Risk Factors Impacting the Project Value Created by Green Buildings in Saudi Arabia

Abstract

:1. Introduction

2. Risk Classification in Green Building Development

2.1. Functional Risks

2.2. Financial Risks

- Due to the common belief that “green cost [is] much higher”, lending amounts can be disproportionate to need resulting in needless debt;

- Return on Investment needs more of a historical perspective to become more predictable;

- Inexperienced teams might lack the skills to properly implement green-oriented technology, which could hinder its effectiveness;

- Company budgets are not usually structured to track life cycle cost (LCC) for a project, making longer-term gains harder to record;

- Costs associated with litigation between the architect/engineers and the owner if certification is not reached;

- Loss of tax incentives if certification is not reached;

- New green building materials might result in issues never encountered previously and be a source of litigation;

- Loss of possible financial gain if the building does not perform as it was intended to; and

- The possible unforeseen conditions of retrofitting existing buildings.

2.3. Operational Risks

2.4. Environmental Risks

2.5. Management Risks

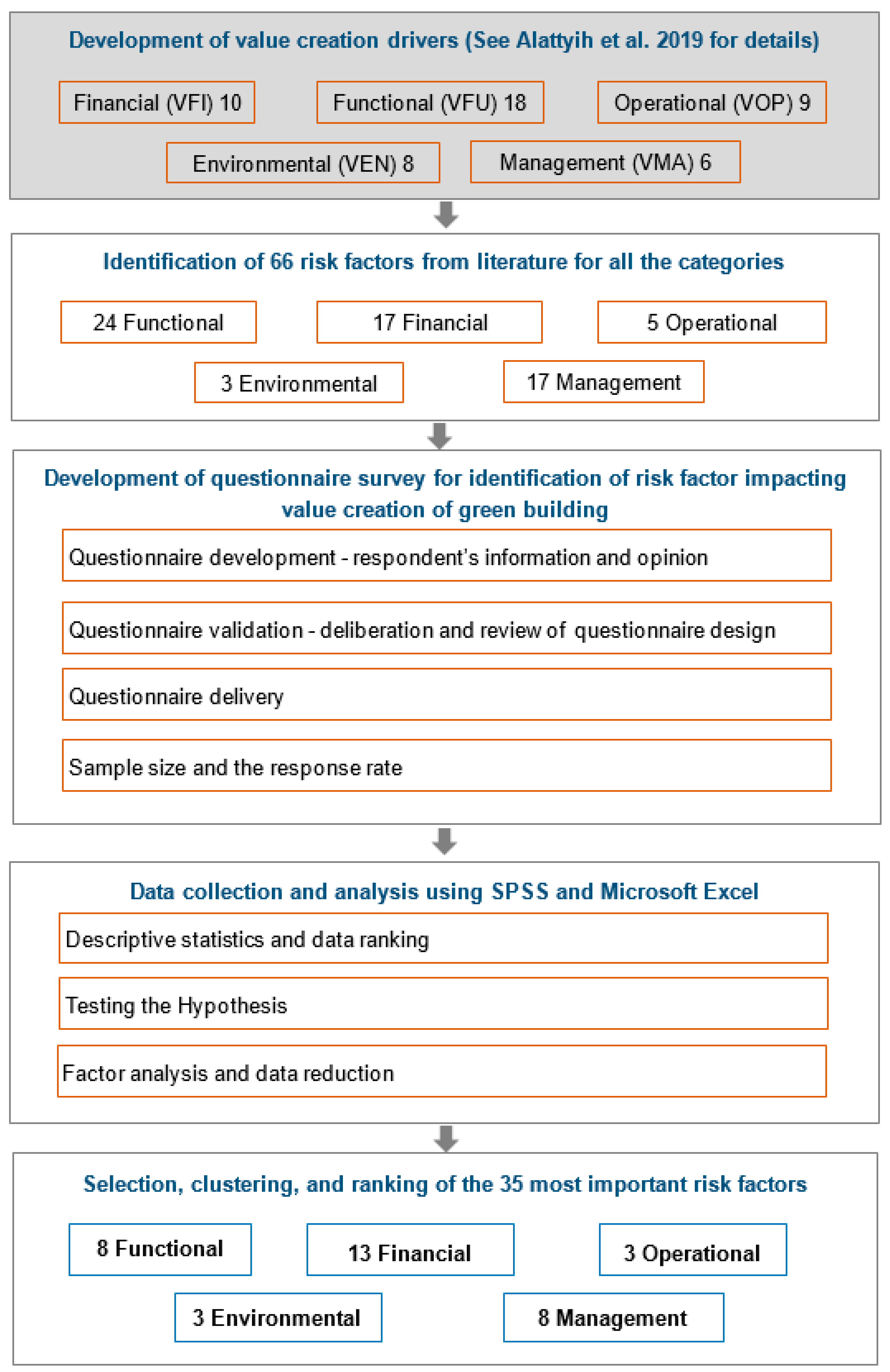

3. Methodology

3.1. Framework for Identification of Risk Factors

3.2. Identification of Risk Factors

3.3. Questionnaire Design and Development

| Group | Code | Risk Factors | References |

|---|---|---|---|

| Functional Risks | R20 | Failure to consider construction implications during design | Isa et al. [29] Al-Yousefi [28] Zou and Couani [25] Wiedemer et al. [27] Green Building Council [30] Boussabaine and Kirkham [21] Muldavin [46] Durmus-Pedini and Ashuri [36] |

| R19 | Failure to design to brief/specification | ||

| R17 | Failure to examine specifications due to unnecessary expense | ||

| R33 | Failure to integrate the various systems to achieve the lowest life cycle costs | ||

| R21 | Design changes | ||

| R22 | Redesign/rework | ||

| R35 | Failure to identify low-value, long-lead-time items | ||

| R36 | Failure to consider design risks | ||

| R15 | Failure to consider constructability issues | ||

| R16 | Failure to appreciate design uncertainty | ||

| R18 | Failure to translate specification into the design | ||

| R23 | Failure to consider changes to current design standards | ||

| R24 | Failure to examine attributes which have no useful function | ||

| R25 | Failure to identify and understand functions | ||

| R26 | Unsuitable functional analysis | ||

| R27 | Failure to identify appropriate alternative function | ||

| R29 | Unproven construction techniques | ||

| R30 | Failure to consider legislative/regulation issues | ||

| R31 | Failure to consider new/change in technology | ||

| R32 | Failure to meet performance or design standards | ||

| R34 | Failure to choose/specify reliable materials | ||

| R37 | Failure to consider inter-dependence between components in design | ||

| R40 | Insufficient space and capacity | ||

| R41 | Failure to consider construction health and safety | ||

| Financial Risks | R11 | Failure to recognize cost–value mismatches | Isa et al. [29] Zurich [31] Zou and Couani [25] NAO [33] Haghnegahdar and Asgharizadeh [32] Boussabaine and Kirkham [21] Green Building Council [30] Cajias and Bienert [47] Eichholtz et al. [48] Parker [49] Davies [35] Muldavin [46] Durmus-Pedini and Ashuri [36] |

| R10 | Failure to identify cost–value relationships | ||

| R8 | Failure to consider the cost of losing potential revenue | ||

| R12 | Failure to appropriately locate cost-to-function allocation | ||

| R9 | Uncertainty about prices | ||

| R5 | Inappropriate cost evaluation criteria | ||

| R6 | Failure to consider future operational costs | ||

| R3 | Failure to consider implication of economic conditions | ||

| R1 | Insufficient funding | ||

| R7 | Failure to recognise cost as resource expenditure | ||

| R65 | Incorrect estimated cost of maintenance | ||

| R63 | Incorrect cost estimate | ||

| R66 | Incorrect estimated cost of energy used | ||

| R2 | Funding is unavailable | ||

| R4 | Inadequate inflation forecasts | ||

| R13 | Failure to identify cost-to-worth relationships | ||

| R14 | Failure to link or identify performance-to-cost relationships | ||

| Operational Risks | R44 | Failure to consider increase in routine maintenance | Lutkendorft and Lorenz [37] Zurich [31] Muldavin [46] Boussabaine and Kirkham [21] |

| R45 | Failure to consider increase in life cycle replacement | ||

| R39 | Failure to consider design impact on operating efficiency | ||

| R42 | Failure to consider component repair and replacement | ||

| R46 | Limited knowledge of maintenance issues | ||

| Environmental Risks | R38 | Failure to consider obsolescence of equipment impact | Boussabaine and Kirkham [21]; Green Building Council [30]; Muldavin [46]; Zurich [31]; Lützkendorfa and Lorenza [37] |

| R43 | Failure to consider maintainability and reparability impact | ||

| R47 | Failure to consider implication of environmental risks | ||

| Management Risks | R49 | Poor project management | Wi and Junge [45] Jha and Iyer [50] NAO [33] Gritzo et al. [44] Muldavin [46] Durmus-Pedini and Ashuri [36] Shen and Liu [51] Zou and Couani [25] |

| R50 | Poor definition of the scope and objectives of projects | ||

| R51 | Project scope unscheduled items | ||

| R57 | Improper project planning and budgeting | ||

| R53 | Lack of coordination and decision-making | ||

| R64 | Incorrect time estimate | ||

| R54 | Poor team relationships | ||

| R28 | Poor design that may lead to higher operation costs | ||

| R48 | Lack of background information | ||

| R52 | Failure to consider construction techniques | ||

| R55 | Programming issues | ||

| R56 | Failure to consider procurement method | ||

| R58 | Failure to build to design | ||

| R59 | Failure to identify complex items or processes with little or no value added to the facility | ||

| R60 | Failure to consider rate of deterioration of components | ||

| R61 | Lack of considering early failure of components and equipment | ||

| R62 | Failure to consider delay and higher cost due to bad weather conditions during construction |

3.4. Statistical Analysis

3.4.1. Descriptive Statistics and Data Ranking

3.4.2. Testing the Hypotheses

3.4.3. Factor Analysis and Data Reduction

4. Results and Discussion

4.1. Descriptive Statistics and Data Ranking

4.2. Testing the Hypothesis

4.3. Factor Analysis

4.3.1. Cluster 1: Financial Risk

4.3.2. Cluster 2: Functional Risk

4.3.3. Cluster 3: Operational Risk

4.3.4. Cluster 4: Environmental Risk

4.3.5. Cluster 5: Management Risk

4.4. Impact of Risk Factors to Value Creation

4.4.1. Financial Risks

4.4.2. Functional Risks

4.4.3. Operational Risks

4.4.4. Environmental Risks

4.4.5. Management Risks

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| What is the likelihood of the following risk factors having an impact on the project value created by green building design? | ||||||

| No. | Risk Factors | Rate the Likelihood Impact of the Risk Factors on Project Value Creation (Please Tick One Box) | ||||

| Very Likely | Likely | Neutral | Unlikely | Very Unlikely | ||

| 1 | Funding is unavailable | |||||

| 2 | Failure to consider implication of economic conditions | |||||

| 3 | Inadequate inflation forecasts | |||||

| 4 | Inappropriate cost evaluation criteria | |||||

| ... | … | |||||

Appendix B

| Code | Mean | Std. Deviation | Severity index | Coefficient of variation | Ranking | ||||||

| Manager | Engineer | Architect | 0 to 5 years | 6 to 10 years | More than 10 years | Overall Ranking | |||||

| R1 | 4.09 | 0.861 | 81.80 | 21.06 | 6 | 7 | 8 | 18 | 4 | 6 | 4 |

| R2 | 3.63 | 1.274 | 72.58 | 35.10 | 59 | 35 | 44 | 24 | 36 | 62 | 56 |

| R3 | 3.81 | 0.940 | 76.18 | 24.68 | 35 | 28 | 31 | 3 | 51 | 33 | 29 |

| R4 | 3.76 | 0.966 | 75.28 | 25.65 | 54 | 17 | 26 | 33 | 41 | 32 | 35 |

| R5 | 3.94 | 0.871 | 78.88 | 22.08 | 22 | 6 | 25 | 45 | 34 | 5 | 13 |

| R6 | 3.96 | 1.065 | 79.10 | 26.93 | 17 | 18 | 3 | 21 | 18 | 16 | 12 |

| R7 | 3.85 | 0.995 | 77.08 | 25.81 | 39 | 25 | 4 | 44 | 35 | 15 | 19 |

| R8 | 3.85 | 0.886 | 77.08 | 22.99 | 34 | 16 | 24 | 29 | 50 | 12 | 20 |

| R9 | 3.83 | 1.069 | 76.63 | 27.89 | 20 | 34 | 42 | 43 | 46 | 14 | 24 |

| R10 | 3.78 | 1.020 | 75.51 | 27.01 | 28 | 49 | 23 | 42 | 54 | 20 | 33 |

| R11 | 3.81 | 0.952 | 76.18 | 24.99 | 26 | 53 | 13 | 20 | 59 | 18 | 30 |

| R12 | 3.82 | 0.860 | 76.40 | 22.52 | 23 | 43 | 18 | 22 | 45 | 21 | 27 |

| R13 | 3.72 | 0.965 | 74.38 | 25.95 | 30 | 60 | 35 | 41 | 63 | 23 | 41 |

| R14 | 3.63 | 0.981 | 72.58 | 27.04 | 45 | 63 | 41 | 59 | 62 | 35 | 55 |

| R15 | 3.54 | 1.139 | 70.79 | 32.17 | 56 | 66 | 34 | 51 | 65 | 52 | 61 |

| R16 | 3.70 | 1.172 | 73.93 | 31.70 | 38 | 48 | 48 | 40 | 40 | 45 | 43 |

| R17 | 3.88 | 0.939 | 77.53 | 24.23 | 33 | 11 | 17 | 2 | 26 | 30 | 17 |

| R18 | 3.69 | 0.984 | 73.71 | 26.70 | 18 | 59 | 61 | 50 | 25 | 56 | 48 |

| R19 | 3.79 | 0.959 | 75.73 | 25.33 | 21 | 15 | 62 | 39 | 43 | 24 | 32 |

| R20 | 3.83 | 0.991 | 76.63 | 25.87 | 19 | 14 | 57 | 25 | 31 | 27 | 23 |

| R21 | 4.04 | 0.928 | 80.90 | 22.95 | 4 | 8 | 40 | 23 | 3 | 11 | 7 |

| R22 | 4.04 | 0.952 | 80.90 | 23.55 | 3 | 13 | 39 | 12 | 10 | 9 | 6 |

| R23 | 3.69 | 0.937 | 73.71 | 25.41 | 37 | 40 | 60 | 38 | 37 | 47 | 46 |

| R24 | 3.76 | 0.966 | 75.28 | 25.65 | 32 | 30 | 50 | 55 | 8 | 51 | 34 |

| R25 | 3.53 | 1.098 | 70.56 | 31.13 | 53 | 52 | 65 | 65 | 52 | 60 | 62 |

| R26 | 3.43 | 1.096 | 68.54 | 31.99 | 65 | 57 | 63 | 66 | 29 | 65 | 65 |

| R27 | 3.56 | 1.022 | 71.24 | 28.69 | 62 | 38 | 59 | 57 | 22 | 63 | 59 |

| R28 | 4.10 | 0.942 | 82.02 | 22.97 | 7 | 4 | 12 | 17 | 7 | 4 | 3 |

| R29 | 3.64 | 0.944 | 72.81 | 25.94 | 58 | 27 | 53 | 32 | 39 | 58 | 54 |

| R30 | 3.33 | 1.106 | 66.52 | 33.24 | 66 | 65 | 54 | 62 | 48 | 66 | 66 |

| R31 | 3.69 | 0.984 | 73.71 | 26.70 | 52 | 46 | 16 | 31 | 21 | 59 | 47 |

| R32 | 3.58 | 1.009 | 71.69 | 28.16 | 49 | 62 | 52 | 61 | 61 | 40 | 58 |

| R33 | 3.82 | 0.960 | 76.40 | 25.13 | 12 | 47 | 43 | 11 | 38 | 28 | 25 |

| R34 | 3.74 | 1.028 | 74.83 | 27.48 | 40 | 23 | 51 | 37 | 44 | 34 | 38 |

| R35 | 4.24 | 0.739 | 84.72 | 17.44 | 1 | 5 | 2 | 1 | 1 | 3 | 1 |

| R36 | 4.03 | 0.885 | 80.67 | 21.94 | 2 | 19 | 38 | 5 | 6 | 13 | 8 |

| R37 | 3.80 | 0.894 | 75.96 | 23.54 | 16 | 33 | 56 | 36 | 30 | 29 | 31 |

| R38 | 3.65 | 1.078 | 73.03 | 29.51 | 29 | 32 | 66 | 58 | 47 | 44 | 53 |

| R39 | 3.92 | 0.944 | 78.43 | 24.08 | 14 | 12 | 33 | 6 | 20 | 22 | 15 |

| R40 | 3.54 | 1.159 | 70.79 | 32.73 | 61 | 37 | 64 | 56 | 53 | 61 | 60 |

| R41 | 3.60 | 1.063 | 71.91 | 29.56 | 57 | 51 | 47 | 16 | 64 | 53 | 57 |

| R42 | 3.44 | 0.953 | 68.76 | 27.72 | 64 | 61 | 58 | 60 | 58 | 64 | 64 |

| R43 | 3.51 | 0.978 | 70.11 | 27.91 | 63 | 56 | 55 | 47 | 66 | 57 | 63 |

| R44 | 3.87 | 0.855 | 77.30 | 22.13 | 25 | 36 | 11 | 8 | 9 | 41 | 18 |

| R45 | 3.82 | 0.886 | 76.40 | 23.20 | 13 | 42 | 49 | 10 | 32 | 31 | 28 |

| R46 | 3.70 | 1.005 | 73.93 | 27.18 | 55 | 29 | 36 | 4 | 56 | 46 | 44 |

| R47 | 3.76 | 0.930 | 75.28 | 24.70 | 50 | 22 | 15 | 35 | 28 | 39 | 36 |

| R48 | 3.73 | 1.042 | 74.61 | 27.93 | 36 | 58 | 14 | 19 | 24 | 54 | 39 |

| R49 | 4.00 | 0.953 | 80.00 | 23.84 | 10 | 10 | 10 | 28 | 11 | 8 | 10 |

| R50 | 3.83 | 0.980 | 76.63 | 25.57 | 15 | 50 | 22 | 15 | 14 | 42 | 22 |

| R51 | 3.89 | 0.845 | 77.75 | 21.74 | 11 | 41 | 21 | 30 | 15 | 25 | 16 |

| R52 | 3.72 | 1.087 | 74.38 | 29.23 | 44 | 45 | 32 | 53 | 19 | 50 | 42 |

| R53 | 3.96 | 0.838 | 79.10 | 21.19 | 8 | 21 | 20 | 14 | 13 | 17 | 11 |

| R54 | 3.84 | 1.010 | 76.85 | 26.29 | 27 | 24 | 30 | 48 | 55 | 7 | 21 |

| R55 | 3.65 | 1.035 | 73.03 | 28.33 | 41 | 64 | 37 | 13 | 60 | 48 | 52 |

| R56 | 3.75 | 0.945 | 75.06 | 25.18 | 47 | 26 | 29 | 46 | 16 | 49 | 37 |

| R57 | 3.92 | 1.068 | 78.43 | 27.25 | 31 | 9 | 7 | 26 | 17 | 19 | 14 |

| R58 | 3.72 | 0.953 | 74.38 | 25.63 | 43 | 54 | 19 | 52 | 23 | 43 | 40 |

| R59 | 3.66 | 0.965 | 73.26 | 26.34 | 42 | 55 | 46 | 49 | 33 | 55 | 51 |

| R60 | 3.66 | 0.916 | 73.26 | 25.02 | 60 | 31 | 28 | 64 | 42 | 37 | 50 |

| R61 | 3.66 | 0.988 | 73.26 | 26.97 | 48 | 44 | 45 | 63 | 57 | 26 | 49 |

| R62 | 3.69 | 1.083 | 73.71 | 29.38 | 51 | 39 | 27 | 54 | 49 | 36 | 45 |

| R63 | 4.08 | 0.815 | 81.57 | 19.98 | 9 | 2 | 9 | 34 | 12 | 2 | 5 |

| R64 | 4.18 | 0.899 | 83.60 | 21.51 | 5 | 1 | 1 | 9 | 2 | 1 | 2 |

| R65 | 4.01 | 0.872 | 80.22 | 21.75 | 24 | 3 | 6 | 27 | 5 | 10 | 9 |

| R66 | 3.82 | 1.061 | 76.40 | 27.78 | 46 | 20 | 5 | 7 | 27 | 38 | 26 |

References

- Green Building. What is Green Building. Available online: https://greenbuildingcanada.ca/green-building-guide/what-is-green-building (accessed on 15 October 2020).

- He, B.J. Towards the next generation of green building for urban heat island mitigation: Zero UHI impact building. Sustain. Cities Soc. 2019, 50, 101647. [Google Scholar] [CrossRef]

- Zinzi, M.; Agnoli, S. Cool and green roofs. An energy and comfort comparison between passive cooling and mitigation urban heat island techniques for residential buildings in the Mediterranean region. Energy Build. 2012, 55, 66–76. [Google Scholar] [CrossRef]

- Alotaibi, K.; Ghumman, A.R.; Haider, H.; Ghazaw, Y.M.; Shafiquzzaman, M. Future predictions of rainfall and temperature using GCM and ANN for arid regions: A case study for the Qassim Region, Saudi Arabia. Water 2018, 10, 1260. [Google Scholar] [CrossRef] [Green Version]

- Alkolibi, F.M. Possible effects of global warming on agriculture and water resources in Saudi Arabia: Impacts and responses. Clim. Chang. 2020, 54, 225–245. [Google Scholar] [CrossRef]

- Shin, M.H.; Kim, H.Y.; Gu, D.; Kim, H. LEED, its efficacy and fallacy in a regional context—An urban heat island case in California. Sustainability 2017, 9, 1674. [Google Scholar] [CrossRef] [Green Version]

- Dwaikat, L.N.; Ali, K.N. The economic benefits of a green building–Evidence from Malaysia. J. Build. Eng. 2018, 18, 448–453. [Google Scholar] [CrossRef]

- MacNaughton, P.; Cao, X.; Buonocore, J.; Cedeno-Laurent, J.; Spengler, J.; Bernstein, A.; Allen, J. Energy savings, emission reductions, and health co-benefits of the green building movement. J. Expo. Sci. Environ. Epidemiol. 2018, 28, 307–318. [Google Scholar] [CrossRef]

- Connaughton, J.N.; Green, S.D. Value Management in Construction: A Client’s Guide; CIRIA: London, UK, 1996. [Google Scholar]

- Banaitiene, N.; Banaitis, A. Risk Management in Construction Projects. Risk Management–Current Issues and Challenges. In Risk Management–Current Issues and Challenges; Banaitiene, N., Ed.; IntechOpen: London, UK, 2012; pp. 429–448. [Google Scholar]

- Godfrey, P.S. Control of Risk a Guide to the Systematic Management of Risk from Construction; CIRIA: London, UK, 1996. [Google Scholar]

- Langford, D. Revaluing Construction-Hard and Soft Values. In CIB Priority Theme-Revaluing Construction: A W065 ‘Organisation and Management of Construction’ Perspective; Sexton, M., Kaehkoenen, K., Lu, S., Eds.; Ciblibrary: Ottawa, ON, Canada, 2007; pp. 66–75. [Google Scholar]

- Gao, Y.; Yang, G.; Xie, Q. Spatial-Temporal Evolution and Driving Factors of Green Building Development in China. Sustainability 2020, 12, 2773. [Google Scholar] [CrossRef] [Green Version]

- ICE. Design and Practice Guide, Creating Value in Engineering; LoThomas Telford: London, UK, 1996. [Google Scholar]

- Leek, S.; Christodoulides, G. A framework of brand value in B2B markets: The contributing role of functional and emotional components. Ind. Mark. Manag. 2012, 41, 106–114. [Google Scholar] [CrossRef]

- Boussabaine, A. Cost Planning of PFI and PPP Building Projects; Taylor & Francis: Abingdon, UK, 2007. [Google Scholar]

- Alalshikh, M. The Development of a Value Management Approach for the Saudi Public Sector. Unpublished. Ph.D. Thesis, University of Leeds, Leeds, UK, 2010. in press. [Google Scholar]

- Snoj, B.; Pisnik Korda, A.; Mumel, D. The relationships among perceived quality, perceived risk and perceived product value. J. Prod. Brand Manag. 2004, 13, 156–167. [Google Scholar] [CrossRef]

- Alattyih, W.; Haider, H.; Boussabaine, H. Development of Value Creation Drivers for Sustainable Design of Green Buildings in Saudi Arabia. Sustainability 2019, 11, 5867. [Google Scholar] [CrossRef] [Green Version]

- Tiong, R.L. BOT projects: Risks and securities. Constr. Manag. Econ. 1990, 8, 315–328. [Google Scholar] [CrossRef]

- Boussabaine, H.A.; Kirkham, R.J. Whole Life-Cycle Costing: Risk and Risk Responses; Blackwell Publishing Ltd.: Oxford, UK, 2008. [Google Scholar]

- Medda, F. A game theory approach for the allocation of risks in transport public private partnerships. Int. J. Proj. Manag. 2007, 25, 213–218. [Google Scholar] [CrossRef]

- Zou, P.X.; Zhang, G.; Wang, J. Understanding the key risks in construction projects in China. Int. J. Proj. Manag. 2007, 25, 601–614. [Google Scholar] [CrossRef]

- Yang, J.; Zou, P.; Keating, B. Analysing Stakeholder-Associated Risks in Green Buildings: A Social Network Analysis Method. In WBC13; Queensland University of Technology: Brisbane, Australia, 2013; pp. 1–12. [Google Scholar]

- Zou, P.; Couani, P. Risks in green building development: A supply chain perspective. In Proceedings of the 36th Australasian University Building Educators Association (AUBEA) Conference, Gold Coast, Queensland, Australia, 27–29 April 2011. [Google Scholar]

- National Research Council. The Owner’s Role in Project Risk Management; The National Academies Press: Washington, DC, USA, 2005. [Google Scholar]

- Wiedemer, J.P.; Goeters, J.E.; Graham, J.E. Real Estate Investment: South.-Western Cengage Learning; South-Western Educational Pub: Mason, OH, USA, 2011. [Google Scholar]

- Al-Yousefi, A. Value Management: Concept & Techniques, 4th ed.; Twaig Publishing: Riyadh, UAE, 2004. [Google Scholar]

- Isa, M.; Rahman, M.M.G.M.A.; Sipan, I.; Hwa, T.K. Factors Affecting Green Office Building Investment in Malaysia. Procedia Soc. Behav. Sci. 2013, 105, 138–148. [Google Scholar] [CrossRef] [Green Version]

- Green Building Council. The Bussine Case Green Building: A Review of the Costs and Benefits for Developers Investors and Occupants. Available online: http://www.worldgbc.org/files/1513/6608/0674/Business_Case_For_Green_Building_Report_WEB_2013-04-11.pdf (accessed on 20 August 2015).

- Zurich Green Building: What are the Risks? Zurich Services Corporation: Schaumburg, IL, USA, 2011.

- Haghnegahdar, L.; Asgharizadeh, E. The Risk and Value Engineering Structures and their Integration with Industrial Projects Management (A Case Study on IK Corporation). World Acad. Sci. Eng. Technol. 2008, 40, 375–383. [Google Scholar]

- NAO. Getting Value for Money from Construction Projects through Design: How Auditors Can. Help, Guidelines to Help Auditors Take Account of Good Design in Public Sector Built Environment Projects; Davis Langdon & Everest. Stairway Communications Ltd.: London, UK, 2004. [Google Scholar]

- Kim, S.; Lim, B.T.H.; Kim, J. Green Features, Symbolic Values and Rental Premium: Systematic Review and Meta-analysis. Procedia Eng. 2017, 180, 41–48. [Google Scholar] [CrossRef]

- Davies, R. Green Value Report: Green Building, Growing Assets; Royal Institution of Chartered Surveyors: London, UK, 2005. [Google Scholar]

- Ashuri, B.; Durmus-Pedini, A. An overview of the benefits and risk factors of going green in existing buildings. Int. J. Facil. Manag. 2010, 1, 1. [Google Scholar]

- Lützkendorf, T.; Lorenz, D. Integrating Sustainability Issues into Property Risk Assessment–An Approach to Communicate the Benefits of Sustainable Design. In Proceedings of the Rethinking Sustainable Construction Conference, Sarasota, FL, USA, 19–22 September 2006. [Google Scholar]

- Zhao, R.J.; Moh, W.H. Value management practices on major construction projects and green building. Front Eng. Manag. 2016, 3, 147–157. [Google Scholar] [CrossRef]

- Novais, R.M.; Senff, L.; Carvalheiras, J.; Labrincha, J.A. Bi-Layered Porous/Cork-Containing Waste-Based Inorganic Polymer Composites: Innovative Material towards Green Buildings. Appl. Sci. 2020, 10, 2995. [Google Scholar] [CrossRef]

- Mutani, G.; Azzolino, C.; Macrì, M.; Mancuso, S. Straw Buildings: A Good Compromise between Environmental Sustainability and Energy-Economic Savings. Appl. Sci. 2020, 10, 2858. [Google Scholar] [CrossRef] [Green Version]

- Shao, B.; Du, X.; Ren, Q. Numerical investigation of energy saving characteristic in building roof coupled with PCM using lattice Boltzmann method with economic analysis. Appl. Sci. 2018, 8, 1739. [Google Scholar] [CrossRef] [Green Version]

- Fawaz, A.N.; Ruparathna, R.; Chhipi-Shrestha, G.; Haider, H.; Hewage, K.; Sadiq, R. Sustainability assessment framework for low rise commercial buildings: Life cycle impact index-based approach. Clean Technol. Environ. Policy 2016, 1, 2579–2590. [Google Scholar]

- Orsi, A.; Guillén-Guillamón, I.; Pellicer, E. Optimization of Green Building Design Processes: Case Studies within the European Union. Sustainability 2020, 12, 2276. [Google Scholar] [CrossRef] [Green Version]

- Gritzo, L.; Doerr, W.; Bill, R.; Nong, S.; Krasner, L. The Influence of Risk Factors on Sustainable Development; FM Global: Boston, MA, USA, 2009. [Google Scholar]

- Wi, H.; Jung, M. Modeling and analysis of project performance factors in an extended project-oriented virtual organization (EProVO). Expert Syst. Appl. 2010, 37, 1143–1151. [Google Scholar] [CrossRef]

- Muldavin, S.R. Value beyond Cost Savings: How to Underwrite Sustainable Properties; Green Building FC: Fort Collins, CO, USA, 2010. [Google Scholar]

- Cajias, M.; Bienert, S. Does sustainability pay off for European listed real estate companies? The dynamics between risk and provision of responsible information. J. Sustain. Real Estate 2011, 3, 211–231. [Google Scholar] [CrossRef] [Green Version]

- Eichholtz, P.; Kok, N.; Quigley, J.M. Sustainability and the Dynamics of Green Building: New Evidence of the Financial Performance of Green Office Buildings in the USA; Research Report by RICS: London, UK, 2010. [Google Scholar]

- Parker, D. Valuation of Green Buildings: Is Greed Becoming Fear? Aust. N. Z. Prop. J. 2008, 1, 552–560. [Google Scholar]

- Jha, K.; Iyer, K. Critical determinants of project coordination. Int. J. Proj. Manag. 2006, 24, 314–322. [Google Scholar] [CrossRef]

- Shen, Q.; Liu, G. Critical success factors for value management studies in construction. J. Constr. Eng. Manag. 2003, 129, 485–491. [Google Scholar] [CrossRef]

- Al-Yousefi, A. Application of Value Engineering in Saudi Arabia and Arabian Gulf Countries; Powerpoint Slides; Ministry of Water and Electricity: Riyadh, Saudi Arabia, 2010. [Google Scholar]

- Al-Yousefi, A. Total Value Management; Powerpoint Slides; Alyousefi Value Engineering: Riyadh, Saudi Arabia, 2011. [Google Scholar]

- Punch, K.F. Introduction to Social Research: Quantitative & Gualitative Approaches, 2nd ed.; SAGE Publications: London, UK, 2005. [Google Scholar]

- Morgan, G.A.; Leech, N.L.; Gloeckner, G.W.; Barret, K.C. SPSS for Introductory Statistics: Use and Interpretation, 2nd ed.; Lawrence Erlbaum Associate Publishers: Mahwah, NJ, USA, 2004. [Google Scholar]

- Field, A. Discovering statistics using SPSS, 2nd ed.; SAGE Publications: London, UK, 2005. [Google Scholar]

- SPSS 22. 0.0.1. SPSS 22.0.0.1 for Windows; SPSS Inc.: Chicago, IL, USA, 2014. [Google Scholar]

- George, D.; Mallery, P. SPSS for Windows Step by Step: A Simple Guide and Reference, 4th ed.; Allyn & Bacon: Boston, MA, USA, 2003. [Google Scholar]

- Akintoye, A. Analysis of factors influencing project cost estimating practice. Constr. Manag. Econ. 2000, 18, 77–89. [Google Scholar] [CrossRef]

- Kaiser, H. An index of factorial simplicity. Psychometrika 1974, 39, 31–36. [Google Scholar] [CrossRef]

- Nykamp, H. Policy Mix for a Transition to Sustainability: Green Buildings in Norway. Sustainability 2020, 12, 446. [Google Scholar] [CrossRef] [Green Version]

| Cronbach’s Alpha | Internal Consistency |

|---|---|

| >0.90 | Excellent |

| 0.80–0.89 | Good |

| 0.70–0.79 | Acceptable |

| 0.60–0.69 | Questionable |

| 0.50–0.59 | Poor |

| <0.50 | Unacceptable |

| Component | Initial Eigenvalues | Extraction Sums of Squared Loadings | Rotation Sums of Squared Loadings | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | |

| 1 | 22.380 | 33.909 | 33.909 | 22.380 | 33.909 | 33.909 | 6.027 | 9.132 | 9.132 |

| 2 | 4.154 | 6.294 | 40.203 | 4.154 | 6.294 | 40.203 | 5.499 | 8.332 | 17.464 |

| 3 | 3.418 | 5.179 | 45.382 | 3.418 | 5.179 | 45.382 | 5.036 | 7.630 | 25.094 |

| 4 | 2.988 | 4.527 | 49.909 | 2.988 | 4.527 | 49.909 | 4.364 | 6.613 | 31.707 |

| 5 | 2.640 | 4.000 | 53.909 | 2.640 | 4.000 | 53.909 | 3.506 | 5.312 | 37.019 |

| 6 | 2.599 | 3.938 | 57.846 | 2.599 | 3.938 | 57.846 | 3.341 | 5.062 | 42.081 |

| 7 | 2.200 | 3.334 | 61.180 | 2.200 | 3.334 | 61.180 | 3.195 | 4.841 | 46.921 |

| 8 | 1.975 | 2.993 | 64.173 | 1.975 | 2.993 | 64.173 | 3.143 | 4.762 | 51.683 |

| 9 | 1.721 | 2.608 | 66.781 | 1.721 | 2.608 | 66.781 | 3.039 | 4.605 | 56.289 |

| 10 | 1.540 | 2.333 | 69.113 | 1.540 | 2.333 | 69.113 | 2.863 | 4.338 | 60.627 |

| 11 | 1.403 | 2.126 | 71.240 | 1.403 | 2.126 | 71.240 | 2.432 | 3.686 | 64.312 |

| 12 | 1.312 | 1.988 | 73.228 | 1.312 | 1.988 | 73.228 | 2.386 | 3.615 | 67.927 |

| 13 | 1.273 | 1.930 | 75.157 | 1.273 | 1.930 | 75.157 | 2.311 | 3.501 | 71.428 |

| 14 | 1.101 | 1.668 | 76.826 | 1.101 | 1.668 | 76.826 | 2.039 | 3.090 | 74.518 |

| 15 | 1.040 | 1.576 | 78.401 | 1.040 | 1.576 | 78.401 | 1.844 | 2.793 | 77.311 |

| 16 | 1.015 | 1.538 | 79.939 | 1.015 | 1.538 | 79.939 | 1.735 | 2.628 | 79.939 |

| 17 | 0.918 | 1.390 | 81.330 | ||||||

| 18 | 0.832 | 1.260 | 82.590 | ||||||

| . | . | . | . | ||||||

| . | . | . | . | ||||||

| . | . | . | . | ||||||

| 65 | 0.009 | 0.014 | 99.991 | ||||||

| 66 | 0.006 | 0.009 | 100.000 | ||||||

| Risk Factor Components | Extracted Eigenvalue | Extraction Sum of Squared Loadings: Variance % | Rotation Sum of Squared Loadings: Variance % | Factor Loading Score | Code | Risk Factor |

|---|---|---|---|---|---|---|

| 1 | 22.380 | 33.909 | 9.132 | 0.801 | R13 | Failure to identify cost-to-worth relationships |

| 0.796 | R11 | Failure to recognize cost–value mismatches | ||||

| 0.781 | R10 | Failure to identify cost–value relationships | ||||

| 0.780 | R14 | Failure to link or identify performance-to-cost relationships | ||||

| 0.600 | R8 | Failure to consider the cost of losing potential revenue | ||||

| 0.598 | R12 | Failure to appropriately locate cost-to-function allocation | ||||

| 0.528 | R9 | Uncertainty about prices | ||||

| 0.425 | R5 | Inappropriate cost evaluation criteria | ||||

| 2 | 4.154 | 6.294 | 8.332 | 0.858 | R27 | Failure to identify appropriate alternative function |

| 0.788 | R26 | Unsuitable functional analysis | ||||

| 0.744 | R25 | Failure to identify and understand functions | ||||

| 0.691 | R24 | Failure to examine attributes which have no useful function | ||||

| 0.539 | R23 | Failure to consider changes to current design standards | ||||

| 0.481 | R59 | Failure to identify complex items or processes with little or no value added to the facility | ||||

| 0.529 | R47 | Failure to consider implication of environmental risks | ||||

| 3 | 3.418 | 5.179 | 7.630 | 0.822 | R61 | Lack of considering early failure of components and equipment |

| 0.726 | R60 | Failure to consider rate of deterioration of components | ||||

| 0.709 | R65 | Incorrect estimated cost of maintenance | ||||

| 0.641 | R62 | Failure to consider delay and higher cost due to bad weather conditions during construction | ||||

| 0.626 | R63 | Incorrect cost estimate | ||||

| 0.527 | R66 | Incorrect estimated cost of energy used | ||||

| 4 | 2.988 | 4.527 | 6.613 | 0.843 | R46 | Limited knowledge of maintenance issues |

| 0.734 | R48 | Lack of background information | ||||

| 0.639 | R44 | Failure to consider increase in routine maintenance | ||||

| 0.592 | R45 | Failure to consider increase in life cycle replacement | ||||

| 0.540 | R39 | Failure to consider design impact on operating efficiency | ||||

| 5 | 2.640 | 4.000 | 5.312 | 0.723 | R42 | Failure to consider component repair and replacement |

| 0.717 | R41 | Failure to consider construction health and safety | ||||

| 0.602 | R43 | Failure to consider maintainability and reparability impact | ||||

| 0.423 | R40 | Insufficient space and capacity | ||||

| 6 | 2.599 | 3.938 | 5.062 | 0.724 | R50 | Poor definition of the scope and objectives of projects |

| 0.699 | R51 | Project scope unscheduled items | ||||

| 0.580 | R58 | Failure to build to design | ||||

| 0.494 | R52 | Failure to consider construction Techniques | ||||

| 0.465 | R49 | Poor project management | ||||

| 7 | 2.200 | 3.334 | 4.841 | 0.785 | R4 | Inadequate inflation forecasts |

| 0.649 | R6 | Failure to consider future operational costs | ||||

| 0.598 | R3 | Failure to consider implication of economic conditions | ||||

| 0.454 | R15 | Failure to consider constructability issues | ||||

| 8 | 1.975 | 2.993 | 4.762 | 0.789 | R20 | Failure to consider construction implications during design |

| 0.732 | R19 | Failure to design to brief/specification | ||||

| 0.502 | R18 | Failure to translate specification into the design | ||||

| 0.497 | R17 | Failure to examine specifications due to unnecessary expense | ||||

| 9 | 1.721 | 2.608 | 4.605 | 0.762 | R57 | Improper project planning and budgeting |

| 0.728 | R56 | Failure to consider procurement method | ||||

| 0.586 | R64 | Incorrect time estimate | ||||

| 0.493 | R53 | Lack of coordination and decision making | ||||

| 10 | 1.540 | 2.333 | 4.338 | 0.633 | R31 | Failure to consider new/change in technology |

| 0.597 | R33 | Failure to integrate the various systems to achieve the lowest LCC | ||||

| 0.577 | R29 | Unproven construction techniques | ||||

| 0.498 | R16 | Failure to appreciate design uncertainty | ||||

| 0.407 | R32 | Failure to meet performance or design standards | ||||

| 11 | 1.403 | 2.126 | 3.686 | 0.773 | R21 | Design changes |

| 0.702 | R22 | Redesign/rework | ||||

| 12 | 1.312 | 1.988 | 3.615 | 0.614 | R38 | Failure to consider obsolescence of equipment impact |

| 0.589 | R37 | Failure to consider inter-dependence between design components | ||||

| 13 | 1.273 | 1.930 | 3.501 | 0.808 | R1 | Insufficient funding |

| 0.499 | R2 | Funding is unavailable | ||||

| 14 | 1.101 | 1.668 | 3.090 | 0.762 | R35 | Failure to identify low-value, long-lead-time items |

| 0.550 | R36 | Failure to consider design risks | ||||

| 15 | 1.040 | 1.576 | 2.793 | 0.612 | R7 | Failure to recognize cost as resource expenditure |

| 0.456 | R30 | Failure to consider legislative/regulation issues | ||||

| 16 | 1.015 | 1.538 | 2.628 | 0.625 | R54 | Poor team relationships |

| 0.468 | R28 | Poor design that may lead to higher operation costs |

| Cluster | Variance % | Component | Code | Risk Factors |

|---|---|---|---|---|

| Financial Risks | 27.897 | 1 | R11 | Failure to recognize cost–value mismatches |

| R10 | Failure to identify cost–value relationships | |||

| R8 | Failure to consider the cost of losing potential revenue | |||

| R12 | Failure to appropriately locate cost-to-function allocation | |||

| R9 | Uncertainty about prices | |||

| R5 | Inappropriate cost evaluation criteria | |||

| 7 | R6 | Failure to consider future operational costs | ||

| R3 | Failure to consider implication of economic conditions | |||

| 13 | R1 | Insufficient funding | ||

| 15 | R7 | Failure to recognize cost as resource expenditure | ||

| 3 | R65 | Incorrect estimated cost of maintenance | ||

| R63 | Incorrect cost estimate | |||

| R66 | Incorrect estimated cost of energy used | |||

| Functional Risks | 15.876 | 8 | R20 | Failure to consider construction implications during design |

| R19 | Failure to design to brief/specification | |||

| R17 | Failure to examine specifications due to unnecessary expense | |||

| 10 | R33 | Failure to integrate the various systems to achieve the lowest life-cycle costs | ||

| 11 | R21 | Design changes | ||

| R22 | Redesign/rework | |||

| 14 | R35 | Failure to identify low-value, long-lead-time items | ||

| R36 | Failure to consider design risks | |||

| Operational Risks | 6.613 | 4 | R44 | Failure to consider increase in routine maintenance |

| R45 | Failure to consider increase in life cycle replacement | |||

| R39 | Failure to consider design impact on operating efficiency | |||

| Environmental Risks | 17.259 | 12 | R38 | Failure to consider obsolescence of equipment impact |

| 5 | R43 | Failure to consider maintainability and reparability impact | ||

| 2 | R47 | Failure to consider implication of environmental risks | ||

| Management Risks | 12.295 | 6 | R49 | Poor project management |

| R50 | Poor definition of the scope and objectives of projects | |||

| R51 | Project scope unscheduled items | |||

| 9 | R57 | Improper project planning and budgeting | ||

| R53 | Lack of coordination and decision making | |||

| R64 | Incorrect time estimate | |||

| 16 | R54 | Poor team relationships | ||

| R28 | Poor design that may lead to higher operation costs |

| Research Question | Environmental Risks: |

|---|---|

| Hypothesis | H0: p > 0.05; H1: p < 0.05; |

| Results | The (ANOVA) results indicated that: There were significant differences between the survey participants regarding Risk factors: R38: Failure to consider obsolescence of equipment impact |

| Researcher’s observation | It appears that architects in KSA are not acquainted with the fact that whole-life performance of green buildings is highly linked to the obsolescence of equipment and components. |

| Conclusion | The null hypothesis was rejected for R38 risk. The null hypothesis (Hypothesis 1: 1 = 0)—(H0: p > 0.05) was retained for other risks. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alattyih, W.; Haider, H.; Boussabaine, H. Risk Factors Impacting the Project Value Created by Green Buildings in Saudi Arabia. Appl. Sci. 2020, 10, 7388. https://doi.org/10.3390/app10217388

Alattyih W, Haider H, Boussabaine H. Risk Factors Impacting the Project Value Created by Green Buildings in Saudi Arabia. Applied Sciences. 2020; 10(21):7388. https://doi.org/10.3390/app10217388

Chicago/Turabian StyleAlattyih, Wael, Husnain Haider, and Halim Boussabaine. 2020. "Risk Factors Impacting the Project Value Created by Green Buildings in Saudi Arabia" Applied Sciences 10, no. 21: 7388. https://doi.org/10.3390/app10217388