The S-Curve as a Tool for Planning and Controlling of Construction Process—Case Study

Abstract

:1. Introduction

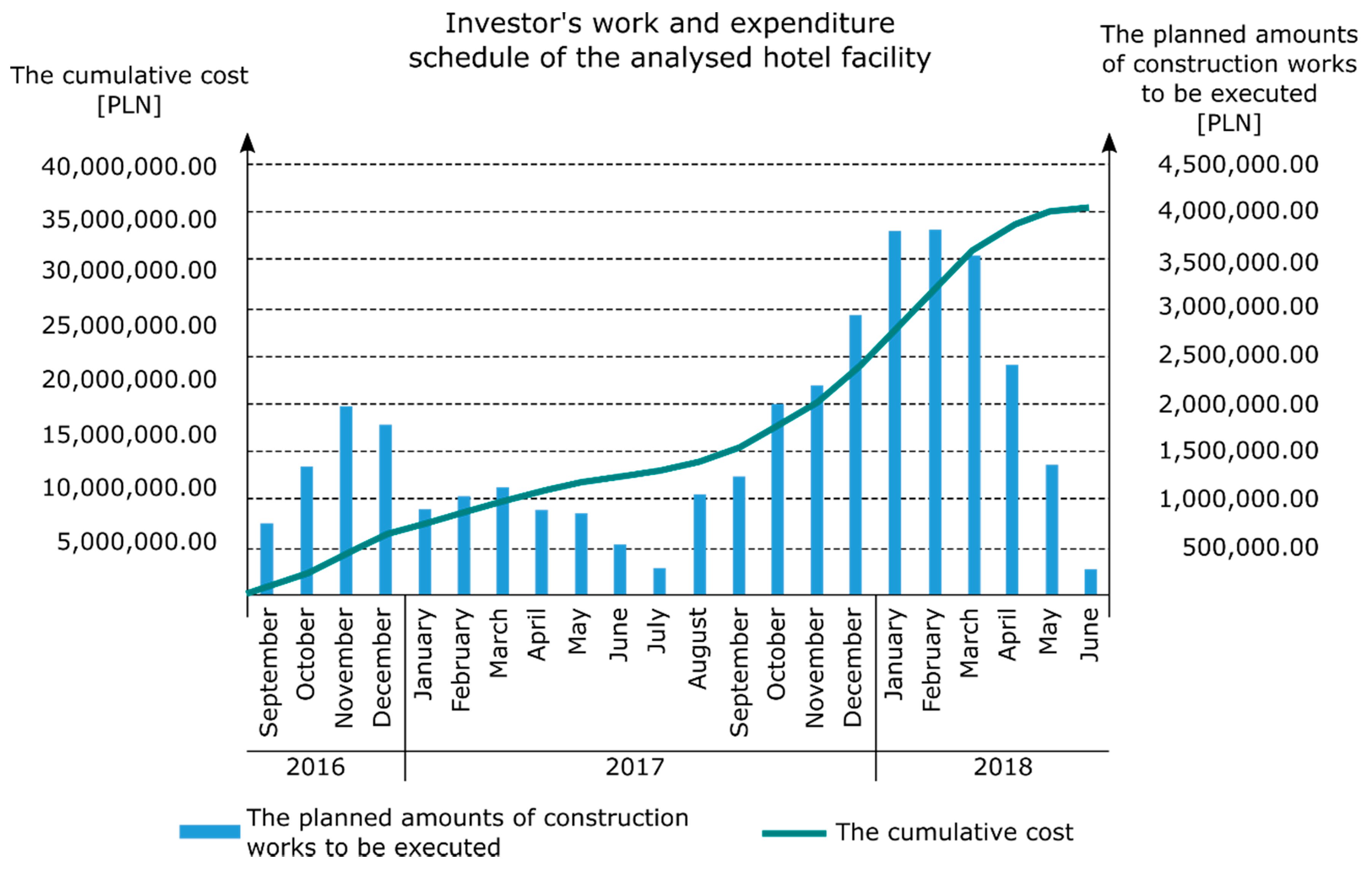

2. Research and Methodology of Measurements

- the budgeted cost of work scheduled () determined for each individual examined period on the basis of the Investor’s work and expenditure schedule;

- the cumulative value of the budgeted cost of work scheduled () for each single examined period, calculated as the cumulative value obtained by adding the value of the budgeted cost of work scheduled from the analyzed period to the value of budgeted cost of work scheduled from the preceding period, determined on the basis of the Investor’s work and expenditure schedule;

- the actual cost of work performed ) determined for each individual examined period on the basis of BIS reports;

- the cumulative value of the actual cost of work performed ) for each examined individual period, calculated as a cumulative value obtained by adding the value of the actual cost of work performed from the analyzed period, based on BIS reports, to the value of the actual costs of the work performed from the preceding period;

- the actual percentage advancement of work performed ), calculated as a ratio of the value of the cumulative actual cost of work performed to the total actual cost of the construction project;

- the planned percentage advancement of work scheduled , calculated as the ratio of the cumulative value of the budgeted cost of work scheduled to the total budgeted cost of the construction project;

- the actual percentage advancement of work scheduled ), calculated as the ratio of the value of the cumulative actual cost of work performed to the total budgeted cost of the construction project;

- the actual schedule variance ), calculated as the difference between the actual duration and the planned duration of the project;

- the actual schedule performance indicator ), calculated as the ratio of the actual duration of the construction project to the planned duration of the project;

- the at-completion variance ), calculated as the difference between the total actual cost of the construction project and the total budgeted cost of the construction project;

- the performance indicator of the at-completion variance ), calculated as the ratio of the total actual cost of the construction project to the total budgeted cost of the construction project.

3. Case Study

- August 2017: The Investor, aiming at a more efficient management of the construction project, signed an annex extending the scope of works of the General Contractor. It included specialist works concerning Leadership in Energy and Environmental Design (LEED) certification, additional fire protection and the execution of power and teletechnical installations in hotel rooms. The value of remuneration increased by 13.0% when compared to the Investor’s schedule and reached the level of PLN 40,815,455.00 net.

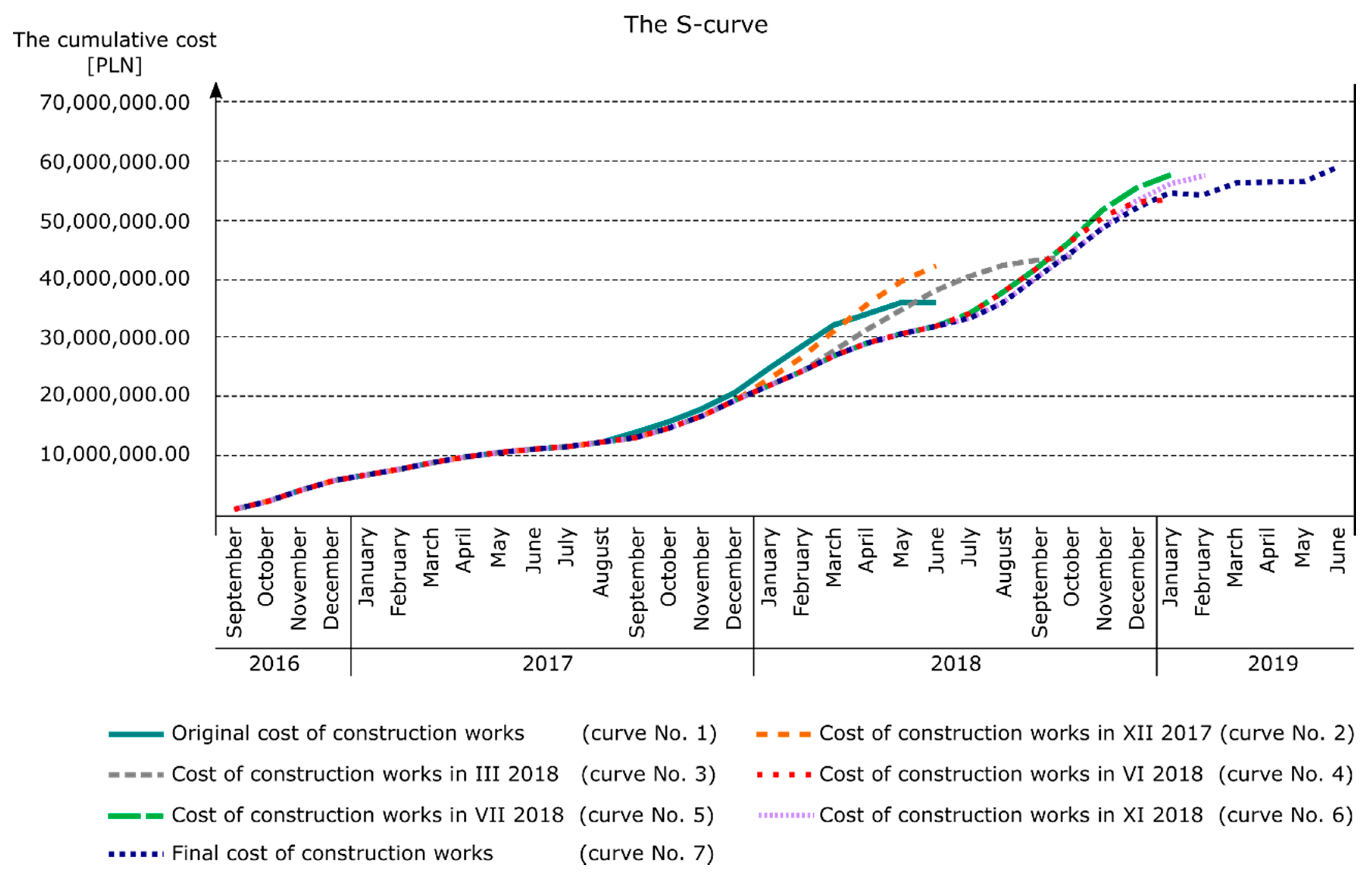

- December 2017: The General Contractor presented, in consultation with the Investor, an updated work schedule that included subsequent annexes regarding changes in the facility, covering door joinery, automation and the building façade, among others. It should be emphasized that the subsequent annexes to the Agreement introduced new elements to its basic scope that were originally excluded from the scope of the General Contractor. Increasing the scope of the subject of the contract concerned the finishing of the premises, including the installation of shower trays and frames in hotel bathrooms. The value of remuneration in December 2017 increased by 17.2% when compared to the Investor’s schedule and reached the level of PLN 42,313,695.00 net. The deadline did not change (curve No. 2 in Figure 2).

- March 2018: The Investor decided to increase the hotel standard (to four stars), which forced the introduction of changes resulting from the difference between the detailed design and the tender design. The changes concerned, among others, sanitary installations, ventilation, electrical installations of rooms, automation and wall arrangement. As a consequence, the value of remuneration increased by 20.8% when compared with the Investor’s schedule, and reached the level of PLN 43,635,084.50 net. The annex to the contract extended the duration of the execution until October 2018 (curve No. 3 in Figure 2).

- June 2018: Another annex significantly modified the basic scope of the contract with the General Contractor (as of September 2017). The Investor commissioned the General Contractor an additional scope of works and, in particular, installations of the residence and public areas (including the hall), catering and multifunctional rooms, and the execution of finishing works involving the equipping of the hotel rooms. The value of remuneration increased by 48.1% when compared to the Investor’s schedule and reached the level of PLN 53,473,979.01 net. The implementation time was extended until January 2019 (curve No. 4 in Figure 2).

- July 2018: Due to the increasing scope of work entrusted to the General Contractor and the extension of the deadline, it was necessary to agree and sign off another annex. Therefore, the value of remuneration increased by 59.4% when compared to the Investor’s schedule and reached the level of PLN 57,564,756.03 net without the end date changing (curve No. 5 in Figure 2), although in October 2018 the investment completion date was extended to February 2019 (curve No. 6 in Figure 2).

- June 2019: final completion of the investment task (i.e., 12 months later than originally planned (June 2018)). The value of remuneration increased by 62.4% and reached the final value of PLN 58,646, 84.75 net (curve No. 7 in Figure 2).

4. Results of the Case Study

- A lack of appropriate preparation for the construction project in the investment planning phase. The Investor planned the cost of implementing the construction project based on prices that were valid in 2016 and did not take into account increases in prices during the subsequent periods of implementation, or the financial fluctuations over time determined by discounted techniques.

- The Investor’s lack of experience in implementing similar construction projects. The Investor had carried out in the past several smaller projects, but not from the hotel sector.

- Changes in the originally adopted standard of the hotel. The Investor incorrectly analyzed the market demand for hotel buildings and initially adopted a lower standard for the facility than required at this location.

- Changes in the scope of work of the General Contractor. Subsequent scopes of work required the General Contractor to develop additional cost estimates and offers, and this took up additional time. In turn, the increase in the scope of works resulted in a significant increase in employment at the construction site, especially with regard to specialized subcontractors. The extension of the implementation time caused an increase in the indirect costs of the General Contractor.

- The current situation of the market imbalance in the construction industry. In the analyzed project period between 2017 and 2019 there were major problems concerning contracting and subcontracting companies at the initially assumed cost level.

- the investment task was completed 12 months later than originally planned;

- the schedule performance efficiency indicator was equal to 1.545, and therefore the project was longer than planned by 54.5%;

- the final cost of the construction works increased by PLN 22,535,338.62 net when compared to the original cost;

- the cost performance efficiency indicator was equal to 1.624, and therefore the project was more expensive than planned by 62.4%;

- analysis of the progress of the hotel facility execution indicates a growing trend of the schedule and cost performance efficiency indicator.

5. Discussion

6. Summary and Conclusions

Author Contributions

Funding

Conflicts of Interest

References and Note

- Project Management Institute. A Guide to the Project Management Body of Knowledge (PMBOK GUIDE), 6th ed.; Project Management Institute (PMI): Newtown Square, PA, USA, 2017. [Google Scholar]

- Plebankiewicz, E.; Zima, K. Wieczorek Damian Life cycle cost modelling of buildings with consideration of the risk. Arch. Civ. Eng. 2016, 62, 149–166. [Google Scholar]

- Kern, A.P.; Formoso, C.T. A model for integrating cost management and production planning and control in construction. J. Financ. Manag. Prop. Constr. 2006, 11, 75–90. [Google Scholar] [CrossRef]

- Hoła, B.; Sawicki, M.; Skibniewski, M. An IT model of a Knowledge Map which supports management in small and medium-sized companies using selected Polish construction enterprises as an example. J. Civ. Eng. Manag. 2015, 21, 1014–1026. [Google Scholar] [CrossRef] [Green Version]

- Kasprowicz, T. Quantitative Identification of Construction Risk. Arch. Civ. Eng. 2017, 63, 63–75. [Google Scholar] [CrossRef] [Green Version]

- Zavadskas, E.K.; Turskis, Z.; Tamošaitienė, J. Risk assessment of construction projects. J. Civ. Eng. Manag. 2010, 16, 33–46. [Google Scholar] [CrossRef] [Green Version]

- Konior, J. Enterprise’s Risk Assessment of Complex Construction Projects. Arch. Civ. Eng. 2015, 61, 63–74. [Google Scholar] [CrossRef] [Green Version]

- Makesh, S.; Mathivanan, M. Analysis on causes of delay in building construction. Int. J. Innov. Technol. Explor. Eng. 2019, 8, 335–341. [Google Scholar]

- Rachid, Z.; Toufik, B.; Mohammed, B. Causes of schedule delays in construction projects in Algeria. Int. J. Constr. Manag. 2019, 19, 371–381. [Google Scholar] [CrossRef]

- Połoński, M. Management of Construction Investment Process; Wydawnictwo SGGW (in Polish): Warszawa, Poland, 2018. [Google Scholar]

- Leśniak, A.; Zima, K. Cost Calculation of Construction Projects Including Sustainability Factors Using the Case Based Reasoning (CBR) Method. Sustainability 2018, 10, 1608. [Google Scholar] [CrossRef] [Green Version]

- Al-Jibouri, S.H. Monitoring systems and their effectiveness for project cost control in construction. Int. J. Proj. Manag. 2003, 21, 145–154. [Google Scholar] [CrossRef] [Green Version]

- Lo, W.; Chen, Y.-T. Optimization of Contractor’s S-Curve. In Proceedings of the 24th International Symposium on Automation & Robotics in Construction (ISARC 2007), 19–21 September 2007; pp. 417–420. Available online: https://www.irbnet.de/daten/iconda/CIB11259.pdf (accessed on 18 March 2020).

- Chao, L.-C.; Chen, H.-T. Predicting project progress via estimation of S-curve’s key geometric feature values. Autom. Constr. 2015, 57, 33–41. [Google Scholar] [CrossRef]

- Cristóbal, J.R.S. The S-curve envelope as a tool for monitoring and control of projects. Procedia Comput. Sci. 2017, 121, 756–761. [Google Scholar] [CrossRef]

- Hsieh, T.Y.; Wang, M.H.L.; Chen, C.W.; Chen, C.Y.; Yu, S.E.; Yang, H.C.; Chen, T.H. A new viewpoint of s-curve regression model and its application to construction management. Int. J. Artif. Intell. Tools 2006, 15, 131–142. [Google Scholar] [CrossRef]

- Hsieh, T.-Y.; Hsiao-Lung Wang, M.; Chen, C.-W. A Case Study of S-Curve Regression Method to Project Control of Construction Management via T-S Fuzzy Model. J. Mar. Sci. Technol. 2004, 12, 209–216. [Google Scholar]

- Chao, L.-C.; Chien, C.-F. Estimating Project S-Curves Using Polynomial Function and Neural Networks. J. Constr. Eng. Manag. 2009, 135, 169–177. [Google Scholar] [CrossRef]

- Chao, L.-C.; Chien, C.-F. A Model for Updating Project S-curve by Using Neural Networks and Matching Progress. Autom. Constr. 2010, 19, 84–91. [Google Scholar] [CrossRef]

- Kim, B.C.; Reinschmidt, K. An S-curve Bayesian model for forecasting probability distributions on project duration and cost at completion. In Proceedings of the CME 25 Conference of Construction Management and Economics, Reading, UK, 16–18 July 2007; pp. 1449–1459. [Google Scholar]

- Cheng, Y.M.; Yu, C.H.; Wang, H.T. Short-interval dynamic forecasting for actual S-curve in the construction phase. J. Constr. Eng. Manag. 2011, 137, 933–941. [Google Scholar] [CrossRef]

- Chen, H.L.; Chen, W.T.; Lin, Y.L. Earned value project management: Improving the predictive power of planned value. Int. J. Proj. Manag. 2016, 34, 22–29. [Google Scholar] [CrossRef]

- De Marco, A.; Narbaev, T. Earned value-based performance monitoring of facility construction projects. J. Facil. Manag. 2013, 11, 69–80. [Google Scholar] [CrossRef] [Green Version]

- Dziadosz, A.; Kapliński, O.; Rejment, M. Usefulness and fields of the application of the Earned Value Management in the implementation of construction projects. Bud. Archit. 2014, 13, 357–364. [Google Scholar]

- Waris, M.; Khamidi, M.F.; Idrus, A. The Cost Monitoring of Construction Projects through Earned Value Analysis. J. Constr. Eng. Proj. Manag. 2012, 2, 42–45. [Google Scholar] [CrossRef] [Green Version]

- Bhosekar, S.K.; Vyas, G. Cost Controlling Using Earned Value Analysis in Construction Industries. Int. J. Eng. Innov. Tech. 2012, 1, 324–332. [Google Scholar]

- Vandevoorde, S.; Vanhoucke, M. A comparison of different project duration forecasting methods using earned value metrics. Int. J. Proj. Manag. 2006, 24, 289–302. [Google Scholar] [CrossRef]

- Kwon, O.; Kim, S.; Paek, J.; Eom, S.-J. Application of Earned Value in the Korean Construction Industry. J. Asian Archit. Build. Eng. 2008, 7, 69–76. [Google Scholar] [CrossRef] [Green Version]

- Khamidi, M.F.; Ali, W.; Idrus, A. Application of Earned Value Management System on an Infrastructure Project: A Malaysian Case Study. Int. Conf. Manag. Sci. Eng. 2011, 8, 1–5. [Google Scholar]

- Połoński, M.; Komendarek, P. Earned value method for operational cost control of civil structure. Quantit. Meth. Econ. 2011, 12, 279–290. [Google Scholar]

- Howes, R. Improving the performance of Earned Value Analysis as a construction project management tool. Eng. Constr. Archit. Manag. 2000, 7, 399–411. [Google Scholar] [CrossRef]

- Czemplik, A. Application of earned value method to progress control of construction projects. Procedia Eng. 2014, 91, 424–428. [Google Scholar] [CrossRef] [Green Version]

- Przywara, D.; Rak, A. The time-cost analysis of schedule monitoring using the earned value method. Tech. Trans. 2017, 5, 57–66. [Google Scholar]

- Bauer-Celny, A.; Konior, J.; Szóstak, M. PM Group Polska sp. z o.o. 2006–2015 and 3EPCM sp. z o.o. 2016–2019, “Initial, Monthly, Close-out Reporting of Bank Investment Supervision”.

- Konior, J. Monitoring of Construction Projects Feasibility by Bank Investment Supervision Approach. Civ. Eng. Archit. 2019, 7, 31–35. [Google Scholar] [CrossRef] [Green Version]

- Kozień, E. Application of approximation technique to on-line updating of the actual cost curve in the earned value method. Czas. Tech. 2017, 9, 181–195. [Google Scholar]

- Gardezi, S.S.S.; Manarvi, I.A.; Gardezi, S.J.S. Time Extension Factors in Construction Industry of Pakistan. Procedia Eng. 2014, 77, 196–204. [Google Scholar] [CrossRef] [Green Version]

- Gebrehiwet, T.; Luo, H. Analysis of Delay Impact on Construction Project Based on RII and Correlation Coefficient: Empirical Study. Procedia Eng. 2017, 196, 366–374. [Google Scholar] [CrossRef]

- Barraza, G.A.; Back, W.E.; Mata, F. Probabilistic Forecasting of Project Performance Using Stochastic S Curves. J. Constr. Eng. Manag. 2004, 130, 25–32. [Google Scholar] [CrossRef]

- Yao, J.-S.; Chen, M.-S.; Lu, H.-F. A fuzzy stochastic single-period model for cash management. Eur. J. Oper. Res. 2006, 170, 72–90. [Google Scholar] [CrossRef]

- Mohagheghi, V.; Meysam Mousavi, S.; Vahdani, B. An Assessment Method for Project Cash Flow under Interval-Valued Fuzzy Environment. J. Optim. Ind. Eng. 2017, 22, 79–80. [Google Scholar]

- Maravas, A.; Pantouvakis, J.-P. Project cash flow analysis in the presence of uncertainty in activity duration and cost. Int. J. Proj. Manag. 2012, 30, 374–384. [Google Scholar] [CrossRef]

| No. | Period | The Budgeted Cost of Work Scheduled According to the Work and Expenditure Schedule | The Cumulative Value of the Budgeted Cost of Work Scheduled | The Actual Cost of Work Performed | The Cumulative Value of the Actual Cost of Work Performed | The Actual Percentage Advancement of Work Performed | The Planned Percentage Advancement of Work Scheduled | The Actual Percentage Advancement of Work Scheduled |

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

| [–] | [–] | [PLN] | [PLN] | [PLN] | [PLN] | [%] | [%] | [%] |

| 1 | Sep.16 | 743,145.00 | 743,145.00 | 743,145.00 | 743,145.00 | 1.27 | 2.06 | 2.06 |

| 2 | Oct.16 | 1,342,960.76 | 2,086,105.76 | 1,342,960.76 | 2,086,105.76 | 3.56 | 5.78 | 5.78 |

| 3 | Nov.16 | 1,962,497.14 | 4,048,602.90 | 1,962,497.14 | 4,048,602.90 | 6.90 | 11.21 | 11.21 |

| 4 | Dec.16 | 1,786,729.02 | 5,835,331.92 | 1,786,729.02 | 5,835,331.92 | 9.95 | 16.16 | 16.16 |

| 5 | Jan.17 | 890,075.82 | 6,725,407.74 | 890,075.82 | 6,725,407.74 | 11.47 | 18.62 | 18.62 |

| 6 | Feb.17 | 1,024,911.29 | 7,750,319.03 | 1,024,911.28 | 7,750,319.02 | 13.22 | 21.46 | 21.46 |

| 7 | Mar.17 | 1,124,204.85 | 8,874,523.88 | 1,124,204.85 | 8,874,523.87 | 15.13 | 24.58 | 24.58 |

| 8 | Apr.17 | 899,863.73 | 9,774,387.61 | 899,863.73 | 9,774,387.60 | 16.67 | 27.07 | 27.07 |

| 9 | May 17 | 860,000.82 | 10,634,388.43 | 860,000.82 | 10,634,388.42 | 18.13 | 29.45 | 29.45 |

| 10 | Jun.17 | 537,721.00 | 11,172,109.43 | 537,721.00 | 11,172,109.42 | 19.05 | 30.94 | 30.94 |

| 11 | Jul.17 | 293,524.63 | 11,465,634.06 | 293,524.63 | 11,465,634.05 | 19.55 | 31.75 | 31.75 |

| 12 | Aug.17 | 1,064,465.00 | 12,530,099.06 | 1,072,251.29 | 12,537,885.34 | 21.38 | 34.70 | 34.72 |

| 13 | Sep.17 | 1,236,413.52 | 13,766,512.58 | 614,825.93 | 13,152,711.27 | 22.43 | 38.12 | 36.42 |

| 14 | Oct.17 | 1,998,683.50 | 15,765,196.08 | 1,509,792.56 | 14,662,503.83 | 25.00 | 43.66 | 40.60 |

| 15 | Nov.17 | 2,195,751.00 | 17,960,947.08 | 2,231,802.48 | 16,894,306.31 | 28.81 | 49.74 | 46.78 |

| 16 | Dec.17 | 2,925,234.00 | 20,886,181.08 | 2,559,405.11 | 19,453,711.42 | 33.17 | 57.84 | 53.87 |

| 17 | Jan.18 | 3,816,618.00 | 24,702,799.08 | 2,644,027.80 | 22,097,739.22 | 37.68 | 68.41 | 61.19 |

| 18 | Feb.18 | 3,825,234.00 | 28,528,033.08 | 2,202,625.30 | 24,300,364.52 | 41.44 | 79.00 | 67.29 |

| 19 | Mar.18 | 3,540,993.30 | 32,069,026.38 | 2,905,521.47 | 27,205,885.99 | 46.39 | 88.81 | 75.34 |

| 20 | Apr.18 | 2,408,845.75 | 34,477,872.13 | 1,947,719.29 | 29,153,605.28 | 49.71 | 95.48 | 80.73 |

| 21 | May.18 | 1,358,443.00 | 35,836,315.13 | 1,488,799.77 | 30,642,405.05 | 52.25 | 99.24 | 84.86 |

| 22 | Jun.18 | 274,831.00 | 36,111,146.13 | 1,191,291.00 | 31,833,696.05 | 54.28 | 100.00 | 88.15 |

| 23 | Jul.18 | 0.00 | 36,111,146.13 | 1,622,583.04 | 33,456,279.09 | 57.05 | 100.00 | 92.65 |

| 24 | Aug.18 | 0.00 | 36,111,146.13 | 2,415,758.53 | 35,872,037.62 | 61.17 | 100.00 | 99.34 |

| 25 | Sep.18 | 0.00 | 36,111,146.13 | 4,252,403.78 | 40,124,441.40 | 68.42 | 100.00 | 111.11 |

| 26 | Oct.18 | 0.00 | 36,111,146.13 | 4,722,806.07 | 44,847,247.47 | 76.47 | 100.00 | 124.19 |

| 27 | Nov.18 | 0.00 | 36,111,146.13 | 4,470,580.10 | 49,317,827.57 | 84.09 | 100.00 | 136.57 |

| 28 | Dec.18 | 0.00 | 36,111,146.13 | 3,013,286.20 | 52,331,113.77 | 89.23 | 100.00 | 144.92 |

| 29 | Jan.19 | 0.00 | 36,111,146.13 | 2,226,044.30 | 54,557,158.07 | 93.03 | 100.00 | 151.08 |

| 30 | Feb.19 | 0.00 | 36,111,146.13 | 0.00 | 54,557,158.07 | 93.03 | 100.00 | 151.08 |

| 31 | Mar.19 | 0.00 | 36,111,146.13 | 2,014,670.58 | 56,571,828.65 | 96.46 | 100.00 | 156.66 |

| 32 | Apr.19 | 0.00 | 36,111,146.13 | 0.00 | 56,571,828.65 | 96.46 | 100.00 | 156.66 |

| 33 | May.19 | 0.00 | 36,111,146.13 | 0.00 | 56,571,828.65 | 96.46 | 100.00 | 156.66 |

| 34 | Jun.19 | 0.00 | 36,111,146.13 | 2,074,556.10 | 58,646,384.75 | 100.00 | 100.00 | 162.41 |

| Work and Expenditure Schedule | Duration | Cost of Construction Works | Deviation from Schedule | Deviation from Budget | Schedule Performance Indicator | Cost Performance Indicator |

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) |

| [–] | [months] | [PLN] | [months] | [PLN] | [–] | [–] |

| Original cost of construction works | 22 | 36,111,146.13 | - | - | - | - |

| Cost of construction works in Dec. 2017 | 22 | 42,313,695.00 | 0 | 6,202,548.87 | 1.000 | 1.172 |

| Cost of construction works in Mar. 2018 | 26 | 4, 635,084.50 | 4 | 7,523,938.37 | 1.182 | 1.208 |

| Cost of construction works in Jun. 2018 | 29 | 53,473,979.01 | 7 | 17,362,832.88 | 1.318 | 1.481 |

| Cost of construction works in Jul. 2018 | 29 | 57,564,756.03 | 7 | 21,453,609.90 | 1.318 | 1.594 |

| Cost of construction works in Nov. 2018 | 30 | 57,564,756.03 | 8 | 21,453,609.90 | 1.364 | 1.594 |

| Final cost of construction works | 34 | 58,646,384.75 | 12 | 22,535,238.62 | 1.545 | 1.624 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Konior, J.; Szóstak, M. The S-Curve as a Tool for Planning and Controlling of Construction Process—Case Study. Appl. Sci. 2020, 10, 2071. https://doi.org/10.3390/app10062071

Konior J, Szóstak M. The S-Curve as a Tool for Planning and Controlling of Construction Process—Case Study. Applied Sciences. 2020; 10(6):2071. https://doi.org/10.3390/app10062071

Chicago/Turabian StyleKonior, Jarosław, and Mariusz Szóstak. 2020. "The S-Curve as a Tool for Planning and Controlling of Construction Process—Case Study" Applied Sciences 10, no. 6: 2071. https://doi.org/10.3390/app10062071

APA StyleKonior, J., & Szóstak, M. (2020). The S-Curve as a Tool for Planning and Controlling of Construction Process—Case Study. Applied Sciences, 10(6), 2071. https://doi.org/10.3390/app10062071