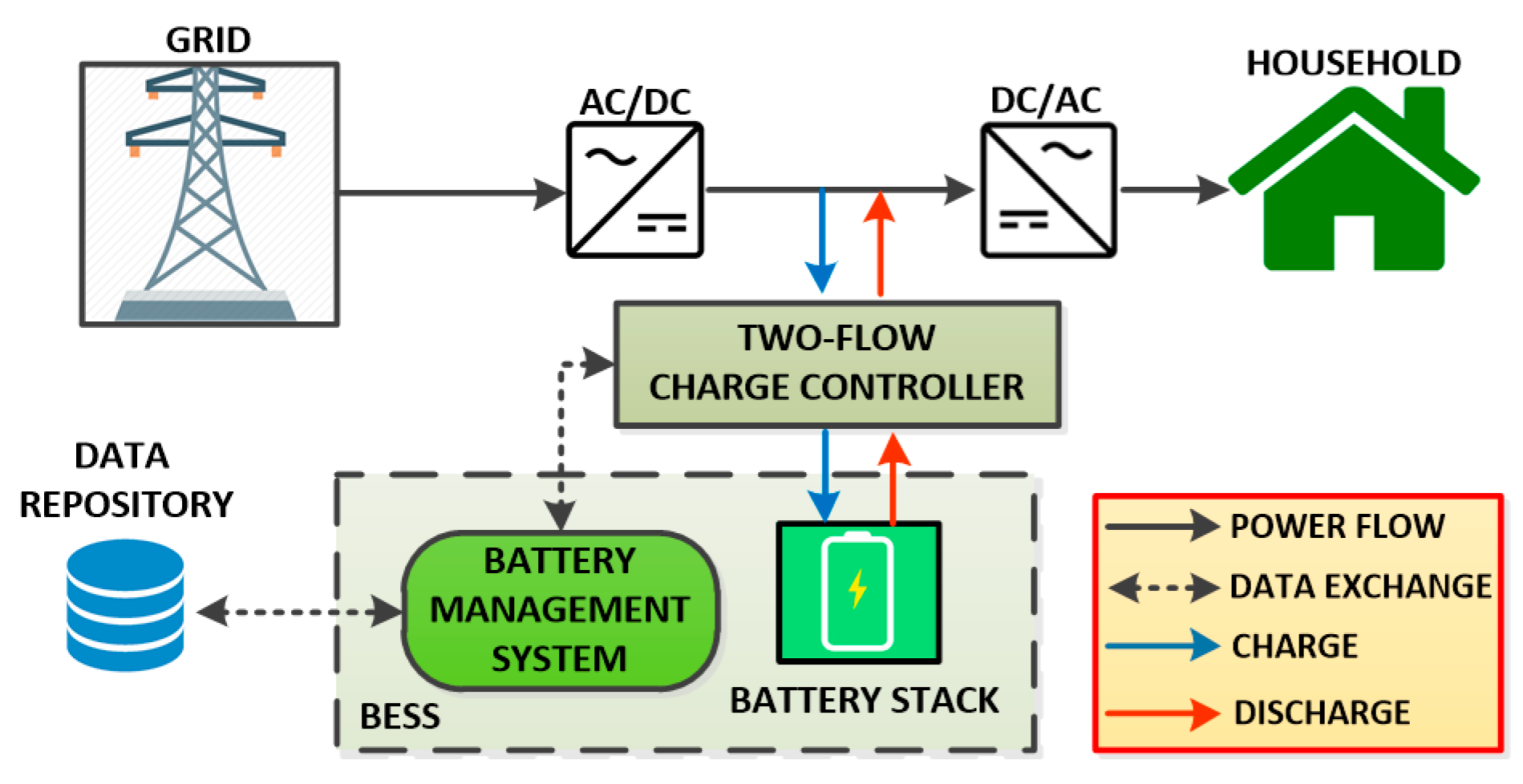

2. Residential BESS without RES in ToU Tariff

3. Battery Mathematical Models

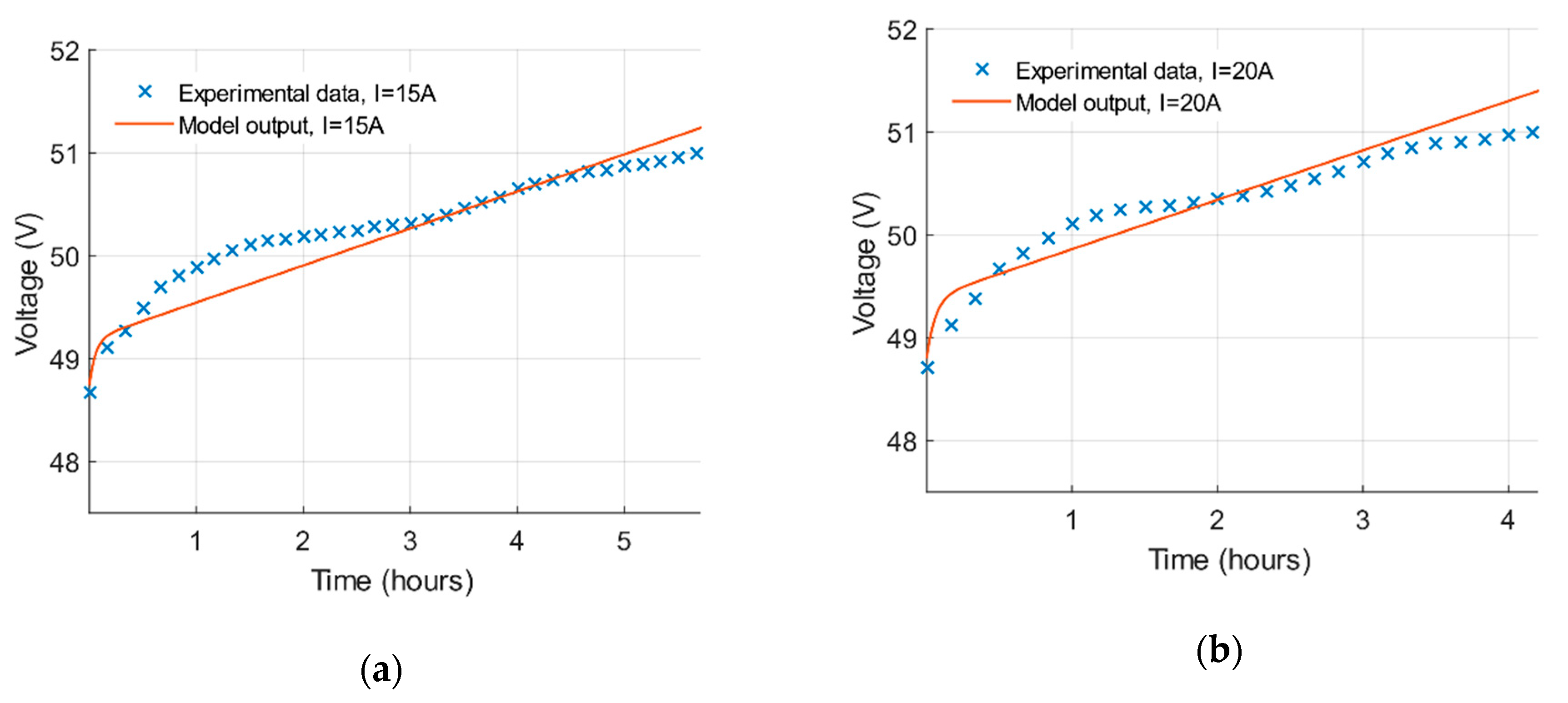

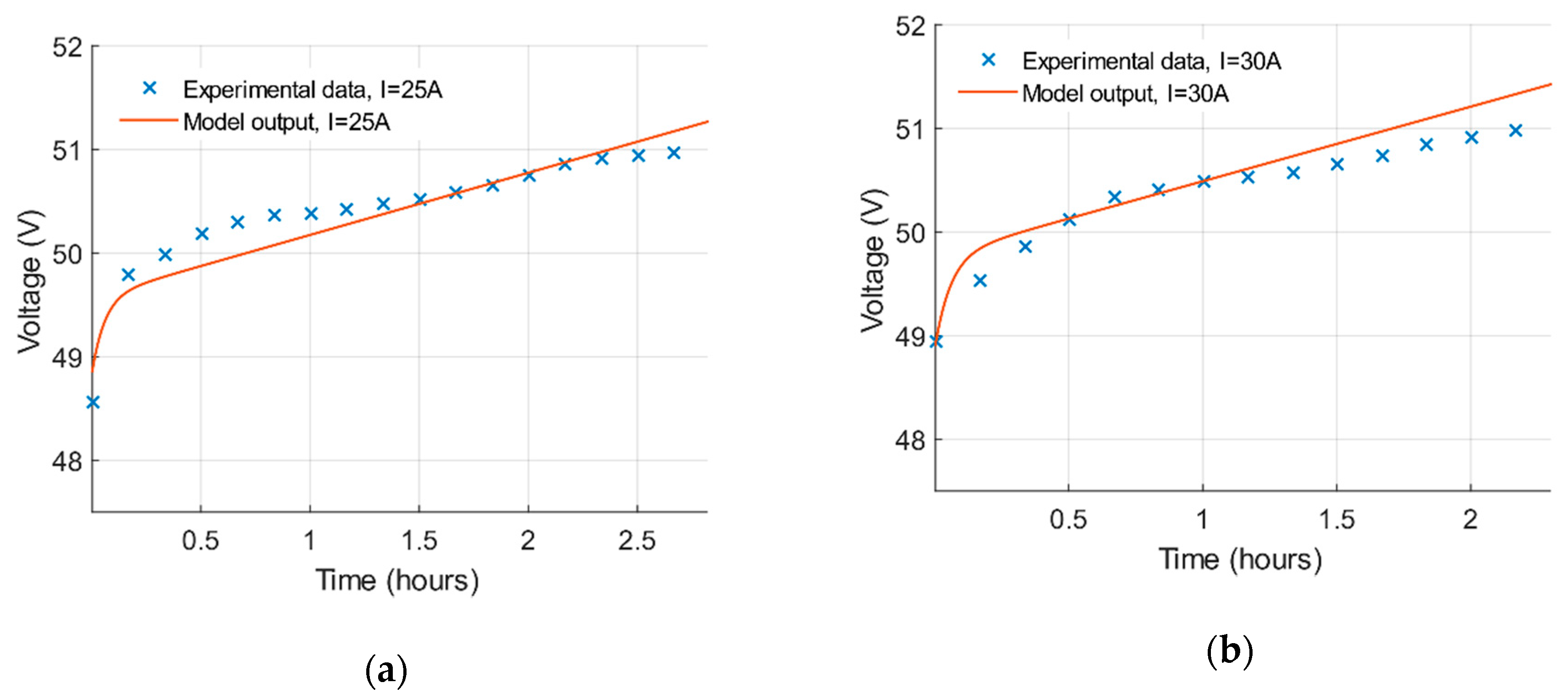

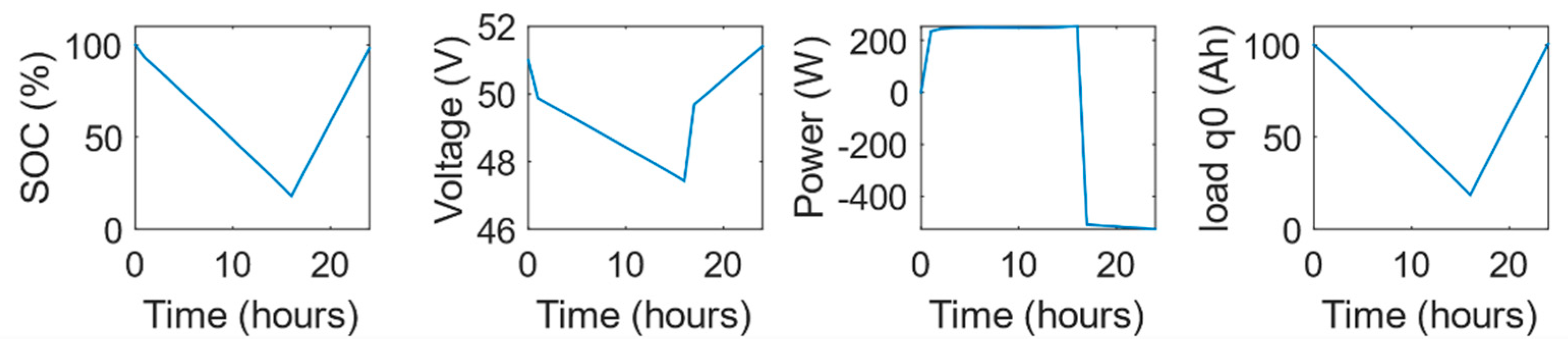

3.1. KiBaM Model

3.2. KiBaM Experimental Validation

3.3. Battery Degradation Model

3.3.1. Charging/Discharging Rate

3.3.2. Depth of Discharge

3.3.3. Multi Factor Model

4. Energy Management Strategies in Residential BESS without RES

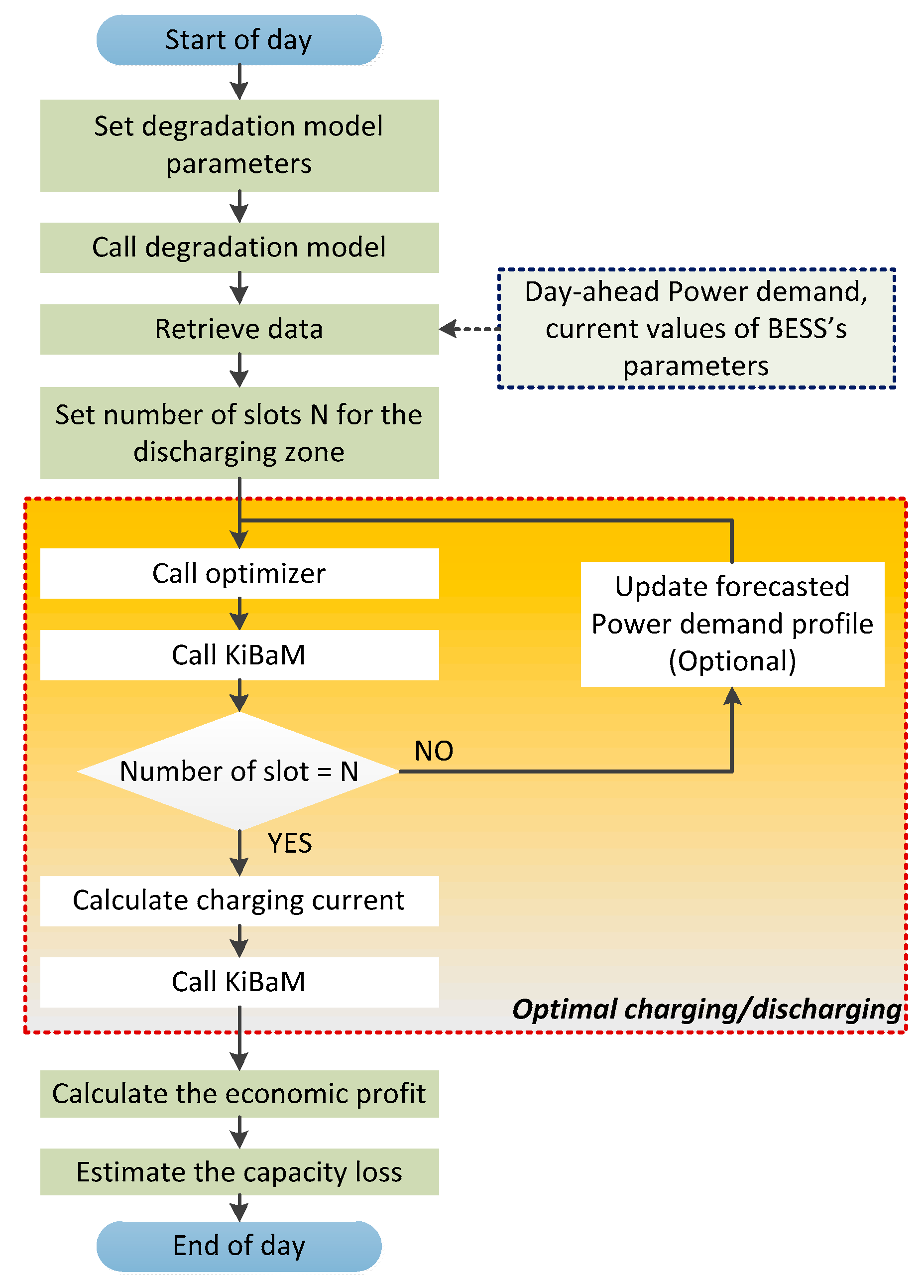

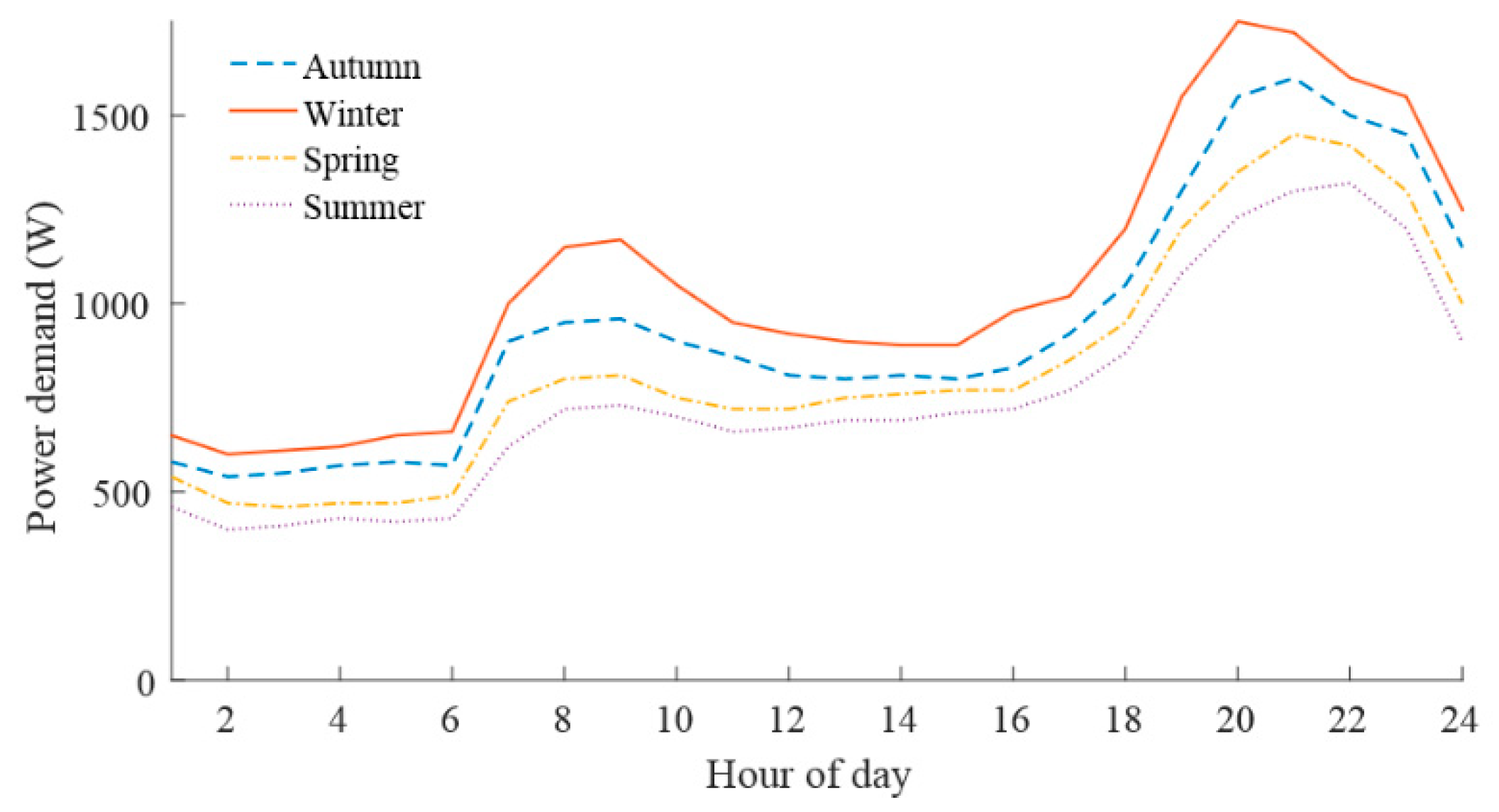

4.1. Energy Management Strategy at Spring/Summer ToU Tariff

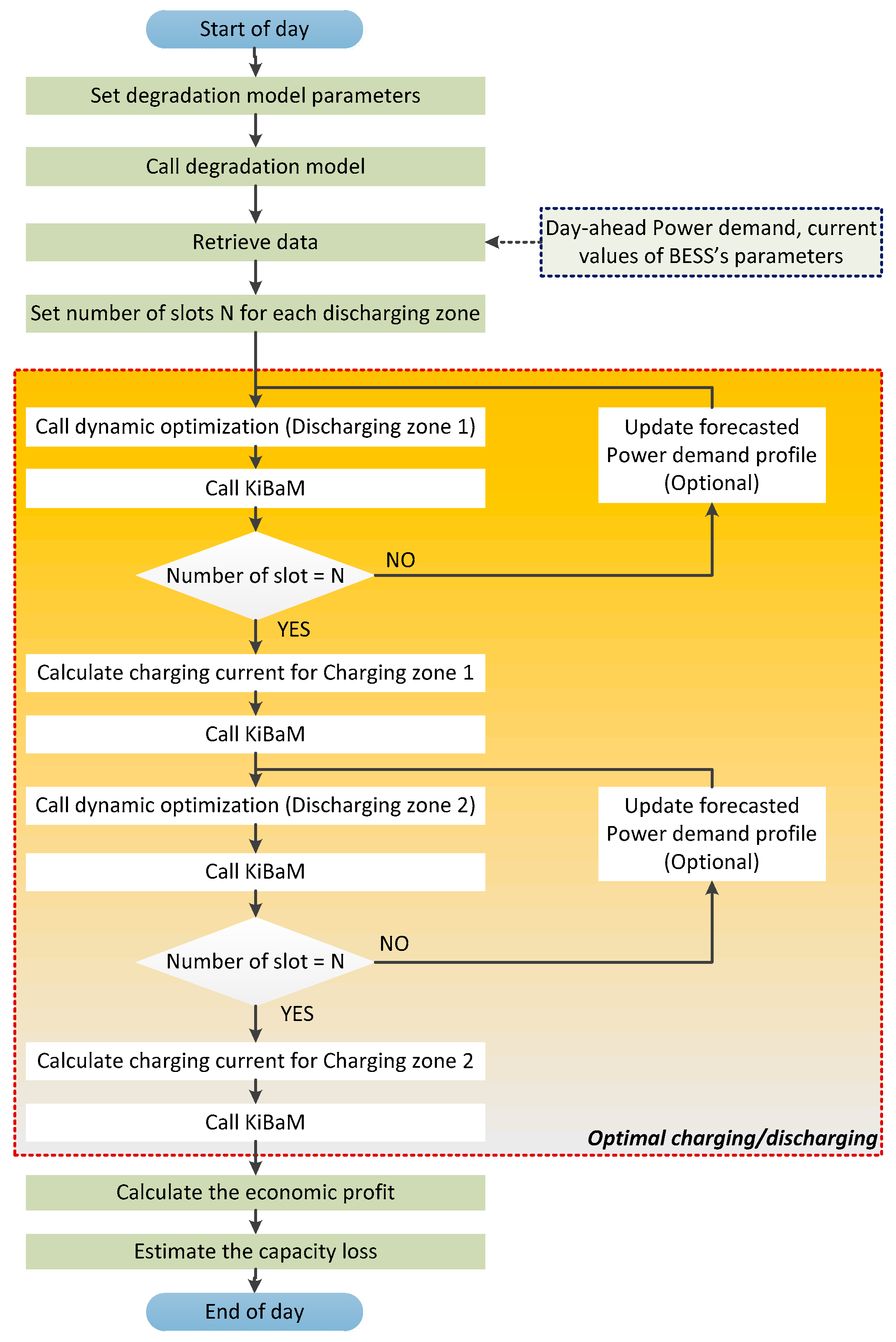

4.2. Energy Management Strategy at Autumn/Winter ToU Tariff

4.3. Dynamic Optimization

4.4. End of Day Calculations

5. Analysis of Behavior and Results

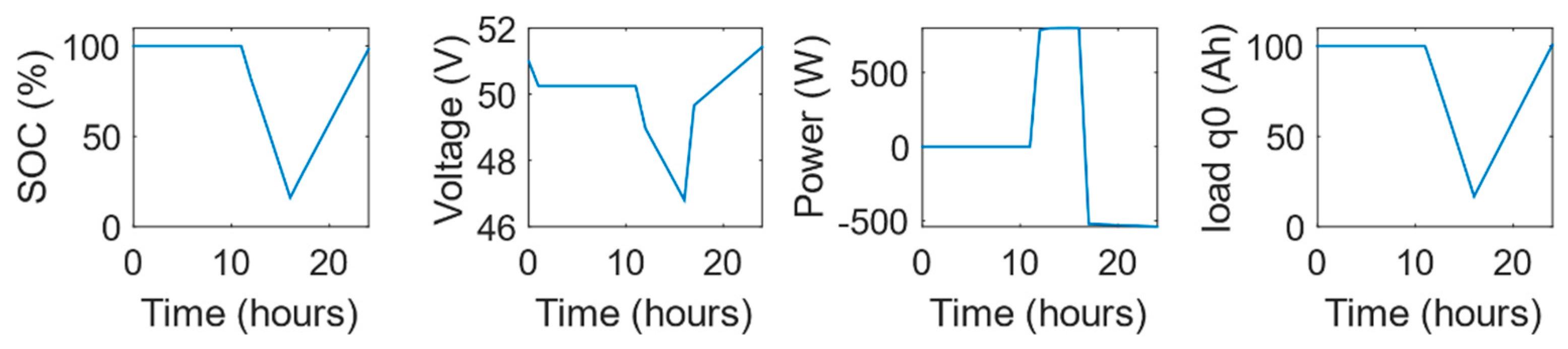

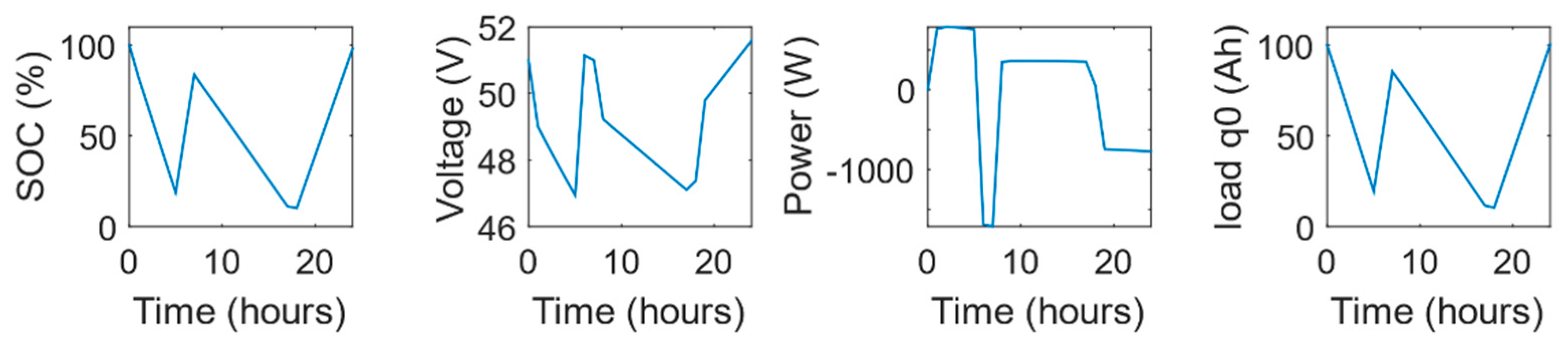

5.1. Simulation Results at Spring/Summer ToU Tariff

5.1.1. Spring Day Scenario

5.1.2. Summer Day Scenario

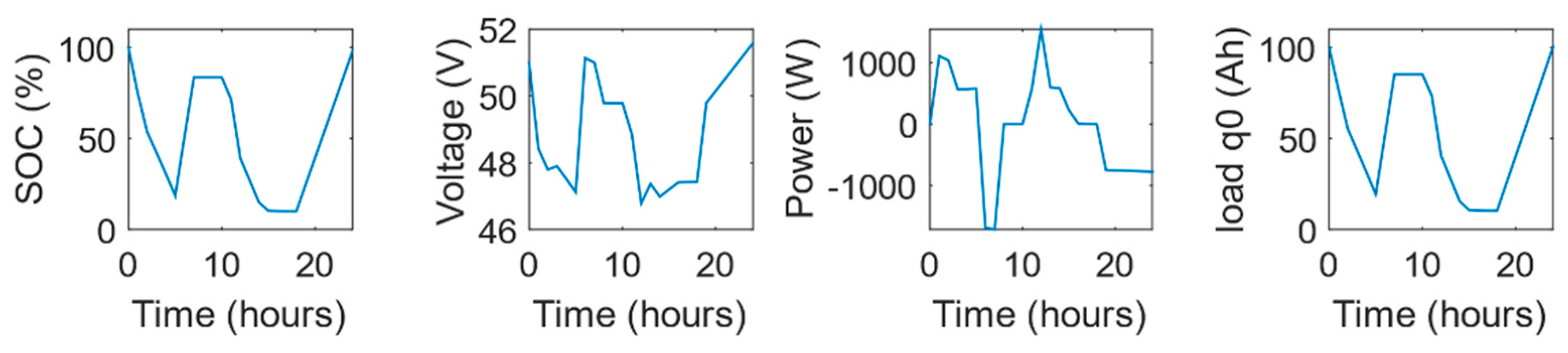

5.2. Simulation Results at Autumn/Winter ToU Tariff

5.2.1. Autumn Day Scenario

5.2.2. Winter Day Scenario

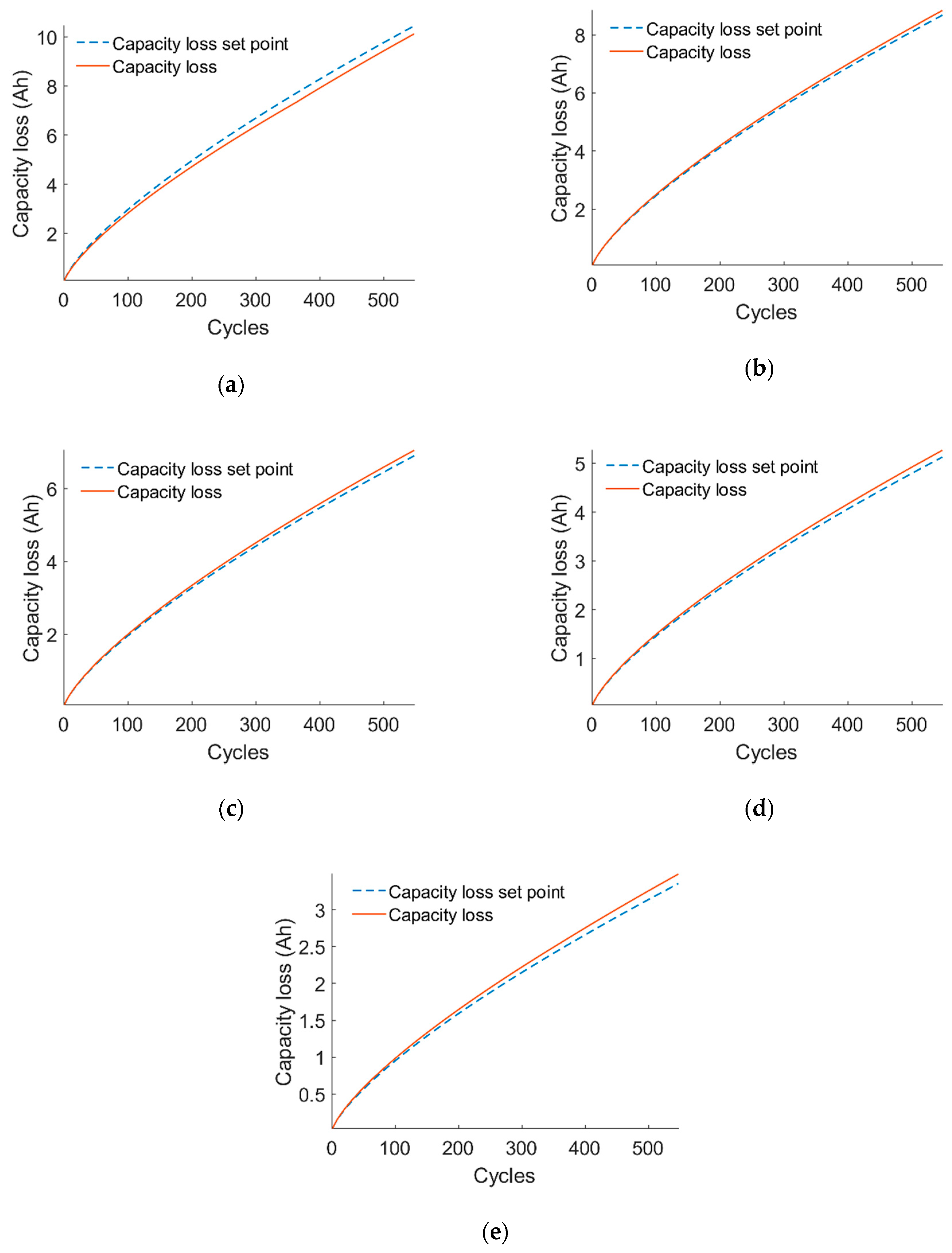

5.3. Multi-Season Simulations

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Bila, M.; Opathella, C.; Venkatesh, B. Grid connected performance of a household lithium-ion battery energy storage system. J. Energy Storage 2016, 6, 178–185. [Google Scholar] [CrossRef]

- Naumann, M.; Karl, R.C.; Truong, C.N.; Jossen, A.; Hesse, H.C. Lithium-ion Battery Cost Analysis in PV-household Application. Energy Procedia 2015, 73, 37–47. [Google Scholar] [CrossRef] [Green Version]

- Raceanu, M.; Bizon, N.; Marinoiu, A.; Varlam, M. Design and Experimental Investigations of an Energy Storage System in Microgrids, Microgrid Architectures. Control. Prot. Methods 2020, 2020, 207–232. [Google Scholar]

- Linssen, J.; Stenzel, P.; Fleer, J. Techno-economic analysis of photovoltaic battery systems and the influence of different consumer load profiles. Appl. Energy 2017, 185, 2019–2025. [Google Scholar] [CrossRef]

- Uddin, K.; Gough, R.; Radcliffe, J.; Marco, J.; Jennings, P. Techno-economic analysis of the viability of residential photovoltaic systems using lithium-ion batteries for energy storage in the United Kingdom. Appl. Energy 2017, 206, 12–21. [Google Scholar] [CrossRef]

- Quoilin, S.; Kavvadias, K.; Mercier, A.; Pappone, I.; Zucker, A. Quantifying self-consumption linked to solar home battery systems: Statistical analysis and economic assessment. Appl. Energy 2016, 182, 58–67. [Google Scholar] [CrossRef]

- Moshövel, J.; Kairies, K.-P.; Magnor, D.; Leuthold, M.; Bost, M.; Gährs, S.; Szczechowicz, E.; Cramer, M.; Sauer, D.U. Analysis of the maximal possible grid relief from PV-peak-power impacts by using storage systems for increased self-consumption. Appl. Energy 2015, 137, 567–575. [Google Scholar] [CrossRef]

- Khalilpour, R.; Vassallo, A. Planning and operation scheduling of PV-battery systems: A novel methodology. Renew. Sustain. Energy Rev. 2016, 53, 194–208. [Google Scholar] [CrossRef]

- Pawel, I. The Cost of Storage—How to Calculate the Levelized Cost of Stored Energy (LCOE) and Applications to Renewable Energy Generation. Energy Procedia 2014, 46, 68–77. [Google Scholar] [CrossRef] [Green Version]

- Galatsopoulos, C.; Papadopoulou, S.; Ziogou, C.; Voutetakis, S. Energy Management Strategy in a Residential Battery Energy Storage System. In Proceedings of the 2018 26th Mediterranean Conference on Control and Automation (MED), Zadar, Croatia, 19–22 June 2018. [Google Scholar]

- Galatsopoulos, C.; Papadopoulou, S.; Ziogou, C.; Trigkas, D.; Yfoulis, C.; Voutetakis, S. Non-Linear Model Predictive Control for Preventing Premature Aging in Battery Energy Storage System. In Proceedings of the 2018 UKACC 12th International Conference on Control (CONTROL), Sheffield, UK, 5–7 September 2018. [Google Scholar]

- Vonsien, S.; Madlener, R. Li-ion battery storage in private households with PV systems: Analyzing the economic impacts of battery aging and pooling. J. Energy Storage 2020, 29, 101407. [Google Scholar] [CrossRef]

- Angenendt, G.; Zurmühlen, S.; Mir-Montazeri, R.; Magnor, D.; Sauer, D.U. Enhancing Battery Lifetime in PV Battery Home Storage System Using Forecast Based Operating Strategies. Energy Procedia 2016, 99, 80–88. [Google Scholar] [CrossRef] [Green Version]

- Iwafune, Y.; Ikegami, T.; da Silva Fonseca, J.G., Jr.; Oozeki, T.; Ogimoto, K. Cooperative home energy management using batteries for a photovoltaic system considering the diversity of households. Energy Convers. Manag. 2015, 96, 322–329. [Google Scholar] [CrossRef]

- Manwell, J.F.; McGowan, J.G. Lead acid battery storage model for hybrid energy systems. Sol. Energy 1993, 50, 399–405. [Google Scholar] [CrossRef]

- Barré, A.; Deguilhem, B.; Grolleau, S.; Gérard, M.; Suard, F.; Riu, D. A review on lithium-ion battery ageing mechanisms and estimations for automotive applications. J. Power Sources 2013, 241, 680–689. [Google Scholar] [CrossRef] [Green Version]

- Stamps, A.T.; Holland, C.E.; White, R.E.; Gatzke, E.P. Analysis of capacity fade in a lithium ion battery. J. Power Sources 2005, 150, 229–239. [Google Scholar] [CrossRef]

- Rezvanizaniani, S.M.; Liu, Z.; Chen, Y.; Lee, J. Review and recent advances in battery health monitoring and prognostics technologies for electric vehicle (EV) safety and mobility. J. Power Sources 2014, 256, 110–124. [Google Scholar] [CrossRef]

- Wenzl, H.; Baring-Gould, I.; Kaiser, R.; Liaw, B.Y.; Lundsager, P.; Manwell, J.; Ruddell, A.; Svoboda, V. Life prediction of batteries for selecting the technically most suitable and cost effective battery. J. Power Sources 2005, 144, 373–384. [Google Scholar] [CrossRef]

- Bloom, I.; Cole, B.W.; Sohn, J.J.; Jones, S.A.; Polzin, E.G.; Battaglia, V.S.; Henriksen, G.L.; Motloch, C.; Richardson, R.; Unkelhaeuser, T.; et al. An accelerated calendar and cycle life study of Li-ion cells. J. Power Sources 2001, 101, 238–247. [Google Scholar] [CrossRef]

- Cui, Y.; Du, C.; Yin, G.; Gao, Y.; Zhang, L.; Guan, T.; Yang, L.; Wang, F. Multi-stress factor model for cycle lifetime prediction of lithium ion batteries with shallow-depth discharge. J. Power Sources 2015, 279, 123–132. [Google Scholar] [CrossRef]

- Wang, J.; Liu, P.; Hicks-Garner, J.; Sherman, E.; Soukiazian, S.; Verbrugge, M.; Tataria, H.; Musser, J.; Finamore, P. Cycle-life model for graphite-LiFePO4 cells. J. Power Sources 2011, 196, 3942–3948. [Google Scholar] [CrossRef]

- Georg Bock, H.; Diehl, M.; Schlöder, J.P.; Allgöwer, F.; Findeisen, R.; Nagy, Z. Real-Time Optimization and Nonlinear Model Predictive Control of Processes Governed by Differential-Algebraic Equations. J. Process. Control. 2000, 12, 577–5851. [Google Scholar] [CrossRef]

| Variable | Description | Unit |

|---|---|---|

| Qloss | Capacity loss | Ah |

| A | Pre-exponential factor | Ah |

| Ea | Activation energy | J*mol−1 |

| R | Gas constant | J*mol−1K−1 |

| T | Temperature | K |

| n | Number of cycles | |

| z | Cycles exponent |

| ξ1 | ξ2 | ξ3 | ξ4 | ξ5 | ξ6 | ξ7 | ξ8 | ξ9 | ξ10 | ξ11 | ξ12 | ξ13 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2330 | 1337 | 13,530 | 433 | 337 | 503 | 2223 | 3138 | 15,767 | 3624 | 1419 | 2721 | 11 |

| DOD | Profit during Autumn | Profit during Winter | Profit during Spring | Profit during Summer | Overall Profit (1 Year) | Capacity Loss (1 Year) |

|---|---|---|---|---|---|---|

| 80% | 20.9 € | 20.9 € | 10.75 € | 10.87 € | 63.42 € | 10.12 Ah |

| 70% | 19.25 € | 19.25 € | 9.38 € | 9.53 € | 57.41 € | 8.84 Ah |

| 60% | 16.25 € | 16.25 € | 7.99 € | 8.08 € | 48.57 € | 7.05 Ah |

| 50% | 13.78 € | 13.78 € | 6.58 € | 6.65 € | 40.79 € | 5.26 Ah |

| 40% | 10.98 € | 10.98 € | 5.16 € | 5.22 € | 32.34 € | 3.48 Ah |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Galatsopoulos, C.; Papadopoulou, S.; Ziogou, C.; Trigkas, D.; Voutetakis, S. Optimal Operation of a Residential Battery Energy Storage System in a Time-of-Use Pricing Environment. Appl. Sci. 2020, 10, 5997. https://doi.org/10.3390/app10175997

Galatsopoulos C, Papadopoulou S, Ziogou C, Trigkas D, Voutetakis S. Optimal Operation of a Residential Battery Energy Storage System in a Time-of-Use Pricing Environment. Applied Sciences. 2020; 10(17):5997. https://doi.org/10.3390/app10175997

Chicago/Turabian StyleGalatsopoulos, Charalampos, Simira Papadopoulou, Chrysovalantou Ziogou, Dimitris Trigkas, and Spyros Voutetakis. 2020. "Optimal Operation of a Residential Battery Energy Storage System in a Time-of-Use Pricing Environment" Applied Sciences 10, no. 17: 5997. https://doi.org/10.3390/app10175997