Deep LSTM with Reinforcement Learning Layer for Financial Trend Prediction in FX High Frequency Trading Systems

Abstract

:1. Introduction

1.1. Deep Learning (LSTM) and RL Based Trading Systems: Literature Review

1.2. Deep Computing-Based Trading Systems: Literature Review

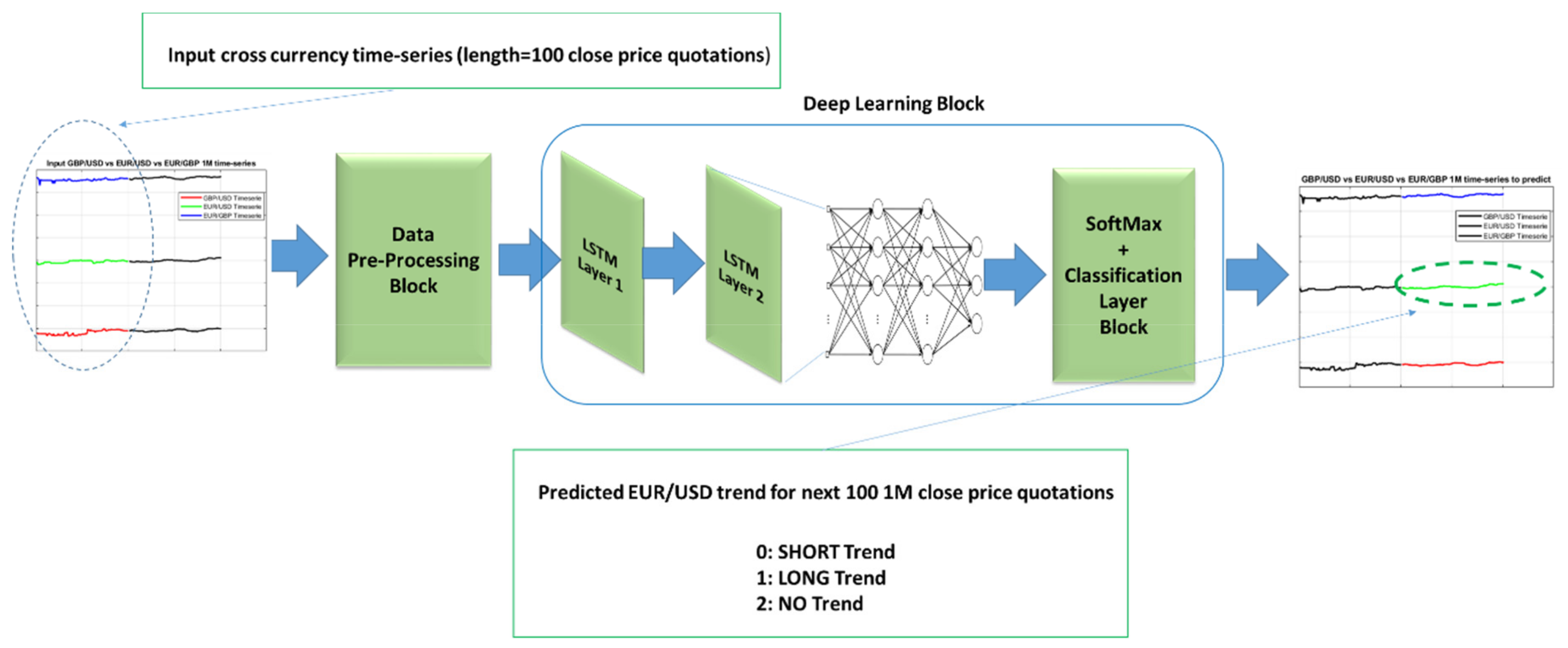

2. Materials and Methods

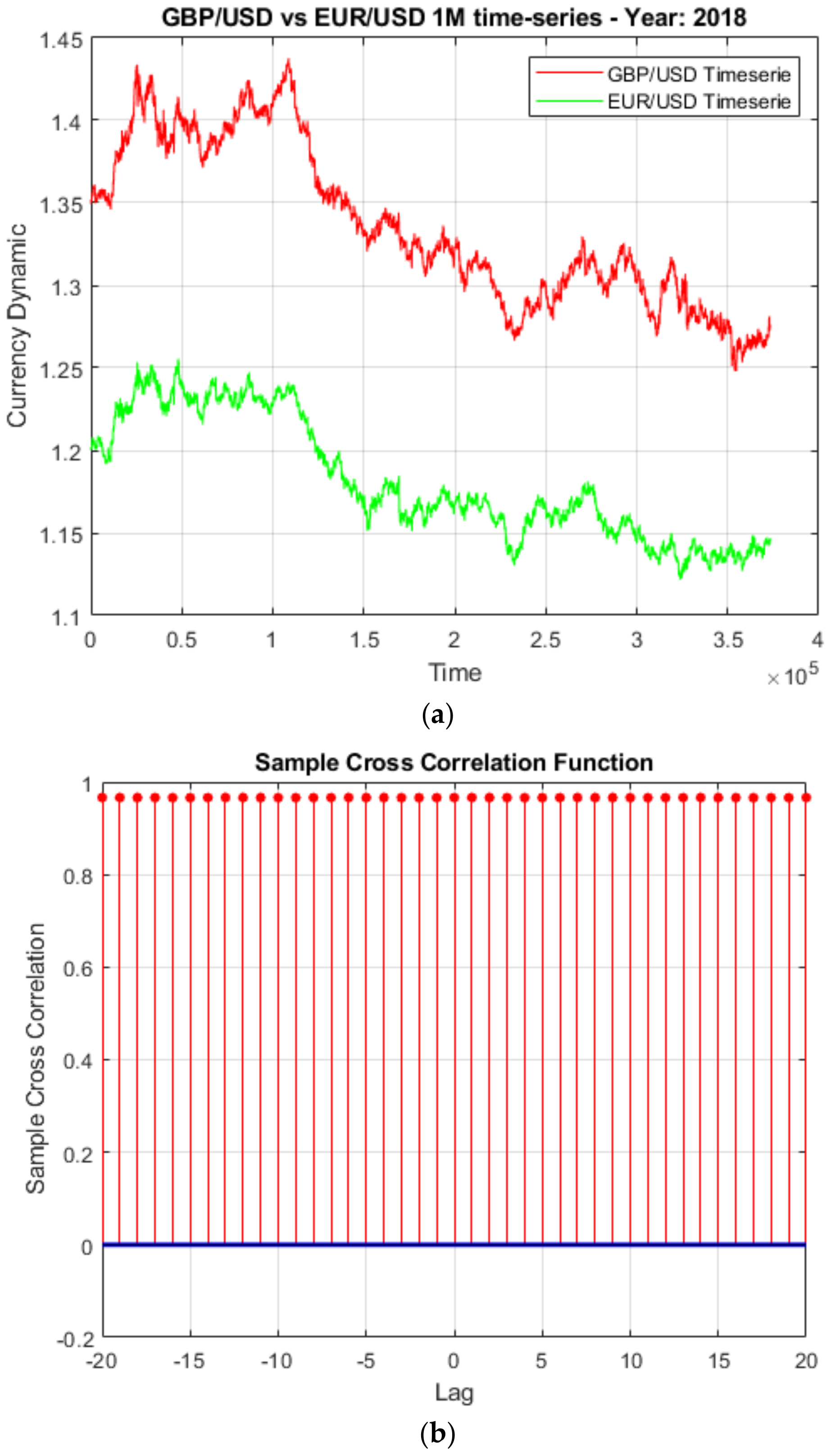

2.1. Data Pre-Processing Block

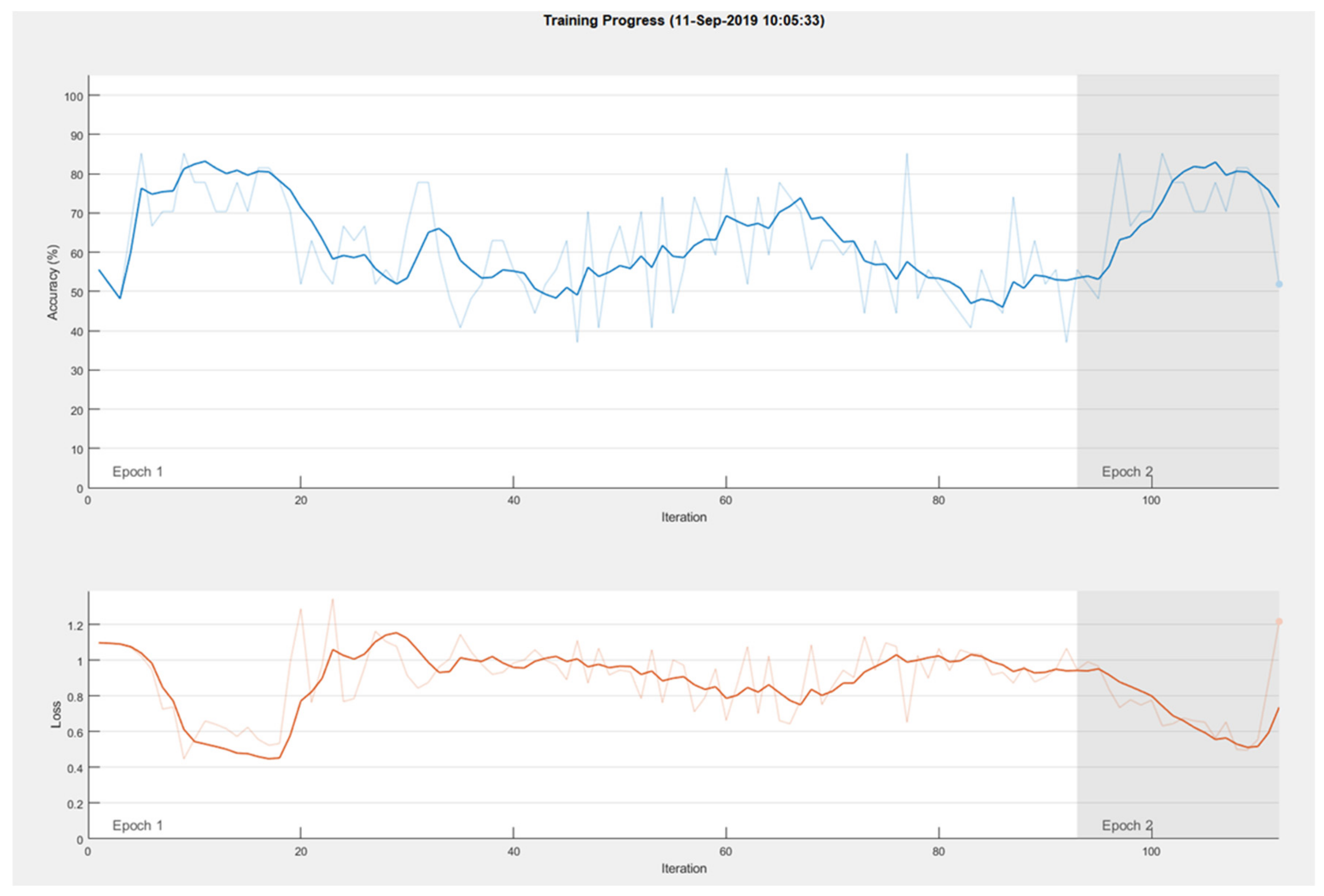

2.2. Deep Learning Block

- represent the LSTM weights

- represent the used biases for each cell

- represents the cell state

- Input layer;

- LSTM layer (HiddenCellNumber);

- LSTM layer (HiddenCellNumber);

- FullyConnected Layer (NumberClasses);

- SoftMaxLayer

- ClassificationLayer

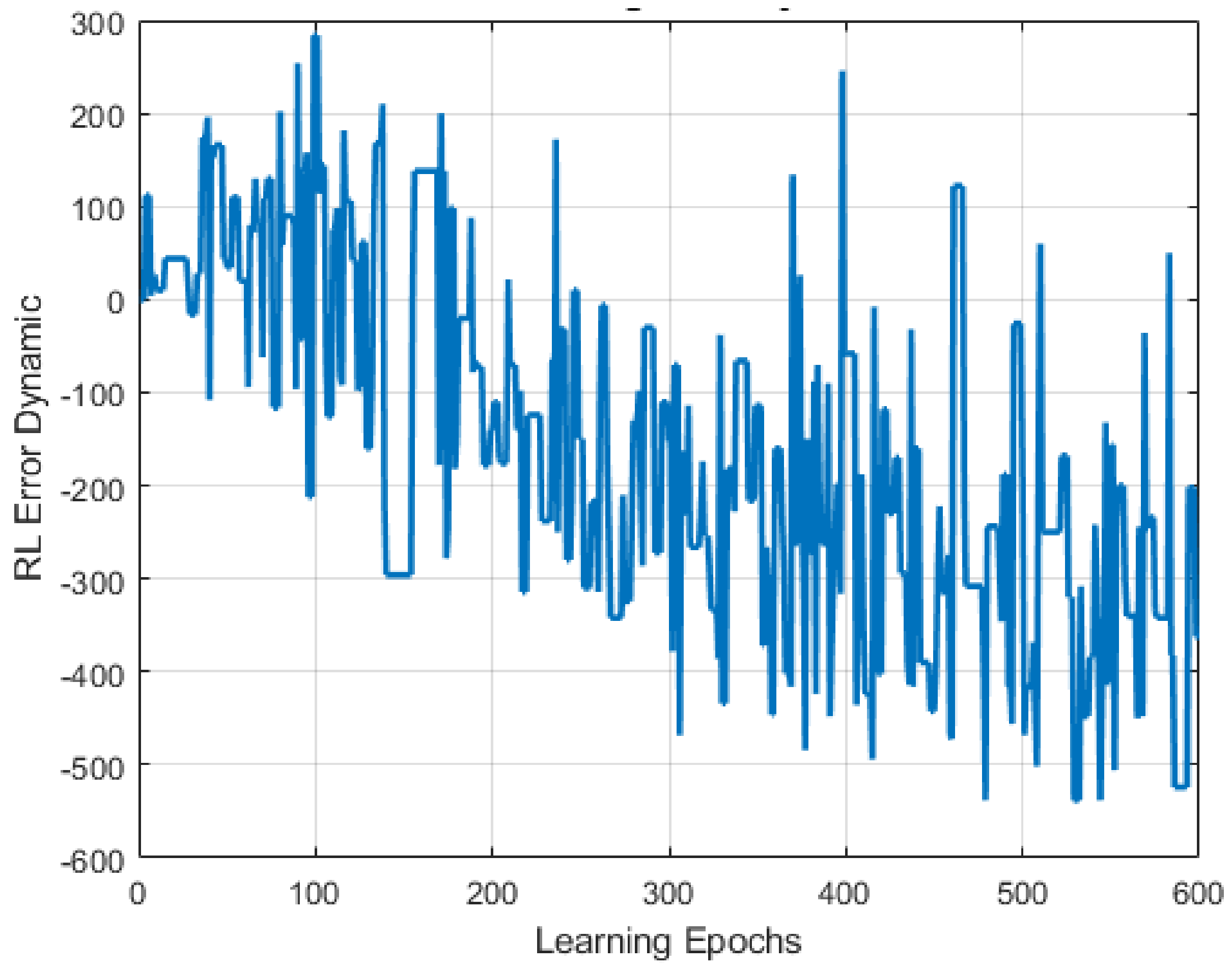

2.3. RL Correction Block

2.4. Currency Trend Forecast Application: HFT Grid Trading System

3. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Rundo, F.; Trenta, F.; Di Stallo, A.L.; Battiato, S. Advanced Markov-Based Machine Learning Framework for Making Adaptive Trading System. Computation 2019, 7, 4. [Google Scholar] [CrossRef]

- Rundo, F.; Trenta, F.; di Stallo, A.L.; Battiato, S. Grid Trading System Robot (GTSbot): A Novel Mathematical Algorithm for Trading FX Market. Appl. Sci. 2019, 9, 1796. [Google Scholar] [CrossRef]

- Nti, I.K.; Adekoya, A.F.; Weyori, B.A. A systematic review of fundamental and technical analysis of stock market predictions. Artif. Intell. Rev. 2019, 1–5. [Google Scholar] [CrossRef]

- Vlasenko, A.; Vlasenko, N.; Vynokurova, O.; Bodyanskiy, Y.; Peleshko, D. A Novel Ensemble Neuro-Fuzzy Model for Financial Time Series Forecasting. Data 2019, 4, 126. [Google Scholar] [CrossRef]

- García, F.; Guijarro, F.; Oliver, J.; Tamošiūnienė, R. Hybrid fuzzy neural network to predict price direction in the German DAX-30 index. Technol. Econ. Dev. Econ. 2018, 24, 2161–2178. [Google Scholar] [CrossRef]

- Li, Y.; Zheng, W.; Zheng, Z. Deep Robust Reinforcement Learning for Practical Algorithmic Trading. IEEE Access 2019, 7, 108014–108022. [Google Scholar] [CrossRef]

- Si, W.; Li, J.; Ding, P.; Rao, R. A Multi-objective Deep Reinforcement Learning Approach for Stock Index Future’s Intraday Trading. In Proceedings of the 2017 10th International Symposium on Computational Intelligence and Design (ISCID), Hangzhou, China, 9–10 December 2017; pp. 431–436. [Google Scholar]

- Chen, T.; Su, W. Local Energy Trading Behavior Modeling With Deep Reinforcement Learning. IEEE Access 2018, 6, 62806–62814. [Google Scholar] [CrossRef]

- Kumar, P.H.; Patil, S.B. Forecasting volatility trend of INR USD currency pair with deep learning LSTM techniques. In Proceedings of the 3rd International Conference on Computational Systems and Information Technology for Sustainable Solutions (CSITSS), Bengaluru, India, 20–22 December 2018; pp. 91–97. [Google Scholar]

- Ma, Y.; Han, R. Research on stock trading strategy based on deep neural network. In Proceedings of the 18th International Conference on Control, Automation and Systems (ICCAS), PyeongChang, Korea, 17–20 October 2018; pp. 92–96. [Google Scholar]

- Chen, C.T.; Chen, A.; Huang, S. Cloning Strategies from Trading Records using Agent-based Reinforcement Learning Algorithm. In Proceedings of the IEEE International Conference on Agents (ICA), Singapore, 28–31 July 2018; pp. 34–37. [Google Scholar]

- Korczak, J.; Hemes, M. Deep learning for financial time series forecasting in A-Trader system. In Proceedings of the Federated Conference on Computer Science and Information Systems (FedCSIS), Prague, Czech Republic, 3–6 September 2017; pp. 905–912. [Google Scholar]

- Wang, J.; Sun, T.; Liu, B.; Cao, Y.; Wang, D. Financial Markets Prediction with Deep Learning. In Proceedings of the 2018 17th IEEE International Conference on Machine Learning and Applications (ICMLA), Orlando, FL, USA, 17–20 December 2018; pp. 97–104. [Google Scholar]

- Lee, R.S.T. Chaotic Type-2 Transient-Fuzzy Deep Neuro-Oscillatory Network (CT2TFDNN) for Worldwide Financial Prediction. IEEE Trans. Fuzzy Syst. May 2019. [Google Scholar] [CrossRef]

- Zarkias, K.S.; Passalis, N.; Tsantekidis, A.; Tefas, A. Deep Reinforcement Learning for Financial Trading Using Price Trailing. In Proceedings of the ICASSP 2019-2019 IEEE International Conference on Acoustics, Speech and Signal Processing (ICASSP), Brighton, UK, 12–17 May 2019; pp. 3067–3071. [Google Scholar]

- Shleifer, A.; Vishny, R. The limits of arbitrage. J. Financ. 1997, 52, 35–55. [Google Scholar] [CrossRef]

- Conoci, S.; Rundo, F.; Petralta, S.; Battiato, S. Advanced skin lesion discrimination pipeline for early melanoma cancer diagnosis towards PoC devices. In Proceedings of the IEEE 2017 European Conference on Circuit Theory and Design (ECCTD), Catania, Italy, 4–6 September 2018. [Google Scholar]

- Rundo, F.; Conoci, S.; Banna, G.L.; Stanco, F.; Battiato, S. Bio-Inspired Feed-Forward System for Skin Lesion Analysis, Screening and Follow-Up. In Image Analysis and Processing - ICIAP 2017; ICIAP 2017. Lecture Notes in Computer Science; Springer: Cham, Switzerland, 2017; Volume 10485, pp. 399–409. [Google Scholar]

- Rundo, F.; Conoci, S.; Banna, G.L.; Ortis, A.; Stanco, F.; Battiato, S. Evaluation of Levenberg–Marquardt neural networks and stacked autoencoders clustering for skin lesion analysis, screening and follow-up. IET Comput. Vis. 2018, 12, 957–962. [Google Scholar] [CrossRef]

- Ortis, A.; Rundo, F.; Di Giore, G.; Battiato, S. Adaptive Compression of Stereoscopic Images. In Image Analysis and Processing – ICIAP 2013; ICIAP 2013. Lecture Notes in Computer Science; Springer: Berlin/Heidelberg, Germany, 2013; Volume 8156, pp. 391–399. [Google Scholar]

- Banna, G.L.; Camerini, A.; Bronte, G.; Anile, G.; Addeo, A.; Rundo, F.; Zanghi, G.; Lal, R.; Libra, M. Oral metronomic vinorelbine in advanced non-small cell lung cancer patients unfit for chemotherapy. Anticancer Res. 2018, 38, 3689–3697. [Google Scholar] [CrossRef] [PubMed]

- Gers, F.; Schmidhuber, E. LSTM recurrent networks learn simple context-free and context-sensitive languages. IEEE Trans. Neural Netw. 2001, 12, 1333–1340. [Google Scholar] [CrossRef] [PubMed]

- Gers, F.; Schraudolph, N.; Schmidhuber, J. Learning precise timing with LSTM recurrent networks. J. Mach. Learn. Res. 2002, 3, 115–143. [Google Scholar]

- Hochreiter, S.; Schmidhuber, J. Long short-term memory. Neural Comput. 1997, 9, 1735–1780. [Google Scholar] [CrossRef] [PubMed]

- Jithesh, V.; Sagayaraj, M.J.; Srinivasa, K.G. LSTM recurrent neural networks for high resolution range profile based radar target classification. In Proceedings of the 3rd International Conference on Computational Intelligence & Communication Technology (CICT), Ghaziabad, India, 9–10 February 2017; pp. 1–6. [Google Scholar]

- Balouji, E.; Gu, I.Y.H.; Bollen, M.H.J.; Bagheri, A.; Nazari, M. A LSTM-based deep learning method with application to voltage dip classification. In Proceedings of the 18th International Conference on Harmonics and Quality of Power (ICHQP), Ljubljana, Slovenia, 13–16 May 2018; pp. 1–5. [Google Scholar]

- Rundo, F.; Petralia, S.; Fallica, G.; Conoci, S. A nonlinear pattern recognition pipeline for PPG/ECG medical assessments. In CNS Sensors, Lecture Notes in Electrical Engineering; Springer: Cham, Switzerland, 2018; Volume 539, pp. 473–480. [Google Scholar]

- Rundo, F.; Ortis, A.; Battiato, S.; Conoci, S. Advanced Bio-Inspired System for Noninvasive Cuff-Less Blood Pressure Estimation from Physiological Signal Analysis. Computation 2018, 6, 46. [Google Scholar] [CrossRef]

- Mazzillo, M.; Maddiona, L.; Rundo, F.; Sciuto, A.; Libertino, S.; Lombardo, S.; Fallica, G. Characterization of sipms with nir long-pass interferential and plastic filters. IEEE Photon. J. 2018, 10, 1–12. [Google Scholar] [CrossRef]

- Vinciguerra, V.; Ambra, E.; Maddiona, L.; Romeo, M.; Mazzillo, M.; Rundo, F.; Fallica, G.; Di Pompeo, F.; Chiarelli, A.M.; Zappasodi, F.; et al. PPG/ECG multisite combo system based on SiPM technology. In CNS Sensors, Lecture Notes in Electrical Engineering; Springer: Cham, Switzerland, 2018; Volume 539, pp. 353–360. [Google Scholar]

- Rundo, F.; Banna, G.L.; Conoci, S. Bio-Inspired Deep-CNN Pipeline for Skin Cancer Early Diagnosis. Computation 2019, 7, 44. [Google Scholar] [CrossRef]

- Battiato, S.; Rundo, F.; Stanco, F. Self Organizing Motor Maps for Color-Mapped Image Re-Indexing. IEEE Trans. Image Process. 2007, 16, 2905–2915. [Google Scholar] [CrossRef] [PubMed]

- Tickstory—Historical Data & Resources for Traders. Available online: https://tickstory.com/ (accessed on 12 September 2019).

- STM32 Platform. Available online: https://www.st.com/content/st_com/en/about/innovation---technology/artificial-intelligence.html (accessed on 12 September 2019).

| Financial Year | Deep Learning Prediction Block | Deep Learning Prediction Block + RL Trend Correction |

|---|---|---|

| 2015 | 71.11 % | 85.24 % |

| 2016 | 69.25 % | 83.29 % |

| 2017 | 73.98 % | 87.16 % |

| 2018 | 70.23 % | 84.92 % |

| Method | FX Currency Cross | ROI (%) | MD (%) |

|---|---|---|---|

| Grid Trading System [2] | EUR/USD | 94.11 | 11.25 |

| Trading System [31] | EUR/USD | 60.77 | 21 |

| Threshold (0.03%)—Strategy 2 [32] | EUR/USD | 97.687 | 50.47 |

| Threshold (0.07%)—Strategy 2 [32] | EUR/USD | 62.707 | 9.93 |

| Proposed | EUR/USD | 98.23 | 15.97 |

| Year(s) | FX Currency Cross | ROI Min (%) | MD Min (%) | ROI Max (%) | MD Max (%) |

|---|---|---|---|---|---|

| 2004–2018 | EUR/USD | 97.65 | 12.66 | 98.81 | 19.28 |

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rundo, F. Deep LSTM with Reinforcement Learning Layer for Financial Trend Prediction in FX High Frequency Trading Systems. Appl. Sci. 2019, 9, 4460. https://doi.org/10.3390/app9204460

Rundo F. Deep LSTM with Reinforcement Learning Layer for Financial Trend Prediction in FX High Frequency Trading Systems. Applied Sciences. 2019; 9(20):4460. https://doi.org/10.3390/app9204460

Chicago/Turabian StyleRundo, Francesco. 2019. "Deep LSTM with Reinforcement Learning Layer for Financial Trend Prediction in FX High Frequency Trading Systems" Applied Sciences 9, no. 20: 4460. https://doi.org/10.3390/app9204460