Experimental Study on the Risk Preference Characteristics of Members in Supply Chain Emergencies

Abstract

:1. Introduction

2. Experimental Design and Methods

2.1. Experimental Hypothesis

2.2. Experimental Design Framework

2.3. Experiment 1: The DOSPERT Scale Test of Conventional Risk and Emergency in a Supply Chain

- Design of the test topics: According to relevant literature about the sorting of supply chain risk, nine key conventional risk fields were identified, namely, moral risk, legal risk, information risk, supply risk, logistics risk, demand risk, cooperation risk, economic risk, and political risk, with each risk field having four topics. For example, in the morality field, one would try to steal the core technology of the other party as a potential competitor when information was shared. Meanwhile, in order to combine the characteristics of supply chain emergencies and the relevance of the research topic, 8 topics regarding supply chain emergencies were selected and compiled. For example, a new acute disease suddenly appeared in the supply workshop, but the workshop was not disinfected because there were not many patients and their infectivity was not ascertained. According to Weber’s five-point test scoring, the options from 5 (very likely) to 1 (very unlikely) were set up.

- Test: 20 voluntary students were selected to fill in the designed questionnaire.

- Reliability test: We carried out the reliability test using Cronbach’s α coefficient on the scale topics through the questionnaire data. The overall data coefficient was measured as 0.911, indicating that the questionnaire had good reliability and could be used for the experiment. The subjects were required to complete all the topics in the questionnaire.

2.4. Experiment 2: Risk Preference Test of Supply Chain Members in Emergencies

2.5. Experiment 3: Risk Preference Test of Supply Chain Emergent Sub-Events

2.6. Subject Statistics and Experimental Procedures

3. Results

3.1. Data Analysis of Experiment 1

3.2. Data Analysis of Experiment 2

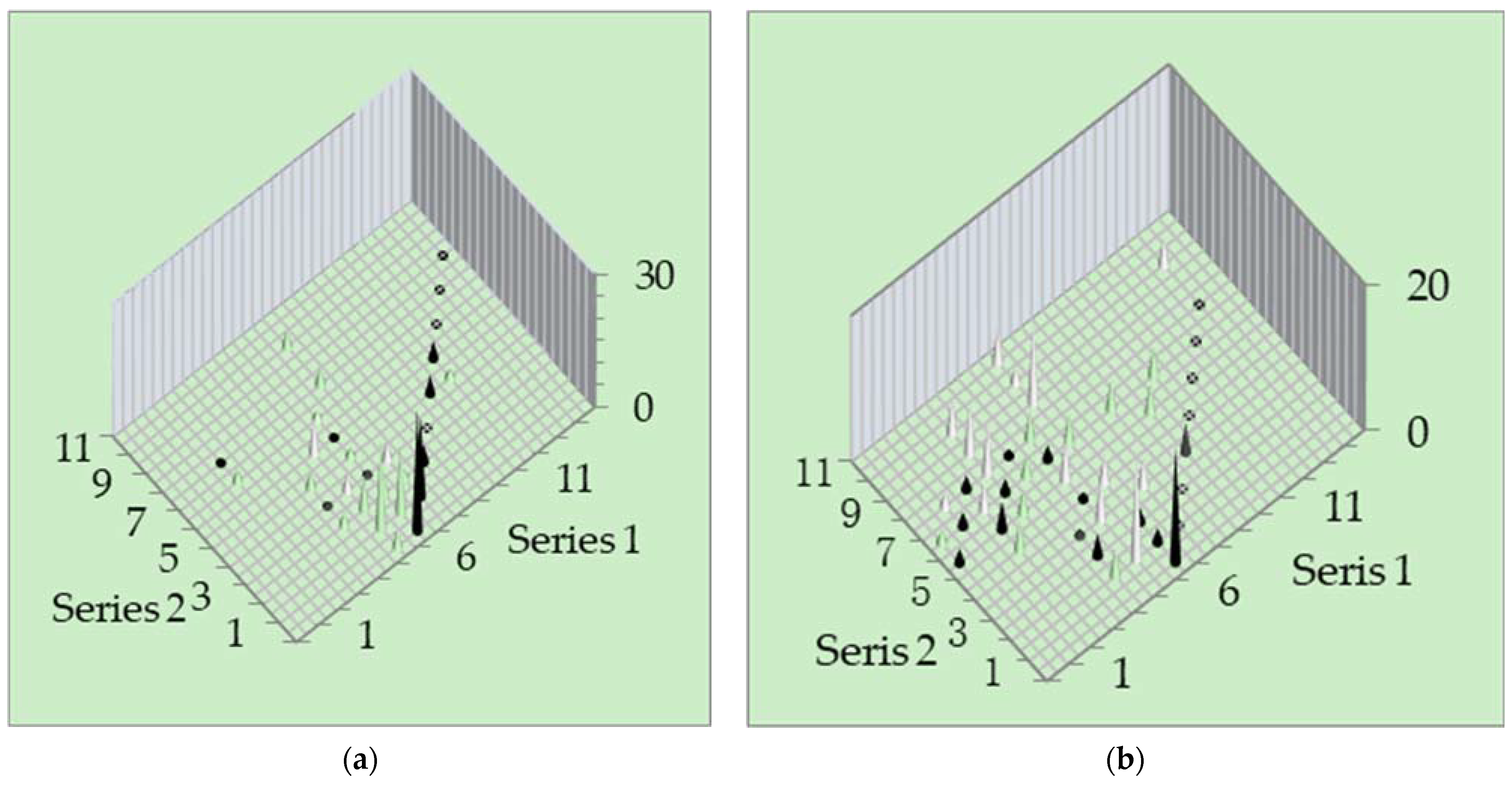

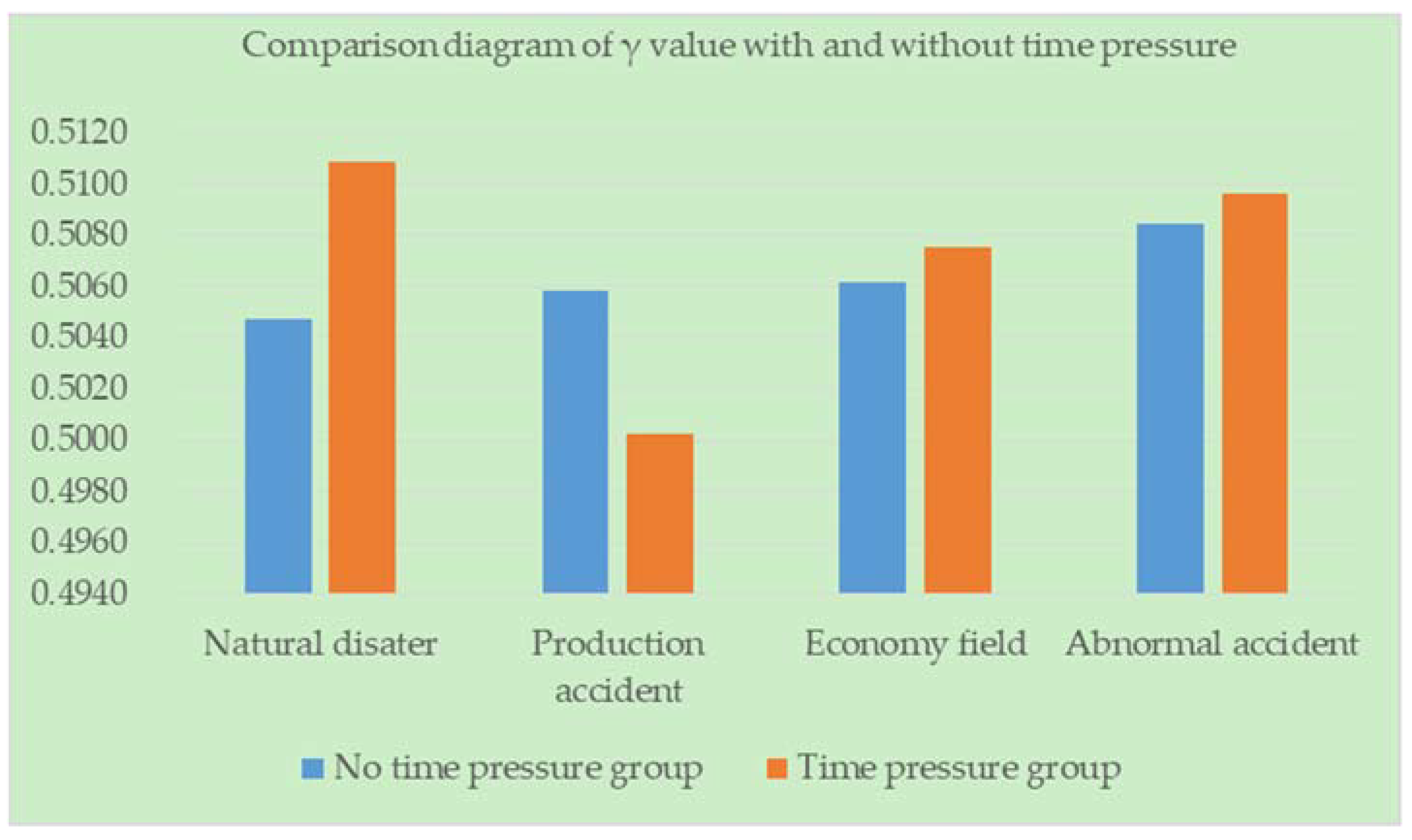

3.3. Data Analysis of Experiment 3

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| 1 2 3 4 5 |

| ○ ○ ○ ○ ○ |

| Extremely unlikely Not sure Extremely likely |

- Interrupting the normal progress of the project and taking over additional projects with considerable revenue. (MR)

- Not making sure to complete the cooperation project on time and not ensuring the quality according to the requirements when the agreed income is reduced by 20%. (MR)

- Trying to steal their core technology as a potential competitor when information is shared. (MR)

- Believing distributions should be fair between the amount of work and income when cooperating with others. (MR)

- Terminating the contract with the current partner early when there is a better partner. (LER)

- Not taking the lead in energy saving and emission reduction when sacrificing 15% of net income to introduce green technology. (LER)

- Priority on productivity and neglecting workplace health and safety. (LER)

- Paying not too much attention to partners’ sense of social responsibility. (LER)

- Purchasing a large number of raw materials for processing and sales when market demand suddenly booms. (IR)

- Increasing orders in order to get more quotas when product is rationed. (IR)

- Not telling partners information that is harmful to them but beneficial to you. (IR)

- Spreading some untrue information to promote sales when inventory is overstocked. (IR)

- Paying more attention to the quality compared to the safety and environmental protection issues of suppliers. (SR)

- Cooperating with raw material suppliers in disaster-prone areas. (SR)

- Competing with the manufacturer for downstream market when the manufacturer is absolutely dependent on you as a supplier. (SR)

- Prioritizing to meeting important customer orders rather than supplying in order. (SR)

- Risking to pass a poor road that has not been taken before in order to deliver the goods to a disaster area on time. (LOR)

- Driving over the speed limit on the endless road with few people and cars when transporting goods without monitoring. (LOR)

- Cooperating with carriers unable to implement effective monitoring. (LOR)

- Continuing to accept order even when the delivery time is delayed due to excessive orders. (LOR)

- Relying on a certain supplier for the supply of important raw materials. (DR)

- Cooperating with low loyalty partners due to the excellent quality of products. (DR)

- Prioritizing to meet the delivery time for unstable key customers and delaying the delivery time for small customers with long-term cooperation. (DR)

- Continuing to increase output although it is impossible to predict the demand in the peak sales period. (DR)

- Sharing your own core technologies on the basis of mutual trust between enterprises. (CR)

- Reducing real-time monitor for long-term service providers. (CR)

- Cooperating with enterprises with bad reputation. (CR)

- Choosing to maximize the interests of enterprises at the expense of the overall interests of the supply chain. (CR)

- Investing 30% of the idle capital of the enterprise in risk stocks (high risk of stocks, but also high returns). (ER)

- Investing 60% of idle funds of enterprises in government bonds (Low risk of bond, but also low returns). (ER)

- Investing 30% of the idle capital of the enterprise in the fixed deposit of the bank (low risk of deposit, but also low returns). (ER)

- Investing 60% of idle funds of enterprises in mutual funds with moderate growth. (ER)

- Investing in regions with a historical tendency of “excluding China”. (PR)

- Purchasing raw materials in areas threatened by terrorism to obtain low cost of the raw materials. (PR)

- Building factories in countries with frequent regime changes in order to obtain cheap labor costs. (PR)

- Debating with foreign cooperative enterprise decision-makers on issues with different opinions on political differences between two countries. (PR)

- Refusing to discard valuables that affect running speed when escaping in debris flow. (EM)

- Not disinfecting the workshop when new acute diseases appear in the production workshop due to few patients and their uncertain infectivity. (EM)

- Repairing the production machine by oneself when it breaks down. (EM)

- Loading items beyond the loading capacity of the sterilization cabinet. (EM)

- Stopping to help a person on the road with few people when transporting goods at night. (EM)

- Confronting with thieves when valuable goods of enterprise are stolen at night. (EM)

- Breaking into the burning room to get the key technical materials. (EM)

- Not reducing production when many other enterprises have been revealed by media due to counterfeit and shoddy products. (EM)

- Note: MR = morality risk, LER = legal risk, IR = information risk, SR = supply risk, LOR = logistics risk, DR = demand risk, CR = cooperation risk, ER = economy risk, PR = politics risk. EM = emergency.

Appendix B

- Scenarios 1: Natural Disaster.

| 1. A:100% save 30,000 ¥ B: 20% save 3,000,000 ¥, 80% save 0. | 9. A:100% save 750,000 ¥ B: 20% save 9,000,000 ¥, 80% save 0. |

| 2. A:100% save 480,000 ¥ B: 40% save 3,000,000 ¥, 60% save 0. | 10. A:100% save 2,850,000 ¥ B: 40% save 9,000,000 ¥, 60% save 0. |

| 3. A:100% save 1,380,000 ¥ B: 60% save 3,000,000 ¥, 40% save 0. | 11. A:100% save 2,100,000 ¥ B: 60% save 9,000,000 ¥, 40% save 0. |

| 4. A:100% save 2,280,000 ¥ B: 80% save 3,000,000 ¥, 20% save 0. | 12. A:100% save 5,760,000 ¥ B: 80% save 9,000,000 ¥, 20% save 0. |

| 5. A:100% save 240,000 ¥ B: 20% save 6,000,000 ¥, 80% save 0. | 13. A:100% save 1,590,000 ¥ B: 20% save 12,000,000 ¥, 80% save 0. |

| 6. A:100% save 1,470,000 ¥ B: 40% save 6,000,000 ¥, 60% save 0. | 14. A:100% save 870,000 ¥ B: 40% save 12,000,000 ¥, 60% save 0. |

| 7. A:100% save1,470,000 ¥ B: 40% save 6,000,000 ¥, 60% save 0. | 15. A:100% save 4,320,000 ¥ B: 60% save 12,000,000 ¥, 40% save 0. |

| 8. A:100% save 3,180,000 ¥ B: 60% save 6,000,000 ¥, 40% save 0. | 16. A:100% save 8,520,000 ¥ B: 80% save 12,000,000 ¥, 20% save 0. |

- Scenarios 2: Production Accident.

| 1. A:100% save 240,000 ¥ B: 20% save 3,000,000 ¥, 80% save 0. | 9. A:100% save 90,000 ¥ B: 20% save 9,000,000 ¥, 80% save 0. |

| 2. A:100% save 960,000 ¥ B: 40% save 3,000,000 ¥, 60% save 0. | 10. A:100% save 1,440,000 ¥ B: 40% save 9,000,000 ¥, 60% save 0. |

| 3. A:100% save 690,000 ¥ B: 60% save 3,000,000 ¥, 40% save 0. | 11. A:100% save 4,110,000 ¥ B: 60% save 9,000,000 ¥, 40% save 0. |

| 4. A:100% save1,920,000 ¥ B: 80% save 3,000,000 ¥, 20% save 0. | 12. A:100% save 6,810,000 ¥ B: 80% save 9,000,000 ¥, 20% save 0. |

| 5. A:100% save 810,000 ¥ B: 20% save 6,000,000 ¥, 80% save 0. | 13. A:100% save 480,000 ¥ B: 20% save 12,000,000 ¥, 80% save 0. |

| 6. A:100% save 450,000 ¥ B: 40% save 6,000,000 ¥, 60% save 0. | 14. A:100% save 2,940,000 ¥ B: 40% save 12,000,000 ¥, 60% save 0. |

| 7. A:100% save2,160,000 ¥ B: 60% save 6,000,000 ¥, 40% save 0. | 15. A:100% save 6,330,000 ¥ B: 60% save 12,000,000 ¥, 40% save 0. |

| 8. A:100% save 4,260,000 ¥ B: 80% save 6,000,000 ¥, 20% save 0. | 16. A:100% save 6,330,000 ¥ B: 80% save 12,000,000 ¥, 20% save 0. |

- Scenarios 3: Economic Field Accident.

| 1. A:100% save 390,000 ¥ B: 20% save 3,000,000 ¥, 80% save 0. | 9. A:100% save 360,000 ¥ B: 20% save 9,000,000 ¥, 80% save 0. |

| 2. A:100% save 210,000 ¥ B: 40% save 3,000,000 ¥, 60% save 0. | 10. A:100% save 2,190,000 ¥ B: 40% save 9,000,000 ¥, 60% save 0. |

| 3. A:100% save 1,080,000 ¥ B: 60% save 3,000,000 ¥, 40% save 0. | 11. A:100% save 4,740,000 ¥ B: 60% save 9,000,000 ¥, 40% save 0. |

| 4. A:100% save2,130,000 ¥ B: 80% save 3,000,000 ¥, 20% save 0. | 12. A:100% save 4,770,000 ¥ B: 80% save 9,000,000 ¥, 20% save 0. |

| 5. A:100% save 60,000 ¥ B: 20% save 6,000,000 ¥, 80% save 0. | 13. A:100% save 1,020,000 ¥ B: 20% save 12,000,000 ¥, 80% save 0. |

| 6. A:100% save 960,000 ¥ B: 40% save 6,000,000 ¥, 60% save 0. | 14. A:100% save 3,810,000 ¥ B: 40% save 12,000,000 ¥, 60% save 0. |

| 7. A:100% save2,730,000 ¥ B: 60% save 6,000,000 ¥, 40% save 0. | 15. A:100% save 2,790,000 ¥ B: 60% save 12,000,000 ¥, 40% save 0. |

| 8. A:100% save 4,530,000 ¥ B: 80% save 6,000,000 ¥, 20% save 0. | 16. A:100% save 7,680,000 ¥ B: 80% save 12,000,000 ¥, 20% save 0. |

- Scenarios 4: Abnormal Accident.

| 1. A:100% save 120,000 ¥ B: 20% save 3,000,000 ¥, 80% save 0. | 9. A:100% save 1,200,000 ¥ B: 20% save 9,000,000 ¥, 80% save 0. |

| 2. A:100% save 720,000 ¥ B: 40% save 3,000,000 ¥, 60% save 0. | 10. A:100% save 660,000 ¥ B: 40% save 9,000,000 ¥, 60% save 0. |

| 3. A:100% save 1,590,000 ¥ B: 60% save 3,000,000 ¥, 40% save 0. | 11. A:100% save 3,240,000 ¥ B: 60% save 9,000,000 ¥, 40% save 0. |

| 4. A:100% save1,590,000 ¥ B: 80% save 3,000,000 ¥, 20% save 0. | 12. A:100% save 6,390,000 ¥ B: 80% save 9,000,000 ¥, 20% save 0. |

| 5. A:100% save 510,000 ¥ B: 20% save 6,000,000 ¥, 80% save 0. | 13. A:100% save 120,000 ¥ B: 20% save 12,000,000 ¥, 80% save 0. |

| 6. A:100% save 1,920,000 ¥ B: 40% save 6,000,000 ¥, 60% save 0. | 14. A:100% save 1,920,000 ¥ B: 40% save 12,000,000 ¥, 60% save 0. |

| 7. A:100% save1,380,000 ¥ B: 60% save 6,000,000 ¥, 40% save 0. | 15. A:100% save 5,460,000 ¥ B: 60% save 12,000,000 ¥, 40% save 0. |

| 8. A:100% save 3,840,000 ¥ B: 80% save 6,000,000 ¥, 20% save 0. | 16. A:100% save 9,090,000 ¥ B: 80% save 12,000,000 ¥, 20% save 0. |

References

- Stephan, M.; Christoph, B. An Empirical Examination of Supply Chain Performance Along Several Dimensions of Risk. J. Bus. Logist. 2008, 29, 307–325. [Google Scholar]

- Coleman, L. Frequency of Man-Made Disasters in the 20th Century. J. Conting Cris. 2006, 38, 131–156. [Google Scholar] [CrossRef]

- Lench, H.C.; Flors, S.A.; Bench, S.W. Discrete Emotions Predict Changes in Cognition, Judgment, Experience, Behavior, and Physiology: A Meta-Analysis of Experimental Emotion Elicitations. Psychol. Bull. 2011, 23, 126–130. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Ma, Q.G.; Wang, X.Y. The Mathematic Description of the Individual and Crowd Behavior under Unconventional Emergency. J. Ind. Eng. Eng. Manag. 2009, 137, 834–855. [Google Scholar]

- Dreyer, A.J.; Stephen, D.; Human, R.; Swanepoel, T.L.; Adams, L.; O’neill, A.; Thomas, K.G. Risky decision making under stressful conditions: Men and women with smaller cortisol elevations make riskier social and economic decisions. Front. Psychol. 2022, 13, 810031. [Google Scholar] [CrossRef]

- Schmitz, F.; Kunina-Habenicht, O.; Hildebrandt, A.; Oberauer, K.; Wilhelm, O. Psychometrics of the Iowa and Berlin gambling tasks: Unresolved issues with reliability and validity for risk taking. Assessment 2020, 27, 232–245. [Google Scholar] [CrossRef]

- Bell, R.P.; Towe, S.L.; Lalee, Z.; Huettel, S.A.; Meade, C.S. Neural sensitivity to risk in adults with co-occurring HIV infection and cocaine use disorder. Cogn. Affect. Behav. Neurosci. 2020, 20, 859–872. [Google Scholar] [CrossRef] [PubMed]

- Hastie, R. Problems for Judgment and Decision Making. Annu. Rev. Psychol. 2001, 52, 653–683. [Google Scholar] [CrossRef] [Green Version]

- Kahneman, D.; Tversky, A. Prospect Theory: An analysis of decision under risk. Econometrica 1979, 47, 263–291. [Google Scholar] [CrossRef] [Green Version]

- Weber, E.U.; Blais, A.R.; Betz, N.E. A domain-specific risk -attitude scale: Measuring risk perceptions and risk behaviors. J. Behav. Decis. Mak. 2002, 15, 263–290. [Google Scholar] [CrossRef]

- Blais, A.R.; Weber, E.U. A domain-specific risk-taking (DOSPERT) scale for adult population. Judgm. Decis. Mak. 2006, 1, 33–47. [Google Scholar] [CrossRef]

- Jun, G.; Jie, W.; Xiao-Hong, G. Analysis of influencing factors of group decision making errors in unconventional Emergencies Based on SIM. Saf. Secur. 2018, 9, 11–14. [Google Scholar]

- Vlaev, I.; Kusev, P.; Stewart, N.; Aldrovandi, S.; Chater, N. Domain effects and financial risk attitudes. Risk Anal. 2010, 30, 1374–1386. [Google Scholar] [CrossRef] [PubMed]

- Angrisani, M.; Cipriani, M.; Guarino, A.; Kendall, R.; Zarate Pina, J.O. Risk Preferences at the Time of COVID-19: An Experiment with Professional Traders and Students. FRB of New York Staff Report No. 927. May 2020. Available online: https://ssrn.com/abstract=3609586 (accessed on 13 May 2020).

- Ben, Z.; Breznitz, S. The effect of time pressure on risky on risky choice behavior. Acta Psychol. 1981, 47, 89–104. [Google Scholar]

- Liu, X.G.; Yang, N.D. Research on Primacy Effect in Emergency Decision Making. Chin. Saf. Sci. 2013, 23, 170–176. [Google Scholar]

- Dixon, G.; Aldao, A. Emotion regulation in context: Examining the spontaneous use of strategies across emotional intensity and type of emotion. Personal. Individ. Differ. 2015, 86, 271–276. [Google Scholar] [CrossRef]

- Liu, D.H.; Peterson, T.; Vincenzi, D. Effect of time pressure and target uncertainty on human operator performace and workload for autonomous unmanned aerial system. Int. J. Ind. Ergon. 2016, 51, 52–58. [Google Scholar] [CrossRef]

- Kirchler, M.; Andersson, D.; Bonn, C.; Johannesson, M.; Sørensen, E.; Stefan, M.; Tinghög, G.; Västfjäll, D. The effect of fast and slow decisions on risk taking. J. Risk Uncertain. 2017, 54, 37–59. [Google Scholar] [CrossRef] [Green Version]

- Kocher, M.G.; Schindler, D. Risk, time pressure, and selection effects. Exp. Econ. 2019, 22, 216–246. [Google Scholar] [CrossRef] [Green Version]

- El, H.A.; Krawczyk, M.; Sylwestrzak, M. Time pressure and risk taking in auctions: A field experiment. J. Behav. Exp. Econ. 2019, 78, 68–79. [Google Scholar]

- Byrne, K.A.; Peters, C.; Willis, H.C.; Phan, D.; Cornwall, A.; Worthy, D.A. Acute stress enhances tolerance of uncertainty during decision-making. Cognition 2020, 205, 104448. [Google Scholar] [CrossRef] [PubMed]

- Buckert, M.; Schwieren, C.; Kudielka, B.M.; Fiebach, C.J. Acute stress affects risk taking but not ambiguity aversion. Front. Neurosci.-Switz. 2014, 8, 82. [Google Scholar] [CrossRef] [Green Version]

- Chen, J.L.; Li, Q.X.; Zhang, C.P. The experimental study on the influence of time pressure and decision maker’s risk attitude on decision-making behavior in emergency. Chin. J. Manag. Sci. 2015, 23, 349–358. [Google Scholar]

- Tanaka, T.; Camerer, C.F.; Nguyen, Q. Risk and time preferences; Linking experimental and household survey data from Vietnam. Am. Econ. Rev. 2010, 100, 557–571. [Google Scholar] [CrossRef] [Green Version]

- Bartczak, A.; Chilton, S. Wildfires in Poland: The impact of risk preferences and loss aversion on environmental choices. Ecol. Econ. 2015, 116, 300–309. [Google Scholar] [CrossRef] [Green Version]

- Lehman, B., III; Beach, L.R. The effects of time constraints on the prochoice screening of decision options. Organ. Behav. Hum. Decis. Process. 1996, 67, 222–228. [Google Scholar]

- Li, S.; Liu, S.; Huang, P.; Liu, S.; Zhang, W.; Guo, X.; Liu, Z. The modulation of attentional deployment on regret: An event-related potential study. Neuro Rep. 2021, 32, 621–630. [Google Scholar] [CrossRef]

- Liu, S.; Lu, Y.; Li, S.; Huang, P.; Li, L.; Liu, S.; Guo, X. Resting-state functional connectivity within orbitofrontal cortex and inferior frontal gyrus modulates the relationship between reflection level and risk-taking behavior in internet gaming disorder. Brain Res. Bull. 2022, 178, 49–56. [Google Scholar] [CrossRef]

- Liu, Z.; Huang, P.; Gong, Y.; Wang, Y.; Wu, Y.; Wang, C.; Guo, X. Altered neural responses to missed chance contribute to the risk-taking behaviour in individuals with Internet gaming disorder. Addict. Biol. 2022, 27, e13124. [Google Scholar] [CrossRef]

- Prelec, D. The Probability Weighting Function. Econometrica 1998, 66, 497–527. [Google Scholar] [CrossRef] [Green Version]

- Mitroff, I.I.; Alpasan, M.C. Preparing for the evil. Prep. Evil 2003, 5–11. [Google Scholar]

- Liu, C.H. The Research of Response Strategies of Incidents of Supply Chain Strategies. Master’s Thesis, Chang’an University, Xi’an, China, 2013. [Google Scholar]

- Liu, E. Time to Change What to Sow: Risk Preferences and Technology Adoption Decisions of Cotton Farmers in China. Rev. Econ. Stat. 2013, 95, 1386–1403. [Google Scholar] [CrossRef] [Green Version]

| Series 1 | Series 2 | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Save Supplies Option A | Save Supplies Option B | EV(A) − EV(B) | Save Supplies Option A | Save Supplies Option B | EV(A) − EV(B) | ||||

| Probability 7/10 | Probability 3/10 | Probability 1/10 | Probability 9/10 | Probability 9/10 | Probability 1/10 | Probability 7/10 | Probability 3/10 | ||

| 250 | 1000 | 1700 | 125 | 192.5 | 1000 | 750 | 1350 | 125 | −7.5 |

| 250 | 1000 | 1875 | 125 | 175 | 1000 | 750 | 1400 | 125 | −42.5 |

| 250 | 1000 | 2075 | 125 | 150 | 1000 | 750 | 1450 | 125 | −77.5 |

| 250 | 1000 | 2325 | 125 | 130 | 1000 | 750 | 1500 | 125 | −112.5 |

| 250 | 1000 | 2650 | 125 | 97.5 | 1000 | 750 | 1550 | 125 | −147.5 |

| 250 | 1000 | 3125 | 125 | 50 | 1000 | 750 | 1625 | 125 | −200 |

| 250 | 1000 | 3750 | 125 | −12.5 | 1000 | 750 | 1700 | 125 | −252.5 |

| 250 | 1000 | 4625 | 125 | −100 | 1000 | 750 | 1800 | 125 | −322.5 |

| 250 | 1000 | 5500 | 125 | −187.5 | 1000 | 750 | 1925 | 125 | −410 |

| 250 | 1000 | 7500 | 125 | −387.5 | 1000 | 750 | 2075 | 125 | −515 |

| 250 | 1000 | 10,000 | 125 | −637.5 | 1000 | 750 | 2250 | 125 | −637.5 |

| 250 | 1000 | 15,000 | 125 | −1137.5 | 1000 | 750 | 2500 | 125 | −812.5 |

| 250 | 1000 | 25,000 | 125 | −2137.5 | 1000 | 750 | 2750 | 125 | −987.5 |

| 250 | 1000 | 42,500 | 125 | −3887.5 | 1000 | 750 | 3250 | 125 | −1337.5 |

| Series 1 | Series 2 | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| σ | α | σ | α | ||||||||||||

| 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 | 1 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 | 1 | ||

| 0.2 | 9 | 10 | 11 | 12 | 13 | 14 | NO | 0.2 | NO | 14 | 13 | 12 | 11 | 10 | 9 |

| 0.3 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 0.3 | 14 | 13 | 12 | 11 | 10 | 9 | 8 |

| 0.4 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 0.4 | 13 | 12 | 11 | 10 | 9 | 8 | 7 |

| 0.5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 0.5 | 12 | 11 | 10 | 9 | 8 | 7 | 6 |

| 0.6 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 0.6 | 11 | 10 | 9 | 8 | 7 | 6 | 5 |

| 0.7 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 0.7 | 10 | 9 | 8 | 7 | 6 | 5 | 4 |

| 0.8 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 0.8 | 9 | 8 | 7 | 6 | 5 | 4 | 3 |

| 0.9 | 2 | 3 | 4 | 5 | 7 | 8 | 9 | 0.9 | 8 | 7 | 6 | 5 | 4 | 3 | 2 |

| 1 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 1 | 7 | 6 | 5 | 4 | 3 | 2 | 1 |

| Gender | Management Position | ||||

|---|---|---|---|---|---|

| Men | Women | Sales | Operation | Technology | |

| Number of people | 220 | 112 | 168 | 104 | 60 |

| Proportion | 66.27% | 33.73% | 50.60% | 31.33% | 18.07% |

| Risk Areas | Risk Neutrality | Risk Aversion | Risk- Seeking | Risk Areas | Risk Neutrality | Risk Aversion | Risk- Seeking |

|---|---|---|---|---|---|---|---|

| Morality | 231 | 41 | 60 | Demand | 232 | 48 | 52 |

| Law | 228 | 60 | 44 | Cooperation | 212 | 60 | 60 |

| Information | 209 | 67 | 56 | Economy | 235 | 53 | 44 |

| Supply | 228 | 64 | 40 | Politics | 220 | 52 | 60 |

| Logistics | 212 | 60 | 60 | Emergency | 215 | 57 | 60 |

| Total Risk Aversion | Risk Aversion or Neutrality | Total Risk Neutrality | Risk Seeking or Neutrality | Total Risk Seeking | All Three Have | |

|---|---|---|---|---|---|---|

| Total | 0 | 92 | 44 | 104 | 0 | 92 |

| The Subjects | The Experiment Field | σ | α |

|---|---|---|---|

| Residents in South Asia | Lottery experiment | 0.59 | 0.74 |

| Chinese farmers | Planting field | 0.48 | 0.69 |

| Supply chain members in China | Supply chain risk | 0.91 | 0.92 |

| The Subjects | The Experiment Field | No Time Pressure | Time Pressure | ||

|---|---|---|---|---|---|

| σ | α | σ | α | ||

| Students | Emergency field | 0.956 | 0.944 | 0.833 | 0.85 |

| Supply chain members | Supply chain risk | 0.909 | 0.917 | 0.702 | 0.8 |

| No Time Pressure | Time Pressure | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Total | The Mean | The Standard Deviation | The Maxi-Mum | The Mini- Mum | Total | The Mean | The Standard Deviation | The Maxi- Mum | The Mini- Mum | |

| Natural disaster | 166 | 0.505 | 0.030 | 0.566 | 0.444 | 166 | 0.511 | 0.048 | 0.575 | 0.425 |

| Production accident | 166 | 0.506 | 0.037 | 0.575 | 0.444 | 166 | 0.500 | 0.032 | 0.575 | 0.425 |

| Economy field | 166 | 0.506 | 0.033 | 0.575 | 0.425 | 166 | 0.508 | 0.038 | 0.575 | 0.425 |

| Abnormal accident | 166 | 0.508 | 0.041 | 0.566 | 0.425 | 166 | 0.510 | 0.044 | 0.575 | 0.425 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gu, Y.; Chen, W.; Liu, H. Experimental Study on the Risk Preference Characteristics of Members in Supply Chain Emergencies. Appl. Sci. 2023, 13, 8188. https://doi.org/10.3390/app13148188

Gu Y, Chen W, Liu H. Experimental Study on the Risk Preference Characteristics of Members in Supply Chain Emergencies. Applied Sciences. 2023; 13(14):8188. https://doi.org/10.3390/app13148188

Chicago/Turabian StyleGu, Yulei, Wenqiang Chen, and Haiping Liu. 2023. "Experimental Study on the Risk Preference Characteristics of Members in Supply Chain Emergencies" Applied Sciences 13, no. 14: 8188. https://doi.org/10.3390/app13148188

APA StyleGu, Y., Chen, W., & Liu, H. (2023). Experimental Study on the Risk Preference Characteristics of Members in Supply Chain Emergencies. Applied Sciences, 13(14), 8188. https://doi.org/10.3390/app13148188